Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.29 no.spe64 Bogotá June 2011

The Risks of Low Interest Rates

Leonardo Gambacorta*

*Bank for International Settlements

This paper has been prepared for Seminario de la revista Ensayos sobre Política Económica, 29 October 2010, at the Bank of the Republic, Bogotá, Colombia. I would like to thank Yener Altunbas, Claudio Borio, Petra Gerlach-Kristen, Simonetta Iannotti and David Marqués-Ibañez for useful comments and discussions. The opinions expressed in this paper are those of the author and do not necessarily reflect those of the Bank for International Settlements (BIS). E-mail: leonardo.gambacorta@bis.org

INTRODUCTION

At present, monetary policy in major advanced economies is highly accommodative; policy rates are close to zero and unconventional monetary measures have been sharply expanded. However, the recovery remains fragile and the policy discussion has shifted from exit timing to the possible distortions that a prolonged period of low interest rates may cause. In addressing the latter issue, this paper examines how far an exceptionally easy monetary policy may have unintended consequences for financial stability.

The main channels by which monetary policy may influence risk-taking have been widely investigated (Borio and Zhu, 2008). There is, however, less evidence for the possible medium to long-term consequences of prolonged periods of policy rates close to zero and the extensive use of balance sheet policies (Borio and Disyatat, 2009; Del Negro, Ferrero and Kiyotaki, 2010). This paper suggests four possible ways by which a prolonged period of low interest rates could create distortions, by: a) inducing "evergreening policies" and postponing necessary adjustment in banks' balance sheets; b) making bank profitability particularly vulnerable to future increases in interest rates; c) distorting the allocation of savings and the functioning of financial markets and d) influencing capital flows to emerging markets and creating pressure on exchange rates.

The remainder of this paper is organised as follows. The next section discusses how monetary policy can affect risk-taking by financial intermediaries. Section III summarises previous empirical evidence. Section IV discusses what lessons can be learned from the financial crisis. Section V analyses in detail the possible distortions caused by low interest rates. The last section summarises the main conclusions.

I. THE RISK-TAKING CHANNEL

The latest financial crisis has drawn the attention of researchers and policymakers to a different dimension of the monetary transmission mechanism, the so-called risk-taking channel (Borio and Zhu, 2008). The risk-taking channel is a "normal" mechanism through which monetary policy affects the economy through the perception and pricing of risk by economic agents. This channel does not necessarily produce distortions. However, an inappropriate policy stance could contribute to the creation of a bubble. For example, a "too accommodative monetary policy" (a prolonged period with interest rates below what historical conditions would suggest) may have caused a moderation in perceived risk in the 2002-06 period, contributing -together with other factors- to the crisis build-up.

First of all, it is worth asking what the points of contact and differences are between the risk-taking channel and the better known bank lending channel (Bernanke and Blinder, 1988). According to the bank lending channel concept, a reduction in short-term interest rates reduces the opportunity cost of holding deposits and modifies bank funding conditions, which in turn affects the supply of bank lending. In the case of imperfect substitutability between loans and bonds, the impact on consumption and investment is larger because the private sector relies more on bank financing. The bank lending channel concept does not account for changes in banks' risk perceptions or risk attitudes.

As for the risk-taking channel, there are at least three ways in which low interest rates could influence financial intermediaries' risk. The first is through the "search for yield" (Rajan, 2005): low interest rates may increase the incentive for asset managers to take on more risk for contractual, behavioural or institutional reasons. For example, in 2003-04 many investors shifted from low-risk government bonds to higher-yielding, but also riskier corporate and emerging market bonds. They were seeking to achieve the nominal returns that had been attainable when interest rates were higher (BIS, 2004). Additionally, institutional or regulatory constraints could amplify this mechanism for life insurance companies and pension funds that typically manage their assets with reference to their liabilities. In some countries, liabilities are linked to a minimum guaranteed nominal rate of return or returns that reflect long-term actuarial assumptions rather than the current level of yields. Such minimum returns may be fixed by statute, as in Switzerland, or contractually, as in some cases in Japan and the United Kingdom in the recent past. In a period of declining interest rates, these may exceed the yields available on highly rated government bonds. The resulting gap can lead institutions to invest in higher-yielding, higher-risk instruments.1

The second way that low interest rates could make banks take on more risk is through their impact on valuations, incomes and cash flows.2 A reduction in the policy rate boosts asset and collateral values, which can in turn modify bank measures of credit risk (Borio, Furfine and Lowe, 2001). For example, low interest rates, by increasing asset prices, tend to reduce asset price volatility and thus risk perception: as a higher stock price increases the value of equity relative to corporate debt, a sharp increase in stock prices reduces corporate leverage and could thus reduce the risk of holding stocks. This example can be applied to the widespread use of value-at-risk methodologies for economic and regulatory capital purposes (Danielsson, Shin and Zigrand, 2004). As volatility tends to decline in rising markets, it releases the risk budgets of financial firms and encourages position-taking. A similar argument is provided in the model by Adrian and Shin (2009), who stress that changes in measured risk determine adjustments in bank balance sheets and leverage conditions and that this, in turn, amplifies business cycle movements.

The third mechanism through which the risk-taking channel may be activated is by the communication policies of a central bank and perceptions of its reaction function.

One example is the pre-commitment to a path for interest rates (eg. keeping them low for a long time). This reduces uncertainty and volatility and improves the perceived risk-return trade-off (eg. the familiar "information ratio" for all sorts of carry trades, be these in interest or currency rates). Another important mechanism is connected with the perception that central banks will behave asymmetrically, not responding directly to signs of risk build-up but only to the materialisation of stress itself, thus providing a sort of (admittedly "fuzzy") ex ante insurance. This channel has recently been formalised by, among others, Diamond and Rajan (2009) and Farhi and Tirole (2009).

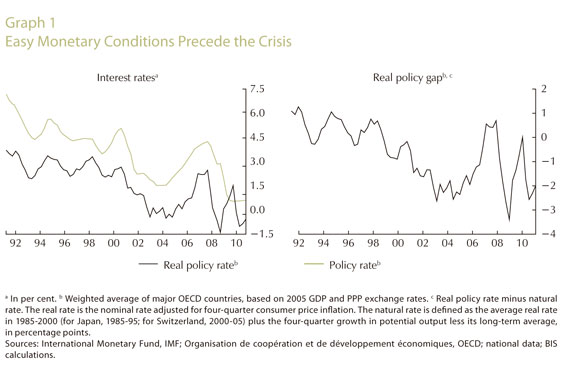

II. EMPIRICAL EVIDENCEIn the aftermath of the dotcom bust, many central banks lowered interest rates to combat recession. With inflation remaining remarkably stable, central banks in a number of developed countries kept interest rates below previous historical norms for some time (see Graph 1). The implication of these strategies for risk-taking did not loom large in policy decisions. First, most central banks around the world had progressively shifted to tight inflation objectives. Second, financial innovation had, for the most part, been regarded as a factor that would strengthen the resilience of the financial system, by resulting in a more efficient allocation of risk.

This prolonged period of low interest rates could have caused an increase in risk-taking through the mechanisms highlighted in the previous section. A few studies have recently started to test for the existence of such a mechanism. The first piece of evidence is provided by Jiménez, Ongena, Peydró and Saurina (2009) in a paper that uses micro data from the Spanish Credit Register over the 1984-2006 period to investigate whether the monetary policy stance affects the risk level of individual bank loans. The authors find that low interest rates affect the riskiness of the loan portfolio of Spanish banks in two conflicting ways. In the short term, low interest rates reduce the default probability of outstanding variable rate loans by reducing the interest burdens of previous borrowers. In the medium term, however, due to the higher collateral values and the search for yield, banks tend to grant more risky loans and, in general, to soften their lending standards: they lend more to borrowers with a bad credit history and with less certain prospects. Overall, these results suggest that low interest rates reduce credit risk in banks' portfolios in the short term -since the volume of outstanding loans is larger than the volume of new loans- but they raise it in the medium term. Similar results are obtained by López, Tenjo and Zárate (2010) for the Colombian case.

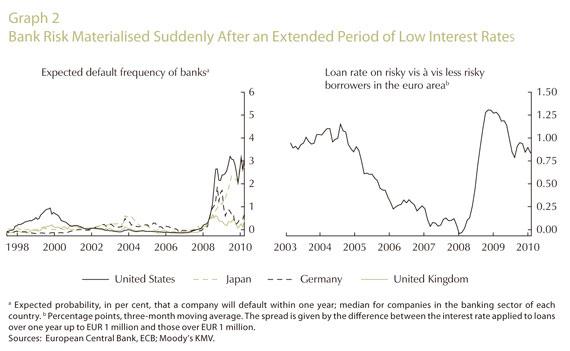

The recent crisis has demonstrated that risks materialise in non-linear ways. The left-hand panel of Graph 2 shows the trend of banks' expected default frequencies (EDFs) in the last decade. Notice how the consequences of banks' risk-taking started to emerge suddenly in the third quarter of 2007, triggered by the subprime crisis, and became even more apparent after Lehman Brothers' bankruptcy in September 2008. Previously, the low level of interest rates went hand in hand with a reduction of the perception of bank risk, just as the evidence put forward by Jiménez et al. (2009) would suggest.

Taking a different, yet complementary, perspective, Ioannidou, Ongena and Peydró (2009) analyse whether the risk-taking channel works not only on the quantity of new loans but also on their interest rates. The authors investigate the impact of changes in interest rates on loan pricing using Bolivian data over the 1999-2003 period. The authors find that, when interest rates are low, banks not only increase the number of new risky loans but also reduce the rates they charge risky borrowers relative to those they charge less risky ones. If the risk-taking channel is at work, in line with the findings of Ioannidou et al. (2009), we should see a progressive reduction in spreads and lending standards in the run-up to the crisis. The right-hand panel of Graph 2 shows, as an example, a clear reduction in the difference between interest rates applied to small and large firms in the euro area prior to the crisis, followed by a sudden increase during the crisis itself. Similar conclusions can be reached by analysing the spread between the interest rate paid on bonds by BBB and AAA firms, a proxy for the spread on risky relative to less risky borrowers. This spread narrowed significantly in both the euro area and the United States during the period of very low interest rates (Gambacorta, 2009).

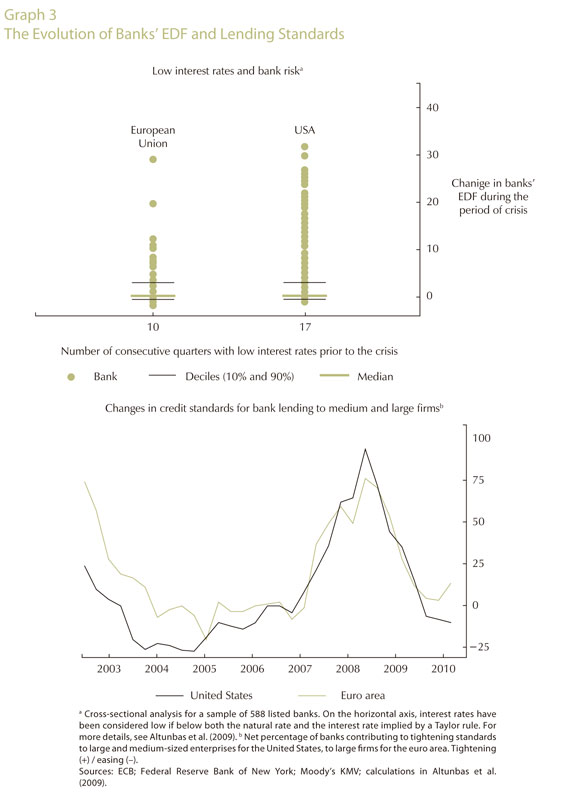

The previous empirical studies are at the country level and do not exploit cross-country differences. Altunbas, Gambacorta and Marqués-Ibañez (2009) try to fill this gap by taking an international perspective. In particular, they analyse the link between monetary policy and banks' EDFs using data for 600 European and US-listed banks over the 1999-2008 period. From a macroeconomic point of view, this analysis is relevant because the dataset represents more than two thirds of total lending provided by banks in the European Union and the United States. To examine whether policy rates were historically low prior to the crisis, they compare them with two benchmarks: a) interest rates implied by the Taylor rule, a common descriptive benchmark for monetary policy and b) natural interest rates, calculated as a smooth trend of past interest rate levels as in the left-hand panel of Graph 1. They find evidence of a link between low interest rates for protracted periods and increased risk-taking by banks over the last decade. The first panel of Graph 3 shows, for example, that in the United States, where the federal funds rate was below the natural rate for 17 consecutive quarters in the 2002-06 period, the subsequent increase in banks' EDFs was greater than in European Union countries, where the policy rate was below the natural rate for only 10 quarters, on average.

Bank lending surveys, in which bank loan officers are asked directly about their willingness to grant credit, provide further evidence on attitudes towards risk. The right-hand panel of Graph 3 reports the results for both the euro area Bank Lending Survey and the US Senior Loan Officer Opinion Survey on Bank Lending. This measure of credit conditions is the difference between the number of banks that reported a tightening in a given quarter and the number that reported an easing. We see that the crisis was preceded by a prolonged period of lending expansion. Consequently, the subsequent materialisation of credit risk that emerged at the beginning of 2007 caused a large drop in the quantity of lending. This evidence is consistent with Maddaloni and Peydró (2010). Using a unique dataset of bank lending standards in the euro area and the United States, the authors find that low (monetary policy) short-term interest rates soften standards for household and corporate loans. This softening -especially for mortgages- is amplified by securitisation activity, weak supervision for bank capital and monetary policy rates that are too low for too long. Conversely, low long-term interest rates do not soften lending standards. Finally, countries with softer pre-crisis lending standards related to negative Taylorrule residuals experienced a worse economic performance afterwards. These results help shed light on the origins of the crisis and have important policy implications.

III. WHAT LESSONS CAN BE LEARNED FROM THE FINANCIAL CRISIS?

Econometric analysis shows that central banks' actions could have an impact on bank risk attitudes. The "risk-taking channel" is a sufficient, but not a necessary, condition for monetary policy "not to be neutral" from a financial stability perspective. It is an additional channel that could be added to other more standard mechanisms through which monetary policy influence asset prices and credit expansion3. The existence of the "risk-taking channel", moreover, does not necessarily mean that monetary policy should actively "lean against asset financial bubbles" and downgrade the price stability objective. Rather, it suggests that central banks should take a longer-term perspective and consider how a prolonged period of low interest rates will affect not only inflation, but also financial stability.

The existence of a risk-taking channel is of interest to both monetary and supervisory authorities. It is important that monetary authorities learn how to factor in the effect of their policies on risk-taking. And, that prudential authorities be especially vigilant during periods of unusually low interest rates; particularly so if these are accompanied by other signs of risk-taking, such as rapid credit and asset price increases.

How might we apply these lessons to the present juncture? Central banks cut policy rates sharply during the crisis in order to stabilise the financial system and the economy. Those cuts, reinforced by unconventional policy measures, helped to forestall an economic meltdown (BIS, 2010). The recent slowdown in growth has pushed ever further into the future market expectations as to the start of the interest rate tightening cycle in advanced economies; and, simultaneously, it has raised the prospect of additional, or continued unconventional measures in many jurisdictions. But, in an environment unlike any we have ever seen, there is significant uncertainty about whether and how additional monetary expansion can provide the desired stimulus to aggregate demand, thus reducing downside risks to growth. Moreover, there are limits to how long monetary policy can remain expansionary. Low interest rates can distort investment decisions and postpone balance sheet adjustments.

IV. DISTORTIONS CAUSED BY LOW INTEREST RATES FOR A PROLONGED PERIOD OF TIME

Even without additional monetary stimulus, the maintenance of an exceptionally accommodative monetary policy with ultra-low interest rates could raise medium-to long-term risks. These could include: a) distortion in credit allocation; b) distortion in investors' perception of risks and effects on future banking sector profitability; c) adverse effects on the allocation of savings and the functioning of financial markets. Beyond these largely domestic concerns and d) ultra-low interest rates in major economies may be a key factor in causing large capital flows to emerging markets, thus exerting strong pressure on their exchange rates.

A. DISTORTION IN CREDIT ALLOCATION

Low interest rates could induce "evergreening policies" and postpone necessary adjustments in banks' balance sheets. Given the low cost of forbearance, very low interest rates may disguise underlying credit weakness; encouraging banks to "extend and pretend" that loans of low-quality borrowers will become good. Past experience has shown that low policy rates allow for the increase of "zombie lending" policies, ie. the rollover of non-viable loans. The case of Japan in the 1990s is instructive: banks permitted debtors to roll over loans on which they could afford the near zero interest payments, but not repayments of principal (Caballero, Hoshi and Kashyap, 2008). Very low rates keep poor-quality borrowers afloat, reducing the incentives to reallocate resources to areas of more vigorous growth, and thus may lower potential output. There is also more recent evidence that evergreening practices have taken place during the crisis in Italy (Albertazzi and Marchetti, 2010).

On the other hand, yield curve flattening by means of balance sheet policies (purchase of long-term government papers) tends to compress interest rate margins on traditional intermediation activity and to reduce the incentive for banks to extend new long-term lending. This not only reduces the profitability of banks in their classical intermediation role, but also limits the supply of lending to non-financial firms and households at a time when these are more likely to encounter financial difficulties. Therefore, despite very low interest rates, banks may lack the right incentives to finance investment and consumption, putting further downward pressure on aggregate demand.

B. DISTORTIONS IN INVESTORS' PERCEPTION OF RISK AND EFFECTS ON FUTURE BANKING SECTOR PROFITABILITY

A prolonged period of low interest rates coupled with low profitability in their traditional intermediation activity could induce banks to take on more risk. As discussed in Section 3, in the presence of low yields, banks and other financial intermediaries may be encouraged to take on risky positions that are more structural in character. This mechanism could be amplified by the large injection of liquidity into the banking sector through new facilities, expansion of eligible collateral, and other quantitative easing measures. The search for yield is not limited to the banking sector. Very low interest rates weaken the solvency position of pension funds and insurance companies, given low returns on assets and the impact of low discount rates on the present value of liabilities and technical provisions. Short-term earnings are currently misleading, given the initial dominance of capital gains when yields fall. Such institutions face incentives to take on additional risk to meet guaranteed return targets. More generally, the business models of pension funds and insurance companies are not able to sustain a prolonged period of low interest rates.

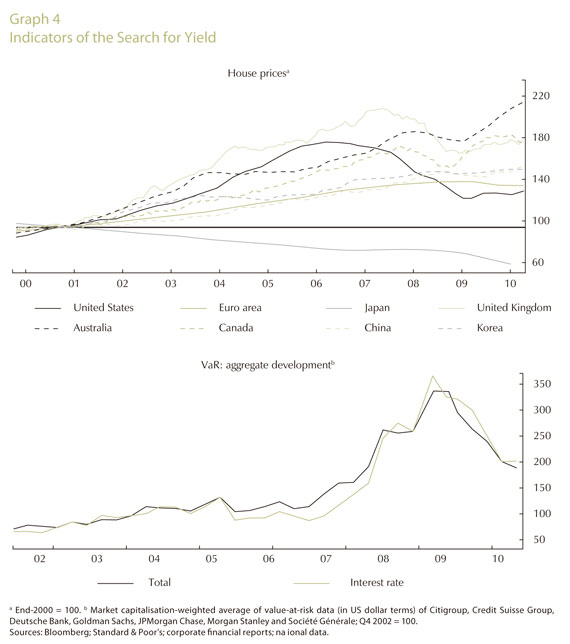

A number of symptoms can indicate a search for yield. The first is an increase in asset prices and a reduction in risk premia. While the recovery in many asset markets in 2009 and early 2010 in part represented a reversal of crisis-related risk aversion, the search for yield phenomenon, against the background of near zero policy rates, could continue to play a role. Despite the normalisation of house prices in many advanced economies, the value-at-risk of major banking groups is still above its average pre-crisis level (see Graph 4).

Low interest rates have reduced the incentive for banks to rebalance their liabilities towards longer-term funding. By shifting their funding profile further towards short- term market financing, banks can reduce interest rate payments. This provides them with breathing space for increasing their profitability in the short term. However, this also exposes bank balance sheet positions to any increase in policy rates. If we also consider the evergreening policies described in the previous section, banks seem particularly exposed at present to a future tightening of monetary policy.

This can raise concerns about the independence of monetary policymakers, because changes in interest rates also have macroprudential implications. If banks' profitability deteriorates just when they need to strengthen their capital base towards the target levels implied by Basel III (BCBS, 2010), their ability to lend could be impaired. A more general point, as noted in Section 2, is that an asymmetric monetary policy -one that cuts rates sharply when the economy falters but fails to raise them quickly when it recovers- gives the financial sector that much less reason to worry about credit or liquidity risk. This could erode the credibility of the central bank.

C. ADVERSE EFFECTS ON THE ALLOCATION OF SAVINGS AND THE FUNCTIONING OF FINANCIAL MARKETS

The price for ultra-low interest rates is paid by anyone who has financial assets and thus forgoes the normal return on them. Therefore, other things being equal, there is a higher incentive to consume. However, a long period of low interest rates could have other profound consequences for savers. As we have seen, low interest rates increase the liabilities of pension schemes or, to put it differently, savers need much larger capital payments to obtain a given level of annuity during retirement. In addition, deflation is a hidden risk for pension schemes. If it occurs, it will cut the nominal incomes of those entities (companies, public sector bodies) that have to fund future pensions, creating another potential gap between assets and liabilities. If pension schemes simply cut benefits, individuals might decide to save more to offset the expected pension shortfall. Were this income effect to become powerful enough, low interest rates could have the perverse effect of encouraging saving. This would frustrate their original purpose, which is primarily to boost spending.

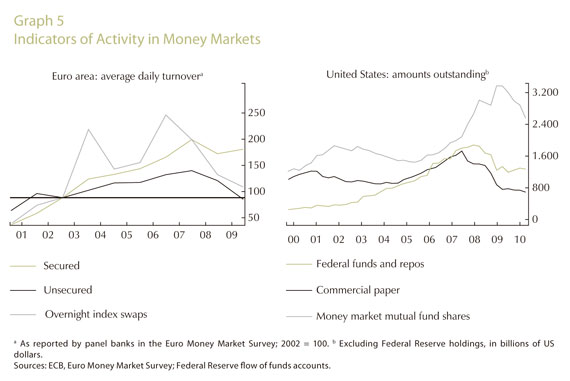

When central banks start raising their policy rates, it will be necessary for money markets to transmit this change to the wider economy if the exit strategy is to be effective. However, low policy rates can paralyse money markets. If the operational costs involved in executing money market deals exceed the interest earned -which is closely related to policy rates -commercial banks may shift resources out of these operations. For example, Japanese money markets atrophied to such an extent in the last decade that the tightening of Japan's monetary policy in 2006 was complicated by overstretched staff on the money market desks at commercial banks (BIS, 2010). Money market volumes in the euro area and the United States have declined since the onset of the financial crisis to a level below that seen in 2003-04, also a period when policy rates were low (see Graph 5).4 It remains to be seen whether volumes will eventually return to their previous levels, or whether low policy rates have in deed reduced money market activity, thus complicating the implementation of exit strategies.

D. LARGE CAPITAL FLOWS TO EMERGING MARKETS AND PRESSURES ON THEIR AXCHANGE RATES

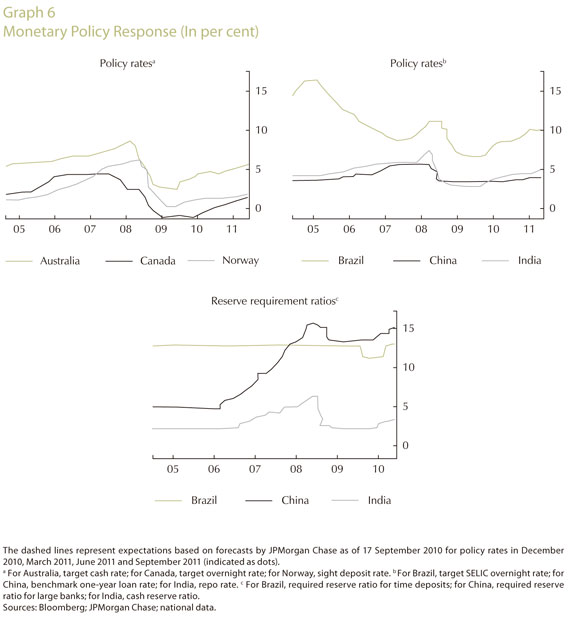

Persistently low rates in the major economies may cause side effects beyond their borders, both in emerging markets and in commodity-exporting industrial countries, which fared comparatively well in the crisis. By the end of May 2010, these countries had begun raising interest rates. Current market expectations point to further tightening, and this has created significant interest rate differentials, both real and nominal, vis-à-vis the main advanced countries. Together with better growth prospects, these differentials have generated capital flows to countries with higher rates, increasing the attractiveness of carry trades.

On the one hand, capital flows may allow a better allocation of economic resources, contributing significantly to growth, especially in emerging market economies. On the other hand, they may, in the current situation, lead to further asset price increases and have an inflationary impact on the macroeconomy. The responsiveness of capital flows to prevailing and expected interest rate differentials (dotted lines in Graph 6) reduces the room for manoeuvre in emerging market economies.

V. CONCLUSIONS

The market turbulence associated with sovereign debt concerns and the weak economic recovery have postponed the return to more normal monetary policy conditions in a number of advanced economies. Discussion has shifted progressively from exit timing to the possible distortions that prolonged low interest rates may cause.

This paper has analysed such possible distortions in: a) the allocation of credit and b) investors' perceptions (and measurement) of risks and exposure of financial institutions to potential future losses. It has also considered c) adverse effects on the allocation of savings and the functioning of financial markets. Beyond these largely domestic concerns, ultra-low interest rates in the major economies may be a key factor in influencing d) large capital flows to emerging markets and creating strong pressures on their exchange rates.

From a policy point of view, the existence of such distortions suggests that policymakers should raise interest rates as soon as macroeconomic conditions allow. The main concern is that policymakers could fall into a trap: the longer interest rates remain low, the higher the probability that they will continue to remain low. There is an evident trade-off: low interest rates are good for macroeconomic stability in the short-run, but could harm long-run financial stability and macroeconomic performance because they tend to amplify risk-taking, expose financial institutions to losses arising from a future tightening of monetary conditions and delay adjustment in their balance sheets

Econometric analysis shows that central banks' actions could have an impact on bank risk attitudes. The "risk-taking channel" is an additional mechanism that could be added to other more standard mechanisms through which monetary policy influence asset prices and credit expansion. However, this finding does not necessarily mean that monetary policy should always actively "lean against financial imbalances" and downgrade the price stability objective. Rather, it suggests that central banks should take a longer-term perspective and consider how a prolonged period of low interest rates will affect not only inflation but also financial and macroeconomic stability.

Authorities worldwide are placing increasing emphasis on developing macroprudential policy tools to counter systemic financial risks. In the past, a number of emerging market economies have used macroprudential policy measures to limit credit growth, property price appreciation and the like. With this experience as a backdrop, the Basel Committee on Banking Supervision has incorporated a countercyclical capital buffer into the new Basel III framework (Drehmann, Borio, Gambacorta, Jiménez and Trucharte, 2010). While various governance arrangements are either being developed or are already in place, it is clear that central banks will play an increasingly significant role in financial stability policy.

COMENTARIOS

1 More generally, financial institutions regularly enter into long-term contracts that oblige them to produce relatively high nominal rates of return. And, the same mechanism could be in place whenever private investors use short-term returns as a way of judging managerial competence and withdraw funds after poor performance (Shleifer and Vishny, 1997).

2 This is close in spirit to the familiar financial accelerator, in which increases in collateral values reduce borrowing constraints (Bernanke, Gertler and Gilchrist, 1996). Adrian and Shin (2009) argue that the risk-taking channel differs from and strengthens the financial accelerator because it focuses on amplification mechanisms brought about by financing frictions in the lending sector.

3 See, among others, Cecchetti, Genberg, Lipsky and Wadhwani (2000) and Christiano, Cosmin, Motto and Rostagno (2010).

4 The drop in market volumes in 2008 was mainly caused by liquidity hoarding, counterparty and collateral concerns, as well as the increased provision of liquidity by central banks, but the continued low level may also reflect the reduced margins available in the current market. In 2009, the money market saw, in the euro area, a rise in the turnover of secured funds and, in the United States towards the end of the year, a small rise in the outstanding amount of federal funds and repos. These advances -observed before the Greek sovereign debt crisis- may mirror an easing of counterparty and collateral concerns and a reduction in central bank open market operations.

REFERENCES

1. Adrian, T., Shin, H. 1. Financial Intermediaries and Monetary Economics, Federal Reserve Bank of New York Staff Reports, núm. 398, 2009. [ Links ]

2. Albertazzi, U.; Marchetti, D. 2. Lending Supply and Unnatural Selection: An Analysis of Bank-firm Relationships in Italy After Lehman, Bank of Italy, Temi di discussione, forthcoming, 2010. [ Links ]

3. Altunbas, Y.; Gambacorta, L.; Marqués-Ibañez, 3. D. "Does Monetary Policy Affect Bank Risk-Taking?", BIS Working Paper, núm. 298, March, 2009. [ Links ]

4. Basel Committee on Banking Supervision, 4. BCBS. An Assessment of the Long-Term Impact of Stronger Capital and Liquidity Requirements, August, 2010. [ Links ]

5. Bank for International Settlements, BIS. 5. 74th Annual Report, June, 2004 [ Links ]

6. Bank for International Settlements, BIS. 6. 80th Annual Report, June, 2010. [ Links ]

7. Bernanke, B.; Blinder, A. "Is it Money or Credit, 7. or Both or Neither? Credit, Money and Aggregate Demand", American Economic Review, vol. 78, núm. 2, pp. 435-439, 1988. [ Links ]

8. Bernanke, B.; Gertler, M.; Gilchrist, S. "The Fi8. nancial Accelerator and the Flight To Quality, Review of Economics and Statistics", vol. 48, pp. 1-5, 1996. [ Links ]

9. Borio, C.; Disyatat, P. Unconventional Monetary 9. Policies - An Appraisal, BIS Working Papers, núm. 292, 2009. [ Links ]

10. Borio, C.; Furfine, C.; Lowe, P. Procyclicality of 10. the Financial System and Financial Stability: Issues and Policy Options, BIS Working Papers, núm. 1, 2001. [ Links ]

11. Borio, C.; Zhu, H. Capital Regulation, Risk-11. Taking and Monetary Policy: A Missing Link in the Transmission Mechanism?, BIS Working Papers, núm. 268, 2008. [ Links ]

12. Brunnermeier, M. Asset Pricing Under Asymmetric Information: Bubbles, Crashes, Technical Analysis and Herding, Oxford University Press, 2001. [ Links ]

13. Caballero, R.; Hoshi, T.; Kashyap, A. "Zombie Lending and Depressed Restructuring in Japan", American Economic Review, vol. 98, pp. 1943-1977, 2008. [ Links ]

14. Cecchetti, S.; Genberg, H.; Lipsky, J.; Wadhwani, S. Asset Prices and Central Bank Policy, Geneva Report on the World Economy, núm. 2, 2000. [ Links ]

15. Christiano, L.; Cosmin, I.; Motto, R.; Rostagno, M. Monetary Policy and Stock Market Booms, NBER Working Paper, núm. 16402, 2010. [ Links ]

16. Danielsson, J.; Shin, H.; Zigrand, J. "The Impact of Risk Regulation on Price Dynamics", Journal of Banking and Finance, vol. 28, pp. 1069-1087, 2004. [ Links ]

17. Del Negro, M.; Ferrero, A.; Kiyotaki, N. The Great Escape? A Quantitative Evaluation of the Fed's Non-Standard Policies, Federal Reserve Bank of New York, mimeo, February, 2010. [ Links ]

18. Diamond, D.; Rajan, R. Illiquidity and Interest Rate Policy, NBER Working Papers, núm. 15197, 2009. [ Links ]

19. Drehmann, M.; Borio, C.; Gambacorta, L.; Jiménez, G.; Trucharte, C. "Countercyclical Capital Buffers: Exploring Options", BIS Working Papers, núm. 317, 2010. [ Links ]

20. Farhi, E.; Tirole, J. "Leverage and the Central Banker's Put", American Economic Review, vol. 99, núm. 2, pp. 589-593, 2009 [ Links ]

21. Gambacorta, L. "Monetary Policy and the Risk-Taking Channel", BIS Quarterly Review, pp. 43-53, December, 2009. [ Links ]

22. Ioannidou, V.; Ongena, S.; Peydró, J. "Monetary Policy and Subprime Lending: A Tall Tale of Low Federal Funds Rates, Hazardous Loan and Reduced Loans Spreads", European Banking Centre Discussion Paper, núm. 2009-04S, 2009. [ Links ]

23. López, P. M.; Tenjo, G. F.; Zárate, S. H. "The Risk-Taking Channel and Monetary Transmission Mechanism in Colombia", mimeo, Banco de la República de Colombia, 2010. [ Links ]

24. Jiménez, G.; Ongena, S.; Peydró, J.; Saurina, J. "Hazardous Times for Monetary Policy: What Do Twenty-Three Million Bank Loans Say About the Effects of Monetary Policy On Credit Risk-Taking?", Banco de España Working Papers, núm. 833, 2009. [ Links ]

25. Maddaloni, A.; Peydró, J. "Bank Risk Taking, Securitization, Supervision, and Low Interest Rates: Evidence From Lending Standards", ECB Working Paper Series, núm. 1248, 2010. [ Links ]

26. Rajan, R. "Has Financial Development Made the World Riskier?", NBER Working Papers, núm. 11728, 2005. [ Links ]

27. Shleifer, A.; Vishny, R. "The Limits of Arbitrage", Journal of Finance, vol. 52, pp. 35-55, 1997. [ Links ]

28. Taylor, J. "The Financial Crisis and the Policy Responses: An Empirical Analysis of What Went Wrong", NBER Working Papers, núm. 14631, 2009. [ Links ]