Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Cuadernos de Administración

Print version ISSN 0120-3592

Cuad. Adm. vol.22 no.39 Bogotá Sep./Dec. 2009

* This article is part of the Project Family Influence on Financial Performance Satisfaction in Mexican Family Businesses. This project started on March 2004 and it was concluded on February 2007. It was a Project supported by the business school of Alliant International University (US) and Tecnologico de Monterrey (Mexico). The article was received on 30-04-2009 and was accepted for publication on 19-10-2009.

** Doctor in Business Administration, Alliant International University, San Diego, USA, 2006; Magister in Business Administration, Instituto Tecnologico y de Estudios Superiores de Monterrey (ITESM), Culiacan, Mexico, 1995; Ingeniero industrial electrico, Instituto Tecnologico de Saltillo, Saltillo, Mexico, 1989. Director of the Business Department at ITESM, Saltillo, Mexico. Member of the National Researchers System in Mexico and member of the Family Business Research Group at ITESM. E-mail: jorge.avendano@itesm.mx.

*** PhD in Strategic Management, Concordia University, Quebec, Canada, 1996. Professor of Strategy at Marshall Goldsmith School of Business of Alliant International University, San Diego, USA. E-mail: lkelly@alliant.edu.

**** PhD in Family Business Management, IESE Business School, University of Navarra, Barcelona, Spain, 2007; Magister in Direccion e Internacionalizacion de la Empresa Familiar, EAE-Universidad Politécnica de Cataluña, Barcelona, Spain, 2003; Licenciada en Administracion de Empresas, Instituto Tecnologico y de Estudios Superiores de Monterrey (ITESM), Monterrey, Mexico, 2002. TEC of Monterrey Family Business Center Director and ITESM Campus Monterrey Family-Owned Business Chair. Worked for the legal firm Cuatrecasas (Barcelona) within the civil, administrative law and tax litigation department writing family business constitutions and offering advice to several governmental institutions. E-mail: rosa.nelly.trevino@itesm.mx.

***** Doctor in Economics and Administrative Sciences, Universidad de Deusto, San Sebastian, Spain, 2006; Magister in Desarrollo Organizacional, Universidad de Monterrey, Monterrey, Mexico, 2000; Licenciado en Sistemas de Computación, Administrativa, Instituto Tecnologico y de Estudios Superiores de Monterrey (ITESM), Monterrey, Mexico, 1986. Professor and researcher of the Administration Department of ITESM, Monterrey, México. Member of the Family Business Research Group at ITESM. E-mail: smadero@itesm.mx.

ABSTRACT

Being a family business is not good or bad per se; it is an extra characteristic that management has to deal with. In fact, family influence can become a blessing or a curse for a company, depending on how family members handle Key Success Family Factors (KSFF). This paper presents the Two Stages Scoring (TSS) model, a tool that companies can use to develop a competitive advantage based precisely on family influence.

TSS Model is based on results obtained in a Mexican Family Businesses research, in which the relationship between family influence and firm performance was tested. The variable "family influence" was measured through the common F-PEC instrument and by FAMILIAL INDEX, while the "firm performance" was measured by CEO level of satisfaction on six financial performance dimensions. Conclusions of the research include that family influence-firm performance relationship is not high for this sample of companies and, as a consequence, the TSS model is proposed based on the idea that firm performance is related more effectively to the KSFF.

Key words: Mexican family businesses, competitive advantage, key success family factors.

RESUMEN

Ser una empresa familiar no es bueno o malo per se; es una característica adicional con la cual debe contar la gerencia empresarial. De hecho, la influencia familiar puede llegar a ser una bendición o una maldición para una compañía, según cómo los miembros de la familia manejen los factores familiares clave para el éxito (FFCE). Este artículo presenta el Modelo de Puntuación Bifásica (MPB), que las compañías pueden usar para desarrollar una ventaja competitiva basada en la influencia familiar. Se respalda en los resultados de una investigación realizada en empresas familiares mexicanas, en la cual se estudió la relación influencia familiar-desempeño empresarial. La variable "influencia familiar" se midió a través de los instrumentos F-PEC tipo común y el FAMILIAL INDEX; la variable "desempeño empresarial", a través de la satisfacción de los directores ejecutivos de las empresas, en seis dimensiones de desempeño financiero. Las conclusiones de la investigación indican que la relación planteada no es alta para esta muestra empresarial; en consecuencia, se propone el modelo MPB con base en la idea de que el desempeño empresarial está más efectivamente relacionado con los FFCE.

Palabras clave: empresas familiares mexicanas, ventaja competitiva, factores familiares clave para el éxito.

RESUMO

Ser uma empresa familiar não é bom ou ruim por si só, é uma característica adicional com a qual a gestão deve lidar. Na verdade, a influência da família pode ser uma bênção ou uma maldição para uma empresa, dependendo de como os membros lidem com os Fatores Chave de Sucesso Familiar (KSFF). Este artigo apresenta as duas fases de pontuação (TSS) do modelo, uma ferramenta que as empresas podem usar para desenvolver uma vantagem competitiva baseada justamente sobre a influência da família. O modelo TSS é baseado nos resultados obtidos em uma pesquisa sobre as empresas familiares mexicanas, em que a relação entre a influência da família e desempenho da empresa foi testado. A variável "influência da família" foi medida através da F-PEC e por o índice familiar; enquanto o "desempenho da empresa" foi medido pelo CEO nível de satisfação em seis dimensões de desempenho financeiro. Em conclusão, o relacionamento influência familiar-desempenho da empresa não é alto para esta amostra de empresas e, como consequência, o modelo TSS é proposto com base na idéia de que o desempenho da empresa está relacionada de forma mais eficaz para o KSFF.

Palavras chave: negócio familiar mexicano, vantagem competitiva, fatores chave de sucesso familiar.

Introduction

The mode in which the owner-family affects the operations of a business captures the attention of many family-business researchers in the world, and is a matter of debate. In this paper it is stated that the relationship between business performance and family influence is not as important as the relationship between business performance and the Key Success Family Factors (KSFF). Based on this conjecture, a model to develop a competitive advantageinthebusinessbasedonitsfamily nature is proposed.

The paper begins with a review of the arguments that some authors use in favor of the positive family influence as well as the arguments against the negative family influence on the business. A survey of Mexican family businesses was conducted and its findings, which explore the nature of the relationship between performance and family influence, are then presented. The family influence was measured using the F-PEC instrument proposed by Astrachan, Klein, and Smyrnios (2002). Due to the fact that many Mexican family businesses do not use the concept of "Governance Board" included in the F-PEC, in their daily activities a second instrument was applied: the FAMILIAL INDEX proposed by Avendaño (2006).

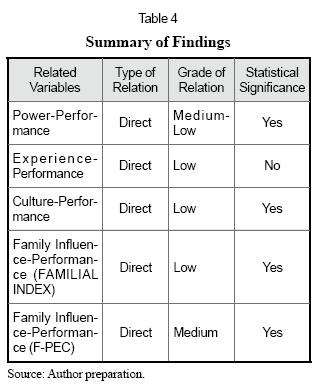

From this research, it could be said that the relationship between performance and family influence is not strong using any of the instruments, FPEC and FAMILIAL INDEX, for the Mexican FB included in the sample.

Next, the concepts and explanations of developed model are presented along with an example of the application to a real Mexican business. Finally, suggestions for future research on this topic are provided.

1. Importance of Family Business

In the global world of today, most countries and regions have businesses as the basic units for economic development, and many of them are family-owned and operated. This form of business is probably the oldest in human history (Lea,1991), and it remains very important even today. The following examples demonstrate the importance of family business: nearly 40% of the 1990 Fortune 500 companies were family owned or controlled (Lea, 1991). The famous Levi Strauss Company was controlled by a family since its beginning -a century and a half ago- and DuPont, controlled by the same family for 170 years, has become the biggest chemical company in the world.

Astrachan and Shanker (2003) presented family business (FB) contributions to the US economy in terms of number of companies,%age of GDP and%age of work force in 2000. Considering their definition, there are 24.2 million family businesses in the USA, which corresponds to 89% of the 27.2 million registered with the Internal Revenue Service (IRS). According to the broad definition, family businesses generated 64% of the Gross Domestic Product (GDP) and employed 62% of the workforce (82 million workers). As can be seen, any of the three criteria yield solid arguments to establish the significance of the family business sector in the U.S. economy.

Similarly, family businesses have a high contribution to the economy in other countries. For example, Neubauer and Lank (1998) presented some rough estimates of the number of family businesses in some countries: in Portugal the number of family businesses accounts for 70% of the total; in the United Kingdom, 75%; Spain, 80%; Switzerland, 85%; and Sweden, Italy and Middle Eastern countries report over 90%.

In Mexico, the contribution of family businesses to the Mexican economy is similar to that of the United States. As evidence, five of the top ten biggest companies in Mexico (Expansion, 2008) are family businesses. These companies are America Movil, Cemex, Femsa, Telmex and Telcel. The other five companies of the top ten are Pemex and CFE (government companies) and Walmart, GM and BBVA-Bancomer (Global companies). Continuing with contributions of FB to Mexican economy, La Porta, López-de-Silanes, and Shleifer (1999) stated that families control nearly 100 % of Mexico's largest firms. Unlike large businesses, there is not enough statistical information on medium and small family firms; there is no census to define the type of businesses (family and non-family) in Mexico and no official agency registers firms in this sector.

Despite the above evidence on the importance of family business in the United States, Mexico and other countries around the world, the research in this field is still evolving (Bird, Welsch, Astrachan, and Pistrui, 2002), with many questions remaining unanswered. One of them is the contribution of family members to business performance: Is it good or bad for a company to have members of the owner family in the organization? How does thefamily influence the business? The next section includes some aspects of this question.

2. Family Influence on the Business

There is no general agreement among researchers on how the family influences the business. Ginebra (1999) identified some common advantages and disadvantages about this business type. Among weaknesses or disadvantages, Ginebra included (a) nepotism; (b)autocracy; (c) difficulty in delegation; (d) paternalism; (e) confusion in cash flows; (f) manipulation by family members; and (g) lack of definition of organizational structure. From this point of view, the family could be seen as a bad influence on a business, and in some extreme situations becomes a curse to family members.

From the opposite point of view, a family influences a business positively. There are some authors who identify advantages on being a family business. James and Kaye (1999) referred to three advantages that family businesses incorporate: (a) implicit contractual relationships among family members pre-exist business involvement, and many of them result in agency costs which are relatively lower than formal, explicit relationships; (b) competitive advantage ensues when the horizons of decision makers are broadened due to commitment to the long-term support of the family; and (c) firm value is enhanced due to the access to family resources, especially when access to other capital is limited.

Continuing with the positive aspects of being a family business, Ginebra recognizes the potential presence of the following strengths in family businesses: (a) comprehension; (b) acceptance of authority; (c) common goals; (d) dedication; (e) flexibility; and (f) agility in deciding and implementing. Some additional advantages are: knowhow, long term horizons, service attitudes, executive stability, and the power of the family group. The best family businesses have always maintained the principles of quality, customer service and respect in their treatment of employees (Goldwasser, 1986).

In addition, the family influence may lead to a sustainable competitive advantage through leveraging on internal resources, as suggested in the resource-based view (RBV) theory (Down, Dibrell, Green, Hansen, and Johnson, 2003). Similarly, Habbershon and Williams (1999) argued that RBV applies to family business and defined "familiness" as the unique bundle of resources that a particular firm has because of the system´s interaction between the family, its individual members, and the business.

From these arguments, family could be seen as a good influence to business and in some extreme situations becomes an absolute blessing to family members. This conclusion is the exact opposite of that proposed earlier.

3. Empirical Research in Mexican Family Business

A survey was applied to various companies in Mexico to pursue the investigation of the relationship between family influence and business performance. The specific purpose of this research was to examine the type of relationship between family influence and the financial performance satisfaction in Mexican family businesses.

3.1 Sample

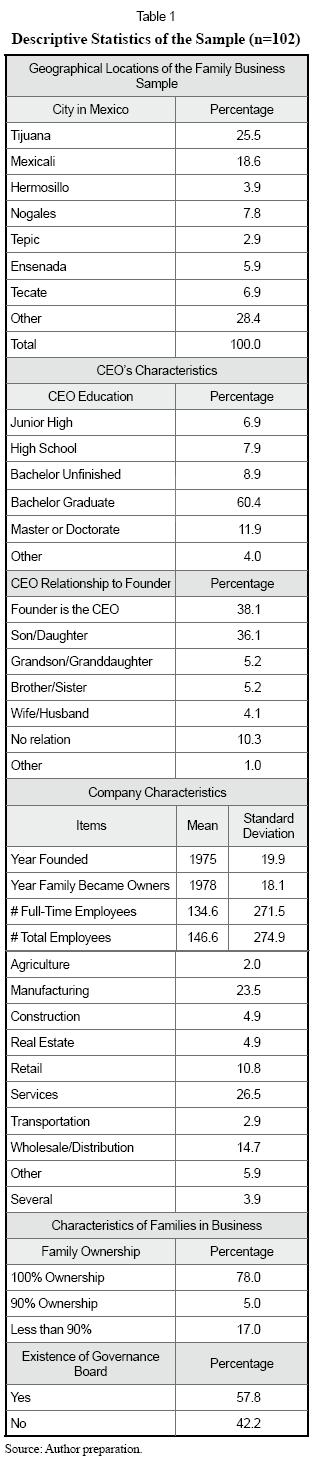

All companies involved in this study are located in the northwest region of Mexico, specifically in the following cities: Tepic, Guadalajara, Culiacán, Hermosillo, Nogales, Mexicali, Tijuana, Tecate, and Ensenada. A total of 354 surveys were sent out and 102 were returned, a response rate of 28.8%. The firm's mailing addresses were extracted from Tecnológico de Monterrey databases and from the Sistema de Información Empresarial Mexicano (SIEM), a public national database of private companies. The criteria for company selection were that the companies were family businesses and that most of them were small-and medium-sized companies. Less than 10 companies were large companies.

Data were collected through a questionnaire sent to the CEO's of companies through: (a) mail or fax; and (b) electronic mail. In addition, 10 face-to-face interviews were conducted as a pretest stage. CEO's were selected as respondents considering they have the overall information of the business.

An interesting finding during the collection process was the fact that many Mexican family businesses were very secretive, and they did not want to share information regarding the family. This made the data collection a very difficult challenge; actions were therefore needed in order to increase the response rate. First, surveys with a presentation letter were printed out on official paper to get the respondents' trust. After that, one big envelope containing the survey and a second envelope with the mailing return address were sent to each firm. Then, the monitoring process took place with a group of 11 people engaged part-time in collecting activities. Six of them were responsible for phone-call monitoring. The first phone call was made to each firm to confirm that the survey had been received, and in some cases it was necessary to re-send the survey by mail, fax, or electronic mail. Three, four, or sometimes more phone calls were made in order to increase the number of survey respondents. Even so, many survey recipients failed to answer effectively.

3.2 Measures

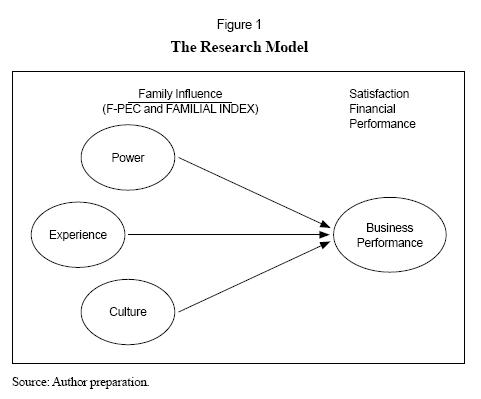

This study focused on the relationship between the variables of family influence and satisfaction with financial performance in Mexican family businesses. The family influence was measured through the F-PEC instrument (Astrachan et al., 2002), which comprises the subscales of Power,Experience, and Culture.

Considering that Governance Board concept, included in power subscale of F-PEC, has low practical usage in Mexican FB, a second instrument was incorporated to measure family influence, the FAMILIAL INDEX (Avendaño, 2006). Both the F-PEC and FAMILIAL INDEX instruments are explained in detail later.On the other side, the financial business performance was measured through the CEO level of satisfaction in six performance dimensions. These dimensions were sales volume growth, net profit growth, return on investment, increasing positive cash flow, operating profit, cash balances/reduced debt. Figure 1 presents the research model used in this study. The specific research questions investigated in this study are the following:

• What is the relationship between thefamily influence, as measured by the F-PEC scale, and the satisfaction with financial performance in Mexican family businesses?

• What is the relationship between the family influence, as measured by the FAMILIAL INDEX, and the satisfaction with financial performance in Mexican family businesses?

3.3 Statistical Analysis

Data were analyzed with multivariate techniques, including correlation matrix analysis, factor analysis, bivariate, multiple regressions, and stepwise regression. SPSS version 12 was used as statistical computer software.

3.4 Results

Table 1 presents the descriptive statistics of thesample.And complete results are presented in detailed format in Avendaño (2006); the main results are summarized next:

3.4.1 Family Influence vs. Business Performance through the F-PEC

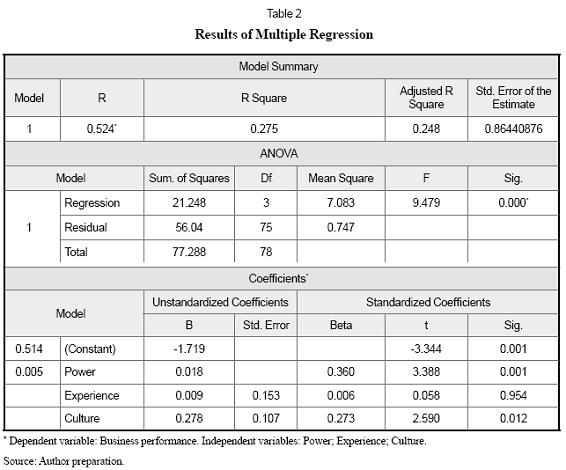

Multiple regression analysis was effected to account for the size of the variance in satisfaction with financial performance for the combination of power, experience and culture. Table 2 presents the results. The combination of power, experience, and culture explains the 24.8% of the variance of performance as measured for this analysis with statistical significance (p=0.0). However, experience subscale individually had no statistical significance (t=0.058, p=0.954). As measured through the F-PEC, family influence compared to satisfaction with financial performance is statistically significant and positive, as can be seen in Table 2, but this influence is not high. Individually, Power and Culture have a positive relation with satisfaction with financial performance, while Experience had no evident relationship.

Thus, Power and Culture influence satisfac-research for cultural construct, but it does tion with financial performance in Mexican not include Experience. Alexander's study family businesses. This finding is consistent had no conclusion for Power construct due with those presented in Alexander's (2003) to missing data.

3.4.2 Family Influence vs. Business Performance through the FAMILIAL INDEX

This section presents findings on the relationship among family influence and business performance satisfaction variables through the FAMILIAL INDEX instrument. Table 3 presents regression results.

Table 3 makes it possible to detect a positive relation (standardized beta=0.342) between FAMILIAL INDEX and Performance with high statistical significance (p=.003). However, the performance variance, explained by FAMILIAL INDEX, is low (Adjusted R Square=0.105).

Table 4 presents a summary of the relationships between independent variables and business performance. As a conclusion it could be said that the relationship between performance and family influence is not high using both instruments (FPEC and FAMILIAL INDEX), for Mexican FB included in the sample. Thus, family influence is not a solid predictor of satisfaction with business performance.

4. Moving to the Potential Competitive Advantage Paradigm

We can confirm from the above discussion that for a business it is not inherently bad or good, positive or negative to be familyinfluenced. Thus, an alternative research path could be explored. Beyond the positive-negative, or good-bad dichotomy, family influence could be seen just as a business characteristic. All the characteristics of a family business can be seen as potential advantages or disadvantages. Depending on how family members manage these characteristics, they become an advantage, a disadvantage or a neutral characteristic regarding the business performance. For example, one family business characteristic -succession- can be an advantage to performance if well managed, but it can be the reason for failure if badly managed. Also, it is possible for succession to be just neutral, without reducing or increasing business performance. The following proposition can be stated:

P1. In a family business, family issues can become an advantage, disadvantage or neutral to business performance depending on how family members manage them.

This proposition requires a definition of family issues for better understanding. Family issues are those characteristics which might affect or improve the business due to family relationships. These family issues can be named KSFF based on similarity to the Key Success Factors (KSF) definition, presented in following section.

5. Key Success Family Factors

In strategic management theory, KSF are the factors that most affect business performance. "Industry's key success factors (KSFs) are the things that most affect industry members' to prosper in the market place" (Thompson and Strickland, 2003, p.106). This refers to the particular strategy elements, product attributes, resources, competencies, competitive capabilities and business outcomes that spell the difference between profit and loss and ultimately between competitive success or failure. Based on similarity with KSF definition, KSFF are defined in this paper as those factors regarding family relationships, with the potential of affecting or improving the overall business performance. Some KSFF candidates are succession, family salary system, ownership distribution, rules for new entrants, previous experience of new entrants, job descriptions, and others. Using KSFF definition, Proposition 1 can be modified as follows:

P2. In a family business, KSFFs can become an advantage, disadvantage or neutral to business performance depending on how family members manage them.

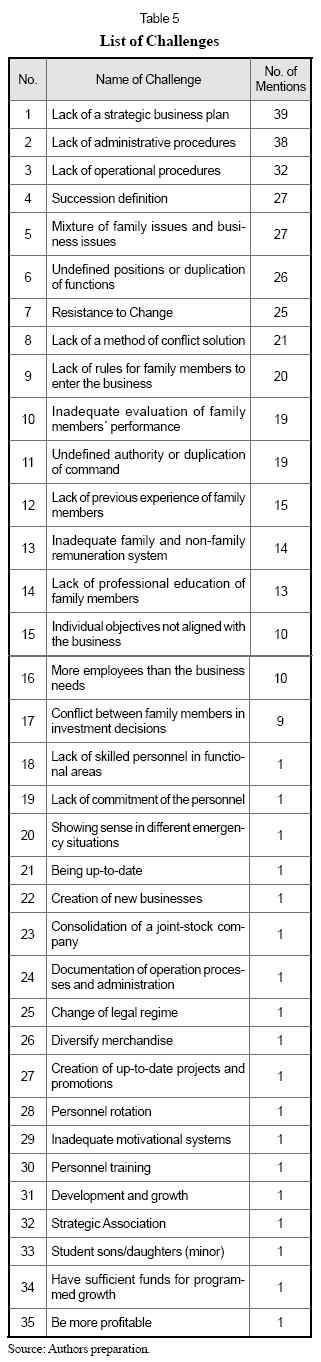

The KSFFs can vary depending on the national culture. For example, in the empirical study applied to Mexican Businesses, one question was included to request respondents to mention all the challenges of the firm, regarding the family relations. Table 5 presents a ranking with the most-mentioned challenges by Mexican family firms.

This list of challenges produced by the survey is a potential list of KSFF's for Mexican companies. An analysis of the challenges faced by the companies of the sample show us that the first three refer to business procedures and strategic directions of the firm more than family ties. These three challenges are commonly present in non-family firms too, so this could be interpreted to mean that family firms share the challenges of lack of an strategic plan, the lack of administrative procedures and the lack of operational procedures with some non-family firms.The nature of a family firm does not exempt it from facing these challenges. On the other hand, challenges with Nos. 4, 5, 9, 10, 12, 13, 14, and 17 in Table 5 are exclusive for family firms, so we can conclude that in addition to usual internal and external challenges, family firms face a set of particular challenges related to family relations. This means in a comparison with non-family firms; family firms face a higher grade of difficult when managing the business. This requires an additional preparation for the Top Management Team of a family firm of topics regarding family conflict solutions.

6. Two-Stage Scoring Model

A Two-Stage Scoring Model (TSS) was developed as a consequence of the results obtained in the empiric research of Mexican FamilyBusinesses. If family influence is not highly related to business performance, then an additional path must be explored in order to take advantage of the family ties and use them in benefit of the firm.

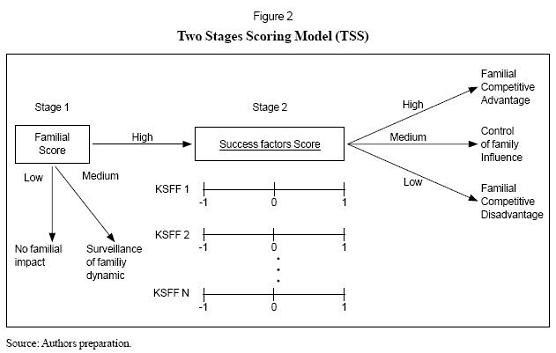

This path is the TSS (Figure 2) which is a conceptual proposal to help companies win a competitive advantage based on family characteristics. This model allows to test Proposition 2 and allows for the potential construction of business competitive advantage based on internal resources, as suggested by Habbershon and Williams (1999), applying the resource-based approach. The TSS model is divided in two main stages; the first is designed to obtain a familial score, and the second is designed to obtain scores for each KSFF.

7. The First Stage of two-Stage Scoring Model

The first stage of TSS provides a score on the influence of a family to a specific company ("Familial Score"), which is categorized as "low" "medium" or "high". A low familial score does not require that the company should worry about family aspects because the company is not a real family business; and the model ceases to apply. For a medium familial score, the situation requires the supervision of family dynamics and taking action only when family problems be come apparent.

Beyond that, the model ceases or apply. But if the familial score is high, then the company is facing a stronger challenge and moves to the second stage of the model. Before explaining the second stage, we must present the ways used to obtain the familial score.

7.1 Familial Score

Familial score is a number in a continuum scale reflecting the influence of thefamily on the business and it can be obtained through one of the available instruments in the family business field. One of them is the F-PEC instrument proposed by Astrachan et al. (2002) which comprises power, experience and culture subscales. Another instrument of measurement is the Familiar Index (Avendaño, 2006) which comprises management and ownership variables. The following section presents these two measurement tools.

7.1.1 F-PEC Scale

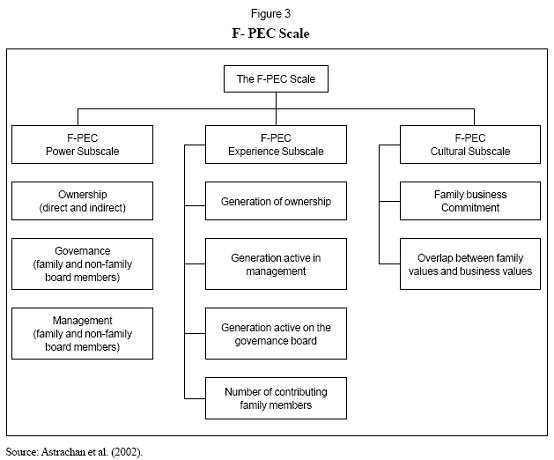

The F-PEC tool is an instrument that assigns a grade of family influence to a business (Astrachan et al., 2002). The F-PEC scale (Family-Power, Experience, Culture) is formed by three subscales: (a) power, (b) experience, and (c) culture. Each subscale comprises some elements as presented in Figure 3. Power subscale comprises (a) ownership, (b) governance, and (c) management. Experience subscale includes four elements: (a) generation of ownership, (b) generation active in management, (c) generation active in governance (on the board), and (d) number ofcontributingfamilymembers.Finally,the culture subscale comprises (a) family business commitment and (b) overlap between family values and business values.

The power subscale comprises the ownership, governance and management elements. According to the F-PEC authors, a family can influence a business through the extent of its ownership, governance and management involvement, which explains the inclusion of these elements on the F-PEC. Among the authors who use ownership or management in their definitions are Barry (1975), Barnes and Hershon (1976), and Stern (1986). The ownershipelementrecordsthesharesowned by family members and non-family members. The governance element includes the quantification of family members, as well as non-family members, participating in the governance board. Finally, management element of the power subscale quantifies the number of members and non-members of the family who participate in the management board.

The experience subscale incorporates the participation of the generation active in ownership, the governance board and the management board, as well as the number of contributing family members. Generation has been considered a definitional factor for many authors like Churchill and Hatten (1987), Ward (1987), and Handler (1989).

The culture subscale refers to organizational culture and comprises family business commitment and overlap between family and business values. Dyer (1986) and Carlock and Ward (2001) gave an important role to the culture aspect of the family business development.

7.1.2 Familial Index

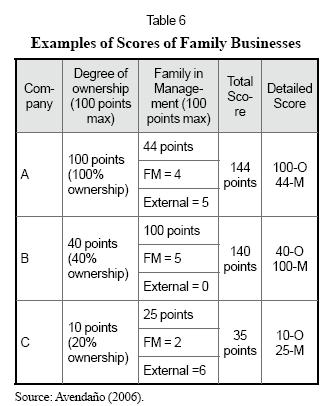

Similar to the F-PEC, the FAMILIAL INDEX is a tool that provides a score on the influence of the family members over the business (Avendaño, 2006). It comprises two important measures of family influence used by some business family authors: (a) degree of family ownership and (b) family in management (Alcorn, 1982; Barnes and Hershon, 1976; Donckels and Frohlich, 1991; Lansberg, Perrow, and Rogolsky, 1988). The FAMILIAL INDEX ranges from zero to 200 points, and each of the two elements has a 100-point maximum. Both elements are described in the following.

Degree of Ownership. This element represents how much of the business is owned by one family. It ranges from zero to 100 points, and the score for a specific business is the result of multiplication of the percentage of family ownership degree by 100. Considering the entrepreneur as the "root" of the family, the members considered to be part of the ownership are wife, siblings, children, grandchildren, nephews and nieces and the original entrepreneur.

Family in Management. This element is an indicator of the degree of participation of family members in management activities, particularly in management board or Top Management Team (TMT), which includes the CEO and all members depending on the CEO. The score is the ratio of TMT members who are family, multiplied by 100.

An additional aspect to consider when compiling the score for a specific company is whether the score is ownership-concentrated, family management-concentrated or a balance between them. This information must therefore be added in to the total score. The following section presents some examples about the possible scores for family businesses and Table 6 presents scores for three companies in total score format and detailed score format.

Scores for company A are 144 total and (100O, 44 M) detailed, which means that this is an ownership-concentrated family business because the ownership (O) score is 100, while the management (M) score is just 44 points. Company B has one 140 total score and(40-O,100-M) detailed because it is management-concentrated. Company C scores are 35 total and (10-O,25-M) detailed, which means low family influence on business.

The FAMILIAL INDEX combines effectiveness in assigning scores with an easy calculation process. It is very simple to obtain data to grade a company, and this could be attractive to some organizations like banks and financial institutions when evaluating the business performance of a family business. The decision for loans or credit line authorizations could be influenced when considering the familial grade of the company.

7.2 Second Stage of TSS

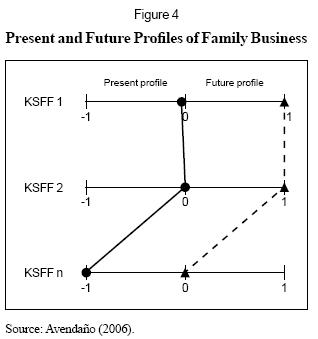

If a company has obtained "high" as Familial Score, it can be seen as a company highly influenced by the family and we can move to the second stage of TSS conceptual model. Here, every KSFF is evaluated in a three-position scaling system (-1, 0, 1) to obtain an initial profile of the company (see Figure 4). Minus one (-1) is assigned to an individual KSFF when it is a problem not yet attended to bythe company; zero (0) means that the KSFF is not a problem and one (1) is assigned when the KSFF is a source of competitive advantage.

The initial profile reveals whether the family influence is advantageous, disadvantageous or neutral to company, at present. In other words, depending on how the company manages family resources, they are an advantage, a disadvantage, or not used at all. After that, the prescription for a company is to prepare a plan for reaching a target (future) profile by means of improving KSFFs. As can be seen, this model is congruent with contingency theory.

8. Application of the Model: An Example

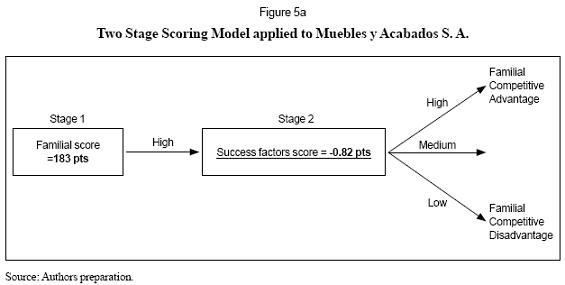

Next there is an example of Muebles y Acabados S. A., a real FB in Mexico. The family owns 100% of the company and the TMT is formed by six people, five of them being part of the owner family. The first stage of the model is to obtain the familial score. In this example, the familial score using FAMILIAL INDEX is 183 points total and 100-O, 83-M detailed score. This means a high influence of family over the business and according to the TSS model, the second stage must beapplied.

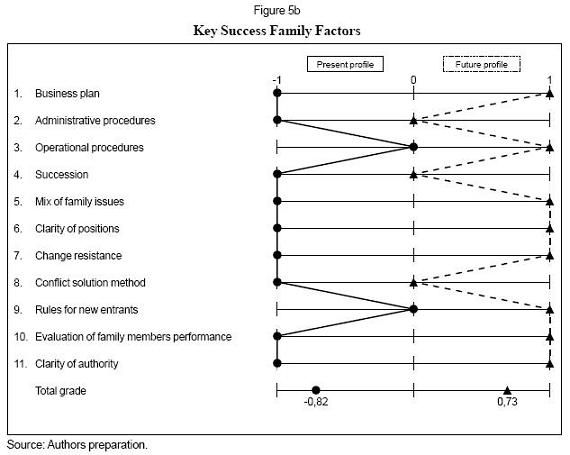

From the ranking of challenges (see Table 5) mentioned by Mexican FB in the survey, the top 11 challenges where selected as KSFF and used in this example to grade Muebles y Acabados. This enabled the Success Factors score to be obtained (see Figure 5a). For this particular example, the success factor score was -0.82 which means that family influence is producing a competitive disadvantage to the business. In the range of -1 to 1, the number -0.82 is the average obtained from the individual scores for each KSSF. Prescription for the company would be to prepare a development plan for the future. Specifically, the business should improve each KSFF in the short term (three years) in order to transform family influence into a competitive advantage. From Figure 5b it is possible to state that Muebles y Acabados must prepare specific projects for following KSFF's: business plan, mix of family issues, clarity of positions, resistance to change, evaluation of family members performance and clarity of authority. Additionally, the company must improve following KSFF: administrative procedures, operational procedures, succession and a method for conflict solution. The target profile had an average of 0.73 once the KSFF were improved.

Conclusions

The TSS model is offered to the consideration of academic and research community of the family business field for analysis and critic. An important element to emphasize is that the model suggests a change in the present form to view family companies. Instead of insisting on the debate regarding the form in which the family affects the company, whether it is good or not for it to be a family business, the model suggests to accept kinship axs just one extra business characteristic, and to focus on those aspects that explain the success or failure of handling family relations inside the businesses.

The results of research into the relationship between family influence and performance shows that family influence is not a solid predictor of good performance in family businesses thus, it was necessary to look beyond this relationship. Instead of exploring "family influence" - "firm performance" relationship,TSS is proposing to change towards the KSFF-firm performance relationship. This relation could contribute to answer to the question: Why some family business are successful at dealing with family ties while others are not? Thus in the author´s criteria, this is a promising topic that could help to create a body of knowledge regarding the identification of best practices for controlling family issues when managing a company.

The most important challenge of the model is to identify what the appropriate KSFF are and how to evaluate them. The national culture is a moderating variable that will potentially affect the identification of KSFF for every country. In this paper, the KSFF proposed for Muebles y Acabados came from a Mexican FB sample. So, KSFF for other countries could be different.

Nevertheless, in the field of family business, comparison between different research studies is very difficult due to the disagreement about the definition of "family business" as used by different authors. The TSS model, suggests the adoption of a unique scale for the family business definition (among the available ones) which allows comparison among research studies, and promotes the accumulation of knowledge.

One important limitation of the research was the availability of information because none of the sample companies were public and CEO's did not want to share information, especially in relation to family issues. It was necessary to insist by phone in order to increase the response rate. Additionally, companies were selected on grounds of convenience because there is no database of family businesses in México. Sample companies were selected from a database of the Tecnológico de Monterrey, a private databa-se, and from SIEM a database in which it is not possible to identify family businesses.

Future Research

TSS Model is evolving from an idea to a useful instrument, and there is plenty of scope for future research. This section includes some of these activities.

1. Selection of one specific instrument to obtain scores of family influence, for example the F-PEC or the FAMILIAL INDEX.

2. The boundaries of the high, medium, and low categories of the familial score for use in the TSS Model should be confirmed.

3. The KSFF for a family business should be confirmed for use in the TSS Model. Here, culture is an additional variable to consider when looking for KSFFs because they could vary from one national culture to another.

4. The scaling system for KSFF in the TSS model should be tested. Fuzzy Logic is a good alternative to work with the Three Position Scaling System proposed (-1, 0, 1).

5. The benefits of getting the average of all KSFF, as an aggregated measure, should be evaluated.

6. A software program of the TSS Model needs to be developed to provide results automatically.

7. The Two Stages Scoring (TSS) Model should be tested in family businesses as a diagnostic instrument for the construction of a competitive advantage in connection with the Resource-Based View Theory (RBV) and Contingency Theory.

References

1. Alcorn, P. B. (1982). Success and survival in the family owned firm. New York: McGraw-Hill. [ Links ]

2. Alexander, J. D. (2003). Effects of family influence on satisfaction with financial performance in family business. Unpublished doctoral dissertation, Auburn University, Auburn, Alabama. [ Links ]

3. Astrachan, J. and Shanker, M. C. (2003, September). Businesses' contribution to U.S. economy: A closer look. Family Business Review, 16 (3), 211. [ Links ]

4. Astrachan, J., Klein, S. B. and Smyrnios, K. X. (2002). The F-PEC scale of family influence: A proposal for solving the family business definition problem. Family Business Review, 15, 45-59. [ Links ]

5. Astrachan, J. et al. (2003). The global entrepreneurship monitor: Family-sponsored ventures. In Research forum proceedings: 14. World conference (pp. 2-14). Lausanne, Switzerland: Family Business Network. [ Links ]

6. Avendaño, A. J. (2006). Family influence on financial performance satisfaction in Mexican businesses. Doctoral dissertation. Alliant International University, San Diego, CA (UMI, Proquest. Dissertations and Thesis). [ Links ]

7. Barnes, L. B. and Hershon, S. A. (1976). Transferring power in the family business. Harvard Business Review, 54 (4), 105-114. [ Links ]

8. Barry, B. (1975). The development of organizational structure in the family firm. Journal of General Management, 3, 42-60. [ Links ]

9. Becker, G. S. (1974). A theory of social interaction. Journal of Political Economy, 82, 1063-1093. [ Links ]

10. Bird, B., Welsch, H., Astrachan, J.H. and Pistrui, D. (2002). Family business research: The evolution of an academic field. Family Business Review, 15 (4): 337-350. [ Links ]

11. Carlock, R.S. and Ward, J.L. (2001). Strategic planning for the family business: Parallel planning to unify the family and business. Houndsmill, NY: Palgrave. [ Links ]

12. Churchill, R. A. and Hatten, K. C. (1987). Nonmarked based transfers of wealth and power: A research framework for small businesses. American Journal of Small Business, 11(3), 51-64. [ Links ]

13. Davis, P. (1983). Realizing the potential of family business. Organizational Dynamics, 12, 47-56. [ Links ]

14. Donckels, R. and Frohlich, E. (1991). Are family businesses really different? European experiences from STRATOS. Family Business Review, 4 (2), 149-160. [ Links ]

15. Down, J., Dibrell, C., Green, M., Hansen, E. and Johnson, A. (2003). A resource-based view and market orientation theory: Examination of the role of "familiness" in family business success. In Research forum proceedings: 14th World Conference (pp.83-95). Lausanne, Switzerland: Family Business Network. [ Links ]

16. Dyer, G.W. (1986). Cultural change in family firms: Anticipating and managing business and family transitions. San Francisco, CA: Jossey-Bass. [ Links ]

17. Expansión (2008, June 23). 500: las empresas más importantes de México. (993), 200-219. [ Links ]

18. Ginebra, J. (1999). Las empresas familiares: su dirección y su continuidad. México DF: Panorama. [ Links ]

19. Goldwasser, T. (1986). Family pride. New York: Dodd, Mead and Company. [ Links ]

20. Gomez-Mejia, L., Nunez-Nickel, M. and Gutierrez, I (2001). The role of family ties in agency contracts. Academy of Management Journal. 44 (1), 81-96. [ Links ]

21. Habbershon, T. and Williams, M. (1999). A resource-based view framework for assessing the strategic advantage of family business. Family Business Review, 12 (1), 27-39. [ Links ]

22. Handler, W. (1989). Methodological issues and considerations in studying family businesses. Family Business Review, 2 (3), 257-276. [ Links ]

23. James, H. and Kaye, K. (1999). What can the family to contribute to business?: Examining contractual relationships. Family Business Review, 12, 61-75. [ Links ]

24. Kelly L. M. and Avendaño, J. (2004). How familial is my family business? Paper presented at the Western Academy of Management. Anchorage, Alaska. [ Links ]

25. Kelly, L. M., Athanassiou, N. and Crittenden, W. F. (2000). Founder centrality and strategic behavior in the family-owned firm. Entrepreneurship Theory and Practice, 25, 27-42. [ Links ]

26. Klein, S. B., Astrachan, J. and Smyrnios, K. X. (2003).Towards the validation of the F-PEC scale of family influence. In Research forum proceedings: 14th World Conference (pp.183-195). Lausanne, Switzerland: Family Business Network. [ Links ]

27. La Porta, R., López-de-Silanes, F. and Shleifer, A. (1999). Corporate ownership around the world. Journal of Finance, 54 (2), 471-517. [ Links ]

28. Lansberg, I. S., Perrow, E. L. and Rogolsky, S. (1988). Family business as an emerging field. Family Business Review, 1 (1), 1-8. [ Links ]

29. Lea, J.W. (1991). Keeping it in thefamily: Successful succession of the family business. New York: John Wiley and Sons. [ Links ]

30. Neubauer, F. and Lank, A. G. (1998). The family business: Its governance for sustainability. New York: Routledge/Jossey-Bass. [ Links ]

31. Shanker, M. C. and Astrachan, J. H. (1996). Myths and realities: Family business's contribution to the US economy. A framework for assessing family business statistics. Family Business Review, 9, 102-123. [ Links ]

32. Sharma, P. (2004, March). An overview of the field of family business studies: Current status and directions for the future. Family Business Review, 17 (1), 1-36. [ Links ]

33.Stern, M.H. (1986). Inside the family-held business. New York: Harcourt Brace Jovanovich. [ Links ]

34. Thompson, A. and Strickland, A. (2003). Strategic management: Concepts and cases. New York. McGraw-Hill. [ Links ]

35. Ward, J. L. (1987). Keeping the family business healthy: How to plan for continuing growth, profitability and family leadership. San Francisco: Jossey-Bass. [ Links ]