Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.30 no.spe67 Bogotá June 2012

Central Banks: Past, Present, Future*

Angela Redish

*University of British Columbia, Vancouver,Canada.

E-mail:angela.redish@ubc.ca.

Paper prepared for the Conference on Monetary History, Banco de la República, Bogotá, Colombia.

I. INTRODUCTION

The current European financial crisis has underlined the critical importance of the design of central banks for monetary, financial and economic stability; and, in particular, it has raised questions about the functionality of a central bank independent of a sovereign fiscal power. But the relationship between the state and the central bank is not only at issue in Europe. In the United States, the question of how separate the Federal Reserve System and the federal government should be is also more frequently heard in policy discussions than it has been for many decades. This paper looks at the question of central bank mandate and design in a larger historical context with the goal of understanding the rationale for the design of the European Central Bank (ECB), and also of developing a better understanding of how central banks will evolve over the next few decades.

Over the centuries, central banks have played four broad roles in the economy: fiscal support, financial stability support, monetary support and macroeconomic support. Let me say a few words about each before looking at some case studies. Central banks can provide revenue or fiscal support for their government in a variety of ways. The use of the power to coin/print money to produce revenue for the sovereign, of course, long predates central banking and the debate over the legitimacy of such use is an equally old one. Medieval European monarchs generated revenue by debasing the coinage, but this power was not always used. In many states, and certainly by the 18th century, the monetary authorities used debasement to finance extraordinary (read wartime) expenditures and to address the problem of wear and tear on coins, but otherwise the coinage was relatively stable.1 The substitution of paper money for coin created easier avenues for raising seignorage revenue: to own the profits of note issue, directly or by taxing them away from a private sector bank, or by requiring a forced loan from a private sector bank, or by printing money. All these methods of extracting seignorage revenue were pursued, but as in the era of coined commodity money, their use depended on the cost and feasibility of alternative mechanisms to raise revenue.

I will provide a quick overview and discussion of the other roles of central banks below. The financial stability role evolved slowly both in terms of learning how to be a lender of last resort and in acceptance of the duty of (largely) private institutions to undertake that role. The monetary support role refers to the role of central banks in providing a medium of exchange and a medium for the settlement of interbank balances (or a medium for final payment). These are connected, but not identical, functions, and their relative significance has evolved over time. Most central banks were established in economies that were on a gold or specie standard or were seen as a mechanism to smooth transition to that standard. Today central banks issue fiat, not convertible bank notes. In some cases, central banks were created to provide a uniform medium of exchange, but that was not always important. Macroeconomic stability here refers to the use of the powers of the central bank either to affect real economic activity over the business cycle, or to affect the secular growth rate of the economy.

What will central banks look like in 20 years? There is an implicit tendency, at least in North America, to think that they will look more or less the same as they do today. Of course, it is accepted that there may be slight rejigging of targets (nominal GDP rather than inflation, or price-levels rather than dual mandates) or of instruments (once again, the 'unconventional' might become 'conventional'), but these are not existential changes. The history of central banking suggests that economists should be prepared for far more significant change, and in this paper I argue that history shows that the institution of central banking is far from immutable.

My goal is not to be predictive -but rather to encourage 'blue sky' thinking-. Just as some of the difficulties that led to the financial crisis in 2008 reflected the failure to use historical data (for example, long runs of data on defaults to calibrate risk models), the crisis that has been unfolding in Europe equally reflects a blindness to historical experience. In his presidential address to the Economic History Association, Barry Eichengreen noted that the International Monetary Fund (IMF) and Bank for International Settlements (BIS) are hiring historians, and this paper provides further evidence for the importance of that policy. Many central banks conduct extensive operational research (with high skill), but spend rather less attention on the consequences of the rapidly evolving social/political and economic environment in which they operate.

I will begin by assessing the foundational rationale for some of the major central banks in existence today, illustrating that many institutions are very different in structure/goal/ownership today than they were at their founding. The section III of the paper picks up the story in the early 20th century and shows that organizations that began for disparate reasons followed a more homogeneous path in the 20th century. The section IV describes the role of the changing technology of money in the changing role of central banks, and in the conclusion I briefly turn to the future of central banking.

II. THE ORIGINS OF CENTRAL BANKS

The central banks in the world today have a variety of different origins: differences in chronology and more interestingly, differences in the stimulus that led to their creation. Central banks were founded on the basis of fiscal need, in response to financial crisis, or political-economic crisis, or to address monetary needs. I will illustrate these differences with a set of central banks and then try to draw some over arching conclusions. I have chosen a subset of examples that indicate the range of difference, but it is far from comprehensive: First, three banks established before the 20th century: the Banks of England, France and Japan; and then, two that began in the 20th century, the Federal Reserve Bank of the United States and the Bank of Canada.

A. THE EARLY CENTRAL BANKS2

The Bank of England was created in 1694 by the Tonnage Act, which gave the proprietors a 12 year charter for the Bank of England, a private limited liability corporation (Wood, 2005). The bank agreed to lend its entire £1.2 million capital to the government at 8%, and received the right to issue notes or take deposits up to 100% of its authorized capital. The timing of the origin reflected both (a) the Glorious Revolution in 1688 which separated the government and the Royal purse and (b) the government's need for funds to fight the Nine Years War. The bank was first and foremost a fiscal initiative. The seignorage revenue from note issue -aided in amount by the monopoly- was shared between the private shareholders and the government. The bank's role in providing a medium of exchange and as financial stability agent were later developments.

While today central banks are most closely associated with the issue of notes that circulate hand-to-hand, it is important to remember that this is not their most critical function today and that it is not the continuation of a long historical tradition. Rather, it is the issue of a medium that can be used to settle debts between financial institutions that is the continuation of the tradition. The earliest notes issued by the Bank of England were not for a fixed (round) denomination, nor were they strictly to bearer. They were in that sense a little closer to cheques -drawn for the amount of a particular payment to an individual- but with the option for the bearer to redeem. These early notes were for amounts of £20 or more (£20 in 1700 would be worth £2,700 today, Williamson). By 1725, notes with a fixed denomination were issued (Feavearyear, 1931), and by 1729 bearer notes were circulating. But even in 1775, the smallest note was for £5 (say £500 today).

The bank did not issue small denomination notes, and it did not have a monopoly over either note issue or deposit banking. But it did have privileges: The Tonnage Act was followed in 1697 by an Act precluding chartering of any other bank -in exchange for a larger loan, (Wood, 2005). 1708 -no companies of more than 6 partners could issue notes.3 By 1775 the Bank of England held coin reserves for London bankers; Bank of England notes weren't legal tender; in case of a run on the provincial banks, they drew on London banks which drew coin out of the Bank of England; by 1800, only the Bank of England's notes circulated in London -private banks outside London circulated their own notes.

The Bank of England's acceptance of its role as lender of last resort is often assigned to the 19th century, but in fact, in a number of different instances in the 18th century, the bank faced runs: In 1720 (South Sea bubble), in 1745 (Bonnie Prince Charlie's win) and in 1797 the bank faced liquidity drains. These were met by combinations of (i) paying out silver to friends who brought it back in through the ¨back door¨; (ii) merchants public agreement to take the bank´s notes; (iii) government fiscal support.

The Bank of France was established just over 100 years later than the Bank of England, but its creation was similarly motivated by the existence of a strong national government in need of funds. Napoleon established the Bank in 1800 and gave the new bank a monopoly of note issue in Paris and any other district in which it would open a branch. The bank was privately held, but (this was Napoleon) the state maintained tight control over the bank and the Bonapartes were amongst the major shareholders. Writing in 1816, the then-governor of the bank, Jean Lafitte, described the bank's position this way: "perfect independence under legitimate surveillance of authority". The governor and two deputy governors, for example, were government appointed.

The French experience with paper money -the notes of the banks of John Law in the early 18th century and the more recent experience of the assignats- had not been good for the note holders. The Bank of France was created both to facilitate payments across France and to provide a source of funds for Napoleon. Importantly, the notes that were issued were for large denominations -even in the 1860s, the most common note was 1000ff, and the minimum denomination was 250ff. 4

The Bank of Japan was established in 1882, 15 years after the Meiji restoration. During those fifteen years a variety of monetary measures were undertaken, but none with the durability of the Bank of Japan. Bank notes were issued by both national banks -explicitly modeled on the US national banking system- and the government. Initially, the national bank notes were convertible into specie, but fiscal exigencies soon weakened that requirement to one of conversion into (inconvertible) government notes. Those notes depreciated rapidly during the Satsuma rebellion (1877).

As in the US following the 1907 panic, the Japanese government surveyed extant central banks to design a new central bank, and it concluded that the Bank of Belgium provided the best model.5 Evidence presented to the US National Monetary Commission (NMC) thirty years later stated that the bank was formed "for the purpose of withdrawing government paper money and national bank notes, changing and unifying these into paper notes having specie reserve." (Natsura, p. 157).

While creating a reliable and uniform currency was a central goal of the government in creating the bank, it undoubtedly helped that the bank provided an interest free ¥22million loan to the government and provided fund management services at no cost. Initially the Japanese government was the major shareholder in the bank, but subsequently the government sold its shares to the Imperial Household (Sakatani, 1910).

Although the Japanese memorandum to the NMC emphasizes that the Bank of Belgium was the role model, Goodhart (1987) points out that in many salient features the Bank of Japan was very different from the Bank of Belgium. The Bank of Belgium was owned by private shareholders, was relatively independent and paid close attention to profits. The descriptions of the Bank of Japan in the NMC accounts barely touch on the shareholders and depict the bank as largely a government supervised agent of government policy.

B. TWO LATER CENTRAL BANKS

The proximate reason for the establishment of the Federal Reserve System was the financial panic of 1907. In October 1907, some members of the New York Clearing House sought assistance from the clearing house itself -which was granted- and the following week the Knickerbocker Trust Company -not a member of the clearing house- suspended payments. A run began on other trust companies which, in turn, withdrew funds from their banks. Alarm in New York was stilled by a massive deposit of funds by J.P. Morgan, but then provincial banks began withdrawing from banks in New York. The withdrawals came at the time of year when the New York banks typically ran down their reserves to provide cash to the regional banks: during harvest season; and by the end of October, the New York banks suspended specie payments, as did banks in many other states.6 The restriction continued until January, 1908.

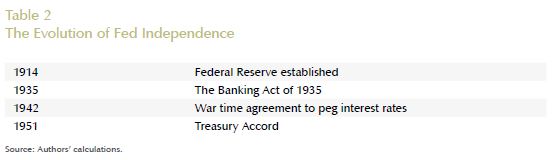

Between 1907 and 1908, GDP fell by 15% in the wake of the financial crisis which provoked an immediate call for monetary reform.7 That call led to the Aldrich-Vreeland Act of 1908 which created a transitional ability for banks to create emergency currency (the plan took effect on June 30, 1915, but notes were not issued under the Act until the outbreak of World War I, and Friedman and Schwartz (1963, p. 172) argue that these notes "probably prevented a monetary panic"); and consequently, a National Monetary Commission was set up to investigate US and international banking history, and to make recommendations for reform. Following discussion of the commission's repor, the Federal Reserve Act was introduced and passed in December, 1913, and the Fed opened for business in November, 1914.

The major concern of the monetary commission was the 'inelasticity' of the currency. There were two major rigidities in the US banking system that the Federal Reserve was intended to address: the lack of a central gold reserve and the inelasticity of the currency. The US banking system was largely comprised of unit banks, a system of small banks without branches. National banks in small towns or rural areas were required to hold reserves, but could hold some of these as (interest bearing) deposits in banks in large nearby cities designated as 'reserve cities', which in turn could hold a share of their reserves in one of the three designated 'central reserve city banks'. The resulting pyramiding of reserves was seen as a critical source of systemic fragility.

A second concern was the inelasticity of the currency. All the currency in circulation was comprised of national bank notes, which were required to be backed by over 100% in federal government bonds. When a depositor wished to withdraw funds from a bank, the bank could not simply print notes. The title of the Federal Reserve Act described itself as, "An Act to provide for the establishment of Federal Reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States and for other purposes".

The Federal Reserve system then was created primarily to increase financial stability, with lesser significance assigned to creating a common currency and establishing a fiscal agent for the government. Financial stability would be enhanced, in part, by having a more elastic currency -the ability to meet the seasonal demand for currency through increased supply of currency would eliminate the increase in interest rates every fall, which heightened the vulnerability of the system.8 In addition, the ability of banks to discount notes for cash at the Federal Reserve meant that banks had a source of liquidity in the event of a liquidity crisis. The particular structure of the system reflected the political environment of the day. The system comprises 12 regional Federal Reserve banks, each owned by the member banks in the region – and membership has been optional. The Federal Reserve Board comprises 7 governors, appointed by the President, confirmed by the Senate, and is responsible for bank supervision and oversight of the regional Federal Reserve banks.

The Bank of Canada is a relatively new institution that opened its doors in March, 1935. Above all, the bank was established as a response to the political challenges created by the Great Depression. Prior to the establishment of the bank, the many functions associated with central banking were absorbed by a variety of institutions. Bank notes were issued by the commercial banks and the clearing house for notes and cheques was organized by the bankers´ association. There were also some notes issued by the Department of Finance -Dominion notes- which had a monopoly on issues under $5, and which also issued large ($10,000+) denomination notes which were used in bank clearings. The Department of Finance also operated a discount window and lent Dominion notes to bankers for appropriate collateral.

There were a number of salient differences between the banking systems of the US and Canada. In the United States there were a large number of unit banks, in Canada there was a small number of branching banks. For example, in 1900 there were 9,101 banks in the US, serving 76 million people, while in Canada there were 35 banks with 708 branches, serving 5.3 million people. The notes of the Canadian chartered banks were supported by general assets, which gave the currency the 'elasticity' which was missing in the United States. Both systems experienced bank failures with losses to depositors (unsurprisingly, a higher number of US banks failed, but the value of depositor losses was similar); however, in Canada, bank failures did not lead to broad banking panics (Bordo, Redish and Rockoff, 1994).

During the Depression of the 1930s no Canadian bank failed, but the Depression was as severe in Canada as in the US, with a decline in real output of 25% and deflation of the same magnitude. In August, 1928, Canada suspended convertibility of the Dominion notes into gold and put tight controls on the export of gold.

Bordo and Redish (1987) assess three competing explanations for the establishment of the Bank of Canada: the need for a lender of last resort, the need for a monetary authority to compensate for the suspension of the gold standard, and a political rationale. They find that the first two forces were relatively muted: There was no perceived need for a lender of last resort – particularly in an environment where the existence of a central bank in the US had not prevented waves of bank failures and many bank runs; the suspension of the gold standard was viewed as temporary and some argued that, in fact, the need for a central bank was greater under the gold standard.9 The paper concluded that there was considerable evidence for the importance of a variety of political motives. Some academics and policy makers argued that Canada needed to be represented at international discussions on monetary affairs;10 others argued that a central bank was an important signal of national maturity; still others that a central bank would supply needed monetary stimulus; finally, the creation and success of a socialist party (the CCF), with a mandate to nationalize the banks, provided a clear impetus to the federal government to take action in the monetary arena.

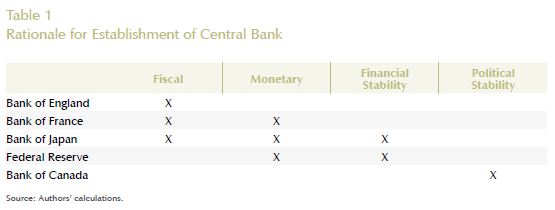

Table 1 summarizes the story to date, and at the risk of imposing an artificial order on events ex post, there seems to be a natural progression. The early central banks were established when there were few alternative sources of revenue and were exploited for that purpose. The US government had found ways to access seignorage revenue without the need for a central bank -by requiring that bank notes be backed by federal government bonds. Similarly, the Canadian government imposed a tax on bank note issues by the private banks which was an effective way to acquire a share of seignorage revenue.

But access to seignorage revenue was not the only rationale for creation of a central bank. The Banks of France and Japan were used to create a uniform medium of exchange across the country. In the US, the national banks had created a uniform system of bank notes before the founding of the Fed, but the US had a fractional reserve banking where deposits were a significant part of the money supply: The Federal Reserve was created to ensure that cheques cleared at par across the country, and more importantly to eliminate the seasonal stresses that the national bank note system had introduced.11 Finally, in Canada -and perhaps more generally for banks created in the 20th century- the primary objective was political stability.

While central banks were established for a variety of reasons, by the end of the twentieth century they were relatively homogeneous institutions.

III. CENTRAL BANKING IN THE TWENTIETH CENTURY

At the beginning of the twentieth century, the central banks of England, France and Japan were privately owned institutions that issued notes that were convertible into gold on demand. In each case, the bank had a monopoly over note issue and acted as the government's fiscal agent; in return for which the bank accepted some responsibility for monetary stability, but the relationship between state and bank was 'constructively ambiguous'. In the early twentieth century, the US, and then Canada, established central banks and the role of the central bank changed several times. By the end of the century, the relationship between the state and the central bank was much clearer -central banks were national institutions that were independent of the political process in their daily operations- and central banks were a fairly homogeneous set of institutions.

A. THE FIRST HALF OF THE 20TH CENTURY: EVOLUTION OF THE ESTABLISHED BANKS

Peter Temin has described the period from 1914 to 1945 as the second Thirty Years War and this period of warfare and depression had enduring effects on the central banks and their relationships with the state. By 1950, central banks had become creatures of the state and their goals were merged with the broader economic objectives of the state.

Until 1931 the Bank of England had maintained a fairly distant relationship with the state that enabled its existence, except during wartime. During the Napoleonic Wars the bank had been required to assist the government. The other area where the central bank's independence was challenged was in its role as lender of last resort. In 1873 Walter Bagehot argued that by virtue of its role as holder of the nation's reserve, the central bank should act as a lender of last resort; that is, in the face of a liquidity crisis it should lend freely, at a penalty interest rate, to other solvent but illiquid banks. Bagehot wrote of his frustration after the Overend Gurney Act during the 1866 crisis when the Bank of England had delayed helping illiquid financial institutions and had thus deepened the financial crisis. Some authors have argued that the absence of financial crises in Britain between 1867 and 1914, and in particular the bank's assistance to the market when Baring Brothers failed in 1890, reflected the bank's acceptance of its lender of last responsibility role. However, in fact the bank did not explicitly embrace that position, and the question of whether it accepted a public role remains open. In the twentieth century however, the relationship between the bank and the state was clarified. In 1931, after six years of issuing a convertible currency, the bank was subordinated to Treasury, and the gold standard suspended. The disconnect between a privately owned bank under government rule was finally over following the end of World War II when the bank was nationalized and monetary policy operated for the national purpose. Throughout most of the second half of the century the Chancellor of the Exchequer managed fiscal and monetary policy. The goals of monetary policy were macroeconomic, but the precise targets (the exchange rate, inflation, unemployment, monetary aggregates and instruments (interest rates, moral suasion, monetary base) varied. In 1997 the Chancellor granted independence over interest rate policy to the Bank of England.

The grant of independence reflected the orthodoxy that developed during the 'Great Moderation' of the 1990s/early 2000s. In the early 1970s, the last vestiges of attachment to the gold standard ended when the US abandoned the $35/oz and the following decade of widespread high inflation led monetary economists to argue that the economy needed a nominal anchor. The work of Kydland and Prescott (1977) and Barro and Gordon (1983) on the time consistency of optimal policy created the theoretical case for an independent central bank. Empirical work (e. g. Alesina and Summers (1983) supported the argument that the more independent a central bank, the lower the inflation rate. Notably, advocates of central bank independence wrote in (and about) an environment devoid of expensive military engagements, one in which the monetary role took central stage away from the financial stability role.

The Bank of France had less independence than the Bank of England in the 19th century, although it too was privately owned. Goodhart (1987) argues that in the 19th century the Bank of France evolved into a lender of last resort. He contrasts the refusal to help the Caisse Générale du Commerce et de l'industrie in 1847 with its more generous attitude towards the Société des dépôts et comptes courants and the Comptoir d'escompte in 1889 and 1891 respectively.

As in Britain, the events of the first half of the twentieth century changed the status of the Bank of France. Following World War I, the extent of the depreciation of the franc created heated discussions between the Governor of the Bank of France and the political authorities (Mouré, 1991). The extent of depreciation, and its obverse, the rate of inflation had immediate consequences for the distribution of wealth and (essentially) who would pay for the war, and the early twenties saw continual conflict between Treasury and the Bank as to how much the Bank would finance government debt. Finally, in 1928 the Poincare stabilization fixed the value of the franc at a value that enriched Treasury and eliminated the conflict between the Bank and Treasury until the mid-1930s, when after the election of the Popular Front the same conflict arose. In 1935, the Popular Front Government de facto nationalized the Bank, and (as in the UK) immediately after World War II, the bank was nationalized. In 1993, the Bank of France was granted independence from political processes and a mandate for price stability, as a prelude to joining the European System of Central Banks.

The Bank of Japan followed a similar path. As noted above, the Bank had limited independence from the outset, but even that was reduced in 1942 when the "Act of 1942" required the bank to act in the national interest -that is, to support the war effort. Following the war, a number of amendments to the Act of 1942 gave greater flexibility to the bank and, as in England and France, the major shift occurred in 1997 (effective 1998) when the bank's mandate was amended to incorporate both price stability and financial stability, and the bank was required to operate with 'transparency and independence'.

B. THE FIRST HALF OF THE CENTURY: THE NEW BANKS

The 'system' nature of the Federal Reserve led to a more complex set of debates as the Federal Reserve Board fought for power against the individual Federal Reserve Banks, as well as against the Federal government.

The Banking Act of 1935 granted new powers to the Fed and shifted power from the individual Federal Reserve Banks to the Board of Governors.12 The Act allowed the Board to set reserve ratios, to set maximum interest rates and to set lending policies. After the passage of the Act, all trade in government securities had to be approved by the Federal Open Market Committee (FOMC) (now comprising all of the board members and 5 regional presidents).

The Treasury Accord signed in March 1951 was an agreement between the Secretary of the Treasury and the Chairman of the Board of Governors of the Federal Reserve which ended the Fed's commitment to a fixed (low) interest rate on Treasury securities. The Accord was far from cordial. From the late 1940s, the Fed had worried about rising inflation and chafed at the ceiling on bond prices to which they had agreed during the war. Tensions were exacerbated as the Korean War was going badly, thus raising inflation fears. In late 1950, the Secretary of the Treasury declared publically that new debt issues would be financed at the existing rate. The New York Times reported: "[L]ast Thursday constituted the first occasion in history on which the head of the Exchequer of a great nation had either the effrontery or the ineptitude, or both, to deliver a public address in which he has so far usurped the function of the central bank as to tell the country what kind of monetary policy it was going to be subjected to" (Hetzel and Leach, 2001).13 Ultimately the issue came to a head when President Truman released a letter to the media stating that the Fed had agreed to keep interest rates at the existing level; The Fed refused to confirm this and in mid-February 1951, the Executive Committee of the Fed told the Treasury that "it was no longer willing to maintain the existing situation in the government security market" (Cited in Hetzel and Leach, 2001, p. 49). The impasse was ultimately resolved by McChesney Martin (Assistant Secretary of the Treasury) and Fed staff members who negotiated an agreement whereby the Fed would keep the discount rate at 1.75% through 1951 and would provide limited temporary support for longer term notes but not beyond $200m.

While typically less dramatic than the fight between the Federal Reserve and the Treasury, establishing the relationship between the Department of Finance and the Bank of Canada also took time and a very public dispute. The critical juncture occurred in 1960. In the late 1950s the Bank of Canada reacted to rising inflation (imported from the US -Korean War) by raising the bank rate -500 basis points in 18 months (Bordo et al., p. 320). The result was the appreciation of the Canadian dollar and high unemployment to which the federal government responded by fiscal expansion. The governor of the bank, James Coyne, argued publically that fiscal expansion was bad for the economy, while academic economists and most commentators argued publically that high interest rates were bad for the economy. The Minister of Finance asked for the resignation of the governor in May 1961, which the Governor refused to tender. The minister then introduced legislation declaring the position of Governor of the Bank of Canada to be vacant. The legislation passed the House of Commons in July, but was rejected by the Senate. The governor then resigned.

The new governor accepted the position conditional on clarification of the relationship between the government and the bank. The memo -which defines the relationship today- requires that should a conflict over monetary policy between the two occur the government would issue a directive to the governor dictating policy. The 'directive' must be published in the Canada Gazette and it is widely understood that the governor would then resign.

The directive power resolves issues of extreme disagreement, but is essentially MAD -mutually assured destruction- and does not actually address the more mundane determinants of monetary policy. Since 1991, that issue has been resolved implicitly. In 1991, the Minister of Finance and the Governor of the Bank of Canada issued a joint statement saying that for the following x number of years the bank would target x% inflation. Such agreements have been issued each subsequent five years. Indeed, the agreement was renewed in November, 2011, promising another 5 years of 2% inflation.

The Bank of Canada has spent much of the last 5 years considering alternative targets for prices -the target rate, price level versus inflation targeting, CPI vs. core targeting, length of horizon, width of bands- and has done some excellent research on these issues. Although there have been suggestions in the Parliament that the new mandate would include a requirement to consider financial stability or employment levels in addition to inflation, the bank and Minister of Finance have argued that 'flexible' inflation targeting allows such goals to be taken into account by the possibility of varying the horizon over which the bank returns the economy to the 2% target inflation level. Most central banks provided some fiscal benefit to the government but this was a stable amount, except during extraordinary times (in times of war) when further assistance was expected and, indeed, required. Central banks understood that they were the lender of last resort in the Bagehot sense of lending at a penalty rate to solvent but illiquid financial institutions. They did not see themselves as playing a macroeconomic role either in stabilizing the economy or in promoting growth. They had a monopoly over note issue but did not provide the nominal anchor for the economy as the gold standard played that role. Finally, the central banks were almost all privately owned, often predominantly by the private banking sector.

By mid-century the picture had changed. During the tumultuous period of war and depression all the central banks were expected to play a macrostabilization role, and after WW II the private central banks were nationalized, thus making it clear they were instruments of the state in peacetime as well as in wartime. Over the next few decades, central banks were expected to follow policies that fine-tuned the economy, keeping inflation and unemployment low. The experience of stagflation in the 1970s changed the attitudes of central bankers and by the 1990s the goal of most central banks was narrowly focused on low inflation. Once a single goal was accepted (that is, trade-offs no longer needed to be made), the case for independence of the central bank was easy to make. Economic theory and empirical evidence supported the argument that independent central banks lowered inflation, and Germany was the poster child for this case. The case for a European Central Bank became clearer. Finally, the 'great moderation' and widespread belief in the efficiency of financial markets reduced the significance attached to the financial stability role of the central bank. If markets could support illiquid (but solvent) financial institutions, then there would be no need for a lender of last resort.

IV. THE TECHNOLOGY OF MONEY

The nature of the medium of exchange has evolved over the last few centuries, and while I'm not sure what the implications of this are for central banking I'm pretty sure they will be profound. In the 17th century, throughout most of Europe, coin was the dominant medium of exchange, and the only means of final payment. Banks existed (notably in Italian cities), but they were banks of deposit rather than noteissuing banks. With the obvious exception of the European Central Bank, all the major central banks began operations during the period when note issues were tied to gold. The central banks did not see themselves as creating a nominal anchor for the economy -that was done by tying the definition of the unit of account to a weight of gold. Through the twentieth century the link to gold was attenuated to the point where in 1971 it disappeared (Redish, 1993). But the nominal anchor had never actually been the gold standard; instead, it was always the political commitment to maintain that unit of account.

The fiscal role of central banks dominated in the early days of central banking. In an economy whose primary form of money was coins, the fiscal authority could generate revenue by debasing the coinage.14 When bank notes supplemented the money stock, the state benefited by issuing the notes, by taxing notes, or by selling the right to issue notes.15 As deposits became the dominant form of money, the importance of seignorage revenue declined as alternative taxes became easier to raise. Today, mature central banks would not identify the earning of seignorage revenue as a significant goal.

As the nature of money changed, the methods to provide a nominal anchor changed in parallel. As long as money was coin, the challenges (other than addressing fiscal goals) were those of dealing with foreign exchange issues and with the effect of the wear and tear on the value of the standard. These were not easily resolved: at a broad brush level, erosion of the coinage led to a gradual debasement as the weight of coins of given nominal value declined.

The creation of bank notes and fractional reserve banking raised the challenge of how to control the quantity of money, as well as creating problems for financial stability. The monetary control problem was typically addressed through limits on the amount of note issue. Perhaps most famously, in the Act of 1844, the British government required the Bank of England to hold 100% gold reserves on note issues greater than £14million; other regimes required a fractional reserve against all notes. In the US, the federal government taxed the issue of state bank notes, and the national banks became monopoly providers of bank notes. In both countries, limits on bank note issue created incentives to develop other monetary media and chequable bank deposits became an important, and then dominant monetary medium.16

In the early post-WW II period, the reserve ratio was viewed as an important tool of monetary policy since it was argued that the stock of money was a reasonably constant multiple of the stock of reserves. This in turn encouraged the use of monetary aggregate targeting whereby control of the stock of reserves would control the rate of growth of the money stock. The result was again that induced innovation led to new monetary forms such as NOW accounts.17 When central banks targeted M1, M2 grew rapidly, as the assets in M2 were excellent substitutes for those in M1. Monetary aggregate targeting was abandoned after less than a decade in the countries that tried it.

Goodhart's law states that, "Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes" and was coined in the context of these attempts at monetary control. It likely applies to attempts to use capital adequacy ratios as well. For example, if equity (an expensive form of capital) must be held against assets depending on the risk weight they are assigned then there is a premium on finding assets whose risk is understated and on holding more of them. More significantly, there is an incentive to find ways to get risky assets off the balance sheet -for example, by securitization. Understandably, using credit ratings as a mechanism to weight assets put more burden on the credit rating mechanisms than they were designed to bear.18

V. CONCLUSION

Central banks have fulfilled a number of mandates -providing monetary unification, uniformity and stability, generating fiscal resources, acting as a tool for macroeconomic stability, and enhancing financial stability. In different periods, different motives have taken pride of place. In western economies the macroeconomic motive dominated after World War II; during the last two decades of the 20th century the monetary stability (e.g., inflation targeting, nominal anchor) goal dominated; then in the early 21st century the financial stability role dominated. The shift away from macroeconomic stability and fiscal contributions of central banks, combined with a belief that the 'market' would support illiquid but solvent financial institutions created an environment where central bank independence took pride of place. This in turn encouraged the creation of a central bank that was not tied to a particular sovereign and which had greater independence than any central bank to date -the European Central Bank.

The mandates of central banks have evolved in response to three factors: the existence of alternative sources of funds for the sovereign, the prevailing economic theory or broader set of philosophical beliefs, and the technology of money and of financial instruments more broadly. All three factors remain in play, and it is likely that central banks will continue to change their colours as their environments change.

COMENTARIOS

1 It was understood early on that debasement was a form of taxation and some medieval communities agreed to pay an alternative tax (monetagium) in explicit exchange for a commitment not to debase (Bisson, 1979).

2 Quinn and Roberds (2007) argue that the Bank of Amsterdam was the first bank to issue 'central bank money'. The bank was created under the auspices of the City of Amsterdam in 1619 and by 1659 receipts for deposits in the bank circulated and were traded. But the Bank of Amsterdam closed in 1819, and I have opted to discuss extant central banks.

3 This led to small 'country banks'; 1826 legislation allowed joint stock banks but not within 65 miles of London.

4 1000ff in 1860 would buy as much as roughly US$2,500 today.

5 This reflected the relative modernity of the bank and the absence of a federal structure in Belgium.

6 Suspension of payments did not mean that all payments were halted. The clearing house issued clearing house certificates which enabled cheques to clear. But deposits could not be withdrawn.

7 GDP data from Historical Statistics Series Ca211.

8 Work by Mankiw, Miron and Weil (1987) suggested that this objective was achieved.

9 In particular, Lord Macmillan who chaired the Royal Commission appointed to assess the need for a central bank stated that, "The gold standard was restored in a world which called for continuous direction and co-operation on the part of the various national authorities" (Canada, 1933).

10 For example, leading academic economist at Queens University wrote: "There are few countries more vitally interested in international cooperation in the monetary and economic fields than Canada, and yet we lack any institution which would permit effective participation in such cooperation".

11 The seasonal variation (that is, high in the fall) in US interest rates reflected the inelasticity of the note supply. Smith and Williamson (1994) show that in Canada where notes were backed by general assets there was no seasonal variation in interest rates. Condition of note issue in the US prior to the establishment of the national banking system varied by state (since banks were all regulated by states), but in many states it was on the basis of general assets.

12 Friedman and Schwartz (1963) saw the change of titles as indicative of this shift. Prior to the Act, the heads of regional banks were governors -the traditional title for heads of central banks- while the board members were 'board members'. Following the Act, the board went from being the Federal Reserve Board to the Board of Governors of the Federal Reserve comprised of governors rather than board members, and the individual banks were run by presidents, no longer governors.

13 In January 1951, Mariner Eccles, one of the Board members responded to a question asked by a congressional committee stating that, "[E]ither the Federal Reserve should be recognized as having some independent status, or it should be considered as simply an agency or a bureau of the Treasury. (U.S. Congress 1951, pp. 172-176).

14 The potential for unexpected/unrecognized debasement to generate short run profits, through higher rates of seignorage, as well as reductions in the real value of debt, is widely accepted. The potential for benefits through secular depreciation/debasement is more hotly debated. See for example, Miskimin (1984) and Sussman (1993).

15 See Sylla, Legler and Wallis (1987) for a description of the variation across US states in how the seignorage was earned indirectly by taxing banks.

16 In the Treatise on Money (1930), Keynes thought it reasonable to build models that assumed that coin and central bank notes were used as reserves by banks and all private individuals paid using cheques drawn on banks.

17 Negotiable Order of Withdrawal accounts were interest bearing chequing accounts that evaded rules on interest on demand deposits.

18 On the liability side of bank balance sheets, the evolution of the repo market has changed the nature of banking and the stabilization power of deposit insurance.

REFERENCIAS

1. Alesina, A.; Summers, L. "Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence", Journal of Money, Credit and Banking, vol. 25, num. 2, pp. 151-162, 1983 [ Links ]

2. Barro, R.; Gordon, D. "A Positive Theory of Monetary Policy in a Natural Rate Model", Journal of Political Economy, vol. 91, num. 4,pp. 589-610, 1983. [ Links ]

3. Betts, C.; Bordo, M.; Redish, A. "A Small Open Economy in Depression: Lessons from Canada in the 1930s", Canadian Journal of Economics, vol. 29, pp. 1-36, 1996. [ Links ]

4. Bisson, T. N. Conservation of Coinage: Monetary Exploitation and its Restraint in France, Catalonia, and Aragon (c.A.D. 1000-c.1225), New York, Clarendon, 1979. [ Links ]

5. Bopp, K. "Nationalization of the Bank of England and the Bank of France", The Journal of Politics, vol. 8, num. 3, pp. 308-318, 1946. [ Links ]

6. Bordo, M.; Redish, A. "Why did the Bank of Canada Emerge in 1935?", Journal of Economic History, vol. 47, num. 2, pp. 405-17, 1987. [ Links ]

7. Bordo, M.; Redish, A. "Credible Commitment and Exchange Rate Stability: Canada's Interwar Experience", Canadian Journal of Economics, vol. 23, pp. 357-86, 1990. [ Links ]

8. Bordo, M.; Redish, A.; Rockoff, H. "The US Banking System from a Northern Exposure: Stability versus Efficiency", Journal of Economic History, vol. 54, pp. 325-41, 1994. [ Links ]

9. Bordo, M.; Gomes, T.; Schembri, L. "Canada and the IMF: Trailblazer or Prodigal Son?", Open Economies Review, vol. 21, num. 2, pp.309-333, 2010. [ Links ]

10. Canada. Royal Commission on Banking and Currency in Canada, p. 59, 1933. [ Links ]

11. Feavearyear, A. E. The Pound Sterling, Oxford, Clarendon Press, 1931. [ Links ]

12. Friedman, M.; Schwartz, A. A Monetary History of the United States, New York, Princeton University Press, 1963. [ Links ]

13. Goodhart, C. The Evolution of Central Banking, Cambridge, MIT Press, 1988. [ Links ]

14. Hetzel, R.; Leach, R. "The Treasury-Fed Accord: A New Narrative Account", Federal Reserve Bank of Richmond, Quarterly Review, vol. 87, num. 1, pp. 33-55, 2001. [ Links ]

15. Katsura, M. "The Banking System of Japan" in Banking in Italy, Russia, Austro-Hungary and Japan (vol. 18, pp. 177-214), National Monetary Commission. [ Links ]

16. Kindleberger, C. Financial History of Western Europe, London, Allen and Unwin, 1984. [ Links ]

17. Kydland, F.; Prescott, E. "Rules Rather than Discretion: The Inconsistency of Optimal Plans", Journal of Political Economy, vol. 85, num. 3, pp. 473-492, 1977. [ Links ]

18. Mankiw, G.; Miron, J.; Weil, D. "The Adjustment of Expectations to a Change in Regime: A Study of the Founding of the Federal Reserve", American Economic Review, May, vol. 77, num. 3, pp. 358-374, 1987. [ Links ]

19. Miskimin, H. Money and Power in Fifteenthcentury France, New Haven, Yale University Press, 1984. [ Links ]

20. Mitchener, K.; Shizume, M.; Weidenmier, M. "Why did Countries Adopt the Gold Standard? Lessons from Japan", Journal of Economic History, vol, 70, num. 1, pp. 27-56, 2009. [ Links ]

21. Mouré, K. Managing the Franc Poincaré, Cambridge, Cambridge University Press, 1991. [ Links ]

22. Naruse, S. "The Banking System of Japan" in Banking in Russia, Austro-Hungary The Netherlands and Japan (pp. 149-175), Washington, National Monetary Commission, GPO, 1910. [ Links ]

23. Officer, L.; Williamson, S. Purchasing Power of Money in the United States from 1774 to 2010, Measuring Worth, 2011. [ Links ]

24. Quinn, S. Securitization of Sovereign Debt: Corporations as a Sovereign Debt Restructuring Mechanism in Britain, 1688-1750, ms,2006. [ Links ]

25. Quinn, S.; Roberds, W. "The Bank of Amsterdam and the Leap to Central Bank Money", American Economic Review, vol. 97, num. 2, pp.262-265, 2007. [ Links ]

26. Redish, A. "Anchors Aweigh: The Transition from Commodity Money to Fiat Money in Western Economies", Canadian Journal of Economics, vol. 26, num. 4, pp. 777-795, 1993. [ Links ]

27. Sakatani, B. "The Banking System of Japan" in Banking in Russia, Austro-Hungary The Netherlands and Japan, Washington, National Monetary Commission, GPO, pp. 141-148, 1910. [ Links ]

28. Sprague, O. "The Banking System of Japan" in Banking in Italy, Russia, Austro-Hungary and Japan (vol. 18, pp. 177-214), National Monetary Commission, 1910. [ Links ]

29. Sussman, N. "Debasements, Royal Revenues, and Inflation in France during the Hundred Years' War, 1415,1422", Journal of Economic History, vol. 53, num. 1, pp. 44-70, 1993. [ Links ]

30. Sutch, R. "Gross national product: 1869–1929 [Standard series]", Table Ca208-212 in S. B.Carter, S. S. Gartner, M. R. Haines, A. L. Olmstead, R. Sutch; G. Wright (Eds.), Historical Statistics of the United States, Earliest Times to the Present: Millennial Edition, New York, Cambridge University Press, 2006. [ Links ]

31. Sylla, R.; Legler, J.; Wallis, J. "Banks and State Public Finance in the New Republic: The United States, 1790-1860", Journal of Economic History, vol. 47, num. 2, pp. 391-403, 1987. [ Links ]

32. Timberlake, Rf. Monetary Policy in the United States, Chicago, University of Chicago Press, 1993. [ Links ]

33. Wood, J. A History of Central Banking in Great Britain and the United States, New York, Cambridge University Press, 2005. [ Links ]