Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.24 no.51 Bogotá Jan./Mar. 2014

https://doi.org/10.15446/innovar.v24n51.41235

http://dx.doi.org/10.15446/innovar.v24n51.41235

Determinants of Working Capital Management in Latin American Companies

Determinantes de la gestión del capital de trabajo en Latinoamérica

Facteurs déterminants de la gestion du capital de travail en Amérique Latine

Determinantes da gestão do capital de trabajo na América Latina

Samuel MongrutI, Darcy Fuenzalida O'SheeII, Claudio Cubillas ZavaletaIII, Johan Cubillas ZavaletaIIII

IProfesor de la Escuela de Graduados del Tecnológico de Monterrey, Campus Querétaro, México. Profesor Asociado del Centro de Investigación de la Universidad del Pacífico (CIUP), Lima, Perú

Correo electrónico: smongrut@itesm.mx

IIDoctor en Ciencias Empresariales de la Universidad de Lleida, España. Magíster en Economía de la Universidad Católica de Chile e Ingeniero Civil Químico de la Universidad Federico Santa María, Chile. Profesor del Departamento de Industrias de la Universidad Federico Santa María, Casilla 110V

Correo electrónico: darcy.fuenzalida@usm.cl

IIILicenciado en Economía de la Universidad del Pacífico, Perú. Analista de Finanzas Corporativas. Centro de Investigación de la Universidad del Pacífico (CIUP), Lima, Perú

Correo electrónico: cmcubillas@gmail.com

IIIILicenciado en Economía de la Universidad del Pacífico, Perú. Analista de Capital Privado. Centro de Investigación de la Universidad del Pacífico (CIUP), Lima, Perú

Correo electrónico: johancubi@gmail.com

Recibido: enero de 2011 Aprobado: abril de 2013.

Abstract:

The aim of this study is to determine the factors that affect working capital management in Latin American companies. Using an unbalanced panel data analysis for companies quoted in five Latin American capital markets it is shown that companies in Argentina, Brazil, Chile and Mexico are holding cash excesses, which could destroy firm value. Results show that the industry cash conversion cycle, the company market power, its future sales and country risk have an influence on the way Latin American companies manage their working capital with significant differences among countries in the region.Key words: Working capital management, international management.

Resumen:

El objetivo de este artículo es determinar los factores que afectan la gestión del capital de trabajo en las compañías latinoamericanas. Mediante el uso de un análisis de datos de panel no balanceados de compañías cotizadas en cinco mercados de capital de Latinoamérica, se demuestra que las compañías en Argentina, Brasil, Chile y México tienen excesos de efectivo, lo que podría destruir el valor de dichas empresas. Los resultados muestran que el ciclo de conversión de efectivo de la industria, el poder de mercado de la compañía, sus ventas futuras y el riesgo del país, influyen sobre la manera en la que las compañías latinoamericanas gestionan su capital de trabajo, con diferencias significativas entre los países de la región.

Palabras clave: gestión de capital de trabajo, gestión internacional.

Résumé:

L'objectif de cet article consiste à déterminer les facteurs qui affectent la gestion du capital de travail dans les compagnies latino-américaines. En utilisant l'analyse de données de panel non mises en équilibre de compagnies reconnues dans cinq marchés de capital d'Amérique latine, il est démontré que les compagnies en Argentine, au Brésil, au Chili et au Mexique ont un excès de liquide, ce qui pourrait détruire la valeur de ces entreprises. Les résultats montrent que le cycle de conversion de liquidités de l'industrie, le pouvoir de marché de la compagnie, ses ventes futures et le risque du pays, influent sur la manière dont les compagnies latino-américaines gèrent leur capital de travail avec des différences significatives entre les différents pays de la région.Mots-clés: gestion du capital de travail, gestion internationale.

Resumo:

O objetivo deste artigo é determinar os fatores que afetam a gestão do capital de trabalho nas companhias latino-americanas. Mediante o uso de uma análise de dados de painel não balanceados de companhias cotizadas em cinco mercados de capital da América Latina, demonstra-se que as companhias na Argentina, Brasil, Chile e no México não têm excessos numerários, o que poderia destruir o valor dessas empresas. Os resultados mostram que o ciclo de conversão numerária da indústria, o poder de mercado da companhia, suas vendas futuras e o risco do país, influenciam sobre a maneira na qual as companhias latino-americanas administram seu capital de trabalho, com diferenças significativas entre os países da região.Palavras chave: gestão de capital de trabalho, gestão internacional.

Introduction

Firms face a number of important decisions in their current operations and one of these important decisions concerns the efficient management of liquidity. This decision is critical, as it is the reason for which many firms get to bankruptcy. In order to understand how important it is to have good liquidity management, one may refer to two North American supermarkets: Walmart and Kmart (Shin and Soenen, 1998). These two companies had similar capital structures in 1994; however, Kmart had a cash conversion cycle (CCC) of 61 days while Walmart had one of 40 days. The cash conversion cycle (CCC) reflects the interval of time (days) required to convert a dollar invested in current assets in cash. It is calculated by adding the average period to collect to the average inventory period, and subtracting the average period of payment.

As a consequence of this difference Kmart faced additional financial costs in the order of US$ 200 million per year. Clearly, this situation was not sustainable because poor working capital management eventually contributed to Kmart's bankruptcy. This example illustrates how working capital management, a key variable for an efficient management of liquidity, could lead the firm to bankruptcy when it is poorly handed. For this reason, the analysis of working capital management is critical, as this practice encompasses a number of policies relative to the management of liquidity. Working capital management provides the firm with information on the liquidity needed to operate efficiently. When payables are due before collectables there is a liquidity problem and, in extreme cases, payments can be suspended, which eventually could lead to the company's financial distress.

Empirical evidence shows that working capital management in the United States (Moussawi R et al., 2006) has significant effects on companies with two different results in place. On the one hand, to hold an adequate level of working capital, that is to say, an adequate management of the CCC, may generate a situation where the company incur in lower financial expenses and maintain a stable growth.

On the other hand, there can be a negative effect on the accumulation of working capital, because overinvestment could destroy the value of companies. An example from Moussawi et al. (2006) showed that the relationship between working capital management and the value of North American companies over the recent past decades was negative, precisely due to this overinvestment.

The case of Europe is very similar. The results of the survey conducted by KPMG (2005) reveal that 74% of the leading companies admitted that capital management is very important, and consequently, they have developed policies to improve its management. However, the European setting shows two problems relative to working capital management. The first, is that they do not analyze the components of CCC as a whole (i.e., they do not integrate credit, cash and inventory policies with the process of sales projections) quite the contrary, the working capital management is carried out from different perspectives assigning unequal objectives to each one of the policies and therefore maintaining an inefficient management of working capital. Only 33% of the European firms analyze CCC in an integrated manner.

The second problem in European firms lies in the conflict between target financial ratios and CCC. The main objective of 58% of surveyed firms is to keep the levels of sales high in order to obtain greater profit to fulfill target financial ratios. Furthermore, the survey showed that there is no good follow-up of the CCC, which means that working capital management could be more reactive to the circumstances of the company rather than well planned and monitored. Working capital management in firms that operate in Latin America shows an evident backward step over the last years. In the mid nineties it was common to obtain loans from abroad, which were channeled through local banks. These loans were placed at very low rates, and periods of 180 days on average.

Furthermore, these loans could be renewed, so that they were substituted by a new loan. For this reason, these loans were considered a permanent source of income. However, since 1997, there was a series of international financial crises, which generated an interruption of these financing sources and companies had to face their obligations by cutting back their operating investments. This led to the financial distress of a great number of companies. Firms sold less and tried to finance themselves with their suppliers, who did not collect, and hence, were in no position to give them extended periods of payment. This is one possible explanation why companies could have held excessive working capital in recent years so as to face this situation of scarcity of suppliers' credit.

The survey carried out by Payne and Bustos (2008) landed at the conclusion that companies in Latin American are inadequately managing their working capital. The uncertainty with regard to payments and collections as well as a poor implementation of sales projections has led firms in Latin America to overinvest in working capital. However, another possible explanation for this overinvestment by firms in Latin America is related to the short term investment horizon. The growth Latin American firms have recorded is recent, and consequently investment policies have not aimed at the long term, but at the short term (Mongrut and Wong, 2005).

This study seeks to analyze the working capital management by firms operating in Latin America. The purpose is to assess whether they are overinvesting in working capital, and subsequently to identify which variables have an impact on their CCC. The study is divided into five parts including this introduction: The second part reviews the literature and describes the working capital management policies in Latin America. The third part is devoted to find out whether firms in our sample from Argentina, Brazil, Chile, Mexico and Peru keep deficit or excess in cash.

In the fourth section a second set of variables was used to analyze the determinants of CCC. In the fifth part, the conclusions of the study are discussed, while at the same time some policy recommendations for the managing of working capital in Latin America are proposed.

Theoretical Framework

The Cash Conversion Cycle (CCC)

Working capital are the funds used to operate in the short term. If receivables are postponed, there can be delays in payments and these could be suspended causing a situation of illiquidity for the firm.

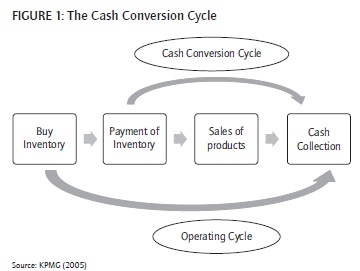

In this context, CCC is an important tool of analysis that enables us to establish more easily why and how the business needs more cash to operate and when and how it will be in a position to refund the negotiated resources. Figure 1 illustrates the CCC.

A business can generate losses during a number of different periods, but it cannot go on indefinitely with poor CCC management. The activities that are directly related to CCC management are the following:

- Determining the effective number of days to collect receivables

- Determining the inventory needs

- Determining the future growth of sales

These activities must be integrated in such a way that the period of time in which the cash is not being used to fund the working capital is minimized. These three activities are carried out through the implementation of three policies: credit policy, inventory policy and cash management policy. The first policy is responsible for planning, executing, and monitoring sales growth projections.

In brief, the goal of working capital management should be to minimize the CCC, without having a negative impact on the quality of its components. That is to say, it is just as bad to have a surplus of working capital as it is to have a deficit of working capital. It is worth stressing there is no specific manual on how to manage working capital, since it depends to a very great extent on the specific circumstances of each company.

Literature review

Existing literature on working capital seems to have lost popularity after the glorious period of the sixties and the seventies, when most of the models of working capital management were developed.

Even though these models were not formulated in an integrated manner, they were a very important discussion topic given their direct effect on the value of firms. Shin and Soenen (1998) researched the relations between CCC and the profitability of the firms for a sample of companies listed in the United States Stock Exchange, during the period spanning from 1975 to 1994. They found a significant negative relationship between the value of the companies and the CCC of the same companies.

In addition to this, Shin and Soenen (1998) intended to come up with the determinants of working capital, and found that its management is correlated in a positive way to firm size. They also established that industry concentration does not affect working capital management and that a greater compensation paid to the CEO of the firm, definitely improves the company's management of working capital. These results suggest that working capital management has an important impact on the profitability of the firms.

Deloof (2003), in turn, carried out research on the relationship between working capital management and the performance of Belgian companies. This author used a sample of 1009 non-financial Belgian companies for a period of time from 1992 to 1996. He came across a significantly negative relationship between gross profits and the average period of receivables, the average period of inventories, and average period of payables. The results suggest that the managers could create value for stockholders if they were to reduce the time periods of receivables and inventories, to reasonably minimum levels. These results show that there is a certain level of working capital that maximizes the value of the firms.

Arcos and Benavides (2006) wanted to estimate the entrepreneurial efficiency of a set of companies in the non- financial sector in Colombia, for the period from 2001 to 2004. The results obtained were consistent with similar studies conducted abroad in that the CCC was inversely related to the profitability of the companies, when measured with respect to the level of sales.

Lazaridis and Tryfonidis (2006) conducted a statistical analysis of 131 firms in Athens for the period 2001- 2004, and concluded that managers may create benefits for the companies if they manage an adequate level of CCC and maintain each one of its components at an optimal level. They also detected a negative relationship between the company's working capital and its profitability.

Vélez-Pareja et al. (2009) carried out a study in Latin American markets, in order to determine the market perception of the use of liquidity surpluses that remain invested in cash and/or short term investments. The results confirmed the agency problem with respect to the undistributed cash by the companies. Liquidity surpluses should be distributed, because if they are not, they destroy the value of firms because the market attaches greater value to the expected value of the share, than the flow of dividends paid out in cash. However, this study has a shortcoming because it includes the return of cash equivalents in the current assets, and therefore, excluded them from the working capital. Hence, if all cash flows were already distributed to shareholders, there are no more possible return from short term investments and the return from these cash equivalent securities represent a contradiction. In brief, whenever financial analysts forecast free cash flows they should distribute all cash flows available and reflect this in the financial statements.

Analysis of working capital management in Latin America

Latin America has recorded a very dynamic development over the past years. It has been possible to observe high levels of sales, which reveal growth rates with two digit figures. Likewise, capital markets have become more integrated to the world markets (Mongrut and Fuenzalida, 2007). Even though financial integration is far from being substantial, the cost of capital for investments has gone down and, as a result of this, Latin America has witnessed the entry of foreign investors with direct investments (Fuenzalida and Mongrut, 2010).

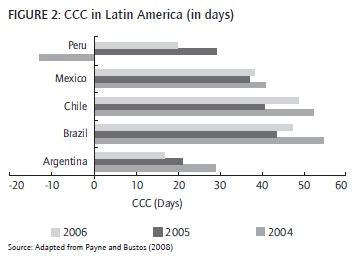

Despite the remarkable growth Latin America has experienced, the management of average working capital has not been adequate. The evidence shows the deterioration of CCC (see Figure 2), due to several problems such as deficient collection policies and poor implementation of sales projections, among others. The results of these problems lead firms in Latin America to hold, on average, an excess of liquidity which losses the alternative return of short term investment (Payne and Bustos, 2008).

One sees that the CCC of Latin American companies have recorded an average increase from 36.9 days in the year 2005, to 37.6 days in 2007. In 2006 one can see that, except for Peru and Argentina, there has been an increase in CCC in Mexico, Brazil and Chile. It is also worth pointing out the high volatility of the CCC shown in the three years summarized in Figure No. 2. Despite this situation, there are companies that have experienced a good working capital management, where the receivables period, as well as the inventory turnover have decreased, while the average payables period has increased.

A comparison of the firms with the best working capital management and those firms that have an average management, reveals that the gap has expanded remarkably, reflected in an average overinvestment in working capital of USD 46 billion in year 2006 (Payne and Bustos, 2008).

Do firms in Latin America have excess of cash?

This section provides an explanation of the methodology used to find out whether the companies, on average, keep excess of cash. This section is divided in two parts: in the first part, a model with three versions is introduced in order to help us find out whether firms, on average, have an excess of cash. In the second part, the sample is described and the results discussed.

Working capital management and firm value

The general hypothesis this section is based on, is that, on average, companies in Latin American countries hold an overinvestment in working capital. Therefore, it is to expect that the relation between investment in working capital and the value of the firm is negative.

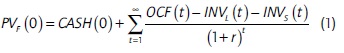

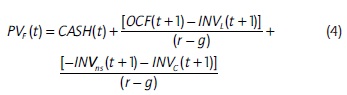

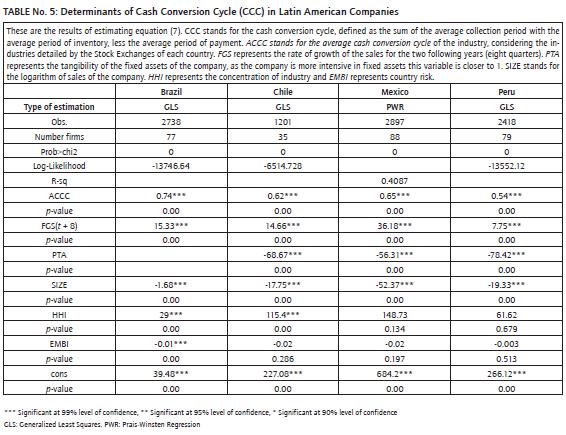

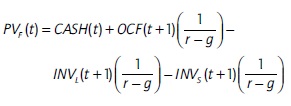

In order to find out the net effect of the investment in working capital on the value of firms, the valuation model developed by Kaplan and Ruback (1995) and followed by Moussawi R. et al. (2006) is used:

Where PVF(0) is the current value of the firm, CASH(0) is the company current value of its cash assets and CCF(t) is the capital cash flow that must be discounted at the unlevered cost of equity (r). This equation could be expressed alternatively in the following way:

Where the firm operating cash flow OCF(t) is equal to:

OCF(t) = REV(t) - EXP(t) + OTH(t)

And where REV (t) is equal to net revenues, EXP(t) is equal to cost of goods sold plus administrative and selling expenses plus taxes, and is depreciation plus amortization. INVL(t) is investment in long-term assets and INVs(t) is investment in current assets (cash balances plus account receivables plus inventory) less current operating liabilities (accounts payables and accrued expenses). However, what matters is the net operating working capital excluding cash balances. For this reason, we are going to estimate three versions of equation (1), with and without changes in cash and cash equivalents and one with only changes in cash excluding cash equivalents. This will allow us to separate the effect of cash management from the rest of the working capital management.

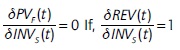

On the basis of the previous method known as the Capital Cash Flow (CCF) Method or the Compressed Adjusted Present Value, one can obtain the first order condition to maximize the company value:

Hence, the company maximizes its value to the extent that a dollar invested in working capital is equal to a dollar in sales. According to Moussawi et al. (2006), in order to analyze the relationship between the value of the firm and its working capital management, one could use three versions of model (1).

First version: changes in short term investments include changes in currents assets

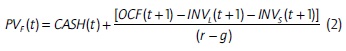

For purposes of the analysis, it is assumed that cash flows grow at a constant rate, so that model (1) may be rewritten as equation (2):

Rewriting the equation yields:

The equation can be restated by means of the following regression model:

The marginal effect of net working capital investment is equal to:

In this way, the optimal level of working capital is attained when β4 is equal to zero. Besides, given that (r - g)-1 > 0, if β4 < 0 would mean that there is overinvestment in net working capital and if β4 > 0 would mean that there is underinvestment in working capital. However, in this model we are not able to distinguish if there is underinvestment or overinvestment in cash and cash equivalents.

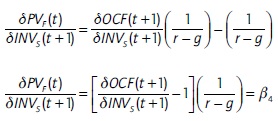

Second version: changes in short term investments are divided in changes in non-cash and cash and cash equivalent investments

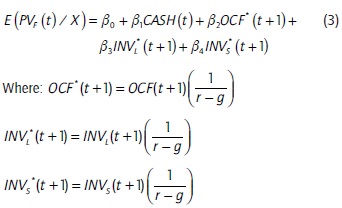

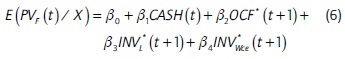

The previous version does not establish any difference between the effect of working capital and the effect of the change in the level of cash and cash equivalents of the company. Therefore, following Moussawi et al. (2006), equation (2) could be written as follows:

In equation (4) the investment in net operating working capital is separated in two parts: the investment in non-cash working capital "INVns(t + 1)" and the investment in cash and cash equivalents "INVc(t + 1)". In this way, it will be possible to identify the effect of investment in cash and cash equivalents.

Rewriting the above equation yields:

Using the regression version of the model:

The marginal effect of investment in net working capital is equal to:

In the regression of the second version, the coefficients β4 < 0 and β5 < 0, are interpreted as overinvestment in working capital and in cash, respectively.

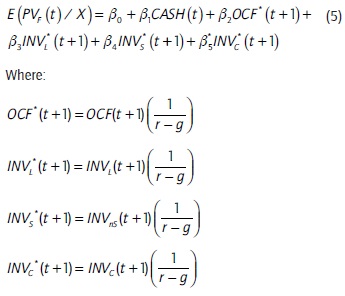

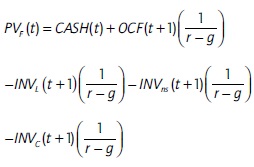

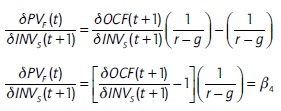

Third version: changes in short term investments are equal to changes in operating working capital [T3]

If we include changes in cash equivalents in the changes of current assets it means that they will be subtracted from the free cash flows. If all cash has been distributed among shareholders then it is not possible to have any more return from short term investments and this will create a contradiction because the investment in marketable securities could generate a return and if so, it should be subtracted net of taxes from the value of the company.

In order to avoid this shortcoming we decide to assume that cash equivalents and their return are effectively distributed among shareholders, which means that we must exclude then from the changes in current assets and include then in the free cash flow. Hence equation (5) will be written as follows:

In this expression, INVWce (t + 1) refers to the company short term investment without changes in cash equivalents (marketable securities). Again, if β4 < 0 would mean that there is overinvestment in net operating working capital without cash equivalents and if β4 > 0 would mean that there is underinvestment.

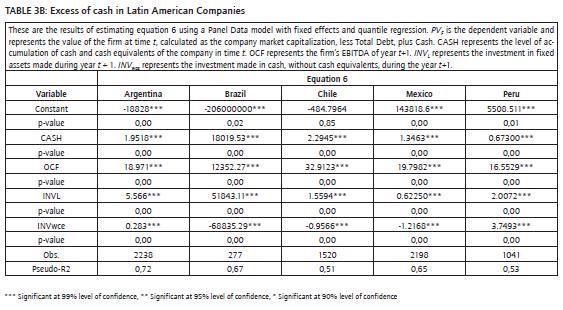

It is important to state that equations (3), (5) and (6) will be estimated using firm level data. Table 1 shows the proxies that one uses to calculate the variables to run regression models (3), (5) and (6).

Sample and results

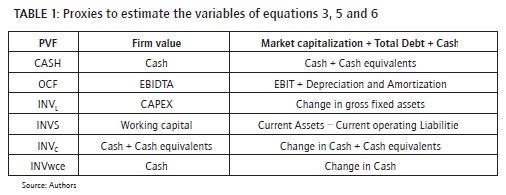

This study included information of non-financial companies and non-utilities from Argentina, Brazil, Chile, Mexico and Peru for the period 1996-2008. Colombia and Venezuela were excluded from the sample due to the scarcity of data and the high volatility of the data available. The information about the companies was obtained from the financial databases "Economatica" and "Bloomberg", and in certain cases, it was completed with public information available at the stock exchanges of the corresponding countries. For example, in the case of Peru, the information contained in the mentioned databases was complemented with information provided by the Lima Stock Exchange.

In some cases, companies were dropped from the sample given the high volatility of their data. In the case of Brazil, there was a smaller amount of data than for the other countries because information on investments in fixed assets was available only from the year 2004 onwards.

In the five countries analyzed, firms that had very scarce information were also left out of the analysis. This is the reason why the number of companies per country differs throughout the years. Table 2 summarizes the number of firms analyzed in each quarter. Only in the case of Chile the number of firms is the same during the study period. It is important to point out that the selected companies are the most representative ones of the corresponding Stock Exchange by market capitalization.

The methodology used to estimate equations 3, 5 and 6 was through an unbalanced Panel data model given that in certain years there was no information available for firms. We ran the Haussmann test (not reported) and obtained that panel data with fixed effects was the best option, so we use it. The next issue was to choose the proper estimation method for the models. Initially we considered pool estimation with ordinary least squares, but the high remaining volatility of the financial data rendered the mean of the sample unrepresentative. Hence, we decide to use a regression per quantile, which is a non parametric estimation with respect to the median, not with respect to the mean of the dependent variable. Furthermore, we correct any problem of heteroskedaskicity presented in the results.

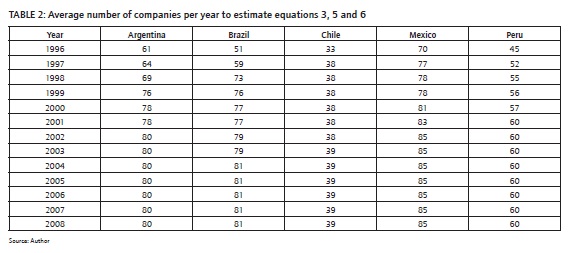

Table 3a (see Appendix) shows the results from estimating the two versions of the first model (equations 3 and 5#ec5), and Table 3b (see Appendix) shows the result from estimating the third version of the model, equation (6). As we may see the Earnings Before Interest and Taxes plus Depreciation and Amortization (EBITDA) and the investments in fixed assets are positively related with the dependent variable in the five countries, which suggests that additional EBITDA and investments in fixed assets would generate an increase in the value for most of the companies.

According to the results, the firms operating in Peru are the only ones that clearly are managing their working capital well. Chile is in a process of improvement, but in the cases of Argentina, Brazil and Mexico the hypothesis of overinvestment in working capital is verified. Furthermore, it is important to note that the effect of overinvestment in cash and cash equivalents is verified in three of the countries studied (Brazilian companies could also be included because they have overinvestment in working capital). This result is consistent with the results obtained by Vélez-Pareja, et al. (2009) where the same problem arose with respect to funds undistributed by the firms.

Determinants of the Cash Conversion Cycle (CCC)

It is important to identify which factors could have an effect in the cash conversion cycle (CCC). To accomplish this goal, this section is divided in two parts: in the first part explains the model to identify the factors, then the second part describes the sample and explains the results.

Model for the CCC

The investment in working capital that a given manufacturing company has, is quite different to that of a services company. Because of this, it is important to take into account the industry effect, so a positive relationship between the level of working capital of the industry and the level of working capital of the company is expected to be found (Hawawini, Viallet and Vora, 1986).

The size of the company is an important variable when it comes to establishing a working capital policy. In principle, larger sized companies ought to have a greater working capital given their higher sales. Despite this, larger sized companies may also have a better relationship with their suppliers, in this way, it is expected that they should maintain a lower investment in working capital. Therefore, the effect that the size of the company may have on its working capital is uncertain.

The proportion of tangible assets that is accounted for by fixed assets exerts an impact on the working capital and it differs across companies. For example, the inventory problems of a manufacturer of parts for motorcars will differ from those of a manufacturer of software. Added to this, the problems of account receivables that these two companies may have will be different. It is expected that companies that are more capital intensive may need to decrease their working capital with some exceptions when the company has substantial market power with its providers such in the case of supermarkets that may have negative CCC.

A firm's sales expectations have an influence on the investment in working capital (Nunn, 1981), and they will also affect the CCC because if a manager anticipates the growth of its sales, it is quite likely that it may increase the investment in inventories. As a result, it is likely that the firm may also increase the use of loans.

Country risk is a variable which is expected to have a significant impact on CCC. Country risk is being measured with an index called "Emerging Markets Bond Index (EMBI)" that indicates the risk premium that international investors must charge for investing in debt issued by public and private companies. In the face of a lower country risk, companies will increase their short and long term investments issuing debt because the risk premium they will have to pay is smaller.

Finally, Moussawi et al. (2006) argue that the market power of the company allows it to have better relationships with its suppliers and clients providing it with advantages over its competitors. Hence, the more concentrated the industry, the greater the company's influence will be over its CCC.

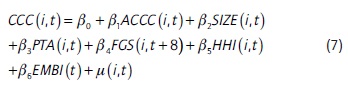

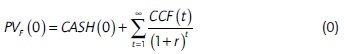

The following model (Moussawi et al., 2006) allows us to identify how the aforementioned factors affect the company working capital. In this case, the dependent variable will be the cash conversion cycle (CCC).

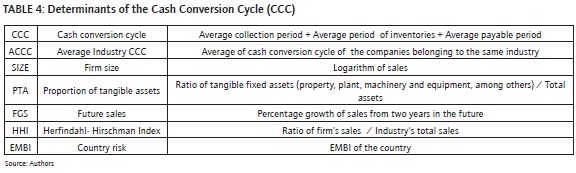

Where sub-index "i" indicates the different companies in each country and the sub-index "t" indicates the period. Table 4 shows the proxies used to calculate the variables to run the regression model in equation 7.

Sample and results

In order to estimate equation 7, we include firms from Brazil, Chile, Mexico and Peru for the period 1998-2008, which do not belong to the financial and public sectors in those countries. In this case Argentina was excluded from the analysis because the Buenos Aires Stock Exchange didn't provide a distribution of companies by industry. Besides, some key information for building the explanatory variables was not found. For the remaining cases, the variables were constructed on the basis of the industry classification given by each country's stock exchange. The data was obtained from Economatica and Bloomberg, and the selected companies are the most representative ones within each stock exchange according to their market capitalization.

The model to estimate was an unbalanced panel data model with fixed effects since information was not available for all companies in all years. The necessary corrections for autocorrelation were also made. Wooldridge (2002) developed a very flexible test in which the lack of autocorrelation is the null hypothesis of this test. If this test is rejected, one may suspect the presence of autocorrelation. This test was applied to each regression and only in the case of Mexico we encountered a problem of this type.

The other problem to be dealt with was heteroskedasticity. For the purposes of this study, we applied Wald's modified test for heteroskedasticity, as this test operates even when the assumption of normality with respect to the errors is not fulfilled. The null hypothesis of this test is that this problem σ2i = σ2 does not exist for all the i = 1...N, where N is the number of companies.

When this null hypothesis is rejected, a problem of heteroskedasticity exists. Once again, the test was applied to the countries selected and this problem was found in the four countries. Once the problems mentioned earlier were identified, adequate solutions were implemented in each case. In the case of Brazil, Chile and Peru feasible generalized least squares estimators were used because they only presented heteroskedasticity. In the case of Mexico, which also presented the autocorrelation problem, one used the Prais-Winsten regression for an unbalanced panel data model.

Table 5 (see Appendix) shows the results of estimating equation 7. In two out of the four countries analyzed the market power of the companies seems not to play an important role in the CCC. This is due to a very high correlation between the size of the company and the Herfindahl-Hirschman index (not reported). Therefore, by including the variable size both effects are captured. In this sense, it can be stated that market power is a variable that affects CCC as long as the firm is large. This result suggests that to the extent that a big company has greater market power, it will have a lower CCC.

The results show that the size of the company has a significantly negative relationship with the CCC because they may have better relationships with their suppliers. In addition to this, larger firms in Latin America are subject to less financing restrictions since they have a greater access to the financial market at lower financial costs than their smaller counterparts.

The practices adopted by the industry also determine the working capital policy. In all countries the average industry CCC is significant and has a positive relationship with the company's CCC, which means that companies try to stay close to industry policy. The expectation of sales growth is positively associated with the company's CCC. As a rule, companies increase their investment in inventories whenever they anticipate a growth in their sales.

Although it was not significant in three out of the four countries, country risk is an important variable in Brazil because in the other countries, where a lower country risk is faced, company uncertainty with respect to market behavior is lower, and consequently, the investment in working capital increases, resulting in CCC increases as well. Finally, the results show that the companies which are more intensive in tangible assets, seek to reduce the investment in working capital, which means that their CCC will decrease too.

Conclusions

The initial hypothesis was that Latin American companies had recorded an overinvestment in working capital during the last decade given their short term investment horizon. In order to verify this hypothesis, three versions of the first model were analyzed. As a result, one could verify this overinvestment hypothesis in three out of the five countries studied (Brazil, Chile and Mexico). However, in the two remaining countries, only in the case of Peru it be argued clearly that there is evidence of an improvement in working capital management.

Given the importance of working capital management, we studied also the determinants of the companies' Cash Conversion Cycle (CCC). The results show that the CCC is negatively correlated with firm size and positively correlated with the industry concentration index, which suggests that Latin American companies are using market power to reduce their CCC.

Similarly, practices adopted by the industry are very important in determining the companies' level of working capital. It was also verified that companies tend to invest in working capital when they anticipate a sales growth and companies in Brazil invest more in working capital whenever there is a lower country risk following in this way a window opportunity as it is also the case with the Initial Public Offerings issued by Latin American companies (Mongrut, Valenzuela and Garay, 2009).

On the basis of these results and the empirical evidence obtained in prior studies, it can be argued that it is necessary to conduct a more exhaustive follow-up study of the working capital policy in Latin American companies in order to formulate a strategy to help companies avoid the chronic problem of overinvestment that could destroy their firm's value.

To this end, Anand and Gupta (2002) made a proposal to develop a monthly report of the main ratios that are part of the CCC and make a ranking of the companies by sectors. This type of ranking could foster financial managers to keep their level of working capital within reasonable bounds.

References

Anand M. & C.P. Gupta (2002) Working Capital Performance of Corporate India: An Empirical Survey for the Year 2000-2001. Management and Accounting Research, 2(1), 43-67. [ Links ]

Arcos M. & J. Benavides (2006). Efecto del ciclo de efectivo sobre la rentabilidad de las firmas Colombianas. Borradores de Economía y Finanzas 9, Cali, Colombia, Ediciones ICESI, 19. [ Links ]

Deloof M. (2003). Does Working capital management Affect Profitability of Belgian Firms? Journal of Business Finance and Accounting, 30(3-4), 573-588. [ Links ]

Fuenzalida D. & S. Mongrut (2010). Estimation of Discount Rates in Latin America: Empirical Evidence and Challenges. Journal of Economic, Finance and Administrative Sciences, 15(28), 7-43. [ Links ]

Hawawini G., C. Viallet, & A. Vora (1986) Industry Influence on Corporate Working Capital Decisions. Sloan Management Review, 27(4)15-24. [ Links ]

Kaplan S. & R. Ruback (1995). The Valuation of Cash Flow Forecasts: An Empirical Analysis. Journal of Finance, 50(4), 1059-1093. [ Links ]

KPMG (2005) Working capital management: How do European Companies Manage their Working Capital? KPMG Survey, Advisory, LLP. [ Links ]

Moussawi R., M. La Plante, R. Kieschnick & N. Baranchuk (2006). Corporate Working capital management: Determinants and Consequences. Working Paper. University of Texas at Dallas. [ Links ]

Lazaridis I. & D. Tryfonidis (2006). Relationship between Working capital management and Profitability of Listed Companies in the Athens Stock Exchange. Journal of Financial Management and Analysis, 19(1), 32-59. [ Links ]

Mongrut S., A. Valenzuela & A. Garay (2009) What Determines Going Public in Latin America? Chapter 13, 255-271. En, Emerging Markets: Performance, Analysis and Innovation, G. N. Gregoriou (Ed.), Chapman-Hall/Taylor and Francis. [ Links ]

Mongrut S. & D Fuenzalida (2007) Valoración de inversiones reales en Latinoamérica: hechos y desafíos. Academicos, 2(4), 67-80. [ Links ]

Mongrut S. and D. Wong (2005) Un examen empírico de las prácticas de presupuesto de capital en el Perú. Estudios Gerenciales, 20(95), 95-111. [ Links ]

Nunn K. (1981). The Strategic Determinants of Working Capital: A Product-Line Perspective. Journal of Financial Research, 4(3), 207-219. [ Links ]

Payne S. & K. Bustos (2008). Latin America companies holding up to US$ 46 Billions in working capital. REL/CFO Magazine, 4(1), February, 1-4. [ Links ]

Shin H. & L. Soenen (1998). Efficiency of Working Capital and Corporate Profitability. Journal Financial Practice and Education, 8(2), 37-45. [ Links ]

Vélez-Pareja I., M. Merlo, D. Londoño, & J. Sarmiento (2009) Potential Dividends and Actual Cash Flows: A Regional Latin American Analysis. Estudios Gerenciales. Journal of Management and Economics of Iberoamerica, 25, (113), 151-184. [ Links ]

Wooldridge J. (2002). Econometric Analysis of Cross Section and Panel Data, Cambridge, MA, MIT Press, 776. [ Links ]