1. Introduction

“No energy company will be unaffected by clean energy transitions. Every part of the industry needs to consider how to respond. Doing nothing is not an option,” International Environmental Agency (IEA) Executive Director, Dr. Birol, emphasized these words in their advocacy for the role of oil and gas (O&G) companies in the energy transition. [1] Certainly, the role of O&G companies in this energy transition is twofold. It is important to acknowledge that the first role of these companies in this energy transition is that they are part of the problem. [2] The burning of fossil fuels is responsible for over two-thirds of the total greenhouse gas (GHG) emissions, [3] highlighting the major role of accountability that these key players hold in influencing the need for an energy transition. The second role is their engagement in committing to solving this problem to sustain a more prospective energy mix. As a result, the O&G industry has faced several challenges in the last three decades in repositioning itself to remain sustainable amidst the climate crisis. This work discusses the sustainability of the O&G industry for the future, where sustainability is deemed to be the integration of O&G to co-exist with renewable resources within the COP26-defined timeline of 2050, [4] analyzing geopolitical and technological influences.

1.1 Historical perspective of the oil & gas industry

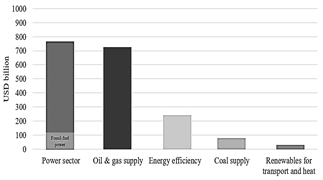

O&G companies are the pillar of our modern-day society as they play a crucial role in supporting and meeting the increasing global energy demand. [5] However, this growth came with significant consequences contributing to the existential climate crisis, such as air and water pollution. [6] Every ton of GHG causes global temperatures to rise closer to the 1.5°C limits; however, the exploration and discovery of more oil, gas, and coal reserves forecast a major threat as we approach our global carbon budget. [7] Furthermore, an increase in fossil fuel projects, as shown in Fig. 1, highlights that the focal point of investments is fossil fuels, with limited growth in the renewables sector. Companies are forecasted to spend $4.9 trillion in capital expenditures on new O&G projects over the next decade; investments such as these lock-in emissions [6] jeopardize our carbon budget and push global warming beyond the projected limit. [7]

Global emissions are not the only source of pollutants, with daily incidents from drilling companies leading to oil spills and explosions that pollute waterways. The British Petroleum (BP) Deepwater Horizon incident spilled 4.9 million barrels of oil into the Gulf of Mexico, [5] which resulted in severe ecological and economic impacts. [8] Fig. 2 illustrates the severity of hazardous liquid pipeline spills from 2010 for TransCanada, Kinder Morgan, and Enbridge. The Dakota Access, Keystone XL, and Line 3 expansion pipeline projects have also affected marginalized communities since oil and gas booms have alarming contamination implications on groundwater accessed by Indigenous communities. [9] Since the onset of the industrial revolution, fossil fuels have played a dominant role in meeting global energy demand as a key driver of socio-economic progress. However, as evidence shows, there are several negative repercussions owing to air and water pollution brought about by practices that the industry perpetuates.

Source: [6].

Figure 2 Simplified map of hazardous liquids pipelines spills from 2010 to present. TransCanada (-), Kinder Morgan (--) and Enbridge (bold).

1.2. Delay and denial

Industry leaders in climate change research have known climate change science and evidence since the 1980s, approximately eleven years before its inception into public speculation. [10] However, some key players within the industry used their research findings to advance their internal processes by actively engaging climate models and findings in their designs, such as accounting for rising sea levels and permafrost challenges during the design of pipelines in Nova Scotia, [11] Research interests favored the central idea of casting out science to delay policy actions in a ploy to remain economically relevant in the industry. [11] Herein lies the challenge: this delay obstructed a more efficient economic transition had the world known about the impending climate crisis. Hence, for these reasons, O&G companies play a crucial role in being accountable for our current climate crisis. Nevertheless, all fossil fuel companies can right their wrongs and join forces collectively harnessing their expertise and resources to help the world accelerate in our trajectory towards a sustainable energy transition; [11] especially with the advent of new policy changes in first and developing countries that favor tackling climate change.

1.3. Growth and demand

The growing demand for new technologies to keep the oil and gas industry relevant is higher now than ever. Emerging technologies are to be considered a “last resort” to aid in the climate crisis and prevent the earth’s temperature from exceeding 1.5°C. This was originally determined in the 2015 Paris Climate agreement with approximately 200 countries assisting in keeping the global Earth temperature below 2°C, with the critical goal being 1.5°C. [4]

The effects of climate change have been felt within the past few decades with worsening propensity; seen through the intensifying of Earth’s water cycle, altering permafrost, and the melting of ice sheets and glaciers in the arctic, with the list going on (forest fires, crop failure, and others). [12] Within the past few years, countries worldwide have declared their stance on how they will (as a nation) assist in limiting warming to ~1.5°C. Due to this ever-rising global temperature, these catastrophic events, such as devastating forest fires from Greece to Canada, will become much more common and render many places inhabitable within the next 50 years. All efforts are needed to hurdle the permanent effects that increasing earth temperatures to even 2°C could potentially bring.

As our societies evolve, the concern for finite reserves was overshadowed by climate change. [11] Therefore, industry leaders need to work towards leaving 75-80% of fossil fuels untouched by shifting their focus to keeping warming below two degrees Celsius.

1.4. The gap in O&G’s energy transition

In recent times, sustainable development has been a growing trend in O&G; increasingly stringent regulations and pressures from the public and stakeholders have spurred O&G companies to operate in environmentally friendly ways. [13] Public reports from O&G companies from 2010 to 2019 have increasingly emphasized the environment, with emissions reductions being an especially vital element. [13] Indeed, due to improvements in emissions mitigation technologies, petroleum refining emissions in the United States (US) have decreased over the last two decades. [14] Besides emissions mitigations, other strategies increasingly used to decrease the environmental impact of the O&G supply chain include increasing energy efficiency and electrification of equipment. [15]

Despite the aforementioned developments in O&G, the key to a sustainable future for O&G is likely a deeper transformation. Even as O&G companies implement and become increasingly committed to sustainable development, emissions from the O&G industry continue to contribute greatly to global emissions. From 2000 to 2018, the global refining sector saw a 13% increase in capacity, causing a 24% increase in emissions. [15] Furthermore, global emissions in 2021 hit a record high of 36.3 Gt [IEA], with O&G contributing about 15% of the share (only accounting for Scope 1 emissions). [16] Even with current progress, industrialization and urbanization increase the demand for O&G products, [15] posing a challenge to the sustainable development of O&G. It is evident that it will take going beyond mitigation of the environmental impacts of current operations for O&G to integrate itself into a sustainable energy transition. The next section of this work will argue what future O&G will need to become a part of is a successful energy transition.

2. O&G energy transition navigation strategies

The vulnerability of the energy landscape is threatened by the need for transformation, given the evidence that continues to accumulate on climate change. [16] Pressure is built to shift the energy sources away from the mantle hydrocarbons hold and towards low-carbon and renewable alternatives for the lead role. However, the total transformation of the energy landscape cannot occur overnight, as it is not a simple shift from “oil and gas” to “energy/renewables”. An energy transition without the engagement of oil and gas industries will not be economically viable. Hence, it hinges on the coalition of major energy key players to expand their current energy mix and contribute to lower emissions to tackle the climate crisis and manage transitional risks. Fig. 3 illustrates the selected global milestones for policies, infrastructure, and technology deployment proposed by the IEA to achieve net-zero emissions by 2050. A consolidated group requires monumental efforts of institutions and stakeholders to ensure the transition to global net-zero emissions (NZE) proceeds successfully with integrative renewables pathways shown in Fig. 3. [17]

Source: [17].

Figure 3 Simplified IEA proposed key milestones in the pathway for net-zero emissions.

2.1. Challenges faced by the oil and gas industry in the energy transition

It is important to highlight the longstanding challenges that the industry faces in energy transition, such as politics, economic activity, and technology which energy companies are required to navigate to expand renewable prospects. [18] Firstly, politics play a crucial role in determining the trajectory of oil and gas companies amidst this energy transition because governments can either (i) change regulations and provide incentives to advocate for energy unification and transition or (ii) dictate an unstable policy and legal framework that ultimately, weakens a country’s political commitment towards energy policies; they downplay the investments needed to motivate research and development towards climate change.

The dynamic in the instance (i) is supported by governmental institutions where the central idea is geared towards balancing producer and consumer interests to pursue affordable and reliable energy security to attain a circular economy. A point in case is the ambitious engagement of the United Kingdom government as a leader in the global energy transition: they have facilitated the development of major projects and policies. Their generous 1 billion Euro investment exemplifies their maturity in the socioeconomic transformation to support carbon capture, utilization and storage (CCUS) business models and their commitment towards “greening oil and gas” as part of their maximizing economic recovery (MER) strategy, [19,20] which requires upstream oil and gas projects to reduce GHG to reasonable amounts which now leads to O&G companies to be flexible and adapt their business models considering the changing regulatory environment owing to the political compliance pressures. These legislative changes can expose the financial weaknesses of O&G companies, as their asset valuations would be lowered, hindering their profitability and future investments in renewables. [18]

In contrast, in small island developing states such as Trinidad and Tobago, where a substantial contributor to gross domestic product (GDP) is predominantly owed to fossil fuel reliance, there is a delay in economic diversification and decarbonization. The small islands are vulnerable to climate change impacts such as increased flooding caused by unpredictable weather conditions and tropical storms, coastal erosion, and increased temperatures. [21] As a result, the government is focused on survival and directing economic reserves to recovery efforts caused by climate change, with no room for reallocation and implementation of sustainable infrastructure reform. [20] Therefore, unlike developed countries, Trinidad and Tobago’s major setback stems from their lack of engagement towards energy policies that outline stringent opportunities for favorable growth and acceleration in this energy transition. In addition to this intertwined connection between financial and political challenges, the uncertainty around technological investments daunts O&G majors. This area is a gamble for oil and gas companies because technology peaks at various cycles to go mainstream and the market for new technologies to facilitate the energy transition are still very competitive as seen by the past experiences of offshore wind and solar solutions. [18]

2.1.1. The United Arab Emirates and the Kingdom of Saudi Arabia

The UAE and the Kingdom of Saudi Arabia are stable and affluent regions in the Middle East that have refocused their energy mix as part of their commitment to diversify and integrate renewable energy sources, namely solar. They have promised to deliver 40-50% of their energy from renewable sources in 2030 and manifest low-carbon intensity in their increased oil and gas production. But these investments are quite paradoxical for two reasons: (i) in a time when energy restructuring is rampant, it is seen that Middle Eastern countries want to stay relevant and competitive in the market, so with their increased production, it is imperative that they stand strong on their low carbon commitment by implementing CCUS facilities to their advantage which might buy them some popularity in possibly being the world’s smallest carbon footprint region [18] and secondly (ii) for the UAE and Saudi Arabia to promote investments in renewable energy, their economies have first to have access to government funding for both the giga and mega projects, but to boost investments, this means that their current O&G operations also need a boost to generate the funds needed. Thus, they are obliged to be seen as world leaders in the energy transition with their low-carbon pledge. Already, both countries have been fledging towards green hydrogen technologies. At the same time, the UAE currently attracts the world’s lowest solar prices from the Al Dhafra plant and has finalized funding for the world’s largest solar project using four 4 million solar panels.

2.1.2. CEE region: Central and Eastern Europe

Important to note is CEE’s stance in compliance with respective governments. European companies are independent, while national oil companies are state-owned. European countries are given the liberty to set their agendas, but they must align with investors’ interest in diversifying their business portfolios. [18] CEE governments have lobbied that the energy transition will involve a gradual shift towards renewables, with the help of natural gas, away from traditional sources such as oil and coal. However, national oil companies rely heavily on the revenue earned from these sources. Therefore, the region’s transition progress reflects the due diligence in their national energy policy implementation. Some Western European countries, such as Romania, the Czech Republic, and Bulgaria, to name a few, are exploring nuclear power. In contrast, Österreichische Mineralölverwaltung Aktiengesellschaft (OMV) Petrom focuses its transition toward reducing its carbon footprint while leveraging demand and its business model. OMV has upstream carbon intensity reduction operations owing to value-add investment in technologies, leading to a decrease in carbon intensity by 26% in 2020. [18] To balance the demand and their product and operations portfolio, it is evident that natural gas plays an integrative role in the sustainable step.

2.1.3. APAC: Asia-Pacific Countries

Asian economies are emerging global renewable energy contributors. [18,22,23] The supplying leaders in Liquified Natural Gas, Malaysia’s Petronas, redefine their energy mix by integrating solar, wind, clean hybrid, and CCUS solutions. The company has diversified its energy portfolio for cleaner solutions integrating gas and new energy to support the transition, including their 1GW fully owned, world-class solar operations and development in India and Malaysia. [24] Since blue hydrogen is a by-product of the LNG process, they are innovating solutions to efficiently produce clean energy to provide them with a sustainable competitive advantage to navigate the energy transitions. In pursuit of the transitions, China National Petroleum Corporation also proposes early strategies to build on its core energy strengths. [25]

2.1.4. South Africa

The country’s dependence on coal has been attributed to challenges in electricity generation. Thus, only 11% of the total energy supply accounts for renewables. But in recent times, there have been efforts in pursuit of the energy transition, as evident by the USD 3.7bn fund allocation to support addressing the country’s electricity supply constraints in the direction of development in two key areas: nuclear technologies and hybrid renewable technologies (wind, solar and battery storage) which presently supplies approximately 40% of all the energy produced on the African continent. Sasol (a national energy and chemical group) has announced plans to address the following: (i) the reduction of emissions through renewable energy; (ii) a transformation of coal-based operations through the introduction of green hydrogen operations; and (iii) a shift of Sasol’s portfolio towards less carbon-intensive business operations using renewable energy and electrolysis. In addition to this, key partnerships such as Sasol and Toyota South Africa focus on establishing a hydrogen infrastructure to promote a clear mobility ecosystem between Johannesburg and Durban in the province of KwaZulu-Natal. [18] These are key indicators of prospective change and positive movements in the direction of reduced emissions, digitalization, and ESG considerations.

3. Technologies and advancements

To limit the effects described in Growth and Demand, there is a drive for researching, creating, and implementing new technologies. Resources are now being sunk into learning how to combat the increasing global temperature. [26] The COP26 conference in the year 2021 focused on countries around the world developing more consistent and rigid climate plans to reduce emissions (more to be discussed further within the report). [26]

Here is where O&G major key players come into play. These companies have been around for decades and are the prominent source of the continuous increase in GHG emissions. [26,27] Since these companies are the key reason for GHG emissions and are the main contributors to global warming, the technological advancements within this industry are what matter most. [26,28] The O&G industry needs to shift gears and adjust the technologies utilized in plants and the materials produced. O&G claims that they are “part of the solution” [26] and will focus more efforts on implementing new technologies to correct decades of damage done by the release of GHG emissions contributing to the rising temperature. The following section of this paper will outline some of the newer and promising technologies (anticipated to try to limit CO2 emissions in the O&G industry), while analyzing whether the implementation and mitigation are feasible according to O&G companies' climate plans and timelines.

3.1. Hydrogen

The first technology to be addressed is Hydrogen. Hydrogen utilization as an energy source is a recent discovery that has been praised since any by-products produced are not of concern it (the only by-product emitted is water vapor), deeming it “clean”. It is estimated that within the next 5-10 years, hydrogen can be implemented in many sectors of O&G. Two types of hydrogen, specifically blue (produced through fossil fuels, but utilizes Carbon Capture and Storage) and green (cleanest hydrogen as it is produced through renewable energy sources, like electrolysis) are of focus as these two are less environmentally damaging.

Hydrogen is a process that is currently being researched and developed (R&D), as it is so new that there are limited plants “up-and-running” with hydrogen. [26,29] The driving force behind utilizing hydrogen in O&G industries is because hydrogen is used to decarbonize manufacturing (steel, mining), transportation (buses, heavy trucks), automotive (hydrogen fuel cells), and can even be integrated into turbines and blast furnaces. [29] Furthermore, the implementation of hydrogen within industry relates to the manufacturing sector. In O&G refineries, the coking coal used in blast oxygen furnace (BOF) processes is being replaced with hydrogen as the energy source. For instance, the Hydrogen Breakthrough Ironmaking Technology (HYBRIT), is a hydrogen-based direct reduction iron (DRI) process, being investigated in Sweden. HYBRIT reduces emissions as it does not use coke or coal; instead, it uses hydrogen and reduces carbon dioxide emissions at all levels of steel production, including reducing iron oxides to iron. [30] In May 2020, the construction of the pilot DRI plant finished, and operation with hydrogen began. The HYBRIT process plant is expected to reveal many answers to technological and engineering questions regarding the implementation of hydrogen within the O&G sector. [30] Recent data and research shows, the emission of CO2 is only 25 kilogram versus burning coal which releases 1600 kilogram of CO2. The implementation of this technology directly relates to O&G as the BOF in refineries and plants can be replaced with hydrogen, reducing emissions.

3.2. Carbon capture and storage (CCS)

The next breakthrough technology is called Carbon Capture and Storage (CCS). CCS essentially “captures” carbon dioxide underground so that it is not released into the atmosphere as emissions. CCS is used to trap CO2 from “point sources” within refineries and plants, then takes this CO2 and moves it underground to prevent emissions (net-zero). [31] The focus of CCS is primarily on the steel and iron plants and refineries that deal with a heavy amount of combustion. [32] Key player companies in the O&G industry are working to develop and implement all new CCS technologies in their refineries, which are mentioned below. [33] The first type of CCS has recently (in 2020) been implemented in the Shell coal-fired Boundary Dam Power Station in Saskatchewan, which captures 1 million tons of CO2 per year on one of its four generators. The CCS can be broken down into two sections: with and without a filter membrane. CCS technology without the filter membrane, primarily captures CO2 with solvents (mainly amines of industry-standard) [34] The CCS with the membrane is similar to what is mentioned above; however, the membrane will separate the feed gas (based on properties) from the other gas molecules, and only CO2 gas can flow through. UOP and Linde are two O&G companies in R&D with CCS utilizing amines. [33]

Another type of CCS is Direct Air Capture (DAC). [34,35] DAC removes CO2 from the atmosphere directly and then stores the CO2 underground in “geological formations”, to avoid GHG emissions (permanently). [33] Currently, about 19 DAC plants are in operation throughout Europe, Canada, and the USA. These plants will capture the CO2 and sell it to be used in other industries (e.g., in food processing). DAC is becoming popular amongst O&G industry names, such as Shell, United Airlines, and Microsoft, as a resource to invest money in. United Airlines recently purchased DAC technologies to implement into their aircrafts in the hopes of becoming carbon neutral/ net-zero by 2050. [32,33]

3.3. Nanoparticles

Nanoparticles have versatile applications throughout refineries and power plants, most applicable in creating a “greener” O&G industry. However, the funding and interest in this technology are very recent, hence, there is a limited number of operations “running” with these technologies (lack of interest in reducing emissions and in nanoparticles has resulted in only now interest ramping up). [36] Much of the currently underway research relates to a chemical-scale setup and still needs to be further tested at a pilot level. [36] This means much of the nanotechnologies are still in R&D. However, research has begun (2020) at the University of Southern California’s (USC’s) Viterbi School of Engineering. They are working on a nanoparticle catalyst (nanocatalyst) that can harness the CO2 emissions and utilize them to produce fuel instead of releasing it into the atmosphere. [36] The carbon dioxide is converted into hydrocarbons that use a smaller chemical reactor and hence, use a smaller amount of energy and power, ultimately releasing less CO2 emissions (since they are used in the process) while creating quality fuel to be utilized in cars. Implementation of this process is expected within the next few years by O&G industry players, such as ExxonMobil and Chevron. [32,36]

3.4. Integration with biorefineries

Political instability in the oil-producing countries and the impact of CO2 released into the atmosphere are also driving the use of petroleum refineries to produce renewable fuels. Processing bio-feedstocks is certainly challenging as the composition variability of the raw materials. Moreover, operational issues are added as biomaterials create fouling and decrease process conversion efficiencies. [37] The engineering challenge in defining integration strategies is potentially feasible, but it requires petroleum refineries to be modified to process bio-feedstocks into renewable fuels. There are currently three potential integration platforms: [37] (i) the sugar platform, based on biochemical conversion processes such as the fermentation of sugars extracted from biomass; (ii) the syngas platform, based on thermochemical conversion processes for the gasification of biomass; and (iii) the constituent platform, based on fractionation processes, to separate biomass constituents for further processing. Some technical challenges delaying the efficient use and adaptation of petroleum refineries to obtain biofuels include logistics to manage the huge volume of different raw materials, raw materials pre-treatments focused on value-creating solutions, the life cycle of catalysts in conversion processes, and the variability in the raw material qualities. Nevertheless, investments, partnership strategies, and logistical challenges remain the main challenges for effectively integrating existing oil refineries to process biomass into biofuels. Finally, product compatibility is crucial in defining the feasibility of this integration, as some of the “new” products must comply with existing specifications.

3.5. Discussion and analysis

While noteworthy progress has been made with new technological advancements utilizing renewable energy, the implementation of these technologies in O&G companies is a lingering concern that ultimately determines whether this industry is sustainable. Many of the above technologies are still heavily in R&D, with very few technologies installed and running in the industry. Many of these technologies will not be ready until the late 2020s or early 2030s. [32] This already poses problems as it has recently been discovered that within 10 years (~2030) the global Earth temperature will already be at 1.5°C. [38] The delay in these technologies can be attributed to ineffective time management and strategic planning that results in limited environmental policies, and economic factors.

Firstly, ineffective time management can directly be seen in technological lags in developmental progress. Many governments worldwide showed limited interest in GHG emissions a little over ten years ago when these technologies should have been in the R&D phase. Some countries, such as the European Union, pledged to cut their CO2 and GHG emissions down to a net-zero value by 2040. [29] However, despite these “pledges” and climate conferences, inadequate action has been taken in devising strong and sustainable timelines by governments and O&G companies. In 2020, research regarding O&G companies and their specific timelines and climate plans revealed that most plans are insufficient and do not foster development toward renewable energies and net-zero emissions. [29] The negative scoring assessment plan(s) of eight well-known O&G companies was based on ten goals: stop exploration, stop approving next extraction projects, declining oil and gas production by 2030, set long-term production phase-out aligned with 1.5 °C, set full equity share (extraction), do not rely on carbon sequestration or offsets, be honest about fossil gas a high carbon, end lobbying and adds obstructing climate solutions, commit to an end date for oil and gas extraction, and commit plans and funding to support workers’ transition into new sectors. The ranking took place on a 3-level ambition, integrity, and transition scale. All eight companies failed to have an adequate phase-out plan and new, renewable energies (discussed further in the report). Many O&G plans are not thoroughly investigated or scrutinized by governments or scientists directly involved in climate change, which leads to disorganized and ineffective timelines.

Many developed countries have pledged net-zero emissions by ~2040 (including Canada, Finland, and Iceland) [32] within the past few years. This has caused intense pressure on scientists and engineers to create and implement renewable energy technologies within the O&G sector. [20] The planning regarding this transition was not executed fast enough, as now pilot plants are only just being built, without knowing whether these technologies will make a great enough impact to reduce GHG emissions faster than the world is currently producing them. For example, it was reported that specific CCS technology only impacts climate models and pilot scale but not a very large contribution to real-world carbon emissions. [32] Furthermore, many environmental policies, laws, and regulations put in place for O&G companies for reducing GHG emissions are very limited. Policies and regulations regarding limiting GHG emissions produced by O&G refineries and power plants have only recently come into effect however, inadequately supporting the use of renewable energy. [39] A prime example of this is in Canada, while there is no policy or regulation encouraging the continued exploration of oil and oil wells, there is no policy prohibiting the exploration and creation of new oil well sites. [39] This leniency in policies has allowed O&G companies to continue operating in a manner that allows them to utilize some resources to implement newer, cleaner, more efficient technologies while continuing to explore new extraction sites and emit GHG. [34] Most existing O&G companies have operational plans that will continue to increase the global temperature. Governments have not performed a thorough investigation into how the plans made by O&G companies will reduce GHG emissions. Due diligence by governments worldwide, has been lacking for a substantial amount of time, with many policies going back under review. [39]

In addition, certain governments themselves have not strongly influenced or pushed the demand for net-zero emissions. For instance, Japan will still support oil and gas despite the initiative set at the recent COP26 summit, pledging (with 200 other countries) to cut down and move away from fossil fuels. [40]

A very large reason for the delay with technologies comes from economic and funding reasons. Much of the technological advancements and drive for renewable energy technologies are associated with funding from O&G companies through governments. In other words, incentives have pushed O&G companies to alter their existing plants and create traction for renewable energy sources. For instance, the United States Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) awarded AltaRock (energy company) a grant of $ 3.9 million (US) in 2019 for research on renewable energy sources, with real-world test sites scheduled for operation in September 2022. [41] These technologies are “ramping up” in terms of R&D as the funding has become more steady, stable, and reliable. [28] Additionally, many countries heavily rely on coal and fossil fuels to sustain their economies, as their main exports are a part of oil and gas. Therefore, countries like China and India are not phasing out but rather, phasing down their reliance on “coal and subsidies for fossil fuels”. [26] The economic issues regarding the influence of oil and gas on keeping countries afloat is a very big driving factor in why these clean technologies are only now having some attention in O&G.

3.6. Radicalization of oil and gas

It is clear that clean and renewable technologies are present in the O&G industry; however, most of these technologies are not as developed or ahead as they should be to mitigate GHG emissions and keep O&G stable. For instance, hydrogen is breaking through in the industry, but there are still ways to go, especially in hydrogen FCEVs; where the hydrogen will be distributed and transported to provide fuel for the consumer vehicles. The technologies require O&G to be reorganized and change everything down to the base foundation, which requires many resources and time. Many of the countries and technologies examined above are centered in developed (or first-world) countries. [20]. There is no mention of “developing” countries that are already not as far advanced as developed countries (due to many factors). Exports and products that help sustain many countries, like Venezuela and Trinidad, rely on oil and gas. In addition, there is a lack of resources present to help these countries shift from conventional oil and gas to more renewable energy sources, like hydrogen. These countries do not have nearly as robust an infrastructure as North America and Europe. Many developing countries focus on surviving short-term, relying on whatever technology is currently set up to produce O&G exports. [20] Financial constraints have already been placed on these countries pre-COVID-19 pandemic and expecting these countries to prioritize the implementation of renewable energy (given all else going on) is a far reach. [32,34]

It is quite challenging to expect these countries to make a timeline with similar progress as global-leading countries, which could sink all their efforts into renewable energy. [20] Countries such as China and India will take a longer amount of time to phase-in renewable energy and will most likely keep aspects of oil and gas prevalent for longer. [32] Shifting back to “developed” countries and their technologies, the implementation is just not as quick as it should be to make a long-lasting impact to keep O&G sustainable. Part of this reason is due to O&G companies still excavating, drilling, and finding new wells - continuing “regular” business, emitting GHG, and increasing the global temperature. O&G companies are using these new technologies, such as CCS in stripping towers, while still emitting CO2 (by finding new extraction sites), defeating the purpose of implementing renewable energy.

4. Conclusions

Oil and gas companies are the foundation of our modern society because they mainly support and meet the growing global energy demand. Nevertheless, the role of energy companies in the O&G industry also hinges on accountability, to accept the historical repercussions of delayed actions that resulted in two-thirds of the total greenhouse gas emissions in the world; to commit to sustaining a more diversified energy mix given the growing demand to keep the industry relevant amidst today’s climate crises. Thus, it is estimated that approximately 30% of the GHG emissions come from the O&G industry. [42] In addition to global emissions, other sources of pollutants derived from this industry include incidents leading to oil spills and explosions that pollute waterways. The industry faces external pressure from low-carbon and renewable alternatives. It is undeniable that several efforts have been placed by O&G companies to favor the energy transition to a sustainable future, however, the industry's volatility requires major energy players to aggressively expand their research, development, and investment to lower emissions and integrate technology into existing processes using digitalization and social governance as a catalyst for transformation. Hydrogen is a major prospect that can be used to decarbonize industries given its ability to integrate in fuel cell manufacturing that checks the target box for the movement towards electrification. Carbon Capture and Storage helps meet net-zero targets by operating direct air capture plants in Europe, Canada, and the USA. In parallel with CCS technological advancements, nanoparticle research and development have the potential to harness CO2 emissions. However, the shift from natural resources to renewable and more sustainable resources requires rigorous phase introductions and strategy implementation not to disrupt the market. Ultimately, the industry's future hinges on policy reformation; it is recommended that policy reform take precedence with an emphasis on terminating new exploration of sites to propel the industry towards renewable energy. With governmental institutions demonstrating due diligence in reviewing the climate change action plan and timeline proposed by each major energy company to reduce GHG emissions. Energy companies need to close the gap on the “how” of their implementation plans, given that time, money, infrastructure, and resources are all at stake. Due to the time-sensitivity of implementation, all efforts should be dedicated to harnessing clean energy to power their refineries and plants and reducing exploration and new excavation to produce oil. The O&G industry needs to implement practical technologies via phased integration as it is vital to keep this industry afloat.