Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO  Similars in Google

Similars in Google

Share

Cuadernos de Administración

Print version ISSN 0120-3592

Cuad. Adm. vol.18 no.30 Bogotá Dec. 2005

* This paper is the result of an investigation sponsored by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior CAPES-Brazil. The authors would like to thank CAPES for its financial support and the Pontifical Catholic University of Rio de Janeiro/PRODOC fellowship, La Universidad de La Sabana and the Bordeaux Business School. This article was received on 14-03-2005, and was approved on 13-12-2005.

** Ph.D. in Industrial Engineering, Pontifical Catholic University of Rio de Janeiro. Professor, Fundação Getúlio Vargas Business School, Department of Production and Operations Management. Visiting professor at Max M. Fisher College of Business, The Ohio State University, Department of Marketing and Logistics. E-mail: annibal@puc-rio.br.

*** MSc in Industrial Engineering, Universidad de Los Andes, Colombia. Associate professor, Instituto de Postgrados, Universidad La Sabana, Colombia. Director, Grupo Cambio e Innovación Tecnológica Reconocido por Colciencias. E-mail: mario.martinez@unisabana.edu.co.

**** Ph.D. in Industrial Engineering, Pontifical Catholic University of Rio de Janeiro. Professor and Dean, Centro Técnico Científico, Pontifical Catholic University of Rio de Janeiro, Department of Industrial Engineering. E-mail: lfscava@ind.puc-rio.br.

***** Ph.D. in Management, University of Glasgow. Professor at Bordeaux Business School, Research Centre on Supply Chain Management. E-mail: maria.veludo@bordeaux-bs.edu.

ABSTRACT

The principal objectives of this paper are to develop a conceptual and theoretical framework to evaluate the cost of protectionism in the Brazilian automobile industry, and present a scheme to compare different studies. A standard partial equilibrium model was developed, and applied to the sub-com-pact vehicle segment of the Brazilian automobile industry. Two important aspects were analyzed: (1) economic indicators, and (2) supply and demand curves. Four economic indicators were used: (1) domestic consumption, (2) domestic production, (3) domestic prices, and (4) world prices. A supply and demand sketch was generated to determine price elasticity, using values obtained from a multiple regression model. The subcompact vehicle segment was chosen because it represents more than 70% of the Brazilian domestic market. 2000 was chosen as the year to examine because this was when an import tariff of 35% was imposed on the automobile industry. This trade barrier provided an interesting case study for the cost of protectionism model. The paper concludes that the model clearly demonstrates protectionist polices’ adverse effects on the Brazilian economy, which experienced a welfare loss borne by consumers, producers and the government.

Key words: evaluation of protectionism, welfare cost of protectionism, Brazilian automobile industry.

RESUMEN

Los principales objetivos de este artículo son: desarrollar un marco conceptual y teórico para evaluar el costo del proteccionismo en la industria automovilística brasileña y presentar un esquema comparativo de diferentes estudios. Se desarrolla un modelo estándar de equilibrio parcial que luego se aplica al segmento de vehículos subcompactos de la industria automovilística brasileña. Se analizan dos aspectos importantes: (1) los indicadores económicos y (2) las curvas de oferta y demanda. Se usan cuatro indicadores económicos: (1) el consumo doméstico, (2) la producción doméstica, (3) los precios domésticos (4) los precios mundiales. Se genera un modelo de oferta y demanda para determinar la elasticidad-precio usando los valores obtenidos mediante un modelo de regresión múltiple. Se eligió el segmento de vehículos subcompactos porque representa más del 70% del mercado interno brasileño. Se escogió el 2000 como período de análisis porque en tal año se creó un arancel a las importaciones automovilísticas del 35%. Esta barrera comercial proporciona un interesante caso de estudio en relación con el estudio de los costos del proteccionismo. El artículo concluye que el modelo demuestra claramente los efectos adversos de las políticas proteccionistas sobre la economía brasileña, la cual experimentó una pérdida de bienestar que recayó sobre los consumidores, los productores y el gobierno.

Palabras clave: evaluación del proteccionismo, costo del proteccionismo, bienestar, industria automovilística brasileña.

Introduction

This paper will develop a model to evaluate the cost of protectionism in the Brazilian automobile market. 2000 was chosen as the study year because this was when an import tariff of 35% was imposed as a trade barrier within the automobile sector. The model will be used to calculate the welfare effect of trade restrictions in the automobile sector, using the international economics trade policy theory of case studies developed for this specific industry.

The automobile sector was chosen because it is the second largest industry in the world; five automobile manufactures are listed in the top 10 revenue earning companies (Fortune, 2003). This scenario is reflected in Brazil, where the automobile sector is the country’s second largest manufacturing industry and three automobile manufactures are in the top 10 revenue earning companies (Gazeta Mercantil, 2004). The level of foreign and domestic direct investment in Brazil in this sector jumped from $489 million in 1980 to $1.750 billion in 2001, a fourfold increase (ANFAVEA, 2003). The history and evolution of the automobile industry in Brazil are closely linked to long-term Government trade policies. This is, in itself, an example of the strong influence of international trade policies on the Brazilian economy. A period of one year was studied in order to understand the immediate effects of policy change (in our model the effects are evident in a year).

The paper first presents a theoretical review of some methods that have been used to measure the welfare cost of protectionism. These studies of the automobile sector are then analyzed, discussed and compared, to enable us to deal with their limitations, and make suggestions and assumptions –all of which are used as guidelines to develop the model. The research methodology is than presented and discussed, followed by a description of the model’s development and its application in the Brazilian automobile industry. We then present our final considerations, research limitations, suggestions for future studies, and conclusions.

1. Evaluating the Cost of Protectionism in the Automobile Industry

Many studies have estimated the welfare cost of trade policies in the automobile industry. Each of them has used different assumptions and produced different results for similar cases, but all of them have developed a model that uses the standard partial equilibrium model as its base. Some of these investigations will be analyzed, compared and discussed as the background for developing our own model.

Table 1 summarizes and compares three studies that analyzed the welfare effects of automobile import restrictions: the National Consumer Council-NCC (1990), Robert Feenstra (1985) and Hufbauer and Elliot (1994). Table 2 presents limitations, assumptions and suggestions for each of the studies. The last row of both tables deals with this paper’s model; making possible a comparison of all four studies.

A common limitation was the fact that only the automobile industry was analyzed. However, it is important to overcome this limitation if broad trade policies are to be proposed. Krugman (1987) reinforces this point by underlining the fact that if a successful strategic trade policy is to be suggested, all industries should be considered. In general, researchers only consider the effect on one sector due to the difficulty of analyzing the consequences on others. According to Laussel and Montet (1994) and De Melo and Tarr (1990), protectionism in one industry might affect others negatively, leading to undesirable welfare changes. To get a more precise picture of protectionism’s effects on the community as a whole, investigations should also analyze other sectors; although the studies presented in Table 1 do give a good indication of the magnitude of these values in the case of the automobile industry.

The NCC and Hufbauer and Elliot studies used the partial equilibrium method to estimate the welfare cost of protectionism. De Melo and Tarr (1990) argue that using this method generates an underestimate due to the fact that the cost of protectionism in each sector is estimated individually, without including the cross-sector effects. To get a more accurate estimate, Wall (1999) suggests using the Gravity Model to estimate the cost to the economy as a whole. As the objective of this study is to estimate the magnitude of the cost of protectionism, not its precise value, we used the partial equilibrium method to generate a good proxy. This was also done by Feenstra (1992), who used the results to estimate the annual costs of protectionism in the US.

Another common limitation of both the NCC and Hufbauer and Elliot studies is that they do not consider domestic tax income. Protectionism usually affects the volume of domestic production and this additional revenue should, therefore, be included in welfare effect analyses. Munk (1969) included the effects of taxes on welfare judgment. According to Munk, welfare judgments can be extremely sensitive to the level of domestic taxes generated by such programs.

Furthermore, using a segmented analysis generates a more accurate estimate. The automobile industry is characterized by extreme product differentiation, so vehicles should be grouped according to their characteristics (De Melo and Messerlin, 1988). Prices vary considerably between simple models (sub-compact) and luxury vehicles. The use of market segmentation was suggested, but not implemented, by the NCC.

2. Methodology

Most of the information used to develop our model was collected in Brazil and the UK (secondary data published in Brazilian and European data books, textbooks, journals and internet sites). A case study of the Brazilian automobile industry was then developed in order to apply the model and estimate the welfare cost of protectionism.

To achieve a good proxy for the magnitude of welfare cost, an analysis of two important aspects was made: (1) the economic indicators used, and (2) a supply and demand curve sketch. This was necessary to estimate the cost value using the partial equilibrium model.

Four economic indicators were used to estimate the welfare cost: the volume of domestic consumption and production, and domestic and world prices. Brazilian national association of motor vehicles (ANFAVEA) data for the first two indicators was measured in units. The domestic price was calculated using a weighted average of suggested retail prices from a Brazilian data book (Quatro Rodas, 2001), and prices were determined from sample of the principal sub-compact vehicles. A similar process was used to obtain the world price. The models in the sample are identical or similar to European models, so European vehicle prices were used as the world price proxy. The suggested European retail prices were obtained from an Italian data book (Quattroruote, 2001). Finally, a cross-sectional time series study was carried out to determine these variables and measure the welfare cost in 2000.

To sketch the demand and supply curves we determined the price elasticity of vehicles in the Brazilian market by developing a multiple regression statistical model.

Prices were converted into US dollars using Brazilian Central Bank (Banco Central do Brasil) and The Economist exchange rate databases. A constant value was chosen (the 2000 dollar) to avoid the influence of US inflation in recent years. The variables were calculated using a 9 year longitudinal time series study (1990–1998). The development of this statistical model followed the standard procedures presented in quantitative research methodology textbooks such as Black (1999).

3. Evaluating the Cost

3.1 An Introduction to the Model

The model is based on a standard partial equilibrium model, and takes into account some of the assumptions, suggestions and considerations from the studies discussed above. The year chosen to apply the model was 2000, which was when a 35% vehicle import tariff was introduced.

To obtain a more precise estimate and simplify the analysis, we used the sub-compact vehicle segment to represent the market because it forms a large proportion of domestic consumption –in the first half of 2001 it represented more than 70% of total domestic production (Quatro Rodas, 2001). The segment was composed of a sample of three specific models chosen from Fiat (Palio and Uno), Ford (Fiesta), GM/Chevrolet (Corsa) and Volkswagen (Gol), the four companies responsible for 94% of domestic production (ANFAVEA, 2000).

Prices were based on a unit value and were calculated using a weighted average of suggested retail prices, including the prices and sales of each model in the sample. As in Feenstra’s (1985) study, only standard versions without options were considered, and retail prices were collected from automobile data books. However, these sources have some limitations: (1) data book prices do not include dealer markups, and (2) using versions without options ignores the fact that some options are not provided as standard equipment, but must be purchased to obtain the vehicle. Although we recognize the fact that these limitations may lead to an underestimate of the welfare cost to consumers, they will not affect the main result of this study; our objective is to measure the magnitude of welfare cost, not its precise value.

To determine the world price we used the NCC (1990) procedure of comparing prices in two markets. In this case the European market was the best one to use due to its strong influence on the Brazilian automobile market. European prices were considered to be the world price, which generated an accurate proxy of what Brazilian auto prices would be without import tariffs. To simplify the analysis, transport and adaptation costs were not considered. To facilitate comparisons all values were converted into US dollars, using 2000 as the base year.

3.2 Applying the Model

Similar to Hufbauer and Elliott (1994) and the NCC (1990), price elasticity was used to obtain the supply and demand curve functions. The intersection of these curves with the world price was considered to be the volume of imports without trade restrictions. The value of this elasticity was calculated using software for statistical model analysis and report writing (SAS).

The number of vehicles Brazilian automobile plants manufacture for the domestic market (Qs), and the quantity of vehicles demanded by Brazilian consumers, are both related to the price of the vehicles (P) and income per capita (I). Although other variables such as public transport conditions and availability and world income also interfere, Qs and Qd functions were related exclusively to P and I, as represented below:

Qs = f (P,I) Qd = f (P,I)

The regression functional form employed logarithmic transformations of all the variables and used annual observations from the period 1990–2000. The functional form, which has Qs and Qd as the dependent variables, and P and I as the explanatory ones, is represented by the following equation:

Log (Q) = β1 + β2 Log (P) + β3 Log (I) (1)

Where the regression parameters are:

β2 is the price elasticity of vehicles in the Brazilian market. This parameter estimate should be negative for the demand curve and positive for the supply curve –as a vehicle’s price rises, its demand falls and its potential supply increases.

β3 this parameter estimate should be positive –as income rises, the quantity of vehicles consumed and produced increases.

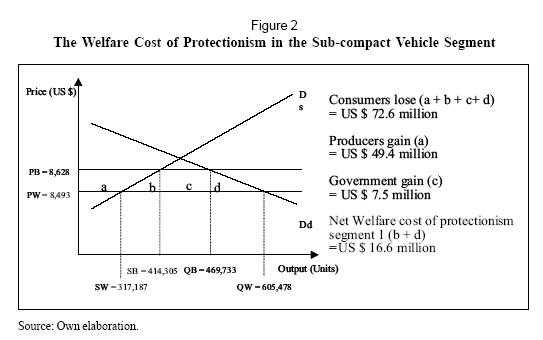

Table 3 presents the values for each of the supply and demand curve regression parameters.

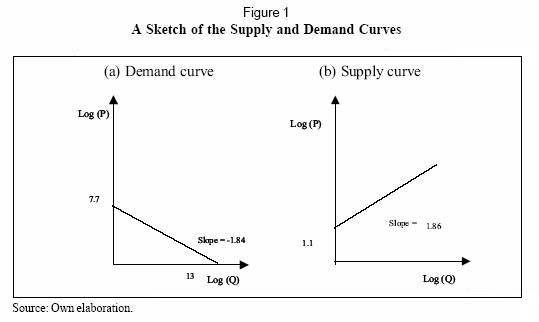

3.2.1 Sketching the Demand Curve

The demand curve function was obtained by substituting in equation (1) the values presented in Table 3, where Q is substituted by Qd. To sketch the curve, 2000 income was used ($3,584). By substituting the income value in equation (1) and doing a simple arithmetic calculation, the following equation, which represents the demand curve function for this segment, was obtained:

Log (Qd) = 13.01 – 1.84 Log (P) (2)

3.2.2 Sketching the Supply Curve

The same sequence was used to sketch the supply curve. The supply function was obtained by substituting in equation (1) the values illustrated in Table 3, where Q is substituted by Qs. As in the case of the demand curve, 2000 income was used ($3,584). By substituting the income value in equation (1), the following equation was obtained:

Log (Qs) = -1.81 + 1.86 Log (P) (3)

The supply curve is sketched in Figure 1 using equation (3).

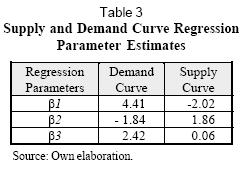

The next step was to determine the welfare cost, which was calculated using the supply and demand curves, and domestic (PB) and world prices. Figure 2 illustrates the partial equilibrium framework, and displays the impact of trade policy on three important stakeholders (consumers, producers, and the government). The welfare cost of protectionism in the sub-compact segment is $16.6 million.

3.2.3 The Results

The 35% import tariff on foreign produced vehicles (which was introduced in 2000) generated a welfare loss of $16.6 million for the Brazilian community, represented in this study by vehicle consumers, producers and the government.

Conclusions

In terms of international trade policy literature this paper represents a new investigation into the welfare cost of protectionism in the Brazilian automobile industry. There is a lack of studies measuring or estimating the welfare cost of import tariffs in the Brazilian automobile industry. With this study we hope to bridge this gap. Furthermore, the model designed for this investigation could be used evaluate the cost of protectionism in other countries.

The assumptions and methodology used in this paper generated some research limitations related to price determination. The sample used models without options (which ignored the fact that some options are not provided as standard equipment) and calculations were based on data books that do not include dealer markups. These restrictions may generate an underestimate of the welfare cost. We recognize these limitations, but believe that they do not significantly affect the results of the study; our goal was to measure the magnitude of the cost of protectionism, not its precise value.

It is important to mention the importance of other economic aspects in the analysis. Economic investigations of unstable economies are complex. Brazil, for example, experienced many different currency values in the 1990s, high accumulated inflation, a recession in the late 1990s, and multiple exchange rate variations (such as that which occurred in January 1999, when the Brazilian Real fell by more than 50% against the US dollar); forgetting some of these items can invalidate a study’s results. This paper, however, considered all of these items, sometimes as part of the research limitations described above.

The estimated cost of protectionism in the Brazilian automobile industry –the 35% import tariff on foreign produced vehicles that was introduced in 2000– was $16.6 million. This represents a welfare loss to the Brazilian community, which in this study was considered to be vehicle consumers, producers and the government.

This figure alone may not represent much to the Brazilian economy as a whole. However, it can be concluded that protectionism in the automobile sector influences the development and results of other domestic industries in the same way as protectionism in other industries affects (influences) the automobile sector. A more precise value of the costs of protectionism to the community as a whole, including a segmented analysis of its impact on other industries and its consequences for the different stakeholders, is recommended for future research.

References list

Associação Nacional de Veículos Automotores (ANFAVEA). Anuário estatístico da indústria automotiva brasileira. São Paulo: ANFAVEA. (2000) [ Links ]

Anuário estatístico da indústria automotiva brasileira. São Paulo: ANFAVEA. (2003). [ Links ]

Black, T. Doing Quantitative Research in the Social Sciences. New York: Sage. (1999). [ Links ]

De Melo, J. and Tarr, D. Welfare Costs of US Quotas on Textile and Apparel, Automobiles, and Steel. Review of Economics and Statistics, 72, 489-497. (1990). [ Links ]

De Melo, J. and Messerlin, P. Price, Quality and Welfare Effects of European VERs on Japanese Autos. European Economic Review (1988), 32 (7), 1527-1546. [ Links ]

Exame. Melhores e Maiores, (2000, June) 78-97, 110, and 123. [ Links ]

Feenstra, R. C. Automobile Prices and Protection: The US – Japan Trade Restraint. Journal of Policy Modelling, (1985).Spring, 49-68. [ Links ]

How Costly is Protectionism? Journal of Economic Perspectives, (1992), 6 (3), 158-178. [ Links ]

Hill, C. W. L. International Business: Competing in the Global Marketplace. Chicago: Irwin. (1998). [ Links ]

Hufbauer, G. C. and Elliott, K. A. Measuring the Costs of protection in the United States. Washington: Institute for International Economics. (1994). [ Links ]

Krugman, P. Is Free Trade Passe? The Journal of Economic Perspectives, (1987), 1 (Fall), 131-144. [ Links ]

Laussel, D. and Montet, C. Strategic Trade Policies. In: D. Greenaway and L. A. Winters (Eds.), Surveys in International Trade. New York: Blackwell. (1994) (pp. 177-205). [ Links ]

Munk, B. The Welfare Costs of Content Protection: The Automobile Industry in Latin America. Journal of Political Economy, (1969), 77 (1), 85-98. [ Links ]

National Consumer Council (NCC), Cars: The cost of trade restrictions to consumers. In: G. Rhys and J. Bridge, Working Paper 4. London: International Trade and the Consumer. (1990). [ Links ]

Quatro Rodas. Brazilian auto Databook. Editora: Abril. (2001). [ Links ]

Quattroruote. Italian auto Databook. (2000). [ Links ]

Saunders, M.; Lewis, P., and Thornhill, A. Research Methods for Business Students. London: Pitman. (2000). [ Links ]

Wall, H. J. Using the Gravity Model to Estimate the Costs of Protection. Federal Reserve Bank of St. Louis Review, (1999), 81 (1), 33-40. [ Links ]

Web-Pages

http://www.bcb.gov.br (2001). Banco Central do Brasil, July.

http://www.economist.com (2001). The Economist, July.

http://www.fortune.com (2001). Fortune, July.

http://www.ipea.gov.br (2001). Instituto de Pesquisa Econômica Aplicada (IPEA), July.