1. Introduction

International Financial Reporting Standards (IFRS) are a set of accounting standards that are being implemented around the world through adoption, convergence or imitation processes, which are due to the need of countries to be competitive internationally, to attract foreign investment from the assurance of financial information.

As stated by Quagli and Paoloni (2012), Financial Reporting Standards for Small and Medium-sized Enterprises is a relevant topic for accounting studies because there is a great debate about application in smaller contexts of the framework and standards derived from large enterprises, or the need to develop new standards specific to smaller companies.

Therefore, the application of international standards has been massified in most countries seeking international competitiveness, and simplifying them at the level of SMEs in the various sectors of the economy, services, trade and industry.

In recent years, global economies have shown patterns in which the share of the industrial sector in the Gross Domestic Product (GDP) has been declining. However, developing economies, such as the Colombian economy, have exhibited behavior contrary to that of developed countries. Starting from the fact that there has been an accelerated deindustrialization, which has led to consequences such as the revaluation of the peso against the dollar, a fact that affects industrial exports notoriously and entails competitiveness and productivity problems for the sector Buendía, Osorio, Rangel, and Mirando (2016).

The Colombian industry is performing at low production, sales and employment levels in much of its productive branches; this performance has unfortunately become the constant of the last years Ávila (2015).

In line with Avila (2015), this situation is also a result of deficiency in the control of production costs and production processes with low competitiveness compared to imported products, which are generally obtained in the market at a lower cost, thus leading to the deindutrialization of the economy.

In order to be competitive, industries must implement IFRS for SMEs comprehensively, including strategic management tools such as the Balanced Scorecard that facilitates the alignment of financial processes; in this case, the optimization of production costs with organizational purposes.

This research aims to warn industrial SMEs of the need to be competitive and contribute to increasing the country’s industrialization indicators by efficiently dealing with costs in the production process, as stated by Morales, María, and Piedra (2005). “If the economic unit does not have the necessary information on the subactivity, it may be forced to make simplistic and, in a way, arbitrary cost allocations, as it is not able to develop precise criteria for its identification and correct measurement. Appropriately identifying these costs allows managers to properly analyze the profitability of their calculation subjects, products, services, centers, activities and processes.

An adequate study and analysis of the installed capacity control issue will allow companies to carry out different measurements and evaluations to their structure of costs and expenses, thereby applying in the best way the international standard and ensuring that institutional objectives will be met.

This research was conducted in 2016 and used the case study methodology, by taking three SMEs in the industrial sector located in the city of Villavicencio as a unit of analysis. The information was collected through a structured interview, the results showed the shortcomings and benefits present in capacity control in production under IFRS for SMEs, section 13, which were contrasted with the contributions by several authors on the implementation process and the strategic management tool known as the Balanced Scorecard Kaplan and Norton (2002).

The literature review for this research provides guidelines for managers and preparers of financial information in the implementation of IFRS for SMEs, Section 13, to include the control of idle capacity in the production process through the Balanced Scorecard, in order to aid the alignment of indicators with the strategies established by management, promoting the competitiveness of the Colombian industry.

2. Literature review

Before addressing the issue of IFRS implementation in SMEs, it is necessary to start with the classification of companies in Colombia (Table 1)

Table 1 Classification of companies in Colombia

| Jobs | Total assets from$ | Total assets up to $ | |

|---|---|---|---|

| Microenterprise | Less than 10 | 344.727.000 | |

| Small | From 11 to 50 | 345.416.454 | 3.447.270.000 |

| Mid-sized | From 51 to 200 | 3.447.959.454 | 20.683.620.000 |

| Large | More than 200 | 20.684.309.454 |

Source: Act 905 of 2004. Congress of the Republic of Colombia.

SMEs in Colombia play an important role in the development of our economy, in different areas such as GDP, exports and employment generation among others (Table 2).

Table 2 Contributions of SMEs to Colombian Development

| Aspect | Contribution |

|---|---|

| Employment generation | 80.8% of employment is generated by micro, small and medium-sized enterprises, whereof 50.3 are generated by micro enterprises and 30.5 are generated by jobs. |

| Exports | Non-mining exports by SMEs reached US$1,437 between January and July 2016. Exports of primary goods are the main export products by MSMEs with US$671.5 sold between January and July 2016. The United States is the country where the largest exports by SMEsare made, with US$434.8 between January and July 2016 |

| GDP | 45% is the contribution of SMEs to the GDP, 38.7 of this figure is generated by small and medium-sized enterprises and 6.3 per cent by micro enterprises. |

| Business Formation | 39.9% of SMEs are companies, the remaining 60.1% are natural persons |

| Manufacturing Sector | In the manufacturing sector, MSMEs account for 90.6% of industrial establishments and generate 43.5% of jobs, contribute 32.6% to gross production and 27% to value added. |

Source: Author’s own elaboration based on the contribution by the Ministry of Commerce, Industry and Tourism (2016).

SMEs, as they make up the largest business fabric and make an important contribution to Colombian development, must be constantly monitored in their evolution and performance against the different trends of the national and international order in administrative, accounting and financial areas, many of them required within the norm, as is the case International Financial Reporting Standards (IFRS).

As stated by Quagli and Paoloni (2012), Financial Reporting Standards for Small and Medium-sized Enterprises is a relevant topic for accounting studies because there is a great debate about their application in smaller contexts of the framework and standards derived from large companies, or the need to develop new standards specific to smaller companies (the so-called “differential report”).

Bozkurt, Islamoglu, and Oz (2013), in the analysis of surveys aimed at professionals interested in accounting and auditing, establish that accounting and finance managers perceive IFRS as a highly qualified regulation that is in accordance with decision-making processes. At the same time, they believe that there are considerable differences between IFRS and the Spanish Accounting Standards, and that IFRS are a very comprehensive and challenging regulation.

Like the previous study, Quagli and Paoloni (2012) conducted an analysis of responses to the “IFRS Public Consultation Questionnaire for SMEs”, promoted by the European Commission, highlighting the assessment of homogeneity among respondents, according to different analysis perspectives between the two users, preparers and also in European countries.

This study highlights the difficulties of adapting IFRS to IFRS for SMEs in the context of the European Union. The premise for this problem is that IFRS are primarily aimed at meeting the information needs of sophisticated external users operating in financial markets, such as investors in equity and financial analysts. The full IFRS rules may be too complex for private companies characterized by financial weakness in the face of increasing demand for information from external parties (Quagli and Paoloni, 2012, p. 7).

From the study carried out by Quagli and Paoloni (2012), the following criticisms to the IASB project (then) are highlighted: The needs of users are very different from that of investors in listed companies, the main objective and need of this standard has not been to develop a standard for SMEs but to offer a simplification for smaller businesses, lack of a deeper study of user needs, among others.

The aspects criticized in international standards still persist, as is the case of Colombian SMEs, in which there are shortcomings inherent in the IFRS simplification process for IFRS for SMEs, which is evidenced in the study by Salazar (2013), (Table 3).

Table 3 Advantages and disadvantages of implementing International financial reporting standards for small and medium enterprises - IFRS for SMEs

| Advantages | It is perceived as an improvement in the quality of financial information. |

| Separate financial information from tax information. | |

| It can help for internal information purposes. | |

| Disadvantages | Increased administrative costs due to the need for training and investment in the process. Increased operational burden due to greater number of procedures. |

| Risks of poor implementation, due to misinterpretation or gaps in the standard. |

Source. Author’s own elaboration based on the contribution by Salazar (2013).

With regard to the implementation of IFRS for SMEs, Section 13, in the industry, in the processing of production costs and the impact of idle capacity thereon, it is relevant to establish that this represents “that part of the structural or operational fixed factors not used in production and can be expressed as the difference between installed capacity and actual production” Osorio, Duque, and Gómez (2009).

(Osorio et al., 2009, p. 8) The term installed capacity evokes a limit in production, a sustainable maximum in the level of the product according to a definition associated with engineering. In a practical sense, sustainability is understood as the highest level of product that each plant, in a given industrial sector, can maintain within the framework of a reasonable work plan. This taking into account the normal production pauses and assuming sufficient inputs to operate the installed machines and equipment.”

Therefore, idle capacity arises from the underutilization of the four installed capacity criteria used in determining production costs. (Table 4)

Table 4 Criteria for determining installed capacity

| Actual Expected Capacity Criterion | It is the amount that is needed to meet the demand of activities, products, services to the next period. It should be borne in mind that under this criterion, unit fixed costs will decrease in cyclical periods. |

| Standard capacity criterion | It is the one that allows companies and areas of responsibility to meet their demand, taking into account seasonal variations and cyclical problems that occur, including idle time of staff and equipment; some estimate that the normal capacity is between 75 and 80% of the maximum or theoretical capacity. |

| Maximum or theoretical capacity criterion | It is an idealistic capacity criterion since it assumes that the personnel plant and the equipment operate at maximum efficiency using 100% of their capacity, and under conditions of maximum and absolute efficiency in the use of resources. It does not include any restrictions for delays or waiting, or discompostures or maintenance of the machines, or inefficiencies. |

| Practical capacity criterion | It represents the possible use of the available physical means considering the normal interruptions to the operation, such as time lost in repairs, preventive maintenance, absence of operators, among others. It is expected |

Source: Author’s own elaboration based on the contribution of Osorio et al., 2009.

2.1. Idle capacity and its effect on IFRS

(Osorio et al., 2009) With regard to idle capacity, there is a substantial change when comparing the international standard with the handling given to this concept, since idle capacity is traditionally not recorded as expenditure in the period in which it originated, as the international standard does; on the contrary, it is allocated as a higher value of product costs. This becomes relevant in environments where idle capacity is high.

The international standard is clear in establishing that idle capacity will be processed as an expense for the period, while the full capacity used will become part of the inventory cost.

IFRS section 13.5 (Fundación IASC, 2009), conceptual as inventory, the sum of acquisition costs, plus transformation costs, the latter comprising the Indirect Manufacturing Costs (CIF) both fixed and variable

IFRS Section 13.8 (Fundación IASC, 2009), denotes “inventory transformation costs... shall also include a systematic distribution of variable or fixed IMCs incurred in processing raw materials into finished products”.

Indirect manufacturing costs (IMC) are an important line in the cost of a product, so it is necessary that the preparers of the financial information identify in a timely manner the idle capacity that may exist and eliminate or reduce it in order to obtain an efficient production process that contributes to the fair allocation of the IMC to the cost of production and generate competitiveness through the costs and expenses structure.

2.2. Allocation of Indirect Manufacturing Costs (IMC)

Rincón and Villamizar (2014) state that in the implementation of IAS/IFRS, IMC gain greater importance in accounting reporting processes, since costs are an impo rtant part of financial information, financial indicators, management analysis and decision-making.

IFRS for SMEs Section 13 (Fundación IASC, 2009), provides that IMC shall be charged to the production process according to the scope of the normal production level, for this purpose the behavior of fixed or variable IMC must be taken into account (Tables 5,6,7).

Table 5 Indirect fixed manufacturing costs

| Fixed IMC (13.9) They remain relatively constant, regardless of the volume of production, such as depreciation and factory buildings and equipment maintenance, as well as costs of plant management and administration. | IMC types - fixed: Maintenance, depreciation, insurance, utilities, repair, indirect labor (according to the type of remuneration) |

Source: Author’s own elaboration, based on the provision of IFRS Section 13. (13.9), Fundación IASC (2009).

Table 6 Indirect variables manufacturing costs

| Variable IMC These are the indirect costs associated with the level of production with a proportional ratio, for instance thereto, we find indirect material, consumption of utilities | IMC types - variable: Indirect material, indirect labor (according to the type of remuneration), maintenance, repair, consumption of utilities. |

Source: Author’s own elaboration, based on the provision of IFRS Section 13, Fundación IASC (2009).

Table 7 Distribution of fixed and variable Indirect manufacturing costs

| Distribution of Fixed IMC (13.9) |

|---|

| They shall be distributed on the basis of the normal capacity of the means of production. Normal capacity means production expected to be achieved on average over a number of periods or seasons under normal circumstances, taking into account the loss from planned maintenance operations. |

| Distribution of variable IMC (13.9) |

| They shall be distributed onto each production unit on the basis of the actual level of use of the means of production. |

Source: Author’s own elaboration, based on the contribution by IFRS Section 13, Fundación IASC (2009).

Once identified, the IMC should be distributed according to the performance of the production between the budgeted and executed volume, i.e. the comparison between the actual and normal capacity.

2.3. Processing of increases or decreases in unit cost resulting from differences between actual and normal capacity

IFRS for SMEs, Section 13, provides that the correct distribution of IMC should take into account the utilization of installed capacity and existing idle capacity, in order to fairly allocate the IMC to the cost of production (Table 8).

Table 8 Processing of increases or decreases in unit cost resulting from differences between actual and normal capacity

| In abnormally high production periods, the fixed IMC value distributed to each production unit will decrease so that inventories are not measured above cost. | In periods of low production, the fixed IMC distributed to each production unit will not increase. Undistributed IMCs shall be recognized as expenses in the period in which they were incurred. |

Source: Author’s own elaboration, based on the provision of IFRS Section 13, Fundación IASC (2009).

2.4. Guidelines for measuring idle capacity in production

Controlling idle capacity allows financial policies to analyze its causes and implement timely solutions to reduce or eliminate idle capacity. The omission of these shortcomings will increase inefficiency, affecting the cost and expenditure structure and thus the competitiveness and productivity of the industry.

To achieve the full utilization of practical capacity according to marketing and production seasonalities, it is imperative to include them in the decisions by the strategic management of the entity, since the articulated work of the administrative, accounting and financial area cannot be ignored.

En los ultimos años ha tomado fuerza el Cuadro de Mando Integral (Balance Scorecard), el cual ha sido aplicado en diversas investigaciones del área organizacional y financiera, entre los cuales se encuentran:

Costa, Jorquera, and Méndez (2005). El Cuadro de Mando Integral - CMI Es un Sistema de Medición del Desempeño que utiliza cuatro perspectivas para controlar la implementación de la estrategia en sus factores críticos de éxito y su adecuación al entorno.

These perspectives are: Growth and learning, financial, client, and internal processes, which contribute to controlling the fulfillment of strategic objectives by measuring key factors and their drivers.

(Costa, et al., 2005, p. 40) highlights as the Benefits of the Balanced Scorecard:

One of the main benefits of the Balanced Scorecard is that it forces management to determine the relevant dimensions of performance to gain a clearer view of the critical aspects to long-term benefits.

It allows managers to know if the improvement in one management area has been achieved at the expense of deterioration in the management of another area.

The Balanced Scorecard helps align strategic indicators at all levels of the organization. That is, making the strategy explicit and translating it into indicators facilitates an organization-wide consensus on what is important.

Carvajal, Dueñas, and Acuña (2017) It is of utmost importance to highlight that the Balanced Scorecard is that business management tool that is useful to measure the evolution of a company’s activity and its results from a strategic point of view and from a general perspective. Managers and senior officials use it for its value as it contributes effectively to the view business in the medium and long term.

Knowing how to establish and communicate the corporate strategy to align resources and people in a given direction is not an easy task, and the Balanced Scorecard helps to achieve this. Through its control indicators, financial and non-financial, periodic information is obtained for better monitoring the achievement of previously established objectives, and a clear vision of the development of the strategy. This makes decision-making easier and more accurate, and deviations can be corrected in time (Carvajal et al., 2017, p. 22).

As stated (Carvajal et al., 2017, p. 22). The use and application of a Balanced Scorecard is not only possible, but also advisable for medium and small-sized enterprises. Its effectiveness does not depend on the size of the company, so both large organizations and SMEs can take advantage of its enormous benefits.

The implementation of IFRS requires the interaction of all areas of the organization, as it requires modifications in its financial processes that permeate the organizational part, which requires investment in training, acquisition of new software, as well as reengineering administrative and accounting-financial processes.

The above is consistent with (Carvajal et al., 2017, p. 6). SMEs generally handle documentation and technology that is less complex than that used in large companies. That is why the changes generated by implementing IFRS within an organization affect not only the accounting-financial area, but all areas, processes and systems of the company, in other words, learning must integrate all personnel involved with the operations and financing of the organization.

Therefore, the perspectives that make up the Balanced Scorecard should include the implementation of IFRS for it to be a comprehensive process aligned with the company’s organizational strategies. (Table 9).

Table 9 Balanced Scorecard perspectives on the implementation of IFRS

| Financial Perspective | The Balanced Scorecard financial perspective maintains financial indicators that are able to summarize the economic consequences and state of an organization. For this reason, the financial perspective is practically the culmination of the strategic maps creating stage, since under its indicators the impact of the strategies developed from the learning perspective will be measured. The factors evaluated by the financial perspective are: Profitability, Growth and Development Sustainability. |

| Internal perspective | These processes are those where a company must be excellent to meet the needs of customers. This perspective includes the activities of an organization that are embedded in the internal processes that make up the value chain of the organization. Such as: Improvements in efficiency, reduction of unit costs, reduction of waste, improvement of morale, increased utilization of employee capacity, increased productivity. |

| Learning and Growth Perspective | This perspective is based on needs in relation to people, technology, assets, partnerships. With which the excellence of the organization is sustained. In addition, questions are asked such as what activities or attitudes human capital must have in order to realize organizational objectives. |

| The Customer’s Perspective | The customer’s perspective indicates the segment of the market that the business is willing to attack and that is likely to represent its income in the short term, this perspective allows to identify the key indicators corresponding to customer satisfaction, loyalty and profitability. |

Source: Author’s own elaboration based on the contribution by Carvajal, Dueñas, & Acuña (2017).

It is imperative to conclude that the incorporation of the Balanced Scorecard into the process of implementing IFRS in SMEs is necessary and useful since it facilitates the achievement of business objectives, the important thing is that the indicators to be established are relevant to each strategy, which will be different for each entity and in accordance with each one’s context.

3. Methodology

3.1. Design

The research used the case study as its methodology, proposed by (Shaw, 1999, p. 65) from the descriptive-inductive method, since from accounting regulations and strategic management tools its applicability is verified in the real context of the industries located in Villavicencio, Colombia.

The question raised in the research was what are the shortcomings and benefits in the control of idle capacity under IFRS, Section 13, in the industrial SMEs of Villavicencio?

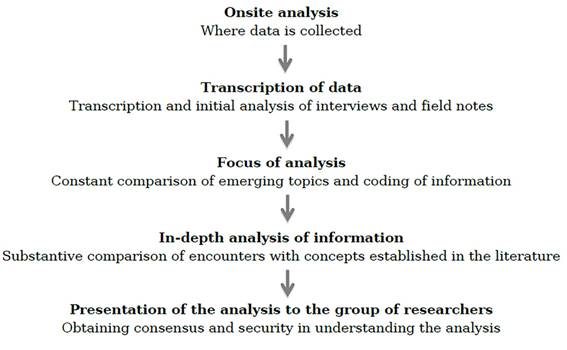

Figure 1 shows the inductive analysis process performed through the following steps.

Onsite analysis

The interview with the owners of the three industrial SMEs subject of analysis was applied in the facilities of each industry studied, belonging to the activity of processing dairy products; wood industry and the production of medicinal gases. where the production process was observed and then the instrument was applied.

The research was carried out in 2016, and the information gathering was supported by undergraduate Public Accounting students, from the last semesters.

Transcription of data

The data were transcribed and consolidated according to what was provided in the interview by each unit under study. The analysis was conducted individually and consolidated thereafter, documenting the similarities and differences in the implementation process of IFRS for SMEs, Section 13.

Focus of analysis

The results obtained on the control of idle capacity were contrasted with what was established in the current regulations and with the contribution of various authors and researchers on the implementation of IFRS, the control of idle capacity, as well as the theoretical contribution of strategic management tools such as the Banalnced scorecard regarding financial, internal, customer and continuous learning perspectives.

In-depth analysis of information

The Inductive analysis was based on what was required in the standard and its applicability in the context of industrial SMEs in Villavicencio. As information was consolidated, it was established whether the SMEs surveyed invested resources and were committed to fully implementing IFRS for SMEs section 13, focusing on establishing accounting procedures aligned with strategic management tools to enable them to control idle capacity in production.

Likewise, it was determined whether the SMEs under study invested resources in training their human talent, adaptating the production process and acquisition of software for the collection of the information required in this process.

4. Results and discussion

Below is the consolidation of the information provided by SMEs subject to analysis (Table 10).

Table 10 Interviews Consolidation

| Aspect | Medical gas industry | Timber industry | Dairy Industry |

|---|---|---|---|

| IFRS Implementation Process | They are in the process of implementing IFRS. | The International Standard was implemented since January 2016. | They are in the process of implementing IFRS. |

| Benefits in the implementation of IFRS | They have shown advantages in the accounting and financial management of assets, but in terms of inventories they have not yet advanced in the implementation process. | They consider that the implementation of IFRS vis-à-vis the local standard is more relevant and reasonable in presenting the economic reality of the company. | They consider the implementation of the standard an extenuating and costly process. |

| They consider the implementation of the standard an extenuating and costly process. | As far as inventories are concerned, they consider that there is no significant difference with the local standard. | As far as inventories are concerned, they consider that there is no significant difference with the local standard. | |

| Production lines | Manufacture of oxygen-generating plants. (They are handled by the production order system). | Unwrought lumber. | Cheeses. |

| Production of industrial and medicinal gases: (They are handled by the system of cost per process). | Immunized rounded logs. | Fermented drinks. | |

| Raw sawn wood . | Bakery. | ||

| Immunized sawn timber. | They use the Cost System by order of production. | ||

| Manufacture of furniture. | |||

| They handle the cost system by order of production. | |||

| IMC Planning | An estimate of the IMC is made without applying a specific methodology. | They carry out IMC planning. | An estimate of the IMC is made without applying a specific methodology. |

| Identification of fixed IMC and variable IMC | Do not identify fixed IMCs and variable IMCs | Identify and classify IMC according to their behavior, fixed, variable and mixed. | Do not identify fixed and variable IMC. |

| Allocation of IMC to the production process | At the end of the period, IMCs are added and allocated through the per-unit-produced prorrating. | The apportionment and allocation of IMC is carried out through the ABC Costing system. | The prorating and allocation of IMC is based on the number of litres of milk processed, according to each production line. |

| IMC allocation based on used capacity and normal capacity | IMC allocated based on capacity used. | IMCs are allocated based on activities consumed by production lines. | IMC allocated based on capacity used. |

| Idle Capacity Control | They do not make an idle capacity periodic measuring study, as they consider that the plant is always at maximum production. | They consider that there is minimal idle capacity. | They do not measure idle capacity, but they are aware that they are producing under 33% of their installed capacity, so their idle capacity is 67%. |

| The changes that are being introduced lead to greater efficiency in the production process and to the elimination of idle capacity. | |||

| Causes of idle capacity | They believe they are using 100% installed capacity. | There is idleness in the activities that are in the process of adjustment in order to achieve greater efficiency, such as the change of machinery, taking into account the production line and classifying the raw material prior to the start of the production process. | Volume is below sales level. |

| Installed capacity compared to sales | They assume sales are consistent with installed capacity in production. | When it comes to production in relation to sales, they consider that this completes their installed capacity, everything that is produced is sold, is in great demand. | Installed capacity in machinery and equipment is higher than the level of sales they currently have. |

| Alternatives to reduce idle capacity | They don’t consider alternatives. | They adjust the logistics and infrastructure of the production plant. | An aggressive marketing policy is required to achieve more sales that match the installed capacity. |

| Benefits in idle capacity control | The benefit is that all costs are allocated to the product fairly. | Contributes to controlling production costs and establishes a sales price with the returns required by partners. | It contributes to controlling production costs and establishing a sales price according to the returns required by the partners. |

| Difficulties in implementing idle capacity control | They believe that any control and adjustment requires investment and financing costs in Colombia are high. | Financial resources are required, which have a high cost of financing. | They claim that using 100% installed capacity is difficult, delayed and costly, so it is now considered normal to have underutilized capacity. |

Source: Author’s own elaboration.

4.1. Shortcomings in the absence of idle capacity control

The results show that two of the SMEs analyzeddo not fully apply IFRS Section 13, since they apply averages or pro-rata to the techniques and tools established by the standard and do not follow up on the idle capacity they present. Therefore, it can be inferred that they do not apply managerial tools such as the Balanced Scorecard, which is evidenced by the following shortcomings:

They do not make IMC budgets for production.

They do not identify fixed IMCs or variable IMCs

In the accounting period they do not follow up on IMC executed

They do not allocate IMCs to expense or cost according to the actual level of production reached in the period.

Do not compare the budgeted IMCs against the actual ones, therefore they do not apply a method to analyze the variation that occurs in order to provide timely feedback on the production process.

They do not perform a study on the idle capacity in production, do not know their installed capacity or used capacity; therefore they do not identify opportunities for cost optimization.

The failures present in these SMEs show weaknesses in their business culture, since they do not apply managerial tools and do not have a policy to invest resources in the implementation of IFRS for SMEs, which they support by stating how costly and wasteful this process is, which is consistent with some of the conclusions by Quagli and Paoloni (2012).

The shortcomings in the control of idle capacity in the industry affect the structure of costs and expenses, failing to meet the expectations of profitability expected by the partners, reducing business competitiveness and possibly accelerating their exit from the market and increasing the rates of deindustrialization of the region and the economy Colombian.

4.2. Benefits in controlling idle capacity in production

The SME in the timber industry has started the process of implementing IFRS SMEs, fully complying with the standard, is a company with business culture, since it cares to strengthen itself organizationally and financially, which is based on:

Correct planning, prorating and distribution of IMC to the cost and expense structure.

Timely identification and correction of failures present in production that lead to generating idle capacity.

Correct determination of production costs.

Provision of resources for training IFRS preparers.

Making permanent investment in the continuous improvement of their production process.

Based on the information collected and analyzed from this SME and contrasted with what was provided in the literature review, the following benefits are highlighted in the implementation of idle capacity control under IFRS for SMEs section 13:

Optimization of production costs.

Adaptation of the installed production capacity according to the company’s sales seasonalities.

Optimization of production costs with high quality standards

Scope of profitability expected by partners.

Growth and permanence in the market.

Strengthening competitiveness and productivity.

The control of idle capacity in industrial SMEs contributes to the optimization of production costs, generation of competitiveness and productivity, contributing to the industrialization of the country’s economy.

5. Conclusions

The implementation of IFRS for SMEs should be carried out pursuant to strategic management tools such as the Balanced Scorecard, as it will ensure the achievement of institutional objectives by aligning financial needs with organizational strategies.

Optimization of production costs framed in strategic management contributes to generating competitiveness and productivity to meet different challenges, which will result in the strengthening of the industrial sector in Colombia and its contribution to the economy.

The results of this research can be used as a basis for future research with a greater scope, which corroborate the findings hereof and that can be contrasted with the post-implementation and inherent effects of IFRS for SMEs in the industry.