Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Lecturas de Economía

Print version ISSN 0120-2596

Lect. Econ. no.72 Medellín Jan./June 2010

ARTÍCULOS

Determinants of Self-Employment Dynamics and their Implications on Entrepreneurial Policy Effectiveness

Determinantes de la dinámica del autoempleo y sus implicaciones sobre la efectividad de la política de promoción empresarial

Les déterminants de la dynamique de l'auto-emploi et leurs implications sur l'efficacité de la politique de soutient aux entreprises

José María Millán*; Emilio Congregado**; Concepción Román***

* Universidad de Huelva. Dirección electrónica: jose.millan@dege.uhu.es. Dirección postal: Departamento de Economía, Universidad de Huelva, Facultad de Ciencias Empresariales, Plaza de la Merced 11, 21071 Huelva (Spain).

** Universidad de Huelva. Dirección electrónica: congregado@uhu.es. Dirección postal: Departamento de Economía, Universidad de Huelva, Facultad de Ciencias Empresariales, Plaza de la Merced 11, 21071 Huelva (Spain).

*** Universidad de Huelva. Dirección electrónica: concepcion.roman@dege.uhu.es. Dirección postal: Departamento de Economía, Universidad de Huelva, Facultad de Ciencias Empresariales, Plaza de la Merced 11, 21071 Huelva (Spain)

–Introduction. –I. Self-employment patterns in the OECD. –II. The current entrepreneurial promotion policy. –III. The determinants of self-employment dynamics. –IV. Data limitations. –Conclusion and discussion. –References.

Abstract: This paper summarizes the main results of the empirical research on self-employment dynamics –particularly entry and success– and discusses their possible implications on entrepreneurial policy effectiveness. The main goal of this study is to promote a debate on this topic, encouraging conditional analyses that serve as guidance in the design of a policy agenda.

Key words: Entrepreneurship, self-employment, entry, success, public policy.

JEL Classification: J18, J24, M13.

Resumen: Este trabajo resume los principales resultados de las investigaciones empíricas sobre la dinámica del autoempleo –en particular entrada y éxito– y discute sus posibles implicaciones sobre la efectividad de la política de promoción empresarial. El principal objetivo de este trabajo es estimular un debate que contribuya al desarrollo de futuros análisis condicionales, para guiar el diseño de la agenda política en este campo.

Palabras clave: iniciativa empresarial, autoempleo, entrada, éxito, políticas públicas.

Clasificación JEL: J18, J24, M13.

Résumé : Ce travail montre les principaux résultats des études empiriques sur la dynamique de l'auto-emploi, notamment en ce qui concerne sa création et son déroulement à fin d'analyser ses implications sur l'efficacité de la politique de soutient aux entreprises. Ainsi, l'objectif principal de ce travail est celui d'entamer un débat autour des conditions nécessaires à l'auto-emploi qui vise la construction d'un agenda politique pour son développement.

Mots clé : Soutient aux entreprises, auto-emploi, entrée, sucèss, politique publiques.

Classification JEL: J18, J24, M13.

Introduction

Over the last decades, self-employment has taken a larger place in total non-agricultural employment in a number of OECD countries (OECD, 2000). However, the causes of this evolution are not yet well understood. At the international level, the clearest statistical relationship is the tendency for self-employment to be lower in countries with higher GDP per capita. Nevertheless GDP per capita has been rising in all countries, including those where self-employment is rising; therefore, other factors are clearly at work.

This perception can help us to understand, to a certain extent, the whys and wherefores of a renewed interest in entrepreneurship research. In fact, entrepreneurship have attracted an increased interest in the world of Economics, which is evident according to the exponential growth of works devoted (mainly empirical) to the economics of entrepreneurship (perhaps, more precisely to the economics of self-employment).

Surprisingly, the evolution of this topic of research has been peculiar. In fact, the progressive introduction of some active promotion self-employment policies in the action policy agenda was prior to the proliferation of propositions and empirical findings. It was to be expected that this fact had profound effects on the effectiveness of entrepreneurial policy.

Hence, we have moved from a situation in which policy makers identified a market failure and decided to intervene, in spite of the weakness of existing propositions, to another one characterized by the existence of more precise findings which can be used as powerful political guidelines.

However, this change has not had yet affected the design of entrepreneurship promotion policy, as a logical corollary. Therefore, this paper attempts to summarize the current state of the entrepreneurial promotion policy and the main empirical research results on self-employment dynamics in order to discuss its possible implications on policy effectiveness.

Thus, the main aim of this work is to stimulate the debate as the stepping stone to the necessary further conditional analysis to be carried out for an adequate design of the action policy agenda.

The organization of this paper is as follows. Section I describes and motivates self-employment patterns in the OECD countries by means of COMPENDIA methodology. Section II discusses the current entrepreneurial promotion policy in the OECD. Section III briefly reviews the main empirical results obtained by self-employment dynamics research and Section IV deals with data limitations for the empirical analysis. Finally, a discussion about the concluding remarks of the paper is contained in the last section.

I. Self-Employment Patterns in the OECD

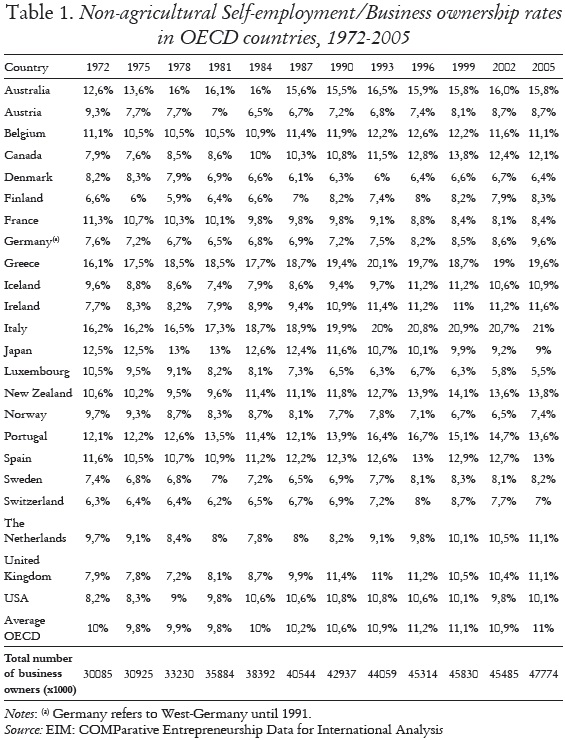

Harmonised data on entrepreneurship per country are not readily available; definitions that are used differ from country to country and available statistical data sets are often not regularly updated. Nevertheless, the COMPENDIA data-set can be used to provide an overall picture of the state of entrepreneurship in the OECD.1 Thus, table 1 presents data on the evolution of non-agricultural self-employment in OECD countries using the COMPENDIA data set.

During the 1990s, self employment grew faster than civilian employment as a whole in most OECD countries. This contrasts with the 1970s, when the share of self-employment tended to fall. Most countries tend to have a U-shape pattern in the rate of self-employment with a decrease in entrepreneurship till the mid-eighties and an increase afterwards.

In terms of the decline of business ownership, several authors have reported a negative relationship between economic development and the self-employment rate. The explanations include different approaches such as ''a rise of real wages associated with economic development which might have raised the opportunity cost of self-employment relative to the return'' (Lucas, 1978; Iyigun and Owen, 1998), or ''the need to exploit economies of scale and scope during the period after the second industrial revolution in the second half of the 19th century'' (Chandler, 1990). However, some other authors have provided evidence of a reversal of the trend towards more self-employment and small business presence in general (Carlsoon, 1989; Loveman and Sengenberger, 1991; Acs and Audretsch, 1993; Acs et al., 1994; Acs, 1996; Thurik, 1999). In this sense, there are many potential reasons for this revival in Western economies2 such as the important role that small firms play in the emerging industries like software and biotechnology, the fact that new technologies have reduced the importance of scale economies in many sectors, the deregulation and privatization movements which have swept the world, the tendency of large firms to concentrate on ''core competences'' and downsize, the increase of the employment share of the services sector which, given the relatively small average firm size of most services, creates more opportunities for business ownership, the increasing incomes and the increases in the ''demand for variety'' as a result, or even ''the view of self-employment as a way of achieve personal goals''. Alternatively, several countries, at different times, have seen growing numbers of self-employed people who work for just one company, and whose self-employment status may be little more than a device to reduce total taxes paid by the firms and workers involved –the phenomenon of so-called dependent self-employment-. The self-employment resurgence would be in that case a way to evade labour market rigidities.3 On the other hand, high levels of unemployment combined with some labour market programmes aimed to promote self-employment entries might be explaining the recent growth in self-employment rates.4 Finally, the fact that the main growth in self-employment is seen in the fastest growing sectors of the service economy suggests that the growth in selfemployment may also be a response to the new opportunities offered by OECD economies.

II. The Current Entrepreneurial Promotion Policy

Over recent decades, entrepreneurial promotion policies have played a key role in policy agenda, but often subordinated to the objectives of the active labour market policies. Thus, entrepreneurship policies focus on promoting transitions from unemployment to self-employment. This fact is a logical corollary, given the ineffectiveness shown by the majority of active labour market policy instruments traditionally used to reduce the high and persistent unemployment rates. The aim is to reduce unemployment directly by shifting people out of an unemployed status into self-employment and indirectly thanks to new jobs created by these new entrepreneurs.

In particular, the European Council defined its objectives in terms of employment and economic growth in Lisbon in 2000. Toward this end, European authorities have been committed to reducing entry barriers to entrepreneurship by designing and implementing a whole spectrum of policies, legislation, programmes and initiatives. Their more remarkable actions reveal a marked tendency or bias in favour of measures promoting the entry of unemployed or target groups (young people and women) into self-employment. In this sense, because the entrepreneurial promotion policies are aimed at not only enhancing self-employment, but also promoting the economic growth and job creation processes, governmental measures cannot be limited to achieving a certain number of self-employed individuals and reducing unemployment temporarily.5 They must also aim for a more permanent effect. However, there are relatively scarce measures aimed at foresting the success (survival and/or growth) of existing selfemployed6. Unfortunately, there are still very few rigorous evaluations of the cost-effectiveness of these and other policies to support self-employment.

Consequently, to increase the entrepreneurial network seems to be a quite imprecise objective in order to promote the economic growth and job creation processes.

III. The Determinants of Self-Employment Dynamics

The entrepreneurial phenomenon is commonly approached from a managerial perspective, setting aside any possible contributions derived from economic theory and empirical research. In order to overcome this deficiency, this section is aimed to present a selective review of the theoretical propositions and empirical results provided by the body of literature devoted to the study of the Economics of Self-employment and Entrepreneurship7 Undoubtedly, establishing (i) why some individuals enter self-employment; (ii) why some quit self-employment shortly after they have started, while others survive; and (iii) why some expand their business by recruiting personnel are crucial questions to improve the effectiveness of the public promotion of entrepreneurial activities.

A. Entering and Surviving within Self-employment

Given the standard theory of on-the-job search (Mortensen, 1986), most previous studies on self-employment consider a model where a rational agent enters into self-employment if the expected utility associated to this occupation exceeds the expected utility of other states (i.e. paidemployment or unemployment).8 However, the choice of labour market state is continually reviewed as individual situations change. Hence, the determinants of self-employment dissolution emerge. Thus, a rational individual will quit self-employment if the expected utility from selfemployment is smaller than the expected utility from other states.9 Some factors explaining these utility differentials and, as a consequence, affecting self-employment entry and survival are discussed below.

Question 1: Are there gender differences in self-employment entry and performance?

As far as gender differences are concerned, females are still a minority of the self-employed workforce (which generally refers to the sum of ownaccount workers and employers) in all developed countries. Some women, however, are classified as unpaid family workers in national statistics but might better be treated as equal partners with the self-employed person who is in formal charge of the business. This omission probably tends to understate the true level of women's entrepreneurship.10 In this sense, once women have overcome all obstacles and family circumstances to become self-employed, there is not a priori any reason which justify lower survival rates, unless similar hurdles reappear.11 On the contrary, most previous studies observe how women have significantly higher failure rates.12

Question 2: Are those individuals with higher education (or qualifications) more likely to enter and success within self-employment?

Regarding the linkages between entrepreneurship and education,13 either a negative or a positive relationship can be proposed. On one hand, education could serve as a filter in such a way that the more educated tend to be better informed, implying that they are more efficient at assessing self-employment opportunities. Moreover, there are many opportunities for self-employment in knowledge-based industries (Keeble et al., 1993).

On the other hand, the skills that make good entrepreneurs are not necessarily those which result in the acquisition of formal education (Casson, 2003). In addition, higher levels of education might be related to higher expected wage earnings, that is, higher opportunity cost of being self-employed. Finally, one would expect, according to the signalling hypothesis, that those planning to enter self-employment have no need to acquire formal qualifications to indicate their quality to potential employers. Consequently, the expected results on self-employment entry and performance are ambiguous.14

Question 3: Does the presence of self-employed parents (or relatives) increases the probability of entry and/or survival?

The argument is that parental labour market status may act as a proxy for intergenerational transfers of entrepreneurial human capital and ability.15

Question 4: Are those older individuals better entrepreneurs?

The role of age has also been explored across entrepreneurial literature.

One might expect older people to be successful within self-employment with a higher probability than younger individuals. Thus, human (and physical) capital requirements of entrepreneurship are often unavailable to younger workers. Besides, older people have had time to build better networks, and to have indentified valuable opportunities in entrepreneurship. On the other hand, the old may be more risk averse than the young, and less capable of working the long hours often undertaken by entrepreneurs.

When we turn to the econometric evidence, most studies tend to find than self-employment is concentrated among individuals in mid-career.16

Question 5: Does the probability of switching out of self-employment decrease with the amount of self-employment experience?

The shape of the empirical hazard rate of self-employment duration mostly presents a negative effect on the exit rate, that is, the hazard decreases with duration. There are two possible explanations of this result. The first one, well-known, is that entrepreneurial success may require time before being well established. The second comes from the fact that individuals improve their entrepreneurial skills along with selfemployment experience.17

Question 6: Does prior experience have a significant impact on selfemployment entering decisions and performance?

Jovanovic's (1982) dynamic selection theory notes that entrepreneurs can only learn about their actual entrepreneurial abilities through the process of starting a new firm. Therefore, those entrepreneurs learning from entrepreneurial experience that they have scarce endowments of entrepreneurial skills select themselves out of entrepreneurship, and there would not be any reason to enter again this state. However, a number of empirical studies have consistently found a positive effect of entrepreneurial experience on the preference to enter again self-employment.18 In this sense, an entrepreneur whose business venture has not succeeded is too often stigmatized, without recognizing that such failures are inevitable in some cases, and that entrepreneurs who have come through them can learn from them, and rebuild a better business next time round.19

Also related with the entrepreneurial skills acquisition process, recent research has shown that that employees of small firms were more likely to switch to self-employment than employees of large firms.20 In this line, presumably larger firms offer fewer entrepreneurial role models. However, this negative relationship between the size of the firm and probability of switching into self-employment might also reflect more favourable working conditions in larger firms in terms of earnings and security to keep the job (Parker, 2007).

Question 7: Are there different entry and/or survival rates across immigrants, different ethnics and racial groups?

We might argue that those who wish to immigrate temporarily in order to accumulate wealth see in entrepreneurship the most effective means to this end. Furthermore, immigrants turn to entrepreneurship as they are disadvantaged with respect to access to paid-employment. In this sense, language difficulties, discrimination, or possession of non-validated foreign qualifications seem to be the main causes. Immigrants are also considered to be self-selected risk takers due to their willingness to leave their homeland to make their way in a foreign country. Consequently, due to the difficulties to enter paid-employment, or the desperate wish –or need- to accumulate wealth, not enough skilled individuals may become self-employed, and this may explain the existence of lower survival rates among immigrants.21

Question 8: Does the probability of survival increase with firm size?

As the firm size increases, it approaches the minimum efficient level of output. Therefore, a negative influence of firm size on the hazard rate is expected. In addition, the existence of higher dismissal costs will be associated with higher exit costs.22

Question 9: Which is the role of relative earnings on self-employment likelihood?

A higher value for earnings as a self-employed should, ceteris paribus, increases the utility of self-employed relative to paid-employed work and make it more likely that an individual chooses to be self-employed. The fundamental econometric problem arising is due to the fact that the earnings of an individual is only observed in the sector which he or she works. This problem is overcome by estimating earnings equations for the selfemployed and the paid employed augmented with the appropriate sample selection corrections. These estimates are then used to predict earnings in the two labour market states. However, not all empirical analyses obtain a clear positive effect from relative earnings.23 Alternatively, other studies introduce some dynamics in the problem, and analyses the role of labour earnings for the decision of switching from paid-employment to selfemployment. Labour earnings can be viewed as the opportunity cost of becoming self-employed and, in this case, high earnings tend to depress the probability of becoming self-employed.24

Question 10: Are pre-entry assets highly correlated with entering chances?

One possible impediment to becoming an entrepreneur is simply the lack of capital. An approach in the literature has emphasized the role of liquidity constraints in the decision of starting-up a new business.25 This hypothesis has been supported by most (but not all) existing empirical studies.26

Question 11: Are wealth variables also highly correlated with selfemployment success?

However, to identify the effect of financial capital on the probability of an individual being successfully self-employed is econometrically difficult: personal assets could be endogenous to whether one is self-employed, or could be correlated with unobserved factors like entrepreneurial ability. Consequently, the existing results are quite diverse.27

Question 12: Does the receipt of any type of unemployment benefits make the individual less likely to enter self-employment?

The effect of the receipt of any type of unemployment benefits on the probability of becoming self-employed is also an interesting issue. It is a well-known fact that the receipt of these benefits generates a direct effect by increasing unemployment duration and reducing the probability of entering employment (self-employment included).28

Question 13: Do taxes and/or deductions have any impact on selfemployment participation and success?

The relationship between tax systems and self-employment likelihood has been subject to controversy. In this sense, high tax rates may in principle have both positive and negative effects on self-employment participation and success. On one hand, tax deduction and evasion opportunities seem to make both entry and survival more likely. However, higher income tax rates might raise the income threshold at which a decision is made in favour of self-employment, acting as an entry barrier to low-skilled selfemployed individuals (which also makes survival more probable, on the other hand). Finally, it also might be argued that taxes can make survival a difficult task by lowering earnings from self-employment.29

Question 14: Does the degree of employment protection affect selfemployment likelihood?

The question of how the strictness of employment protection legislation (EPL) affects self-employment has no clear-cut answer. There are several reasons to expect that the strictness of EPL decreases selfemployment. Firstly, the degree of risk aversion and the differences in risk of self-employment and paid-employment might play central roles in the determination of occupational choice. Thus, the strictness of EPL increases the individual's opportunity cost of changing employers or of leaving a secure salaried job to become an entrepreneur (Parker, 1997). On the other hand, EPL imposes sunk costs for self-employed workers who decide to take on employees and, therefore, it may deter individuals with higher growth expectations from entering self-employment if they think their business will be prevented from reaching optimal size (van Stel et al., 2007; Klapper et al., 2007). However, these arguments do not consider contracting out directly. Actually, this relationship could be weakened and turned into a positive one if employers can circumvent EPL by contracting out work via the route of dependent self-employment. In this sense, several studies argue for a positive relationship between EPL and self-employment, since self-employment could be the response to labour market policies.30

Question 15: How does the introduction of schemes supporting selfemployment affect entry and/or survival?

The introduction of schemes supporting self-employment has become an issue that is discussed as an increasingly important policy measure in many countries. In this sense, despite the variation across countries in the number of participants, the eligibility criteria, and the level of expenditure, these schemes share a common feature–i.e., they offer unemployed individuals and other disadvantaged groups economic incentives for the start-up phase corresponding to their self-employment activity. Traditionally, the effectiveness of these programs has been tested by means of two types of studies. The first type uses micro data to measure the impact of program participation on individuals' employment and earnings. In particular, empirical evidence on the effectiveness of start-up subsidies usually uses the survival rate, the number of jobs created directly by the new business, and the employability and income of participants as main indicators for evaluating self-employment programmes, comparing the outcomes of participants with a defined comparison group.31 The second type uses aggregate data to measure the net effects of programs on aggregate employment and unemployment.32 However, a recent type of framework has emerged, where the effect of public expenditure on start-up incentives on self-employment entries and survival is analysed.33

Question 16: Which is the existing correlation between cyclical variables (such as unemployment or GDP rates) and self-employment?

The correlation between cyclical variables (such as unemployment or GDP rates) and self-employment has also been widely examined in the literature. However, the theory provides an ambiguous prediction. The recession-push hypothesis states that when prospects on the labour market worsen, people will enter and remain as self-employed due to lack of alternative employment options.34 In contrast, the prosperity-pull argument states that individuals will enter and stay in self-employment, when prospects in the economy are good because of favourable business conditions and good demand.35 It may also happen that both effects work at the same time and, as a result, neither dominates the other.36 In the same sense, there are recent works trying to conciliate the existing results in the literature by providing new evidence on the relationship between business cycle and entrepreneurship.37

B. Other Interesting Dynamics: From Own-account Worker to Employer

Own-account self-employed covers a diverse range of occupational realities, from artisans and farmers to the professional liberal or the hightechnology consultant with an international clientele. Thus, leaving aside some singular activities which, given their nature, find a suitable environment in own-account self-employment, the logical growth and expansion of any entrepreneurial venture should result in transitions from own-account worker to employer. However, some elements can foster or hinder the decision to become a job creator. On the one hand, the own character of the expansion process joint with the financial needs and the labour costs can determine, the viability and convenience of this expansion.

Thus, the demand shock character (general or individual, permanent or transitory), the business cycle and the impact of labour market regulations will play a key role. On the other hand, the abilities to manage a team and the ability to assume the new paperwork will be two additional elements to consider, before deciding to opt for growth.

Therefore, if we want to analyze the hire of employees as a sign of success, the main issues to resolve should be: (i) which are the underlying factors contributing to the transition from own-account work to employer?; (ii) how important are the financial issues concerning this decision? and (iii) how determinant is the existing labour market regulation in this kind of transitions?

To the best of our knowledge, Congregado et al. (2010) is the only econometric analysis on the transitions from own-account work to employer which exists to date.38 Furthermore, there still only remains rather limited literature on the determinants of job creation by the selfemployed.39

IV. Data limitations

Regarding the availability of data, the main deficiencies are due to the absence of international specific datasets trying to capture self-employment dynamics. On the contrary, the main body of the existing empirical research is conducted by means of the available individual-based data sets (i.e. Human Population Surveys). These surveys are designed to study the labour market but fail to offer a general picture of the entrepreneurship issue. In this sense, individual-based data sets –as the European Community Household Panel (ECHP) or the European Statistics on Income and Living Conditions (EU-SILC)- do not have certain business information, while firm-based ones do not cover other individual aspects of the entrepreneur.

As limitations are shared, it would be of great interest to move forward in the design of joint surveys of enterprises and entrepreneurs as the ''Quadros de Pessoal'' dataset (Portugal), the Panel Study of Entrepreneurship Dynamics (PSED) for the US, the Eurostat survey on the ''Factors of Business Success'' (FOBS), or the new firm database from Statistic Denmark, which has been linked to the Integrated Database for Labour Market Research (IDA). The obvious advantage of this data is that the econometric analysis can condition both firm and individual-level data and, thus, avoid the problem of omitted variables which may otherwise bias results.

In addition, not all models and techniques –discrete choice models, sample selection models and earnings functions, duration models, and decomposition techniques- are suitable for the micro-data offered by the Human Population Surveys. Thus, the rotating panel feature, (as the EU-SILC) can be considered as an appropriate design to be exploited by discrete choice models, sample selection models and some decomposition techniques. Moreover, this design allows to verify with more reliability the role played by economic aggregate conditions in the individual decision making process. By contrast, the same rotating feature constitutes a disadvantage when trying to estimate duration models because the individuals remain in the sample for some quarters or years at most. For these survival studies, the full panel survey (as the ECHP) is preferable.

Finally, although the available information only allows carrying out partial analyses of the entrepreneurship phenomenon, not all the blame can be put on data deficiencies. In this sense, part of the problem comes from the fact that the economic analysis of entrepreneurship has not yet reached the degree of development necessary to reveal clear statistical necessities. As a result, there have been erratic uses of sources and indicators depending on the specific approach adopted: individual entrepreneurial network analysis, corporate entrepreneurial network analysis or firm demography studies.

As these obstacles are overcome, a homogenization of the demands for this type of data should be created to improve the statistical measurements that would allow capturing the different dimensions in which entrepreneurship affects economic activity.

Conclusion and discussion

This paper summarizes the main empirical research results on self-employment dynamics and discusses their possible implications on entrepreneurial policy effectiveness. The main aim of this work is to stimulate the debate as the stepping stone to the necessary further conditional analysis to be carried out for an adequate design of the action policy agenda. Thus, the principal conclusions and reflections derived from the analysis can be enumerated as follows.

A central issue within the entrepreneurial promotion policy is the design of a set of instruments directed at encouraging people to become self-employed, that is, to favour the choice of self-employment as an alternative to unemployment. Thus, in light of the existing results, start-up incentives seem to improve self-employment likelihood by contributing to overcome the liquidity constraints. Therefore, to evaluate the effectiveness of these incentives, it becomes crucial to first define their policy objectives. If, as an instrument of active labour market policies, start-up incentives are intended to improve the chances of people moving back into work, they can be considered adequate instruments. However, we will agree that the objective cannot be limited to achieving a certain number of self-employed temporally but also to pay attention to obtaining mid and long-term effects. In other words, if start-up incentives are considered as entrepreneurship policy, these incentives aim at not only enhancing self-employment but also favouring those forms of self-employment that further contribute to economic growth and job-creation processes. Therefore, an adequate design of these types of incentives becomes necessary. Toward this end, two recommendations (at least) might emerge: (i) the introduction of training and advice programs in order to raise the productivity of selfemployment projects to be subsidized; (ii) the extension of the scope of start-up incentives target groups, also funding innovative projects of individuals with higher human capital endowments.

Finally, in the light of the existing results, under strict employment protection regulation, public expenditure designed to move the unemployed back to employment might be detrimental for employment rights and the social protection of workers by favouring the development of atypical forms of employment that are outside the scope of labour laws.

Therefore, it seems crucial to take into account (and further analyze) the possible interactions between different labour market institutions (and the business cycle phase, expansion or recession) when defining the regulatory environment.

References

1. Acs, Zoltan (1996). ''Small firms and economic growth.'' In Admiraal, Piet H. (Ed.), Small business in the modern economy, Oxford, U.K, Blackwell Publishers. [ Links ]

2. Acs, Zoltan and Audretsch, David (1993). Small firms and entrepreneurship; an east-west perspective, U.K, Cambridge University Press. [ Links ]

3. Acs, Zoltan; Audretsch, David and Evans, David (1994). ''The determinants of variation in the self-employment rates across countries and over time'', Discussion Paper, No. 871, London, CEPR. [ Links ]

4. Andersson, Pernilla (2009). ''Exits from self-Employment: is there a nativeimmigrant difference in Sweden?'', International Migration Review (forthcoming). [ Links ]

5. Andersson, Pernilla and Wadensjö, Eskil (2007). ''Do the unemployed become successful entrepreneurs?'', International Journal of Manpower, No. 28, pp. 604-626. [ Links ]

6. Audretsch, David (2002). Entrepreneurship: a survey of the literature, Prepared for the European Commission, Enterprise Directorate General. [ Links ]

7. Barkham, Richard (1994). ''Entrepreneurial characteristics and the size of the new firm: a model and an econometric test'', Small Business Economics, No. 6, pp. 117-125. [ Links ]

8. Bates, Timothy (1990). ''Entrepreneur human capital inputs and small business longevity'', Review of Economics and Statistics, No. 72, pp. 551-559. [ Links ]

9. Bates, Timothy (1999). ''Exiting self-employment: an analysis of Asian immigrant-owned small businesses'', Small Business Economics, No. 13, pp. 171-183. [ Links ]

10. Bernhardt, Irwin (1994). ''Comparative advantage in self-employment and paid work'', Canadian Journal of Economics, No. 27, pp. 273-289. [ Links ]

11. Blanchflower, David Graham (2000). ''Self-employment in OECD countries'', Labour Economics, No. 7, pp. 471-505. [ Links ]

12. Blanchflower, David Graham (2004). ''Self-employment: more may not be better'', Swedish Economic Policy Review, No. 11, pp. 15-74. [ Links ]

13. Blanchflower, David Graham and Meyer, Bruce (1994). ''A longitudinal analysis of young entrepreneurs in Australia and the United States'', Small Business Economics, No. 6, pp. 1-20. [ Links ]

14. Blanchflower, David Graham and Oswald, Andrew (1998). ''What makes an entrepreneur?'', Journal of Labor Economics, No. 16, pp. 26-60. [ Links ]

15. Block, Jörn and Sandner, Philipp (2009). ''Necessity and opportunity entrepreneurs and their duration in self-employment: evidence from German micro data'', Journal of Industry, Competition and Trade, No. 9, pp. 117-137. [ Links ]

16. Boden Jr, Richard (1996). ''Gender and self-employment selection: an empirical assessment'', Journal of Socioeconomics, No. 25, pp. 671-682. [ Links ]

17. Boone, Jan and Van Ours, Jan (2004). ''Effective active labor market policies'', IZA Discussion Paper, No. 1335. [ Links ]

18. Bruce, Donald (2000). ''Effects of the United States tax system on transitions into self-employment'', Labour Economics, No. 7, pp. 545-574. [ Links ]

19. Bruce, Donald (2002). ''Taxes and entrepreneurial endurance: evidence from the self-employed'', National Tax Journal, No. 55, pp. 5-24. [ Links ]

20. Bruce, Donald and Schuetze, Herbert (2004). ''Tax policy and entrepreneurship'', Swedish Economic Policy Review, No. 2, pp. 233-265. [ Links ]

21. Brüderl, Josef and Preisendörfer, Peter (1998). ''Network support and the success of newly founded businesses'', Small Business Economics, No. 10, pp. 213-225. [ Links ]

22. Brüderl, Josef; Preisendörfer, Peter and Ziegler, Rolf (1992). ''Survival chances of newly founded business organizations'', American Sociological Review, No. 57, pp. 227-242. [ Links ]

23. Burke, Andrew; FitzRoy, Felix and Nolan, Michael (2000). ''When less is more: distinguishing between entrepreneurial choice and performance'', Oxford Bulletin of Economics and Statistics, No. 65, pp. 567-587. [ Links ]

24. Burke, Andrew; FitzRoy, Felix and Nolan, Michael (2002). ''Selfemployment wealth and job creation: the roles of gender, nonpecuniary motivation and entrepreneurial ability'', Small Business Economics, No. 19, pp. 255-270. [ Links ]

25. Carlsson, Bo (1989). ''The evolution of manufacturing technology and its impact on industrial structure: an international study'', Small Business Economics, No. 1, pp. 21-37. [ Links ]

26. Carrasco, Raquel (1999). ''Transitions to and from self-employment in Spain: an empirical analysis'', Oxford Bulletin of Economics and Statistics, No. 61, pp. 315-341. [ Links ]

27. Carree, Martin; Van Stel, André; Thurik, Roy and Wennekers, Sander (2002). ''Economic development and business ownership: an analysis using data of 23 OECD countries in the period 1976-1996'', Small Business Economics, No. 19, pp. 271-290. [ Links ]

28. Carroll, Robert; Holtz-Eakin, Douglas; Rider, Mark and Rosen, Harvey (2000). ''Income taxes and entrepreneurs' use of labour'', Journal of Labor Economics, No. 18, pp. 324-351. [ Links ]

29. Casson, Mark (2003). ''The entrepreneur: an economic theory'', second edition, Cheltenham, Edward Elgar. [ Links ]

30. Clark, Kenneth and Drinkwater, Stephen (1998). ''Ethnicity and selfemployment in Britain'', Oxford Bulletin of Economics and Statistics, No. 60, pp. 383-407. [ Links ]

31. Clark, Kenneth and Drinkwater, Stephen (2000). ''Pushed out or pulled in? Self-employment among minorities in England and Wales'', Labour Economics, No. 7, pp. 603-628. [ Links ]

32. Clark, Kenneth and Drinkwater, Stephen (2010). ''Recent trends in minority ethnic entrepreneurship in Britain'', International Small Business Journal, No. 28, pp. 136-146. [ Links ]

33. COM (2004). ''Communication from the Commission to the Council, the European Parliament, the European Economic and Social Committee and the Committee of Regions'', Action Plan: The European Agenda for Entrepreneurship. [ Links ]

34. Congregado, Emilio; Millán, José María and Román, Concepción (2009). ''The emergence of new entrepreneurs in Europe'', Mimeo, Universidad de Huelva, available at: http://ssrn.com/abstract=1535422. [ Links ]

35. Congregado, Emilio; Millán, José María and Román, Concepción (2010). ''Transitions within self-employment: from own-account worker to employer'', Mimeo, Universidad de Huelva, available at: http://ssrn.com/abstract=1557330. [ Links ]

36. Cooper, Arnold; Gimeno-Gascon, Javier and Woo Carolyn (1991). ''A resource-based prediction of new venture survival and growth'', Academy of Management Proceedings, pp. 68-72. [ Links ]

37. Cooper, Arnold; Gimeno-Gascon, Javier and Woo, Carolyn (1992). ''Entrepreneurs' exit decisions: the role of threshold expectations''. In: Academy of Management Best Paper Proceedings, The Academy of Management. [ Links ]

38. Cooper, Arnold; Gimeno-Gascon, Javier and Woo, Carolyn (1994). ''Initial human and financial capital as predictors of new venture performance'', Journal of Business Venturing, No. 9, pp. 371-395. [ Links ]

39. Cowling, Marc; Taylor, Mark and Mitchell, Peter (2004). ''Job creators'', The Manchester School, No. 72, Vol. 5, pp. 601-617. [ Links ]

40. Cressy, Robert (1996). ''Are business startups debt-rationed?'', Economic Journal, No. 106, pp. 1253-1270. [ Links ]

41. Cueto, Begoña and Mato, Javier (2006). ''An analysis of self-employment subsidies with duration models'', Applied Economics, No. 38, pp. 23-32. [ Links ]

42. Chandler Jr, Alfred (1990). Scale and scope: the dynamics of industrial capitalism, U.S, Harvard University Press. [ Links ]

43. De Wit, Gerrit (1993). ''Models of self-employment in a competitive market'', Journal of Economic Surveys, No. 7, pp. 367-397. [ Links ]

44. De Wit, Gerrit and Van Winden, Frans (1989). ''An empirical analysis of self-employment in the Netherlands'', Small Business Economics, No. 1, pp. 263-272. [ Links ]

45. De Wit, Gerrit and Van Winden, Frans (1990). ''An empirical analysis of self-employment in the Netherlands'', Economic Letters, No. 32, pp. 97-100. [ Links ]

46. De Wit, Gerrit and Van Winden, Frans (1991). ''An M-sector, N-group behavioural model of self-employment'', Small Business Economics, No. 3, pp. 49-66. [ Links ]

47. Del Monte, Alfredo and Scalera, Domenico (2001). ''The life duration of small firms born within a start-up programme. Evidence from Italy'', Regional Studies, No. 35, pp. 11-21. [ Links ]

48. Dolton, Peter and Makepeace, Gerald (1990). ''Self-employment among graduates'', Bulletin of Economic Research, No. 42, pp. 35-53. [ Links ]

49. Dunn, Thomas and Holtz-Eakin, Douglas (2000). ''Financial capital, human capital and the transition to self-employment: evidence from intergenerational links'', Journal of Labor Economics, No. 18, pp. 282- 305. [ Links ]

50. Ejrnæs, Mette and Hochguertel, Stefan (2008). ''Entrepreneurial moral hazard in income insurance: empirical evidence from a large administrative sample'', Discussion Paper, No. 19, Network for Studies on Pensions, Aging and Retirement. [ Links ]

51. Evans, David and Jovanovic, Boyan (1989). ''An estimated model of entrepreneurial choice under liquidity constraints'', Journal of Political Economy, No. 97, pp. 808-827. [ Links ]

52. Evans, David and Leighton, Linda (1989). ''Some empirical aspects of entrepreneurship'', American Economic Review, No. 79, pp. 519-535. [ Links ]

53. Fairlie, Robert (1999). ''The absence of the African-American owned business: an analysis of the dynamics of self-employment'', Journal of Labor Economics, No. 17, pp. 80-108. [ Links ]

54. Fairlie, Robert and Robb, Alicia (2007). ''Why are black-owned businesses less successful than white-owned businesses? The role of families, inheritances, and business human capital'', Journal of Labor Economics, No. 25, pp. 289-323. [ Links ]

55. Fairlie, Robert and Krashinsky, Harry (2006). ''Liquidity constraints, household wealth, and entrepreneurship revisited'', IZA Discussion Paper, No. 2201. [ Links ]

56. Falter, Jean-Marc (2002). ''Self-employment entry and duration in Switzerland'', Working paper, Employment Center, University of Geneva. [ Links ]

57. Felstead, Alan and Leighton, Patricia (1992). ''Issues, themes and reflections on the 'enterprise culture'''. In: The new entrepreneurs: selfemployment and small business in Europe, Kogan Page. [ Links ]

58. Fertala, Nikolinka (2008). ''The shadow of death: do regional differences matter for firm survival across native and immigrant entrepreneurs?'', Empirica, No. 35, pp. 59-80. [ Links ]

59. Fölster, Stefan (2000). ''Do entrepreneurs create jobs?'', Small Business Economics, No. 14, pp. 137-148. [ Links ]

60. Fujii, Edwin and Hawley, Clifford (1991). ''Empirical aspects of selfemployment'', Economics Letters, No. 36, pp. 323-329. [ Links ]

61. Georgarakos, Dimitris and Tatsiramos, Konstantinos (2009). ''Entrepreneurship and survival dynamics of immigrants to the U.S. and their descendants'', Labour Economics, No. 16, pp. 161-170. [ Links ]

62. Georgellis, Yannis; Sessions, John and Nikolaos, Tsitsianis (2007). ''Pecuniary and non-pecuniary aspects of self-employment survival'', Quarterly Review of Economics and Finance, No. 47, pp. 94-112. [ Links ]

63. Giannetti, Mariassunta and Simonov, Andrei (2004). ''On the determinants of entrepreneurial activity: social norms, economic environment and individual characteristics'', Swedish Economic Policy Review, No. 11, pp. 269-313. [ Links ]

64. Gill, Andrew (1988). ''Choice of employment status and the wages of employees and the self-employed: some further evidence'', Journal of Applied Econometrics, No. 3, pp. 229-234. [ Links ]

65. Gimeno-Gascon, Javier; Folta, Timothy; Cooper, Arnold and Woo, Carolyn (1997). ''Survival of the fittest? Entrepreneurial human capital and the persistence of underperforming firms'', Administrative Science Quarterly, No. 42, pp. 750-783. [ Links ]

66. Greene, William (2003). Econometric analysis, fifth edition, New Jersey, Prentice-Hall. [ Links ]

67. Grilo, Isabel and Thurik, Roy (2004). ''Determinants of entreprenerurship in europe'', ERIM Report Series Research in Management, ERS-2004-106-ORG. [ Links ]

68. Gurley-Calvez, Tami (2006). ''Health insurance deductibility and entrepreneurial survival'', Report developed under contract with the Small Business Administration, Office of Advocacy. [ Links ]

69. Gurley-Calvez, Tami and Bruce, Donald (2008). ''Do tax cuts promote entrepreneurial longevity?'', National Tax Journal, No. 61, pp. 225-250. [ Links ]

70. Hamilton, Robert (1989). ''Unemployment and business formation rates: reconciling time series and cross-section evidence'', Environment and Planning, No. 21, pp. 249-255. [ Links ]

71. Haapanen, Mika and Hannu, Tervo (2009). ''Self-employment duration in urban and rural locations'', Applied Economics, No. 41, pp. 2449-2461. [ Links ]

72. Henley, Andrew (2005). ''Job creation by the self-employed: the roles of entrepreneurial and financial capital'', Small Business Economics, No. 25, pp. 175-196. [ Links ]

73. Holmes, Thomas and Schmitz Jr, James (1996). ''Managerial tenure, business age, and small business turnover'', Journal of Labor Economics, No. 14, pp. 79-99. [ Links ]

74. Holtz-Eakin, Douglas; Joulfaian, David and Rosen, Harvey (1994a). ''Entrepreneurial decisions and liquidity constraints'', Rand Journal of Economics, No. 25, pp. 334-347. [ Links ]

75. Holtz-Eakin, Douglas; Joulfaian, David and Rosen, Harvey (1994b). ''Sticking it out: entrepreneurial survival and liquidity constraints'', Journal of Political Economy, No. 102, pp. 53-75. [ Links ]

76. Hout, Michael and Rosen, Harvey (2000). ''Self-employment, family background and race'', Journal of Human Resources, No. 15, pp. 670-692. [ Links ]

77. Hyytinen, Ari and Maliranta, Mika (2006). ''When do employees leave their job for entrepreneurship: evidence from linked employeremployee data'', ETLA Discussion Paper, No. 1023. [ Links ]

78. Iyigun, Murat and Owen, Ann (1998). ''Risk, entrepreneurship, and human capital accumulation'', American Economic Review, Papers and Proceedings, No. 88, pp. 454-457. [ Links ]

79. Jensen, Kræn; Nielsen, Helena; Ejrnæs, Mette and Würtz, Allan (2003). ''Self-employment among immigrants: a last ressort?'', CAM Working Paper, Institute of Economics, University of Copenhagen, WP 2003-08. [ Links ]

80. Johansson, Edvard (2000). ''Self-employment and the predicted earnings differential, evidence from Finland'', Finnish Economic Papers, No. 13, pp. 45-55. [ Links ]

81. Johansson, Edvard (2001). ''Determinants of self-employment duration, evidence from Finnish micro-data'', Mimeo, Swedish School of Economics and Business Administration. [ Links ]

82. Jørgensen, Rasmus (2005). ''A duration analysis of Danish start-ups'', Centre for Economic and Business Research'', CEBR student paper. [ Links ]

83. Jovanovic, Boyan (1982). ''Selection and the evolution of industry'', Econometrica, No. 50, pp. 649-670. [ Links ]

84. Kalleberg, Arne and Leicht, Kevin (1991). ''Gender and organizational performance: determinants of small business survival and success'', Academy of Management Journal, No. 34, pp. 136-161. [ Links ]

85. Kangasharju, Aki and Pekkala, Sari (2002). ''The role of education in self-employment success in Finland'', Growth and Change, No. 33, pp. 216-237. [ Links ]

86. Keeble, David; Walker, Sheila and Robson, Martin (1993). ''New firm formation and small business growth: spatial and temporal variations and determinants in the United Kingdom'', Employment Department Research Series, London, HMSO, No. 15. [ Links ]

87. Klapper, Leora; Laeven, Luc and Raghuram, Rajan (2007). ''Entry regulation as a barrier to entrepreneurship'', Journal of Financial Economics, No. 82, pp. 591-629. [ Links ]

88. Lancaster, Tony (1990). The analysis of transition data, U.K, Cambridge University Press. [ Links ]

89. Lin, Zhengxi; Picot, Garnett and Compton, Janice (2000). ''The entry and exit dynamics of self-employment in Canada'', Small Business Economics, No. 15, pp. 105-125. [ Links ]

90. Lindh, Thomas and Ohlsoon, Henry (1996). ''Self-employment and windfall gains: evidence from the Swedish lottery'', Economic Journal, No. 106, pp. 1515-1526. [ Links ]

91. Lofstrom, Magnus and Wang, Chunbei (2006). ''Hispanic self-employment: a dynamic analysis of business ownership'', IZA Discussion Paper, No. 2101. [ Links ]

92. Loveman, Gary and Sengenberger, Werner (1991). ''The re-emergence of small-scale production; an international comparison'', Small Business Economics, No. 3, pp. 1-37. [ Links ]

93. Lucas Jr, Robert (1978). ''On the size distribution of firms'', BELL Journal of Economics, No. 9, pp. 508-523. [ Links ]

94. Maddala, Gangadharrao (1983). Limited-dependent and qualitative variables in econometrics, U.K, Cambridge University Press. [ Links ]

95. Marshall, Katherine (1999). ''Working together – self-employed couples'', Perspectives on Labour and Income, Statistics Canada, No. 11, pp. 9-13. [ Links ]

96. Martínez-Granado, Maite (2002). ''Self-employment and labour market transitions: a multiple state model'', CEPR Discussion Paper, No. 3661. [ Links ]

97. Mathur, Aparna (2008). ''Health insurance and job creation by the selfemployed'', Small Business Economics, DOI 10.1007/s11187-008-9164-4. [ Links ]

98. Meyer, Bruce (1990). ''Why are there so few black entrepreneurs?'', NBER Working Paper, No. 3537, National Bureau of Economic Research. [ Links ]

99. Millán, José María, Congregado, Emilio and Román, Concepción (2010). ''Determinants of self-employment survival in Europe'', Small Business Economics, DOI: 10.1007/s11187-010-9260-0. [ Links ]

100. Moore, Carol and Mueller, Richard (2002). ''The transition from paid to self-employment in Canada: the importance of push factors'', Applied Economics, No. 34, pp. 791-801. [ Links ]

101. Mortensen, Dale (1986). ''Job search and labor market analysis''. In: Handbook of labor economics, Amsterdam, North-Holland: Elsevier. [ Links ]

102. Muñoz, Fernando and Cueto, Begoña (2008). ''The sustainability of startup firms among formerly wage workers'', Business Economic Series, Working Paper, No. 31, Universidad Carlos III de Madrid. [ Links ]

103. Nziramasanga, Mudziviri and Lee, Min Soo (2001). ''Duration of selfemployment in developing countries: evidence from small enterprises in Zimbabwe'', Small Business Economics, No. 17, pp. 239-253. [ Links ]

104. Nziramasanga, Mudziviri and Lee, Min Soo (2002). ''On the duration of self-employment: the impact of macroeconomic conditions'', Journal of Development Studies, No. 39, pp. 46-73. [ Links ]

105. Oecd (2000). ''The partial renaissance of self-employment'', The Employment Outlook, chapter 5, Paris, OECD. [ Links ]

106. Parker, Simon (1997). ''The effects of risk on self-employment'', Small Business Economics, No. 9, pp. 515-522. [ Links ]

107. Parker, Simon (2002). ''Do banks ration credit to new enterprises? And should governments intervene?'', Scottish Journal of Political Economy, No. 49, pp. 162-195. [ Links ]

108. Parker, Simon (2003). ''Does tax evasion affect occupational choice?'', Oxford Bulletin of Economics and Statistics, No. 65, pp. 379-394. [ Links ]

109. Parker, Simon (2004). The economics of self-employment and entrepreneurship, U.K, Cambridge University Press. [ Links ]

110. Parker, Simon (2007). ''Which firms do the entrepreneurs come from?'', Economics Bulletin, No. 10, pp. 1-9. [ Links ]

111. Parker, Simon (2009a). The economics of entrepreneurship, U.K, Cambridge University Press. [ Links ]

112. Parker, Simon (2009b). ''Why do small firms produce the entrepreneurs?'', Journal of Socio-Economics, No. 38, pp. 484-494. [ Links ]

113. Rees, Hedley and Shah, Anup (1986). ''An empirical analysis of selfemployment in the UK'', Journal of Applied Econometrics, No. 1, pp. 95-108. [ Links ]

114. Reize, Frank (2004). ''Leaving unemployment for self-employment. An empirical study'', ZEW Economics Studies, No. 25, Manheim, Germany, Physica-Verlag. [ Links ]

115. Rissman, Ellen (2003). ''Self-employment as an alternative to unemployment'', Working Paper, No. 34, Federal Reserve Bank of Chicago. [ Links ]

116. Rissman, Ellen (2006). ''The self-employment duration of younger men over the business cycle'', Economic Perspectives, Federal Reserve Bank of Chicago, No. 30, pp. 14-21. [ Links ]

117. Román, Concepción; Congregado, Emilio and Millán, José María (2009). ''Dependent self-employment as a way to evade employment protection legislation'', Small Business Economics, DOI: 10.1007/s11187-009-9241-3. [ Links ]

118. Román, Concepción; Congregado, Emilio and Millán, José María (2010). ''Start-up incentives: entrepreneurship policy or active labour market programme?'', Mimeo, Universidad de Huelva, Available at: http://ssrn.com/abstract=1619990. [ Links ]

119. Schuetze, Herbert (2000). ''Taxes, economic conditions and recent trends in male self-employment: a Canada-US comparison'', Labour Economics, No. 7, pp. 507-544. [ Links ]

120. Schuetze, Herbert (2008). ''Tax incentives and entrepreneurship: measurement and data considerations''. In: Measuring entrepreneurship: building a statistical system, New York, Springer. [ Links ]

121. Storey, David (1994). Understanding the small business sector, London, Routledge. [ Links ]

122. Taylor, Mark (1996). ''Earnings, independence or unemployment: why become self-employed?'', Oxford Bulletin of Economics and Statistics, No. 58, pp. 253-266. [ Links ]

123. Taylor, Mark (1999). ''Survival of the fittest? An analysis of selfemployment duration in Britain'', Economic Journal, No. 109, pp. 140-155. [ Links ]

124. Taylor, Mark (2001). ''Self-employment and windfall gains in Britain: evidence from panel data'', Economica, New Series, 68, No. 272, pp. 539-565. [ Links ]

125. Taylor, Mark (2004). ''Self-employment in Britain: when, who and why?'', Swedish Economic Policy Review, No. 11, pp. 139-173. [ Links ]

126. Thurik, Roy (1999). ''Entrepreneurship, industrial transformation and growth''. In: The sources of entrepreneurial activity, Stamford, U.S, JAI Press. [ Links ]

127. Tokila, Anu (2009). ''Start-up grants and self-employment duration'', Paper presented at the Spring Meeting of Young Economists, Istanbul, Turkey. [ Links ]

128. Van der Sluis, Justin; Van Praag, Mirjam and Vijverberg, Wim (2008). ''Education and entrepreneurship selection and performance: a review of the empirical literature'', Journal of Economic Surveys, No. 22, pp. 795-841. [ Links ]

129. Van Praag, Mirjam (2003). ''Business survival and success of young small business owners'', Small Business Economics, No. 21, pp. 1-17. [ Links ]

130. Van Praag, Mirjam and Van Ophem, Hans (1995). ''Determinants of willingness and opportunity to start as an entrepreneur'', Kyklos, No. 48, pp. 513-540. [ Links ]

131. Van Stel, André (2005). ''Compendia: harmonizing business ownership data across countries and over time'', International Entrepreneurship and Management Journal, No. 1, pp. 105-123, Reprinted in Congregado, Emilio (Ed.), Measuring entrepreneurship: building a statistical system, 2008, New York, Springer. [ Links ]

132. Van Stel, André; Storey, David and Thurik, Roy (2007). ''The effect of business regulations on nascent and young business entrepreneurship'', Small Business Economics, No. 28, pp. 171-186. [ Links ]

133. Wagner, Joachim (2004). ''Are young and small firms hothouses for nascent entrepreneurs?'', Applied Economics Quarterly, No. 50, pp. 379-391. [ Links ]

134. Werner, Arndt and Moog, Petra (2009). ''Why do employees leave their jobs for self-employment? The impact of entrepreneurial working conditions in small firms'', MPRA Paper, No. 18826, Available at: http://mpra.ub.uni-muenchen.de/18826. [ Links ]

135. Westhead, Paul and Cowling, Marc (1995). ''Employment change in independent owner-managed high technology firms in Great Britain'', Small Business Economics, No. 7, pp. 111-140. [ Links ]

136. Wooldridge, Jeffrey (2002). Econometric analysis of cross section and panel data, Cambridge, U.S, MIT Press. [ Links ]

Primera versión recibida en marzo de 2010;

versión final aceptada en junio de 2010

NOTAS

1 The dataset COMPENDIA contains harmonized data on the number of business owners and the business ownership rate (number of business owners as share of labour force) for 23 OECD countries over the period 1972-2006. The acronym COMPENDIA stands for ''COMParative ENtrepreneurship Data for International Analysis''. Business ownership rates have been made comparable across countries and over time. See Van Stel (2005) for details.

2 See Carree et al. (2002, pp. 274-275) for a detailed list.

3 Román et al. (2009) show the contrary impact that some different measures of labour market regulation causes on transitions from paid-employment to dependent self-employment compared with transitions to independent self-employment.

4 Román et al. (2010) suggest that the coexistence of recession periods, start-up incentives, and strict employment protection favours transitions from unemployment to own-account work.

5 An obvious risk of these measures is that they can distort occupational choice, by encouraging non-skilled individuals to enter self-employment who may return to unemployment when economic conditions changes or even, when incentives disappear. In this sense, Rissman (2003) use the basic job search model (Mortensen, 1986) to develop a self-employment model for unemployed workers, where those unemployed individuals can supplement their income during spells of unemployment with earnings generated from self-employment.

6 In addition, according to the ''Action Plan: The European agenda for Entrepreneurship (2004)'', the EU is not fully exploiting its entrepreneurial potential as it is failing to encourage enough people to become an entrepreneur. Thus, according to the Eurobarometer although 47% of Europeans say they prefer self-employment, only 17% actually realise their ambitions. See COM (2004) 70 final, for details.

7 Other excellent surveys are Blanchflower (2000, 2004), Audretsch (2002), Parker (2004, 2009a) or Reize (2004) among others.

8 See Maddala (1983), Lancaster (1990), Wooldridge (2002) or Greene (2003) for more details of this methodology.

9 For a more detailed explanation of this methodology, see the ''Stephen P. Jenkins' Lecture Notes'' corresponding to the course Survival Analysis by Stephen P. Jenkins, provided by the University of Essex Summer School among other universities and institutions. For a detailed review of the determinants of self-employment survival in Europe, see Millán et al. (2010).

10 See Felstead and Leighton (1992) and Marshall (1999).

11 Thus, Kalleberg and Leicht (1991), Cooper et al. (1991, 1992, 1994), Brüderl and Preisendörfer (1998) and Andersson (2009) obtained evidence supporting that gender has an insignificant effect on business survival rates.

12 With the exception of the work by Giannetti and Simonov (2004), who show how males are less likely to stay longer in self-employment than females, on the other hand, there are several examples of the opposite result (see Holmes and Schmitz, 1996; Taylor, 1999; Nziramasanga and Lee, 2001; Falter, 2002; Georgellis et al., 2007; Block and Sandner, 2009; Haapanen and Tervo, 2009 or Millán et al., 2010 among others).

13 Van der Sluis et al. (2008) surveyed the literature.

14 Concerning entries, the evidence generally points to a positive effect of educational attainment (Rees and Shah, 1986; Gill, 1988; Dolton and Makepeace, 1990; Taylor, 1996; Clark and Drinkwater, 1998; Carrasco, 1999; Blanchflower, 2000; Congregado et al. 2009). However, other studies found insignificant effects of education (Evans and Jovanovic, 1989; Evans and Leighton, 1989; Taylor 2001), and several have detected negative effects (Bruce, 2000; Johansson, 2000). As regards to survival, Bates (1990), Cooper et al. (1991, 1994), Brüderl et al. (1992), Cressy (1996), Falter (2002), Cueto and Mato (2006), Ejrnæs and Hochguertel (2008), Haapanen and Tervo (2009) and Millán et al. (2010) find education to be an important factor in increasing self-employment longevity. However, Cooper et al. (1992), Carrasco (1999), Taylor (1999), Johansson (2001) or Georgellis et al. (2007) do not find any statistically important effect of education on survival. Finally, Kangasharju and Pekkala (2002) observe how exit probability is lower for the highly educated during economic downturn, but higher in economic upturn.

15 Evans and Leighton (1989), De Wit and Van Winden (1989, 1990), Taylor (1996), Dunn and Holtz-Eakin (2000), Hout and Rosen (2000) or Congregado et al. (2009) among others find that relatives' self-employment experience have a strong and positive effect on the probability of becoming self-employed. Regarding survival, Cooper et al. (1991, 1992, 1994), Gimeno- Gascon et al. (1997), Haapanen and Tervo (2009) and Millán et al. (2010) report a higher probability of survival if the entrepreneur's parents or relatives had owned (or currently own) a business.

16 Most empirical studies test if age has a non-linear effect on the probability of entering and/or surviving, by including both a linear and a quadratic term in the analysis. Thus, Rees and Shah (1986), Holtz-Eakin et al. (1994a, 1994b), Taylor (1996), Clark and Drinkwater (1998) or Congregado et al. (2009) reported positive (usually quadratic) effects from age on the probability of being or becoming self-employed. As regards to self-employment duration, Holtz-Eakin et al. (1994b), Taylor (2004), Block and Sandner (2009), Haapanen and Tervo (2009) and Millán et al. (2010) find that the negative quadratic term begins to dominate the positive linear term at roughly the age of 43, indicating that past this age, people become more likely to opt out of entrepreneurship in favour of wage earning, ceteris paribus.

17 Examples supporting this hypothesis include the work of Evans and Leighton (1989), Bates (1990), Brüderl et al. (1992), Holtz-Eakin et al. (1994b), Carrasco (1999), Taylor (1999), Falter (2002), Martínez-Granado (2002), Van Praag (2003), Taylor (2004), Rissman (2006), Haapanen and Tervo (2009) or Millán et al. (2010).

18 Evans and Leighton (1989), Congregado et al. (2009) and Román et al. (2009, 2010) obtain that previous self-employment experience has a positive and significant impact on the probability of re-entering self-employment.

19 Holmes and Schmitz (1996), Taylor (1999), Georgellis et al. (2007) and Millán et al. (2010) show that those individuals with previous experience as self-employed are less likely to fail. However, Brüderl et al. (1992), Cooper et al. (1992), Cressy (1996), Gimeno-Gascon et al. (1997), Martínez-Granado (2002) and Van Praag (2003) do not observe any relationship between entrepreneurial experience, and self-employment survival.

20 See Boden (1996), Wagner (2004), Hyytinen and Malirante (2006), Parker (2009b) or Werner and Moog (2009).

21 Bates (1999), Jensen et al. (2003), Georgarakos and Tatsiramos (2009) and Clark and Drinkwater (2010) point out differences between immigrants themselves. Holmes and Schmitz (1996), Fairlie (1999), Taylor (1999), Hout and Rosen (2000), Martínez-Granado (2002) and Fairlie and Robb (2007) focus on differences between white and non-white individuals.

22 Brüderl et al. (1992) and Jørgensen (2005) find that those with a higher number of employees are less likely to exit self-employment. However, Georgellis et al. (2007) find lower survival rates for those self-employed who has employees.

23 By means of this tool, Bernhardt (1994), Taylor (1996), Clark and Drinkwater (2000) and Johansson (2000) find that the probability of being self-employed depends positively on the predicted earnings differential. Rees and Shah (1986), Dolton and Makepeace (1990), De Wit and Van Winden (1989, 1990, 1991) and De Wit (1993), however, do not find any significant influence on the choices of paid/self-employment sector. Finally, Gill (1988) and Parker (2003) reported mixed results.

24 Evans and Jovanovic (1989), Evans and Leighton (1989), Meyer (1990), Blanchflower and Meyer (1994) and Johansson (2000) report that low paid workers are more likely to switch from paid-employment to self-employment. However, Roman et al. (2009) obtain insignificant results.

25 Parker (2002) surveyed this literature.

26 Illustrative examples supporting this hypothesis are Evans and Jovanovic (1989), Evans and Leighton (1989), Fujii and Hawley (1991) and Holtz-Eakin et al. (1994a) for the US, Rees and Shah (1986), Dolton and Makepeace (1990), Blanchflower and Oswald (1998), Clark and Drinkwater (2000) and Parker (2003) for the UK, Bernhardt (1994) for Canada, and Congregado et al. (2009) for the EU-15. On the other hand, Gill (1988) observed a significant but negative effect over the likelihood of participation in entrepreneurship, by using US data. Finally, De Wit and Van Winden (1989, 1990, 1991) and De Wit (1993) reported insignificant effects using Dutch data while Grilo and Thurik (2004) supported the lack of significance of this variable across the EU-15.

27 Thus, Johansson (2001), Nziramasanga and Lee (2001, 2002), Cueto and Mato (2006), Fairlie and Krashinsky (2006), Georgellis et al. (2007), Block and Sandner (2009), Haapanen and Tervo (2009) and Millán et al. (2010) show as different proxies of wealth such as lower loan costs, self-employment earnings, home ownership, pre-entry assets or the receipt of interest and dividend payments increase the probability of survival. On the other hand, Taylor (1999, 2001, 2004), Falter (2002) and Van Praag (2003) find financial variables to be insignificant.

28 Carrasco (1999), Congregado et al. (2009) and Román et al. (2010) observes how unemployment benefits affect negatively transitions from unemployment to self-employment.

29 The number of studies focused on the role of taxes on self-employment entry is quite large. See Bruce and Schuetze (2004) or Schuetze (2008) for a review. Surprisingly, studies analysing the effects of taxes on entrepreneurial longevity are rather scarce. See Bruce (2002), Gurley-Calvez (2006), Fertala (2008), Gurley-Calvez and Bruce (2008) and Millán et al. (2010) as notable exceptions.

30 Román et al. (2009) surveyed the theoretical and empirical literature of the so-called dependent self-employment phenomenon and obtained that EPL strictness encourages employers to contract out work to their own paid employees by the formula of dependent self-employment, while making transitions from paid-employment to independent self-employment less likely. Millán et al. (2010) and Román et al. (2010) also support both positive and negative arguments on the relationship between self-employment and EPL by detecting a non-linear effect of EPL strictness on self-employment survival (inverted U-shaped pattern), and entries from unemployment (U-shaped pattern), respectively.

31 Examples of microeconometric evaluations of start-up subsidies are Pfeiffer and Reize (2000), Baumgartner and Caliendo (2008) and Caliendo and Kritikos (2009) for Germany, Carling and Richardson (2001) and Andersson and Wadensjö (2007) for Sweden, Del Monte and Scalera (2001) for Italy, Meager et al. (2003) for UK, Perry (2006) for New Zealand, Cueto and Mato (2006) for Spain, Ejrnæs and Hochguertel (2008) for Denmark and Tokila (2009) for Finland.

32 However, to the best of our knowledge, there are no studies that analyse the effect of these incentives on aggregate self-employment. For a review of the few studies that evaluate the effects of active labour market programmes from a macro point of view, see Boone and van Ours (2004).

33 In this sense, Román et al. (2009) show that public expenditure on start-up incentives has positive effects on transitions from paid-employment to self-employment. However, this effect is stronger for individuals entering dependent self-employment. In addition, Román et al. (2010) observe that this spending also increases the probabilities of entering from unemployment to own-account self-employment (whereas it does not seem to have any effect on employership chances). Finally, Millán et al. (2010) show that this expenditure decreases the risk of exiting self-employment, specifically for the group of individuals entering selfemployment from unemployment.

34 Concerning flows into self-employment see for instance Schuetze (2000). Examples regarding self-employment survival include Johansson (2001) and Rissman (2006).

35 Examples supporting this argument for self-employment entries are Hamilton (1989), Van Praag and Van Ophem (1995), Lindh and Ohlsoon (1996), Taylor (1996), Blanchflower and Oswald (1998), Clark and Drinkwater (1998, 2000), Carrasco (1999) and Bruce (2000). As regards to self-employment success, see Carrasco (1999), Taylor (1999), Fertala (2008), Muñoz and Cueto, (2008), Andersson (2009), Haapanen and Tervo (2009) and Millán et al. (2010).

36 Neither Lin et al. (2000) nor Moore and Mueller (2002) present statistical evidence supporting the dominance of the push-hypothesis over the pull on self-employment entries. Concerning the length of the spells as self-employed, the same applies for Lin et al. (2000), Van Praag (2003) and Georgellis et al. (2007).

37 Román et al. (2009) observe that the recession-push argument applies for those entering from paid-employment to dependent self-employment while the prosperity-pull hypothesis applies for individuals switching to from paid-employment to independent self-employment. In addition, Román et al. (2010) show that transitions from unemployment to employership are more likely when economic conditions are good, supporting the prosperity-pull argument, whereas the refugee-effect hypothesis applies for those unemployed entering own-account selfemployment.

38 Their results suggest a positive impact on these transitions of previous experience within the labour market, presence of relatives self-employed and own-account work incomes. In addition, they find a clear negative impact of the unemployment rate on this type of transitions which supports prosperity-pull argument. Finally, the authors also detect international divergences in this kind of transitions which suggest the presence of specific regional factors at the institutional and/or cultural level.

39 Examples of this literature are Barkham (1994), Westhead and Cowling (1995), Burke et al. (2000, 2002), Cowling et al. (2004) and Henley (2005) for the UK, Carroll et al. (2000) and Mathur (2008) for the US and Fölster (2000) for Sweden.