Introduction

Why firms exist and what defines their boundaries are matters of great importance for firm researchers and managers (Baronian, 2020; Koenig, 2020). With the objective of increasing this understanding, two theoretical approaches stand out: the transactional approach (Cheung, 1983; Demsetz, 1988) and the capabilities approach (Barney, 1999; Conner & Prahalad, 1996).

The literature geared towards exploring firm boundaries by means of the transactional approach manifests the understanding that firms have internalised the transactions that were vulnerable to opportunism (Williamson, 1975; 1985). Due to the limitations of this perspective, different researchers have brought to light an approach oriented towards the role of a firm´s essential capabilities in defining its boundaries. This second approach states that firms with more developed capabilities1 internalise several activities, which were previously undertaken by market suppliers (Jacobides & Winter, 2005; Madhok, 2002; Poppo & Zenger, 1998). These two approaches were considered rival theories for understanding firm boundaries.

In the last decade, as opposed to studies that consider these two approaches to be at odds with each other, a group of researchers have suggested that treating them as rivals limits the understanding of how firms survive market opportunism (Argyres & Zenger, 2012; Eapen & Krishnan, 2019; Gulbrandsen et al., 2017; Huikkola et al., 2020; Liu & Trefler, 2020; Mahoney & Qian, 2013; Simshauser, 2020). In accord with this integral point of view, our study is motivated by three rifts that remain in the theoretical integration between both approaches. First of all, since the transaction cost economy approach does not consider transactions to be dependent on the firm’s governance structure, this theory discards the evolutionary process of management activities pertaining to transactions (Argyres & Zenger, 2012). Second, the literature regarding this strategy considers that transactional capabilities play a vital role in a firm’s growth (Penrose, 1959). However, the studies that develop an understanding regarding the nature of transactions still rule out these capabilities as a determining factor, which limits them (Madhok, 2002; Argyres & Zenger, 2012). Third, although there are studies integrating both approaches (Guichardaz et al., 2019; Koenig, 2020; Meissner et al., 2021), understanding which essential capabilities directly influence the firm boundary definition process is still an unexplored area.

In this sense, for a firm to determine whether to conduct its activities internally or externally (Baronian, 2020; Connelly et al., 2020; Garzella et al., 2021), this study uses two constructs: technological capability and transactional capability. Thus, the objective of this article is to analyse company boundaries considering technological and transactional capabilities. In order to fulfill this goal, an exploratory multiple case study was carried out with firms belonging to four levels of technological intensity.

Aside from this introduction, this study contains a review of the aspects that determine firm boundaries. Subsequently, it delves deeper into the subject of firm capabilities. Following the literature review, the method is described, in the wake of the results and the discussion thereof. The article concludes with the final considerations.

Firm boundaries

Within the theories that examine firm boundaries, Transaction Cost Economics (TCE) has been used as the main theoretical approach for determining the boundaries of firms. Beginning with a contention by Coase (1937) regarding the reason firms exist, the comprehension of the matters that influence the boundary definition of firms was fostered. These matters consist of economic frictions that were detected in the contract patterns established by firms. These frictions were termed transaction costs. Based on this information, studies evolved with the objective of exploring the determinants of a theoretical explanation regarding the boundaries of firms.

Firm boundaries is a field of study that requires the simultaneous use of different interdependent and complementary lenses (Huikkola et al., 2020; Koenig, 2020). Thus, economic theories began to work on integrating the firm capability approach with the methodology pertaining to transaction costs in order to define firm boundaries (Argyres & Zenger, 2010).

However, the tenuous line that divides both approaches led Argyres and Zenger (2012) to inquire: Which of these matters more (to the firms), the capabilities or the transaction costs? They argued that to treat these two approaches as opposed to each other is a huge mistake. Gulbrandsen et al. (2017) emphasised the importance of interlinking these two theories for analysing firm boundaries.

The converging of these two theoretical currents represents an advance not only for research on the boundaries of firms, but also for defining a firm’s operational strategy (Ovuakporie et al., 2021). To combine both approaches in order to choose between developing new abilities internally or externalising its processes represents a challenge for firms (Simshauser, 2020). Thus, firm decisions to expand their boundaries by adding technological or transactional capability represents an important point in defining the business ecosystem (Jacobides et al., 2018; Huikkola et al., 2020). As such, to develop an integrative approach for this agent known as the firm can play a disruptive role in strategic behaviour related to firm growth.

Jacobides and Winter (2005) emphasised the need for a deep understanding of this integrative approach, which defines capabilities as fundamental for the expansion of firm boundaries and establishes transaction costs as a moderating factor. In this sense, Gulbrandsen et al. (2017) underscored the search for a comparative and theoretical complementation between these approaches given that firm boundary analyses are limited when essential capabilities are not identified and analysed.

In order to evaluate the firm’s essential capabilities, different authors have defended the importance of evaluating these capabilities while considering transaction costs (Foss & Foss, 2005; Jacobides & Winter, 2005; Tello-Gamarra & Zawislak, 2013). However, to understand which capabilities impact the expansion of a firm’s boundaries, a few basic assumptions are necessary. Firstly, it is vital to understand the nature of the firm in order to understand its expansion process. In this sense, Tello-Gamarra (2013) affirms that the nature of the firm is technological and transactional. Secondly, analysing the capabilities that surround both vectors (technological and transactional) is considered necessary, because the firm’s economic growth is directly based on its capabilities to generate technology and to commercialise it (Reichert & Zawislak, 2014; Reichert et al., 2020; Tello-Gamarra & Zawislak, 2013). Thirdly, Joseph Schumpeter (1911) recognised that economic growth occurs due to the correlation between economic and technological progress. Based on these three assumptions, this article analyses technological capability and transactional capability as the capabilities that determine a firm’s boundaries. These capabilities will be explained in the following section.

Technological and transactional capabilities

Studies on a firm´s capabilities are based on the concept that firms require strategic attitudes in order to function (Ulrich & Lake, 1991). Initially, Richardson (1972) defined these capabilities as the firm´s abilities, knowledge, and skills.

From that moment on, various authors have defined these capabilities in different ways, such as for example central competencies (Prahalad & Hamel, 1990), distinctive competencies (Snow & Hrebiniak, 1980), organisational capabilities (Chandler, 1992), invisible assets (Itami & Roehl, 1991), human resources (Barney, 1999) and routine repertoire (Nelson & Winter, 1982).

Studies on the capabilities of firms have defended the idea that for a firm to fill market gaps and achieve superior performance, over time, it must develop abilities both internally and externally, thus defining the firm´s boundaries (Gawer, 2020; Meissner et al., 2021; Kurkharskyy, 2020; Ulrich & Lake, 1991; Zawislak et al., 2012). These capabilities are responsible for differentiating a firm from its competitors (Teixeira et al., 2020). Vasconcelos et al. (2020) state that a firm’s competitive differential stems from the capabilities developed in its processes. In this sense, the firm needs the capabilities to “create” and “trade” products to satisfy market demands. For Tello-Gamarra (2013), the firm’s existence and boundaries abide, mainly, in two capabilities the firm develops. One capability is for creating and the other for trading in the market. That is to say, technological and transactional capabilities.

Technological capability

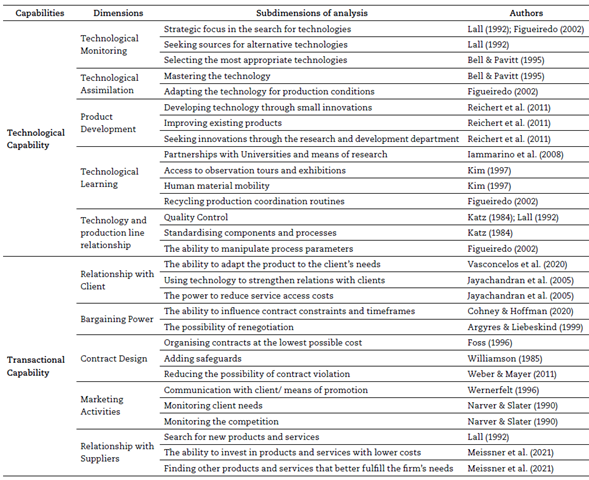

Regarding technological capability, in theory the development of this capability is considered to be a continuous process. Lall (1992) understands that this process occurs due to the firm’s creation of knowledge based on its accumulation of capabilities and its contacts with the market. Furthermore, Katz (1984) underscores that a firm’s structural adaptations for developing technological capability take some time, requiringmany evaluations for more favourable suitability. According to various authors (Bell & Pavitt, 1995; Figueiredo, 2002; Iammarino et al., 2008; Katz, 1984; Kim, 1997; Lall, 1992; Reichert et al., 2011; Zawislak et al., 2018), technological capability is a construct which is comprised of the following dimensions: (i) technological monitoring, (ii) technological learning, (iii) technological assimilation, (iv) product development process and (v) technological correlation in the production line.

Such dimensions stem from the idea that the firms that lead the market expend effort to monitor new technologies in the external environment, by selecting a strategy for the search, detection, and selection of appropriate technologies (Bell & Pavitt, 1995; Figueiredo, 2002). Upon identifying technologies, firms seek to learn them. This process of technological learning is seen as stemming from incentives such as partnerships with research centers (Iammarino et al., 2008), exposure and human material accessible to new technologies (Kim, 1997) as well as maintaining a recycling routine in the production management process (Figueiredo, 2002). This technological knowledge is not distributed equally among firms, as this knowledge is directed towards the need to incorporate technologies through a process known as technological assimilation. To incorporate such technologies, the firm goes through the process of mastering the technology (Bell & Pavitt, 1995) and adapting it to the productive reality (Figueiredo, 2002). Subsequently, upon incorporating the technology, the need to formalise the product development process arises (Reichert et al., 2011). Finally, it is necessary to develop structural adaptations such as factors linked to quality and process standards manipulation (Katz, 1984) for implementing the technology in the production line. The new technology is successfully incorporated when the firm formalises new processes, with management techniques and development practices (Zawislak et al., 2018).

Reichert et al. (2011) note that a firm´s evolution related to technological capability is tied to this construct’s dimensions and variables (see Table 1). To manage these technological changes, Pavitt (1998) points out that firms develop their technological capability incrementally. Thus, these stages favour firms when they continue doing what they already know in a more technologically developed manner.

Transactional capability

Transactional capability is a construct that emerged from the integration of the capabilities and the transaction cost economics perspectives (Tello-Gamarra et al., 2017). Oliver Williamson (1991) provided some ideas regarding this integration, emphasising the relevance of governance structures, which are divided into transaction costs and competencies as a hypothetical route for integrating these concepts to align transactions, which vary in their attributes of organisational efficiency. By means of the transactional capability in their governance structure, firms can decide whether to use intermediaries to avoid contractual risks in their transactions (Guichardaz et al., 2019).

According to Tello-Gamarra and Zawislak (2013, p. 1), transactional capability is defined as “the repertoire of abilities, processes, experiences, skills, knowledge and routines that the firm uses to reduce its transaction costs (ex-ante and ex-post)”. This capability allows companies to market their products with the lowest possible transaction cost (Tello-Gamarra, 2013). According to Teixeira et al. (2020), transactional capability can be understood as a set of routines, resources, governance designs and abilities that allow the firm to conduct intermediation activities between its partners and clients, in order to obtain relational rents (Teixeira et al., 2020).

According to existing literature, the transactional capability construct is comprised of the following dimensions: (i) relationship with the client, (ii) bargaining power, (iii) contract design, (iv) marketing activities and (v) relationship with/access to suppliers (Argyres & Liebeskind, 1999; Cohney & Hoffman, 2020; Hernani-Merino & Tello-Gamarra, 2019; Jayachandran et al., 2005; Narver & Slater, 1990; Tello-Gamarra, 2013; Vasconcelos et al., 2020; Zawislak et al., 2018).

Regarding these dimensions, these authors pointed out the need to manage the relationships to adapt the product to the clients’ needs (Vasconcelos et al., 2020) and reduce the clients’ access costs (Jayachandran et al., 2005). This study understands that a firm’s performance is also associated with its relationship with suppliers, through which it is possibleto acquire products with lower costs that better fulfill the firm´s needs (Meissner et al., 2021).

To connect the universe of relationships, this study considers that marketing activities are needed to guarantee the monitoring of the firm (Narver & Slater, 1990) and communication (Wernerfelt, 1996) with the external environment. Through this monitoring, the firm increases its chances of closing new contracts (Hernani-Merino & Tello-Gamarra, 2019). Beyond this, bargaining power is the ability to influence the contract´s conditions, regarding both timeframes and constraints (Argyres & Liebeskind, 1999; Cohney & Hoffman, 2020) and, providing for this, to establish a set of safeguards in the contract design to prevent its violation.

Thus, by means of the dimensions of this construct (Table 1), it is possible for a firm to choose between “doing” or “trading” certain activities, limiting its boundaries of action (Tello-Gamarra, 2013). These dimensions are fundamental for analysing the case studies from four firms which were selected in accordance with the four levels of technological intensity established by the Organisation for Economic Cooperation and Development (OCDE, 2003). The selectionof these four firms from different technological intensity levels permits a broader analysis of the influence of the capabilities on a firm´s boundaries.

Method

The chosen method is a multiple case study, based on the technological capability and transactional capability constructs and their respective subdimensions (see Table 1). The study was carried out in three stages: case selection, data collection and data analysis.

Case study selection

Case identification was conducted based on a sequence of criteria. In this case study, three criteria were established for the sample selection, as follows: (i) Being in a leadership position in their sectors; (ii) Being located in Brazil’s southernmost region; and (iii) Belonging to the four different technological intensity levels established by the OCDE (2003). Having defined these criteria, the firms were selected by convenience as long as they observed the three criteria. The four firms that were selected for this study fulfilled all the selection criteria.

Data collection

Based on the theoretical background, a semi-structured interview protocol was established. This interview protocol was established with open questions that permitted the collection of information on firm boundaries, and transactional and technological capabilities. Four top-level managers were identified and interviewed regarding their respective firms. The interviewed managers were selected due to their decision-making responsibility regarding strategic aspects related to the boundaries of the firms analysed.

The interview script was organised based on general and specific questions. In order to not confuse the interviewee, each general question was accompanied by specific questions pertaining to the general research fields. During the interview, the subsequent subject was broached once the previous one had been finished. All interviews were recorded and later transcribed. Afterwards, a content analysis was carried out, codifying the relevant information within a structured perspective. Any information that was unclear led to follow-up questions. Afterwards, an internal data analysis was carried out to identify and compare the recurring information patterns.

Data analysis

Finally, convergence points were established in the interview results, specifying how the capabilities are seen by the firms. These results measure crucial points pertaining to technological and transactional capabilities and how these capabilities correlate with the boundaries of the enterprise. This analysis is conducted by the variables that form these constructs. In this sense, there are qualitative comments that describe the firms’ points of decision concerning eitherdoing or trading. These points are the basis for propositions that explain the firm boundary expansion process by way of technological and transactional capabilities.

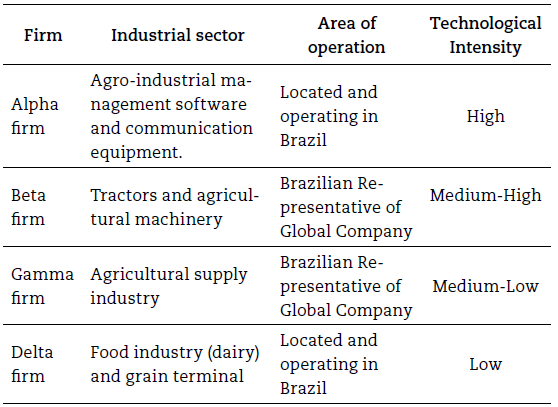

For a broader analysis of the technological and transactional capability aggregation process, the case studies were conducted using logical replication, in which each case is treated as an independent experiment. The multiple cases were selected to make it possible to comprehend the existence of said capabilities in a broader manner. The analysed firms were given the names Alpha, Beta, Gamma and Delta. Changing their names was important in order to keep their identities secret (see Table 2).

Interviewee profiles

This study contains information regarding firms belonging to different levels of technological intensity, with one representative each from the high, medium-high, medium-low and low levels (OCDE, 2003). Choosing firms with different technological intensity levels allows for a broader evaluation of the technological capability and transactional capability constructs.

Alpha Firm - High technological intensity

Alpha firm is characterised as a firm with high technological intensity as it works with integrated management equipment for rural property management processes. By means of the development of a software to manage these establishments, this firm declares that selling information to producers is its main business.

Beta Firm - Medium-high technological intensity

Beta firm is a Brazilian firm that represents an American manufacturer of forest and agricultural machines and their accessories. This firm is characterised as an organisation with a medium-high technological intensity level. This firmrepresents a corporation with one of the highest revenues in the world in supplying agricultural equipment and specialised services.

Gamma Firm - Medium-low technological intensity

This firm has been active for over 100 years in the production and commercialisation of nitrogenated fertilisers and is classified as a firm with a medium-low technological intensity level. Its product portfolio consists of the production of nitrates, ammonia, urea, and genetically modified grains. Its products are currently used in agriculture in more than 60 countries.

Delta Firm - Low technological intensity

Delta firm is an agricultural company that works with agribusiness products, grains and dairy products and is interposed in the low technological intensity level. The logistical unit is responsible for receiving, storing, and shipping agricultural bulk goods, representing around 14% of Brazilian soy exportation and 52% of grain movement in Rio Grande do Sul. The analysed agribusiness unit is responsible for the experimentation, validation and diffusion of agricultural technologies and practices, seeking the sustainable profitability of rural properties, forming the largest economic support and grain or cattle production network. For example, the dairy unit has got one of the most modernproductive processes in Latin America, with a production capacity of 2.2 million litres of milk per day.

Results

The results obtained in the interviews were crucial to understanding how firms expand their boundaries through technological capability and transactional capability constructs. The analysis carried out with different levels of technological intensity permitted a broader understanding of firm behavior, as described in the following sections.

Technological Capability

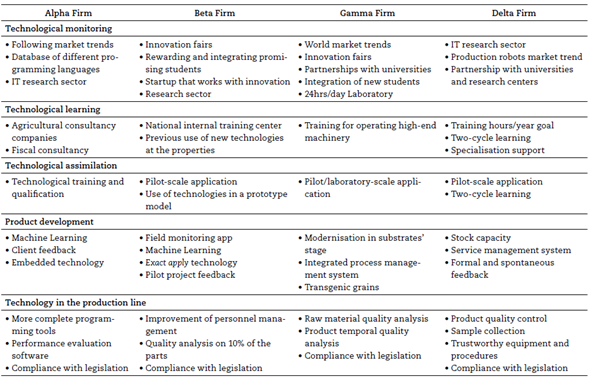

In this section, we describe how technological capability is developed by the analysed firms in accordance with its dimensions, which are: technological monitoring, technological learning, technological assimilation, product development process and technology in the production line (see Table 3).

Technological monitoring. The results demonstrated that the firms from all four levels of technological intensity monitored new technologies. Beta firm reported developing a Startup for the sole purpose of closely monitoring market innovations. Additionally, Alpha firm mentioned the importance of consultants for assistance with the monitoring of technologies and managers.

Technological learning. The four firms assert that the formalisation of a new process depends on labour specialisation. For example, Gamma firm emphasises this relevance in the statement: “We continue upgrading ourselves with technological innovations and also by getting involved a lot in research… certifying collaborators so that they can operate latest generation machinery with ease”. This process is directly linked to a learning routine, which complements the comprehension of this capability. Beta firm emphasises the importance of human material when they declare that “The company supports innovation fairs, giving students problems to solve and seeking out the ones who propose the best solutions”. Additionally, Delta firm affirms that they provide financial bonuses to their employees who fulfill the minimum annual training goals.

Technological assimilation. The four firms stated that the process of technological assimilation develops progressively. Delta firm commented that: “new technological routines are applied on an experimental scale with new process parameters, so that later these technologies can make a difference in our process”. Similarly, Beta firm mentioned that technological innovations are applied on a pilot scale, where their properties are measured and then afterwards a new process is formalised, with the development of compact innovations and improvements.

Product development. All four firms maintained the importance of formally recording the development processes for new products. These records begin at the laboratory-scale stage of development and proceed to the industrial-scale process, both of which have different types of records. In this sense, performance analyses carried out during the development of new products are fundamental activities for controlling and formalising new processes. For instance, Alpha firm stated that this activity is the main information vehicle the firm must understand to continue its expansion.

Technology in the production line. This dimension stems from the correct structuring of the previous dimensions. The interviewees from the firms highlighted that factors such as mastering technology, acquiring complementary machinery and maintaining quality control are necessary factors for using a new technology in the production line. Delta firm explained this process in detail: “When we are going to apply a technology and automation in the factory, we start with a pilot-scale, we apply it, master the technology and, once we have mastered its application, we expand it to the other areas”. Alpha firm adds that: “the analysis of client satisfaction culminates in an aggregation of technology through complementary machinery with advanced embedded technology…”.

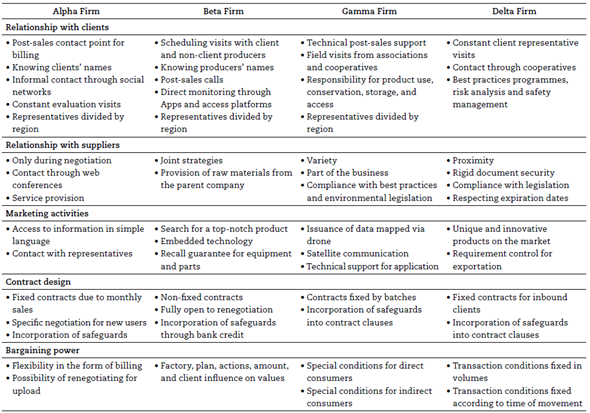

Transactional capability

As for the results of the transactional capability construct (see Table 4), they can be understood by way of the following dimensions: relationship with client, relationship with supplier, marketing activities, contract design and bargaining power. These five dimensions are described below. Relationship with clients. Two important points were brought up in the interviews regarding this dimension. The first has to do with the use of client retention activities to strengthen these relationships. Alpha firm mentions that these relationships must be maintained in the after-sales period. They emphasise this trust in the statement: “It is more comfortable for the client to have a personal commitment to our representative for the company’s demands to be channeled”. The second point concerns the use of informal communication with clients. All the firms involved brought up these points. Gamma firm highlighted the fact that in general the client feels important when the firm calls on them.

Relationship with suppliers. The firms emphasised that the creation of the strategic process should transpire in alignment with the suppliers. Delta firm declares that: “both the contact with the general manager and the contact through cooperatives strengthen a firm’s relationships with its clients, establishing contracts with a total of 160 thousand milk and soy producers in the state of Rio Grande do Sul alone”. Gamma firm corroborated this, stating that it is important for the suppliers, whether of services or materials and supplies, to feel like they are partners, a part of the business.

Marketing activities. This dimension is buttressed by the firms through their comprehension of the producer’s true needs. All the firms declared that they monitor client needs through strategically located representatives, due to the specificity of their services. Gamma firm set forth that “… with strategically placed professionals divided by area and by region, they are able to understand and establish a relationship with the producer, mapping a correlation of clients and potential clients”. With this, the strategies are created to fulfill the needs of each group of clients.

Contract design. Regarding contract design, the firms emphasise the contract´s flexibility. Alpha firm points out that this has to do with harvest seasonality. These contracts frequently need financial institutions to serve as intermediaries, considered the main safeguard for the transactions. Gamma firm relates that: “based on client needs, contracts are created with clauses meant to safeguard both parties in case of non-compliance with the terms established during negotiation”.

Bargaining power. The firms emphasise that incorporating safeguards against opportunism in transactions is a transactional necessity and increases time management possibilities. By reducing opportunism, it is possible to be more flexible when negotiating contracts. Thus, it is possible to include payroll activities and periodical billing to comply with this demand. The managers from Alpha and Beta firms stated that financing through banks or commitment contracts are effective alternatives. Thanks to them, transaction frequency tends to increase, fulfilling the specific needs of clients. Gamma firm emphasised the need to fulfill each of its client’s specific needs to strengthen the relationships. As such, transaction uncertainty is reduced with these relationships and this closeness allows the firm to better negotiate its assets with its clients.

In this sense, based on the assumption that the expansion of firm’s boundaries is a phenomenon that depends on the accumulation of capabilities, the information that was correlated explains how technological and transactional capabilities manifest in the firm’s structures. Furthermore, it is possible to understand that the firms follow a common trajectory in acquiring these capabilities. Thus, a set of insights was identified to comprehend how this process is structured. The levels of technological intensity permitted a broader understanding of the influence these dimensions have on firms.

Analysis of results

Capabilities and firm limits

In the case studies, we demonstrated that all the interviewed firms conduct activities oriented towards technological and transactional capabilities, explaining their relevance in the market in which they act. The analyses brought up insights pertaining to the firms´ technological and transactional capabilities, as well as their boundaries.

This study understands that to expand firm boundaries entails a process of reinventing the firm, which maintains itsperformance thanks to the differential it possesses in its capabilities. Barney (2020) asserts that when firms have well-developed capabilities, they can expand their boundaries through new transactional deals or new productive processes. Since firms are constantly developing their capabilities, the resources that define firm differential can change over time to adapt to technological changes.

To manage these new market resources, the analyses highlight the correlation between a firm’s capabilities and its knowledge (Bhatia, 2021; Valdez-Juárez & Castillo-Vergara, 2021). Thus, the firms demonstrated the need for knowledge in order to expand their boundaries. The four firms emphasised the constant monitoring of new technologies, regardless of their size. Also, they elucidated the knowledge stemming from their relationships with suppliers and clients. This knowledge has been shown to be crucial and as a result, the firms do not limit themselves to doing what they already know, but use the knowledge incrementally to improve their activities.

This knowledge makes the firm grow and, consequently, need more information to operate. During the growth process, the firm internalises the market transactions within its boundaries. This is only possible due to the accumulation of capabilities. Thus, the capabilities substantiate that they are linked to the level of knowledge possessed by the firmsand to how this knowledge (technological and transactional) increases through time.

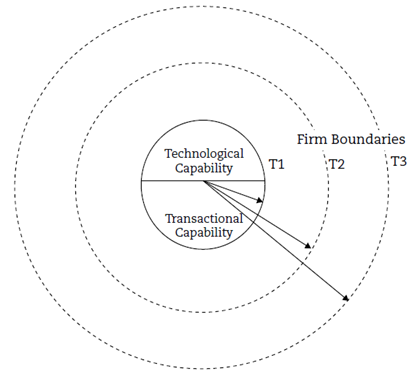

These conditions are illustrated in Figure 1, in which T1, T2 and T3 represent different moments for the firm. A firm begins its activities based on the essential capabilities in T1. At this point, a small fraction of the transactions is internalised within its boundaries and another fraction is conveyed through the market. As the firm develops its capabilities in T2, it can carry out activities oriented towards absorbing technology and improving contract conditions, internalising (even more) transactions within its boundaries. Subsequently, in T3, the firm continues accumulating its capabilities and, consequently, expanding its boundaries. These stages transpire as firms accumulate capabilities.

Source: author´s own elaboration.

Figure 1 Accumulation of capabilities for expanding firm boundaries

Thus, it is possible to note that both capabilities interact in the process of expanding a firm’s boundaries. This interaction is vital for a firm to decide whether to internally develop or transact a certain stage of the capability incorporation process.

Propositions regarding firm boundaries

Upon analysing firm boundaries from the perspective of technological and transactional capabilities, this study identified that a firm obtains an advantage in its market through the differential knowledge it possesses. This knowledge is the consequence of a vacuity that the firm translated into information and abilities, which are tradeable. These resources represent the construction of the firm´s technological and transactional know-how (Gawer, 2020).

The value the firm delivers to the market is based on the combination of this compounded technological and transactional know-how. This factor does not necessarily impact in the development of formal capabilities and informal operational structures may stem from different levels of capabilities. For example, a firm with a simple technological structure may have its success favoured due to being the only one of its kind in a certain geographic location (Zawislak et al., 2012).

Notwithstanding, although technological capability is crucial, it is not enough to guarantee that products are traded by suppliers and clients. In this sense, it is possible for the firm to be created with technologically based knowledge for developing prototypes and processes on a pilot-scale. Nonetheless, this knowledge does not guarantee the firm´s success, as it needs to develop the knowledge on scale and trade it with lower transaction costs. Thus, it is possible to use these insights in the following propositions:

Proposition I - All industrial firms have technological and transactional capabilities.

Without regard to this, although a firm possesses both capabilities, it is important to understand which one of them represents the differential that defines the firm. The existence of a capability that defines the firm’s differential prompted the literature to structure its findings based on different standpoints for a few years (Barney, 1999; Chandler, 1992; Lall, 1992). Thus, this study clarifies that a firm’s differential stems from a dominant capability.

Despite the firms having one capability that is more developed than the other, it is important to emphasise that the fact that a firm has a stronger technological or transactional vector is not a static definition. In this sense, the analysed firms confirmed an investment in the development of technological and transactional capabilities, which are both developed independently. These results demonstrated that each firm will always have combined technological and transactional capabilities, despite being at different levels, for expanding their boundaries. For the firms to remain competitive in the market, they would constantly “race” against their competitors to develop their technological and transactional capabilities. This factor explains the second proposition:

Proposition II - Firms with more developed capabilities (technological or transactional) expand their boundaries.

Finally, this factor materialises due to the firm beginning with the minimum level of developed capabilities. Thus, by identifying new market gaps, a firm expands its boundaries with the intent to fill the gaps with new abilities (Meissner et al., 2021). With the market’s evolution, new gaps appear in a way that incites the firms need to continue their evolution in order to remain competitive and, thus, expand their boundaries (Argyres & Zenger, 2010). This expansion occurs when the capabilities are absorbed and their importance is noted in the different stages of the process (Katz, 1984; Zawislak et al., 2018).

However, the development of technological or transactional capabilities is an independent process that presents synchronous and cyclical behaviour in leading firms in the market. To decide which capability to develop and when to transmigrate is a delicate strategic decision the firm must make by processing information within the firm’s boundaries. Thus, the firm can decide to use the technological vector, the transactional one or a mix of both to orient this stage. In this sense, we have a foundation for a third proposition, which is:

Proposition III - The firms can expand their boundaries by accumulating technological capability, transactional capability, or both.

Technological and transactional changes in firms stem from new capabilities incorporated by the firm and reflected in processes and dealings of a technological or transactional nature. The analysed firms demonstrated that after positively testing these new processes and transactions, they formalise them in their process structure. The formalisation of a new process (technological or transactional) at the firm shows that it has expanded its boundaries.

Final considerations

This article aimed to analyses firm boundaries considering technological and transactional capabilities. To this end, there was an exploratory analysis of multiple cases covering the dimensions of technological and transactional capabilities. This study provided three contributions, expressed by way of three theoretical propositions that can help to explain the expansion of a firm´s boundaries.

The first proposition articulated that all firms possess technological and transactional capabilities. These two capabilities are reflected in the know-how that the firm possesses with the intention of creating valuable solutions for consumers (Zawislak et al., 2012). This know-how allows them to differentiate themselves from their competitors and obtain a competitive advantage (Teixeira et al., 2020). Therefore, a firm cannot survive in the market without technological and transactional capabilities.

Similarly, the second proposition explained that the firms in which these capabilities are well developed expand their boundaries of action. In this sense, the development process for these capabilities is comprised of dimensions that describe how this expansion occurs through the technological (Lall, 1992; Katz, 1984) and transactional vectors (Zawislak et al., 2018; Tello-Gamarra, 2013).

Finally, the third proposition pointed out that the firm boundaries expansion process can take place by means of the technological vector, the transactional one or through both simultaneously. Thus, the decision to invest in the technological or the transactional capability is specific to each firm and must be made by its manager. This proposition exhibits the complementarity (Ovuakporie et al., 2021) of both capabilities, but not a relationship of interdependence (Connelly et al., 2020).

Considering these three propositions, it is possible to say that technological and transactional capabilities are essential for expanding the boundaries of firms at any level of technological intensity.

Despite arriving at some interesting findings, this study has its limitations. Since it is qualitative in nature, quantitative studies should be conducted to deepen the understanding of firm boundaries, with the technological and transactional capability constructs serving as an important starting point. Furthermore, as this study was carried out with firms from Brazil’s southernmost region, the responses may represent an organizational behaviour that is specific to a region, lacking an understanding of different economies. Future studies can cover larger regions2.