Servicios Personalizados

Revista

Articulo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Accesos

Accesos

Links relacionados

-

Citado por Google

Citado por Google -

Similares en

SciELO

Similares en

SciELO -

Similares en Google

Similares en Google

Compartir

Innovar

versión impresa ISSN 0121-5051

Innovar v.21 n.40 Bogotá mayo/ago. 2011

Antonio Duréndez*, Antonia Madrid-Guijarro** & Domingo García-Pérez-de-Lema***

* Universidad Politécnica de Cartagena, Spain. E-mail: antonio.durendez@upct.es

** Universidad Politécnica de Cartagena, Spain. E-mail: antonia.madrid@upct.es

*** Universidad Politécnica de Cartagena, Spain. E-mail: domingo.garcia@upct.es

Recibido: junio de 2009 Aprobado: octubre de 2010

Abstract:

The aim of this paper is to research on organizational culture and management of family firms. We identify family-firms innovative culture and assess the relationship between organizational culture, management control systems (MCS) use and their effects on performance of SME family-firms. With this purpose, we carry out an empirical analysis on a sample of Spanish SMEs (285 family and 151 non-family firms). Results show that (1) family-firms have a more hierarchical culture and a lesser extent of MCS use than non-family firms have, and (2) an innovative culture and the use of MCS have positive influences on family-firm performance.

Keywords:

Family firm, culture, management control systems, innovation, performance.

Resumen:

El objetivo principal de este trabajo es analizar la cultura empresarial y los mecanismos de control de la gestión de la empresa familiar. Para ello, en primer lugar identificamos los distintos tipos de cultura empresarial, haciendo especial hincapié en las características de la cultura innovadora, y en segundo lugar evaluamos el efecto de la cultura empresarial y el uso de mecanismos de control de la gestión sobre el rendimiento de las Pyme familiares. Con este objetivo, llevamos a cabo un análisis empírico sobre una muestra de Pymes españolas (285 empresas familiares y 151 empresas no familiares). Los resultados muestran que (1) las empresas familiares se caracterizan por una cultura más jerárquica y por un menor uso de sistemas de control de gestión que las empresas no familiares, y (2) una cultura innovadora y el uso de sistemas de control influyen positivamente sobre el rendimiento de la empresa familiar.

Palabras clave:

empresa familiar, cultura, sistemas de control de gestión, innovación, rendimiento.

Résumé:

L'objectif principal de ce travail est d'analyser la culture entrepreneuriale et les mécanismes de contrôle de gestion de l'entreprise familiale. Pour ce faire nous avons tout d'abord identifié les différents types de culture entrepreneuriale, tout en soulignant principalement les caractéristiques innovatrices, ensuite, nous avons évalué l'effet de la culture entrepreneuriale et l'utilisation de mécanismes de contrôle de gestion sur le rendement des petites et moyennes entreprises familiales. A cet effet, une analyse empirique a été effectuée sur un échantillon de petites et moyennes entreprises espagnoles (285 entreprises familiales et 151 entreprises non familiales). Les résultats montrent que les entreprises familiales présentent une culture plus hiérarchique et une utilisation moins importante de systèmes de contrôle de gestion que les entreprises non familiales et, que la culture innovatrice et l'utilisation de systèmes de contrôle influencent de façon positive le rendement de l'entreprise familiale.

Mots-clefs:

entreprise familiale, culture, systèmes de contrôle de gestion, innovation, rendement.

Resumo:

O objetivo principal deste trabalho é analisar a cultura empresarial e os mecanismos de controle da gestão da empresa familiar. Para tanto, em primeiro lugar identificamos os distintos tipos de cultura empresarial, com especial ênfase nas características da cultura inovadora, e em segundo lugar avaliamos o efeito da cultura empresarial e o uso de mecanismos de controle da gestão sobre o rendimento das PME familiares. Com este objetivo, realizamos uma análise empírica sobre uma mostra de PME espanholas (285 empresas familiares e 151 empresas não familiares). Os resultados mostram que (1) as empresas familiares caracterizam-se por uma cultura mais hierárquica e por um menor uso de sistemas de controle de gestão que as empresas não familiares, e (2) uma cultura inovadora e o uso de sistemas de controle influem positivamente sobre o rendimento da empresa familiar.

Palavras chave:

empresa familiar, cultura, sistemas de controle de gestão, inovação, rendimento.

Previous research studies highlight the importance of family firms in current economies due to their great capacity to generate employment, as well as to their contribution to drive economic activity and to create wealth. The particular idiosyncrasy of family businesses could be the reason they have different cultural and strategic management behaviours to those of nonfamily firms. Family businesses often have "intangible assets", such as family dedication and commitment towards the company (Peteraf, 1993). These aspects imply a more diligent protection of company traditions and values (Monreal et al., 2002).

Organizational culture stands for collection of beliefs, expectations and values shared by the people in a company (Leal, 1991). These beliefs and expectations generate behavioural rules that make the company different. The culture encompasses values and preferences about the goals the company must achieve (De Long & Fahey, 2000). Around the family company, literature has identified a differentiated managerial culture, since two very independent subsystems-family and business-cohabit jointly with divergent goals (Schwass, 2000). This fact leads to mix values from both subsystems that can be a source of troubles (Monreal, et al. 2002). The hierarchical values of the family determine the framework of cultural beliefs that condition the future development of the company, so the family culture will settle on the business strategy (Dodero, 2002).

The most studied hypothesis by academicians is that broadly established cultures strengthen business performance (Rosenthal & Masarech, 2003). This hypothesis is based on the idea that organizations benefit from having motivated employees aimed to achieve common goals (Kotter & Heskett, 1992).

In addition, a well-developed and structured information system is a sustainable competitive advantage (Barney, 1991, Morikawa, 2004). As management decisions should be based on unbiased information, managerial techniques such us financial planning, cost accounting and financial diagnosis should be common tools in the decision-making process. Nevertheless, several studies show that the use of management control systems is not broadly implemented in family firms (Kotey, 2005; Willingham & Wright, 1985).

The aim of this study is to analyse culture, management control systems and their effects on performance of family firms. We carry out an empirical study on a sample of 436 Spanish firms (285 family and 151 non-family firms). The research questions we want to answer are the following: Is culture of family firms different from non-family firms? Is the use of management control systems in family firms different from non-family firms? Does innovative culture improve family firm performance? Can management control systems help family firms to achieve a higher performance?

We make the following contributions to family-firms research. We deal with the gap identified by Zahra et al. (2004) and Sharma et al. (1997), since most of the previous studies analysing family-firms culture have focused just on family firms, without taking into account the potential differences between family and non-family firms. Furthermore, we contribute to identify family-firms culture starting from Cameron and Quinn's model. Due to innovative culture allows companies to achieve sustainable competitive advantages (Vermeulen, 2004), and it is a decisive factor for economic growth (Cheng & Tao, 1999), we complete the model adding a new type of culture called "innovative culture". Measuring innovation, we also contribute to enhance the previous limited research on the role of innovation within family firms (Craig & Moores, 2006). In that sense, identifying new dimensions on business culture could help us to get better understanding on family business behaviour. Additionally, because of the organizational control systems are needed to transmit and reinforce the culture of the firm (Flamholtz, 1983), we analyse the differences in management control systems between family and non-family firms. Finally, we pursue to test the effects of organizational culture and the use of a management control system on firm performance.

The remaining of the paper is organized as follows. Firstly, we determine the theoretical framework. We make a review of the empirical literature, and then we define our hypotheses. Secondly, we explain the methodology used in the empirical study: Sample description, variables and the models outlined. Thirdly, we carry out the analysis of results and finally, we include the main conclusions.

Family firm culture

The culture shows the values, rules and customs of the company. The managerial culture is a factor that can help companies to achieve the planned goals. If managers change the values, rules and customs of the company, they could modify employees' behaviour and attitude, leading to an improvement in the firm performance. In this sense, the culture is achieving importance as a managerial instrument to enhance the performance.

In previous research literature around family firms' culture, no theory supports the existence of a generally accepted values and beliefs around what a family organizational culture is. In this connection, there are some studies with different overviews on family business culture, so the different research approaches trying to identify family firms culture by building a theory have failed, or unless are heterogeneous. Following, we present the main research body on family firms culture.

Randøy & Goel (2003), James (1999), Danco (1975), and Poza (1989) identify family values like trust and paternalism that can encourage an atmosphere of commitment towards the company. According to Schein (1985), Denison et al. (2004), Gallo & Amat (2003), the family culture is made up by the beliefs and the values of the founder. In a way, these motivations are powerful cultural drivers. They sustain that family culture is rich in core values and performance- enhancing behaviours. To this effect, high levels of trust and commitment may result in greater efficiency and higher profitability than those of non-family firms (Lee, 2006). Founders are very influential and their prior knowledge and experiences may cause them to form belief systems about how to carry out daily activities (Johnson & Gill, 1993).

Habbershon et al. (2003, 1999), Chua et al. (1999), Olson et al. (2003), and Hollander & Elman (1988) maintain that the interactions between family and business subsystems generate a bundle of unique resources and capabilities that they call "familiness", carrying out a competitive advantage according to RBV (Resourcebased view). According to Hoffman et al. (2006), "family capital" is a special form of social capital (resources coming from relationships among people) that is limited to family relationships. Other proposals identify a double orientation-family oriented firms that will be rather rigid and will centralize decision making, so business serves the family (Ward, 1987), and business oriented firms, where family serves the business called business first firms (Dunn, 1995).

In accordance with Pollak (1985), the own characteristics of the family companies are included in four main concepts: altruism, loyalty, monitoring and incentives. Family altruism is the disinterested attitude among the family members to promote the well-being of the entire family members. In a way, the decisions are made keeping in mind everybody. This supposes that the family bonds are narrowed, giving place to a higher involvement and responsibility of relatives within the business. Another characteristic is the loyalty towards the family; the main concern is the family.

Therefore, the family sentiment promotes values and attitudes of respect towards the family that will be transferred to the company. Monitoring is easy and more efficient because of the joining of the business and family relationships, since the communication and linking of the family members is very transparent and quick. The incentives system works in more efficient manner since the company is a way of life and subsistence for the future generations of the family.

Some researches on family companies have tried to identify and describe the cultural attributes of the family entrepreneur. Dyer (1986) points out three typologies of family companies: Patriarchal or autocratic one, where the founder or some member of the family exercises a dominant authoritarianism, so other family members should accept his goals and decisions; collaborator one, where the founder or head of the family shares the information and the decisions with the relatives. In this type of firm, all the family members participate on the decision making process, in a way that the family shares goals and values maintaining the family solidarity. Incompatible, where the individual goals prevail, what gives place to a higher amount of problems among the family members. Under this typology, the family solidarity values are breaking due to the predominance of individual goals.

Other studies identify the paternalistic or autocratic culture as the main culture associate to family firms. According to Dyer (1986) and Sorenson (2000), the main kind of leader in a family business is paternalistic or autocratic. Autocratic leaders retain key information and decision authority, and coerce others to agree (Bass, 1990).

Patriarchal family firm owners may also have doubts about the competence of managers, who have previously little responsibility in the firm, thus reducing the level of trust (Harrison et al., 1997).

Zahra et al. (2004) research on family firms culture by testing four dimensions: Individual orientation versus group cultural orientation, internal orientation versus external cultural orientation, assumptions concerning coordination and control, and short orientation versus long-term time orientation. They compare family versus non-family firms, achieving the conclusion that external orientation in family firms' culture is a significant antecedent of entrepreneurship, improving the ability to identify opportunities.

This reasoning is reflected in the following hypothesis:

H1: Family firms hold an organizational culture different from non-family companies.

Once the culture has been defined, the second step implies using the organizational control system to transmit and reinforce the culture of the family firm throughout the organization to manage strategic and operational decisions and actions (Flamholtz, 1983). The relationships between an organisation's control system and culture are two-way because once created, they have an impact on the way values are subsequently changed, and this means culture is regarded as something manageable thought partly created through the passage of the organization (Herath et al., 2006).

The theoretical framework about the need of MCS in the family firm is based on two views. On one hand, Agency Theory and Stewardship Theory consider that family firms need to a lesser extent to implement MCS. This theoretical position is sustained by the inexistence of agency cost due to the concurrence of ownership and control in family companies (Jensen & Meckling, 1976; Fama & Jensen, 1983; Harris & Raviv, 1991; Stulz, 1999). Stewardship Theory suggests that managers behave as stewards devoted to interests of the owners, in a manner that the personal goals of family managers may be subordinated to company goals because they are intrinsic to family managers (Chrisman et al., 2007; Miller & Le Breton-Miller, 2006; McConaughy et al., 2001; Daily & Dollinger, 1993; Thompson, 1960). In this context, Corbetta & Salvato (2004) argue that control mechanism on family managers may lower steward's motivation provoking a negative effect on the pro-organizational behavior of family managers. These facts lead Stewardship theory to predict that owners will not impose management control mechanisms on family manager because imposing them on family managers will lower performance (Chrisman et al., 2007).

On the other hand, authors such as Carney & Gedajlovic (2002) affirm that the coupling of ownership and control allows majority of owners to adopt inefficient practices that reflect their own particularistic values and interests. In that sense, Gómez-Mejía et al. (2001), Schulze et al. (2002) and Lubatkin et al. (2005) indicate that ownercontrol engenders agency problems because the effectiveness of external control mechanisms is compromised when ownership is concentrated. These authors find agency costs associated to family firms, thought of their nature and basis are different from the case of the companies where ownership and control are not together. This way, the agency costs in the case of family companies come from self-control of owner-manager and the problems originated by the altruism of the family. Agency costs in family firms give place not to allocate managing positions according to the abilities of the candidates, but exclusively for family altruism. Because of agency cost due to altruism, the firm could bear inefficiency problems in the management function. These facts lead to predict, for the case of family firms, the need to control the decision-making process in hands of family managers.

Most of the previous empirical evidence supports family firms are characterized by a lower and a different use of MCS than that of non-family firms (Kotey, 2005; Chua et al. 2003; Perren et al., 1999). Perren et al. (1999) and Willingham & Wright (1985) confirm that owner-managers in small firms move from informal methods of financial decision-making process to methods that are more formal, depending on the business life cycle. Business growth seems to be the factor that determines the change towards a more formalized and transparent control system. Furthermore, financial management decisions of owner-managers are based upon evolutionary change and dynamic processes, as well as on relationships established between owners and external advisers, such as accountants, bank managers or other professionals (Deakins et al., 2002).

Ho & Wong (2001) indicate that owned-managed companies are less transparent when providing financial information, and they are more reluctant to facilitate voluntary accounting and financial information. Financial infomation in family businesses can be more partial than in non-family businesses (Gallo, 1998). From another point of view, according to Trostel & Nichols (1982), financial controls are used in family firms with the main purpose of tax minimization, instead of being used for strategic and performance decisions. Sorenson (2000) found negative or neutral relationships between autocratic leadership and formal planning in family businesses. In general, management practices tend to be informal in small family firms, with relatively low percentages of small firms undertaking management processes. Most of small family firms prepare regular income and expenditure reports. However, they use to a lesser extent budget forecasting than non-family firms (Kotey, 2005).

In the research, we propose three main tools to assess the management system of family firms: cost accounting systems, short-term and cash-flows budgets, and financial analysis. A cost accounting system allows managers to elaborate information for decision-making process regarding to inventories valuation, cost control, cost-benefit analysis, and products and markets performance. Financial planning lets firms assess their financial requirements with enough time. Thus, efficiently considering the different financing choices is possible. Finally, a financial analysis helps the company to realise its strengths and weaknesses, as far as liquidity, solvency, indebtedness and performance are concerned.

These arguments lead to the formulation of this hypothesis:

H2: Family firms use to a lesser extent management tools for the decision-making process than non-family firms.

The central issue associated with organizational culture is its linkage with organizational performance. An increasing body of evidence supports a linkage between an organization's culture and its firm performance. Economic turbulence cannot provide sustainable performance unless an organisation's culture and people are fully prepared and aligned to support changes. Culture is what distinguishes truly high-performing organisations from the pack (Jeuchter et al., 1998).

Evidence has confirmed that companies that put emphasis in key managerial components, such as customers, stakeholders and employees, and leadership, outperform those that do not have these cultural characteristics (Kotter & Heskett, 1992; Wagner & Spencer, 1996). Companies with strong cultures get higher performance than those with weak cultures (Kotter & Heskett, 1992; Gordon & Di Tomaso, 1992; Burt et al., 1994). Indeed, Kotter & Heskett (1992) revealed that during a 10-year period, companies that deliberately built their cultures achieved better performance than those without a clear culture. Sorensen (2002) showed that companies with strong cultures adapt quicker to the changing environment. The well-developed organizational cultures facilitate the stability of the performance in uncertainty environments. However, as the volatility increases, these benefits dramatically decrease. This pattern is consistent with the main trade-off between exploration and exploitation pointed by March (1991). This author suggests that companies with strong culture are extremely good at taking advantage of established competences, but they find difficulties to discover new competences that best fit with the changing environment conditions. These results suggest that the best strategy for companies would be to develop cultures clearly based on the exploratory learning attitude and innovation (Gordon & Di Tomaso, 1992).

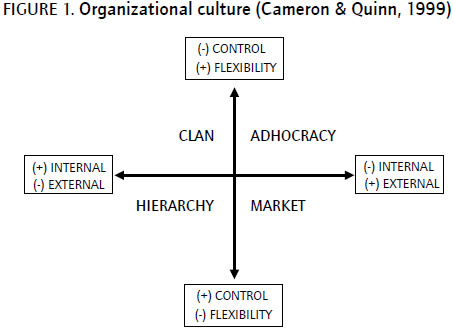

"Organizational Culture Assessment Instrument" proposed by Cameron & Quinn (1999) identifies four cultures: market, hierarchy, clan and adhocracy. The market culture puts emphasis on the competitive advantage and the supremacy in the market, leading to achieve the best performance. Regarding hierarchical culture, the main characteristic is its focus on the bureaucratic and formal aspects of organizations, giving place to a low business performance. Adhocratic culture highlights the importance of innovation and a risk-taking approach. Finally, clan culture stresses values such as the loyalty, tradition, in a manner where internal focus on the organization could lead to a lack of attention on the changing needs of the market. The orientation of the business on the external over the internal aspects is associated to a higher performance (Sorensen, 2002). Additionally, Nemeth (1997) considers that innovative culture strengthens the cohesion, the loyalty and some clear rules of attitudes and appropriate behaviours. Furthermore, it promotes the autonomy of the working teams, the management support for innovative research, the departmental relationships, and the perception of a competent management, as well as trust and honesty (Shirivastava & Souder, 1987).

Considering these premises, we establish the following hypothesis:

H3: The innovative culture influences positively the family firm performance.

Regarding family firm arguments supported by Schulze et al. (2002) and Lubatkin et al. (2005), they predict a positive effect of the use of MCS mechanisms on performance because of the elimination of inefficiencies caused by the negative side of altruism and self-control. Analysing an issue we have to keep in mind that MCS are not only used to control manager's actions but also to improve the decision making process. According to Simons (1995), the key issue of management control systems is to manage the trade-off between creative innovation and predictable goal achievement, and to balance the dilemma between control and flexibility.

Previous research literature confirms the effect of the use of management control systems on performance, and its importance on the innovation process. In this sense, Chapman (1997) argues that innovation requires adequate use of management control systems. Dávila (2000) positively relates management control systems with innovation and performance, and they are needed to ensure innovation effectiveness (Simons, 1995). Bright et al. (1992) find a relationship between the development of new cost techniques and the improvement of product performance. Chenhall & Langfield-Smith (1998), on a sample of 140 Australian industrial companies, find evidence on the positive relation between use of management control systems and company performance. Adler et al. (2000) show, after analysing 165 industrial companies of New Zealand, that management control systems positively influences product performance. Eventually, McMahon & Davies (1994) state a positive correlation between amplitude and frequency of accounting information elaborated by the company and the net profit per employee. Bisbe & Otley (2004), on a sample of 120 Spanish companies, show that the greater the use of management control systems is, the greater the effect of innovation on SME performance is. Kennedy & Affleck-Graves (2001) indicate how the implementation of ABC cost control systems has a positive effect on performance.

These arguments lead to the following hypothesis:

H4: The use of management control systems increases the family firm performance.

Sample

Data was obtained from the project Introducción de la Cultura Innovadora en las Empresas, funded by the European Union. This database contains qualitative and quantitative information gathered through a self-administered questionnaire that was addressed to the company manager. The fieldwork was developed in May and June 2003. Our target population was composed of companies from 10 to 250-employee size. The distribution of companies in the population has been considered starting from the Directorio de Empresas del Instituto Nacional de Estadística. The sample is composed by 436 Spanish SMEs companies (285 family firms and 151 non-family firms). In table 1, we show the profile of the sample.

Several empirical studies establish different definitions on the concept of family firm (Villalonga & Amit, 2006; Miller et al., 2007). All of them consider whether ownership and control of the company relies on hands of the family group, as well as whether most of management positions are handled by the members of the family group (Sharma et al., 1997; Westhead & Cowling, 1998; Upton & Petty., 2000; Chua et al., 2003). We tend to agree with Basu (2004) that in family firm research there is no consensus on the exact definition of a family business. Nonetheless, in 2009 the European Group of Owner Managed and Family Enterprises (GEEF) and the Family Business Network (FBN) accepted the following definition: 1. The majority of votes is in possession of the natural person(s) who established the firm, or in possession of the natural person(s) who has/ have acquired the share capital of the firm, or in the possession of their spouses, parents, child or children's direct heirs; 2. The majority of votes may be indirect or direct; 3. At least one representative of the family or kin is involved in the management or administration of the firm; 4. Listed companies meet the definition of family enterprise if the person who established or acquired the firm (share capital) or their families or descendants possess 25 per cent of the right to vote mandated by their share capital.

According to GEEF definition on family firms, we have just able to accomplish with the first criteria-ownership in the capital structure-so we have considered a business to be a family firm when the family holds more than 50% of the capital ownership. To test for non-6 response bias, we use late respondents as surrogates for non-respondents (Nwachukwu et al., 1997). Responses of firms answering to the initial mailing (85% of the sample) were tested with those responding to the follow-up (15% of the sample). No responses were significantly different between the two groups using t and chi-squares tests for all the variables in the models.

Measurement of variables

Organizational culture variable.

This concept is measured by the Organizational Culture Assessment Instrument proposed by Cameron & Quinn (1999). These authors identify four cultures: market, hierarchy, clan and adhocracy, in relation to two dimensions. The first dimension shows the company orientation towards control, stability and order. The companies within this dimension fluctuate between, on one hand, those with high stability, predictable and order emphasis, and on the other hand those maintaining high flexibility levels, organic structures and adaptation skills. The second dimension regards the internal versus external business orientation. Considering these two variables, we obtain the four types of culture (see Figure 1).

The clan culture is typical in companies that look for the internal control of the organization but with flexibility, worrying about its employees and showing a special customer concern. The adhocratic culture is related to companies focused on external aspects of the organization, looking for a high degree of flexibility and innovation. The market culture appears in those organizations that stress the external orientation of the business, but considering at the same time the need for control and internal stability. The hierarchical culture pays special attention to internal aspects requiring control and stability. The literature states that in any organization, in spite of having features of the four cultures, one culture usually prevails over the others.

In the questionnaire, managers were asked to distribute 100 points among four possible answers in relation to "company definition", "managerial style", "shared values by personnel" and "key successful aspects of the business" (see Table 2).

The total value of the clan culture is obtained by adding the relative points to the answer "a" for the 4 questions. The total value of the adhocratic culture implies the sum of the points associated to the answers "b". The total value of the market culture contains the points of the answers "c". The total value of the hierarchical culture is the sum of the "d" answers.

Clan culture value = (a1 + a2 + a3 + a4) = P1

Adhocratic culture value = (b1 + b2 + b3 + b4) = P2

Market culture value = (c1 + c2 + c3 + c4) = P3

Hierarchical culture value = (d1+ d2+ d3 + d4) = P4

Innovative culture variable.

The values, rules and customs of an innovative culture are in accord with those of the adhocratic and the clan cultures. This argument is according to previous empirical results, since family firms with a greater innovational posture having both less formality and greater decentralization (Craig & Moores, 2006). Innovative companies hold a clear and flexible orientation and are prone to changes. For this reason, a new variable "innovative culture" has been calculated through a mathematical algorithm. According to the results of a panel of organisational research experts, this algorithm is composed by three components that measure the value of the innovative culture. This variable ranges between 0 and 1. The more innovative the company is, the higher the variable value is.

Innovative culture = (Z1 + Z2x100 + Z3x100)/300

Where:

Z1 reflects the total importance of clan (P1) and adhocratic (P2) cultures. Z1= P1 + P2.

Z2 measures the importance of adhocratic culture in relation to the sum of cultures that conforms the innovative culture (adhocratic and clan cultures). This component is needed because the panel of experts considered that the adhocratic culture is more important than the clan culture in the definition of the innovative culture. Z2 = P2/(P1 + P2). Z3 considers the difference between the importance given to both clan and adhocratic cultures. According to the panel of experts, the smaller the difference between adhocratic and clan cultures is, the more innovative the company is. Z3 = 1 - [(|P2 - P1|)/(P1 + P2)]

Management Control Systems variable (MCS)

To analyse the level of MCS use, we measure the subjective perception of managers about three items through a 5-point Likert scale. The items considered are management accounting techniques, short-term cash-flow budgets and financial analysis. The variable is the average of those three items, ranging from 1 to 5. Choe (2004) and Hoque & James (2000) have used this type of measure. Table 3 shows the reliability of the scales, verifying the consistency of the variable. Furthermore, by means of a factorial analysis, we prove that the previous indicators sum up in a single factor properly reflect the considered measure about the use of MCS.

Control variables.

Size. This variable is the natural logarithm of the number of full-time equivalent employees in 2003. This type of studies has been broadly used the number of employees as a size measurement (Malmi, 1999; Hoque & James, 2000).

Age. This variable is the natural logarithm of the age of the firm. Managers have used this variable in the family firm context because this kind of firms could face some family problems associated to complexity of the succession process (Daily & Dollinger, 1993; Ward, 2001).

Sector. As manufacturing and service firms compose our sample, we consider a dummy variable that takes value 0 when the company belongs to the service sector and value 1 when the firm belongs to the manufacturing sector.

Performance variable.

Traditionally, researchers have successfully measured performance in family-firms studies with quantitative information, through measures of financial performance (Anderson & Reeb, 2003; Villalonga & Amit, 2006) or operational performance (Lee, 2006). Nevertheless, we have used the manager's perception about the competitive position of the company, due that we wanted to consider performance dimensions not contained in accounting information, such as intangible assets, essential for competitive success (Kaplan & Norton, 1993). Other problem we wanted to solve through qualitative information is the lag between the date of the survey and the publication of the accounting information, since annual accounts are made publicly available around seven months after the end of the accounting period. Finally, competitive success is a relative concept (AECA, 1988), thus the relative position of the company compared to its competitors becomes one of the main indicators of success or failure.

We have used the performance variables proposed by Quinn & Rohrbaugh (1983). These authors set a framework for the organizational analysis, distinguishing three dimensions within organizational efficiency. The first dimension relates to the organizational approach, from an internal point of view, based on a "micro" perspective about good understanding and development of personnel, to an external one, whose emphasis relies on a "macro" level of business success. The second dimension is focused on the organizational structure, making emphasis on business stability and flexibility. The third dimension is based on organizational means and aims. Four performance models arise from the combination of these three dimensions:

Model of internal processes. This model focused on internal control, giving high importance to the information communication, and considering stability and control as the main goals.

Model of open system. This model is founded on external flexibility, considering as main goals growth, resources and external support.

Rational model. This model is related to control from an external point of view, focusing on efficiency and productivity criteria.

Model of human relations. This model pays attention to flexibility from an internal point of view to develop the human resources within the firm.

To assess these models, 12 items are used (3 items per each model) through a Likert scale from 1 to 5. We build a global performance variable, as the average of the 12 items, with a theoretical rank from 1 to 5. Table 4 shows the items used as well as the reliability of the scales and the statistic tests.

In table 5, we include the correlations matrix among all the variables used in the analysis. As we can verify the correlation values among independent variables are normally correct, so we discard multicollinearity among independent variables.

Statistical models

Once we have defined the two groups of analysis (family firms and non-family firms), our interest is to study the differences between these two groups in relation to the behaviour of the variables: organizational culture and MCS use. To test these differences, we use the ANOVA test, and Kruskall-Wallis test when the hypotheses of normality and variances homogeneity are not matched by the data. From a multivariate point of view, we use logit regression analysis. The Logit model is particularly suited for the analysis since the dependent variable (Family versus non-family firms) is an indicator variable (see Pindyck & Rubinfeld, 1981). By interpreting the regression coefficients, we can analyze the association between a series of independent variables and the fact that a firm is a family firm. The Logit model to test H1 is the following:

Family firmi = b0 + b1·culturei + b2·sizei + b3·agei + b4·sectori + εi

Where, Family firm is a dummy variable that takes value 1 to identify the family firms, and value 0 to identify nonfamily firms. Culture identifies the five types of culture studied (clan, adhocratic, hierarchical, market and innovative cultures). Size is the natural logarithm of the number of full-time equivalent employees in 2003. Age is the natural logarithm of the age of the firm. Sector takes value 0 for service firms and value 1 for manufacturing firms. We run this logit model five times, one considering each type of culture. The Logit model to test H2 is the following:

Family firmi = a0 + a1·MCSi + a2 ·sizei + a3·agei + a4·sectori + εi

Where, MCS is the Management Control Systems use (average of 3 tools: management accounting, short-term cashflow budgets and financial analysis).

The research starts testing the existence of organizational culture and management control systems differences between family and non-family firms, to identify the main characteristics associated to family organizational culture. Nevertheless, once we have proved family firms maintain a differentiated culture and MCS from non-family businesses, we just focus on the family firms sample because of our second purpose regards to analyse the influence of this particular organizational culture on performance of the family firm.

To verify the effect of organizational culture (H3) and MCS use (H4) on family firm performance, we use the hierarchical regression analysis. This method allows us to introduce the independent variables in different steps, so we can analyse the effects of each group of independent variables. In our case, firstly, we introduce the control variables and the culture variables, and later on, we introduce the MCS use variable. The standardized coefficients express the expected change in the dependent variable for each variation unit in the independent variables. The comparison between the two models is carried out through the change in R2, that indicates if the new variable (MCS use), incorporated to the second model, has influence on the analysed dependent variable (Global Performance).

Model 1: Global Performancei = c0 + c1·culturei + c2· sizei + c3·agei + c4·sectori + εi

Model 2: Global Performancei = c'0 + c'1·culturei + c'2·sizei + c'3·agei + c'4·sectori + c5 ·MCS + ε'i

Where Global Performance is the average of the 12 items linked to the Quinn and Rohrbaugh's model (1983). These models are estimated only for the family firm sample. We estimate one model for each type of culture.

Table 6 reveals the mean value of each type of culture for family and non-family firms. On one hand, the level of adhocratic culture in family firms (19.84) is significantly lower than in non-family firms (22.08). The same result is found for the level of innovative culture, where non-family firms are characterised by a more innovative culture (0.566) than that of family firms (0.541). On the other hand, the hierarchical culture is more important for the family firms. In fact, the mean value of hierarchical culture level ascends to 26.92 for family firms, while this value decreases to 22.69 for non-family firms. This difference is significant at 95%.

Table 7 shows the results from the five logit regression analyses by examining the importance of the relationships between the probability of being a family firm and the different types of culture (clan, adhocracy, market, hierarchy, innovation), taking into account the control variables. The chi-square statistics indicate that the models fit the data fairly well, except for the estimations that consider clan and market cultures as independent variables. The coefficients for adhocratic culture (-0.022), hierarchical culture (0.020) and innovative culture (-1.614) are highly significant in the different estimations. These results verify H1 from a multivariate point of view-family firms are characterised by a different culture than non-family firms. In fact, family firms are less adhocratic, more hierarchical and less innovative than non-family firms are. These findings are in line with previously identified culture values in family businesses research, such as autocratic leadership and patriarchal or paternalistic culture (Marshall et al., 2006; Kotey, 2005; Sorenson, 2000; Harrison et al., 1997; Bass, 1990).

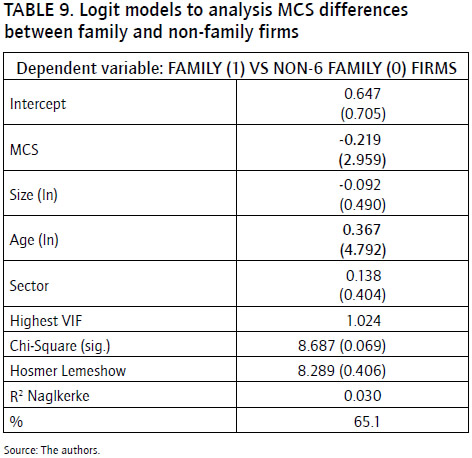

Table 8 presents the results about the differences in MCS use. The univariate analysis indicates that non-family firms use these managerial tools more than family firms do. Indeed, in a scale from 1 to 5, the mean use of these tools is 3.61 for family businesses, while this value increases to 3.79 for the non-family firms. This difference is significant at 95% level. The difference is due to a higher level of implementation of cash-flow budgets and the firm financial position analysis.

Table 9 reveals the results from the logit regression analysis by exploring the importance of relationships between the probability of being a family firm and the use of MCS, taking into account the control variables. The chi-square statistic indicates that the model fits the data fairly well. The coefficient associated to the MCS is negative (-0.219). This finding leads to consider that family firms use MCS more than non-family firms. These results verify H2, showing differences between family and non-family firms in terms of MCS use.

Table 10 shows estimations of models 1 and 2 considering the five types of culture as independent variables separately. We note in all the models independent variables have a variance inflation factor (VIF) below 1.08, so we discard the presence of multicollinearity. The test of White (1980) has not rejected homoscedasticity in all the models. Therefore, coefficients show consistent standard error, which ensures the relevance and reliability of our estimations.

About the third hypothesis, the most innovative cultures- adhocratic and clan-have a positive and significant influence on performance. In addition, the innovative culture variable (as a mix of adhocratic and clan cultures) has a positive coefficient with a very high significance (99%). Therefore, we can accept our hypothesis that considers those companies with more innovative cultures achieve a higher performance. Our results are in line with those of Bhaskaran (2006), Hsueh & Tu (2004), Rosenau et al. (1996), Morcillo (1997), DiBella & Nevis (1998), and Tushman & O'Reilly (2002), who support innovative firms perform better.

These results are showed in Table 10 for each model 1, where the standardised coefficients associated to the culture variables are positive and significant for estimations type 1 (clan culture: 0.226***), type 2 (adhocratic culture: 0.184***) and type 5 (innovative culture: 0.257***). Nevertheless, we cannot obtain significant evidence on the relationship between market culture and performance (model 1 for type 3), since the global fitness of the model is hardly significant (F: 1.550). We find a negative and significant relationship between hierarchical culture and performance (model 1, type 4: -0.246***). This result also proves that the degree of hierarchical culture is associated with a worse performance.

Models 2, testing the MCS use, reveal the results of the hierarchical regressions (Table 10). These results show the positive and significant effect of MCS use on performance, once we have taken into account the influence of culture. This is so because the change in R2 is significant for each type of estimation, as F statistic values disclose. In models 2, MCS use has a significant and a positive coefficient (Type 1: 0.163**; Type 2: 0.144**; Type 3: 0.161**; Type 4: 0.148**; Type 5: 0.129**). Therefore, H4 is confirmed.

There is not a consensus about a theory that supports the existence of a generally accepted values and beliefs around what the family organizational culture is. The research approaches trying to identify a unique family firm culture are heterogeneous and makes the comparison between studies difficult. In this sense, the main aim of the study is to contribute identifying aspects associated to family business, to fill a gap in literature around what the cultural and organizational characteristics associated to family firms are. With this research we try to go one step forward contributing with new results to build a general theory on family firms, starting from a broadly tested model which classifies business in five cultures: market, hierarchy, clan, adhocracy (Cameron and Quinn Model, 1999), adding an innovative culture as a mix of clan and adhocratic cultures. We compare organizational culture variables between family and non-family firms to analyse the cultural differences filling a gap in the literature identified by Zahra et al. (2004).

The findings confirm the existence of cultural differences between family and non-family firms. In a manner, family firms have their own cultural values and beliefs. They maintain higher hierarchical and lower adhocratic values than non-family firms. That means non-family firms are more dynamic and adventurous than family businesses. In the same way, regarding managerial style, non-family firms concede more importance than family firms to promote individual initiatives, risk taking and innovation, so there is a commitment to innovation and continuous development.

Family firms appear to be more hierarchical than non-family firms are. Thus, they are more formalized and structured companies, promoting employment stability and little uncertainty. This fact is related to one of the main concerns of the founder, since the altruism towards his relatives refers to get a stable and lasting employment. Besides, a more hierarchical organization supposes to keep a respect towards established rules and company policies, as well as to accomplish with organizational hierarchy. Regarding strategic issues, a hierarchical organization within family firms implies looking for efficiency, development of planning for the production function, as well as implementing low costs strategy.

Organizational culture is linked to firm performance (Rosenthal & Masarech, 2003), therefore we test the effects of organizational culture on family-firms performance. The results point out towards a negative effect of hierarchical culture on performance. Furthermore, adhocratic and clan cultures have a positive and significant influence on performance. Family firms that promote understanding the company like a great family-sharing the same values such as loyalty and commitment, working as a team and worrying about employee satisfaction-will develop a clan culture and reaching higher performance. Besides, those family firms, which are characterised by a dynamic and adventurous view of the firm, by individual initiatives and innovation as key aspects in managerial style, and commitment towards innovation and development of new and innovative products as key values shared by employees, will develop an adhocratic culture and achieving higher performance.

We also measure the effect of the innovative culture variable (as a mix of adhocratic and clan cultures) to contribute enhancing the previous limited research on the role of innovation within family firms (Craig & Moores, 2006). To this effect, identifying new dimensions on business culture could help us to get better understanding on family business behaviour. The results confirm the more innovative the family firm is, the higher performance the firm will achieve.

Additionally, due to the organizational control systems are needed to transmit and reinforce the culture of the firm (Flamholtz, 1983), we analyse the differences in management control systems between family and non-family firms. In this case, we take into account specificities of family firm within the framework of Agency and Stewardship Theories. We test the degree of implementation of a cost accounting system, short-term and cash-flow budgets and the use of financial analysis for the decision-making process between family and non-family firms. Our results confirm the less use of such management controls in the case of family firms. We have obtained evidence to confirm that the implementation of management controls in family firms affects positively the firm performance. A priori, it seems to be evidence to sustain the reasoning followed by Schulze et al. (2002) and Lubatkin et al. (2005) that predicts a positive effect of the use of MCS mechanisms on performance because the elimination of inefficiencies caused by the negative side of altruism and self-control. Analysing this issue, we have to keep in mind that MCS are not only used to control manager's actions, but also to improve the decision-making process. According to Simons (1995), the key issue of management control systems is to manage the trade-off between creative innovation and predictable goal achievement, and balancing the dilemma between control and flexibility.

This research analyses the relationship among organizational culture, management control systems and performance of family firms, using a sample of 436 family (285) and non-family (151) firms. To measure family firm culture, we base our research on the Organizational Culture Assessment Instrument proposed by Cameron & Quinn (1999), in which four cultures can be identified: market, hierarchical, clan and adhocratic. This model has been improved by building a new type of culture called "innovative culture", because of innovative culture allows companies to achieve sustainable competitive advantages. The results confirm organizational cultural differences between family and non-family firms. Family firms have their own culture, since they have higher hierarchical and lower adhocratic values than non-family firms. These results are in line with previously identified culture values in family business research, such as autocratic and patriarchal or paternalistic culture. Furthermore, the empirical evidence proves that an innovative culture (a mixture of clan and adhocracy) influences positively on family firm performance, while a hierarchical culture has the opposite effect.

As far as management control systems are concerned, we found non-family firms use managerial tools more than family firms do. Additionally, our findings show that management control systems allow the company to achieve higher organizational performance. Thus, we verify that management control systems become an essential factor for family firms, since they provide essential information for decision-making process.

We expect our results to be useful for family firms' entrepreneurs, because they should be aware of benefits from the implementation of an innovative culture and the use of management control systems. They should understand that an innovative attitude implies the adoption of new ideas and values that are not threats but strengths, to gain competitiveness and assure the future of the family firm. The best strategy could be to focus on exploratory learning and innovation. In this connection, family firms should face key issues such as the succession process, internationalization, professionalization, from an innovative point of view. We also expect the results of the study help policy makers to drive their efforts in continually facilitating the progress of family firm, knowing they are main contributors to welfare and well-being of developed economies.

The research has some limitations that provide avenues for future research. Several researchers have developed many definitions to identify the concept of family firm, considering variables related to ownership and control. Unfortunately, in this research we have only been able to identify the family ownership in the equity. In future research we will consider family firm when it has the following characteristics: the family owns and controls the company, as well as the decision-making process, and there is a clear intention of passing on the company to the next generation, according to Sharma et al. (1997), Romano et al. (2000), and Monreal et al. (2002).

To test the use of management control systems in family firms with the intention of reducing agency costs, to control outside members in the board of directors would be interesting for the characteristics associated to the board of directors, as well as for founder's tenure. Another important agency cost control mechanism to consider is the incentive compensation policies (Chrisman et al., 2007). With the information of the study, we are not able to identify the causality between the fact of being a family firm and the less use of these controls. In this sense, we will consider in future research the moderate effects associated to self-control of owner-manager and the problems originated by the altruism of the family.

We are aware that we do not consider some important information regarding specific characteristics from country culture, that should be included in future research. Country cultural values will determine the general framework the entrepreneur faces when he starts and runs a business. Besides, we should interpret the results cautiously, since the sample reflects just the opinions from national family-firms. This fact does not allow the generalization of results. Moreover, the survey is self-reported and it was only launched to the manager of the company, missing some other important perceptions about the family firm culture, such as those from family members, employees and board members.

Furthermore, the study only focuses on private small and medium sized companies, the extension of the results to large sized and public companies will help us to understand the complete population of family firms. This line of research is justified because governance mechanisms of large sized family companies will lead to a different approach to Agency and Stewardship Theories (Jaskiewicz & Klein, 2007). Private small and medium sized firms have a high concentration of ownership and strong presence of owners in the management, thus the goal alignment between owners and managers is higher than in large listed companies.

Additionally, the results of the research would improve and strengthen if we could consider a longitudinal database instead of cross-sectional information. In this sense, the usefulness of our results would improve verifying the positive effect of the implementation of an innovative culture and MCS on family firm performance from a longitudinal perspective, increasing the awareness of family firms about the importance to consider these factors as a source of competitive advantages.

Adler, R., Everett, A.M. & Waldron, M. (2000). Advanced management accounting techniques in manufacturing: utilization, benefits, and barriers to implementation. Accounting Forum, 24(2), 131-50. [ Links ]

AECA. (1988). La competitividad de la empresa: concepto, características y factores determinantes. Principios de Organización de Empresas. Documento 4. Madrid: AECA. [ Links ]

Anderson, R.C. & Reeb, D.M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58, 1301-1328. [ Links ]

Barney, J.B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99-120. [ Links ]

Bass, B.M. (1990). Bass and Stogdill's handbook of leadership. New York: The Free Press. [ Links ]

Basu, A. (2004). Entrepreneurial aspirations among family business owners: An analysis of ethnic business owners in the UK. International Journal of Entrepreneurial Behaviour & Research, 10(1-2), 12-33. [ Links ]

Bhaskaran, S. (2006). Incremental innovation and business performance: Small and medium-size food enterprises in a concentrated industry environment. Journal of Small Business Management, 44(1), 64-80. [ Links ]

Bisbe, J. & Otley, D. (2004). The effects of the interactive use of management control systems on product innovation. Accounting, Organizations and Society, 29, 709-737. [ Links ]

Bright, J., Davies, R.E., Downes, C.A. & Sweeting, R.C. (1992). The deployment of costing techniques and practices: A UK study. Management Accounting Research, 3, 201-211. [ Links ]

Bruns, W.J. & Waterhouse, J.H. (Autumn 1975). Budgetary control and organization structure. Journal of Accounting Research, 13, 177-203. [ Links ]

Burt, R. S., Gabbay, S. M., Holt, G. & Moran, P. (1994). Contingent organization as a network theory: The culture performance contingency function. Acta Sociológica, 37, 345-370. [ Links ]

Cameron, K. S. & Quinn, R. E. (1999). Diagnosing and changing organizational culture. Base on the competing values framework. Reading, Mass: Addison-Wesley. [ Links ]

Carney, M. & Gedajlovic, E. (2002). The coupling of ownership and control, and the allocation of financial resources: Evidence from Hong Kong. Journal of Management Studies, 39(1), 123-146. [ Links ]

Chapman, C. S. (1997). Reflections on a contingency view of accounting. Accounting Organizations and Society, 22, 189-205. [ Links ]

Cheng, L. K. & Tao, Z. (1999). The impact of public policies on innovation and imitation: the role of technology in growth models. International Economic Review, 40(1), 187-207. [ Links ]

Chenhall, R.H. & Langfield-Smith, K. (1998). Adoption and benefits of management accounting practices: An Australian study. Management Accounting Research, 9, 1-19. [ Links ]

Chenhall, R.H. & Langfield-Smith, K. (1998b). The relationship between strategic priorities, management techniques and management accounting: An empirical investigation using a systems approach. Accounting, Organizations and Society, 23(3), 243-264. [ Links ]

Choe, J.M. (2004). The relationships among management accounting information, organizational learning and production performance. Journal of Strategic Information Systems, 13, 61-85. [ Links ]

Chrisman, J.J., Chua, J.H., Kellermanns, F.W. & Chang, E.P.C. (2007). Are family managers agents or stewards? An exploratory study in privately held family firms. Journal of Business Research, 60(10), 1030-1038. [ Links ]

Chua, J.H., Chrisman, J. & Sharma, P. (1999). Defining the family business by behaviour. Entrepreneurship Theory and Practice, 23(4), 19-39. [ Links ]

Chua, J.H., Chrisman, J.J. & Steier, L.P. (2003). Extending the theoretical horizon of family business research. Entrepreneurship Theory and Practice, 27(4), 331-338. [ Links ]

Corbetta, G. & Salvato, C. (2004). Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence. Entrepreneurship Theory & Practice, 28(4), 355-362. [ Links ]

Craig, J.B. & Moores, K. (2006). A 10-year longitudinal investigation of strategy, systems, and environment on innovation in family firms. Family Business Review, 19(1), 1-10. [ Links ]

Daily, C.M. & Dollinger, M.J. (1993). Alternative methodologies for indentifying family versus non family-managed businesses. Journal of Small Business Management, 31, 79-90. [ Links ]

Danco, L.A. (1975). Beyond survival: A business owner's guide for success. Cleveland, Ohio: USA Center for Family Business. [ Links ]

Dávila, A. (2000). An empirical study on the drivers of management control systems design in new product development. Accounting, Organizations and Society, 25, 383-410. [ Links ]

De Long, D. & Fahey, L. (2000). Diagnóstico de las barreras culturales frente a la gestión del conocimiento. Academy of Management Executive, 14(4), 113-127. [ Links ]

Deakins, D., Morrison, A. & Galloway, L. (2002). Evolution, financial management and learning in the small firm. Journal of Small Business and Enterprise Development, 9(1), 7-16. [ Links ]

Denison, D.R., Lief, C. & Ward, J.L. (2004). Culture in family-owned enterprises: Recognizing and leveraging unique strengths. Family Business Review, 17(1), 61-70. [ Links ]

DiBella, A. & Nevis, E. C. (1998). How organizations learn: An integrated strategy for building learning capability. San Francisco: Jossey-Bass. [ Links ]

Dodero, S. (2002). El secreto de las empresas familiares exitosas. Buenos Aires: El Ateneo. [ Links ]

Dunn, B. (1995). Success themes in Scottish family enterprises: Philosophies and practices through generations. Family Business Review, 8, 17-28. [ Links ]

Dyer, W. (1986). Cultural change in family firms. San Francisco: Jossey-Bass. [ Links ]

Fama, E.F. & Jensen, M.C. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325. [ Links ]

Flamholtz, E.G. (1983). Accounting, budgeting and control systems in their organizational context: Theoretical and empirical perspectives. Accounting, Organizations and Society, 8(2-3), 153-169. [ Links ]

Gallo, M.A. (1998). La sucesión en la empresa familiar. Barcelona: Colección Estudios e Informes de la Caixa 12. [ Links ]

Gallo, M.A. & Amat, J.M. (2003). Los secretos de las empresas familiares centenarias. Barcelona: Deusto. [ Links ]

Gómez-Mejía, L., Núñez-Nickel, M. & Gutiérrez, I. (2001). The role of family ties in agency contracts. Academy of Management Journal, 44(1), 81-95. [ Links ]

Gordon, G.G. & Di Tomaso, N. (1992). Predicting corporate performance from organizational culture. Journal of Management Studies, 29, 783-799. [ Links ]

Habbershon, T.G. & Williams, M. (1999). A resource-based framework for assessing the strategic advantages of family firms. Family Business Review, 12, 1-25. [ Links ]

Habbershon, T.G., Williams, M. & MacMillan, I.C. (2003). A unified systems perspective of family firm performance. Journal of Business Venturing, 18, 451-465. [ Links ]

Harris, M. & Raviv, A. (1991). The theory of capital structure. The Journal of finance, 46(1), 297-355. [ Links ]

Harrison, R.T., Dibben, M.R. & Mason, C. (1997). The role of trust in the informal investor's investment decision: An exploratory analysis. Entrepreneurship Theory and Practice, 24(4), 63-81. [ Links ]

Herath, S.K., Herath, A. & Abdul Azeez, A. (2006). Family firms and corporate culture: A case study from a Less Developed Country (LDC). International Journal of Management and Enterprise Development, 3(3), 227-243. [ Links ]

Ho, S. & Wong, K.S. (2001). A study of the relationship between corporate governance structures and the extent of voluntary disclosure. Journal of International Accounting, Auditing and Taxation, 10, 139-156. [ Links ]

Hoffman, J., Hoelscher, M. & Sorenson, R. (2006). Achieving sustained competitive advantage: A family capital theory. Family Business Review, 19(2), 135-144. [ Links ]

Hollander, B.S. & Elman, N.S. (1988). Family-owned businesses: an emerging field of inquiry. Family Business Review, 1(2), 145-164. [ Links ]

Hoque, Z. & James, W. (2000). Linking balanced scorecard measures to size and market factors: Impact on organizational performance. Journal of Management Accounting Research, 12, 1-17. [ Links ]

Hsueh, L. & Tu, Y. (2004). Innovation and the operational performance of newly established small and medium enterprises in Taiwan. Small Business Economics, 23, 99-113. [ Links ]

James, H. S. (1999). Owner as manager, extended horizons and the family firm. International Journal of the Economics of Business, 6(1), 41-55. [ Links ]

Jaskiewicz, P. & Klein, S. (2007). The impact of goal alignment on board composition and board size in family businesses. Journal of Business Research, 60(10), 1080-1089. [ Links ]

Jensen, M. C. & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3, 305-360. [ Links ]

Jeuchter, W.M., Fisher, C. & Alford, R.J. (1998). Five conditions for high performance cultures. Training and Development, 52(5), 63-67. [ Links ]

Johnson, P. & Gill, J. (1993). Management control and organizational behaviour. London: Paul Chapman. [ Links ]

Kaplan, R.S. & Norton, D.P. (1993). Evaluación de resultados: algo más que números. Harvard-Deusto Business Review, 55, 18-25. [ Links ]

Kennedy, T. & Affleck-Graves, J. (2001). The impact of activity-based costing techniques on firm performance. Journal of Management Accounting Research, 13, 19-45. [ Links ]

Kotey, B. (2005). Goals, management practices and performance of family SMEs. International Journal of Entrepreneurial Behaviour & Research, 11(1), 3-24. [ Links ]

Kotter, J. P. & Heskett, J. L. (1992). Corporate culture and performance. New York: The Free Press. [ Links ]

Leal Millan, A. (1991). Conocer la cultura de las organizaciones. Una base para la estrategia y el cambio. Madrid: Actualidad Editorial. [ Links ]

Lee, J. (2006). Family firm performance: Further evidence. Family Business Review, 19(2), 103-114. [ Links ]

Lubatkin, M.H., Schulze, W.S., Ling, Y. & Dino, R.N. (2005). The effects of parental altruism on the governance of family-managed firms. Journal of Organizational Behaviour, 26, 313-330. [ Links ]

Malmi, T. (1999). Activity-based costing diffusion across organizations: An exploratory empirical analysis of Finnish firms. Accounting, Organizations and Society, 24, 649-672. [ Links ]

March, J.G. (1991). Exploration and exploitation in organizational learning. Annual Review of Sociology, 14, 319-340. [ Links ]

Marshall, J.P., Sorenson, R., Brigham, K., Wieling, E., Reifman, A. & Wampler, R. S. (2006). The paradox for the family firm CEO : Owner age relationship to succession-related processes and plans. Journal of Business Venturing, 21, 348-368. [ Links ]

McConaughy, D.L., Matthews, C. H. & Fialko, A.S. (2001). Founding family controlled firms: performance, risk, and value. Journal of Small Business Management, 39(1), 31-49. [ Links ]

McMahon, R. & Davies, L. (1994). Financial reporting and analysis practices in small enterprises: their association with growth rate and financial performance. Journal of Small Business Management, 32(1), 9-17. [ Links ]

Merchant, K.A. (1984). Influences on departmental budgeting: An empirical examination of a contingency model. Accounting, Organizations and Society, 9(3/4), 291-307. [ Links ]

Miller, D. & Le Breton-Miller, I. (2006). Family governance and firm performance: Agency, stewardship, and capabilities. Family Business Review, 19(1), 73-87. [ Links ]

Miller, D., Le, I., Lester, R. & Cannella, A. (2007). Are family firms really superior performers? Journal of Corporate Finance, 13, 829-858. [ Links ]

Monreal, J., Calvo-Flores, A., García, D., Meroño, A., Ortiz, P. & Sabater, R. (2002). La empresa familiar: realidad económica y cultura empresarial. Madrid: Civitas. [ Links ]

Morcillo, P. (1997). Dirección estratégica de la tecnología e innovación. Un enfoque de competencias. Madrid: Civitas. [ Links ]

Morikawa, M. (2004). Information technology and the performance of Japanese SMEs. Small Business Economics, 23, 171-77. [ Links ]

Nemeth, C. J. (1997). Managing innovation: When less is more. California Management Review, 40(1), 59-74. [ Links ]

Nwachukwu, S., Vitell, S., Gilbert, F. & Barnes, J. (1997). Ethics and social responsibility in marketing: An examination of the ethics evaluation of advertising Strategies. Journal of Business Research, 39(2), 107-118. [ Links ]

Olson, P.D., Zuiker, V.S., Danes, S.M., Stafford, K., Heck, R. K.Z. & Duncan, K.A. (2003). The impact of the family and the business on family business sustainability. Journal of Business Venturing, 18(5), 639-666. [ Links ]

Perren, L., Berry, A. & Partridge, M. (1999). The evolution of management information, control and decision-making processes in small, growth orientated, service sector businesses. Small Business and Enterprise Development, 5(4), 351-362. [ Links ]

Peteraf, M.A. (1993). The cornerstone of competitive advantage. A resource- based view. Strategic Management Journal, 14(3), 179-191. [ Links ]

Pindyck, R. & Rubinfeld, D. (1981). Econometric models and economic forecasts. New York: McGraw-Hill. [ Links ]

Pollak, R. (1985). A transaction cost approach to familiar and households. Journal of Economic Literature, 23, 581-608. [ Links ]

Poza, E.J. (1989). Smart growth: Critical choices for business continuity and prosperity. San Francisco: Jossey-Bass. [ Links ]

Quinn, R.E. & Rohrbaugh, J. (1983). A spatial model of effectiveness criteria: Towards a competing values approach to organizational analysis. Management Science, 29(3), 363-377. [ Links ]

Randøy, T. & Goel, S. (2003). Ownership structure, founding family leadership, and performance in (Norwegian SMEs: Implications for financing entrepreneurial opportunities. Journal of Business Venturing, 18(5), 619-637. [ Links ]

Romano, C.A., Tanewski, G.A. & Smyrnios, K.X. (2000). Capital structure decision making: A model for family business. Journal of Business Venturing, 16, 285-310. [ Links ]

Rosenau, M.D., Griffin, A., Castellion, G. & Anschuetz, N. (1996). The PDMA handbook of new product development. New York: John Wiley and Sons. [ Links ]

Rosenthal, J. & Masarech, M. (2003). High performance cultures: How values can drive business results. Journal of Organizational Excellence, 22(2), 3-18. [ Links ]

Schein, E.H. (1985). Organizational change and leadership: A dynamic view. San Francisco: Jossey-Bass. [ Links ]

Schulze, W.S., Lubatkin, M.H. & Dino, R.N. (2002). Altruism, agency, and the competitiveness of family firms. Managerial and Decision Economics, 23, 247-259. [ Links ]

Schwass, J. (2000). Relaciones entre propiedad y profesionales no familiares. Conferencia de la Cátedra de la Empresa Familiar, 110, Universidad de Barcelona. [ Links ]

Sharma, P., Chrisman, J.J. & Chua, J.H. (1997). Strategic management of family business: Past research and future challenges. Family Business Review, 10(1), 1-35. [ Links ]

Shirivastava, P. & Souder, W. E. (1987). The strategic management of technological innovations: a review and a model. Journal of Management Studies, 24(1), 25-41. [ Links ]

Simons, R. (March-April 1995). Control in an age of empowerment. Harvard Business Review, 80-88. [ Links ]

Sonrensen, J. (2002). The strength of corporate culture and the reliability of firm performance. Administrative Science Quarterly, 47(1), 70-91. [ Links ]

Sorenson, R.L. (2000). The contribution of leadership style and practices to family and business success. Family Business Review, 13(3), 183-200. [ Links ]

Stulz, R.M. (1999). Globalization, corporate finance, and the cost of capital. Journal of Applied Corporate Finance, 12, 8-25. [ Links ]

Thompson, T.K. (1960). Stewardship in contemporary Theology. New York: Association Press. [ Links ]

Trostel, A.O. & Nichols, M.L. (1982). Privately held companies and publicly held companies: A comparison of strategic choices and management processes. Academy of Management Journal, 25(1), 47-62. [ Links ]

Tushman, M. L. & O'Reilly III , C.A. (2002). Winning through innovation. A practical guide to leading organizational change and renewal. Boston: Harvard Business School Press. [ Links ]

Upton, N. & Petty, W. (2000). Venture capital investment and US family business. Venture Capital, 2(1), 27-39. [ Links ]

Vermeulen, P. (2004). Managing product innovation in financial service firms. European Management Journal, 22(1), 43-50. [ Links ]

Villalonga, B. & Amit, R. (2006). How do family ownership, control, and management affect firm value? Journal of Financial Economics, 80(2), 385-417. [ Links ]

Wagner, D.B. & Spencer J.L. (1996). The role of surveys in transforming culture: Data, knowledge, and action. In Kraut, A.I. (Eds.), Organizational surveys: Tools for assessment and change. San Francisco: Jossey-Bass. [ Links ]

Ward, J.L. (1987). Keeping the family business healthy: How to plan for continuing growth, profitability, and family leadership. San Francisco: Jossey-Bass. [ Links ]

Ward, J.L. (2001). Tensión y fracaso empresarial. Iniciativa Emprendedora y Empresa Familiar, 26, 38-41. [ Links ]

Westhead, P. & Cowling, M. (1998). Family firm research: The need for a methodological rethink. Entrepreneurship: Theory and Practice, 23(1), 31-57. [ Links ]

White, H. (1980). A heteroscedasticity-consistent covariance matrix and a direct test for heteroscedasticity. Econometrica, 48, 817-838. [ Links ]

Willingham, J.J. & Wright, W.F. (1985). Financial statement errors and internal control judgments auditing. A Journal of Practice & Theory, 5(1), 57-70. [ Links ]

Yasuda, T. (2005). Firm growth, size, age and behaviour in Japanese manufacturing. Small Business Economics, 24, 1-15. [ Links ]

Zahra, S.A., Hayton, J.C. & Salvato, C. (2004). Entrepreneurship in family vs non-family firms: A resource-based analysis of the effect of organizatonal culture. Entrepreneurship Theory and Practice, 28(4), 363-381. [ Links ]