Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Ensayos sobre POLÍTICA ECONÓMICA

Print version ISSN 0120-4483

Ens. polit. econ. vol.32 no.74 Bogotá Jan./June 2014

An Empirical Analysis of the Relationship between US and Colombian Long-Term Sovereign Bond Yields

Un análisis empírico de la relación entre las tasas de interés de los bonos soberanos de largo plazo de Estados Unidos y Colombia

Alexander Guarína,*, José Fernando Morenob, and Hernando Vargasc

a Researcher, Banco de la República, Bogotá, Colombia

b Professional Economist, Banco de la República, Bogotá, Colombia

c Technical Deputy Governor, Banco de la República, Bogotá, Colombia

* Corresponding author. E-mail address: aguarilo@banrep.gov.co (A. Guarín).

History of the article:

Received December 13, 2013 Accepted June 13, 2014

ABSTRACT

We study the relationship between US and Colombian sovereign debt interest rates between 2004 and 2013. We also evaluate the response of the Colombian long-term bond yield and other asset prices to shocks to the US long-term Treasury rate. Two empirical exercises are performed. First, we use a moving window linear regression to examine the link between sovereign bond yields. Second, we estimate a VARX-MGARCH model to compute the short-term response of local asset prices to foreign financial shocks. Our exercises consider data with daily frequency. The analysis is performed on three sample periods (i.e., before, during, and after the global financial crisis). Our findings show that the link between sovereign bond yields has changed over time. Moreover, the short-run responses of local asset prices to foreign financial shocks have been qualitatively different in the three periods. The especial role of US Treasuries as a "safe haven asset" during highly volatile time spans seems to be at the root of these changes.

Keywords: Long-term bond yields, Global financial crisis, Emerging markets, Moving window linear regression, VARX-MGARCH model.

JEL Classification: E44, E52, G21, C30, E43, E58, F42, G15.

RESUMEN

En este documento se estudia la relación entre las tasas de interés de la deuda pública de Estados Unidos y Colombia entre 2004 y 2013. También se evalúa la respuesta de la tasa de los bonos colombianos de largo plazo y el precio de otros activos locales a choques a la tasa de los bonos del Tesoro de los Estados Unidos. Se llevan a cabo dos ejercicios empíricos. Primero, se usa un modelo de regresión lineal con ventanas móviles para examinar la relación entre las tasas de interés de los bonos de ambos países. Segundo, se estima un modelo VARX-MGARCH para calcular la respuesta de corto plazo de los precios de activos locales frente a choques financieros externos. Estos ejercicios consideran datos con frecuencia diaria. El análisis es realizado para tres periodos (es decir, antes, durante y después de la crisis financiera global).

Los resultados muestran que la relación entre las tasas de interés de los bonos soberanos ha cambiado a través del tiempo. Además, las respuestas de corto plazo de los precios de activos locales frente a choques financieros externos han sido cualitativamente diferentes en los tres periodos. La característica especial de los bonos del Tesoro de Estados Unidos como un "activo refugio" durante un periodo de alta volatilidad parece explicar gran parte de estos cambios.

Palabras clave: Tasas de interés de los bonos a largo plazo, Crisis financiera global, Mercados emergentes, Regresión lineal con ventanas móviles, Modelo VARX-MGARCH.

Clasificación JEL: C30, E43, E58, F42, G15.

1. Introduction

Consequent with the recent global financial crisis and the economic slowdown in 2008, the Federal Reserve (Fed) and central banks of the largest advanced economies1 pushed down its monetary policy rate to boost the economy and to prevent a deeper recession. Accordingly, the short-term interest rate reached the zero lower-bound, and hence, the scope of the traditional monetary policy to raise the economy became ineffective (Doh, 2010; Chen et al., 2012). In consequence, central banks adopted instruments from unconventional monetary policy2. In particular, the Fed implemented since 2008 a program of asset purchases known as Quantitative Easing (QE)3.

The QE policy has led to a reduction of the net supply of long-term bonds, higher security prices and lower long-term yields (Doh, 2010; Curdia and Woodford, 2011; Gagnon et al., 2011; Jones and Kulish, 2013; D'Amico and King, 2013). Nevertheless, the same measures also boosted other asset prices (e.g., commodities and stocks) and increased the market liquidity (Peersman, 2011; Joyce et al., 2011; Curdia et al., 2012; Glick and Leduc, 2012; Schenkelberg and Watzka, 2013; Cronin, 2014).

Turner (2013) and Turner (2014) highlight that the lower long-term bond yields in US and other advanced economies along with the wide market liquidity have pushed international investors into emerging markets and reduced the long-term interest rates in these economies. This process has also entailed other effects such as the appreciation of the local currency, rapid credit growth, inflationary pressures and booms on asset prices (García-Cicco, 2011; Chen et al., 2012; Glick and Leduc, 2012; Moore et al., 2013; Fratzscher et al., 2013; Londoño and Sapriza, 2014).

The shifts in the local long-term sovereign bond yield are crucial for the financial market because this yield acts as benchmark for the pricing of long-run assets. For example, a reduction in this rate encourages the lengthening in the maturity of credit obligations and the undertaking of long-run investment projects (Turner, 2014). Nevertheless, if the long-term yield stays low for a prolonged period, financial stability risks could arise. For instance, an excessive leverage could lead to credit boom episodes and the overvaluation of long-term assets (e.g. houses and stocks) (Turner, 2013; Turner, 2014).

Furthermore, Clare and Lekkos (2000) and Edwards (2010) state that in periods of financial crisis where the correlation of bond yields between distinct economies increases, the ability of the monetary authority to affect the term structure of the interest rates decreases. In those cases, the yield curve is mainly influenced by international factors.

Therefore, the analysis of the relationship between long-term bond yields of emerging and advanced countries, its evolution over time and the effects of changes in these rates are crucial issues for macroprudential policy, financial stability, government debt management, and monetary policy.

Our aim in this paper is to study the changing relationship between the United States (US) and Colombian long-term sovereign bond yield over time. Moreover, we want to analyze the response of Colombian asset prices to shocks to the US Treasury yield and how these responses changed during the global financial crisis.

This paper performs two empirical exercises. First, we employ the moving window linear regression (MWLR) to examine the link between local asset prices and the US long-term Treasury rate. Later, we also use the MWLR to study the relationship between Colombian and US bond yields controlling for the sovereign risk premium and the expected currency depreciation.

Second, we estimate a VARX-MGARCH model to compute the response of local asset prices to three distinct shocks to the US long-term Treasury yield. The source of these shocks are changes in the global volatility, the Treasury term premium and the stance of monetary policy in US. Local asset prices considered in this research are the Colombian long-term sovereign interest rate, the foreign exchange rate, Credit Default Swap (CDS) spreads and the stock market index value.

Our empirical exercises employ daily data of US and Colombian financial variables between June 2004 and November 2013. In addition, for our second exercise we divide the sample into three periods, namely before, during and after global financial crisis. The estimation is performed on each sample period. Hence, we avoid to obscure the effects derived from periods with distinct economic and financial characteristics.

We contribute to the burgeoning literature on this topic in three aspects. First, our empirical exercises are performed on daily data of financial variables. The volatility in our econometric exercises is modeled using GARCH processes. Second, our estimations and responses to shocks are computed for the pre-crisis, crisis and post-crisis periods. This analysis allows us to highlight different effects from shocks which could be associated to economic features of the period of study. Otherwise these effects could be missed. Third, our study is concentrated on the effects of three distinct shocks affecting the US long-term bond yield. The response of Colombian asset prices to surprises on the US Treasury rate could be different depending on the source of the shock.

Our findings show that the relationship between US and Colombian long-term sovereign bond yields has changed over time. In fact, the sign of this link turned negative between the second half of 2007 and the "Tapering" announcement. Our results also suggest that since 2008 the importance of the effects of movements of the US long-term Treasury rate on Colombian asset prices has increased. We also find that the short-run responses of both the Colombian interest rate and other local asset prices to shocks to the US long-term bond yield have been qualitatively different, depending on the sample period and the source of the shock. These changes seem to suggest, first, an especial role of US Treasuries as a "safe haven asset" during the global financial crisis period, and second, a subsequent differentiation of local assets.

The remainder of the paper is organized as follows. Section 2 describes the main stylized facts on the recent evolution of US and Colombia sovereign debt interest rates. In Section 3, we perform a moving window linear regression analysis to study the relationship between long-term bond yields over time. Section 4 estimates the short-run responses on local asset prices to shocks to the US Treasury rate. Finally, Section 5 concludes.

2. Stylized Facts

This section is divided into two parts. The first one illustrates the dynamics of long-term bond yields for the US, Colombia and other emerging countries. In addition, we compare the evolution of some financial variables for Colombia with net capital inflows into its economy.

In the second part, we analyze the changing relationship between US and Colombian interest rates. We divide our sample into three time spans. Moreover, we highlight the main financial facts during those periods.

2.1. Long-Term Sovereign Bon d Yield Dynamics

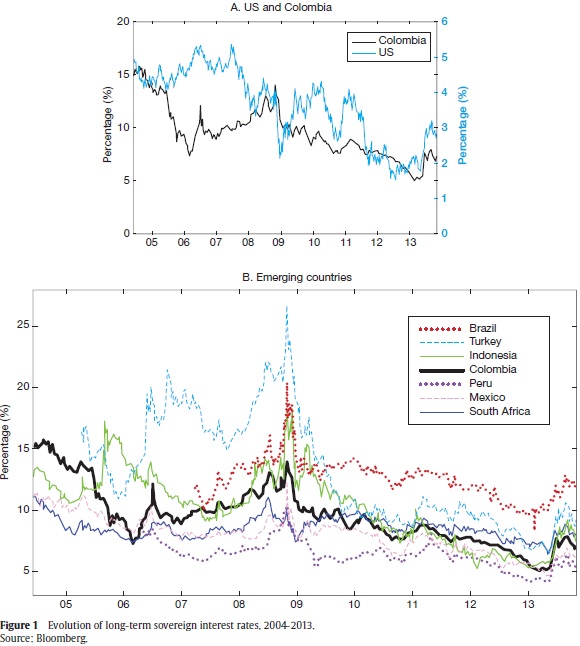

Panel A in Figure 1 plots the 10-year US Treasury rate and the 10-year Colombian sovereign bond yield between June 2004 and November 2013. If the full sample period is examined, then both interest rates exhibit a negative trend. However, this tendency changes along the sample when shorter time spans are considered.

Between 2004 and the first half of 2007, the US Treasury yield exhibits a positive slope as a consequence of the increases in the Fed funds rate to control inflation expectations. From there, bond yields have been decreasing as a result of the expansive monetary policy adopted by the Fed (i.e. the policy rate at the zero lower-bound, the QE program and the Operation Twist) to cope with the global financial crisis. Nonetheless, there are short time spans in 2009 and 2010 when the US Treasury yield corrected upwards after reductions in the global risk perception.

In the Colombian case, the long-term interest rate showed sharp variations through the sample period. Between June 2004 and February 2006, this rate dropped as a result of better fundamentals and external conditions in emerging countries, and the decline in the Colombian risk spread4. From March 2006 to October 2008, the same interest rate rose mainly in response to two facts. First, the Central Bank of Colombia increased the monetary policy rate to cope with domestic inflationary pressures. Second, the rise of global risk since mid-2007 because of the beginning of the global financial crisis and the collapse of financial entities such as Lehman Brothers. Since October 2008, the long-term sovereign bond yield has been decreasing as a consequence of the spillover effects of the unconventional measures adopted by the US and other advanced economies.

Panel B in Figure 1 shows 10-year sovereign bond yields for Colombia, Brazil, Turkey, Indonesia, Peru, Mexico and South Africa between June 2004 and November 2013 according to available data. These bond yields exhibit similar dynamics. Nevertheless, these interest rates seem to be completely aligned after the Lehman Brothers bankruptcy episode. This behavior appears to be related to the lower risk perception and better terms of trade of emerging economies.

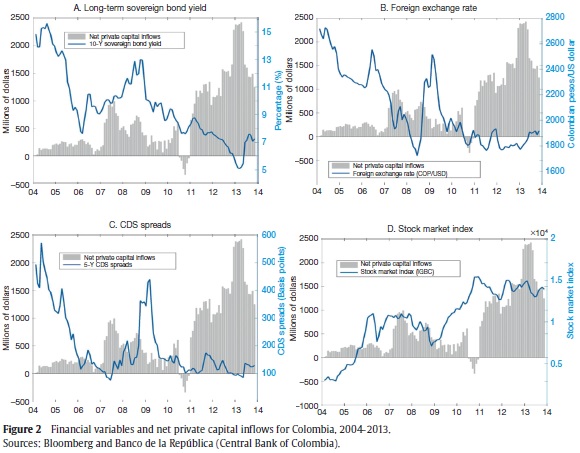

Figure 25 compares the evolution of four Colombian financial variables with net private capital inflows into Colombia between June 2004 and November 2013. Panels A to D plot the 10-year sovereign interest rate, the foreign exchange rate of Colombian pesos per dollar, the 5-year CDS spread and the stock market index (IGBC), respectively. Each panel also draws the sixth order moving average6 of monthly net private capital inflows observed in the Consolidated Exchange Balance7. The capital flows include both portfolio and foreign direct investment.

Colombia has recorded net capital inflows during the last decade, with exception of a short period at the end of 2010. Furthermore, since 2011 these capital inflows have been larger than in previous years due in part to positive net portfolio investments.

On the other hand, our four financial variables exhibited clear trends along the sample period. In particular, the long-term bond yield, the foreign exchange rate and CDS spreads dropped, while the stock market index rose. The behavior of these variables before 2007 is explained mainly by local factors in the Colombian market. Between 2007 and 2008, there are specific breaks in the trend of these time series as a consequence of the risk and the economic uncertainty associated to the beginning of the global financial crisis. After this period, the trend of these financial variables has been again decreasing. The tendency in this period is associated to the spillover effects of QE measures (see for example, García-Cicco, 2011; Chen et al., 2012; Glick and Leduc, 2012; Moore et al., 2013; Fratzscher et al., 2013; Londoño and Sapriza, 2014).

2.2. The Relationship Between US and Colombian Bond Yields: Before, During and After Global Financial Crisis

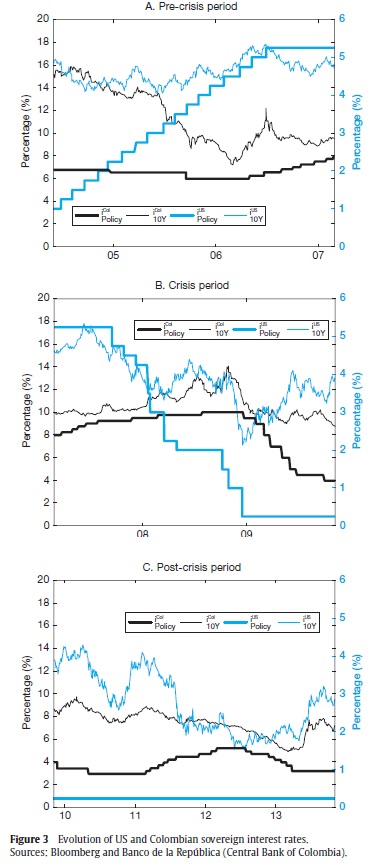

Figure 3 plots both the long-term sovereign bond yields and the monetary policy rates for US and Colombia between June 2004 and November 2013. The evolution of these interest rates is divided into three sample periods, namely before (Panel A), during (Panel B) and after (Panel C) the global financial crisis. From now on, these periods are denominated as pre-crisis, crisis and post-crisis periods. The specific dates of each time span are defined to reflect significant changes in the correlation between long-term bond yields due to financial events or news with high impact on the market.

2.2.1. The US Monetary Policy Tightening and the Colombian Bond Market Development

Panel A in Figure 3 illustrates the pre-crisis period (i.e. from June 2004 to February 2007). This subsample is characterized by a positive correlation between long-term bond yields and a non-significant relationship between monetary policy rates. In this period, the Fed increased sharply its policy rate to stop inflationary pressures. Moreover, since July 2006 the US market presented an inverted yield curve, and hence, early warning signals of the future recession were evident. In the same time span, Colombian long-term bond yields dropped, while the policy rate remained relatively stable. In fact, banks increased their fixed income portfolios in local sovereign debt and achieved exceptional profits as the inflation rate fell.

2.2.2. The Global Financial Crisis and the International Recession

Panel B in Figure 3 exhibits the dynamics of interest rates at the crisis time (i.e. from February 2007 to October 2009). This period is, in general, defined by a negative correlation between US and Colombian long-term bond yields, the reduction of the Fed funds rate up to reaching the zero lower-bound, a decreasing trend of the long-term Treasury rate and a large demand of safe assets. Moreover, several financial events and news with high impact in the market were issued8. On the other hand, between 2006 and 2008 the Central Bank of Colombia rose the monetary policy rate to stop inflationary pressures, and subsequently, it started its reduction in 2009. Long-term sovereign bond yields also exhibited a declining trend during this period.

At the end of 2008, the correlation between long-term sovereign bond yields turned positive as a result, in great part, of the Lehman Brothers Bankruptcy episode. This event increased the economic uncertainty as well as the risk perception in the global financial market. In order to avoid a financial collapse, the Fed announced in November 2008 the first part of its QE program. This set of measures started in March 2009.

2.2.3. QE2, QE3, the Greek Debt Crisis and Tapering

Panel C in Figure 3 considers the post-crisis period (i.e. between November 2009 and November 2013). This time span is characterized by low interest rates in the US and Colombian markets as a result of the QE program, particularly QE2 and QE3, the Operation Twist and their spillover effects on emerging economies (see for example, García-Cicco, 2011; Glick and Leduc, 2012; Moore et al., 2013; Fratzscher et al, 2013; Londoño and Sapriza, 2014). In general, the correlation between both long-term bond yields after the global financial crisis is positive. The Greek debt crisis increased the demand for local safe assets in emerging markets. In May 2013 the Fed announced the end of the QE program (i.e. the "Tapering" announcement) which led immediately to the rise of bond yields in both markets.

3. The Changing Relationship Betwe en US and Colombian Sovereign Bond Yields

In this section we describe data and their sources. We also analyze the relationship between US and Colombian long-term interest rates over time. Our analysis is based on the MWLR.

3.1. Data

Our data set considers daily time series9 of local and foreign financial variables between June 2004 and November 2013. Our set of domestic variables includes the 10-year Colombian sovereign bond yield (iCol), the Colombian stock market value index (igbc), sovereign credit default swap (CDS) spreads (cds) on 5-year10 Colombian sovereign bonds denominated in US dollars, the foreign exchange rate denominated as Colombian pesos per US dollar (cop) and its expected value for a horizon of 10 years (cope)11. Our foreign variable is the 10-year US Treasury yield (iUS).

All our econometric exercises employ the logarithm of the Colombian stock market value index (ligbc), the logarithm of the foreign exchange rate (lcop) and its expected value for a horizon of 10 years (lcope). CDS spreads are expressed as a percentage.

The data source of iCol is the Central Bank of Colombia. This is constructed using the Nelson-Siegel methodology. The remaining variables are taken from Bloomberg.

3.2. Moving Window Linear Regression (MWLR) Analysis

We perform a MWLR analysis to understand how the relationship between US and Colombian long-term bond yields and other local asset prices have changed over time12. In particular, this exercise provides evidence on the pattern of this link during the global financial crisis and the implementation of the QE program.

The MWLR exercises are run on a 435-day (approximately 2-year data) rolling sample basis. The moving window begins with a sample from January 29th 2003 to January 4th 2005 and concludes with a sample from December 28th 2011 to November 7th 201313. In our estimates, we use a GJR-GARCH (1,1) process to model the variance of errors, hence, taking into account the changing volatility commonly found in high frequency financial data (see Appendix A).

We carry out two sets of MWLR exercises. The first one examines the relationship between changes in the US long-term Treasury rate and changes in a Colombian asset price. The latter could be the local long-term sovereign bond yield, the foreign exchange rate, CDS spreads or the stock market index. In particular, we estimate the model stated by

where k indexes the rolling sample. For each window k, β(k) = [β0(k), β1(k)] is the estimated coefficient vector, ytk denotes the dependent variable, itkus is the US long-term Treasury rate, and atk are the errors. The latter are assumed to be heteroscedastic. We carry out four MWLR exercises. For each one, ytk takes the value of one of the following Colombian variables: the long-term interest rate itkCol , the logarithm of the foreign exchange rate lcoptk, the value of CDS spreads cdstk or the logarithm of the stock value index ligbctk 14.

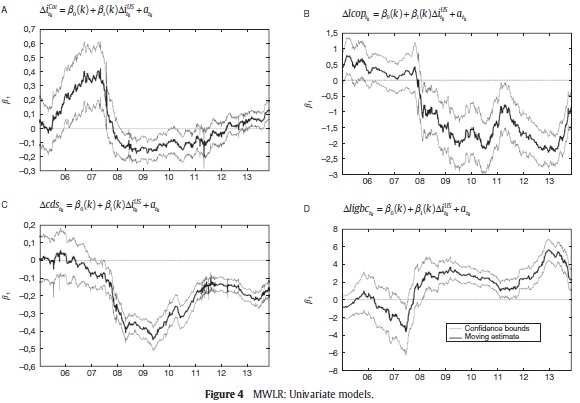

Figure 4 plots the estimated coefficient and its confidence interval for each MWLR of equation (1). The dates on the horizontal axis of each panel correspond to the end-day of each rolling regression.

Panel A in Figure 4 shows the moving window estimate of β1 A. Moving window estimate of β1 when y takes the values of the Colombian long-term interest rate iCol. This panel illustrates a remarkable shift through time between both long-term interest rates. The positive correlation from 2006 to 2007 turns negative between 2008 and 2011. This link is again positive after 2012.

Panels B-D in Figure 4 illustrate the behavior of the moving window estimate of β1 when y takes the values of the foreign exchange rate (lcop), CDS spreads (cds) and the logarithm of the stock value index (ligbc). This figure provides evidence on the changing pattern in the relationship between local asset prices and the US long-term Treasury rate. Our estimates show that before the second half of 2007 those relationships are not statistically significant. Nevertheless, in the middle and after the global financial crisis (since the end of 2007) the link between the US Treasury rate and lcop (negative), cds (negative) and ligbc (positive) became significant. These sharp variations suggest important changes in the nature of shocks hitting these variables throughout the sample period, and particularly, during the global financial crisis.

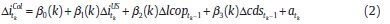

In our second MWLR exercise, we again analyze the relationship between changes in the Colombian and US long-term interest rates controlling for other relevant financial variables. In this case we estimate the equation stated by

where k indexes the rolling sample. For each window k, β(k) = [β0(k), β1(k), β2(k), β3(k)] is the new estimated coefficient vector, and atk denotes the regression errors. The latter are again assumed to be heteroscedastic. In this new specification we include both cdstk-1 and lcoptk-1 as explanatory variables to control for the effects that changes in the sovereign risk premium and the expected depreciation could have on itkCol . Note that we consider the lagged values of cdstk and lcoptk to minimize problems of endogeneity in our econometric exercise.

Panels A-C in Figure 5 show the evolution of the moving window stimate of β1, β2 and β3 for the explanatory variables iUS, lcop and cds, respectively. This exercise also provides evidence on the changing relationship between long-term sovereign interest rates. In particular, the link between US and Colombian bond yields is positive before the second half of 2007. From there, it turns negative up to the end of 2012. Moreover, the dynamics of our estimated β1 coefficient is similar to that found in Panel A in Figure 4.

On the other hand, the relationships between iCol and the variables lcop and cds have also changed through time. Panels B and C in Figure 5 show that these two links are positive and significant before the second half of 2007. Even more, in the first part of that year, the impact of changes in CDS spreads on the Colombian sovereign bond yield is stronger than in the previous period. Nevertheless, since 2008 these relationships are not statistically significant15.

3.3. The Link Between US and Colombian Long-term Interest Rates From the Perspective of Shocks

Panel A in Figures 4 and 5 show a positive relationship between US and Colombian long-term interest rates before the second half of 2007 and after the end of 2012. This link is negative during the global financial crisis, and subsequently, in the period of implementation of unconventional policies adopted by the Fed.

The relationship between long-term bond yields can be understood from the source of the shock affecting the US Treasury rate. For example, a positive link between both interest rates could be explained by a shock whose origin is the tightening of the current or expected monetary policy in the US. This shock induces the sale of local bonds, capital outflows from Colombia and, consequently, an increase of long-term interest rates and the depreciation of the local currency.

This response would be greater if the change in the US Treasury rate is perceived as permanent or highly persistent. In this case, domestic factors determining the short-term local interest rate or its expected future path would also be affected by the shock (e.g. increases in the "natural interest rate" of the small open economy, inflationary pressures derived from the depreciation of the currency, or the reaction of the local central bank to these effects).

Similarly, a shock to the US Treasury rate stemming from the rising of the term premium induces a positive link between US and Colombian long-term bond yields. This shock reflects an increase in the uncertainty on the future path of the US short-term interest rate. The latter effect could also be associated to increases in the risk and the uncertainty derived from US economic conditions. In this case, the shock would also affect the country risk.

On the other hand, a negative relationship between US and Colombian long-term bond yields could be explained by the role of US Treasuries as a "safe haven asset" during the global financial crisis. Under this context, shocks buffeting the US long-term interest rate are linked to movements toward or away from "safe haven assets". Therefore, a reduction in the US Treasury rate is associated to a larger appetite for safe assets, capital outflows from emerging economies and the fall of local asset prices, including sovereign bonds.

In this case, shocks to the US long-term Treasury rate would not only include surprises associated to expectations about the US monetary policy or the Treasury term premium, but also a "safe haven" premium during the crisis period. Moreover, shifts in the appetite for safe assets would not only be reflected in the prices of US Treasuries, but also in the price of emerging country assets. This hypothesis highlights the usefulness of including a measure of the global risk and the economic uncertainty within our analysis. The VIX index is the natural candidate for this purpose.

In the next section we undertake an exploration of the short-term responses of some Colombian asset prices to external financial shocks.

4. The Short-term Responses of Colombian As set Prices to External Financial Shocks

US Treasury interest rates are endogenous variables subject to different shocks which may simultaneously affect asset prices in emerging countries (e.g. long-term interest rates, the foreign exchange rate, CDS spreads and the stock market index). Hence, the "transmission" of changes in US long-term bond yields to local asset prices implies the response of all these variables to shocks from different sources. The frequency and predominance of the latter change over time.

In order to capture this idea, we estimate the response of the Colombian long-term interest rate and other asset prices to three shocks, namely the global volatility and the economic uncertainty, the term premium and the stance of monetary policy. These shocks can impact asset prices directly and through the US Treasury rate channel.

Consider the following VARX(p,q) model:

where μ is a vector of means, Ai and Bi stand for the coefficient matrices associated to the endogenous and exogenous variables, respectively and εt ∼ WN(0,∑t) is a vector of errors. We assume a Baba-Engle-Kraft-Kroner (BEKK) multivariate GARCH model as defined in Engle and Kroner (1995). The latter is used to model the high volatility of financial time series with daily frequency in the sample.

Vectors Yt = (itCol, ligbct, lcopt, lcopet, cdst,  )16 and Xt = (VIXt, itUS, MOVEt) stand for the sets of endogenous and exogenous variables17, respectively. These vectors are included in first differences in the estimation.

)16 and Xt = (VIXt, itUS, MOVEt) stand for the sets of endogenous and exogenous variables17, respectively. These vectors are included in first differences in the estimation.

Variables itCol, ligbct, lcopt, lcopet, cdst and itUS were already defined in Section 3.1. The variable  denotes the monetary policy rate for Colombia. We use the Colombian interbank rate as proxy for

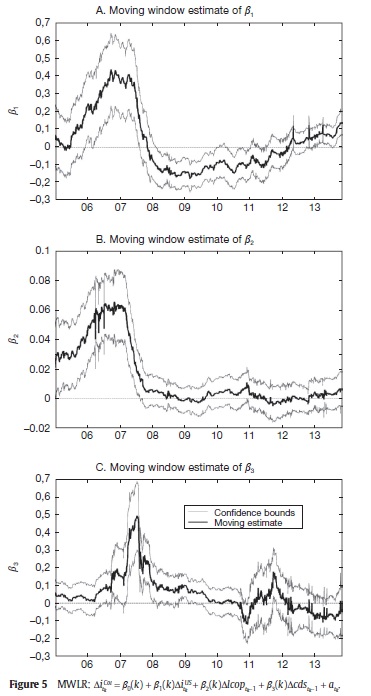

denotes the monetary policy rate for Colombia. We use the Colombian interbank rate as proxy for  . The VIX18 and the MOVE19 are used as proxies for the US market volatility and the US Treasury term premium, respectively. The VIX picks the effects of global uncertainty shocks, while the MOVE captures the uncertainty on the future path of short-term interest rates in the US market. Tobias et al. (2013) and Cieslak and Povala (2013) point out that the MOVE is highly correlated with the 10-year US Treasury term premium. Figure 6 shows the evolution of the VIX and the MOVE between 2004 and 2013. The VIX and the MOVE showed relevant changes in the US stock- and bond-market volatility in the second-half of 2007 and at the end of 2008, as a result of the beginning of the global financial crisis and the Lehman Brothers bankruptcy, respectively. The VIX also exhibited important variations in mid-2010 and in the second-half of 2011, while the most important changes of the MOVE were in mid-2009 and at the end of 2013 with the Tapering.

. The VIX18 and the MOVE19 are used as proxies for the US market volatility and the US Treasury term premium, respectively. The VIX picks the effects of global uncertainty shocks, while the MOVE captures the uncertainty on the future path of short-term interest rates in the US market. Tobias et al. (2013) and Cieslak and Povala (2013) point out that the MOVE is highly correlated with the 10-year US Treasury term premium. Figure 6 shows the evolution of the VIX and the MOVE between 2004 and 2013. The VIX and the MOVE showed relevant changes in the US stock- and bond-market volatility in the second-half of 2007 and at the end of 2008, as a result of the beginning of the global financial crisis and the Lehman Brothers bankruptcy, respectively. The VIX also exhibited important variations in mid-2010 and in the second-half of 2011, while the most important changes of the MOVE were in mid-2009 and at the end of 2013 with the Tapering.

VARX equations consider contemporaneous and lagged values of our exogenous variables (itUS , VIXt, MOVEt). Hence, the responses of local asset prices to an itUS shock capture the impact of changes in the US long-term Treasury rate that are not explained by movements of the VIX or the MOVE. Therefore, the responses to itUS shocks must reflect changes in the stance of monetary policy in the US and "other effects".

The VARX-MGARCH model is estimated for three sample periods. The latter correspond to the same time spans defined in Section 2.2 (i.e. the periods before, during and after the global financial crisis). The estimates of the VARX-MGARCH for each sample period are used to perform the impulse-response analysis to shocks to exogenous variables (i.e. multiplier analysis). In particular, we study the responses of Colombian asset prices20 to shocks to VIX, MOVE and itUS. Appendix C presents the technical details of the estimation method, compiles the main results and makes a brief summary of the specification test.

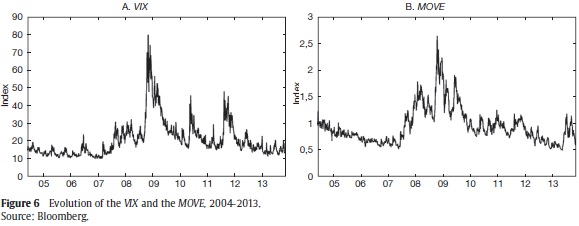

4.1. Pre-crisis Period

Figure 7 shows the multiplier analysis for the pre-crisis period (i.e. from June 2004 to February 2007). For this sample, shocks to VIX lead to positive responses in cds, lcop, lcope, iCol and a negative reaction in ligbc. Hence, an increase in the US market volatility induce a rise in Colombian long-term interest rates (i.e. a fall in the value of the long-term bond portfolio) and a decline in stock prices. Investors carry out a reallocation of their resources away from local markets, which causes a depreciation of the currency and an increase in the perception of country risk.

For the same period a positive shock to either the stance of monetary policy in US (itUS) or the term premium (MOVE) produces a depreciation of the currency (lcop) and an increase in the Colombian long-term bond yield (iCol). Moreover, the shock to MOVE also leads to a positive response in the country risk perception (cds) and higher expectations of future devaluation. On the other hand, none of these two shocks has a significant effect on the stock market index value (ligbc).

These results suggest that in this period of relative stability in the market, bond investment decisions are characterized mainly by the search for high returns. Positive shocks to global volatility, the term premium and the stance of monetary policy in the US increase the Treasury yield, and lead to sales of sovereign long-term bonds and local currency. Further, in this period only risk shocks are able to produce significant shifts in stock prices.

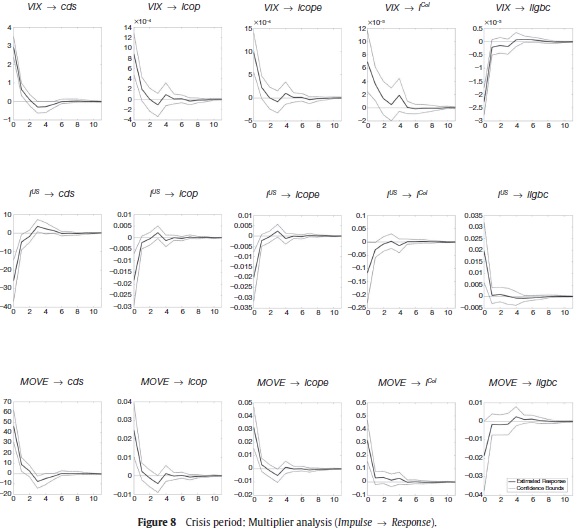

4.2. The Crisis Period

Figure 8 illustrates the multiplier analysis for the crisis period (i.e. from February 2007 to October 2009). As in the results for the pre-crisis period, positive shocks to either the US risk (VIX) or the Treasury term premium (MOVE) lead to a fall in the prices of sovereign bonds —i.e. a rise in the long-term bond yield (itCol)—, a depreciation of the local currency (lcopt), a decline in stock prices (ligbct) and a rise in the perception of sovereign risk (cdst).

However, an itUS shock provides a qualitatively different story. A positive shock to itUS leads to a reduction in local long-term bond yields, an appreciation of local currency, an increase in stock prices, and a fall in the country risk perception. Notice the response to this shock is opposite to that observed in the pre-crisis period. Moreover, the impacts on cds and ligbc become statistically significant in this time span. On the contrary, if the itUS shock is negative, (i.e. there is a reduction in the US long-term Treasury rate, and hence, a higher market value of these securities), the response is an increase in the Colombian long-term bond yield (i.e. a fall in the local bond portfolio), a devaluation of the currency and a decline in stock prices.

In the crisis period the response of local asset prices to an itUS shock suggests that US Treasuries became a "safe haven asset" in the midst of an atmosphere of economic uncertainty and high levels of risk. Under these circumstances, Colombia and other emerging economies are observed as a potential source of losses in an episode of crisis. In this scenario, a negative shock to itUS reduces the US long-term Treasury rate, and leads to capital outflows from the Colombian financial market (i.e. bonds, stocks and local currency) into the US Treasury market. These changes in the portfolio composition aim to reduce the exposure to emerging market risk by investing in the "safest assets".

As we already mentioned, the shock to itUS considers surprises in the stance of monetary policy and "other effects". We suggest that in this climate of high levels of uncertainty, the "other effects" component captures the desire of investors to hedge the emerging market risk exposure using "safe haven assets". These results also suggest that the VIX fails to completely capture changes in global risk aversion or in the fear of a generalized economic collapse. In this crisis period, shocks to itUS pick mostly movements toward or away from safe assets.

4.3. Post-crisis Period

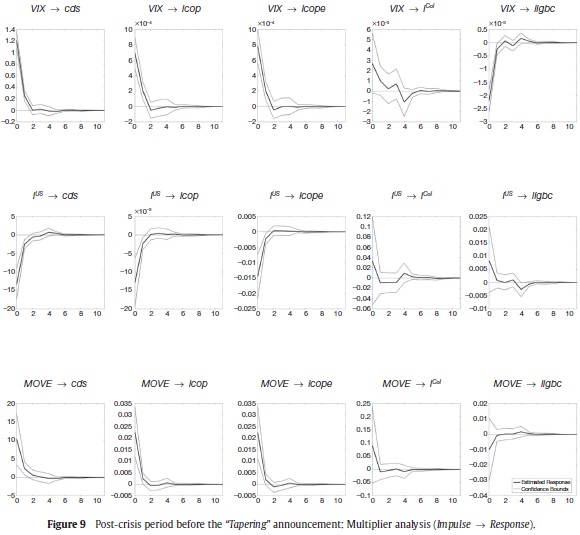

For the post-crisis period we examine two subsamples. The first one considers data between November 2009 and April 2013 (i.e. before the "Tapering" announcement), and the second one uses data from November 2009 to November 2013.

4.3.1. Post-crisis Period Before the "Tapering" Announcement

Figure 9 presents the multiplier analysis for the post-crisis period before the "Tapering" announcement. The qualitative responses of the country risk spread (cds), the foreign exchange rate (lcop) and the expectations of future depreciation (lcope) to VIX, itUS and MOVE shocks do not change with respect to the results presented for the crisis period.

These results suggest that US Treasuries partially keep its condition of "safe haven asset". The uncertainty associated to the slow recovery of the US economy, the Greek debt crisis, and the unconventional policies adopted by advanced economies are possible explanations for this condition.

However, for this period, all local assets do not seem to be in the same basket. In particular, unlike the crisis period, MOVE and itUS shocks do not produce statistically significant responses of the long-term interest rates. This result provides evidence on a market differentiation that distinguishes long-term sovereign bonds from other Colombian assets. Accordingly, the sensitivity of local long-term bonds to external financial shocks may have been reduced.

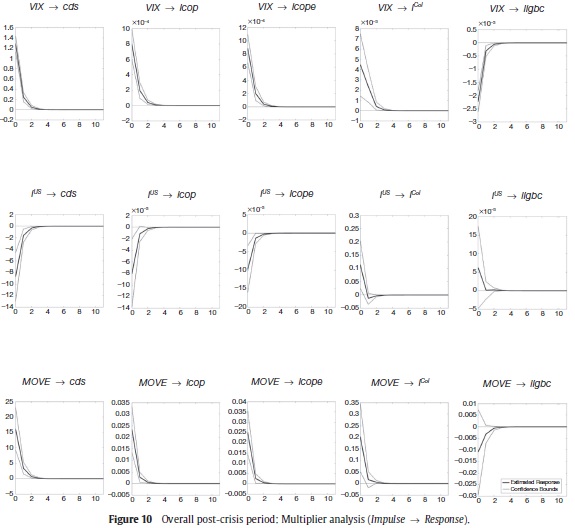

4.3.2. Overall Post-crisis Period

Figure 10 exhibits the multiplier analysis for the overall post-crisis period (i.e. between November 2009 and November 2013). The qualitative responses of local asset prices other than the local long-term interest rate to external financial variable shocks of the financial variables in this analysis are similar to those observed in the post-crisis period before the "Tapering" announcement.

The responses of the long-term bond yield to shocks to VIX, itUS and MOVE are positive and statistically significant. These results are in agreement with the gradual retrenchment of the unconventional monetary policy adopted by the Fed through its QE3 program. These findings suggest that the local long-term interest rate was more sensitive to the "Tapering" announcement than other local asset prices.

5. Conclusions

The understanding of the relationship between the long-term interest rates of advanced and emerging countries requires the identification of specific shocks that affect their dynamics. Our findings suggest that changes in the nature and importance of these shocks are behind the time-varying link between the US Treasury rate and Colombian asset prices, including local long-term bond yields.

In particular, our results show that the short-run response of the local long-term interest rate, CDS spreads, the foreign exchange rate and the stock market index value to shocks to the US Treasury rate have been qualitatively different depending on both the sample period (i.e. before, during and after the global financial crisis) and the source of the shock.

Our findings suggest that in the pre-crisis period, investment decisions are characterized mainly by the search for high returns. Positive shocks to global volatility, the term premium and the stance of monetary policy in the US increase the Treasury yield, and lead to a rise in local long-term interest rates, a decline in stock prices, a depreciation of the currency and a higher perception of country risk.

During the financial crisis, shocks to the US Treasury rate caused by changes in global volatility or the term premium show the same qualitative responses observed in the pre-crisis period. However, the responses to an itUS shock provide a different story. A positive shock to itUS leads to a reduction in local long-term bond yields, the appreciation of the local currency, an increase in stock prices, and a fall in the country risk perception.

We suggest that in the crisis period (i.e. an atmosphere of economic uncertainty and high levels of risk), a shock to itUS captures the desire of investors to hedge the risk exposure using "safe haven assets". The latter effect was dominant during the global financial crisis. These results also suggest that the VIX fails to pick completely changes in global risk aversion or in the fear of a generalized economic collapse.

In the post-crisis period, the responses of the Colombian long-term bond yield and other asset prices are similar to those observed during the crisis. Our findings indicate that this period is also characterized by a especial role of US Treasuries as a "safe haven asset". Nevertheless, there are signals of a possible differentiation between local asset types.

Acknowledgements

We would like to express our gratitude to Luis Fernando Melo for his advice on empirical methods used in this document and Lisset Venegas for her assistance in the research work. We benefited from comments by José E. Gómez, Franz Hamann, Carlos León, Jair Ojeda, Jorge Toro, and Juan Pablo Zárate. The opinions, statements, findings and interpretations presented in this paper are responsibility of the authors and do not necessarily represent those of Banco de la República nor of its Board of Directors. As usual, all errors and omissions in this work are our responsibility.

Notes

1US, UK, Canada, Japan and Euro area.2See Bernanke and Reinhart (2004) for a detailed description on instruments used under this policy scheme.

3This program has been addressed to buy long-term Treasury bonds and Mortgage-Backed securities (MBS). The Fed also performed the "Operation Twist" in 2011. In this action, the Fed sold short-term Treasury bonds and bought the same class of securities with long-term maturities.

4This reduction is associated to better terms of trade, fiscal consolidation, improvements in the security conditions and the deepening of the public debt market in local currency.

5This figure aims to show long-run trends of net capital inflows for Colombia and other local financial variables. We have constructed this figure using monthly information, and therefore, we could be missing patterns implicit in data with higher frequency (e.g. short-run responses found in results in Sections 3 and 4). Moreover, the variable capital inflows includes both direct and portfolio investments.

6This order captures the average of capital inflows during the last semester and, hence, we avoid excessive volatility in our analysis.

7Corresponds to the cash-basis current and capital transactions done in the dollar spot market.

8For example, in February 2007 HSBC fires to the head of its US mortgage lending division and Freddie Mac announced that it would not buy risky mortgage securities. Furthermore, along 2007 and 2008 financial and real sector companies reported losses associated to the mortgage business, and the Fed warned on its negative effects on the economy.

9The use of daily financial data in this paper provides several advantages in comparison with studies based on lower time frequencies. In particular, the data set is richer in terms of observations for short-time periods, and hence, we can perform MWLR and VARX-MGARCH exercises for the pre-crisis, crisis and post-crisis periods. We can also capture short-term responses of financial variables that are not possible to uncover with monthly data. In fact, the sample period in this paper is characterized by extremely high volatile time spans which imply daily changes in financial decisions, and hence, movements in interest rates, asset prices, economic variables and short-time reallocation of resources between markets.

1010-year CDS spreads data are not available for our full sample period. Nevertheless, 5-year CDS contracts are highly liquid and represent effectively the country risk.

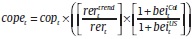

11Cope is calculated as where rert is the real exchange rate and rerttrend is its trend, while beitCol and beitUS are the Colombian and US break-even inflation to 10 years, respectively. The construction of cope assumes that agents expect a correction of real exchange rate misalignments. The rert and rerttrend correspond to Colombia-US bilateral trade weighted real exchange rate. The real exchange rate trend is computed with the Hodrick-Prescott filter. The data source of rer is the Central Bank of Colombia while remaining variables are taken from Bloomberg.

where rert is the real exchange rate and rerttrend is its trend, while beitCol and beitUS are the Colombian and US break-even inflation to 10 years, respectively. The construction of cope assumes that agents expect a correction of real exchange rate misalignments. The rert and rerttrend correspond to Colombia-US bilateral trade weighted real exchange rate. The real exchange rate trend is computed with the Hodrick-Prescott filter. The data source of rer is the Central Bank of Colombia while remaining variables are taken from Bloomberg.

12Cronin (2014) highlights that the analysis over time of the relationship between financial variables provides more information that a static assessment with the full sample.

13For the MWLR exercises, we have required to extend our original sample with data since 2003 to have at least two years of observations in the first window of our rolling regression.

14This econometric exercise could suffer from omitted-variable bias. However, this MWLR meets the aim of providing evidence on the changing relationship between iUS and four Colombian financial variables. In addition, our results are robust to including the VIX in the MWLR.

15We also carry out the MWLR of Equation (2) using as proxy for the expected devaluation dlcopet*, the difference between lcopet and lcopt. Figure A1 in Appendix B presents the moving window estimate of coefficients β1, β2 and β3 of this exercise. The dynamics of estimated coefficients β1 and β3 in Figure A1 is very similar to that exhibited in Figure 5. These findings show that there are no relevant differences in the estimated coefficient β1 when either lcoptk-1 or dlcope*tk-1 is used as proxy for the expected depreciation.

16As a robustness check, we estimated the VARX-MGARCH model without the variable lcope. The latter is not observable, and hence, the proxy that we use in this exercise may introduce noise in the estimation. Nevertheless, the responses of the remaining variables do not present relevant changes with respect to findings reported in this section. The variable lcope in the multiplier analysis show how the expectations of future depreciation or appreciation change with respect to different shocks.

17In order to control for specific events like FOMC meetings and the publication of its minutes (as suggested by Wrigth, 2012, and Londoño and Sapriza, 2014), we included a dummy variable that collects the dates of those events.

18The VIX is the Chicago Board Options Exchange Market Volatility Index. This is a measure of the implied volatility of S&P 500 index options over the next 30-day period.

19The MOVE is the Merrill Lynch Option Volatility Estimate index. This is a weighted average of the normalized implied yield volatility for 1-month Treasury options on the 2-year (20%), 5-year (20%), 10-year (40%) and 30-year (20%) maturities. The weights are based on option trading volumes in each maturity.

20For all sample periods, the responses of  to external financial shocks in this analysis are not statistically significant.

to external financial shocks in this analysis are not statistically significant.

21The volatility modeling can improve the efficiency in parameter estimation and the accuracy in confidence intervals (Tsay, 2010).

References

Bernanke, B., and Reinhart V. (2004). Conducting Monetary Policy at Very Low Short-Term Interest Rates. American Economic Review 94, 85-90. [ Links ]

Chen, Q., Filardo, A., He, D., and Zhu, F. (2012). International Spillovers of Central Bank Balance Sheet Policies. In: B. for International Settlements (ed.): Are Central Bank Balance Sheets in Asia too Large? Vol. 66. Bank for International Settlements, p. 220-264. [ Links ]

Cieslak, A., and Povala, P. (2013). Information in the Term Structure of Yield Curve Volatility. Working paper, Northwestern University. [ Links ]

Clare, A., and Lekkos, L. (2000). An Analysis of the Relationship between International Bond Markets. Working Paper Series 123, Bank of England. [ Links ]

Cúrdia, V., and Woodford, M. (2011). The Central-Bank Balance Sheet as an Instrument of Monetary Policy. Journal of Monetary Economics 58, 54-79. [ Links ]

Cronin, D. (2014). The Interaction between Money and Asset Markets: A Spillover Index Approach. Journal of Macroeconomics 39, 185-202. [ Links ]

Curdia, B., Ferrero, A., and Chen, H. (2012). The Macroeconomic Effects of Large-Scale Asset Purchase Programs. 2012 Meeting Papers 372, Society for Economic Dynamics. [ Links ]

D'Amico, S., and King, T.B. (2013). Flow and Stock Effects of Large-Scale Treasury Purchases: Evidence on the Importance of Local Supply. Journal of Financial Economics 108, 425-448. [ Links ]

Doh, T. (2010). The Efficacy of Large-Scale Asset Purchases at the Zero Lower Bound. Economic Review (Q II), 5-34. [ Links ]

Edwards, S. (2010). The International Transmission of Interest Rate Shocks: The Federal Reserve and Emerging Markets in Latin America and Asia. Journal of International Money and Finance 29, 685-703. [ Links ]

Engle, R., and Kroner, K. (1995). Multivariate Simultaneous Generalized ARCH. Econometric Theory 11, 122-150. [ Links ]

Fratzscher, M., Lo Duca, M., and Straub, R. (2013). On the International Spillovers of US Quantitative Easing. Discussion Papers of DIW Berlin 1304, German Institute for Economic Research. [ Links ]

Gagnon, J., Raskin, M., Remanche, J., and Sack, B. (2011). The Financial Market Effects of the Federal Reserve's Large-Scale Asset Purchases. International Journal of Central Banking 7, 3-43. [ Links ]

García-Cicco, J. (2011). On the Quantitative Effects of Unconventional Monetary Policies in Small Open Economies. International Journal of Central Banking 7, 53-115. [ Links ]

Glick, R., and Leduc, S. (2012). Central Bank Announcements of Asset Purchases and the Impact on Global Financial and Commodity Markets. Journal of International Money and Finance 31, 2078-2101. [ Links ]

Jones, C., and Kulish, M. (2013). Long-Term Interest Rates, Risk Premia and Unconventional Monetary Policy. Journal of Economic Dynamics & Control 37, 2547-2561. [ Links ]

Joyce, M., Lasaosa, A., Stevens, I., and Tong, M. (2011). The Financial Market Impact of Quantitative Easing in the United Kingdom. International Journal of Central Banking 7, 113-161. [ Links ]

Londoño, J., and Sapriza, H. (2014). U.S. Unconventional Monetary Policy and Contagion to Emerging Market Economies. International finance discussion papers, Federal Reserve Board. [ Links ]

Moore, J., Nam, S., Suh, and M., Tepper, A. (2013). Estimating the Impacts of U.S. LSAPs on Emerging Market Economies' Local Currency Bond Markets. Staff Reports 595, Federal Reserve Bank of New York. [ Links ]

Peersman, G. (2011). Macroeconomic Effects of Unconventional Monetary Policy in the Euro Area. Working Papers Series, European Central Bank No. 1397. [ Links ]

Schenkelberg, H., and Watzka, S. (2013). Real Effects of Quantitative Easing at the Zero Lower Bound: Structural VAR-based evidence from Japan. Journal of International Money and Finance 33, 327-357. [ Links ]

Stock, J.H., and Watson, M.W. (2011). Introduction to Econometrics. Boston: Addison-Wesley, 3rd ed. [ Links ]

Tobias, A., Crump, R., and Moench, E. (2013). Pricing the Term Structure with Linear Regressions. Journal of Financial Economics 110, 110-138. [ Links ]

Tsay, R. (2010). Analysis of Financial Time Series. New Jersey: John Wiley & Sons, 3rd ed. [ Links ]

Turner, P. (2013). Benign Neglect of the Long-Term Interest Rate. BIS Working Papers 403, Bank for International Settlements. [ Links ]

Turner, P. (2014). The Global Long-Term Interest Rate, Financial Risks and Policy Choices in EMEs. BIS Working Papers 441, Bank for International Settlements. [ Links ]

Wright, J. (2012). What Does Monetary Policy Do to Long-Term Interest Rates at the Zero Lower Bound? The Economic Journal 122, 447-466. [ Links ]

Zivot, E., and Wang, J. (2006). Modeling Financial Time Series with S-Plus. Springer, 2nd ed. [ Links ]