Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Lecturas de Economía

Print version ISSN 0120-2596

Lect. Econ. no.74 Medellín Jan./June 2011

ARTÍCULOS

Manufacturing Employment and Wage Differentials After Structural Adjustment Reforms in Colombia: An Efficiency Wages Approach

Empleo y diferencias salariales en el sector manufacturero después de las reformas de ajuste estructural en Colombia: Un enfoque de salarios de eficiencia

L'emploi industriel et le différentiel salarial après l'ajustement des reformes structurelles en

Colombie : une approche du salaire d'efficience

Rodrigo Taborda*; Juan Guataquí**

* Docente e investigador. Dirección electrónica: rodrigo.taborda@urosario.edu.co. Dirección postal: Departamento de Economía. Universidad del Rosario. Calle 14 #

4-69. Bogotá, Colombia.

** Docente e investigador. Dirección electrónica: juan.guataqui@urosario.edu.co. Dirección postal: Universidad del Rosario. Departamento de Economía. Calle 14 # 4-69. Bogotá, Colombia.

–Introduction. –I. A Job Rotation Model. –II. Data and Variable Construction.–III. Econometric Approach. –IV. Estimation Results. –Conclusion. –References.

Primera versión recibida en octubre de 2010; versión final aceptada en febrero de 2011

ABSTRACT

In the framework of the structural reforms in Colombia one of the most important policy proposals was reducing rigidities in the labor market. A perspective to assess the results of such reforms is the analysis of the relationship between firm employment and wage differentials in manufacturing before and after the reforms. If the labor reforms reached the intended objective of making more flexible the labor market, the employment levels must change faster, along with the behavior of wages and other labor costs, given some characteristics of firms and the economy. This paper addresses this topic proposing a model of wage differential and employment growth and testing its propositions before and after the structural reforms and controlling for industry and firm characteristics. A first finding is the confirmation of the positive relationship proposed between intra-industry wage differential and employment. In the inter-industry wage differential estimation, we find heterogeneous responses depending on the industry and a reduction in the autonomous labor turnover.

Keywords: Efficiency wages, turn over, Colombia's manufacturing industry.

JEL codes: E24, J63, J64.

RESUMEN

Una de las políticas más importantes en el proceso de reformas estructurales en Colombia a principios de la deécada de 1990 fue la reducción de las rigideces en el mercado laboral. Una posición para evaluar los resultados de tales reformas es analizar la relación entre empleo de las firmas y diferencial salarial antes y después de las reformas. Si las reformas laborales implementadas conjuntamente con la apertura económica lograron su objetivo de mayor flexibilidad en el mercado laboral, el nivel de empleo debió haber cambiado más rápido, conjuntamente con el comportamiento de los salarios y otros costos laborales, contabilizando por las características de las firmas y de la economía. Este documento aborda este tema proponiendo un modelo de diferenciales salariales y crecimiento de empleo, y prueba esta relación entre los períodos de reforma, controlando por características de la industria y el empleo. Un resultado es la confirmación de una relación positiva entre el diferencial de salario intra–industrial y el cambio en el empleo neto. Para el diferencial salarial inter-industrial, se encuentran respuestas heterogéneas dependiendo de la industria y una reducción en la rotación laboral autónoma.

Palabras clave: Salarios de eficiencia, rotación laboral, industria manufacturera, Colombia.

Clasificación JEL: E24, J63, J64.

RÉSUMÉ

La réduction des rigidités sur le marché du travail a été une politique très important dans la réforme structurelle qui a subi l'économie colombienne au début des années 90. Une manière d'évaluer les résultats d'une telle réforme consiste à analyser la relation entre l'emploi industriel et le différentiel salarial avant et après ces réformes. Si les réformes sur le marché du travail ont atteint leur objectif d'une plus grande flexibilité, nous attendons alors un changement assez rapide sur le niveau d'emploi, ainsi que sur le comportement des salaires et d'autres coûts du travail, étant donnée les caractéristiques propres des entreprises et de l'économie dans son ensemble. Cet article propose un modèle de différentiels salariaux et de croissance de l'emploi pour montrer sa relation pendant les périodes de réforme. Nous confirmons alors l'existence d'une relation positive entre le changement dans le niveau d'emploi net et le différentiel salarial intra-industriel, ceci offre des réponses hétérogènes lesquelles dépendent à la fois du type d'entreprise prise en compte et du niveau de rotation du travail.

Mots clé : Salaires d'efficience, rotation du travail, industrie, Colombie.

Classification JEL : E24, J63, J64.

INTRODUCTION

The purpose of this paper is twofold: first, to formulate a model that relates employment levels with intra and inter-industry wage differentials at firm level with respect to the firm's industry and to other industries. Secondly, to test empirically the model's implications for Colombian manufacturing. As part of the structural reforms undertaken in the economic and political landscape of Colombia in the early 1990s, changes to the labor-industrial relations were introduced with several objectives in mind. One of the goals of this reform was to reduce exogenous rigidities in the labor market. For the purpose of this study both the reduction in payments for unfair dismissals and the omission of an administrative legal process in the settlement of alleged unfair dismissals are important. These two factors were used as influential variables over the payroll plant size, since the penalties and the length of judiciary decisions discourage the optimization of the number of workers and distort wage policy.

In the structural adjustment reforms of the 1990s, achieving labor market flexibility was considered an important requirement for restoring economic growth in developing countries (World Bank, 1987; Williamson, 1990). In many economies labor markets are usually subject to several institutional arrangements and laws that hinder a fast adjustment once the economies are opened to international trade. Some countries attempted to improve labor market flexibility by undertaking major labor reforms, but many countries, including Colombia, left aside more ambitious reforms1.

Hiring and firing costs, especially the latter, have usually been treated as an exogenous variable since they are usually regulated by contract laws. But they can also be considered endogenous if employers take them into account when deciding on plant size (payroll size, in terms of number of workers) as part of the objective of minimizing costs. This interplay between creation and destruction of labor, as well as its costs, seems to be one source of intra and inter-industry wage differentials arising from specific characteristics of industries and firms. In other words, different firms and industries face idiosyncratic costs associated with labor turnover.

Another approach in the literature addressing these issues focuses on the causal relationships between wage differentials, efficiency wages and downward wage rigidity. In this case, the efficiency wages hypothesis offers a link between labor turnover costs and plant size (in terms of number of workers). Firms will be willing to pay wages above the marginal productivity of workers in order to retain them and reduce turnover and its costs (Stiglitz, 1974; Salop, 1979; Weiss, 1990) or as a discipline device (Shapiro and Stiglitz, 1984). In the same fashion, firms find it costly to pay wages below marginal productivity. In this case, workers who feel under-valued would try to find a new job, giving firms a reason to pay higher wages, and avoid the costs of resignations and replacements.

Empirical studies testing efficiency wage hypothesis are sparse mostly due to the fact that data on labor productivity and turnover costs (labor demand) are not readily available, as most data sources are household surveys (labor supply focus). Among the few available studies, Krueger and Summers (1988) address the issue directly, studying on wage differentials among industries in United States. Konings and Walsh (1994) test the efficiency wage hypothesis relating employees and firms' rent sharing behavior, postulating an alternative efficiency wage model than maintains the concept of high wages paid by firms. Campbell (1993) and Campbell and Kamlani (1997), working with firm-level surveys, found that firms with higher turnover costs pay higher wages, thus supporting the efficiency wage-turnover model predictions, which is one of the many theoretical considerations supported by Bewley (1999).

As the first explicit attempt of providing flexibility to the labor market, the 1990's labor reform aimed to reduce specific rigidities regarding labor turnover, specially related with payment due to unfair dismissal and the introduction of temporary labor contracts (Echeverry and Santamaría, 2004). The empirical evidence related with the specific impact of this reform over labor market outcomes (Kugler, 2000, 2004; Cardenas and Bernal, 2003) suggests that both informality and unemployment got reduced. Nonetheless, two points must be made regarding these studies. Firstly, there is not a consensual study that has managed to completely isolate the specific effect of the labor reform from the structural features of the Colombian economy and the specific conditions of economic growth that our country faced through the early nineties (Guataquí and García, 2009). Second, as far as now, data for these studies have been based on time series (Cardenas and Bernal, 2003) and labor supply oriented - household surveys. This is the first study to provide empirical evidence based on labor demand oriented data2.

The empirical findings reported here are consistent with the proposed relationship between firm's job rotation and wage differentials. More precisely, a positive relationship between intra-industry wage differential and firm's job rotation is found. In the case of inter-industry wage differentials it is not clear whether the wage differential increases or decreases firm's employment: in some industries it seems to decrease it, contrary to the relationship stated in the model and found in the intra-industry evidence. It is also found that for blue-collar ones, employment growth is higher when compared to white-collar workers. Although unemployment level is not significant for blue-collar workers, it is so for white-collar workers.

The remainder of this paper presents the model in section I. Section II describes the data and variables used, section III presents the econometric methodology, and last section concludes.

I. A job rotation model

The model developed in this section begins with the concept of wage differentials in a dual economy (Stiglitz, 1974). The conditions of rural and urban wage differentials from the Stiglitz model are modified as firm and industry wage differentials, and these are used in a job rotation function that maps employment and wage differentials. It is also assumed that employment costs are a function of wage differentials.

A. The job rotation function

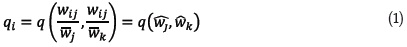

The employment growth (q) is a function of the wage differential between the wage paid in firm (i) belonging to industry (j) with respect to the average wage paid by its corresponding industry (j) and other industries (k).

where:

qi: Job rotation (or net employment growth) in firm i.

wij: Wage of firm i in industry j.

: Average wage of industry j.

: Average wage of industry j.

: Average wage of industry k.

: Average wage of industry k.

: wage ratio for firm in industry with respect to industry j.

: wage ratio for firm in industry with respect to industry j.

: wage ratio for firm in industry with respect to industry k.

: wage ratio for firm in industry with respect to industry k.

WE: Equilibrium wage.

The following assumptions are used on the job rotation function:

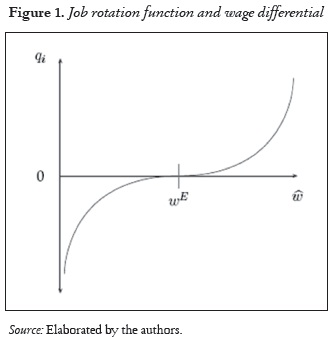

The logic behind the employment growth function and the additional assumptions goes as follows. The employment growth rate of the firm will be negative if wages in firm (i) are below the average wage of its industry (j) or an alternative industry (k) (to the left of wE in Graph 1). Workers with similar characteristics will be willing to switch jobs if they observe that their wages are below the industry average. Firms, however, want to minimize their employees rotation in order to reduce the associated costs (T) and thereby will be willing to pay higher wages that are closer to the industry average, in order to induce its workers not to quit. The opposite goes to the case with firms whose wages are above the industry average (right hand-side of wE in Graph 1). In this case job rotation will be positive (that is, workers from other firms would be eager to work in firms with wages above the average) and such firms would tend to reduce their wages toward the industry average in order to reduce employment rotation costs (T).

The assumption made on the second order condition of the job rotation function is important for two reasons. Firstly, it ensures that the optimization problem of the firm (cost minimization) will obtain a minimum. Second, the function is concave (convex) for negative (positive) values of the job rotation rate, that is, for wages below (above) the industry average. As shown in section I.C the equilibrium is defined by the wages of the firm being equal to the wages in the industry (and other related industries). Therefore firms want to set wages closer to the industry average, but the convexity / concavity of the function implies that in order to reduce the job rotation rate, they will have to make a further effort in increasing / reducing wages as long as firms reach a zero job rotation rate. This second feature is consistent with the fact that firms pay wages that are different to the industry average.

The model yields the following propositions. First, job rotation is a function of inter and intra-industry wage differentials, and, a) it will take negative values if a firm's wages are below industry average; b) it will take positive values if a firm's wages are above industry average. Second, job rotation and wage differential are related in a non-linear way that makes it increasingly difficult for firms to reach equilibrium wages. Therefore, there will be firms paying wages above as well as below the industry average wage.

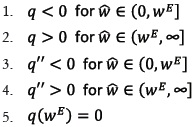

The unemployment rate, firm's output growth and the industry's output growth are included in the model as explanatory variables. An inverse relation between the job rotation rate and unemployment is expected. Job rotation will decrease if the unemployment rate of the economy increases; workers will not try to change jobs if there is a high rate of unemployment, regardless of the wage differential in their firm. Firm and industry output growth are also important and reflect the business cycle dynamics and its effect on job rotation. A decreasing output in firm (i) would mean there is less need for variable input and therefore layoffs will occur. The effect of an increase in firm's output (i), however, is not clear. Expansion of production can come from both input –labor and capital– or a combination of both. The sign of the relationship will depend on whether they are strong or weak substitutes.

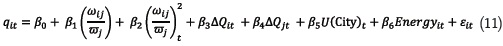

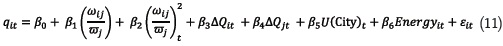

The equation to be estimated is:

Where:

u: Unemployment rate of the economy.

ΔQi: Growth in output of firm i.

ΔQj:Growth in output of industry j.

ΔQk: Growth in output of industry k.

B. Firm's Labor Costs and Optimization

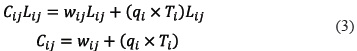

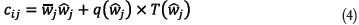

Assuming labor is homogeneous and all firms within a sector are identical. Total labor costs are defined as wages plus specific training, hiring and firing costs in the economy.

Where:

Cij : Total labor cost per employee of firm i of industry j.

Lij: Number of workers of firm i of industry j.

qi: Job rotation in firm i.

Ti =T( ): Training, hiring and firing costs.

): Training, hiring and firing costs.

These costs are fixed within a firm but are a decreasing function of the wage differential. In other words, the higher the wage differential paid to a worker (or the higher the wage), the lower the effect of such a fixed cost on total labor cost. Furthermore, this implies that even in equilibrium when there is no wage differential, and therefore no job rotation, these costs still exist. This also means that  .

.

For simplicity, replace equiation  in equiation (3) and rewrite the total labor cost in terms of wage differentials:

in equiation (3) and rewrite the total labor cost in terms of wage differentials:

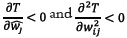

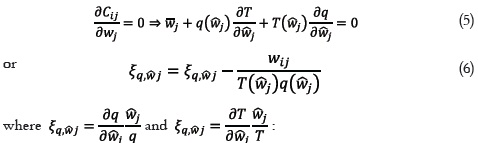

Firms minimize equation (4), the first order conditions for the wage differential wj, is:

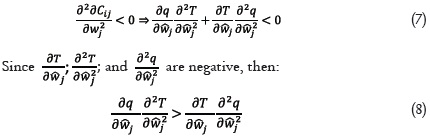

the second order condition is:

A condition that can be expressed in terms of elasticities emerges from the job rotation function and its interaction with rotation costs in an optimization problem. The responsiveness of job rotation to wage differential should be equal to the responsiveness of job rotation costs to wage differential minus wages weighted by (inverse) total rotation cost. This also implies that rotation's cost elasticity is higher than labor turnover elasticity. Finally, equation (5) states that job rotation from wage differential comes through job rotation costs, but these costs are unobservable. Therefore the estimation strategy for the relationship between labor turnover and wage differential is the one of fixed effects under panel data econometrics. The second order condition is satisfied given the assumptions of the job rotation and job rotation cost functions.

C. Equilibrium

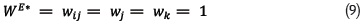

The economy-wide equilibrium (zero job rotation) and the target of reaching minimum associated costs to wage differentials, requires wages in firm (i) to be equal to wages of its corresponding industry (j) and an alternative industry (k):

This equilibrium condition comes from the assumptions in the construction of the turnover function.

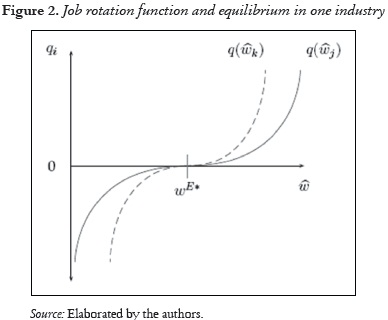

From this equilibrium condition, firms that minimize labor costs set their wages below theirs and other industries' average wages. Firms that do not minimize costs are setting wages above the equilibrium. From construction of the job rotation function (assumption 5) and the definition of the equilibrium, both industry and off-industry job rotation functions will cross only in wE*(see Graph 2), i.e. no firm can have wages above (below) its industry (j) and at the same time below (above) the industry (k). Furthermore, from first order condition equation (5), an optimum exists when wij= wj. This optimum is a minimum only when second order condition is negative. This condition is met since second derivative of the job rotation function is negative in the interval (0, we).

The industry-wide equilibrium condition in the job market requires firm (i) wages to be equal only to wages paid in its corresponding industry (j), that is, industries set different equilibrium wages.

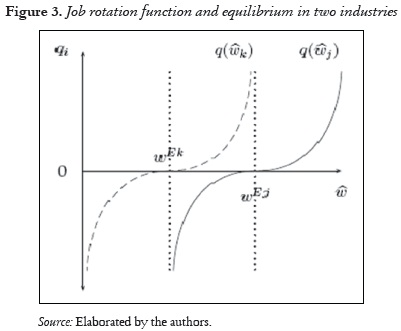

In the industry-wide equilibrium, firms that minimize costs have set their wages below their industry's average wage and above or equal to other industries' average wage. To reach this equilibrium a relationship between wages in each industry and industry characteristics must be set. With homogeneous workers, as in our model, the only difference in equilibrium wages comes from the rentsharing hypothesis, where industry characteristics are the source of different wages for homogeneous workers. If this is the case, then each industry will have its own job rotation function, but the intra-industry wage equilibrium will be higher for some industries than for others. For simplicity, let's assume there are only two industries (j) and (k), where wEK< wEj; the case is depicted in Graph 3.

From the equilibrium condition 9 we know that for firms to minimize cost, they will pay wages equal to their industry's average. However firms will not pay wages below other industries' average, otherwise the homogeneous worker will switch industry. This argument can be reinforced if, despite being homogeneous, workers do have a combination of sector- specific skills (specific training) and generic skills, something that makes them more valuable to the employer3. The latter would allow them to work in any industry (for example, the job of a secretary might be the same in a university as in the petrochemical industry), but the former would imply that firms do want to retain them since their on-the-job learning would have a negative impact if the worker happens to leave or is fired. Homogeneous workers that have acquired industry / firm - specific knowledge are more costly to be laid-off (for example, firing a secretary with 10 years tenure can be more costly in terms of the learning costs of the new secretary than firing one with only one year tenure).

Graph 3 depicts the case where firms set wages between wEK, the equilibrium wage in other industry, and wEjthe equilibrium wage in their corresponding industry. Thus, in summary, for both definitions of equilibrium in the economy and industry-wide, firms minimizing labor costs will not set wages above their industry average. For the industry-wide equilibrium there will be a lower bound constraint defined by an alternative industry's average wage.

II. Data and variable construction

The data used for the estimation represents a sub sample of incumbent firms of Colombia's Annual Manufacturing Survey (AMS) for 23 years (from 1976 to 1999, excluding 19774). These firms have been selected because their wage setting behavior is typical of a long-run profit maximizing firm, as assumed in the model. The wage policy of a new firm or one about to close down would be different. Survival theory of the firm suggests that new firms in the industry may offer higher wages to attract good workers who would help them to succeed in their recent entry into the industry and firms about to close might be reducing their pool of workers and wages more quickly than the optimal.

Data on employment and wages of permanent and temporary workers employed directly by the firm, in both white and blue-collar categories, are used. Blue-collar workers (BC) are those involved directly in the production processes. The data set allows to split them between laborers, technicians and apprentices. White-collar workers (WC) are those employed in administrative, sales and management duties. Given the disaggregated structure of the information and its time dimension, the preferred measure of change in labor as an input from year t to t + 1 is a Törnqvist quantity index in logarithmic form.

Wages for white and blue-collar workers are obtained by dividing the total wage bill by the number of workers. Output is measured using the Törnqvist quantity index. Output is deflated using Consumer Price Index (CPI) 1998=100, and both blue and white-collar workers' wages are deflated using low and high income CPI, respectively5. CPI is obtained for each city, allowing a more accurate measure of city wage differentials. The CPI is taken for September instead of end of the year, to avoid the seasonality factor common in Colombia's time series, due to the Christmas season.

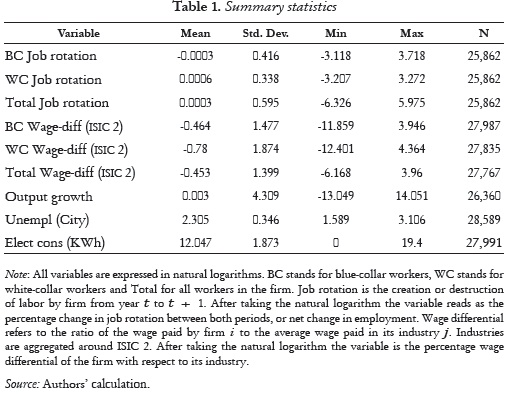

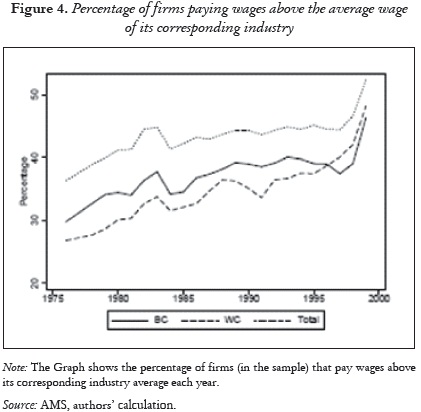

Wage differential is calculated as in equation (1) taking natural logarithm to the ratio of wages between firm (i) of industry (j) and average wage in the respective industry and the average wage of the alternative industry (k). Finally, unemployment rate is also measured by city, for the month of September. Data for December is excluded for seasonal reasons, as it is heavily biased due to the Christmas season that boosts output, employment and labor supply. Table 1 shows the descriptive statistics of the variables used in the estimation. By restricting the sample to firms that have remained active for the chosen time span as a whole, the data set ends up having only firms located in the cities of Bogotá, Medellín and Cali, the main three industrial cities. Graph 4 shows the percentage of firms paying wages above the industry average.

III. Econometric approach

The empirical strategy involves two estimations. The first estimation is for the relationship proposed in the equation for intra-industry wage differential (Equation 11). The second estimation involves estimating the full specification of intra and inter-industry wage differential effects on job rotation (Equation 2). In both specifications the presence of a time structural change in job rotation due to the labor reform of 1990 and differences among industries at ISIC 2 level is tested.

Equation (11) includes the wage differential of firm i with respect to its International Standard Industrial Classification (ISIC) 2 industry, and is squared to capture nonlinearity between job rotation and the wage differential proposed in section I.A; output growth of firm i and output growth of industry to which firm belongs, for the city where the firm is located; unemployment in the city where firm i is located; and electricity consumption in KWh as a proxy variable for capital intensity.

Fixed Effects (FE) estimator is the econometric method chosen for the estimation. In using Fixed Effects the unobserved (fixed) components correlated with the explanatory variables are taken away, reducing the bias which could arise from using a different estimation method. Besides this, FE method is preferred over Ordinary Least Squares (OLS) in order to acknowledge the existence of different characteristics among industries, furthermore characteristics that are idiosyncratic and not randomly assigned to the firms belonging to an industry activity.

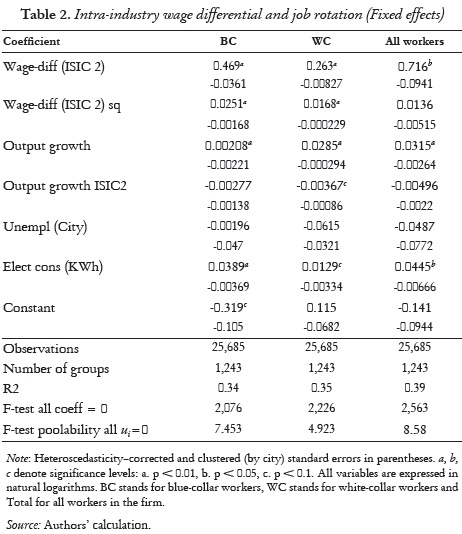

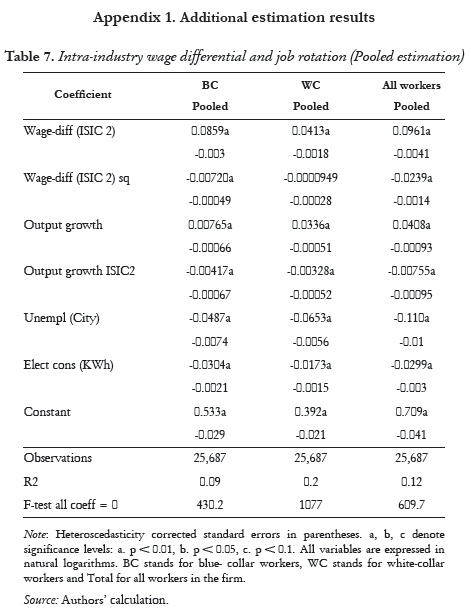

For the purpose of this paper, the FE specification assumes that there is a firm-specific non-observed component in job rotation associated with the independent variables, specifically with wage differentials. Furthermore, in relation to the current model, training, hiring and firing costs are firm-specific, unobserved factors. Although economy-wide regulations on labor standards and industrial relations are the same for all firms, industries and firms do face idiosyncratic costs related to job rotation, and strongly associated with wage differential. It is also being assumed that firms respond in different ways with respect to changes in the legal and economic framework. This is the case for the current estimation, specifically from 1990 onwards, when Colombia's firms were presented with a new set of legal and economic rules in labor-industrial relations. The Fixed Effects estimation for blue-collar, white-collar and all workers is presented in Table 2 (Table 7 in the Appendix shows this specification for pooled regression)6.

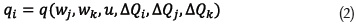

IV. Estimation Results

Both the coefficients from the FE estimation, and their change in respect of the pooled one (OLS), imply that there are unobserved factors which bias the pooled regression. For blue-collar workers, the fixed effects results suggest that when the wage differential of a firm with respect to the average wage of the industry (ISIC 2) changes by 10%, the job rotation of the firm will increase by 4.69%; for white-collar workers job rotation will increase by 2.63% and for all workers 7%. From the model and the estimation it may be seen that job rotation is related to wage differentials among firms within their own industry and city. Likewise, the significance of the squared term supports the hypothesis of a non-linear relationship between the wage differential and job rotation.

The corresponding level of unemployment in the city where the firm is located, shows the expected sign, i. e., at higher levels of unemployment lower job rotation. This follows the logic that workers will be less willing to change jobs if the regional level of unemployment is high. For blue-collar workers the coefficient is low and non-significant (a feature observed in further estimations). For white-collar workers the effect is higher: a 10% increase in the level of unemployment means a reduction of 0.6% rotation rate, and for all the workers this, means a 0.48% reduction. These results are interesting regardless of the varying nature and causes of unemployment in Colombia. For instance, the unemployment rate of the country increased sharply after 1995, from 8.71% to 20% in 1999. Between 1995 and 1996, the unemployment rate increased by 37% (3.23 percentage points, from 8.71% to 11.94%). This percentage change would mean a reduction in the rotation rate of 11%.

The additional variables used –firm's output, firm-industry's output, and electric power consumption–are used mostly to control for individual and industry features. Firms with high output growth and high electric power consumption seem to have higher rotation rates. The coefficient on the corresponding industry output is negative and relatively small: a 100% increase in output of the industry would be required to reduce job rotation by 0.3% for all workers.

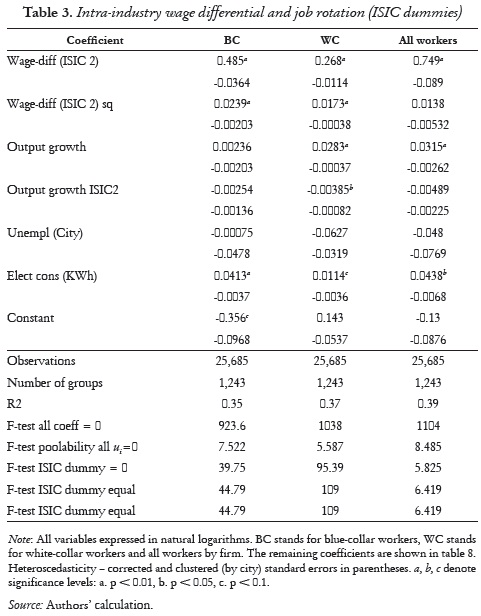

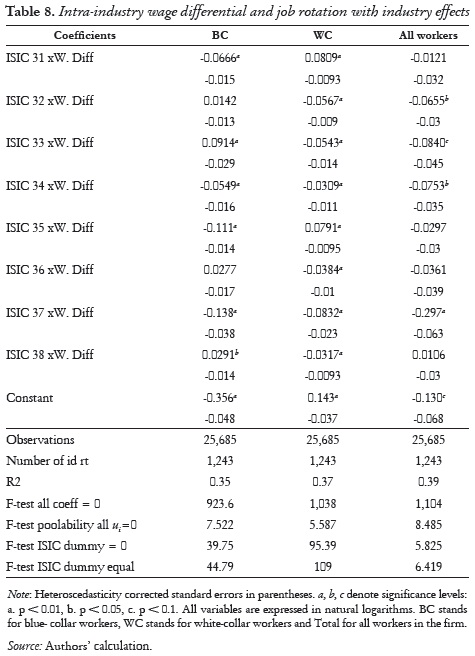

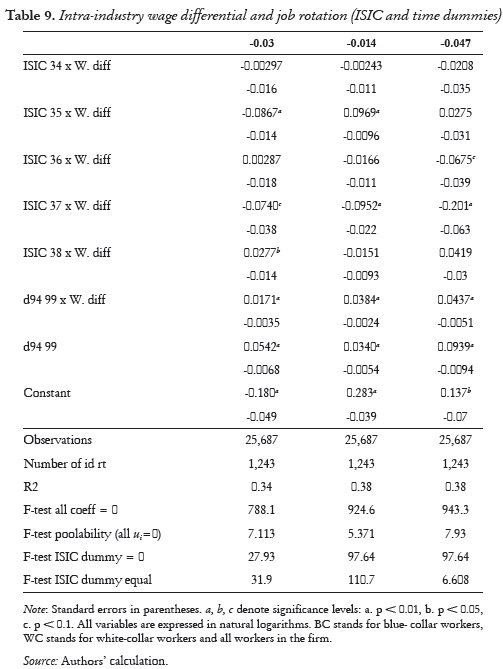

In order to test whether the positive relationship between job rotation and industry wage differential differs along ISIC classification, a dummy variable at ISIC 2 level, which inter-acts with the wage differential coefficient (the parameter of interest) is used (Table 3)7. Although the results of the basic parameters do not change from the ones presented in table 2, the test for statistical significance in the industry dummies suggests this is a sensible estimation, since there are differences between industries regarding the effect of wage differential and job rotation. Table 8 in the appendix shows the coefficient for the ISIC dummies interacting with the wage differential (the reference group is ''other industries'' (ISIC 39)). For blue-collar workers the wage differential effect on job rotation in textiles and wood manufacturing industry (ISIC 32 and 33, respectively) is higher, whereas it happens to be lower for chemicals and petroleum (ISIC 35).

In the case of white-collar workers, the wage differential effect on job rotation is negative for the basic metal industries (ISIC 37), and positive for chemicals and oil. For all workers, the only significant difference is observed in the basic metals industry (ISIC 37), which shows a lower compared to sector ''other industries''.

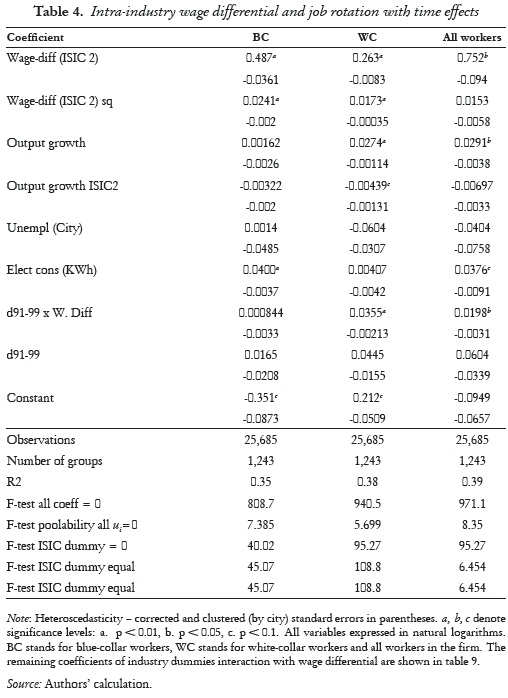

The next set of results tests whether or not a structural change in the relationship between job rotation and wage differential took place as a consequence of the economic reforms of 1990, especially the labor reform. Introducing a time dummy variable for the period after the reform would show the autonomous change in job rotation, and at the same time the time dummy variable interacting with the wage differential would show the effect of the reform over the relationship between job rotation and wage differential after the reform. Since the basic assumption of the Fixed Effects estimation is the existence of an unobserved, firm idiosyncratic component, that is, the costs associated with job rotation, the inclusion of this time dummy can be interpreted as the change in these costs after the labor reform.

Results of the time dummy variable for the period 1991 to 1999, using the period 1976 to 1990 as the base dummy, are shown in Table 4. The coefficients and basic relationships found previously do not change, but the dummies bring additional information about the effect of wage differentials and job rotation through the period after the labor reform. For this period, which coincides with the implementation of several other economic reforms in the early 1990s, job rotation is higher –in all labor categories with respect to the previous regime– from 3.5% for white-collar workers to 2% for all workers. The change over time of the unobserved component is also significant, based on the specification: labor costs associated with hiring and firing rose 1.6% for blue-collar workers, 4.4% for whitecollar workers and 6% for all workers. In other words, the unobserved idiosyncratic variables associated with paying wages above / below the industry average (hiring and firing costs) increased the job rotation of firms after the labor reform of 1993.

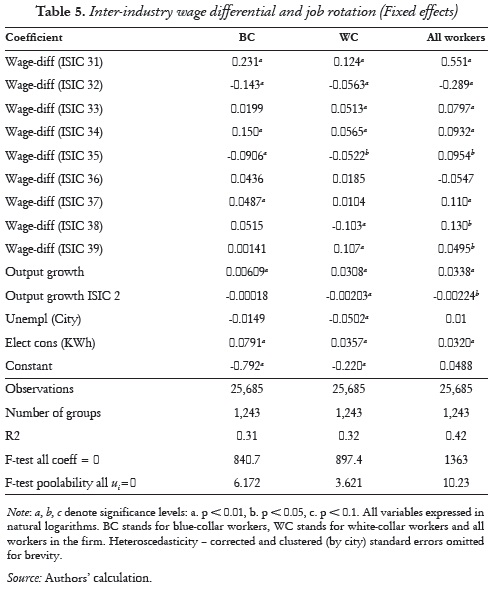

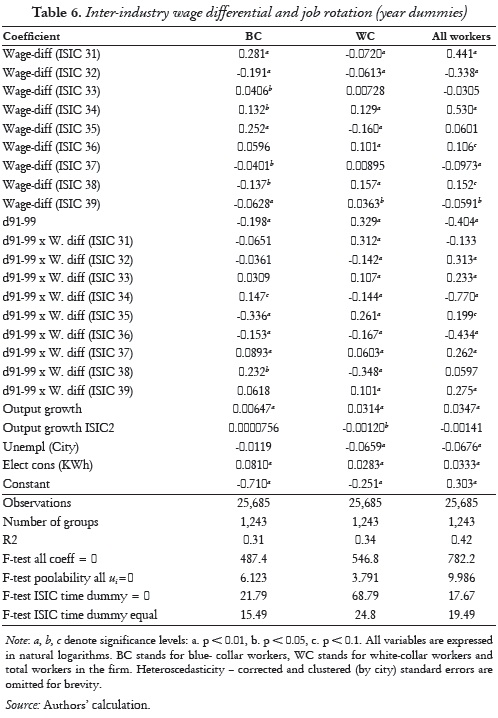

The next step in the empirical strategy is to inquire about inter-industry wage differentials being a source of job rotation and employment. To do so, equation (12) is estimated including the wage differential of firm (i) against other industries (k), in which its own industry (j) is included8. This specification allows us to enquire on the effect of inter-industry wage differential and job rotation, and, as previously, the wage differential is measured by industries in the same city, as well as by output and unemployment. Table 5 and 6 show the estimation results with and without the time structural break.

The changes in coefficients the intra-industry estimation should be interpreted carefully. A negative coefficient is found in the wage differential of firms with respect to the textile industry (ISIC 32), so the higher the wage differential of firms, the lower the job rotation. The same result occurs for blue and white-collar wages in the chemical and petroleum industry (ISIC 35) and for metal products (ISIC 38) for white-collar workers. The coefficients for output and electricity behave as in previous estimations. It is noteworthy that unemployment is not significant for all workers, although it continues to hold the expected relationship for white-collar workers and as previously, it does not happen to be significant for blue-collar ones9. Unemployment remained nonsignificant for blue-collar workers.

Results for the estimation which included a dummy variable to capture the effects of the labor market reform and introduction of other economic policies in the early 1990s is shown in Table 6. Under this specification the wage differential is found again, with the textile industry exerting an effect that is contrary to the expectations. However, the coefficient after the labor reform is positive, significant and higher, which acknowledges the fact that after the reforms, the unobserved component of labor costs associated with job rotation rose for this industry (similar to the finding for intra–industry wage differentials)10. For the wood manufacturing industry (ISIC 33) there seems to be a very weak relationship, which is not surprising since the importance of this particular industry is not high in industry as a whole. For the period after the reform, the variable is significant for both white-collar and total workers, capturing the effect of the labor reform over the relationship between wage differential and job rotation.

The coefficient associated with the intercept-dummy ‘d91-99' is statistically significant and negative for blue-collar workers. This can be interpreted as a change respect to the previous period of the autonomous unobserved component of the Fixed Effects estimation, that is, labor costs associated with the creation and destruction of labor. Thus it can be concluded that there was a reduction of 20% in rotation costs. But for white-collar workers the coefficient is positive and higher, with an increase of 32% in rotation costs. The previous estimation of this parameter (Table 4) where only intra-industry wage differentials were considered, gave a positive sign. For the manufacture of chemicals (ISIC 35) and the manufacture of non-metallic mineral products (ISIC 36) the relationship between wage differential and job rotation for blue-collar workers decreased after the reforms; this is also the case for white-collar workers in textiles (ISIC 32), paper products (ISIC 34), mineral products (ISIC 36) and metal products, machinery and equipment (ISIC 38). For basic metal industries (ISIC 37), metal products, machinery and equipment (ISIC 38) among blue-collar workers and food and beverages (ISIC 31), manufacture of wood products (ISIC 33) and manufacture of chemicals (ISIC 35) for white-collar workers, this relationship increased. These results are an indication that in these industries, the reform had an effect on the costs associated with the creation and destruction of labor, with mixed results and intensities.

Conclusion

This paper has examined the impact of structural adjustment reforms on employment in Colombian manufacturing. Since job rotation costs are not observable at firm level, a relationship between job rotation and intra / interindustry wage differentials is proposed. There is evidence of a positive, non-linear relationship between wage differential and employment, supporting the idea that firms pay wages above (or below) their industry average to reduce the associated costs with job rotation, which is a variant of efficiency wage theory. This is a notable result, as firm-level rigidities have not been inquired as possible explanations for aggregate involuntary unemployment in the Colombian literature.

In the empirical testing of the job rotation function the Fixed Effects (FE) estimation was used to reduce the bias from the unobserved – fixed – variable, this is the firm's job rotation costs. The results of the estimation are consistent with the model proposed, for blue-collar and white-collar workers, and also for the total number of workers. The estimation is robust for additional specification variables such as industry dummies and structural breaks. As the results show, blue-collar workers' rotation is more responsive (4.6%) to intra–industry wage differentials in comparison to white-collar workers (2.6%), to a 10% increase in the wage differential. Testing for structural change after the labor reforms of the early 1990s, provided evidence of changes in the relationship between job rotation and the intra–industry wage differential, and resulted in a measure of the percentage change in autonomous job rotation (associated with the unobservable variable) compared to the pre-reform period. In this case a 4.5% increase was found for blue-collar workers, a 1.6% increase for white-collar workers and 6% for all workers.

It was found that the impact of inter-industry wage differentials on job rotation varies significantly across industries. The wage differential with respect to the textiles industry seems to have quite a strong effect on job rotation. One important message from the results found in the inter-industry estimation is that the heterogeneity in responses among industries and firms must be taken into account. Also in this estimation, the magnitude of the structural break shows a reduction in the autonomous job rotation after the labor reform of 1990 for blue-collar workers and positive for white-collar ones, with mixed results for different industries.

For the post-reform period in the job rotation of blue-collar workers associated with the non–observable variable, the labor creation / destruction costs, and a corresponding increase in the rotation of white-collar workers. In the context of structural reforms aiming for more competitive and open economies, the labor market reforms undertaken in developing economies have become an important area of debate. In the light of the model and empirical estimation, the wage differential takes a significant role in the creation or destruction of labor in different industries. Although industry wage differentials are difficult to examine from the perspective of the structural reforms, this paper has shown how important this factor is in the level of manufacturing employment.

References 1. Bewley, Truman (1999). Why Wages Don't Fall During a Recession, Cambridge, Harvard University Press. [ Links ] 2. Campnell, Carl (1993). ''Do Firms Pay Efficiency Wages? Evidence with Data at the Firm Level'', Journal of Labor Economics, Vol. 11, No. 3, pp. 442-470. [ Links ] 3. Campbell, Carl and Kamlani, Kunal (1997). ''The Reasons for Wage Rigidity: Evidence from a Survey of Firms'', The Quarterly Journal of Economics, Vol. 112, No. 3, pp. 759-789. [ Links ] 4. Cardenas, Mauricio and Bernal, Raquel (2003). ''Determinants of Labor Demand in Colombia: 1976-1996''. In: Heckmkan, James and Pages, Carmen. (Eds.), Law and Employment: Lessons from Latin America and the Caribbean, (pp. 229-272), University of Chicago Press. [ Links ] 5. Echeverry, Juan and Santamaría, Mauricio (2004). ''The Political Economy of Labor Reform in Colombia'', Documentos CEDE. No. 3618. [ Links ] 6. Guataquí, Juan y García, Andrés (2009). ''Efectos de la reforma laboral: ¿más trabajo y menos empleos?'', Ensayos sobre política económica, Vol. 27, No. 60, pp. 46-79. [ Links ] 7. Heckman, James and Pages-Serra, Carmen (2000). ''The Cost of Job Security Regulation: Evidence from Latin American Labormarkets'', Economia, Vol. 1, No. 1, pp. 109-144. [ Links ] 8. Iadb (Ed.) (2003). Good Jobs Wanted: Labor Markets in Latin America, Washington DC, Interamerican Development Bank. [ Links ] 9. Iregui, Ana; Melo, Ligia and Ramírez, María (2010). ''Downward Wage Rigidities and Other Firms Responses to an Economic Slowdown: Evidence from a Survey of Colombian Firms'', Borradores de Economía, No. 612, pp. 1-48. [ Links ] 10. Konings, Josef and Walsh, Patrick (1994). ''Evidence of Efficiency Wage Payments in UK Firm Level Panel Data'', The Economic Journal, Vol. 104, No. 424, pp. 542-555. [ Links ] 11. Krueger, Alan and Summers, Laurence (1988). ''Efficiency Wages and the Inter-Industry Wage Structure'', Econometrica, Vol. 56, No. 2, pp. 259-293. [ Links ] 12. Kugler, Adriana (2000). ''The Incidence of Job Security Regulations on Labor Market Flexibility and Compliance in Colombia: Evidence from the 1990 Reform'', RES Working Paper, No. R-393, pp. 1-62. [ Links ] 13. Kugler, Adriana (2004). The Effect of Job Security Regulations on Labor Market Flexibility: Evidence from the Colombian Labor Market Reform, NBER Working Papers, No. 10215, pp. 1-66. [ Links ] 14. Neal, Derek (1997). ''The Link Between Ability and Specialization. An Explanation for Observed Correlations between Wages and Mobility Rates'', Journal of Human Resources, Vol. 33, No. 1, pp. 173-200. [ Links ] 15. Salop, Steven (1979). ''A Model of the Natural Rate of Unemployment''. American Economic Review, Vol. 69, No. 1, pp. 117-25. [ Links ] 16. Shapiro, Carl and Stiglitz, Joseph (1984). ''Equilibrium Unemployment as a Worker Discipline Device'', American Economic Review, Vol. 74, No. 3, pp. 433-44. [ Links ] 17. Stiglitz, Joseph (1974). ''Alternative Theories of Wage Determination and Unemployment in LDCs: The Labor Turnover Model'', Quarterly Journal of Economics, Vol. 88, No. 2, pp. 194-227. [ Links ] 18. Weiss, Andrew (1990). Efficiency Wages: Models of Unemployment, Layoffs and Wage Dispersion, Princeton, Princeton University Press. [ Links ] 19. Williamson, John (Ed.) (1990). Latin American Adjustment: How Much has it Happened, Washington DC, Institute for International Economics. [ Links ] 20. World Bank (1987). World Development Report 1987, Oxford, Oxford University Press and World Bank. [ Links ] Appendices NOTAS 1 Despite the fact that the country undertook another labor reform in 2002, unemployment rate is one of the highest in Latin America. For an assessment of the state of labor markets in Latin America after labor reforms see IADB (2003). Also, Heckman and Pages-Serra (2000) account for the reform effects on job security. 2 An alternative data source is the one compiled by Iregui et al. (2010) after undertaking a survey among human resource managers in Colombia, finding evidence that supports efficiency wages theory, from its turnover costs application. 3 For a treatment of sector-specific skills and generic-skills, wages and turnover, see Neal (1997). Neal develops a model in which the unit of analysis is individuals that choose certain generic/ specific combination of training, then face labor demand and from wage level and nonpecuniary aspects (job satisfaction) of the workplace, decide to change their job or to remain on it. 4 1977 was omitted because of serious data attrition, therefore for any calculation regarding 1977, 1976 is used. 5 When variables are expressed in natural logarithm this was taken over the Törnqvist quantity index. 6 The pooled estimation shows the expected sign and the variables are significant for the labor classification. 7 Since industry classification does not change over time, in order to capture the effect it is necessary to create the interaction variable. 8 The initial estimation included output of other industries, but this variable was not included in the tables below since neither significant results were obtained after its inclusion, nor were other parameters of interest affected by its exclusion. 9 A previous estimation included intra–industry wage differential, it seemed reasonable to have it to compare the variable in respect of the inter–industry estimation, although the results do not differ much, this regression is omitted since we suspect a collinearity problem. The intra-industry wage differential for ISIC sectors with many firms would be estimated twice and would create a bias. 10 This is an industry that happened to be highly affected by higher trade openness to imported goods.