1. Introduction

The subject of technological valuation is increasingly relevant, constituting an important part of technological management processes. Its results are necessary in a wide range of business and industrial activities ranging from technology transfer processes to the estimation of internal strengths from technology-based organizations (Angelo, Domenico, Luigi and Iacobelli, 2008; Watkins, 1998).

Technological valuation as a topic of research is in continuous development, and it has been pointed out that it has as much of art as of science, because although many of the techniques on which valuation processes are based have a solid financial and mathematical base, decision makers often resort to their instinct and experience (Hunt, Probert, Wong and Phaal, 2003; Paulson and Huber, 2001). Elói and Santiago (2008) indicate that the purpose of valuation is not to predict the exact value of technology, but to provide an expected value that captures the risks and uncertainties inherent to the process of technological innovation. Nevertheless, estimating the potential value of a technology-based innovation is a relevant issue that has not been satisfactorily addressed in the academic literature (Chanaron, 2013).

Notwithstanding, technological valuation has been studied and applied mainly in developed countries, and the most documented experiences proceed from research in such areas, while in developing countries such as Latin Americans there is little Information available on the subject (Jiménez, 2015). Hence, this paper aims to analyze the management of technological valuation in some Colombian companies and identify the challenges that they must face. The document initially addresses the characterization of technological valuation in less developed contexts, following the description of the methodology used, based on comparative reference techniques, and then presents the results obtained through this exercise. Lastly, it identifies challenges in the management of technological valuation for the companies studied, as well as the conclusions from this research.

2. Particularities of technological valuation in developing economies

According to Angelo et al. (2008), reference can be made to a restricted definition and a broad definition of technology, the first related to tangible elements and associated technical knowledge, while the broad concept encompasses the total technological capacity of productive systems. In this vein, various authors (Kakati and Dhar, 1991; Kaplan, 1986; Paramanathan, Farrukh, Phaal, and Probert, 2004; Raafat, 2002, among others) have suggested that in technological valuation, the restricted concept of technology can be limiting by causing these valuation processes to focus on tangible aspects with a purely economic approach.

The value of technology can be understood in different dimensions, not only economic, and is enriched by retaking the broad conceptualization of technology, and considering the importance of intangible elements such as technological capabilities. The latter are defined as the set of knowledge, skills, experiences and resources (such as information, organizational structures and networks), incorporated into routines, processes and products, which allow an organization to promote and manage technological changes, that is, developing or adapting technology and generating innovations; these capacities are the outcome of gradual and cumulative learning processes, dependent on the context in which they occur and, therefore, specific to each organization (Bell and Pavitt, 1993; Figueiredo, 2001, 2004; Jiménez, 2015; Lall, 1992; Takahashi, 2002; Viotti, 2002).

According to Bell and Pavitt (1993), it has usually been understood that only through (passive) technology diffusion, developing countries can achieve industrial growth, ignoring the value and importance of intangible resources required to generate and to manage technical change; namely, its technological capabilities by interpreting them only as a minor complement of the production capacity. Therefore, according to these authors, there has been a misconception of diffusion, away from innovation, ignoring that countries adopting and using technology can leverage it to generate local solutions based on the adaptation and improvement of foreign technologies based on learning processes and the accumulation of technological capacities.

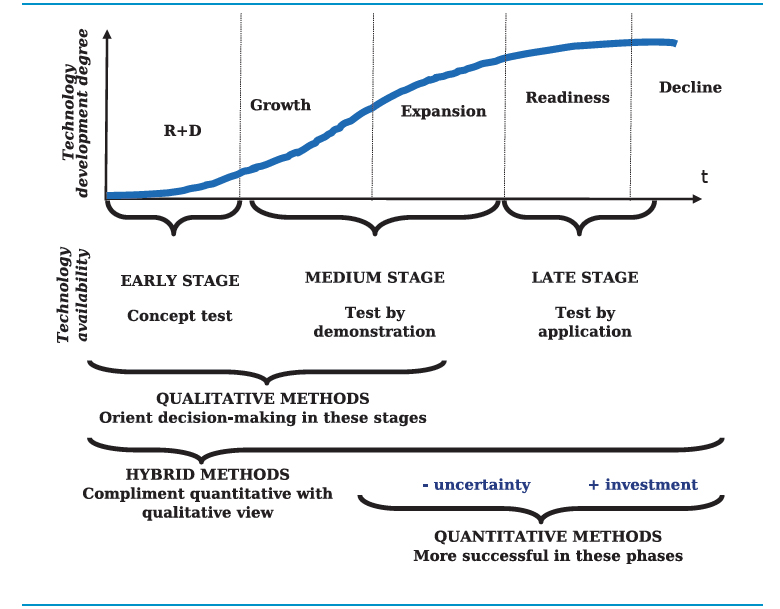

By taking as a reference the concept of technology life cycle, it can be noted that in developing countries such as Colombia, technologies are generally located in the last stages of the cycle (expansion, maturity and decline); being particularly used in conventional industrial production. These technologies count with established markets and historical data that facilitate the performance of analyses and forecasts. Likewise, they are known and sufficiently tested, unlike those employed and generated in developed countries which, upon being at the beginning of the technological cycle, are high-risk and hence difficult to manage (Bhattacherjee, 1998). When these type of technologies support and complement locally available technologies, a first step can be taken in the dynamization of less developed economies, and in the generation of technological capacities through learning and technological accumulation.

Figure 1 shows the relationship between the life cycle of technology and the methods used to value it, based upon what was proposed by Probert, Farrukh, Dissel and Phaal (2011), with respect to technology Readiness levels. These authors indicate that the readiness of technology implies the usage of quantitative methods, since in said phase (known as Test by application) technical uncertainty is very low, and it is relevant to calculate future returns by using discounted-cash-flow techniques and real options.

Source: Adapted from Mejia (1998) and Probert et al. (2011)

Figure 1 Relationship between the technological cycle and technological valuation methods

For the valuation of technologies such as those commonly available in developing contexts various methods are found in the literature; however, from what has been presented in Figure 1, it may be said that quantitative techniques and methods such as discounted-cash-flow, or cost and market methods are preferably oriented towards this type of technology.

In summary, technological valuation based mainly on quantitative methods is preferentially oriented to the expansion and maturity stages, where the technologies have already been tested and, therefore, there is less risk and uncertainty. These technologies are characteristics of developing countries such as Colombia, whose technology-generating capabilities are limited. This type of valuation has, nonetheless, involved technology in its entire dimension to a lesser extent by focusing on the monetary aspect and the tangible component.

In the face of the reality of Latin American countries, where capacities and learning are the options to advance technologically, technology and its valuation must be analyzed from a broad perspective that includes both tangible and intangible aspects. In this way, one can speak of an expanded technological valuation (Jiménez and Castellanos, 2014) that retakes the broad definition of technology by including technological capacities within the concept of valuation, in search for more relevance for the context of developing countries like Colombia.

Likewise, starting off from the rudimentary characteristics of the productive apparatus in less developed contexts, it may be inferred that the management of these devices has similar traits, which in turn affects the management of processes such as technological valuation, so that the information in connection thereto is usually scarce due to lack of documentation and informality. Therefore, the approach to technological valuation needs to resort to different elements from those employed in developed countries (for example, financial information), like the concept of technological capabilities, because of their relevance in technologically and economically lagged countries.

3. Methodology

This work was based on an analysis of the context in which technological valuation can be carried out in some Colombian companies. The conducted study is exploratory and employed comparative referencing techniques or benchmarking (Camp, 1993; Spendolini, 1994), with information from primary sources obtained through the design and application of a reference instrument, as detailed below. The steps of the methodology followed are described below:

3.1. Selection of companies for the study

To select the companies that participated in this analysis, the following criteria were taken into account:

Geographic concentration: there is a high geographical concentration of companies of all sizes. According to the Cámara de Comercio de Bogotá (2015), the departments of Cundinamarca, Antioquia, Santander, Valle del Cauca and Atlántico concentrate 79% of the large companies, as well as 62% of the micro-enterprises and SMEs in the country. The largest concentration is in Bogotá, with 22.8% of the total micro, small and medium-sized enterprises. Based on this information, the analysis carried out focused on companies located in the city of Bogotá.

Characteristics of the companies in Bogotá: according to the Cámara de Comercio de Bogotá (2012, 2015), at the Bogotá-Cundinamarca region lies the largest number of companies in the country, and 93.2% of the companies in the city (191,945 establishments) are micro and small.

The main activities of the companies at Bogotá are related to services (44%), trade (35%) and the manufacturing industry (13%)(Cámara de Comercio de Bogotá, 2015). Taking into account production characteristics in developing countries such as Colombia, supported by traditional sector technologies, manufacturing companies were taken as object of analysis as they represent the third most important economic sector in Bogotá.

Strategic sectors for Bogotá: the internal productivity Agenda of the Bogotá-Cundinamarca region (Alcaldía Mayor de Bogotá and Universidad Militar Nueva Granada, 2012) established 17 dynamic productive segments of impact in the region called Apuestas productivas (Productive bets) and grouped into four categories: agro-industrial sector, industrial sector, services sector and promissory sector. The industrial sector prioritized by this agenda includes the following productive bets: 1) textiles and confections. 2) Chemical and plastic products. 3) Other chemical products (cosmetics, cleaning products, pharmaceuticals and agrochemicals). 4) Paper, press, editorials and graphic arts. 5) Auto parts and automotive. 6) Beverages. 7) Construction materials, ceramics and glass.

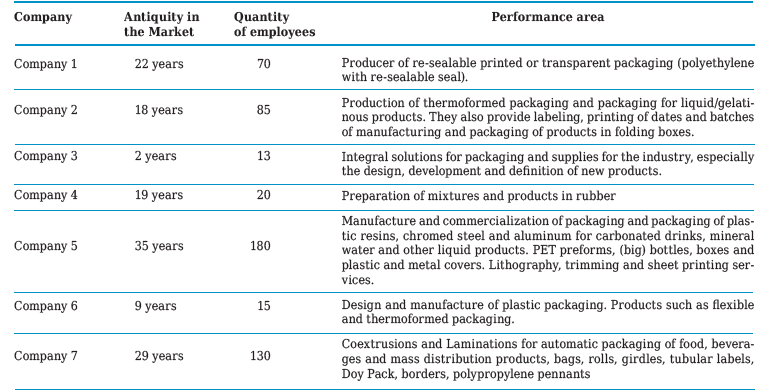

As a result of the application of the criteria described (geographic concentration, characteristics of the companies in Bogotá and strategic sectors for Bogotá), along with the use of information about companies that have participated in previous studies (Castellanos, Fúquene, Ramírez, González and Castellanos, 2013) performed within the research group where this work was developed, finally there were seven companies pertaining to productive bet number 2 (chemicals and plastics, in the preceding paragraph), producers of plastic packaging, located in the city of Bogotá, as detailed in Table 1. It is important to clarify that at no time was a statistically representative sample intended to be concretized. For reasons of confidentiality, the names of the companies consulted are not mentioned in this paper.

3.2. Variable and sub-variable definition

The variables and sub-variables on which this study was based were established from the review of the literature on the subject of technological valuation and the particular conditions of developing countries such as Colombia, which permit to establish a relationship between this valuation and technological capacities by taking the broad conceptualization of the technology as a basis (as discussed in section 2). The established variables are: technological valuation processes (with three sub-variables: technology acquisition, technological valuation and technology evaluation), and technological capabilities (with four sub-variables: technical and physical systems, human capital, organizational, management and institutional systems, and products and services). Table 2 summarizes the conceptualization and justification of each variable and sub-variable.

Table 2 Variables and sub-variables for the analysis in some companies

Source: Author’s own elaboration based on Bell & Pavitt (1993); Dutrénit (2001); Takahashi (2002); Viotti (2002); Figueiredo (2004, 2005); Li & Chen (2006); Elói and Santiago (2008); Ivarsson & Gorschek (2009); Jolly (2012); Probert et al . (2013); Farrukh, Phaal, Mortara & Probert (2013); Jun et al. (2015), among others.

3.3. Elaboration and application of the instrument

The availability of information regarding the application of technological valuation in Colombian companies is very low, both throughout specialized literature and the documentation of the processes that the businessmen themselves carry out, which was evidenced by upon requesting information to the people consulted for this research.

Semi-structured interviews were used, for which an instrument of consultation was designed consisting in a questionnaire that allowed to compile information on the variables established for the analysis. This instrument underwent revisions and simulations in the research group in which the work was developed, in order to validate its contents, to know if the questions were of easy understanding, and to determine the time used in the application thereof. For its application the selected companies were each reached via e-mail, and then the making of visits proceeded so as to carry out the interviews, which, in general, were tended to by managers of administrative and production areas.

3.4. Data tabulation and Information analysis

For the analysis of the information collected by means of the consultation instrument, a tabulation of all the obtained answers whose value depends on the type of question was made; this activity was supported by the use of the Excel tool. It is important to clarify that the value taken by each sub-variable is the outcome of weighting the questions that make it up.

Subsequently, we proceeded to generate the radars that allow to graphically represent the information obtained for the set of consulted companies; each radar constitutes a variable, made up in turn by sub-variables that form the axes. From thereon, a per-variable analysis was performed determining the best practice, which is built with the highest scores obtained in each sub-variable by any of the companies, the practice or average behavior, result deviation among companies and the gaps found between average, best and ideal practice (this corresponds to the highest possible score in the sub-variable that make it up, in this case, 5 points).

4. Results and discussion

Below the most relevant results are presented on the management of technological valuation in the consulted plastic-packaging-producing companies.

4.1. Technological valuation processes

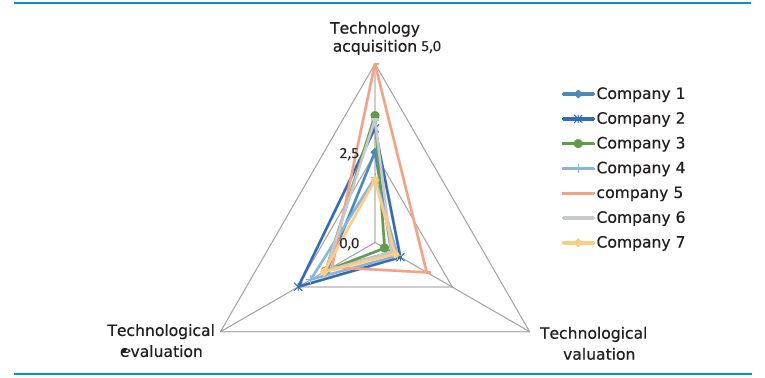

The results for all the companies consulted are shown in Figure 2 where the homogeneity in this variable is appreciated. The sub-variable that shows the lowest scores is technological valuation in accordance with what is found in literature regarding the uncommon conduct of such processes in Colombian companies, or at least the absence of documentation thereof. In the case of the companies consulted, ignorance and low interest from businessmen to determine the value that technology represents, not only in the economic vein but in the contribution that it makes to an organization’s competitive advantage, is evident. The technology acquisition and technology evaluation sub-variables obtain better results; nevertheless, it is observed that the majority of companies yield low results with respect to the ideal practice (which corresponds to the score of 5 for all the sub-variables). The high values presented by the companies in these last two variables are given by activities such as the use of standardized procedures for equipment purchases and the assessment of key criteria in technology selection processes.

Source: author's own elaboration.

Figure 2 Radar of technological valuation processes in consulted companies producing plastic packaging

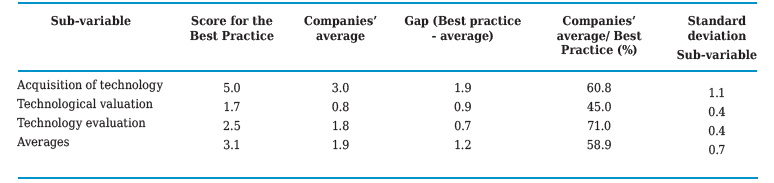

Figure 3 shows the average performance of all the companies participating in the study, which in all evaluated aspects is below the best practice of the set of companies, generating performance gaps that show opportunities for improvement regarding technological valuation. On the other hand, when analyzing the best practice from the set with respect to the ideal practice, low performance from two of the analyzed sub-variables is evidenced, since the obtained values do not reach the 3.5 score considered as acceptable4. Within the technology acquisition sub-variable the best practice achieves a score equal to that of ideal practice (5 points), due to one of the studied companies’ outstanding score in activities such as process documentation and evaluation of critical aspects for the technology purchasing. Notwithstanding, when analyzing each company’s specific results it is emphasized that an analysis of factors is always made to select technology, although not through a standardized procedure.

Source: Author's own elaboration.

Figure 3 Processes of technological valuation, best practice against the average practice of the set of companies consulted

Table 3 presents the numerical data of the results obtained in the analyzed variable. The largest gap is given lies in the sub-variable acquisition of technology with a value of 1.9 points, which is as considered high. For the technological valuation and technology evaluation sub-variables, the gap does not exceed unity; however, it is important to emphasize that, both the best practice as well as the average of companies, experience low performance compared to the ideal practice, especially in technological valuation, where the average of the consulted companies is 0.8 points. The average of the technological valuation processes variable equals 1.9, and the average obtained by the best practice equals 3.1; thus, the average for the set of the studied companies does not pass 60% of the mean of their best practice, which allows to define a general weakness in this topic and opportunity for improvement of 40%. The variable’s deviation may be deemed as low (0.7), and reflecting the homogeneity of the results obtained by the consulted companies.

4.2. Technological capabilities

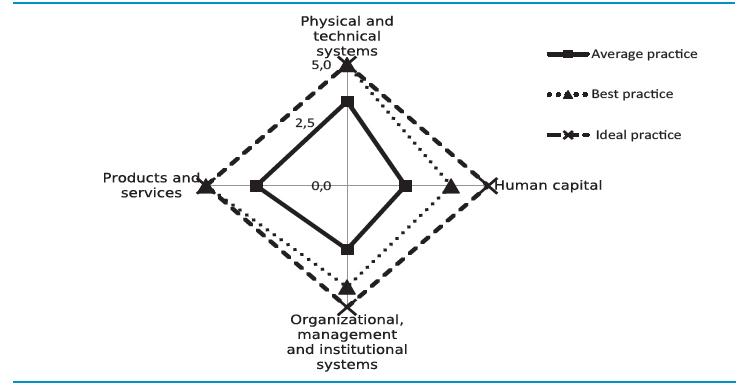

The results for the company set is shown in Figure 4, where we can observe two companies’ differentiated behavior with respect to the set, which outstands on account of its high performance, equal to the optimum, in two of the sub-variables evaluated; the rest of the companies present a similar tendency among themselves. The sub-variables that attained the best performance for total consulted are technical and physical systems, as well as products and services. In the first scenario, these results evidence the performance of activities such as technological-type improvements on productive processes either with existing machinery or new technology. Regarding the second sub-variable the results are founded on aspects such as developing new products and the position of leadership they claim to have in the market.

Source: Author's own elaboration

Figure 4 Radar of technological capabilities in consulted plastic packaging producing companies

On the other hand, it is important to highlight the low performance achieved by the human capital sub-variable, which permits to infer that there attention lack when it comes to developing and strengthening people’s capacities leading to miss out on the value of knowledge, skills and experience to attain innovations. With regards to the organizational, management and institutional systems, only company 5 managed to obtain an elevated score (4.2) as it studies and anticipates the needs of customers, distributors, creditors, employees and shareholders, and it also believes it has few economic limitations to innovate. Meanwhile the rest of companies consulted lies below 3.5, signaling to flaws in consolidating its technological capacities through its organizational routines.

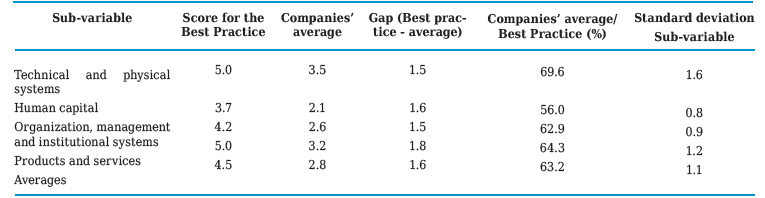

Figure 5 allows to visualize the current state of the best practice and the average practice at the companies that took part in this study with regards to the technological capabilities variable, as well as to determine the gaps and criteria heterogeneity within the analyzed set. It outstands that the best practice reaches the ideal value (5 points) for two sub-variables, which offers great learning potentialities to contribute to the marking out of the set of companies. It is also worth highlighting that all sub-variables attained high scores; this means that each company has its strengths in the analyzed subject, meaning they are capable of being taken as reference to diminish the graphically-observed gaps.

Source: Author's own elaboration

Figure 5 Technological capabilities, best practice against the average practice of the group of companies consulted

A qualitative analysis of the practices by the set of companies is summed up in Table 4. The companies analyzed present low performance with regards to technological capabilities (2.8 points), with emphasized weaknesses on the human capital and organizational, management and institutional systems. The largest gap is at the products and services sub-variable, an outcome due to the best practice achieving the ideal value, whereas the average of the set does not reach the 3.5 score considered as acceptable. The average of the group of companies does not exceed 70% of the average of their best practice, thus allowing to establish a general weakness in technological capabilities among respondents, and an opportunity for the improvement of 30%. The standard deviation of the variable is high, indicating a high variation of the results obtained in the studied subject, i.e., the features of the technological capabilities variable are different for each company, therefore, do not present a particular trend.

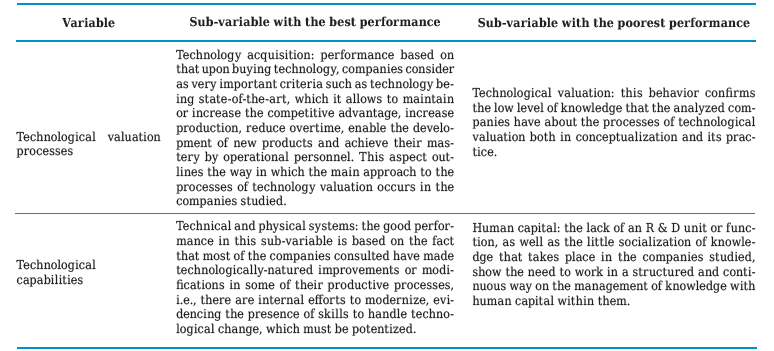

4.3. Outstanding sub-variables

Based on the results from the study on the technological valuation management at some Colombian companies, several relevant aspects are identified: in general terms, the variable that has the best result on average is technological capabilities, which is based on actions such as the performance of modifications or technological-type improvements in some productive processes in the last years, as well as on the development of new products. The variable with poorest performance is technology valuation processes, reflecting on this type of process the general ignorance within the participating companies. In Table 5 are shown the sub-variables that on average present the best and the poorest performance per variable.

Table 5 Sub-variables with best and poorest performance in the group of companies consulted

Source: Author’s own elaboration.

Analyzing some companies in the plastic packaging sector of the city of Bogotá confirmed the premise that the subject of technological valuation is very little handled in the analyzed area, although it is not possible to generalize this result given the characteristics of the study presented.

5. Challenges of technological valuation management

The overview generated through the study in seven Bogotá companies producers of plastic packaging, allows to identify two challenges for technological valuation management and its context:

Appropriation of technological valuation concepts and methodologies: it was evidenced that, in general, there are weaknesses in the companies producing plastic packaging that were consulted, with respect to technological valuation processes associated with the conceptual ignorance as well as the way in which they are put into practice. It was established that the companies studied use technologies that constitute the support for the development of their productive function, but no technological management processes that enable the usage of technology´s full potential to create competitive advantages are carried out.

The weaknesses observed with respect to processes of technological valuation in the companies consulted are largely related to the fact that they are medium and small in size, since they should place greater emphasis on the productive aspects to ensure their sustainability in general, while resources to invest in the development of new processes, products and technology management are scarce; additionally, human resources prepared professionally for these activities are scarce as well.

Generation, strengthening and measurement of technological capabilities: in the companies analyzed it was observed that little is known about the technological capabilities each one counts with, because no processes to measure such capacities are performed, nor activities that consciously and planned promote their strengthening. Product development is the main innovative activity carried out, where the client’s needs have an influence and adaptations of the existing technology are made, but there is not a unit or differentiated R & D function within the companies facilitating continuous processes of knowledge generation. There are also no collaborative activities occurring with other actors from society who dedicate to research; universities for instance.

It is important to highlight that although the companies consulted do not have much propensity to perform analyzes or measurements on their technological capabilities, there are traits that allow us to infer that they have developed processes of accumulation of these capacities in connection to technological learning, although there are weaknesses in the management of the human capital, which is key to achieving such learning at a high level.

6. Conclusions

Through this research, it was possible to analyze the management of technological valuation in some Colombian companies by exploring the context in which these processes can occur and, in addition, linking the concept of technological capabilities to the purpose of granting greater relevance to the study of the subject of technological valuation in developing countries like Colombia.

In the study of technological valuation management by consulting a group of Colombian companies from the flexible-plastic packaging sector, what was stated in the literature was corroborated: the analyzed companies know very little about technological valuation processes, and do not formalize any approach made to this topic in practice. These companies have strengths in terms of their technological capabilities, since they develop activities that enable their creation and accumulation, although it is not usual to carry out studies aimed at measuring said capacities.

Analyzing the context and management of technological valuation in some companies allowed us to identify two challenges related to the two variables studied: technological valuation processes and technological capabilities. These challenges point to the need for greater preparation in the studied business field around the conceptual strengthening and mastery of the technological valuation topic in the framework of technology management and in the field of developing countries such as Colombia. The second challenge is to achieve both the strengthening of technological capabilities and the consolidation of processes for their measurement in the companies consulted, so that they may have a complete overview of this issue for successful decision-making that ultimately results in greater use of the technological factor and in the generation of competitive advantages