Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Lecturas de Economía

Print version ISSN 0120-2596

Lect. Econ. no.81 Medellín July/Dec. 2014

ARTICLES

Insurance use and economic growth in Latin America. Some panel data evidence*

Aseguramiento y crecimiento económico en América Latina. Evidencia a partir de datos de panel

Assurances et croissance économique en Amérique latine. Une étude à partir des données de panel

Ángela Concha**; Rodrigo Taborda***

** Ángela Concha: Matrix Consulting. Av. Presidente Riesco 5435 piso 20. Santiago de Chile. Chile. E-mail: angelaconchaco@gmail.com.

*** Assistant Professor. Universidad de los Andes, Facultad de Administración. Calle 21 # 1-20. Bogotá. Colombia. E-mail: r.taborda@uniandes.edu.co.

–Introduction. –I. Literature review on the relationship between economic growth and the financial and insurance industries. –II. Empirical strategy. –III. Data measurement and sources. –IV. Results. –Conclusions. –Bibliography. –Appendices.

Primera versión recibida el 26 de noviembre de 2013; versión final aceptada el 11 de febrero de 2014

ABSTRACT

Empirical and theoretical analyses suggest that there is a positive relationship between financial development and economic growth. A higher degree of financial development brings about growth in the long term by means of risk diversification, efficient capital use, increased savings opportunities, and trade of goods and services. As a gear of the financial engine, the insurance industry helps to diversify risk. The authors perform an empirical assessment of the relationship between the use of insurance and economic growth in eleven Latin American countries from 1980 to 2009. From a growth equation specification, a 1% increase in insurance use is associated with a rise in economic growth ranging from 0.17% to 0.44%.

Key words: Insurance, economic growth, financial development, Latin America.

JEL Classification: G22, O16, O54.

RESUMEN

Existe evidencia empírica y teórica de una relación positiva entre el desarrollo financiero y el crecimiento económico. Un mayor nivel de desarrollo financiero promueve el crecimiento en el largo plazo mediante la diversificación del riesgo, el uso eficiente del capital, mayores oportunidades de ahorro y el comercio de bienes y servicios. Un sector importante del sistema financiero es la industria de aseguramiento, que ayuda a diversificar el riesgo de la actividad económica. El artículo lleva a cabo una evaluación empírica de la relación entre niveles de aseguramiento y crecimiento económico en once países de Latinoamérica entre 1980 y 2009. A partir de diferentes estimaciones de una ecuación de crecimiento económico, se encuentra que un incremento del 1% en el nivel de aseguramiento está asociado con un crecimiento entre 0,17% y 0,44% en la actividad económica.

Palabras clave: aseguramiento, crecimiento económico, desarrollo financiero, América Latina.

Clasificación JEL: G22, O16, O54.

RÉSUMÉ

Il existe des tests aussi bien empiriques que théoriques de la relation positive entre le développement financier et la croissance économique. En effet, ces tests montrent qu'un niveau plus élevé de développement financier favorise la croissance à long terme en diversifiant les risques, permet l'utilisation efficient du capital, augmente les possibilités d'épargner plus et favorise le commerce de biens et de services. Une partie importante du système financier est le marché des assurances puisqu'il contribue à distribuer le risque de l'activité économique. Cet article présente une évaluation empirique de la relation entre les niveaux de l'assurance et de la croissance économique dans onze pays d'Amérique latine entre 1980 et 2009. Tout en utilisant des différentes estimations de l'équation de la croissance économique, nous constatons que l'augmentation de 1% dans le niveau d'assurance, est associée à une augmentation entre 0,17% et 0,44% de l'activité économique.

Mots-clés: assurance, croissance économique, développement financier, Amérique latine.

Classification JEL: G22, O16, O54.

Introduction

As a gear of the financial engine, the insurance industry fosters economic growth, working in tandem with other agents and regulatory institutions. The insurance sector: (i) Identifies and measures risk levels, discerning the costs of riskier activities and the efficient allocation of resources towards achieving enhanced productivity and risk-coverage; (ii) encourages risk-averse agents to take greater chances, thereby increasing their returns with respect to uninsured activities; (iii) averts adverse income shocks to both firms and households, thus stabilizing their consumption and expenditure paths; (iv) has become a major source of long-term and capital investment opportunities for shareholders (Skiper, 1997).

The relevance of the financial sector for economic growth has been studied empirically by analyzing the relationships between banking, stock markets and growth at country levels (Roubini and Sala-i-Martin, 1992; King and Levine, 1993; Levine and Zervos, 1998; Valickova, Havranek and Horvath, 2014), and at industry levels (Rajan and Zingales, 1998; Braun and Larrain, 2005). The studies that include the insurance sector are more recent (among them Webb, Grace and Skipper, 2002; Haiss and Sümegi, 2008; Arena, 2008). The basic finding has been the existence of a positive relationship between the financial and insurance sectors and economic growth; however, no agreement on a causal relationship has been reached.

To date, there are no studies on the relationship between insurance use and economic growth using data only for Latin American countries. Studying the region itself becomes important when the existing literature analyses Latin America as a subgroup of countries belonging to underdeveloped or low-income economies, mixed with Middle Eastern, Asian and South African countries.1 However, economic growth in the last two decades has taken the region to an intermediate stage of development that deserves particular attention in studying the finance–growth and insurance–growth nexus (de la Torre, Ize and Schmukler, 2012). This paper provides evidence of such a relationship for a set of 11 countries within the region, between 1980 and 2009. The main estimation results suggest that a 10% increase in life, non-life and total insurance use has a positive association with per capita GDP, ranging from 0.05 to 0.08%. Moreover, and in line with the international evidence for developed countries, a two-way effect between the financial sector and the insurance sector with economic growth is found. The eventual choice between credit and insurance in adverse times could help explain such an effect.

After this introduction, the paper is organized as follows: In section I, the background literature developed over the last two decades is reviewed. Section II outlines the empirical strategy. Section III describes the data, the sources and additional procedures. In section IV, the main results are presented. And the last section provides some brief conclusions.

I. Literature review on the relationship between economic growth and the financial and insurance industries

While the insurance industry plays a key role in the financial sector, the relationship between the latter and economic growth has been widely researched over the last twenty years. Overall, the sector's positive impact on growth has been explained through two approaches: The capital accumulation view (Gurley and Shaw, 1955), and the total factor productivity perspective (Greenwood and Jovanovic, 1990; King and Levine, 1993).

Levine (1997) describes five tasks within the financial sector that have an impact on economic growth: 1) Efficient capital distribution; 2) the monitoring and promotion of corporate governance; 3) risk management and diversification; 4) savings accumulation; and 5) the trading of goods and services.

The empirical research on the financial sector-economic growth relationship is vast. It goes back to the early 1960s and up to the rise of the endogenous growth theory. The early work of Gurley and Shaw (1955, 1967), Raymond (1969) and McKinnon (1973) highlighted the role of financial intermediation and found its positive relationship with economic growth. In the 1990s, King and Levine (1993), and Roubini and Sala-i-Martin (1992) confirmed that the development of the financial sector was in line with longterm growth. Moreover, Roubini and Sala-i-Martin (1992) included a financial repression variable to demonstrate how it halts growth. Subsequently, other studies included measures of stock market activity into their estimations (Levine, 1997; Arestis and Demetriades, 1997; Levine and Zervos, 1998; Demirgüç- Kunt and Maksimovic, 1998).

Later on, some methodological approaches evolved along with growth econometrics (Durlauf, Johnson and Temple, 2005; Ang, 2008). Some seminal works within this trend are: Least squares (Raymond, 1969; Demirgüç-Kunt and Maksimovic, 1998; Levine and Zervos, 1998); panel data methods (De Gregorio and Guidotti, 1995; Rajan and Zingales, 1998; Levine, 1997); dynamic panel data (Rousseau and Wachtel, 2000; Beck and Levine, 2004), and time series analysis (Arestis and Demetriades, 1997; Ang, 2008).

Regardless of the given theoretical, empirical or econometric approach, findings of positive relationships between the stock market, banking and economic growth have been consistent (see Valickova et al., 2014). Moreover, Minsky (2005) found that financial crises bring about instability and adverse effects upon economic growth, particularly in developing economies. Conversely, in a study of 12 Latin American countries, using data from 1950 to 1985, De Gregorio and Guidotti (1995) found that banking (measured as the credit-GDP ratio) had a negative relationship with growth.

A. Insurance use and economic growth

Informed by the studies exploring the relationship between economic growth and the financial sector, more recent research has analyzed the same connection with the insurance industry. The main avenues through which insurance use may affect economic growth are: Risk mitigation (e.g. when insured, households and individuals may lessen their losses in adverse times) and capital deepening (investors may make long-term capital investments with no uncertainty or fear of loss, thereby fostering output growth, innovation, research and development). Moreover, the insurance industry collects fees in large amounts that must be invested for the eventual repayment of claims. This income feeds the financial system with resources and capital, which end up impacting the stock market as well. However, Skiper (1997) highlighted the neglect of insurance and its economic impact both within the literature and among policy makers.

Most of the existing research on the insurance industry in Latin America has focused on moral hazard, adverse selection and insurance premium. However, given the industry's growth, the financial role of insurance and its contribution to economic development (side by side banking and the stock market) are receiving increased attention.

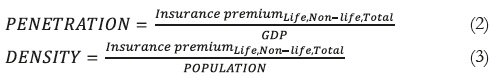

A basic approach to measure the insurance industry's role would require: i) Valuing the investments within the economy controlled by this industry; ii) defining its penetration (understood as the share of insurance contracts, i.e. their value, to GDP); or iii) determining its density (a per-capita insurance measure). The first assessment is difficult because of the private and strategic nature of this information. However, penetration and density may be easily estimated from the data available.

An underlying assumption of research studies using cross-country and panel data is the existence of an ''S curve'', where insurance consumption is lower in low-income countries and higher and more dynamic in high-income economies (Outreville, 1990, 1996; Enz, 2000; Lee et al., 2013). Further analyses are based on the economic growth literature. Webb, Grace and Skipper (2002), using panel data for 55 developed countries between 1980 and 1996, and including financial intermediation within a growth equation, found that insurance and banking increase capital productivity via aggregate investment. However, no causal relationship between insurance use and economic growth was properly established. Likewise, Ward and Zurbruegg (2000), based on a sample of 9 OECD countries from 1961 to 1996, found that the insurance-growth relationship varies across nations and that it is mostly determined by country-specific characteristics such as culture, regulations, and the legal environment.2

These results are in line with those presented by Haiss and Sümegi (2008). Using data for 29 European countries between 1992 and 2005, these authors assessed the relationship between insurance and growth excluding the financial sector. They found no significant relationship for the whole data set. However, when they measured the relationship within samples characterized by high or low degrees of financial development, life insurance had a positive relationship with growth in the high- degree group, and non-life insurance had a positive relationship with growth in the low-degree group. Azman-Saini and Smith (2011), using a dynamic panel approach, find that insurance sector development has a positive effect upon growth via productivity in developed countries, while it does through capital accumulation in developing countries.

Some authors have used a measure of stock-market deepening. Catalan, Impavido and Musalem (2000) included the assets of the insurance industry and two valuations of the stock market in a regression for 14 OECD countries from 1975 to 1997. Their results suggest that insurance use is associated with stock-market capitalization; however, there is no relationship with the annual value of traded stocks. Arena (2008) and Han, Moshirian and Tian (2010) analyzed economic growth and financial institutions (banks, stock brokerage and insurance companies) in panels of 55 and 77 countries, respectively. Both studies included developing and industrialized countries. Their main finding was that both life and damages insurance had a positive effect on economic growth. However, Arena (2008) and Chen et al. (2012) found that life insurance had a higher effect in industrialized countries, whereas Han et al. (2010) confirmed this relationship within the developing nations. These studies found that financial intermediaries complement the role of insurance; the effect upon growth is greater when both variables are interacted in the regression analysis.

Last, Njegomir and Stojic' (2010) assessed the same relationship for five ex-Yugoslavian countries, paying particular attention to insurance companies as institutional investors. Through a fixed-effects estimation, they found a positive relationship between the insurance industry and growth.

II. Empirical strategy

The methodological approach to assess the growth-insurance relationship in 11 Latin American countries from 1980 to 2009 was the estimation of an econometric panel data model (refer to section III for details on data and sources). The equation to be estimated follows the growth econometrics literature, in light of the results described in the literature review (section I) and the inclusion of the initial GDP level with the aim to frame the estimation under the conditional (beta) convergence hypothesis. Under this approach, the fixed-effects model is unsuitable to perform the estimation because the transformation applied to the data wipes off the time constant variables (i.e. initial GDP).

Consequently, the first estimation method was the Random Effects (RE) model,3 and our second estimation method uses the Hausman-Taylor (HT) estimator (Baltagi, 2008). The latter is used to account for the endogeneity of the regressors obviated in the RE estimation. Last, two long-panel models were estimated based on a panel data structure for a larger time period (t) with respect to the number of countries (n). Therefore, firstly a conventional RE model with an AR(1) error structure ui,t = ρui,t − 1 + ∈ was estimated. And, subsequently, a pooled-Ordinary Least Squares (OLS) (Hoechle, 2007), which includes individual as well as time effects for a long panel data structure. This approach allows general form auto-correlated errors AR(p), instead of restricting them to be AR(1) (Cameron and Trivedi, 2005; 2009). The preferred (and reported) estimation results are the HT and Pooled-OLS AR(p) (table 3). We applied the three econometric modeling options to the original annual data, and then to the data averaged for two-, three-, four- and five-year time spans.4

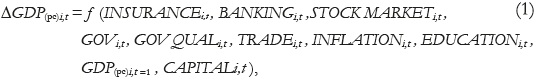

The relationship estimated is expressed as follows:

where the first three variables are the ones of interest to this analysis; the last two are the standard variables to be included in a growth regression; and the remaining variables are control ones, often used to explain economic growth (Loayza and Soto, 2002). More specifically,5

GDP (growth): The dependent variable. It is included in the regression using the real Gross Domestic Product (GDP) per capita growth for the sample of countries under analysis.

INSURANCE: The variable of interest. It is included in the regression (as a natural logarithm) using insurance penetration and insurance density, each of them for the subsets of total, life and non-life insurance. The expected sign of the coefficient is positive.

BANKING: This is a control variable belonging to the financial sector and becomes part of the second set of variables of interest. It is included in the regression (as a natural logarithm) using domestic credit from the banking sector (as share of GDP) and M1 + M2 (as share of GDP), both measures −although subject to criticism− are considered to provide valuable information on the financial structure of the set of countries. The expected sign of the coefficient is positive.

STOCK MARKET: This is a control variable belonging to the financial sector and becomes part of a second set of variables of interest. It is included in the regression (as a natural logarithm) using the value of stocks traded as share of GDP. The expected sign of the coefficient is positive.

GOV (government expenditure): This is a control variable belonging to standard information for economic growth. The variable acknowledges the role of government in economic growth. Regardless of the amount or effectiveness of this expenditure, it should not be neglected in the assessment of economic growth performance. It is included in the regression (as a natural logarithm) using government expenditure as share of GDP. The expected sign of the coefficient is unknown.

GOV QUAL (government quality): This is a control variable belonging to standard information for economic growth. The variable recognizes the need of a good institutional environment in nurturing economic growth and insurance deepening. It is included in the regression (as a natural logarithm) using a measurement of government quality. The expected sign of the coefficient is unknown.

TRADE: This is a control variable belonging to standard information for economic growth. It is included in the regression (as a natural logarithm) as the value of international trade (imports and exports) as a share of GDP. The expected sign of the coefficient is positive.

INFLATION: This is a control variable belonging to standard information for economic growth. Usual findings on the relationship between economic growth and inflation suggest that low levels of inflation are associated to better economic performance. It is included in the regression (as a natural logarithm) using the percentage change in the consumer price index (CPI). The expected sign of the coefficient is negative.

EDUCATION: This is a control variable belonging to standard information for economic growth. The variable is intended to show the value of human capital in the economic performance of the countries. It is included in the regression (as a natural logarithm) using the secondary school enrollment with respect to total enrollment. The expected sign of the coefficient is positive.

GDPt=1 (initial GDP): This is a control variable included in the regression with the goal of accounting for the diversity in the level of national income among the countries studied. Furthermore, the corresponding coefficient will report the hypothesis of conditional convergence in the economic growth literature. It is included in the regression (as a natural logarithm) using the initial (1980) GDP level. The expected sign of the coefficient is negative.

CAPITAL: This is a control variable aiming to measure capital accumulation in the economy. This variable is included in the regression (as a natural logarithm) using the gross capital formation as share of GDP. The expected sign of the coefficient is positive.

III. Data measurement and sources

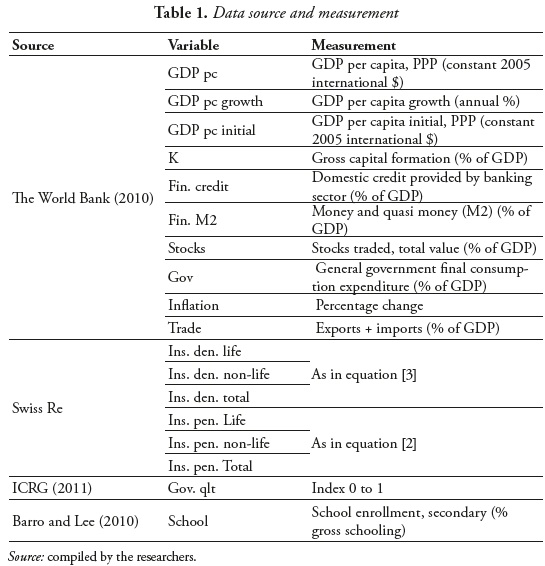

Based on a pre-selection of the basic variables required to estimate the proposed model, the researchers collected data for the largest number of Latin American countries and the longest period of time possible. Consequently, they gathered information on 17 variables within 11 countries (Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Panama, Peru, Uruguay, and Venezuela) over a 30-year period (1980 to 2009).6 All data came from public sources, except the insurance information, which was generously provided by Swiss Re to the research team solely for academic purposes. Table 1 displays the sources of data and the measurement units.

The variables of interest deserve special attention: INSURANCE is measured by both its PENETRATION (equation 2) and its DENSITY (equation 3), in both cases for the sub-sets of total, life and non-life insurance.

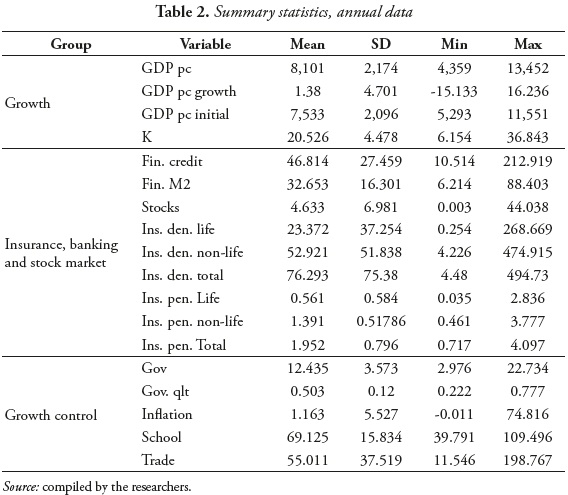

Table 2 presents some descriptive statistics of the variables in levels suitable for analytic purposes. However, in the estimated regressions, all the explanatory variables are expressed as natural logarithms. Among the growth variables, the average economic growth rate for the countries in the time period studied ranges from -16% to 15%, with an average of 1.3%. These figures show high volatility growth in the region in the past 30 years. Among the financial variables, the domestic credit provided by the banking sector is equal to 32% on average, while the value of stocks traded with respect to GDP averages 4.6%. Among the variables of interest, insurance density is higher in the non-life segment than in life insurance. Insurance penetration shows the same pattern of being higher in non-life than in life insurance.

The remaining control variables summary statistics show the stage of economic development in the region. Government expenditure is on average 12%, not surpassing 22% for any given year-country combination. Also, government quality average is 0.5 in a scale from 0 to 1. No country in the sample has a score higher than 0.77. Average inflation in the region is 1.1%, with a standard deviation of 5.5. Figures should not be mixed with some countries in the region with serious episodes of hyperinflation during the 1980s.

Average schooling and trade figures are in line with a fair behavior of the Latin American economies in the last thirty years.

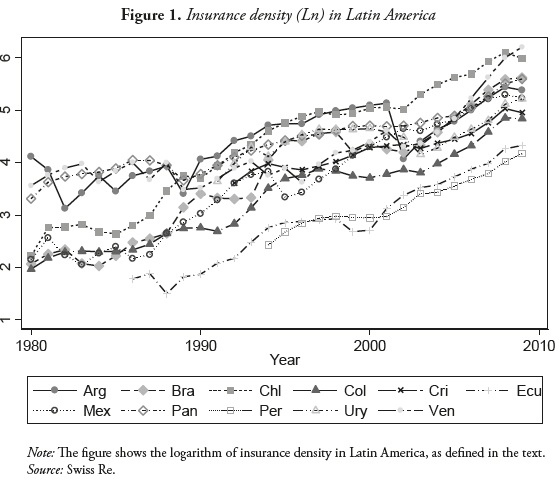

Figure 1 shows the time series behavior of the main variable of interest, insurance density. The growing trend of insurance premium per person in the region is indicative of the widespread adoption of all types of insurance in Latin America. This growing trend shows a twofold increase in insurance from 1980 to 2010. It also shows the insurance industry has faced setbacks, as in Argentina in the early 2000s, and vast progress as in Chile with an almost threefold increase.

IV. Results

According to our econometric estimations, there is a positive relationship between insurance use and economic growth. This relationship is statistically significant when insurance density is considered as the measure of insurance. The additional explanatory variables, usually included in a growth equation, are statistically significant as well.

Table 3 presents the results of the HT and Pooled-OLS AR(p) estimations (Hoechle, 2007), including individual and time effects for a long panel data structure, allowing general form auto-correlated errors for the data averaged for two- and four-year periods. In sum, based on methods that diminish estimation biases, our study indicates that insurance density deserves special attention. It turns out to be the most appropriate variable to capture the effect of insurance use upon economic growth across all estimations.

Under the Pooled-OLS AR(p) estimations, the insurance coefficients are all positive and highly statistically significant, that is, life insurance in the twoyear averaged data and all measures (life, non-life and total insurance) in the four-year averaged data. The coefficients range from 0.74 to 1.39 (0.17 and 0.44 growth points, using the corresponding average insurance penetration from Table 2). The banking variable (Fin. credit) shows a highly significant negative coefficient, which is in line with the arguments and findings of Minsky (2005) and De Gregorio and Guidotti (1995). The stock market variable, although positive, is only statistically significant in the two-year averaged data, which suggests its rather weak role concerning growth.

The remaining variables, those usually included in growth regressions, showed the expected signs and statistical significance. The initial GDP, government and inflation variables display a negative sign. Trade, capital and schooling are positive and statistically significant.

Conclusions

This study explored the relationship between insurance use and economic growth. Following the existing evidence provided by the finance and growth literature, this relationship is estimated for a sample of 11 Latin American countries between 1980 and 2009. The findings confirmed the existence of a positive relationship between insurance use and economic growth, which was particularly strong for the life insurance variable. This finding supports arguments in favor of the relevance of the insurance industry to foster economic prosperity.

NOTAS

* This paper is an extension of the Master's Thesis that Ms. Ángela Concha submitted to Universidad de los Andes in Bogotá, Colombia, in December of 2011. By then, Ms. Concha was working at FASECOLDA, the Colombian Federation of Insurance Companies. Ms. Concha appreciates FASECOLDA'S cooperation and that of Swiss Re, whose generous input was invaluable for the completion of the research project. The authors thank María Angélica Samper Corté (www.transcrear.com) for English proofreading and editing.

1 This is how Latin American countries are included in the work of Arena (2008); Chen, Lee and Lee (2012), and Lee, Lee and Chiu (2013) when conclusions are reached regarding developing countries.

2 This finding is very much in line with the far-reaching results of Hofstede (1995) and La Porta et al. (1998).

3 The authors also estimated standard Fixed Effects (FE) and RE models, refer to table 4 in the appendices for such set of estimation results.

4 These modeling options were chosen over the Arellano-Bond dynamic panel estimators after several rounds employing them, and facing a considerable loss of information due to the limited number of countries included in the sample.

5 The authors recognize that the choice of an econometric approach and of given variables has repercussions; they are aware of the vast literature on economic-growth determinants, and also familiar with the econometric literature on the myriad of variables that may be included in a regression analysis on economic growth (Sala-i-Martin, 1997; Sala-i-Martin, Doppelhofer and Miller, 2004). However, they emphasize that their study seeks to reveal the relationship between insurance use and economic growth, not to propose insurance as a breakthrough to the research community.

6 Not all countries in the sample had available information to conform a balanced panel data set, therefore the estimation results bellow will show sample sizes lower than 330 observations.

Bibliography

Ang, James B. (2008). ''A survey of recent developments in the literature of finance and growth'', Journal of Economic Surveys, Vol. 22, Issue 3, pp. 536–576. [ Links ]

Arellano, Manuel and Bond, Stephen (1991). ''Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations'', The Review of Economic Studies, Vol. 58, No. 2, pp. 277–97. [ Links ]

Arena, Marco (2008). ''Does insurance market activity promote economic growth? a cross- country study for industrialized and developing countries'', Journal of Risk & Insurance, Vol. 75, No. 4, pp. 921–946. [ Links ]

Arestis, Philip and Demetriades, Panicos (1997). ''Financial development and economic growth: Assessing the evidence'', The Economic Journal, Vol. 107, No. 442, pp. 783–99. [ Links ]

Azman-Saini, W. and Smith, Peter (2011). ''Finance And Growth: New Evidence On The Role Of Insurance'', South African Journal of Economics, Vol. 79, Issue 2, pp. 111–127. [ Links ]

Baltagi, Badi (2008). Econometric analysis of panel data (4th ed.). Chichester: John Wiley & Sons. [ Links ]

Barro, Robert and Lee, Jong-Wha (2010). ''A new data set of educational attainment in the world, 1950-2010''. NBER Working Papers, No. 15902, National Bureau of Economic Research, Inc. [ Links ]

Beck, Thorsten and Levine, Ross (2004). ''Stock markets, banks, and growth: Panel evidence'', Journal of Banking & Finance, Vol. 28, Issue 3, pp. 423–442. [ Links ]

Braun, Matías and Larrain, Borja (2005). ''Finance and the business cycle: International, Inter-industry evidence'', The Journal of Finance, Vol. 60, No. 3, pp. 1097–1128. [ Links ]

Cameron, Colin and Trivedi, Pravin (2005). Microeconometrics: methods and applications. Cambridge, UK: Oxford University Press. [ Links ]

Cameron, Colin and Trivedi, Pravin (2009). Microeconometrics Using Stata. College Station, TX: StataCorp LP. [ Links ]

Catalan, Mario; Impavido, Gregorio and Musalem, Alberto (2000). ''Contractual savings or stock market development, which leads?'', Policy Research Working Paper, No. 2421. World Bank. [ Links ]

Pei-Fen, Chen; Chien-Chiang, Lee and Chi-Feng, Lee (2012). ''How does the development of the life insurance market affect economic growth? Some international evidence'', Journal of International Development, Vol. 24, Issue 7, pp. 865–893. [ Links ]

De Gregorio, J. and Guidotti, P.E. (1995). ''Financial development and economic growth'', World Development, Vol. 23, No. 3, pp. 433–448. [ Links ]

De la Torre, Augusto; Ize, Alain and Schmukler, Sergio (2012). Financial Development in Latin America and the Caribbean: The Road Ahead. Washington: The World Bank. [ Links ]

Demirgüç-Kunt, Asli and Maksimovic, Vojislav (1998). ''Law, finance, and firm growth'', Journal of Finance, Vol. 53, No. 6, pp. 2107–2137. [ Links ]

Durlauf, Steven; Johnson, Paul and Temple, Jonathan (2005). ''Growth econometrics''. In: Aghion, Philippe and Durlauf, Steven (Eds.), Handbook of Economic Growth (Vol. 1) (pp. 555-677). The Netherlands: Elsevier. [ Links ]

Enz, Rudolf (2000). ''The S-curve relation between per-capita income and insurance penetration'', Geneva Papers on Risk and Insurance- Issues and Practice, Vol. 25, No. 3, pp. 396–406. [ Links ]

Greenwood, Jeremy and Jovanovic, Boyan (1990). ''Financial development, growth, and the distribution of income'', Journal of Political Economy , Vol. 98, No. 5, pp. 1076–1107. [ Links ]

Gurley, J. and Shaw, E. (1955). ''Financial aspects of economic development'', American Economic Review, Vol. 45, No. 4, pp. 515–538. [ Links ]

Gurley, J. and Shaw, E. (1967). ''Financial structure and economic development'', Economic Development and Cultural Change, Vol. 15, No. 3, pp. 257–268. [ Links ]

Haiss, Peter and Sümegi, Kjell (2008). ''The relationship between insurance and economic growth in Europe: a theoretical and empirical analysis'', Empirica, Vol. 35, Vol. 4, pp. 405–431. [ Links ]

Han, Liyan; Li, Donghui; Moshirian, Fariboz and Tian, Yanhui (2010). ''Insurance development and economic growth'', The Geneva Papers on Risk and Insurance - Issues and Practice, Vol. 35, No. 2, pp. 183–199. [ Links ]

Hoechle, Daniel (2007). ''Robust standard errors for panel regressions with cross-sectional dependence'', Stata Journal, Vol.7, No. 3, pp. 281–312. [ Links ]

Hofstede, Geert (1995). ''Insurance as a product of national values'', The Geneva papers on risk and insurance, Vol. 20, No. 77, pp. 423–429. [ Links ]

ICRG (2011). ''International country risk guide (ICRG), quality of government''. Technical report, Political Risk Services. [ Links ]

King, Robert and Levine, Ross (1993). ''Finance and growth: Schumpeter might be right'', The Quarterly Journal of Economics, Vol. 108, No. 3, pp. 717–37. [ Links ]

La Porta, Rafael; Lopez-de-Silanes, Florencio; Shleifer, Andrei and Vishny, Robert (1998). ''Law and finance'', Journal of Political Economy, Vol. 106, No. 6, pp. 1113–1155. [ Links ]

Lee, Chien-Chiang; Lee, Chi-Chuan and Chiu, Yi-Bin (2013). ''The link between life insurance activities and economic growth: Some new evidence'', Journal of International Money and Finance, Vol. 32, pp. 405–427. [ Links ]

Levine, Ross (1997). ''Financial development and economic growth: Views and agenda'', Journal of Economic Literature, Vol. 35, No. 2, pp. 688–726. [ Links ]

Levine, Ross and Zervos, Sara (1998). ''Stock markets, banks, and economic growth'', American Economic Review, Vol. 88, No. 3, pp. 537–58. [ Links ]

Loayza, Norman and Soto, Raimundo (2002). ''The sources of economic growth: An overview''. In: Loayza, Norman and Soto, Rimundo (Eds.), Central Banking, Analysis, and Economic Policies Book Series (Vol. 6): Economic Growth: Sources, Trends, and Cycles (pp. 1-40). Chile: Banco Central de Chile. [ Links ]

McKinnon, Ronald (1973). Money and capital in economic development. Washington D.C.: Brookings Institution Press. [ Links ]

Minsky, Hyman (2005). ''The financial instability hypothesis: a clarification''. In: Feldstein, Martin (Ed.), The risk of economic crisis (pp. 158–166). Chicago: University of Chicago Press. [ Links ]

Njegomir, Vladimir and Stojic', Dragan (2010). ''Does insurance promote economic growth: The evidence from ex-Yugoslavia region'', Ekonomska misao i praksa, Vol. 19, No. 1, pp. 31–48. [ Links ]

Outreville, J. Françoise (1990). ''The economic significance of insurance markets in developing countries'', Journal of Risk and Insurance, Vol. 57, No. 3, pp. 487–498. [ Links ]

Outreville, J. Françoise (1996). ''Life insurance markets in developing countries'', Journal of Risk and Insurance, Vol. 63, No. 2, pp. 263–278. [ Links ]

Rajan, Raghuram and Zingales, Luigi (1998). ''Financial dependence and growth'', American Economic Review, Vol. 88, No. 3, pp. 559–86. [ Links ]

Raymond, G. (1969). Financial structure and development. New Haven: Yale University Press. [ Links ]

Roubini, Nouriel and Sala-i-Martin, Xavier (1992). ''Financial repression and economic growth'', Journal of Development Economics, Vol. 39, No. 1, pp. 5–30. [ Links ]

Rousseau, Peter and Wachtel, Paul (2000). ''Equity markets and growth: Cross-country evidence on timing and outcomes, 1980-1995''. Journal of Banking & Finance, Vol. 24, No. 12, pp. 1933–1957. [ Links ]

Sala-I-Martin, Xavier (1997). ''I just ran two million regressions''. The American Economic Review, Vol. 87, No. 2, pp. 178–183. [ Links ]

Sala-I-Martin, Xavier; Doppelhofer, Gernot and Miller, Ronald (2004). ''Determinants of long-term growth: A Bayesian averaging of classical estimates (BACE) approach''. The American Economic Review, Vol. 94, No. 4, pp. 813–835. [ Links ]

Skiper, Harold. (1997). ''Foreign insurers in emerging markets: issues and concerns''. Occasional Paper, No. 1. International Insurance Foundation. [ Links ]

The World Bank (2010). World development indicators 2012. Washington: Autor. [ Links ]

Valickova, Petra; Havranek, Tomas and Horvath, Roman (2014). ''Financial development and economic growth: a meta-analysis''. Journal of Economic Surveys. Doi: 10.1111/joes.12068 [ Links ]

Ward, Damian and Zurbruegg, Ralf (2000). ''Does insurance promote economic growth? Evidence from OECD countries'', Journal of Risk and Insurance, Vol. 67, No. 4, pp. 489–506. [ Links ]

Webb, I.; Grace, M and Skipper, H. (2002). ''The effect of banking and insurance on the growth of capital and output''. Working paper 02-1. Center for risk management insurance. [ Links ]

Appendices

Appendix A. Additional estimation results.