Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Desarrollo y Sociedad

Print version ISSN 0120-3584

Desarro. soc. no.65 Bogotá Jan./June 2010

Fiscal Policy Restrictions on Inflation Targeting: A Political Economy Approach*

Restricciones de política fiscal sobre la inflación objetivo: una aproximación de economía política

Hernando Vargas Yanneth Rocío Betancourt **

* This is an updated version of the paper presented in the Second High-Level Seminar of the Eurosystem and Latin American Central Banks held in Lisbon on 14-15 October 2004.

** The authors are, respectively, Deputy Governor and Head of the Macroeconomic Programming section of the Banco de la República, Colombia. Carrera 7a num. 14-78 Bogotá. E-mail: hvargahe@banrep.gov.co. Corresponding author's e-mail: ybetanga@banrep.gov.co. The opinions expressed in this paper are those of the authors and do not represent the views of the Banco de la República or of its Board of Directors.

This article was received May 15, 2008, modified May 10, 2010 and finally accepted May 24, 2010.

Abstract

Fiscal policy may impose restrictions on Inflation Targeting when Central Bank Independence (CBI) is institutionally weak and society has a real exchange rate target that is highly valued. In this environment, fiscal policy constrains the decisions of a committed, independent Central Bank (CB) regarding inflation. When such a pressure is strong enough to threaten CBI , monetary authorities react by setting an inflation target that differs from the one that would prevail in the absence of those threats. A simple model is used to illustrate this point where the CB takes into account the probability of survival as an independent institution.

Key words: Central bank independence, fiscal policy restrictions, inflation targeting.

JEL classification: E52, E58, E63.

Resumen

La política fiscal puede imponer restricciones sobre la inflación objetivo, cuando la independencia del banco central es institucionalmente débil y la sociedad tiene una meta de tasa de cambio que es fuertemente valorada. En este caso, la política fiscal restringe las decisiones de inflación de un banco central independiente y comprometido. Cuando dicha presión es lo suficientemente fuerte como para amenazar la independencia del banco, las autoridades monetarias reaccionan fijando una meta de inflación que difiere de aquella que prevalecería en ausencia de tal amenaza. Para ilustrar este punto se utiliza un modelo simple donde el banco central toma en cuenta la probabilidad de sobrevivir como una institución independiente.

Palabras clave: independencia del banco central, restricciones de política fiscal, inflación objetivo.

Clasificación JEL: E52, E58, E63.

Introduction

In an open economy with fragile institutions, fiscal policy may influence monetary policy decisions and outcomes beyond the fiscal dominance channel postulated by Sargent and Wallace (1981). When Central Bank Independence (CBI) faces serious and repeated threats from the Government, Congress or other sectors, inflation expectations and the incentives of the Central Bank (CB) are affected. The private sector will take into account the probability of CBI removal when forming inflation expectations, while the CB will value its survival as an independent institution in terms of the macroeconomic outcomes.

In such a situation, if the Central Bank perceives that too low an inflation rate increases the probability of the removal of independence, it may choose to pursue a gradual path of disinflation1 or it may try to accommodate other objectives, in addition to inflation. In particular, since the size of Government expenditure affects the relative price of non-tradables goods and the magnitude of public debt may have an impact on sovereign spreads, the behavior of fiscal variables helps determine the equilibrium Real Exchange Rate (RER) 2. If the latter differs from society's target, there will be pressure on the CB to deliver a RER close to the target. In this case, fiscal policy may influence monetary policy (the CB 's inflation targets) when "the authorities", representing society, have a RER target that is highly valued.

For instance, a permanent rise in public expenditure (usually biased toward non-tradable sectors) may drive the equilibrium RER below the authorities' RER target. Then, there will be pressure on the CB to deliver a RER closer to the target, probably by producing an 'inflation surprise'. If this pressure turns into serious threats to its independence, even a committed CB may set inflation targets above the rates that would prevail in the absence of these threats. In doing so, the CB tries to increase its probability of survival as an independent institution to deliver an inlation rate below the discretionary level.

Furthermore, if fiscal policy is not flexible and cannot be used to compensate external shocks (e.g. to terms of trade or international interest rates), the CB's inflation targets will be affected by those shocks and the threats to its independence. In a disinlation process, this means that the CB may be too timid in fighting inflation in the presence of shocks that appreciate the currency in real terms. In addition, when public debt is very high and there are doubts about the Government's ability to repay it, a successful fiscal adjustment program will probably generate a reduction in the sovereign debt spreads and a real appreciation. This may also induce a relaxation in the disinflation process.

These ideas are modelled in this paper following the Barro and Gordon (1983) and Cukierman (1992) frameworks, by introducing a third stage in their sequential policy game. In this new stage an attempt is made to remove CBI . Since overriding the independent CB requires a qualified majority and the support of the public, it is assumed that the probability of an attempt to remove CBI (or the probability of success in such an attempt) is a function of the distance between the authorities' RER target and the RER implied by the CB's inflation target. The larger the difference, the broader the support to reform the CB . With this feature, the independent CB can influence its probability of survival through its choice of the inflation target and, therefore, ends up trying to accommodate other objectives at the cost of higher inflation.

The paper is organized as follows. In the first part a discussion regarding disinflation, CBI and threats to the latter is given to motivate our hypothesis. Then, the model used to illustrate the previous ideas is presented.

I. Disinflation and threats to central bank independence

During the last twenty years many countries around the world have been successful in controlling inflation either by shock or gradual stabilizations. The former have been used by high inflation countries whereas gradual disinflations have been implemented by countries with a lower level of inflation. Additionally, the participation of the government in the disinflation process has been greater when inflation is high rather than when it is low. For example, in Chile this process was gradual and was mainly done by the CB while Argentina, Bolivia and Israel applied the shock stabilization with a high intervention of the government (Cukierman, 2006). In Colombia the independent CB started a process of inflation reduction in 1991 that has taken more than a decade and has implied a slow pace of disinflation3.

Different explanations have been given to the varying speed of disinflation processes. One of them is related to the strategy adopted by central banks for achieving price stability. In this framework, disinflation can be reached by adopting a deliberate path towards a low inflation level or by using an opportunistic strategy (Bomfim and Rudebush, 1997). The latter implies that a central bank does not take any action to reduce inflation but waits for external favourable shocks (e.g. supply shocks or unforeseen recessions) to reduce inflation (Orphanides and Wilcox, 2002). This opportunistic approach implies a gradual path of disinflation, but with a high cost in terms of the central bank's credibility.

Another explanation is given by Collard et al. (2007) who develop a New Keynesian model in which gradual disinflation emerges as a result of deep habits and countercyclical mark-ups. Deep habits imply that the price elasticity of demand in all good markets decreases in the face of a recession and, as a result, firms increase mark-ups. In this context, a central bank that reduces its inflation target and follows a Taylor Rule will produce a gradual, hump-shaped response of both inflation and the nominal interest rate.

A low level of credibility of the CB may imply a high cost of disinflation in terms of unemployment (a high sacrifice ratio) and, thus, may also explain the "low" speed of disinflation pursued by some central banks. This lack of credibility may in turn be related to the effect of time inconsistency and discretionary monetary policy on inflation expectations and the formation of nominal wages and prices. A solution to this problem consists of removing all discretionary power from the government and delegating monetary policy to an independent and conservative central banker who takes into account the social preferences regarding the target of inflation and output, but places a higher weight on the inflation target than the government does (Rogoff, 1985)4.

However, the empirical literature has found a negative relationship between CBI and the speed of disinflation (Jordan, 1999), as well as a positive link between CBI and the sacrifice ratio (Fischer, 1995; Fischer, 1996). Nevertheless, these results depend on models that assume exogenous persistence of inflation. When the latter is explained by the degree of CBI, lower inflation persistence and a higher speed of disinflation are associated to a high level of CBI (Diana and Sidiro-poulos, 2004)5.

A different strand of the literature argues that CBI may not be sufficient to produce a rapid disinflation when the lack of consensus in society about the benefits of low levels of inflation weakens the institution of an independent CB and make it more vulnerable to threats coming from many sectors. Therefore, a central bank conducting a policy that lacks broad political and public support6 exhibits an independence level lower than the legal7 one and can sooner or later be overridden8. Lohmann (1992) shows that if the authorities retain the option to override the central banker's decisions in the presence of large shocks to output, the central banker accommodates the policymaker's objectives in order to avoid being overridden.

This paper falls under this approach and considers an independent central bank in a fragile institutional framework, where threats to CBI may be realized. In this context, the central bank partially accommodates objectives other than inflation in order to survive as an independent entity. More precisely, threats to CBI emerge when the authorities have a real exchange rate (RER) target that is more depreciated than the RER implied by the CB's inflation target. In this case, external pressures on the CB may be exerted to deliver a higher depreciation. In such a situation, the response of a committed, independent CB is to select an inflation rate above the level that would have been chosen in the absence of threats to its independence.

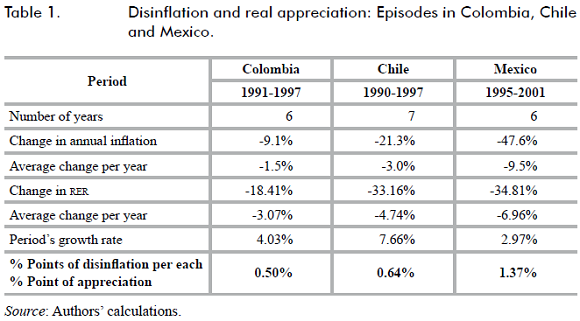

This implies that disinflation will be gradual in periods of real appreciation of the currency. For example, a gradual disinflation process was observed in Colombia during 1991-1997, when the currency appreciated in real terms. Table 1 shows that such a disinflation was slower than episodes of disinflation in other Latin American economies that did not have hard pegs and exhibited a real appreciation of their currencies9. At the same time, threats to CBI were issued on several occasions during that period in Colombia (Vargas and Betancourt, 2010)10.

Finally, another implication of our model is that fiscal policy may influence CB behaviour through its effect on the equilibrium RER, given the possibility of threats to CBI and in the presence of a depreciated RER target that is highly valued by society.

II. The model

A. Framework

A simple model is posited here to find the equilibrium in a sequential game in which an independent CB committed with an inflation target is threatened to be removed if its policy does not support the society's RER objective. This objective is reflected in the authorities' preferences. By "authorities" we mean the Government, Congress or an institution with the possibility of removing CBI. The key assumption of the model is that the attempt to remove CBI has a probability of success that depends on the difference between the society's RER target and the RER implied by the announced inflation target.

In this sequential game an independent CB announces an inflation target, then the private sector forms its inflation expectation and, at a third stage, "the authorities" make an attempt at removing CBI to achieve a more depreciated RER, closer to their target. The structure of the game is similar to the one considered in Barro and Gordon (1983) and Cukierman (1992). The difference is the introduction of the third stage in which an attempt is made to remove CBI. With this feature, the independent CB can influence its probability of survival through its choice of the inflation target and, therefore, ends up trying to accommodate other objectives at the cost of higher inflation.

Since overriding the independent CB requires a qualified majority and the support of the public, it is assumed that the probability of an attempt to remove CBI (or the probability of success in such an attempt) is a function of the distance between the authorities' RER target and the implied RER by the CB's inflation target. The larger the difference, the broader the support to reform the CB, since, for example, exporters and tradeable goods producers would strongly lobby to avoid an ex-ante appreciated RER. Thus, it is assumed that these pressure groups suffer from the dynamic inconsistency problem that explains the existence of an independent CB in the first place.

The private sector is assumed to have rational expectations. Therefore, it takes into account the probability of independent CB survival when forming its inflation expectations. The committed CB in turn incorporates into its decision problem both the probability of removal from office and the reaction function of the private sector (its expectations). Finally, it is assumed that "the authorities" are unable to commit to a target and are thus subjected to an inflation bias.

The result is that, in equilibrium, a committed, independent CB selects an inflation rate above the level chosen in the absence of threats to its independence. Intuitively, the CB tries to "survive" with the purpose of delivering an outcome that is better than pure discretion and, in order to increase its probability of "survival", the CB accepts higher levels of inflation. This means that a threatened, committed CB will disinflate slowly when the equilibrium RER is below the RER target, and especially, when the equilibrium RER appreciates starting from a point below the RER target. This behavior could help explain why disinflation was slow in Colombia when there were fundamental reasons for a real appreciation of the currency. It can also explain how fiscal policy influences inflation targeting through its impact on the RER and the "political economy" channel described above11.

B. Assumptions

In addition to the setting described above, the following are the main assumptions of the model. Nominal wages are set at the beginning of a one-period contract according to the expected price level. Hence, exporters or other tradable goods producers derive benefits from local currency prices above the expected level. These benefits, in turn, are highly valued by society. This may reflect a strong lobby by powerful tradable goods producers on the basis of employment increases in those sectors.

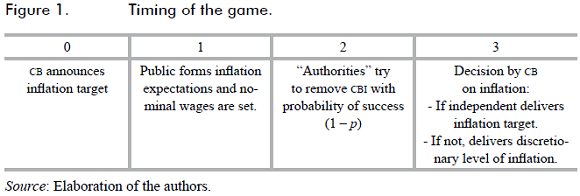

The game has four stages, which are represented in the figure 1.

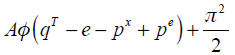

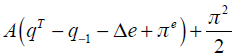

The CB and "the authorities" have the same preferences in terms of inflation and the RER. They dislike an inflation rate different from an optimal level, assumed to be zero, and a RER that is more appreciated than society's RER target. Thus, both the CB and "the authorities" want to minimize the same objective cost function:

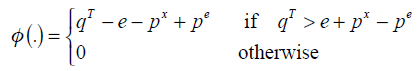

Where qT is the "society's" RER target, e is the nominal exchange rate, px is the external price index, pe is the expected domestic price level and A is a parameter denoting the weight of the RER target in the objective function12. The function Φ(.) is specified as follows:

Hence, it is assumed that the CB and "the Authorities" care about deviations from the RER target only when it lies above (is more depreciated than) the expected RER 13. For simplicity and given the motivation of the paper, attention will be restricted only to this case and p will be assumed to be zero. So, the objective cost function can be expressed as:

Furthermore, it is assumed that the nominal exchange rate floats, so nominal depreciation is jointly determined by an exogenous, fundamental-driven, equilibrium RER, q*, and inflation (chosen by the CB). Thus Δe = (q* - q-1) + π, where q-1 is the previous level of the RER 14. The policymaker's cost objective becomes:

Recall that attention is restricted to the case in which the RER target is more depreciated than the expected RER and, in particular, it is assumed that the RER target is more depreciated than the equilibrium RER, (qT - q*) > 0.

Notice that the CB and the authorities share the same obj ective function. The difference between them lies on their ability to commit to an inflation target. While the independent CB can commit, the authorities would deliver a higher discretionary inflation level because they would try to obtain a more depreciated currency by surprising agents.

The timing of the game is as follows:

• At stage 3, "the authorities" or a CB that is not able to commit to an inflation target, will choose the discretional level of inflation π = A to minimize this cost, given inflation expectations.

• At stage 2, "the authorities" want the discretionary solution π = A, regardless of the inflation target, and would like to remove the independent, committed CB if the inflation target differs from A. The probability of an attempt to do so (or of a successful attempt) is (1 - p), where p = p(q* + (πα - πe) - qT) is the probability of survival of the independent CB and πa is the inflation target previously chosen by the CB. This probability depends on the distance between the expected RER, (q* + πα - πe), and the target RER, qT, and is assumed to have the following properties:

It means that in the relevant range of analysis, the probability of survival of the independent CB increases with the expected RER .

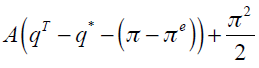

If the attempt to eliminate CBI occurs and is successful, the discretionary solution is obtained, π = A. If not, the independent CB stays and delivers π = πa, where A > πa. Thus, at stage 1 the private sector calculates the expected inflation as follows:

• At stage 0, the committed, independent CB solves its decision problem and announces the inflation target πα, taking into account the reaction function of the private sector, πe = πe (p,πα), and the probability of keeping its independence, p = p (q* + (πα - πe) - qT).

C. Equilibrium

In the absence of threats to CBI, the committed CB announces an inflation target, πα, and delivers the optimal inflation under the rule π = πα = 0 (Barro and Gordon, 1983). Then the public will fully believe this target, and both inflation and the inflation surprise will be set to zero (the efficient outcome).

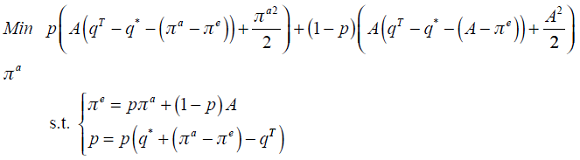

Under threats to CBI, however, the committed CB is uncertain about whether an attempt to remove its independence will be made or whether it will be successful. Hence, the risk neutral CB chooses the inflation target in order to minimize the expected value of its objective cost function:

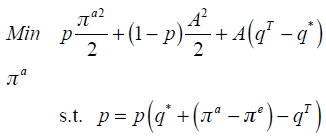

This problem can be rewritten as:

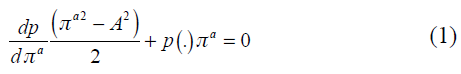

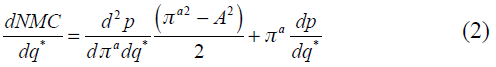

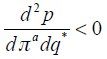

And the first order necessary condition is the following:

Which implies that the CB will choose the inflation target, πα, such that the Net Marginal Cost (henceforth NMC) of inflation, taking into account the effect on the probability of survival, will be zero. In this case, the independent CB faces a trade off between the cost of an inefficiently high inflation rate and the benefit of a higher probability of survival.

D. Results

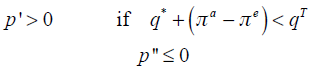

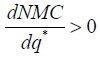

If the probability of survival increases with the inflation target  15, as the intuition would suggest, and given the assumptions made about the probability function p(.), the following results are obtained:

15, as the intuition would suggest, and given the assumptions made about the probability function p(.), the following results are obtained:

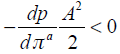

Result 1: In the presence of threats to CBI, the optimal inflation target for the independent CB, πα, is greater than zero. Suppose πα = 0, then

the NMC of inflation becomes negative:  Therefore, it pays for the CB to increase inflation provided that the second order condition is met16.

Therefore, it pays for the CB to increase inflation provided that the second order condition is met16.

Result 2: The optimal inflation for the independent CB , πα, is less than A. Suppose πα = A, then the NMC of inflation becomes positive if p(q* - qT) is greater than zero17. This means that the marginal net benefit from increasing inflation at πα = A is negative. Therefore, it pays to decrease inlation, provided that the second order condition is met.

Summing up, when the target RER is more depreciated than the equilibrium RER, q* < qT, the committed CB will announce an inflation target that is above the equilibrium level in the absence of threats to its independence, but that is still below the discretionary level of inlation: 0 < πα < A. Intuitively, when the CB is threatened and it can influence its probability of survival, there are additional marginal benefits from inflation (higher probability of survival) and, as a result, equilibrium inlation is also higher.

In addition to these results, equation (1) may be used to find the effect of movements in the equilibrium RER on the inflation target:

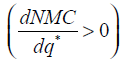

Equation (2) represents the change in the NMC of inflation that follows a change in the equilibrium RER. It can be verified that if the probability of survival increases with a depreciation of the equilibrium RER  , as the intuition would suggest, and under the assumptions made so far, the NMC of inflation rises with the equilibrium RER

, as the intuition would suggest, and under the assumptions made so far, the NMC of inflation rises with the equilibrium RER  . See the Appendix for a proof. Therefore:

. See the Appendix for a proof. Therefore:

Result 3: An appreciation of the equilibrium RER reduces the NMC of inflation and increases the equilibrium inflation target. Intuitively, this happens because a more appreciated equilibrium RER reduces the probability of survival of the independent CB . Hence, a rise in the inflation target increases inflation expectations by less than before, as the probability of survival is lower. Thus, the benefit of the "inflation surprise", πα - πe, in terms of reaching a higher RER is greater than before, and so is the marginal benefit of inflation18. In practice, this result means that a threatened, committed CB will disinflate slowly when the equilibrium RER is below the RER target, and especially, when the equilibrium RER appreciates starting from a point below the RER target.

The implications of this conclusion in terms of the effect of fiscal policy on inflation targeting in this context can be made clear now.

Result 4: A permanent increase in government expenditure that is biased toward non-tradeable goods will appreciate the equilibrium RER. In these circumstances, disinflation will be slower.

Result 5: If government expenditure is inflexible and cannot offset a real appreciation driven by fundamental external factors, disinflation will be slower.

Result 6: If initially the equilibrium RER is high because vulnerable public finances generate high sovereign spreads, a successful adjustment program will produce a real appreciation. If the initial equilibrium RER is below or equal to the RER target, disinflation will be slower.

IV. Conclusions

When Central Bank Independence (CBI) faces serious and repeated threats from the Government, Congress or other sectors, inflation expectations and the incentives of the Central Bank (CB) are affected. In such a situation, if the CB perceives that too low an inflation rate increases the probability of the removal of its independence, it may choose to pursue a gradual path of disinflation or it may try to accommodate other objectives, in addition to inflation.

Pressures on the CB may be exerted when society has a real exchange rate (RER) target more depreciated than the RER implied by the CB's inflation target. In this case, the response of a committed, independent CB is to select an inflation rate above the level chosen in the absence of threats to its independence. Thus, when fiscal policy induces an equilibrium real appreciation, or when it is so inflexible that cannot be used to offset the impact of external shocks on the RER, a link between fiscal policy and inflation targeting appears through the effects of threats to CBI on inflation expectations and the CB's decision process.

This behavior helps explain why disinflation could be slow when there are fundamental reasons for a real appreciation of the currency. It can also explain how fiscal policy influences inflation targeting through its impact on the RER and the "political economy" channel beyond the fiscal dominance channel postulated by Sargent and Wallace (1981).

FOOT NOTES

1 See for example Cukierman (2000).

2 In this paper we define RER as  , where p* is the foreign price level, p is the domestic price level and e is the nominal exchange rate.

, where p* is the foreign price level, p is the domestic price level and e is the nominal exchange rate.

3 The speed of disinflation during 1991-1998, the period of two-digit inflation in Colombia, was around 2% and from 1999 to 2006, when the inflation reached one digit, it was on average 0.7%. The experience of other countries has shown that the speed of disinflation is reduced after the inflation reaches one digit.

4 A second proposal is based on the principal-agent approach, and looks for a performance contract between the government (the principal) and the central bank (the agent) that provides the latter with the incentives to optimize the social welfare function (Walsh, 1995).

5 Furthermore, even if era and the sacrifice ratio were directly related, Cukierman (2002) shows that CBI is welfare enhancing because of the positive long term benefits derived from stable prices and the short run gains from temporary monetary expansions.

6 When inflation is sufficiently sustained, society becomes accustomed to it, reducing opposition to inflation and eroding actual CBI (Cukierman, 1992).

7 Measures of actual independence of the central bank show a level of independence that is different from the legal one because of the existence of informal arrangements that do not follow the CB law. Although most empirical research is related to the measurement of legal CBI (see Grilli, Masciandaro and Tabellini, 1991 and Eijffinger and Schaling, 1992), other studies have tried to develop some measures of actual independence and have developed indicators of political vulnerability (see Cukierman, 1992, Cukierman, Webb and Neyapti, 1992 and Cukierman and Webb, 1995).

8 In addition to the lack of public opposition to inflation, other reasons to override CBI are the lack of democratic accountability and the potential break of coordination between monetary and fiscal policy (Goodhart, 1994).

9 For each point of annual real appreciation, Colombian disinflation (1991-1997) was lower than in Chile (1990-1997) and Mexico (1995-2001). However, in the case of Mexico, a lower growth rate (and probably a negative output gap) may help explain part of the difference.

10 Real and serious threats to era from the government or Congress have been documented for different countries, even for the most autonomous central banks like the Bundesbank (Siklos and Bohl, 2005).

11 This game is similar to the one considered in Cukierman (1992), Ch. 5, in which a relationship between fiscal variables and inflation appears through the strategic interaction between labor unions and a CB that is subject to an inflation bias for "mercantilist" motives.

12 All variables are expressed in logarithms.

13 This asymmetric cost function is similar to the one posited by Cukierman (1992), page 165.

14 Notice that it is assumed that nominal depreciation incorporates the effect of monetary policy (through inflation), changes in the equilibrium RER and the correction of possible past deviations from equilibrium RER: Δe = (q* - q*-1) + (q*-1 - q-1) + π.

15 The Appendix shows that  .

.

16 It can be shown that the second order condition is fulfilled if  .

.

17 This is reasonable to have p(q* - qT) > 0 since it is assumed that q* < qT.

18 The assumption p"(.) ≤ 0 also helps explain this result. Intuitively, a rise in RER reduces the response of the probability of survival to higher inflation targets.

19 The latter is the same as the assumption made to show that  .

.

References

1. BARRO, R., and GORDON, D. (1983). "A positive theory of monetary policy in a natural rate model", Journal of Political Economy, 91:589-610. [ Links ]

2. BOMFIM, A., and RUDEBUSH, G. (1997). "Opportunistic and deliberate disinflation under imperfect credibility" (Working Paper 97-09). Federal Reserve Bank of San Francisco. [ Links ]

3. COLLARD, F.; FEVE, P., and MATHERON, J. (2007). "The dynamic effects of disinflation policies" (Working Paper 190). Banque de France. [ Links ]

4. CUKIERMAN, A. (1992). Central Bank strategy, credibility and independence: Theory and evidence. Cambridge, mit Press. [ Links ]

5. CUKIERMAN, A. (2000). "Establishing a reputation for dependability by means of inflation targets", Economics of Governance, 1:53-76. [ Links ]

6. CUKIERMAN, A. (2002). "Does a higher sacrifice ratio mean that Central Bank independence is excessive?", Annals of Economics and Finance, 3:1-25. [ Links ]

7. CUKIERMAN, A. (2006). "Independencia del banco central e instituciones responsables de la política monetaria: pasado, presente y futuro", Economía Chilena, 9(1). [ Links ]

8. CUKIERMAN, A., and WEBB, S. (1995). "Political influence on the Central Bank: International evidence", The World Bank Economic Review, 9:397-423. [ Links ]

9. CUKIERMAN, A.; WEBB, S. and NEYAPTI, B. (1992). "Measuring the independence of Central Banks and its effects on policy outcomes", The World Bank Economic Review, 6:353-398. [ Links ]

10. DIANA, G., and SIDIROPOULOS, M. (2004). "Central Bank independence, speed of disinflation and the sacrifice ratio", Open Economies Review, 15(4):385-402. [ Links ]

11. EIJFFINGER, S., and SCHALING, E. (1992). "Central Bank independence: Criteria and indices", Research Memorandum, No. 548, Department of Economics, Tilburg University. [ Links ]

12. FISCHER, S. (1995). "Modern central banking", in Capie F. et al. (Eds.), The future of central banking. Cambridge and NY, Cambridge University Press. [ Links ]

13. FISCHER, A. M. (1996). "Central Bank independence and sacrifice ratios", Open Economies Review, 7:5-18. [ Links ]

14. GOODHART, Ch. (1994). "Game theory for central bankers: A report to the governor of the Bank of England", Journal of Economic Literature, 32:101-114. [ Links ]

15. GRILLI, V.; MASCIANDARO, D., and TABELLINI, G. (1991). "Political and monetary institutions and public financial policies in industrialized countries", Economic Policy, 13:341-392. [ Links ]

16. JORDAN, T. (1999). "Central Bank independence and sacrifice ratio", European Journal of Political Economy, 15:229-255. [ Links ]

17. LOHMAN, S. (1992). "Optimal commitment in monetary policy: Credibility versus flexibility", American Economy Review, 82:273-286. [ Links ]

18. ORPHANIDES, A., and WILCOX, D. (2002). "The opportunistic approach to disinflation", International Finance, 5(1):47-71. [ Links ]

19. ROGOFF, K. (1985). "The optimal degree of commitment to an intermediate monetary target", Quarterly Journal of Economics, 100:1169-1190. [ Links ]

20. SARGENT, T., and WALLACE, N. (1981). "Some unpleasant monetarist arithmetic", Federal Bank of Minneapolis Quarterly Review, 5(3):1-18. [ Links ]

21. SIKLOS, P., and BOHL, M. (2005). "The Bundesbank's communications strategy and policy conflicts with the federal government", Southern Economic Journal, 72(2):395-409. [ Links ]

22. VARGAS, H., and BETANCOURT, R. (2010). "Amenazas a la independencia del banco central y su efecto en la inflación", El Trimestre Económico, LXXVII(1, 305):105-128. [ Links ]

23. WALSH, C. E. (1995). "Optimal contracts for central bankers", American Economic Review, 85:150-167. [ Links ]

Appendix

Response of the probability of survival to the inflation target

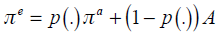

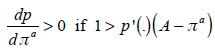

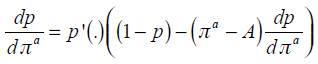

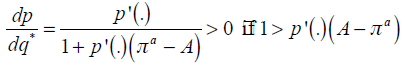

Given inflation expectations πe = pπα + (1 - p )A, the probability function becomes p = p(q* - qT + (1 - p)(πα - A)) and the response of it to the inflation target is as follows:

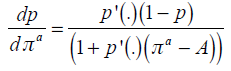

which can be rewritten as:

Since A > πα and p' > 0 when q* + (πα - πe) < qT, it follows that  if 1 > p'(.)(A - πα).

if 1 > p'(.)(A - πα).

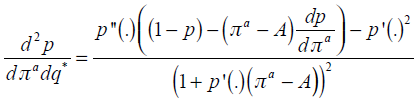

Proof of

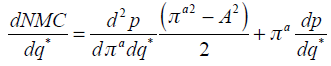

According to equation (2):

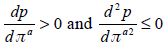

Then, for  it is sufficient that

it is sufficient that  and

and

We will assume that  because it is intuitively consistent with the basic assumptions (the closer the RER is to the RER target, the higher the probability of independent CB survival, for RER levels below the RER target). From p = p (q* - qT + (1 - p)(πα - A)), it is easily shown that

because it is intuitively consistent with the basic assumptions (the closer the RER is to the RER target, the higher the probability of independent CB survival, for RER levels below the RER target). From p = p (q* - qT + (1 - p)(πα - A)), it is easily shown that  19.

19.

Since:

It is easily verified that this expression is negative when p" (.) ≤ 0 and  , both of which are assumptions previously made. This completes the proof.

, both of which are assumptions previously made. This completes the proof.