Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Cuadernos de Administración

Print version ISSN 0120-3592

Cuad. Adm. vol.25 no.44 Bogotá Jan./une 2012

Family business performance: evidence from Mexico*

Tomás Ignacio Espinoza Aguiló** Nicolás Felipe Espinoza Aguiló***

* El artículo es el resultado del proyecto de investigación "Family companies and their performance: evidence from México", realizado en el año 2011.

** Magíster en Ciencias de la Administración, Pontificia Universidad Católica de Chile, Santiago, Chile, 2012; ingeniero comercial, Universidad de Chile, Santiago, Chile, 2009; profesor de Finanzas, Pontificia Universidad Católica de Chile, Santiago, Chile. Correo electrónico: tiespino@uc.cl

*** Magíster en Ciencias de la Administración, Pontificia Universidad Católica de Chile, Santiago, Chile, 2009; magíster en Finanzas, Universidad de Chile, Santiago, Chile, 2007; licenciado en Ciencias de la Administración, Universidad de Chile, Santiago, Chile, 2006; ingeniero comercial, Universidad de Chile, Santiago, Chile, 2006; jefe del Área de Empresas Públicas y Universidades, División de Análisis Contable, Contraloría General de la República de Chile, Santiago, Chile. Correo electrónico: nespinozaa@contraloria.cl

Se recibió el 08-04-2011 y se aprobó el 28-04-2012.

Abstract

Based on the work of Anderson & Reeb (2003), the current paper aims to examine whether, under the peculiar influence of the Mexican corporate system, there are differences in the performance of family and non-family firms. The authors propose an analysis that allows conducting a comprehensive study and comparison between companies with different ownership structures (family vs. non-family firms), differentiated by heterogeneously developed governance patterns. Likewise, the effects of the degree of ownership concentration on performance are also analyzed. Moreover, evidence is shown of contrasting relationships between governance mechanisms and performance in family and non-family firms. Results are consistent with those of Anderson & Reeb (2003).

Keywords: Firm performance, family ownership, family firm, ownership concentration, corporate governance.

JEL Classification: G32, L25.

El desempeño de las empresas familiares: evidencias del caso mexicano

Resumen

Con base en el trabajo de Anderson y Reeb (2003), el presente documento analiza si, bajo la influencia específica del sistema corporativo mexicano, existen diferencias en el desempeño de las empresas familiares y no familiares. El enfoque propuesto permite llevar a cabo un estudio comparativo integral entre ambos tipos de empresa, el cual caracteriza sus formas contrastantes de gobierno y los procesos que han llevado a su desarrollo. Igualmente, se analiza el efecto que tienen distintos niveles de concentración de la propiedad en la empresa sobre su desempeño. Más aun, las evidencias indican que cada uno de los dos tipos de empresa estudiados presenta relaciones específicas entre forma de gobierno y desempeño.

Palabras clave: Desempeño empresarial, propiedad familiar, empresas familiares, concentración de la propiedad, gobierno corporativo.

Clasificación JEL: G32, L25.

O desempenho das empresas familiares: evidências do caso mexicano

Resumo

Baseado no trabalho de Anderson e Reeb (2003), o presente documento analisa se, sob a influência específica do sistema corporativo mexicano, existem diferenças no desempenho das empresas familiares e não familiares. O enfoque proposto permite levar a cabo um estudo comparativo integral entre ambos os tipos de empresa, o qual caracteriza suas formas contrastantes de governo e os processos que o conduziram ao seu desenvolvimento. Da mesma forma, analisa-se o efeito dos diferentes níveis de concentração da propriedade na empresa sobre seu desempenho. E mais ainda, as evidências indicam que cada um - dos dois tipos de empresa estudados - apresenta relações específicas entre forma de governo e desempenho.

Palavras chave: Desempenho empresarial, propriedade familiar, empresas familiares. concentração da propriedade, governo corporativo.

Classificação JEL: G32, L25.

Introduction

Does ownership per se increase or decrease family business performance? This is not an easy question to answer. With respect to u.s.A. firms, we can find different points of view. Anderson and Reeb (2003) have found that family firms have a better performance than non-family firms, while Holderness and Sheehan (1988) have found the opposite relation. Whether family firms have a better or worse performance is an empirical matter that depends on many factors embedded in the local context of each country, which certainly influences ownership structure. La Porta, Lopez-de-Silanes, Shleifer and Vishny (1997, 1999) argue that ownership structure is determined by the legal system operating in each country. La Porta, López de Silanes, and Shleifer (2006) propose that the positive influence of entrepreneurial cash flow rights on firm value should be greater in countries where shareholders receive less protection. They show that civil law countries like Mexico with low protection granted to shareholders have a trend towards greater ownership concentration, which is increasing the number of family firms. On the other hand, common law countries, which tend to grant more protection to shareholders, allow greater ownership dispersion. In summary, the mentioned authors demonstrate a relationship between shareholder protection and ownership concentration.

In studying family companies, where, according to some authors, it is more difficult to mitigate agency problems, Jensen and Meckling (1976) and Morck et al. (1989, 1990) found empirical evidence of such problems, together with the mechanisms by which they are constrained. Fama and Jensen (1983) argue that companies in which ownership is concentrated and exerts considerable control tend to change benefits for private rent; while Demsetz (1983) explains that the owner chooses the consumption of non-pecuniary resources at the expense of those required for profitable projects. Finally, Morck et al. (1988) report a nonlinear relationship between ownership concentration and firm value. In general, it can be said that ownership concentration has been found to have a negative effect on company value.

Shleifer and Vishny (1997) provide evidence that the more control shareholders exert on the company, the more they try to extract benefits from it. Morck et al. (2000) and Perez-Gonzales (2001) argue that family firms hire relatives for important job positions in the company, even when they are less efficient than professional managers available in the market. Other authors such as Barclay and Holderness (1989), Barclay et al. (1993), Bebchuk (1999), Claessens et al. (2002), Claessens et al. (2000), Johnson and Mitton (2002), Morck et al. (2000), Nenova (2000) and Rajan and Zinglaes (2001) argue that shareholders that concentrate ownership tend to exchange profits for private benefits. Undiversified firms such as family businesses may tend not to maximize profits because they do not separate owner financial preferences from those of the company, thus being in disadvantage with non-family companies.

However, it is not a universal view that family businesses are less efficient. Demsetz and Lehn (1985) show that, through concentration and control, managers can mitigate the problems of managerial expropriation by placing relatives in key positions, which makes it easier for the family to monitor and control the company. Shleifer and Vishny (1986) found a positive relationship between ownership concentration and performance. In a study on western European countries, Maury (2006) found that family ownership improves performance, while Claessens et al. (1999), De Angelo (2000), Claessens et al. (2000), Friend and Lang (1988), Johnson et al. (1985) and Singell (1997) argue that large shareholders can mitigate managerial expropriation in companies with concentrated ownership and control. This is so not only because the presence of relatives inside the company facilitates monitoring by the family, but also because the family has more experience in the sector in question, all the more when they are the founders.

Villalonga and Amit (2006) show that family ownership creates value only when the founder serves as the CEO of the firm or as its Chairperson. James (1999) reports that family firms have greater investment efficiency because they have longer investment horizons, which mitigates the problem of myopic investment decisions by managers. Lee (2006) and Wang (2005) argue that family firms do not have incentives to behave opportunistically and that the board shall adopt policies to prevent damage to the reputation of the family and improve firm performance in the long term. Other authors (Claessens et al., 2002; Gorton and Schmid, 1996; Himmelberg et al., 1999; Holderness et al., 1999; La Porta et al., 2002; Lee, 2006; Morck et al., 1988; Schleifer and Vishny, 1997) have contributed general evidence that family firms show better performances than non-family ones. The relationship between ownership structure and performance is an empirical and dissimilar matter. The literature reports negative, positive and endogenous relationships among these two factors across a range of different countries.

Based on the mentioned work of Anderson and Reeb (2003), in the current research we studied the relationship between family ownership and firm performance on all the companies listed in the Mexican Stock Exchange, using a two-way, fixed-effect regression model. In order to measure performance, we established cross sectional comparisons between accounting and market data from family and non-family companies, so we could also check for active control of the company exerted by family members. Our main focus was to find the relationship between family ownership and firm performance by answering the same four questions brought up by Anderson and Reeb (2003) "First, are family firms less profitable or less valuable than nonfamily firms? Second, does the relation between family ownership and firm performance differ between younger and older family firms? Third, if founding-family ownership influences performance, is the performance/ownership relation linear over all ranges of family holdings? Fourth, does the level of family involvement or family members acting as CEO negatively impact firm performance?".

As in most developing countries, the majority of Mexican firms are family businesses. Regardless of size, the most dominant ones are owned and managed by one or more families or descendants of the founding family. Nevertheless, very few studies refer to Mexican family businesses, mainly because of the difficulty to access information about company ownership and control structure. Indeed, the composition of companies in Mexico is very peculiar due to high ownership concentration. Therefore, we defined a family business as the one that (i) allows founding or owner family members in the board of directors and (ii) satisfies the fractional equity ownership proposed by Anderson and Reeb (2003). for the study we considered a sample of companies listed in the Mexican Stock Exchange during the 2000-2010 period. Companies were segmented by industry to analyze the sector effect on business performance.

Thus, by controlling industry and year effects, we found that family companies have better performances than non-family ones. We found that variables such as debt, size and age correlate negatively with discretionary accruals. When we studied this relation with regards to CEO status, we could observe that companies in which the CEO is the founder or an owner-family member have better accounting and market performances. Le Breton-Miller and Miller (2006) argue that managers of family-owned businesses focus on sustainability for the benefit of the family members-owners. Therefore, we believe that, when compared to non-family companies, family ones mitigate the problems of opportunistic behavior on the part of managers and have greater and more efficient investment horizons, as well as better monitoring possibilities. To conclude, our results provide statistically significant evidence that Mexican family companies have a better economic performance than non-family ones.

In the lines below, the paper is structured as follows: the first section, "Performance and governance of the company", explains family companies in the Mexican context; the second section, "Sample and data collection", presents the surveyed data and the corresponding statistical summary. The next section introduces the "Methodology" employed; while the fourth section presents our empirical "Results" and the "Discussion section" ponders the relation between government mechanism and ownership structure. The last section presents our research "Conclusions".

Performance and governance of the company

The benefits of family ownership

Family firms can provide several benefits. Jensen and Meckling (1976) showed that property control can be advantageous. Having longer investment horizons, family firms are likely to tackle long-term-profit projects, because they want the company to persist in time and be inherited by family members. Similarly, James (1999) argues that families have longer investment horizons, thus achieving greater efficiency, while Stein (1988, 1989) has found that firms with such investment horizons are less myopic when maximizing long-term utility, and Lan Chen and Tsung Hsu (2009) suggest that firms with elevated family ownership may use R&D investment more efficiently than firms with low family ownership. Demsetz and Lehn (1985) have shown that concentrated ownership companies are family firms with lower supervision costs resulting from cheaper agency costs, thus achieving greater efficiency and maximizing the value of the company. Grossman and Hart (1980) argue that better performance by concentrated ownership firms (as compared to that of separated ownership firms) results from their increased incentives to perform better supervision. Mauge (1998) and Shliefer and Vishny (1997) argue that family business owners are always trying to minimize the risk afforded by the company, so they tend not to make too risky investments. Families are concerned with passing the business to their future generations and not just with wealth. Thus, the survival of the company is a major concern for families, who are more likely to maximize its value. In sum, family firms have sufficient conditions to achieve better performance standards than non-family firms.

The costs of family ownership

While family businesses have benefits associated to their concentrated ownership structure, this property scheme is also disadvantageous, as it can be seen in the limited supply of talent in the family and the problems derived from management entrenchment. Regarding the former, the company is compromised by the commitment to maintain the control in the hands of the family, who end up monopolizing managerial and supervisory positions (La Porta et al., 1999). This makes it complicated to hire new staff based on decision-making skills, which, in turn, increases the risk of recruiting unskillful officers when it comes to maximizing the value of the company.

On the other hand, the combination of ownership and control in a family business can lead the owner to exert an overwhelming leadership, which can, in turn, generate management entrenchment problems. The entrenchment hypothesis is based on the argument that ownership concentration creates incentives for large or controlling shareholders to expropriate wealth from small shareholders (Fama and Jensen, 1983, Shleifer and Vishny, 1997). In this sense, authors such as Fama and Jensen (1983) have found that companies with elevated ownership concentration change benefits for private income, and Schleifer and Vishny (1997) argue that they try to obtain private profits from the business. In turn, Gomez-Mejia et al. (2001) observed that family member managers are less responsible than external ones. Generalizing, Claessens et al. (2000) argue that family companies exhibit poor performances in as much as their owners try to increase their own wealth and ensure their personal interests at the expense of small shareholders. They are able to expropriate wealth from the firm through excessive compensations, special dividends, and even suboptimal decisions resulting in poor functioning of the company.

Governance mechanisms, debt and firm value

A good deal of research has been conducted on the influence of corporate governance mechanisms on firm performance. Plenty of the empirical work in this area has focused on how governance mechanisms have been designed to motivate managers to make choices leading to the creation of value for the company. In this sense, we can find a number of studies showing a positive correlation between governance variables and proxies of company value (Chidambaram, Palia and Zheng, 2006) through mechanisms that include design elements held by firms such as ownership concentration (family), advice management and debt. Numerous studies (Gompers, Ishii and Metrick, 2003; Jensen and Murphy, 1990; Morck et al., 1988 and Yermack, 1996, among others) suggest that changes in these internal mechanisms of governance could lead to a better alignment of interests between company shareholders and managers, which, in turn, would result in greater value creation. The board of directors is considered an intermediate point between managers and owners, who select its members to monitor and limit the freedom decision of the managers. There are a number of empirical studies that explore the relationship between various aspects of the management board and the operation of the company.

Regarding company financial leverage, it should be noted that the role of financial institutions is not limited to a mere intermediation. In fact, they play an important role within the company by acting as its shareholders. In this sense, Pound (1988) proposes three hypotheses about the relationship between institutional ownership and firm value: 1) the efficient monitoring hypothesis, 2) the conflict of interest possibility, and 3) the hypothesis of strategic alignment. According to the hypothesis of efficient supervision, institutional investors have a greater knowledge that allows them to monitor the directors at a lower cost than minority shareholders. Yet, conflicts of interest may arise. The hypothesis of strategic alignment suggests that the cooperation between institutional investors and managers leads to a negative relationship between institutional ownership and company value. Managers prefer self-financing over new issues of equity or debt. They do not want to be under surveillance by the capital markets or to increase the likelihood of failure in the company. For their part, shareholders prefer cash flow to be reimbursed in the form of dividends instead of retained. Therefore, the distribution of free cash flow can generate confrontations between managers and company owners and lead to the overinvestment problem emphasized by Jensen (1986) in the theory of free cash flow.

The Mexican context

As in most developing countries, Mexican firms are mainly family businesses. Regardless of size, dominant companies in this country are owned and managed by one or more families and descendants of the founding family. Nevertheless, very few studies refer to Mexican family firms, mainly because of the difficulty to gain access to information about their ownership and control structures1. Despite these difficulties, two main features come clear about said structures. First, these companies present a remarkable ownership concentration; and second, many of them are directly or indirectly controlled by one of the numerous conglomerates acting in the market, which are usually controlled by their dominant shareholders through relatively complex structures such as pyramids, cross-holdings and dual class shares2.

In Mexico, families play an essential role in defining corporate governance practices. Analytically, the predominance of the family corporate structure has been explained in terms of the conflict theory as the result of the existence of a framework to protect inefficient property rights. In this context, the choice of maintaining the company in the hands of the family is a rational decision, because, for the owner of the company, it is a fine strategy to increase the value of their share. This result is consistent with that of Schleifer and Vishny (1997), who found an inverse relationship between the protection of shareholder rights and corporate ownership concentration. La Porta et al. (1999) clearly document how in most developing economies, companies exhibit a high level of ownership concentration, which, together with conglomerate structures, exerts a powerful influence. For example, most board members in Mexican companies are there with the purpose of controlling shareholders through family ties, friendship, business relationships and labor contracts. Babatz (1997) and Husted and Serrano (2001) show that 53% of a company's managers or senior executives are also managers of other companies of the same group, or are relatives of the executives of the company.

According to Castañeda (2000), in most Mexican firms the president of the board is the main stockholder and the general manager. Therefore, they practically have no opposition from independent board members. This author shows that, in average, only 20% of the firms allow a majority of external members in the board, and this fact does not necessarily mean independence, since they can be involved with another company of the same business group. Besides, an average 35.2% of board members belong to the president's family while 38.7% of them are executive managers and around 57% are employees or relatives of the president.

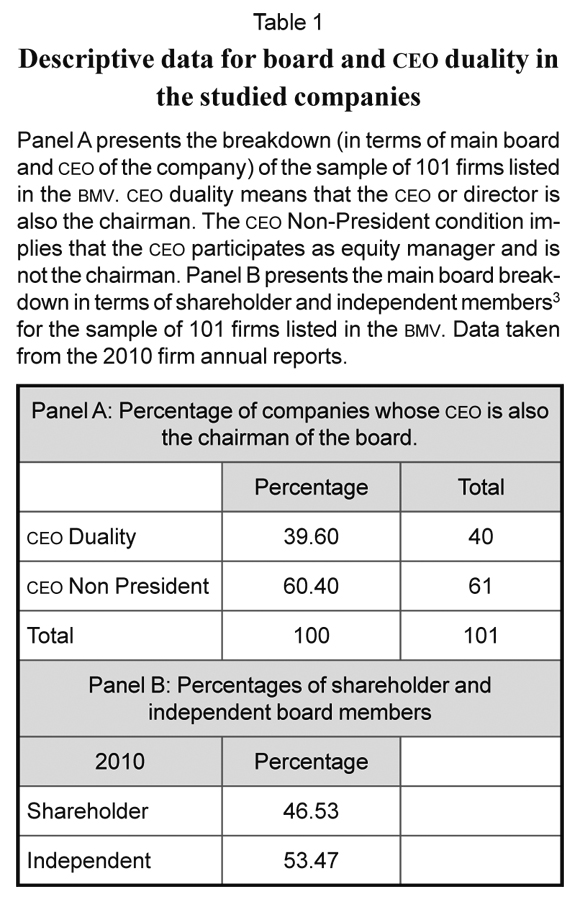

In turn, our data parallel these results. As we can see in panels A and B of Table 1, 46.53% of the board members of the studied companies are equity holders while 53.47% are independent. Additionally, in 39.60% of the companies the CEO or director is also the chairman, and in 60.40% of them the CEO participates as equity manager. As we can see, company composition in Mexico is very peculiar because of high ownership concentration. For the purpose of the current work, we defined a family business as the one in which the funding family is present in the board of directors and satisfies the fractional equity ownership proposed by Anderson and Reeb (2003) for their definition.

It is important to say that the Mexican corporate system has much in common with the European or Latin-American corporate governance models and does not show the degree of ownership control specialization seen in the Anglo-Saxon one. In Mexican companies, as in other European or Latin American enterprises, ownership is relatively more concentrated (Barca and Becht, 2001; DaSiveira, 2007; Facio and Lang ,2002; Khanna and Palepu, 1999; La Porta et al., 1999). This concentration tends to occur in large blocks of shareholders (mostly families), which implies a majority control such as that observed in France, Spain, Germany or Italy, and contrasts with ownership separation in the U.S. system (Berglöf, 1990; De Andres et al., 2005; La Porta et al., 1999, La Porta et al., 2000; Prowse, 1994; Shleifer and Vishny, 1997). Although said concentration of power might prevent agency problems stemming from ownership and control separation, it also brings about problems such as risk concentration, forgoing of specialization advantages (managerial ability, specific investment, etc.) or minority shareholder expropriation (De Andres et al., 2005; La Porta et al., 1998).

Research focus and hypothesis

Based on the work of Anderson and Reeb (2003), our main focus in the present research is the relationship between family ownership and firm performance, as evaluated on all the companies listed in the Mexican Stock Exchange. For such purpose, we used a two-way fixed-effect regression model to reveal performance differences between family and non-family firms, resorting to accounting and market parameters of performance. Just as the above mentioned authors, we focused on answering the same four questions "First, are family firms more profitable or less valuable than non-family firms? Second, does the relation between family ownership and firm performance differ between younger and older family firms? Third, if founding-family ownership influences performance, is the performance/ownership relation linear over all ranges of family holdings? Fourth, does the level of family involvement or family members acting as CEO negatively impact firm performance?"3

Strengths and limitations of our study

The main strength of this investigation is its focusing on an emerging market country, in contrast with previous studies, which are mostly oriented to developed markets such as those of Japan, North America or Europe. So we believe it will be a remarkable contribution to the literature on emerging markets in the Latin American context, specifically clearing some aspects of the Mexican case, whose outstanding ownership concentration and number of family businesses have been scarcely studied.

Regarding the weaknesses of the current work, we must consider the little importance of the Mexican market in the world context, which, in turn, results from the low trading volume determined by high ownership concentration. On the other hand, that is precisely the reason for this work.

Sample and Data Collection

The Sample

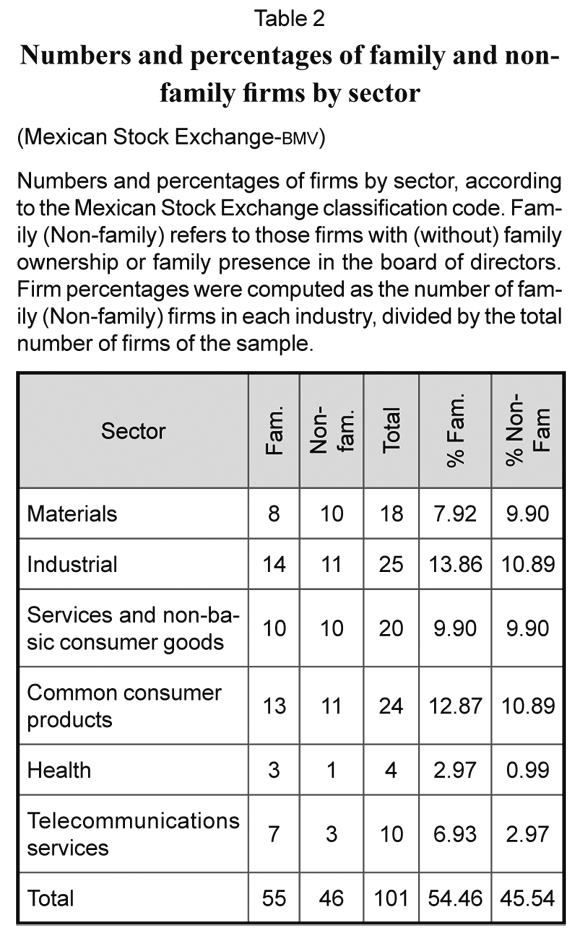

From the total number of companies (132) listed in the Mexican Stock Exchange for the 2000-2010 period, we excluded the financial corporations (because they are not comparable to other industries and it is difficult to calculate Tobin's q for banks), nonprofit institutions and firms that did not include enough information in their financial statements, finally resulting in a total of 101 companies. Information sources were Economatica, from which we obtained the quarterly reports and financial indicators, and the company annual reports published by the Mexican Stock Exchange on its website, from where we took the information about company age and industrial sector. Table 2 shows the number of companies that make up our sample. Their classification is based on sector and family ownership structure. Of the total number of analyzed companies, 54.46% were identified as family firms, and 45.54% as non-family firms.

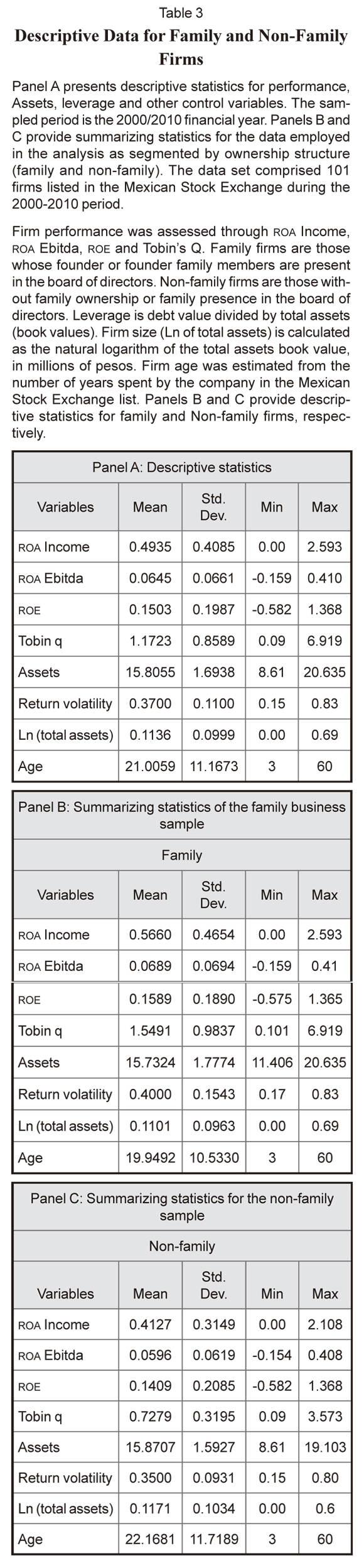

In the context of the average Mexican firm size, be it in terms of assets, sales or employees, the sampled companies basically classify as medium to large ones. Although this could raise some caveat about a possible sample bias, the descriptive statistics presented in Panel A of Table 3 show that firm size (in terms of assets) is quite heterogeneous and highly dispersed around the mean value, so it is assumed that the results are not size biased. The sample composition is quite industry-balanced, although there is a slight bias towards infrequent industries and consumer product firms, at the expense of health or telecommunications companies. However, this can be explained by the heavier concentration of the former in the Mexican market.

Measures of Firm Performance and Control Variables

The available data are intended to comprise a number of features of the companies such as ownership, control structure, size, leverage and market valuation. Now, let us describe briefly the most important issues related to the specification of the variables.

A key aspect of the present study is the definition of what a family company is, in opposition to a non-family one. Thus, we defined a family business as the one in which the funding family is present in the board of directors and satisfies the fractional equity ownership proposed by Anderson and Reeb (2003) for their definition. Similarly, authors such as McConaughy et al., (2001) consider a company as family-owned when the director comes from the controlling family, contrasting with other works that define such firms as those in which the family in question controls only 20% or 30% of the property. As it can be seen in table 2, family firms represent 54.46% of the total sample.

The above mentioned variables indicate majority control and behave as proxies of ownership and control specialization parameters. In order to measure performance, we used roa Income, roa Ebitda, roe and Tobin's q. Based on previous works (De Andres et al., 2005; Delgado, 2003; Wang, 2006; Warfield et al., 1995), and in order to embody a series of other performance determinants, we additionally included some control variables such as firm size (Assets), debt (Leverage), Age, firm risk (Return volatility), industry classification and year dummies for all the studied period. Assets represent firm size and, to some extent, they indicate problems stemming from asymmetric information (Devereux and Schiantarelli, 1990). Dummy industry variables were included to identify each sector's influence on the performance of a given company. Detailed comments about such influence can be found in the sensitivity analysis section (De Andres et al., 2005). Analysis also included a dummy year for each year of the sample. Age is a control variable, included here because older firms are less likely to be family-owned (Wang, 2006). The variable "CEO founder" corresponds to firms whose CEO is a member of the owning family. Miller and Le Breton Miller (2006) found such companies to have better returns.

Panels B and C of Table 3 present descriptive statistics disaggregated in family and non-family companies. As we can see, Leverage shows a value of 0.1101 for family firms and of 0.1171 for non-family ones. This shows that, in average, non-family firms have higher debt ratios. Both company types were found to be similar in size (15.8841 for family businesses and 15.7190 for non-family ones). Age average data reflect that non-family firms (22.17 years) tend to be older than family (19.94 years) firms.

Methodology

Regression analysis

With regard to the basic model to be estimated, and just as Anderson and Reeb (2003), we used a two-way fixed-effect model. It has been built including most of the previously cited variables. This model can be expressed with the following equation:

Performance = β + β1 Family Firmi + β2CEO Fami + β3 Assetsi + β4 Laveragei + β5 Agei + β1-6 Industryi + β2000-2010 Year Dummyi + εi

The fixed effects are each industry's dummy industry and year dummy for each year of the sample. The specified model was independently tested including different dummy variables: CEO hire = 1 when the CEO is external to the owner family, who, in turn, are present in the firm. CEO founder = 1 when the CEO is the founder or comes from his/her family. Young family firm = 1 when firm age is less than 30 years and the family is present in the firm. Old family firm = 1 when firm age is greater than or equals 30 years and the family is present in the firm.

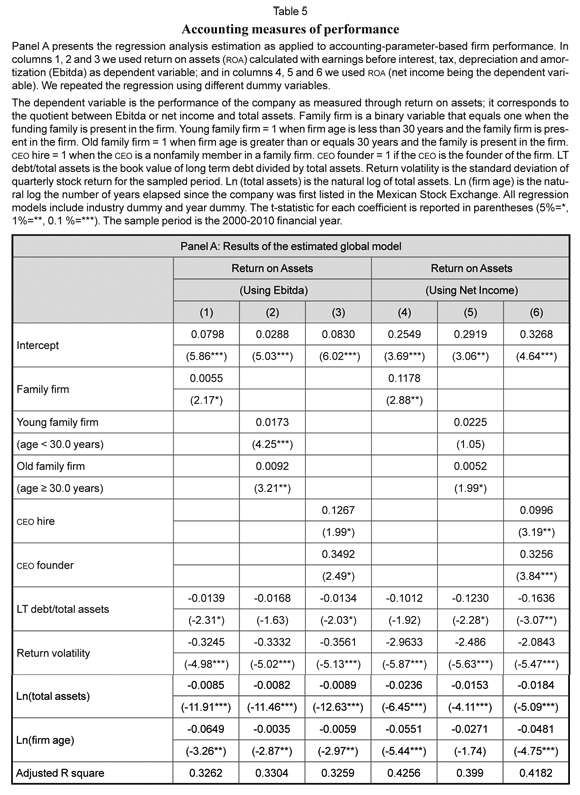

The results of the multivariate analysis as applied to accounting parameters are presented in table 5. In columns 1, 2, 3, we used return on assets (roa) calculated with earnings before interest, tax, depreciation and amortization (Ebitda) as dependent variable. In row 1, we estimated the complete model. In row 2, we included two dummies: Young Family Firm and Old Family Firm. In row 3, estimation was made with other two dummies: CEO hire and CEO founder. In columns 4, 5 and 6 we used roa, net income being the dependent variable.

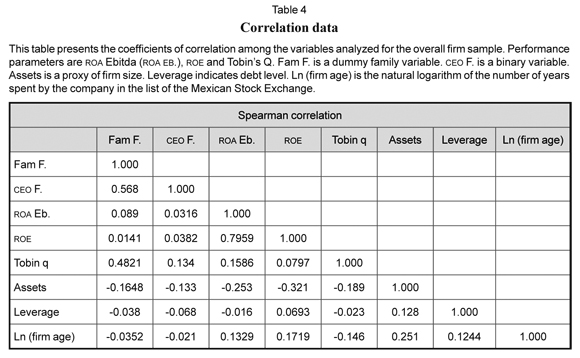

Correlation analysis

Table 4 shows the correlation matrix of the variables used for the analysis. The variable Family Firm (Fam F.) is positively correlated with company performance parameters, and so is the variable Family Management (CEO F.). This indicates better performance of the firm when a family member manages it, thus confirming this fact as a more general assertion. The variables Leverage and size, as well as the control variable Age, are negatively correlated with market parameters of performance.

Results

A general outlook at the basic results reveals some interesting issues. For instance, there is a group of explanatory variables coming out from significant to an acceptable level. Moreover, the significance of the whole model in terms of the adjusted R2 is high enough.

As we can see in columns 1 and 4 of Panel A (Table 5), there is significant evidence that family firms perform better than non-family ones when calculation is based on either roa Ebitda or Net Income over assets. In columns 2 and 5 of Table 5, the regression specification controlled firm age; in this case, we only considered family firms, classified as "Young" or "Old". We arbitrary defined the 30 year old threshold to separate between young and old firms. In columns 2 and 5 (Table 5) we can see how young firms perform better than old family firms, and how both company classes positively correlate with roa. Then, we considered the effect of active and passive family involvement in firm management on accounting parameters. Columns 3 and 6 (Table 5) present the results: variables such as CEO founder (as opposed to CEO hired) indicate better (worse) firm performance. In sum, active family involvement in management has a positive impact on firm performance.

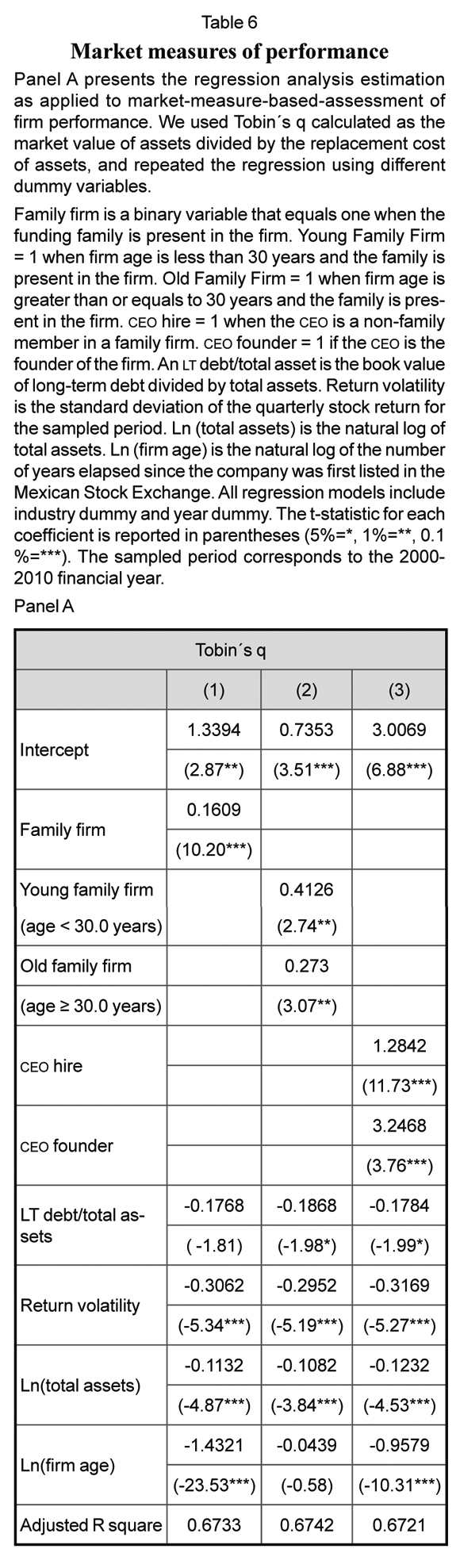

Based on the market performance of family and non-family firms, Table 6 regresses Tobin's q as dependent variable. In column 1, the variable Family firm performs as binary variable, resulting in a positively significant coefficient. These data allow concluding that family firms have a greater and significant market performances than non-family firms. Column 2 (Table 6) discriminates between young and old companies, showing again that they both have a positive impact (which is greater in the case of young companies) on the market performance of family firms. Finally, in column 3 of the same table, the CEO binary variable results prove to be consistent with the accounting-parameter-based estimation of performance presented above, thus indicating that founders are associated to better performance.

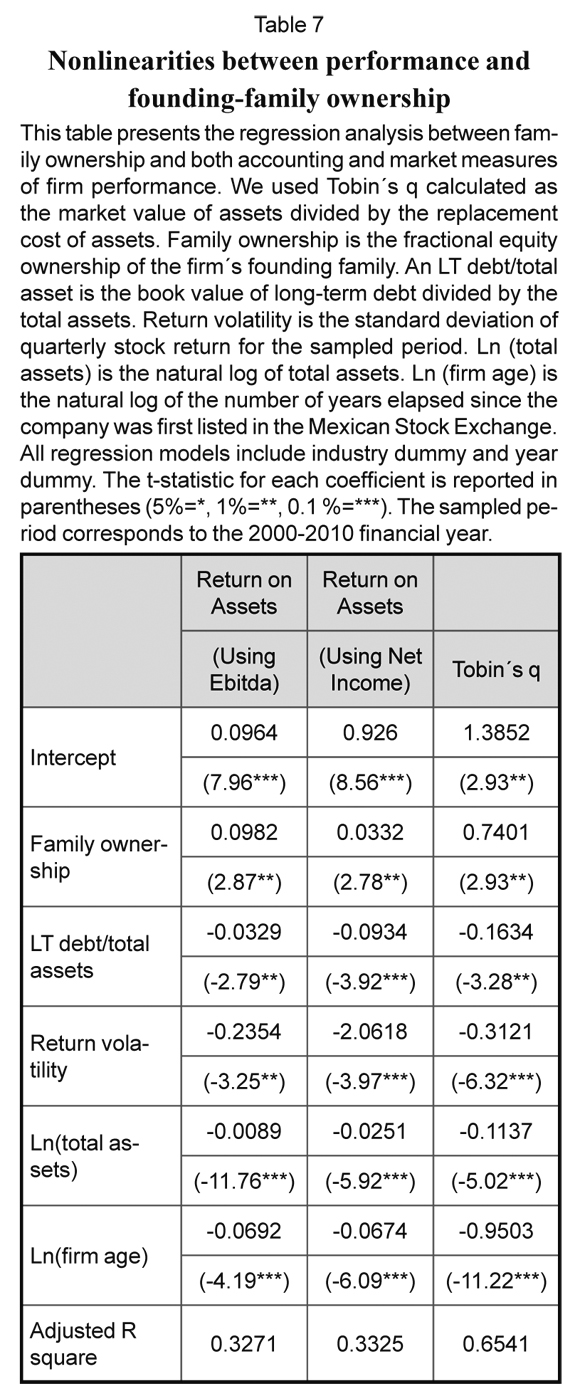

Table 7 presents nonlinearities between family ownership and firm performance. The latter was assessed through both accounting (columns 1 and 2) and market (in column 3) parameters. The data reveal that companies increase and then decrease their performance with ownership concentration4 increments.

In sum, the results presented in Tables 5, 6 and 7 indicate, at a statistically significant level, that the family-owned variable (Family Firm) has a positive influence on performance. These results suggest that, for Mexican companies, increased ownership concentration is associated to company outcome improvement. An argument that goes along with the traditional view that ownership concentration in families provides closer supervision on the functioning of the company, thus leading to better performances.

A likely explanation for this phenomenon lies on the notion that high ownership concentration may, to some extent, offset the lesser protection granted to investors under the prevailing institutional framework in the Mexican environment. The latter would be causing the owners to concentrate and seek an active participation in the decision-making process to improve performance. Regarding debt influence, the results highlight a statistically significant negative correlation with company performance.

Furthermore, in order to estimate the detailed influence of ownership structure on performance, we evaluated the effect of founding family ownership percentage (Table 7), finding a positive correlation between increasing levels of ownership concentration and performance. Thus, we have obtained evidence that these governing mechanisms act differently depending on the type of company we are considering. The reason for this might lie on the way companies are governed depending on their ownership structure. In the case of family businesses, the owners tend to impose a strong oversight on performance, while non-family companies use different governance mechanisms such as high levels of debt to facilitate adequate performance monitoring. In the latter case, property concentration would become a redundant steering mechanism leading to lower performances. Hence, as indicated by Coles et al. (2001) and Re-diker and Seth (1995), there is a substitution mechanism between governance forms.

Finally, regarding the control variables, size (Assets) and Age have mostly negatively significant coefficients. The traditional econometric models' predictive power is due, in large way, to good model specification, significance of regression coefficients, absence of autocorrelation and successfully passing heteroskedasticity tests; which is the case of our model5.

Discussion section

Most research on corporate governance has traditionally focused on the analysis of governance mechanisms, which is usually limited to their unilateral effects. Nevertheless, recent studies such as those of Agrawal and Knoeber (1996), Bushman and Smith (2001), Coles et al. (2001), Kini et al. (1995) seem to take us in a new direction by explicitly recognizing interaction between governance mechanisms. This new line of research highlights the company's ability to design an efficient corporate governance system through the selection of different supplementary mechanisms, thus resulting in a series of alternatives that can be used to control agency problems in the company. Hence, the use of each mechanism is relative to the use of others, thus reducing the importance of their individual effects on creating firm value, which are overcome by the combined effects of all selected mechanisms (Agrawal and Knoeber, 1996).

At this point, the contribution of our work is the analysis of the effect of different governance mechanisms, namely ownership structure, management and debt advice, on the performance of the company. This is particularly significant if we take into account that the latter two can have different impacts depending on the ownership structure of the company. Ownership is an important matter that depends on the environment in which the company operates (Shlelifer and Vishny, 1997 and La Porta et al. 2000). In turn, governance mechanisms may vary depending on the ownership structure of each company. However, empirical evidence indicates that most countries around the world, with the exception of the u.s.A and the UK, have a concentrated ownership structure because they grant little protection to shareholders, which leads to ownership concentration as the best way to protect the company against the potential excesses of management (La Porta et al.1998). In the current research, Mexico has offered an interesting setting to study the effects of such governance changes in emerging economies and presents important lessons for other countries with similar ownership structure and regulatory environments.

With this work, we intend to contribute to the debate in a relatively recent and little explored line of research whose importance is highlighted by the fact that the attainment of the ultimate goal of any company, which is value creation, depends on studying the interrelation between governance mechanisms in a given institutional framework, in order to give them a better use. This is an issue that is slowly improving governance practices across Latin America, and is precisely what the capital markets and companies value about corporate governance. In spite of this, we still have many important unanswered questions about the different dimensions of corporate governance in Latin America. We expect the present work to provide insight into new answers about emerging economies, since they are likely to operate in different environments than Anglo-Saxon countries, for which the implementation of solutions could also be different.

Conclusion

We have studied the relationship between family ownership and firm performance using a sample of 101 public Mexican companies studied during the 2000-2010 period. First, we applied a univariate analysis in order to obtain some preliminary conclusions. Then, we used a multivariate analysis to confer greater robustness to the results.

Using accounting and market performance parameters, we found statistically significant evidence that family firms have better economic performances than non-family firms. When using either roa Ebitda or Net Income over assets we found that family firms exhibit a positive and significant correlation with roa. Just as well, we could observe that young firms perform better than old family firms. In considering the effect of active and passive family involvement in firm management, we found that, although both founding and hired CEOs have a positive impact on performance, the former determine better accounting results.

In using market parameters of performance for family and non-family firms, we found that the former have a greater and significant Tobin's q. When we included CEO as binary variable we found the same results we had previously reached with the accounting parameters of performance. We found that founders are associated to greater performance.

The analysis of nonlinearities shows that the relationship between family ownership and firm performance is not uniform across different levels of family ownership. In fact, both accounting and market parameters of performance were observed to increase first and then decrease as concentration of ownership increases.

These results are statistically significant and suggest that, for Mexican companies, increased ownership concentration is associated to improved company outcome. This is an argument that goes along with the traditional view that ownership concentration in families provides closer supervision of company functioning, thus leading to better performances. This can be explained by considering that high ownership concentration may offset, to some extent, the lesser protection granted to investors under the prevailing institutional framework of the Mexican environment, which, in turn, causes the owners to concentrate and seek active participation in decision-making processes to reach better performances. Regarding debt influence, it was observed to have a negatively significant correlation with performance.

Finally, regarding the limitations of this study, it is important to consider more variables in order to gain clearer insight into the reason why family businesses in Mexico perform better than non-family ones. Indeed, it is noteworthy to consider that models with larger databases and larger numbers of variables could incorporate board effects in the estimation, which would give us a broader view of the results. It would also be important to develop the idea of interaction between government mechanisms, which is likely to open new avenues of research in the family business field, since it has been shown that they are not independent.

Notas al pie de página

1Accessibility was drastically improved in 2002, when the annual reports of the listed companies, which are submitted to the National Banking and Securities Commission (in Spanish, Comisión Nacional Bancaria y de Valores, cnbv) of the Federal Government began to be available on the web site of the Mexican Stock Exchange (in Spanish, Bolsa Mexicana de Valores, bmv).

2Usually, class A shares convey full voting rights and are tightly held by the controlling family. Most traded stocks have limited voting rights and are held by the minority shareholders (Castañeda, 2000).

3The Shareholder director is the holder of more than 2% of the firm's capital. Independent directors are those who are not linked with the management team of the company and meet the requirements of the code of best corporate practices.

4We make multiples estimation considering differences levels of ownership concentration and always finding that companies increase their performance but then decrease with increasing in ownership concentration.

5Breusch-Godfrey indicators do not reveal autocorrelation problems in the regression, while the White test indicates no rejection of the homoskedasticity hypothesis. In addition, the variance inflation factor test does not indicate muhicoflinearrty problems.

Lista de referencias

1. Agrawal, A., and Knoeber, C. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis, 31 (3), 377-397. [ Links ]

2. Anderson, R., and Reeb, D. (2003). Founding family ownership and firm performance: Evidence from the S&P 500. Journal of Finance, 58 (3), 1301-1328. [ Links ]

3. Babatz, G. (1997). Agency problems, ownership structure, and voting structure under lax corporate governance rules: The case of Mexico. Ph.D. thesis, Harvard University. [ Links ]

4. Barca, F., and Becht, M. (2001). The control of corporate Europe. Oxford: Oxford University Press. [ Links ]

5. Barclay, M., and Clifford H. (1989). Private benefits from control of public corporations. Journal of Financial Economics, 25, 371-396. [ Links ]

6. Bebchuck, L. (1999). A rent protection theory of corporate ownership and control. NBER Working Paper no. 7203. [ Links ]

7. Berglöf, E. (1990). Corporate control and capital structure. Essays on property rights and financial contracts. Stockholm: Institute of International Business. [ Links ]

8. Bushman, R., and Smith A. (2001). Financial accounting information, and corporate governance. Journal of Accounting and Economics, 32, 237-333. [ Links ]

9. Castañeda, G. (2000). Governance of large corporations in Mexico and productivity implications. Abante, Studies in Business Management, 3 (1), 57-89. [ Links ]

10. Chidambaran, N., Palia, D., and Zheng, Y. (2006). Does better corporate governance "cause" better firm performance? Working Paper Rutgers Business School, Newark. [ Links ]

11. Claessens, S., and Djankov, S. (1999). Ownership concentration and corporate performance in the Czech Republic. CEPR Discussion Papers 2145. [ Links ]

12. Claessens, S., Djankov, S., and Lang, L. (2000). The separation of ownership and control in East Asian Corporations. Journal of Financial Economics, 58 (1-2), 81-112. [ Links ]

13. Claessens, S., Djankov, S., Fan, J., and Lang, L. (2002). Disentangling the incentive and entrenchment effects of large shareholdings. Journal of Finance, 57 (6), 2741-2771. [ Links ]

14. Coles, J., McWilliams, V., and Sen, N. (2001). An examination of the relationship of governance mechanisms to performance. Journal of Management, 27, 23-50. [ Links ]

15. De Andres, P., Azofra, V., and López, F. (2005). Corporate boards in OECD Countries: Size composition, functioning and effectiveness. Corporate Governance: An International Review, 13 (2), 197-210. [ Links ]

16. De Andres, P., López, F., and Rodríguez, J. (2005). Financial decisions and growth opportunities: a Spanish firm's panel data analysis. Applied Financial Economics, 15, 391-407. [ Links ]

17. De Angelo, H., and De Angelo, L. (2000). Controlling stockholders and the disciplinary role of corporate payout policy: A study of the times mirror company. Journal of Financial Economics, 56, 153-207. [ Links ]

18. Delgado, M. (2003). Factores determinantes de la discrecionalidad contable: una aplicación empírica a las empresas cotizadas españolas. Burgos, España: Servicio de Publicaciones de la Universidad de Burgos. [ Links ]

19. Demsetz, H. (1983). The structure of ownership and the theory of the firm. Journal of Law and Economic, 25, 375-390. [ Links ]

20. Demsetz, H., and Lehn, K. (1985). The structure of corporate ownership: causes and consequences. Journal of Political Economy, 93, 1155-1177. [ Links ]

21. Devereux, M., and Schiantarelli, F. (1990). Investment, financial factors, and cash flow: evidence from UK panel data. In R. Glenn Hubbard (Ed.), Asymmetric information, corporate finance, and investment (pp. 279-306). University of Chicago Press. [ Links ]

22. Faccio, M., and Lang, L. (2002). The ultimate ownership ofwestern European corporations. Journal of Financial Economics, 65 (3), 365-395. [ Links ]

23. Fama, E., and Jensen, M. (1983). Separation of ownership and control. Journal of Law and Economics, 26, 301-325. [ Links ]

24. Fernández, A., Gómez-Ansón, S., and Fernández, C. (1998). El papel supervisor del consejo de administración sobre la actuación gerencial. Evidencia para el caso español. Investigaciones Económicas, 22, 501-516. [ Links ]

25. Friend, I., and Lang, L. (1988). An empirical test of the impact of managerial self-interest on corporate capital structure. Journal of Finance, 43, 271-281. [ Links ]

26. Gomez-Mejía, L., Núñez-Nickel, M., and Gutiérrez, I. (2001). The role of family ties in agency contracts. Academy of Management Journal, 44, 81-95. [ Links ]

27. Gompers, P., Ishii, J., and Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 18, 107-155. [ Links ]

28. Gorton, G., and Schmid, F. (1996). Universal banking and performance of German firms. National Bureau of Economic Research, Cambridge, Massachusetts, Working paper 5453. [ Links ]

29. Grossman, S., and Hart, O. (1980). Takeover bids, the free-rider problem and the theory of the corporation. Bell Journal of Economy, 11, 42-64. [ Links ]

30. Himmelberg, C., Hubbart, G., and Palia, D. (1999). Understanding the determinants of managerial ownership and the link between ownership and performance. Journal of Financial Economics, 53, 353-384. [ Links ]

31. Holderness, C., Kroszner, R., and Sheehan, D. (1999). Were the good old days that good? Changes in managerial stock ownership since the great depression. Journal of Finance, 54 (2), 435-469. [ Links ]

32. Holderness, C., and Sheehan, D. (1988). The role of majority shareholders in publicly held corporations: An exploratory analysis. Journal of Financial Economics, 20, 317-346. [ Links ]

34. Husted, B., and Serrano, C. (2001). Corporate governance in México. Monterrey, itesm, Egade, Research paper. [ Links ]

35. James, H. (1999). Owner as manager, extended horizons and the family firm. International Journal of the Economics of Business, 6, 41-56. [ Links ]

36. Jensen, M. (1986). Agency costs and free cash flow, corporate finance, and takeovers. American Economic Review, 76, 323-329. [ Links ]

37. Jensen, M. (1993). The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48 (3), 831-880. [ Links ]

38. Jensen, M., and Meckling, W. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of FinancialEconomics, 3 (4), 305-360. [ Links ]

39. Jensen, M., and Murphy, K. (1990). Performance pay out and top management incentives. Journal of Political Economy, 98, 225-264. [ Links ]

40. Johnson, B., Magee, R., Nagarajan, N., and Newman, H. (1985). An analysis of the stock price reaction to sudden executive deaths: Implications for the managerial labor market. Journal of Accounting and Economics, 7, 151-174. [ Links ]

41. Johnson, S., and Mitton, T. (2002). Who gains from capital controls? Evidence from Malaysia. Journal of Financial Economics. [ Links ]

42. Khanna, T., and Palepu, K. (1999). Policy shocks, market intermediaries, and corporate strategy: Evidence from Chile and India. Journal of Economics and Management Strategy, 8, 271-310. [ Links ]

43. Kini, O., Kracaw, W., and Mian, S. (1995). Corporate takeovers, firm performance, and board composition. Journal of Corporate Finance, 1, 383-412. [ Links ]

44. Lan Chen, H., and Tsung HSU, W. (2009). Family ownership, board independence, and R&D investment. Family Business Review, 22 (4), 347-362. [ Links ]

45. La Porta, R., Lopez de Sahnas, F., Shleifer, A., and Vishny, R. (1997). Trust in large organizations. American Economic Review, 87 (2), 333-339. [ Links ]

46. La Porta, R., Lopez de Salinas, F., Shleifer, A., and Vishny, R. (1998). Law and finance. Journal of Political Economy, 52 (3), 1113-1155. [ Links ]

47. La Porta, R., Lopez de Salinas, F., Shleifer, A., and Vishny, R. (1999). Corporate ownership around the world. Journal of Finance, 54 (2), 471-520. [ Links ]

48. La Porta, R., Lopez de Salinas, F., Shleifer, A., and Vishny, R. (2000). Investors protection and corporate governance. Journal of Financial Economics, 58, 3-27. [ Links ]

49. La Porta, R., Lopez de Salinas, F., and Shleifer, A. (2002). Investor protection and corporate evaluation, Journal of Finance, 58 (1-2), 3-27. [ Links ]

50. La Porta, R., Lopez de Salinas, F., and Shleifer, A. (2006). What works in securities laws? Journal of Finance, 61, 1-32. [ Links ]

51. Le Breton-Miller, I., and Miller, D. (2006). Why do some family businesses out-compete? Governance, long-term orientations, and sustainable capability. Entrepreneurship: Theory & Practice, 30, 731-746. [ Links ]

52. Lee J. (2006). Family firm performance: further evidence. Family Business Review, 19 (2), 103-114. [ Links ]

53. Maug, E. (1998). Large shareholders as monitors: Is there a tradeoff between liquidity and control? Journal of Finance, 53 (1), 65-98. [ Links ]

54. Maury, B. (2006). Family ownership and firm performance: Evidence from western European corporations. Journal of Corporate Finance, 12, 321-341. [ Links ]

55. McConaughy, D., Matthews, C. and Fialko, A. (2001). Founding family controlled firms: Performance, risk and value. Journal of Small Business Management, 39, 31-49. [ Links ]

56. Miller, D., and Le Breton Miller, I. (2006). Family governance and firm performance: Agency, stewardship, and capabilities. Family Business Review, 19 (1), 73-87. [ Links ]

57. Morck, R., Shleifer, A., and Vishny, R. (1988). Management ownership and market valuation: An empirical analysis. Journal ofFinancial Economics, 20, 293-315. [ Links ]

58. Morck, R., Shleifer, A., and Vishny, R. (1989). Alternative mechanisms for corporate control. American Economic Review, 79 (4), 842-852. [ Links ]

59. Morck, R., Shleifer, A., and Vishny, R. (1990). Do managerial objectives drive bad acquisitions? Journal of Finance, 45 (1), 31-48. [ Links ]

60. Morck, R., Stangeland, D. A., and Yeung, B. (2000). Inherited wealth, corporate control, and economic growth: The Canadian disease. In R. Morck (Ed.), Concentrated corporate ownership. University of Chicago Press, National Bureau of Economic Research, conference volume. [ Links ]

61. Nenova, T. (2000). The value of corporate votes and control benefits: A cross-country analysis. Harvard University, Economics, working paper. [ Links ]

62. Pérez-González, F. (2001). Does inherited control hurt firms' performance? Ph.D. dissertation, Harvard University. [ Links ]

63. Pound, J. (1988). Proxy contests and the efficiency of shareholder oversight. Journal of Financial Economics, 22, 237-265. [ Links ]

64. Prowse, S. (1994). Corporate governance in an international perspective; a survey of corporate control mechanisms among large firms in the United States, the United Kingdom, Japan and Germany. Economic Paper, 41, 7-79. [ Links ]

65. Rajan, R., and Zingales, L. (2001). The great reversals: The politics of financial development in the 20th century. National Bureau of Economic Research, working paper no. 8178. [ Links ]

66. Rediker, K., and Seth, A. (1995). Boards of directors and substitution effects of alternative governance mechanisms. Strategic Management Journal, 16, 85-99. [ Links ]

67. Shleifer, A., and Vishny, R. (1986). Large shareholders and corporate control. Journal of Political Economy, 94 (3), 461-488. [ Links ]

68. Shleifer, A., and Vishny, R. (1997). A survey of corporate governance. Journal of Finance, 52 (2), 737-783. [ Links ]

69. Singell, L. (1997). Nepotism, discrimination, and the persistence of utility-maximizing, owner operated firms. Southern Economics Journal, 63, 904-920. [ Links ]

70. Stein, J. (1988). Takeover threats and managerial myopia. Journal of Political Economy, 96, 61-80. [ Links ]

71. Stein, J. (1989). Efficient capital markets, inefficient firms: A model of myopic corporate behavior. Quarterly Journal ofEconomics, 103, 655-669. [ Links ]

72. Villalonga, B., and Amit, R. (2006). How do family ownership, control and management affect firm value? Journal of Financial Economics, 80 (2), 385-417. [ Links ]

73. Wang, D. (2006). Founding family ownership and earnings quality. Journal of Accounting Research, 44 (3), 619. [ Links ]

74. Warfield, T., Wild, J., and Wild, K. (1995). Managerial ownership, accounting choices, and informa-tiveness of earnings. Journal of Accounting and Economics, 16 (1), 61-91. [ Links ]

75. Yermack, D. (1996). Higher market valuation of companies with a small board of directors, Journal of Financial Economics, 40 (2), 185-211. [ Links ]