1. Introduction

In Brazil, family construction companies provide a significant share of goods and services in the construction industry. Approximately 50% of the 50 largest building companies in the country are family-owned [1]; therefore, the economic relevance of family construction companies is paramount.

Family construction companies need to protect themselves and minimize their weaknesses; therefore, good management practices, in the form of sound corporate governance, should be encouraged.

According to the Brazilian Institute of Corporate Governance (IBGC), corporate governance recommendations help monitor and encourage management, lead to improvements, preserve and enhance organizational value, and facilitate access to bank loans [2].

The level of professionalization of family organizations tends to be low, especially because of poor management systems which do not favor autonomy, transparency, accuracy of information, or organizational value [3]. In Brazil, the level of governance in family construction companies may be far from ideal.

To understand the current situation of these organizations, a proper assessment of the level of application of corporate governance practices is mandatory. The aim of this study is to evaluate the basic corporate governance practices applied by family construction companies and to identify practices that may reduce recurring challenges in these companies based on IBGC recommendations.

2. Family business

A family business is an organization that has its origin and history tied to one or more families, or an organization which keeps family members in the business administration [4].

The relationship between the company and the family may result in strengths and weaknesses. Strengths include rapid decision making, lean organization, credibility of stakeholders, loyalty and dedication to internal relations, strong influence of the leader in the motivation of employees, and continuous and integrated administrative guidelines [5]. In addition, a strong, long-term vision may derive from the fact that, in many cases, the company is the family’s only source of income [6].

However, family businesses have their weaknesses, and these are the focus of this study. Vulnerabilities include, but are not limited to inefficient corporate structure (informality) [6-12] and overlap of ownership and management in the same individual, because it leads to conflicts of interest in the organization [7,9-11].

Organizational succession is one of the major obstacles to family businesses because of its influence in the mortality of the company [6-12]. Another obstacle is how to keep family members and stakeholders up-to-date on current affairs and decisions; [10] this challenge can be mitigated by good governance practices, which can promote effective communication and deliberation on property matters [9].

In the model of corporate governance, the quality of accounting numbers is essential [13]. Approximately 63% of family business use bank loans as their main source of resource acquisition; [10] for family organizations with poor corporate governance, loans are expensive and limited [12]. Companies with adequate levels of governance have greater access to finance, improve capital cost, valuation, and organizational performance [14-15]. Therefore, family companies should implement at least basic corporate governance practices to improve procedures and increase control, transparency and organizational value.

3. Corporate governance in family business

Corporate governance started effectively in the 1990s to remedy the typical "agency conflict" in joint-stock companies. Agency conflict is the dispute between the agent (owner) and the principal (partner), where the agent's focus shifts from the goals of the investors and stakeholders to their own individual benefits [16].

Corporate governance practices can guide management, help monitor and follow-up activities, and structure organizational growth. The recommendations contribute to the sustainability and longevity of the business, and may be adapted to any type of organization, including family businesses [8].

Good corporate governance practices may also enhance liquidity, growth, and internal management. Difficulties such as intrafamilial differences, succession disputes and misuse of assets can be resolved through recommendations [14].

In 2014, IBGC issued a practical guide called "Good Corporate Governance Practices for Closed-Cap Enterprises" to guide limited or closed capital companies. As most of these organizations are under family control, these guidelines are the main reference for our study [17]. For the early stages of corporate governance, IBGC suggests the following:

3.1. Control bodies and mechanisms:

This part of the study analyzes practices that provide minimal conditions to create a stable, standardized organization, initiating a process of maturing. Recommended practices include standardizing processes, observing accounting standards, defining organizational structure and implementing a system to produce information and consolidate data. To increase control, IBGC recommends internal audits; surprisingly, more than half of the organizations surveyed do not have an audit committee [18-19]. IBGC also recommends hiring an independent external audit to increase information reliability, facilitate access to credit lines, and increase owners’ confidence based on audited balance sheets; besides, an audited company may also improve their fraud risk assessments. Therefore, practices related to control bodies and mechanisms improve the understanding of the organization and increase transparency and reliability, leading to a more professional company.

3.2. Ownership:

This section investigates how companies deal with partners and organizational control. A Committee/Meeting of Shareholders provides an environment conducive to aligning decisions and objectives among owners. In addition, partners’ rights and responsibilities must be documented in the Statute/Bylaws of the Company (for joint-stock companies and limited societies, respectively), or in Partnership Agreements (documents available for all members, but with clauses in force only to the signatories of the contract). Clear rules are important to mitigate potential conflicts; in organizations with high concentration of ownership, such as family businesses, corporate governance tends to be positively affected, facilitating the adoption of best practices [20-21].

3.3. Advisory Board or Board of Directors:

This is the main body of the governance structure.

The board runs the business, protecting its purposes, strategies and objectives. It is also responsible for monitoring the performance of executives; it is the link between the interests of the administration and the owner(s) of capital. Because it is subordinate to the partners, it has to render accountability to them. In early stages or corporate governance, companies may choose an Advisory Board to advise members on organization guidelines. In more advanced stages, a Board of Directors deliberates and guides business strategies. In both cases, IBGC recommends an internal regiment to regulate the functioning body. In addition, naming at least one independent director is advisable to improve performance. Independent directors improve supervision and control, and support the company’s reputation in the market. Previous studies indicate that 75% of organizations have a governing body; [19] however, the independence of the board is remarkably low among Brazilian companies [20,22]. In most organizations, the board is composed by informants or representatives of the controlling family or group. In many companies, there are no independent directors [23].

3.4. Family Council:

These recommendations primarily reduce negative interferences and increase the benefits of family relationships in organizations. The Family Council discusses family issues exclusively, minimizing conflicts in preliminary meetings. Here, as in the Board of Directors, IBGC recommends a regiment to discipline its operation. In addition, topics to be discussed in future meetings should be communicated in advance to facilitate decision-making and increase effectiveness. The subjects discussed in Family Councils include preservation of family values, alignment of family expectations with the future of the organization, succession planning of ownership, and definition of rules to acquire participation in the business company. Considering the relevance of the Family Council, it is surprising to find that only 30% of organizations have one [19].

3.5. Relevant documents:

The documents that guide the implementation of corporate governance in family businesses are: 1) Partnership Agreements and Statute/Bylaws, which regulate relations between owners; 2) Family Protocols, which define entities’ limits, rights and duties, and are in general linked to Family Councils; 3) Internal Regulations, which regulate the organization and the performance of the Advisory Board or the Board of Directors; and 4) Codes of Conduct, which establish behavioral guidelines for employees and partners in internal and external relationships. In general, the Codes of Conduct define the proper ways to carry out denunciations and deal with ethical dilemmas.

4. Materials and methods

Our main study question was: "What is the degree of application of basic corporate governance practices in family construction companies?". Our approach to answer this question involved five steps: bibliographic search, survey of expert opinions, data processing and analysis, results and discussion, and conclusions.

4.1. Bibliographic search

A bibliographic search was carried out in search engines, such as Google Scholar, and in national and international databases, such as Web of Science, Scopus, and Scielo. Our main source of information was the CAPES/Brazil Portal, which provides access to full texts in more than 38,000 journals.

Keywords included 'corporate governance,' 'family business,' and 'Brazilian construction companies'.

4.2. Survey of expert opinions

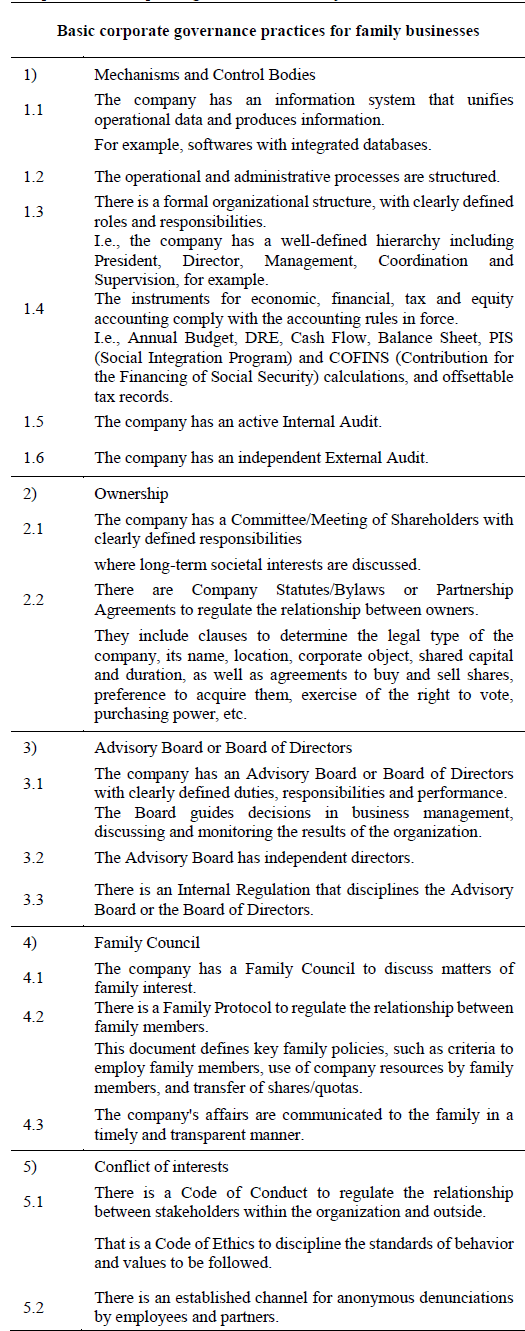

This study included thirty-three companies surveyed with Google Forms. The survey comprised twenty questions, four referring to demographic data and sixteen referring to basic corporate governance practices according to the IBGC guidelines. Questions were grouped into five categories: Control Mechanisms and Bodies (six items), Ownership (two items), Advisory Board or Board of Directors (three items), Family Council (three items) and Conflicts of Interests (two items).

A simple Google search resulted in a list of family construction companies, which were contacted mainly by e-mail, but also by telephone.

Sixty-eight companies met the profile of family companies; 33 participated in the survey, seven could not or would not respond, and the remaining did not respond in time.

Respondents were professionals working in civil engineering, with over 5 years’ experience in infrastructure projects and extensive knowledge about the organization.

According to the Central Limit Theorem, the distribution tends to be normal when the number of elements in a sample is greater than 30. Therefore, it is possible to discover the hypothetical value of the population mean [24]. Moreover, considering that a detailed study of all family companies would be costly and time-consuming, our study used a non-probabilistic sampling method.

The use of convenience sampling is justified because it is the most common type of sampling in studies considering geographic proximity of information, researchers’ time, data access and willingness of volunteers [25]. The sample is classified as non-probabilistic because it is impossible to access the population size; therefore, the probability of sample selection is unknown.

Before the interview, a pre-test was administered to identify potential confusion and eliminate inconsistencies. The questionnaire was then revised based on the comments received. Respondents started by answering the demographic questions, and then completed their assessment of the adequacy of corporate governance practices based on a five-point Likert scale, ranging from “strongly disagree" to "strongly agree". Participants answered all questions in 10 weeks (7/31/2017 to 10/2/2017). Table 1 presents the basic corporate governance practices investigated.

4.3. Data processing and analysis

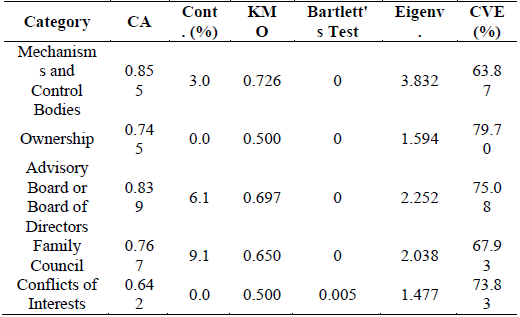

The questionnaire was validated considering reliability, content and constructor. Reliability was verified with Cronbach's Alpha (CA), which confirms the accuracy and consistency of the instrument. It is reasonable to assume that the questionnaire will produce similar results when answered by equivalent samples [24]. Most researchers use Cronbach's Alpha above 0.70. However, 0.60 is accepted for new instruments, as it the case here [26].

Unanswered questions were lower than 10%; therefore, the five categories were validated for content. This analysis is in agreement with the current literature, and ensures the correct understanding of the instrument [27].

The last validation was that of the constructor. The Kaiser-Mayer-Olkin (KMO) and Bartlett's Sphericity Tests were performed. The KMO allows the use of factor analysis; values above 0.5 should be accepted to apply the model. The Bartlett Sphericity test is used to analyze the hypothesis that the variables are not correlated in the population. In this test, if the p-value is lower than 0.05, the hypothesis is rejected, and thus the results can be extrapolated [28].

The perceived scores in all categories showed an Eigenvalue higher than 1.00, which indicates that there is only one object in each category. The Cumulative Variance Explained (CVE) was analyzed to verify the need for factor extraction. Values above 60% are suggested for validation [29]. Table 2 presents the statistical results that validate the research.

5. Results and discussion

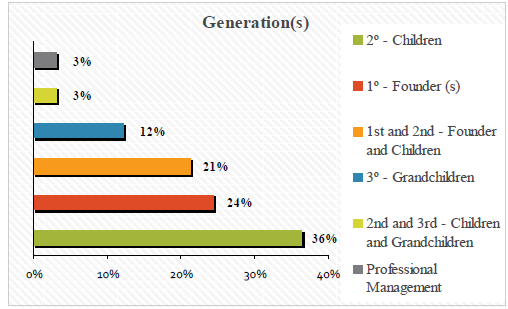

According to the 33 respondents, approximately 24% of the sample (eight companies) are 1st Generation (under the control of the founder). Thirty-seven percent (twelve companies) of the family construction companies are 2nd Generation, i.e. there has been a transition from the founders to their children. Companies transitioning between 1st and 2nd generations (i.e. with both founders and their children) account for 21% of the sample (seven companies), and only 12% (four companies) reached the 3rd generation, with grandchildren at the forefront of business management. These results are in line with the PWC survey conducted in 2016, which also found an average family life of only 12% for the third generation.

Tied with 3% were a family building company with an overlap between 2nd and 3rd generations (children and grandchildren) and a professionally managed company, where the only role of the family is that of owners.

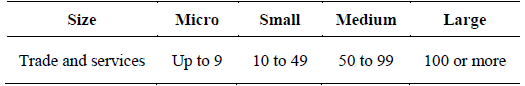

In this study, family construction companies were classified as service providers mainly because they produce heterogeneous real estates, with distinctive characteristics [30]. The size of the organizations in the service segments is classified according to the number of employees, as shown in Table 3 [31].

According to Table 3, large companies accounted for the largest group in our sample (73%; twelve four companies). Small construction companies accounted for 15% of our sample (five), and the smallest group included micro and medium-sized businesses, accounting for 6% (two) of the participants.

Table 3 Classification of company size by number of employees for the service sector

Source: SEBRAE/SC. Legislation - Classification Criteria of Business: MEI - ME - EPP. Access: Oct 3, 2017. Available at: http://www.sebrae-sc.com.br/leis/default.asp?vcdtexto=4154

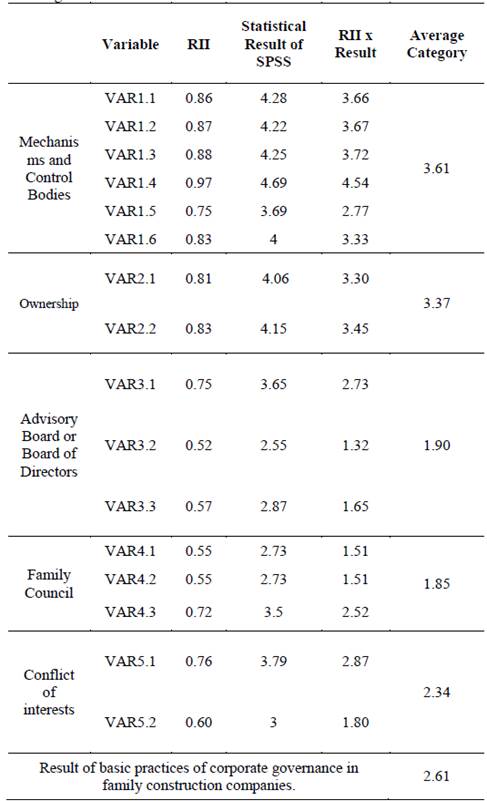

The performance of each category was: Mechanisms and Control Bodies (3.61); Ownership (3.37); Conflicts of Interests (2.34); Advisory Board or Board of Directors (1.90); and Family Council (1.85). According to our data, the group of Brazilian family construction companies presented a final score of 2.61.

Table 4 summarizes the scores for each category and variable investigated. The final mean of each group was obtained by multiplying the RII by the mean of each item, and then defining the weighted average. The "RII x Result" column shows the adjusted measures of each variable; results are given in the "Average Category" column.

Table 4 Results by variable and category, and final average of the practices investigated.

Source: Software SPSS (The Authors).

The category of Mechanisms and Control Bodies performed best (3.61); that means the first action of these businesses is to create control mechanisms to standardize and professionalize the company.

The most implemented element in this category was the preparation of economic, financial, tax and equity statements (VAR1.4; 4.54). This indicates that most of the family construction companies apply accounting standards and norms; however, our data shows that they place low value on internal audits (VAR1.5) and independent audits (VAR1.6) (2.77 and 3.33, respectively). Family construction companies start by hiring external audits, but implement internal controls later.

These low rates are in agreement with previous findings [18,19]. Thus, the information presented by these companies is not reliable or transparent enough.

The second most highly evaluated recommendation is also in Mechanisms and Control Bodies. The definition of the organizational structure (VAR1.3) scored 3.72. In the same category, two other practices are worth mentioning: the presence of an information system to collect/process data and produce information (VAR 1.1) and the definition of structured operational and administrative processes (VAR1.2), with scores of 3.66 and 3.67, respectively. These results indicate that family construction companies start their governance model by standardizing procedures and business structures and that, after accounting adjustments, they define their processes and information systems in an attempt to become more consistent and knowledgeable about themselves.

The next category investigated was Ownership, with the second best score (3.37). Data from this group indicate that, in most cases, organizations start by defining and formalizing the relations in the business company with Statute/Bylaws or Partnership Agreements (VAR2.2). VAR2.2 scored 3.45, while the existence of a Committee/Meeting of Shareholders (VAR2.1) scored 3.30.

However, the Advisory Board or Board of Directors category scored 1.90, only higher than the Family Council category. This is an unsatisfactory result, because the boards are the core of the governance structure. The provision of the body (VAR3.1) received the highest score (2.73). The second highest score (1.65) was for Internal Regulation (VAR3.3). The lowest score was the external, independent professional (VAR3.2) to ensure impartiality, with a score of 1.31. This finding is in agreement with previous studies, which also pointed to the weak independence of the Boards. [20,22,23] It is worth noticing that 73% of the companies interviewed are large, which further aggravates the problem.

To investigate how well companies manage their family-related issues, our study analyzed the Family Council category, with the score of 1.85. This group of practices implies that few companies have a Family Council (VAR4.1) and a Family Protocol (VAR4.2) to discipline the relationships between family members. Both practices scored 1.51, allowing us to infer that the two recommendations appear almost simultaneously. This low score had already been predicted by [19]. However, even when the council and the protocol are not formally established, a larger number of family building companies (2.52) implement communication (VAR4.3), behaving in a more informal manner.

The last category investigated was Conflict of Interests, with a score of 2.34. In this group, two points were raised: the existence of a Code of Conduct (VAR5.1) and the provision of a channel that allows anonymous denunciations for fraud and misconduct (VAR5.2), with scores of 2.87 and 1.80, respectively. Thus, the formalization of a Code of Conduct seems to be more important than actually uncovering cases of misconduct. This scenario allows us to infer that family construction companies are more committed to looking good than actually being good.

The overall average of all categories resulted in the disappointing score of 2.61, which is opposed to previous findings; [20,21] here, the concentration of ownership did not lead to an acceptable score for corporate governance practices. It is worth noticing that most respondents are large, and that 37% of them are already in the second generation; that further aggravates the problem.

In addition, many of the recurring challenges in family organizations could be mitigated by the practices investigated here. The practices listed under Mechanisms and Control Bodies, for example, maintain credible financial and economic statements authenticated by an independent audit, and are helpful in several situations. Accurate results [13-15] make it easier for companies to obtain third-party resources, increase transparency in conflict resolution, improve accountability to stakeholders, deal with family growth, and increase control and oversight over the separation of ownership and management.

The regulation of relations between partners in the Property category and the establishment of a Board of Directors with at least one independent member are invaluable for family construction companies. These practices strengthen the separation between the roles of partners and managers, leading to a more professional organization, with easier access to financing and even with specific environments to discuss the succession of managers and owners. Low scores in the Ownership categories indicate that the management of these issues is far from ideal.

The categories of Family Council and Conflicts of Interest deal with the challenges of maintaining family values and principles, resolving internal differences and managing growth in the number of dependents. Family Protocols and the Codes of Conduct define parameters for decision-making in cases of family conflict and deviations from expected behavior, aligning expectations and defining rights and duties. Therefore, these documents define rules to protect the organization, guide conflicting decisions, and strengthen the separation between family, society and management issues.

The unsatisfactory scores observed in these categories allow us to infer that that family construction companies are highly vulnerable to the negative impacts of relationships between family members and to potential fraud and deviations; therefore, they are highly susceptible to failure in their long-term objectives. It is essential to improve the management model of governance in these organizations.

6. Conclusion

Approximately fifty percent of the 50 largest construction companies in Brazil are family owned. Therefore, family construction companies are crucial for the country's economy. To protect themselves against fraud, crises, and problems inherent to a family organization, at least basic corporate governance recommendations must be in place. Therefore, to understand the current situation of these organizations, this study aimed at measuring the level of implementation of basic practices recommended by the Brazilian Institute of Corporate Governance (IBGC) in family construction companies.

Considering the group of practices investigated in this study, our results indicate that the first action of family construction companies is to create tools and control mechanisms to standardize and professionalize the company. However, the reliability and transparency of the information provided are not equally high due to the lower compliance to internal and external auditing, as observed in previous studies.

In addition, our data suggest that few family construction companies implement the basic practices of the main governance body, the Board of Directors. A small number of organizations have autonomous advisors, in agreement with studies that highlight the low independence of the existing Councils. This situation jeopardizes the management of family construction companies, especially because most of them are large corporations.

The low scores in the Ownership categories, mainly in the Board of Directors, are an indication of poor strategies to deal with the separation between the roles of the members and the managers. On family matters, most family construction companies do not have a Family Council and its respective regulatory instrument. In spite of that, a larger number of companies communicate family members about organizational matters, acting more informally. Such results hinder the companies’ professionalization.

In addition, few companies have a Code of Conduct to resolve internal conflicts, and an even lower share provides a channel for anonymous complaints. Thus, it is possible to infer that the few organizations involved in conflict resolution are more committed to looking ethical than actually behaving ethically.

Therefore, the governance structure of the management model in family construction companies in Brazil is weak when compared to the basic model recommended by IBGC.