INTRODUCTION

As an emerging open economy, Turkey depends heavily on foreign trade, particularly on imported raw materials. Simultaneously, in the last decade, it experienced a depreciation of the currency, leading to a sharp impact not only on foreign trade but also on the entire economy. To understand the dynamics of the Turkish economy, it is crucial to examine how the labor market, as part of the economy (especially the employment in manufacturing industries), is affected by the fluctuations of the exchange rate.

In this laissez-faire economy, generally, the exchange rate plays a crucial role as it determines the path of exports and imports and also the output of the economy. Depreciation of a currency makes domestic goods more affordable for foreigners, and it accelerates the volume of exports. Imports, on the other hand, tend to fall upon such depreciation. Depreciation inflates prices in the local market as imports, such as energy commodities (e.g., oil and gas), become more expensive, negatively affecting imports but improving exports. Therefore, the exchange rate has a strong net first hand impact on foreign trade and the entire economy thereafter.

As we observe, Turkey has experienced a severe depreciation in the last decade. The exchange rate jumped from 1 USD = 1.74 Turkish Lira (TL) in January 2008, to 5.76 TL in April-2019. The significant amount of depreciation became approximately 380% (TCMB, 2019). This kind of volatility in the exchange rate severely affected the real economy of Turkey. Consequently, the labour market, that plays a significant role in the Turkish economy, is also gets affected. Recently, Turkeys labour market has had a negative impact. The latest news published by the Turkish Statistical Institute in January-2019 shows that the employment rate has decreased by 1.9% compared to the previous year. Sector-wise employment rates are 17%, 19.90%, 5.40%, and 57.7% in agriculture, industry, construction, and service sectors, respectively. Moreover, employment in agriculture and the construction sector has decreased by 0.7% and 1.6%, respectively, while the industry sector employment rate remained constant. However, the service sector gained more employment than the previous year (Turkey Statistical Institute, 2020). Despite the constant employment in the industry sector, the industry-level analysis reflects a downward employment trend in some sectors. Hence, the primary challenge is to determine the effects of the exchange rate and its economic consequences, especially on employment and wage. Besides, the terms of trade, i.e., the ratio of export to import, has noticeable impacts on output and subsequently on employment and wage. Thus, the exchange rate and the terms of trade are two major economic indicators in the context of an open economy that require scientific investigation to analyze their effects on employment and wage.

These diversified channels drive further to examine the relationship between exchange rate and employment.

In this empirical research, using quarterly data from 2010 to 2017, we will address four core questions. Firstly, how do the fluctuations in the exchange rates impact employment and wages in the Turkish manufacturing industry? Secondly, how would international trade affect employment and real wages? Thirdly, how the effect of the top 25% larger industries on employment and wages, considering the terms of trade, will be analyzed? Lastly, how will the interaction between the exchange rate and the top 25% of larger industries affect employment and wages?

The research uniquely reveals that the interaction between currency appreciation and the top 25% larger industries indicates a moderate increase in employment. Furthermore, the appreciation of the domestic currency causes employment to decrease at the industry level.

The entire paper is outlined in five more sections. The second section presents the detailed literature review related to exchange rate, terms of trade and employment nexus. The following sections present the study's theoretical foundation, followed by details of data collection and econometric methodology. Finally, section six shows the estimation and discussion of the results, followed by the conclusion section.

LITERATURE REVIEW

It is well known that the fluctuation in exchange rate results in the national income and therefore the variation in employment. The influence of the exchange rate on employment could be analyzed simply: the appreciation of currency raises the price of domestic products, which, in turn, becomes more expensive relative to foreign products because of the absence of compensation for the currency appreciation to local producers. This reduces the demand for local products; subsequently, domestic producers will be less competitive in the market. As a result, it contracts employment in the domestic market (Branson & Love,1988; Goldberg et al., 1999; Demir, 2010; Gourinchas, 1998; Alexandre et al., 2011; Burgess & Knetter, 1998; Nucci & Pozzolo, 2010; Filiztekin, 2004).

Although there were many empirical studies, Branson and Love (1988), for the first time, reported a negative relationship between employment and exchange rate fluctuation. Using the US data from 1970 to 1986, they regressed the log employment on the exchange rate, controlling the other variables for every manufacturing sector separately. Their findings demonstrated that appreciation of the US dollar, between 1980 and 1985, reduced employment by around 5% in the US market. Moreover, Goldberg et al. (1999) determined the impact of the exchange rate varied to the nature of markets and industry patterns. The effect of the exchange rate was more pronounced in the manufacturing sectors than in the non-durable and non-manufacturing sectors outside of the service sector.

Furthermore, it was found that the exchange rate altered the employment of job-changing and job-switching. A worker's job-switching possibility within the same type of industries was more than the probability of job changing from different industries. On the other hand, applying the Fixed Effects Model, the Dynamic GMM method, and using the firm-level 691-panel data from 1983-2005, Demir (2010) found that the exchange rate movement has a measurable effect on the level of employment. Nonetheless, it depended on two other factors: the firm's share in output and level of indebtedness. When the firm had a larger export share in output and a higher level of indebtedness, the effect of the exchange rate was strikingly higher on employment.

This response of employment to the exchange rate is not limited to the manufacturing sector. The 1% appreciation of the exchange rate in the tradable sector also reduced employment in the US economy by 10%. The sensitivity of the exchange rate appeared more in the import-competing industries rather than export-competing industries (Gourinchas, 1998). Besides, the effects of the exchange rate were measured using the four components of the labor market, which include wages, overtime wages, employment, and overtime employment. This analysis revealed the major impacts of the exchange rate on overtime activity. In contrast, the labor market's adjustment and response to the exchange rate for other components such as wages, overtime wages, and employment were less significant (Campa & Goldberg, 2001).

The employment and wages in the lower mark-up industries are more sensitive to the exchange rate movement. In line with this study, using the Fixed-effect model and data of G-7 countries, it was found that France and Germany were less sensitive to exchange rate movement and much slower to adjust to long-run steady states due to mark-up adjustment. However, other G-7 countries, i.e., USA, Japan, Canada, the UK and Italy, swiftly responded to the exchange rate fluctuation. Similarly, to detect the long-run relationship between employment and exchange rate, Burgess and Knetter (1998) applied the panel cointegration analysis and annual data (1975-1999) from France and reported that the appreciation of national currency reduced the employment in the manufacturing sector. They also confirmed that the long-run elasticity has the expected relationship between exchange rate and employment. Furthermore, openness and productivity with the exchange rate play a crucial role to determine the level of employment, hours, and job flows. A study (Alexandre et al., 2011) employing the Portuguese data 1988-2006 from OECD-STAN bilateral trade database for 20 manufacturing sectors concluded that the more low-technology sectors exposed to international trade, the more they suffered for the exchange rate fluctuation. Subsequently, they adjusted this impact of the exchange rate through employment destruction. On the other hand, high-technology industries appeared not to be that sensitive to exchange rate shock.

The market power of firms, along with exchange rate variation magnifies the response of employment and hours. Nucci and Pozzolo (2010) reported that the firms with low-level monopoly power confronted the high-level import penetration to the domestic market. In addition, its response was more robust to the exchange rate fluctuation. For this study, the firm-level data during 19841998 were collected from the sources of the Company Accounts Data Service Reports and the Survey of Investment in Italian Manufacturing (SIM).

On the other hand, export, as one of the determinants of gross domestic product, plays a crucial role in accelerating economic development and has a meaningful impact on the level of employment. In general, the rise in export increases the gross output, and in order to maintain this level of production, more labor is needed. As a result, it generates more employment opportunities. Most of the literature finds that growth in export leads to an increase in the level of employment (Akku§, 2014; Ketabforoush et al. 2014; Erlat, 2000; Greenaway et al., 1999; Gul & Kamaci, 2012; Hao, 2011; Polat & Uslu, 2011; Tandogan, 2019). In addition, Hao (2011), in an empirical study by using the data from 1980 to 2007 in Chinese textile industries, investigated the short and long-run response of employment to rise in export, and found the positive impact of export on employment not only in the short run but also in the long run. The sort-run impact, however, was more pronounced than the long-run impact.

Similarly, applying the Fully Modified Ordinary Least Squares (FMOLS) and Vector Error Correction (VEC) model with the monthly data from January-2005 and September-2015, Aydiner (2016) explored the positive impact of export on employment in both the short and long-run. Moreover, regional-level export led to an increase in regional employment. The empirical study has covered the export and employment of two sub-regions in Turkey from 2005 to 2016, where a rise in export resulted in increasing employment at the regional level (Tandogan, 2019). The firm-level study also corroborated this positive link between export and employment in Turkey, including the top 1000 Turkish export-oriented firms. The estimation demonstrated that an increase in export by 1%, resulted in rising employment by 0.20%. Nevertheless, the labor-intensive firms responded more effectively than capital-intensive firms.

Gul and Kamaci, (2012), using evidence from developed and developing countries' data during the periods of 1980-2010 and 1993-2010, investigated the causality between international trade and employment and found the bi-directional relationship. In addition, trade openness contributed the favourable economic growth, which is certified by the study of Ahmad (2013). However, an increase in trade volume, comprising the export and import volumes of the 167 manufacturing industries in the United Kingdom during 1979-1991, reduced the labor demand since openness tended to increase the efficiency and productivity within the firms (Greenaway et al., 1999).

Table 1 Tabular form of the literature review

| Author(s) and year | Context | Nature of the study | Relationship |

|---|---|---|---|

| Hao (2011), Barro (1996) | Empirical studies were analyzing the short and long-run effects of the textile industry’s export on employment in China from 1980 to 2007. | Empirical study | +ve |

| Tandoğan (2019) | The empirical study covers the export and employment of two sub-regions in Turkey from 2005 to 2016. | Empirical study | +ve |

| Akkuş (2014) | The research based upon data from 2003 to 2010 from the Turkish manufacturing sector and incorporating the variables of international trade and productivity assesses the change in employment. | Empirical study | +ve |

| Aydiner (2016) | Including the top 1000 Turkish-export firms, it estimates the effect of export and non-export sales on employment | Empirical study | +ve |

| Erlat (2000) | Dividing the import substitution and export orientation regimes into four sub-periods from 1969 to 1996, it analyzes the net-export effects on employment | Theoretical with empirical justification | Pre-1980:+ve, Post-1980: no effect |

| Greenaway et al. (1999) | This empirical assessment using the 167 United Kingdom manufacturing industries from 1979-1991 estimates the impacts of terms of trade on employment. | The Dynamic Panel Framework | -ve |

| Gul & Kamacı (2012) | Using the developed and developing countries’ data from the periods of 1980-2010 and 1993-2010 correspondingly, it examines the relationship between international trade and employment. | Empirical Study | Causality |

| Polat & Uslu (2011) | The impacts of international trade are being investigated using the data from 1992 to 2001 for 95 manufacturing industries. | Theoretical with empirical justification | +ve |

| Polat et al. (2011) | The study estimates the impact of foreign trade on employment including 22 Turkish manufacturing industries during 2003-2008 | The Panel Data Analysis | No effect |

| Ketabforoush et al. (2014) | This analysis using the data of 1976-2005 found the relationship between export and employment | Autoregressive- Distributed Lag Model | +ve |

| Pashtoon (2018) | This empirical study applying ARDL model focuses on Afghanistan from 2004 to 2016 | Empirical Study | No effect |

Although numerous studies reported that foreign trade has either positive or adverse effect on employment, several studies focusing on Turkish manufacturing industries concluded that the terms of trade, particularly export, has no noticeable effect on employment (Erlat, 2000; Polat et al., 2011; Polat & Uslu, 2011). Another empirical analysis of 22 Turkish manufacturing industries (2-digit NACE Rev classification) also explored that foreign trade has no impactful role on employment, while production positively influences employment, and wages adversely affect employment ( Polat et al., 2011).

On the other hand, the industry level analysis covering 95 Turkish manufacturing industries with theoretical justification concluded that export in the current cycle had no assessable impact on employment; however, the lagged value of export represented a statistically meaningful positive relationship with employment (Polat & Uslu, 2011). Likewise, focusing on two different economic regimes (a pre-1980 period defined as an import substitution industrial policy and a post-1980 export-oriented period), an increase in export had a considerable impact on employment in pre-1980. However, the export post-1980 had no notable effect on employment. A rise in exports mediates a drastic reduction in employment as a buffer, even though there was no effect on employment from exports (Erlat, 2000).

To summarise, all the previous studies exhibit various aspects of the exchange rate, terms of trade, and employment nexus in different contexts. However, the perspective of Turkey using the latest data can make a ground-breaking contribution to the existing body of knowledge. Moreover, the foreign trade variables, productivity, efficiency, and the labour market nexus in the Turkish economy through this study will guide future research at the firm level.

THEORETICAL FOUNDATION

In principle, the exchange rate shock through the demand and supply channels affects real production. In demand networks, currency appreciation makes domestic manufactured goods more expensive. As a result, exports face more competition in the international market at a higher price, reducing the demand for domestic goods. It would eventually drag down domestic production and costs. Such reduction in production affects the demand for labour, which has an impact on the level of employment. There are, of course, many other factors that affect the employment level in an economy; empirical studies by Branson and Love (1988); Goldberg et al. (1999); Demir (2010) ; Gourinchas (1998); Alexandre et al. (2011); Burgess and Knetter (1998); Nucci and Pozzolo (2010); Filiztekin (2004) indicate the nexus between currency appreciation and the level of employment. In this context, we use a simpler version of Dincer and Kandil (2011), who proposed the demand and supply model.

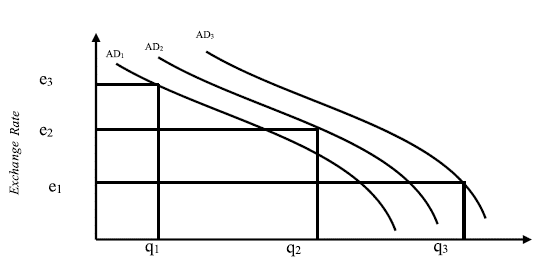

An assumed economy where the initial exchange rate and domestic demand prevail respectively at points e2 and q2 on the AD1 (aggregate demand) curve provides a scenario in figure 1. After a shock of the exchange rate, which refers to currency appreciation, it shifts from e2 to e3; the domestic production would become costly on the foreign market, thereby facing competition and reducing the demand for such goods. As a result, higher prices are constraining domestic production. Thus, the change in exchange rates from e2 to e3 eventually shifts downward the aggregate demand curve from AD2 to AD1 and decreases domestic demand from q2 to q1. Therefore, more currency appreciation would bring down further domestic demand. Conversely, currency depreciation, which changes the exchange rate from e2 to e1, will shift the aggregate demand curve from AD2 to AD3. This change makes the domestic products cheaper and competitive in the international market, paving the way for an increase in domestic production from q2 to q3.

On the supply side, the shock of the exchange rate, which means the appreciation of the currency, avails the imported products in the local market at a cheaper cost. The cost of production would be reduced; therefore, the domestic output would be increased.

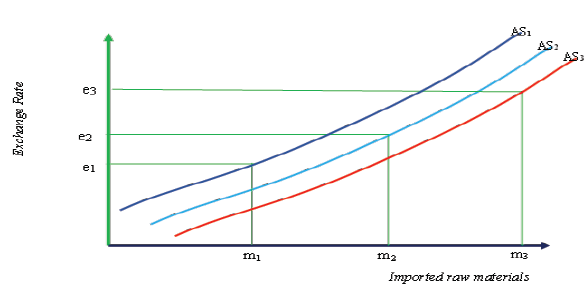

In an emerging open economy, the initial exchange rate at e2 imports raw materials m2 amount. The appreciation of currency moves the exchange rate from e2 to e3 and this move lessens the price of imported raw materials in the domestic market. Therefore, the use of imported raw materials in local production would continue to increase. Finally, this change in the exchange rate will increase the availability of imported raw materials, that is to say, from m2 to It would minimize the cost of production, which could trigger the level of employment; however, the change depends on the mixture of production materials. The heavy dependence on the imported raw materials could lower the cost of production, which maximizes the overall production in currency appreciation. Nevertheless, the dominance of domestic raw materials in production might raise the prices. As a result, the rising prices may bring down the demand for goods for higher prices, thus lowering domestic production. On the other hand, a change in the exchange rate from e2 to e, depreciating the local currency lifts the expense of imported goods in the domestic market. The lifting expense on imported goods shifts the aggregate supply leftward from AS2 to AS, and results in a declining the supply of imported goods to mL (See figure 2).

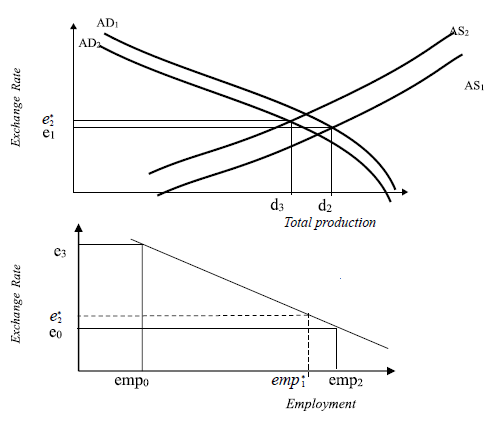

Both the demand and supply curves will interact to decide the production level. Achieving an equilibrium point will depend on the speed of adjustment, which is determined by the elasticity of demand to exchange rate and price elasticity of supply. Here, in figure 3, the exchange rate e1 determines the production level d1 at an initial equilibrium point. In the case of the Turkish manufacturing industry, the appreciation of currency reduces the export, and it shifts the aggregate demand curve downward to AD2.

In terms of supply, the appreciation of the currency, in theory, increases the supply of imported raw materials; nevertheless, in our study, it scales down the imports of raw materials, which shifts the aggregate supply curve leftward from AS1 to AS2, not rightward. The reduction in demand for export also decreases the supply of raw materials because the elasticity of demand to exchange rate fluctuation is higher than the price elasticity of supply.

Furthermore, export and import are heavily dependent on each other. The imported raw materials are used in the production of exported goods, so a reduction in export triggers a fall in the import of raw materials in the quantity of imported raw materials. This conceptual framework is supported by the empirical studies of Dincer and Kandil (2011); Erlat (2000); Filiztekin, (2004).

In brief, currency appreciation reduces domestic production from q2 to q3 which subsequently decreases the demand for labour. Finally, it shrinks the employment from emp3 to emp2 Even though currency appreciation reduces employment, it is not a substantial amount and is not statistically meaningful.

DATA COLLECTION

The data used for this study come from manufacturing industries. The data have been collected from two sources: the Turkish Statistical Institute and Central Bank of the Republic of Turkey (CBRT). Employment, gross wage, and salary, export and import index, and inflation are industry-specific index data obtained from the Turkish Statistical Institute and the exchange rate index from CBRT. It comprises the quarterly index data from 2010 to 2017 with the base year 2010. There are 19 two-digit manufacturing industries (ISIC Rev 4 classification) compiled in our data set.

METHODOLOGY

This study applies the conventional econometric model to account for the exchange rate effect on employment and the real wage.

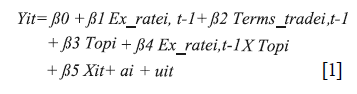

Yit is denoted as employment and Ex_rate is the real effective exchange rate. The Terms_trade refers to the ratio of export to import, while the Topi represents the 25% larger industries in respect of Terms_trade as a dummy variable equal to one. We also employ the interaction terms between the exchange rate and the top 25% of more prominent industries because the larger exporters simultaneously become the larger importers (Amiti et al., 2014). Hence, we want to investigate how larger industries affect smaller industries differently in employment. X is the control variable. Furthermore, ai is the unobserved industry-specific effect and µit is the error term.

Z as a dependent variable represents the real wage in the second model.

Before carrying out the panel regression, some econometric requirements must be met. First, the properties of the cross-section and the time series must be considered. We investigate the cross-section dependence test by employing the Pesaran (2004). The tests reject the null hypothesis of no cross-section, confirming that there is cross-section dependence in this data (see Table 3 Cross-Sections Dependence Tests). Also, the first-generation unit root tests, Hadri LM and IPS, are used to evaluate the properties of the time series (Hadri, 2000; Im et al., 2003). While Hadri's LM test has the null hypothesis of no unit root to account for heterogeneity and individual deterministic trend, the IPS unit root test shows that all individual series in the panel have unit-roots (Hadri, 2000, Im et al., 2003). Both tests show that the panels have unit-roots. So, the pooled OLS is not allowed because of the time trend, which would provide a spurious regression. In addition, Pesaran (2007) suggested a simple unit root test in light of the potential cross-sectional dependency and serially correlated errors. This method is for the individual series, using ADF regression, where the mean of the current and lagged cross-section is taken. Hence, CIPS (Pesaron, 2007) and Za SPC and Za LA tests (Hadri & Kurozumi, 2012) are also investigated for second-generation unit root test. The advantage of second generation test over the first-generation test is that it considers the cross-section correlation (Guloglu et al., 2012). In this study, we apply the unit root tests to variables and also to individual industries, as well as overall industries. CIPS and Za SPC and Za LA deliver the conflicting results of unit root testing, which refers to the different order of integration. Thus, for the cointegration test, Westerlund (2008) offered an approach in which the null hypothesis is no cointegration against the alternative hypothesis of cointegration. It results in the existence of cointegration.

In this empirical study, the earlier tests verified the cross-section dependence, unit root, and cointegration (see Table 3 Cross-Sections Dependence Tests, Table 4 CADF Statistics for Each Country, Table 5 CIPS Statistics for All Industries, Table 6 Hadri LM & IPS Unit Root Test, Table 7 Second Generation Unit Root Test, Table 8 Cointegration Test).

The data provides that it has cross-section dependence with unit root and cointegration. In this context, Fixed and Random Effect Models are suitable for this empirical study; however, the Fixed Effect Model is applied because the cross-section is smaller than the time series, while the random effect model is preferable for the whole population (Wooldridge, 2012). In addition, we use the one-way fixed-effect test to check the individual or industry effect in this model, as suggested by Baltagi (2005). Assuming the time effect in this model, for the existence of the individual effect, we will test the null hypothesis that the unobserved individual effect is equal to zero.

H 0 : µ 1 = . . . = µ n-1 , = 0, here N= 19 industries allowing λt = 0 for t = 1, . . . , 32 - 1

In this case, the null hypothesis is rejected, and it indicates the individual effect verified by the One-way Fixed-Effect Test.

RESULTS AND DISCUSSION

In this empirical study, two models are used to find the effect of the exchange rate on employment and wages. The first model is applied to explore the response of employment to the change in the exchange rate and its interaction with the top 25% larger industries in respect to terms of trade. Similarly, the response of wage to exchange rate is accounted for using the Fixed Effect Model. Industry fixed effect models are applied to decide the response of the real wage to capture the effect of the exchange rate (currency appreciation) and the terms of trade.

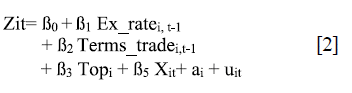

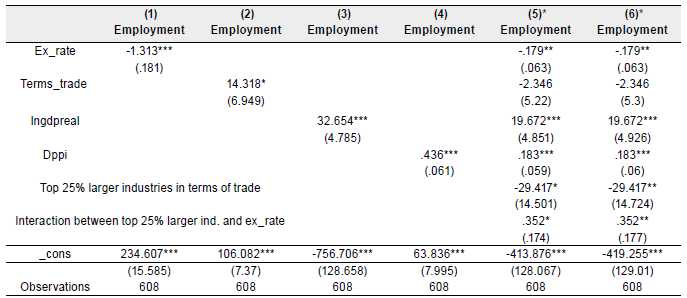

Table 10 summarizes the impact of the exchange rate on employment. Columns one to six show the regression model using the multiple form variables and analyzes how changes in the explanatory variables affect the level of employment. The values within the brackets represent the robust standard deviation. The star at the top of the coefficients estimates the significance level. In column 1, the response of employment to changes in the exchange rate is notably negative; the rise of the exchange rate substantially reduces the level of employment until quarter one, i.e. three months. As Alexandre et al. (2011) find, the lag of the exchange rate has an impact on employment in the current period; their empirical research similarly uses one lag that justifies our findings.

Likewise, the effects of the terms of trade on employment reflect the impact up-to lag one, which is corroborated by the study of Polat and Uslu (2011). In their empirical research, using annual data, they demonstrated that export lag has a marked impact on current employment. In comparison, it is observed that log GDP and inflation, as control variables, have a grater impact on employment in columns 3 and 4. To justify our variables in the models, we use the Fixed Effect models in column 5 and the Random Effect model in column 6.

Both models show a similar relationship pattern and value of coefficients that verify our findings.

The terms of trade are defined as the export volume to import volume ratio. In this regard, a one-unit increase in terms of trade denotes either rise in export or a reduction in imports. The source of employment impact derives from the export shock, not the import shock in this study. The terms of trade lead to a substantial increase in the level of employment. On the other hand, GDP and inflation are used as control variables. Both inflation and GDP have a strong association with employment (Akcoraoglu, 2010; Karahan et al., 2012). The one per cent growth of GDP increases the level of employment by about 20%. Moreover, an increase in inflation by 1% raises employment by 0.15%. The GDP shows a more pronounced effect on employment than inflation.

The full model also presents that the appreciation of the Turkish Lira is seen to have a negative association with employment but is insignificant in our study. This finding is supported by the studies of Branson and Love (1988); Goldberg et al. (1999); Demir (2010). Furthermore, the terms of trade positively affect employment. This influence derives from the export volume, not from import volume. A rise in export contributes to a substantial increase in employment. However, terms of trade in the column-five model do not show any significant relationship, with a robust standard deviation. This finding is corroborated by the studies of Erlat (2000); Polat et al. (2011); Polat and Uslu (2011).

However, in contrast to smaller industries, larger industries regarding terms of trade have a more rigorous negative effect on employment. Top 25% of larger industries decrease employment levels by more than 27.32% compared to smaller 75% industries. The reason behind this pronounced effect is that, as Amiti et al. (2014) argued, the bigger exporters are at the same time, the bigger importers. While larger industries produce the exported goods using the imported input, the benefit of a high-level of export on employment is outweighed by the heavily imported inputs. In addition, Turkish manufacturing industries are heavily dependent on imported inputs (Filiztekin, 2004). Thus, these arguments justify the fact that larger industries reduce employment more than smaller ones.

On the other hand, the interaction between the exchange rate and larger industries increases employment levels. Since the currency appreciation makes the imported inputs cheaper, the bigger industries would get benefit from using this cheaper imported input in production. As a result, this interaction term increases the level of employment.

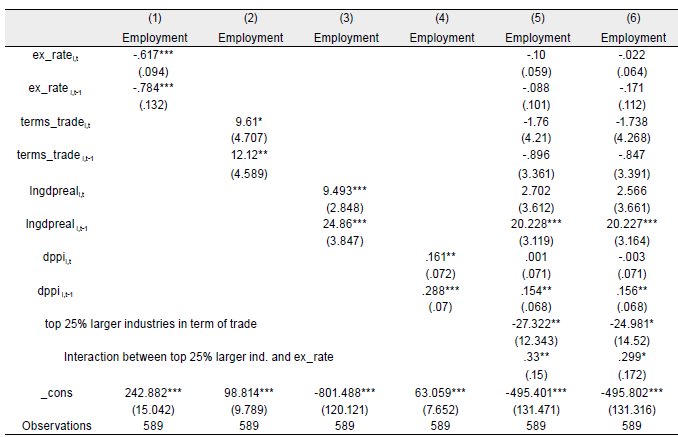

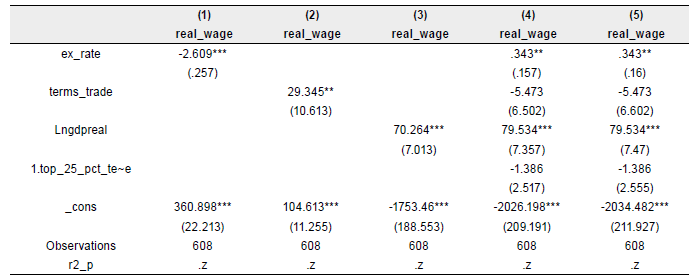

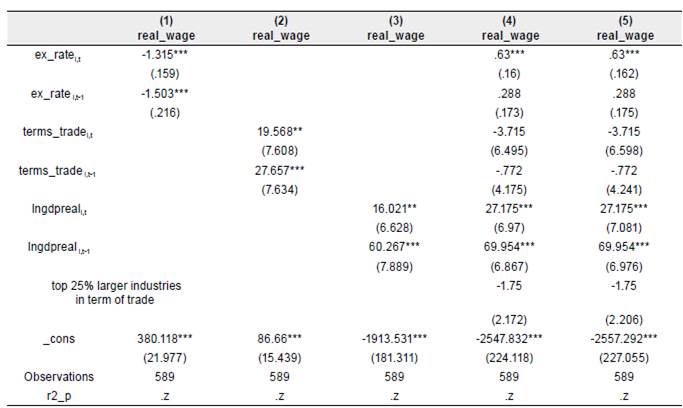

The second model of the study (Table 12 Real Wage Model with Lag) outlines briefly how the exchange rate influences the real wage. Here, the models in columns up to 3 explain the individual variable impact on real wage. The full model is explained in columns 4 and 5, in which the Fixed Effect and Random Effect models are used, respectively. The currency appreciation has a positive effect on real wages. One percent increase in the exchange rate raises the real wage by 0.63% in the current period. It is supported by the study of Filiztekin (2004). At one lag which is after one quarter, there is no significant exchange rate relationship on real wage. While the response of real wage to exchange rate movement is positive, the terms of trade do not reflect any significant influence on real wage. The log GDP is used as a control variable in column 3. The link between GDP and real wages is exceptionally positive. Better economic conditions tend to increase the real wage. Therefore, the higher output raises the demand for labor and eventually raises the real wage for labor.

CONCLUSION

This study focuses on the impact of the exchange rate on employment and real wage in Turkish manufacturing industries using the quarterly data from 2010 to 2017. It entails nineteen manufacturing industries where the exchange rate contains the value of the real effective exchange rate, and the export volume-to-import ratio is the terms of trade. The study shows that the exchange rate fluctuations referring to Turkish Lira appreciation have a negative, however, negligible effect on employment, whereas it has a highly positive impact on real wage. By contrast, the exchange rate variation has a more pronounced effect on real wage than on employment. On the other hand, the terms of trade have no substantial influence on employment and the real wage. Nonetheless, with respect to terms of trade, the top 25% of the larger industries have a negative impact on employment due to the heavy reliance of the larger exporting industries on imported inputs. However, the interaction between currency appreciation and the top 25% larger industries increases employment moderately. The study provides insight to policymakers to take into consideration the sensitivity of larger industries, which are more responsive to the changes in currency appreciation. Despite the fact the findings described above, the scope of the study is limited to nineteen Turkish manufacturing industries without distinguishing the characteristic of rural and urban manufacturing industries. The heterogeneity within the industries is also not considered. Using the firm-level data could reflect a more accurate relationship between the variables; however, we employed sectorial level data in this research. For future research, micro-level data, market exposure and factor intensities could be considered to explore the effects of openness and export intensity on employment levels.