1. Introduction

Between 20 and 50 per cent of international migrants leave their host country within five years of their arrival, either through return migration or outmigration to a third country (Dustmann & Görlach, 2016; Wahba, 2014). Motivations for return migration include strategic accumulation of human capital or the fulfilment of an accumulation target that allows returnees to become entrepreneurs in their home economies (Stark, 2019). The positive relationship between return migration and entrepreneurship has been widely documented in previous literature with factors such as the duration of migration, remittances while abroad and skills acquisition positively affecting return migrants’ chances of becoming entrepreneurs upon return (Collier et al., 2018; Démurger & Xu, 2011; Dustmann & Kirchkamp, 2002; Lianos & Pseiridis, 2009; Piracha & Vadean, 2010; Wahba & Zenou, 2012). However, not all migrants are entrepreneurs, and different types of migrants are much more likely to become entrepreneurs, with varying success rates. It is therefore necessary to explore the relationships between forced return and entrepreneurship or migration and entrepreneurship by necessity versus opportunity (Croitoru, 2019; Naudé et al., 2017). The first surges because of lack of other alternatives and the latter because individuals are able to identify a good business opportunity. This may be particularly relevant for countries such as Mexico where most of the migration is undocumented and where the recent tightening of anti-immigration measures in the United States can significantly influence migration duration decisions and forced return (Masferrer & Roberts, 2016; Massey et al., 2016). Also in this country, a large proportion of micro businesses in exploratory studies can be identified as necessity entrepreneurs (Calderon et al., 2016).

In the case of Mexico, studies indicate that return migrants earn higher incomes than non-migrants, which can be explained in part by their migration experience (Reinhold & Thom, 2013). However, the relationship between return migration and income has changed over time, as the income advantage of return migrants has recently diminished (Campos-Vazquez & Lara, 2012). Micro enterprises’ connections to international migration have enabled them to increase capital investment and to attain a higher product capital ratio and greater land productivity, suggesting that the relationship of microbusinesses to international migration allows for a decrease in liquidity constraints (Taylor & Lopez-Feldman, 2010; Woodruff & Zenteno, 2007), even though these enterprises may be micro (Massey & Parrado, 1998). In Mexico, there is a positive relationship between return migration and entrepreneurship, possibly because the skills gained during the migration experience allow a migrant to start a business upon returning (Hagan & Wassink, 2016). However, the literature on return migration and entrepreneurship in Mexico has not established whether this positive relationship is influenced by endogeneity or whether productive enterprises can become companies that generate jobs. Nor has it examined the roles of asset accumulation and changes in the migration system. This work complements the literature on the relationship between return migration and entrepreneurship, including the possibility of creating larger firms, and whether this relationship is similar in terms of accumulation of assets. We also study how the relationship has changed over time, considering that the risks associated with undocumented migration have increased in the 21st century.

As a database for our research project, we use information collected by the Mexican Migration Project (MMP) until February 2019. Each year, the MMP takes samples from three to five communities in Mexico, collecting sociodemographic, occupational, migration, and asset holding history, among other data for both migrant and non-migrant households. The MMP was created in 1982 by an interdisciplinary group of researchers from Mexico and the United States to expand scholars’ knowledge on Mexican migration to the United States (Office of Population Research & Departamento de Estudios sobre Movimientos Sociales, 2020).

In this study, we define entrepreneurship as self-employment, excluding those engaged in street sales or agricultural and livestock businesses. Whith this definition, 23.2 per cent of the households in the study engage in entrepeneurship. We analyzed businesses whith four or more employees; 3.9 per cent of the houselholds in our sample meet this criterion. We considered ownership of urban assets other than the household residence, wich applies to 7.4 per cent of households in the sample. In the first instance, probit models were used to observe the correlation between return migration and these variables. However, this relationship is not necessarily causal. For example, return migrants could be more risk-tolerant agents, which is also conducive to entrepreneurship. Likewise, migration is expensive and can only be accessed initially by households with a higher value of assets. Thus, the greater asset ownership required for entrepreneurship is not necessarily a result of migration as much as it is its cause. To control for these factors, we used lagged community migration 30 years earlier as an instrument of return migration, revealing the effect of migration networks on migration and, by using lagged data, controls for a correlation between the recent migration phenomenon and economic opportunities in the localities of origin (Mckenzie & Rapoport, 2007; Taylor & Lopez-Feldman, 2010). As both the explanatory and independent variables are binary, we improve the robustness of our estimate by using a recursive bivariate model, as this estimation strategy may be preferable in small samples and has been used previously to analyze the relationship between return migration and entrepreneurship (Démurger & Xu, 2011; Wahba & Zenou, 2012) and between remittances and entrepreneurship (Kotorri et al., 2020).

The results of the probit models indicate a positive correlation between return migration and entrepreneurship. However, when controlling for the possible endogeneity of the variables, this positive relationship is maintained only in communities interviewed after 2001. For previous periods, we find no correlation and a negative causal effect with unobserved factors that influence both entrepreneurship and migration. When looking at businesses with four or more employees, there is no relationship between return migration and entrepreneurship. The evidence suggests that return migrants still face barriers to constructing more economically relevant companies in terms of jobs. Although return migrants possess more assets than non-migrants, a significant proportion of return migrants could prefer to rent their assets rather than start their own enterprises. This strategy is scarcely discussed in previous literature and may be explained by the large income disparities between the source and destination countries.

In the next section, we describe our data and empirical strategy in greater depth. Section three details our research results and, finally, section four presents the findings.

2. Data and empirical strategy

2.1. Data

This study uses data from the Mexican Migration Project (MMP), an initiative by an interdisciplinary team of researchers that has been gathering information since 1982. Each year, the MMP collects information from households in three to five different communities. As of 2019, the MMP has studied 170 communities and has made information available on 28,831 households. This study uses information from households whose heads are over 30 years of age and currently residing in Mexico. This allows a reasonable amount of time for heads of household to migrate, return and begin a business. For each head of household, we consider his or her migration history, age, schooling, and marital status. We also use household variables such as the number of children, the presence of children under six years of age, and persons older than 70 to reveal the family structure. For localities, we use information about their degree of rurality; whether they have access from a paved road to a highway; whether they are located in the country’s central region, which has traditionally been subject to more migration; and the year they were surveyed. The data source also provides information on household businesses and assets, the year businesses began operations or were acquired, the year they closed operations or were sold, and whether they were financed with US dollars (i.e., with money coming from migration). For businesses, we know their type of activity and number of employees. With this information, we were able to find out whether households owned a business, excluding activities such as street sales, agriculture, and livestock to eliminate enterprises that could be considered subsistence activities made necessary by limited opportunities in the formal sector of the economy. Regarding migrants’ assets, we focus on those other than their home that could be used in enterprises either directly as a business’ base of operations or as collateral. Properties in this category include an additional house, apartment buildings, urban land, or place of business. Given the Mexican land tenure regime in place during our study period, wherein agricultural land could not be used as collateral, we decided to exclude farmland from our asset analysis. Finally, to select businesses with a higher capacity for job creation, we evaluated businesses with four or more employees. In total, valid information is available for 21,207 households.

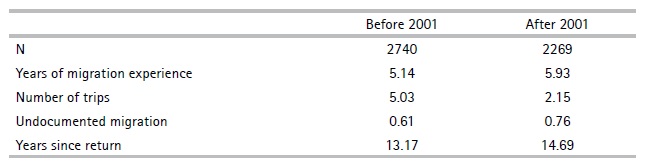

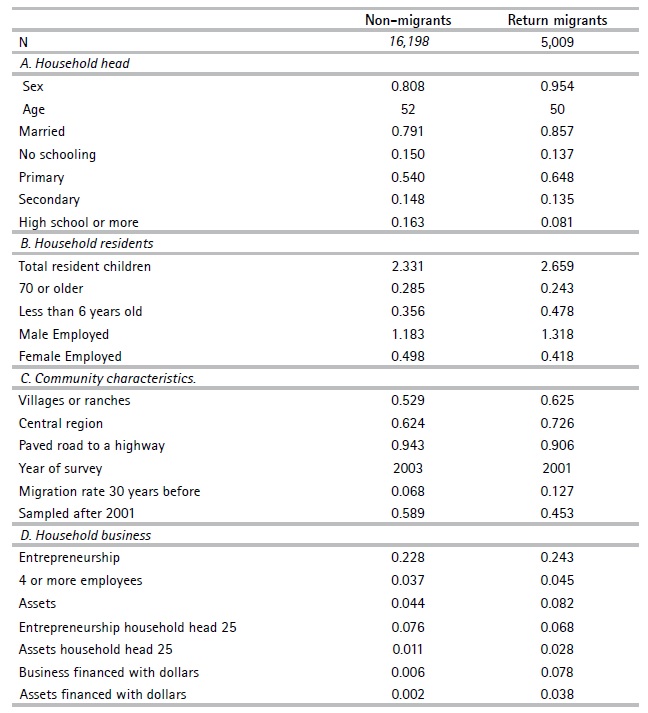

Table 1 presents the average values of the variables. Given the sample, all differences between return migrants and non-migrants are statistically significant. Households where the head of household is a return migrant account for 23.6 per cent of the sample. A greater proportion of heads of household who are return migrants are male. Migrant heads of household tend to be married and younger than non-migrant heads of household. Compared to non-migrants, return migrants are more likely to have only primary school education and less likely to have higher levels of education. There are more children residing in migrant households, including children under six years of age, but fewer adults aged 70 or older. Of household members who are employed, most are male, in line with the division of labor in patriarchal societies, with return migrant households having a higher proportion of employed males. Community variables show that return migration happens mainly in smaller communities, located in the central region and with less access to paved roads from the closest highway. There was a higher proportion of return migrants in communities studied in the early years. However, no conclusions can be drawn from this, as the communities incorporated each year are not necessarily representative of the national population. Return migrants are concentrated in communities where migration was greater 30 years before the study year, which is consistent with literature describing migration as a cumulative phenomenon. Also, a similar proportion of households were surveyed before and after 2001.

Table 1. Descriptive statistics

Notes:Own elaboration of MMP 2020 data. Assets refer to ownership of urban assets other than the household residence, typically another house, building, or place of business. All differences are statistically significant.

Table 1 also shows information on entrepreneurship and asset holding. Both defined broadly and narrowed to owning an enterprise with four or more employees, a slightly higher proportion of return migrants appear to be engaged in entrepreneurship. In addition, twice as many households with a return migrant head of household own assets besides the household residence. Before heads of household turned 25, return migrants presented a slightly lower proportion of entrepreneurship than non-migrants, although they already had more assets. Overall, the data suggest that, once the head of household is 25 years old, households of return migrants are more likely to engage in entrepreneurship than those of non-migrants, and they have accumulated more assets, possibly as a result of the migration experience. The estimates in the following section yield results consistent with the descriptive statistics. The latest variables in Table 1 suggest that these enterprises and assets are, to a significant extent, due to the migration process, as about one-third of the enterprises and nearly half of the assets of return migrant households were financed directly with US dollars. In households without return migration, however, almost none were financed with US dollars. These data further suggest that the impact of migration on entrepreneurship in Mexico found in previous literature (Massey & Parrado, 1998; Woodruff & Zenteno, 2007) arises solely from households with return migration, rather than from households that only receive remittances.

The migration process between Mexico and the United States has undergone major changes in recent years, transitioning from a circular flow characterized by multiple trips between the two countries to more permanent settlement (Massey et al., 2016). However, migrants who stay in the US long term face the constant threat of removal (Masferrer & Roberts, 2016). Due to the 2001 terrorist attacks in the United States, that year marks a turning point in US immigration policy, adding greater restrictions on migration from Mexico in particular (Meyers, 2003; Mitchell, 2006). Table 2 shows differences in the type of migration experience between return migrant heads of household before and after 2001. In the first period, the duration of the migration experience was shorter, spread over a greater number of trips, and was more often documented than in the latter period. In addition, the number of years in Mexico since the last return was lower in communities interviewed before 2001. These data coincide with the characterization of migration before the gradual increase in migration restrictions as circular, with more opportunities to migrate legally.

2.2. Empirical strategy

We intend to estimate the impact of return migrant status on entrepreneurship, controlling for other variables. The simplest way to do so is to use a linear probability model such as the following:

In Equation (1)Yim is a dichotomous variable for household i in community m with a value of 1 for households with entrepreneurs and 0 for households without. Riis a dichotomous variable representing return migrant status. The most important parameter is γ, which measures the impact of a change in migration status from non-migrant to return migrant on the likelihood of entrepreneurship. Xim is a vector of control variables that can be at the household or community level. In the first instance, we include characteristics of the head of household and other members of the household as controls, including sex, age, marital status, and four variables indicative of the education level of the head of household, as well as the number of total resident children, children under the age of six and the number of employed males and females in the household. In Mexico, the economic possibilities of return migrants are highly correlated with economic opportunities in their localities of origin (Lindstrom, 1996), so we have added variables related to community characteristics, including a dichotomous variable for smaller communities, a variable indicator of paved access to highways, another variable indicator of belonging to the country’s central region, and the year when the community was surveyed. To control for the influence of characteristics of the household of origin and the head of household’s pre-migration choices, we included two additional variables: asset holding and entrepreneurship when the head of household was 25 years old. This set of controls is very similar to those used in previous literature on return migration and entrepreneurship (Démurger & Xu, 2011; Wahba & Zenou, 2012). We also include assets whose evolution can affect the migration process (Kabubo-Mariara, 2003; Valsecchi, 2014) and that can be a critical resource for financing a new business. Errors are grouped at the community level. An alternative to estimating Equation (1) by ordinary least squares is to use a nonlinear model such as the probit model, which assumes that ԑim is normally distributed and can be estimated by the maximum likelihood. Our work reports the marginal effects at the mean that have a very similar interpretation to γ.

If the return migration variable is correlated with the error term in Equation (1) using these sets of controls, the interpretation of our parameter of interest would not be causal but would be collecting effects from unobserved factors. For example, if both migration and entrepreneurship require risk-friendly attitudes, a positive correlation between return migration and entrepreneurship only reflects the effect of this characteristic of migrants on entrepreneurship, rather than the effect of migration. To address this problem of endogeneity, we can use an instrument for the return migrant variable. In this case, an additional equation is estimated in the first stage:

This first stage estimates the status of a return migrant with the same vector of variables Xim , but adds at least one additional variable to construct the vector Zim . In our case, we use community-level migration as a variable that is correlated with return migration status because migration relies heavily on migration networks (Démurger & Xu, 2011). For the identification process to be valid, this variable must not be correlated with the error term in Equation (1). To limit the possible correlation between present-day community-level migration and economic entrepreneurship opportunities, we use migration at the community level with a 30-year delay similar to previous literature on the Mexican case (Taylor & Lopez-Feldman, 2010).

As the entrepreneurship variable and the return migration condition variable are both dichotomous estimations by instrumental variables, they may perform poorly in small samples. To avoid this problem, equations (1) and (2) can be estimated using a recursive bivariate model, a solution used in previous literature on return migration and entrepreneurship when using small samples (Démurger & Xu, 2011; Wahba & Zenou, 2012) and when studying the relationship between remittance receipt status and entrepreneurship (Kotorri et al., 2020). Although our sample is larger than those in the previous literature, we show that our results are qualitatively similar to those obtained by an estimate of two-stage instrumental variables, using this model. Moreover, instrumental variables estimators come only from those affected by the instrument, while in the recursive bivariate model, we can estimate the effect on different subpopulations.

3. Results

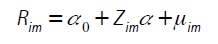

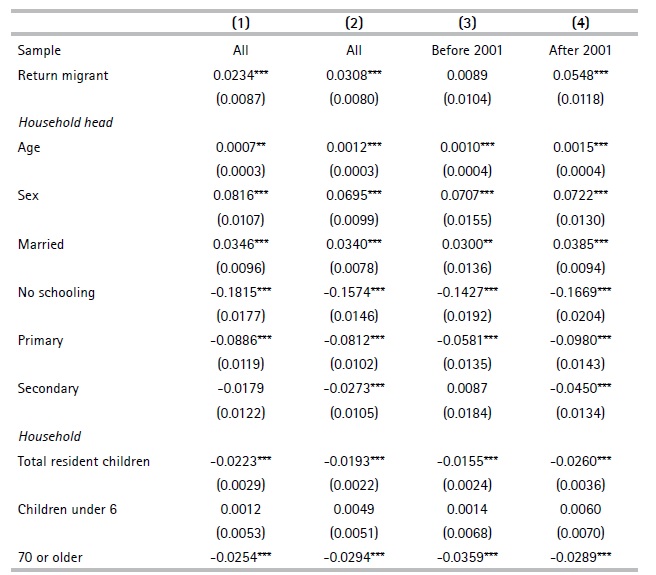

3.1. Entrepreneurship

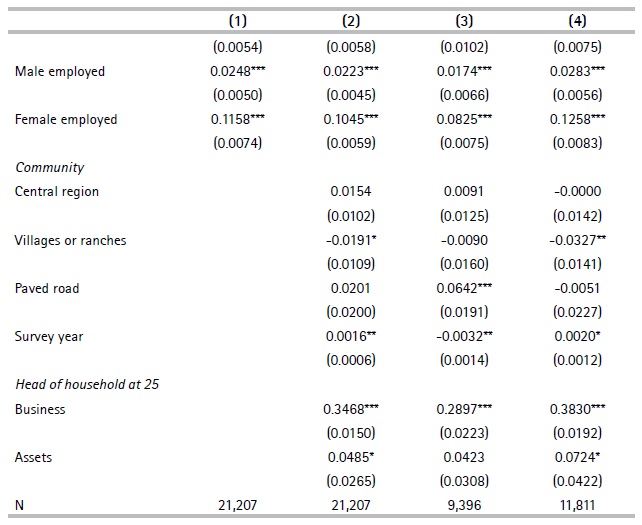

The results of the probit model are shown in Table 3. In the first column, we use the characteristics of the head of household and the other household members as controls. The results indicate that return migration increases the probability of entrepreneurship by 0.02. Results from other controls indicate that entrepreneurship is more likely in households with older, male, and married heads of household. Concerning education, the results show that less-educated heads of household are less likely to engage in entrepreneurship than heads of household with a high school education or beyond. As the number of total resident children or older adults increases, the likelihood of entrepreneurship decreases. However, if more household members are employed, the probability of entrepreneurship increases, particularly for women; for every woman in the household participating in the labor market, the probability of entrepreneurship increases by 0.12. The impact of this factor is only surpassed by the difference between the household heads’ lowest and highest levels of education.

Economic and entrepreneurship opportunities may vary in different geographical contexts, especially in a country as large as Mexico. This may also be correlated with the geography of return migration (Lindstrom, 1996). For this reason, in Column (2), we added several indicator variables, including residing in the central region, as migration rates have historically been highest in this region; communities considered villages or ranches, which also have higher migration rates; and a variable indicator for access to highways by paved roads to capture the impact on the most geographically marginalized communities in the country. We also added the year the survey was applied in the community to capture any temporary trend of entrepreneurship in Mexico.

Another set of added controls refers to the enterprises owned by the head of household and any assets he or she held at age 25. This controls for heterogeneity in access to resources needed for entrepreneurship in a country with underdeveloped financial institutions. Even with these controls, return migration still has a positive relationship with entrepreneurship, with an estimated 0.03 increase in probability. The marginal effects of the additional controls show that there are fewer enterprises in villages and ranches, that the likelihood of entrepreneurship has increased over time in the communities surveyed, and that the enterprises and assets owned by the 25-year-old head of household significantly explain subsequent entrepreneurship.

Table 3. Return migration and entrepreneurship (Cont...)

Notes:‘Before 2001’ and ‘after 2001’ indicate the year the community was surveyed, with 2001 included in the last category. Assets refer to ownership of urban assets other than the household residence, typically another house, building, or place of business. Standard errors clustered at the community level in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

Columns (3) and (4) divide the sample into communities that were surveyed before or after 2001 to capture changes in the relationship between migration and entrepreneurship caused by transitioning from a circular migration system to one with greater restrictions on migration, longer stays in the United States, and a higher proportion of forced returns (Masferrer & Roberts, 2016; Massey et al., 2016). The results show that, in communities surveyed after 2001, the relationship between migration and entrepreneurship is significant, whereas there is no significant effect prior to 2001. For the other variables, there are few significant differences. Prior to 2001, access to highways via paved roads had a positive effect on entrepreneurship, while no effect was found after 2001. Communities being villages or ranches has a negative effect only among the most recently interviewed communities.

The effect of survey year also changes from one period to another, showing that there is no clear temporal tendency.

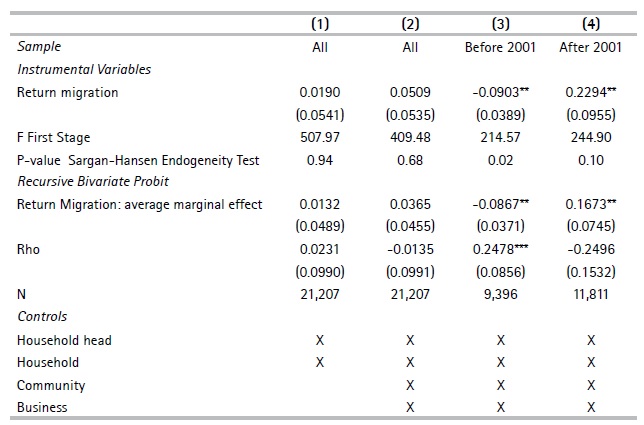

These results do not necessarily offer a causal explanation, as there may be unobserved variables that cause both migration and entrepreneurship. To further assess the link between return migration and entrepreneurship, we present the results when using instrumental variables and a recursive bivariate probit model in Table 4. Each column estimates equations (1) and (2) with the same set of controls as the corresponding columns in Table 3; the results of the controls do not differ substantially, so they are omitted. We use lagged migration 30 years before at community level as an instrument of return migration. Results with instrumental variables in columns (1) and (2) show that there is no significant relationship between migration and entrepreneurship when considering the entire period. However, the endogeneity test, based on Sargan-Hansen statistics, reflects that there is no statistically significant difference if we treat return migration as endogenous or exogenous; in that case, we can take ordinary least estimators as better due to higher efficiency (Baum et al., 2002), which provides results that are similar to the first two columns of Table 3. When dividing the sample into communities according to the year they were surveyed, we find that return migration has a positive impact on entrepreneurship among communities surveyed after 2001, while, before 2001, the impact was negative. One explanation for this finding is that, during the circular migration period, the possibility of re-emigrating to the United States with relatively little risk inhibited entrepreneurship in Mexico, while, after 2001, entrepreneurship in Mexico was a better alternative to a new migration with a higher chance of failure. Migrants may have preferred to re-migrate instead of engaging in entrepreneurship considering that the increase in their income is almost fourfold in the case of Mexican migration to the United States (Lara, 2017). The average marginal effects of the recursive bivariate probit model are consistent with the significance and signs of the effect using instrumental variables, which also suggest that the causal effect is similar among those affected by the instrument and other return migrants. In addition, the Rho coefficient shows the correlation between the error terms of equations (1) and (2). This coefficient is positive and significant for the communities surveyed before 2001, which indicates the presence of unobserved factors that cause both migration and entrepreneurship, with risk-friendly attitudes or unobserved skills as two possible explanations.

Table 4. Return migration and entrepreneurship: Causality

Notes:‘Before 2001’ and ‘after 2001’ indicate the year the community was surveyed, with 2001 included in the last category. Household head: age, indicators of sex, marital status, and schooling levels. Household controls: total resident children, children under 6, number of 70 years or older, male employed and female employed. Community controls: indicators of central region, villages or ranches, paved road to highway, and year of survey. Business controls: indicator of business at 25 household head age and assets at 25 household head age. F statistic and standard errors (in parentheses) with clusters at the community level.*** p<0.01, ** p<0.05, * p<0.1.

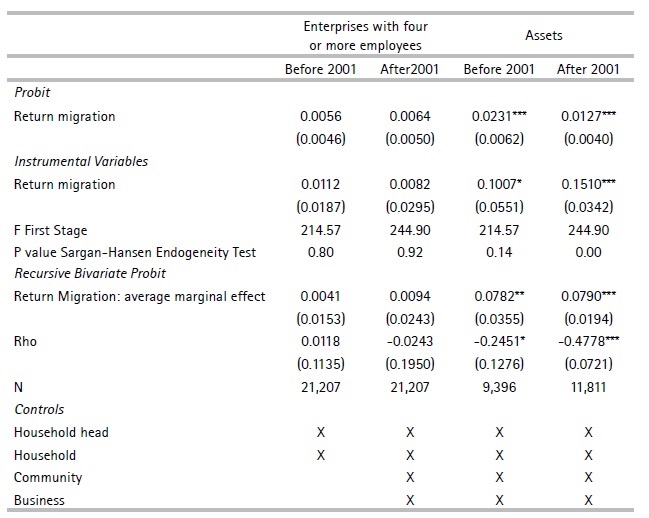

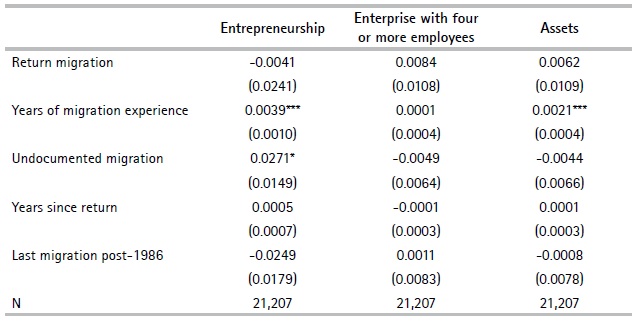

3.2. Enterprise size and assets

The results shown in the previous section indicate a relationship between return migration and entrepreneurship that has changed over time. In this section, we examine whether this relationship is sustained if we only consider enterprises with a greater capacity to generate jobs and if there have also been changes in the ability to accumulate assets. Table 5 presents the results for these two dichotomous variables, using models with the same controls and specifications as tables 3 and 4. The results of the probit model, the estimation with instrumental variables, and the recursive bivariate probit model are similar. There is no significant relationship between return migration and enterprises with four or more employees in any period. In contrast, in both periods, return migrants tend to accumulate more assets in Mexico, with the coefficients of instrumental variables being greater than the marginal effects of the probit model, indicating that the possibly exogenous effect of migration driven by migration networks is greater than the correlation observed in the probit model; however, only after 2001 the endogeneity test, based on Sargan-Hansen statistics, indicates that we have to prefer instrumental variables estimators. In the recursive bivariate probit model, the average marginal effect is consistent with a positive effect of return migration on asset holdings in both periods that lies between the two previous estimators; there is also a negative Rho, indicating that there are factors not included in our model that increase migration but limit the acquisition of assets in both periods. For example, if migrants are impatient individuals, they would tend to accumulate fewer assets, and impatience could also induce migration. In the end, however, skills and savings gained during the migratory process allow them to acquire more assets than non-migrants.

Table 5. Return migration, enterprises with four or employees and asset holding

Notes:‘Before 2001’ and ‘after 2001’ indicate the year the community was surveyed, with 2001 included in the last category. All specifications include controls. Household head controls: age, indicators of sex, marital status, and schooling levels. Household controls: total resident children, children under 6, number of 70 years or older, male employed, and female employed. Community controls: indicators of central region, villages or ranches, paved road to highway, and year of survey. Business controls: indicator of business at 25 household head age and assets at 25 household head age. Assets refer to ownership of urban assets other than the household residence, typically another house, building, or place of business. F statistic and standard errors (in parentheses) with clusters at the community level. *** p<0.01, ** p<0.05, * p<0.1.

3.3. Exogeneity of instrumental variable

The estimation strategy with instrumental variables requires for past migration to only affect the entrepreneurship decision through return migration, once we have conditioned this on the set of controls. For example, this assumption could be violated if migration in the past is due to economic disadvantages in the region of origin that persist for a long period of time and inhibit entrepreneurship in recent periods. Another possibility is that there is a culture favorable to both migration and entrepreneurship in the region of origin. While we have included community characteristic variables, some factors may still have been omitted. To avoid this concern we calculated an additional estimate based on the last three columns of tables 2 and 3. We included three variables at municipality level with information from 1950 that could affect both migration in the past and entrepreneurship in the most recent years; the first is the proportion of the male population engaged in agriculture, the second is the proportion of the population with six schooling years or more, and the third is the proportion of the self-employed population. When we include these variables, the results of the impact of return migration on entrepreneurship and asset holding in tables 2 and 3 are practically unchanged. The sign and significance are maintained; the magnitudes are slightly modified; and F statistics of the first stage decrease, but without threatening the relevance of the instrumental variable.

3.4. Migratory experience

In this section, we describe the influence of the type of migration experience on establishing enterprises and accumulating assets. Acquiring skills and accumulating savings both require a relatively long migration experience. Undocumented migration can lead to lower-quality jobs in the destination economy and increase the likelihood of forced return. To reintegrate into the source economy, migrants must regain social ties. Thus, more years since returning to Mexico may be a relevant variable in establishing enterprises and accumulating assets. Finally, to try to capture a period when restrictions on migration from Mexico to the United States have consistently increased, we added an indicator variable of whether the last migration took place post-1986. In this year the United States enacted the Immigration Reform and Control Act, to promote the regularization of undocumented resident migrants in exchange for greater immigration control measures.

Table 6 shows the results of the three variables previously studied using the complete sample and the characteristics of the head of household, other household members, the community, and the head of household before age 25 as controls. The results show that the duration of the migration experience is a fundamental determinant of entrepreneurship, in general, and of asset accumulation. Undocumented migration for the most recent migration is positively correlated with the likelihood of entrepreneurship. The other variables related to the migration experience are not significant. In the case of enterprises with four or more employees, no variable of the migration experience is significant. As noted in Table 2, years of migration experience and the proportion of undocumented migration increased among communities surveyed after 2001, and the results shown in Table 6 suggest that this may be an unobserved factor explaining differences in entrepreneurship between periods.

Table 6. Migration experience, entrepreneurship, and assets

Notes:All specifications include the following controls. Household head controls: age, indicators of sex, marital status, and schooling levels. Household controls: total resident children, children under 6, number of 70 years or older, male employed, and female employed. Community controls: indicators of central region, villages or ranches, paved road to highway, and year of survey. Business controls: indicator of business at 25 household head age and assets at 25 household head age. Standard errors clustered at the community level in parentheses. *** p<0.01, ** p<0.05, * p<0.1.

4. Discussion and conclusions

In this study, we have shown that there is a positive correlation between return migration and entrepreneurship in Mexico. The results indicate that migration also allows for greater asset accumulation, but does not necessarily facilitate the establishment of larger businesses. Remarkably, a suggestive causal interpretation of the positive relationship between return migration and entrepreneurship is more robust post-2001, a period with increased migration restrictions, suggesting that, in this period, migrants may have seen entrepreneurship as a more favorable alternative to migrating again. In the pre-2001 period, when the border was more open, migration patterns were more circular, with increased asset accumulation but less entrepreneurship using our suggestive causal results. This strategy is reasonable given the large income disparities between Mexico and the United States, where a low-skill worker in the United States can earn a higher income than a micro entrepreneur in Mexico. This could mean that entrepreneurship by return migrants is not necessarily an optimal decision at individual level and, in many cases, is due to changes in migration restrictions. This relationship needs to be studied in other contexts of international migration and changes in restrictions. In both periods, however, return migration appears to have a positive effect on development, as it allows for a greater flow of capital to migrants’ home communities, which can be used in enterprises by migrants themselves or by third parties. The results suggest that migration leads to an influx of capital to the communities of origin, but there is a need to create businesses with greater potential for job creation.

Data availability statement

The data that support the findings of this study are openly available in Mexican Migration Project at https://mmp.opr.princeton.edu/, with 170 communities as available at 2020.