1.Introduction

The multi-business company, understood as a group of businesses managed jointly, is the result of the growth of a company from the creation or acquisition of other businesses. The formation and management of this set of businesses is the focus of the study of strategy at the corporate level (Chandler, 1991, p. 9; Goold and Campbell, 1998; Goold, Campbell and Alexander, 1994; Kanter, 1989; Porter, 1987). In the literature on corporate strategy, multi-business companies are also recognized as conglomerates, modern corporations or diversified firms. In Latin America, this type of company is also recognized as an economic group (Leff, 1978; Ramachandran, Manikandan and Pant, 2013; Stolovich, 1995) and as a business group in Colombia, on account of Law 222 from 1995 (Supersociedades, 2008). The groups called the “big four” are an example of this type of multi-business company in Colombia: Familia Santodomingo, Familia Ardila Lulle, Familia Sarmiento Angulo and the Grupo Empresarial Antioqueño (Wilches-Sánchez and Rodríguez-Romero, 2016).

Normally, the multi-business strategy is defined and executed from a general or central office (Chandler, 1962, 1991), also known as a corporate headquarters (HQ) (Birkinshaw, Braunerhjelm, Holm and Terjesen, 2006; Collis, Young and Goold, 2007). It is also known as a parent company (or Corporate Parent) (Campbell, Goold and Alexander, 1995). These corporate headquarters have been recognized as the most relevant organizational innovation of the 20th century, since it separated the operations of individual businesses from the strategic responsibilities of the multi-business company (Menz, Kunisch and Collis, 2015).

Headquarters are understood as a central organizational unit wherefrom business units (BUs) are managed (Menzet al., 2015). From the beginning of the strategy academic field, Chandler (1962) in his text Strategy and Structure refers to the headquarters as a central office wherein executives coordinate, evaluate, define goals and policies and allocate the resources required by a series of semi-autonomous and self-contained divisions (Chandler, 1962, p. 9); nowadays, these divisions can also be understood as business units. In other words, the headquarters are staffed by corporate executives who, from a central office, manage the multi-business company (Chandler, 1991).

Birkinshaw et al., (2006) state that the headquarters (HQ) have two essential elements: 1) a senior management team which typically has an official meeting location; and 2) a series of corporate functions that have the formal responsibility of fulfilling certain roles (treasury, investor relations, corporate communications, among others). Each of these functions is performed from a physically locateable location. Furthermore, these authors argue that there is a third element that characterizes the headquarters: the legal domicile. That is, a location from which the legal representation that bestows “nationality” on the company is exercised.

In Colombia, there is an economic group that does jointly manage its business from its headquarters, but has neither staffing nor a central office. Even so, the senior management of this group exercises functions related to the corporate level of the strategy. This is the case put forward in Londoño-Correa’s (2002) research on the Grupo Empresarial Antioqueño (GEA). Therein, the author characterizes this group as a corporate center due to the corporate functions it has developed, such as: portfolio definition, internal management and external management (Londoño-Correa, 2003). This Colombian group is recognized because “it is not a legal entity, nor does it have a corporate name. Yet, it is one of the most powerful conglomerates in the country” (Dinero, 2016). This group’s strategic management’s particularity should draw the attention of academics and practitioners of corporate strategy.

Corporate strategy is concerned with both the definition of the business portfolio and its management. Therefore, it is convenient to know in greater detail the functions, strategies and structures from which multi-business companies are managed in emerging countries, in which particular cases such as GEA appear. The specificity of this case motivated this research into the management of Leonisa, a Colombian company in the textile sector. This exploratory work presents the characterization of this company’s headquarters, based on the analysis of its operation and the revision of the organizational structure adopted for joint management. Furthermore, the purposes that keep Leonisa together as a multi-business company are analyzed. This exploratory research is one of the first phases of a major research project, conducted in more than 20 multi-business companies in six Colombian regions (Rivas-Montoya and Londoño-Correa, 2017).

Leonisa is a company with over 60 years of experience in the production and marketing of underwear and swimwear. Over the years, the company has made changes in its strategy and structure to speed up its production processes and reach its customers in more than 20 countries.

The first part of this paper presents a review of the literature on corporate centers and multi-divisional structure. In the second, the methodological approach of the research is detailed, and the third describes Leonisa as a multi-business company. The fourth section discusses the results of the research thereafter. Finally, the paper concludes with the most relevant results, an invitation for future research and the identification of this research’s limitations.

2. Literature Review

While corporate strategy addresses the questions: what business to be into and what business to be out of? (definition by portafolio) and how to manage the business as a whole) (Porter, 1987), competitive strategy concerns itself with responding: who is my client? What is my value proposition? Where am I going to compete? What are my capabilities and strategic resources that allow me to create and sustain competitive advantage? (Osterwalder and Pigneur, 2010; Osterwalder, Pigneur, Bernarda and Smith, 2014; Porter, 2008). Along the same line, it is important to clarify that it is the corporate strategy that deals with multi-business management, while the competitive one is at the level of each business unit and may be different for each of one. Functional strategies support the fulfillment of the value proposition and the creation and maintenance of competitive advantage (De Wit and Meyer, 2010).

Hence, the corporate strategy deals with the configuration and management of multi-business companies (MBCs), understood as an organization structured through business units (BUs) that focus on different product/market segments but have some degree of connection between them (Eisenhardt and Piezunka, 2011). Such organizations have been recognized in the literature as multi-divisional (M-Form) organizations, highlighted by Chandler (1962) in his research on Strategy and Structure in four major U.S. corporations (General Motors, Dupont, Standard Oil of New Jersey and Sears Roebuck).

This paper draws on the concepts of organizational structure from the perspectives of (Mintzberg, 1984; Whittington, 2003) Sánchez-Bueno and Suárez-González, 2010) to address the concept of multi-divisional structure, understood as that form that prevails in multi-business companies and reflects the tension between the autonomy to which business unit managers aspire and the control exercised by a higher-level corporate hierarchy recognized as a corporate headquarters (HQ) (Rivas, 2013).

In his text on organizations structuring, Mintzberg (1984), presents five structural configurations (simple structure, machine bureaucracy, professional bureaucracy, divisional form and adhocracy), most often described in the literature on organizational theory. According to this author, most organizations experience them all, leaning towards one, according to the corresponding configuration in each organization. Regarding the divisional configuration, it specifically refers to the multi-divisional form (M-form) as the structure that emerges when companies become so large that the simple divisional form becomes insufficient and, therefore, divisions appear above divisions. Whittington (2003), describes the organizational structure based on questions such as:

Who has the resources, who communicates with whom, who is responsible for what, who can do what, what can be done on their own and what can be done with others, what kinds of careers are available and what is the flow of knowledge throughout the organization(p. 319).

As can be inferred from the above quote, the relationship between strategy and structure is of the essence for the achievement of the company’s objectives (Whittington, 2003). Additionally, this author warns that, in the case of multi-business enterprises, the functional (or divisional) structure in terms of Mintzberg (1984) is insufficient to deal with the tension between the headquarters and the business units or divisions that characterize this type of company. On this account, the multidivisional structure is adopted as it separates the business or operational responsibilities from the strategic responsibilities that remain at the headquarters. The multidivisional structure clearly expresses a tension typical of multi-business companies: centralization vs. decentralization. While centralization offers the benefits of economies of scale, process consistency, knowledge and capacity building possibilities, decentralization allows managers greater autonomy in decision-making and resource allocation, thereby facilitating the speed, creativity and innovation required by competitive markets (Kates and Galbraith, 2007).

In relation to the management of the multi-business company, Eisenhardt and Piezunka (2011), three main choices posited by the corporate strategy stand out: control and motivation of the BUs; collaborations between BUs and scope of the firm. In addition, these authors refer to two perspectives from which multi-business companies have been studied: the traditional one and the complex one. While the traditional one focuses on the leading role of the headquarters in strategic choices, the complex one emphasizes the role of Business Units’ managers and suggests that the HQ rather than controlling should facilitate collaboration processes between BUs. It is then possible to infer that competition as the focus of each business unit’s strategy is insufficient when the BU is focused not only on its own performance, but also on the joint creation of economic value for the multi-business company. Thusly, the idea of collaboration between BUs appears as essential for the materialization of this jointly created value, recognized in literature as synergy (Rivas and Londoño-Correa, 2017).

In this respect, Sánchez-Bueno and Suárez-González (2010) expand the concept of a multi-divisional structure with three new forms: multi-divisional cooperative, multi-divisional competitive and inner network. The cooperative multi-divisional structure is characterized by less decentralization and greater integration between divisions, while the competitive structure has less integration between divisions and a high degree of operational decentralization. In contrast, the inner network is characterized by a high degree of operational decentralization and integration between divisions. These three new forms were the result of studies carried out in one hundred Spanish companies in the period between 1993 and 2003. The arising of structures other than the divisional ones, due to their processes and mechanisms for decision-making, such as the so-called multiple divisional network (N-form: multidivisional network), shows the substitution of traditional structures by new forms that differ in aspects such as technological and human interdependence, critical organizational levels, the communication network, the role of the headquarters, amongst others (Sánchez-Bueno and Suárez-González, 2010). The N-form emphasizes lateral rather than vertical interactions; it proposes a shift to a place of command and control as opposed to bureaucratization. In addition, it posits the creation of networks, instead of managerialism (Whittington and Mayer, 1997, p. 253). Namely, as argued by Whittington and Mayer (2000), the N-form is a flatter, more flexible and horizontal form of organization than the M-form, but there are no differences in decentralized operations and the centralized corporate strategy as it seems to remain intact.

On the subject of strategic management from a central office or headquarters, Mintzberg (1984) asserts the latter is concerned with managing a strategic portfolio, allocating global financial resources, designing performance management systems, replacing and appointing division managers, monitoring divisional behavior on a personal level and providing support services to divisions. In turn, Menz et al. (2015) refer to the corporate headquarters as the central organizational unit in the contemporary corporation, through which value is created for the entire firm or multi-business enterprise.

Once the concepts of multi-divisional structure and corporate headquarters have been clarified, the following section presents the methodological approach of the research on the Leonisa group.

3. Methodological approach

For the characterization of Leonisa’s headquarters, a qualitative study was conducted in 2016 (Galeano, 2004) which addressed the following research questions: What are the purposes of the company in forming a business group? What structure does the Leonisa Group adopt to support these functions? What are the functions of Leonisa’s headquarters? To answer these questions, the general purpose consisted in characterizing Leonisa’s headquarters by analyzing its structure. To this end, specific objectives were defined as follows: 1) Identify the purposes for creating the Leonisa Group; 2) Identify the structure of the organization; and 3) Describe the business and administrative functions of the Leonisa corporate headquarters.

To characterize Leonisa’s headquarters, its structure was researched on the corporate level of the strategy. Firstly, an exploration on journals specializing on the Business and Management area and the category of Strategy and Management from Scimago Journal and Country Rank (2015) and ISI Web of Science was carried out for the period comprised between 2005 and 2015. The search was conducted using keywords that could account for the multi-business company from an administrative perspective such as Headquarters, Multi-business Firm and Multidivisional. The initial result yielded 142 papers, of which 28 were selected, published in English or Spanish, directly related to the field of corporate strategy. Subsequently, 15 papers were selected, which specifically referred to the multi-divisional structure in the context of multi-business companies. Furthermore, some books and handbooks by authors recognized in the field of strategy for their contributions on organizational structure were reviewed.

The literature review on multi-divisional structure gains relevance in publications produced between 2005 and 2015, particularly in the context of developed countries. These articles have been published by widely recognized journals, such as Organization Science, Journal of International Management, Strategic Management Journal, among others. As shown in table 1, which presents the authors’ universities and countries of affiliation, Latin American universities and authors therefrom are lacking, which justifies this type of research.

Table 1 Research on multi-divisional structure: countries, universities and theoretical approaches

| Countries of affiliation | Universities | Theoretical approximations |

|---|---|---|

| United States (9 authors) | University of Sydney | Resource Based View of the Firm (RBVF) (8 papers) |

| United Kingdom (4) | University of Uppsala | Knowledge Based View of the Firm (KBVF) (6) |

| Australia (4) | Universidad de Salamanca | Theory of the Firm (1) |

| Spain (3) | Mergers and Acquisitions (M&A) (1) | |

| Sweden (3) | ||

| Singapore (2) | ||

| Italy | ||

| Canada | ||

| China | ||

| United Arab Emirates |

Source: Author’s own elaboration.

In the theoretical approaches on organizational structure presented by the revised papers, the Resource Based View of the Firm (RBVF) stands out with eight papers (Alfoldi, Clegg and McGaughey, 2012; Bardolet, Fox and Lovallo, 2011; Cao, Gedajlovic, and Zhang, 2009; Chung, Gibbons and Schoch, 2006; Lupton and Beamish, 2014; Pitelis, 2007). In this same vein, the role of the Knowledge Based View of the Firm (KBVF) is also evident, with six papers based upon it (Birkinshaw and Lingblad, 2005; Connell and Voola, 2007; Egelhoff, 2010; Galán and Sánchez-Bueno, 2009; Vahlne, Schweizer, and Johanson, 2012). Finally, both the Theory of the Firm (Zhou, 2011) and the theoretical references on Mergers and Acquisitions (MyA, Mergers and Acquisitions) (Tallman and Koza, 2010), were present in only one paper respectively. Table 1 shows the countries of affiliation for the universities where the authors of the 15 papers studied work, the universities that stand out for their research on multi-divisional structure and the theoretical approaches from which such research has been carried out.

The reviewed papers proved insufficient to conceptualize on the multidivisional structure that characterizes multi-business enterprises, since they focused on very specific issues without referring to the assumptions whereon the different forms adopted by the multi-business companies’ structures are typified. On this account, it was decided to complement this information with other authors recognized within the topic of multidivisional structure.

Secondly, two techniques were used to collect the data: semi-structured interview and documentary review. There were two criteria for selecting the interviewees: the management level of the different businesses (managers and former managers) and the possibility of access to information (or the willingness of the interviewees to share information). The seven semi-structured interviews were conducted with executives and former executives of both Leonisa and the parent company, as well as from its enterprises or subsidiaries (business units), which were selected from different hierarchical positions within the structure of each company for their roles as heads, directors or managers. Each of them was interviewed for one hour in August and September 2016.

The documentary review was conducted on websites, annual reports of the organization, and public domain documents written about Leonisa. The analysis of the data was carried out through a process of categorization or codification, open at first and then selective thereafter, based on the transcription of interviews and revised documents. Therefore, the theoretical categories defined in the conceptual framework were complemented by those emerging from the fieldwork.

4. General aspects of the origin and development of Leonisa

Leonisa is currently headquartered in Medellin, Colombia, where it produces and markets underwear through various companies described in Table 2.

Table 2 Companies belonging to Leonisa

| Company | Creation | Purposes | Structure |

|---|---|---|---|

| Votre Passion | 1991 | To establish a commercial network of saleswomen to reach a larger number of customers located anywhere in the country. 2. To diversify the portfolio in complementary products: women’s outerwear, men’s outerwear, youthwear, cosmetics, and accessories. | CEO and a group of seven managers: CFO, Marketing, Sales, Logistics, Procurement, IT and Human Resources. |

| Prym LeSensuel | 1984 | To manufacture products for Leonisa’s companies from surplus inputs, generating turnover of the materials not used by the headquarters, to turn them into first-class products and to commercialize them in the different channels of the group. | General Management accompanied by a production and administrative team. |

| Prym | 1984 | To produce swimwear as an independent company. | General Management and a primary team for the areas of Production, Marketing and Finance. |

| Dissen | 1989 | To commercialize the products manufactured in the original business in the Colombian retail sector. It is segmented into two major groups (wholly-owned and not-wholly-owned) and reports on the achievement of goals to the organization’s headquarters directly. | Administrative director in charge of accounting, portfolio, credit and collections; and three commercial managers. |

Source: Author’s own elaboration

Leonisa has shaped its business portfolio over the years based on a growth strategy that seeks to minimize risk and increase the speed of its operation. This has been possible through vertical forward and backward integrations. Each company has strengthened the group’s growth process in different strategic aspects. For instance, the forward vertical integration can be seen when Votre Passion was created as Leonisa’s catalogue sales subsidiary; and Prym Le Sensuel, in order to optimize idle time and surplus materials, made it possible to have first-class products marketed in different sales channels, which has allowed Leonisa to control more than 80% of its sales through catalogue, online and retail sales. In the case of vertical backward integration, the production of fabrics, the dyeing and finishing processes and the manufacturing of its products through cooperatives that work exclusively for Leonisa stand out.

4.1.Creation, industrial development, logistics development and internationalization

On November 20, 1956, in the city of Armenia, Colombia, the Urrea brothers - Marco Aurelio, Joaquín, Luis Enrique and Julio - founded the company. At the time, there was no company dedicated to the production of women’s underwear in this country, and the Urrea brothers saw this as a business opportunity. Afterwards, they moved to Medellín, where they set up a workshop, got a filleting machine, a sewing machine, and began importing fabrics and supplies (Ramírez, 2006).

In 1966, Leonisa began its process of internationalization to the Caribbean Islands and Venezuela, through the sale of its flagship product, the reference 1000 brassiere. Later on, it continued its expansion to fourteen other Latin American and three European countries from product distribution subsidiaries, and from a garment plant in Costa Rica to serve the Central American market (Sanabria, 2005).

In 1990, the Leonisa Distribution Center (CDL) was born with the objective of centralizing, in Medellín, the operation of the different sales channels and optimizing the flow of the company’s inventory in accordance with market needs. From there, national and international orders began to be met and negotiations with freight forwarders began in order to achieve economies of scale in the distribution of products. The entire export and import operation is managed from the headquarters or central office, and none of the subsidiaries is allowed perform operations outside the Leonisa foreign trade team.

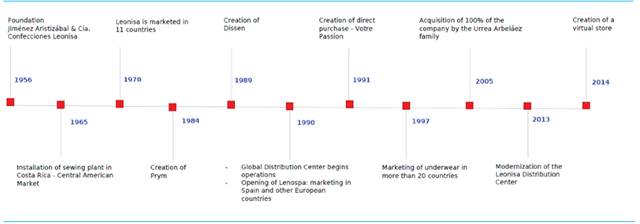

Figure 1 presents a timeline with Leonisa’s most representative facts from its creation in 1956 to 2014.

4.2. Leonisa’s strategy

As a multi-business company, Leonisa counts with strategies at the corporate, competitive and operational levels. Its corporate strategy is characterized as related diversification, with vertical backward and forward integration. Integrations are strategies to diversify the core business into adjacent activities in the network or value chain. Backwards integration has been accomplished through the creation of companies that supply the inputs for underwear and swimwear production, where each specializes in the production of specific parts that were previously purchased from third parties. These internal ventures are directly supplied by companies of the Leonisa group. The forward integration created companies wherein direct contact with the end customer is held through its retail, direct and online distribution channels, thereby achieving more than 90% of Leonisa’s sales through companies belonging to the group itself. The corporate strategy has become a multi-business company managed through a multi-divisional structure. Leonisa’s headquarters are the central body from which corporate guidelines are provided to each of the group’s companies. In addition to the general guidelines, the competitive strategy for each company is also defined.

The competitive strategy developed in recent years has been based on two main pillars: differentiation and total look. The former seeks to develop new products, different from those offered in the market. And the latter, with a concept that integrates the different product lines, seeks to create an identity for the Leonisa woman through the use of underwear. In line with the above, Leonisa has strengthened its competitive strategy to continue to grow sales in the four channels and promote the positioning of the brand worldwide.

As for Leonisa’s operational strategy, it should be noted that it focuses on producing between 30% and 40% in its own plants, while the remaining amount is produced in cooperatives located in Antioquia (Sanabría, 2005). The corporate, as well as the competitive and operational strategies are managed from the headquarters or head office (Leonisa), where strategic decisions are made to promote the growth of the company and achieve the long-term objectives set.

4.3.Functioning and structure of Leonisa

The management of the whole business is carried out, partly, from Leonisa’s headquarters as the parent company; this is evidenced by the different corporate functions carried out therein. For example, regarding internal management, all subsidiaries are supported from the areas of Treasury, Audit and IT. The Treasury area manages the company’s investments centrally, in accordance with the group’s total profitability. The Audit area oversees the execution of the processes in each company, according to the policies established by the headquarters. In turn, the IT area is responsible for developments for all subsidiaries, based on the needs of both production and distribution companies.

In relation to commercial management, support is provided to all subsidiaries from the Foreign Trade and Distribution Channels area. The Foreign Trade team is in charge of managing the import operations of raw materials and finished products, and exports from Colombia to their different destinations. In distribution channels, the company has its own stores in the retail market, large department stores in major chains, online sales through the virtual store at www.leonisa.com, and the direct sales channel, which represents nearly 70% of the company’s sales. The four main distribution channels are national and international in scope. For instance, in a country like Peru, the brand has a presence with its own stores (retail), Falabella (large department stores), direct sales (a subsidiary of Leonisa) and the online store.

The subsidiaries report periodically to the headquarters, where portfolio and structure decisions are made for each company belonging to the group, according to the performance achieved by each of them. The corporate center controls the compliance with the competitive and operational strategy, carrying out frequent audits to guarantee the execution of the guidelines transmitted from the headquarters.

Leonisa counts with channels for the commercialization of products in more than fourteen countries, through catalog sales, online stores, wholly-owned stores, large and small department stores and authorized distributors. In the United States, for instance, it has all the alternatives. It also has a presence in Mexico, Peru, Puerto Rico, Guatemala and Spain; it also serves markets in Canada, Germany, Portugal, Bolivia, Ecuador and Costa Rica. The subsidiary in Spain handles orders from all over Europe, and has currently attained significant sales in countries such as the United Kingdom, France, Italy, Sweden, Norway and Finland.

The main office coordinates each country’s product portfolio, monitors compliance with established business goals and authorizes operational and administrative reforms. The opening of new distribution channels must also be consulted and approved by the headquarters, in order to meet the commitments established from the centralized manufacturing plant in Colombia.

5. Analysis and results

As can be inferred from the description presented in the previous section, the Leonisa group does not have a corporate center as defined by the literature. Namely, there is no hierarchy of corporate executives dedicated exclusively to the management of the business as a whole. In other words, there is no fixed structure, with identifiable staffing and physical headquarters. Notwithstanding, since Leonisa as a producer and marketer of underwear evolved into a multi-business company, it was necessary to exercise corporate functions that led it to adopt a multi-divisional structure, but not an autonomous corporate center. In this respect, some similarities are drawn between it and the Grupo Empresarial Antioqueño, mentioned above, since its headquarters make decisions associated with the management of the business portfolio and its structure. But it differs because Leonisa’s ownership relationship (family-owned) enables it to have any decision, such as including new product lines, new marketing strategies, and new locations, among others, monitored and approved by Leonisa’s executives and board members, who exercise control over each business unit or subsidiary: Votre Passion, Prym Le Sensuel, Prym, Dissen and each foreign distributor.

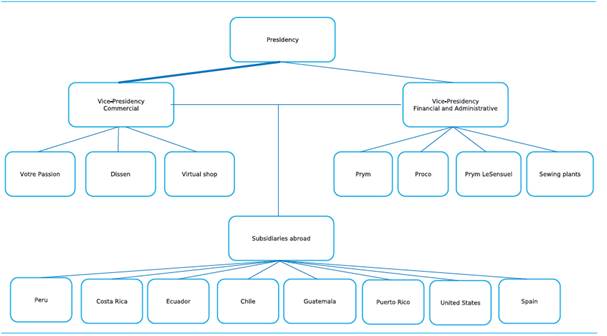

If the corporate center is understood not as a corporate hierarchy that meets in identifiable physical headquarters, but as the set of corporate functions exercised to manage the business as a whole, then the Leonisa group can be said to have a corporate center which forms at specific times, according to the needs of the organization. Nevertheless, in relation to the management of subsidiaries abroad, each company has a basic payroll that functions as a copy of the administrative structure in Colombia, but on a smaller scale. For instance, there is a small distribution center in each country, which operates under the same technology as Colombia’s distribution center. Likewise, there is a treasury team and an administrative-financial team; both lend support to the General Manager, who is also the legal representative. In addition, each process has a counterpart in Colombia from which it receives the headquarters’ guidelines. All this allows to infer that the Leonisa group remains under the multi-divisional structure (M-form) as Figure 2 will show as exhibited by Galán, Sánchez and Zúñiga-Vicente, (2005) where the company has divisions for its operation; however, the company differentiates itself inasmuch as the responsibilities of the business are not explicitly separated from strategic decision-making into a specific corporate center.

Leonisa was formed as a group from the creation of its different companies, with the purpose of minimizing risks in its growth strategy and, at the same time, streamlining both productive and commercial operations. By doing so, they are deemed capable of creating synergy, i.e. greater value can be created by jointly managing the companies formed. As one of the company’s senior managers says:

[...] to the extent that synergies have arisen, to the extent that tariff tax benefits have been identified, companies have been either separated or grouped together again or again; this is the purpose for which each of them has been created [...] (Interview with Chief Financial Officer September 7, 2016).

And another executive raises:

[...] the vice presidents are very smart when they create these companies, because they are creating them thinking about business speed and tax optimization [...] (Interview with the Administrative Director on September 12, 2016).

In addition to the foregoing, the company has promoted the creation of production cooperatives to increase operational speed, strengthen social work in municipalities of Antioquia and, finally, to increase production flexibility.

The structure of the Leonisa Group results from its corporate strategy of vertical integration, both forward and backward. In this structure, two fronts are identified: industrial and commercial. The first is served through its production subsidiaries, which are responsible for supplying the inputs for the manufacturing of underwear. This process occurs as a backward vertical integration. For example, one company is responsible for the purchase and processing of the fabric, another for the thermal processes, another for the garment, and so on until it is shielded, thus favoring specialization in production. On the commercial front (forward vertical integration), all products are received and sold across multiple platforms to reach a larger number of customers. As one of the interviewees states:

[...] this organization has been going on in the sense of not being seen as a mere manufacturing company, but more as a trading company, with the brand, that knows who makes the product and has the knowledge of how to distribute it and reach an end consumer, so these are the three levers that the organization has: the brand, the industrial continuation and the distribution channels[...] (Interview with the director of treasury on September 23, 2016).

Corporate functions, business (or new revenue generation) and administrative (or cost and expense reduction), are performed from the headquarters. Following this line of thinking, the existence of a corporate center is asserted, which manages the group of companies through the centralization of decision-making, corporate guidelines, and the consolidation of information from each of the subsidiaries.

The following processes were identified as centralized: controllership, audit, compensation, legal, risk and insurance and brand management. In the Controllership area, the accounts of all the companies are cross-referenced; this cross-referencing enables an integral view of the group’s final income. In Audit, all processes are validated and the need for implementation of new projects is identified. In the Compensation area, the novelties regarding the payroll of each subsidiary are centralized, as well as the settlements and payments to parafiscal entities. The Legal process consists on carrying out all the group’s legal processes and reviewing contracts for the provision of services and the purchase of goods. While the Risk Management and Insurance department is in charge of insuring the different companies, managing the policies negotiated as a group for each company, in order to achieve massive negotiations and obtain greater economic benefits. And finally, the Brand Management process provides the necessary guidelines to maintain the group’s coherence, i.e., that each company and subsidiary has the approved brand in all the countries where it has a presence. In relation to the brand, one of Leonisa’s former directors posits:

[....] what is intended is, like any multinational or brand present anywhere in the world, that when consumers arrive at that point of sale, they will not be able to really identify in which country they are because layout of the store or the arrangement of everything is exactly the same[...] (Interview with former supply manager September 13, 2016).

All this leads to the conclusion that, although there are several centralized processes in the Leonisa group, the subsidiaries are free to put changes and improvements forward to the headquarters. These proposals have been evaluated and implemented in both production and commercial processes. For instance, if a subsidiary sees an opportunity to open a new sales channel, the proposal is presented to the headquarters. On the other hand, Leonisa’s central office promotes the formation of corporate committees, where spaces for strategy discussion are generated. These spaces have as their objective alignment the different processes from a single corporate guideline. By way of illustration, the corporate procurement committee is made up of people from the headquarters and Votre; from there, synergies are promoted with the aim of improving bargaining power with suppliers.

In addition to the corporate functions, processes and committees mentioned above, there is the role of each company’s boards of directors, as they make the final decisions. This implies that, while there is a certain level of autonomy for companies and subsidiaries, centralized control is maintained, not only by the boards of each company, but also by the board of Leonisa as the parent company. Control is exercised through these periodic meetings, at which each subsidiary, whether it is a producer or trader, international or local, presents its results, follow-ups, projections, authorization requests and improvement plans to the board in a monthly basis. This is how all companies periodically connect to headquarters through a unified meeting format. And, from the board of directors of Leonisa, the global aspect of the corporate strategy is defined and maintained. Along the same lines, Leonisa can be said to promote the concept of socialization put forward by Chung et al. (2006). This concept suggests that there is an informal and subtle mechanism that, in addition to the structural and formal mechanisms, integrates the different business units.

With regards to the allocation of resources from headquarters to the different subsidiaries, there are guidelines for developing the budget of each country or company. For this purpose, the Manager of each one makes an initial proposal that he presents to the Board of Directors and justifies the expenses or investments. Nonetheless, there is no clear direction to encourage the interaction of subsidiaries or the creation of synergies between them. In other words, the synergies achieved thus far have generated spontaneously in response to the needs of a specific company. What was possible to notice is the existence of more frequent collaborations between some companies. For example, Dissen collaborates with Votre in the evacuation of non-portfolio products and, additionally, supports the saleswomen’s collection through the stores, which facilitates constant communication between both companies. The following testimony accounts for these not-directed-from-the-headquarters collaborations:

[...] there is no constant structure or committee or periodic meetings where companies are dealt with, but as the needs arise, we go one way or another[...] (Interview with Chief Financial Officer September 7, 2016).

One synergy resulting from spontaneous collaborations between companies, lies in the usage of the surplus from underwear manufacturing inputs, which occurs between Votre and Prym Le Sensuel. This type of synergy that comes from collaboration between units is recognized in the literature as cross-business synergies (Eisenhardt and Galunic, 2000;Knoll, 2007).

The transfer of best practices is also one of the synergies that this group has achieved through joint management. An example the foregoing is the creation of the direct-sales channel in Colombia in 1991, which was replicated in eight countries without using franchises or management thereof through third parties, and a centralized management of the brand image. One of the interviewees comments on this:

[...] Prym is a company specialized in swimwear with the autonomy to know, direct and manage the entire swimwear business, and is fed by the knowledge and experience of Leonisa, who is the backer of the brand [...] (Interview with the Supply Manager on September 9, 2016).

All of the above illustrates the structure of the companies belonging to the Leonisa group in Figure 2, from the commercial and administrative (including the productive) fronts.

This figure shows the multidivisional structure of the Leonisa Group, where a corporate center made up of executives dedicated exclusively to defining the business portfolio and managing it is nowhere to be seen. Nevertheless, the exercise of corporate functions and centralized processes, as well as the role played by boards of directors and corporate committees, provide for a corporate center immersed in Leonisa’s headquarters, wherefrom local and foreign companies and subsidiaries are coordinated.

6. Conclusions

Leonisa exercises centralized functions and processes through a multi-divisional structure, characteristic of a multi-business company. However, it does not have an autonomous corporate center, i.e., an exclusive corporate hierarchy, with easily identifiable staffing and fixed headquarters. This corporate center is formed only when making decisions that impact the corporate strategy and the functioning of each subsidiary in relation to the whole becomes necessary.

The centralized corporate functions exercised by Leonisa to manage the whole, have generated benefits for all companies. An example of the above is the control of the subsidiaries’ expenses, as well as the strategic management of resources, capacities and investments. In addition, the gains from joint negotiation with suppliers, especially abroad, are clear and materialize in economies of scale.

The two main purposes for the formation of the Leonisa group identified by this research, associated with economic objectives, were: risk minimization and operational efficiency. The first purpose arises from concerns related to the political or economic situation in the countries where the group has a presence. For instance, should Colombia become an unliveable country or Costa Rica become an unviable country at some point, products could be supplied through polyfunctional plants, which would not be specialized in a single product line. This, of course, grants greater versatility and efficiency in meeting market demands. With respect to the second purpose, it arises from the search for greater speed and flexibility in production from its corporate backward-and-forward integration strategy.

From the point of view of the multi-divisional structure of the Leonisa group, the centralization of processes has allowed it to dilute the labor costs in connection to the shared use areas from the main headquarters. In addition, the multidivisional nature of the commercial and production fronts has allowed the company greater control over its processes and to align its competitive strategy in each of its subsidiaries. Furthermore, it was possible to identify the spontaneous way in which synergies are achieved between different subsidiaries, whether producers or marketers, according to the need at hand. It was also possible to recognize synergies promoted from the headquarters, such as its omnichannel strategy and brand management.

According to the results of this research, the corporate center of the Leonisa group is similar to that of the GEA, inasmuch as it does not have fixed staffing or independent headquarters. Namely, this case also takes distance from the literature presented on the corporate centers of multi-business companies in developed countries. This particularity, identified in the GEA and Leonisa, allows us to infer that multi-business administration in Colombia is not necessarily carried out from an easily identifiable corporate center and with an exclusive corporate staffing, but that it is also possible to manage several businesses together without an explicitly constituted corporate center.

The complexity of managing a multi-business enterprise, and in particular that of the Leonisa group, would justify further research. For example, it would be interesting to analyze the possibility of rethinking the current multi-divisional structure based on the centralization of new processes. Or, to review the possibility of consolidating a single logistics team, integrating Votre’s and the corporate team, with the aim of making the group more customer-oriented rather than company-specific. It would also be advisable to research other companies in the textile sector given the crisis that this sector has been experiencing in recent years; a crisis that invites us to rethink not only the strategy but also the structure of the companies in the textile sector; as well as to research on the coexistence of formal multi-divisional structures with other types of informal organizational forms. In addition, a contribution to the teaching of corporate-level strategy, if a multi-case study were carried out that would at least allow conceptual generalization of the different strategies and structures adopted by Colombian multi-business companies.

Finally, it should be noted that this research does not enable generalizations since its interest was focused on characterizing Leonisa’s corporate center based on the identification of purposes, and on the structure it has adopted to manage its business set, functions and corporate processes. Moreover, the literature review only revised databases of higher academic recognition (ISI and Scopus), which could leave out publications on cases of Latin American companies.