1. Introduction

The stabilising role of fiscal policy is elusive in Latin America. Empirical studies show that fiscal policy has traditionally been procyclical in the region, as in other emerging economies (e.g. Gavin and Perotti, 1997, Talvi and Vegh, 2005, Cardenas and Perry, 2011). The dependence of Latin American finances on external credit and the recurrence of sudden stops may have made the region more prone to this behaviour. Since worsening financing conditions tend to be associated with economic weakness, the dearth of financing led to fiscal constraints (Kaminsky, Reinhart and Vegh, 2004 and Alberola and Montero, 2006). Furthermore, the importance of commodities in exports and revenues in most of the countries analysed is expected to introduce an additional procyclical bias in their fiscal policies (Céspedes and Velasco, 2014 and IMF Fiscal Monitor, 2015).

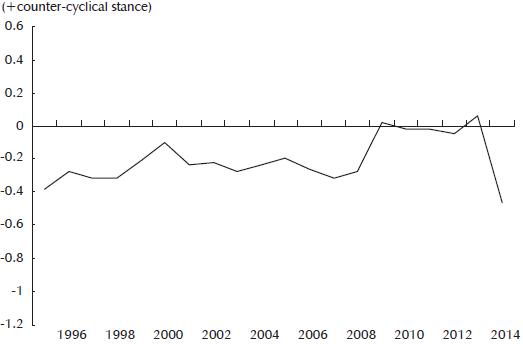

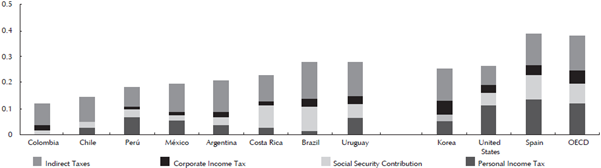

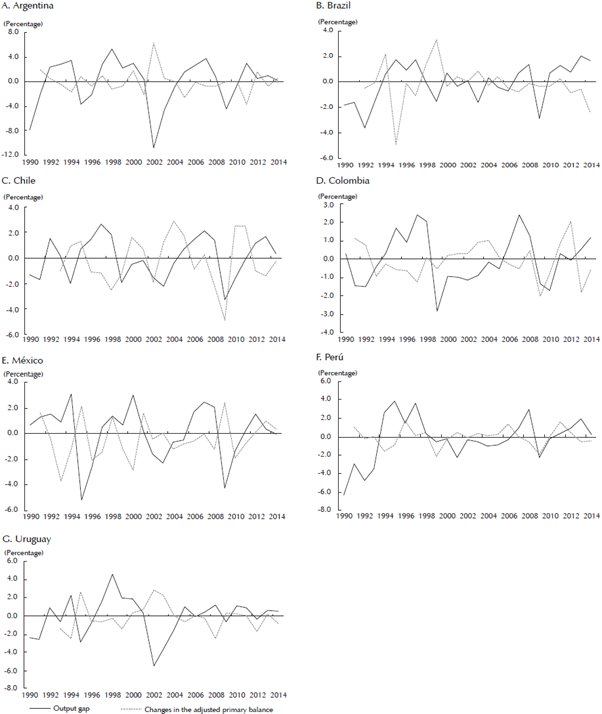

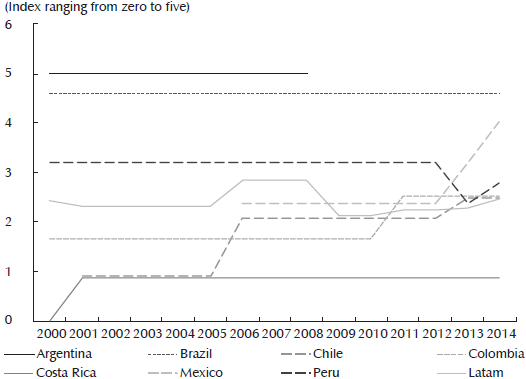

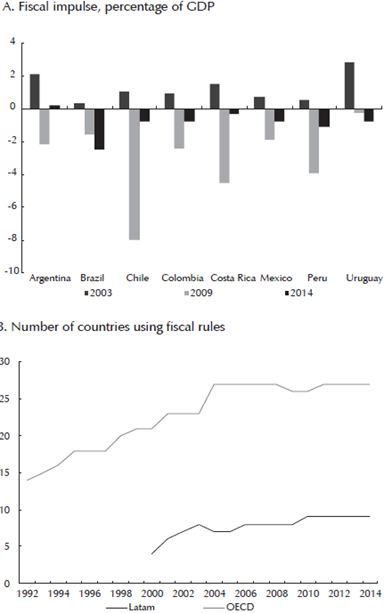

Things could have changed. On the one hand, the resilience shown to the 2008 financial crisis by most Latin American economies allowed them to mitigate its real impact through monetary and fiscal expansions, as shown by the expansionary fiscal stance. This implied a large fall in the adjusted primary fiscal balance —see figure 1, panel A—, something highlighted by some empirical studies (see Daude, Melguizo and Neut, 2011, Klemm, 2014, Vegh and Vuletin, 2014, and Fernández-Arias and Pérez, 2014). On the other hand, the improvement in macroeconomic management in the last two decades coincided with the progressive adoption of sounder fiscal frameworks, specifically with fiscal rules, as shown in figure 1, panel B. Fiscal rules could facilitate the stabilising role of fiscal policies and ensure debt sustainability in the long run, avoiding expenditure increases in good times, tax hikes in bad times, and allowing the full functioning of the automatic stabilisers.1

Has Latin America graduated to a more stabilising fiscal policy? Do more stable financing conditions or the implementation of fiscal rules contribute to an improved behaviour of fiscal policy? We address these questions by analysing the fiscal policy stance and the impact of financing conditions and fiscal rules on fiscal behaviour for the period 1990-2014 in Argentina 2, Brazil, Chile, Colombia, Costa Rica, Mexico, Peru and Uruguay3. The paper contributes to the literature on fiscal policy in Latin America, going beyond the above references to explore the factors lying behind the fiscal stance in the region, and provides a framework of analysis for fiscal policy behaviour in the face of external (financial conditions) and internal (self-imposed fiscal rules) constraints.

We obtain three main results: i) although fiscal policy reacted countercyclically to the financial crisis, this positive development has had no continuity, and fiscal policy continues to be procyclical overall in the region, placing on hold the idea of graduation of fiscal policy to a stabilising behaviour ; ii) financing conditions are confirmed to be the key driver of the fiscal stance in the region, in particular, they explain the procyclicality of fiscal policy; and iii) on the other hand, fiscal rules reduce procyclicality and allow an overall neutral fiscal stance.

Fiscal impulse is defined as the change of cyclically adjusted primary balance. A negative number implies an expansionary fiscal stance. Fiscal rules have been established in Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Jamaica, Mexico, Panama and Peru. For further details, see appendix A and B. Sources: Authors’ elaboration, database prepared for this paper (panel A); IMF Fiscal Rules Dataset (panel B).

Figure 1 Fiscal stance and fiscal rules in Latin America

The fiscal policy stance is determined by the change in the cyclically adjusted primary balance, but with a twist which is relevant for Latin America. We control for the evolution of commodity prices updating Daude, Melguizo and Neut (2011). The assessment of financing conditions takes into account the costs of financing and the underlying debt situation. When financial conditions tighten, in particular in a deteriorating debt environment, the room for an expanding fiscal policy may become constrained. We thus update and extend Alberola and Montero (2006) methodology, considering as a proxy for financing conditions, the adjusted primary balance that would stabilise debt at any point in time (threshold balance), and also taking into account the debt dynamics.

On top of this, we explore the impact of fiscal rules on fiscal policy. Fiscal rules do not only entail quantitative, but also qualitative variables, which make their correct tabulation challenging. In order to do so, we rely on the IMF Fiscal Rule Dataset (Budina et al., 2012) to construct a fiscal rule index. We also test the relevance of some of their key qualitative features, notably rule coverage, enforcement, and flexibility. In spite of this, some caution is still taken in the interpretation of the results. As stated in Berganza (2012), these qualitative variables will only register fiscal rule de jure, leaving aside the de facto implementation of the recommendations of the rule.

Finally, we address the issues of endogeneity and reverse causality using instrumental variables. Financing conditions could be driven by the fiscal policy stance, and not the other way round. Similarly, the adoption of fiscal rules may be the culmination of a process of improving fiscal discipline, and not its cause (Elbadawi et al, 2014). Also, our results should be taken with caution, given the limited sample and the difficulties to properly account for the endogeneity of fiscal rules.

The paper is structured as follows. Section 2 describes the methodology to compute the fiscal stance and provides preliminary evidence on the cyclicality of fiscal policy. Section 3 proposes the indicators of fiscal financing conditions, and analyses the link between the fiscal stance and changes in financing conditions. Section 4 adds fiscal rules in order to test their impact on the fiscal policy stance. Section 5 reports several robustness analyses and extensions. Section 6 concludes by summing up the results and assessing the implications for fiscal policy in Latin America going forward.

2. Assessing the fiscal stance in Latin America: data, methodology and results

We define the fiscal stance as the discretionary variation of the primary balance (e.g. net of interest payments on public debt) not explained by the impact of the business and commodity cycles. The data covers the non-financial public sector (NFPS), including public enterprises, as reported by the IMF.4 In order to compute the cyclically adjusted primary balance (b*), we follow the OECD approach (Girouard and André. 2005). The estimation is modified for Latin America by Daude, Melguizo and Neut (2011) so as to include tax and non-tax revenues from commodities (see appendix A). Given the small size of expenditure automatic stabilisers in the region, notably unemployment benefits (in contrast to developed economies), we apply this methodology only to revenues, as is usually the case in emerging countries. The output gap (GAP=Y/Y * ), where Y* is the trend output, is computed using a standard HP filter (lambda = 6.25), with annual projections up to 2020 taken from the IMF World Economic Outlook Database.

In order to empirically characterise the cyclicality of fiscal policy, we first regress the changes in the adjusted primary balance (∆b * ) on the estimated output gap

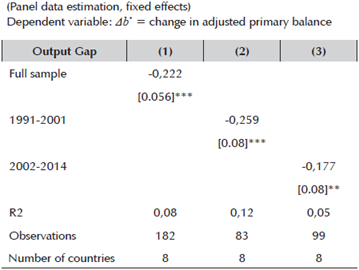

Table 1 presents the estimated coefficient β, using the fixed effects estimator in order to take into account unobserved heterogeneity.5

Table 1 Estimation of the fiscal stance in Latin America

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Source: Authors’ calculations.

The estimated coefficient is negative and significant (column 1), confirming that fiscal policy has been procyclical in the last two decades in this sample of countries in Latin America. However, this effect has varied over time. Columns 2 and 3 show the estimation coefficients, splitting the sample into two periods, 1990-2001 and 2002-2014, confirming the stronger procyclicality in the first period. 6 As an illustrative exercise, given the small sample, we perform a rolling-window estimation, setting a five-year window (figure 2). We find almost constant procyclicality from the 1990s until the crisis. During the crisis and immediately after, the parameters moved towards neutrality (coefficient around 0). Note that the big shift occurs in 2009 and 2010, showing the countercyclical response to the crisis. The improvement stalled thereafter and, in the last years of the window (2010-14), the coefficient sharply fell back again into procyclical territory.7

3. Financing conditions and the fiscal stance in Latin America

The previous evidence consistently supports the idea that discretionary fiscal policy has been procyclical in Latin America since 1990, with short exceptions.

The boom in commodity prices and global liquidity glut before the global financial crisis improved financing conditions and facilitated the access to cheap credit by Latin American governments, loosening the fiscal constraints in an expansionary phase. On the contrary, sudden stops of capital, derived from external or internal circumstances, did not only bring about economic adjustments, but also constrained fiscal policies. The result in both cases would have induced procyclical policies due to the changing financing conditions. Given that the worsening of the financing conditions in 2008-2009 was less persistent than in past episodes, the stabilising role of fiscal policy in the aftermath of the crisis could be explained by the financial resilience of the region.

3.1. Alternative measures of financing conditions

An important question is how to gauge financing conditions and their evolution. A first approximation could be the change in the spreads on external sovereign debt, as they take into account present and future sovereign risk. However, the change in the spreads does not convey the actual change in the overall financing costs, since spreads do not take into account —at least directly— the fiscal burden of the country or how it evolves in response to a change in financing conditions.

An alternative and preferred indicator of how the evolution of financing conditions affects fiscal performance is based on the actual change in the debt service of the country, which conveys the level of debt and its cost. Along this line, we follow Alberola and Montero (2006) in order to measure the financing situation of the public sector, focusing on the actual change in financing costs. A modified version of this indicator can blend market perceptions with actual changes in financing costs.

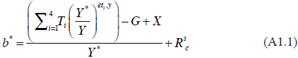

The indicator is built as follows. We compute the primary balance (b’), which would render the debt stable at a given point in time, and we denote it as threshold balance  A primary balance below (above) that estimate would make the debt grow (decrease). More specifically, given the growth of the economy

A primary balance below (above) that estimate would make the debt grow (decrease). More specifically, given the growth of the economy  the stock of debt in the previous period, in terms of GDP

the stock of debt in the previous period, in terms of GDP  and the cost of the debt

and the cost of the debt  we compute the threshold balance

we compute the threshold balance as:

as:

This threshold balance conveys the evolution of the financing conditions (reflected in r), but it also controls for the fiscal burden that they imply, since the increase in the threshold primary balance is proportional to the size of debt in the previous year. Finally, this expression conveys the impact of economic conditions through g, which alleviates the financing burden in good times and worsens it during economic downturns. The cost of debt (r) is derived, ex post, by dividing the interest payments by total debt, to obtain the implied cost of debt.8

Another relevant consideration is that fiscal policy constraints may also become more apparent when the fiscal trajectory is worsening. To account for this factor, we control the regressions for the debt dynamics (dd) by computing the difference between the threshold and the primary balance in the previous period.

A positive value of dd reflects that the primary balance b´ falls short of the threshold balance  indicating a worsening debt dynamics, and vice versa when the primary balance is higher than the threshold balance.

indicating a worsening debt dynamics, and vice versa when the primary balance is higher than the threshold balance.

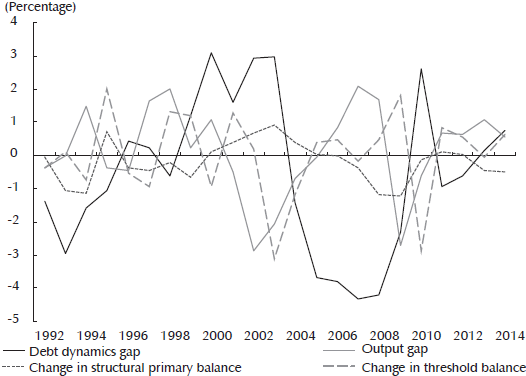

Figure 3 shows the evolution of the mean aggregate of the financial variables, together with the adjusted primary balance and the output gap (see appendix A for the evolution of the output gap and adjusted primary balance by country). Financing conditions became tighter after the emerging market crisis of 1998-2002. From 2004 and on, the region entered a period of fast decreasing debt, based on significant primary fiscal surpluses during the expansion period that started in 2003. The global financial crisis shoots up the threshold balance, reflecting an intense tightening of the financing conditions, but this time the fiscal stance moves to expansionary, implying countercyclicality. The rebound in 2010 assured loose financing conditions, but did not come with a procyclical response. In 2011 and 2012, some countries experienced fiscal savings together with decreasing debt and positive output gaps for the first time in our sample (i.e. “countercyclicality also in good times”). But note that in the last two years, 2013 and 2014, the positive output gaps coincide with expansionary fiscal stances; that is, a possible return to procyclicality, in spite of deteriorating financing conditions.

3.2. Explaining the fiscal stance with financing conditions: empirical approach

Our empirical framework to study the influence of financing conditions on the fiscal stance consists in regressing the changes of the adjusted primary balance  on our proxies for financing conditions:

on our proxies for financing conditions:

A positive δ, the parameter related to the changes in the threshold balance  would indicate that governments react to a worsening in financing conditions by restraining fiscal policy. The reaction of fiscal policy is also expected to depend on the dynamics of public debt

would indicate that governments react to a worsening in financing conditions by restraining fiscal policy. The reaction of fiscal policy is also expected to depend on the dynamics of public debt  When this term is positive, debt dynamics are worsening, possibly restraining the fiscal scope and putting upward pressure on the primary balance. Therefore, we expect γ to be positive. We include the output gap (GAP) in the regression to assess the fiscal policy stance after controlling for the financing conditions. If, as we expect, the financing conditions explain the fiscal stance, the coefficient of the output gap should lose relevance.

When this term is positive, debt dynamics are worsening, possibly restraining the fiscal scope and putting upward pressure on the primary balance. Therefore, we expect γ to be positive. We include the output gap (GAP) in the regression to assess the fiscal policy stance after controlling for the financing conditions. If, as we expect, the financing conditions explain the fiscal stance, the coefficient of the output gap should lose relevance.

With regard to the econometrics, we estimate equation (4) using a fixed effects estimator to take into account the possible omitted variable bias coming from the presence of unobserved country heterogeneity. Moreover, there are several sources of endogeneity. In particular, the financing costs included in the model could be affected by the fiscal stance through two channels. First, the real interest rate could be influenced by the announced fiscal policy. Second, the fiscal stance can affect the growth rate, and thus the threshold balances.9 Against this background, the fixed effects estimator would be consistent, but only under the strict exogeneity of the regressors, which could not be the case. In order to take into account the possible endogeneity between the financial variables and the fiscal impulse, we also use an instrumental variables (IV) estimator. We chose several instruments, including suitable lags of the independent variables.10

3.3. Main results

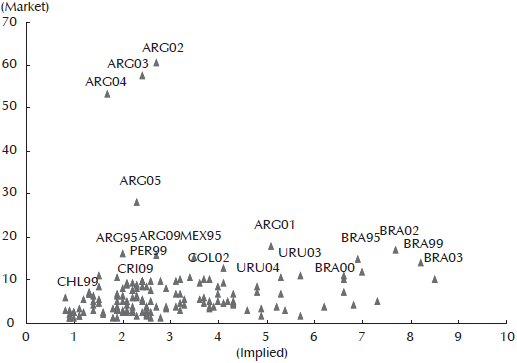

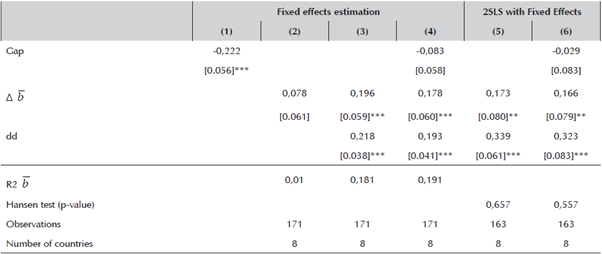

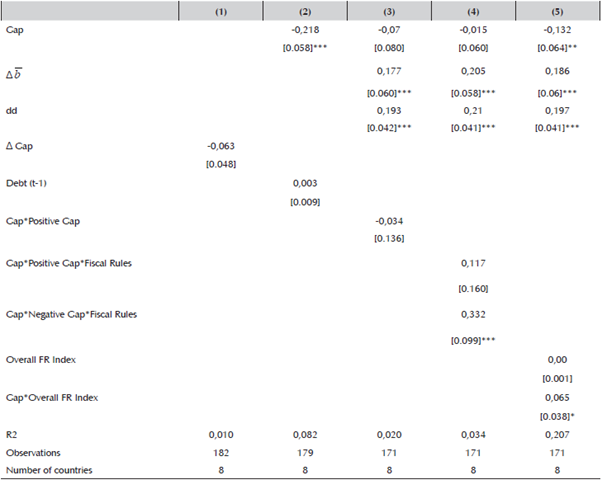

The results of the estimation of equation (4) using, first, fixed effects, and then instrumental variables are presented in table 2. Column 1 recalls the simple regression between the output gap and the change in the adjusted primary balance in table 1. The next columns include the estimates of the additional variables. The change in the threshold balance  is computed here, defining the interest rate r in equation (2) as the ex post cost of financing11.

is computed here, defining the interest rate r in equation (2) as the ex post cost of financing11.  is not significant on its own (column 2), but it becomes strongly so when controlling for the debt dynamics

is not significant on its own (column 2), but it becomes strongly so when controlling for the debt dynamics  which is also highly significant (column 3). Furthermore, the signs are both positive as expected, implying that tighter financing conditions in a context of worsening debt dynamics induce fiscal restraint. Finally, when controlling for these variables, the output gap loses significance, implying that the procyclical behaviour of fiscal policy is fully accounted for by the worsening financing environment (column 4).

which is also highly significant (column 3). Furthermore, the signs are both positive as expected, implying that tighter financing conditions in a context of worsening debt dynamics induce fiscal restraint. Finally, when controlling for these variables, the output gap loses significance, implying that the procyclical behaviour of fiscal policy is fully accounted for by the worsening financing environment (column 4).

Table 2 Financing conditions effects on fiscal policy in Latin America (Panel data estimation) Dependent variable: Δb* = change in adjusted primary balance

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Outliers dropped: Argentina 2002-2006.

Source: Authors’ calculations.

Regarding endogeneity issues, note that if there were reverse causation, that is, if the fiscal stance affects the financing conditions, the expected sign would be the opposite: an expansionary or loose fiscal behaviour would be associated with the worsening of financial conditions; so, if anything, this strengthens the results. In any case, for the sake of robustness, columns 5 and 6 in table 2 present the results of the instrumental variables approach. We find that, consistent with previous results, the fiscal stance is neutral if we control for the endogenous impact of financing conditions. Both remain significant and with an effect similar in size to the previous estimation. The behaviour of the instruments is correct as measured by the standard tests. Therefore, we can conclude that the evolution of financing conditions explains the observed procyclicality of fiscal policy in Latin America: worse conditions induce fiscal restraint and vice versa.

4. The role of fiscal rules

The relative improvement in the stabilisation role of fiscal policy in Latin America has coincided with the proliferation of fiscal rules in the region. This section attempts to properly assess the relation between these rules and the fiscal stance, based on the empirical approach of section 3. Furthermore, assessing the impact of fiscal rules requires not only considering their existence, but also some of their key features, such as their level of coverage, formal enforcements, legal basis and supporting procedures.

4.1. Fiscal rules, financing conditions and fiscal stance: main results

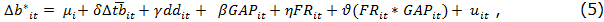

order to formally assess the role that fiscal rules have had on the fiscal stance, we extend the results from the previous section and consider the following specification:

in which we have added to the previous framework the variable  related to the existence of a fiscal rule in country i at time t. The identification of the fiscal rules and their time tabulation is provided in appendix appendix 2. This specification is flexible enough so that

related to the existence of a fiscal rule in country i at time t. The identification of the fiscal rules and their time tabulation is provided in appendix appendix 2. This specification is flexible enough so that  can represent a fiscal rule dummy, the value of the index or of one of its sub-indexes, as described below. This variable is introduced interacting with the output gap, in order to take into account that most fiscal rules affect fiscal policy as a function of the cyclical position of the economy. The parameter β would capture the impact of the output gap, filtering out fiscal rules and β + ϑ the overall impact of the gap, when fiscal rules are considered. We also include the fiscal rule with no interaction, to test whether the presence of fiscal rules makes countries save more independently of the position in the cycle.

can represent a fiscal rule dummy, the value of the index or of one of its sub-indexes, as described below. This variable is introduced interacting with the output gap, in order to take into account that most fiscal rules affect fiscal policy as a function of the cyclical position of the economy. The parameter β would capture the impact of the output gap, filtering out fiscal rules and β + ϑ the overall impact of the gap, when fiscal rules are considered. We also include the fiscal rule with no interaction, to test whether the presence of fiscal rules makes countries save more independently of the position in the cycle.

The problem of reverse causality is the main caveat of the estimation of fiscal rules´ effect on the fiscal stance. Fiscal rules may not be an instrument to discipline governments, but rather the result of the government´s (and society´s) preferences for a more robust fiscal environment. Or they might even be a signal to financial markets.12 In order to address this issue, we also instrument our fiscal rule indicator with institutional variables, mainly the durability of a regime, using the Polity IV Dataset, which establishes a chronological record of every political change and regime characteristics for countries covered by the data.13 The logic behind the use of this instrument is the possibility of capturing the historical pattern of durable institutions in a country.14 Therefore, the intuition is that durable regimes will influence future fiscal decisions through the implementation of fiscal institutions, namely fiscal rules, to ensure the continuation of stability through balanced fiscal balances. In order to use this, we construct a dummy variable that takes value 1 when a country has a regime durability of 20 years or more, and 0 otherwise. The results are robust to other durability spans.

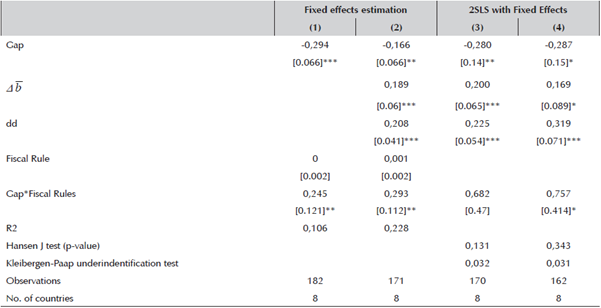

Table 3 shows the results of the estimation of fiscal rules taking into account only the existence of a fiscal rule in a country at time t. In column 1 we report the simple fixed effect estimator of the adjusted primary balance on the gap and the fiscal rules. We find that both effects are significant and with very similar parameter values. Therefore, without fiscal rules the fiscal stance would be procyclical, while it is neutral when fiscal rules are in place. Column 2 reports the within-group fixed effect estimator including the financial variables. We find that financial variables are still significant and with the predicted signs, while the output gap coefficient for a country without fiscal rules is also negative and significant. However, now the presence of fiscal rules is not only significant to explain the different cyclical behaviour of fiscal policy, but the interaction coefficient ,ϑ , is greater than the coefficient the output gap, indicating that, when controlling for fiscal rules, fiscal policy is significantly procyclical. In none of the cases is the fiscal rule per se significant, rejecting the hypothesis that they incorporate pro-savings behaviour irrespective of the economic cycle.

Columns 3 and 4 report the results using the IV approach. In column 3 we instrument the fiscal rule dummy variable using the years of durability of the regime as instrument,15 and adding a dummy variable reflecting the durability of governments (to add some degree of non-linearity), while treating the financial variables as controls. The effects of the financing conditions are similar and still significant, as before. However, the effect from fiscal rules is not significant. Moreover, the difference in the size and precision of the estimations of the fiscal rules’ coefficients in table 3, should call into question the stability of the parameters. Nevertheless, in column 4, with the introduction of suitable lags in the instrumental variable, we find that the effect of fiscal rules is significant and the Δ b change in the threshold balance (∆ b ) is only significant at the 90% level of confidence. This suggests that the presence of fiscal rules may induce some endogenous behaviour of financial variables, for example, because of their effect on the financing costs of the country.

Table 3 Fiscal rules, financing conditions and fiscal policy in Latin America (Panel data estimation) Dependent variable: Δb* = change in adjusted primary balance

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Outliers dropped: Argentina 2002-2006.

In (3) instruments are Durability -dummy and Durability -dummy (t-1).

In (4) instruments are Durability -dummyand Durability

Source: Authors’ calculations.

5. Robustness analysis and extensions

A set of robustness checks of the results is advised, given all the caveats mentioned above: i) using changes to the output gap instead of output gap levels; ii) including past debt levels as an alternative gauge of financing conditions; iii) considering asymmetries in the fiscal response depending on the sign of the output gap; and iv) getting deeper into the effects of different features of the fiscal rules and “second generation” sub-indexes.

In table 4, column 1, we present the response of the fiscal impulse to changes in the output gap. The estimated response is robust to the one presented in section 2. We find a procyclical fiscal policy on average, while the degree of procyclicality has diminished in the last part of the sample. However, the degree of procyclicality under this specification is non-significant in the aggregate. We also test for sustainability concerns in a simpler way, using past debt levels as a regressor (column 2). Under this specification, debt levels are not significant, which reinforces the idea that the dynamics of financing conditions, as captured by the threshold balance  and the debt dynamics dd is the driver of procyclicality in the region, rather than just the level of debt.

and the debt dynamics dd is the driver of procyclicality in the region, rather than just the level of debt.

Table 4 Fiscal rules, financing conditions and fiscal policy in Latin America -sensitivity tests (Panel data estimation, fixed effects) Dependent variable: Δb* = change in adjusted primary balance

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Outliers dropped: Argentina 2002-2006.

Source: Authors’ calculations.

In columns 3 and 4, we explore possible asymmetries in the reaction of fiscal policy and the impact of fiscal rules. We include the financing conditions variables in the three regressions. In column 3, we test whether countries have been more procyclical during expansions than during recessions, adding an interaction with a dummy, taking the value of 1 when the output gap is positive. While there is some evidence supporting this idea, and the coefficient of the interaction of the output gap and the cyclical position is negative, it is not significant. In column 4, we show the results of multiplying the dummy variable explained in column 3 with the dummy denoting the presence of fiscal rules, in order to test whether fiscal policies governed by fiscal rules have been more procyclical in booms than in busts. However, this specification assumes that, without fiscal rules, countries behave equally regardless of their cyclical position. We find that fiscal rules are more effective when the output gap is negative, suggesting that they help stabilise in downturns.

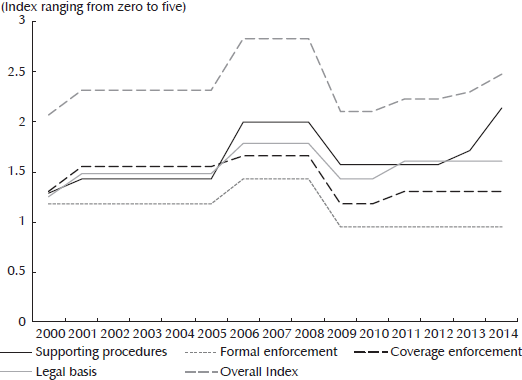

Finally, in column 5 of table 4, we go beyond the mere existence of fiscal rules including the “fiscal rule index” (see construction details in appendix B). Since the implementation and use of fiscal rules is not homogeneous across countries and their characteristics may vary, we include the “overall fiscal index” to address the heterogeneity of fiscal rules in the region. The interaction coefficient is significant and has a positive sign with the inclusion of financing conditions. As the previous results, the output gap and the financing conditions show the expected signs and are significant. The interaction coefficient of the overall index is smaller than the output gap when the value of the index is lower than 3 (which is the case in the majority of the countries), which would account for a more neutral discretionary fiscal policy, rather than a countercyclical fiscal policy. Again, the overall index without interactions is not significant.

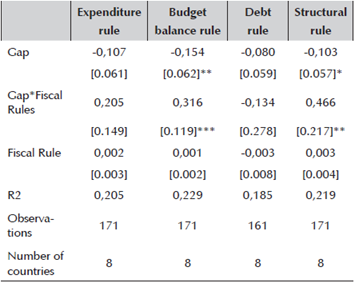

In table 5 we test whether different types of rules have different impacts on the fiscal stance of the government. We introduce the different types of rules as independent variables in the fixed effects estimator studied before, controlling for the impact of financing conditions. We find that budget balance rules and structural rules are correlated with a more countercyclical fiscal stance. Expenditure rules and debt rules appear irrelevant. Moreover, we find that none of the different types of rules taken in isolation affect the fiscal stance, as shown by the non-significance of the effect of the dummy variable 16.

Table 5 Types of fiscal rules, financing conditions and fiscal policy in Latin America (Panel data estimation, fixed effects) Dependent variable: Δb* = change in adjusted primary balance

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Outliers dropped: Argentina 2002-2006.

Financing conditions included in all regressions.

Source: Authors’ calculations.

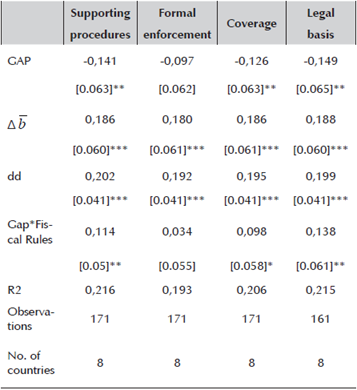

Finally, table 6 shows the effects of the different fiscal rule sub-indexes that capture an array of different characteristics (see appendix 2 for more details). The only sub-index that is non-significant is the formal enforcement of the rule. In other words, surprisingly enough, the existence of formal enforcement procedures (measured as in the IMF Fiscal Rules Dataset) plays no role as an explanatory variable of the countercyclicality of the countries’ fiscal policy. On the contrary, the coverage enforcement, legal basis and supporting procedures sub-index do seem to play a role. In the case of coverage enforcement, countries with a fiscal rule with a wider coverage (general government vs central government) tend to behave more countercyclically. Similarly, the supporting procedures sub-index shows that having an independent body monitoring implementation (or suggesting the proper assumptions) will behave similarly to the coverage enforcement sub-index (as in Bova, Carcenac and Guerguil, 2014). The most important aspects of a rule to prevent countries from behaving procyclically are the stronger legal basis of a rule and the supporting procedures. However, again, these results should be taken with caution. For the majority of the economies under study, the legal basis for the fiscal rules is statutory (and not constitutional, a legal treaty or a political agreement) and has not varied since 2000 (with the exception of Chile). As a result, most of the variation of the index comes from the introduction of a new fiscal rule rather than a change in the legal basis, reflecting a similar influence as the case where we only take into account the existence of a fiscal rule.17

Table 6 Fiscal rule sub-indexes, financing conditions and fiscal policy in Latin America (Panel data estimation, fixed effects) Dependent variable: Δb* = change in adjusted primary balance

Robust standard errors in brackets. *, **, *** denote statistical significance at 10%, 5% and 1%, respectively.

Outliers dropped: Argentina 2002-2006.

Financing conditions included in all regressions.

Source: Authors’ calculations.

6. Conclusions

This paper has reviewed the fiscal policy stance in Latin America and two possible determinants, financing conditions and fiscal rules.

Fiscal policy, traditionally procyclical in Latin America, became less so in the aftermath of the crisis. The mitigation of procyclicality in the last period is heavily influenced by the strong countercyclical behaviour during the crisis in the year 2009. However, the progress towards more stabilising fiscal policy has reversed in recent years. Indeed, positive output gaps have been accompanied by fiscal expansions in the last few years, and, even more recently, fiscal consolidation is being implemented at a time of faltering growth.

Overall, financing conditions, when considered with the dynamics of debt, turn out to be a key determinant of the fiscal policy stance. Worsening financing conditions, which tend to coincide with difficult economic times, constrain fiscal policy. Favourable financing conditions, more prominent in good times, favour fiscal profligacy. The outcome, quite robust empirically, is that fiscal procyclicality is explained by changing financing conditions.

On the institutional front, most countries in Latin America have strengthened their fiscal frameworks, notably through the use of fiscal rules. Our results are robust in showing that countries with fiscal rules have behaved less procyclically during the last two decades. Furthermore, for certain fiscal rule specifications the estimations cannot reject that they have enabled the implementation of countercyclical fiscal policies during certain periods, specifically as a reaction to the financial crisis. Also after the crisis, countries with fiscal rules show relatively better performance than countries without rules. Among these countries, and very tentatively, countries with fiscal rules with a wider coverage (general government vs central government), and with supporting procedures (e.g. an independent body which monitors implementation or suggests the appropriate set of assumptions) outperform the others in terms of stabilisation. Similarly, budget balance rules and structural rules are correlated with a more countercyclical fiscal stance.

All empirical work of this kind has to be taken with caution. While endogeneity or reverse causation is not an issue in the case of financing conditions determining the fiscal stance, the adoption of fiscal rules may be a consequence rather than a cause of more fiscal good practices and discipline.

What should we expect from the fiscal stance in Latin America going forward? Lower commodity prices and weak growth prospects constrain fiscal policy in much of Latin America. Lower commodity prices reduce tax revenues. Output gaps are into negative territory and financing conditions tightened due to the start of the anticipated lift-off, the weaker prospects for growth in the region and the reduced appetite for risk. The significant increase in average yield on government bonds combined with lower growth has impacted negatively on debt dynamics. Under such circumstances, fiscal positions will need to be improved even during the downturn, thus entrenching their procyclical bias in the current environment.

All in all, more research and evidence are needed to conclude that fiscal policy has “graduated” in Latin America - at least for some countries - as recently expressed by the IDB (Powell, 2015) and the IMF (Celasun et al., 2015). Yes, some progress was observed around the crisis, but the most recent behaviour grants caution before reaching a final verdict. As a matter of fact, our results cool down such optimistic conclusion.