INTRODUCTION

Traditional finance and behavior finance are different schools of thought. According to the traditional finance theory, every investor is rational when making an investment decision. However, after a series of research, it was observed that human decisions often depend on their nature, perceptions, and behaviors, cognitive or emotional biases hidden deeply in the back of the mind. The new school of thought of behavioral finance has started to change after gathering enough information confirming specific human behavior that conflicts with traditional finance theory. Investment decision processes based on estimates and much knowledge of market participants are being attracted more unrealistically these days in global financial markets.

Behavioral finance is the study of the impact of psychology on the behavior of financial professionals and the resulting effect on markets. Behavioral finance helps to describe why and how markets can be inefficient (Sewell, 2007). Behavioral finance is a comparatively modern field of finance that has just emerged to address the failures in the reliability of the traditional assumptions of predictable utility maximization with the inefficient market of the rational investor. Although psychology plays a significant role in investor behavior, it has only recently become popular. Certainly, numerous economists and psychologists have been trying to integrate these fields relatively recently. From the above discussion related to behavioral finance, it is clear that behavioral finance is a branch of finance that concentrates on the study of the decision-making process of market investors, who may have irrational behaviors, in the psychological aspect. There are several behavioral factors that affect the decision-making process of investors, such as factors related to heuristic theory, factors related to prospect theory, market factors and herding factors. The main focus of our study is the impact of heuristic factors on investor's decision-making process and investment performance. A discussion of heuristic theory is raised in the following paragraph.

Heuristic theory defines the rule of thumb thar investors use to facilitate decision-making in uncertain and complex situations (Ritter, 2003).

Previous research has been conducted on the impact of heuristic factors on investment outcomes of individuals and institutional investors (Barber & Odean, 2008). Most of the researchers conduct researches on the direct relationship between heuristic factors and investment performance and focus less on multiple mediating mechanisms between heuristic factors and investment performance to fill the gap between the multiple mechanisms for further exploring the relationships and discovering a mediating mechanism that gives a better understanding of the processes (Farooq et al., 2013). The mediating mechanism between the four heuristic factors and investment performance provides a better understanding of investment decision making and improved investment performance (Plous, 1993). It offers a clear picture of the relationship between the heuristic factors and investment performance and the understanding of the mediating mechanism to provide details to the financial advisor and investors (Peloza, 2009). To the best of our knowledge, the study of the multi-mechanism related to heuristic factors and investment performance results in a better understanding of investment processes.

The problem statement addressed in this study is "the impact of heuristics factors on investment performance: exploring the mechanisms mediating stock market anomalies". To make an efficient decision requires a basic economic concept (Lusardi & Mitchell, 2005). Peoples make systematic thinking errors in making decisions.

This research is intended to address the following objectives: To observe the relationship between heuristic factors and investment performance of individual investors.

To know the impact level of the heuristic factors on investment performance of individual investors in the Pakistan stock market.

To determine the level of impact of the mediating role of stock market anomalies (fundamental and technical anomalies) between heuristic factors and investment performance.

Our study explores five factors -anchoring, availability, gambler's fallacy, illusion of control, and use of conservatism- as an independent variable that searches the differential impact on market anomalies and investment performance. Understanding these heuristic factors can help investors improve their understanding of stock picking behavior as well as make better investment decisions.

LITERATURE REVIEW

According to Bacho & Sechel (2013), for the elements of fundamental analysis of stocks, fundamental anomalies refer to anomalies in the trading of financial instruments. The basic principle of fundamental analysis refers to the fact that the change in market prices of financial securities is the result of supply and demand for that financial instrument. Well, technical anomalies are associated with the elements of technical analysis and technical analysis is very useful for predicting price movement in the market based on volume and past price trends (Bacho & Sechel, 2013).

Anchoring Heuristic and Investment Performance

Aziz & Khan (2016) examined the behavioral factors that influence decisions and investment performance of individual investors. Result shows that there has been a positive relationship between the anchoring heuristic and investment performance of individual investors. According to Ishfaq & Anjum (2015), anchoring has a positive and significant effect on investment performance. The study conducted by Menike et al. (2015) found that anchoring has a positive significant impact on the investment performance. According to Ranjbar et al. (2014), investment performance is positively affected by anchoring bias. Obara (2015) concluded that anchoring positively impacts investment returns. And according to Shah et al. (2018), anchoring negatively affects investment decisions and investment performance.

Availability Heuristic and Investment Performance

The study carried out by Alrabadi et al. (2018) found that availability bias has significant impact on investment performance of individual investors. According to Khan (2015), availability bias negatively affects investment decisions and performance. Javed et al. (2017) concluded that availability bias positively and significantly impacts investment performance.

Gamblers Fallacy Heuristic and Investment Performance

In the study of Anum (2017) to analyze the behavioral factors and their impact on investment performance and investment decisions, it is shown that there is a significant and positive relationship between the gambler's fallacy heuristics and investment performance. Aziz & Khan (2016) found that gambler's fallacy positively affects the investment performance of the individual investors. According to Mahmood et al. (2016), the gambler's fallacy significantly affects investment performance of individual investors.

Conservatism Heuristics and Investment Performance

According to Bakar & Yi (2016), conservatism bias has significantly impact on investment decisions and investment performance. In the study of Zhang et al. (2015) they found that there is a noteworthy relationship between the conservatism heuristic, investment decisions and investment performance. Thomas (2018), meanwhile, investigated the influences of behavioural biases on retail investors and found that the conservatism bias has a remarkable impact on investment performance. Chitra & Jayashree (2014), in their study, analyze the demographic profile differences in investor behavior and uncover the important relationship between conservatism and investment performance.

Illusion of Control Heuristic and Investment Performance

According to Bashir et al. (2013), illusion of control heuristic significantly affects investment decision and investment performance. The study conducted by Manuel & Mathew (2017) found that illusion of control heuristic has an important relationship with investment performance.

Anchoring Bias Relationship with Fundamental Anomalies and Technical Anomalies

According to Andersen (2010), anchoring decision making is the human propensity to rely too much on one piece of information available in the market, such as news, abnormal trading volumes and extreme stock performance. Investors focus on famous and popular stocks and ignore market fundamentals. This type of investor focus leads to fundamental anomalies.

Relationship of Availability Bias to Fundamental Anomalies and Technical Anomalies In the Stock Market

According to Read & Grushka (2011), when the investor makes the decision based on readily available information, then he ignores the fundamentals of the stocks and leaves the fundamental anomalies of the stock market.

As stated by Kirkpatrick & Dahlquist (2010), in the selection of the stocks or securities investor focus on the past stock prices and stock volumes as base factor. In line with Mizrach & Weerts (2009), In technical analysis, prior stock price and stock volume information are key characteristics for predicting future stock returns. In this situation, investors use previous stock prices and stock volume information to make investment decisions due to the presence of availability bias.

Gambler's Fallacy Heuristics and Technical Anomalies

According to Bhattacharya (2012), the investors believe that if something has happened recently, the probability of an opposite phenomenon decreases and the probability of a similar phenomenon increases. In this situation, investor predicts future tendency of occurrence event based on past event occurred in the market. In accordance with Ceren & Akkaya (2013), when investors incorrectly forecast such a trend, they can get it into trouble. The Gambler's Fallacy is said to occur when an investor works under the perception that errors in random events are self-correcting.

Relationship of the Illusion of Control Heuristics to Fundamental Anomalies and Technical Anomalies

Read & Grushka (2011) said that when investors use the illusion of heuristic control in their decision-making process, in this situation investors may overestimate the occurrence of the kinds of event that is easily recalled by non-frequency and easily accessible in investors' self-control. When the investor makes the decision by self-control, fundamental anomalies are created by ignoring the fundamentals of the stock. Pompian (2011) said that most investors are unaware of stock value investment strategies due to the growth intention of mutual funds and ignore stock fundamentals.

Relationship of Conservatism Heuristics to Fundamental Anomalies and Technical Anomalies

As Bhattacharya (2012) states, when situations change, some investors under-react due to the natural tendency to be slow to adapt to changes. Thus, the conservatism bias is opposite to the overreaction bias.

In line with Kirkpatrick & Dahlquist (2010), in selecting stocks or securities, the investor focuses on past stock prices and stock volumes as a base factor and predicts future stocks prices by using technical analysis. Such investor behavior is why the market differs from efficient market hypothesis (EMH). According to the above arguments, investor ignores technical analysis in stocks selection.

Fundamental Anomalies and Investment Performance

Ul Abdin et al. (2017) investigated the direct impact of prospect factors on investment decisions and investment performance at the individual level. Result shows that there is a positive relationship between the fundamental anomalies and investment performance of the individual investors. The said authors (2017) explore the impact of heuristics on investment decision and performance through multiple mediation mechanism and find that fundamental anomalies have an impact on investment performance.

Technical Anomalies and Investment Performance

Ul Abdin et al. (2017) investigated the direct impact of prospect factors on investment decisions and investment performance at the individual level and found that there is no significant relationship between technical anomalies and investment performance. They (2017) explore the impact of heuristics on investment decision and investment performance thorough multiple mediation mechanism. The results of this study show that technical anomalies lead to investment performance.

THEORETICAL FRAMEWORK

Hypothesis

H1: There is a significant relationship between anchoring heuristic and investment performance.

H2: There is a significant relationship between availability heuristic and investment performance.

H3: There is a significant relationship between gambler's fallacy heuristic and investment performance.

H4: There is a significant relationship between conservatism heuristic and investment performance.

H5: There is a significant relationship between illusions of control heuristic and investment performance.

H6 (a): The higher the level of anchoring bias, the greater the production of fundamental anomalies in the stock market.

H6 (b): The higher the level of anchoring bias, the greater the production of technical anomalies in the stock market.

H7 (a): The higher the level of availability bias, the greater the production of fundamental anomalies in the stock market.

H7 (b): The higher the level of availability bias, the greater the production of technical anomalies in the stock market.

H8 (b): The gambler's fallacy has fundamental anomalies.

H8 (b): The gambler's fallacy has technical anomalies.

H9 (a): The conservatism has fundamental anomalies.

H9 (b): The conservatism has technical anomalies.

H10 (a): The illusion of control has fundamental anomalies.

H10 (b): The illusion of control has technical anomalies.

H11: Fundamental anomalies impact investment performance.

H12: Technical anomalies impact investment performance.

Operationalization of Variables

To measure the heuristic factors, we have focused on the five components of heuristics -anchoring, availability, gambler's fallacy, illusion of control and conservatism- used as independent variables (Figure 1). Two items measured the anchoring component of heuristics adopted by Ul Abdin et al. (2017). Two items studied the availability component of heuristics assumed by these authors (2017). Three items focused on conservatism scale implemented by Chitra & Jayashree (2014). Two items measured the gambler's fallacy component of heuristics endorsed by Kudryavtsev et al. (2013). Three items measured the illusion of control heuristic scale used by Ullah (2015). In this research, the investment performance is utilized as a dependent variable. Investment performance has been measured through the three items used by Ul Abdin et al. (2017). In this research, there are two fundamental and technical stock market anomalies used as mediating variables. Three items are focused on measuring the fundamental anomaly and two items used to measure the technical anomalies used by Ul Abdin et al. (2017).

RESEARCH METHODOLOGY

This study was conducted in an unconstrained setting and is called cross-sectional because the data were collected at one point in time. It was causal because cause and effect relationships between variables are investigated.

The target population was the individual and institutional investors who invest in the Pakistan stock market. The Pakistan stock market is divided into three parts: Karachi stock market, Lahore stock market and Islamabad stock market. Data were collected through the help of brokers and stock market managers. Personally administered questionnaires were used to collect data. Moreover, some data were collected by online Google form questionnaire. The target was a total of 400 respondents, of which 250 responses were retrieved. The questionnaire was composed of 21 items on a five-point Likert scale. A convenient sampling technique was used. Questionnaires from different researchers were adopted. The questionnaire used contains two sections: the first, 21 statements used to measure the constructs in five-point Likert scale, and the second, descriptive information.

The data were analyzed with SPSS software. Factor analysis, reliability analysis, t-test, ANOVA and multivariate analysis were performed.

Table 1 indicates that the Cronbach's alpha value of all variables is greater than 0.6 and the F-test also shows the significance for each factor used in this study (Shah et al., 2018). These results show that all items used in the variables are reliable for further analysis.

RESULTS AND DISCUSSION

Table 3 presents the correlation analysis between the variables. The results indicate the correlation coefficient for eight variables. The correlation results show that each variable is correlated with each other because the value of correlation coefficient is on (r =1). The output shows that anchoring heuristic is negatively related to technical anomalies with coefficient correlation of r = -.001 which is significant at p<0.05. This means that anchoring heuristics increase, and technical anomalies decrease. Anchoring heuristics are positively related to availability, conservatism, illusion of control, fundamental anomalies, and investment performance.

This means, in turn, that increasing the anchoring heuristic also increases these all variables. The output shows the availability heuristic positively correlated with anchoring, conservatism, illusion of control, fundamental anomalies, and investment performance. The output demonstrates that conservation positively correlated with availability, illusion of control, fundamental anomalies, and investment performance. The gambler's fallacy correlates negatively with technical anomalies with a coefficient correlation r = -.072 with a significance of p<0.05. Illusion of control is positively correlated with anchoring, availability, conservatism, gambler fallacy, technical anomalies fundamental anomalies and investment performance.

Fundamental anomalies correlate positively with anchoring, availability, conservatism, gambler's fallacy, illusion of control technical anomalies and investment performance. Technical anomalies correlate negatively with anchoring and gambler's fallacy, and positively with availability, conservatism, illusion of control, fundamental anomalies, and investment performance. Fundamental anomalies are positively correlated with availability, conservatism, illusion of control, anchoring, gambler's fallacy, and investment performance.

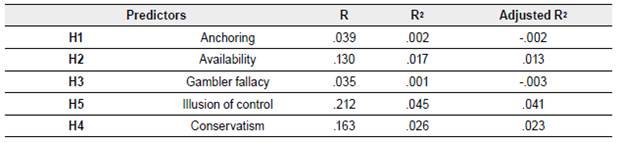

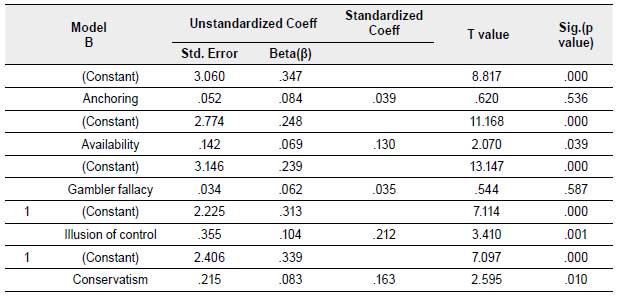

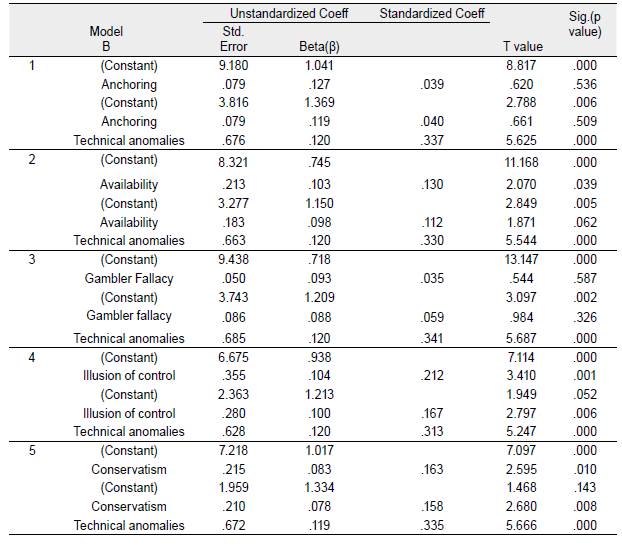

The output shows that there is an insignificant relationship of anchoring to investment performance with significance value of >0.05. So that H1 is rejected. It means that investment performance does not change due to change in anchoring heuristic. Availability heuristic has a positive and significant relationship to investment performance with the beta (β) value at .130, value of t =2.07 and significance level of < 0.05, and the value R2 =0.017 expresses that investment performance 1.7% changed due to change in availability heuristics. Hypothesis (H2) is accepted. It means investment performance changes due to change in availability heuristic. The output indicates that there is an insignificant relationship of gambler's fallacy heuristic to investment performance with significance value of >0.05. So that H3 is rejected. It denotes that investment performance does not change due to change in gambler fallacy heuristic. Illusion of control heuristic has a positive significant relationship to investment performance with the (β) value .212, value of t =3.41 and significance level of < 0.05 and R2 = 0.045. It means that investment performance 4.5% changes due to change in illusion of control heuristic. Hypothesis (H4) is accepted. Meaning that investment performance changes due to change in availability heuristic.

Conservatism heuristic has a positive and significant relationship to investment performance with the (β) value at .163, value of t =2.595 and significance level of < 0.05, and R2 = .0.026 indicates that investment performance 2.6% changes due to change in availability heuristic (Table 5).

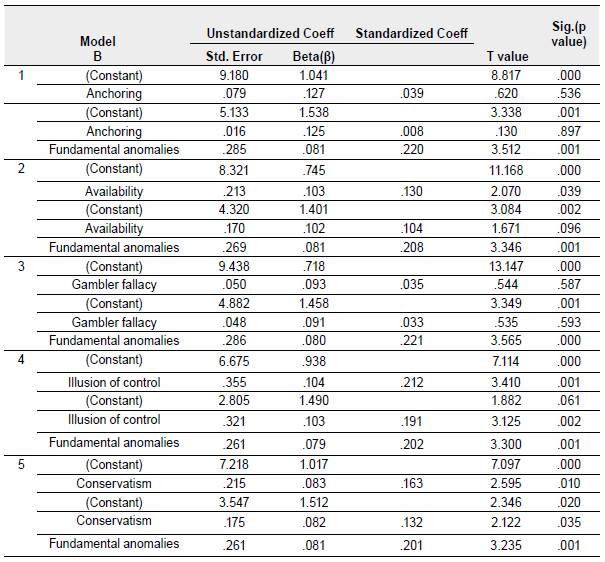

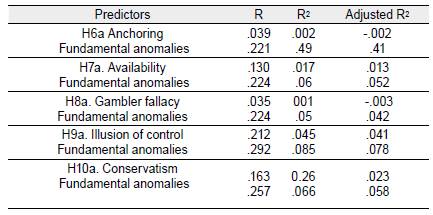

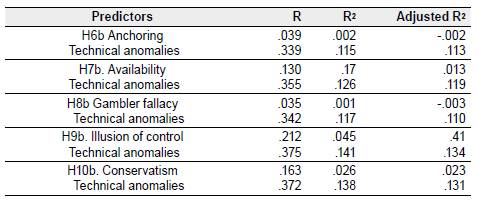

Results of the Regression Analysis of Mediation

Results in tables 6 and 7 indicate that there is an insignificant indirect relationship between investment performances and the anchoring heuristic through fundamental anomalies with a significance value greater than 0.05. The indirect relationship between availability bias and investment is insignificant across fundamental stock market anomalies with a significance value greater than 0.05. The indirect relationship of the gambler's fallacy is insignificant with a significance value greater than 0.05. The output shows that there is indirect positive relationship between conservatism and investment performance through fundamental stock market anomalies (R2 =0.066 significance level >0.05). It shows that 6.6% changes in investment performance through fundamental stock anomalies. The result indicates that there is indirect positive relationship between illusion of control and investment performance through fundamental stock market anomalies (R2 =0.085 significance level >0.05). It means that 8.5% changes in investment performance through fundamental stock anomalies. The result of the above table shows that H9a and H10a are accepted and H6a, H7a and H8a are rejected.

The result demonstrates that there is an indirect positive relationship between conservatism and investment performance via technical stock market anomalies (R2 =0.138 significance level >0.05). It means that 13.8% changes in investment performance through technical stock anomalies. The result indicates that there is an indirect positive relationship between illusion of control and investment performance via technical stock market anomalies (R2 =.141 significance level >0.05). It suggests that 14.8% changes in investment performance through technical stock anomalies. The result shows that anchoring, availability, and gambler's fallacy do not produce technical anomalies of the stock market affecting the investor's investment return with a significance value greater than 0.05. The result shows that H9b, H10b are accepted and H6b, H7b, H8b are rejected.

The result of mediation regression shows that conservatism and illusion of control impact on investment performance by producing fundamental and technical anomalies of the stock market. Anchoring, availability, and gambler's fallacy do not influence investment performance through the involved technical and fundamental stock market anomalies.

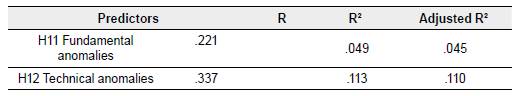

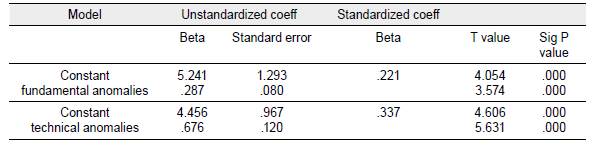

Results of Regression Analyses of Stock Market Anomalies for Investment Performance

The output shows that a positive and significant relationship of fundamental anomalies to investment performance with (β) value at .287 at significance level of .000. R2 = .049 that means 4.9% investment performance changes by changing in fundamental anomalies, and therefore, H11 is accepted. The output indicates that positive and significant relationship of technical anomalies with investment performance with (β) value at .676 at significance level 0.000. R2 = .113 shows that 11.3% changes in investment performance due to change in technical anomalies, and therefore, H12 is accepted.

FINAL DISCUSSION

Regression results of dependent and independent variables show that there is a significant positive relationship between availability heuristic, illusion of control bias and conservatism heuristic to investment performance. It indicates that the involvement of these heuristics in investment decisions influences individual investor's overall investment performance (Venkatapathy & Sultana, 2016). The findings show that there is no significant impact of anchoring bias on investment performance. This finding is consistent with the result from Ul Abdin et al. (2017). The results show that there is a significant impact of availability bias on investment performance. This finding is consistent with the result from Alrabadi et al. (2018) and Javed et al. (2017). The result further determines that the illusion of control bias has a positive significant impact on investors' investment performance. This result is in line with the indications documented in studies such as that of Bashir et al. (2013). In addition, conservatism bias has a significant impact on investors' investment performance which is consistent with the conclusions of Bakar & Yi (2016) and Zhang et al. (2015). The study result shows that anchoring and gambler's fallacy bias do not affect the individual investors' overall investment performance. In the mediation regression result, conservatism and illusion of control produced fundamental and technical stock market anomalies and affected investors' investment returns through fundamental and stock market technical anomalies. The findings show that conservatism bias is significantly linked with fundamental analysis. This result is in line with the indications documented in Bhattacharya's studies (2012). The findings show that conservatism bias is significantly linked with technical analysis. This result is consistent with the indications documented in Shen & Loh's studies (2004). Our study result indicates that anchoring bias, availability heuristic and gambler's fallacy do not produce stock market fundamental anomalies; it means that these variables do not influence investment performance by stock market fundamental anomalies, and that anchoring bias, availability heuristic and gambler's fallacy bias do not produce stock market technical anomalies, indicating that these variables do not influence investment performance by stock market technical anomalies.

CONCLUSIONS

Our study result indicates that stock market fundamental and technical anomalies have influenced individual investors' investment performance. The findings show that there is a significant impact of fundamental anomalies on investment performance. This finding is in line with the result of Ul Abdin et al. (2017).

The study draws an overview of the impacts of behavioral factors on the investment performance of individuals and the mechanism of mediating stock market anomalies in the Pakistan stock market. This study is based on behavioral finance approaches, which differs from the previous studies in Pakistan mainly based on traditional finance. This research is one of the few studies on the factors influencing stock market investment decisions in Pakistan using behavioral finance. In addition to individual investors, who can directly benefit from the findings of this study, securities organizations can use these findings as a reference for their analysis and prediction of stock market trends. Corporations, which raise capital from shareholders, can use the findings of this study to make good decisions to attract investors to buy their shares.

This research has several limitations that can be addressed in future research. First, this study only focuses on the impact of heuristic factors on investment performance. There are many other factors, such as perspective factors and market factors, that generate anomalies in the stock market and disrupt overall investment performance. Second, the measurement scale of this study contains two to four items to measure a variable. Future research should increase the scale items in the study. The third limitation is the small sample size. In this study, 250 respondents were used for data analysis in order to increase the sample size and obtain more accurate results. Fourth, another limitation is that in this study only the reliability test and, subsequently, the construct validity test were used. Fifth, an additional limitation is that SPSS software was used in this study for data analysis, but Amos or smart Pls software could be used in future research or in the extension of the same research.