Serviços Personalizados

Journal

Artigo

Indicadores

-

Citado por SciELO

Citado por SciELO -

Acessos

Acessos

Links relacionados

-

Citado por Google

Citado por Google -

Similares em

SciELO

Similares em

SciELO -

Similares em Google

Similares em Google

Compartilhar

Innovar

versão impressa ISSN 0121-5051

Innovar v.21 n.39 Bogotá jan./maio 2011

Diego A. Agudelo* & Milena M. Castaño**

* PhD in Finance, Indiana University Bloomington, USA. Associate Professor, Universidad EAFIT, Medellín, Colombia. Chair of the Master Science on Finance, EAFIT University, Medellín, Colombia. E-mail: dagudelo@eafit.edu.co

** Master Science on Finance, EAFIT University. Credit Risk Analyst of Banco de Santander, Medellín, Colombia. E-mail: mcasta16@eafit.edu.co

Recibido: diciembre de 2009 Aprobado: noviembre de 2010

Abstract:

Foreign portfolio flows have been blamed for causing instability in emerging markets, especially during financial crises. This study measured the effect of foreign capital flows on volatility and exposure to world market risk in the six largest Latin American stock markets: Argentina, Brazil, Colombia, Chile, Mexico and Peru, for around 10 years including the 2008 World financial crisis. This will test whether these flows cause instability for those markets and increase their exposure to international stock market returns. A proprietary database, from Emerging Portoflio.com and time series models, both univariate (ARCH-GARCH) and multivariate (VAR), are used to estimate the effect foreign portfolio flows on the risk variables and the causality of these effects. We found no strong evidence to support the hypothesis that foreign flows cause instability in the Latin American stock markets, in spite of some evidence of causing price pressure. Instead, the evidence points to a strong dependence of market returns on international stock and foreign exchange markets, both in means and in volatility, instrumental to transmit crisis to those markets.

Keywords:

foreign portfolio flows, emerging markets, market risk, ARCH-GARCH, VAR.

Resumen:

Los flujos capitales extranjeros de corto plazo han sido repetidamente señalados de causar inestabilidad en los mercados financieros emergentes, en particular en las crisis financieras, en lo que ha sido denominado el efecto de los "capitales golondrina". Este estudio, se estima el efecto de los flujos de capital extranjero de portafolio en la volatilidad y el riesgo sistémico mundial de los seis mayores mercados accionarios latinoamericanos: Argentina, Brasil, Chile, Colombia, México y Perú, en un período de 10 años que incluye la crisis financiera mundial del 2008. Para ello se emplean modelos econométricos de serie des tiempo, tanto de volatilidad condicional (ARCH-GARCH) como multivariados (VAR), así como la base de datos propietaria de Emerging_Portfolio.com. No encontramos evidencia decisiva para soportar la hipótesis de que dichos flujos causan inestabilidad en los mercados accionarios latinoamericanos, pero sí alguna evidencia del efecto de presión de precios ( "price pressure"). En su lugar, la evidencia apunta a que la transmisión de las crisis puede adjudicarse, en muy buena parte, a la alta interrelación de dichos mercados, tanto en rendimientos como en volatilidad, con los mercados accionarios y de divisas internacionales.

Palabras clave:

crecimiento del portafolio internacional, surgimiento de mercados, riesgo de mercado, ARCH-GARCH, VAR.

Résumé:

Les flux de capitaux étrangers à court terme ont été souvent accusés de produire un manque de stabilité pour les marchés financiers émergents, particulièrement lors de crises financières, ce qui a été dénommé effet de capitaux «golondrina». Cette recherche estime l'effet des flux de capitaux étrangers du portefeuille sur la volatilité et le risque systémique mondial des six plus grands marchés actionnaires latino-américains: L'Argentine, le Brésil, le Chili, la Colombie, le Mexique et le Pérou, durant une période de 10 ans, comprenant la crise financière mondiale de 2008. Pour ce faire, des modèles économétriques de série de temps, autant de volatilité conditionnelle (ARCH-GARCH) que multi variés (VAR) sont utilisés, ainsi que la base de données propriétaire de Emerging_Portfolio.com. Les résultats obtenus ne permettent pas d'établir de façon évidente que ces flux entraînent un manque de stabilité des marchés actionnaires latino-américains, mais ils mettent plutôt en évidence l'effet de pression sur les prix («price pressure»). Par contre, il est évident que la transmission des crises peut être attribuée, en grande partie, à l'interrelation élevée de ces marchés, autant en rendements qu'en volatilité, avec les marchés actionnaires et de devises internationales.

Mots-clefs:

croissance du portefeuille international, surgissement de marchés, risque de marché, ARCH-GARCH, VAR.

Resumo:

Os fluxos de capitais estrangeiros de curto prazo tem sido repetidamente acusados de causar instabilidade nos mercados financeiros emergentes, em particular nas crises financeiras, no que foi denominado o efeito dos "capitais andorinha". Neste estudo, estima- se o efeito dos fluxos de capital estrangeiro de portfólio na volatilidade e o risco sistêmico mundial dos seis maiores mercados acionários latino-americanos: Argentina, Brasil, Chile, Colômbia, México e Peru, em um período de 10 anos que inclui a crise financeira mundial de 2008. Para isso empregaram-se modelos econométricos de série de tempo, tanto de volatilidade condicional (ARCH-GARCH) como multivariados (VAR), assim como a base de dados proprietária de Emerging_Portfolio.com. Não encontramos evidência decisiva para apoiar a hipótese de que tais fluxos causem instabilidade nos mercados acionários latino-americanos, mas sim alguma evidência do efeito de pressão de preços ("price pressure"). Em seu lugar, a evidência aponta a que a transmissão das crises pode ser adjudicada, em grande parte, à alta inter-relação de ditos mercados, tanto em rendimentos como em volatilidade, com os mercados acionários e de divisas internacionais.

Palavras chave:

crescimento do portfólio internacional, surgimento de mercados, risco de mercado, ARCH-GARCH, VAR.

Introduction[1]

Increasing financial integration between financial markets around the world in the last 30 years has brought new investment opportunities. International investors have looked to take advantage of important capital gains, increased diversification, foreign exchange appreciation and differentials in interest rates (di Tella 2004; Ferrer, 1999). As part of an increasing interest on financial integration, academics have been studying the effect of portfolio funds on emerging financial markets. If foreign portfolio funds have been overall helpful or harmful for emerging markets is a complex, and still not completely solved question, that reappears from time to time, especially during times as the 2008 World financial crisis.

On the positive side, some authors have associated foreign portfolio funds to the decreasing cost of capital for listed companies (Bekaert and Harvey, 2000; Errunza and Miller, 2000; Miller, 1999), increasing market efficiency (Kim and Singal, 2000) and more diversification choices for investors (Villariño, 2001).

On the other side, Krugman (1998, 1999) and Stiglitz (2000) expressed fears of excessive volatilities and inflation, increased boom and bust cycles and appreciation of exchange rates caused by the instability of foreign investor's flows and holdings. Unlike foreign direct investment, which is widely regarded as beneficial, foreign portfolio flows are considered potentially damaging for emerging economies. Foreign portfolio investments, sometimes dubbed 'hot money', might flee from a developing country at the first sign of trouble during times of financial stress, further disrupting its capital markets. Empirical studies as Warther (1995), Brennan and Cao (1997), and Griffin, Nardari and Stulz (2004) have supported this point of view. Moreover, this behavior has been criticized in the context of the worldwide financial crises during the 90s, especially the Mexican (Villarino, 2001) and the Asian crisis (Flood & de Paterson, 2008). A more recent example is provided by the 2008 World financial crisis, when most emerging markets experienced important withdrawals of foreign capital along with large negative returns. Therefore some economists have called for increasing regulation on foreign flows to emerging markets (Eichengreen 1999; Ffrench-Davis and Griffith-Jones, 2002; Ito and Portes, 1998; Rubin and Weisberg, 2003).

In contrast, Edwards (1999) argues against capital controls in emerging countries due to being costly and ineffective in avoiding crises, and fostering corruption. Although most of the emerging markets identified by Standard and Poors (2004) currently have few or no direct barriers to the entry of foreign investors, still countries such as India, China, Colombia, Indonesia, the Philippines, Saudi Arabia, Taiwan and Thailand have either formal restrictions for foreign outflows or ceilings to foreign ownership. In Latin America, from 2007 to 2009, Colombia and Brazil restricted the mobility of foreign flows in and out the security markets in order to stabilize and mitigate appreciations of their currencies against the dollar. Still, the question of whether foreign flow causes increasing risk in emerging markets is to be solved empirically.

Excessive volatility is widely regarded as harmful in stock markets. From a theoretical standpoint, there are at least three reasons for this. First, classical Asset pricing models require higher expected returns (i.e. "Equitiy Risk premium") in more volatile markets (Cochrane, 2001), implying a higher cost of capital for projects and companies, and lower market value. Second, in the efficient market literature (Fama, 1970) price is an unbiased estimator or the intrinsic value of an asset, but higher volatilities reduce the value of market price as an indicator for economic decisions, thus impairing the market efficiency (Shiller, 1981). Finally, in the market microstructure models, higher volatility leads to lower liquidity, by increasing the adverse selection and inventory costs for a market marker (Glosten and Milgrom, 1985; Ho and Stoll, 1981; Kyle, 1985).

Bekaert et al., (2002) and Frenkel and Menkhoff (2003) have provided empirical evidence of increasing volatility in emerging markets due to foreign flows. Both studies analyze the period around the liberalization of the markets. Moreover, Bae, et al., (2004) provide evidence at firm level that links higher volatility with share ownership by foreign investors. Besides Richards (2005), provide evidence of increasing volatility due to foreign trading in six emerging markets of Asia during a period just after the Asian crisis. However, the issue is far from being settled: Rea (1996), Froot et al., (2001) and Alemmanni and Haas (2006) do not find larger volatility related to foreign flows, whereas Choe et al., (1999), Bekaert and Harvey (1998), Henry (2000) and Kim and Singal (2000) cannot find evidence of increasing volatility on the liberalization of the markets.

Excessive comovement of emerging stock markets with international markets, as measured by the beta respect to international returns (herein named "world beta") or the correlation with them, is also generally perceived as negative, at least for two reasons. First, it clearly reduces the benefit of international diversification for both local and foreign investors in emerging markets. Second, higher comovements are especially harmful during financial crises, those times where risk reduction is likely to be needed the most (Bekaert and Harvey, 2003). Transmission of negative returns across stock markets has been too large to be justified by fundamental factors during crises, which has been dubbed 'Contagion' (Bekaert and Harvey, 2003). International traders have attributed contagion to portfolio recomposition or behavioural effects (Bikhchandani et al., 1992; Calvo 1998; Calvo and Mendoza, 2000). Whereas increasing correlation upon liberalization has been evidenced in different studies (Bekaert and Harvey, 2000), the eventual link between foreign flows and increasing correlation in a post-liberalization period has not been tested to our knowledge.

In this context, we study the effects of foreign portfolio flows on six Latin American emerging stock markets: Argentina, Brazil, Chile, Colombia, Mexico and Peru. We estimate the effects of those short-term flows on two risk measures: First, the volatility of the local stock market returns and, second, the local market systemic risk, measured as the market sensitivity to international stock market returns (world beta). This is achieved modeling the relationship between risk measures, and measures of foreign flows, in two types of econometric models of the return: univariate ARCH_GARCH models at daily frequency, return, and multivariate 4-VAR models at monthly frequency. In both types of models, it is critical to control for variables that might well explain increasing risk, as international equity market returns and foreign exchange rate returns.

This paper contributes to the international finance literature by testing the relationship between foreign activity and risk in the six larger Latin American stock markets, in a period that includes the 2008 World financial crisis. Differently from the last big crises that hit the worldwide financial markets: the Asian crisis in 1998, and the Russian crisis in 1999, the 2008 one originated not in the emerging markets but in the developed ones of US and Europe, and brought about a world-wide recession only surpassed in depth and length by the 1930 depression. In that respect, this study provides an answer the question of whether foreign flows have a role on increasing the risks of Latin American markets in the context of an exogenous shock, with stronger economies and more mature markets than those of the late 90s.

In a more technical vein, this paper contributes to the literature by testing directly a relationship between foreign flows and world betas, which has not been done before. Besides, it uses a proprietary database of foreign flows that has not been used in this branch of study.

This paper is organized as follows: The first section describes the data set used and examines the evolution and possible relationships between the variables in the studied period. The second section explains the econometric models used to test them and defines the hypothesis to be tested; the third section presents and discusses the results. Finally, fourth section concludes and presents suggestions for future research.

Data

This study comprises the six largest stock exchanges of Latin America: Argentina, Brazil, Chile, Colombia, Mexico and Peru. Table 1 shows a summary statistics for the markets. Portfolio flows are taken from the proprietary database of Emerging Portfolio. Starting in 1993, this database compiles the buys and sales of more than 1.500 funds that invest in 65 emerging markets, with more than US$160 billion in capital, comprising about 90% of the foreign portfolio investments in those markets. For each country, holdings and net flows (buys minus sales) are reported in dollars on a monthly basis. Figure 1 presents the total monthly net flows for the six countries of the study from April 1995 to December 2008. It is apparent the increasing size and volatility of those flows, the inflow peaks during 2005 and 2007, corresponding to the boom in emerging stock markets, and the huge outflows during 2008, related to the World financial crisis.

Daily values for the main index of the local stock market, the S&P500 and the dollar exchange rate were taken from Bloomberg, whereas total trading values and market capitalizations of the six markets, at a monthly frequency, come from the database of the World Federation of Exchanges (WFE).

Econometric modeling of returns, foreign flows and control variables require transformations that guarantee stationarity. Specifically, local market returns, S&P500 returns, and foreign exchange returns are calculated as the logarithmic difference of the market indexes in local currency (RETURN), the S&P500 index in dollars (SP500_RET), and the dollar exchange rate (FEX_RET) respectively, both at daily and monthly frequencies. Net portfolio fund flows are normalized by the monthly market capitalization, obtaining the share of market capitalization due to foreign portfolio investment (FOR_CAP).[2] Dickey-Fuller and Philipps-Perron tests were applied to each series to assure stationarity.

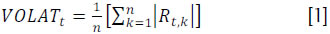

Volatility of the returns is one of the two risk measures of the study. The daily univariate model requires a proper specification of the conditional volatility in models of the ARCH_GARCH type, as usual in the literature (Campbell et al., 1997). For the multivariable monthly models, monthly volatility (VOLAT)[3] is defined as the average absolute value of the daily returns within the month, as follows:

Where

Rt,k: Daily return of the local stock index, in month t, day k.

n: number of trading days in month t

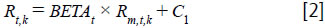

For the monthly multivariable model we calculate the variable, as the world beta, this is, the sensitivity of the local stock market to international stock market returns.

BETA is estimated for each month "t" in the following OLS regression

Where

Rt,k: Daily return of the local stock index, in month t, day k.

Rm,t,k: Daily return (in US$) of the S&P500 index, in month t, day k.

The study period for each country, listed in Table 2, is defined not only by the availability of data, but also, in three cases by structural changes in the series of returns, induced by times of excessive volatility or institutional changes,[4] that demanded the partition of the series. Specifically, for the daily univariate model Argentina's series are divided around November 2001, due to the excessive instability in markets brought on by the 'Corralito crisis'. Colombia sample period starts in July 2001, with the starting of the Colombian Stock Exchange, formed from the merger of the three previous regional exchanges. Colombian series had to be divided in two, excluding the months of May and June of 2006, when the Colombian securities market experienced extremely negative and positive returns that could not be incorporated in a univariate time series model. For similar reasons, we partitioned the Peru series on early July 2006.

To motivate the analysis of this paper, the time series plot of the main variables of the study are presented for each country in figures 2 to 7 (see figures 2, 3, 4, 5, 6 & 7): The main stock market index, the volatility, world beta, FOR_CAP and the share of foreign investors on market capitalization. Volatility and world beta are calculated on daily returns during a six-month window.

Overall, the series of the six Latin-American markets present a general pattern that can be described as follows: Prices tend to increase in the sample period, reaching a peak between 2007 and 2008. Increases were particularly dramatic for Colombia and Peru. The indexes for those markets grew about 10-fold between July 2001 and January 2008. In Argentina, prices dropped by 47% between July and November 2001. This period corresponds to the Corralito crisis. Colombia experienced a quick crash in prices and a similarly swift rebound in prices between May and July in 2006. None of those two events appears to be associated to a dramatic change of foreign flows in either market. On the contrary, the drop in prices in the last part of 2008, corresponding to the World financial crisis, is associated with a reduction in the foreign share in all the countries, with the sole exception of Chile.

Volatility for each country tends to move stably within a range, but increases dramatically to a peak around October 2008, corresponding to the World financial crisis. Other than that, there are peaks in volatility in Argentina in 2001 associated with the Corralito crisis, and in Colombia in the middle of 2006 to the aforementioned crash and rebound. The volatility series do not seem to move along with either foreign flows or foreign share for any of the six countries. Foreign flows are actually very volatile, but their clusters do not match the ones of the return volatility.

The world beta series present a more varied behavior across countries. In Argentina, Chile and Colombia, beta moves in a range between 0 and 1.0, with some peaks and valleys associated with high volatility times. In Brazil, it oscillates between 0 and 1.0 until a period beginning in 2004 when it rises, going as high as 2.5. Indeed Brazil has been known in recent years to have become a market very sensitive to the US market movements. In Mexico, beta moves between 0.5 and 1.5, until 2006, where it reaches a peak of 2, and then progressively decreases until 0.7. Peru's Beta exhibits a different behavior: very low and relative stable values, mostly between 0 and 0.5, until 2006, and then a lot of variation in a wider range between -1 and 2.0. In all countries, peaks in beta are found between 2006 and 2007, corresponding to the boom in emerging markets but tapers off from 2008 onwards. This suggests a relationship with foreign share that also experienced a local or global peak in each country between 2006 and 2007 and decreased in the last part of the sample. On the other hand, the cases of Chile, Mexico and Peru do not support that relationship, taking the whole 10 year sample period, since foreign shares have decreased but betas have risen.

Overall, the time series plots do not show any apparent relationship between volatility and foreign flows, but do suggest some relationship between foreign holdings and world betas. This has to be tested formally in an econometric model that properly controls for other factors. Indeed, it might be that the world beta-foreign holdings relationship is spurious. For example, at the peak of the boom cycle, emerging markets tend to be more volatile and attract more foreign portfolio investment. Now, higher volatility also increases the beta with respect to international markets.[5] Thus, an anecdotic observation might lead to inferring that foreign investors make emerging markets more volatile and more sensitive to international markets. At the same time, if real economic relationships exist, they may be too entangled to appear at first glance. Econometric models are called for to perform a proper test of these relationships.

Econometric models

Daily univariate models

As mentioned, this paper uses two types of models to test for the effects of foreign flows on the risk of six Latin American stock exchanges. First, at daily frequency, a univariate model from the ARCH-GARCH family is used to model daily returns and conditional volatility, since they provide for conditional heteroskedasticity of the variance, and allow including exogenous factors. These models account for volatility clusters, whereas allowing controlling effects on the mean or the conditional volatility from exogenous variables. When required EGARCH models were also used, since they account for the leverage effect, namely that negative returns have a larger effect on conditional volatility than positive returns (Nelson, 1991).

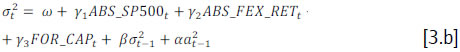

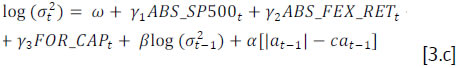

Campbell et al., (1997, p. 488) support the use of exogenous variables in the volatility equation of both GARCH and EGARCH model to test the effect of those variables on the conditional volatility. A specific example is provided by Flannery and Protopapadakis (2002) that control in the volatility equation of the GARCH(1,1) model of market returns for the volatilities of the treasury bill rate and the junk bond premium , as well as for holidays and macro announcements. Therefore, the proposed time series model is the following:

The variance equation for the GARCH (1,1) model is the following:

Whereas the variance equation for the EGARCH model (1,1) is:

The coefficient C2 for the S&P500 return can be clearly identified with the world beta, a measure of the sensitivity of the local market to the US market. The model also includes a trend variable t, and two interactive variables SP500xt and FOR_CAPxSP500, that account for changes on beta over time and changes on beta due to foreign flows. Terms Rt-k and at-k account for AR and MA effects, respectively, required for assuring white noise in the residuals.

Besides, the conditional variance equation [3.b] includes past conditional variance and past disturbance effects, as usual in a GARCH model. It also includes the absolute value of the S&P500 and the Foreign Exchange returns, ABS_SP500 and ABS_FEX_RET, respectively, to account for volatility transmission from those markets on the local stock market. FOR_CAP is included in the variance equation to test for the assumed effects of foreign investors on the volatility of the local market.

Dummy variables were included to filter out day of the week, month and holiday effects, both in the equations of the mean and the variance of model [3]. Some dummies were used to filter our extreme returns as required. The level of the ARMA model in the mean and the GARCH model are determined based on the residual and squareof- residual correlograms. This procedure assures that the residuals of equation [3.a] are white noise in levels and squares.

Expected signs of the coefficients for the different regressors in model [3] as given by the extant empirical and theoretical literature . Regarding the foreign exchange returns, two basic arguments are usually presented. First, the 'Portfolio Balancing' premise of Frankel (1983) argues that a bullish trend in the equity markets usually attracts foreign investors, driving down the foreign exchange rate. This has been empirically supported by Ferrari and Amalfi (2007) in Colombia, and Muller and Verschoor (2007) for Taiwan. In contrast, the "market of goods" argument of Dornbusch and Fischer (1980) states that, providing that most of the local listed companies are net exporters, higher foreign exchange rates lead to higher earnings and returns on the local stock market. Beer and Hebein (2008) and Harmantzis and Miao (2009) have provided evidence on this in 10 developed markets in developed and emerging countries. Actually, both effects might be working at the same time in a given country, depending on the degree of globalization of the companies, and the relevance of foreign flows in its security markets. Based on anecdotal evidence that supports the "Portfolio Rebalancing" theory, it is expected a negative relationship between foreign exchange and local market returns for the Latin American case.

It is very much expected that the S&P500 return be positively related to local stock market returns. Both fundamental and trading-related reasons have been provided to explain this. Economic globalization in the last 30 years has strengthened the economic ties between countries, whereas financial liberalization has meant that foreign speculators are increasingly more important players in the emerging stock markets (Edison and Warnock, 2009). In this context, the existent of a worldwide systematic risk seems indisputable (Bodie et al., 2005). Benelli and Ganguly (2007), Lucey and Zhang (2007), Miralles and Miralles (2005), among others, have documented this strong relationship of Latin American markets with international ones, especially those of US. Therefore, we do expect a positive relationship between the S&P500 return (measured in US dollars) and the local stock market return (measured in local currency)[6] and a positive coefficient of the interactive SP500xT term.

On the effect of foreign flows (FOR_CAP) on returns, a positive relationship is hypothesized, as given by two empirical observations on the extant literature. The first one, called "price pressure" (Froot et al., 2001), assumes that foreign buys (sell), due to their larger liquidity demand and size of trade rises (lower) emerging market prices. The "price pressure" might also come from informational reasons, since there is some evidence that foreign buys (sells) are positive (negative) signal for an emerging market (Richards, 2005). Alternatively, positive (negative) returns on emerging markets should lead to buys (sells) from foreigners, as they might extrapolate that this trend continues, in what is called "return chasing" (Choe et al., 2005).

Regarding to the increasing effect of foreign flows in both volatility and world betas, there are studies that do find such effects (Bae et al., 2004; Frenkeln and Menkhoff, 2003), while other do not (Alemmani and Hass, 2006; Dvorak, 2001; Rea, 1996). We assume, as the null hypothesis, that in the variance equation [3.b] the coefficient of FOR_CAP is not different from zero, and so the coefficient of the interactive variable FOR_CAPxSP500 in the mean equation [3.a]. The term SP500xT is included in the mean equation to control for any economic factor, different to foreign flows, that increases over time the systemic risk of the local market. Such an effect might be due, among others, to increasing financial or commercial integration with developed markets, or an increasing role of ADRs, implying that the term SP500xT has a positive coefficient on the mean equation.

Monthly multivariate model

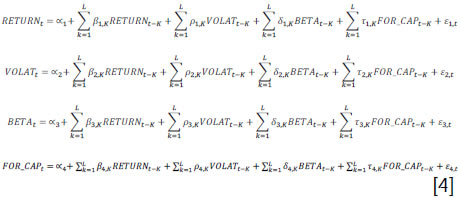

Whereas univariate models are fit to describe high frequency financial series, they are not appropriate to model in lower frequencies (de Arce Borda, 2004). Since we are interested in the effects of foreign flows not only during a time span of a few days, but also during several months, we need to model returns and flows in a monthly basis. Additionally, univariate models do not describe multiple interactive effects between critical variables in a stock market. Thus, following the literature on Foreign flow effects (Bekaert et al., 2002; Griffin et al., 2006; Richards, 2005), we propose a non-structural monthly vector autoregressive model (VAR). Non-structural VAR models are defined as a system of linear simultaneous equations in which each variable is modeled as dependent of its own lags and of those of the other variables, thus treating, in principle, all variables as endogenous. For this study, we take as endogenous variables, the monthly returns, monthly volatility (VOLAT), the sensitivity to international markets (BETA), and the measure of foreign flows (FOR_CAP). The proposed model is expressed as follows:

Where

RETURNt: Monthly return for the Exchange, as given by the market index

VOLATt : Monthly volatility for the Exchange, as defined in eq. [1]

BETAt : Sensitivity to international markets, defined as the beta of eq. [2]

FOR_CAPt : Measure of foreign flows, defined before.

ε1t, ε2t, ε3t, ε4t: disturbance terms in each equation

L: Number of lags required by the model, specific for each country.

A VAR model has two main technical requirements. First, it requires finding the number of optimal number of lags to obtain a parsimonious model, which is accomplished by minimizing the Akaike (AI C) and Schwartz (SBC) statistics.[7]

Second, white noise has to be achieved in residuals of the model, as measured by the LM autocorrelation and the VAR heterokesdaticity tests. Whenever required, lags were increased or dummy variables were included for specific dates to filter out extreme values, assuring white noise.

VAR models allow to test whether a given variable might cause changes in other variables. To do so, we performed the Block Exogeneity Wald test, which excludes the lags of the assumed exogenous variable in a given equation (corresponding to an assumed endogenous variable), and measures whether the model changes significantly. If that is the case, it is said that the exogenous variable is said to Granger-cause the endogenous one (Enders, 1995, p. 316). Now, the Granger causality test does not indicate either the sign or the dynamics of the effect between the variables. Instead, this can be seen in the Impulse- Response function, which traces the response of the endogenous variables to a standardized shock on the exogenous variable.[8]

The Expected signs on the VAR model are also taken from the mentioned references for the univariate model. It is expected that positive shocks on the foreign flows (FOR_CAP) induce positive shocks on the volatility of the market (VOLAT), and the beta with the US market (BETA). In turn, the 'price pressure' hypothesis implies that positive shocks on FOR_CAP cause positive shock on RETURN, whereas the 'return chasing' story implies the same positive relationship but that the causal relationship runs the other way around.

Results

Univariate model

Table 3 presents the results of the univariate model [3] with effects ARMA, as well as conditional volatility coefficients and corresponding p-values. There are nine versions of the model corresponding to six countries, since -as explained before- the series of three countries had to be divided in two because of structural breaks.

First, we discuss the resulting coefficients of the control variables. The foreign exchange variable (FEX_RET) has a negative coefficient, significant at 5% level, in five out of nine cases. Exceptions are Colombia in both periods, and Argentina II . In general, the evidence of Latin American Markets supports the 'Portfolio balance' point of view of Frankel (1983). Only in one case, Argentina after Corralito, there is a positive and significant coefficient for this variable, supporting the 'market of goods' rationale of Dornsbuch and Fischer (1980).

As expected, the SP500_RET coefficient is significant and positive in seven cases, with the exceptions of Colombia I and Perú II . This is a clear evidence of the integration of Latin American stock markets to that of the U.S. In contrast, Betas are lower or not significant for Colombia and Peru, which might be explained by being historically less developed and internationally integrated stock markets.

The coefficient of the SP500xT term is significant and positive, at least at the 10% level, for five out of nine cases, detecting an increasing beta over time, as expected. This effect is particularly high for Brazil and both periods of Argentina, with betas rising on 0.3, 0.43 and 0.48, respectively. [9] Exceptions are Colombia I and II , Mexico and Peru II .

Now, we turn to the effect of foreign flows on the mean equation [3.a]. This is given by two coefficients-the corresponding to FOR_CAP and FOR_CAPxSP500. FOR_CAP is significant, at least at the 10% level, for Colombia I, Argentina I and Perú I. As explained before, these results are consistent with both the "price pressure" and "return chasing" stories, but do not distinguish between the two. FOR_CAPxSP500 variable, which measures how foreign investors increase the sensitivity to international markets, is only significant for Colombia I and Peru II , at 5% and 10% levels respectively. It is notable that this result only shows up in the historically less developed stock markets of the region (at least until 2005, see Table 1), during their periods of lower foreign holding shares (see Figures 5, 6 & 7).

Table 3 presents the results of the conditional variance equation [3.b]. Regarding the transmission of volatility from the foreign exchange rate and international equity markets, the coefficient of ABS_FEX_RET appears significant at the 5% level in three cases: Chile, Peru and Argentina II with the expected positive sign; whereas the ABS_SP500_RET coefficient is positive and significant for Colombia II , Chile, Peru and Brazil. Taking together the above results on the equation [3], they agree with Flannery and Protopapadakis (2002) in the sense that if a variable is a risk factor for the stock market, its volatility should transmit to stock returns.

Finally, we focus on the coefficient of FOR_CAP on the conditional variance equation [3.b]. It appears as positive and significant at the 10% level in Mexico and Peru, consistent with foreigners inducing volatility in emerging stock markets. Nevertheless, the same variable has a negative and significant coefficient in Argentina II and Chile. Taken together the evidence is inconclusive in the role of Foreign investors in causing volatility in the studied markets.[10]

Multivariate model

The results for the multivariate model [4], Granger causality- Block exogeneity tests and Impulse-Response function (IRF) plots, are presented in Table 4 and Figures 8, 9 & 10. Table 4 present the result of the Wald statistic p-value testing whether the row variable Granger causes the column variable. Significant statistics at the 5% level are in bold, at the 10% level are underlined. The sign and dynamics of the causality can be inferred from the IRF plots.[11]

First, we check the causality between foreign flows and return. Argentina and Mexico show evidence of Granger causality from returns to foreign flows, and the short-term response in the corresponding IRF plot is consistent with the 'return chasing' explanation. Conversely, Brazil and Mexico exhibit the reverse causality: Foreign flows Granger cause returns, and the IRF plot show a positive response, which is consistent with the 'price pressure' story.

The Granger causality tests along with the IRF plots show returns causing volatility in Brazil and Argentina, in an inverse relation: positive (negative) returns induce an increase (reduction) of volatility, consistent with the Leverage effect (Nelson, 1991).

Similarly, the multivariate model results present volatility causing betas for Colombia, Mexico and Peru, in a direct direction: positive shocks to volatility cause higher betas. This relationship seems to reflect the persistence on volatility and the fact that, holding correlation and the S&P500 volatility constant, beta increase with an increase of volatility.[12]

The proposed VAR model also provides an answer to the central question of this study. First, the results of the Granger causality test support in no case that foreign flows induce higher volatility and neither the IRF plots. Second, with the only exception of México, there is no evidence of foreign flows causing Beta. Even in the case of México, the IRF plot does not show a clear effect, but if anything appears to be inverse, contradicting the assumed hypothesis. Overall, the multivariate model indicates that foreign flows do not have a discernible effect on the volatility and systemic risk of the six Latin American markets of the study.

As in any other study of this kind, the reader should be aware that the results are constrained by the limitations of the empirical models. First, the univariate model [3] of daily returns only might detect short-term effects on both the volatility and betas. Moreover, at this frequency the return distribution exhibits low signal-to-noise ratio, since volatility is significantly higher than the average return. Thus, noise can disguise any true relationship between the risk variables and the exogenous ones. Second, whereas the 4-VAR model at monthly frequency can detect effects in longer period, any causality of shorter term, for example daily or intradaily, will not be detected by it. Finally, as in any other econometric model, the GARCH, EGARCH and VAR models can be very sensitive to outliers and overfitting. Whereas we controlled for outliers, and used parsimony criteria to select simple models, chances are that the hypothesized relationship between foreign flows and risk might have been discarded in the process.

Conclusions

Several authors using different methodologies, theories and data have studied the influence of Foreign Portfolio flows in emerging markets. Considering the results together, the results are ambiguous. This study contributes to the literature, testing not only effects on volatility but also in systematic risk, and using a not yet used data, more recent sample periods that includes the 2008 World financial crisis, two different econometric models, and focusing on six emerging markets of the same region.

The results of this study, taken together, indicate that there is no significant evidence that foreign portfolio flows increase the risk of the six Latin American markets. In particular, we observe the following:

- Only in two out of nine cases, there is a positive and significant effect from foreign flows on the betas to S&P500 returns: Colombia, before the 2006 crisis, and Peru, after July 2006. We suspect that this result might be due to the relative low development and integration of both markets, which might make them more sensitive to Foreign flows. Moreover, the fact that those effects do not show up in the VA R monthly model suggest that, if anything, those effects are either spurious or very short-lived.

- According to the VAR monthly model, there is no evidence of foreign flows having lasting effects on the volatility of the markets. In turn, the univariate model shows only a positive effect in two out of nine samples, but a negative and significant effect in two others.

The evidence presented here does support empirical regularities reported in other studies on the behavior of returns on emerging markets. It reports an important dependence of the local stock returns on the returns of the foreign exchange rate and international equity markets, both in mean and in volatility. We leave to future research to prove that the causality runs from those markets to the stock one, and if those economic variables are priced risk factors of the equity market. We find also evidence of returns causing higher foreign flows in some countries ('return chasing') but also of foreign flows causing higher returns ('price pressure'), that has also been found in other emerging markets.

We conclude that foreign exchange and international returns do have a more important role on increasing risk and dependence on international markets than foreign flows, providing no support to the policy of restricting foreign portfolio flows due to alleged increasing risks or causing instability in Latin American stock markets. We have left for future studies whether they have disrupting effects on the foreign exchange rate markets.

Footnotes

[1] This article is based on the thesis of Milena M. Castaño to obtain the Master Science on Finance in EAFIT University.

[2] Alternative measures were considered the total value of foreign portfolio holdings, its first difference, and the first difference of the absolute value of the net fund flows. Total value traded in dollars, as taken from the WFE, was tried as an alternative to market capitalization as normalizing variable. Whereas several of those alternatives were discarded for non-stationarity, FOR_CAP was the most significant in both the univariate and the VAR models.

[3] Absolute values of returns have been used as a measure of volatility in similar VAR models by Chordia et al. (2005) and Agudelo (2010). The following two alternative measures of volatility were also considered, but performed poorly in the multivariate model: the standard deviation of daily returns, and the average conditional volatility measured with a GARCH (1,1). Results can be obtained from the authors on request.

[4] We tested the structural change on returns for those three stock markets using the Chow break point test, on times related to crises. For Argentina on 20 November 2001, it delivered an F-test of 3.765 (0.052 p-value), for Colombia on 28 April 2006, 11.72 (0.00063), and for Peru on 4 July 2006 3.774 (0.052).

[5] Holding constant the correlation between the two markets and the US market risk, higher local volatility leads to higher beta, since beta = correlation x stand. Dev Local market/stand. Dev. US market.

[6] Whether US return should be measured in US dollars or in the local currency in the model is, in principle, an open question. We tried both and found the first a more meaningful measure, since entering the US return in local currency exaggerates the corresponding effect of the Foreign exchange return. Moreover, local traders in Colombia track closely the SP 500 expressed in US dollars.

[7] Whenever the two indicators gave contradictory results, SBC was upheld, since it has show better asymptotical behavior (Enders, 2005, p. 88).

[8] Cholesky decomposition is required in Unstructured VAR models to orthogonalize the disturbances. It allows resolving a system of matricial equations. This requires defining an order on the variables. Usual practice requires inverting the variables order and verifying that the IRF results do not depend critically on it.

[9] Calculated as the estimated coefficient multiplied by the number of estimated trading days of the period.

[10] Alternative measures of foreign flows did not have a strong effect on volatility either.

[11] To obtain the IRFs, the Cholesky decomposition requires ranking the variables. The order chosen was, initially: RETURN, VOLAT, BETA and FOR_CAP. Robustness of IRF relations were checked by inverting the order of the Cholesky decomposition. Results are qualitatively the same, and available from the authors upon request.

[12] BETA = correlation x stand. Dev Local market /stand. Dev. US market.

References

Agudelo, D. (2010). Friend or foe? Foreign investors and the liquidity of six Asian markets. Asia-Pacific Journal of Financial Studies, 39, 261-300. [ Links ]

Alemmani, B. & Haas, J. R. (2006). Behavior and effects of equity foreign investors on emerging markets. Published paper. [ Links ]

Bae, K., Chan, K. & Ng, A. (2004). Investibility and return volatility. Journal of Financial Economics, 71, 239-263. [ Links ]

Beer F. & Hebein F. (2008). An Assessment of the stock market and exchange rate Dynamics in industrialized and emerging markets. International Business & Economics Research Journal, 7(8), 59-70. [ Links ]

Bekaert, G. & Harvey, C. R. (1998). Capital flows and emerging market equity returns. NBER working paper 6669. [ Links ]

Bekaert, G. & Harvey, C. R. (2000). Foreign speculators and emerging equity markets. Journal of Finance, 55, 565-614. [ Links ]

Bekaert, G. & Harvey, C. (2003). Emerging markets finance. Journal of Empirical Finance, 10, 3-57. [ Links ]

Bekaert, G., Harvey, C. R. & Lumsdaine, R.L. (2002). The Dynamics of emerging market equity flows. Journal of International Money and Finance, 21, 295-350. [ Links ]

Benelli, R. & Ganguly, S. (2007). Financial linkages between the United States and Latin America-Evidence from Daily Data. International Monetary Fund, Working Paper. [ Links ]

Bikhchandani, S., Hirshleifer, D. & Welch, I. (1998). Learning from the behavior of others: Conformity, fads, and informational cascades. Journal of Economic Perspectives, 12, 151-70. [ Links ]

Bodie, Z., Kane, A. & Marcus, A. (2005). Investments (Sixth edition). New York: McGraw-Hill Irwin. [ Links ]

Brennan, M. & Cao, H. (1997). International portfolio investment flows. Journal of Finance, 52, 1851-1880. [ Links ]

Calvo, G. (1998). Capital market contagion and recession: An explanation of the Russian Virus. Working Paper. [ Links ]

Calvo, G. & Mendoza, E. (2000). Rational contagion and the globalization of securities markets. Journal of International Economics, 51, 79-113. [ Links ]

Campbell, J., Lo, A. & MacKinlay, A. (1997). The Econometrics of financial markets. Princeton, NJ: Princeton University Press. [ Links ]

Choe, H., Kho, B-C. & Stultz, R. (1999). Do foreign investors destabilize stocks markets? The Korean experience in 1997. Journal of Financial Economics, 54, 227-264. [ Links ]

Choe, H., Kho, B-C. & Stulz, R. (2005). Do domestic investors have an edge? The trading experience of foreign investors in Korea. Review of Financial Studies, 18, 795-829. [ Links ]

Chordia, T., Sarkar, A. & Subrahmanyam, A. (2005). An empirical analysis of stock and bond market liquidity. Review of Financial Studies, 18, 85-130. [ Links ]

Cochrane, J. H. (2001). Asset pricing. Princeton. New Jersey: Princeton University Press. [ Links ]

De Arce Borda, R. (2004). 20 años de modelos ARCH: una visión de conjunto de las distintas variantes de la familia. Estudios de Economía Aplicada, 22, 22. [ Links ]

Di Tella, T. (2004). Diccionario de ciencias sociales y políticas. Editorial Ariel. [ Links ]

Dornbusch, R. & Fischer S. (1980). Exchange rates and the current account. American Economic Review, 70(5), 960-971. [ Links ]

Dvórak, T. (2001). Does foreign trading destabilize local stock markets? Published paper. Department of Economics. Williams College. [ Links ]

Edison, H. & Warnock,. E. (2009). Cross-border listings, capital controls, and equity flows to emerging markets. NBER Working Paper W12589. [ Links ]

Edwards, S. (1999). International capital flows and the emerging markets: Amending the rules of the game? Federal Reserve Bank of Boston Conference Series 43, June 1999, 137-57. [ Links ]

Eichengreen, B. (1999). Toward a new international financial architecture. Washington, DC: Institute of International Economics. [ Links ]

Enders, W. (1995). Applied econometric time series. Iowa State University, John Wiley. [ Links ]

Errunza, V. R. & Miller, D. P. (2000). Market segmentation and the cost of capital in international equity markets. Journal of Financial and Quantitative Analysis, 35, 577-600. [ Links ]

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25(2), 383-417. [ Links ]

Ferrari, C. & Amalfi, A. (2007). Business and economic foundation in valuation of shares: The Colombian stock exchange. Cuadernos de Administración, 20(33), 11-48. [ Links ]

Ferrer, A. (1999). La globalización, la crisis financiera y Latinoamérica. Revista Comercio Exterior, 49(6), 527-536. [ Links ]

French-Davis, R. & Griffith-Jones S. (2002). Capital flows to developing countries since the Asian Crises: How to manage their volatility. Working paper UNU/WIDER Research Project. [ Links ]

Flannery, M. J. & Protopapadakis, A. A. (2002). Macroeconomic factor do influence aggregate stock return. Review of Financial Studies, 15, 751-782. [ Links ]

Flood, D. & De Paterson, M. (2008). Efectos de las crisis asiática y de Rusia en la economía y agricultura del Ecuador. Ministerio de Agricultura, Ganadería, Acuacultura y Pesca del Ecuador. http://www.sica.gov.ec/agro/docs/crisis_mundial.html [ Links ]

Frankel, J. A. (1983). Monetary and portfolio-balance models of exchange rate determination, in economic interdependence and flexible exchange rates. In J. S. Bhandari & B. H. Putnam (ed.). Cambridge, MA: MIT Press. [ Links ]

Frenkel, M. & Menkhoff, L. (2003). Are foreign institutional investors good for emerging markets? Published paper. [ Links ]

Froot, K. A., O'Connell, P.G. & Seasholes, M. S. (2001). The portfolio flows of international investors. Journal of Financial Economics, 59, 151-193. [ Links ]

Glosten, L. R. & Milgrom, P. R. (1985). Bid, ask, and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics, 14, 71-100. [ Links ]

Griffin, J. M., Nardari, F. & Stulz, R. (2004). Daily cross border flows: Pushed or pulled? The Review of Economics and Statistics, 86, 641-657. [ Links ]

Griffin, J. M., Nardari, F. & Stulz, R. (2006). Do investors trade more when stocks have performed well? Evidence from 46 countries. Review of Financial Studies. [ Links ]

Harmantzis, F. & Miao, L. (2009). Dynamic Asymmetric Dependencies between Equities and Exchange Rate Markets. Stevens Institute of Technology. Working Paper. [ Links ]

Henry, P. B. (2000). Stock market liberalization, economic reform and emerging market equity prices. Journal of Finance, 55, 529-564. [ Links ]

Ho, T. & Stoll, H. R. (1981). Optimal dealer pricing under transactions and return uncertainty. Journal of Financial Economics, 9, 47-73. [ Links ]

Ito, T. & Portes, R. (1998). Dealing with the Asian Financial Crises. European Economic Perspectives, CERP. [ Links ]

Kim, E. H. & Singal, V. (2000). Stock market openings: Experience of emerging economies. Journal of Business, 73, 25-66. [ Links ]

Krugman, P. (1998). What happened to Asia? MIT, Unpublished paper. [ Links ]

Krugman, P. (1999). Balance sheets, the transformers the problem and the financial crises. Cambridge: Department of Economics. [ Links ]

Kyle, A. S. (1985). Continuous auctions and insider trading. Econometrica, 53, 1315-1335. [ Links ]

Lucey, B. & Zhang, Q. (2007). Integration analysis of Latin American stock markets 1993-2007. SSRN: http://ssrn.com/abstract=1047421. [ Links ]

Nelson D. B. (1991). Conditional heteroskedasticity in asset returns: A new approach. Econometrica, 59, 347-370. [ Links ]

Miller, D. P. (1999). The impact of international market segmentation on securities prices: evidence from depositary receipts. Journal of Financial Economics, 51, 103-123. [ Links ]

Miralles M., J. L. & Miralles Q., J. L. (2005). Análisis de los efectos de las correlaciones bursátiles en la composición de las carteras óptimas. Revista Española de Financiación and Contabilidad, 34(126), 689-708. [ Links ]

Muller, A. & Verschoor, W. F. C. (2007). Asian foreign exchange risk exposure. Journal of the Japanese and International Economies, 21(1), 16-37. [ Links ]

Rea, J. (1996). U. S. emerging market funds: Hot money or stable source of investment capital. Investment Company Institute Perspective, 2(6). [ Links ]

Richards, A. (2005). Big fish in small ponds: The trading behavior and price impact of foreign investors in Asian emerging equity markets. Journal of Financial and Quantitative Analysis, 40(1), 27. [ Links ]

Rubin, R. & Weisberg, J. (2003). In an uncertain world: Tough choices from Wall Street to Washington. New York: Random House. [ Links ]

Shiller, R. J. (1981). Do stock prices move too much to be justified by subsequent changes in dividends? American Economic Review, 71, 421-436. [ Links ]

Standard & Poors. (2004). Global Stock Markets Factbook. New York: McGraw-Hill. [ Links ]

Stiglitz, J. (2000). Capital market liberalization, economic growth and instability. World Development, 25, 1075-1086. [ Links ]

Villariño, A. (2001). Turbulencias financieras y riesgos de mercado. Madrid: Prentice Hall. [ Links ]

Warther, V. A. (1995). Aggregate mutual fund and security returns. Journal of Financial Economics, 39, 205-235. [ Links ]