1. INTRODUCTION

The purpose of this paper is to document the decline in the rate of inflation in emerging economies that implemented an inflation targeting (IT) regime. I examine 14 emerging economies that implemented IT: Brazil, Chile, Colombia, Mexico, Peru, the Czech Republic, Hungary, Poland, South Africa, Indonesia, Korea, Israel, Philippines, and Thailand. The average rate of inflation in these countries declined by double digits in many cases throughout the implementation period, and have remained low and relatively stable despite the significant shocks that have hit over the last decade. By any measure, IT has been an amazing success story [Mishkin and Schmidt-Hebbel (2007)].

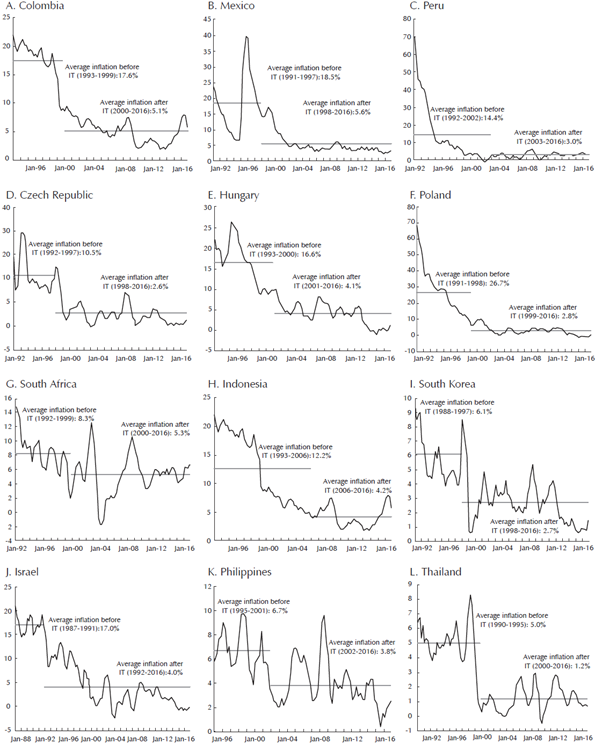

Section 3.1 plots the rate of inflation in these countries several years prior to the IT regime, up to the present. Because IT was implemented in these countries at different times, one cannot argue that synchronization of "good luck" shocks played a significant role in reducing inflation.

In Section 3.2, I also document the inability of these countries to hit an exact inflation target over the last decade. However, I view this as a success story given the amount of turbulence that hit these economies over that time frame. Inflation expectations appear to be well anchored despite the sizable shocks faced by policy makers.

Why has IT been so successful in these countries? To get a better understanding of this question, Section 2 documents the policies and procedures put in place during the implementation of the inflation targeting regime. Two aspects stand out:

First, the IT regime brought with it enhanced policy coordination among various governmental agencies. In nearly all countries, committees composed of central bankers and other government officials work together to set the inflation target. In some countries (e.g., Israel), committee members include academics and other private citizens. Section 4 lays out standard theory of policy coordination. Without coordination, rational expectations equilibrium do not exist in well-developed monetary models.

Second, transparency in the policy making process increased substantially with IT. Nearly all central banks publish inflation targets several years out. Nearly all central banks publish minutes of policy meetings or hold scheduled press conferences. When inflation targets are not hit, a few central banks make public explanations as to why the target was missed. Also, by targeting inflation, private agents have a much better understanding of the policy goal (as opposed to a stated goal of a "strong currency", for example). The release of information and transparency associated with IT has allowed agents to anchor expectations on specific inflation targets.

Section 4 lays out a well-established theory that emphasizes the importance of policy coordination in determining the price level. The theory shows how monetary and fiscal policy work together to control inflation and stabilize government debt. If this coordination is not forthcoming, the price level cannot be determined and expectations are not anchored. This theory supports the notion that because IT forced policy makers to focus on a specific goal, expectations of inflation became better anchored. Section 2 provides prime facie evidence that IT did indeed bring policy makers together in order to set the inflation target and implement policy to achieve the inflation target.

2. INFLATION TARGETING REGIMES

This section briefly documents how inflation targeting (IT) is implemented in 14 countries that are labeled "emerging economies" by Ball (2010). The countries are Brazil, Chile, Colombia, Mexico, Peru, the Czech Republic, Hungary, Poland, South Africa, Indonesia, Korea, Israel, Philippines, and Thailand. The purpose is to highlight specific aspects of the policy that are common across the countries, as opposed to thoroughly documenting the history and implementation of IT. Specifically, IT regimes have at least two things in common: increased transparency and a movement toward policy coordination.

Section 3 shows the impressive success of IT in bringing down the rate of inflation in all 14 countries. Some countries, like Brazil, had rampant inflation prior to IT. While I do not perform any rigorous econometrics to test what factors were most important, the experiment was obviously a success. The goal of this section is to document how each central bank describes IT in their own words in order to provide evidence of commonalities across countries.

2.1 BRAZIL

The Central Bank of Brazil's (BCB) Monetary Policy Committee (COPOM) was created on June 20th 1996 with the stated goal of enhancing monetary policy transparency. The COPOM is comprised of the members of the Central Bank's Board of Governors: the Central Bank Governor and the Deputy Governors of Monetary Policy, Economic Policy, International Affairs and Risk Management, Financial Regulation, Financial System Organization and Control of Farm Credit, Supervision, Administration, Institutional Relations and Citizenship. The heads of the seven Central Bank Departments (the Department of Economics (DEPEC), Foreign Reserves Department (DEPIN), Department of Banking Operations and Payments System (DEBAN), Open Market Operations Department (DEMAB), Investor Relations and Special Studies Department (GERIN), International Affairs Department (DERIN) and Research Department (DEPEP)) also regularly attend COPOM meetings. Each department gives presentations about topics that range from the level of current and projected inflation to trends in the macroeconomy.

The National Monetary Council, which consists of the Minister of Finance, the Minister of Planning, Development and Management and the Governor of the Central Bank of Brazil, sets the inflation target. If inflation breaches the target, the Governor of the Central Bank is required to write an open letter to the Minister of Finance explaining the reasons the target was missed, as well as the measures required to bring inflation back to the target, and the time period over which these measures are expected to take effect.

The IT reforms in Brazil have brought more policy institutions to the table to weigh in on economic objectives. The only publicly stated objective is the inflation target.

2.2 CHILE

The Central Bank of Chile (CBC) has maintained an IT regime with a stated goal of 3% with a plus/minus 1% tolerance since 2007.1 According to the CBC, this objective should be permanently achieved in a medium-term horizon of two years. From the CB's website:

The main merit of this regime is that, while it restricts the discretionary powers of the monetary authorities, it permits the achievement of stabilization policies. An inflation-targeting regime establishes specific objectives, providing the Central Bank with the freedom to use the instruments and policies necessary to achieve this aim. Communication with the public is optimized using a simple, easily understood indicator, which is able to strongly influence inflationary expectations. Monetary policy can also play a role in stabilizing output over the short term, as long as it is consistent with meeting the inflation target in the medium term.

The Central Bank's sole commitment is now to maintain inflation within the target range, as well as reflecting the authority's confidence in the market to determine autonomously the value of the national currency. In a highly volatile world of enormous openness to capital, maintaining a foreign exchange commitment is not only a difficult task, but also, as recent experience has taught, potentially very costly. A flexible approach to the foreign exchange rate eliminates this commitment, focusing Central Bank efforts on the inflation target, which becomes the nominal anchor for the economy, avoiding any possible confusion.

The leadership of the CBC consists of a board comprised of five members appointed by the President of the Republic with approval of the Senate. The board is responsible for carrying out the stated IT goals along with "stability of the currency and normal functioning of internal and external payment systems."

2.3 COLOMBIA

The Board of Directors sets the inflation target and consists of seven members with one vote each: the Minister of Finance, five full-time members and the General Manager of the Bank. The president of Colombia appoints two members every four years.

The Bank explicitly discusses how to achieve greater transparency with respect to setting policy.

The Bank makes explicit use of its constitutional mandate to achieve and guarantee price stability-the prime objective of monetary policy. The Bank announces the inflation targets with sufficient notice thereby enabling economic agents to take them into account in their decision making. The bank analyses various economic indicators and uses a wide variety of models with diverse foci (statistical and forecasting, structural and simulation) to strengthen further its ability for making economic forecasts. The Bank carries out sensitivity analyses for risk management. It assesses changes in inflation forecasts under different domestic and international scenarios. The Bank interacts with other Central Banks and is open to the opinion of the national and international academic communities by means of organising and participating in seminars and forums dealing with subjects that are central to the Colombian and world economies. The Bank organises periodical meetings with various sectors of Colombian society (businessmen, employees, Congressmen, etc.) with the purpose of hearing their opinions and of explaining the Banks policy-decisions and their results. In its policy of transparency, the Bank publishes reports explaining decisions on monetary policies, including a monthly inflation report.

In addition to the reports mentioned above, in accordance with Law 31, Art. 5, the Board must present a report to Congress twice a year on the economy. The report also covers the basic monetary and exchange rate policies during each period, including the level of international reserves and the Bank's financial situation. Why and how the IT will be achieved plays a prominent role as well in these bi-annual meetings.

2.4 CZECH REPUBLIC

The central bank of the Czech Republic (CNB) moved to a more transparent IT regime in 1998 with an emphasis on medium-run targets and an explicit public announcement of an inflation target or sequence of targets. The decision-making body is the Bank Board, which consists of the CNB Governor, two Vice-Governors and four other Bank Board members. All Bank Board members are appointed by the President of the Czech Republic for a maximum of two six-year terms.

On it's website, the CNB has the following description of the policy making process:

In its monetary policy decision-making, the CNB Bank Board assesses the latest CNB forecast and evaluates the risks of non-fulfillment of this forecast. Based on these considerations the Bank Board then votes on whether and how to change the settings of monetary policy instruments. By changing these instruments the central bank seeks to offset excessive inflationary or dis-inflationary pressures which are deviating future inflation from the inflation target or from the tolerance band around this target.

Inflation, or expected inflation, can, however, result from extraordinary shocks as a rule on the supply side whose inflationary or disinflationary effects unwind over a period of time. Any attempt to entirely offset these effects by changing the settings of monetary policy instruments would needlessly cause short-term fluctuations in the economy. If the inflation forecast moves outside the inflation target tolerance band for a time due to such shocks, this is usually regarded under inflation targeting as an exemption from the central bank's objective of keeping inflation close to the target. The CNB like many other inflation-targeting central banks has adopted this practice and in justified situations works with "caveats", i.e. exceptions from its obligation to hit the inflation target.

The caveats are "large shocks" that are outside of the control of the central bank.

In the inflation targeting regime, the need for escape clauses derives from the occurrence of large shock changes in exogenous factors (particularly supply-side shocks) that are completely or largely outside the purview of central bank monetary policy. Attempts to keep inflation on target in these circumstances might cause undesirable volatility of output and employment. If such a shock deflects projected inflation from the target, the CNB does not respond to the primary impacts of the shock. It will apply an exemption (escape clause) from the obligation to hit the inflation target and accept the temporary deviation of the inflation forecast and consequently also future inflation from the target caused in this way. There is a whole range of shocks which can create room for applying such escape clauses. Changes to indirect taxes are one such shock.

2.5 HUNGARY

The central bank of Hungary (MNB) states as its "primary statutory objective" to achieve and maintain price stability. IT was adopted in 2001 and the process of achieving an inflation target is described as follows:

The MNB can meet its inflation target by changing the central bank base rate to an appropriate extent and pace. In Hungary, setting the key policy rate is the responsibility of the Monetary Council, the MNB's supreme decision-making body. The Council convenes as required by circumstances, usually twice but at least once a month, according to a pre-announced schedule. From the meetings one is a rate-setting meeting each month. The Council sets interest rates by a simple majority vote of members present. In the event of a tie, the Governor of the MNB has a casting vote. In case the Governor is prevented from voting, the Deputy Governor has a casting vote. The Council issues a statement explaining the reasons behind its action on the day of the interest rate decision. Abridged minutes of the Council's rate-setting meetings are released regularly, before the next rate-setting meeting takes place. The aim of the minutes is to lend higher transparency to the monetary policy decision-making process and provide economic agents with a deeper insight into the Council's evaluation of current economic conditions. Publishing the individual votes makes decision-makers accountable in respect of their contribution to the fulfillment of the mandate of price stability defined by Parliament.

The MNB's website also contains a thorough discussion of the transmission mechanisms of monetary policy. One section discusses the importance of inflation expectations.

The expectations channel has a key role in modern central banking. One explanation for this is that it is not only the central bank's current interest rate decisions, but also its expected behaviour, which may influence developments in the real economy and inflation. If the central bank has a sufficiently credible commitment to price stability, then economic agents will take their price and wage-setting decisions in the expectation that it is the central bank's target which will drive the medium-term outlook for inflation. In this case, inflation expectations are said to be "anchored", which is indispensable for maintaining price stability and makes it much easier for the central bank to bring inflation back to target, should an adverse shock occur.

2.6 INDONESIA

IT was formally adopted in 2005 and replaced the crawling exchange rate system as the nominal anchor for monetary policy. The target is set by Government officials in a Memorandum of Understanding between the Government and Bank Indonesia, the inflation target is established for three year period in a Decree of the Minister of Finance (KMK).

The implementation of IT, as explained by the Bank Indonesia, emphasizes the importance of setting a target that is easily understood by the public. It describes the process accordingly:

The Bank Indonesia announces future inflation targets for specific periods. During each period, Bank Indonesia will evaluate whether the inflation projection is on track with the adopted target. This projection employs a number of models and various information depicting future inflation conditions. If the inflation projection is no longer compatible with the target, Bank Indonesia then responds with the instruments at its disposal. For example, if the inflation projection overshoots the target, Bank Indonesia will adopt a tight bias monetary policy. Bank Indonesia issues regular explanations to the public on the assessment of inflation conditions, the future outlook and decisions taken. If the inflation target is not reached, an explanation must be provided to the public and measures taken to put inflation back on course for its target.

A nominal anchor is used in the ITF for a number of reasons: The ITF is more easily understood by the public. With an explicit inflation target, the public will understand the direction of inflation. In contrast, when a base money target is employed, the public has greater difficulty in understanding the future direction of inflation, especially if the linkage with inflation is unclear. The ITF focuses on inflation as the monetary policy priority, in keeping with the mandate vested in Bank Indonesia. The ITF is forward looking, as appropriate to the time lag for policy to have impact on inflation. The ITF strengthens the transparency and accountability of monetary policy and in so doing boosts monetary policy credibility. Transparency, accountability and clarity of objectives form part of the good governance of a bank vested with independence. The ITF does not require an assumption of stability in the relationship between money supply, output and inflation. Instead, the ITF represents a more comprehensive approach that takes account of a number of information variables on the condition of the economy.

2.7 ISRAEL

The IT regime in Israel was one of the first in the world. According to the central bank, the main objective of monetary policy is to maintain price stability in order to help to create a business environment that supports sustainable economic growth. Price stability is defined in terms of an inflation target that the government has been setting since 1992. The objective of monetary policy is to attain the target.

The central bank describes the monetary mechanisms in the following manner:

To attain the inflation target, the Bank of Israel sets the level of short-term interest rates. Too low a level of interest would lead to overexpansion and inflationary pressures, while too steep a rise in the rate of interest would result in excessive restraint of economic activity. Monetary policy, through the interest rate, also affects inflation expectations of the public (individuals and companies) and through them the decisions the public makes on the basis of those expectations.

Experience in Israel and abroad shows that inflation has a distorting effect on vital aspects of the economy-production, consumption, foreign trade, the labor market, and the financial markets-to the detriment of stable economic growth. Hence the importance that the Bank of Israel (like other central banks) attaches to the battle against inflation.

Each month, the Bank of Israel determines the interest rate level that is needed to maintain price stability (or to converge into the range defined as price stability within a reasonable period of time), and to support financial stability, and attain the government's other objectives, primarily growth and employment. To make this decision and as a basis for formulating monetary policy, the Research Department and Market Operations Department formulate an outline of the state of the inflation environment and the forces that affect it by analyzing current information about activity, the labor market and prices, capital market indicators, and using quantitative empirical models that the Bank has developed to predict inflation.

The website contains additional descriptions of specific policy instruments (e.g., repo rates) and the effect that these instruments have on the economy.

2.8 MEXICO

One of the few countries in the sample that has a stated primary goal other than inflation targeting is Mexico. According the central bank's website, the main goal of Banco de Mexico is "to preserve the value of Mexico's currency in the long term in order to improve Mexicans' well-being." It is also relatively opaque in its policy goals and instruments.

The central bank emphasizes autonomy, defined as "no authority can demand credit from it."

Banco de Mexico's autonomy rests on three pillars. The first is a legal pillar consisting of a constitutional mandate which establishes that its main priority is to foster the currency's purchasing power. The second pillar consists of the integration of its Governing Board and the rules by which it operates. This collegiate body comprises a governor and four deputy governors who are appointed by the President but cannot be removed from their post at his discretion. They serve alternately. The governor serves for six years, starting in the middle of a six-year presidential term and ending after the first three years of the following presidential term. Deputy governors serve for eight years and are replaced alternately every two years. The third pillar is the administrative autonomy the law confers on the central bank.

Significant progress in monetary policy has been made since the middle of the last decade with the adoption of a benchmark rate (the overnight interbank funding rate) as Banco de Mexico's monetary policy instrument. Since April 2004, monetary policy announcements were setting minimum interest rates and so the market was already operating "de facto" following the rate indicated by Banco de Mexico. Thus, formal migration to a benchmark rate operational target was implemented without altering the way in which Banco de Mexico had been operating. This change also facilitated the understanding of monetary policy actions and brought its implementation into line with that of other central banks.

2.9 PERU

In contrast to Mexico, Peru has basic definitions of policy instruments and basic economic explanations on its central bank's (BCRP) website. The BCRP website is one of the most informative in terms of policy making and transparency. For example, on inflation: "Inflation is detrimental to economic development because it prevents money from adequately fulfilling its functions as a medium of exchange, as a unit of account, and as a store of value. Inflation discourages investment and promotes speculation because it generates distortions in the price system, as well as an inefficient allocation of resources. The devaluation of money resulting from generalized and continuous rises in the prices of goods and services affects mainly low-income groups as these groups have usually no easy access to inflation hedging mechanisms. Thus, by maintaining inflation low, the BCRP creates the necessary conditions for normal economic activity which, in turn, contributes to achieving higher levels of sustained economic growth."

There are series of FAQs on the website which describes the basic function of the central bank. For example: What are the functions of the BCRP? What does the BCRP independence consist of? What is the highest authority of the BCRP? What is the BCRP inflation target? Why did the BCRP reduce its inflation target from 2.5 percent in 2002-2006 to 2.0 percent? What is the interbank interest rate? What type of dollarization is there in the Peruvian economy? Why does the BCRP carry out foreign exchange operations?

With respect to IT, the BCRP describes the process accordingly,

The inflation target is continuously measured against the last-12-month Consumer Price Index (CPI) for Metropolitan Lima to evaluate if the target has been met. Should inflation deviate from the target range, the Central Bank will take any necessary action to make it return to the target range, taking into account the lags of monetary policy.

In order to achieve price stability, the Central Bank seeks to prevent possible deviations of inflation vis-a-vis the target on a timely basis, given that BCRP's monetary decisions will affect inflation only after some quarters.

Monetary policy actions consist of modifying the reference interest rate for the interbank market, just like the other central banks following this scheme do. Depending on whether inflationary or deflationary pressures are observed in the economy, the BCRP will preventively modify the reference interest rate to maintain inflation at the target level.

At the beginning of every year, the BCRP publishes the dates when the Board of the Central Bank will make monetary policy decisions usually at the first meeting of the Board every month. The Board's agreements and decisions are then immediately announced to the public through press releases explaining the main reasons that support said decisions. These press releases are also published on the Central Bank's web site (http://www.bcrp.gob.pe).

In order to generate credibility regarding the inflation target and contribute to anchor inflation expectations, it is important that the BCRP inform the public how it intends to meet the target, as well as the arguments explaining the Central Bank's decisions. Therefore, in addition to the press releases, the BCRP publishes an Inflation Report every four months. This document, which is also found on the Bank's web site, analyzes the recent evolution of inflation and the actions adopted by the Central Bank, as well as the Banks vision on the evolution of economic variables and on how they might influence on inflation's future trend. Moreover, the Inflation Report also examines the main factors that could deviate inflation one way or another, which is called risk balance.

The BCRP monetary decisions are taken in a transparent manner, in line with the inflation target, taking into account the forecasts published in the Inflation Report. Therefore, the monthly press releases on the monetary program for the month are usually based on the Inflation Report or refer to it.

2.10 PHILIPPINES

The Development Budget and Coordination Committee (DBCC), an inter-agency economic planning body together with the central bank (BSP) sets the annual inflation target. The BSP makes the announcement of the inflation target two years in advance. Begninning in 2010, the BSP announced a shift to a fixed inflation target for the medium term, beginning with a target of 4.0 percent with a 1.0 percentage point deviation. The BSP describes the process of IT accordingly:

Inflation targeting is an approach to monetary policy that involves the use of a publicly announced inflation target set by the Government, which the BSP commits to achieve over a two-year horizon. Promoting price stability is the BSP's main priority, and the target serves as a guide for the public's expectations about future inflation, allowing them to plan ahead with greater certainty. The Advisory Committee was established as an integral part of the institutional setting for inflation targeting. It is tasked to deliberate, discuss and make recommendations on monetary policy to the Monetary Board.

Monetary operations refer to the buying/selling of government securities, lending/borrowing against underlying assets as collateral, acceptance of fixed-term deposits, foreign exchange swaps, and the use of other monetary instruments of the BSP aimed at influencing the underlying demand and supply conditions for central bank money. On 3 June 2016, the BSP formally adopted an interest rate corridor (IRC) system as a framework for conducting its monetary operations. The IRC is a system for guiding short-term market rates towards the BSP policy interest rate which is the overnight reverse repurchase (RRP) rate. It consists of a rate at which the central bank (CB) lends to banks (typically an overnight lending rate) and a rate at which it takes deposits from them (deposit rate). In a standard corridor, the lending rate will be above the CB target/policy rate (thereby forming an upper bound for short-term market rates), and the deposit rate will be below the CB rate (thereby forming the lower bound).

2.11 POLAND

IT is set by the Monetary Policy Council which describes the basic objective of monetary policy as "maintaining price stability" and that "stable prices are an indispensable element of constructing solid foundations for long-term economic growth."

The implementation of IT is described below:

Since 1999 the direct inflation target strategy has been utilized in the implementation of monetary policy. Within the framework of this strategy, the Monetary Policy Council defines the inflation target and then adjusts basic interest rates in order to maximise the probability of hitting the target. The NBP maintains interest rates at a level consistent with the adopted inflation target by influencing the level of nominal short-term interest rates on the money market. Money market rates affect loan and deposit rates at commercial banks and thus the size of loans, the demand within the economy and the inflation rate. The set of monetary policy instruments used by the NBP enables it to determine interest rates on the market. These instruments include open market operations, reserve requirements and credit-deposit operations.

2.12 SOUTH AFRICA

South Africa has had difficulty pinning down an exact target to hit.

Since the introduction of the flexible inflation-targeting framework in February 2000, the specification of the target has been reviewed on a number of occasions. The initial target measure was the CPIX, which was defined as the consumer price index for metropolitan and other urban areas, excluding the interest cost on mortgage bonds. This variant of the CPI was chosen because the headline or overall CPI was at that time influenced directly by changes in the Banks monetary policy. However, following revisions to the methodology employed to compile the CPI, which resulted in, inter alia, a change in the treatment of housing, mortgage interest costs no longer needed to be removed from the CPI when evaluating the effects of monetary policy.

When inflation targeting was introduced, the first target was specified as a calendar year average (for 2002) for CPIX inflation. Subsequent targets were also specified in terms of an average for a particular calendar year. In November 2003 the Minister of Finance announced that the calendar-year averaging would fall away and that the target would apply continuously.

The central bank website makes clear that in "monetary policy decision-making processes, committees are preferred above individuals. Not one central bank has replaced a committee with a single decision-maker, a fact that has both theoretical and empirical support; the ability to draw diverse viewpoints from constituent members in committees ensures that there is likely to be some moderation of extreme positions and policies and more even policymaking."

Policy is set by the Monetary Policy Committee (MPC), which consists of eight members of the Bank: the Governor, three deputy governors and four senior officials of the Bank. South Africa's commitment to transparent monetary policy has resulted in several initiatives to improve the communication of its policies to the public. The MPC concludes each meeting with a press conference by the Governor of the Bank explaining the reasons for the MPC's policy stance. The Bank also publishes its Monetary Policy Review (MPR) twice a year. According to the central bank, "this Review is aimed at broadening the understanding of the intentions and conduct of monetary policy. Moreover, the Review analyses the domestic and international developments that have impacted on inflation and motivates the monetary policy reaction to these developments. An assessment of the future outlook for the factors determining inflation as well as the Bank's forecast of the future path of inflation is provided in the MPR."

2.13 THAILAND

Another early adopter of IT, the Bank of Thailand (BoT) has been using a flexible inflation target since 2000. The Bank of Thailand Act explicitly states Thailand's monetary policy framework as:

By December of each year, the Monetary Policy Board, with a corporative agreement with the Minister, shall determine targets of monetary policy for the following year which shall be regarded as the guideline for the State and the BOT for the purpose of implementing any measure to maintain the price stability. The Minister shall propose the agreed targets of monetary policy to the Cabinet for approving. Upon the approval, it shall be published in the Government Gazette.

The BoT provides rationale for adopting IT:

Despite the success of the inflation targeting framework with the core inflation as policy target in achieving price stability since its beginning in 2000, some important deficiencies with the core inflation may diminish its effectiveness going forward. Compared to core inflation, headline inflation is better in reflecting more accurately the change in the cost of living since it captures changes in prices of all goods and services in the CPI basket, including raw food and energy prices which account for 27 percent of the CPI basket. Therefore, headline inflation is more in tune with the understanding of general public of what constitutes the cost of living, and has been widely used as reference for saving decisions by households and for investment and price setting decisions by businesses. In addition, in recent years, core inflation has somewhat lost its ability to track overall inflationary pressure as it has diverged from headline inflation for much longer time period, compared to the past. This is likely because changes in raw food and energy prices have increasingly more influence on the inflation dynamics over the past decade. Lastly, it is in line with international practices, with all countries under the inflation targeting framework currently use headline inflation as policy target. Therefore, adopting headline inflation as policy target will improve the efficiency of central bank's communication with the public and thus strengthen the monetary policy effectiveness in anchoring long term inflation expectations.

And a rational for the specific target:

Changing from the range of 0.5 3.0 percent to point target at 2.5 percent gives clearer policy signals to the public. It prevents them from mistaking the bounds as target. Thus, point target should help anchor long term inflation expectation more effectively. Nevertheless, the tolerance band of ± 1.5 percent is needed to provide some flexibility to absorb temporary shocks from the volatile fluctuations in raw food and energy prices.

3. TWO OBSERVATIONS

This section examines the rate of inflation in the 14 countries before and after inflation targeting (IT). Two observations are made. First, the rate of inflation came down significantly in all countries around the adoption date of IT. Given that the countries are diverse and the date of implementation was different in each country, it is obvious that IT was successful along this dimension. The second set of figures documents the inability of the central banks to hit the inflation target over the medium run. This poses the greatest challenge for IT going forward.

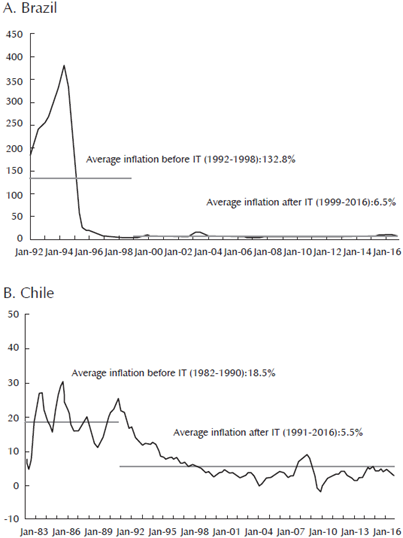

3.1 OBSERVATION ONE: REDUCTION IN RATE OF INFLATION

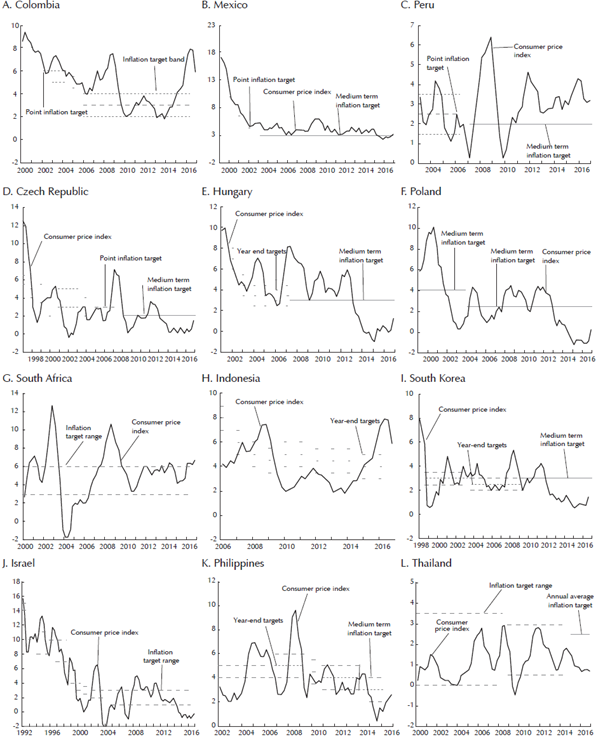

The first set of figures plots the year-over-year change in the rate of inflation six to eight years before IT, and several years following IT. Unless otherwise stated, year-over-year consumer price indices (CPI) are plotted and collected from OECD.Stat, CEIC, World Bank, FRED databases and central bank websites. The implementation date of IT was found on central bank websites In some cases, like Chile, an inflation target was gradually introduced.

Sources: OECD.Stat, CEIC, World Bank, FRED databases and central bank websites.

Figure 1: Inflation Targeting

The figures show that the rate of inflation declined substantially in every country that implemented IT. The figure contains two solid lines which represent average inflation before IT and average inflation after. The average rate of inflation was in double digits in many countries prior to IT. In Brazil, for example, the inflation rate averaged 132.8% prior to IT and 6.5% following. Following the implementation of IT, inflation rates came down by several orders of magnitude. In none of the countries did inflation return to its pre-IT levels. The upshot is simple: The rate of inflation fell substantially and remained low after the implementation of IT.

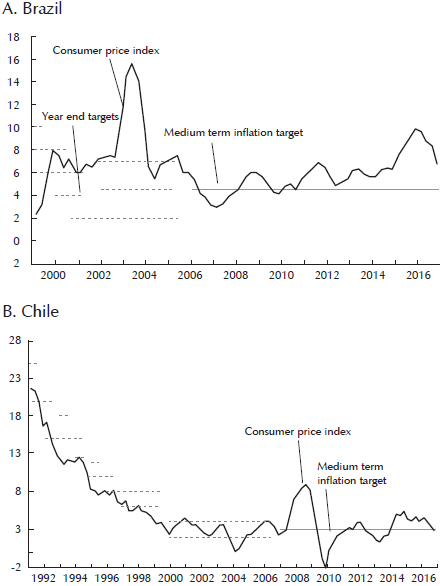

3.2 OBSERVATION TWO: MISSING TARGETS

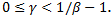

The second set of figures documents how frequently inflation targets are missed in these countries. The inflation targets are reported by the central banks. Several central banks have medium-run inflation targets (solid red line). The medium-run is typically defined as two years. Other central banks have a range for the inflation target (e.g., 2% ±1% These are plotted as dashed-dotted lines. On implementation of IT, some countries gradually implemented a lower rate of inflation (e.g., Chile). These are plotted as dashed lines.

Sources: OECD.Stat, CEIC, World Bank, FRED databases and central bank websites.

Figure 3: Inflation Targeting

The figures show that hitting an inflation target or even a range for inflation is difficult. Not a single country has been able to keep inflation within a 2% band of the medium-term inflation target. In many countries, the inflation rate is too high, but in a few inflation is persistently lower than target (e.g., Poland). The time horizon for these observations includes the financial crisis of 2008. The size of the shocks hitting many of these economies at that time were quite large. Of course, these factors made it extremely difficult to hit inflation targets.

One point of concern might be drift in inflation. Peru and Poland are good examples of inflation drift. Inflation in Peru has been consistently above target for the last six years while inflation in Poland has been consistently below over the same time frame. However, compared to the years prior to IT, these drifts are benign. Peru had an inflation rate that exceeded 60% while Poland had inflation in the double digits.

Sources: OECD.Stat, CEIC, World Bank, FRED databases and central bank websites.

Figure 4: Inflation Targeting in South America

The upshot is that these small-open economies are constantly buffeted with shocks that are difficult for policy makers to smooth. Focusing expectations on an inflation target has, thus far, worked extraordinarily well-even throughout the financial crisis. In my opinion, the deviations from target are minimal relative to the size of the shocks that these economies faced during this time period. Continuing to attempt to hit medium-run (and possibly longer-run) targets helps smooth shocks by anchoring expectations. Along this dimension, I believe IT has been an obvious success story.

4. A SIMPLE MODEL OF MONETARY-FISCAL INTERACTIONS

The point of this section is to show how policy coordination can pin down the price level. Section 2 provides prima facie evidence that policy coordination increased substantially due to IT. Nearly all central banks rely on policy coordination to achieve stated goals. This manifests itself as committees comprised of individuals from all forms of government (and occasionally, as in the case of Israel, private citizens). I am not arguing that this factor alone pulled the rate of inflation down in these countries but that it helped anchor expectations.

I present a simple analytical model of price-level determination that is designed to make plain the importance of the interactions between monetary and fiscal policies. The model and results are not new. The model draws from Leeper (1991), Sims (1994), and Woodford (2001). These papers were the first to establish how monetary and fiscal policies jointly determine equilibrium. My results draw from these papers as well as Davig et al. (2010) and Leeper and Walker (2011).

An infinitely lived representative household is endowed each period with a constant quantity of non-storable goods, γ. A government issues nominal one-period bonds, which defines the price level, P , as the rate at which bonds exchange for goods. I abstract from the possibility that seigniorage revenue can be used to finance government expenditures by restricting the economy to the cashless limit.2

Households maximize discounted expected utility by choosing sequences of consumption and bonds,

subject to the budget constraint

The household pays lump-sum taxes, τt , receives lump-sum transfers, zt, and purchases bonds Bt, each period.

For simplicity, I assume that government spending is identically zero each period, and that the government chooses sequences of taxes, transfers, and debt to satisfy

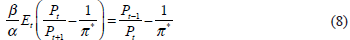

Goods clearing yields ct = y for t ≥ 0 and the household’s consumption Euler equation reduces to the simple Fisher relation

which relates the nominal interest rate Rt to the real rate β and expected inflation.

4.1 POLICY COORDINATION

Monetary and fiscal policy will determine the price level in equilibrium. I will write these policies as rules that must achieve two aims-control inflation and stabilize government debt. There is no pre-ordained view as to which policy is to be assigned to which task. Fiscal policy can just as easily control inflation as monetary policy; and monetary policy can stabilize government debt. The conventional assignment of tasks, which I will call Regime M (for monetary), has monetary policy targeting inflation and fiscal policy adjusting to stabilize debt. An alternative assignment, which I will call Regime F (for fiscal), does the opposite; monetary policy maintains the value of debt and fiscal policy controls inflation.

If policy coordination is not forthcoming and neither monetary policy nor fiscal policy stabilize debt, then no stable (covariance stationary) equilibrium will emerge. Thus, it requires policy coordination for the rational expectations equilibrium to be well defined.

The manner in which the policy rules are written is identical in each regime. For analytical convenience, the monetary policy rule will be written somewhat unconventionally in terms of the inverse of the nominal interest and inflation rates

Where π* is the inflation target and R* = π*/β is the steady state nominal interest rate.

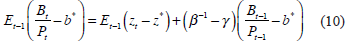

Fiscal policy adjusts taxes in response to the state of government debt

where b* is the real debt (or debt-GDP) target, τ* is the steady state level of taxes, and r = 1/β-1 is the net real interest rate.

It is how strongly the coefficients α and γ respond that determines whether Regime F or Regime M prevails. Regime M materializes if the nominal interest rate responds strongly enough to inflation (α > 1/β) and taxes respond to stabilize debt (γ > r = 1/β-1).Imposing that γ exceeds the net real interest rate guarantees that any increase in government debt creates an expectation that future taxes will rise by enough to both service the higher debt and retire it back to 𝑏 ∗ . Regime M is the conventional assignment that is studied in monetary textbooks (Galí (2008) and Woodford (2003)).

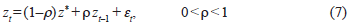

I assume that transfers evolve exogenously according to the stochastic process

where  is steady-state transfers and

is steady-state transfers and  is a serially uncorrelated shock with

is a serially uncorrelated shock with

Following Leeper and Walker (2011), equilibrium inflation in Regime M is obtained by combining (4) and (5) to yield the difference equation

Aggressive reactions of monetary policy to inflation imply that  and the unique bounded solution for inflation is

and the unique bounded solution for inflation is

so equilibrium inflation is always on target, as is expected inflation.

Substituting the tax rule, (6), into the government's budget constraint, (3), taking expectations conditional on information at t-1, and employing the Fisher relation, (4), yields the expected evolution of real debt

Because  , debt that is above target brings forth the expectation of higher taxes, so (10) describes how debt is expected to return to steady state following a shock to zt. In a steady state in which

, debt that is above target brings forth the expectation of higher taxes, so (10) describes how debt is expected to return to steady state following a shock to zt. In a steady state in which  debt is

debt is  equal to the present value of primary surpluses.

equal to the present value of primary surpluses.

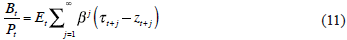

The value of government debt can be obtained by imposing equilibrium on the government's flow constraint, taking conditional expectations, and "solving forward" to arrive at

This condition states that the real value of debt is equal to the discounted, expected value of surpluses. Any change change in taxes or transfers must be offset to keep debt stable. Thus fiscal policy follows Ricardian equivalence. Agents know that in Regime M, any dollar increase in transfers (taxes) will be completely offset in discounted present value terms and therefore, will not affect the price level.

An alternative policy regime can also uniquely determine the equilibrium. In this regime, monetary policy's primary concern is not inflation stabilization. The recent zero-lower bound episode of the United States and other economies is a good example. The policy interest rate was unresponsive to changes in inflation. Likewise, it is often the case that fiscal adjustments are not always completely offsetting as in Regime M. Political factors can prevent taxes from increasing to offset increases in debt-GDP levels. Some countries simply do not have the fiscal infrastructure in place to generate the necessary tax revenues. Others might be at or near the peak of their Laffer curves, suggesting they are close to the fiscal limit. In this case, tax policy is active and

In Regime F, the nominal interest rate is set independently of inflation. For transparency, I will set  and

and  In this case, taxes are set independently of debt, γ = 0 and

In this case, taxes are set independently of debt, γ = 0 and  While these parameter choices might seem extreme, the qualitative points that emerge generalize to other specifications of passive monetary/active tax policies.

While these parameter choices might seem extreme, the qualitative points that emerge generalize to other specifications of passive monetary/active tax policies.

Imposing the tax rule on the intertemporal equilibrium condition, (11), gives

and the government's flow constraint, (3), gives the price level as

At time t, the numerator of this expression is predetermined, representing the nominal value of household wealth carried into period t. The denominator is the expected present value of primary fiscal surpluses from date t on, which is exogenous. So long as  and the present value of revenues exceeds the present value of transfers, a condition that must hold if government debt has positive value, expression (13) delivers a unique

and the present value of revenues exceeds the present value of transfers, a condition that must hold if government debt has positive value, expression (13) delivers a unique

To understand the differences in regime, consider the following thought experiment. Consider an increase in current transfer payments,  financed by new debt issuance,

financed by new debt issuance,  In Regime M, there is an expectation that fiscal policy at some point in the future will adjust accordingly and bonds will not be net wealth [Barro (1974)]. Alternatively in Regime F, there is no offsetting change in fiscal policy expected. Bonds become net wealth. This leads to an increase in aggregate demand through the wealth effect channel and, in turn, to an increase in the current price level. Thus Pt must rise to revalue current debt to be consistent with the new expected path of transfers as shown in (13): the value of debt falls in line with the lower expected present value of surpluses.

In Regime M, there is an expectation that fiscal policy at some point in the future will adjust accordingly and bonds will not be net wealth [Barro (1974)]. Alternatively in Regime F, there is no offsetting change in fiscal policy expected. Bonds become net wealth. This leads to an increase in aggregate demand through the wealth effect channel and, in turn, to an increase in the current price level. Thus Pt must rise to revalue current debt to be consistent with the new expected path of transfers as shown in (13): the value of debt falls in line with the lower expected present value of surpluses.

Both of these equilibria have a long history in the monetary economics literature and are well established. The main takeaway for the purposes of this paper is that one policy must be set to stabilize debt while the other controls inflation. The ordering with which this is accomplished depends upon policy parameters. However, suppose both the fiscal authority increases transfers and there is no forthcoming fiscal adjustment. Also assume that the monetary authority is not following a Taylor rule and the response of the nominal rate to inflation in (5) is close to zero.3 In this scenario, there does not exist a rational expectations equilibrium with stable inflation. The expected value of debt and/or inflation is not a stationary object, so no rational expectations equilibrium exists in the space of square summable random variables.

Apparently, anchoring expectations in either Regime M or Regime F requires some policy coordination. Without it, the inflation process would like similar to those found in the pre-IT era of the inflation targeting countries discussed above (that is, non-stationary). The notion that IT brought policy makers together and forced some coordination on a singular underlying goal certainly helped anchor expectations on those stated goals.

5 CONCLUDING THOUGHTS

Inflation targeting successfully brought the rate of inflation down in 14 emerging economies and has stabilized inflation expectations. The policy making process appears to be much more transparent and open. Committees consisting of central bankers, government officials and even private citizens are now responsible for setting the target and enacting policy to hit the target. These reforms have allowed the anchoring of inflation expectations.

I presented a simple model of policy coordination that shows how monetary and fiscal policy jointly determine the price level. If this coordination is not forthcoming, a stationary rational expectations equilibrium will not materialize. I presented prima facie evidence that this type of policy coordination increased substantially when IT was implemented in these countries.

More work needs to be done to fully understand why and how IT has been so successful. Current theories on information flows are inadequate for fully understanding the dynamics presented in Section 3. Models of rational expectations typically assume that all agents are fully informed and there is no information transmission in the conduct of monetary policy. I believe this is an important omission in our models. The structural reforms associated with IT brought about significant changes in how policy is communicated, which led to an anchoring of expectations. We need a better understanding of this mechanism.