INTRODUCTION

Fintech has been of growing interest to the scientific community, because it has had a significant transformation in its implementation in the financial field; however, as mentioned by Gomber et al. (2017), digital finance encompasses a wide range of new financial products, financial businesses, finance-related software, and new forms of communication and customer interaction, offered by fintech companies and innovative financial service providers. Therefore, it is necessary to investigate the knowledge contributions to the different levels of fintech and start-up research with which it is possible to observe knowledge gaps that support new lines of research for the academic community.

Technology applied to the financial field has generated importance over time for its large-scale positive impacts as it optimizes various processes related to user interaction and finance. According to Takeda and Ito (2021), the term fintech first appeared in the early 1990s and defines certain characteristics of fintech:

Leverage disruptive technologies, such as those of the Fourth Industrial Revolution, in the financial services sector.

Use technology (IT) to improve the quality of financial service delivery.

In recent years, there has been a focus on financial literacy and education.

It is the delivery of financial and banking services driven by software and algorithms.

Fintech brings different benefits related to different segments; however, one of the main challenges are regulation and financial literacy, as well as Zavolokina et al. (2016) mention that changes in such regulations can have a positive influence encouraging innovation, or a negative influence, challenging the financial sector players such as traditional banking institutions and stock exchanges around the world.

Zarrouk et al. (2021) conducted a logit modeling study to identify the main economic factors affecting the sustainability of fintech ventures in Saudi Arabia. This study proposes an instrument that is used to evaluate the hypotheses of sustainability of the ventures and small businesses responsible for financial services supported by information technology.

Medina et al. (2023) stated that fintech is considered as an indicator of economic recovery for SMEs and start-ups in the face of the negative scenarios caused by the COVID-19 pandemic. In light of the above, it is imperative to recognize that the pandemic has accelerated the adoption of technological platforms and services in organizations, allowing them to move to fintech services to manage their processes.

This article aims to help fill the knowledge gap by conducting a systematic literature review using the PRISMA protocol, complemented by the academic Tree of Science algorithm, on the relationship between fintech and startups. This study synthesizes the existing literature of previous academic work, develops trends for research on fintech and start-ups, and identifies avenues for future research.

This research reviews and contributes to the literature on fintech applications in the context of start-ups, in three main ways. First, the literature review provides four categories of fintech applications in start-ups (business financing, innovation and financial information, financial technology and finance and regulation). Secondly, the use of hybrid Tree of Science (ToS) and Bibliometrix scientometric techniques to improve the results under the PRISMA protocol, and thirdly, the use of fintech as management and business models for the development of incipient companies from an approach of sustainable competitive advantage.

The relevance of the relationship between knowledge and innovation for start-ups has attracted the interest of researchers from different fields, such as strategic management, fintech, innovation and entrepreneurship. Previous studies have focused on human resource management and innovation (Seeck & Diehl, 2017 ); open innovation using knowledge management as a lens (Natalicchio et al., 2017); identifying market, legal and regulatory knowledge as key success factors for environmentally sustainable product innovation (De Medeiros et al., 2014); the influence of knowledge management processes on innovation; and barriers to tacit knowledge transfer that affect supplier innovation capabilities in buyer-supplier collaborations (Sikombe & Phiri, 2019). Other studies focus specifically on start-ups teams (Klotz & Lynch, 2014), the internationalization of start-ups (Andersson et al., 2014), venture capital financing (Wallmeroth et al., 2018), and university spin-offs (Villasís-Keever et al., 2018).

This article is organized as follows. After the Introduction, the PRISMA protocol review procedure used in this study is presented. Immediately, the results of the systematic literature review are shown. The next section provides an in-depth analysis and discussion of the results obtained. Based on the results of the systematic literature review, the subsequent section identifies the knowledge gaps, and, finally, conclusions are presented.

RESEARCH METHODOLOGY

Fintech and start-ups is a topic that is in a growth phase due to the new emerging technologies that are changing the world of finance and the market as the impact on start-ups. Zarrouk et al. (2021) state that the emergence of fintech is critical to the growth of innovation, the stimulation of the economy, the facilitation of collaboration and the improvement of competition in emerging start-ups.

The present methodology recognizes the methodological contribution of the state of the art of fintech developed for the Colombian context, since it allows to observe the particularities of Colombia compared to Latin America during the COVID-19 pandemic (Medina et al., 2023).

For this reason, this study proposes a SLR PRISMA with software tolos to complement the systematic literature review in order to find the trends of fintech and start-ups for decision making based on data for future lines of research. The search methodology proposed by Yepes-Núñez (2021) makes it possible to conduct a systematic literature review that explores the relationship between fintech and start-ups. On the other hand, the methodology proposed by Kitchenham (2012) is based on the PRISMA scheme for the systematic literature review of software engineering.

Definition of Research Question

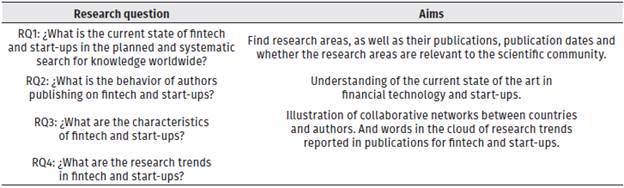

In this step, the research questions are defined to get a detailed view of the topic. The research objectives are i) to discover trends in fintech and start-up chain ii) to classify fintech and startups iii) to identify fintech and start-up research cooperation networks iv) to analyze fintech and start-ups in research opportunities in trends. Table 1 shows the research equations.

In Table 1, four questions were asked. Objective 1 has an SLR question where multiple studies are collected and analyzed through a systematic process related to RQ1; Objective 2 is linked to RQ2, and Objective 3 is related to RQ3 and RQ4.

Search

In this stage, articles are collected from the following databases: WoS, Scopus, Google Scholar and IEEE Xplore. The search was conducted in January 2023. The search equation: fintech and start-ups was used. Table 2 presents the structure of the search equations for each database.

Table 2 Search in database

| Scientific database | Query strings |

|---|---|

| Scopus | Fintech and Start-ups |

| Web of Science (WoS) | Fintech and Start-ups |

| Google Scholar | Fintech and Start-ups |

| IEEE Xplore | Fintech and Start-ups |

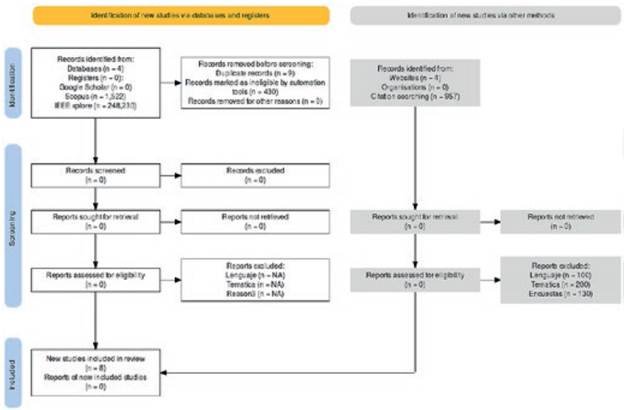

As shown in Table 2, for the construction of the equation, different academic search engines were used to have all the existing information related to fintech and start-ups. At the end of this stage, the total number of studies under review was 8 articles (Figure 1). Figure 1 shows the classification procedure of the articles found to which PRISMA protocol exclusion criteria are applied, and Figure 2 indicates the annual production from 2016 to 2021 in the four databases.

Figure 1 reveals that the number of studies with which the PRISMA protocol was used to construct the SLR is 8, once the exclusion criteria were established in the search equation. To find the articles in the Google Scholar database, it was necessary to use the Publish or Perish (PoP) software to extract the documents by items: title, abstract and authors.

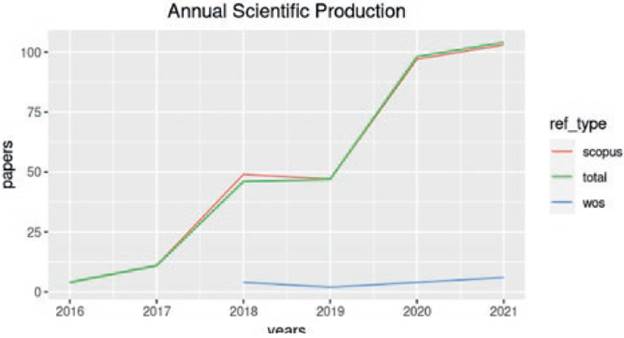

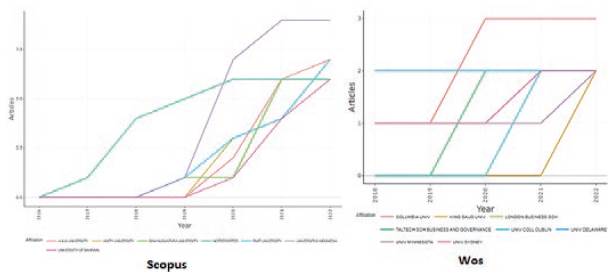

Thus, when using the ToS tool to identify the annual production of the academic community, the Scopus and WoS databases are selected for comparison as shown in Figure 2.

Based on Figure 2, the ToS tool, the most relevant academic production period from 2016 to 2021 with greater relevance in Scopus than in WoS, was selected.

Study Selection

In this step, the relevant articles that would help to answer the research questions were selected. For this purpose, a set of inclusion and exclusion criteria are defined in Table 3.

Table 3 Inclusion and exclusion criteria for relevant documents

| Inclusion criteria | Exclusion criteria |

|---|---|

| Documents demonstrating the application of blockchain in education that are part of the grey literature. | Editorial comments and opinions |

| Papers proposing feasible solutions to blockchain problems in education (method, technique, model and conceptual framework). | Documents that present surveys |

| Papers proposing solutions that have been evaluated (implemented, simulated and mathematically modeled) that are part of the grey literature. | Documents written in languages other than English |

| Documents produced in English only. | |

| Papers published in journals and conferences that are part of the grey literature | Books |

Based on the above results, we proceeded to exclude documents outside the scope of this study. Thus, only documents that met all the inclusion criteria were included, filtering the studies according to the title, abstract, and list of keywords.

Data Extraction

In this stage, the information necessary to address the research questions of this study was gathered. Therefore, the review criteria containing 9 review criteria were established and implemented in 72 documents included in this scientometric review: name of authors, title, DOI, affiliation, abstract, keywords, type of documents, language and source.

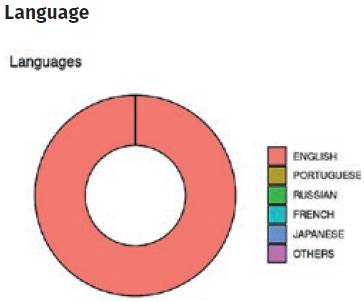

Here, the languages of scientific publications related to fintech and start-ups are identified (Figure 3).

The predominant visibility language in the articles is English.

RESULTS

The 72 articles were examined through a network analysis in the construction of the scientific tree supported by the Bibliometrix platform to answer each of the research questions. The initial search on the search equation defined in the systematic literature review was performed in Web of Science, Scopus, IEEE Xplore and Google Scholar using Publish or Perish (PoP).

The results were exported to the ToS scientometric platform, which generates a tree structure, with classic articles at the root, structural documents at the trunk, and recent documents at the leaves, thus determining subcategories by citation analysis.

The first 20 documents of the search result are exported to a file in txt format, and so on until 20 documents are found, which will be the seed of the science tree for the bibliographic analysis process, using a graph-based algorithm.

The seed data correspond to the name of the authors, name of the journal, journal edition, abstract, keywords, affiliation, country of origin, DOI and the references cited in each article; these data make it possible to classify the results to establish a category analogous to one of the parts of a tree (root, stem and leaves).

The .txt file is loaded into the R Studio Cloud software, a new project is generated and the ToS algorithm is installed, which generates a graph that is composed of nodes and edges, in which the articles or research papers are the nodes and the connections between them are the edges.

The characterization of the nodes within the network is based on two criteria; the first locates the documents with the highest degree of citation (entries); the second locates the research papers that cite the previous ones, but that at the same time are cited by other recent authors, that is, they are located between the roots and the leaves, i.e., in the trunk, thus obtaining a high intermediation in the network and will be classified as structural.

And articles that cite others in the network (root and backbone) but are not cited, will be leaves (Zuluaga et al., 2022). The perspectives of fintech and startups are constructed by citation analysis, through a clustering algorithm (Blondel et al., 2008), then the concepts that compose each perspective are identified and analyzed from text mining of the R Cloud package.

The ToS algorithm is complemented by the Bibliometrix (Aria & Cuccurullo, 2017) tool that focuses on the visualization of the behavior of the data extracted from the consulted databases.

Publication Distribution and Geographical

The distribution of the selected articles by year of publication is presented for each database in Figure 4.

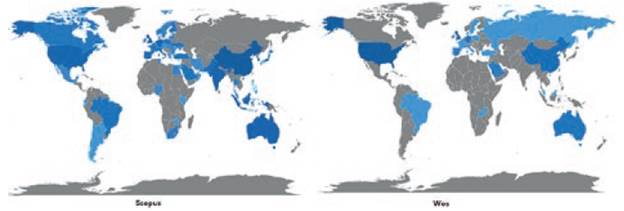

Based on the scientific production worldwide, Figure 4 demonstrates differences in the Scopus and WoS databases, as shown in the Scopus database with more than 35 countries that make up the academic community, of which China, India, Australia, the United States of America, Indonesia, Germany and Italy are the most prominent and are represented in blue, generating greater productivity for fintech and start-ups.

On the other hand, the WoS database shows 22 countries of which only the United States of America and China stand out as world leaders in terms of production in topics related to research.

Summary of Contributions

This section will illustrate the behavior of the main authors in the Scopus and WoS databases, as well as the co-citation words and clusters found.

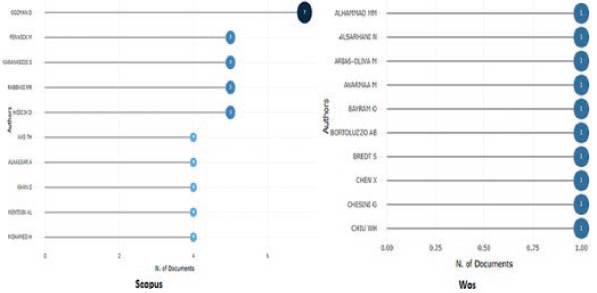

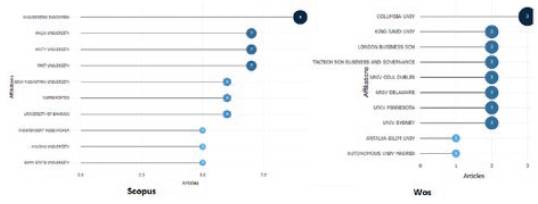

The most relevant authors per database consulted are shown in Figure 5.

In Figure 5, 10 relevant authors per database are observed, showing a difference between both databases. The Scopus database highlights that China is the world leader in academic production where the author Gozman D has 5 articles produced and 3 authors below him with 4 documents each and for the Wos database has 1 document produced by each author. Figure 6 shows the network of co-citation of keywords in the Scopus and WoS databases that indicate specific approaches to the knowledge gaps identified by the academic community on the subject.

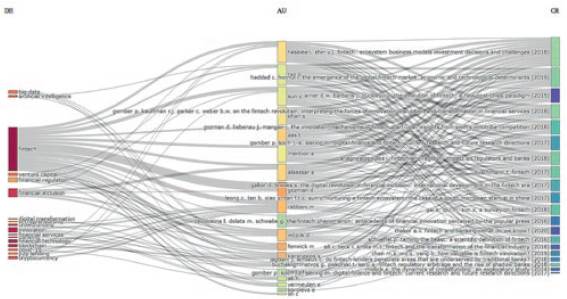

Figure 6 shows a complex network with a large number of edges concentrated in a specific cluster that refers to the combination of fintech and start-ups and refers to the combination of information systems, industry, information management, business, financial inclusion and e-money as words that stand out. Figure 7 indicates the ToS cluster in the Scopus and WoS databases.

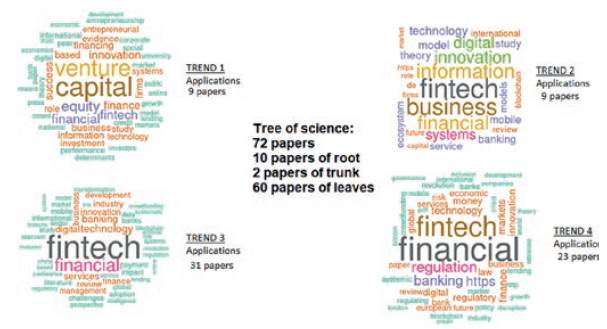

Figure 7 shows the trends found as a result of the ToS algorithm. We will now describe each of the four clusters found.

Trend 1: Business financing: in this cluster are the documents pertained to venture capital, which emphasize the importance of helping to finance emerging companies so that they can be productive since their business model provides them with adequate growth opportunities. At the root of the tree in this cluster, according to Beck (2007), financial development disproportionately increases the income of the poorest quintile and reduces income inequality. About 40% of the long-term impact of financial development on the income growth of the poorest quintile results from reductions in income inequality, while 60% is due to the impact of financial development on aggregate economic growth. On the other hand, regarding the trunk, considered a structural article of the solutions proposed by fintech and start-ups, Ahlers (2015) indicates that according to his empirical review, it is highlighted that retaining capital and providing more detailed information on risks can be interpreted as effective signals and, therefore, can have a strong impact on the probability of success in financing. Regarding the leaf, Adnan (2022) proposes to develop a model to improve social justice through the Zakat Foundation in Bangladesh using donation-based crowdfunding. Macchiavello (2018) proposes a regulatory scenario for initiatives and ventures referred to fintech services, based on a review of regulatory trends in financial services assisted by information and communication technologies. A total of 9 articles were found in this group related to entrepreneurial funding sources.

Trend 2: Innovation and financial information: this includes documents related to innovation and financial technology and business information, in which the root of the tree of this cluster is found. Hsieh and Shannon (2005) indicate that current applications of content analysis show three distinct approaches: conventional, directed or summative. All three approaches are used to interpret the meaning of the content of text data and therefore adhere to the naturalistic paradigm. The main differences between the approaches are the coding schemes, the origins of the codes, and the threats to reliability. In conventional content analysis, the coding categories are derived directly from the text data. On the other hand, regarding the record considered a structural document, Njihia and Merali (2013) demonstrate the value of Archer's morphogenetic (MA) approach to understand and explain the complexity of the broader context within which much information and communication technology (ICT) projects in developing countries are implemented and conclude that explicit attention is paid to time and temporality, and the broader context of projects. On the other hand, Salameh and Bass (2022) explore how software architecture can be governed and aligned and indicate that architecture governance it comprises an organizational structure change and an architecture change management process. The study by Vardomatskya et al. (2021) proposes a theoretical system-atization of the construction of fintech, highlighting as a result the competition between traditional banking services and information technology organizations, which implies a scenario of transformation of banks into technology service companies and companies in the information technology sector through technological ventures that are increasingly entering the financial sector. In this group, a total of 9 articles related to the modernization of the financial system were found.

Trend 3: Financial technology: in this cluster are the documents related to financial technology and finance, in which the root of this cluster is found. Anderson and Srinivasan (2003) indicate that, although e-satisfaction has an impact on e-loyalty, this relationship is moderated by individual-level factors of consumers and business-level factors of companies. Regarding the trunk considered as a structural document in the development of financial technology, Kalmykova and Ryabova (2016) mention that, for now, this market has many different concepts: P2P credit, e-wallets, bitcoins, mPOS acquisition, T-commerce, mobile banking, etc. People can get any credit through special services on the Internet from other users without the involvement of banks, pay by credit card using mobile devices and get information about spending and income according to the card anywhere in the world. These tools make life easier, however, they pose a serious threat to banks. Additionally, Sánchez (2022) states that innovations in financial business models driven by technology not only imply changes in the provision of financial services but also changes in the market, regulation, industrial networks, dominant actors and culture. Bethlendi and Szocs (2022), for their part, define the actors and roles in the existence of a fintech ecosystem for organizations in which organizations such as Apple and Amazon have played a more preponderant role in the ecosystem because of the acceleration of technological services demanded by the banking sector during the COVID-19 pandemic. A total of 31 articles were found in this group related to technological development.

Trend 4: Finance and regulation: in it are documents related to regulation and fintech, in which the root of this cluster is found. Porteous (2006) mentions the rapid expansion of mobile phones, which means that the number of mobile users may already exceed the number of banked people in many low-income countries. This channel can not only reduce the cost of financial transactions for the provider and customer, but also enable new participants in the financial sector and new relationships formed for the distribution of services. On the other hand, regarding the trunk considered as a structural article in financial technology, Arner et al. (2015) say that the latest evolution of fintech led by startups poses challenges for both regulators and market participants, particularly in balancing the potential benefits of innovation with the potential risks of new approaches, as countered to Anifa et al. (2022), who propose that the evolution of fintech in start-ups is driven by innovation in financial risk management. Shukla and Dubey (2022) evidence that India is the second largest fintech adopter in the world and that the pace of growth of fintech startups requires control and regulatory processes issued by the central banks of the countries, since through measurement instruments it is evident that security, solvency and compliance are key factors for the success of the regulations. A total of 23 articles related to fintech regulation were found in this group.

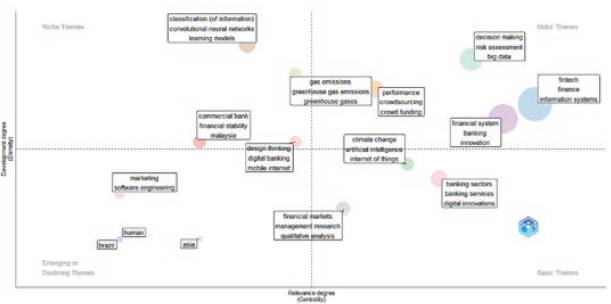

Figure 8 illustrates the thematic map of fintech and startup research resulting from the scientometric literature review.

In Figure 8, a Cartesian plane is observed between the degree of development and the degree of relevance, which divides the plane into four quadrants, which are driving themes, basic themes, emergence of themes due to the decline of other themes, and niche themes. On this level, it can be seen that the highest degree of development is in niche topics that are growing, such as fintech, finance, business, evolution and innovation.

Dynamic

This section shows the dynamics of the sources in the Scopus and WoS databases about fintech and startups for the academic community. Figure 9 indicates the relevance of sources in Bibliometrix platform.

According to Figure 9, the source dynamics in the WoS database do not grow, on the contrary, they are maintained compared to the Scopus database. Scientific research provides increasing source dynamics over the years, especially sustainability sources. One of the most relevant is financial innovation since 2016, and an increase is also visualized from 2020 to 2022, followed by technology and social change.

Correlations

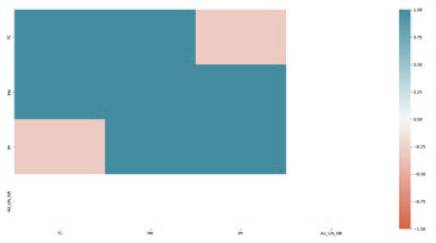

This section shows the correlation between the variables of the bibliometric analysis generated by the Tree of Science algorithm from the Scopus and WOS databases, as represented in Figure 10.

Figure 10 shows that the variable TC of the ToS algorithm indicates the citation rate of each of the articles obtained. The PM variable is the average of the indicator for each article, the variable PY is the year of publication of each article obtained by the algorithm, and the variable AU_UN_NR is the record of the type of document found without reference, i.e., it measures the number of articles without reference obtained by the algorithm.

The scale of the r-squared correlation coefficient is shown in the heat map, where green represents the strongest correlations and beige the weakest and negative correlations. Thus, citation rate and publication year represent weak correlations, corresponding to a coefficient of 0.25 (on a scale of 0 to 1), and the strongest correlations between CT and PM exceed the correlation coefficient of 0.75 (on a scale of 0 to 1).

DISCUSSION

The systematic review of the eight publications mentioned above provided the information necessary to answer the three initial research questions.

RQ1: ¿ What is the current state of the art for the use of fintech and start-ups?

Through the PRISMA protocol, records from Google Scholar, Scopus, Wos and IEEE Xplore are identified, as well as a total of eight studies and publications delimited in the review of interest by the PRISMA protocol, which in Figure 2 indicates that this is a research area that has increased in recent years, generating attention from the academic community. Figure 4 demonstrates that there is academic production in different areas worldwide; however, the most relevant continents are North America, Asia and Oceania. The number of articles by most relevant affiliations per database consulted is shown in Figure 11.

The information collected in Bibliometrix allows a quantitative and statistical analysis of the publications of the articles from the highest to the lowest academic production of scientific research for the Scopus and WoS databases. Figure 11 show the fintech and start-up are topics in revolution for their transformation, it is evident that universities are more related in their research activities to the fields of fintech referred to venture capital, financial services, and regulation, with little participation in the areas of fintech and start-ups.

The three field diagrams for the Scopus and WoS databases consulted are shown in Figure 12.

Figure 12 shows that the Scopus database presents a greater variety of topics in innovation, disruption and transformation where authors develop their academic production, including regulatory sandboxes. In contrast, the WoS database indicates a smaller number of authors and more limited interactions in research topics in financial technology and equity risk.

Figure 11 also illustrates that the research areas identified by the first objective of this study confirm that research has focused on fintech and start-ups, reflecting that the research topic has not been addressed by others.

RQ2: ¿What is the behavior of authors who publish about fintech and start-ups?

According to Figure 5, it is observed that the relevant authors in the most prominent research topic have a maximum number of nine articles produced at the University of Indonesia in the Asian continent, which implies that it is still a new area for the academic community. On the other hand, it is observed that the most relevant authors belong to countries such as China and the United States.

Figure 6 shows that the most relevant authors research topics related to information systems, management, business, inclusion, venture capital, regulation, and electronic money. Authors in the trends show that there are concerns in the regulation of fintech to be implemented, for this reason there is a tendency of authors to be regulated, since fintech is an innovative revolution in the traditional financial market. Therefore, Lee and Shin (2018) point that fintech projects inherently involve technical as well as economic and regulatory uncertainties.

Potential regulatory intervention is a key factor in the growth rate of fintech and start-ups. Real options applicable to fintech projects include: (1) defer option, which gives management the option to wait/learn more to see if a project will be profitable; (2) expand option, which gives management the option to invest more in a profitable project; (3) abandon option, which gives management the option to abandon a project that is operating at a loss and sell or redeploy assets; and (4) contract option, which allows management to reduce a project that is operating at a loss.

Based on the above, the financial industry is in an important process. Despite the innovative revolution of fintech, there are questions about various issues; therefore, their study has increased in academic research in recent years. For example, Lee and Shin (2018) mention that in this moment of disruptive innovation, both start-ups fintech and traditional financial institutions face the following challenges: investment management, customer management, regulation, technology integration, security and privacy, and risk management.

Consequently, Haddad and Hornuf (2019) say that fintech-assisted startups need sufficient funding to develop and scale their business models. When traditional and venture capital markets are well-developed, entrepreneurs have better access to the capital needed to finance their businesses. Therefore, venture capital is an activity that has the potential to generate equity financing and economic support not only for their development but can also benefit society as a whole.

Figure 11 shows the behavior of researchers worldwide, as reported by Bibliometrix analysis using the Scopus and WoS databases. They are in the paradigm of technology, in information systems and in financial management and inclusion, which demonstrates that the academic community is focused on fintech because it is a disruptive innovation capable of moving the financial market and the industry.

RQ3: ¿What are the characteristics of fintech and start-ups that could benefit the company?

Based on Gozman et al. (2018) research, the emergence of financial technology around the world is driven by efforts to deconstruct and reimagine the business models embedded in financial services. Fintech facilitates access to the world of finance and manages to generate high market share in the financial market, economy and industry.

Anagnostopoulos (2018) sees disruptive innovation as having the potential for consumer welfare outcomes, regulatory and supervisory gains, and reputational gains for the financial services industry. It becomes even more important as the financial services industry evolves. Today's financial digitization opens up opportunities for technological innovation, making it easier to conduct all types of transactions; in short, it is a revolution that is changing the market for the better.

Zavolokina et al. (2016) refer to fintech, on the one hand, as a financial service intervened by innovative technologies to meet tomorrow's requirements: high efficiency, cost reduction, business process improvement, speed, flexibility and innovation. On the other hand, they refer to fintech in relation to companies and, more typically, to start-ups that serve as intermediaries for these services. In this way, start-ups have a great capacity to adapt to any type of change, since the integration of technology in the processes of small and large companies favors sustainable growth.

RQ4: ¿What are the trends in fintech and start-up research?

To answer this question, the ToS algorithm was used, which developed the trends and the number of articles per trend, classifying the oldest articles as corresponding to the root of the tree, that is, the reference or classic articles; the most modern articles as corresponding to the trunks of the tree, which belong to the structural articles, that is, they cite the root and are cited by future studies; and the most modern articles are the leaves of the tree, which are characterized by citing studies of the tree trunk and root. For the present SLR few articles were found and in total the applied algorithm allowed to find 4 trends described in Figure 7.

As can be seen in Figure 7, the trends found were business financing, innovation and financial information, financial technology, finance and regulation, which implies that the algorithm made it possible to determine that the search equation developed in this study shows that the application of financial technology has opportunities for action in the business and social sphere, however, there are shortcomings in the regulation of fintech.

Given the above, it is key to mention the research of the leaf articles found for each trend, in which the knowledge gaps and the contributions of the research developed are identified.

Trend 1: 378 articles were found, in which Ferrer et al. (2023) including repercussions on digital transactions. Investors considering transactions on these platforms require confidence in both the platform and the project in order to make the right decision. For this reason, this study analyzes the links between the parties involved in the process. A survey was sent to 135 investors on the Colectual platform in January 2022, and the research method adopted is Fuzzy Set Qualitative Comparative Analysis (fsQCA proposes that trust is necessary to invest and that the crowd-funding platform gains relevance.

Trend 2: 352 articles were found, in which Salameh and Bass (2022) indicate that the role of software architecture in large-scale agile development is important because multiple teams must work together to release a single software product while helping to maximize the autonomy of teams.

Trend 3: 334 articles were found, in which Sánchez (2022) reflects that technology-driven innovations in financial business models involve not only changes in the provision of financial services, but also changes in the market, regulation, industry networks, dominant players and culture.

Trend 3: 263 articles were found, in which Anifa et al. (2022) consider that technological innovations change the way financial services are practiced and lead to disruption in start-ups. Although fintech is helping to improve financial services, reduce customer constraints and reduce operating costs, it could pose a threat to start-ups as well as financial service providers.

RESEARCH GAP

This section mentions the studies related to the subject of this study, as well as the knowledge gaps that have been raised by different authors in the academic community.

The topic of research on fintech and start-ups is continuously growing in the academic community, especially due to characteristics such as: adaptability to needs, cost savings, coverage, time. and profitability. In this regard, Haddad and Hornuf (2019) mention that fintech and start-ups need financial support to grow. In addition, these authors (2019) indicate that the coefficients of the venture capital financing variable are positive and highly significant for the subcategories that most closely resemble the value chain of a traditional bank: financing, payment, and asset management.

It is important to know the positive contributions of fintech to generate cooperation in the financing of startups, as mentioned by Anagnostopoulos (2018) with the example that the preparation of regulators to instill a cultural change and harmonize technological advances with regulation could probably achieve many of the desired results.

Finally, based on the systematic review of literature on fintech and start-ups, it is deduced that it is necessary to take advantage of the benefits that technology provides to automate and improve processes in start-ups.

LIMITATIONS

There are two limitations to this systematic review of the literature. The first is the limited number of databases consulted. Many more could have been consulted, and there is always a risk that an article published in other sources is not included. It was shown that fintech and start-ups are a topic of growing interest in the academic community. However, only the most relevant databases related to the topic have been selected.

The second limitation is the risk of bias in the selection of publications. To avoid this, we followed a fixed set of criteria to include or exclude studies. The number of publications on fintech and start-ups has increased in recent years, and the most rigorous are those published in peer-refereed journals, and this was one of the most restrictive filters for study selection.

CONCLUSIONS

The purpose of this article was to expose the growing interest of the educational community for fintech and start-ups, using an SLR through the PRISM protocol, with a complex network analysis. For this, searches were carried out in Web of Science, Scopus, Google Scholar and IEEE Xplore, the Tree of Science algorithm was used in the R Cloud platform combined with the Bibliometrix software to obtain a tree structure.

The result of this research is expressed through the analogy of a tree, the co-occurrence of keywords, and collaborative networks between countries so that the evolution of this area of knowledge is explicitly understood. Root documents are considered as the starting point of the relationship between fintech and start-ups; trunk documents provide the structure of the concept, and leaf research documents are considered the fintech and start-up trend documents for a comprehensive and unbiased synthesis of various relevant studies.

Fintech and start-ups are showing their potential through the different initiatives that have been researched and published in recent years. Their characteristics open up a new range of possibilities for strengthening the security, trust and efficient use of academic information, securely facilitating the exchange, exploitation and verification and financing of start-ups, as well as new fields for the academic community.

Fintech and start-ups tends show research opportunities from different fields of knowledge such as management, finance, technology and economics.

The variables with the highest degree of correlation as measured by the r-squared coefficient are the citation rate and the average h-indicator, and the variables with the weakest correlations are the citation rate and the year of publication of the article.