Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.32 no.74 Bogotá Jan./June 2014

Analyzing the Exchange Rate Pass-through in Mexico: Evidence Post Inflation Targeting Implementation

Analizando el traspaso del tipo de cambio en México: evidencia tras la implementación de la política de inflación objetivo

Sylvia Beatriz Guillermo Peóna,* and Martín Alberto Rodríguez Brindisb

a Profesor and Researcher, Facultad de Economía, Benemérita Universidad Autónoma de Puebla, Puebla, Mexico

b Profesor and Researcher, Escuela de Economía y Negocios, Universidad Anáhuac, Oaxaca, Mexico

* Corresponding author. E-mail addresses: silvia.guillermo@correo.buap.mx; sguiller@ucla.edu (S.B. Guillermo Peón).

History of the article:Received October 24, 2013 Accepted May 19, 2014

ABSTRACT

This paper presents an analysis of the exchange rate pass-through mechanism for the Mexican economy after the formal adoption of inflation targeting policy. In particular, this research work analyzes how a change in the nominal exchange rate depreciation is transmitted to domestic prices along the distribution chain of pricing. The analysis is carried out using a recursive Structural Vector Autorregression with exogenous variables (recursive SVAR-X) model, which aims at the estimation of structural impulse-response-functions as a tool to analyze the degree and speed of the effect of exchange rate depreciation changes on domestic prices. Additionally, variance decompositions are computed to capture the relative importance of exchange rate depreciation shocks in explaining inflation fluctuations. Our results show that, for the period of analysis (after the formal adoption of inflation targeting in Mexico), the exchange rate pass-through to consumer prices is quite small and fast and exchange rate surprises are not relevant to explain consumer price inflation variation.

Keywords: Exchange rate pass-through in Mexico, Structural VAR-X models, Impulse-response functions.

JEL Classification: E31, F31, F41, C32.

RESUMEN

Este trabajo de investigación presenta un análisis del mecanismo de traspaso de movimientos del tipo de cambio para la economía mexicana después de la implementación formal de la política de objetivos de inflación. En particular, este trabajo de investigación analiza cómo un cambio en la tasa de depreciación del tipo de cambio nominal se transmite a los precios locales a lo largo de la cadena de precios. El análisis se lleva a cabo utilizando un modelo VAR estructural recursivo con una variable exógena (SVAR-X), cuyo objetivo es la estimación de las funciones impulso-respuesta estructurales como una herramienta para analizar el grado y la rapidez de los efectos en los precios por los cambios en la depreciación del tipo de cambio. Además, la descomposición de varianzas se lleva a cabo para captar la importancia que los choques en la depreciación del tipo de cambio tienen en las fluctuaciones de la tasa de inflación. Nuestros resultados muestran que, para el periodo de análisis (después de la adopción de la política de objetivos de inflación en México), el traspaso del tipo de cambio a los precios del consumidor es muy pequeño y rápido y que las sorpresas en el tipo de cambio no son relevantes para explicar la variación de la inflación en precios al consumidor.

Palabras clave: Traspaso del tipo de cambio en México, Modelos VAR-X estructurales, Funciones impulso-respuesta.

Clasificación JEL: E31, F31, F41, C32.

1. Introduction

Domestic price stability is a key element to consider in the design of monetary policy, and the fact that exchange rate changes affect inflation dynamics makes the understanding of the exchange rate pass-through (ERPT) mechanism a subject of particular interest for monetary policy makers, especially in small open economies like Mexico. Additionally, the understanding of how nominal exchange rate changes are reflected in domestic prices of goods and services provides elements to analyze the transmission mechanism of monetary policy on real exchange rate behavior, and hence on the real sector of the economy.

The exchange rate pass-through can be understood as the degree to which exchange rate changes are passed on into domestic prices along the distribution chain. Exchange rate shocks may affect prices at different stages both directly as well as indirectly. The conventional transmission mechanism of the exchange rate works in two stages. In the first stage the exchange rate changes have a direct effect on import prices and in the second stage, the mechanism works through its impact on producer prices and consumer prices.

This paper presents an analysis of the ERPT mechanism for the Mexican economy after the formal adoption of inflation targeting. In particular, using a data set from January 2001 to March 2013, this research work analyzes how a change in the exchange rate depreciation is transmitted to domestic prices along different stages of the distribution chain of pricing.

The analysis is carried out using a recursive Structural Vector Autorregression with exogenous variables (recursive SVAR-X) model which, unlike the traditional VAR model with exogenous variables, allows us to impose overidentified restrictions on the contemporaneous matrix of coefficients in order to improve estimation results. The SVAR-X framework aims at the estimation of structural impulse-response-functions as a tool to analyze the degree and timing of the effect of exchange rate depreciation changes on domestic prices along the distribution chain. Additionally, variance decompositions are computed to capture the relative importance of exchange rate depreciation shocks in explaining inflation fluctuations.

Given that Mexico is an oil exporter country and given the relevance that this commodity price has in the country's supply of foreign currency, our model includes the oil price index as exogenous variable in the system of equations. The recognition of the impact of oil prices on Mexico's exchange rate and on the other variables in the model represents an important contribution to the literature on ERPT for Mexico. And because this study aims at finding evidence on how the exchange rate changes are passed on into prices along the distribution pricing chain, three basic price indexes are taken into account and are the center of the empirical analysis: Import Prices, Producer Prices and Consumer Prices. Additionally, a measure of domestic economic activity is included as well as the interest rate which is the monetary policy instrument. The data sample consists of monthly observations starting from January 2001 as we are interested in analyzing the size and speed of the ERPT once the inflation targeting policy is implemented in Mexico.

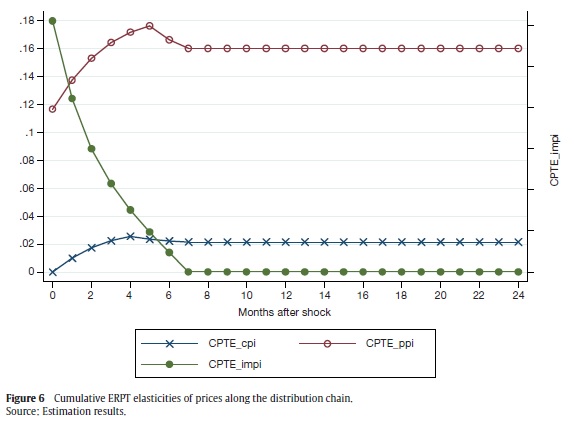

Based on the estimated cumulative structural impulse responses and following Capistrán et al. (2012), we estimated the cumulative ERPT elasticities. Our results show that the ERPT to import prices is nearly complete, as its corresponding cumulative pass-through elasticity is 0.97 on impact and it decays to 0.91. This result is in line with other studies for Mexico. In regard producer prices, our results show a smaller cumulative pass-through elasticity close to 0.12 on impact and increasing to 0.17 six months after the shock. And finally, the corresponding elasticity on consumer prices is zero on impact and it increases to its highest value of 0.026 after four months and then stabilizes around 0.021 because consumer price responses are not significant afterwards. This implies that, at most 2.6 percent of a change in the exchange rate is passed onto consumer prices four months after the shock which is a very small and short effect of the exchange rate depreciation on consumer prices. The estimated variance decompositions show that exchange rate depreciation shocks are a very important determinant of the variance of import price inflation, while they moderately explain producer price inflation variation, and do not explain (statistically) the consumer price inflation variance. This result provides evidence that, for the period of analysis (after the formal adoption of inflation targeting in Mexico), exchange rate surprises are not relevant to explain consumer price inflation variation. Thus, according to our findings, not only the size of the ERPT declines along the distribution chain of pricing, but also does the share of variance explained by exchange rate shocks.

The paper is organized as follows: section 2 presents a brief theoretical background and literature review; section 3 presents a detailed explanation of the methodology based on a SVAR-X approach used to assess the size and speed of the ERPT along the distribution pricing chain; in this section we also present estimation results of the structural impulse response functions and variance decompositions which are used as analytical tool to assess the size and speed of the pass-through of exchange rate shocks to prices; and because we believe that theory as well as empirical research findings must help to improve policy design, in section 4 we present some comments regarding the ERPT implications on the real exchange rate behavior; in particular, we develop some arguments to explain why a very small exchange rate pass-through on consumer prices does not imply that policymakers can implement a RER targeting policy in an effort to gain competitiveness and to benefit export-oriented industries. Finally, conclusions are presented in section 5.

2. Background

By the end of 1994, Mexico was forced to abandon the exchange rate peg regime adopting a new floating rate regime instead. Under this situation, Banco de México faced the challenge of providing the economy with a nominal anchor to achieve financial and price stability (Ramos-Francia and Torres, 2005). Monetary authorities' efforts were concentrated on reducing inflation and in 2001 Banco de México announced the formal adoption of an inflation targeting framework1 which has substantially helped to anchor inflation expectations (Capistrán and Ramos-Francia, 2010). Several empirical studies have presented evidence showing that, once inflation targeting was implemented in Mexico, the transmission mechanism of monetary policy has changed (Gaytán, 2006; Sidaui and Ramos-Francia, 2008) in the sense that monetary policy instruments are more effective in reducing the impact of shocks. In particular, Capistrán et al. (2012) "find that the exchange rate pass-through seems to have decreased substantially from 2001 onwards, which coincides with the adoption of an inflation targeting regime by Banco de México."

The monetary transmission mechanism can be defined as the way in which policy induced changes in short-term interest rates or the money stock affect economic activity and inflation through several channels2. One of the most important transmission channels is the exchange rate where changes in this variable could have inflationary and trade implications. This is the reason why the understanding of how exchange rate shocks affect domestic prices becomes a very important issue when designing monetary policies.

The ERPT can be understood as the degree to which exchange rate changes are passed on into domestic prices along the distribution chain. A high degree of pass-through can generate a depreciation-inflation spiral (as it was experienced in Mexico during the 80s and early 90s) thus affecting the inflation target. In such a case, the design of monetary policy must be coordinated with the foreign exchange policy to counteract the inflationary as well as trade implications of exchange rate shocks. On the other hand, a low degree of exchange rate pass-through allows the monetary policy actions to control inflation, to be more independent of exchange rate fluctuations (Capistrán et al., 2012).

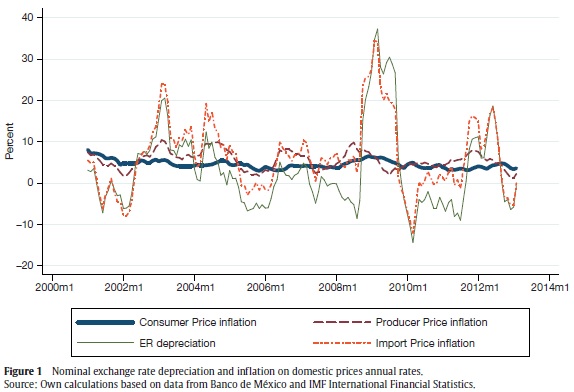

Exchange rate shocks may affect prices at different stages both directly as well as indirectly. The conventional transmission mechanism of the exchange rate works in two stages. In the first stage the exchange rate changes have a direct effect on import prices, and in the second stage, the mechanism works through its impact on producer prices and consumer prices. The assumption that shocks are, at least partially, passed-through via previous stages may provide insights for both the adjustment speed and the size of the pass-through to prices at different stages (Hahn, 2003). Figure 1 shows the time path from January 2001 to March 2013 of inflation on domestic prices and the nominal exchange rate depreciation in Mexico. As we may observe, inflation on domestic currency prices of imported goods follow the exchange rate depreciation very close, while the producer and consumer price inflations appear to be less affected by the exchange rate depreciation during the time span of our study.

As mentioned, the most direct way in which nominal exchange rate changes are transmitted onto domestic prices is through domestic currency prices of imported goods. How the exchange rate affects domestic prices via import prices depends to a large extent on the pricing behavior of foreign competitors of importable goods. Under a pricing to market scheme (Krugman, 1987) foreign firms deliberately set prices in different countries with an eye to their competitors in the local markets. Thus local importers and/or foreign firms' distributors fix the import price in the local currency of the market they are selling to, and price discrimination might exist. Depending upon their market power, foreign firms are forced to absorb foreign exchange fluctuations. In this case, the ERPT to import prices will be low and could be zero in an extreme case. On the other hand, when prices of imported goods are quoted in foreign currency and are sold to consumers at the going market exchange rate, any change in the exchange rate will be transmitted to the consumer prices of the importing country. In this case the ERPT to import prices would be complete. Most of the studies exploring how exchange rate changes affect import prices of goods generally have found that pass-through to import prices is incomplete, implying that import prices are less volatile than exchange rates (Campa and Goldberg, 2008).

Empirical literature findings for industrialized and developing countries report that the ERPT declines along the distribution chain (Choudhri et al., 2005; Hahn, 2003; Rowland, 2004; Wolden, 2006; McCarthy, 2006). The degree of pass-through is usually the highest for import prices, lower for producer prices and lowest for consumer prices. Two factors may explain the differences in the size of the pass-through along the distribution chain (Hahn, 2003). The first one refers to the share of prices in the index that are affected by the exchange rate shock. The share of tradable goods (that are likely to be more affected by exchange rate shocks than non-tradable goods) tends to decrease in price indices along the distribution chain. The differences in share of tradable goods between each price stage are often attributed to local distribution costs. Distribution costs include much more than transporting goods across countries. They include wholesale and retail services, marketing and advertising and local transportation services. All these costs (of non-tradables) taken together could lead to high distribution margins, meaning that local distribution costs represent a high fraction of the retail price for consumption goods (Burstein et al., 2003). The second factor affecting the pass-through size along the distribution chain is the number of stages that have to be passed. Because at each price stage the pass-through seems to be incomplete, then the more stages to pass-through, the smaller will be the size of the shock effect in the final price stage.

The pricing behavior (pricing power) of foreign competitors of importable goods, the share of tradable goods at each price stage and the number of stages that have to be passed along the distribution chain, are microeconomic factors affecting the size of the ERPT to domestic prices. However there is substantial literature explaining the relationship between the ERPT (size and trend) and macroeconomic factors. Taylor (2000) examines "the possibility that lower and more stable inflation is a factor behind the reduction in the degree to which firms 'pass through' (to their own prices) both price increases at competing firms and cost increases due to exchange rate movements or other factors." The main point of Taylor's paper is that lower inflation has led to lower pass-through. The author presents a simple microeconomic model of price setting to show that the low inflation observed in many countries in the 1990s may itself have reduced the measured pass-through or pricing power of firms. According to Taylor's model, the pass-through and the persistence of costs and/or price changes are directly related. When firms decide how much to adjust their prices, greatly take into account expectations of future costs and price movements. A depreciation will raise the costs of imports evaluated in domestic currency units and if the depreciation is viewed as temporary, the firms will pass through less of the depreciation in the form of higher prices. Hence, less persistent exchange rate fluctuations (less persistent costs fluctuations) will lead to smaller exchange rate pass-through sizes (low inflation). But Taylor's study also presents econometric evidence showing a reduction in the persistence of aggregate inflation as the inflation rate has been reduced. Therefore, lower inflation is associated with lower persistence of changes (shocks) in costs in the economy; and again, if firms perceive a shock to the exchange rate as temporary because there is a low inflation rate in the economy, this will lead to a smaller ERPT size. In this sense, Taylor's model explains why a change to a lower inflation environment (e.g. due to an inflation targeting policy) may lead to a lower degree of persistence of shocks to prices, hence decreasing the size of the ERPT. A test of Taylor's hypothesis is not the aim of this paper, but there is a substantial empirical literature addressing this issue. For example, Choudhri and Hakura (2006) used a general equilibrium framework based on new open-economy macroeconomic models as theoretical framework and a large database from 1979 to 2000, for 71 countries (developing and industrial), to explore how inflation affects the pass-through, and found evidence of a positive and significant association between the pass-through and the average inflation rate across countries in the sample. Campa and Goldberg (2005) use data from 1975 through 2003 for 23 OECD countries (Mexico among them) to provide cross-country, time series, and industry-specific evidence on the pass-through of exchange rates into import prices. Consistent with Taylor's (2000) arguments, Campa and Goldberg's findings show that pass-through into import prices is lower for countries with low average inflation and low exchange rate variability. The authors also found evidence that pass-through rates have been declining over time in some of the OECD countries, and short-run exchange rate pass-through elasticities rise with price inflation (or higher money growth rates). More evidence on how the ERPT exhibits a decline as a shift to a low inflation environment occurs can be found in Bailliu and Fujji (2004), Gagnon and Ihrig (2004)3, Baqueiro et al. (2004)4, Pinto (2007), and Frankel et al. (2012).5 A study by Gaytán and González (2006), on data for Mexico, shows evidence that there was a major structural change in the transmission mechanism around the date of formal adoption of the inflation targeting framework, and after this change, real exchange rate fluctuations have had smaller effects on the process of price formation.

There have been other contributions to the literature exploring the determinants of the ERPT to consumer prices. In their 2010 study, Deveraux and Yetman argue that sticky prices represent a key determinant of exchange rate pass-through. These authors describe their model in a two-equation dynamic system in domestic price inflation and the real exchange rate. When the model is calibrated to data from low inflation countries, the findings are that the principal determinant of low pass-through is the slow adjustment of prices. When the model is calibrated to a wider set of countries, including both low-inflation and high-inflation countries, the model implies that exchange rate pass-through is increasing in average inflation, but at a declining rate.

How are the size and speed of the ERPT measured? The econometric techniques used to model and to analyze the ERPT to domestic prices can be broadly divided into four categories (Mwase, 2006): single equation econometric methods, VAR models, structural VAR models, and dynamic stochastic general equilibrium models. For the Mexican case, the ERPT has been analyzed using univariate models and VAR models. Early studies like the one by Garcés (2001) found that the exchange rate was the most important channel of monetary transmission mechanism. Using a data set from 1985 to 1998 (pre-inflation targeting policy implementation data set), he estimated that approximately 68 percent of a nominal depreciation was transmitted to consumer prices6 after 36 months (65 percent and 80 percent of this long run impact was reached in months 12 and 18 respectively). However, recent studies have shown that, after inflation targeting was formally adopted in 2001, the ERPT to prices has decreased in a significant way (Pinto, 2007).7 Sidaoui and Ramos Francia (2008) set up two VAR model versions (a basic one with five endogenous variables, and an extended VAR with eight endogenous variables). Using data for the period 1996 to 2006, their results show that prior to 2001 (pre-inflation targeting formal adoption), a one percent exchange rate depreciation generated a long-run increase in prices of around 0.8 percent, and after 2001 (post-inflation targeting formal adoption) the cumulative effect on prices of a one percent nominal depreciation is close to zero. A more recent study by Capistrán et al. (2012) presents an analysis of the ERPT also using a basic VAR approach. Their results based on orthogonal impulse response functions show that, after inflation targeting policy was implemented, the exchange rate impact on consumer prices is statistically insignificant.

3. Analyzing the ERPT Under a Structural VAR-X Model Approach

3.1. The Structural VAR-X Model

The starting point of our analysis is a six-endogenous variable structural VAR model with the oil price index as exogenous variable (SVAR-X) model. The choice of the variables was based on previous works for different countries by Hahn (2003), and Ca'Zorzi et al. (2007), previous work for Mexico by Capistrán et al. (2012), and keeping in mind that the analysis particularly aims at estimating the effect of changes in the exchange rate on domestic prices. To capture the effects of the real side of the economy the model includes the Global Indicator of Economic Activity for Mexico (igae8) as part of the endogenous variables set and the oil price index (oilp) as exogenous variable. Because oil exports are an important source of foreign currency for Mexico, oil price changes (strongly) affect the exchange rate and hence may affect the ERPT mechanism along the distribution chain.9 To capture the impact of monetary policy, the model includes the short run (nominal) interest rate (i_rate).10For the Mexican case, the formal adoption of inflation targeting policy in 2001 seems to have changed the way exchange rate fluctuations are passed onto domestic prices (Gaytán and González, 2006; Sidaui et al., 2008). Hence, excluding the monetary policy from the model could bias our results on the ERPT.

The model also includes the nominal exchange rate Pesos/USD (ex_rate), which together with the price indices of all stages of the distribution chain —i.e. import prices11 (impi), producer prices (ppi), and consumer prices (cpi)— are key variables in our analysis. With this, the model recognizes that shocks may affect prices at different stages both directly as well as indirectly via previous price stages. Hence, the adjustment speed as well as the size of the pass-through to prices at different stages could be different.

The model setup is based on the time series properties of the data, which were assessed using Augmented Dickey-Fuller Tests12 (ADFT) for each variable in the model.13 All variables, except the interest rate, were expressed in natural logs. The tests results are presented in Appendix B. Summarizing the results we can say that, for the period of analysis, and except for the interest rate which is integrated of order zero I(0), all variables are integrated of order one, I(1). Based on the unit root properties of the variables a suitable SVAR-X model for our analysis is setup in log differences. The interest rate however, is considered in levels. Additionally, and given that we have monthly observations, we use the twelve-seasonal difference (or difference of order twelve) of each I(1) variable; that is, for the k-th I(1) variable in the system, Δ12 ykt = ykt - ykt-12. Because the first difference (with respect to its twelve lag) of the natural log of a variable can be treated as an approximation of the percentage change in that variable, we will refer to Δ12 ykt as the annual growth rate of ykt. Therefore, the data set for our model consists of monthly observations of annual growth rates. Finally, the data sources are Banco de México, INEGI and The International Monetary Fund (data description and summary statistics are presented in Table A1, Appendix A).

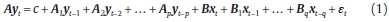

The structural form model can be expressed as:

or

where

is the vector of K=6 endogenous variables, L is the lag operator, A is the K×K matrix of contemporaneous effects, A1, A2, ... , Ap are K×K matrices of dynamic effects between the endogenous variables; xt = (Δ12oilpt) is the vector of M=1 (in our model) exogenous variables, B, B1, ... , Bq are the K×M matrices (K×1 vectors in our model) of contemporaneous and dynamic effects related to the exogenous variables;14 εt is a K×1 vector of structural shocks, and in particular, εt is a linear combination of the reduced form VAR disturbances ut, that is:

where

For a proper choice of A, εt has a diagonal covariance matrix Σε, and a vector moving average (MA-X) representation of the model in (1) will be based on the structural shocks εt and the exogenous variables and given by:15

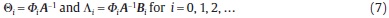

where16

and using the lag operator equation (6) can be expressed as:

Both Θ(L) and ∧(L) are infinite polynomials in the lag operator L, where each matrix of Θ(L) is of size K×K and each matrix of L(L) is of size K×M. Also, the elements of the Θi matrices represent the responses to structural shocks εt. On the other hand, the Li matrices contain the effects that changes in the exogenous variables have on the endogenous variables. "Everything else held constant, a unit change in the m-th exogenous variable in period t induces a marginal change of dkm,i units in the k-th endogenous variable in period t + i. The elements of the Li matrices are therefore called dynamic multipliers" (Lütkepohl, 2005, p. 392).

Finding A such that εt has a diagonal covariance matrix Σε is the conventional approach to finding a model with contemporaneously uncorrelated disturbances which focuses in modeling the contemporaneous relations between the observable variables directly. Therefore, if the appropriate choice of A translates into an identified structural form of model (1), the corresponding structural impulse-responses will be unique.17 Normalization restrictions (writing the k-th equation of (1) with ykt as the left-hand side variable) together with a Wold causal ordering (recursive structure), provide the K(K+1)/2 necessary restrictions to uniquely identify the structural shocks and impulse-responses. The recursive structure in our model would imply that the annual growth rate of IGAE (Δ12igaet) may have an instantaneous impact on all other variables in the model, and the interest rate (i_ratet) as monetary policy instrument may also have an instantaneous impact on all other variables except on IGAE, and so on. The variables ordering as presented in expression (3) is chosen following Hahn (2003) and Capistrán et al. (2012). In particular, the annual growth rate of IGAE is ordered in first place in our model (Hahn, 2003; Peersman and Smets, 2001; Capistrán et al., 2012) implying that policy shocks (through interest rates), shocks on the nominal exchange rate and on prices have no contemporaneous impact on the real economic activity. The interest rate is ordered in second place in our system as we expect the monetary policy variable to have a contemporaneous impact on the exchange rate and prices.

The exchange rate is ordered in third place, and this allows us to analyze how its changes are passed on into domestic prices along the distribution chain. Hence, exchange rate shocks may contemporaneously affect prices along the distribution chain.18 Finally, we have import prices, producer and consumer prices, representing the distribution chain ordering.

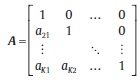

Thus, we can define A as a lower triangular matrix:

This set of restrictions imposed on the matrix of contemporaneous effects (A) such that εt = Aut has a diagonal variance-covariance matrix, provide just-identified structural shocks εt. Hence, this set of restrictions also ensure just-identified impulse-responses which are qualitatively the same as the orthogonalized impulse-responses based on a Cholesky decomposition of the variance-covariance matrix of the reduced form VAR-X disturbances19 Σu.

However, the reason to use an SVAR-X model in our study relies on the fact that it allows us to place some additional short run constraints —in addition to the traditional recursive structure— to help us improve the estimates of contemporaneous effects (those unrestricted elements of matrix A), and hence help us to improve the estimation of the structural impulse-response functions (IRFs). In other words, we estimate an overidentified SVAR-X model to analyze the structural IRFs. The lag order of the model is 2, and it was chosen according to the Akaike Information Criterion (AIC) and the Final Prediction Error (FPE) criterion.20 Additional restrictions on the matrix of contemporaneous effects A were determined following the sequential elimination of regressors procedure suggested in Brüggemann et al. (2003) and Lütkepohl (2005). By finding out what contemporaneous coefficients are statistically insignificant (post-estimation), we defined the overidentification restrictions for our SVAR-X model. The sequential elimination of regressors procedure also allows us to focus efforts on a search for restrictions on the underlying VAR-X parameters.21 The aim at this stage is to specify an underlying VAR-X model containing all necessary right-hand side variables and as parsimonious as possible; a model which could also help us to improve the accuracy of the implied impulse-responses (Brüggemann et al., 2003). The procedure involves testing zero restrictions on individual coefficients in each of the seven equations. At each step of the procedure a single regressor was sequentially eliminated in one equation22 if its corresponding P-value was higher than 0.1. We ended up with the underlying VAR-X results showing significant unconstraint coefficients of variables at the 10% significance level and none of the equation-level model statistics (F) fail to reject the null hypothesis at 1% significance level. In regard the overidentified restrictions, the procedure results showed that the economic activity growth rate contemporaneously affects the consumer price inflation only; the interest rate contemporaneously affects the exchange rate depreciation rate only; import price inflation is contemporaneously affected by the exchange rate depreciation only and producer price inflation is contemporaneously affected by import price inflation. Finally the consumer price inflation is contemporaneously affected by all variables except the interest rate and the exchange rate depreciation23. The likelihood ratio test of overidentifing restrictons (7 restrictions) reported a P-value of 0.748, implying that we fail to reject the null hypothesis that any overidentified restrictions are valid. Tables A2 and A3 in Appendix A show estimation results for the underlying VAR-X coefficients (after the elimination of 49 insignificant regressors) and short-run (contemporaneous) effects respectively.

3.2. The Effect of Exchange Rate Movements Into Prices: Impulse-Response Analysis

Using the SVAR-X estimation results, the transmission mechanism of the exchange rate movements into domestic prices along the distribution chain are estimated through the corresponding structural impulse-response functions. It is convenient at this point to recall that the structural impulse-response functions are obtained from the estimated elements of Θi in equation (6) and these are also functions of the contemporaneous and dynamic estimated coefficients (as shown in expression (7) and footnote 16).

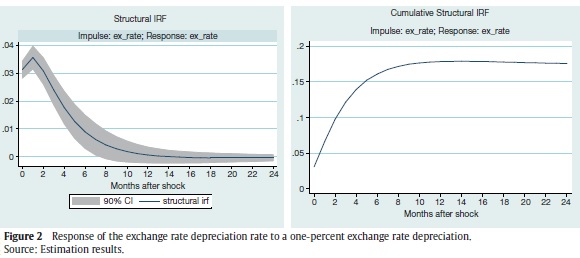

The system is perturbed by a one-time unit shock on the exchange rate, which represents a one-percentage point24 increase in the exchange rate, and we analyze how the shock changes the time path of import price, producer price and consumer price inflations. Point estimates of the impulse-responses and their corresponding 90% confidence intervals are calculated for a time horizon of 24 months. Because structural shocks are standardized to one-percent shock, the vertical axis in figures displaying the cumulative IRFs indicates the estimated percentage point change in the respective response variable due to a one-percent shock, after s periods.

Figure 2 shows how the exchange rate reacts to its own 1% depreciation shock. The shock causes a series of small increases in the annualized exchange rate depreciation (Δ12ex_ratet) that last for 7 months and responses are insignificant from thereafter. Thus, considering significantly different from zero responses only, the cumulative response of the exchange rate reaches its maximum (almost 17 percent) 7 months after the shock.25 As regards the lastingness of this response, our result shows a shorter effect of the exchange rate on itself compared to the one reported by Capistrán et al. (2012); when using a sample from 1997 to 2010 for Mexico (a time span that includes pre and post inflation targeting data), these authors report that the exchange rate response to its own shock lasts for 12 months if only significant responses are taken into account.

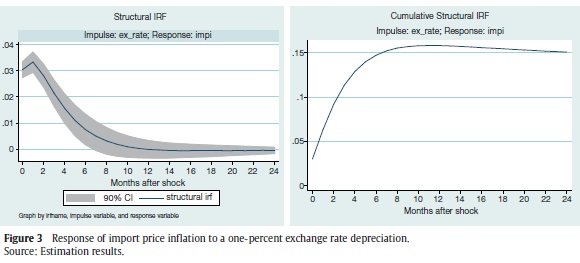

3.2.1. Import Price Inflation Response

Figure 3 displays the response of import price inflation to a one percent increase in the exchange rate, and we may say that it is very similar to that observed for the exchange rate (as response to its own shock). The one percent depreciation shock also causes a series of small increases in the annualized import price inflation lasting for 6 months (increases are not significant from that point on). Thus, considering significant responses only, the cumulative response of import prices to the exchange rate depreciation shock is 15.2 percent, which is very close to the cumulated response of the exchange rate depreciation itself. This result provides evidence that the ERPT to import prices is nearly complete.

3.2.2. Producer Price Inflation Response

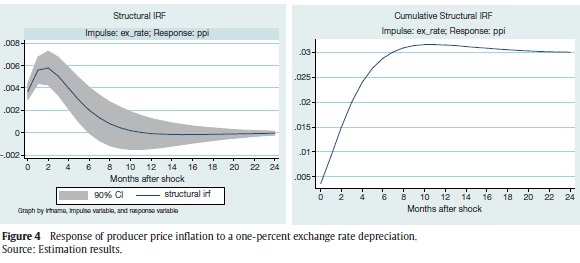

Figure 4 shows the response of producer price inflation to the exchange rate shock and we may observe that not only the degree of ERPT is smaller compared to the previous price stage (imports), but the persistence of effects is one month shorter, implying a faster adjustment of producer prices compared to the adjustment of import prices. This time, a 1% depreciation shock causes very small, but statistically different from zero, monthly increases on producer price inflation that die out after five months because effects are insignificant from the sixth month on. The impact effect of the pass-through is 0.37 percentage points which accumulates to 2.7 percentage points five months after the shock (again, considering significant responses only).

3.2.3. Consumer Price Inflation Response

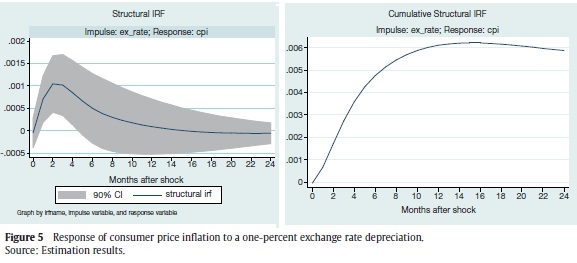

Finally, the response of consumer price inflation to an exchange rate depreciation shock is depicted in Figure 5. The one percent increase in the exchange rate has a very short and small effect on consumer prices. Responses after the shock are statistically significant (at 10% significance level26) from month 1 to 4 only 27 and the accumulated significant response on consumer price inflation is barely 0.36 percentage points. Thus, we may say that the adjustment process of consumer prices takes only four months after the shock. Summarizing the results, an exchange rate depreciation shock has a much larger impact on import prices compared to the impact on the second stage of the distribution pricing chain (producer and consumer prices).

3.3. Cumulative Pass-Through Elasticity

In order to provide a better understanding and interpretation to the degree of the ERPT along the distribution chain, we calculated the cumulative elasticity of each price index with respect to the exchange rate shock as suggested by Capistrán et al. (2012). The cumulative exchange rate pass-through elasticity (CPTE) s periods after a shock that took place at time t is defined as follows:

Where Δ%Price Indext,t+s is the cumulative inflation change (in the corresponding prices, i.e. import, producer and consumer) s periods after the shock, and Δ%ex_ratet,t+s is the cumulative exchange rate depreciation change s periods after the shock. In other words, the CPTE at period s is the ratio of the cumulative response of the corresponding price inflation to the cumulative response of the exchange rate depreciation, both evaluated s periods after the exchange rate shock. Because the accumulated inflation response can be interpreted as the percentage change in the corresponding price index (at period t + s) due to a one percent exchange rate depreciation, then the ratio of cumulative responses of price inflation to exchange rate depreciation is an elasticity.

Figure 6 displays the CPTE of import, producer and consumer prices. The reader may realize once more that the pass-through degree to import prices is the highest and it occurs immediately, with an impact elasticity (at s = 0) very close to one. Even though this pass-through elasticity of import prices decreases during 7 months following the shock, it remains quite high (91%), implying an almost complete ERPT at this stage of the distribution chain. This result is explained by the fact that, as regards of tradable goods, Mexico is mostly a price taker country28 in international markets. In line with Krugman (1987), a complete ERPT on import prices also implies that foreign firms are not pricing to market. In other words, foreign competitors of importable goods are not aligning their prices to the prevailing domestic prices of importable goods as response to the Peso/USD depreciation (there is no price discrimination). As our results show, 7 months after an exchange rate shock, 91% of the exchange rate depreciation is passed on into import prices, indicating a nearly complete pass-through. This result also provides some evidence regarding a possible strategy of local currency pricing29 (pricing to market) being implemented by foreign competitors of some importable goods. In such situation, foreign firms absorb foreign exchange fluctuations (or at least part of them) in their profit margins. The degree to which foreign competitors are willing to accept changes in their profit margins depends upon their market power, which in turn is determined by factors like product differentiation and market integration.

In regard the CPTE of producer prices, Figure 6 shows that the impact effect of the pass-through is about 12 percent which increases to 17.6 percent after 5 months and slightly decreases thereafter because the exchange rate shock has a more lasting effect on the exchange rate depreciation itself (7 months), compared to the corresponding one on the producer price inflation (only 5 months). Thus, by month 7 after the shock, 16% of the exchange rate depreciation is passed on into producer prices and it stays the same afterwards. Our results are quite smaller compared to the ones reported for producer prices30 in Capistrán et al. (2012) pre-inflation targeting adoption period (57% by month 24 after the exchange rate shock), but similar in size to those reported for the post-inflation targeting period (20% by month 24 after the shock).

The CPTE of consumer prices is zero on impact and it barely increases to 2.6 percent after four months and because inflation responses to the exchange rate depreciation are zero thereafter, the elasticity of consumer prices ends up being 2.2 percent. Thus our results show a very short effect of the exchange rate depreciation on consumer prices and hence a quite small corresponding cumulative pass-through elasticity.31 Capistrán et al. (2012) report that, previous to the inflation targeting adoption, the CPTE for consumer prices of tradable goods reaches 60% by month 12 after an exchange rate shock, and the same CPTE is not statistically different from zero for the post inflation targeting adoption period.

Our findings add evidence on the declining behavior of the ERPT along the distribution chain of pricing. As explained in section 2, the share of prices in the index that are affected by the exchange rate shock and the number of stages that have to be passed, are two factors explaining the declining ERPT along the distribution chain. The share of tradable goods (that are likely to be more affected by exchange rate shocks than non-tradable goods), tends to decrease in the price indices along the distribution chain. And because at each price stage the pass-through is incomplete, then the more stages to pass-through, the smaller is the size of the shock effect in the final price stage. Our results also show that exchange rate shocks are more persistent on import prices (7 months) compared to producer prices (5 months) and compared to consumer prices (only 4 months).

Summarizing our results on the size of ERPT on producer and consumer prices, we may say that it is very modest, and this conclusion coincides with other studies done under different methodologies (Gaytán and González, 2006;32 Capistrán et al., 2012; Sidaui and Ramos-Francia, 2008). Our findings also show that the degree of persistence of exchange rate shocks, and hence the size of the pass-through to domestic prices, is low for Mexico and this coincides with a period in which the country has been experiencing low inflation levels as result of the formal adoption of inflation targeting policy.

For the case of Mexico, there is growing evidence that, once the inflation targeting policy was implemented in 2001, the convergence to a low and stable inflation equilibrium has reduced the importance of the exchange rate in the formation of inflation expectations and in the price setting of agents (Sidaui and Ramos-Francia, 2008). The extent to which firms match an increase in costs (e.g. due to exchange rate depreciation) at competing firms by increasing their own price depends on how persistent the increase is expected to be. But because low and more stable inflation should be associated with less persistent inflation (Taylor, 2000), this explains the pass-through decline in low inflation environments.33

3.4. The Relative Importance of Exchange Rate Depreciation Shocks on Inflation Fluctuations

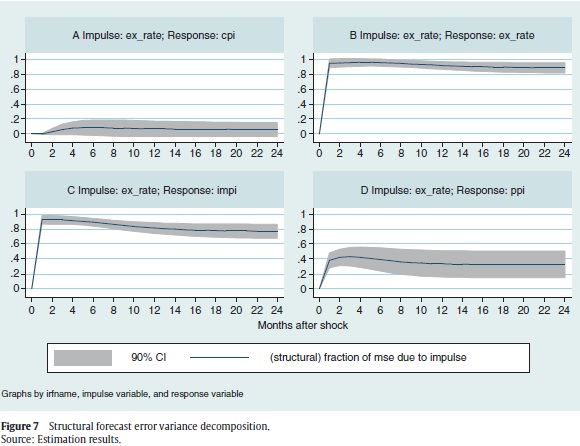

In this section, we use Forecast Error Variance Decomposition (FEVD) as analytical tool to assess the relative importance of exchange rate depreciation shocks in explaining fluctuations in import, producer and consumer price inflation. While impulse-response functions provide information on the size and speed of exchange rate depreciation shocks on inflation at each price stage (size and speed of the pass-through), they give no information on the importance of shocks for the variance of inflation of the corresponding price index. The structural FEVD measures the fraction of the s-step ahead forecast error variance of an endogenous variable that can be attributed to structural shocks to itself or to another endogenous variable in the system.34 Figure 7 shows the contribution of the forecast error variance explained by an exchange rate depreciation shock on the relevant variables in our analysis at this time. Complete results over forecast horizons of 6, 12, and 24 months are reported in Table A4 in Appendix A.

We may see in Figure 7C that exchange rate depreciation shocks are a very important determinant of the variance of import price inflation. They account for about 90 percent of the variance over a 6-months forecast horizon and this effect decreases to 77 percent for a 24-months forecast horizon. As previously explained, this is a reasonable result considering that Mexico is mostly a price taker country in international markets. Thus, we should expect —as it is evidenced by our results— exchange rate shocks (ceteris paribus) to be a very important source of variation for import prices (expressed in pesos). As shown in Table A4, the fraction of variance of import price inflation explained by shocks on itself, is barely 0.055 (or 5.5 percent) for a 6-months forecast horizon, and it increases to 0.11 (11 percent) as the forecast-horizon goes to 24-months.

With regard to the variance of producer price inflation (Figure 7D), we may observe that exchange rate depreciation shocks are also important. On impact they account for 38 percent of the variance and the share slightly decreases to 32 percent by the end of the 24-months forecast horizon. The other important source of variation of producer price inflation are the shocks on itself as they explain between 55 and 62 percent (slightly increasing) of the forecast error variance over different forecast horizons (Table A4).

As for consumer prices, Figure 7A shows that exchange rate shocks do not explain consumer price inflation variation (fraction of its forecast error variance explained by exchange rate shocks is not statistically different from zero over different forecast horizons). This result confirms that, for our period of analysis (after the adoption of inflation targeting in Mexico), exchange rate surprises are not relevant to explain consumer price inflation variation and these findings are also in line with Taylor's suggestion that the degree of ERPT decreases in low inflation environments. In contrast, the most important sources of variability of consumer price inflation are producer price inflation and consumer price inflation itself with variance shares between 23 and 35 percent and between 55 and 37 percent respectively. In other words, after inflation targeting implementation in Mexico, surprises on producer prices and on consumer prices are the relevant determinants of consumer price inflation fluctuations.

4. A Comment on Implications of the ERPT for the Real Exchange Rate behavior

Closing our previous discussion on how exchange rate shocks affect the size and speed of the pass-through to prices and their corresponding fractions of forecast error variances, we may say that, for the period of analysis, the process of price formation pays less attention to fluctuations on the exchange rate depreciation compared to what other studies report for the period before inflation targeting implementation. In particular, we found evidence of very modest and very fast response of consumer price inflation to exchange rate depreciation shocks.

What are the implications of these findings for the real exchange rate in Mexico? Being the real price that makes the real demand and real supply of foreign currency to be in equilibrium (Harberger, 1995 and 2004), the RER is obviously influenced by these market forces. From 2001 to 2011, Mexico experienced important increases in capital inflows. The annual foreign direct investment reached levels around 23,000 million dollars on average during these eleven years. In addition, as consequence of the rise in oil price, Mexico's oil exports proceeds have been substantially growing at a 12% annual rate on average during the same period. These two facts have significantly affected (increased) the real supply of foreign currency and as a result, Mexico's real exchange rate index levels have been below those observed during the previous four decades. Rises in the real prices of export goods (e.g., oil for the case of Mexico) lead to real appreciation of the currency (Dutch disease) and capital inflows have a similar effect so long as they are not spent exclusively on tradable goods (Harberger, 2004).

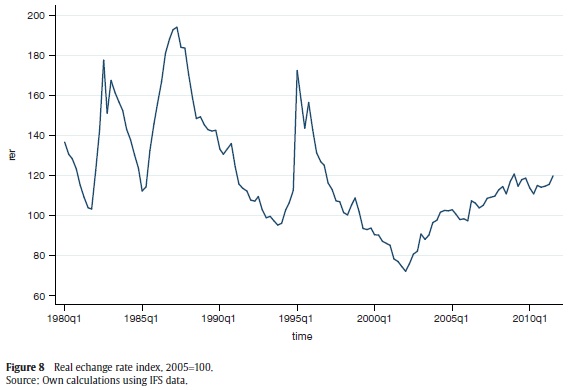

Figure 8 displays the RER series and we can observe relatively low levels of this variable during the last thirteen years even though inflation targeting policy has been successful. Moreover, from 2007 to 2011 the RER seems to have changed its trend.

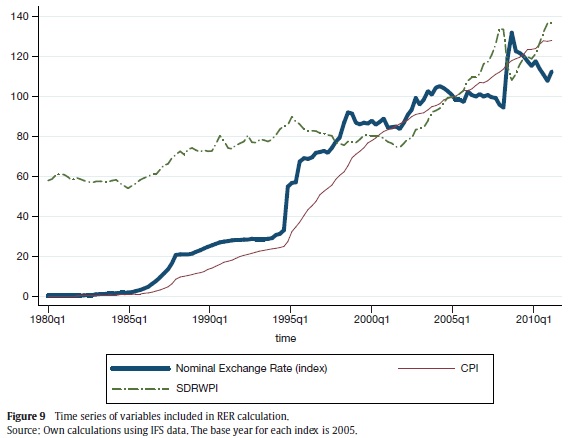

At this point, it is convenient to recall that the real exchange Et trate is defined as RERt =  , where Et, P*t and Pt are the nominal Pt exchange rate (Pesos/USD), the dollar price deflator (world price index of a large and representative basket of tradable goods) and the domestic price index (usually the CPI) respectively. With this definition in mind it is easy to understand that, even though the consumer price inflation has been successfully controlled and even though world prices of tradable goods continue to rise, the nominal exchange rate levels are not that high to take the RER up to those levels observed in the past. Figure 9 displays the time series of the variables used in the RER calculation. In particular, the SDRWPI variable is used as world-price index (world-price deflator)35 of tradable goods P* t , the CPI as the domestic price deflator, and the nominal exchange rate is shown as an index. We can observe that, before the year 2001, world-prices and the nominal exchange rate index were above the CPI while after 2001 they fluctuate around the CPI, and the three indices closely approach to each other making the RER relatively low (compared to past decades).

, where Et, P*t and Pt are the nominal Pt exchange rate (Pesos/USD), the dollar price deflator (world price index of a large and representative basket of tradable goods) and the domestic price index (usually the CPI) respectively. With this definition in mind it is easy to understand that, even though the consumer price inflation has been successfully controlled and even though world prices of tradable goods continue to rise, the nominal exchange rate levels are not that high to take the RER up to those levels observed in the past. Figure 9 displays the time series of the variables used in the RER calculation. In particular, the SDRWPI variable is used as world-price index (world-price deflator)35 of tradable goods P* t , the CPI as the domestic price deflator, and the nominal exchange rate is shown as an index. We can observe that, before the year 2001, world-prices and the nominal exchange rate index were above the CPI while after 2001 they fluctuate around the CPI, and the three indices closely approach to each other making the RER relatively low (compared to past decades).

Obviously, low levels of real exchange rate are not good incentives for export-oriented industries. As a result, leaders of some export-oriented Mexican industries as well as some economic analysts have been continuously suggesting that Mexican authorities in charge of the foreign exchange policy,36 should intervene the foreign exchange market in order to have nominal devaluations of the Mexican peso, hence targeting a higher real exchange rate level (in an effort to gain competitiveness). However, targeting both inflation and real exchange rate in an open economy with a high degree of capital mobility, is not feasible.37 The RER targeting policy would —sooner or later— imply the abandonment of inflation targeting.

Certainly, our previous analysis on the ERPT could suggest that, given the evidence of a small and fast pass-through of nominal exchange rate depreciation shocks into consumer prices, this implies that nominal exchange rate depreciations will generate real exchange rate depreciations, with their corresponding incentives (benefits) for export-oriented industries. However, along this research work we have mentioned several studies —and we can include our results among them— with supporting evidence in favor of Taylor's (2000) hypothesis that the ERPT decreases in low inflation environments. But low inflation levels in Mexico are explained by the success of inflation targeting policy. Empirical evidence of the benefits of this monetary policy strategy in anchoring inflation expectations (Capistrán and Ramos-Francia, 2010) shows that inflation targeting has not only implied a change in the policy reaction to different shocks that affect inflation, but also the way in which the monetary policy is transmitted to other variables has changed. In particular, because of inflation targeting, the information content about inflationary pressures derived from exchange rate changes, has decreased considerably (Sidaui and Ramos-Francia, 2008). Therefore, to relax inflation control or to abandon the inflation targeting policy as consequence of RER targeting, will change back again the way in which the stance of monetary policy is transmitted, and more important, will change inflation expectations.

As regards the importance of expectations in the inflationary process, Ramos-Francia and Torres (2008) and Sidaui and Ramos-Francia (2008) show evidence that, once inflation targeting was implemented, the expectations channel of monetary policy has substantially contributed to induce a stronger and faster reduction of inflation. Not only the forward-looking component of the inflation process has gained importance (and the backward-looking component has shown a reduction in its relative importance), but there is also an increasing role of expectations in determining the response of the economy to shocks. Thus, the abandonment of the inflation control policy will generate high inflation expectations and will very likely increase the degree in which exchange rate shocks are transmitted to consumer prices, and a high degree of ERPT can generate a depreciation-inflation spiral, making inflation control even harder (Obstfeld, 1982). Under this scenario (which was already experienced in Mexico before the inflation targeting policy), a more depreciated RER can only be attained temporarily and will lead to some combination of higher inflation and higher domestic real interest rates (Calvo et al., 1995). Finally, and following all these ideas, we may say that distributional effects of RER targeting could be questionable.

5. Conclusions

In this research paper we have provided empirical evidence on the ERPT into domestic prices. In other words, the analysis presented in this paper provided evidence on how the exchange rate depreciation changes affect inflation dynamics along the pricing chain after inflation targeting framework was implemented in Mexico. The analysis was based on a recursive Structural VAR-X model with overidentified restrictions which helped to improve the estimation of the matrix of contemporaneous effects and hence helped to improve the estimation of structural impulse-response functions and variance decompositions.

Based on the estimated structural impulse-response functions, we were able to obtain information on the size and the speed of the pass-through of exchange rate depreciation shocks. Our results show that the ERPT to import prices is nearly complete. The cumulative ERPT elasticity of import prices is 0.91, 7 months after the exchange rate depreciation shock. This result is explained by the fact that, as regards of tradable goods, Mexico is mostly a price taker country in international markets; but also a nearly complete ERPT on import prices could represent some evidence regarding a possible strategy of price discrimination being implemented by foreign competitors of some importable goods.

In regard producer prices, our results show a smaller cumulative ERPT elasticity of 0.17. This is basically explained by the fact that the producer price index includes both tradable and nontradable goods. The duration of exchange rate shock effects is also shorter (5 months) on producer prices compared with duration on import prices.

According to our findings, the cumulative ERPT elasticity on consumer prices is zero on impact and it increases to its highest value of 0.026 after 4 months. Thus, our results show a very short effect of the exchange rate depreciation on consumer prices and a quite small corresponding cumulative pass-through elasticity. Compared to estimations obtained using pre-inflation targeting data and reported in previous studies by other authors (Garcés, 1999; Sidaui and Ramos-Francia, 2008; Capistrán et al., 2012), our estimated ERPT elasticities using post-inflation targeting data are smaller and the adjustment speed to exchange rate shocks is faster.

The estimated variance decompositions allowed us to show that exchange rate depreciation shocks are a very important determinant of the variance of import price inflation. However, the share of variance explained by exchange rate shocks also declines along the distribution chain of pricing, as these shocks only explain —at most— 40 percent of producer price inflation variation and they do not have statistically significant influence on consumer price inflation variance. This result confirms that, after the adoption of inflation targeting in Mexico, exchange rate surprises are not relevant to explain consumer price inflation variation.

As final remark, we have presented some arguments to explain why a very small exchange rate pass-through into consumer prices does not imply that policymakers can implement a RER targeting policy in an effort to gain competitiveness and to benefit export-oriented industries. Foreign exchange market intervention in order to have nominal devaluations of the Mexican peso and hence targeting a higher real exchange rate level would imply to relax the inflation control. However, as it has been shown in several empirical studies applied to Mexico and other countries, a low degree of ERPT to consumer prices is associated with low inflation environments. The abandonment of inflation targeting policy most likely will increase the ERPT back again, making RER targeting temporarily attainable.

Acknowledgement

We would like to thank one of the anonymous referees for very valuable comments and suggestions that greatly helped to improve our paper. We also would like to thank professor Christopher F. Baum for his helpful suggestion on an earlier version of this research work presented at Stata Conference 2013 in New Orleans.

Notes

1The conduct of monetary policy towards an inflation targeting framework started as a gradual process two years before its formal adoption (Sidaui and Ramos-Francia, 2008).

2Interest rate channel, credit channel and the asset price channel. The exchange rate channel can be classified into the asset price channel (Sidaui and Ramos-Francia, 2008).

3These authors used a sample of 11 industrialized countries, and their findings show that the standard deviation of inflation explains the pass-through coefficient (into the CPI) better than does the average inflation rate.

4The aim of these authors' study was to show that low and stable inflation regimes propitiate a decrease in the ERPT. The study used data from 16 small open economies (Mexico among them), and showed that the size of the ERPT declines as inflation decreases.

5Using a new data set —prices of eight narrowly defined brand commodities, observed in 76 countries—, these authors show evidence that part (and only part) of the downward trend in pass-through to imported goods prices, and in turn to 'competitors' prices and the CPI, can be explained by changes in the monetary environment —including a fall in long-term inflation.

6The author used a consumer price index calculated by Gamboa (1997) and based on a basket of consumer goods not subject to price control by the government.

7The author presents empirical evidence regarding ERPT in five emerging markets that adopted inflation targeting policy: Brazil, Mexico, South Korea, South Africa and Czech Republic.

8The IGAE (Índice Global de la Actividad Económica) is an index commonly used in Mexico as a proxy variable for the monthly GDP series. This index is computed by the National Institute of Geography and Statistics (INEGI), and it shows the evolution of the economic activity of the country with monthly periodicity. Its construction uses the methodological and conceptual framework of the National Accounts, which is the same used in the calculation of quarterly GDP. The IGAE then is expressed as an index of the physical volume of production (with a base year). See Elizondo (2012) for a comprehensive explanation of how the IGAE is used to forecast the monthly GDP.

9Our estimation results show statistically different from zero dynamic multipliers for oil prices on the exchange rate depreciation and domestic price indices. In particular, our estimates indicate that a one percent increase in oil prices will generate a 12% cumulative exchange rate appreciation in one year, which falls to 8% by the end of the second year after the oil price change. The cumulative effect on import prices, however, is smaller and shorter (only a 3.5% cumulative fall by month 6 after the shock in oil prices). See figure A1 in Appendix A.

10See "Monetary Policy Implementation through an Operational Interest Rate Target", Monetary Policy Implementation Documents, Banco de México.

11Expressed in pesos.

12The ADFT was performed for each variable in levels and first differences. In order to show robustness to the inclusion of lagged differences in the test, we report the results for different number of lagged differences in each case.

13All variables used in the model were also tested for seasonality using the X-12 ARIMA program, which reports the combined test for the presence of identifiable seasonality (see Table A1 for data description).

14See Lütkepohl (2005), chapter 10, and Ocampo and Rodriguez (2012) for a better discussion on SVAR-X models.

15See Lütkepohl (2005), p. 368.

16Note that the Φi matrices are defined as follows: Φ0 = IK and Φi = for ∑Φ i-jj=1 i=1, 2, 3,... and Aj (j = 1,2,..., p) are the matrices of dynamic effects in expression (1) and (2).

for ∑Φ i-jj=1 i=1, 2, 3,... and Aj (j = 1,2,..., p) are the matrices of dynamic effects in expression (1) and (2).

17Lütkepohl (2005), p. 359.

18Other authors place the nominal interest rate at the end of the system of equations. In particular, Christiano, Eichembaum, and Evans (1998) used a recursive structure ordering output, prices and commodity prices before the variable considered the monetary policy instrument, in each of what they called "three benchmark recursive identification schemes". The explanation for this is consistent with the notion that output and prices do not move appreciably in the impact period of a monetary policy shock. Gaytán and González-García (2006) also present applied work using a recursive structure with the interest rate (monetary policy instrument) ordered at the end of the system.

19The orthogonalized shocks, however, have unit variances, which may not be the case for the structural shocks εt. See Lütkepohl (2005), p. 360.

20Following Lütkepohl (2005), p. 152, in small samples, AIC and FPE may have better properties (choose the correct order more often) than Hannan and Quin (HQIC) and Schwarz Bayesian Information Criterion (SBIC). Also, because AIC and FPE are designed for minimizing the forecast error variance, in small as well as large samples, models based on these criteria may produce superior forecasts.

21Hausman Endogeneity tests were applied before proceeding with the SVAR-X model estimation. In particular, the log-differences of import prices (in USD terms to isolate its effect from that of the exchange rate), IGAE and exchange rate, were tested for exogeneity in a two-equation model with log-differences of the producer price index (Δ12 ppi) and the consumer price index (Δ12 cpi) as dependent variables. The tests compare the performance of the least square estimators to the instrumental variable estimators. Under the null hypothesis, both the least squares estimators and instrumental variable estimators are consistent, hence there is no systematic difference between them. The Hausman test for each of the two equations was implemented in two forms. The first form was carried out using the well-known two-step procedure. The F (3,125]statistic for the Hausman test implemented on Δ12 ppi equation was 0.24 and its P-value was 0.867; the corresponding test implemented on Δ12 cpi equation reported an F (3,125]statistic of 0.12 with a P-value equal to 0.9489. For both cases, the results indicate that we fail to reject the null hypothesis of no systematic differences between the least squares and instrumental variable estimators. In other words, we cannot reject exogeneity of import prices, IGAE and the exchange rate in the Δ12 ppi and Δ12 cpi equations. The second form of Hausman test directly examines the differences between the least squares and instrumental variable estimates, and it was implemented for both equations using Hausman Stata command. However, the reported χ2 statistics were negative for both equations. The Hausman test in this context can be carried out for specific coefficients using a t-test, where t = bIV,k - bIV,k / [se(bLS,k)2 - se(bLS,k)2]½ (see Hill et al., 2011). The corresponding sample values of the t-statistics for the three potentially endogenous variables in the Δ12 ppi equation were 1.4088, 0.4355 and -0.5060. Using the standard 5% large sample critical value of 1.96, we cannot reject the null hypothesis of no systematic differences between the estimators (we fail to reject exogeneity of import prices, IGAE and the exchange rate). In the Δ12 cpi equation, the corresponding sample values of the t-statistics for the three potentially endogenous variables were -1.3701, -0.8402, and -0.8089; once more, we fail to reject the null hypothesis of exogeneity. The two forms of Hausman test were also implemented to test Δ12 ppi for exogeneity in the Δ12 cpi equation but now considering the IGAE, import prices (in domestic currency terms) and the exchange rate as exogenous variables in this equation. The reported F (1,125]statistic was 0.32 with a P-value of 0.5697. The sample value of the t-statistic for the potentially endogenous variable (Δ12 ppit) was 0.8185. Therefore, under both Hausman test forms we fail to reject the null hypothesis of no systematic difference between the least squares and IV estimators (there is no evidence to reject that Δ12 ppit is exogenous in the Δ12 cpi equation).

22Brüggemann and Lütkepohl (2001) have shown that this strategy is equivalent to sequential elimination based on model selection criteria for suitably chosen critical values of the test-statistic (t-ratios) (in Brüggemann et al., 2003, p. 3).

23These additional zero restrictions correspond to setting a21 = a31 = a41 = a42 = a51 = a52 = a62 = 0.

24Stata scales the reduced form VAR (underlying VAR-X) innovations ut to have unit variance. This allows the structural IRFs constructed from equation (6) to be interpreted as the effect on variable k of a one-time unit increase in the structural shock to variable j after s periods (Stata Time-Series Reference Manual, Release 11, p. 370).

25It should be highlighted here that we are analyzing impulse-response functions based on structural shocks εt, which are linear combinations of the reduced form VAR-X shocks. This is basically the reason why we do not observe a response equal to one on the exchange rate depreciation to its own shock at s = 0.

26We use asymptotic standard errors to compute the confidence intervals. Stata does not compute bootstrap standard errors for overidentified structural VAR models. However, the structural IRF's and forecast-error variance decompositions in this paper were estimated using the small-sample correction for the maximum likelihood estimator of the underlying VAR disturbances variance-covariance matrix

(see Stata Time-Series Reference Manual, Release 11, p. 168).

(see Stata Time-Series Reference Manual, Release 11, p. 168).

27We follow Lütkepohl's Zero Impulse Responses proposition, which asserts that "... for a K-dimensional, stationary, stable VAR(p), if the first pK-p responses of variable j to an impulse in variable k are zero, all following responses must also be zero" (Lütkepohl, 2005, p. 55). In our model, K=6 and p=2 and the first response (at s=0) is insignificant while responses 1, 2, 3 and 4 are statistically different from zero at 10% significance level. Hence, we may consider that inflation has non-zero responses to the exchange rate depreciation. In other words, consumer prices still react to exchange rate shocks, but the reaction is very small and the whole effect passesthrough very fast.

28The exceptions would be those highly differentiated tradable goods.

29Frankel et al. (2012).

30Capistrán et al. (2012) use more disaggregated data for producer prices. In particular, they use two producer price indices: PPI for goods and PPI for services. Their results for the 2001-2010 sample show a CPTE for goods of about 20% in 24 months, while the CPTE for services is not statistically different from zero.

31For the sample period 2001-2010, Capistrán et al. (2012) report zero passthrough elasticity of consumer prices for the two indices they work with (tradables and non-tradables). Sidaui and Ramos-Francia (2008) also report a close to zero cumulative effect on prices of a nominal depreciation after 2001.

32Unlike our model, these authors analyze the impact of real exchange rate shocks on prices.

33Evidence for other countries in this regard can be found in Pinto (2007) and Ca'Zorzi et al. (2007).

34The forecast error variance of the variable is decomposed into components accounted for by innovations in the different variables of the system. See Lütkepohl (2005, p. 63-66) for a formal definition and discussion on this issue.

35SDRWPI is the abbreviation of Special Drawing Rights Wholesale Price Index, and is an index used as the world-price deflator (P*) to calculate a multilateral RER. This index is calculated as a weighted average of the wholesale price index of five countries: USA, Germany, Japan, United Kingdom and France, where the weights are those employed by the IMF in the calculation of the Special Drawing Rights. See Guillermo (2000) and Harberger (2004) for a comprehensive explanation on RER definition and measurement.

36The Foreign Exchange policy in Mexico is responsibility of The Foreign Exchange Commission, which is made up of officials from the Ministry of Finance and Banco de México (The Central Bank).

37In an open economy, either the money supply or the nominal exchange rate can serve as nominal anchor. Such an anchor is usually viewed as a necessary condition for macroeconomic stability (Calvo, et al., 1995).

References

Alarco Tosoni, G. (2010). Exportaciones, tipo de cambio y enfermedad holandesa: el caso peruano. Centro de Negocios de la Pontificia Universidad Católica de Perú, Lima. [ Links ]

Bailliu, J., and Fujii, E. (2004). Exchange rate pass-through and the inflation environment in industrialized countries: an empirical investigation. Bank of Canada, Working paper N.o 2004-21. [ Links ]

Baqueiro, A., Díaz de León, A., and Torres, A. (2004). ¿Temor a la flotación o a la inflación? La importancia del traspaso del tipo de cambio a los precios. Ensayos Sobre Política Económica 44, 64-94. [ Links ]

Brüggemann, R. & Lütkepohl, H. (2001). Lag Selection in Subset VAR Models with an Application to a U.S. Monetary System, in Econometric Studies: A Festschrift in Honour of Joachim Frohn, R. Friedmann, L. Knüppel, H. Lütkepohl (eds.), Münster: LIT-Verlag, pp. 107-128. [ Links ]

Bruggemann, R., Krolzig, H.M., and Lütkepohl, H. (2003). Comparison of Model Reduction Methods for VAR processes. Economics Papers 2003-W13, Economics Group, Nuffield College, University of Oxford, Oxford. [ Links ]

Burstein, A.T., Neves, J.C., and Rebelo, S. (2003). Distribution costs and real exchange rate dynamics during exchange-rate-based stabilizations. Journal of Monetary Economics 50, 1189-1214. [ Links ]

Calvo, G.A., Reinhart, C.M., and Vegh, C.A. (1995). La tasa de cambio real como meta de política: teoría y evidencia. Journal of Development Economics 47, 97-133. [ Links ]

Campa, J.M., and Goldberg, L.S. (2005). Exchange rate pass-through into import prices. The Review of Economics and Statistics 87, 679-690. [ Links ]

Campa, J.M., and Goldberg, L.S. (2008). Pass-through of exchange rates to consumption prices: what has changed and why? In: International financial issues in the Pacific rim: global imbalances, financial liberalization, and exchange rate policy (NBER-EASE Volume 17). Takatoshi, I., Rose, A.K., editors. The University of Chicago Press, Chicago. [ Links ]

Capistrán, C., and Ramos-Francia, M. (2010). Does inflation targeting affect the dispersion of inflation expectations? Journal of Money, Credit and Banking 42. The Ohio State University. [ Links ]

Capistrán, C., Ibarra-Ramírez, R., and Ramos-Francia, M. (2012). El traspaso de movimientos del tipo de cambio a los precios: un análisis para la economía mexicana. El Trimestre Económico LXXIX 813-838. Fondo de Cultura Económica. [ Links ]

Ca'Zorzi, M., Hahn, E., and Sánchez, M. (2007). Exchange rate pass-through in emerging markets. European Central Bank, Working Paper No. 739. [ Links ]

Choudhri, E.U., Faruqee, H., and Hakura, D.S. (2005). Explaining the exchange rate pass-through in different prices. Journal of International Economics 65, 349-374. Elsevier. [ Links ]

Choudhri, E.U., and Hakura, D.S. (2006). Exchange rate pass-through to domestic prices: does the inflationary environment matter? Journal of International Money and Finance 25, 614-639. Elsevier. [ Links ]

Christiano, L.J., Eichenbaum, M., and Evans, C.L. (1998). Monetary policy shocks: what have we learned and to what end? Working paper, August 1998. Devereux, M.B., and Yetman, J. (2010). Price adjustment and exchange rate passthrough. Journal of International Money and Finance 29, 181-200. Elsevier. [ Links ]

Elizondo, R. (2012). Estimaciones del PIB mensual basadas en el IGAE. Documentos de Investigación. Working Paper 2012-11, Banco de México. [ Links ]

Frankel, J.A, Parsley, D.C., and Wei S.J. (2012). Slow passthrough around the world: a new import for developing countries? Open Economies Review 23, 213-251. [ Links ]

Gagnon, J.E., and Ihrig, J. (2004). Monetary policy and exchange rate pass-through. International Journal of Finance and Economics 9, 315-338. Wiley. [ Links ]

Garcés Díaz, D.G. (2001). Determinación del nivel de precios y la dinámica inflacionaria en México. Monetaria XXIV. Centro de Estudios Monetarios Latinoamericanos. [ Links ]

Gaytán, A., and González-García, J. (2006). Structural changes in the transmission mechanism of monetary policy in Mexico: a non-linear VAR approach. Documento de Investigación 2006-06, Dirección General de Investigación Económica, Banco de México. [ Links ]

Guillermo Peón, S.B. (2000). A theoretical and empirical analysis on real exchange rate behavior and measurement. Ph.D. Dissertation. University of California, Los Angeles. [ Links ]

Hahn, E. (2003). Pass-through of external shocks to Euro area inflation. European Central Bank. Working Paper Series, Working Paper No. 243. [ Links ]

Harberger, A.C. (1995). Mexico's exchange rate crisis. Paper prepared for Bancomer. University of California, Los Angeles. [ Links ]

Harberger, A.C. (2004). The real exchange rate: issues of concept and measurement. University of California, Los Angeles. [ Links ]

Hill, R.C., Griffiths, W.E., and Lim, G.C. (2011). Principles of Econometrics. Fourth Edition. Wiley. [ Links ]

Lütkepohl, H. (2005). New introduction to multiple time series analysis. Springer-Verlag. [ Links ]

McCarthy, J. (2006). Pass-through of exchange rates and import prices to domestic inflation in some industrialized economies. Federal Reserve Bank of New York. [ Links ]

Mwase, N. (2006). An empirical investigation of the exchange rate pass-through to inflation in Tanzania. International Monetary Fund, Monetary and Financial Systems Department, Working Paper WP/06/150. [ Links ]

Ocampo, S., Rodríguez, N. (2012). An introductory review of a structural VAR-X estimation and applications. Revista Colombiana de Estadística 35, 479-508. [ Links ]

Peersman, G., Smets, F. (2001). The monetary transmission mechanism in the Euro area: more evidence from VAR analysis. European Central Bank Working Paper 91. [ Links ]

Pinto Nogeira, R. (2007). Inflation targeting and exchange rate pass-through. Economia Aplicada 11, 189-208. [ Links ]

Ramos Francia, M., and Torres García, A. (2005). Reducing inflation through inflation targeting: the Mexican experience. In: Monetary policy and macroeconomic stabilization in Latin America. Langhammer, R.J., Vinhas de Souza, L., editors. Springer-Verlag. [ Links ]

Ramos Francia, M., and Torres García, A. (2008). Inflation dynamics in Mexico: A characterization using the new Phillips curve. The North American Journal of Economics and Finance 19, 274-289. Elsevier. [ Links ]

Rowland, P. (2004). Exchange rate pass-through to domestic prices: the case of Colombia. Ensayos Sobre Política Económica 47, 106-125. Banco de la República, Colombia. [ Links ]

Sidaoui, J., and Ramos-Francia, M. (2008). The monetary transmission mechanism in Mexico: recent developments. In: Transmission mechanisms for monetary policy in emerging markets. Bank for International Settlements 35. [ Links ]

Taylor, J. (2000). Low inflation, pass-through and the pricing power of firms. European Economic Review 44, 1389-1408. [ Links ]

Warmedinger, T. (2004). Import prices and pricing to market effects in the Euro area. European Central Bank. Working Paper Series. Working paper No. 299. [ Links ]