1.Introduction

The development of business activities carries a vital importance for the economic growth of the country and its regions; however, it can be observed that nowadays many companies are not prepared to respond to the continuous changes and demands of the environment. Despite the encouragement and promotion of business creation by government agencies, business development centers and higher education institutions, among others, there are also high levels of desertion from small and medium-sized enterprises with a very short life cycle (Confecámaras, 2016).

On the other hand, the pressure of the environment and some business constraints such as empirical management, lack of knowledge of administrative techniques and managerial skills, scarce innovation and absence of strategic direction, among other aspects, constitute factors that significantly influence the permanence of companies in the market. The foregoing shows the need for Colombian companies to adopt strategic management approaches with a long-term view that allows them to grow and generate value for their stakeholders.

Therefore, the objective of this research is to explore the most representative aspects of the strategy and the generation of value in service-providing companies that have won the Colombian Management Quality Award from the Ministry of Commerce, Industry and Tourism, in 2013 and 2014. These companies stand out by their quality-and-productivity-oriented administrative practices, with competitive goods and services, and a strategic mindset (Tarapuez, Guzmán and Parra, 2017) focused on value creation, wherefore they are vital references for companies seeking to grow and set themselves in the market.

Some studies explain the relationship between strategy and value generation from a multidimensional perspective (Rashidirad, Salimian, Soltani and Fazeli, 2017); however, the adoption of different strategies brings about different results (Muñoz, 2016). Despite the above, other research agrees that strategic emphasis should be examined according to the relative performance of the company and the context in which it operates, in order to make decisions on resource allocation regarding the creation or capture of value (Han, Mittal and Zhang, 2017). On the other hand, Quesada and Meneses (2011) state that strategic management directly influences business success and processes of value creation.

From another perspective, the interaction between competitive strategies and dynamic capacities in knowledge and innovation management depends on measurement practices that are consistent with mechanisms for feedback and reinvestment of captured value in order to generate sustainable competitive advantages that form the basis for value creation (Gloet and Samson, 2016).

Other studies, in turn, reflect the existing interaction between value creation and capturing (Priem and Swink, quoted by Skilton, 2014; Campos and Ledur, 2016). Nevertheless, some companies seeking to invest in value creation feel pressured to spend more resources on value-capturing tactics for fear of opportunism. The balance between these two strategies depends on control held over resources and trust between partners (Panico, 2017).

In accordance with the foregoing, this document’s structure will be as follows: in the first instance, it will present the theoretical framework on strategy and value generation. In the second part, it will explain the methodology used for the development of the research. Thirdly, it will describe and discuss the results obtained, while the fourth section will account for the conclusions. Finally, at the end will be a list of the bibliographical references.

2.Theoretical framework

Throughout history, the term strategy has been used in many contexts, from military organizations to its integration into the business lexicon of the 20th century. From the 1960s onwards, the strategy began to be conceived as a logical and conscious process that contributed to management decision making; it was subsequently analyzed from the economic perspective and the business environment.

From a managerial perspective, for authors such as Chandler (2003) and Andrews, (1976), quoted by Prieto (2017), the strategy includes the set of objectives, goals and plans needed to guide the organization and its decisions. Meanwhile, Mintzberg, Ahlstrand and Lampel (2010) define it as the set of actions that occur over time.

From a business standpoint, strategy is recognized by Hofer and Schendel (1985, p. 4) as “one of the main tools for senior management to cope with both external and internal changes”. According to Porter (2009), the strategy is based on the development of activities that are different from those of the competition, and if they are similar, they should be better and in a different way.

Likewise, for Ansoff (2007), the strategy guides the organization’s behavior and is a powerful tool for adapting to change and achieving success (Miles and Snow, 2003), since according to Drucker (2011), the purpose of the strategy is to empower the organization to achieve its objectives in an unpredictable environment. For Ohmae (2004), it is the way in which a company harnesses its strengths to set itself apart from its competitors positively.

For Mintzberg et al. (2010, p. 468) “Strategy creation is designing with criteria, intuitive imagination and emergent learning, it is transformation and perpetuation; it must include individual knowledge and social interaction”, to set up direction, concentrate efforts, define the organization and provide consistency, as well as the 5ps of the strategy, such as plan, paragon, position, pattern and perspective.

The strategy is classified according to the general orientation of the company regarding growth, stability and reduction (Glueck, 1972, quoted by Rue and Byars, 1997); according to the way of competing in the market, it falls into cost leadership, differentiation and focus or concentration (Porter, 2009); according to the capacity for innovation (Miles and Snow, 2003) and based on the vision and building up of the future (Mojica, 2005), it does so into inactive, reactive, pre-active and proactive.

Strategy development requires companies to make assertive decisions for their growth; according to Jones and George (2006), the strategy is a conglomerate of decisions related to goals, activities, and resources. Pérez (2012) states that the strategy refers to the capacity to follow a few steps to act strategically and calls it a strategic process, which implies a long-term direction, formal stages with goals, objectives, programs, activities and resources, taking into account changes in the environment.

On the other hand, it is important to identify the essential capacities or core competencies of the organization (Prahalad and Hamel, 1990), with which it is possible to obtain competitive advantages, which demand the resources to be valuable, rare, inimitable and the organization must be able to harness them (Barney, 1997, quoted by Calderón, Álvarez and Naranjo, 2008). In this way, it is possible to enhance strengths, overcome weaknesses, seize opportunities and counteract threats. According to Calderón, Álvarez and Naranjo, (2014), a resource is valuable when it adds value to the product or service and the user prefers it to that of the competition.

In terms of value generation, 21st century companies are increasingly exposed to competition from large multinationals and economic conglomerates due to phenomena such as market globalization, global capital flows and privatization, which cause their concerns to shift and has them analyze not only traditional financial indicators, but also aspects related to long-term prospects, which contribute to increasing their value.

To create value in organizations, strategies need to be coherent and embedded in decisions that affect financial performance and in the mechanisms used for financial management. Likewise, the creation of value requires being attentive to changes in the environment, thus achieving organizational consistency between the different strategies and their flexibility in the continuous search for competitiveness (Álvarez, 2016).

Consequently, companies promote and foster a culture of value creation for owners (García, 2003), with the implementation of processes within a system that includes: strategic direction, financial management, and human talent management.

As for inducing force, Morrisey (quoted by García, 2003, p. 46) defines it as “the main factor that affects all the important decisions that influence the future of the company”; Robert (1997) supports this concept in which organizations must be observed as bodies moving in some direction that induces them to do so and is called inducing force.

In this sense, García (2003) asserts that if the creation of value is the success of the strategy and this, in turn, relies to a large extent on the identification of its inductive force, what concerns this force becomes the critical factor on which the major strategic value-generating initiatives underlie; this is called the “value-inducing force”,

Generally, companies define a single business component, which establishes the need to focus on products, customers, areas and market segments, with which they determine their profile. In other cases, there is a hierarchy of inducing forces, one of them at the institutional level and the others per business unit (García, 2003). The value-inducing forces are the type of customer or user, market category, type of product or service, production capacity, technology or know-how, sales or marketing method, distribution method, natural resource, size or growth, and profitability.

In recent decades, the value of a company has been related more to intangible aspects rather than tangible ones; the former play a relevant role and enable the management, improvement, and measurement of organizational capacities (Parra, Ramírez and Díaz, 2007). Other assets such as intellectual capital, cooperative ethics and organizational routines (García, 2003) are tied to innovation in service delivery. On the other hand, the relationship with stakeholders can be a source of competitive advantage, insofar as it serves to structure and develop fundamental competencies that generate value for them.

The Colombian Management Quality Award, created by Decree 1653 from 1975, is a recognition of the national government to public and private organizations, which stand out for having a practical approach towards quality and productivity in the performance of their management processes, to achieve high competitiveness; it examines elements such as strategy and strategic management, leadership, human talent management, customer and market management, process management, information management, knowledge and innovation management, social responsibility and results (Mincomercio, 2012).

In partnership with the Corporación Calidad (Quality Corporation), the Ministry of Commerce, Industry and Tourism, aims to serve as a reference for all types of organizations to develop practices that allow them to be productive and competitive worldwide, thereby creating value for social groups. As a result of implementing this model, the importance of strategic direction in organizations has become evident, wherefore this factor has become a fundamental reference for business management.

3. Methodology

This research is deductive, exploratory and descriptive in nature. The research design for this paper uses the case study from two perspectives: firstly, it is collective since it works with seven companies as Annex 1 will show and, secondly, it is instrumental because the interest is focused on understanding the existing relationship between strategy and value creation in the firms under analysis. As it is a case study, the sample is purposive based on the thematic interest of the authors.

The case design of this paper includes the elements outlined by Yin (2014), which allow us to address the how and why of a specific situation in two contexts: a) When the researcher has little control over the phenomenon to be researched, or b) When the subject of the study is a real phenomenon that occurs within the current situation of the researcher. The process for developing a case study consists of five steps (Jiménez, 2012), which are outlined in Figure 1.

Firstly, the selection and definition of the case was made. This stage defined the analysis units, which corresponded to the service-providing companies that won the Colombian Management Quality Award from the Ministry of Commerce, Industry and Tourism during 2013 and 2014. This award classifies companies in different categories: in the private sector, it classifies them into industrial and service-providing organizations, while at the same time sub-classifying them into large, medium, small and micro-sized. In total, nine companies were awarded the aforementioned accolade in the period under review, which belong to different sub-sectors of service provision, sizes and regions of the country.

Secondly, once the problem was identified, a list of questions was drawn up to design the survey. The question format included aspects related to stakeholder liability and participation, key components of the strategic process, and distinctive resources and capabilities, within which value-creating elements were identified. Once the survey was designed, a discussion was sustained with the research team in order to eliminate redundant, ambiguous or poorly worded questions so that they would be understandable to the respondents.

A pilot test was then conducted with representatives of five companies from the city of Armenia. In this step, some aspects of improvement related to wording, clarity of questions and duplicity of inquiries were detected and improved in the final format of the survey.

Thirdly, company managers were located and contacted to raise their awareness on the research project, socialize its objectives and generate commitment. Subsequently, the survey was sent to each company with informed consent and the option to fill it out via e-mail was provided. The information was collected between July 2015 and January 2016. The data obtained were interpreted in accordance with the structure of the survey, which allowed us to link variables and understand their impact on strategic decisions and organizational management.

Subsequently, the obtained results were analyzed and interpreted, wherefore primary information was obtained from seven out of the nine winning companies (78% of the population). Additionally, secondary sources such as management reports and institutional business pages were used. Finally, the research report was prepared.

4.Results and discussion

The development of this research required grouping the study variables by affinity in three dimensions: a) Accountability in the strategic orientation and participation of stakeholders; b) Components of the strategic process (diagnosis, formulation, deployment, monitoring and control); c) Strategic resources and distinctive capacities. The result of the foregoing was some elements of the value creation system being recognized within the dimensions, as Figure 2 will show.

At each stage of the strategic process, the following aspects were identified: a) in the diagnosis, the tools and methodologies for internal (strengths and weaknesses) and external (opportunities and threats) analysis; b) in the formulation, the elements concerning the strategic platform, timetable of the plans, review and updating thereof, and typologies of strategy; c) in the deployment, the areas that most contribute to the achievement of the objectives and budgetary allocation criteria for the execution of plans, programs and projects; and, d) in the monitoring and control, the strategic and operational measurement mechanisms and tools.

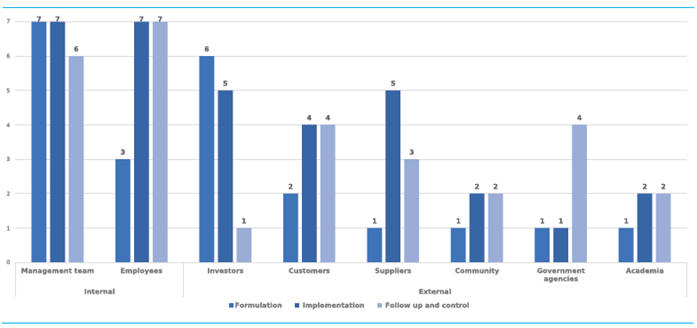

Concerning internal stakeholders, the companies analyzed make their strategic decisions at the three stages of the institutional level, i.e. the board of directors, management and the management team. The intermediate level has a limited participation in this first stage, so it follows that companies tend to be centralized. In response to this situation, Campos, Suárez and Ojeda (2013) posit a model that stimulates a participatory attitude to decision-making, which is associated with strategic formulation and implementation.

In connection to situational diagnosis, liability varies according to the perspective of the analysis. In the external environment, largely, such accountability falls on the institutional level, especially on the management team and management itself, while in the internal sphere it is mainly concentrated at the intermediate level, particularly in high-performance areas and teams. In terms of management, the management team is the one that exercises the greatest leadership.

In terms of deployment and strategic control, the intermediate level has the greatest participation through its areas, strategic business units and high-performance teams; nevertheless, the responsibility falls on the institutional level, especially on the management team.

About external stakeholders in the strategic process shown in Figure 3, their participation noteworthy as follows: investors in the targeting, suppliers and customers in the deployment, and government agencies and customers in the control. This relationship with stakeholders constitutes a source of competitive advantage (García, 2003), however, it can be observed that academia and the community have a low participation in these stages.

Source: Authors’ own elaboration. Information with the number of companies

Figure 3 Liability and Participation of stakeholders in the Strategic Process

4.1.Components of the strategic process

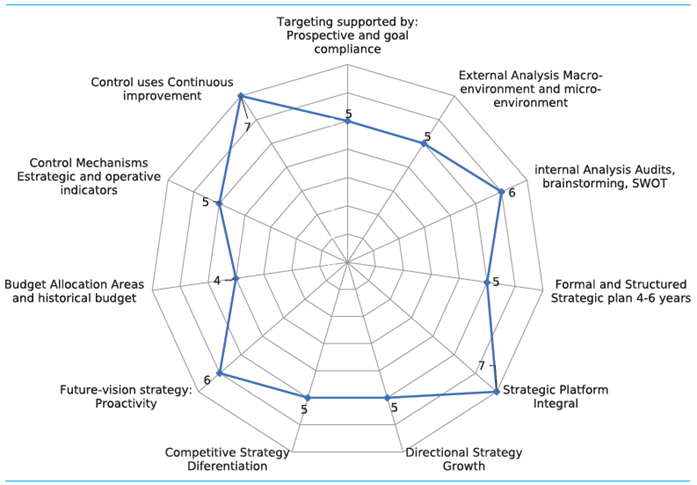

The strategic process is derived from the targeting and decisions made from the institutional level and is composed by internal and external analysis and diagnosis, and formulation, deployment and monitoring and control. A set of elements was analyzed at each stage, as will account Figure 4 for.

Source: Authors’ own elaboration. Graph´s information with the number of companies

Figure 4 Key Components of the Strategic Process in the Companies

4.1.1. Situational Analysis and Diagnosis

Companies use different methodologies and tools that allow them to have a holistic and integral vision of the business. With respect to methodologies, in external analysis, most companies analyze political, economic, social and technological factors, as well as the sector in which they operate and the stakeholders. In terms of internal diagnosis, they find support on internal and external audits, the value chain and the identification of strategic resources and distinctive capabilities. Among the statistical tools, the most-commonly used are the SWOT analysis and brainstorming.

4.1.2. Strategic formulation

Most companies prepare their strategic plan for a period of between 4 and 6 years, which is reviewed and updated at annual intervals generally, and their strategic platform is comprehensive, because it includes fundamental elements such as mission, vision, objectives, organizational strategies and policies, and corporate principles and values. Only one of the company analyzed does not consider the last two aspects. The companies analyzed interpret the strategy as a guideline for action, which contributes to the achievement of their objectives (Mintzberg et al. 2010).

In this regard, González, Rodríguez and Moreno (2014) argue that strategic planning in companies is partially applied with traditional management models, while Mora, Vera and Melgarejo (2015) assert that its impact is significant to organizational management. Among the targeting tools used by the analyzed companies lie strategic prospective, financial projections and the achievement of goals and objectives, important factors in the value-creating system.

According to Frigo and Litman (2004), value creation is based on three categories: the objectives or goals set up for the maximization of financial value, market positioning and support activities that are essential to meet the corporate purpose and achieve financing. For Ortiz (2011), another way for managers to manage value is to gear their efforts towards achieving profitability.

Most companies identify with the strategy of growth, differentiation and proactivity. According to Esparza and García (2011), companies with a market culture resort to defensive (reactive) strategies and compete on focus, while Tarapuez, Guzmán and Parra (2016) state that proactive and pre-active firms have a comprehensive strategic process, supported by models such as the one proposed by Campos et al.(2013), which promotes proactivity and participation. For Calderón, Álvarez and Naranjo (2009), Colombian companies develop strategies to differentiate themselves by quality and cost leadership.

4.1.3. Strategic deployment

At this stage, companies have clearly identified their main and support activities, the former being those that contribute greatly to the achievement of their objectives. Only one company states that all processes contribute significantly to the achievement of its purposes, due to the knowledge generated throughout its history. Likewise, only one company has a system based on rising its staff’s awareness on the importance of the concept of value, which is incorporated into all the actions it develops. The implementation of this system is the result of a strategic mindset.

Six of the seven surveyed companies have clear budgets for the implementation of plans and projects. The historical record and the projects of the areas are the main criteria for budget allocation and distribution. According to Manotas (2009), the projects presented must contribute to the social impact and to improving the quality of the product. Moreover, their prioritization is carried out through the hierarchical analytical process and their assessment through quantitative data such as the internal rate of return and the current net value.

According to the above, companies have an efficient use of financial resources based on the projects of their areas and by identifying those that contribute to achievieving the basic financial objective (García, 2009). Such distribution of resources allows companies to maintain or improve their performance and be aligned with strategic direction (Lo, 2013; Grant, 1991; Prahalad and Hamel, 1990 quoted by Calderón et al. 2008).

4.1.4. Strategic control

From a strategic standpoint, some companies have implemented the Balanced Scorecard that measures compliance with organizational objectives, goals and performance indicators to monitor value (García, 2003; Ganga, Ramos, Leal and Pérez, 2015). According to Ortiz (2011), this tool is used more for upper control, however, there are companies that use strategic indicators and do not have the Balanced Scorecard.

Additionally, among the most commonly used control mechanisms and tools are operational and financial indicators, which are supporting value drivers to optimize macro value drivers. For De Carvalho and Rubens (2013), private equity firms show a better level of financial management than those of the State, with greater availability of resources and the usage of financial indicators and cash flow, which allows them to improve their initial value.

Some of the companies analyzed show solidity, liquidity and sound operating cash flow. In this sense, Botero, Garnica and Soto (2013) find that corporate financial management becomes a key aspect enabling the establishment of value generation criteria, which are essential to achieve competitiveness.

For most firms, strategy and decisions focus on the type of product or service, size and growth, and profitability primarily. Secondly, companies focus on the market’s category, because they serve a specific segment and identify its preferences with the right timing and new services. According to Saavedra, Luna and Saavedra (2012), the positioning of a company is not only its value -which is subordinated to future values, when it is listed on the stock exchange-, but its service to society, especially, through better quality products and services at competitive prices that bring in more users.

For monitoring and control, companies identify organizational flaws and possible deviations through periodic meetings and feedback, and stakeholder complaints. This way, there is a focus on continuous improvement through leadership, innovation and change.

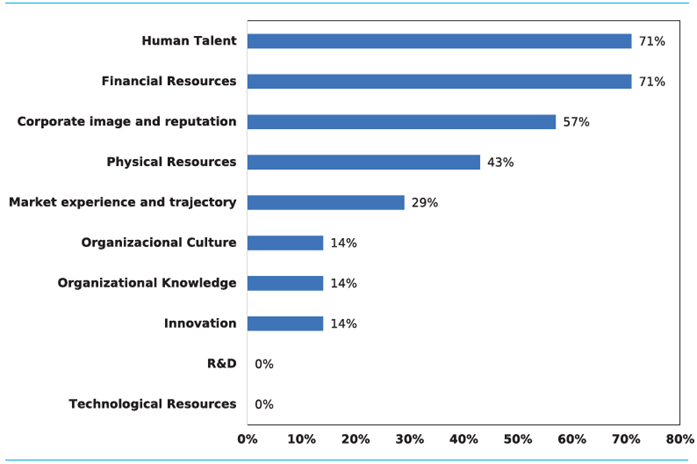

4.2. Strategic resources and distinctive capabilities

For the identification of strategic resources and distinctive capabilities of the companies, based on a set of organizational factors displayed in Figure 5, human talent, financial resources, and corporate reputation and image are found to occupy the first place, which is why they represent a source of competitive advantage, according to Figure 6. According to Parra et al (2007), financial resources allow for an increase in the productive capacity of work and improvement of performance through training, education and the experience of employees, while for Gonçalves, Ferreira, Ferreira and Farinha (2018), innovation and the human dimension are the forefront for SMEs to attain competitive advantages.

Nevertheless, the companies under study, even though they display elements of the value-creating system, are noted to not reckon technological resources, and research and development as priorities.

In turn, Calderón et al. (2009, 2010) find that product innovation, specialization and the pursuit of reputation are strategic factors for companies, as well as process improvement, being customer-orientated, product quality and business productivity, given their high impact on organizational effectiveness. On the contrary, Alfoqahaa (2018) concludes that innovation is weakly associated with the success of SMEs. According to Ynzunza and Izar (2013), technology and innovation, and market orientation are conditions that pertain to organizational growth and are reflected in prospecting (proactive) and analyzing (pre-active) companies.

5.Conclusions

In this research, the most representative aspects of strategy and value generation in the service-providing companies that won the Colombian Management Quality Award from the Ministry of Commerce, Industry and Tourism in 2013 and 2014 were recognized; consequently, these conclusions are only valid for these firms. Three dimensions of the strategy and its relationship to the value-creating system were analyzed, to wit: stakeholder liability and participation, components of the strategic process and distinctive resources and capabilities.

The decisions pertaining to the strategic process in each of its stages lie under the direct responsibility of the institutional level, which in addition to exercising leadership, delegates to the intermediate level the development of some activities inherent to this process.

External stakeholders participate to varying degrees in the stages of the strategic process of the companies analyzed, which indicates that they interact directly with their specific environment. It is striking that academia and the community have a precarious tie to the development of the strategic process of these companies.

For situational diagnosis, the companies under study exhaustively monitor their internal and external environments. To this end, they rely on structured tools and methodologies that allow them to have a holistic and integral vision of the business, recognize their key success factors and define their strategic direction more clearly.

Companies have structured formal and long-term strategic plans, possess a comprehensive strategic platform and see the strategy as a guideline for action that contributes to the achievement of their objectives. Companies identify themselves especially with growth, differentiation and proactivity strategies.

The companies analyzed acknowledge that their main activities are those that generate value, therefore, the plans and projects derived therefrom are one of the main criteria for budget allocation and distribution.

Within the main monitoring and control mechanisms, companies use strategic, operational and financial indicators. The former measure the fulfillment of their organizational objectives, while the other indicators define criteria for generating value from the financial perspective. Despite the use of strategic indicators, not all companies have implemented the Balanced Scorecard. These mechanisms contribute to continuous improvement and leadership, innovation and change support them.

Human talent, financial resources and corporate reputation and image are strategic resources and the distinctive capabilities of the analyzed companies, which represent a source of competitive advantage for them. In particular, technological resources and research, and development are not observed to be a priority for the firms studied.

The strategic orientation for value generation within the companies under analysis is geared towards the type of product or service, size and growth, profitability and market category. The analyzed enterprises contemplate aspects of a value-creating system reflected in their competitiveness and permanence in the market.

As a result of this research, it is clear that studies are needed in order to analyze the relationship between strategy and the generation of value in other areas and sectors, as well as the role innovation and research and development departments play within value management.