Introduction

The development of well-structured capital markets2 has allowed the deepening and diversification of the financial system in developed and emerging countries. These markets are the funding source for the productive sector.They offer investment options for savings and also provide mechanisms to diversify financial risk. In this regard, a greater extent of participation, segmentation and interaction of several agents enable the development of capital markets based on higher deepening and democratization. This is why many countries, including Colombia, have developed financial education programs to promote the knowledge and participation of citizens in the financial system, and particularly in the equity market. However, citizens' participation in this market has faced major delays because most of them do not know the basics of its operation, thus affecting the savings and investment trade off in the stock market.

The existing studies on this topic, which are few, show that financial illiteracy is generalized and individuals lack knowledge of even the most basic economic principles (Lusardi & Mitchell, 2007; Hilgert, Hogarth & Beverly, 2003). Furthermore, the extensive information and documentation available in Colombia in regard to the stock market contrasts with the scarce literature on knowledge of the equity market and its determinants. Ariza and Giraldo (2013) descriptively analyzed the stock market and suggested strategies to promote financial education at school as well as investment mechanisms for small and medium enterprises (SMEs) in this market. Among their findings, it is worth pointing out the savings deficit of the population in Colombia as a constraint to enter the stock market and shortcomings in the supply of products responding to the needs and expectations of the investors and businesses that require funding.

Moreover, Uribe (2007) highlighted the positive evolution of the Colombian stock market in the past years. This expansion was above the average of other markets in the region and has a growing tendency during the next decades. Despite these progresses, the Colombian market remains a highly concentrated and shallow one with respect to its regional peers.3The majority of the activities carried out in the Colombian securities market are focused on the performance of products traded in the stock market and on the analysis of specific products using several assessment techniques. Evidence from empirical studies on citizens' knowledge about the equity market in Colombia is null; hence, this study significantly contributes to the literature since it characterizes the socioeconomic profile and identifies the knowledge level that citizens of the Colombian city of Barranquilla have in regard to the equity market,4 as well as the factors that explain participation in this market. This study takes as reference the one developed by Van Rooij, Lusardi and Alessie (2011), and empirically analyzes the knowledge and understanding scales of the equity market using a binomial and ordinal logit model. The probability of investment is also assessed based on several variables such as income, education, savings, and social stratum, among others. This additional information allows characterizing the economic profile of the citizens of Barranquilla. In order to achieve these objectives, this paper is structured as follows: The second section includes a theoretical review of the equity market and the factors that facilitate/inhibit its development in the national and international context. The third section sets forth the methodology used for the econometric estimation and the results. Finally, the conclusions are presented.

I. Literature Review

In developed countries, the increased interaction of economic agents with the capital market has contributed to its development and deepening. Part of this interaction is a result of greater democratization and participation of several agents. Mohanty (2002) states that the expansion of the investor base has positive effects on stock market deepening by increasing its size, providing more liquidity and diversifying financial risk. Moreover, a large number of investors can encourage technological innovation, improve negotiation and transaction processes, and reduce costs. For this reason, small investors (citizens) find in this market an investment alternative through its several share options.5

Although higher saving rates favor such investment, the existence of financial education programs-that include the promotion of equity investment and financial literacy-is also essential (OCDE, 2005).6 Some experiments carried out by financial literacy national programs in New Zealand and Australia show positive results between the population's level of financial knowledge and investment in the equity market. In general, the average citizen in these countries understands the basic concepts of risk, return, investment and diversification reasonably well (Ispierto & Oliver, 2011). However, limited participation of citizens in the equity market remains a predominant characteristic of global financial systems. Haliassos and Lyon (1994) show that less than 50% of households in the United States have stakes in the equity market, mostly concentrated in a financial product. Similarly, Attanasio, Banks and Tanner (2002) report that over 75% of households in the United Kingdom do not have direct investments in the equity market. These authors study the implications of limited participation in the asset and stock market, particularly using asset valuation models based on consumption Euler equations. Their results show a higher probability of having or investing on assets as individuals become elderly. Also, individuals manage to improve their level of financial literacy in a temporary framework, although the positive effect of higher education tends to decrease over time for the stock market. In a study of income dynamics, Mankiw and Zeldes (1991) find that only a small proportion of households own stocks.

As for the factors that influence investment in the equity market, several studies have suggested that age, education, occupation, income and attitude toward risk play an important role as determinants of participation in the equity market (Sungur, 2003). Haliassos and Bertaut (1995) investigate a series of explanatory factors of financial education on the basis of the Survey of Consumer Finances and performed a logit estimation using 4,103 observations. Their results show that university education is more likely to influence the decision to invest in the stock market in contrast to those with lower educational level, who prefer savings deposits as an investment option.

Other studies have documented how individuals' financial decisions are significantly influenced by the absence of basic knowledge on finance. Bernheim and Garrett (2003) analyze the results of a financial survey conducted on US individuals from 30 to 48 years old and concluded that saving rates increased with the provision of financial education. Specifically, they find that the probability to participate in certain savings programs is higher for employees who are familiar with educational retirement programs in contrast with those who did not have any knowledge.

Bernheim, Garrett and Maki (2001) analyze the effects of financial education during school age on individual savings. The main conclusion is that education programs significantly increase the individuals' saving rates and the stock of wealth during adulthood. Lusardi and Mitchell (2007) analyze the level of financial literacy among individuals older than fifty years and find that financial knowledge is scarce. However, individuals with greater financial knowledge are more likely to invest in more sophisticated products such as stocks, bonds, mutual funds, among others. Similarly, their behaviors are more rational and planned when weighing the cost (commission)-benefit (return) ratio in their trading decisions.

The correlation between the equity market and the level of financial education analyzed by Van Rooij et al. (2011) exhibits particular behaviors, since financial education and investment decisions differ substantially depending on the education, age and gender of individuals. This suggests that any program aiming for financial education would be more effective if it is oriented to specific groups of the population. Similarly, the lack of economic/financial knowledge decreases the probability to participate in the stock market.

Bucker-Koenen and Lusardi (2011) use instrumental variable methods to identify the causality direction based on questions that measure the previous financial concepts that individuals have before entering into the stock market. They conclude that financial knowledge has a positive and significant effect on financial decisions, and not vice versa.

Hilgert et al. (2003) use data from the monthly consumer survey conducted on consumers from the University of Michigan and noted that debt and credit management are correlated with individuals' financial knowledge. The results of this study demonstrate the existence of a positive correlation between household financial literacy and the stock of wealth. In turn, they find that the two basic channels that contribute to this positive relationship are that the provision of financial literacy favorably induces individuals to invest in equity securities, and that these individuals have a greater tendency to financially plan their retirement.

Moreover, the Economic and Financial Education (EFE) program implemented in several countries such as the United States, Australia, Brazil, Slovenia, Spain, Ghana, Holland, India, Ireland, Japan, Malaysia, New Zealand, Portugal, Czech Republic, United Kingdom, Canada, Chile, Estonia, Indonesia, Mexico, Peru, Poland, Romania, Turkey and South Africa, was replicated in Colombia in 2010 with the name of National Strategy for Economic and Financial Education (NSEFE). The Ministry of Finance and Public Credit, the Ministry of Education, the Central Bank, the Financial Superintendence of Colombia, the Guarantee Fund of Financial Institutions, and the Stock Market Self-Regulatory Organization assumed the leadership in this strategy. The purpose of this program is to provide the Colombian population with more and better tools to support decisions and improve financial expertise on issues related to personal and household finances. Complementing this initiative, Bill No. 082 in 2011 was submitted to the Colombian Congress proposing the establishment of EFE services and consumer organizations across preschool, primary and secondary educational institutions in private and public entities all over the country. Moreover, the 2010-2014 National Development Plan determined the inclusion of EFE in the design of programs developing core competencies, in accordance with the provisions of Law No. 115 of 1994 (Quintero, 2014).

In the 1990s, the Central Bank started a program called "The Central Bank in the classrooms", which included campaigns aimed at promoting economic education in primary and secondary schools. The objective was to contribute through various activities and educational materials to the training of the future economically responsible citizens.

Similarly, Asobancaria, Fogafin and other entities maintain financial education programs as "Balance your pocket", "Do not be hardheaded", "Learn more, be more", "Heavyweights", "yodecidomibanco.com" in order to sensitize and financially educate the population. In addition to these initiatives, the national government issued Law 1328 in 2009, called "Financial Reform", which sets the parameters for the financial sector entities−supervised by the Financial Superintendence of Colombia−to provide financial education to its members (Gonzalez & Rojas, 2008).

As for participation of people and businesses in the Colombian stock market, lack of knowledge is the main cause of their backwardness in contrast with developed countries and several Asian and Latin American countries. Moreover, the creation of the Center for Capital Market Development failed to have an actual impact on its target audience (businesses and the general population).7 This was evidenced on the lack of knowledge related to the functioning and importance of the capital market (Roncallo, 2009).

Similarly, Londoño and Londoño (2008) conduct a research on the market for financial products of small investors in the coffee sector. Their results show that small investors prefer low-risk alternatives, represented in portfolios that include savings accounts, term deposits, bonds, share repos, and public debt securities. This conservative attitude toward investment occurs due to the low level of knowledge and the lack of investment programs for this customer segment.

Vargas (2013) develops a study on how to promote stock market participation in social strata 2 and 3 in Bogotá. His study shows that there are educational, financial and personal barriers for its promotion. Lack of dissemination of the investment alternatives offered by the Colombian stock market largely explains the limited participation of investors from strata 2-3, in addition to lack of an equity market culture and high risk aversion. Despite this finding, the study reveals that most of the population of these strata has available resources to invest, since 91% of the surveyed population declared to have savings that range from $100,000 to $1,000,000.

Ariza and Giraldo (2013) descriptively analyze the stock market. They suggest strategies to promote financial education from school and propose investment mechanisms for SMEs in this market.

II. Methodology and Data

The empirical basis of this study comes from a survey conducted on the citizens of the district of Barranquilla during the second half of 2014. The sample consists of 800 individuals, which correspond to 0.057% of the population (1,386,865 inhabitants, according to the Colombian Statistics Department), selected via simple random sampling. With a significance level of 5%, a sample error of 3.71% and a response rate of 95%, the database is constructed with 697 final observations (103 are discarded due to statistical bias) distributed in the five areas of the city (105 South East, 105 South West, 233 North historic center, 172 Riomar and 82 metropolitan area).

For the empirical study, a questionnaire with specific and complementary information regarding the citizens' characteristics and their financial situation was constructed. This instrument is divided into three sections and includes multiple-choice closed questions, as well as dichotomous, scalar and valuation questions. In the first section, the citizen's socio-demographic characteristics are explored. In the second section, we investigate their economic information and financial habits. In the third section, the level and the factors that favor or condition their ownership and knowledge of the Colombian equity market are analyzed.

A. Data analysis

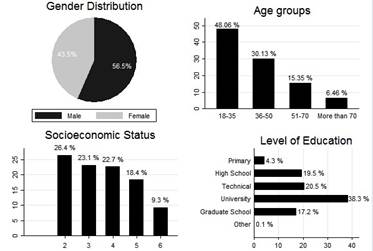

Figure 1 shows some of the general characteristics of the sample. By sex, the sample included 56.53% of men and 43.47% of women; nearly half of the respondents are in the range of 18-35 years old. By socioeconomic status, socioeconomic stratum 2 has the highest share while the socioeconomic stratum 6 the lowest. By educational level, 38.31% of the sample holds a university degree, followed by 20.52% that are technicians or technologists, 17.52% with postgraduate training, and about 24% has secondary education or less.

Regarding the level of financial literacy, 52.7% of the respondents state that they do not have any knowledge of the equity market and its investment instruments (Figure 2), that is, 6 out of 10 respondents do not recognize that market. This lack of knowledge is accentuated when referring to specific funding instruments (70.47%). Additionally, only 16.5% is aware of the existence of the NSEFE.8 In terms of gender, the data show a gender gap in terms of lack of knowledge in regard to the equity market: 63% for women and 37% for men. Moreover, a direct relation is shown between knowledge of the equity market and respondents' education level. This relation is closer when the knowledge level of the equity market and the proportion of people who have a stake in the equity market are examined (Figure 3).

Econometric estimations are carried out in order to confirm the information provided by the data at a descriptive level. These estimations allow examining the relations and correlations of the main variables of analysis.

B. Econometric strategy

To examine the factors that influence the knowledge and participation of Barranquilla's private investors in the equity market, we proceed to run two discrete choice models (ordered and binary logit) in order to analyze: (i) The variables that influence individuals' knowledge of the equity market; and (ii) the variables that influence the likelihood of investing in the Colombia Stock Exchange (BVC).

Figure 3 Investment in the Colombia Stock Exchange according to levels of education and equity market knowledge

The first step was to estimate the determinants of individuals' level of knowledge of the BVC. The respondents were asked to perform a self-assessment of their knowledge level of the equity market in order to quantify this variable. A Likert scale from 1 to 5 was used to rate if an individual's knowledge was null, low, average, high or very high. Since the values of the outcome variable are ordinal in nature and, therefore, it is not possible to ascertain the cardinal distance between each of the possible outcomes, the dependent variable L (knowledge level) takes N categories of ln responses, where n = 1,...,N, arranged as follows:

According to Miranda and Rabe-Hesketh (2006), the latent response variable for the i-th individual is determined according to the following equation:

for the i-th individual is determined according to the following equation:

where xi represents a vector of explanatory variables and λ,εi and τi represent a load factor, a heterogeneity term and a random error, respectively. The constant term is replaced by the thresholds that determine the change of the observed responses from one category to another:

where ks , with s = 1...N − 1, represents the parameter corresponding to the several thresholds. This is a latent variable that is only observable for those citizens who claim to have knowledge of the Colombian equity market and assign a value to that knowledge.

Once the variables that have influence on the knowledge level of the equity market are identified, the next step is to ascertain the influence that this knowledge has on investment in the BVC. To do this, a logit model was estimated due to the binary nature of the dependent variable (Greene, 2003), examining the probability of occurrence of one event for each of the independent variables that comprise it.

According to Long and Freese (2006), the logit model can be expressed in probabilistic terms, where predicting the probability of occurrence an event Y given X, is Pr(y = 1 | x). To restrict probability predictions to that range, the linear probability model might be:

where vector x denote the observed independent variables and ε is the random error term.

Firstly, the probability is transformed into the ratios

This formulation indicates the occurrence frequency of an event (y = 1) with respect to non-occurrence (y = 0). The ratios log or logit is within the range of −∞ to ∞, and it assumes the linear logit form, which interpretation is frequently focused on changes in probability ratios:

Since the independent variable, knowledge level of the equity market, responds to a self-assessment scale, this variable could be censured to the extent that individuals have an anecdotal knowledge of the market or they do not recognize their notions about the equity market as such. This could mean that only those with formal training or experience in the equity market claim to have high or very high levels of knowledge. Similar to Polder et al. (2009), it is proposed to use predictions obtained from the ordered logit model described above instead of the knowledge level of the equity market variable in order to mitigate this selection bias.

III. Results analysis

A. Determinants of knowledge of the Colombian equity market

The results confirm to a great extent the information showed by the descriptive data. First, the estimates of the ordered logit model shown in Table 1 allow us to observe that older people have more knowledge of the Colombian equity market. Also, the fact of having completed postgraduate studies positively influences the knowledge of this market. However, as already evidenced in previous studies (Van Rooij et al., 2011), to have specific knowledge of that market is more important than the level of education per se. In this study, knowledge was measured by using a variable that indicated the scientific field of studies undertaken by the respondent. In this case, it is possible to approximate it by the sector in which the respondent performs. Specifically, working in the financial sector has a statistically significant influence on knowledge of the equity market.

Table 1 Ordered Probit. Knowledge level

Note: ***, **, and * denote statistical significance at a 1%, 5%, and 10% confidence level, respectively. Source: authors' calculations using data from our survey

As expected, with regard to the financial variables, the higher the possibility of actual investment in the equity market, the greater is the knowledge of potential investors. While the variables related to wage levels have no significant influence, savings capacity does have it. To have a higher level of savings has a positive effect on the probability of knowing the equity market, in contrast with those people who do not save (ceteris paribus). This seems to coincide with the findings of Bernheim et al. (2001). The probability that people who are able to save between 10 and 15% and between 15 and 20% of their income have knowledge of the equity market is 0.62 and 1.17 times higher, respectively, than the probability of those who have no savings capacity at all.

Finally, an important aspect revealed by the study is that the level of knowledge of the equity market is significantly affected by the types of media used by individuals to learn about the equity market. In this sense, individuals who use the internet and specialized press have 3.66 and 3.17 times higher probability to know about the equity market than those using other types of media. The use of television as mass media to obtain equity market information is also significant but less influential.

B. Determinants of the possibility to invest in the stock market

The results in Table 2 aim to analyze which characteristics have influence on the probability to invest in the BVC. This model incorporates as independent variables the probability of having low, average, high and very high knowledge of the Colombian equity market. This probability is obtained from the predictions made with the previous model. For these estimates, only the sub-sample of those individuals who said they had knowledge of the equity market is used. This fact reduces the number of observations to 222 individuals. The dependent variable, in this case, consists of those individuals who report to have invested in the BVC.9

Table 2 Probit estimation. Share in the equity market

Note: ****, **, and * denote statistical significance at a 1%, 5%, and 10% confidence level, respectively. Source: authors' calculations using data from our survey

Firstly, we see that the model, considering the set of explanatory variables, is adequate. Secondly, we can confirm that the probability of having high and very high level of knowledge of the equity market increases the probability of investing in it. As in the previous case, and as shown in previous studies (Sungur, 2003), age has a positive influence on individuals' participation in the stock exchange. Finally, the percentage of savings is also statistically significant.

Specifically, individuals with saving rates higher than 25.1% of their income participate more actively through investments in the BVC. This fact is consistent with the study carried out by Ariza and Giraldo (2013), which identifies savings as one of the major limitations of investment in the BVC. More specifically, Bernheim et al. (2001) states that individuals' savings capacity and wealth stock are among the determinants of stock market participation.

Conclusions

There is little knowledge and participation in the equity market in Colombia, and particularly in Barranquilla. This situation is caused by lack of knowledge and information about this market, in addition to income restrictions and indifference. These causes, combined with individuals' preferences for the banking market as the main savings option, reveal limitations at the citizen level with regard to education and information about specific markets such as the stock exchange.

Our results show that knowledge of the equity market is higher in older individuals with postgraduate education. For the case of Colombia, and even more so in Barranquilla, this reinforces the fact that the equity market is a very exclusive one that remains reserved for a minority with specific knowledge and resources. Especially, the highest level of knowledge and participation in this market is represented by socio-economic strata 4 to 6 from the North Central and Riomar historical locations.

The weight of market exclusivity of the equity market is more directly reflected in the relationship of knowledge and participation in it with the fact of working in the financial sector. The influence of this variable is greater than the aforementioned two variables. It is also confirmed that, beyond the income level, the savings rate (measured as a percentage of income) is important. Finally, it is worth to point out the influence of the media through which small investors read market-related news. While traditional media (print press) is still important, the surge of internet and television to a lesser extent denotes significant trend changes in how users satisfy their need for information.

Moreover, the results regarding stock market participation confirm the importance of prior knowledge as the main variable explaining the probability of involvement. Those who know the market are more likely to take part in it. Logically, the age and availability of savings for investment go with this fact. These two items are clearly related to the extent that people are able to cover household needs, debts and other financial expenses.

Regarding financial education as an underlying element of knowledge and equity investment, the results are not very satisfactory. Although the government and some institutions have developed campaigns and educational programs in regard to economic and financial issues, their scope is very limited in terms of coverage. The proof of this is the lack of knowledge (85%) about the NSEFE among the surveyed population, which in turn contrasts with the interest to know about the advantages of the equity market (79%) and the importance of incorporating financial and equity subjects in the curricula of secondary education in the country (88%).

With regard to the obstacles to investment in the Colombian equity market, it is worth to point out the high costs of direct intermediation (commissions) in relation to the amounts of individual investment, lack of information, and regulation and market supervision. In line with this, other obstacles could be the lack of new issuers and defection of individual investors, instability of the tax regime, as well as distrust in the equity market as a consequence of the recent embezzlement by the largest brokerage firm in the country.

Finally, it is important to strengthen and enhance financial education programs in all strata of the population, so that sound knowledge and effective participation of citizens in the Colombian equity market is attained.