Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.30 no.68 Bogotá Jan./June 2012

The Risk-taking Channelin Colombia Revisited*

Retomar el canal de toma de riesgo en Colombia*

Retomar o canal de tomada de risco na Colômbia*

Martha López

Fernando Tenjo

Héctor Zárate

*The authors are,respectively, researcher,Department of Macroeconomic Modelling,Banco de la República;Board of Directors member- Banco de la República;

researcher, Banco de la República.We thank Hernando Vargas, and Andrés González for comments on earlier drafts. We also thank participants to the 2nd BIS CCA conference on "Monetary policy, financial stability and the business cycle", Ottawa 12-13 may, 2011 for comments on earlier drafts.

The views expressed in the paper are those of the authors and do not represent those of the Banco de la República or its Board of Directors.

E-mail: mlopezpi@banrep.gov.co; ftenjoga@banrep.gov.co; hzaratso@banrep.gov.co.

Document received:15 February 2012;final version accepted:23 May 2012.

Levels of interest rates below historical norms may have enhanced financial instability in both developed and in developing economies during the 2000´s.

The risk-taking channel of monetary transmission policy is a recent theory that explains the interaction between risk perceptions of the financial system and monetary policy. This paper presents empirical evidence of the risk-taking channel of monetary policy using detailed information on consumer and commercial loans from the Colombian banking system. Using probit and duration models, we find that the banking system takes on more risk when the level of interest rates are too low. We also find that the response to interest rates is higher in the case of commercial loans.

JEL classification: E44, G21, L14.

Keywords: Monetary policy, lending standards,risk taking, duration analysis, probit models.

Niveles de tasas de interés por debajo de sus niveles históricos pueden haber contribuido a una mayor inestabilidad en economías tanto desarrolladas

como en desarrollo durante la década del 2000. El canal de toma de riesgo de la transmisión de la política monetaria es una teoría reciente que

explica la relación entre las percepciones de riesgo del sistema financiero y la política monetaria. En este artículo se presenta evidencia empírica de la

evidencia del canal de toma de riesgo utilizando información detallada de créditos comerciales y de consumo del sistema bancario en Colombia.

Mediante el uso de modelos probit y de duración encontramos que el sistema bancario toma riesgo cuando las tasas de interés se encuentran demasiado

bajas. También encontramos que la respuesta a las tasas de interés es más alta en el caso de los créditos comerciales.

Clasificación JEL: E44, G21, L14.

Palabras clave: política monetaria, toma de riesgo,análisis de duración, modelos probit.

Níveis de taxas de juros abaixo de seus níveis históricos podem ter contribuído com uma maior instabilidade em economias tanto desenvolvidas como

em desenvolvimento durante a década de 2000. O canal de tomada de risco da transmissão da política monetária é uma teoria recente que explica a relação

entre as percepções de risco do sistema financeiro e da política monetária. Neste artigo se apresenta evidência empírica da evidência do canal de tomada de risco utilizando informação detalhada de créditos comerciais e de consumo do sistema bancário na Colômbia. Mediante o uso de modelos probit e de duração, consta que o sistema bancário toma risco quando as taxas de juros se encontram demasiadamente baixas. Também consta que a resposta à s taxas de juros é mais alta no caso dos créditos comerciais.

Classificação JEL: E44, G21, L14.

Palavras-chave: política monetária, tomada de risco,análise de duração, modelos probit.

I. INTRODUCTION

Recent global financial crises have led to the need for a better understanding of the link between the monetary policy and the financial system. Levels of interest rates below historical norms and lack of regulation may have enhanced financial instability, which has, in turn, motivated some recent developments in monetary policy theory. One of these developments is the risk taking channel in the transmission of monetary policy, based on work by Borio and Zhu (2008), Disyatat (2010), Adrian and Shin (2009) among others. Particular emphasis has been placed on how policy actions impact banks' and other financial institutions' perceptions and attitudes on risk, leading to shifts in the supply of credit. The main hypothesis of this monetary policy transmission mechanism is that when interest rates are too low, the search for yield induces financial intermediaries to take on more risk by investing in riskier assets.

In addition, according to this channel, monetary policy transmission can be reinforced by two aspects: variations in the health of financial intermediaries in terms of leverage and asset quality, and variations in perception of risk and willingness to bear risk.

In a recent paper, López, Tenjo and Zarate (2010) found evidence of the existence of the risk taking channel of monetary policy in the case of Colombia. In the study, the authors use data for over 2 million commercial loans. The focus on commercial loans is crucial given that the proportion of commercial loans on total loans is about 50% in Colombia. Nonetheless, the behavior of consumer loans seems to be not only more sensitive to the monetary policy rate but they also represent a large proportion of total loans, 25%. Our interest in this paper is twofold. First we investigate if there is a risk taking behavior of banks in Colombia when they grant loans to households. Second, we compare the incidence of the risk taking channel in commercial and consumer loans.

The paper is organized as follows: the first section is this brief introduction. Section II presents the conceptual framework of the risk-taking channel of monetary policy and overviews the empirical evidence. Section III describes the empirical strategy of the paper. Section IV summarizes the timing and description of variables. Section V presents the main findings of the empirical work. Section VI presents the comparison of risk taking behavior between commercial and consumer loans. Finally, the conclusions of the paper are presented in Section VII.

II. THE RISK-TAKING CHANNEL:

THEORY AND EVIDENCE

There are two important ways in which low levels of interest rates may influence risk taking. The first is through search for yield. Nominal interest rates that are low compared to historical norms may create incentives for assets managers to take on more risk for contractual, behavioral or institutional reasons (for example to meet a target nominal return). "For example, in 2003-04 many investors shifted from lowrisk government bonds to higher-yielding, but riskier corporate and emerging market bonds. They were seeking to meet the nominal returns they had been able to achieve when interest rates were higher", Gambacorta (2009). At times when interest rates are low, the search for yield is often associated with the expansion of investments into riskier assets and borrowers as downside risks are played down, Disyatat (2010).

The second way is through the variations in financial health of financial institutions measured by asset quality and leverage. Borio and Zhu (2008) have emphasized this aspect by pointing out that monetary policy may be reinforced because it has an impact on the risk perceptions and the willingness to bear risk. One avenue through which such effects may work is via the impact of interest rates on financial buffers or the perceived vulnerability of agents to future economic shocks, Disyatat (2010). A reduction in the policy rate boosts asset and collateral values, which in turn can modify bank estimates of probabilities of default, loss-given-default and volatilities. Anticipation of higher economic activity may lower the risk of bankruptcy.

The body of literature detailing empirical evidence is growing. A study by Gambacorta (2009) finds evidence that, for a large sample of industrial countries, expected probability of default for banks was negatively related with long periods of low levels of interest rates during the 2007-2008 US financial crisis. Altunbas, Gambacorta and Marques (2009) analyze the link between short term interest rates and expected default frequencies using data for 600 European and US banks over the period 1999-2008. Similarly, Jimenez, Ongena, Peydró and Saurina (2009) provide evidence that Spanish banks grant more risky loans and reduce lending standards at lower levels of short term interest rates. Ioannidou, Ongena and Peydró (2009) find similar results in the case of Bolivia and for the case of Colombia, López et al. (2010) also find that low rates of interest rates are related to banks' risk-taking behavior.

III. EMPIRICAL STRATEGY TO ASSESS CREDIT

RISK-TAKING AT THE CONSUMER LOANS LEVEL

In order to test the existence of a risk-taking channel at the consumers loans level we outline four aspects. First, we use a Superfinanciera dataset (the banking supervisionagency in Colombia) recorded by each bank in the 341 form. Second, we define a measure of credit risk. Third, we address a number of steps that help us to identify supply of credit from its demand (using loan and borrower characteristics/identity and interactions with bank characteristics). Four, we define a measure of the monetary policy stance.

A. THE DATASET ON CONSUMER BANK LOANS

Consumer loans are discriminated into credit card loans, automobile loans and "other". The proportion of loans different to credit cards and automobiles is 73% of total consumer loans and it is a more homogeneous group in terms of maturity, amount and collateral (these kinds of loans does not have collateral requirements).

Therefore, we focus our analysis on these kinds of loans. We employ a stratified random sampling method to select a sample that consist of 131,265 consumer loans (13% of population). The sample statistics are expanded to the population in order to undertake the inference.

The dataset contains confidential information at loan level on each loan granted by all banks operating in Colombia during the period 2000.Q1-2011.Q2. We have borrower, bank and loan information. For each borrower, we identify the number of bank connections, the age of the borrower in his financial system and the credit history. For each loan we have information on the default status, amount, and maturity. For bank characteristics, we have information on the size of the banks, leverage level, non-performing loans and interbank position.

B. THE CREDIT RISK MEASURES

We use two approximations to credit risk-taking. First, we measure credit risk-taking with ex ante borrower-level proxies. As a first approximation, we employ probit models to analyze whether a loan is granted to a borrower with bad credit history (depending on default on another loan in the previous 6 months) or without credit history. However, even though low levels of interest rates may lead to more lending to risky borrowers, this does not imply risk-taking per se because the net-worth of the risky borrowers also improves.

Hence, in order to isolate the change in credit risk-taking, we employ duration

models that allow us to analyze the impact of interest rates on loans not only at origination but also during the life of the loan. In this case, we can measure the impact of short-term interest rates prior to origination on the loan hazard rate, which is the probability that a loan defaults in a period of time given that it did not default before. In addition, this possibility further contributes to econometric identification. Certainly, when policy interest rates are high at the origination of the loan it may lead to a lower risk-taking behavior by banks (as its net worth is lower), but it also results in higher risk-taking once the loan is outstanding due to the borrowers' net worth being lower.

C. SUPPLY AND DEMAND IDENTIFICATION

PROBLEM AND STEPS TO APPROACH IT

The rich information contained in the Superfinanciera dataset allows us to mitigate the identification problem that we face in the econometric estimation. The identification problem consists in the difficulty to isolate supply from demand responses to changes in policy rates when the level of credit in the economy adjusts to the new policy conditions. However, four different steps allow us to conduct a proper identification.

First, lower short-term interest rates result in higher loan demand from both risky and safe borrowers. Therefore, if the demand for loans from risky borrowers is higher than the demand from safe borrowers, and if the banks´ appetite for risk remains unaffected, we would expect a tightening in lending standards. Hence, controlling for lending standards, such as amount and maturity of loans helps to mitigate the identification problem, Jimenez et al. (2009).

Second, given that we have information on the identity of borrowers and other borrower characteristics, it is possible to absorb the variations in the risk of the set of borrowers over the monetary policy cycle.

Third, as in Jimenez et al. (2009), we see the extent to which the strength of banks'balance sheet and moral hazard problems, proxied by bank size, affects the sensitivity of their risk-taking behavior to monetary policy shocks.

Finally, we use the information on borrower credit history to obtain an indicator that allows us to identify how the monetary shocks induce changes in the allocation of banks' lending between risky and safe borrowers. Comparison of this indicator with the evolution of short term interest rates gives us a good approximation of the risk taking behavior of banks.

D. THE MONETARY POLICY STANCE

Causality between policy interest rates and credit risk-taking usually runs in both directions. When the monetary authority systematically reacts to credit market considerations, policy interest rates are not exogenous. However, for the sample period that we are analyzing, the monetary authority in Colombia did not systematically react to credit-risk. Only during 2007 did the central bank take some measures to deal with excessive credit growth.

Nonetheless, in order to have an exogenous measure of the stance of the monetary policy, we adopt a measure proposed by Gambacorta (2009) which is the deviation of the real interest rate from its natural level. This measure allows us to have an explicit level of interest rate that we consider too low. A low level of interest rate would be a level that is below the natural rate of interest. The natural rate of interest is the one estimated by Gonzalez, Melo, Rojas and Rojas (2010) using a semi-structural model for a small open economy. In this case, "the natural rate of interest is defined as the interest rate that does not affect the output dynamics in the short run and assures output and inflation convergence to their long run equilibrium", Gonzalez et al.(2010).

IV. TIMING AND DESCRIPTION OF VARIABLES

A loan l by a bank b is granted to borrower j in quarter t. If T denotes the time to maturity of the loan, default would occur in quarter t + T.

We present three complementary analyses. We use probit models to see the extent to which the stance of monetary policy at the origination of a loan (time t - 1) explains the probability that borrowers with recent bad credit history or no credit history are granted a loan at time t. The ratio of loans granted to risky borrowers vis a vis safe borrowers given the monetary policy stance strengthens identification. Duration models differentiate the impact of monetary policy at the origination of the loan (t - 1) and during the life of the loan (t + T - 1).

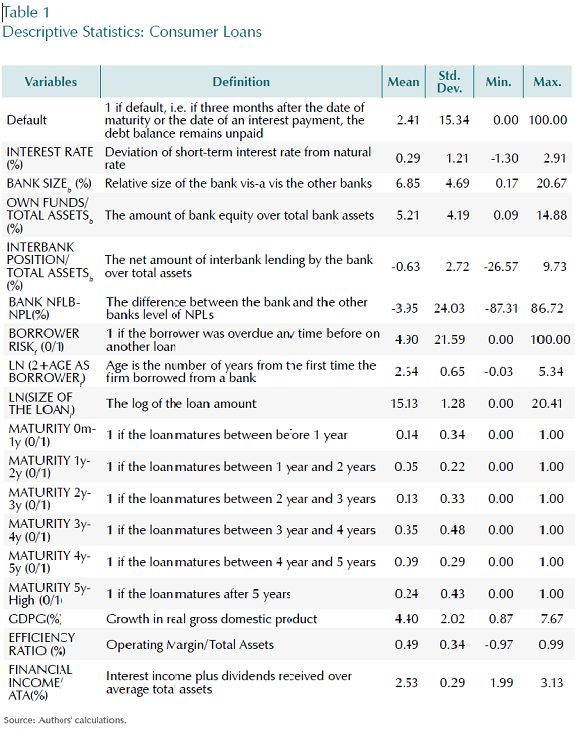

The definitions and descriptive statistics of the dependent and independent variables are presented in Table 1. As independent variable we use the stance of monetary policy measured as the deviation of the real short-term interest rate from its natural level. As controls we use variables related to banks´ characteristics and variables that help us to absorb some demand factors. These control variables are linked to borrower and loan characteristics. We also control for the business cycle represented by the GDP growth rate.

Credit risk-taking may also vary from bank to bank. For example, small banks may have more appetite for risk and banks with higher own fund at stake may take lower risks. Some bank characteristics included as control variables for banks are SIZE (each bank total assets/ bank system total assets), OWN FUNDS/TOTAL ASSETS (the amount of bank equity over total assets), a measure of risk appetite measured by BANK NPLb-NPL (the difference between the bank and banking system non-performing loans) and INTERBANK POSITION (which is bank net interbank lending).

Another valuable feature of our dataset is that it allows us to include borrower and loan characteristics that help to disentangle supply and demand effects as the composition of the pool of borrowers and loans may change over time. The variable LN (1+NUMBER OF BANK RELATIONSHIPS) allows us to identify the number of bank connections of each borrower. The variable LN(2+AGE AS BORROWER) measures the age of the borrower in the financial system. As loan characteristics, we include the loan amount, LN(SIZE OF THE LOAN) and maturity of the loans using dummies for 1 to 2 years, 2 to 3 years, and 4 to 5 years, benchmark being short-term loans from 0 months to 1 year.

V. RESULTS

A. DISCRETE CHOICE MODELS

We start by analyzing the evidence provided by the probit models where we link the loans to borrowers with recent bad credit history (defined as a borrower who was in default in the six months previous to the date he/she obtained a loan) or no credit history to the interest rate at origination, period t -1. We also include the control variables mentioned above. Results are presented in Table 2.

The negative coefficient on the interest rate constitutes one of our main results. When interest rates are low, banks grant more loans to borrowers with recent bad credit history (RBCH) and to borrowers with no credit history (NCH). Controlling for variables related to bank behavior, borrower characteristics and lending standards, it is possible to say that it is very probable that the remaining variation in credit is due to supply effects. Moreover, using our cross-section information, it is possible to perform a triple interaction between RBCH borrowers, interest rates and bank size, and establish which banks will be more prone to take on risk.

In the case of the variables related to banks' characteristics our findings are the following: In column I of Table 2, the coefficient on the variable BANK SIZE, indicates that small banks grant more loans to riskier borrowers than large banks. Banks with a higher ratio of OWN FUNDS to TOTAL ASSETS grant fewer loans to riskier borrowers and banks with non-performing loans (NPL) above average persist in risky borrowing.

With respect to the variables that absorb some of the variation in loans due to increased demand, we have most of the expected results. Borrowers that have many bank connections are likely to have been performing poorly recently. Similarly, older borrowers in the financial system are likely to have been performing badly. With respect to adjustment in lending standards in response to lower quality borrowers, the positive sign for the coefficient on LOAN SIZE indicates that when a risky borrower is granted a loan, banks do not adjust their lending standards to smaller loans, thus taking more risk. The adjustment to higher standards, however, seems to take the form of a shorter maturity for loans to lower quality borrowers.

Finally, to further identify supply effects, we use cross-sectional variation in bank characteristics in two triple interactions. First a triple interaction between bank size, interest rate and borrower risk, and then a triple interaction between banks leverage, interest rate and borrower's risk. Columns I and II in Table 2 present the results. We find that the positive coefficient on the interaction imply that when interest rates are low, small banks grant more loans to riskier borrowers. That is, smaller banks react more strongly to expansionary monetary policy in terms of risk taking as suggested by Rajan (2006). Similarly, model II in Table 2 shows that the same applies to banks with higher leverage ratios.

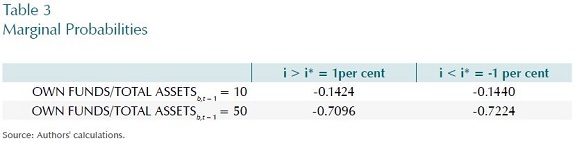

This latter interaction points to an interesting policy implication. Table 3 illustrates the effect of different combinations of policy stance (policy rate 1% above or below the natural rate) and leverage (10 or 50 for the variable OWN FUNDS/TOTAL ASSETS) on the marginal probability that a bank grants a loan to a risky borrower.The results suggest that policy rates above the natural rate, combined with higher capital requirements for banks, greatly contribute to prevent risk-taking behavior in credit markets.

B. DURATION MODELS

Although the results from the discrete choice models suggest the existence of a risk taking channel, it is necessary to take into account two fundamental aspects of the lending activity. First, banks grant more loans to riskier borrowers at lower policy rates because they perceive an improvement in borrowers' balance sheets and, therefore,a lower probability of defaults on loans. Therefore, to establish whether the banks have a higher risk appetite, we need to determine whether the individual loans have higher or lower probability of default.

Second, since average loan maturity may change over time, more risk-taking would entail lending at longer maturities. Hence, we need to analyze credit risk taking employing duration models to assess how the hazard rate is affected by monetary policy.

1. The Hazard Function

Following Jimenez et al. (2009), we analyze the time to default of the individual bank loan, or "loan spell", as a measure of risk. A default event occurs if three months after the date of maturity or the date of an interest payment, the debt balance remains unpaid. The hazard rate is effectively a per-period measure of credit risk-taking and has an intuitive interpretation as the per-period probability of loan default provided the loan âsurvives' up to that period. We rely on a parametric Weibull specification to determine the shape of the hazard function with respect to time. The Weibull distribution allows for monotonically positive or negative duration dependence.

Because some loans may be subject to repayments, it is possible that we cannot observe a default on these loans. Such a loan spells can be considered right censored.

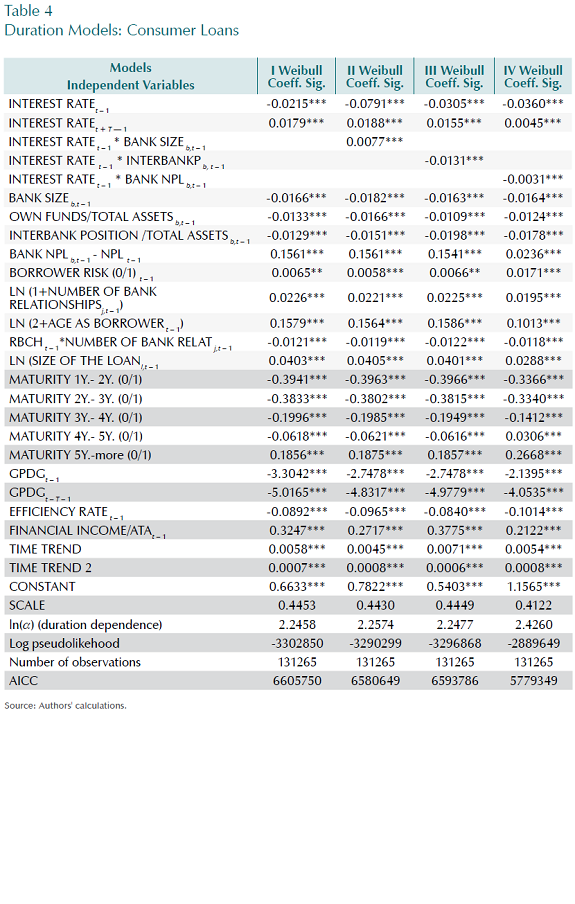

2. Duration Models Results

The results for duration models are reported in Table 4. Our main findings correspond to the first two rows in the table. First, when interest rates are low, the probability of default of new loans increases. The estimated coefficient on INTEREST RATE t - 1 in column I is -0.0215. Second, when interest rates are low the probability of default of outstanding loans is lower. The estimated coefficient on INTEREST RATE t + T - 1 in column I is 0.0179. In this sense, it is necessary to highlight that the risk taking channel is a medium-term process. In the short term the impact of lower interest rate is to decrease the probability of default of outstanding loans, but in the medium term, the number of riskier loans granted increases.

With respect to the variables that correspond to bank characteristics, the results suggest that smaller banks, with lower own funds and non-performing loans higher than the average have more risk appetite. This is an expected behavior, as banks with more funds at stake are less willing to risk their assets. Small banks that are more exposed to moral hazard problems have higher probabilities of default.

The results for borrower characteristics are in line with the results in the probit models and help to disentangle the supply effect. Borrowers with more bank connections exhibit higher probability of default and, as indicated by probit models,banks grant more loans to these borrowers. Similarly, older borrowers are riskier according to the duration model and the probability that the banks grant more loans to borrowers with RBCH when they are old in the financial system is higher according to the probit models.

With respect to loan characteristics, which are related to lending standards, when there is higher demand for loans, the results are mixed. When the loan amount is large, the probability of default increases and, according to the probit models, the probability of granting loans to RBCH borrower increase when the loan amount is large. This is evidence of risk taking behavior. In addition, long-term loans are riskier than short-term loans and, according to the probit models banks do adjust their lending standards with this respect.

The probability of default of both new and outstanding loans is negatively related to the growth rate of the GDP. This is an indication that a more dynamic economic activity mitigates risk taking behavior of banks.

Finally, in columns II, III and IV of Table 4, we present the results of duration models including interactions between interest rates and bank characteristics. Theory suggests that banks' propensity to adjust credit risk-taking in response to monetary policy conditions may depend upon bank size, liquidity and non-performing loans. These interactions further contribute to addressing identification problems, Jimenez et al. (2009).

Smaller banks not only take more credit risk but, when interest rate are low, their appetite for risk increases. Furthermore, banks that rely more on the interbank market take more risk. This behavior is reinforced with the stance of monetary policy. Banks with a relative higher ratio of non-performing loans seem to continue in their ways by granting loans with higher hazard rates. Monetary policy, however, counteracts this behavior.

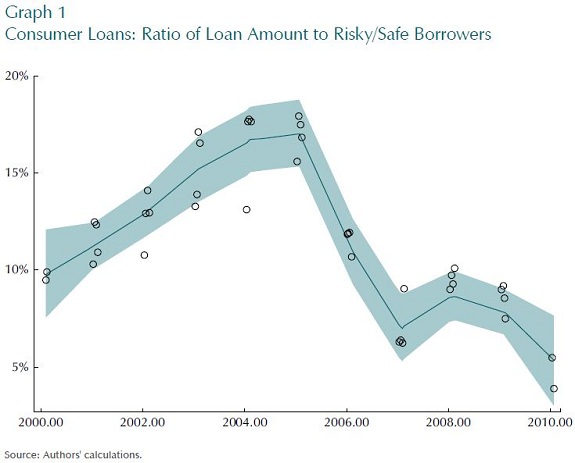

C. RISK TAKING AND THE SUPPLY OF LOANS TO RISKY BORROWERS

Next, we present the evolution of the supply of loans to risky borrowers relative to safe borrowers during the sample period (2002.Q1-2011.Q2). In Graph 1, we observe that during the 2004-2006 period, the supply of loans to risky borrowers relative to safe borrowers increased from 12% to 16%. This happened after a long period of low interest rates. After 2007, when the monetary policy stance was more restrictive, the risk-taking behavior of banks seems to have decreased. This constitutes suggestive evidence that in the case of consumer loans, banks' appetite for risk indeed moved according to the level of the short term interest rates. It is important to stress that even though during 2011, consumer lending increased considerably, the risk taking behavior of banks was similar to that observed in 2007. This may be due to the fact that the short term interest rate was higher than the natural rate until march 2010.

VI. COMPARISON BETWEEN COMMERCIAL AND CONSUMER LOANS

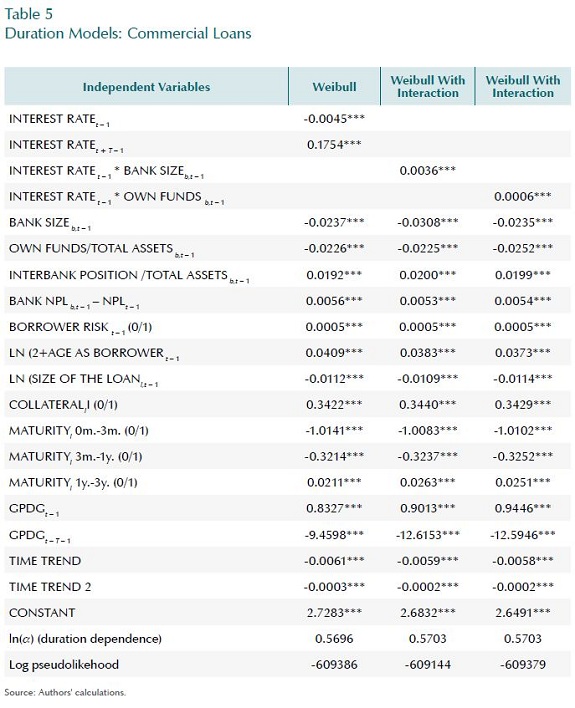

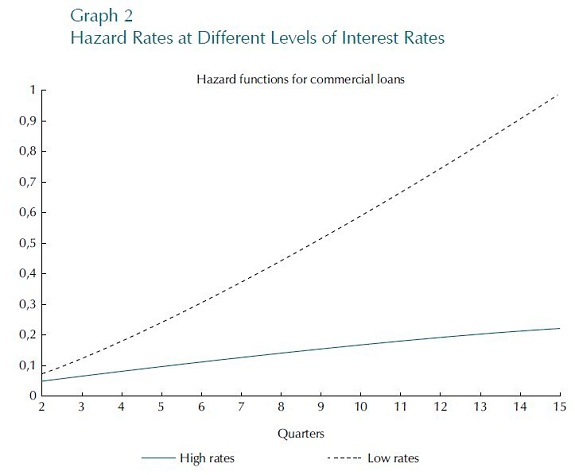

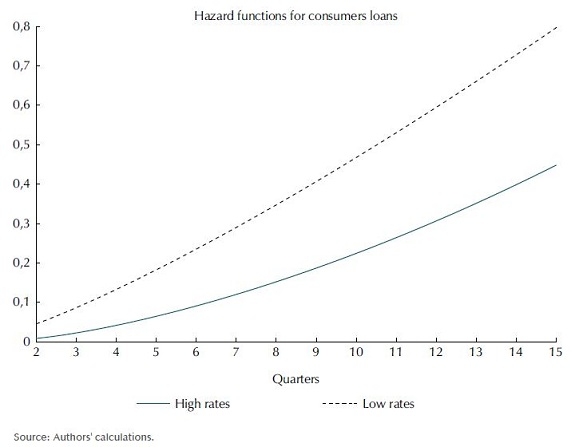

In order to be able to compare the results obtained by López et al. (2010) for commercial loans, we reproduce here the resulting duration analysis that was(Table5). Interestingly, the effect of an expansionary policy stance on the probability of default of commercial and consumer loans is the same: low interest rates increase this probability for new loans and decrease it for those already granted.

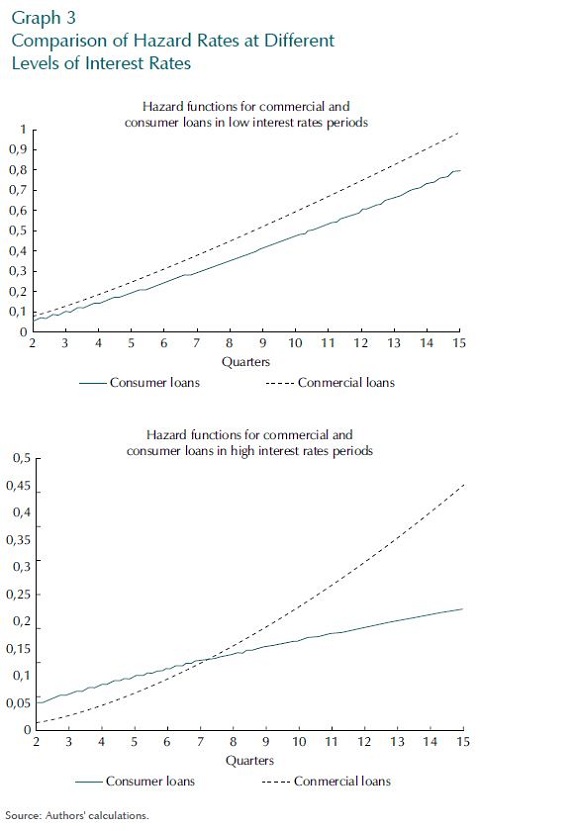

In addition to this, bank, loan and borrower characteristics, the control variables in both exercises, also display similar results. This means that whatever evidence there is of a risk-taking channel of monetary policy in Colombia applies to both types of lending. There is, however, a substantial difference in their response to monetary policy shocks. In Graph 2, we present the corresponding hazard rates for commercial and consumer loans for periods when the short term interest rate was low and when it was above the natural interest rate. The reaction of the hazard rate to the level of interest rates is stronger in the case of the commercial loans. As we can see in Graphs 2 and 3, consumer loans are less responsive to the monetary policy stance.

VII. CONCLUSIONS

This paper contributes to the growing empirical literature on the risk taking channel of monetary policy, and is the first paper that investigates the evidence of this channel in the case of consumer loans. We also compared our results with the evidence found in the case of commercial loans in López et al. (2010) and we conclude that the response of commercial loans to monetary policy rates is stronger than in the case of consumer loans.

We use the Superfinanciera 341 form, a dataset that contains information on commercial and consumer loans since 2002, and information on the difference between the policy interest rate and the natural interest rate as a measure of monetary policy stance.

By controlling for bank, loan, borrower and macroeconomic characteristics, we found evidence that, prior to origination, lower short-term interest rates induce banks to soften their lending standards and grant more loans to borrowers with recent bad credit history or no credit history. We also analyzed an indicator that measures the ratio of the amount of loans granted to risky borrowers to the amount granted to safe borrowers and find that when interest rates are low for a long period of time the indicator increases. More importantly, we found that, in these circumstances banks grant loans with a higher hazard rate (default probability).

In the case of outstanding loans, prior to origination, lower interest rates imply lower credit risk. When interest rates are low the default probability of these loans is lower. Therefore the impact of monetary policy is different for new and for outstanding loans.

This affects credit risk in the economy. At the beginning, when the amount of outstanding loans is larger than the volume of new loans, lower interest rates decrease credit risk. However, in the medium-term, as new loans increase, an expansionary monetary policy leads to higher credit risk.

In addition, bank size affects risk taking behavior. Small banks take on more extra risk when interest rates are low. This may be due to the fact that these banks face more moral hazard problems. We find evidence that when interest rates are low, small banks grant more loans to risky borrowers.

Finally, a comparison between the hazard rates for consumer and for commercial loans shows that when interest rates are low, the hazard rate of commercial loans is significantly steeper than the hazard for consumer loans. The opposite happens in the case of high interest rates. This means that in order to discourage risk taking behavior of banks in the case of the consumer loans, a more aggressive monetary policy or more instruments are required to achieve the goal.

REFERENCES

1. Adrian, T.; Shin, H. "Financial 1. Intermediaries and Monetary Economics", Staff Reports, num. 398, Federal Reserve Bank of New York, October, 2009. [ Links ]

2. Altunbas, Y.; Gambacorta, L.; Marques, I. D."An Empirical Assessment of the Risk-taking Channel", paper presented at the BIS/ECB conference on "Monetary policy and financial stability", 10-11 September, 2009. [ Links ]

3. Borio, C.; Zhu, H. "Capital Regulation, Risktaking and Monetary Policy: A Missing Link in the Transmission Mechanism", BIS Working Papers, num. 268, December, 2008. [ Links ]

4. Diamond, D.; Rajan, R. G. "Money in a Theory of Banking", American Economic Review, num.96, pp. 30-53, 2006. [ Links ]

5. Disyatat, P. "The Bank Lending Channel Revisited",BIS Working Papers, num. 297, February,2010. [ Links ]

6. Gambacorta, L. "Monetary Policy and theRisk-taking Channel", BIS Quarterly Review,December, 2009. [ Links ]

7. Gonzalez, E.; Melo, L.; Rojas, L.; Rojas, B."Estimations of the Natural Rate of Interest in Colombia", Borradores de Economía, num. 626,2010. [ Links ]

8. Ioannidou, V.; Ongena, S.; Peydró, J. "Monetary Policy, Risk-taking and Pricing: Evidence from a Natural Experiment", paper presented at the NBER Summer Institute, Cambridge, MA,2009. [ Links ]

9. Jimenez, G.; Ongena, S.; Peydró, J.; Saurina, J."Hazardous Times for Monetary Policy: What Do Twenty-three Million Bank Loans Say About the Effects of Monetary Policy On Credit Risk-taking?", paper presented at the American Finance Association Meetings, San Francisco,2009. [ Links ]

10. López, M.; Tenjo, F.; Zárate, H. "The Risktaking Channel and Monetary Transmission Mechanism in Colombia", Ensayos sobre Política Económica, vol. 29, num. 64, 2010 [ Links ]