1. Introduction

This article is the outcome of a research, whose roots were oriented to the criticism of the traditional teaching-learning processes within accounting, based on the mechanistic and traditional paradigm, which is characterized by a particularization: “Perceiving man as a machine composed of divisible parts, maintaining the Newtonian absolute truth, causing social discomfort and preventing a forced reading of the organic and integral totality of some phenomena” (Céspedes, 2013, p. 44).

As a consequence of the above, it is alluded to the seduction of the training of the student of Public Accounting by the methods of a Cartesian notion, when, on the contrary, an ethical, humanistic, and transforming accounting subject is required. Therefore, it is noted a priori that “one of the problems that mark the epistemological development of the accounting discipline is the need to expand its object of study to include the representation of the social phenomenon” (Ortiz, 2010, p. 241).

Now, it is pertinent to specify the convenience of the positivist approach to accounting research, and the historical participation of the orthodox current in the establishment of theories and guides for action and educational praxis in accounting. However, the hegemony of financial accounting as a focus of attention has represented a configuration of utilitarian visions that strengthen the instrumentalization of the accounting profession.

As a result of these assumptions based on the history of accounting, it is possible to approach the understanding of its current teaching, study, and praxis. Accordingly, some judgments have been presented by researchers, academics, and other professionals who raise criticism, from their radical notions; for example, Franco (2014) mentions the following:

A major issue in the evolution of accounting thought consists in the reductionism of knowing by islands; a rigorous construction of accounting as an object of knowledge has not been possible; on the contrary, several segments have been taken in that direction (p. 172).

Based on the above, this article takes up the problems of fragmentation and aims at generating proposals and elements for the formation of an integral accounting professional, as well as his or her different life tasks, who embrace the social sciences to understand the problems, transformations, antinomies, and contradictions of his or her personal and professional environment.

This is why the article uses as its primary theoretical structure the bases of complex thinking (transversally), which in terms of Morin (2004) is “much more a logical notion than a quantitative notion. It has of course many quantitative supports and characters that effectively challenge the modes of calculation, but it is a notion of another kind. It is a notion to be explored, to be defined” (p. 2).

When detailing the intention of the work, it should be noted that it arises from the need to approach research from latent processes that have been little addressed and require to be interpreted in the academy and organizations. Therefore, the allusion to the complex as the central axis of this text is based on an imperative that, added to the background of the subject to be developed, allows establishing a course of action supported by the contributions and research references, together with their theoretical and epistemic tensions.

This is how complex thinking is promoted and explained based on a premise: “At the heart of the complexity paradigm is the problem of the insufficiency and necessity of logic, of the “dialectical” or dialogic confrontation of contradiction” (Morin, 2004, p. 9). This opens the way to an urgent reflection for the accounting community, offering elements to confront functional logic and reconstruct new scenarios where technique responds to collective economic projects and the general interest.

In this way, findings resulting from fieldwork whose content includes a documentary review and semi-structured interviews, which are appropriate for qualitative research, are revealed; demonstrating the ability that social sciences have had to influence the training of public accountants. It also shows the capacity to work from complex thinking in Colombia and the development of academic proposals that on several occasions have transcended to praxis, or in some cases are limited to continue feeding the accounting theory.

In summary, this research, whose main objective is to explain the incidence of social sciences in accounting, conceiving the contributions of complexity in the integral formation of the public accountant, is developed. To this end, the first specific objective is to study complex thinking and its different contributions from a historical and critical perspective. Next, it seeks to analyze the current incidence of social sciences in the education of the public accountant and its current state in the accounting praxis. And finally, the paper explains the influence of the complexity paradigm in comprehensive accounting education, through the inclusion of social sciences in accounting.

At the same time, the research methodology is detailed, in which the type of study carried out, the data collection techniques and the primary and secondary sources are related. Subsequently, the results are detailed, presented in chapters where their significance is explained; exposing the main projects involving social disciplines and practical cases that, in addition to their representative value for accounting theorization, are influenced by the essence of complex thinking.

Finally, elements that seek to provoke thought through reflections and recommendations derived from the text are presented. Here we synthesize how the complexity paradigm, in support of the social sciences, is decisive for the reconstruction of personal, social, and organizational projects through actions that humanize the professional practice of the public accountant, and we invite to deepen the research line.

2. Theoretical approaches

2.1. Accounting from complex approaches and its relationship with the social sciences

This section will begin by mentioning the so-called multipurpose accounting, which has been tried to be configured within the framework of financial accounting and, particularly, in the language that has embodied hegemonic accounting thinking. This expression responds to an equality of criteria for the initial measurement where tax provisions converge with international accounting regulations.

The allusion refers to normative remission to grant effectiveness to a legal relationship arising under the rules of another legal system, having the law an essential link to interpret the notions and causes of the above. However, even when the legislation takes certain elements from the International Financial Reporting Standards, and even refers to the cost for the mentioned case, the category of multipurpose accounting in its epistemological, theoretical, and methodological conception is questionable.

Now, the category, branch, or any semantic classification of multipurpose accounting was mentioned to question the domain of multipurpose accounting in the accounting framework. When the term “multipurpose” is used or similar expressions are included in the discourse, reference is made to various ways in which the accounting task can manifest its language, for example, measurement. However, when the actual context is examined, only the tax provision and international accounting standards can be broken down as expressions of a purpose that claims to be multipurpose but includes only two branches of accounting.

In contrast to the multipurpose accounting proposal, whose advance in the instrumental dimension should not be overlooked, a normative and immanent critique is based on models and proposals where transdisciplinary relations are promoted, with the Brazilian Antônio Lópes de Sá, which gives rise to a Latin American school known as neo-patrimonialism with an advanced approach to accounting relations in terms of logic; the Argentine Carlos García Casella, who subjected Richard Mattessich’s “basic assumptions” to a process of criticism and analyzed the problems relationally and in the form of theoretical reconstruction.

In addition, contributions with and from the sciences are highlighted at the national level, with such works being championed by public accountants such as Rafael Franco, Mauricio Gómez, Gabriel Rueda, William Rojas, Marco Machado, Héctor Sarmiento, among others, in addition to the aforementioned pioneer Jack Araujo. Among the research mentioned, it is worth mentioning the work Contabilidad integral, in which Franco (1998) addresses the proposal of a single structure that simultaneously handles information on planning, budget, and facts, focused on the financial area, but with a complex application in time perspective; that is to say, advancing the look to the past of financial accounting.

From the integrality addressed in the above-mentioned work and its relationship with the complex, the essence of complexity is clarified, under a premise: “Good science -as in fact also good philosophy- does not start from definitions nor does it work with them. If anything, it arrives at definitions. Good science works with problems” (Maldonado and Gómez, 2010, p. 12). However, the starting point is a conception of Morin (1996) who defines:

“Complexity is a fabric (complexus: that which is woven together) of heterogeneous constituents inseparably associated: it presents the paradox of the one and the multiple. The fabric of events, actions, interactions, retroactions, determinations, and randomness constitute our phenomenal world” (p. 17).

Viguri (2019), on his side, conceives complexity as a way of analyzing reality from a theory proper to nature and its phenomena: non-linearity. And by that precept, he perceives it as immersed in the phenomenon and not as a response to a quality of reality estimated in itself.

Beginning to understand the complexity paradigm, the articulation of accounting with the social sciences is facilitated, from a complex approach; for which Rojas (2007) indicates that incorporating these sciences into a public accounting program promotes reasoning, the construction of theories and methods that humanize social relations; as well as the relationship of human beings with nature. This, of course, requires a link or a series of links that contemplate the dialogic relationship between accounting and those disciplinary fields, transcending linear logic.

3. Methodology

This work was conducted under a descriptive-reflective qualitative approach because it “aims to conceptualize reality, based on the information obtained from the population or the people studied” (Bernal, 2010, p. 60). Its design is framed in hermeneutic research with a horizon of critical understanding, in which “phenomena are subjected to intertextuality processes” (Alonso, 2017, p. 44).

Regarding the first instrument applied, semi-structured interviews were conducted with teachers, researchers, and specialists recognized for their theoretical and/or practical development of the subject at the national level, in person and others supported by technological means; chosen through the convenience sampling modality classified in the category of non-probabilistic sampling, as shown in Table 1.

Table 1 Thematic and/or practical experts

| Categories | Expert interviewed |

|---|---|

| Complexity in accounting; social sciences; Comprehensive accounting; Accounting; Accountics. | Expert 1 |

| Complex thinking; Critical accounting; Social sciences in accounting. | Expert 2 |

| Social sciences; Social theory and accounting; Popular accounting. | Expert 3 |

| Social sciences, Critical theory; Sociology, and accounting. | Expert 4 |

| Administrative and management sciences; Accounting Research, Accounting Education. | Expert 5 |

| Popular accounting; Accounting theory and praxis; Social sciences in accounting; Popular Education. | Expert 6 |

Source: Authors’ own elaboration.

Subsequently, audio recordings were requested to document the information obtained in these interviews for their respective transition and analysis, to meet the objectives of this work. Likewise, recordings of academic spaces were requested, such as national congresses, accounting interdisciplinary seminars, and academic forums, which served as support to expand the projected academic contributions.

For the management and analysis of the information obtained, analysis tables were required, composed of approaches, theoretical categories, findings, and gaps, which allowed interpreting the results related to social science research in accounting and the theoretical-practical tools immersed in complex thinking from the accounting discipline.

The work required primary information sources, defined according to Bernal (2010) as first-hand information from the source that originates the events or phenomena. It is worth mentioning here the experts interviewed in the field and the environments or scenarios of debate and knowledge generation analyzed. Secondary sources of information were also valid, due to their usefulness in providing legitimacy to the information found. These include specialized and interdisciplinary journals, printed books, master and doctoral theses related to the subject of social sciences (in a broad sense and relation to accounting) and complex thinking, and other similar documents.

4. Results

First of all, the existence of a broad trajectory of linkage between social sciences, accounting research, and projects oriented to complex schemes of measurement, representation, and disclosure is highlighted. Based on the discoveries made and in support of the meetings and interviews with the professionals mentioned above, the main findings classified in the following sections will be presented.

4.1. Complexity. Contextual approaches

It is indicated that systemic approaches and accounting models immersed in complex programs cannot be disassociated from modernity, since the appearance of these theories emerges in modernity. Hence, complex thinking was used, and not strictly speaking the sciences of complexity, since the latter use the same canons of Cartesianism: fixing frameworks, concepts, categories, etc.

All this is refuted by complex thinking, since this - as the expert explains 2- “is a way of approaching the fields of knowledge, of unfolding them, making them evident, showing the second order categories; which generates in accounting, a universe of possibilities, alternative scenarios” (Personal communication, February 4, 2021).

Having specified the links of complexity with scientific knowledge and its expressions, a series of precepts of the latter were considered within the framework of accounting research and training. Thus, it is thought of as an alternative that is still bounded by mechanistic concepts and judgments, as expressed by Expert 2:

The Cartesian perspective is predominant, both in accounting theory and accounting praxis, which has to do with the role it has played in modernity and Cartesian thought (as the maximum expression of modernity). It should then be considered that the definition of systems is a product of modernity (Personal communication, February 4, 2021).

In this sense, the preliminary association between the sciences of complexity with the natural sciences and the predominance of the latter over the so-called soft sciences is understandable, an aspect that has been summarized in a lapidary way: “The bulk of science -in a broad sense- that is taught and worked in the country is normal science in the Kunhian sense of the word” (Maldonado, 2005;4 p. 2).

Subsequently, the complex went from the exclusive power of the hard sciences to encompass other domains such as the social sciences, under a precept: “Any claim to the monopoly of science is, for that very reason, unscientific” (Morin, 1996, p. 49). Despite the above, the social sciences have affirmed their adherence since their beginnings to what is proclaimed by complex thinking; however, the legacy and imposition of the classical or hard sciences had a significant influence on their procedure.

Accordingly, in The Epistemology of Complexity it is formulated: “The tragedy of the human sciences and the social sciences especially, is that wanting to base its scientificity on the natural sciences, it found simplifying and mutilating principles in which it was impossible to conceive being” (Morin, 2004, p. 8). As noted, complex thinking provided epistemological and methodical elements to open up the social sciences, in terms of the Gulbenkian Commission, and to break schemes historically distinguished by pragmatic work, as in the case of finance, administration, and accounting, which will be shown in the following sections.

4.2. How do social sciences affect accounting?

Regarding social studies in accounting, the inclusion of social sciences in the curriculum was found to comply with requirements or even as forced academic initiatives; that is, without resorting to the dialogue of knowledge, understanding the implicit dialogic meaning of the term.

On the other hand, discordance was found in the relationship between the social sciences and accounting. In this regard, expert 2 (Personal communication, 2021) expresses the following: “Some perspectives take from the social sciences but extrapolate categories on accounting; so that these fields of knowledge are superimposed on the epistemological and methodological contributions of accounting”.

To illustrate the above, some contributions will be listed, to analyze their approach, contrast the findings, and evaluate the practical significance of such proposals, several of which emerged as formative research and were consolidated over time, through mechanisms of action adjusted and nurtured with the new challenges demanded by the historical moment and the evolution of accounting (Table 2).

Table 2 Social science-accounting linkage

| Social Science | The effect of interaction with accounting |

|---|---|

| Anthropology | It offers the possibility of understanding cultural phenomena, their recognition, and their significance in the territories. It also allows advancing towards an instrumental dimension from the area in question: “Measurement, valuation, and control of cultural goods and products: tangible and intangible cultural heritage” (Arias, 2014, p. 75). |

| Political Science | Muñoz & Sarmiento (2010) comment on the importance of these sciences to think about power relations within the framework of ideological conflicts immersed in accounting systems and to build a political project per territorial needs and the bases of accounting in terms of social justice. |

| Management Sciences | They facilitate the understanding of the organizational and behavioral improvement of the rationally organized subject, with the help of decision-making processes in complex environments: the entity is perceived as a systemic unit. |

| Law | It allows the legal and normative frameworks to be discerned. The relationship between these two disciplines opens up a range of possibilities that cut across economic, tax, corporate, etc. fields. |

| Law-Sociology | They prepare for the understanding of legal matters; an issue that has repercussions in the professional field of the public accountant. |

| Sociology | “It orients the participation of the accounting subject in a reality that transforms and intervenes while studying it” (Expert 2, Personal communication, February 4, 2021). |

| Sociology- History | “It gives a glimpse of the sociohistorical relationships surrounding a subject interconnected with his or her community” (Expert 4, Personal communication, December 3, 2021). |

| History | It helps to understand the evolution of accounting in a contextual sense as opposed to ahistorical and universalizable models. |

| History-Economy | It provides tools to understand the technical relationships between production and distribution. |

| Economy | According to Arias (2014), economics provides accounting with elements to understand wealth, resources, and the relationships that are forged around it. |

Source: Authors’ own elaboration.

Table 2 lists some of the social disciplines that have created links with accounting, generating added value for academia and professional practice: “To form a critical spirit that allows deconstructing and proposing new theories and techniques to produce accounting, financial and social information capable of replacing the reifying representations of the economic world” (Rojas, 2007, p. 17).

Concerning the above, some researchers were strengthening specific fields or developing other academic lines linked to a specific social discipline. Thus, for example, anthropology was postulated, as shown in Table 2, and ethnography was incorporated with its techniques and procedures to understand the culture of the “other” and to derive some methodical suggestions as described below (Table 3).

Table 3 Anthropology and accounting

| Guiding text | Authors | Referral/Proposal |

|---|---|---|

| An attempt to reconstruct the accounting of the Makuna shaman who inhabits the jungles of Vaupés in the Colombian Amazon | Fuentes & Peña (2016) | Accounting ethnology with a fixed objective: “The accounting culture and its measurement processes of a society in a social-historical context” (Fuentes & Peña, 2016, p. 293) |

| Measuring the cultural heritage: a challenge for accounting | Del Socorro, Castillo, & Villareal (2009) | Cultural accounting is oriented to the valuation of heritage employing alternative indicators and models that arise from the historiographic context. |

| Some relationships between accounting and culture | Ocampo, Rodríguez, & Gómez (2008) | Understanding culture from the critical perspective of accounting. Ocampo, Rodríguez, & Gómez (2008) allude to an interaction of accounting with other disciplines, where anthropology serves as a basis to forge paths detached from the Western vision of accounting and financial logic as the core. |

Source: Authors’ own elaboration.

Another feature of the incorporation of social sciences into accounting education was reflected in specialties of one or several disciplines, as is the case of social accounting, where Araujo (1995) proposes social balance sheets to be accountable to the community, after making a historical review of the attempts to build a corporate social responsibility, marked by limits that define how far to be socially responsible: the company, society, the environment.

A similar thing happens when cost and administrative accounting are consolidated, having as support the management sciences, whose transformations have allowed the transition from an orthodox vision to developments sprouted within the framework of heterodox currents, taking as an example Duque (2016) who stipulates the critical theory and the theory of systems for a systematization of experiences regarding a space of analysis of cost systems. In this regard, expert 5 states:

There is a need for academic initiatives driven by an accounting subject that reasons from systemic thinking and critical thinking, around projects that not only involve socio-environmental accounting, but also finance, management, or costs. (Personal communication, February 12, 2022).

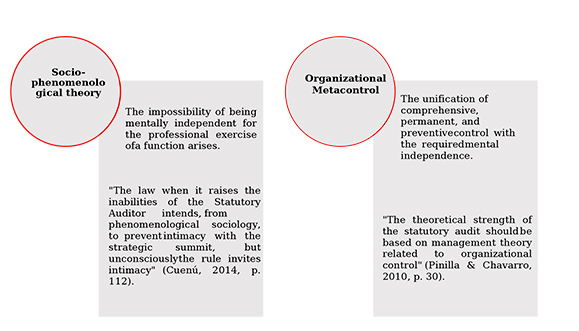

At the same time, studies were found on statutory auditing from the sociological field, having as a reference the socio-phenomenological theory; or under administrative theories (as opposed to the assertions of its legal nature) with organizational meta- control as the central axis; an issue that helps to transcend the notion of comprehensive auditing as a practice analogous to statutory auditing (Figure 1).

As an example, the statutory audit was brought up, whose epistemic dispute does not only lie in the duality of the juridical-legal and administrative sphere but is approached from a sociological perspective, as summarized in Figure 1. It is emphasized that sociology has created relations with accounting, with a long trajectory that has influenced the social dimension and accounting research. In this regard, expert 4 states the following:

“Sociology enables the conception of accounting as a social construction, provides elements to understand its historical development, the way it is understood and used according to different interests and moments, and the intentionality of its regulation” (Personal communication, November 3, 2021).

Nevertheless, the accounting classification, in terms of lines or subjects as the case may be, is insufficient for a comprehensive understanding. Concerning this, the incorporation of subjects in the curricula from a functionalist perspective was evidenced. For example, the inclusion of sociology or history with an ahistorical perception; leads to the study of data without the critical analysis of accounting and what it has represented for cultures and societies over time, so Rojas and Giraldo (2015) warn about the danger of using social sciences to make up the curriculum design, or in more infamous cases, for manipulation in favor of single thinking and the instrumentalization of knowledge.

Under this perspective and based on the concurrence of complex interactions and interdependencies, expert 2 focuses on the expectations and socio-historical motivations of the subject, emphasizing accounting education:

The social sciences are not to change accounting, but our view of it. In the curriculum, they should not aim at enriching accounting, but at the cognitive subject that transforms reality when it is studied, and that is the way accounting does change. (Personal Communication, 2022).

Similarly, reference is again made to a process that disputes with order and adds new ways of thinking and skills that attend to their social environment, but also to their vision of the profession, consolidating a proposal of the author already cited, in further research along with other authors: “Instead of emphasizing a unitary logic of transitional efficiency, students will understand that accounting should use a causal analysis in a historical context” (Rojas and Giraldo, 2015, p. 268).

4.1.1. Accountics, a proposal under construction.

Regarding integral accounting, mentioned in previous lines, it should be noted that it is still under construction and, likewise, its derivations. Even so, it maintains continuity in the generation of debates and academic-research proposals. In this regard, expert 1 comments:

The need to stop perceiving accounting on a single basis of measurement is raised and the term accountics is incorporated, which addresses the ontological problem, giving foundation to the concept of community from the accounting point of view. It is perhaps the most advanced form of complex accounting thinking in Colombia (Personal communication, March 27, 2021).

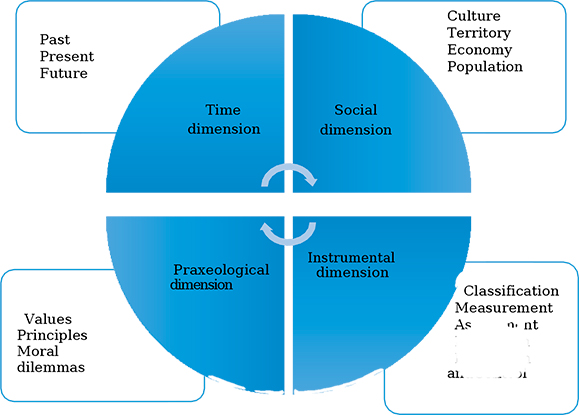

To predict or even account for socioeconomic phenomena, the use of representations built based on reality and not on forced models is unavoidable. In this sense, accounting takes from economics, sociology, and law some elements for the development of its social dimension. A multidisciplinary connection is required to address culture, territory, economy, and society in accounting disclosures, whose connotation transcends the compendium of classic financial reports (Figure 2).

Additionally, hermeneutics is contemplated, in association with economics and accounting, to embrace the instrumental dimension and reformulate it through its classificatory, measurement, and valuation processes; as well as the contemplation of law and management sciences for the field of disclosure and control, perceived from the Latin school of regulation.

The praxeological dimension of accounting is approached to analyze the forms of decision and influence of the accountant under the conception of accounting as a moral discipline. And finally, as a transversal factor to the other components, the perception of past, present, and future time is required. Therefore, history is seen to analyze the evolution of accounting in a socio-historical understanding and to promote interpretation and decision-making in a contextual sense, rather than in a chronological notion.

Similarly, Rueda (2010) proposes interdisciplinary research that starts from a critical study of the international accounting technique and regulation, to unveil the current state of accounting and associate it with other disciplines that facilitate the development of programs susceptible of being included in the political agenda and that contribute to social equity. In addition, some authors express: “We believe that this positioning in the three dimensions mentioned (ontology, epistemology, and methodology) and the commitment to an open social science are the hallmarks of accounting heterodoxy” (Gómez and Ospina, 2009, p. 31).

It is worth adding that, as a function of complex thinking, integral proposals have been developed that integrate ecological and environmental variables, as is the case of three-dimensional accounting, which for the subject are not dealt with, but it is relevant to mention due to the capacity to rethink the instrumental dimensions.

4.1.2. Popular Accounting. A theoretical-practical approach with socio- political projection.

In terms similar to the aforementioned authors, Céspedes (2013) alludes to the conflict to quantify the qualitative, about the incorporation of intangibles in accounting reports and suggests in contrast the relevance of a collective debate of a qualitative order that addresses such elements. In agreement with the author, popular accounting emerges as one of the recent ways to evolve in accounting practice.

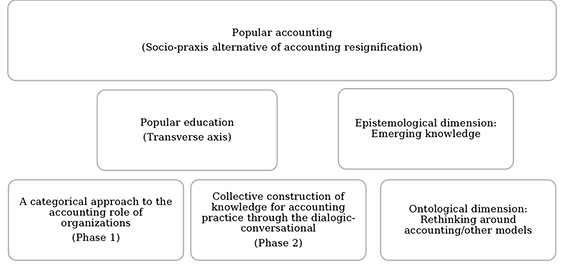

The foundations of popular accounting are fostered by popular education: “It is a pedagogical-political and social practice that seeks to resignify the knowledge and accounting practices that organizations develop to respond to their needs and generate the conditions for the emergence of other accounting practices located with the organizations” (Gallón et al., 2020, p. 38). In this regard, expert 3 comments on the subject:

“In addition to pedagogy, other social disciplines are required, more for the elements they provide than for their frameworks and categories. For example, anthropology to understand the worldview of organizations that, because of their social or political projection, think themselves about their environment from other points of view and socially construct alternative accounting practices from the popular”. (Personal Communication, 2021).

One of the challenges contemplated from the first phase of the Popular Accounting project involved the articulation between academia and organizational action with the foundations of the dialogic-conversational; where the role of the target population to be studied becomes transforming and, to that extent, required the appropriation of theoretical-practical tools by the members of the organizations, and not only by the researchers and professionals of Public Accounting.

Therefore, social sciences are incorporated, such as the ones described in the results, and other disciplines related to the business sector: “Economics and management sciences allow reasoning about production relations and the various phases in which accounting intervenes: the budgetary, administrative and control areas and the capacity to strengthen the self-management of the entity” (Expert 6, Personal communication, 2021).

In addition, complex thinking is reaffirmed in the framework of popular accounting due to the domain of its object; that is, the existence of several possibilities of content, and not a strictly delimited one, in addition to the notion of cognitive individual that it proposes: “To respond to the praxis and agency of the subjects, which implies their protagonism in the process of thinking, reflecting critically and recreating accounting practices” (Gallón et al., 2020, p. 42). Based on this, a scheme that synthesizes the phases and dimensions of the indicated project is provided.

Thus, in the Popular Accounting project (Figure 3), the entity, and the practices themselves are thought from the complex, presenting a difference with accountics: the non- assimilation of models (contametric in this case) to execute the proposals of resignification of accounting in theoretical and procedural terms, which does not represent conditioning to give validity to accounting; rather, it generates other options for disclosure in its reports.

5. Discussions

As a consequence of the results found through the respective instruments, the need to reason about how the social sciences responded to specialized needs as individual disciplines are pointed out, which motivates a discussion regarding the problem of a specialization that, in search of determined elements to study, neglects the harmonious reality of the environment. This can be seen in the analytical method of The Archaeology of Knowledge, where, according to Foucault (2002), the disciplines establish a control system that conditions the discursive through adherence to identity rules and a task framed in a range of actions.

With what has been expressed up to this point, the complex but necessary incorporation of social sciences for the interpretation of socioeconomic facts from an integral perspective is exposed, which, for accounting, Rojas (2007) calls: “to contribute to the development of an instrument for recording and interpreting business activities that are more in line with the harmony between the entities that make up the world” (p. 13).

It is not a matter of breaking the disciplinary condition in which the social sciences are presented, an issue that would merit a more profound discussion supported by both research and practice, but of knowing how to include, take advantage of, and articulate knowledge, understanding that the notion of knowledge is propitious when integrality in knowledge is sought; for which reason, in addition to inter- and multidisciplinarity, it is suggested to speak of dialogue of knowledge.

The above indication is made clear to face the dangers of the dissociation that disciplines run and, among them, accounting when in its joint operation with one or several social sciences it is the object of the legislation and of a specialization mainly determined by the institutional framework and by interest groups.

Thus, it is imperative the incidence of social sciences in accounting education to “help students to be able to read, think and act distantly from the principles that govern the dominant instrumental productive rationality” (Rojas, 2007, p. 9). Therefore, Rueda (2010) suggests an accounting for deliberative democracy that demands the disclosure of information with a social, financial and economic function by entities capable of contributing to the development of their country and their social environment; an approach that, supported by models built with social disciplines and based on alternative thinking schemes, seeks to break the linear mechanics that not only guides knowledge but also the physiognomy and operability of organizations.

6. Conclusions

By way of conclusion, it is mentioned that the mastery of complexity can mark for the practice of the accounting profession, a competitive advantage traced by broad thinking schemes that facilitate the development of skills and competencies to meet the demands that afflict organizations and society itself. Even so, the public accountant requires the theory and the technical and scientific knowledge that allows him/her to understand the financial and social environment of the entities where he/she operates, recognizing in this process, the subject as an actor gifted to change the circumstances that surround the companies, the society and the environment.

Secondly, and by the incidence of social sciences, it is concluded that some of their references can be articulated from accounting, allowing not only to take criteria or tools from the other sciences, but to generate a dialogic act that leads to form the future professional in a multidisciplinary sense, able to contribute to the socioeconomic problems from that same way; so that the accounting professional can think in a complex way, and not a standardized guideline to follow uncritically, the accounting processes and the society itself.

Although the social sciences broaden the field to “humanize” the profession or extend its object, the predominance of financial logic continues, while the purpose is to conquer a conception of accounting that includes social and symbolic criteria. However, even with the conditions and limitations expressed in their participation, they establish the opening to another panorama, to the point of thinking in a Foucauldian sense, in a different accounting.

It should be noted that the present proposal demands a transformation of praxis through the construction, which means focusing theory on practical dynamism in the fields where accounting may have a place. In this order of thought, the possible difficulties involved in a nascent action of the critical perspective are expressed, when there is a legal framework that covers organizations and guides the way of operating in accounting; therefore, it is suggested to continue strengthening the subject and explore different aspects that invigorate the research spectrum from a specific social science, in connection with accounting, or from scenarios that have demanded to think accounting under critical and alternative models.