INTRODUCTION

In Colombia, the agricultural sector has been seriously affected by a series of social conflicts, a high level of poverty and recently by the effects of climate change. For this reason, in the last legislations of the country, rural development, the modernization of the sector and the increase in agricultural productivity have been issues of great importance. In particular, the department of Valle del Cauca, located in the Colombian southwest, has been a department ravaged by violence, armed groups, and insecurity, especially in the rural sector; however, it has the highest agricultural yields at the national level, according to the last national agricultural census (CNA by its acronyms in Spanish) carried out in 2014 (DANE, 2017).

Regarding banana production in Colombia during 2020, it exceeded 2.4 million tons with a harvested area of more than 103,000 hectares and an average yield per hectare of 24.4t/ha; on the other hand, 86% of national production was intended for export (MADR, 2021). In the case of Valle del Cauca, it ranks third as the department with the highest production, with 68,300 tons and an average yield of 14t/ha. It should be noted that in terms of production for national consumption, it ranks first place with 25% (MADR, 2021).

Thus, examining the production and economic factors that influence banana crops become of special importance for Colombia and Valle del Cauca. Additionally, through the evaluation of public policies, it is sought to generate changes in a social reality, and create a platform of plans, programs, and projects aimed at resolving part of the existing social, economic and development issues for some banana producers in Valle del Cauca.

According to Ali et al. (2014), since in agriculture the expenses and investments for land preparation, sowing, maintenance, and harvesting require an immediate investment and the cash flows appear only when the production is sold, credit emerges as the element that allows these liquidity restrictions to be overcome, leading the activity to an optimum level of production. Likewise, the credit allows the channeling of resources to capital investments, such as agricultural machinery and those items that imply the inclusion of modern processes in the activity; this leads to increases in production (Wirakusuma et al., 2021).

For their part, international authors such as Mahalakshmi et al. (2016) have pointed out that among the economic factors affecting yield of banana crops, price fluctuations are the main reason cited by the farmer, and lack of credit and capital are the second main causes affecting the yield of the crop.

Access to agricultural credits programs is an important productivity factor in Colombia, but only 13.51% of farmers apply for credit, despite the fact that 88.9% are approved by some financial entity (DANE, 2016), which indicates that the main problem is not access to credit specifically; the difficulty lies rather in the land conflicts in Colombia, which can be summarized as armed conflict, land with agricultural vocation dedicated to other activities and social inequality, which have negatively affected access to land and, therefore, the access to credit (Deininger et al., 2013), this situation directly affects the well-being of farmers, with the average per capita income of the UPAs that receive credit being 1.80 times higher than the average per capita income of the UPAs that do not receive credit (Leibovich et al., 2013).

Different authors (Chandio et al., 2016; Shivaswamy et al., 2020; Nordjo et al., 2019), have used different methodologies to evaluate the impact of access to agricultural credit on productivity and, in general, on various factors related to the quality of life in the agricultural sector for a certain group of people. Regarding the relationship between access to credit and agricultural productivity, most of the theoretical developments show a positive effect, as will be mentioned below.

Dong & Featherstone (2010) analyzed the impacts of credit constraints on agricultural productivity and rural household income in China using an endogenous switching regression model that accounts for both heterogeneity and sample selection issues. The results were positive and show that schooling in the rural sector increases, as well as agricultural productivity and the income of rural households improve by 31.6 and 23.2%, respectively, all of these with the elimination of credit restrictions.

Obisesan (2013) studied how limitations in obtaining agricultural credit hamper the productivity and income of small rural farmers. To do this, they used cross-sectional data from 150 households of small cassava farmers in Nigeria. The analysis was carried out using descriptive statistics, a logistic regression model, and the Foster, Greer and Thorbecke (FGT) class of measures. The results showed that among the significant determinants of access to credit are gender, age, main occupation, if they are members of a farmers association, and crop yield. On the other hand, the FGT revealed a high rate of poverty among cassava farmers (66.7%), with a higher incidence in those without access to credit.

Diallo et al. (2020) used Stochastic Frontier Analysis (SFA) to estimate the effect of agricultural credit on rice farmers’ productivity and efficiency. They found that the effects of access to agricultural credit, gender, education, ethnicity, use of improved seeds, and land tenure system on the technical inefficiency of rice production are significant. In the specific case of access to agricultural credit, authors found that farmers with access to credit obtain 37.32% more rice production than their counterparts.

Authors such as Owusu (2017) and Elahi et al. (2018) analyzed the effect of agricultural credit and agricultural advice together with financial services on the agricultural productivity of cassava and wheat respectively. For this, they implemented the Propensity Score Matching (PSM) technique, which is proposed in this work. These authors found positive and significant results in the productivity of the mentioned crops with the treatment variables considered by each one of them.

In Colombia, Echavarría et al. (2017) used PSM methodology as well for study the effect of the agricultural credit on some variables, such as farm yield, and the Multidimensional Poverty Index (MPI) for long and short cycle crops at the national level. In general, the results suggested that the various types of credit have a positive and significant effect on yield, those results are between 3 and 28%.

De La Hoz (2018) analyzed the relationship between credit and agricultural production in dynamics of agricultural production in Colombia, through a mixed research approach, one of them addressed in this work and which consists of the analysis of the relationship of credit and agricultural activity by destination of financing resources and the preferences of farmers. To do so, he applied PSM methodology and found a positive but small effect of agricultural credit on productivity. In addition, they found that farmers do not allocate financing resources on specific items that imply higher yields, but on the farmer's immediate needs.

The main purpose of this research is to investigate the question of how access to agricultural credit programs affects banana yields in the department of Valle del Cauca (Colombia). To achieve this purpose, the following main research objective was proposed: to evaluate the impact of access of banana farmers in Valle del Cauca to agricultural credit programs on banana yield using PSM (Propensity Score Matching) technique. To meet this objective, not only the general effect of the credit on the yield was evaluated, but also the effect on the banana yield depending on the preferences of the farmer regarding the investment of the amount obtained with the agricultural credit.

MATERIALS AND METHODS

In principle, the effect of the credit is understood as the impact that the financing resources have on the development of the agricultural production cycle in the crop of interest. To this end, it is proposed to use the PSM impact evaluation methodology, which allows for a comprehensive evaluation of the results generated by the credit and determines its contribution as a public policy instrument in the development of agricultural sector. For the analysis of the effect of credit and its role within the agricultural production cycle, the general effect on crop yield was evaluated, and then the relationship between credit and yield by destination of financing resources was analyzed. In this case, the estimation seeks to find results differentiated by the destination of the resources received.

Data. This research was based on survey data from National Agricultural Census (CNA, for its acronym in Spanish), carried out in 2014 in Colombia. CNA is the last and most recent national agricultural census carried out in Colombia, whose anonymized database was fully enabled until 2017.

The CNA is identified at the level of the Agricultural Production Unit or Non-Agricultural Production Unit (UPA or UPNA for its acronym in Spanish, respectively); therefore, the UPA is the analysis unit of this research. On the other hand, the identification of the UPAs with and without credit approval and of the variables included in the estimation was carried out from the review of the CNA questionnaire, which has 180 questions in total, of which 13 were selected (Table 1).

The Valle del Cauca (Colombia), which is the zone of interest for this study, located in the southwest of the country, whose surface is 22,140 km2 (Mutis, 1996), has 4.2% of the registered units (122,704), of which 76,874 are UPAs and the rest are UPNAs. To meet the objectives proposed in this research, the data basedatabase was filtered, and it was reduced banana farmers (2,380 UPAs).

Table 1 Identification of questions for the construction of variables from CNA.

| CNA Question 2014 | Answer Options -Original questionnaire | Measurement form |

|---|---|---|

| 136. During 2013, for the development of agricultural activities, did you request credit or financing? | a) Yes b) No | It takes a value of one (1) for the “Yes” option and zero (0) for the “No” option. |

| 136a. Was the credit or financing requested approved? | a) Yes b) No | It takes a value of one (1) for the “Yes” option and zero (0) for the “No” option. |

| 52. Which of the following irrigation systems do you use? | a) Aspersion b) Drip c) Gravity d) Pumping e) Manual f) Does not use | A dichotomous variable was created for the following category: • Pressure irrigation systems (Aspersion, Drip, Pumping) It will take a value of one (1) if any pressure irrigation system were used and zero (0) in any other case. |

| 54. How much is the area sown or planted? | Measure in hectares | Measures the total number of hectares sowed with crops in the UPA. |

| 57a Amount obtained from production | Measurement in tons | Measures the total tons obtained by the UPA. |

| 76. During 2013, to improve the soil, it applied: | a) Organic fertilizer b) Chemical fertilizer c) Corrector of soil acidity d) Burns e) Prayers f) Rites g) Payments h) Did not apply | A dichotomous variable was created for the following category: • Chemical Fertilizer It will take a value of one (1) if chemical fertilizer was used and zero (0) in any other case. |

| 117. Today, is there machinery for the activity’s development? | a) Yes b) No | It takes a value of one (1) for option “a” and zero (0) for the others. |

| 135. During 2013, you received assistance or advice for the development of agricultural activities: | a) Yes b) No | It takes a value of one (1) for the “Yes” option and zero (0) for the “No” option. |

| 138. In total, how many people worked permanently to carry out agricultural activities in the last 30 days? (Including the farmer and members of his household) | Number of people | Number of permanent employees (Natural logarithm) |

| 140. How many daily employees did you hire directly, to carry out agricultural activities, during the last 30 days? | Number of people | Number of daily employees (Natural logarithm) |

| 150. How much is the total area of the Agricultural Production Unit? | Measure in hectares | Measure the total area of the UPA (Natural logarithm) |

| 170. According to your culture, people, and physical features, you are or are recognized as: | a) Indigenous b) Gypsy c) Raizal d) Black e) Palenquero f) None of the above | Percentage majority, for which option “f” is considered for majorities and for minorities the other cases. |

| 175. What is the highest education level attained, and the last year or grade passed at that level? | a) Preschool b) Basic primary c) Basic secondary d) Medium e) Technician f) Technological g) University h) Postgraduate i) None | • Percentage of people with without education (Option: None) |

Dependent and Independent Variables. The variable of interest was the yield, which was calculated as the natural logarithm of the division of the total tons produced (question 57a) by the total sown area measured in hectares (question 54).

On the other hand, agricultural credit as treatment variable responds to the CNA question 136a. Was the requested credit or financing approved? It is a dichotomous variable in which, if the credit was approved, the value it takes is 1 and 0 if it was not obtained.

Method. Because credits are not awarded randomly among farmers, there is a selection bias problem. Consequently, this research applies the Propensity Score Matching PSM methodology to obtain the true causal effect of the granting of agricultural credit.

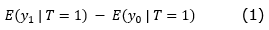

In mathematical terms, the treatment condition is denoted by T=1 for those who received the treatment (credit) and 𝑇=0 otherwise, and the impact variable (yield) of interest is denoted by 𝑦 1 if the credit was received and 𝑦 0 otherwise. Then, the goal is to estimate the difference in the result with and without the treatment for the treated group, Equation 1:

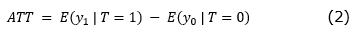

When treatment is randomized, there are no observable differences between the treated and untreated groups. In this case, the mean impact of treatment in a randomized experiment can be calculated as, Equation 2:

Where ATT is the Average Treatment effect on the Treated (ATT), and the assumption is that 𝐸 ( 𝑦 0 | 𝑇=1)=𝐸 ( 𝑦 0 | 𝑇=0).

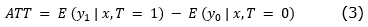

In the case of this research, the allocation of the different agricultural credit programs is not random, therefore, the treatment and control groups may vary in their observable characteristics, then it can no longer be assumed that 𝐸 ( 𝑦 0 | 𝑇=1) = 𝐸 ( 𝑦 0 | 𝑇=0). Thus, the treatment outcome for the non-participant group is not a valid counterfactual for the no-treatment treatment group.

The status of said allocation is determined by some set of covariates (𝑥) denominates as control variables in this research, therefore, to determine the impact of the treatment, a control group that is similar in (𝑥) to the treatment group is established. The average treatment effect is based on the difference in the average outcomes of the individuals in the treatment group and this "matched" control group with a similar set of (𝑥).

Formally, the impact of the treatment is given by the following expression, Equation 3:

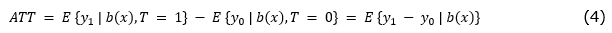

On the other hand, it should be mentioned that the propensity scores (PS) are defined as the conditional probability 𝑏(𝑥) that an individual will be assigned to the treatment group given the covariates of the individual; therefore, it is sufficient for the PSM methodology if the propensity scores coincide.

Then, the average treatment effect can be obtained by comparing the treatment group and the matched control group, conditional only on propensity score. Therefore, the impact of the credit on banana crops yield can be obtained with the following expression, Equation 4:

It is important to mention that it cannot be established or demonstrated that there are no differences in unobserved variables, since these can affect both the probability of participation and the results.

According to Caliendo and Kopeinig (2008), the methodology for implementing this approach can be summarized as follows: First, estimate the probability of participation in the program. Next, predict the participation probabilities for all individuals and limit the sample to those with common support. Then, choose a matching algorithm, for this study, Radius matching method with a caliper of 0.1 was considered. Afterward, verify that the treatment and control groups have balanced variables based on their predicted probabilities. Finally, calculate the program impacts by taking the appropriately weighted average of the difference between treated and untreated outcome variables, and calculate standard errors and confidence intervals to determine the statistical significance of the impacts.

All the statistical modeling was carried out with the STATA V. 12 Software.

Control variables. As mentioned in the method section, to apply the PSM methodology with reliable results, a series of control variables are necessary to create a comparable treatment and control group. Therefore, those variables that could be related to the high productivity of the crop and the granting of an agricultural loan, such as systems or technology used in the crops, were considered.

For example, it was considered if the farmer implements a pressure irrigation system (drip, sprinkler, pumping), the existence or not of agricultural machinery, and if the farmer applies chemical fertilization. On the other hand, other important factors as the area of land (in hectares) occupied by the UPA and the use of permanent and/or temporary employees were also considered.

Other characteristics that could be related to the granting of credit are some characteristics of the farmers, such as the level of education calculated as percentage of people without any education level (basic or high) living in the farm, as well as their race, understanding by majority those who do not belong to an indigenous, gypsy, raizal or black groups and finally, another variable considered is whether the farmer received technical assistance.

Thus, these variables become control variables, since they influence agricultural productivity and systematically generate different groups.

RESULTS AND DISCUSSION

Descriptive statistics. This section presents a brief descriptive analysis (Table 2) corresponding to the sample used to estimate the impact of agricultural credit.

Table 2 Definition and descriptive statistics of variables.

| Control variables | Definition | Untreated (Without credit) | Treated (With credit) | Mean Diff. | ||

|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | |||

| Agr_mach | Existence of agricultural machinery. | 0.339 | 0.474 | 0.582 | 0.495 | -0.243*** |

| Technical_assistance | Agricultural assistance or advice. | 0.511 | 0.500 | 0.533 | 0.501 | -0.022 |

| Soil_2 | Use of Chemical fertilizers | 0.221 | 0.415 | 0.615 | 0.489 | -0.394*** |

| ln_area_UPA_ha | UPA (Agricultural Production Unit) Area. | 0.910 | 1.647 | 1.226 | 1.312 | -0.316** |

| ln_employees | Daily employees on the farm. | 0.668 | 0.648 | 0.736 | 0.648 | -0.067 |

| ln_dayly_employees | Number Permanent Employees. | 1.429 | 1.104 | 1.644 | 1.398 | -0.215 |

| Without_education_pct | Level of education (% Without education). | 14.334 | 26.293 | 8.560 | 21.929 | 5.774** |

| Majority_pct | Ethnic group (% Majorities). | 31.764 | 45.975 | 81.694 | 38.594 | -49.93*** |

| Irr_pres | Implementation of an agricultural irrigation system (Pressure) | 0.053 | 0.223 | 0.148 | 0.356 | -0.095*** |

Note: *p < 0.10, **p < 0.05, ***p < 0.01

According to the results of the descriptive statistics alone, when the agricultural credit is approved, technical assistance is provided, and the number of permanent and daily employees is determined, there are no significant differences between the average values of the two groups, but there is a higher value in the group of those who accessed an agricultural credit than in the control group (without credit).

There are significant differences between the control and treatment groups if the farmer implements some type of innovation on the farm, such as the use of agricultural machinery, applying chemical fertilizer to the soil, or if a pressurized irrigation system is installed. On average, of those who accessed an agricultural loan, 58.2% have agricultural machinery, 62% implement chemical fertilization, and 15% use pressurized irrigation systems, the latter being especially low; that would speak of a low implementation of an irrigation system with these characteristics in the study crop.

The group that did not receive any type of credit has an average of 14.3% of its population without any type of basic or higher education, while those who received credit had an average of 8.6%. On the other hand, on average, 82% of the people who received some types of agricultural credit are part of the majority; therefore, minorities have very low participation rate of only 18%.

In general, as can be seen in Table , there are significant different means between the group that had access to agricultural credit and those that did not, which leads to the conclusion that they are not randomly distributed; therefore, they require specific methodologies to avoid selection bias.

Probit Model. Based on the model implementation algorithm, a probit model was utilized to calculate the likelihood of obtaining agricultural credit.

The estimation results are displayed in Table 3, where significant coefficients can be observed. Notably, owning agricultural machinery (Agr_mach), using chemical fertilizers (Soil_2), and not belonging to an ethnic minority (majority_pct) are associated with higher probabilities of receiving credit. On the other hand, a negative coefficient was obtained for farmers without any education (without_education_pct), indicating a significant reduction in the probability of receiving credit for this population.

Table 3 Estimation of the probability of accessing agricultural credit.

| Variables | Coef. | S. E |

|---|---|---|

| Agr_mach | 0.2139*** | 0.0810 |

| Technical_assistance | 0.0033 | 0.0773 |

| Soil_2 | 0.2499*** | 0.0834 |

| ln_area_apu_ha | 0.0209 | 0.0275 |

| ln_employees | 0.0832 | 0.0594 |

| ln_dayly_employees | 0.0335 | 0.0316 |

| Without_education_pct | -0.0082*** | 0.0019 |

| Majority_pct | 0.0074*** | 0.0011 |

| Irr_pres | 0.0572 | 0.1057 |

| Cons | -1.6974*** | 0.1222 |

Note: *p < 0.10, **p < 0.05, ***p < 0.01

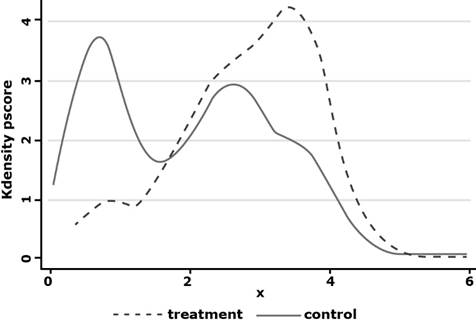

Common support. To accurately assess the impact of credit on banana yield, it is crucial to first confirm that the common support condition is met. This condition ensures that the estimates obtained are valid by matching each treated unit with an untreated unit.

Figure 1 shows the existence of common support since each UPA with credit and a defined probability can be paired or “matched” to a unit without credit with a similar probability.

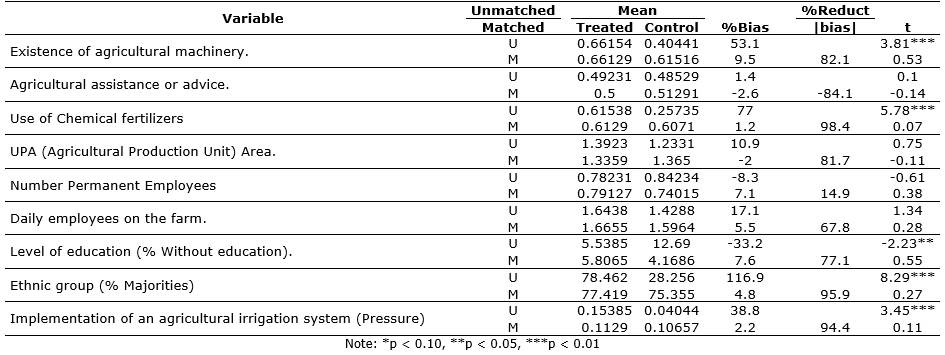

Balance test. After confirming the assumption of common support, an evaluation was conducted to assess the quality of the matching. The findings of the balance test are presented in Table 4.

As can be seen in Table 4, there is evidence of a reduction in the selection bias in the observables, indicating that the two groups are comparable and therefore, the impact that the credit has on the banana-producing units under study can be determined.

Impact of credit on banana yield. As can be seen in Table 5, the impact of agricultural credit on banana yields is positive and significant, and therefore it can be stated that banana farmers who access agricultural credit achieve an average increase of 6.2% in tons produced per hectare; that is, with access to agricultural credit, the farmer manages to increase yields on average from 8.8 to 9.3t/ha.

Table 5 Impact of agricultural credit on banana yield.

| Variable | ATT | ||

|---|---|---|---|

| Difference | S.E | ||

| Yield (t/ha) | 0.0623317* | 0.0335775 | |

| Sample number of Control group | 272 | ||

| Sample number of Treatment group | 62 | ||

Note: *p < 0.10, **p < 0.05, ***p < 0.01.

As mentioned in the introduction, according to MADR (2021), approximately 86% of national production is destined for the international market, in which Colombia ranks ninth in the world (3% of the world's banana production). However, production for export is concentrated in three departments: Antioquia (66%), Magdalena (29%), and Guajira (6%). Despite this, Valle del Cauca is the leading farmer for domestic consumption (25%); therefore, maintaining and improving banana yields not only ensures domestic demand but can also lead to its active participation in production for export as well. In line with the results obtained and as mentioned above, access to agricultural credit is expected to increase banana yields by 6.2%; therefore, current national government policies for banana farmers should encourage and invite them to actively participate in existing financing programs, according with the benefits obtained in the productivity. However, the results of the CNA, show that only 10% of banana farmers in Valle del Cauca applied for agricultural credit, even though approximately 86% of these were approved (DANE, 2017). Therefore, the high approval rate in contrast to the low participation rate may be evidence that the institutions have not developed good strategies to reach the entire population potentially interested in obtaining agricultural credit, and therefore there are difficulties for the farmer to know, be interested, and finally decide to apply for agricultural credit.

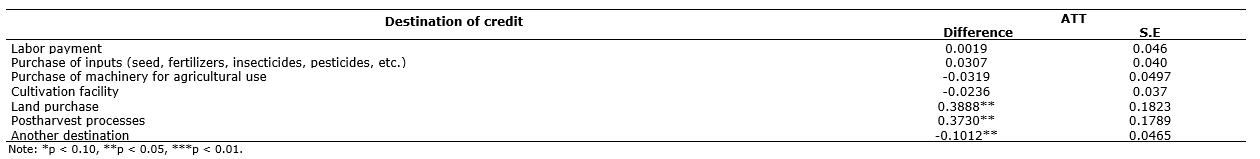

Credit and yield by destination of financing resources. In terms of the destination of the financing resources, Table 6 shows that those resources invested in the purchase or acquisition of land as well as investment in post-harvest processes, which give added value to production generate an effect that is even greater than the general effect.

UPAs that invest in land acquisition are expected to boost banana yields by 39% on average. This result is to be expected since land is fundamental, and its area is a key resource in yield crop, since according to Bagamba (2007), size is positively related to farm productivity. Moreover, as suggested by other authors such as Otsuka et al. (2016), the predominance of small farms limits agricultural growth and competitiveness. However, the introduction of new technologies and innovations, such as mini tractors combined with machinery service rental markets, allow the introduction of very high-tech agriculture on small plots of land and further diminishes any returns to scale (Fuglie et al., 2020).

Likewise, when it is decided to invest in post-harvest processes, the result is quantified in an average increase of 37%; however, the results of the CNA show that only 1.6% of the resources are allocated to this item (DANE, 2017), and despite the good impact it has on banana crop yields. Post-harvest processes are typically associated with farm mechanization and, as such, the adoption of innovative technologies, unlike Rani et al. (2019) , who found that the adoption of some agricultural credit increased the probability of adopting technology for banana crops. In the case of Valle del Cauca (Colombia), investment in these processes is minimal, and the acquisition of agricultural machinery ranks fourth in investment with 15%, behind the payment of agricultural inputs (35.3%), the installation of the crop (19.6%), and the payment of labor (18%).

On the other hand, taking into account the above figures, it should be noted that the main use of agricultural credit is for the purchase of agricultural inputs, which was found in this study not to have a statistically significant effect on the increase in banana crop yields. For his part, Rodríguez Paz (2020) points out in his work that some negative results in crop productivity in Colombia may be because farmers allocate the resources obtained to maintain the crop and not to improve its productivity. Another interesting result is the negative and statistically significant effect (decrease of 10%) on banana yields if the preference is to invest in other items not related to any of those directly related to the agricultural activity in Table 6. According to the CNA, 3.7% of the resources obtained from an agricultural credit have another purpose that is detrimental to the increase in yields of the crop under study.

Similarly, as mentioned by De La Hoz (2018) in his work, some farmers in Colombia stated that they use part of the credit to meet the daily needs of their household while the productive cycle of the crop is completed, and since many times there are no other sources of income, it is decided to invest in daily expenses such as health, education, food, and clothing, among others. This leads to a negative effect on the yield of the crop; however, it is evidence of the economic difficulties of the Colombian farmers.

CONCLUSIONS

Access to agricultural credit was found to have a higher probability for farmers who have their own machinery, use chemical fertilizers, have education, and do not belong to an ethnic minority. By applying the PSM methodology, it was found that agricultural credit has a positive effect on banana yields, especially when invested in land or post-harvest processes. However, investing in non-agricultural items showed a negative effect on yields. The study highlights the importance of land as a productive factor and post-harvest processes to improve product quality and income. The study also suggests that additional factors like natural disasters and the quality of advice and support from financing entities should be considered in future research. The study calls on entities offering agricultural credit to improve their strategies and encourage more farmer participation in credit programs.