Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Desarrollo y Sociedad

Print version ISSN 0120-3584

Desarro. soc. no.65 Bogotá Jan./June 2010

Three-Part Tariffs and Short-Run Rationality in the Local Fixed Telephone Consumption: Empirical Evidence from Medellín*

Tarifa en tres partes y racionalidad de corto plazo en el consumo de telefonía fija: evidencia empírica para Medellín

Jorge Barrientos **

David Tobón Orozco ***

John Fredy Bedoya ****

* This paper was presented in the weekly seminar at the Colombian Central Bank (Banco de la República), Medellín 31/07/2009.

** Researcher of the Applied Microeconomics Group at the Centro de Investigaciones y Consultorias (cic) and professor of economics, University of Antioquia, e-mail: jbarr@udea.edu.co. Postal Address: Ciudad Universitaria, bloque 13, A. A. 1226, Medellín, Colombia.

*** Director of the Applied Microeconomics Group (cic) and associated professor of economics, University of Antioquia, e-mail: davidtobon@udea.edu.co. Address: Calle 67 núm. 53-108, bloque 13, office 121, Medellín, Colombia. Phone (574) 2195837, fax (574) 2195843.

**** Assistant researcher of the Applied Microeconomics Group (cic), University of Antioquia, e-mail: jfbedoya13@gmail.com. Address: Calle 67 núm. 53-108, bloque 13, office 121, Medellín, Colombia. Phone (574) 2195837, fax (574) 2195843.

This paper was received January 30, 2009, modified May 7, 2010 and finally accepted May 14, 2010.

Abstract

In this paper we are interested in investigating the effects of the three-part tariffs system on consumers' behavior in the local fixed telephone service provided by the incumbent Telecommunications Company UNE in Medellin, which was authorized by the Telecommunications Regulatory Commission (CRT, for its Spanish name). In order to study consumer behavior and the effect of this tariff system we specify a sort of Engel Curve, which relates expenditure in fixed telephone service and expenditure in public utilities. Endogeneity problems could well arise from this specification, so the empirical strategy for studying households' consumption is based on a panel data analysis by performing instrumental variables and GMM procedures. Our results supports the hypothesis that consumers surpass expected consumption levels and therefore the total payment for the service is greater than planned, showing a sort of short-run irrationality in consumption.

Key words: Three-part tariffs, consumers' behavior, rationality, endogeneity, GMM estimators.

JEL classification: C14, C33, G38, D12, D60.

Resumen

En este artículo se estudia el efecto de las tarifas en tres partes sobre el comportamiento de los consumidores en el consumo de servicios de telefonía local fija suministrados por la firma UNE, con la autorización de la Comisión de Regulación de Telecomunicaciones (CRT). Para ello se especifica un tipo de modelo empírico correspondiente a lo que se conoce como curva de Engel, la cual relaciona el gasto en telefonía fija y el gasto total en servicios públicos. Algunos problemas de endogeneidad surgen, de modo que se aplica un método de momentos generalizado a la estructura de datos de panel subyacente. Adicionalmente, se estima un modelo dinámico de datos de panel para observar el ajuste mensual en el consumo. Los resultados sugieren que los consumidores, lejos de aprender de los errores, sistemáticamente se equivocan y sobrepasan su consumo esperado, lo que indica cierta irracionalidad en el corto plazo.

Palabras clave: tarifa en tres partes, comportamiento del consumidor, irracionalidad, endogeneidad, estimadores GMM.

Clasificación JEL: C14, C33, G38, D12, D60.

Introduction

Nowadays the use of nonlinear tariffs in public utility services is very common. They are based on the assumption that consumers will behave rationally by making choices according to their expectation of monthly consumption of telephone minutes. Moreover, that kind of system tariffs are supposed to improve the consumers' welfare by increasing the surplus of the highest demands, increasing the provider's revenue and ensuring the participation of the lowest demand in the market (Brown and Sibley, 1983; Willig, 1978). On this regard, Armstrong (2005) and Reiss and White (2006), among others, find that it depends heavily on several circumstances; since on the one hand, in a monopoly situation, the provider's revenue increases greatly, but overall consumer surplus could be reduced, favoring some (mainly high demands) and in detriment of low demands, and on the other hand, under competition, these results will be ambiguous. The final outcome will depend on the consumers' response and the information firms have about consumers.

A type of non-linear tariff that has been used recently, mainly in telecommunications, is the well-known three-part tariff. It comprises a fixed charge, called access price, a "basic" consumption included in the fixed charge and a price for each additional unit of consumption in excess of the basic consumption, usually called marginal price. The fixed charge increases with the basic consumption chosen, and the variable charge decreases with each chosen plan. Marginal price increases if the actual consumption is greater than the "basic" consumption.

The effects of this pricing scheme on consumers' behavior have not been sufficiently explored in the empirical literature. Lambrecht, Seim, Skiera, Thomadsen and Viard (2007) find that the consumer's choice is based on the fixed charge of the plan rather than on expected consumption, which will be later determined according to the chosen plan. The consumers' uncertainty potentially reduces their welfare and increases the firm's revenues, which are higher than those obtained with a two-part tariff. Nonetheless, the array of consumers' choices under a scheme designed to maximize profits must be explored from an empirical point of view (see, for instance, Reiss and White, 2006).

This paper provides empirical evidence on the effects of three-part tariffs on consumers' behavior in the local fixed telephone service provided by the incumbent Telecommunications Company UNE in Medellín since February 2006 until December 2006 when telmex entered the market. This non-linear tariff was authorized by the Telecommunications Regulatory Commission (CRT , for its Spanish name), through Resolution 1250 of 2005, allowing companies to offer to consumers tariff plans according to their consumption needs, which replaced the traditional fixed-charge and variable charge per telephone impulse tariff. An important consequence of three-part tariffs we explore is that there are winners as well as losers, which is not only a function of the type of demands, whether high or low, and this kind of tariffs could encourage a persistent increase in consumption over time.

The empirical strategy for studying month-to-month households' consumption is based on a panel data analysis. The first approach consists of specifying a linear relationship among the regressors (invariant across time), the non-observable heterogeneities and the households' monthly minutes consumption. The possibility of endogeneity between minutes consumption (and telephone expenditure) and expenditure on other public utility services (water, garbage disposal and electricity) forces us to correct the problem by performing the Generalized Method of Moments-GMM.

The second approach, which is dynamic, consists of specifying a linear relationship between minutes consumption and its lag. Again, in this context endogeneity problems will appear when we try to estimate the parameter of interest by using a first-difference model, so that the GMM estimator offers an alternative to study consumption adjustment over time. The main advantage of the GMM procedure is that it allows us to use all possible lags as instruments. For the sake of comparison, we also show the estimations using the ols approach, Anderson-Hsiao's procedure, within-groups estimations, Two-Stage Least Squares (2SLS) and GMM.

The layout of this paper is as follow: First, non-linear tariff mechanisms are defined and three-part tariff consequences on behavior are analytically foreseen. Next, a description of the available information is given and econometric estimation results are offered. Finally, our conclusions and interesting topics for future research are presented

I. Nonlinear and three-part tariffs

Usually two-part tariffs distinguish between average and marginal payment1. The type of payment is determined by consumers' socio-demographic and economic characteristics rather than by the company's cost structure. This payment scheme improves efficiency with respect to a tariff system that equals the average cost (provided that the marginal price is less than the average cost); in consequence the resulting deficit is compensated with a fixed charge (access charge) that turns up from distributing the fixed cost among all the demands. The implementation of two-part tariffs will be socially plausible providing that the fixed charge is such that the income-effect is low and ensuring that low-demand consumers are not excluded from the service (low income level or weak preferences).

In Colombia, this type of tariff was applied to the local telephone service until 2005, where the average reference cost (CMeR) was charged through the monthly tariff T(q) = F + p(q) where T(q) = (CMeR - CC)/12 and CC is the connection charge (access to the network). The average reference cost CMeR is a yearly-based component of the remunerated long term average cost (usually 15 years) with a rate of return of 13% and additional adjustment factors due to total costs dispersion and companies' demands in the different localities. Moreover, a range for the charge of F was established, that is, 0,15 T(q) « F «0,50 T(q), where F represents the basic costs of permanent availability of the service, in which much variability should not exist (Resolution 087 of 1997 of the CRT). This led to the implementation of different two-part tariffs in each city, depending on the relationship between F and p(q) chosen by the local provider.

On applying the different two-part tariffs (the most common form of non-linear tariffs) the economics of regulation suggests it is more convenient to offer as many different tariff plans as there are consumers. The highest fixed charge corresponds with lower variable payment so that consumers self-select the most convenient plan, depending on their preferences, income, and expected consumption. Consequently, the lowest demand would pay a high variable charge and a fixed charge nearing zero whereas the highest demand would pay a high fixed charge and a marginal price going to zero, thus avoiding the exclusion of low demand consumers and reducing the average payment of the highest demands (Brown and Sibley, 1986). These tariffs can be used in the same city, locality or neighborhood regardless of the cost of providing the service.

So far it has been held that two-part tariffs will improve welfare, understood as the sum of the surplus of consumers and the benefits of the firm, in comparison with a tariff equal to the average cost. We mean that any uniform price, other than the marginal cost, can be dominated in Pareto's sense by a non-linear tariff program and by increasing at least the welfare of the highest demands, increasing company revenue, and holding the lowest demands at least constant (Brown and Sybley, 1986; Willig, 1978).

This latter is what Armstrong (2005) and Reiss and White (2006), among others, pointed out, using dynamic models or revising the welfare issue in the supply-demand space instead of the typical formalization of the firm's budget restriction of the welfare economy. As we mentioned before, this depends on several circumstances since, under a monopoly situation, the firm's revenues are highly increased, but overall consumers' surplus is reduced in favor of some (mainly high demands) and against low demands, and thus the effects on welfare are ambiguous. When consumers are new or do not know the offers well, the firm's revenues are further increased. These results are deepened when the firm supplies several products and establishes minimum-term contract from consumers. Under competition, results are not clear and depend on the consumers' response and on the information firms have about consumers.

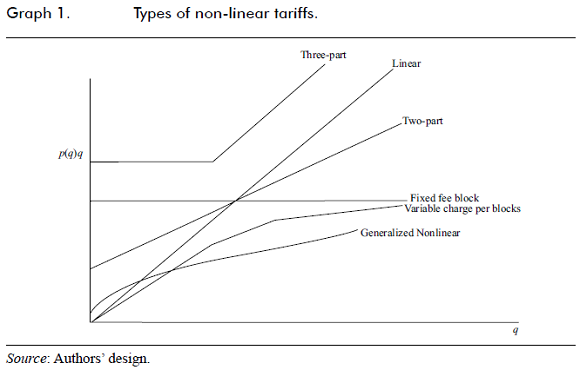

In practice, a firm can design different non-linear tariffs, depending on the distribution of the costs between the fixed and the variable part (graph 1). Across the tariffs, we find: 1) A two-part tariff with both a fixed part and a variable component with a slope constant, which can exclude lower demands; 2) A two-part tariff where the highest fixed charges correspond with lower variable charges, as demands gets higher; 3) A fixed-fee block tariff, increasing this charge with an increase in the allowed consumption amount; 4) A variable-charge-only tariff, decreasing this charge as demand increases; 5) Fixed payment or variable charge change as demanded amounts change until reaching a tariff of the kind F(q), as in 3), or p(q) in the case of 4), both declining as consumption increases; 6) Finally, a generalized non-linear tariff program T(q) = F(q) + p(q) could be sketched to pool all the possibilities (Braeutigam, 1989).

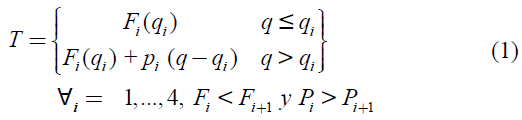

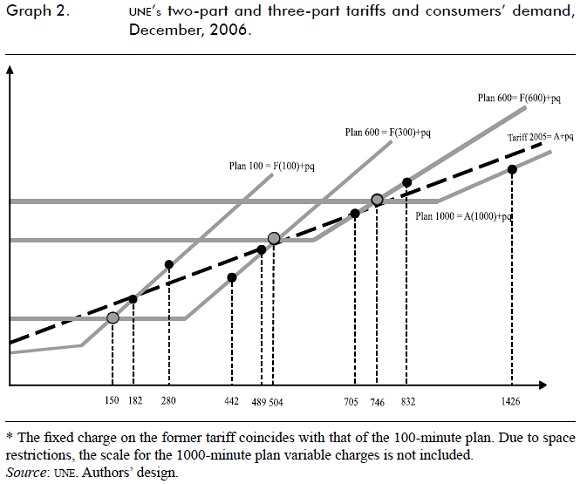

In 2005, the CRT issued Resolution 1250: "Consumers will be able to choose tariff plans according to their consumption needs and in correspondence with the current trends under which the Telecommunications industry is developed in Colombia and the world". This allowed companies with a market-share over 60% to offer different plans as long as their revenues were kept constant and with the restriction to offer the lower-income strata consumers (especially strata i and n) a variable-cost-only tariff within the plans. The following is the tariff scheme applied by une2 since February 2006:

Minute amounts included on each Fi are 100, 300, 600 and 1000; no plans are offered for over 1000 minutes, but the variable charge decreases in the ranks 1000-1500, 1501-2000, 2001-3000 and over 3000 minutes (Bedoya and Ceballos, 2008).

This scheme is a variety of non-linear tariff 5), called in the literature Three-Part Tariff, and defined by a fixed or access charge, a "basic" consumption amount included in the price and a marginal price for each unit of consumption in excess of the basic consumption. The fixed charge increases with the basic consumption chosen, and the variable charge decreases with each higher consumption plan. Therefore, a tariff's marginal price depends on consumption: it is zero if it remains within the basic consumption and positive if it exceeds it. With respect to the consequences on consumer behavior, Lambrecht et al. (2007) have found that:

1. Access charge and basic consumption affect mainly the consumer's plan choice more than the expected consumption; this consumption will be later determined according to the chosen plan. Therefore, there will be a temporary separation between tariff and consumption, unlike traditional two-part tariffs, whose marginal payment is constant.

2. Consumers' expected expenditure increases with consumption variation steering the consumer to prefer high consumption tariff plans, mainly if uncertainty over consumption is high.

3. Basic charge and consumers' uncertainty potentially decreases consumer's welfare and increases company's revenues. These are greater than those obtained with a two-part tariff.

4. The firm will be motivated to focus on consumers with a high consumption variability to increase its sales.

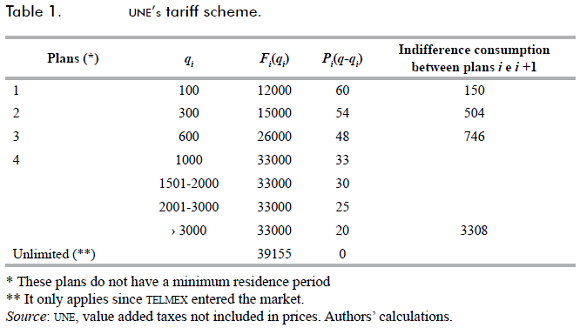

A first approximation to the consequences of UNE's tariff scheme on consumer behavior can be done descriptively (graph 2)3. The dotted line represents the former tariff scheme, T(q) = F + p(q), and the scale represents the four three-part tariff packages offered, where 150, 504 and 746 minutes are the points of indifference between paying Fi (qi ) = Pi + Pi (q _ qi ) and Fi+1 (qi+1 )∀i. This means it will be more profitable for a consumer with a tariff plan of qi minutes to choose qi + 1 when the minutes used in excess of the plan are the same as in the indifference point4.

Note, for instance, that if a consumer surpasses 150 minutes and does not choose the 300-minute plan, she will pay more, in fact, much more when compared with the former tariff. And if consumption is over 489 minutes, using the 300-minute plan, or over 705 on the 600-minute plan, she will pay more than on the former tariff. With regard to the 1000-minute tariff, there is a long stretch of consumption before both income lines cross, which goes from 746 to 2000 minutes. Here we find that any increase in consumption across this stretch will lead to a greater increase in billing than in consumption due to the curve's slope, and it will be even greater on the two-part tariff. That shows there can be losses for some consumers' welfare, depending on where their new consumption is located.

Evidence shows that consumers who signed up for the 100-minute plan in December 2006 had an average consumption of 280 minutes, which means an overbilling that could have been avoided if the 300-minute plan had been chosen, and is much higher than the amount that would have been billed on the former plan. Users who bought the 300-minute plan consumed 442 minutes on average, which places them below the payment line of the two-part tariff and therefore in a better situation. Users who signed up for the 600-minute plan used the service during 832 minutes on average, which places them above the former plan and, therefore, in a worse situation. Finally, consumers on the 1000-minute plan consumed 1,462 minutes on average, placing them below the dotted line and, therefore, in a better situation5.

A. Description of the data

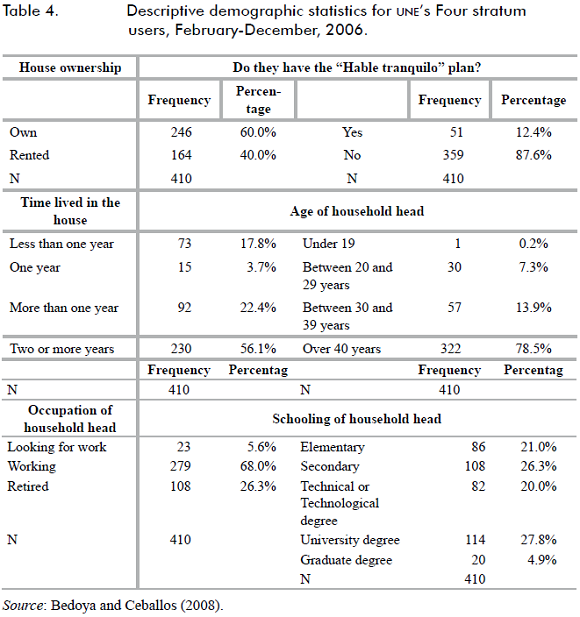

For this paper, we consider the local telephone consumption of four hundred and ten households (410 households) between February and December 2006, as well as their billing and some demographic data such as house ownership, time living in the same house, age of household head, his/her occupation, schooling, total number of people in the household, number of people by age range (younger than 19, between 20 and 29, between 30 and 39 and older than 40 years old) and their expenditure on public utilities6.

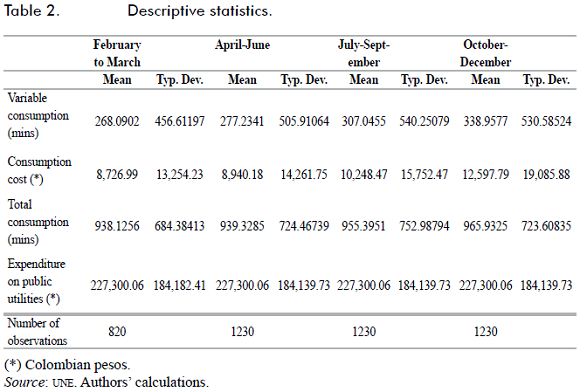

Table 2 shows the behavior of the variable consumption (minutes consumed in excess of the plan chosen by the consumer), the cost of this type of consumption (consumption cost), the total consumption (minutes included on each plan plus variable consumption) and the expenditure on household public utilities7. On average, these variables increase throughout the year, together with their typical deviation, which means that users have significantly increased their consumption throughout the year and, therefore, payment for it has also increased. The great variability of the data shows that this payment is not close from its average.

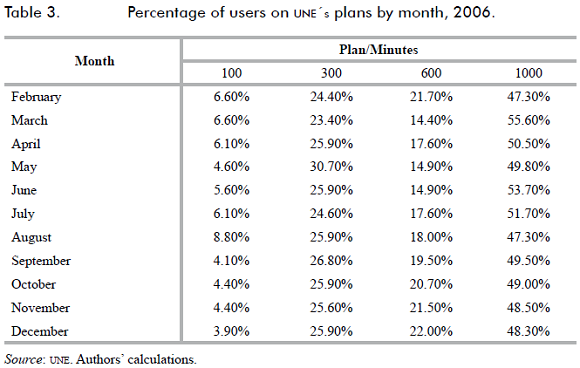

It is worth noting that, on average, variable consumption grew by 8.18% during the year, whereas billing grew by 13.33% and total consumption grew only 0.98%. According to table 3, there is a significant decrease in the number of 100-minute plan users, whereas the other users increase with respect to February levels, mainly those on the 300 and 1000-minute plans.

The rest of the variables that will be used represent user demographic categorizations, which are invariant over time or invariant over very short stretches. Most of the houses in which the telephone lines are registered are owned by the family who dwells in them (60%) and have lived in them for more than 2 years (56.1%). On average, the household head is employed, in her forties, and with a technical education level. These households, on average, are composed of 3 members (25.6%). However, 24.1% is composed of 2 people, 23.4% of 4 people, 9.5% of one person and the remaining 17.2% of more than 5 people. Additionally, in 23.2% of these houses there are household members under 19; in 23.6% people between 20 and 29 years old; in 16.6%, people between 30 and 39 years old, and in 36.5% people over 40 years old.

II. Empirical strategy A. Panel data model

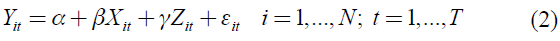

A first approximation for investigating consumption behavior and expenditure relationships could be performed by specifying a linear model, given by the following expression:

Where Xit is a matrix of dimension (N x T) x k, of time varying household characteristics observables, Zit is a set of time invariant demographic characteristics and εit is the classical error term with conditional expected value equal to zero. Bedoya and Ceballos (2008) estimate this model with interesting results. However, these results do not take into account unobservable heterogeneities that characterize families or households.

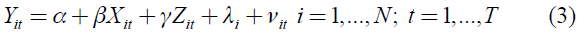

Unlike the first model, we are considering unobservable individual effects, so that our specification can be written as follow:

Where λi is an time invariant individual effect, which could be random or fixed, Xit is the individual characteristics vector, Zi is a set of time invariant demographic characteristics, β is the parameter to be estimated and vit is the classical error such that E(v|X ) = 0 .Note that different dependent variables generate different specifications. In this study, we could use three specifications where the dependent variable can be the variable consumption, the total consumption or the consumption's total cost.

It is worth noting that non-observable heterogeneity, λi , can be correlated with observables. If we have strictly exogenous time varying and/or endogenous time invariant observables we could perform fixed effect estimators (within group); in doing so we obtain consistent estimators just for β. As a matter of fact, it is too difficult to motivate no-correlation between the time-invariant non-observable effect and the observables, especially with micro data. However, if we want to know the effect of time-invariant observables on the outcomes, a kind of instrumental variables estimator, via the Hausman-Taylor (HT) procedure, is needed. Nevertheless, the HT estimation procedure assumes that observables are not correlated with the idiosyncratic error term, which sometimes is not satisfied.

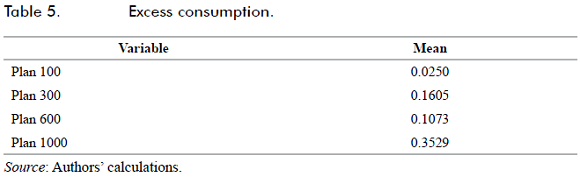

Let us stress that our dependent variable is defined as the additional consumption to the plan chosen by households, so we consider this to be the most important outcome for our empirical exercises. The following table shows the percentage of households that exceeded their minutes' consumption with respect to what they originally signed up, for all the period of the analysis:

Precisely, the percentage of households which exceeded their minutes' consumption are those who signed up for the 300 and 10000 minute plans. In general, all of them exceeded their consumption, which translates into additional revenue for the service provider, since these minutes are drastically more expensive. It is worth noting that by definition excess consumption is not constant because it represents additional consumption, which in theory has no limit. This is why we do not take total consumption as our variable of interest.

Our matrix Xi for every t, contains the set of independent variables or socio-demographic characteristics, which for our specific case are the following: number of people per household, whether the household head owns the house, the type of plan chosen by the household head, log of total expenditure and, finally, the number of years the household head has been living in the house, see Table 6 column (0).

It is worth noting that another well-known problem that could arise is endogeneity because total public utilities expenditure is included in the matrix of regressors and it is jointly determined with telephone expenditure and therefore constitute a joint consumption variable. This generates an endogeneity problem by simultaneity. As it is usually expressed in the Engel curve analysis literature (Banks, Blundell and Lewbel (1997); Barrientos (2006, 2009); Blundell, Duncan and Pendakur (1998); Deaton and Muellbauer (1980)), among others, this problem should be solved by using a Two Stages Least Square estimator combined with Generalized Least Square transformation-GLS.

In this case, the endogenous variable is the (logarithm of) total expenditure and the instrumental variable par excellence is the family income. Additionally, we include as instruments all exogenous variables included in the original specification. As we will see this procedure strongly improves the estimation of the conditional mean.

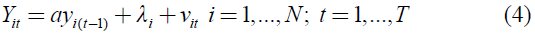

B. A dynamic approach

The empirical specifications (2)-(3) can be considered static, in the sense that they do not take into account telephone consumption time adjustment with respect to the plan chosen in the past by each household. To take into account the effect of the adjustment on time, we use an empirical model that can be written as:

where yi(t-i) is the lagged dependent variable, λi is a non-observable and time invariant fixed effect and vit is the error term with expected value equal to zero and constant variance, serially uncorrelated and independent between consumers. We are going to assume that λi is stochastic, and therefore it is necessarily correlated with the lag (unless it is a degenerated random variable, which is not the case).

An issue that must be dealt with is the inconsistency of the most common estimators in the literature, for instance ols or Anderson-Hsiao estimators. If we apply minimum quadratic regression, we will obtain an estimator that is necessarily inconsistent. The source of the inconsistency could be eliminated by using first differences, in which case the term λi should disappear to obtain the within-group estimator. However, this triggers a correlation between the transformed independent variable and the transformed error. Increasing N does not make it disappear, so it is necessary to use an estimator that is consistent for fixed T (compared to N).

The empirical strategy should be different to avoid such inconsistency. To this end, it is necessary to find an appropriate set of instruments to overcome the endogeneity produced by the lagged variable as regress (yi(t-1)). Since T > 3, we have the pairy yi(t-2), yi(t-3) as instruments. However, for model (4) to work, it must be expressed in first differences:

Where Δyit = yit - yi(t-1) with E(Δvit) = 0. Using ols we will obtain an inconsistent estimator, but using Two-Stage Least Squares with instruments, which are correlated to Δyi(t-1) but orthogonal to Δvit , we will obtain consistent estimators. Nonetheless, by using all the possible instruments, or the generalized method of moment's estimator -GMM, it is possible to obtain a more efficient estimator than the one resulting from using T-2 instruments (see Arellano and Bond, 1991).

III. Empirical results

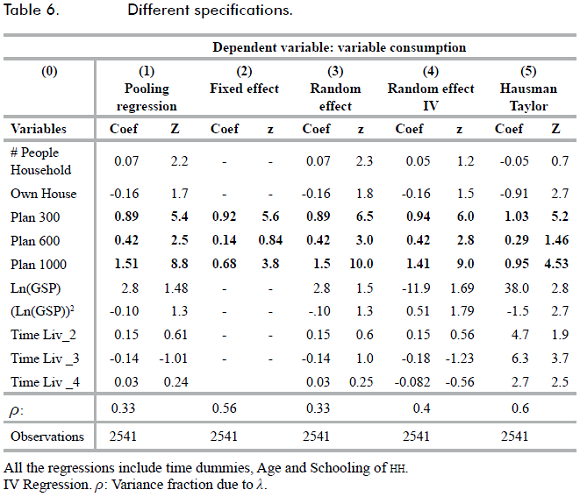

Column 1 in table 6 shows the ordinary least square regression, column 2 shows the fixed effect estimator, column 3 shows the random effect estimator, and column 4 shows the random effect using the instrumental variables procedure by performing Two-Stage Least Squares estimation, which is enough to guarantee consistency if the true model is linear. Column 5 shows the HT estimator. By construction columns (1), (3), (4) and (5) show results pertaining to a kind of Engel curve, which relates consumption variable and total expenditure in public utilities of household i at moment t.

According to column 1 the Engel parametric specification does not seem to be the most appropriate in this case since the estimated coefficient of the logarithm of total expenditure on utilities is not statistically significant. Note that a simple linear specification such as this in column (1) does not seem quite suitable to draw clear conclusions, especially if we do not take into account the possible correlation among observables and not observables.

It is clear too that the fixed effect is not appropriate for estimating our Engel Curve. All time-invariant observables were eliminated from the model and only information for different plans are still usable. Random effect models estimation, or GLS transformation in column (3), even when they include instrumental variables (see column (4)), do not allow for enough curvature since the estimated parameter for the (Ln(GSP))2 variable is not statistically significant or has an unexpected sign. Note that the HT estimator reports the correct sign for estimated parameters, both for total expenditure and its second power.

It is worth noting that estimated parameters for each plan (300, 600 and 1000) for all specification are positive (and highly significant), which is unexpected if agents were completely rational. In fact it means that plans lead consumers to exceed they original consumption. Note that at the beginning the agents believe that their chosen amount of minutes will be enough, do not update their expectations and, on average, end up with inconsistencies month after month. Price range segmentation, or nonlinearity in demand, seems to confirm empirically what the theory predicts: the service provider ends up making additional profits from the typical consumer's irrationality and excess consumption.

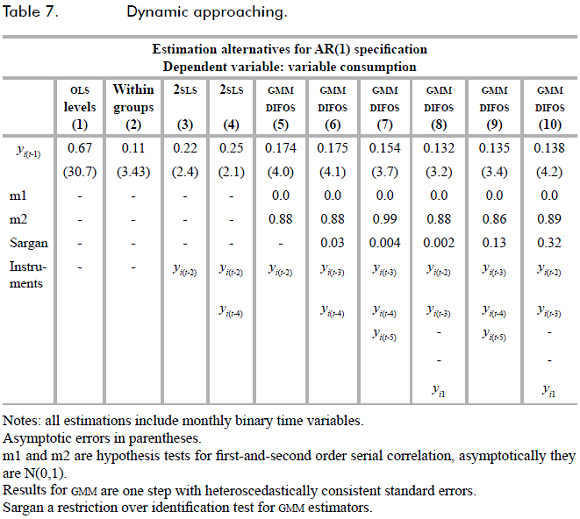

Finally, upon estimating model (3), a sustained increase in additional consumption can be seen across months if we include time-dummies. This dynamic aspect, perhaps roughly expressed in the estimated parameters for these time-dummies, is captured in model estimations (4) and (5). Table 7 shows a dynamic approximation for the additional minutes consumption and its adjustment over time.

From all estimation cases it is possible to find that there is, in general, a significant gap in consumption given by the estimated . Additionally, there is another gap in estimation when using the ols estimator and Within-Group; and even if we use the Two-Stage Least Square estimator with only two instruments (AH estimator). For instance, we have that  OLS = 0.67,

OLS = 0.67,  WG = 0.11 and

WG = 0.11 and  AH = 0.25. However, when estimating using three instruments, the adjustment in variable consumption of additional minutes is on average 16%. When using all possible instruments, the adjustment in consumption, via an increase in additional minutes, is just 13%. All of them are significant and independent from the variance and covariance matrix used to obtain the standard errors matrix.

AH = 0.25. However, when estimating using three instruments, the adjustment in variable consumption of additional minutes is on average 16%. When using all possible instruments, the adjustment in consumption, via an increase in additional minutes, is just 13%. All of them are significant and independent from the variance and covariance matrix used to obtain the standard errors matrix.

Note that we are interested in estimating the parameter α rather than the λi vector, a consistent and unbiased estimation of the parameter α gives us an idea of consumer behavior at time t conditional on the behavior in the past. Given that the dependent variable is excess consumption of the families then a negative sing for  would show us a sort of rationality, in the sense that additional consumption of minutes would show families that every month they make mistakes, but every month to a lesser extent.

would show us a sort of rationality, in the sense that additional consumption of minutes would show families that every month they make mistakes, but every month to a lesser extent.

Empirical results show that the adjustment in additional minutes' consumption in the fixed local telephone service has been on the rise across months. Minutes included in the chosen plans have not been enough, which has lead to additional consumption that was not in the consumption "plans" or "preferences" of the agents. In summary, not having robust evidence of an adjustment in additional consumption for the following months (not even under 5%), inconsistency in additional consumption shows that neither consumption plans, nor preferences, nor errors were corrected. This indicates a sort of irrationality of the agents at the time of signing up for these types of plans.

IV. Conclusions

CRT regulatory commission granted the telecommunications companies liberty to offer tariff plans that allowed consumers of the fixed local telephone service make choices consistent with their consumption plans. This made it possible for the incumbent to offer a three-part tariff limited to a reduced number of plans. Theoretical and empirical evidence shows that, in general, these plans modify consumer behavior (and probably reduce consumers' welfare, which is a hypothesis to be tested in the future) since they base their plan choice on the fixed charge and the minutes included, and not on their expected consumption. These plans can be designed so that consumers increase their consumption over time and even demand plans with more minutes included.

The empirical results show that consumers surpass expected consumption levels and therefore the total payment for the service is greater than planned. Moreover, the company would rightfully believe that there is a high probability that many consumers will decide in the future to switch to a plan with more minutes, induced by successive deviations from the original plan. As a matter of fact, dynamic specification shows that there exists a gap that is not corrected (or updated) over time, showing a sort of short-run irrationality that should be corrected in the long-run. It is the behavior that we should expect from a typical agent in the neo-classical context.

Finally, one important limitation preventing us from drawing more robust conclusions is the lack of supplementary socio-demographic information both about the household and the household head.

FOOT NOTES

1 There are different forms of price discrimination, including charging different consumers different prices for the same good (third-degree price discrimination); making the marginal price depend on the number of units purchased (nonlinear pricing) or on whether other products are also purchased from the same firm (bundling); whether this is the first time a consumer has purchased from the firm (introductory offers; customer "poaching") or whether the customer has previously purchased other similar goods from the firm. On the other hand, a firm's range of instruments to discriminate prices depends on the possibility of arbitrage and resale between consumers, on their ability to make anonymous contact with firms and pretend to be a new customer, thus benefiting from introductory prices. Finally it will depend on whether the regulatory entity allows the firm to discriminate prices, keeping maximum prices or average costs constant and whether it is aware of the possibility of firms passing information to other firms about their customers' behavior in different markets (Armstrong, 2005).

2 This service was provided since 1917 by the municipality of Medellin. Since 1955 it was part of one of the services offered by the local autonomous public entity Empresas Públicas de Medellin (EPM). In 2006 this business was divided when the new EPM Telecomunicaciones Company was created, under the mixed-nature brand UNE. The company Telmex offered from the start a fixed charge with unlimited amount of minutes, to which UNE responded with the same option, but maintaining the tariff plan studied in this paper. All these offers are part of packages which include cable television, broad band and telephone service. A complete consumer behavior and welfare analysis should consider the different goods offered by the companies. Armstrong and Vickers (2007) show that in a multiproduct monopoly case non linear tariffs increase firm's revenues and social welfare but not consumer's overall surplus (there will be winners and losers); when consumers may buy a certain product from each firm they can increase their surplus at the expense of the firm's revenues. When there are duopolies offering multiple services, the effects are ambiguous, depending on the heterogeneity and elasticity of demand, choice and provider switching costs, and loyalty to a brand.

3 This paper focuses on stratum IV consumers, who, by law, do not receive subsidies or have to pay tariff surcharges. Consumption of plans correspond to those of December 2006 and the plans had been effective since February 2006. Consumption for two-part tariff was measured in impulses for which there is no technical conversion factor because it depended on random factors associated with the call, such as telephone answering time and call duration. Graph 2 shows that for the onversion from impulse into minutes the domestic average calculated by the CRT (2000) was used, which is equivalent to 1.31 minutes per impulse, which results in a tariff per minute of 27 pesos on the former plan (See Bedoya and Ceballos, 2008).

4 UNE allows customers to automatically adjust between each plan by using the "Hable Tranquilo" option, at an additional monthly cost of 2500, which is, for instance, equivalent to 21% of the monthly cost of the plan with the fewest minutes. It can be observed from table 4 that only 12.44% of the user sample chose the "Hable Tranquilo" option.

5 On previous work, Bedoya and Ceballos (2008) find that users made mistakes when choosing their plan and that the adjustment process took all of the year 2006, being more critical for low demand users, since high demands are tied to a single plan (1000 minutes), which negatively affects these users because they are the ones who value the service the most.

6 Bedoya and Ceballos (2008). Consumption and billing data provided by UNE.

7 If a user has all the services, the bill will include local and long distance telephone service, electricity, gas, tap water and basic garbage collection service (offered by the garbage collection company evm but billed by EPM), cable television and Internet. UNE also offers packages that include cable television, Internet and telephone service.

References

1. ARELLANO, M., and BOND, S. (1991). "Some tests of specification for panel data: Monte Carlo. Evidence and an application to employment equations", Review of Economic Studies, 58:277-297. [ Links ]

2. ARMSTRONG, M., and VICKERS, J. (2007). "Competitive nonlinear pricing and bundling", Mimeo, Review of Economic Studies, 77(1):30-60. [ Links ]

3. ARMNSTRONG, M. (2005). Recent developments in the economics of price discrimination. Mimeo. London, Department of Economics University College. [ Links ]

4. BANKS, J.; BLUNDELL, R., and LEWBEL, A. (1997). "Quadratic Engel Curves and consumer demand", The Review of Economics and Statistics, 79(4):527-539. [ Links ]

5. BARRIENTOS MARÍN, J. (2006). "Estimation and testing additive partially linear model in a system of Engel Curve's" (Working Paper ivie). WP-AD. [ Links ]

6. BARRIENTOS MARÍN, J. (2009). "On the consumer behavior in urban colombia: The case of Bogotá", Ensayos sobre Política Económica, 27(59):82-99. [ Links ]

7. BEDOYA, J. F. y CEBALLOS, G. (2008). Discriminación de precios en las tarifas de telefonía fija: los planes de EPM. Memoria de grado, Departamento de Economía, Universidad de Antioquia. [ Links ]

8. BLUNDELL, R.; DUNCAN, A., and PENDAKUR, K. (1998). "Semiparametric estimation and consumer demand", Journal of Applied Econometrics, 13(5):435-461. [ Links ]

9. BRAEUTIGAM, R. (1989). "Optimal policies for natural monopolies", in R. Schmalensee and R. Willlig (Eds.), Handbook of industrial organization (cap. 23). Amsterdam, North Holland. [ Links ]

10. BROWN, S. J., and SIBLEY, D. S. (1983). The theory of public utility pricing. Cambridge, Cambridge University Press. [ Links ]

11. DEATON, A., and MUELLBAUER, J. (1980). Economic and consumer behavior. Cambridge, Cambridge University Press. [ Links ]

12. REPÚBLICA DE COLOMBIA (2000). Comisión de Regulación de Telecomunicaciones (CRT), Validación del factor de conversión impulso-minuto: informe final. [ Links ]

13. REPÚBLICA DE COLOMBIA (2000). Comisión de Regulación de Telecomunicaciones (CRT), Resolución 87 de 1997. [ Links ]

14. REPÚBLICA DE COLOMBIA (2000). Comisión de Regulación de Telecomunicaciones (CRT), Resolución 1250 de 2005. [ Links ]

15. LAMBRECHT, A.; SEIM, K.; SKIERA, B.; THOMADSEN, R., and VIARD, B. (2007). "Does uncertainty matter? Consumer behavior under three-part tariffs", Marketing Science, 56(2):334-342. [ Links ]

16. REISS, P., and WHITE, M. (2006). "Evaluating welfare with nonlinear prices" (Working Paper 12370). nber. [ Links ]

17. SLESNICK, D. (1998). "Empirical approaches to the measurement of welfare", Journal of Economic Literature, American Economic Association, 36(4):2108-2165. [ Links ]

18. WILLIG, R. (1978). "Pareto-superior nonlinear outlay schedules", Bell Journal of Economics, 9(1):56-69. [ Links ]