1. Introduction

The study of the attitudes of owners and managers towards decision-making on the financial environment, in the Mexican business context, as attribution to the economization of transactional cost (Coase, 1937; Williamson 1973, 1979; Jones, 1987). Within the theory of organizational economics that seeks to answer the question, how do economic organizations work? (Espinosa Luna, 2016, p. 45). Decision-makers in organizations “seek to maximize their behaviour towards priority and stable systems, but do so... in the presence of cognitive limits, incomplete information and difficulties in monitoring and capacity to enforce agreements” (DiMaggio and Powell, 2001, p. 36).

The initial discussions are based on two theoretical approaches, that of the Firm (TF) and transactional costs (TCT). TF is a complement to an institutional economics theory about why markets exist, and consequently how prices form (Müller, 2009). In turn, TCT offers two theoretical perspectives, the first one is exposed by Coase (1937) on markets operating cost, which he calls transactional costs. The other theoretical perspective is seen in Williamson, who proposes transactional costs within uncertainty schemes and under government structures. In other words, the behavior of individuals and the conditions of the institutional environment or the environment per se determine transactional costs (Espinosa, 2016).

Williamson (1973) defined transactional costs as an economic exchange subordinated to limited rationality understood as the speed to receive, store, retrieve and process information error-free by individuals. driven by the effort to achieve profit in transactions, or opportunism. This depends on the ways of organization or practices that individuals live. Graff (as it was cited by Macagnan, 2013) defines transactional costs as:

“the costs of managing are relationship of trade. These include the costs of negotiating, designing and monitoring... and the opportunity is associated with managing an inefficient [exchange] contract until a new agreement is recognized as necessary and then obtained” (pp. 135-136).

Perhaps, for this reason, the contributions of the TCT explain the existence of the company depending on decision making, reasonable calculation, which affect the productivity and profit levels of firms. For its part, Putterman and Kroszner (1996), on the nature of the firm that intra-firm relations are influenced by markets, this is characteristically palpable in terms of remuneration to individuals belonging to an organization, and consequently their performance. It is, therefore, Simon (1957), within the theory of economic behavior, the first to use the term limited rationality, a concept with a low degree of specification (Barros, 2010), since it poses a bridge between the theory of behavior [individual] and the economic theory that places the individual as an economic agent and the link is decision-making among many possible alternatives. Simon defines bounded rationality as a relationship of conformity (effectiveness) between pre-established (alternative) extremes and the means to achieve them. Decisions in organizations can be based on fact and value-based premises, which include empirical elements such as normative (Simon, 1976). The factual premises, or fact-based, are based on knowledge and information about the organization and its environment (Simon, 1976; Barros, 2010). Meanwhile, value premises include objectives as moral and legal constraints facing the decision-maker (Bakka, Fivelsdal, and Lindkvist, 2001).

A factual assessment theoretically proposes three steps: (i) a list of possible behavioral alternatives, (ii) determining all consequences to follow under a probability path and (iii) the comparison of alternatives that are evaluated within the pre-established terms such as utility, benefit, payment function or another benefit (Barnard and Simon, 1947; Barros, 2010).

The objective of this paper is to determine the financial-natured factual assumptions by decision makers that explain the behavior or limited rationality towards strategic financial planning by microenterprises that are more susceptible to disappear in the market; whether the transaction cost, determined by the information processing speed and the level of knowledge available to a decision maker (Williamson, 1973), plays a role as a unit of analysis that allows conducting research in various forms (Salgado, 2003). It is essential to evaluate which factors determine the knowledge or information that delimit the financial behavior of the microentrepreneur in decision making, and the consequence of the decision is the transactional cost to be bourned. Again, the comparison of alternatives is also governed by value premises, highlighting the importance of decision and moving this research away from the theory of choice1, thus focusing on the business perspective towards the construction of financial planning (Saavedra and Espíndola, 2016; Hallen and Pahnke, 2016; Diéguez Castrillón, Sinde Cantorna, and Gueimonde Canto, 2014; Medina, de la Garza Ramos, and García, 2008; Sandoval and Abreu, 2008). For Saavedra and Espíndola (2016) there are several works asserting that the absence of a financial horizon by small and medium-sized enterprises (SMEs) is a cause for loss of competitiveness and possible business extinction. However, few works address the problem from limited rationality (Ahi, Baronchelli, Kuivalainen, and Piantoni, 2017; de Lurdes Calisto, 2017; Surma, 2015) and decision-makers within a financial perspective.

Significant importance arises from the selection of alternatives that lead to prevailing in the market or the non-extinction of business; understanding the survival of companies as the number of businesses that survive for every 100 that enter an economic activity in Mexico (INEGI, 2018). Statistical results show that around 30% of Mexican businesses disappear in their first year, and more than half when they reach the fifth year of life as shown in Table 1. This highlights the great corporate death in the Mexican economic environment. One possible cause is the problem of selecting financial alternatives for the best choice that will affect business development (Bracker and Pearson, 1986), leaving us as a research question: How is the rationality of the manager or owner oriented towards financial decision making?

Table 1 Survivors per 100 businesses entering an economic activity by economic sector, according to age

| Business age | Manufacturing | Commerce | Private non-financial services | Total |

|---|---|---|---|---|

| 0 | 100 | 100 | 100 | 100 |

| 1 | 70 | 66 | 68 | 67 |

| 5 | 40 | 33 | 36 | 35 |

| 10 | 30 | 23 | 26 | 25 |

| 15 | 24 | 16 | 20 | 19 |

| 20 | 20 | 12 | 15 | 15 |

| 25 | 17 | 9 | 12 | 11 |

Source: Taken from the INEGI, 2016research.

2. Theoretical framework

This research is supported jointly by the prescriptive decision theory, which is based on the right choice by real individuals, given their cognitive and informational limitations (González, 2004), that is, how entrepreneurs decide given the limited amount of information available on a financial choice situation.

Our interest in carrying out this exploratory study on the analysis of financial decision-making by Mexican microentrepreneurs is to contribute to the financial-natured limited rationality without biasing only to human behavior under the individual sphere, but to consider it as the rational action that requires thoughts and collective decisions, as stated by Veblen (Estrada, 2008). Therefore, our question is: What is the financial rationality of microenterprise owners or managers facing the most dynamic and changing market demands, given that each subject lives a rational choice process under the limitations inherent to the business dimension?

Within this perspective, owners or managers make parametric decisions, “-or strategic, that is, if the decisions of the stakeholders are interdependent” (González, 2004, p. 141), that is, under an economic system, stakeholders are connected and react to each others’ decisions. Thence the need to outline decision maker-based behaviors in order to favor the survival of the company, necessarily leads to determining the best possible option towards obtaining monetary resources and the allocation thereof, at what time to invest or increase their production or services, are one of the many possible decisions driven by the pre-established benefits and subordinated by the conventional practices that Mexican businessmen live under.

In this sense, the research orientation incorporates the importance of financial analysis itself that seeks: “to identify the economic and financial aspects that show the conditions in which the company operates with respect to the level of solvency, indebtedness, efficiency, performance and profitability, facilitating the making of managerial, economic and financial decisions within business activity” (Nava, 2009, p. 607).

There are works that highlight the role of financial administration as a driver of growth and development in SMEs. Bracker and Pearson (1986) give us the idea that the planning and financial performance of small businesses was limited by the rational process geared towards survival and together with a short-term vision, and recognize entrepreneurs’ growth as a consequence of planning their development. Alvarez and Abreu (2008) state that the growth of SMEs in Mexico was the result of good resource management. In turn, bankruptcy was the result of financial strategies, so the choice of by decision makers [subject of our study] defined the success of companies. A comparative study of the financial and administrative profile of small businesses in Mexico by the PYMES-CUMEX Network (2010) showed that most companies make decisions based on accounting information and make long-term projections, in which cases they have also had access to financing. This reinforces the importance of the quality of reliable financial information in decision-making for the survival of Mexican SMEs (Fosado, 2007). Another useful tool for decision-making are available financial records and control (i.e., basic financial statements: statement of income, balance sheet, etc.) which assume an interpretative role for rational choice by SMEs (Sandoval and Abreu, 2008).

Becerra and Sandoval (2009) conclude that financial administration is a utopia for microenterprises and lack tools for this purpose. López and Quintero (2011) asserted that Mexican microentrepreneurs need more attention, and require better and greater financing alternatives to start or continue operating. The lack of observation and research on Mexican microenterprises is evident. Another work on financial management developed in the information technology sector contributed to the pragmatic nature of business in the quality of the individual (rational economic agent), which concluded that most companies with smaller dimensions do not have staff dedicated to setting up financial resources strategies; however, it does confirm the existence of financial information in the making of strategic business decisions (Saavedra and Espíndola, 2016). Regarding the planning of financial needs, the smaller companies demonstrated that they formulate their financial objectives, both in the short and long term, and abide by the management of work capital as a survival strategy in the market, deferring fixed investments.

3. Analytical framework

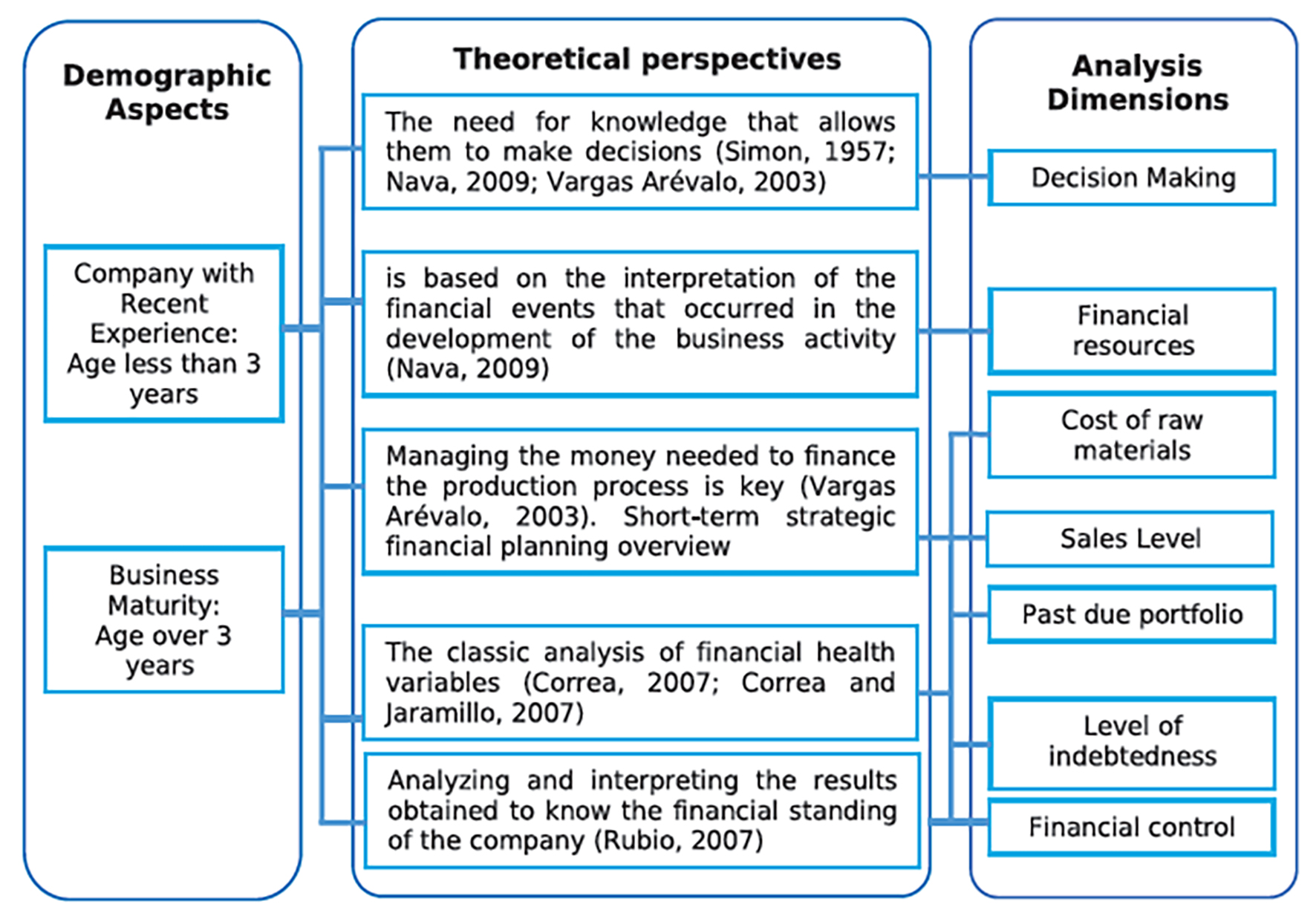

For the construction of the analytical framework on financial rationality, it was taken into account that the information seeks the measurement of assets, liabilities, income and expenses in order to provide data on the financial standing of the company, their yield, as well as the cash flows that constitute elements that an economic individual uses to rationally choose the strategy to follow that will achieve have the company remain and develope in the market (Figure 1).

The International Accounting Standards Committee (IASC Foundation) has since 2001 developed a set of globally accepted financial reporting standards for SMEs, and according to these (IFRS FOR SMEs) the dimensions of financial resource management, working capital management, indebtedness, and financial control are defined. Farfan Liévano (2010) recognize that the main user of financial information is the administrator or owner of SMEs.

Nava (2009) proposes financial analysis as a key tool for efficient financial management that helps “financial problems that are difficult to manage; face financial costs, risk, low profitability, conflicts to be financed with own and permanent resources, making ineffective investment decisions, control of operations, distribution of dividends, among others” (Nava 2009, p. 609).

For its part, a distinguishing element based on financial analysis in SMEs is to know the importance of “having liquid resources”. They add strategic value to a company, and even more so when they are recently launched (Vargas Arévalo, 2003).

Inquiring about the classic dimensions of financial analysis related to knowing the “business financial health” of SMEs, experts conclude that there are three basic analyses: liquidity, indebtedness and profitability (Correa and Jaramillo, 2007; Correa, 2007) that help in decision-making. Consequently, the financial analysis consists in turning significant financial information [statements] into useful decision-making tools (Rubio, 2007).

4. Research Objectives

The objective hereof is to determine the scope of financial rationality by microentrepreneurs, checking the valuations in order of importance that stakeholders make to take a financial decision with the resources they possess for it.

The research seeks to categorize analytical dimensions as financial resources, the level of indebtedness, overdue portfolio, raw material costs, sales level, financial control and finally categorize decision-making to explain owners or managers limited rationality from the most sensitive Mexican microenterprises to remain in the market.

For this purpose, the following research hypothesis has been proposed:

H1: Bounded Financial Rationality is positively influenced by the maturity of the company, exercises a positive effect on the better performance of the opportunity towards financial transactional costs in Microenterprises, given by its permanence in the market.

5. Methodology

5.1. Database

Companies with a maximum of 10 employees, called microenterprises, located in the municipality of Puebla, in the State of Puebla, Mexico, were considered for this exploratory study. According to the National Institute of Statistics and Geography, under the National Statistical Directory of Economic Units, a record of 55.6812 economic units was obtained2. Once the sample3 was determined, a data collection instrument was designed with 35 items grouped into seven dimensions that make up the analytical framework on financial rationality such as a) financial resources, b) indebtedness level, c) past due portfolio, d) raw material costs, e) sales level, f) financial control and (g) decision-making.

Subsequently, 109 randomly selected surveys were obtained and jointly stratified by business sector: trade, transformation and services. For better geographical coverage, the municipality of Puebla was divided into four quadrants, thus obtaining 19 transformation companies, 46 trade companies and 44 service companies. Particularly, one of the limitations found in the application of the questionnaire was the response time by owners or administrators.

5.2. Information processing

This research is mostly exploratory and qualitative. For this purpose, the responses collected per questionnaire were coded and treated using the SPSS statistical software, which initially determined a reliability analysis on the 35 items obtaining a Cronbach alpha result of 0.80. In order to evaluate the rational financial perception by managers or owners, the consequent step was to conduct a binary logistic regression analysis, with which we can distinguish financial rationality at two moments: 1) by companies not older than 3 years, and 2) by those with more years in operation.

6. Descriptive results of the Data Collection Instrument

Then, the frequencies obtained over a total of 35 items, grouped by dimensions, are externalized. This descriptive result does NOT allow us to explain the rationality of the owners or administrators, but it does present the diversity of perceptions by respondents. Only 11 of the 35 items observed give us a clear perception of the financial guidelines followed by Mexican microenterprises (Annex 1). A clear concern was to default financial commitments because of the lack of resources, where the majority of respondents have a positive opinion on the consideration towards ease of obtaining loans.

Within the possibility of losing financial resources on account of expanding the earned overdue portfolio, they are fully in agreement to provide financing to their clients. This is a reflection of the thought of prevailing in the markets in which they operate, which possibly leads to an increase of the overdue portfolio as a result of customers defaulting their credits.

Another behavior observed was to value their proneness to avoid facing low sales levels. Together, the results indicate that there is a clear valuation by NOT considering that the economic situation in the country influences impoverished sales (80%, Annex 1 item 22). In short, there is no business myopia about focusing only on the local or national market, which is reinforced by the thought of being in global markets where the presence of foreign competitors does not limit their sales growth.

However, this first approach does not allow us to group the data according to the permanence in the market, where, 50 companies of the total sample obtained an average age of two years, and those with an average life of 16 years of operation, numbered 59. For this reason, a binary system was chosen for analysis, coding as start-ups (under 3 years old) with a “one”, and with a zero for those that were mature, older than 3 years old. The results of the data collection instrument are measured and recorded as explained in Annex 2.

Seeking to establish a statistical correlation between the financial dimensions and the age or years of operation of a company, modeling on the 35 items that are part of the seven financial dimensions, coded each variable as dummy4.

The Modeling and the relationship between the occurrence of determinants can be formulated as follows:

Model (1)

𝐴𝑖 = (I1𝑖, I2𝑖 , I3𝑖, I4𝑖, I5𝑖, II6𝑖, II7𝑖, II8𝑖 ..., II35𝑖 ) + 𝑒𝑖

𝑒𝑖, a stochastic disturbance term assumes that it is independent and normally distributed through observations.

7. Empirical results of the application of the proposed model

To test the validity of the model (1) we use the pseudo-Pearson (R2) statistical value that checks the quality to replicate the results or its predictive efficiency. The most satisfactory test we obtained was the Nagelkerke R2 value, which is 96.4% which indicates in turn that the remaining 3.6% is explained by other independent, categorical variables that were not included in the model, which is quite an acceptable value (Table 2).

Table 2 Statistical tests to model 1

| Step | -2 log of likelihood | R Square of Cox and Snell | NagelKerke Square R. |

|---|---|---|---|

| 4 | 11.090 | 0.721 | 0.964 |

Source: Author´s survey (Computer software SPSS Version 20).

Model 1 Summary

Another test to determine the goodness of fit of a logit model was by the percentage of global hits, which were 96.3%, again quite an acceptable value.

Once found the best set of explanatory variables predicting rational valuation by owners when a newborn company, less than three years in operation, or dependent variable for the model (1) assumes a unit value, the first results obtained were the categorical variables that came out of the probability equation of A or model (1), therefore:

IV.18. Have you ever had money problems buying raw materials?

V. 25. Do you think you are currently aware of the break-even point you must have to maintain the necessary sales?

V. 23. Do you believe that there is a greater presence of competitors and this influences the decline in sales?

It is in this order of importance that they left the probability equation, and it allows us to infer that Mexican companies assume the possible risk of not acquiring raw materials, however, it is not a peculiar feature of financial rationing by emerging companies. Another element that explains Mexican idiosyncrasy is using the break-even point in sales to define the direction to follow. Simultaneously, the threat of increased rivalry in the market by a greater presence of competitors that decrease sales does not assume an explanatory role in financial rationality.

7.1. Probability Equation

The resulting probability equation, once it is not possible to remove or add more variables to the model (1), is:

Log(p⁄1-p)= -530.527+39.092I.1(1)+39

.506I.1(2)+78.694I.1(3)+40.021I.1(4)+2

82.597I.2(1)+33.868I.2(2)-23.724I.2(3)-

35.593I.2(4)+17.961I.3(1)-68.736I.3(2)-44.96-

3I.3(3)+187.73I.3(4)-70.535I.4(1)+193.64

3I.4(2)+334.953I.4(3)+309.018I.4(4)+42

2.631I.5(1)+109.481I.5(2)+81.795I.5(3)+

136.728I.5(4)+137.593II.6(1)+59.173II.6(2)+80.52II.6(3)+220.002II.6(4)-102.303II

.7(1)+40.28II.7(2)+116.925II.7(3)+111.

774II.7(4)-160.959II.8(1)+76.14II.8(2)-

179.279II.8(3)+3.971II.8(4)+87.97II

.9(1)+12.242II.9(2)+81.899II.9(3)-

40.22II.9(4)+283.238II.10(1)+265.694II.10(2)+191.686II.10(3)+52.056II.10(4)+61.703I

II.11(1)-276.946III.11(2)-191.997III.11(3)+2.17

III.11(4)+157.042III.12(1)+36.254III.12(2)+16

.566III.12(3)-297.41III.12(4)-392.295III.13(1)-

65.497III.13(2)+59.936III.13(3)+110.115II

I.13(4)+105.312III.14(1)+266.248III.14

(2)+225.238III.14(3)+392.212III.14(4)-

80.175III.15(1)-98.131III.15(2)+53.815II

I.15(3)+63.977III.15(4)-141.543IV.16(1)-

56.528IV.16(2)-151.192IV.16(3)-60.777IV

.16(4)+7.055IV.17(1)+18.757IV.17(2)-

236.951IV.17(3)-95.386IV.17(4)+7.485IV.19(1)-

232.123IV.19(2)-19-

.623IV.19(3)-88.407IV.19(4)-

437.56IV.20(1)+36.763IV.20(2)-

121.466IV.20(3)-219.296IV.20(4)-16.119V.2

1(1)+111.295V.21(2)+25.069V.21(3)+153.8

1V.21(4)-238.925V.22(1)-50.459V.22(2)+298.2

5V.22(3)+37.334V.22(4)

Subsequently, the variables that abandoned the equation were: 26. Do you consider that you currently have an adequate record of cash entries in the company?, 27. Do you consider that you currently have an adequate record of the company’s money outflows?, 28. Do you know the concept of financial statement?, 29. Do you currently have financial statements?, 30. Are you currently registered with the Ministry of Finance and Public Credit?, 31. Do you know the concept of Financial Administration?, 32. Do you know any method to forecast sales?, 33. Do you currently know what the profits of your company are?, 34. Have you currently hired someone to assist you in financial matters?, and, 35. Do you think you need to learn on matters related to financial administration?

So, we infer that managers have the ability to interpret and use financial information for decision making in search of better possible returns, since the above variables outside the equation belong to two dimensions whose purpose was to check for lack of financial control and whether the decision making by the entrepreneurs was under parameters of financial analysis, we found that just over half of the respondents have knowledge on issues related to financial administration (Annex 1).

7.2. Limited financial rationality

The mental construction was carried out by a mathematical calculation5 to categorize the financial rationality of the owner or administrator of companies with operating seniority less than three years. The decisions or behaviors of entrepreneurs that allow them to make a decision were exemplified, considering norms, behaviors, contexts, ideas determined by financial dimensions towards a better possible option (Table 3). The results show a commonly accepted practice that the income generated by the company be used to pay personal or family expenses of the owners, which is clearly a hindrance in the sound management of financial resources. At the same time, it is evident that those companies with over years of operation do not agree with the possibility of lacking financial resources for their operation, but this is not the case for emerging companies that strongly agree with this idea. This allows us to infer the existence of errors in the process of planning and evaluating their current and future financial needs as a young economic entity.

Table 3 Map of the financial rationality model

| Dimensions | Probability Equation | Mature Company | Transition | Newborn Company | ||||

|---|---|---|---|---|---|---|---|---|

| I Limited Resources | 1. At any point in the company’s life have resources for its operation lacked? | Little agree | Strongly agree | Little agree | Little agree | Little agree | Strongly agree | Strongly agree |

| 2. Has the company ever ceased to meet its financial commitments due to lack of resources? | Agree | Strongly agree | Strongly agree | Fully Agree | Strongly agree | Strongly agree | Strongly agree | |

| 3. Have sufficient financial resources been generated to make investments within the company so that it can grow? | Little agree | Little agree | Fully disagree | Little agree | Little agree | Agree | Strongly agree | |

| 4. Is a share of the financial resources generated within the company used to pay personal or family expenses? | Agree | Agree | Agree | Agree | Agree | Agree | Strongly agree | |

| 5. Do the company’s activities guarantee the generation of desired profits? | Agree | Agree | Agree | Agree | Agree | Strongly agree | Strongly agree | |

| II Level of indebtedness | 6. Has the company applied for any kind of Loan at any time in life? | Agree | Agree | Fully disagree | Fully disagree | Fully disagree | Agree | Strongly agree |

| 7. Do you think it is easy to obtain Loans? | Strongly agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | |

| 8. If you get a loan, would you allocate 100% of it to the company’s investment? | Little agree | Little agree | Agree | Agree | Agree | Agree | Strongly agree | |

| 9. Do you believe that the income generated by the company would make it possible to repay a loan if applied for it? | Little agree | Little agree | Agree | Agree | Agree | Agree | Strongly agree | |

| 10. Do you think that if it was easy to obtain financing to invest in the improvement of the company? | Little agree | Agree | Agree | Agree | Agree | Strongly agree | Strongly agree | |

| III Overdue Portfolio | 11. Do you consider it important to offer credit to your customers to have more sales? | Agree | Strongly agree | Fully Agree | Fully Agree | Fully Agree | Strongly agree | Strongly agree |

| 12. Do you consider it a high risk to provide credit to your customers? | Little agree | Little agree | Agree | Agree | Agree | Strongly agree | Strongly agree | |

| 13. Do you currently provide financing to your clients? | Strongly agree | Strongly agree | Fully Agree | Fully Agree | Fully Agree | Strongly agree | Strongly agree | |

| 14. Do you consider that there is an additional cost to recover payment of the credits? | Little agree | Agree | Little agree | Little agree | Little agree | Strongly agree | Strongly agree | |

| 15. Do you feel that you currently have financial problems because your customers have not paid their credits? | Agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | Strongly agree | |

| IV Increase in the costs of raw materials | 16. Do you think that the increase in raw materials creates economic problems for you? | Little agree | Little agree | Little agree | Little agree | Little agree | Agree | Strongly agree |

| 17. Do you currently get credit from your suppliers to face increases in raw materials? | Agree | Agree | Agree | Agree | Agree | Strongly agree | Strongly agree | |

| 19. Have you had to buy lower quality materials in the face of increased costs? | Agree | Agree | Agree | Agree | Agree | Strongly agree | Strongly agree | |

| 20. Do cost increases not allow you to have inventory for unconsidered orders? | Agree | Agree | Agree | Agree | Agree | Agree | Strongly agree | |

| V Low Sales Level | 21. Do you think that at some point in life the company has faced declines in sales? | Little agree | Little agree | Little agree | Little agree | Little agree | Agree | Strongly agree |

| 22. Do you believe that the economic situation facing the country influences the decline in sales? | Little agree | Little agree | Little agree | Little agree | Little agree | Agree | Strongly agree | |

| Probability of being a newborn company | 0.000% | 0.0001% | 0.1416% | 38.556% | 99.998% | 100.0% | 100.0% | |

Source: Author’s own calculations. Elaborated from the probability equation, Model (1). The colors reflect the variety of perception of each item.

A decisive element is their perception of the ease for micro-entrepreneurs to obtain loans regardless of their time in the market. However, there is an asymmetry in the use of financial resources emanating from a loan, where younger companies allocate 100% of these to the enterprise, and not in the same way for mature firms. However, companies with greater survival in the market do not consider that the income generated by the company would make it possible to repay a loan, which constitutes a clear financial limiting rationale6 towards not being indebted by those owners with greater longevity in the market. In short, decision makers in newborn companies are positively overestimating their capacity to repay a loan.

One of the dimensions that showed greater consensus was the appreciation of the idea in the increase in raw material costs and, jointly, to a lesser extent, the idea of the impact of decreased sales. The acquisition of credit from suppliers, as a response to the increases in raw materials, is a definite behavior that influences the business life of the microentrepreneur, as well as the idea of sacrificing the quality of inputs and raw materials, and of having optimal inventory levels that best respond to increases in supply costs.

Finally, the sales decreasing by a mature company does not attribute to the economic situation facing the country, as if it happens for younger companies. Thus, the survival of a company is defined by its potential to add value to its products and services it markets. This is evident when considering that the more veteran microentrepreneurs do not agree on whether at any point in their lives have they faced declines in sales. The model [1] showed decision makers who have greater factual elements and with greater human capital acquired by prevailing in the market, to make decisions within their environment and under their governance schemes that regulate rational strategic behavior, that is, they know where they are headed financially given their limited capabilities defined by their business size.

8. Conclusions

Behavior is substantively rational when it is suitable for the realization of certain purposes, subject to given conditions and restrictions (Simon, 1976). Therefore, it is concluded that the financial rationality observed by younger companies strictly obeys to only maintaining the “business financial health” (Correa, 2007), and is warned by the business objective pursued to have the liquidity levels that allow it to survive in the market. Correa (2007) also states that microenterprises are more likely to be indebted, a fact that becomes evident only by those less-than-three-year-old companies and not by those mature companies. This shows that rationality is driven by the behavior of decision-makers with talent and market knowledge, capable of using information management and processing techniques, and where business size is not a constraint to maintaining longevity.

Finally, the model did prove that limited financial rationality is positively influenced by business maturity explained by the analogy between intuition and the financial situational perception of the microentrepreneur, which is guided by learning and not just by the business scale. Clearly, the results show limited financial rationality to strongly influence the technical knowledge level that the person responsible for the choice has on the strategic path to follow.

In short, this research provides a framework to analyze limited rationality, since most of the papers address the decision (financial) problems about profit and loss, and the formulation of Bernoulli in parameters of a utility function, not useful to explain the risky options (Kahneman, 2003) faced by the analyst or decision maker. However, the proposed analytical framework, such as the one offered herein, is not a substitute for the findings and contributions on financial rationality, since limited rationality obeys in its first years of life to the tactical, that is to say, that decision-making is geared towards an opportunity (Williamson, 1979) for better contracts that are determined by their actions in the day-to-day. This is surely the emergence of new ideas and new results.