1. Introduction

Organizations that produce or distribute goods or services are human creations generically considered as artificial systems, as opposed to natural systems (the climate, animals, the human body, etc.), who have automatic self-maintenance mechanisms that are activated when the environmental conditions in which they develop threaten their existence or their function.

Artificial systems lack such mechanisms and it is precisely the evaluation process that assumes this role of self-maintenance and, consequently, is deployed with the intention of producing changes in the functioning of the system to ensure its stability. This explains why evaluation acquires maximum relevance in a contemporaneity characterized by intense changes in the needs, desires and demands of the different interested parties or interest groups of the organizations.

The previous arguments are particularly relevant in banking institutions, which constitute an essential component of the financial system; due to its high participation and influence on economic activity. Its efficient operation is essential for the development of any country; hence, the fact of providing quality services is a strategic element. However, Camisón, Cruz, and González (2006), have established that:

(...) the lack of generally accepted theoretical frameworks, the heterogeneity of approaches, the fragmentation and the diversity of initiatives, emanating from different disciplines, (…) have contributed to generating confusion among managers, who must face great diversity of ways to define quality and approaches to its management. The complexity of both concepts (quality and quality management) means that they have been defined and interpreted in very different ways, which in turn has led to approaches and implementation models that are also different in their principles and practices (pp. XXII-XXIII).

The impact of the stated inaccuracies is evident in the contemporary scientific literature on quality assessment in the field of services in general, and in banking specifically, where it is possible to discern a profusion of approaches to deploy this process. Such approaches are limited with respect to the need to develop quality assessment from a conception consistent with the precepts of total quality management. The occurrence of the above, added to the theoretical dispersion already described, reveals the existence of a problem of a theoretical and methodological nature in order to deploy the quality assessment process in the context of banking services.

Thus, this reflection article aims to systematize the theoretical references that support the quality assessment process in the context of banking services. In this sense, it was essential to critically analyze, after a description, the traditional approaches referred in the literature on the evaluation of the quality of services and their contextualization to banking. This made possible as the main value and utility of this article, to formulate a methodological proposal for the deployment of the process of evaluating the quality of services in banking entities, consistent with the statements of total quality management.

2. Theoretical Framework

2.1. Approaches to assessing the quality of services

A large part of the literature studied by the authors of this work related to the quality of services (Grönroos, 1984; Parasuraman, Zeithaml, and Berry, 1985; Zeithaml, Parasuraman, and Berry, 1993; Camisón et al., 2006; Talib, Rahman, and Qureshi, 2012; as well as Talib, 2013, among the most significant), is conclusive in recognizing that its evaluation must be developed differently from how this process unfolds in tangible goods.

Such consideration has found its foundation in distinctive characteristics of services that, according to the aforementioned authors, make them different from tangible goods. These can be synthesized in the following:

Intangibility: services cannot be appreciated through the intervention of the five senses, which implies difficulties in establishing precise specifications for their provision that allow standardizing their quality.

Heterogeneity: it is explained from the understanding that the specifications of the provision of the service, according to Zeithaml et al. (1993) “(…) it may vary from supplier to supplier, from client to client and from one day to the next” (p. 32). This could have its origin, according to these authors, in the human factor, since their actions and behaviors are difficult to standardize, which causes greater difficulty in ensuring uniformity between what the organization intends to offer and what the consumer actually receives.

Simultaneity: the provision of the service is inseparable from its consumption. Tangible goods are first produced, then sold and then consumed, while in the specific case of services, these processes run simultaneously. This conditions the existence of another of the distinctive characteristics of the services: their perishable and non-storable nature.

Given the existence of these characteristics, which supposedly imply the absence of objective standards to develop the evaluation of quality in the context of services, the aforementioned authors agree that this process should be subject to the study of consumer judgments, resulting of the comparison between what they expect from the service and what they perceive they received from it.

Thus, the concept of perceived quality has been enthroned as a central category to be operationalized to evaluate the quality of services. Such conception, according to criteria shared with Martínez García (2009), Martínez García and Martínez Caro (2010a), Pérez-Rave and Muñoz-Giraldo 2014, Ameer (2014), was strengthened with the development of the paradigm of the disconfirmation of expectations, theory generally accepted to explain the satisfaction / dissatisfaction process.

According to this theory, the consumer, after the consumption experience, makes a comparison between his perception of the performance of a tangible good or a service and his previous expectations related to what he expects to receive, which result from his needs and desires. The level of consumer satisfaction lies in the differences that arise between expectations and perceptions.

Based on the acceptance of the paradigm of disconfirmation of expectations, and although the number of conceptions used for the evaluation of quality in the context of the services that are described in the literature is wide, studies consulted (Martínez García, 2009 ; Torres Samuel and Vásquez Stanescu, 2015, Abdul Khader and Madhavi, 2017, among others) coincide in identifying two conceptions to develop this process, commonly named according to their geographical origins: the Nordic and North American schools.

In the works published by Grönroos (1984, 1988 fundamentally), as well as those by Gummesson, Lehtinen and Lehtinen cited by Gummerus and Von Koskull (2015), the genesis of the theoretical tradition associated with the Nordic school is essentially concentrated. Grönroos started by considering the quality of the service as a multidimensional variable perceived by the consumers, which is produced in the comparison that these make between what they expect from a service and what they experience after consuming it.

The expected service, according to Grönroos (1984, 1988), is conditioned by factors such as market communication (advertising, public relations, sales promotion, etc.), corporate image and consumer needs. Two dimensions influence the service experienced by the consumer: technical quality (“what” the consumer receives) and functional quality (“how” he receives it). Technical quality refers to what the client perceives that he receives at the time of his interaction with the organization that offers him a service. Functional quality is associated with the benefits that the consumer can achieve according to how the service is provided.

In the model proposed by Grönroos, this author establishes that the consumer perceives the quality of the service as a result of the integration between technical quality and functional quality, but mediated by the corporate image. That is, the consumer creates an image of the organization providing the service, using the information to which they have access, either due to their previous experience in consuming the service, or due to the communication that the organization has issued.

Grönroos suggests that functional quality plays a role of greater specific weight than technical quality, and that the meeting between the service provider and the customer constitutes the foundation of quality. The fact that this happens does not diminish the importance of the technical quality that in one way or another influences and determines the perceived quality. In the words of Camisón et al. (2006), the North American school “(…) has had its most conspicuous champions in Parasuraman, Zeithaml and Berry” (p. 173). In their scientific production (Parasuraman et al., 1985, 1988, 1991 and 1994; Zeithaml et al., 1993, among others), these researchers synthesized a theoretical-methodological tradition that they called the model of discrepancies

Parasuraman et al. (1985) argued that the existence of the inherent characteristics of the services already described imply that their quality is more difficult to evaluate than that of tangible goods. That the very nature of the services leads to greater variability in their quality and, consequently, to a greater perceived risk of the consumer compared to most goods. That, in the absence of objective standards, the evaluation (by the consumer) of the quality of the service takes place through a comparison between expectations and perceptions of the service and, finally, that in the evaluation of the quality that the consumers make, they make reference both to the results and to the service provision processes.

In their research, these authors identified discrepancies or imbalances that limit the quality of services. They are: between the expectations of consumers with the service and the perception that the management of the organization has about what they expect from it. There are also discrepancies between the perception of the managers on the expectations of the consumers, and, the specifications to the employees of the way in which they should provide the service. Finally, there are discrepancies between those specifications and how the service is actually delivered; and between what is offered or promised to the consumer through external communication and the actual specifications of the service.

These four discrepancies that occur internally in service provider organizations cause, in the opinion of Parasuraman et al. (1985) a fifth: between consumer expectations and the perception that he has about the service he really receives. Thus, Parasuraman et al. (1985) circumscribed the category perceived quality of service to an evaluative judgment of a global nature, formulated by the client and which is reflected in their attitude about the excellence or superiority of this with respect to their needs, as an expression of their perception of them; In other words, the degree and direction of consumer discrepancies between their perceptions and expectations about the service.

Based on these considerations, Parasuraman et al. (1985), understood that making the evaluation of the quality of services operational requires identifying and measuring the expectations and perceptions of consumers about them, which concretizes this process to the determination of the differences between what they expect from the service ( expectations) and what they actually receive (perceptions).

For this, Parasuraman et al. (1985, 1988), after a market investigation of users of five different service modalities and after various adjustments, they concluded that the evaluation of service quality is operationalized in five generic dimensions: tangible elements, reliability, response capacity, security (which includes professionalism, courtesy, credibility and security), empathy (which includes accessibility, communication and understanding of the user). These dimensions are in turn operationalized in 22 satisfaction elements that allow measuring both the expectations and the perceptions of the consumers of the service under evaluation.

Supported by these insights, Parasuraman et al. (1988) developed and refined a measurement scale that they identified as Servqual (acronym for the term in English language service quality), the first relevant explicit approximation designed with the purpose of evaluating the quality of service perceived by the consumer. When using this scale, the surveyed consumer should assess their expectations with the service under evaluation and their resulting perceptions of having consumed it. Using a Likert-type scale of seven response points with a range of 1 to 7 (1 means “totally disagree” and 7 indicates “totally agree”), the surveyed consumers must indicate their degree of agreement with the 22 elements of satisfaction associated with the aforementioned dimensions, in addition to assessing the relative importance of each of the dimensions of quality of service, distributing a total of 100 points among the different dimensions.

The data obtained from the application of the Servqual scale, according to Zeithaml et al. (1993), predict the overall quality of the service as perceived by consumers, and, therefore, can be used to quantify the deficiencies in the quality of the service with different levels of analysis. Furthermore, these data determine which dimensions are most important to consumers, allowing efforts to improve service quality to focus on these areas. That is, Servqual makes it possible to determine the relative importance of the five dimensions in the global assessment of quality perceptions by consumers.

2.2. Critical analysis of the approaches to assessing the quality of services

It is the criterion of the authors of this work that the difference that Grönroos makes between technical quality and functional quality is his main contribution to the study of service quality. Other investigations that have followed this differentiation are those of Oberoi and Hales in addition to Palmer and Manni cited by Sánchez Hernández (2008), as well as those of Gummesson, Eiglier and Langeard and those of Lehtinen and Lehtinen, mentioned by Gummerus and Von Koskull (2015), as well as Lassar et al., alluded to in the research by Martínez García and Martínez Caro (2010a).

It is also unquestionable that the distinction between the most tangible aspects of the service and the facets that describe the process of social interaction between employees and consumers had an important subsequent impact that, according to Sánchez Hernández (2008), influenced the North American school. In summary, this school has focused mainly on the concept of quality of service without looking for empirical evidence to support it. This has been the main reason why it has not been widely developed.

Despite its great diffusion in the academic literature and been refined through its generalization to a wide variety of services, the Servqual scale provided by Parasuraman, Zeithaml and Berry of the North American school, has not been without criticism with which the authors of this work agree. These can be classified into two types: those related to their theoretical support (that is, to the discrepancy model) and those related to the operationalization of the service quality evaluation process.

Among the criticisms that disagree with the theoretical support of the Servqual scale, those aimed at refuting the disconfirming paradigm on which the discrepancies model stands. Certainly, using a theoretical paradigm that explains the formation of satisfaction / dissatisfaction to evaluate the quality of the service causes confusion; Although the perceived quality supposes an attitude related, although not equivalent to satisfaction (Sánchez Hernández, 2008; Reyes Benítez, 2010), the two concepts imply subjective evaluations made by the client, but there are relevant differences between them.

Another valid criticism of the theoretical support of Servqual, in a position shared with Ladhari, (2009), as well as Jain and Aggarwal (2015), lies in the generalization to all kinds of services of its dimensions and elements of satisfaction. In this sense, a large number of researchers, including Boshoff, Mels and Nel; Carman and Koelemeijer cited by Camisón et al. (2006) as well as Kursunluoglu Yarimoglu (2014), among others, have identified generic dimensions different from the five proposed in the Servqual scale. This validates what was stated by Idrovo Arguello (2019) citing Golpani, in the sense that: “despite the efforts made from different perspectives and in very diverse sectors, the lack of agreement on the identification of the variables associated with service quality continues to be remarkable today” (p. 71).

The Servqual scale has also received criticism concerning the way to operationalize the quality assessment process, particularly with regard to the use of expectations as a standard of comparison. Thus, the positions of researchers such as Carman, Teas, Babakus and Boller, Cronin and Taylor (cited by Martínez García, 2009) stand out, who have argued that, although it is important to obtain information on expectations, their assessment from an independent scale it does not provide supplementary information to what perceptions already contain.

From this perspective, in the investigations of Cronin and Taylor, in addition to Teas (alluded to in Martínez García, 2009), these authors spoke out for the development of the service quality evaluation process based on assuming it as an exclusive function of perception by the consumer of the service result. To assess the quality of the service, according to these researchers, it is only necessary to evaluate the perceptions of the customers, avoiding expectations. To do this, a single scale is constructed that only includes the list of items for perception of the result, of which the most popular is the one called by Cronin and Taylor as Servperf.

2.3. Approaches to assessing the quality of banking services

Despite the aforementioned criticisms of the model of discrepancies provided by Parasuraman, Zeithaml and Berry (as well as the Servqual scale that materializes it in practice), the author of this paper fully agrees with the conclusions made by Ladhari (2009), Rodrígues, Barkur, Varambally, and Motlagh (2011), Rotondaro Pereira, Monteiro de Carvalho, and Gilioli Rotondaro (2013), de Barros Jerônimo and Medeiros (2014), Mauri, Minazzi, and Muccio (2015), Abdul Khader and Madhavi (2017) as well as Idrovo Arguello (2019). These researchers conclude that the model of discrepancies has been the predominant one in the scientific literature on quality assessment in the context of services.

The generalized use of this model derived from the North American school to various service activities (for example, those referred to in the research of Seth, Deshmukh, and Vrat, 2005; Martínez García and Martínez Caro 2010b; Jain and Aggarwal, 2015; Ramezani Ghotbabadi , Feiz, and Baharun, 2015; as well as Polyakova and Mirza, 2015), manifests its precursor character over other existing ones.

The above arguments become evident when studying research on quality assessment in the context of banking services, where the predominance of using the fundamentals of the Servqual scale to develop this process is evident. From this perspective, there are two trends: one reiterative and the other adaptive.

The reiterative trend, is reviewed by the investigations of Moros Ochoa (2010), Islam and Ali (2011) as well as González Álvarez (2013, 2015). This trend is also analyzed by Lau, Cheung, Lam, and Chu (2013); Cui, Lewis and Park; Sureshchandar, Rajendran and Anantharaman; Arasli, Mehtap-Smadi, and Katircioglu; Yee, Yeung, and Cheng; as well as Thuy and Hau cited in Ensslin, Ensslin, and Pinto (2013). It was also possible to consult the research of Freitas de Amorim Filho, Coutinho de Melo, Neves de Queiroz Claudino, de Barros Jeronimo, and Dumke de Medeiros (2015) among others, in which the same dimensions of the Servqual scale are used as conceived by its authors, to evaluate the quality of banking services.

From the literature consulted, the trend that can be distinguished with the greatest profusion is the adaptive one. This, as its name indicates, seeks to minimize or eradicate from the process of evaluating the quality of banking services, the criticism made to the Servqual scale referring to the generalization to all types of services of its dimensions and associated satisfaction elements.

Thus, from the perspective of adaptations to the Servqual scale, Sangeetha and Mahalingam (2011) described in their research the contributions made by Mersha and Adlakha; Avkiran; Levesque and McDougall; Ennew, Reed, and Binks; Blanchard and Galloway; Bahia and Nantel; Sureshchandar, Rajendran, and Kamalanabhan; Karatepe, Avci, and Tekinkus; Al-Hawari, Hartley, and Ward; Ehigie, Mukherjee, and Nath; Wang, Kwan, and Hee; Newman and Cowling; Lasser, Manolis, and Winsor, Caruana, among others.

From this same adaptive perspective of the fundamentals of the Servqual scale, the contributions made by Karatepe, Yavas, and Babakus were relevant; Ladhari, Ladhari, and Morales referred to by Titko, Lace, and Kozlovskis (2013). Similarly, the studies of Spathis, Petridou, and Glaveli; Glaveli, Petridou, Liassides, and Spathis as well as Ehigie reported in the research by Ensslin et al. (2013) are circumscribed in this trend.

Similarly, Al-Jazzazi and Sultan (2015) summarized the works, which, from this tradition, were carried out by Zhou; Guo, Duff, and Hair; Jabnoun and Khalifa; Yavas, Jamal, and Naser; Estiri, Hosseini, Yazdani, and Nejad; as well as Aburoub, Hersh, and Aladwan. Also relevant are the contributions of Amin and Isa; Othman and Owen; Guo, Angus, and Hair as well as Obaid referred by Grazhdani and Vërçuni (2015). Asif, Awan, Jajja, and Ahmad (2016) when describing some scales cited here plus those of Kumar, Kee, and Manshor as well as Taap, Chong, Kumar, and Fong that are inscribed within the adaptive current, proposed a within this same perspective.

Other investigations in which both trends in the use of the fundamentals of the servqual scale are described to evaluate the quality of banking services were studied in Miguel-Dávila and Flórez-Romero (2008), Pattanayak and Maddulety (2013), Grazhdani, Vërçuni, and Merrollari (2015), Paul, Mittal, and Srivastav (2016), Berdugo Correa, Barbosa Correa, and Prada Angarita (2016) as well as Marques Santos and Cândido (2016).

In addition, it was possible to identify in the systematization carried out, investigations aimed at directly assessing the perceptions of customers about the banking services received, consistent with the fundamentals of the Servperf scale, but with adjustments and modifications to the dimensions that it proposes. From this perspective, are remarkable the studies of Santiago Merino (1999); Garcia Mestanza; Jabnoun and Al-Tanami; Ting; Sharma, and Mehta in addition to Bauer, Hammerschmidt, and Falk (cited by Miguel-Dávila and Flórez-Romero, 2008); Jabnoun and Al-Tanami; Beerli, Martín, and Quintana in addition to Ting alluded to by Ensslin et al., (2013); Bauer et al. referred by González Álvarez (2013), Ushantha, Wijeratne, and Samantha (2014), Torres Fragoso and Luna Espinoza (2017), Vera and Trujillo (2018).

From the foregoing it can be inferred that most of these investigations aimed at developing applications to evaluate the quality of banking services have concentrated on replicating, adapting, adding and / or modifying the dimensions proposed in Servqual and Servperf, but fundamentally respecting the theoretical-methodological precepts on which these are based. The criticisms already exposed to these scales are applicable to them. The generality of the dimensions that are recognized in the aforementioned research can be concentrated in those proposed in a generic way by Sangeetha and Mahalingam (2011), Grazhdani, et al. (2015), Berdugo Correa et al. (2016) and Idrovo Arguello (2019) simplified, according to the authors of this work, in the following:

Tangible dimension: customer perception of the physical conditions, appearance, facilities, equipment and communication devices necessary for the bank to provide its services.

Guarantee dimension: customer perception of the bank’s ability to meet the commitments made.

Responsiveness dimension: customer perception of the bank’s ability to provide a quick and effective solution to their requirements.

Security dimension: customer perception about the privacy of their information and transactions in the provision of the service.

Empathy dimension: customer perception of the bank’s contact staff’s ability to personalize services, adjusting to their needs with courtesy and transmitting trust.

Technology and connectivity dimension: customer perception of the efficiency and availability of technological means to facilitate the provision of the banking service.

Coverage dimension: customer perception of the breadth of services based on whether they are sufficiently diversified according to their needs.

Accessibility dimension: customer perception of the degree of ease to access the services provided by the bank.

The aforementioned authors argue that it is necessary to continue working on the conceptualization of specific dimensions that help to offer a concrete operationalization of the variable quality of service in the banking field for the purposes of its evaluation.

3. Discussion

It is the criterion of the authors of this work that services (and banking in particular) are susceptible to being standardized, so assuming heterogeneity as an inherent characteristic of these implies difficulties to standardize them, imposes a barrier for their quality management in general, and, for your specific evaluation. That is why it is important to note the necessary contextualization of the dimensions of the banking service, to the specific characteristics of its process of provision and consumption, described as quality requirements, in which not only those of its external customers must converge, but also those of other parties interested in it.

Simultaneity as a distinctive feature of services is valid as understood by the authors of this work. However, and despite being recognized as valid, the evaluation of the quality of banking services has focused on their act of consumption, that is, on identifying the perception of external customers as a result of consuming them, avoiding the evaluative act determining the conformity of the requirements of other interested parties.

The foregoing leads to affirm that the main point of reference to the studies cited in this work on quality assessment in the context of banking services, is the biased point of view in which almost all of its authors have proposed to develop it. Most of these coincide in circumscribing it from the point of view of the assessment of the quality perceived by the consumer, avoiding the determination of the conformity of the requirements of the rest of the interest groups or interested parties of the organization providing the banking service, and therefore Consequently, the necessary global or total approach under which the quality category and its management must be understood.

While recognizing the importance of determining value judgments as a central component of the evaluation process through the design and implementation of a measurement scale, it is necessary to emphasize that the evaluation of the quality of services in general, and banking services in specific, it is associated with a broader process that involves the deployment of a systemic set of periodic operations. Those operations are fundamentally associated with obtaining and interpreting reliable and valid information on the degree of conformity of the quality requirements of the banking service to be considered. In addition, on its basis, contribute to the decision-making process that stimulates its improvement.

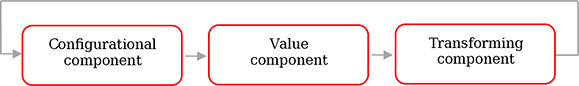

Consistent with the previous definition, it is the criteria of the authors of this article that the evaluation process of the quality of banking services should be based on a systemic approach structured in three components (configurational, evaluative and transforming of the banking service under evaluation). The configurational component must fulfill the function of generating information on the quality requirements of the banking service being evaluated, which must be identified in a regulatory document of the banking institution. In the quality requirements of the banking service under evaluation, the needs and expectations of all the parties interested in it must converge in a harmonized manner.

The order of operation of the evaluation considers as continuity of the process, the evaluation of the quality of the banking service under evaluation. Consequently, the value component is established. This must fulfill the function of determining the conformity of the quality requirements of the banking service under evaluation. This component must reveal the degree to which the specified quality requirements related to the banking service evaluated are accomplished, the result of which will be assigned an evaluation criterion of “compliant” or “non-compliant”. The issuance of a “compliant” value judgment implies that the quality requirements of the banking service under evaluation have been accomplished; otherwise, it is classified as “non-compliant”.

Subject to the evaluative component, and in correspondence with the logic of the evaluation process, the transforming component is identified, which is charged with guiding the generation of actions that contribute to the improvement of the configuration of the banking service under evaluation. The actions identified must be aimed at increasing the capacity to meet the quality requirements of the valued banking service, that is, its continuous improvement.

To comply with the above, it is unavoidable to identify corrective and preventive actions aimed at adding, modifying, reducing or eliminating quality requirements of the banking service under evaluation. A corrective action is one aimed at eliminating the cause of a non-conformity identified in the banking service under evaluation and preventing it from happening again; A preventive action is one aimed at eliminating the cause of a potential nonconformity or other potentially undesirable situation.

From a systemic approach, the configurational component constitutes the starting force that provides the process of evaluating the quality of the banking service object of evaluation (Figure 1) with its “inputs”, that is, its operational needs of operation in terms of the information associated with the quality requirements in which the banking service under evaluation is configured. The mechanism for converting “inputs” into “outputs” is evidenced in the evaluative component when determining the conformity of the quality requirements. The transforming component summarizes the purpose of the banking service quality assessment process: the contribution to the continuous improvement of its configuration.

4. Conclusions

The most representative models for evaluating the quality of services and their contextualization to banking services are limited with respect to the need to develop this process from a conception consistent with the focus on the fundamentals of total quality management. Therefore, it prevails a restricted perspective to assess the quality perceived by consumers and bypassing the determination of compliance with the requirements of other interested parties, as well as an essential component: the contribution to continuous improvement.

To specify the process of evaluating the quality of the banking service to the deployment of a systemic set of periodic operations, associated with obtaining and interpreting reliable and valid information on the degree of conformity of the quality requirements of the banking service to be considered and, on its basis, contributing to the decision-making process that stimulates its improvement, would make possible the production of research results that, from a systemic approach, consider three components (configurational, evaluative and transforming of the banking service under evaluation).