1. Introduction

The Liquor de Antioquia Factory has been subject to the government of Antioquia as subordinate to the Secretary of Finance thanks to administrative acts issued by governors of the department since 1968. This has made it subject to the changing political heritage and a legal structure that denatures its industrial and commercial mission. Hence, towards the month of June 2018, the Council of State, Chamber of Administrative Litigation, exhorted the Government of Antioquia so that within a period of two years:

(...) adopt the organization and legal structure that corresponds to the development of the industrial and commercial activities that it carries out, that is, the production, marketing, and sale of liquors, alcohols, and related products, under the protection of the income monopoly of distilled liquors, as indicated in this judicial order (…). (Sentencia Consejo de Estado, 2018).

The ruling forces us to rethink the legal structure of the FLA on three possible scenarios: production through its liquor industry or the maquila system and the signing of contracts that temporarily allow production to be carried out by third parties. The first two are based on a direct exercise of the production monopoly; the latter arises from its indirect exercise.

The Antioquia Liquor Factory is, without a doubt and according to figures, the most important rentier monopoly in the country (Zapata, 2019). In 2016, a market share of approximately 54.42% regarding the most representative official liquor industries (Caldas liquor industry, Valle liquor industry, Cundinamarca Liquor Company, Cauca liquor industry). Consequently, it ranks as the most stable and profitable income monopoly in the country, managing to contribute a total of 928 billion pesos to the department in the year 2017 and thus contributing to raising the quality of life of Antioqueños (Arango, 2018).

The proposal of this work arises, then, from the need to execute projects that, articulated with strategic planning, promote the stability and growth of the liquor industry in light of its imminent legal transformation. The problem revolves around establishing to what degree the sale of physicochemical testing services by the laboratory of the Liquors of Antioquia factory will be profitable and sustainable, evaluating the financial position and performance of the laboratory to make better and more accurate decisions (Sainjargal, Naranchimeg, Khurelbaatar, and Chimedsuren, 2020).

With the primary objective of evaluating the market and finding the financial viability of the project for the sale of physicochemical tests at the Antioquia Liquor Factory laboratory, an AutoRegressive Moving Average econometric model will be used as the demand estimation methodology. I achieved roughly forecast the project’s seasonal income streams. In addition, financial criteria will be used that, such as the Net Present Value and Internal Rate of Return (NPV and IRR), manage to provide conclusive results regarding the profitability and acceptability of the business idea. “Financial analysis is of special importance to outside stakeholders because it is based on public financial statements, which are the main source of information for outsiders” (Laitinen, 2018).

2. Literature review

In this work, an analysis of the financial profitability of the sales strategy of the physicochemical tests to liquors offered by the laboratory of the Antioquia liquor factory will be carried out. Given the legal nature of the company and the scientific heritage of the laboratory, institutional, political, legal, economic, and technical variables should be considered. Thus, the project for the sale of the physicochemical tests that is the subject of this work is, under the current context, an idea that can be economically profitable but legally and politically unfeasible as a consequence of what the constitution and the law predispose. Following, with the above, it is necessary to carry out the financial evaluation exercise of the project without ignoring the possible scenarios proposed by the State Council (Sentencia Consejo de Estado, 2018).

In the process of evaluating the conversion strategy into a Strategic Business Unit to the FLA Laboratory, the economic and financial evaluation of projects will be used as a basic tool, as well as a basic analysis of the market that allows a glimpse of its most relevant characteristics. We will start by considering that, as proposed by (Baca Urbina, 2013), the evaluation of a project requires a series of cycles that will allow and facilitate decision-making. In this way, a market study will be required, first, that provides tools to identify whether the project can indeed cover an unsatisfied need and whether, therefore, it accounts for a potential demand that achieves temporary viability to the project.

In a second moment, a technical study is carried out under which the optimal production size is determined given the installed capacity, technology, and available manpower. Then, an economic study will be carried out that implies the systematization of the monetary information to determine the total costs, initial investment, depreciation, amortization, minimum acceptable rate of return, and the net cash flows of the project. The above will, in turn, serve as a basic input for the economic and financial evaluation that requires the choice of criteria and identification of alternatives (Baca Urbina, 2013).

Thus, the implementation of the strategy of sale of the physicochemical tests to third parties can only be justified if the evaluation criteria of the selected project show satisfactory results and comply with the profit margin that the laboratory management staff expects or intends to receive.

The conceptual framework that is generated around the evaluation of projects invites us to think about two possible paths for the analysis of profitability and the construction of net cash flow: the first is the possibility of examining them from the point of view of the project and, the second, from the investor’s perspective (Vega Castro and González Cerrud, 2014). In the case of the sales strategy of the physicochemical tests of liquors to third parties, the profitability analysis of the project and not the investor will be carried out; that is, a financial evaluation of the negotiation idea proposed by the laboratory managers will be carried out and not one that examines profitability from the investor’s perspective. This is because, since the initial capital investment was already executed with the formal creation of the laboratory as a dependency on the departmental rents monopoly. However, the initial investment should be taken into consideration, as will be seen, for the construction of the project’s net cash flow.

Project evaluation is a tool that can provide vast information to central administration on the advantages and disadvantages of allocating resources to an idea or proposal. This facilitates assertive and efficient decision-making as long as the associated risks are assessed and anticipated with the judicious analysis of the variables and antecedents involved. The study of the economic feasibility of a project requires the estimation of cash flows that include income, costs, investments, and benefits. Sapag and Sapag (2008) affirm that “the projection of cash flow constitutes one of the most important elements of the study of a project, since the evaluation of the same will be carried out on the results that are determined in it” (p. 291).

After the construction of the cash flow, the choice of financial evaluation criteria is required to facilitate optimal decision-making on the execution of the project. The profitability indices generally mentioned in the literature are Net Present Value (NPV) and Internal Rate of Return or Yield (IRR). The inconsistencies when applying IRR have given this method a bad name and therefore some authors, such as Balyeat and Cagle (2015) and Osborne (2010) prefer to use the Net Present Value.

In the end, a positive monetary value in the NPV will indicate the annual average amount that the equity of the business or the company should increase as a result of the effective implementation of the project. To make use of the previous financial indicator (NPV), The project managers must define the Minimum Acceptable Rate of Return (MARR) that will indicate the minimum acceptable rate of return that the proponents or project managers expect to receive. If this value is 0, it is presumed that an insufficient financial return will be obtained to cover inflation (Carbonel, 2016).

Since 1969, the National Planning Department (NPD) indicated that for projects that could in the future lead to an increase in public benefit, the social rate of return, as they call it, should be 12% (Piraquive, G., Matamoros, M., Cespedes, E., y Rodríguez Chacón, J., 2018). However, around 2015, an update of this rate was made and it was found that, given the current Colombian economic dynamics, the rate of return on capital is approximately 9%. Of course, the document presenting the update also defines the social discount rate as follows:

(…) It measures the cost at which a society is willing to sacrifice present consumption for tomorrow’s consumption. Between today’s consumption and the fruits of the investment. The higher the discount rate, the greater the willingness of society to consume more today than tomorrow (p. 2).

The Board of Directors of Bank of the Republic proposes a long-term inflation target of 3% (Gómez-Restrepo, J., Uribe, J. D., y Vargas-Herrera, H., 2017); therefore, applying the 9% rate proposed by the NPD to the net cash flow from the physicochemical tests is acceptable, timely, and reasonable because, among other things, it was generated under guidelines that allow forecasting the minimum expected for projects aimed at raising the quality of life of the population. In addition, the yield proposed by this public organization covers not only long-term annual inflation but also the investment yield rate of the Colombian financial market, which, according to the financial superintendence and for fixed-term certificates, is approximately 5.11% annual.

Now, the IRR as a financial indicator allows us to find the discount rate for which the NPV is equal to zero. In other words, the rate at which the project fails to generate sufficient profitability to increase its equity in the long term but, at least, manages to cover the inflation generated year after year during its execution. If the IRR is greater than the TMAR, the investment will be accepted and it is concluded that the project is economically viable.

These analysis methods will allow to verifying, in quantitative terms, the feasibility of the project to sell the physicochemical analyzes to third parties. It should be added that to obtain accurate and conclusive results, a variable that reflects the change in costs and prices due to the variability of the value of the currency over time (Inflation) and another that expresses the salvage value of fixed assets must be included. at the end of the time horizon in which the project will be evaluated (5 years), it will be assumed that this data at the end will be the equivalent to the book value of the physical capital of the laboratory for the period; that is, the amount corresponding to its acquisition value subtracting the depreciation of the period in which the business idea will be executed.

In addition, here it will be important to find the quantities and the price at which the sales income from the FLA laboratory managed to cover the costs and expenses involved in providing the service. On this balance point, Baca Urbina (2013) adds that:

(…) Although it is not an evaluation technique, due to the methodological disadvantages it presents, it is an important point of reference for a production company to determine the level of production in which total costs equal total income (p. 7).

Decision-making around a business idea is conceived as a process that requires the systematic analysis of the variables and possible scenarios. It is unlikely that the estimates made through the implementation of the financial evaluation of projects are completely accurate; however, there may be qualitative and quantitative approximations that make it possible to assert whether or not the project is to be carried out. The “optimal” result of the application of the latter will always depend on the expectations of the managers and the articulated analysis of the parameters and possible convergence scenarios.

3. Methodology

For the construction of the cash flow of the project for the sale of the physicochemical tests, it was necessary to search and consolidate information concerning the inventory of fixed assets of the laboratory and the entry of annual samples from the different areas of the FLA. In addition, it was required to carry out the costing of the tests through extensive knowledge of cost accounting and the analysis procedures used by the Laboratory.

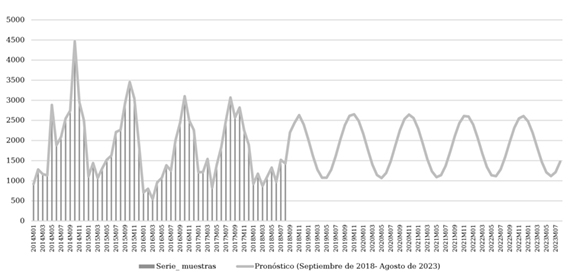

An AutoRegressive Moving Average Model (ARMA) is used as the demand projection method, the period-by-period estimation results of which are set out in annex 1 graph. To achieve these values, the historical data series for the entry of samples was required for the period between January 2014 and August 2018; Due to the non-systematic nature of the time series, an econometric equation must be generated under which the seasonal characteristics of the data are reliably predicted. The Table 1 shown above is derived from using the statistical package e-views for the generation of the model and the equation that best fits the data and its characteristics

The R2 (R-squared) of any model exhibits, in a generalized way, the ability of the dependent variable to approximate the independent variable. That is, for this particular case, the period of time manages to determine, given the model, 82.68% of the number of samples entered into the Laboratory of the Antioquia Liquors factory in the period studied. In other words, the model used manages to explain the variation of the Variable Test Entry by 82.68%. Under this context, the fit of the model is acceptable and, therefore, can be used to estimate demand by analysis in subsequent years (2019-2023).

Table 1 Automatic ARIMA Forecasting

| Variable | Coefficient | Std.error | t-statistic | Probab. | |

|---|---|---|---|---|---|

| C | 1.913,220 | 302,8364 | 6,317668 | 0,0000 | |

| AR(1) | -1,757858 | 0,090649 | 0,0906495 | 0,0000 | |

| AR(2) | -0,882393 | 0,093702 | -9,417063 | 0,0000 | |

| SAR (12) | 0,352783 | 0.833072 | 0,423472 | 0,674 | |

| SAR(24) | 0,383541 | 0.868099 | 0,441817 | 0,6608 | |

| MA(1) | 2,393821 | 231,0186 | 0,010362 | 0,9918 | |

| MA(2) | 2,528597 | 489,7176 | 0,005163 | 0,0059 | |

| MA(3) | 1,746894 | 508,4699 | 0,003436 | 0,9973 | |

| MA(4) | 0,668885 | 259,2989 | 0,002580 | 0,9980 | |

| SMA(12) | -0,31209 | 0,965042 | 0,032339 | 0,9743 | |

| SMA(24) | 0,211889 | 0,979887 | 0,277469 | 0,7827 | |

| SIMGMASQ | 119735,8 | 327421,9 | 0,365693 | 0,7163 | |

| Other results | |||||

| R-squared | 0,826879 | Mean dependent var | 1819,679 | ||

| Adjusted R-square | 0,783599 | S.D. dependent var | 839,1695 | ||

| S.E.of regression | 390,3729 | Akaike info criterion | 15,33899 | ||

| Sum squared resid | 6705203 | Schwarz criterion | 15,773 | ||

| Log- likelihood | -417,4918 | Hannan-Quinn crit. | 15,50725 | ||

| F-statistic | 19,10522 | Durbin-Watson stat | 1,842036 | ||

| Prob(F-Statistic) | 0.00000 | ||||

Date: 10/29/18 Included observations: 56 Forecast length :60

Source: Authors’ own elaboration.

3.1. Construction of cash flow for the sale project of the FLA physicochemical tests

As mentioned previously, for the construction of the net cash flow of the project for the sale of the physicochemical analyzes, some caveats must be taken into consideration:

A large percentage of the investment in physical and technological capital was executed with the creation of the Laboratory as a dependency of the Liquor factory of Antioquia. For this reason, a process of consolidation and validation of information must be carried out that allows finding the total acquisition value of the fixed assets belonging to this area.

The estimation of the demand for analysis was predicted based on the historical data series of samples entering the laboratory. The market does not provide enough information to establish, even roughly, the potential demand of the project, and this is the reason why it is necessary to resort to the Laboratory’s management system as the only robust and reliable data source. However, a serious fault would be to presume that all these samples come from external agents - even more so when the market is incipient and the rigorous application of the standard will require institutional changes beyond the control of the laboratory. Therefore, it is established that the entry of samples by clients external to the FLA will be between 20% and 40% of the total forecasted samples based on the laboratory’s historical trends. In addition, a scenario will be proposed under which there is a progressive increase in the demand for analysis by customers outside the factory, as follows: In the first year, this represents 20% of the total forecast samples, in the second 25 %, in the third 30% and, so on, until the fifth year where the entry of samples for third party analysis will represent 40% of the total.

The construction of the flow requires the definition of the price of each test and the determination of the number of average analyzes about, the annual number of samples entered. According to historical data, it is found that the total number of samples received annually is distributed approximately like this among the different areas (Table 2).

4. Results

A reasonable acceptance criterion of the business idea concerning, the results obtained follows that two conditions are met: the first implies that, for the proposed scenario, the IRR reaches or exceeds the 9% estimated by the DNP and, the second requires that the monetary values of the NPV be positive. Despite this, it must be considered that the decision on implementation is subject to little information regarding the number of samples that - in effect and being an incipient market - may be received from external clients. Arbitrarily, it was stipulated that this value could be between 20% and 40% of the total estimated for the laboratory of the official Antioquia monopoly. In the end, the input of samples for third-party analysis should have been assumed as a percentage of the estimated total because, the information on the demand is limited and depends largely on the current institutional framework and compliance with the standard. The inaccuracies in the behavior of the agents in the market lead to the need for a myriad of premises and assumptions that, undoubtedly, will generate uncertainty and alterations regarding the decision on the execution or not of the sale project of the physicochemical tests.

The net cash flow and the financial indicators of the NPV and IRR were applied for the criteria specified below:

The first criterion for the exercise of the financial evaluation is based on the possible conversion scenarios of the legal nature of the FLA. Namely, the case in which the factory is transformed into a departmental industrial and commercial company is considered first; here appears a special regime in which the rate for income and complementary taxes corresponds to 9% of the gross profit of the project. The second scenario summons the case in which the production is carried out through the maquiladora system or the signing of contracts that temporarily allow production to be carried out by third parties; This context implies a tax rate of 33% for income and complementary taxes, addition, it is stipulated that in both scenarios (maquila and contract signing) the same considerations apply as for a private company.

The entry of samples from external clients corresponds to 20%, 25%, 30%, 35%, and 40% of the total forecast for the years 2018, 2019, 2020, 2021, 2022. For each of these scenarios, an independent net cash flow, without forgetting that they will be linked to the possibilities of legal conversion previously exposed.

An attractive rate of return (TMAR) of 9%, 12%, 12.27%, and 15.36% will be applied to the cash flows. The last two values correspond to the 3% inflation adjustment applied to the first two rates.

The assumptions outlined suggest that, in the end, there will be a total of 24 cash flows that will cover some of the possibilities that the LAB-FLA project to sell physicochemical analysis to external clients will face. The exercise of the evaluation of the sale project of the physicochemical tests to liquors reveals the following results for both conversion possibilities:

4.1. State industrial and commercial company

In line with the results of the economic evaluation and the background of the project, the hypothesis that the laboratory is self-sustaining as a result of the sale to third parties of the physicochemical analysis of liquors that it performs is partially verified. It is found that, for the case in which the factory becomes an industrial and commercial company, and when the samples from third parties correspond to 32% of the total entered, the project will be able to offset the costs and expenses incurred for the realization of the trials and, in addition, obtain the minimum attractive rate of return of 9%, 12%, 12.27% and 15.36%. This is based, moreover, on the factual fact that inflation is an inalienable economic phenomenon and that, as seen.

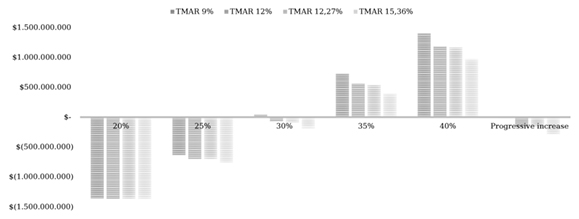

Figure 1 shows that there is an inverse relationship between the project’s minimum rate of return and the NPV obtained. That is, the higher the expected return on invested capital, the lower the value in which wealth and capital will increase as a result of the implementation of the project.

Figure 1 NPV of the LAB-FLA project under the legal and tax status of an industrial and commercial company of the State

Additionally, the graph reveals that, only from the NPV point of view, the business idea is unfeasible for an ARR of 12%, 12.27%, and 15.36% if the total of samples entered by third parties is below 30% of the total estimated samples; However, with the same percentage of samples and if the ARR is 9%, the project becomes profitable as a response to achieving an NPV of$ 41,991,994; likewise, it will cover the yield proposed by the National Planning Department (NPD) for projects that bring social benefits. Even with the above, all the values obtained here are very close to being located in an NPV equivalent to 0, for which it is expected that the acceptance criteria of the project, which these are met simultaneously with the NPV (For all the assumed MRT) and the IRR are positive (and the latter is at least 9%), implying, at least, that the number of samples from third parties is located at 32% (Table 3).

On the other hand, the possible percentages of IRR, for the different scenarios of input of samples by external clients, are expressed by the following Table 4.

Table 3 Number of trials

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|

| 6073 | 7082 | 7070 | 7062 | 7056 |

Source: Authors’ own elaboration.

Table 4 State industrial and commercial company

| % Third Party Samples of Total Predicted | ||||||

|---|---|---|---|---|---|---|

| twenty% | 25% | 30% | 35% | 40% | Progressive increase | |

| IRR | -47.74 | -9.28 | 10.06 | 25.84 | 39.80 | 8.75 |

Source: Authors’ own elaboration.

According to the definition of the IRR exposed in the literature review, the values shown in the table indicate the performance at which, given the number of samples entered, the NPV is zero. Thus, for example, when the entry of samples by third parties is 20% of the total, the rate of return expected by the project managers should be -47.74%, which allows us to deduce that, under this context, the Implementation of the proposal is unfeasible from the economic and financial point of view.

Likewise, the table shows that, when the percentage of third-party samples corresponds to 30% of the forecast total, the internal rate of return is 1.06 percentage points above that stipulated for social projects according to the NPD (9%); This implies that this percentage of samples will even generate higher profitability than what was agreed as the minimum acceptable for the execution of the financial evaluation of the project. The analysis of the results of the financial indicator IRR is not by itself a determining factor for making decisions about the implementation or not of the project, because the chosen decision criterion compromises its reading and analysis in contrast to the results obtained for the financial indicator. of the NPV.

4.2. Production through the maquila system or the signing of contracts that temporarily allow production to be carried out by third parties

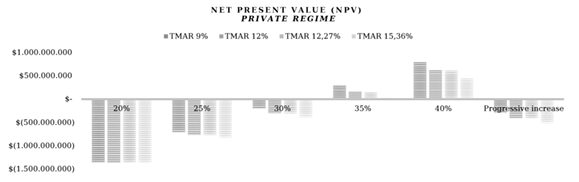

The results of this exercise are, without a doubt, a little more pessimistic compared to those obtained for the scenario under which the legal heritage of the Antioquia liquor factory is coupled with that of a State industrial and commercial company. This can be explained why, for this type of state figure, a tax burden is applied 24 percentage points lower than that which occurs for a private-type regime (Maquila, subscription of contracts by third parties). Namely, natural or legal persons obliged to declare will have a current rate (2018) of 33% on the gross profit of the fiscal year, while industrial and commercial companies will incur a rate of 9%.

Figure 2 shows the values in pesos of the NPV for each of the minimum attractive rates of return suggested. For this case, it can be concluded that the established yield of 9% does not provide a way to increase the financial value of the company when the entry of samples from external clients corresponds to 30% of the forecast total. From this and bringing theory up, it is hardly reasonable to intuit that for the other rates of return, the wealth of the organization will also be reduced. Is in contrast to what was obtained for an industrial and commercial state company.

Source: Authors’ own elaboration

Figure 2 Net present value of the LAB-FLA project under the legal and tax status of a private company

Now, the chosen decision criterion is met for both indicators (positive NPV and IRR greater than or equal to 9%) only when the entry of third-party samples corresponds to a minimum of 35% of the total estimated using the ARMA model for the years of execution. of the project. The year-by-year distribution of the income of these samples will be given by the following Table 5.

For their part, the IRR percentages, for the different scenarios of sample entry by external clients, are expressed by the following Table 6.

From the analysis of the cash flows that emerge from the two possible conversion scenarios, it is concluded that, in the case of the State industrial and commercial company, the project for the sale of the physicochemical tests will only be viable and economically profitable if it is achieved that the income of the samples from third parties is at least 32% of those predicted, also considering that the analyzes that supply them (samples) are equivalent to the internally determined standards.

Table 5 Number of trials

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|

| 6642 | 7746 | 7733 | 7724 | 7718 |

Source: Authors’ own elaboration.

Table 6 Company under the private regime (Maquila or subscription of contracts by third parties)

| % Third Party Samples of Total Predicted | ||||||

|---|---|---|---|---|---|---|

| twenty% | 25% | 30% | 35% | 40% | Progressive increase | |

| IRR | -47.74% | -11.90% | 3.62% | 16.33% | 27.53% | 2.94% |

Source: Authors’ own elaboration.

It is added that for neither of the two conversion possibilities exposed, the progressive increase in the entry of samples by third parties reveals a satisfactory result. This is, given the current situation and applicability of the standard, one of the scenarios that are more adjusted to reality. Today, the possibility that, with a nascent market, there will be an effective demand comparable to that outlined for the regimes or categories that the court requires is low.

With these findings, it is possible to categorize the market and realize that the long-term profitability of the project is uncertain as a result of variables that, such as strict compliance with the standard, are beyond the control of its managers and are beyond the scope of this investigation. Indeed, structural changes are required that make it possible to assert, with less uncertainty, the reliability of the results and, consequently, the real economic and financial viability of the application of the project.

5. Conclusions

The political framework and the institutional framework considerably determine the evolution of the market, the behavior of the agents, and the economic and social development of the communities. The FLA has historically been subject to a highly politicized environment because of a legal nature that denatures its industrial and commercial vocation, but since 2020 it has become an industrial and commercial company of the State, which gives it greater administrative and budgetary autonomy for the management of the resources it receives.

The two conversion scenarios proposed by the executive can be categorized into two aspects: the first is the permanence of the state as the main investor but under the figure of an industrial and commercial company of the state and, the second, which in turn contains two possibilities, It implies the convergence towards a maquila or the signing of contracts so that the industrial production of alcoholic beverages in Antioquia remains in the hands of a third party. To implement strategies that allow the achievement of greater social and/or private benefits, the FLA’s physicochemical analysis laboratory intends to implement a project for the sale of its services to external clients.

Even though the physicochemical analysis laboratory of the Antioquia liquor factory has an incontrovertible competitive advantage due to accreditation under ISO 17025: 2017 standard, the sale of the tests is also subject to the management that the Colombian Institute of Technical Standards and Certification [ICONTEC] meet the product certification standard. It is concluded that if rigorous compliance with these regulations were to be presented, the market structure would assume oligopolistic characteristics, with a tendency inelastic product and attractive profit margins but with undeniable restrictions on the entry of new competitors as a result of the vast scientific team, physical capital and technical personnel required to provide the service.

What is identified, after the economic and financial evaluation exercise, is a still incipient market for physicochemical analysis of liquors, with little information and an effective demand that is difficult to estimate. Likewise, it is found that in Colombia there are several, potential customers, mostly involved with the production and distribution of liquors and alcoholic beverages.

The results of this exercise show that the project for the sale of physicochemical analyzes requires the entry of a certain number of annual samples to become viable and profitable. Regarding this, if the case arises in which the Antioquia liquor factory goes from being subordinate to the Secretary of the Treasury of the Antioquia governorate to becoming an industrial and commercial company of the state, a median of 7062 annual samples (32% of the total predicted for each year) for which the same analysis patterns applied that were determined for those that come from the different areas within the FLA.

If the category or regime of a private applies, implies that the input of a median of 7724 annual samples must be submitted (35% of the total estimated for each year). The little information makes it difficult to reliably determine the potential demand and, therefore, the decision on the implementation of the project must consider a certain degree of uncertainty regarding the results obtained.