Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Desarrollo y Sociedad

Print version ISSN 0120-3584

Desarro. soc. no.64 Bogotá July./Dec. 2009

Health Expenditure Financing as Incentive for Participation in ROSCAs1

El financiamiento del gasto en salud como incentivo para la participación en las asociaciones de ahorro y crédito rotativo

Kristiano Raccanello *

Jayant Anand **

* Universidad de las Américas Puebla, Economics Department, Exhacienda Sta. Catarina Mártir, 72820, Cholula, Puebla, México, e-mail: kristiano.raccanello@udlap.mx.

** Department of Anthropology & Sociology, University of Wisconsin-Barron County, 1800 College Drive, Rice Lake, WI 54868, USA, e-mail: jayant.anand@uwc.edu.

1 We would like to thank the two anonymous referees and the support from Ximena Peña -invited editor. The usual disclaimer applies.

This article was received May 15, 2009, modified August 31, 2009 and finally accepted November 10, 2009.

Abstract

Rotating Savings and Credit Associations (ROSCAs) are a common informal saving method recognized as a social protection system that can be used to deal with the monetary consequences of different types of economic shocks. This paper tests the hypothesis that current participation in ROSCAs will be encouraged when funds saved during previous membership in such associations were useful for financing extraordinary as well as unexpected expenses related to health needs. The probit model estimation supports this hypothesis and also suggests that savings from ROSCAs used for preventive health services encourage further participation.

Key words: ROSCAs, health expenditures, informal health financing, vulnerability, Mexico.

JEL Classification: D71, G21, O17.

Resumen

Las asociaciones de ahorro y crédito rotativo son un mecanismo de ahorro informal que ha sido reconocido como un sistema de protección social apto para enfrentar las consecuencias monetarias de distintos tipos de choques de naturaleza económica. En este artículo se analiza si la participación actual en estas asociaciones se incentiva cuando los recursos ahorrados fueron utilizados en el pasado para financiar gastos en salud extraordinarios o imprevistos. La estimación del modelo probit apoya esta hipótesis y sugiere que también los ahorros acumulados que han sido utilizados en servicios de salud preventiva estimulan la participación actual.

Palabras clave: asociaciones de ahorro y crédito rotativo, gasto en salud, financiamiento informal de la salud, vulnerabilidad, México.

Clasificación JEL: D71, G21, O17.

I. Social protection networks and insurance

The poor are exposed to many risks that affect their income and these may be classified according to the severity (catastrophic or non-catastrophic), their extent (idiosyncratic or covariate), and frequency (single or repeated). Strategies to cope with them can be grouped into those that are taken before (ex ante) and after (ex post) the event occurred and whose consequences lead to an income or welfare loss (World Bank, 2000). The former can be preventive (that seeks to reduce the probability of occurrence of the event) or for the purpose of mitigation (aimed at reducing the income/welfare variability). The latter are those that are intended to minimize the direct consequences of the event once it has occurred. Governments and international agencies provide alternative methods such as transfers, subsidies, training and assistance programs among others, in order to reduce the household vulnerability in terms of income, consumption and basic services (Holzmann and Jørgensen, 1999).

However, households rely on formal and informal mechanisms to reduce the probability of shocks occurrence, the variability, and the negative impacts that follow (Townsend, 1994; 1995). Holzmann and Jørgensen (2000) suggest that risk management strategies can be divided into three groups: informal, based on the market, and those supplied by the government. Both informal mechanisms as well as those based on the market achieve their goal for idiosyncratic risks, but they have low effectiveness for covariate risks. For broader risks, only government managed strategies can provide some protection (Holzmann, 2003).

II. Shocks, safety nets and social capital

It is important to understand that poverty has a multidimensional character which includes, but not limited to, vulnerability, basic services accessibility, decent housing, health status, and monetary aspects (World Bank, 2000). This is exemplified by the fact that once a health shock has occurred the sick person faces direct (cost of medicines and treatments) and indirect related disease costs (reduction of labor supply) (Gertler and Gruber, 1997) that creates an unanticipated need of money (Rutherford, 2000).

The literature suggests that most developing countries are typified by a small tax base, high incidence of tax evasion, and negligible reach of private health insurance to the poorest (Agenor and Montiel, 1999; Gumber and Kulkarni, 2000; Preker, Langenbrunner, and Jakab, 2002) and Mexico is no different. In this country, thirty-seven percent of households work in the informal economy that accounts for 10% of the GDP (INEGI, n.d.); these households generally lack both public and private health insurance. A closer look reveals that in 2001 in Mexico private health expenditures exceeded public health spending, and out-of-pocket expenditures were also related to poor households' risk of catastrophic expenditure (Comisión Mexicana de Macroeconomia y Salud, 2006). The inefficiency and the low-quality of the Mexican public health system are highlighted by the fact that the poorest households in Mexico face the greatest challenges in meeting health needs. In the year 2000, 57% of Mexicans were not covered by any public health institution, 40% were registered with the Mexican Social Security Institute, and only 1% of the population had private health insurance (INEGI , 2001; Secretaría de Salud, 2003). During the period 1994-2000 about 5% of Mexican households suffered catastrophic expenditures (health expenditure exceeding 30% of their household disposable income) (Secretaría de Salud, 2003). For households in the first and second quartile of monthly income, the proportion of out-of-pocket expenditures in the worst case is 45.2% of monthly income. Expenditure on medicines is the most important problem followed by medical fees (Table 1).

Because health shocks involve out-of-pocket expenditures (Lindelow and Wagstaff, 2005) especially when people are uninsured, low-income households have to seek alternative sources to finance their health needs and rely on different strategies for smoothing income and consumption (Dercon, 2002; Russell, 2003). In developed economies, households generally access formal credit markets by owning assets as collateral because banks and insurers make lending decisions on the basis of credit risk information available for the borrower (Diagne, 1999). However, in most developing countries non-possession or insufficient amounts of valuable collateral, combined with the lack of information about the creditworthiness of borrowers, contribute to the exclusion of poor households from formal credit markets. Under these circumstances, the economically disadvantaged have alternative sources of funds that allow diversification of health financing risks (Balkenhol and Churchill, 2002; Soriano, Dror, Alampay, and Bayugo, 2002). Such alternatives may include, but are not limited to, borrowing from local moneylenders and pawnbrokers (McIntyre and Thiede, 2003) or resorting to resources available through informal networks (Fafchams and Lund, 2003; Dercon, Bold, De Weerdt, and Pankhurst, 2006) like close friends and family or rotating savings and credit associations (ROSCAs) among others.

The term "safety net" generally refers to "noncontributory transfer programs targeted in some manner to the poor or vulnerable" (World Bank, 2008: 4). Such programs can be financed by the state or through private channels. Safety nets delivered via private action include "interhousehold transfers, community support arrangements, private religious contributions, private contributions to nongovernmental organizations, and other forms of charity" and can sometimes exceed state funds (World Bank, 2008, p. 6). According to the World Bank (2000), informal networks, known as social safety nets, are those informal mechanisms that protect people from low income and poverty risks by mitigating the effects of a shock for vulnerable households. Generally, borrowing from family and close friends does not entail interest payment, being usually motivated by implicit reciprocity. Such arrangements require a certain degree of trust between the parties involved. Also, informal networks foster social capital - interpersonal trust, expectations of reciprocity, and sharing of resources (Kawachi and Berkman, 2000) - which in turn plays an important role in coping with economic shocks (Carter and Maluccio, 2003).

Besides family and friends, the poor also have access to informal institutions that provide credit (Dercon and De Weerdt, 2006) based on a "social collateral" consisting of the reputation of the borrower that replaces the traditional physical or financial collateral (Van Baste-laer, 2000). The implicit reciprocity that participants assume when being part of such informal institutions has been documented from an anthropological point of view (Beals, 1970) and more recently from a rational cost-benefit perspective (Thomas and Worrall, 2002). Among such informal institutions, ROSCAs are cornerstones that are built around mutual trust among its members. ROSCAs encourage a culture of saving by providing a system for funds management (Rutherford, 1998) especially when because of the small amounts of individual savings accumulated by the poor, the formal banking system is generally not interested in collecting and managing these funds (Rutherford, 2000).

III. ROSCAs

The ROSCA, generally known as tanda in Mexico, is a mechanism of social protection (World Bank, 2000) that has been studied from an anthropological point of view by Geertz (1962) and its existence has been observed in several countries (Ardener, 1964).

Overall, the ROSCA consists of a group of individuals, usually between 10 and 20, that at predetermined intervals contribute a certain amount of money to a common fund called the "pot". The sum of all savings, or the "pot", is then assigned to one of the members. Once a member has received the pot, this member is not eligible to receive it again until all members of the group have had their turn.

Several variants of the ROSCA have been identified emphasizing the high flexibility of this informal saving method (Boumann, 1977; Aryeetey, 1995). Some of these associations allow that the total amount saved can be distributed on a rotating basis - in which case the mechanism is known as pure ROSCA. In other cases, according to the members' needs, withdrawals from the accumulated capital fund are allowed - in this case the mechanism is known as Accumulating Savings and Credit Association (ASCA). Because leaving a ROSCA may cause it to collapse (Johnson, 2004), it is probable that the member who withdrew from the association will not be invited to participate in the future; we are tempted to think that the same rationale is also valid for ASCAs.

When funds are distributed on a rotating basis, the literature points out that the most common methods to establish the order are: randomly, by auction (Besley, Coate, and Loury, 1993), or according to some discretion rule (Boumann, 1977; Kovsted and Lyk-Jensen, 1999). Although there is no restriction whatsoever regarding the use of funds raised (Von Pischke, 1992), the rationale for participation regularly lies in the possibility of saving (Vélez-Ibáñez, 1983; Adams and Canavesi, 1992), providing at the same time an opportunity for cultivating interpersonal relationships (Vélez-Ibáñez, 1983; Von Pischke, 1992; Kane, 2001).

Once a member has received the pot s/he may have an incentive to default on remaining payments. However, this situation is unusual because of the role of social capital among ROSCA's members. Social capital is a key element to belong to a ROSCA that encourages the fulfillment of the obligation (Von Pischke, 1992), and provides flexibility in case of unexpected needs (Adams and Canavesi, 1992; Anderson, Baland, and Moene, 2003). Possibly because of the lack of saving alternatives or access to the formal financial system (Mansell Carstens, 1995), households use ROSCAs as a savings system to meet planned expenditures (related to education or to ritual obligations) but they may also use it to face extraordinary expenses related to a sudden need arising from any illness or accident. Even though these are not among the main motivations, in several studies preventive and/or health risks related reasons for belonging to a ROSCA have been mentioned (Boumann, 1977; Vélez-Ibáñez, 1983).

Because regular contributions often do not represent a large nominal monetary amount, total savings on an individual basis in a ROSCA is relatively small. As mentioned, these savings can be used to finance all or part of the costs deriving from some idiosyncratic shocks. Regardless whether the association is a rotating or cumulative one, because all eligible members cannot receive the pot simultaneously, ROSCAs are not suitable to provide an efficient protection mechanism against widespread (covariate) shocks.

Generally, ROSCA members show some socioeconomic homogeneity and several ROSCAs are organized among colleagues in the workplace (Lomnitz, 1975; Vélez-Ibáñez, 1983; Adams and Canavesi, 1992; Khatib-Chahidi, 1995). Recently, Raccanello, Anand, and Arroyo Martínez (2009) found that social capital not only makes informal financial arrangements successful, but can also act as an incentive to engage in such associations.

IV. Hypothesis and methodology

Consistent with the decision-making literature that people are unlikely to change their behavior if previous experience was positive (Inman and Zeelenberg, 2002), the hypothesis of this paper posits that actual participation in ROSCAs should be encouraged when funds saved during previous membership in such associations had been useful for financing extraordinary and unexpected expenses, particularly those related to health needs. In this case, ROSCAs would serve as risk mitigation mechanisms associated with minor health problems from a monetary perspective.

Between January and March of 2005 we conducted a survey in the municipality of San Andrés Cholula, Puebla (Mexico) in order to obtain information about ROSCAs and other informal credit mechanisms on which people relied for services payments, for saving, for food or clothes purchasing, and as a means to finance health expenditures. The survey was divided into four parts which included: households' socio-economic characteristics, health indicators, ROSCAs and other financing mechanisms. First, we conducted a pilot survey and then the final questionnaire was administered on a convenience sample of 400 households of the municipality.

Compared to most probability samples, convenience samples are relatively less expensive and less time consuming. Moreover, convenience samples are comprised of sampling units that are accessible and cooperative. However, such samples can have potential sources of selection bias and thus compromise representativeness. Therefore, often, inferences drawn from convenience samples are not generali-zable to the larger population (Malhotra, 2003, p. 321). Nonetheless, despite having used convenience sampling, our sample does not seem to be biased since descriptive statistics (Table A.1 in appendix) show patterns which are similar to those provided by the INEGI (2000) where according to the Census about 33.79% of the population earned more than two minimum monthly wages.

V. Descriptive statistics

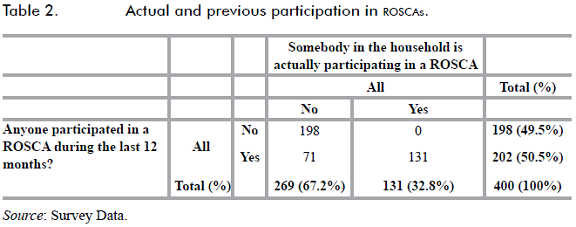

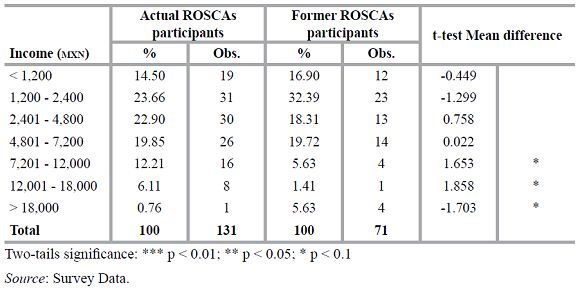

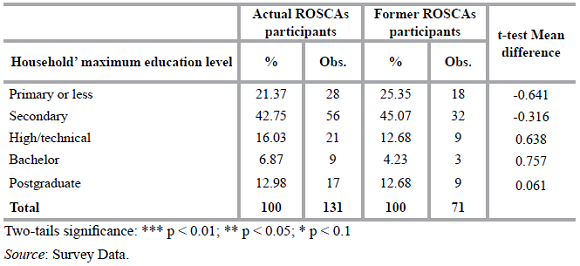

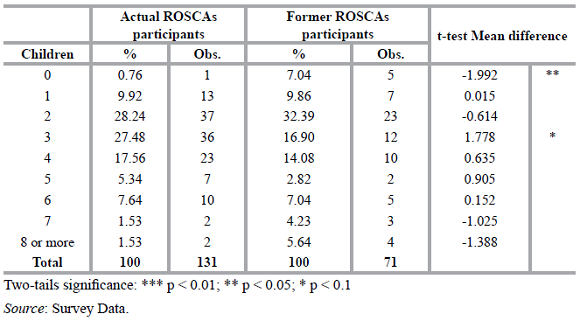

The most important feature of the survey was ROSCA membership both in the previous year (2004) and at the time of the survey. Out of the 400 households surveyed, 32.8% (131 observations) pointed out that currently at least one member belonged to a ROSCA and 50.5% (202 observations) confirmed that somebody had participated in at least one ROSCA during the past year (Table 2). We observed that all households that at the time of the survey had at least one member participating in a ROSCA were also members during the previous year. Also, 71 observations consisted of households whose members no longer belonged to any ROSCA. Thus, the sample is made up of 131 households currently participating and 71 households who abandoned ROSCAs between 2004 and 2005. Finally, the remaining 198 households did not have any member participating during the previous year and none of them are currently involved in any ROSCA.

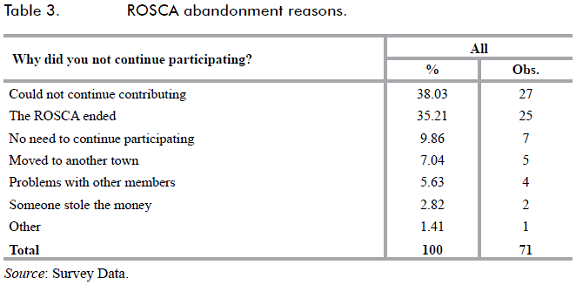

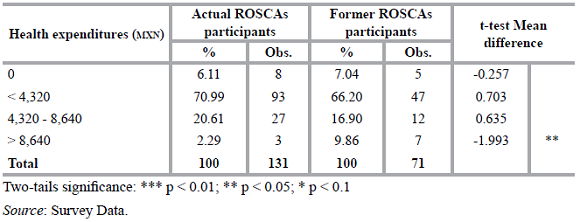

For those households that ceased belonging to ROSCAs we inquired about the reasons for this decision. The main reason was because they could not continue saving the established amount (38.03%). Other reasons for abandoning the ROSCA were because the association completed its full cycle (35.21%) or because the purpose for which the ROSCA began was achieved and there was no need to continuing it (Table 3). Tables A.1 to A.4 (in appendix) show that although some slight differences (based on mean difference t-tests) between current and former ROSCAs participants could be detected, they do not show a definite pattern except for high health expenditures (> 8,640 MXN). Comparative statistics for households that continue participating in ROSCAs and for the most important dropout categories are reported in Table A.5 (in appendix). Compared to households that left ROSCAs because they could not continue contributing, those that currently participate show a higher rate of house ownership (67.18% vs. 40.74%), have at least one bank account (29.77% vs. 18.52%), and have a higher income and higher health expenditures - except for the highest level - 2.29% vs. 14.81% (non significant). Also, the majority of households have medical insurance (65.65% vs. 37.04%). Furthermore, according to comparative statistics between households that abandoned the ROSCA because it ended and those that continued in the savings club, a similar pattern was detected in the same variables as those households that left ROSCAs because could not continue contributing (Table A.5).

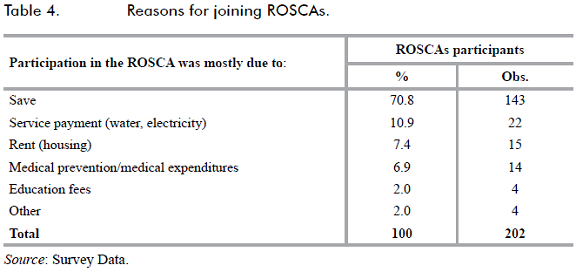

For almost all households who had experience with ROSCAs (90.6%) the "pot" was useful in meeting unforeseen expenditures, supporting the protection purpose of this saving method. Regarding the reasons for joining a ROSCA, most households started participating to accumulate precautionary savings (70.8%); prevention motives and funding expenses related to health shocks were explicitly mentioned by only 6.9% of the sample. The results suggest that savings in ROSCAs finance those expenditures that can be (easily) anticipated. In this case, Table 4 would report that households could join ROSCAs for both precautionary as well to pay specific expenditures.

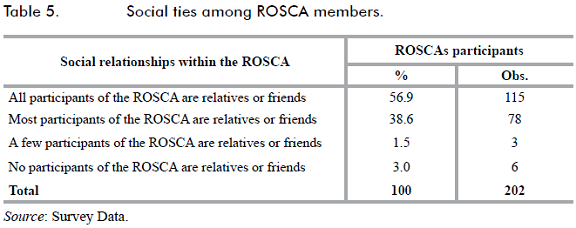

In accordance with the literature, social ties among ROSCA participants are strong as relatives or friends are overwhelmingly involved (95.5%) (Table 5).

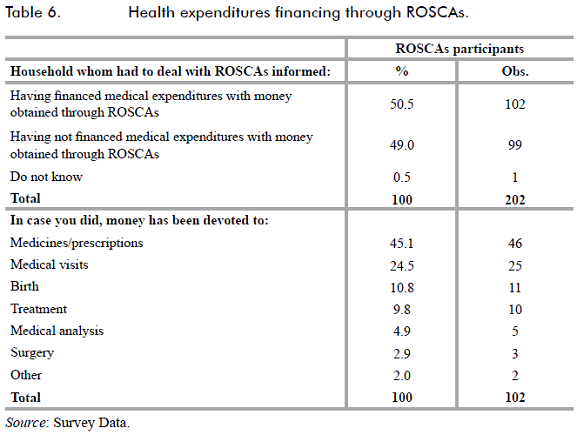

Even when health reasons are not the main motivation to join a ROSCA , ROSCAs are common sources of funds for health expenditures (Table 6). More than half of the sample (50.5%) reported having funded a drug or medical visits with money obtained through saving associations. Medicines/prescriptions (45.1%), visits (24.5%), and births (10.8%) were the most funded expenditures. It is noteworthy that ROSCAs are seldom used to finance surgery related expenses possibly because the amount of funds saved in the association are not high; monthly savings per member in ROSCAs vary between 400 to 2,000 Mexican Pesos (1 MXN = 11.15 USD at the time of the survey).

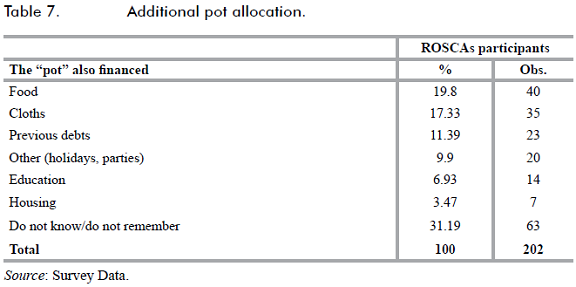

The pot was also designated to face other expenses. Table 7 reports that savings were devoted to buy food and cloths, but also to repay previous debts. A minor use involved funding holidays or parties, education and housing expenses. Because we enquired a household member that was not necessarily the one who belongs/belonged to ROSCAs, about 31% of the sample did not know/remember the pot allocation.

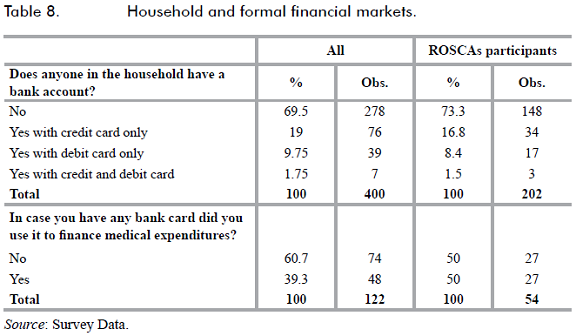

Formal financial market access is limited to households in this municipality. nearly 70% of the total (278 observations) reported not having any bank account. For households involved in a ROSCA the situation is similar with 73% not having a bank account. About 50% of households that have some debit or credit card rely on it for medical expenses (Table 8).

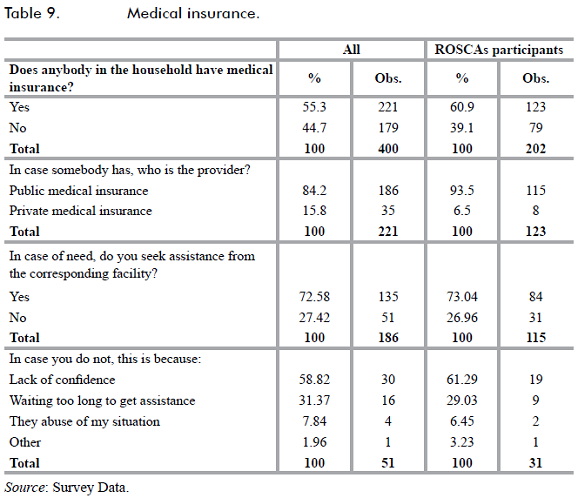

Approximately 55% of the households have at least one member with medical insurance, the figure rises to almost 61% for households participating in the ROSCAs. In both cases the large majority is shielded by public medical insurance and about 73% use public hospitals; the remaining do not use public services mainly because of the lack of confidence in the service received (Table 9).

VI. Econometric model

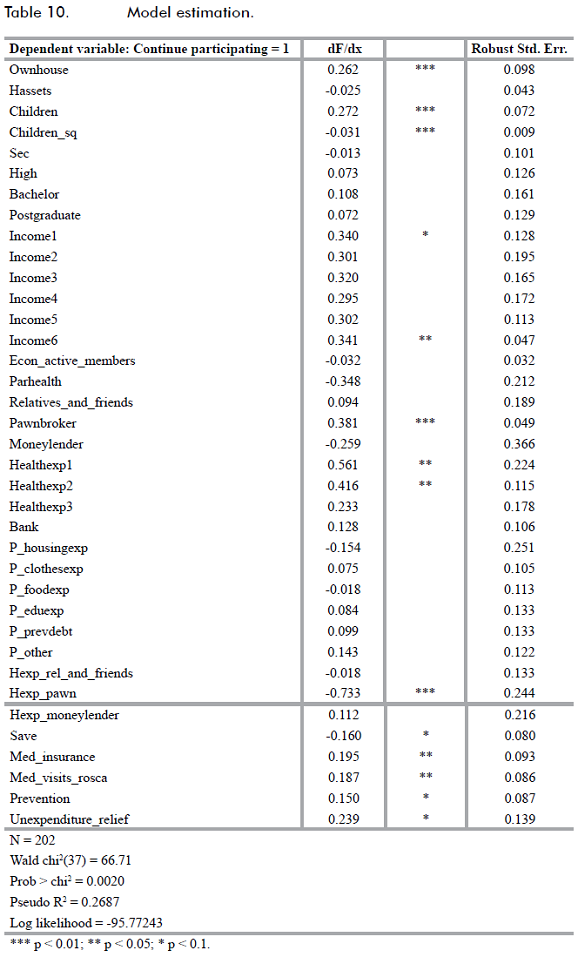

A probit model was estimated in order to analyze which factors contributed to explain member's continuous participation in ROSCAs. In particular, we focused on whether this decision, controlling for the saving motive and other expenses financed through ROSCAs' savings, is related to the benefits obtained by the household during the member's previous participation in ROSCAs. These benefits are strictly related to the health shocks protection features and to meet unforeseen health expenditures. The implicit form of the model to test the hypothesis is represented by equation (1), where the vector X represents the socioeconomic variables set, vector Y refers to financing variables set and Z embodies medical expenditures variables. Other control variables are grouped in C vector; the descriptive statistics of the full variable set are reported in the appendix (Table A.6).

P(Continue participating in ROSCAi = 1 | x) = Φ(X,Y,Z,C) + εi (1)

In the model the dependent variable (continue_part) is dichotomous and takes value of 1 if at least one current member of the household continues participating in a ROSCA, and 0 when any household's member no longer participates. Our sample is composed of all surveyed households that had some experience with ROSCAs (202 observations).

A. Description of model variables

1. Socioeconomic variables

Ownhouse is a dichotomous variable that takes the value of 1 if the household owns its house, 0 otherwise. The number of assets (i.e. television, refrigerator and computer) of the household, is represented by the variable hassets. The number of children in the household is introduced in the model through the variable children; in order to detect any non-linear behavior we added its square (children_sq).

The highest educational level of the household is represented by five dichotomous variables. The variable prim takes value of 1 if the highest educational level in the household is primary school (or less), 0 for any other level. Because the primary level represents the base category, the variable prim is not included in the model. Likewise, we defined sec (secondary school), high (high school/technical), bachelor (undergraduate) and postgraduate (postgraduate school level).

The household's monthly income is incorporated into the model through dichotomous variables: income1 takes value of 1 if the total household income is less than 1,200 MXN , 0 otherwise. Similarly, for higher income ranges we defined income2 (1,200-2,400 MXN); income3 (2,401-4,800 MXN); income4 (4,801-7,200 MXN) income5 (7,201-12,000 MXN) income6 (12,001-18,000 MXN) and income7 (>18,000 MXN). The last variable (income7) represents the base category.

The variable econ_active_members indicates the number of economically active household members that are generating some income.

When the health status of at least a parent is poor or very poor the variable parhealth takes value of 1 and 0 when they both have regular, good or very good health.

2. Financing variables

To consider other informal financing methods that households may have employed, the following dichotomous variables were added to the model: relatives_and_friends takes value of 1 if the household has resorted to loans from any relatives and/or friends in the last year, 0 on the contrary. Likewise, the variable pawnbroker takes value of 1 if the household has pawned at least one item in the last year and 0 otherwise; moneylender takes value of 1 if in the past year the household had borrowed at least once from a loan shark, 0 otherwise.

The household's access to formal credit market is represented by the variable bank which takes value of 1 if at least one household member has a credit card, a debit card or both; 0 if the household has none.

3. Medical expenditures variables

Health expenditures during the last year were included in the model through dichotomous variables according to their magnitude. The variable healthexp0 takes value of 1 if the household did not have any expense (0 MXN), and takes value of 0 if the household spent any amount during the past year; healthexpl takes value of 1 if health expenditure was less than 4,320 MXN , and 0 otherwise. Likewise, we defined: healthexp2 (4,320 to 8,640 MXN) and healthexp3 (> 8,640 MXN). Healthexp0 represents the base category and does not appear in the model.

To consider whether households coping with medical expenses resorted to borrowing from informal sources, we added three interaction variables between health expenditures and informal financing sources. Thus, the variable hexp_rel_and_friends takes value of 1 if the household faced health expenses and received a loan through relatives and/or friends; 0 otherwise. The variables hexp_pawn and hexp_moneylender refer to resources obtained through pawning or moneylenders respectively when health expenditures also occurred.

The dichotomous variable med_insurance, considers the effect whether any household member has medical insurance, in which case it takes value of 1, 0 otherwise.

The three variables that will test our hypothesis are: med_visits_rosca, prevention and unexpenditure_relief. Med_visits_rosca is a dichoto-mous variable that takes the value of 1 when household that had a member who participated in a ROSCA has addressed some health spending (such as medicines or medical visits) with the money saved in a ROSCA, 0 otherwise. The dichotomous variable prevention takes the value of 1 when household has used the money saved in the ROSCA for diseases prevention (viz. vaccines), 0 otherwise. Unexpenditure_relief is also a dichotomous variable that takes value of 1 when the household considers that ROSCAs was a relief to decrease unforeseen expenditures, and 0 otherwise.

4. Control variables

In order to consider whether money accumulated in ROSCAs have been spent for other purposes besides medical expenditures, p_housingexp takes value of 1 if the "pot" was devoted to pay housing expenditures and 0 otherwise. Similarly the following variables were defined: p_clothesexp, p_foodexp, p_eduexp, p_prevdebt and p_other which stand for clothes, food, education expenditures, debt repayment and other reasons respectively. The category when the respondents did not know/remember the final allocation of funds (p_dk_dr) was omitted in the model.

Finally, to consider whether the household was motivated to join a ROSCA because of its willingness to save, the variable save takes value of 1 if participating in ROSCAs was because of precautionary saving motive and 0 otherwise.

VII. Discussion

According to the model estimation (Table 10), house ownership is a significant element (+26.2%) correlated with further participation in the ROSCAs. Ownhouse is a proxy variable for the household's wealth that is associated with a higher household disposable income which could make it easier to participate in the ROSCA. Also, the number of children in the household (children) is positively related with continuous participation although at a decreasing rate (children_sq has a negative sign).

Household educational level variables are not significant for any school degree. On the other hand, income plays a key factor; households with a monthly income lower than 1,200 MXN and between 12,001 and 18,000 MXN show a higher probability to continue participating (+34% and 34.1% respectively) compared to households that earn more than 18,000 MXN. This finding tends to confirm Vélez-Ibáñez's (1983) result when pointing out that ROSCAs are used by both low and high income people.

The variable related to parents' health status (parhealth) has a negative association with continuing participating in ROSCAs but it is not significant.

With reference to loans obtained through relatives and friends (relatives_ and_friends), pawning (pawnbroker) and local loan sharks (moneylender), only funds obtained through asset pawning are related to a higher probability to continue participating in the ROSCAs (+38.1%). But, having access to financial markets (bank) has no significant association with the continuation of participation in ROSCAs.

Those households that during last year had health expenditure below 8,640 MXN would be more likely to continue participating in ROSCAs (healthexp0 is the base category). So, having experienced health expenditures during the past year is related to a higher probability of continuing participating in ROSCAs. According to estimates, the probability of continuing in ROSCAs is 56.1% and 41.6% higher if households' health expenditures were below 4,320 MXN or between 4,320 and 8,640 MXN respectively. As expected, lower health expenditures (healthexpl) are related to a larger increase in participation likelihood because of the amount of money saved in ROSCAs; this is probably why healthexp3 (health expenditures higher than 8,640 MXN) is not significant.

When the household dealt with the informal financial sector in order to fund medical expenditures, we found that only funds obtained through pawning (hexp_pawn) are related to a significant drop (-73.3%) in the likelihood of continuing participating in ROSCAs. Since households that pawned some assets would have to repay the loans and accrued interests, they probably would have seen a reduction in their available resources due to high interest rates charged by pawnbrokers (Racca-nello, Moreno Gallegos, and Pineda Hernández, 2009); a situation that could be related to losing ROSCA membership. In fact, when the household is short of funds members would opt for abandoning instead of defaulting. Abandonment could be perceived as a decision due to household financial distress. This situation could not harm the relationship among members who will probably be aware of it because of the intimate ties among them. On the contrary, and based on the existing literature (Aryeetey, 1995), defaulting is considered an offence to other members that could result in social sanctioning.

Because less than 7% of the households who obtained loans through relative and friends had to pay interests related to them, resorting to (commonly) interest-free loans from relatives and friends was one of the most popular mechanisms to cope with monetary needs associated to health shocks; 36% of households alleged having drawn on them mostly because of the confidence in the lender. In this case, the safetynet's flexibility would not harm nor encourage participation in ROSCAs. Hence, this is probably why hexp_rel_and_friends is not significant.

According to the variable med_insurance there is a positive relationship with a continuing participation in ROSCAs. Despite the fact that having health insurance may require additional payments (premiums) in order to use it - depending on the circumstances under which the event might have occurred and according to the provider (the government or a private company) - most of the insured hold a government provided health insurance (Table 9). In this case, the deficient/low quality perceived of medical attention, and the long time required in receiving it, may boost household out-of-pocket payments when resorting to private health institutions. Thus, despite being insured, households would still pay for private medical care (about 85% of households that participate in ROSCAs had to rely on private medical services at least once, and 16.3% paid for 5 or more private medical visits in the last year) that could indirectly originate the need for additional resources that could be provided to some extent by ROSCAs.

Continuation of participation in ROSCAs is significantly increased when the household has used saved funds to prevent diseases (prevention) (+15%) and when accumulated savings provided through the association have been used to finance medicines and medical visits (med_visits_ rosca) (+18.7%). According to previous experience, the positive relationship would suggest that maintaining ROSCA membership is considered a method that helps to deal with health expenditures both ex ante (prevention purposes) and ex post (mitigating purposes). Additionally, savings in ROSCAs can also be used to make ends meet in case of unexpected expenditures; the estimates point out that this feature (unexpenditure_relief) is highly appreciated by households, being positively correlated with the likelihood of continued participation (+23.9%). Estimations reveal that unexpected expenditures financed through savings in ROSCAs matter most for continuing participating than payments actually made because all variables related to other expenses (p_clothesexp, p_foodexp, p_eduexp, p_prevdebt and p_other) were not significant. This suggests that the benefits, related to health expenditures financing, that households earned during earlier participation by at least one of its members in a ROSCA promote further participation.

Additionally, an interesting result is provided by the variable save. According to descriptive statistics (Table 4) households mentioned that they joined the ROSCA to save for precautionary motive but estimates suggest that continuous participation would be negatively related to saving motive (-16%). This apparent counterintuitive result can be easily explained considering that households would consider how previous membership helped in making ends meet for continuing participation in ROSCAs. While saving is an ex-ante motive for participating, it would be the (ex-post) problem solved through spending the accumulated savings that would determine if previous experience was positive (Inman and Zeelenberg, 2002). In other words, even when households join a ROSCA because they want to save, estimates support that health expenses and other unexpected expenditures financed through savings from the ROSCA foster future membership.

Inherently, the model estimates could be affected by sample selection bias due to the dependent variable specification; this is because households abandoned ROSCAs for both monetary (i.e. household could not continue contributing) as well as non-monetary (i.e. ROSCA ended) factors (table 3). Those households that belong to the most important abandonment categories show a similar pattern in nearly all variables that are statistically different from those that continue to participate (table A.5). Households that left ROSCAs have lower income, but also face lesser health expenditures; however, these variables account for a higher vulnerability that represents a lower, but still important, risk exposure. Nevertheless, because we found that there are several reasons for which households left the saving club that are not all linked to an implicit higher vulnerability (table 3), we are tempted to consider that the sample bias should not be too large.

Based on the foregoing arguments, the current involvement in the ROSCA would be statistically linked according to the granted advantages enjoyed during the previous participation which members would be eager to receive even further.

VIII. Conclusions

According to field results, we found that ROSCAs are a saving mechanism that are widely used in the municipality of San Andres Cholula, Puebla and whose characteristics are aligned with the literature. During the year prior to the survey (2004) 50.5% of surveyed households had at least one member involved in at least one ROSCA and at the time of the survey 33% were still participating. The membership drop was mainly due to the lack of money that needed to be saved in the association or because the ROSCA came to its end. However, continuous participation in ROSCAs is positively correlated with the benefits that members gained from earlier participation that motivate further membership. In particular, the funds provided through ROSCAs that helped to meet a household's unexpected contingencies and health expenditures seem to encourage current involvement. According to the World Bank (2000, table 8.3, p. 141) ROSCAs are group based informal mechanisms that mitigate risk through diversification. Our results show that people would be looking for some sort of insurance focusing on the importance of ROSCAs as a mechanism to reduce the household's vulnerability associated with health and other unexpected expenditures. Our findings from this study corroborate the theory that a previous positive experience increases the likelihood of the continued use of a strategy (Inman and Zeelenberg, 2002).

Although the literature mentions that people join ROSCAs because of the lack of access to formal financial saving system (Rutherford, 2000), we found that benefits obtained in previous participation is what seems to maintain membership. This highlights the importance of the membership in informal associations for households living in vulnerable circumstances that allow facing unexpected contingencies as well as the role of these associations as an avenue to deal with the exposure to different kind of expenses sometimes linked to the low quality of public health service.

The importance of informal associations relies on its nature. Because of the socioeconomic homogeneity of the participants, despite the intimate ties among them, ROSCAs have a limited shielding power in terms of resources being linked to households' savings. In order to broaden the association's scope it would need to have access to larger funds that could be provided through alternative financing systems at the community level such as Community Based Organizations (CBOS) or Cooperative Credit Unions (CCUS). The CBO and CCU'S purpose is to organize and coordinate the use of savings to face members' health needs and they also decrease community dependency from local moneylenders (Agarwal and Sarasua, 2002). In order to overcome the ROSCAs inability to mitigate covariate shocks, the establishment of a larger scale CBO reinsurance program is advised. In this case, the vulnerability to covariate shocks because of localization, limited membership and low savings could be more easily overcome (Dror, 2002).

Appendix

Table A.2 Education levels.

Table A.3 C hildren in the household.

Table A.4 Health expenditures.

References

1. ADAMS, D. W., and CANAVESI, M. L. (1992). "Rotating savings and credit associations in Bolivia". In D. W. Adams and D. A. Fitchett (Eds.), Informalfinance in low-income countries (pp. 313-323). Boulder, CO, Westview Press. [ Links ]

2. AGARWAL, S., and SARASUA, I. (2002). "Community-based health financing: Care India's experience in the maternal and infant survival project", Research in Healthcare Financial Management, 7(1):85-94. [ Links ]

3. AGENOR, P. R., and MONTIEL, P. J. (1999). Development macroeconomics (2nd Ed.). Princeton, NJ, Princeton University Press. [ Links ]

4. ANDERSON, S.; BALAND, J. M., and MOENE, K. O. (2003). Sustainability and organizational design in informal groups: Some evidence from Kenyan ROSCAs. Canada, University of British Columbia. [ Links ]

5. ARDENER, S. (1964). "The comparative study of rotating credit associations", Journal of the Royal anthropological Institute, 94(2):201-229. [ Links ]

6. ARYEETEY, E. (1995). Filling the niche - Informal finance in Africa. Nairobi, African Economic Research Consortium. [ Links ]

7. BALKENHOL, B., and CHURCHILL, C. (2002). "From micro-finance to micro health insurance". In D.M. Dror and A.S. Preker (Eds.), Social reinsurance - A new approach to sustainable community health financing. Washington, D. C., World Bank. [ Links ]

8. BEALS, R. L. (1970). "Gifting, reciprocity, savings, and credit in peasant Oaxaca", Southwestern Journal of Anthropology, 26:231-241. [ Links ]

9. BESLEY, T.; COATE, S., and LOURY, G. (1993). "The economics of rotating savings and credit associations", The American Economic Review, 83:792-810. [ Links ]

10. BOUMAN, F. J. A. (1977). "Indigenous savings and credit societies in the developing world", Savings and Development, 1:181-214. [ Links ]

11. CARTER, M. R., and MALUCCIO, J. A. (2003). "Social capital and coping with economic shocks: An analysis of stunting of South African children", World Development, 31(7):1147-1163. [ Links ]

12. COMISIÓN MEXICANA DE MACROECONOMÍA Y SALUD. (2006). Macroeconomía y salud. Invertir en saludpara el desarrollo económico. Colección Biblioteca de la Salud. México, Fondo de Cultura Económica. [ Links ]

13. DERCON, S. (2002). Income risk, coping stategies and safety nets. Discussion Paper 22. Helsinki, United Nations University/ World Institute for Development Economic Research. [ Links ]

14. DERCON, S.; BOLD, T.; DE WEERDT, J., and PANKHURST, A. (2006). "Group-based funeral insurance in Ethiopia and Tanzania", World Development, 34:685-703. [ Links ]

15. DERCON, S., and DE WEERDT, J. (2006). "Risk-sharing networks and insurance against illness", Journal of Development Economics, 81:337-356. [ Links ]

16. DIAGNE, A. (1999). Determinants of household access to participation in formal and informal credit markets in Malawi. Food Consumption and Nutrition Division Discussion Paper 67. Washington, D. C., International Food Policy Research Institute. [ Links ]

17. DROR, D. M. (2002). "Health insurance and reinsurance at the community level". In D. M. Dror and A. S. Preker (Eds.), Social re-insurance - A new approach to sustainable community health financing (pp. 103-123). Washington, D. C. and Geneve, The World Bank and International Labour Office. [ Links ]

18. FAFCHAMPS, M., and LUND, S. (2003). "Risk-sharing networks in rural Philippines", Journal of Development Economics, 71:261-287. [ Links ]

19. GEERTZ, C. (1962). "The rotating credit association: A 'Middle Rung' in development", Economic Development and Cultural Change, 10:241-263. [ Links ]

20. GERTLER, P., and GRUBER, J. (1997). "Insuring consumption against illness" (Working Paper 6035). Cambridge, M. A., National Bureau of Economic Research. [ Links ]

21. GUMBER, A., and KULKARNI, V. (2000). "Health insurance for informal sector - Case study of Gujarat", Economic and Political Weekly, 35(40):3607-3613. [ Links ]

22. HOLZMANN, R., and Jørgensen, S. (1999). Social protection as social risk management: Conceptual underpinnings for the social protection sector strategy paper. Social Protection Discussion Paper 9904. Washington, D. C., The World Bank. [ Links ]

23. HOLZMANN, R., and Jørgensen, S. (2000). Social risk management: A new conceptual framework for social protection and beyond. Social Protection Discussion Paper 0006. Washington, D. C., The World Bank. [ Links ]

24. HOLZMANN, R. (2003). "Risk and vulnerability: The forward looking role of social protection in a globalizing world". In E. Dowler and P. Mosely (Eds.), Poverty and social exclusion in north and south (pp.47-82). London and New York, Rout-ledge. [ Links ]

25. INEGI. (n.d.). Sistema de Cuentas Nacionales de México. "Cuenta Satélite del Subsector Informal de los Hogares 1996-2003". Retrieved on August 12th, 2006, from http://www.inegi.gob.mx/est/contenidos/espanol/tematicos/mediano/med.asp?t=cusa04&c=1686 [ Links ]

26. INEGI. (2000). Censo general de población y vivienda. Zona metropolitana Puebla-Tlaxcala. Síntesis de resultados. Aguas-calientes, Ags. [ Links ]

27. INEGI. (2001). XII Censo general de población y vivienda 2000. Aguascalientes, Ags. [ Links ]

28. INMAN, J. J., and ZEELENBERG, M. (2002). "Regret in repeat purchase versus switching decisions: The attenuating role of decision justifiability", Journal of Consumer Research, 29(1):116-128. [ Links ]

29. JOHNSON, S. (2004). "The impact of microfinance institutions in local financial markets: A case study from Kenya", Journal of International Development, 16(3):501-517. [ Links ]

30. KANE, A. (2001). "Financial arrangements across borders: Women's predominant participation in popular finance, from Thilogne and Dakar to Paris. A Senegalese case study". In B. Lemire, R. Pearson, and G. Campbell (Eds.), Women and credit - researching the past, refiguring the future (pp. 295-317). Washington, D. C., Berg and Oxford International Publishers. [ Links ]

31. KAWACHI, I., and BERKMAN, L. (2000). "Social cohesion, social capital and health". In L. Berkman and I. Kawachi (Eds.), Social epidemiology (pp. 174-190). New York, Oxford University Press. [ Links ]

32. KHATIB-CHAHIDI, J. (1995). "Gold coins and coffee ROSCAs: Coping with inflation the Turkish way in Northern Cyprus". In S. Ardener and S. Burman (Eds.), Money-Go-Rounds: The importance ofrotating savings and credit associations for women (pp. 241-261). Washington, D. C., Berg and Oxford International Publishers. [ Links ]

33. KOVSTED, J., and LYK-JENSEN, P. (1999). "Rotating savings and credit association: The choice between random and bidding allocation of funds", Journal of Development Economics, 60:143-172. [ Links ]

34. LINDELOW, M., and WAGSTAFF, A. (2005). "Health shocks in China: Are the poor and uninsured less protected?" (Working Paper 3740). Washington, D. C., The World Bank Policy Research. [ Links ]

35. LOMNITZ, L. (1975). Cómo sobreviven los marginados. México, Siglo XXI Editores. [ Links ]

36. MALHOTRA, N. K. (2003). Marketing research: An applied orientation (4th Ed.). Upper Saddle River, NJ, Pearson/Prentice Hall. [ Links ]

37. MANSELL CARSTENS, C. (1995). Las finanzas populares en México. México, cemla, Editorial Milenio and itam. [ Links ]

38. MCINTYRE, D., and THIEDE, M. A. (2003). Review of studies dealing with economic and social consequences of high medical expenditures with a special Jocus on the medical poverty trap. Cape Town, Health Economics Unit, University of Cape Town. [ Links ]

39. PREKER, A. S.; LANGENBRUNNER, J., and JAKAB, M. (2002). "Rich-poor differences in health care financing". In D. M. Dror and A. S. Preker (Eds.), Social re-insurance - A new approach to sustainable community health financing (pp. 21-36). Washington, D. C. and Geneve, The World Bank and International Labour Office. [ Links ]

40. RACCANELLO, K.; ANAND, J., and ARROYO MARTÍNEZ, P. (2009). "Social capital as an incentive for participation and formation of women-dominant ROSCAs". In D. C. Wood (Ed.), Economic development, integration, and morality in Asia and the Americas (pp. 407-429). Bingly, Emerald. [ Links ]

41. RACCANELLO, K.; MORENO GALLEGOS, A. y PINEDA HERNÁNDEZ, T. (2009). Créditos predatorios y educación financiera. El caso del empeño. Documento de trabajo, Departamento de Economía, Fundación Universidad de las Américas Puebla, México. [ Links ]

42. RUSSELL, S. (2003). "The economic burden of illness for households. a review of cost of illness and coping strategy studies focusing on malaria, tuberculosis and HIV/AIDS" (Working Paper 15). DCPP. School of Development Studies: University of East Anglia. [ Links ]

43. RUTHERFORD, S. (1998). "The savings of the poor: Improving financial services in Bangladesh", Journal of International Development, 10(1):1-15. [ Links ]

44. RUTHERFORD, S. (2000). The poor and their money. New Delhi, Oxford University Press and Department for International Development. [ Links ]

45. SECRETARÍA DE SALUD (SSA). (2003). Encuesta Nacional de Salud 2000. México, Secretaría de Salud. [ Links ]

46. SORIANO, E. S.; DROR, D. M.; ALAMPAY, E., and BAYUGO, Y. (2002). "Attitudes toward solidarity, risk, and insurance in the rural Philippines". In D. M. Dror and A. S. Preker (Eds.), Social reinsurance. A new approach to sustainable community health financing (pp. 377-394). Washington, D. C., World Bank. [ Links ]

47. THOMAS, J. P., and WORRALL, T. (2002). "Gift-giving, quasi-credit and reciprocity", Rationality and Society, 14:308-352. [ Links ]

48. TOWNSEND, R. (1994). "Risk and insurance in village India", Econometrica, 62:539-591. [ Links ]

49. TOWNSEND, R. (1995). "Consumption insurance: An evaluation of risk-bearing systems in low-income countries", Journal of Economic Perspectives, 9:83-102. [ Links ]

50. VÉLEZ-IBÁÑEZ, C. G. (1983). Bonds of mutual trust. The cultural systems of rotating credit associations among urban Mexicans and Chicanos. New Brunswick, Rutgers University Press. [ Links ]

51. VAN BASTELAER, T. (2000). "Does social capital facilitate the poor's access to credit? A review of the microeconomic literature" (Social Capital Initiative Working Paper 8). Washington, D. C., World Bank. [ Links ]

52. VON PISCHKE, J. D. (1992). "ROSCAs: State-of-the-art financial intermediation". In D. W. Adams and D. A. Fitchett (Eds.), Informalfinance in low-income countries (pp. 325-335). Boulder CO, Westview Press. [ Links ]

53. WORLD BANK [The]. (2000). World Development Report 2000/2001 - Attacking Poverty. Washington, D. C., Oxford University Press for the World Bank. [ Links ]

54. WORLD BANK [The]. (2008). For protection and promotion: The design and implementation of effective safety nets. Washington, D. C., The World Bank. [ Links ]