Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.25 no.4 Bogotá Jan./June 2007

PENSION FUND MANAGERS AND THE STRUCTURE OF THE FOREIGN EXCHANGE MARKET

LAS ADMINISTRADORAS DE FONDOS DE PENSIONES Y LA ESTRUCTURA DEL MERCADO CAMBIARIO

HERNANDO VARGAS, YANNETH ROCÍO BETANCOURT*

* The opinions expressed are those of the authors and do not represent the views of the Banco de la República or of its Board of Directors. We are grateful to nonymous referees for suggestions and comments.

In order, the authors are, Deputy Governor, and Assistant to the Deputy Governor, Banco de la República.

E-mails: hvargahe@banrep.gov.co, and ybetanga@banrep.gov.co.

Document received 13 April 2007; final version accepted 24 August 2007.

* Las opiniones expresadas corresponden a los autores y no representan los puntos de vista del Banco de la República ni de su Junta Directiva. Agradecemos las valiosas sugerencias y comentarios de los evaluadores anónimos.

Los autores son, en su orden, Gerente Técnico, y Asistente de la Gerencia Técnica del Banco de la República.

Correos electrónicos: hvargahe@banrep.gov.co y ybetanga@banrep.gov.co

Documento recibido el 13 de abril de 2007; versión final aceptada el 24 de agosto de 2007.

The effects of the Pension Fund Managers (PFM) behavior on the Foreign Exchange (FX) market may be important, given the size of their portfolio and their possible market power. Some authors argue that when big investors like PFM trade large volumes in the FX market, they may infl uence other agents decisions, increasing the impact on the exchange rate. However, when PFM have market power, they will take into account their infl uence on the exchange rate and will moderate their trading volume. This paper seeks to demonstrate the existence of this mitigating effect under different theoretical FX market structures.

JEL Classifi cation: G23; F31; D43.

Keywords: pension funds, foreign exchange market, market power.

El comportamiento de las administradoras de fondos de pensiones (AFP) puede tener efectos importantes en el mercado cambiario debido al tamaño de su portafolio y su posible poder de mercado. Algunos autores señalan que las acciones de grandes inversionistas, como las AFP, en el mercado cambiario pueden infl uir en las decisiones de otros agentes incrementando el impacto sobre la tasa de cambio; sin embargo, cuando las AFP tienen poder de mercado moderan su volumen transado al tener en cuenta su infl uencia sobre la tasa de cambio. Este artículo demuestra la existencia de este efecto moderador sobre diferentes estructuras del mercado cambiario.

Clasifi cación JEL: G23; F31; D43.

Palabras clave: fondos de pensiones, mercado cambiario, poder de mercado.

I. INTRODUCTION

The intervention of local institutional investors, like Pension Fund Managers (PFM), in the foreign exchange market could have effects on the exchange rate volatility, given the size and the market power of these agents. As noted by J. P. Morgan (2002) the effect of these institutional investors on the foreign exchange market can be important, given the size of their portfolios. For the Chilean case, Zahler (2005) states that the impact of PFM on the foreign exchange market can be strong due to the concentration of managers and the regulation on the rate of return of pension funds.1 Additionally, this author argues that the pressures on the exchange rate could be exacerbated because the PFMs investment decisions are dominated by the short run expected returns, despite their long run aim. According to Zahler (2005), large shifts of the foreign currency holdings in the PFMs portfolios over a short span may destabilize the foreign exchange market and, hence, may justify limits on the size of the PFM foreign investments or on the speed of such shifts.

The fact that these large investors trade big volumes in the foreign exchange market may also infl uence other agents decisions, increasing the impact on the exchange rate. However, this effect can be mitigated because agents with market power will consider the impact that their actions have on the exchange rate, on the value of their foreign currency transactions and on other agents actions. Therefore, PFM with market power will take into account these effects, reducing the volume of their transactions and the pressure on the exchange rate. For the same reason, they will respond less to shocks on exchange rate expectations and on the interest rate differential than under perfect competition. Moreover, the equilibrium exchange rate under non-competitive structures will respond to exogenous shocks in the foreign currency net supply (e. g. exports changes, terms of trade, etc ), in contrast to the competitive case.

The idea of this paper is to show the existence of this mitigating effect under different theoretical foreign exchange market structures. The results of the non competitive structures will be contrasted with the benchmark case of perfect competition. The remainder of this paper is organized as follows. Section II reviews some microeconomic literature about the foreign exchange market. Section III analyses the behavior of PFM and its impact on the exchange rate under different market structures. Section IV concludes and summarizes the results of this paper.

II. MICROECONOMIC LITERATURE ON THE FOREIGN EXCHANGE MARKET

In contrast to the traditional macroeconomic literature, the micro literature analyzes the behavior and interaction of individual agents in the foreign exchange market, taking into account the effects of asymmetric information and the agents heterogeneity. This literature refers then to micro aspects of the foreign exchange market, such as the transmission of information among market agents, their behavior and the implications of the agents expectations heterogeneity on trading volume and exchange rate volatility. Because this literature tries to understand the mechanisms that generate shifts in the exchange rate that are unexplained by movements in macroeconomic fundamentals, it focuses on the mechanics of foreign exchange trading.

Much of the early literature of the foreign exchange market microstructure is concerned with the analysis of the process by which agents form expectations about the exchange rate. By contrast with the simplifying assumption of rational expectations that underlies the traditional literature, the microstructure literature uses direct measures of expectations, like surveys of market participants. These foreign exchange survey data studies suggest a strong heterogeneity and an increasing dispersion of expectations especially at longer forecast horizons. They also fi nd a reversion in expectations, so that the direction of the long run expectations differs from the direction of the short run expectations.2 Additionally, Froot and Ito (1989) fi nd an overreaction of the short term expectations with respect to the long term expectations when the exchange rate changes.

This literature suggests that the discrepancy between expectations at different horizons may be explained by the use of different forecasting techniques in the short and in the long run. The chartist or technical analysis, which identifi es broad ranges within which exchange rates are expected to move by using trends, graphic patterns and descriptive statistics, is the predominant technique used for short run forecasting. In contrast, fundamental analysis and conventional exchange rate models are used for long-run exchange rate forecasting.3 The fact that standard exchange rate models have poor performance and that chartist techniques are used by many foreign exchange practitioners to predict the exchange rate at short run horizons suggests that non fundamentals factors could dominate the short run movements of the exchange rate. Insofar as this short run behavior is generalized, the foreign exchange market can be prone to speculative movements following unexpected deviations of the exchange rate with respect to the economic fundamentals.4

Many studies in the microstructure literature have found a strong contemporaneous correlation between trading volume and the exchange rate volatility (see Sarno and Taylor [2001]?for a survey of this literature). In the context of portfolio choice models, Lyons (1991) explains the trading volume mainly by differences in valuations, which can be due to different expectations or because the volume of transactions themselves may inf luence valuations over time. In this context, if large volumes of foreign currency are traded due to non fundamental reasons (speculative behavior), the movements of the exchange rate can be very important. This is especially the case when the transactions of agents with market power can inf luence the expectations and the valuations of other agents and their trading volume, generating a stronger impact on the exchange rate.

Although the market power of some agents in the foreign exchange market can be very important to explain changes in the trading volume and in the exchange rate, the micro literature has not focused on non competitive practices in the international foreign exchange markets.5 It is diffi cult to think of non competitive behavior when there are a large number of participants in the market and the transmission of information is fast. However, non competitive behavior can exist in small domestic foreign exchange markets,6 since the agents portfolio size may affect the market through the trading volume and its impact on the expectations of other agents.

This paper goes in this direction and tries to explain the consequences of non competitive market structures on the exchange rate. Specifi cally we will demonstrate the existence of an effect of market power that moderates the impact of agents decisions on the exchange rate, which we call the mitigating effect. If agents with market power consider the effects that their actions have on others valuations and on the exchange rate, then they will moderate their trading volume, mitigating the pressure on the exchange rate and making the foreign exchange market less prone to speculative movements. In particular, given the increasing size of assets managed by private pension funds7 we consider the case where they are within the most important investors in the foreign exchange market, such that they may have some market power and may infl uence the other agents decisions.

III. PENSION FUND MANAGERS AND DIFFERENT FOREIGN EXCHANGE MARKET STRUCTURES

In this section, different structures of the foreign exchange market, in a static framework, 8 will be modeled to show the consequences on the exchange rate of the PFM market power and the existence of the mitigating effect. First, we are going to present the benchmark case where perfect competition is assumed. Then, a simple model of monopsony will be introduced to see the effect of a big PFM on the exchange rate. After that, an oligopsony à la Cournot will be analyzed in order to identify the effects of N PFM with market power. Finally, an oligopsony à la Stackelberg with one PFM as a leader and N - 1 PFM as followers will be analyzed. The results of each one of these structures will be compared with respect to the benchmark case, in which there are not market power effects.

A. GENERAL ASSUMPTIONS

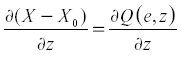

We assume that there are two types of agents in the foreign exchange market: PFM who demand foreign currency and other agents like exporters who supply foreign currency. Although there can be other agents demanding foreign currency, we are interested in the key role played by the PFM which are among the big players in the FOREX market.9 For this reason, the behavior of other agents different from PFM, like importers, is taken into account in the foreign currency net supply function Q(e, z), where Q is the net amount of foreign currency supplied, e is the exchange rate defi ned as domestic currency/foreign currency, and z corresponds to exogenous variables that affect the net supply of foreign currency (e.g. exports changes, terms of trade, etc ).

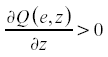

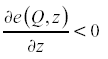

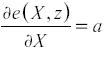

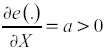

This function is assumed to be increasing in the exchange rate  and

and

positively related to the exogenous variables  . We can also write this

. We can also write this

function in the inverse form, e(Q, z), with  .

.

In order to analyze the decisions of the PFM in the FOREX market, we assume that there are two kinds of assets in which they can allocate their funds: assets in domestic currency (l) and foreign currency assets (x). We also assume that each PFM has a fi xed amount (m) to invest in these two assets, which means that the portfolio size of the PFM does not change.10 Additionally an initial composition of their portfolio between the two assets (l0 and x0) is assumed, thus when a PFM demands an amount x of foreign currency his net purchase of this asset is x - x0, the same for the other asset.

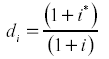

B. PERFECT COMPETITION

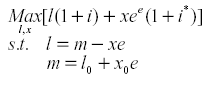

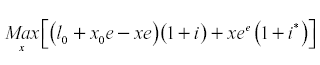

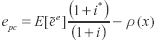

In this setting all the agents share the same exchange rate expectations and PFM take prices as given. In this case, the size of agents portfolios does not matter and all react in the same way with respect to changes in the interest rates and other variables. The optimal decision of a risk neutral PFM is to choose his portfolio composition between assets in domestic currency l and foreign currency assets x, in order to maximize his portfolio expected return (in local currency11) given a portfolio initial composition (l0 and x0) and a fi xed amount to invest m. Thus, the manager reallocates his portfolio given the observed exchange rate, e, the domestic and foreign interest rates (i and i*, respectively) and the exchange rate expectation, ee, which is the same for everybody.12

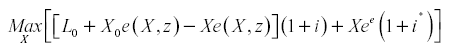

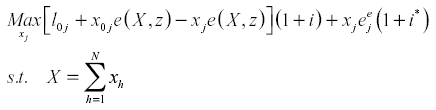

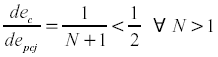

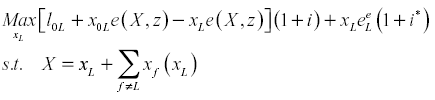

The maximization problem of a typical PFM is then:

The reduced form of this problem is:

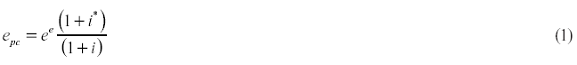

The interior solution of this problem (x> 0, l > 0) is given by the interest rate parity condition:

It corresponds to the equilibrium exchange rate under perfect competition (epc), at which the typical PFM demands an amount x of foreign currency and his net purchase of this asset is x - x0.13 For all PFM the net demand of foreign currency corresponds to the sum of the individual net purchases X - X0. In equilibrium, the total amount of foreign currency supplied by other agents in the economy, Q, is equal to the total demand by PFM, X - X0. It implies that the equilibrium conditions in the foreign exchange market are:

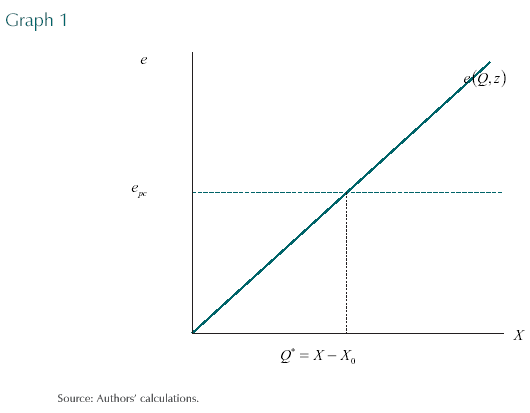

To simplify and because X0 is given, the foreign currency net supply can be written as e(X, z), if at each price the supplied amount is equal to the demanded amount. By simplicity we also assume that  with a a positive constant (Graph 1).14

with a a positive constant (Graph 1).14

Result 1: In the perfect competition equilibrium, the exchange rate is defi ned by the interest rate parity condition (1) and the amount of foreign currency traded is given by equation (2).

Result 2: The equilibrium exchange rate under perfect competition, epc, is determined only by the interest rate differential,  , and the exchange rate expectations, ee (equation [1]). This implies that any change in these variables affects proportionally the equilibrium exchange rate.

, and the exchange rate expectations, ee (equation [1]). This implies that any change in these variables affects proportionally the equilibrium exchange rate.

Result 3: The equilibrium exchange rate under perfect competition does not react to an exogenous shock in the foreign currency net supply,  . Therefore any exogenous change in the supply is totally absorbed by the demanded amount of foreign currency; there is not an effect on price.

. Therefore any exogenous change in the supply is totally absorbed by the demanded amount of foreign currency; there is not an effect on price.

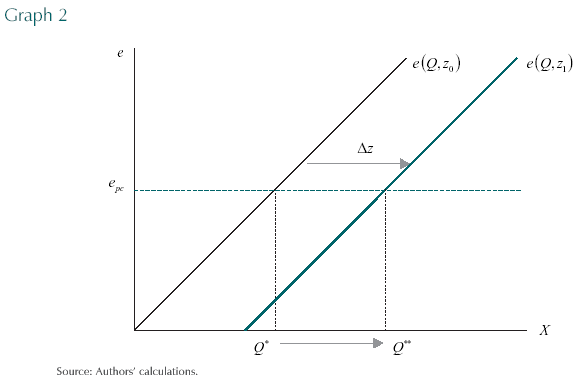

This result implies that when there is an exogenous shock on the foreign currency net supply (e. g. exports changes, terms of trade, etc

), PFM absorb completely the additional supply until the interest rate parity condition is reestablished (Graph 2). It means that  .

.

C. MONOPSONY

Under this structure there is only one PFM who faces the total net supply of foreign currency; then the total net demand of this asset (X - X0) is exclusively his decision. As a result, this agent knows that any change in his trading volume has an impact on the exchange rate and hence on the valuation of his net purchases. The PFM with monopsony power takes into account the effect of his transactions on the exchange rate, thus his optimization problem is:

from the fi rst order condition, the equilibrium exchange rate under monopsony is:

Result 4: Since  , the equilibrium exchange rate under monopsony is lower than in perfect competition when the monopsonist has a positive net demand of foreign currency (X0-X)< 0.

, the equilibrium exchange rate under monopsony is lower than in perfect competition when the monopsonist has a positive net demand of foreign currency (X0-X)< 0.

Intuitively, when the optimal decision of the monopsonist is to buy foreign currency, he knows that the additional purchase of a unit of foreign currency will increase the exchange rate and hence the cost of his purchases. For this reason, the monopsonist will demand less than the total demanded amount under perfect competition, thus the equilibrium exchange rate will be less depreciated than in the perfect competition case (this is the mitigating effect).

By the same token, when the monopsonist fi nds it optimal to sell foreign currency ((X0-X)> 0), he knows that selling an additional unit of this asset reduces the exchange rate and thus the value of his total sales. To avoid this adverse effect on his sales, the monopsonist reduces his foreign currency supply and the exchange rate will be more depreciated than in perfect competition.

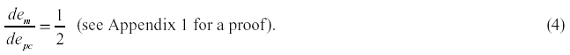

Result 5: The response of the monopsony equilibrium exchange rate, em, to shocks to the interest rate differential or to the exchange rate expectations is less (half) than the response of the perfect competition exchange rate, epc, to the same shocks:

This follows because the monopsonist responds less to these shocks than in perfect competition given that he takes into account the impact of his transactions on the exchange rate and on the value of his total purchases or sales (the mitigating effect).

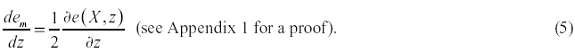

Result 6: An exogenous shock to the foreign currency net supply has a negative impact on the monopsony equilibrium exchange rate:

In contrast to the perfect competition case where  , under monopsony the exchange rate reacts to exogenous shocks to the net supply of foreign currency. Intuitively, when there is an exogenous shock, the monopsonist does not absorb all the excess supply because he considers the effect of his purchases on the exchange rate. Thus, the shock is not completely absorbed by the trading volume and the equilibrium exchange rate will adjust to a new equilibrium.

, under monopsony the exchange rate reacts to exogenous shocks to the net supply of foreign currency. Intuitively, when there is an exogenous shock, the monopsonist does not absorb all the excess supply because he considers the effect of his purchases on the exchange rate. Thus, the shock is not completely absorbed by the trading volume and the equilibrium exchange rate will adjust to a new equilibrium.

For example, if there is an exogenous increase in exports (or terms of trade) the foreign currency supply will rise by more than the demand of the monopsonist, and there will be an excess of supply that appreciates the exchange rate. The new equilibrium exchange rate will be lower than in perfect competition, where the additional supply is absorbed totally by PFM.

D. COURNOT OLIGOPSONY

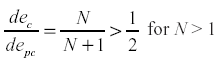

In this case the market structure is characterized by N pension fund managers who act simultaneously and take the value of the others net purchases as given. The optimization problem for a PFM j is as follows:

The fi rst order condition is now:

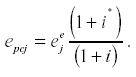

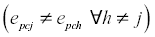

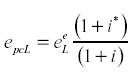

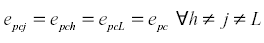

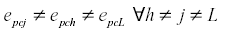

Where the exchange rate expectations among PFM are allowed to differ, so that:

Result 7: As in the monopsony case, the equilibrium exchange rate under a Cournot oligopsony structure is lower than in perfect competition when PFM have a positive net demand for foreign currency, (x0j-xj)< 0.

As before, this result is explained by the existence of market power. Agents with market power consider the effect of their transactions on the exchange rate and thus on the value of their purchases (or sales), inducing them to reduce their trading volume and moderating the impact on the exchange rate. This is again the mitigating effect of market power.

The effects of generalized or specific changes in expectations can be analyzed under different specifi cations of the model, depending on whether there is convergence or divergence of expectations.

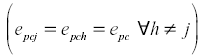

Result 8: If expectations converge  , the impact of a generalized shock to expectations or to the interest rate differential on the equilibrium exchange rate is smaller in oligopsony than in perfect competition:

, the impact of a generalized shock to expectations or to the interest rate differential on the equilibrium exchange rate is smaller in oligopsony than in perfect competition:

In addition, given that de  , the effect of a generalized shock to expectations on the oligopsony equilibrium exchange rate is greater than in monopsony (see Appendix 1 for a proof).

, the effect of a generalized shock to expectations on the oligopsony equilibrium exchange rate is greater than in monopsony (see Appendix 1 for a proof).

As PFM with market power know that any change in their demand for foreign currency has an adverse effect on the value of their purchases (or sales), they respond less to these shocks than when this effect is not realized (e.g. under perfect competition). However, the impact on the exchange rate is greater than in monopsony because more, smaller individuals are reacting simultaneously to a generalized shock to expectations (or to the interest rate differential), taking the actions of others as given. Hence, the sum of the changes in the quantities traded by all the Cournot competitors is larger than the change in the quantity traded by the monopsonist in the face of the same shock.

Result 9: If expectations differ among PFM  , the impact of a shock to the expectations of only one PFM on the equilibrium exchange rate is lower than the impact of a generalized shock to expectations:

, the impact of a shock to the expectations of only one PFM on the equilibrium exchange rate is lower than the impact of a generalized shock to expectations:

, the effect of a change in the expectations of one agent on the equilibrium exchange rate under Cournot competition is less than the effect in monopsony (see Appendix 1).

, the effect of a change in the expectations of one agent on the equilibrium exchange rate under Cournot competition is less than the effect in monopsony (see Appendix 1). This result implies that when there is a shock to the expectations of only one individual, the impact on the Cournot equilibrium exchange rate will be less than in the case where all PFM are hit simultaneously by the same shock. At the same time, the equilibrium exchange rate will respond more to changes in the monopsonists expectations than to movements of the expectations of only one agent in the oligopoly structure.15

Result 10: As in monopsony, an exogenous shock on the foreign currency net supply has a negative impact on the Cournot equilibrium exchange rate:

However, since N > 1, more individuals can absorb the excess supply, so that the equilibrium exchange rate has to adjust less than in the monopsony case.

E. STACKELBERG OLIGOPSONY

In this structure, there are N pension fund managers with market power, but now one of them acts as a leader and the others N - 1 act as followers. This is a sequential game in which the leader moves fi rst and then the followers observe the leaders action and take it into account to make their decisions. At the same time, the leader considers the reaction of the followers in his optimal decision.

In this setting, it is assumed that all followers respond in the same way to the leaders transaction and that there are two effects of this action: a direct effect that affects only the trading volume of the followers and an indirect effect that infl uences the followers expectations. In the fi rst case, the followers will react inversely to a change in the leaders trading volume, while in the second case the change in the followers net demand is in the same direction as the leaders movement.

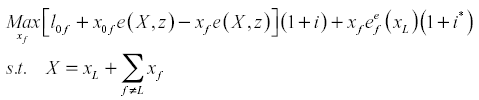

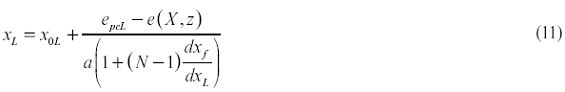

The analysis of this sequential game begins by the followers decision, which is the same as the decision of a Cournot competitor. The maximization problem of a typical follower is then:

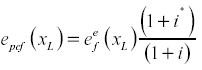

where the followers expectation may depend on the leaders transaction efe= efe (xL), if there exist the above mentioned indirect effect. If not, efe is exogenous.

The first order condition implies that:

In general: .

.

Now the leaders maximization problem is given by:

and his optimal demand is:

with

The equilibrium exchange rate in the Stackelberg oligopsony follows from equations (10) and (11).

Result 11: If only the direct effect of the leaders transaction is taken into account efe is exogenous the impact of a generalized shock to expectations (if expectations converge )on the Stackelberg equilibrium exchange rate is lower than in perfect competition:

)on the Stackelberg equilibrium exchange rate is lower than in perfect competition:

This confi rms the existence of a mitigating effect of market power on the equilibrium exchange rate (see Appendix 1 for a proof).

However, this impact is higher than in the monopsony and Cournot equilibria. Although the leaders reaction to a generalized shock to expectations is similar to the monopsonists, the convergence of expectations implies that the followers will react in the same way as the leader (demand more foreign currency in the face of increased expectations of depreciation). This higher demand implies that the exchange rate will change more than in monopsony. In contrast to the Cournot player, who takes the others demand as given, the Stackelberg leader knows that any increase in his demand will reduce the demand of the followers (direct effect). However, he also knows that this decreasing in the followers demand is partially offset by the generalized expectations of depreciation. Hence, the leader will demand more than the Cournot competitor, followers will demand less, but the effect of the former will be stronger. The total demand will be higher than under Cournot and thus the equilibrium exchange rate.

Result 12: When only the direct effect is taken into account (efe is exogenous), the impact of a specifi c shock to the leaders expectations (if expectations diverge  ) on the equilibrium exchange rate is smaller than the impact of a generalized shock to expectations:

) on the equilibrium exchange rate is smaller than the impact of a generalized shock to expectations:

This can be verifi ed by comparing equations (12) and (13). If only the leader experiments an increase of his expectations of depreciation, only his demand for foreign currency will rise. This contrasts with the case of converging expectations, where a shift in the latter is generalized and induces a change in the demand for foreign currency of all the agents.

Result 13: When both the direct and the indirect effects are considered (efe=efe (xL)), the impact of a shock to the leaders expectations on the equilibrium exchange rate is the same as in the case where only the direct effect is assumed (ef e is exogenous ) and expectations diverge ( ):

):

In this case, the leader considers the effect that his transaction has on the followers expectations. An increase in the leaders expectations of depreciation induces a rise in his demand for foreign currency. This, in turn produces higher followers expectations of depreciation and an expansion of their demand for foreign currency. This reaction of the followers implies an additional upward pressure on the exchange rate. Thus, in order to avoid this adverse effect on the cost of his purchases, the leader will moderate the increase in his demand. This implies that the mitigating effect of market power is stronger since the leader not only tries to alleviate the direct impact of his additional demand on the market, but also has to offset the effect of his actions on the followers expectations.

Result 14: The impact of an exogenous shock to the foreign currency net supply on the Stackelberg equilibrium exchange rate is negative and less than the impact under monopsony:16

This result follows from comparing equation (15) with equation (5). Intuitively, as in the cases of monopsony and Cournot competition, an exogenous change in the foreign currency net supply is not totally absorbed by PFM because of the mitigating effect.

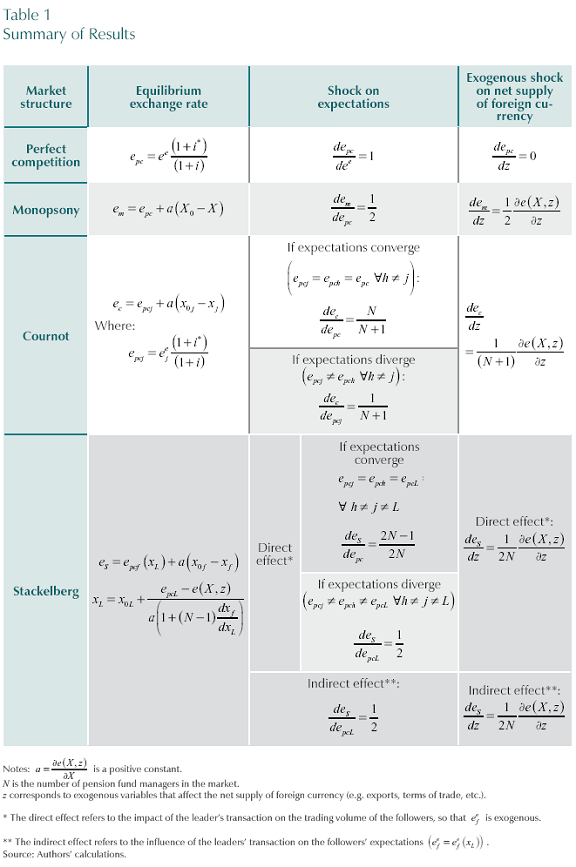

In sum, the equilibrium results under the different market structures are shown in Table 1. The existence of the mitigating effect of market power can be seen by comparing the perfect competition outcomes with the outcomes under other market structures.

IV. CONCLUSIONS

The concern about the destabilizing effect of PFM on the foreign exchange market (given the increasing size of their portfolios) can be alleviated by the existence of a mitigating effect of market power. This effect implies that PFM with market power will consider the impact that their actions have on the exchange rate, on the value of their foreign currency transactions and on other agents decisions. For this reason, PFM will moderate the volume of their transactions and, therefore, the pressure on the exchange rate.

Although the investment decisions of PFM can be dominated by the short run expected returns (as suggested by Zahler [2005]), and given that non-fundamentals factors could dominate the short run movements of the exchange rate (as the evidence suggests), the fact that market power has a mitigating effect on the exchange rate can make the foreign exchange market less prone to speculative movements. Therefore, the argument that large shifts of the foreign currency holdings in the PFM portfolios over a short span may destabilize the foreign exchange market is weakened when there is market power.

This paper shows that, due to the mitigating effect, PFM with market power will respond less to shocks to exchange rate expectations (or to the interest rate differential) than under perfect competition. Furthermore, in contrast to the competitive case, the equilibrium exchange rate will respond to exogenous shocks to the foreign currency net supply (e.g. exports changes, terms of trade, etc ). In perfect competition PFM absorb completely the additional supply until the interest rate parity condition is reestablished. However, when PFM have market power, the excess supply generated by an exogenous shock is not completely absorbed by the PFM, because they consider the effect of their purchases on the exchange rate.

Comentarios

1 This regulation can generate a herd effect.

2 This means that expectations of additional depreciations in the short run follow an observed depreciation while it is followed by expectations of a moderate appreciation in the long run.

3 Taylor and Allen (1992) suggest a broad consensus of the participants in the London foreign exchange market with respect to the importance given to the chartist analysis. They find that almost 90% of the respondents use some chartist technique when they form their short run exchange rate expectations (intraday to one week) and 60% of the respondents regard charts at least as important as fundamentals. Moreover, the importance given to economic fundamentals increases for longer horizons (from one month to one year). Cheung and Wong (2000) find that the majority of respondents in the foreign exchange markets of Hong Kong, Tokyo and Singapore recognizes the existence of significant effects of non fundamentals factors on short run exchange rates expectations. Lui and Mole (1998) report dealers in Hong Kong have a skew toward technical analysis at short horizons and toward fundamental analysis at longer horizons.

4 A number of researchers have constructed different models, in the vein of Frankel and Froot (1987), to show the role of non fundamentalist traders in the generation of bubbles in the foreign exchange market.

5 These are the markets for currencies with international demand like dollars or euros.

6 These are markets for currencies like the Colombian peso, which are not internationally demanded.

7 This has been widely documented (e. g. Davis and Steil, 2001)

8 Under this static framework the terms of investment are not relevant.

9 It means that given the portfolio size of PFM they can demand more than the supplied amount by other agents in the foreign exchange market.

10 It also implies that each PFM can invest a maximum amount m in each asset.

11 This is important because the pensions are given in local currency.

12 Since our objective is to determine the effects on the exchange rate of PFMs actions in the FOREX market, we only analyze the partial equilibrium for this market. Thus, we do not analyze other markets like the money market and, for this reason; the domestic interest rate is exogenous.

13 The solution under perfect competition is similar when agents are risk-averse and have CARA utility functions except for the existence of a risk premium:  . In this case, the intuition about the mitigating effect is reinforced by risk aversion. Intuitively, a large PFM with market power will also have a foreign exchange exposure that is greater than that of a smaller, competitive PFM. Hence the response of the former to a shock in i* or E[ee] will be more muted due to both the market power effect and the risk aversion effect (see Appendix 1).

. In this case, the intuition about the mitigating effect is reinforced by risk aversion. Intuitively, a large PFM with market power will also have a foreign exchange exposure that is greater than that of a smaller, competitive PFM. Hence the response of the former to a shock in i* or E[ee] will be more muted due to both the market power effect and the risk aversion effect (see Appendix 1).

14 Taking the more general assumption  , 0 the results remain the same, they do not depend on the linearity of the supply function.

, 0 the results remain the same, they do not depend on the linearity of the supply function.

15 Although the demand of the agent with changing expectations will vary more than the monopsonists demand, the other agents will react inversely to the change of the demand of this agent.

16 This impact is the same when either both effects or only the direct effect are considered.

REFERENCES

1. Cheung, Y.; Wong, C. A Survey of Market Practitioners: Views on Exchange Rate Dynamics, Journal of International Economics, vol. 51, no. 2, pp. 401-419, 2000. [ Links ]

2. Davis, E.; Steil, B. Institutional Investors, Cambridge Massachusetts: MIT Press, 2001. [ Links ]

3. Frankel, J.; Froot, K. Using Survey Data to Test Standard Propositions Regarding Exchange Rate Expectations, American Economic Review, vol. 77, no. 1, pp. 133-153, 1987. [ Links ]

4. Froot, K.; Ito, T. On the Consistency of shortrun and long-run Exchange Rate Expectations, Journal of International Money and Finance, vol. 8, no. 4, pp. 487-510, 1989. [ Links ]

5. J. P. Morgan, Pension Fund Reform: Anticipating FX Implications, Global Foreign Exchange Research, 2002. [ Links ]

6. Lui, Y.; Mole, D. The Use of Fundamental and Technical Analyses by Foreign Exchange Dealers: Hong Kong Evidence, Journal of International Money and Finance, vol. 17, no. 3, pp. 535-545, 1998. [ Links ]

7. Lyons, R. Private Beliefs and Information Externalities in the Foreign Exchange Market, working paper, no. 3889, National Bureau of Economic Research, 1991. [ Links ]

8. Sarno, L.; Taylor, M. The Microstructure of the Foreign-Exchange Market: A Selective Survey of the Literature, Princeton Studies in International Economics, no. 89, May, 2001. [ Links ]

9. Taylor, M.; Allen, H. The Use of Technical Analysis in the Foreign Exchange Market, Journal of International Money and Finance, vol. 11, no. 3, pp. 304-314, 1992. [ Links ]

10. Zahler, R. Estabilidad macroeconómica e inversión de los fondos de pensiones: el caso de Chile, Crecimiento Esquivo y Volatilidad Financiera, Ricardo Ffrench-Davis Editor, 2005. [ Links ]