1. Introduction

In order for organizations to satisfy markets and products with the quality desired by consumers, they need to innovate in their products and processes, which leads to the need for a comprehensive approach that includes the improvement of their processes and the investments it requires.

The development of investment projects in the pre-investment stage has generally been carried out from a perspective of generating new businesses, with modernizations, expansions and improvements also being topics of study; both require an adequate and flexible conceptual base that is integrated into organizations management.

Another aspect that has characterized investment projects is their definition perspective, generally biased towards the intervention form and not the object to intervene-that is, processes-which limits the comprehensive analysis in organizational systems from an optimization and improvement vision.

In this situation, it is necessary to incorporate the process approach in the definition of investment projects, much needed in an industrial dynamism scenario.

The research has a theoretical justification due to the conceptual contribution in the field of investment projects; its practical justification is based on providing a conceptual framework that allows addressing the investments of operating organizations more adequately.

This research aims to create a new definition of investment projects incorporating the process approach.

2. Theoretical framework

The investment project is a planning tool that allows making decisions about the execution of capital resources, its use has commonly been developed for to generate new businesses, but it is also applied in the improvement of different areas (logistics, occupational security and health, production, among others) of businesses in operation in order to satisfy both internal and external customers.

Currently, due to the markets globalization level, flexible organizations-that can satisfy more select markets with products and services with the quality desired by consumers-are required. This implies that organizations must constantly innovate in their products and in their processes; therefore, investments become the fundamental means to achieve such improvements. It should be borne in mind that “market orientation and great flexibility in the process improves the innovation quality and contributes to accelerate the project’s execution” (Álvarez, 1999, p. 458).

2.1. Object of intervention in the projects

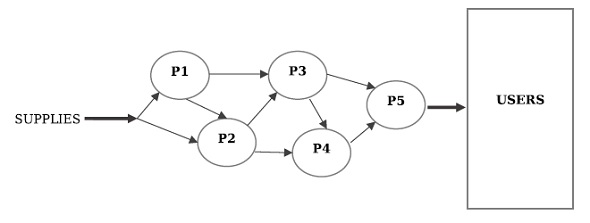

Industrial organizations can be represented as a set of processes that interact with each other to provide a series of products and/or services to certain users drawing from a set of inputs and resource utilization, as shown in Figure 1. Therefore, “the processes allow achieving the organization objectives and providing the services that users require” (Pérez, 2015, p. 45).

The process approach allows organi-zations to identify, organize and manage the activities they carry out in order to create value for the client , for this purpose, it integrates the processes into a system. Likewise, process-based management conceives the organization as a system that interrelates several subsystems that are the processes that comprise it, this allows identifying the processes and analyzing them in order to assess which ones must be perfected, guaranteeing a more effective and more efficient projection and performance (Valdés, 2010).

The projects intervene in the organizational systems, which are generally consisted of processes, which allows “a comprehensive vision of the changes that can be generated with the investments” (Bravo, 2013, p. 22).

Frequently, the processes definitions are framed in the way an organization perform its functions. That is, it refers to “a logical concatenation of activities that fulfill a certain purpose, through time and place, driven by events” (Bernhard, 2012, p. 9); also understood as “an organized series of related activities, which together create a result of value for customers” (Hammer and Champy, 1994, p. 68). Both processes definitions focus on procedures, which has a partial perspective because other factors intervene in the processes.

For Pérez (2015, p. 55) the factors involved in a process are the following:

People.

Materials (supplies).

Physical resources (machinery, equipment, facilities, hardware, software).

Process methods (description of how to use resources, who does it, when and how).

Environment (scope of activities).

Process improvement involves changes in each of the factors, independently or in combination, to meet the requirements of internal and external customers. Some changes in factors such as infrastructure and equipment require investment.

Both the investment projects and the process approach have elements in common, they intervene in the production or service systems made up of processes in order to improve the results for the client, for which a comprehensive definition is required.

In the case of cooperation projects in the identification, formulation and evaluation phases of the study, they are structured based on processes, some of the cross-cutting processes being: the participation of the actors, environmental analysis, and gender analysis. Likewise, “each process can be applied through a set of tools that vary according to the particularities of the project context” (Londoño, 2009, p. 37).

Process management has also been used in the project execution stage as an administrative framework, as described below:

Repetitive processes that involve functional areas and respond to routine and systematized work, only one sector in particular, that of construction or engineering is organized by projects, organize most of the companies.

However, projects that go beyond the departmental scope and influence daily work are repeatedly presented; for this reason, companies should choose the alternative of managing their projects from the process management approach.

According to ISO 9000, the project is defined as a “unique process consisting of a set of coordinated and controlled activities with start and end dates, carried out to achieve an objective in accordance with specific requirements, including time, cost and resource limitations” (Pérez, 2015, p. 257).

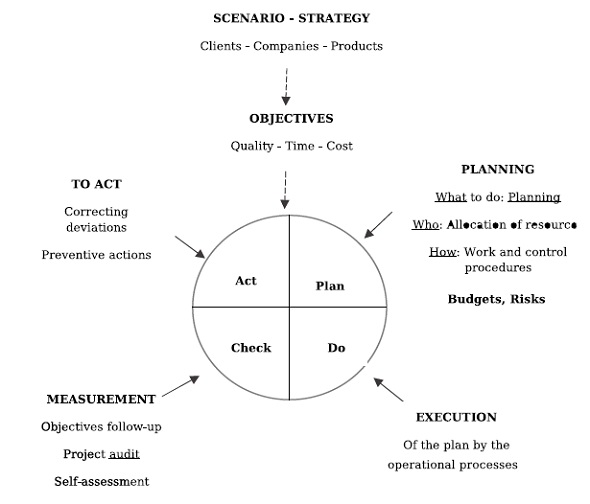

Thus, the way an organization manages its projects must be seen as a process whose management cycle, according to Pérez (2015, p. 258), has the following components:

Scenario-Strategy: every project is executed in an environment and under a strategy.

QSP Objectives for Quality - Service - Costs.

Planning: action plan that is executable and achieves the objectives.

Execution: act of carrying out the action plan in operational terms.

Measurement: refers to the monitoring of project objectives.

To act: phase that is related to the correction of deviations or the taking of preventive actions that ensure objectives.

Figure 2 shows the scheme that summarizes the described components.

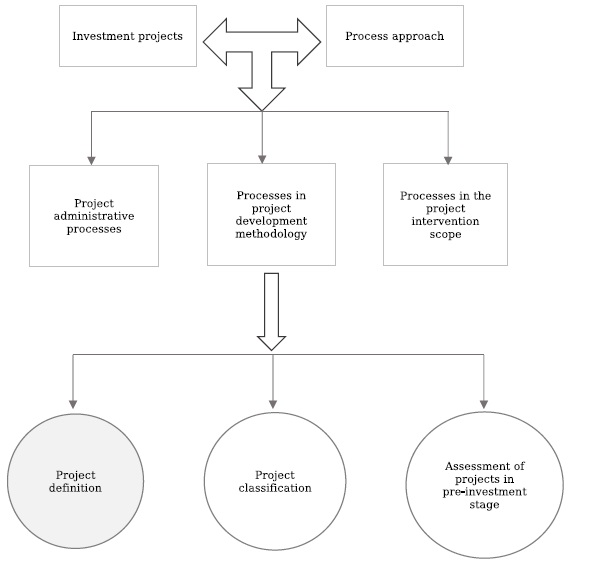

Due to the aforementioned background, as the production or service systems are common intervention elements of the process approach and investment projects, it is important to broaden their conceptual relationship, specifically in the pre-investment stage. For this purpose, the relationship between both disciplines is presented in three dimensions:

1. The administrative processes of the project

It refers to the set of activities grouped into processes that allow obtaining the pre-investment study, for example:

Planning: This is the first stage of the process in which the objectives of the project are designed and the plans to follow are drawn up to fulfill it.

Organization: This is the second stage of the process in which the work of the activities defined in the planning stage is divided and assigned.

Direction: Third stage of the process. It consists in executing the plans through the people who are in charge of the project.

Control: Fourth and last stage of the process, consists in verifying that the plans became facts, that is, that the objective of our project has been met (Hernández, 2016).

One of the aspects that is little taken into account in the study of a project is the one that refers to the specific factors of its administration executive activity: organization, administrative procedures, legal aspects and environmental regulations. Therefore, the administrative study consists in determining the organizational aspects that a new company should consider for its establishment such as its strategic planning, its organizational structure, its legal, fiscal, and labor aspects, the sources establishment and recruitment methods, the selection process and induction that will be given to the new employees necessary for their qualification. (López, Aceves, Pellat, and Puerta, 2008).

2. Processes in project development methodology

It refers to the incorporation of the process approach to the conceptualization and methodologies for the preparation of the pre-investment study, such as:

In the definition of projects: in order to describe new situations that arise in organizations and incorporate them into the conceptual framework.

In the project classification: there are typologies of interventions related to the processes unforeseen in the project classifications.

In projects formulation and assessment: the integration of process improvement and its economic impact is required in the pre-investment stage.

3. Processes in the project intervention scope

These are the processes of the organizational scope that are involved in the project, for example, in the case of hazardous waste management, there are the processes of receiving waste, primary storage, pre-treatment, waste shredding, incineration and final disposal.

Therefore, “these processes must be planned, monitored and verified in such a way that the result can be evaluated in order to adjust it to the organization new and changing demands” (Moreira, 2007, p.18).

In order to define the research, the definition of investment projects will only be treated within the framework of the process approach. Figure 3 displays the latter, showing the relationship between investment projects and the process approach, as well as the three dimensions generated in this interaction.

2.2. Investment projects

In order to know the scope of the definitions of investment projects found in specialized bibliographies, we will describe a set of terms most frequently used:

Unique process consisting of a set of coordinated and controlled activities with start and end dates, carried out to achieve an objective in accordance with specific requirements, including time, cost and resources limitations (ISO 9000, 2015).

“It is a methodically designed set of planned and related activities that uses resources to generate concrete results, aimed at achieving defined objectives” (Córdoba, 2006, p. 3).

Project is the compilation of information, its processing and analysis, in order to have sufficient background that allows estimating the advantages and disadvantages of investing certain resources in a certain activity that configure sufficient judgment elements to decide to what extent to advance this investment alternative (Bazanni and Cruz, 2008, p. 309).

A project is a complex, non-routine effort, limited by time, budget, resources and performance specifications and designed to meet the needs of the client (Gray and Larson, 2009, p. 5).

“Investment projects include calculations and plans, as well as the projection of allocation of financial, human and material resources in order to produce a satisfactor of human needs” (Morales and Morales, 2009, p. 9).

“Set of activities that are developed in a coherent way with the purpose of obtaining a final result in response to a business need or opportunity in a given time and through the use of resources” (Murcia, 2009, p. 5).

“It is a plan that, if a certain amount of capital is assigned to and is provided with supplies of various kinds, will produce a good or service, useful to the human being or to society” (Baca, 2010, p. 2).

“It is a temporary effort that gradually allows achieving a single or unique deliverable result” (Arboleda, 2013, p. 3).

“The set of studies, background analyses, surveys, assumptions and conclusions, which formulated and presented in an orderly manner, allow evaluating the convenience or not of allocating factors and resources to the establishment of a given production unit” (Guerrero, 2013, p. 3).

“It is a planning that consists in integrating a set of interrelated and coordinated activities” (Hernández Hernández, Hernández Villalobos, and Hernández Suárez, 2005, p. 20).

“The project is the combination of human and non-human resources, brought together in a temporary organization to achieve a specific purpose, creating a unique service or product” (Gonzales, 2014, p. 9).

“It is the search for an intelligent solution to the approach of a problem that tends to address, among many others, a human need” (Sapag Chain, Sapag Chain, and Sapag Puelma, 2014, p. 1).

Gitman and Zutter (2012) mention that a project is: a set of detailed plans that aims to increase the productivity of the company to increase profits or provision of services, through the optimal use of funds in a reasonable period of time (Cited in Angulo, 2016, p.19).

According to Ribera (2011) Projects are the unique sequence of complex and interconnected activities that have an objective or purpose that must be achieved within an established period, within a budget and according to specifications (Cited in Echevarría, 2017, p. 176)

“An investment project constitutes a set of actions, which once implemented, increase the efficiency and distribution of a good or service” (Meza, 2017, p. 11).

Zarbo (2016), mentions that “Projects change a current situation into a desired one; therefore, the projects turn a strategy into reality, and vision into value” (Cited in Aponte, Muñoz, and Álzate, 2017, p. 146).

“It is a proposal of intervention on a business environment, in a certain time, based on a set of information and background, with which the benefits and costs resulting from allocating resources are estimated, to achieve business objectives” (Andía, 2018, p. 55).

A project is a temporary effort carried out to create a unique product, service or result (Project Management Institute, 2017).

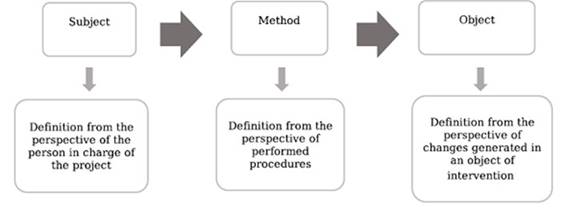

In order to analyze and classify the different definitions made for investment projects, they will be integrated into three perspectives: subject, method and object. This will determine the predominant approach in this discipline; Figure 4 summarizes each one of the perspectives.

Each perspective is detailed as follows:

Subject perspective

It refers to the approach of the definition of investment projects from the perspective of the person or people who carry out the study. Here is situation (h) and (l). A basic definition from this perspective would be related to the intellectual effort that combines a set of disciplines to achieve a study.

Method perspective

It refers to the approach of defining investment projects from the point of view of the activities to be carried out as part of the intervention procedures. Definitions (a), (b), (c), (d), (e), (f), (g), (i), (j), (k), (m), (n), (o) and (r) have this characteristic.

Object perspective

It refers to the approach of the definition of investment projects from the change generated in the object of intervention, usually a business or public organization. The (p), (q) definitions have this characteristic partially.

Table 1 summarizes the results of the classification of the investment projects definitions.

Table 1 Number of definitions according to the Perspective type

| Subject perspective | Method perspective | Object perspective | |

|---|---|---|---|

| Number of Definitions | 2 | 14 | 2 |

Source: Author own elaboration.

According to the above, most of the definitions of investment projects fit into the perspective of the intervention method (78%) of the total analyzed. This is correct but limited when you want to understand the characteristics from the point of view of whoever elaborates the study (11%) or, from the point of view of the changes that are going to be generated in the organization, specifically in the processes (11%).

In this investigation, the latter has been taken as the object of investigation: the definition of investment projects from the change that is going to be generated in the object of intervention, due to the importance in conceptual development and the need for its application in organizations, those that manage their systems through processes.

3. Methodology

The type of research according to its fundamental purpose (Caballero, 2014) is basic or pure. According to Hernández, Fernández, and Baptista (2014) , the scope of the research study can be exploratory, descriptive, correlational, and explanatory. The one that best fits this study is the descriptive one, since the definition of investment projects will be presented under a new approach.

4. Discussion

As result of the investigation, the following can be deduced:

On many occasions, investment projects are only associated with physical resources (infrastructure, equipment, furniture), so when executing them they allowed the operational capacity expansion but did not necessarily manage to improve the quality of service. This mistaken perception of intervention is not characteristic of the private sector but also of the public sector. Modifying the analysis approach of the projects implies a greater attention to the way of interrelation of the activities that are carried out in organizational systems, for this reason, the processes become the fundamental base of the new perspective of investment projects. This result is partially similar to that obtained in another temporal and spatial dimension presented by Baca (2006, p. 2) “It is the search for an intelligent solution to the approach of a problem aimed at solving, among many, a human need” which implicitly denotes that other aspects are required in addition to physical resources.

Given the businesses dynamism, it is required that the investment projects currently include a comprehensive, flexible but also detailed approach in their internal aspects that allow generating value to their internal and external clients. This result is similar in form to that described in another temporal and spatial dimension presented by Pérez (2015) as an advantage of the process approach “It provides a broader and more global vision of the organization (value chain) and its internal relationships. It allows understanding the company as a process that generates satisfied customers”.

4.1. New definition of investment projects

After analyzing both disciplines conceptually, it is determined that the investment projects and the process approach have elements in common, they intervene in the production or service systems in order to improve them.

Therefore, investment projects can be integrated and defined from the process perspective as follows:

It is that proposal in which the processes that make up the production or service systems in the asset component are temporarily and comprehensively intervened, whether tangible (infrastructure, machines, among others) and intangible (training, technical designs, procedures, among others), whose final objective is to improve and/or expand the services provided by the organizational system.

Through investments, the following factors of organizational processes can be improved:

People, through training.

Physical resources (machinery, tools, facilities, hardware), through construction, acquisition and improvement of said resources.

Process methods for changing, improving and automating processes.

Environment, in order to improve existing environmental conditions or recover degraded areas.

The established definition has the following characteristics:

It is a temporary intervention, since the projects allow improving the organization permanent functions.

It intervenes in the processes in a comprehensive way, allowing a wide and complete vision of certain defined areas within the organization and its relationship with its environment.

Production or service systems, the definition is flexible for both private sector as well as public sector organizations.

Asset component, investments have the characteristic of being capital expenses and not current expenses.

Improving and/or expanding services can be applied for internal and external customers to the organization.

The previous definition allows intervening in organizations from the projects and processes approach, a necessity to meet the new management conditions in organizations.

5. Conclusions

The following conclusions were drawn as a result of the investigation:

The definition of investment projects from the point of view of the object of intervention offers a different perspective of understanding the changes generated in the processes of organizations in their asset components, whether they are tangible or intangible.

The definition of investment projects from the perspective of processes allows a global and interdisciplinary vision to intervene in operating organizations.

The process approach allows expanding the usual factors of intervention in investment projects and including the procedures established in the organizations processes.