Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Estudios Gerenciales

Print version ISSN 0123-5923

estud.gerenc. vol.18 no.85 Cali Oct./Dec. 2002

HOW TO MOTIVATE FASTER GROWTH IN COLOMBIA: THE LEADING SECTOR STRATEGY REVISITED

ROGER J. SANDILANDS*

Roger Sandilands is a Reader in Economics. A graduate of Strathclyde and Simon Fraser Universities, he has held university posts in the United Kingdom, Canada, Singapore, Sweden and Peru, and has worked as an economic consultant to the United Nations, the Colombian Agricultural Research Institute, and the Colombian National Planning Office. His books include Monetary Correction and Housing Finance in Latin America (Gower, 1980): The Life and Political Economy of Lauchlin Currie: New Dealer, Presidential Adviser, and Development Economist (Duke University Press, 1990); and Money and Growth: Selected Paper of Allyn Abbott Young (Routledge, 1999).

Fecha de recepción: 21-10-2002 Fecha de aceptación: 16-12-2002

*His published papers deal with international trade, housing finance, land value taxation, monetary policy, growth theory, agricultural modernization, industrialization, and the economic history of the Great Depression. He has also been Managing Editor of the Journal of Economic Studies.

ABSTRAC

This paper reproduces two public lectures given at an Incolda conference in Bogota, October 1, 2002 on "La Realidad de la Economía Colombiana". It reviews the great structural changes in output and employment over recent decades and how macroeconomic policies can strengthen or weaken the natural forces underlying these changes. It distinguishes between potentially inflationary policies designed to increase demand in a monetary sense, and those that focus on institutional changes that enhance competition and mobility. It explains how inflation distorts the allocation of resources, and why it especially harms long-term housing finance and exports. It explains the logic of Lauchlin Currie´s leading sector theory of growth and shows why and how housing and exports can be given special protection to accelerate development.

KEY WORDS

Colombia, growth, structural changes, inflationary policies, leading sector theory of growth, housing sector, exports sector, development.

Clasification: B

It has been a few years since I worked serioly on the details of the Colombian economy, so I am a little divorced from the contemporary reality, which I do understand is extremely complex and fragile at the moment. But I hope that the work that I have done in and on Colombia since I first came here in 1968 gives me a long-term perspective that will justify my addressing this distinguished audience today.

When I first arrived here in the late 1960s the structure of the Colombian economy was very different from what it is today. The population was "only" 17 millions. This was up from 10 millions in 1950 when the first World Bank Mission arrived, and even then the mission report complained of an excessively high birth rate. This was the mission headed by Lauchlin Currie, and the health expert on the team, Dr Joseph Mountin of the US Public Health Service, later initiated work in the National Health Service in Washington that led eventually to the pill.1 Currie remained in Colombia after delivering his famous Informe Currie -the World Bank Report of 1950- and he played a very important -and, naturally, very controversial- part in guiding Colombia´s economic development in the following four decades. I was a student of Lauchlin Currie´s in graduate school in Canada and what I have to say today owes much to his influence and to the work I have done here in Colombia in association with him at Planeación Nacional and other places.

When the first World Bank Mission arrived here in 1950, about 70 percent of the Colombian population lived in rural areas; by the late 1960s this proportion had fallen to less than 40 percent. Today it is around 25 percent. There was always an imbalance between the proportion of the work force engaged in agriculture and the proportion of the GDP generated by that sector -around a third in 1950, a quarter in the late 1960s and around 13 percent today. A simple arithmetic calculation shows you that this puts average rural output and incomes per worker significantly below the incomes of workers in the urban sectors.

Urban workers -in manufacturing, commerce, construction and services- are much more productive than their rural counterparts in terms of the value of what they can produce. This is the most powerful reason for the continuing mass migration from village to town and from town to city in Colombia over the past 50 years. This process has been powerfully reinforced by the continuing process of technification of agriculture that displaces rural labour in the face of low elasticity of demand for the products of this sector. This process of technification still has a long way to go before productivity levels approach those in North America and Europe where barely 2 percent of the active population now work in agriculture. Of course, rural violence is another factor but this is nothing new in Colombia, though there has recently been a tragic increase in this expulsion factor.

Rural -urban migration is just one manifestation of underlying natural market forces at work-forces that persuade or compel resources from sectors where the return is low to activities where the return is much higher. When labour and capital move from the textile sector in Bogota toward the electronics sector (or to pharmaceutics or conmmerce or construction) because of higher returns in the latter over time, this is a process that is encouraged. But when labour and capital move from Boyaca to Bogota this is often seen as a cause for regret; as a Bad Thing.

This regret is understandable. The social, psychological and infrastructural burdens associated whith the economic mobility mechanism in the process of rural-urban migration are much greater than in the case of urban- urban mobility. And much greater than anything experienced in Europe or North America at comparable stages of their development. Nevertheless, the more that these burdens are assumed and tackled the greater the efficiency of the economic machine, and the greater the potential increase in overall GDP and in average real incomes and living standards for rural and urban workers alike. Indeed, the rewards -in terms of potentially much higher growth rates than in 19th century Europe and Nort America- are also much greater if policy makers put oil rather than sand into the mobility mechanism.

It is no accident that compound growth rates in the Asian tigers have been as high as 8-10 percent per year the last few decades. At these rates there is a doubling of per capita incomes every 10 years. Thus in Singapore, for example, a country that I also first visited in the 1960s and where I have recently spent 6 years of my working life, living standards today are about 8 times higher than in the 1960s and per capita income higher than in most of Europe.

The problem for Colombia is of course compounded by the fact that the birth rate continues to be much higher than in Europe and North America in the 19th century, while mortality rates have come tumbling down. Thus Colombia´s population today is more than double what it was when I first came to Colombia, and more than 4 times what it was when the first World Bank Mission launched Colombia on its first serious development programme. That is an extra 33 millions, whith nearly a million more each year or so.

Fortunately, population growth is slower now than in the 1960s. This is largely due not so much to the pill as to the incentive to reduce the birth rate. This is due to the impact on incentives of higher rates or urbanization, higher incomes, greater job opportunities for women outside of the home, and higher levels of education, particularly for girls.

Does Colombia need all these extra people to fuel its economic development? Of course most of them will eventually be members of the work force. But the productivity of the work force depends on how disciplined and educated they are. And, above all, on how much physical capital and technology they each will have to work with. It is the productivity of the work force, not their number, that makes for a high per capita level of income, a high standard of living, and a more equal distribution.

My own thinking of these issues is, as mentioned, considerably influenced by Lauchlin Currie, who in turn was greatly influenced by his Harvard mentor, the great American economist Allyn Young whose most famous writing was delivered as the presidential address to the British Association in 1928, on "Increasing Returns and Economic Progress" while Young was a visiting professor at the London School of Economics. (Young had the unique distinction of being president of the AEA, the ASA and the BA.) Let me try to explain the relevance of his theories to an audience of Colombian entrepreneurs.

Young´s theme took as its point of departure Adam Smith´s famous account, in the opening chapters of The Wealth of Nations, of the economies of scale available in a simple pin factory. This was written in 1776 -a time when Britain was a developing country like Colombia today, so Smith´s writings are still relevant. The key point was that the opportunities to exploit the amazing possibilities of enhanced productivity via specialization depended on the size of the market. Hence Smith´s famous aphorism that "the division of labour depends on the size of the market."

Young developed this basic insight. He explained that the form in which specialization -and hence productivity growth- occurs in the modern economy was via specialization by firm as well as within firms. And accompanying this specialization was a greater degree of "roundaboutness" or capitalintensity. Hence the growing economy is a more and more complex economy in which industrial diversification and sub-division is just as important, or more important than industrial concentration and monopoly.

Competition, mobility, and unrestricted access to the cheapest and best goods and services available at home and abroad were the key conditions. Competition, mobility and openness increase both the ability to produce more via specialization, and to enjoy greater purchasing power, or increased real incomes. And it was increasing real incomes (arising from the ability to use one´s income to buy the cheapest and best available goods and services) that represented the increased real demand or size of the market.

From these insights it is possible to construct a theory of cumulative causation or self sustaining growth. Depending on the degree of competition and mobility, falling costs of production will be passed on to consumers in the form of lower prices or higher real wages. This is what increases the size of the market. This in turn increases the incentive and the finance needed to expand output and productive capacity throughout the economy, and to adopt productivity-enhancing technologies and organizations in existing and new industries.

Increased market size makes for changes that are both quantitative and qualitative. The qualitative changes -new technologies, new ways of organizing firms and industries, new skills, new products, new jobs- engender macroeconomic increasing returns that are largely automatic, or the natural result of market forces.

This has come to be known as the Young-Currie multiplier. It means that the growth rate has an endogenous tendency to continue at the same rate year after year. For growth means that the real market size is bigger each year. Thus growth increases the division of labour. But increased division of labour, or specialization, increases productivity and growth. Thus, in Young´s words: "the division of labour is limited by the division of labour"; or growth is limited by growth. This implies that automatic market forces may perpetuate a slow as well as a fast growth rate. The existing growth rate, whatever it is, has a tendency to continue at the same rate.

The key problem for policy makers is how to convert a slow growth trend into a fast growth trend. Or in other words, how can policy makers expand the size of market demand in order more fully to capture the benefits of specialization and achieve greater increasing returns?

The answer does not lie in an increase in the money supply or in continuous fiscal deficits. That way there may indeed be an increase in monetary demand. And in Colombia there has never been any difficulty in achieving that. If that were the solution Colombia would have had one of the fastest growth rates in the world in the past 40 years. Instead it has one of the slowest -and much slower than that of the Asian tigers and much below Colombia´s potential. This is a country immensely rich in entrepreneurial and natural resources, but these resources have been largely underutilized.

The solution lies in measures that increase real demand.

But real demand depends on real supply, and vice versa. How break into this circle, to ensure that the circle expands year after as fast as possible? The answer is that much more attention needs to be given to the factors that hold back an increase in real demand for the goods and services that Colombia is capable of producing if only the incentive is given. It is not just, or mainly, a matter of increasing the supply of capital, or foreign exchange, or workers. It is a matter of how to make it appear worthwhile to entrepreneurs. Who will use their own or other people´s money to invest in new capacity and technology if the potential increase in supply looks as if it will outstrip the potential increase in demand? In those circumstances and increase in supply at the level of the individual firm or individual sector may result in a fall in price that is faster than the potential cost savings. The potential result is bankruptcy. So the individual entrepreneur holds back and increases output only in line with the historic trend. And in Colombia this secular trend has been rather miserable.

Thus it is incumbent upon policymakers to get the macroeconomic conditions right.

In my opinion there have been two major, related failings here:

(i) The first is the belief that the major constraint on non-residential business expansion is a lack of credit and/or interest rates are too high.

(ii) The second is the belief that devaluation causes inflation and that therefore the best way to control inflation is to control the exchange rate.

Both of these issues are intimately related to the recent problem of recession worldwide, and in particular to Colombia´s recent economic misery.2 After the break I shall go into these two issues a little more deeply.

But what if the main cause of inflation is actually an excessive expansion of the money supply? What if this is partly brought on by a central bank upon which strong political pressures are brought to bear to keep interest rates low? What if the Banco de la Republica acts not solely as a central bank whose prime role is to control the supply of money in line with the real growth of the economy but also as a development bank that provides development finance and cheap credit to favoured farmers and industrialists? In these circumstances there is a real conflict of objectives; and in the past the cheap money lobby or the influence of the spending ministers has prevailed too often.

The result has been an inflation rate much higher than the world average. This has had at least two extremely damaging effects on investment and the efficiency of the economy (as well as noxious effects on the distribution of income). The first concerns the effect on trading opportunities with the rest of the world. The second concerns the market for housing finance, and hence investment in building and related industries.

- FOREIGN TRADE

- THE HOUSING MARKET

Let me first discuss the issue of foreign trade opportunities.

In Colombia the tendency has frequently been to control the exchange rate instead of the money supply in the face of inflation. This has produced a chronic tendency toward an overvalued exchange rate. This has made Colombia´s imports artificially cheap and her exports artificially expensive. This means that when trying to sell their goods and services, Colombian producers have had to rely too much on the limited domestic market and not enough on the potentially vast world market.

Import controls and export subsidies have been employed to try to help Colombian producers, but these have created an excessively large bureaucracy. This is extremely frustrating to business, wastes productive resources, and is partial and discriminatory. It does little to enable Colombia to increase its world market penetration. When the demand is limited, supply has to follow the distorted and limited pattern of demand. Specialization, diversification, and the adoption of new technologies are frustrated. Increasing returns and fast growth are sacrificed.

In parenthesis, I may mention a related problem that Colombian industrialists face when the exchange rate is overvalued and the country experiences chronic balance-of-payments difficulties. In trying to deal with the allocation of foreign exchange bureaucratically rather than through the market mechanism civil servants at Incomex tell industrialists what they can and cannot buy from abroad. With a chronic unemployment problem and low wages, you are told by civil servants to spend your money (not theirs) on labour-intensive methods rather than the methods that you regard as most economic and suited to your particular needs. The import of capital-intensive technologies are discouraged and even prohibited.

Let me give you an example, though I am sure many of you will have similar or better examples than mine. I know an energetic Colombian industrialist who was denied an import licence for an advanced German machine that would produce drip irrigation tubes rapidly and cheaply. Instead he was forced to use antiquated second-hand machinery bought locally. The machine broke down frequently and was slow. The up-front capital cost of this machine was much less than the foreign one; but what of the overall costs of production for the tubes? Overall costs included the costs of slowness and breakdown, and the labour costs were also higher. Nevertheless, the increased labour- intensity of the antiquated, lowproductivity methods is often been regarded as an advantage rather than a disadvantage in the eyes of the economically illiterate. With higher unit costs and smaller output, the irrigation equipment is sold at a higher price to farmers and flower growers. Ultimately domestic consumers of food and the foreign purchasers of flowers face higher prices. Domestic and foreign sales are thus lower than would be possible if the manufacturer had been free to use his own best technical and economic judgments when investing his own money.

The lesson is a universal one. If costs are artificially raised through protectionism, the home and foreign markets available to Colombian producers generally is lower. Protection for one group is disprotection for the rest of the economy. Whith smaller markets, the incentive for all Colombian producers to invest and innovate is lower. Low demand, low incentives, low growth: A vicious cycle is perpetuated.

Thus there is an intimate connection between the health of the sectors supplying foreign markets and those supplying the home market. They do not expand at each others´expense. Their fortunes, and that of the whole economy, are mutually reinforcing -either in the upward or in the downward direction. If, for example, the housing sector is sick, it will be harder not easier for exporters to keep their costs low and to exploit economies of scale.

This brings me to the second debilitating effect of inflation (or an excessive expansion of monetary demand), namely, its debilitating effect on real demand in the housing market. Once again the problem relates to the view that credit ought to be offered on the cheapest possible terms to borrowers. And just as industrialists constantly lobby the government and central bank to keep interest rates low and credit cheap, so in the market for housing finance the voice of the borrower has greater political weight than the voice of the saver.

The result? Big potential demand for housing finance, but small supply. And the market always clears at the short end. A short supply means that large potential demand becomes short effective demand. The key problem for policy-makers is how to convert potential into actual demand.

The housing finance market is not like most other credit markets, because it typically finances an asset whose value is usually very large relative to the borrower´s income, and so needs to be on much longer terms than most. When inflation is high nominal interest rates are also high, even when they are negative in real terms. At high nominal rates of interest, say 20 percent, there is a major "front-endloading" or cash squeeze problem for borrowers. To buy an apartment with a mortgage of $100.000 requires that the borrower pay $20.000 in interest payments alone in the first year. This may nearly exceed his entire annual income even though in theory that apartment should be easily affordable in the long term to someone with his income. Furthermore, even if he could overcome the frontend loading problem, why would savers bothers to put their money into the system if inflation is, say, 22 percent or more? That is, if interest rates in the corporaciones de vivienda (CAVs) are negative in real terms. And they would be doubly reluctant if the banks specializing in short-term loans to other types of borrower are able to offer better rates to lenders and extract higher rates from borrowers.

(Incidentally, now that Colombia´s CAVs have been fused into the banks, the banks may have less incentive than when the CAVs were independent specialist institutions, to use their funds to finance housing rather than automobiles and consumer credit. I well recall Dr Gabriel Rosas presenting a paper on behalf of Lauchlin Currie at a convention in Cartagena in 1991 that warned of the benefits of financial specialization and the dangers of multi-banking. A pity his words have not been heeded.)

The main pint is that inflation introduces a major distortion into capital markets by discriminating heavily against housing. Yet this is the very sector where potential demand is very great. It is also a sector with a relatively low import content. And it has the potential to employ hundreds of thousands of workers in relatively well-paying jobs, even when efficient capital-intensive building methods are employed.

A dynamic housing sector is vital also to the better functioning of the labour mobility mechanism. Workers moving from village to town, from town to city, and from city slums into better accommodation in the same city need housing if they are to make the move easily. Thus housing is a vital part of a job creation programme. It employs labour directly in the building of houses and related infrastructure. And it plays a crucial indirect role in making labour available to other employers in industry, commerce and services. An increased supply of housing at lower cost reduces the cost of an important wage good, and so enables employers to cut their own wage costs without reducing the standard of living of the workers.

Furthermore, by playing this vital role in oiling the labour-mobility mechanism, a dynamic construction sector enables more and more workers to move from low-to higher-paying jobs. Ultimately real wages all round should increase, thanks to the overall productivity-enhancing effects of better mobility and the way in which this in turn increases overall size of the market, or GDP. This is what encourages investment and innovation that would not otherwise have been worthwhile.

Note too that those idnustrialists who are producing goods and services that enter into the building of houses (the construction sector itself is basically an assembly industry) see no point in expanding their operations greatly, or establishing new specialist plants that yield big economies of scale, unless they are happy with the prospective increase in demand for their products: bricks, cement, glass, pipes, sanitary fixtures, furnishings, paint, etc. They need an incentive; and the incentive comes from an expansion in demand, not in terms of money only, but in real terms.

It is in this sense that for many years Professor Currie pushed hard for the adoption of a leading sector strategy in Colombia, with construction and exports as the two most important candidates for this role.

Exports were to be encouraged through the preservation of a more permanently competitive exchange rate. This would be achieved through policies that ensured that the external value of the peso kept in line with its internal value. If domestic inflation is depreciating the internal value of the peso then its external value should be allowed to reflect this. Otherwise a major distortion is introduced into the market signaling process.

Housing was to be encouraged through the valor constante system that guaranteed savers a fair return on their savings while at the same time making it much easier for borrowers to pay a reasonable real interest rate to savers without encountering the crippling cash flow problem that had artificially restrained demand for many years.

In the early years of the valor constante system it operated fairly closely to a theoretical and practical ideal. Savings flowed into the system at a rate that astonished the skeptics; but demand increased even more rapidly. Construction boomed without recourse to massive subsidies or burden on the taxpayer or the central bank. Colombia´s growth rate was higher in this period than before or since. But sadly, over the years, once the borrowers had got their mortgages they formed a powerful pressure group to persuade the government to weaken the system by loosening the index link with inflation. This was to the detriment of savers and jeopardized the competitiveness of the housing finance system vis-a-vis the rest of the capital markets. As saving declined the government has had to rely more and more on "social" housing, at great fiscal cost and with far less housing constructed than in the past, and with a socially and economically costly pattern of urban development.

Thus, although housing has a great potential as a leading sector in the potential acceleration of the rate of economic growth in Colombia, it also has the potential to lead the economy down as well as up. I hope that as a tribute to the unparalleled efforts of Lauchlin Currie on behalf of faster economic growth and social justice in Colombia from the time of his arrival here in 1949 right up to his death in 1993, Colombian policymakers may make amends and ensure that his leading sectors strategy is resurrected. It would be a fitting way to mark the centenary of his birth a week from today.

FOOTNOTES

1. However, it takes much more than the availability of the pill to bring the birth rate down - see below

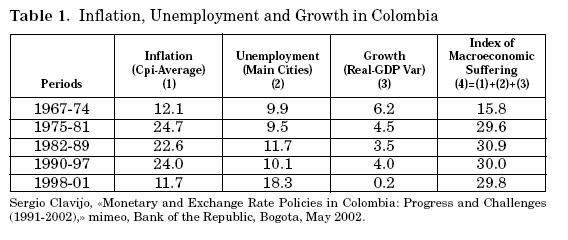

2. Show Sergio Clavijo´s "Index of economy misery", 1967-2001