1. Introduction

In the financial sphere, technology has made it possible to generate notable innovations in financial products and services with the aim of making them faster, more efficient and safer for users. One of the most significant advances dates back to 2008, when the so-called cryptocurrencies were issued for the first time with a view to positioning themselves as a virtual means of payment that transcends geographical limits and borders.

Recently, in an environment of the COVID - 19 pandemic and with marked economic and financial difficulties in the world context, relevant changes are perceived in people’s consumption habits and preferences, the same happens in the financial markets; in response to the high degree of volatility of the stock markets, investors explored new alternatives to invest and diversify their financial resources, in such a way that risk is deconcentrated.

In honor of its performance and trajectory, Bitcoin is recognized by experts as the queen of cryptocurrencies, a denomination that gives it a certain degree of confidence and preference over other cryptocurrencies. However, the use of Bitcoin is influenced by some factors, such as the lack of interest in exploring and learning about new technologies, the paradigm that transactions should be carried out only with paper money and the idea that the risk of monetary loss is “directly immersed” in any virtual transaction; this last element should be considered by every investor, and as far as possible, should be minimized.

Let us also note that, in the case of Bitcoin investments, what is considered “risk” for investors is considered “opportunity” for cybercriminals to obtain quick and easy money; based on the above, the following research question is defined for this study: Is the cryptocurrency Bitcoin (BTC) cryptocurrency vulnerable?

In this regard, in Spain (2020), Rivas, Sanchez and Ruiz conducted a study entitled: “Bitcoin Futures: Aspects to consider in their valuation before a possible creation of a European market”, which was published in the European University Journal of the EAE Business School. In general terms, taking as a starting point the development of the Bitcoin futures market in the USA, this study examines a different approach to the valuation of Bitcoin futures and analyzes the creation of a market for this asset in Europe.

Similarly, in Spain, Mata González (2018) from the University of Valencia prepared a Research paper, for a Master’s Degree in Banking and Quantitative Finance, called: “Does Bitcoin work financially?”, in which the peculiarities of the most famous and important cryptocurrency worldwide, the Bitcoin, were studied with respect to the Theory of Market Efficiency.

Likewise, in Stockholm - Sweden (2017), the thesis called “Improving the Security and Efficiency of Blockchain - based Cryptocurrencies” analyzes the double spending of Bitcoin, since, given the acceleration of its adoption in society, digital currencies are vulnerable to being spent more than once; this is called a double spending attack. In that context, to prevent double-spending attacks and thus enable fast transaction confirmations, it is proposed to use Trusted Execution Enviroments (TEE) security guarantees.

For the purposes of the development of this study, the general objective was defined as: “To analyze the cryptography of the Bitcoin virtual currency to determine the risk of computer vulnerability in the investment”; the specific objectives are:

Describe the investment process in the Bitcoin cryptocurrency.

Study the cryptography of the Bitcoin virtual currency.

Interpret the Bitcoin virtual currency transaction system.

Categorize the malicious transactions executed in the Bitcoin network.

Design an investment scheme that allows the investor to operate with Bitcoin safely.

The research “Analysis of the cryptography of the virtual currency Bitcoin to minimize the risk of computer vulnerability in the investment” is carried out with the purpose of contributing to the authentic knowledge in relation to the investment in the cryptocurrency Bitcoin; thus, it is intended to make available the results so that these are incorporated in the areas of knowledge corresponding to the social, economic and financial sciences. In such a way that, it contributes to increase the confidence of citizens in Bitcoin; since, if the citizen understands how this cryptocurrency works, he/she will make prudent and methodical investment decisions.

2. Theoretical Framework

2.1. Money

From birth and throughout their lives, absolutely all human beings experience a series of needs that need to be satisfied for their subsistence, growth and development. Nowadays, the satisfiers of needs are obtained by giving a certain amount of money in exchange for that which satisfies human needs. In this sense, human beings develop a series of activities whose physical or intellectual effort is rewarded with: money.

Money Works as:

Payment medium

Some economists such as Parkin (2018) consider money to have the function of a means of payment, a function that consists of “a method of settling a debt. When a payment has been made, there is no outstanding obligation between the parties to a transaction” (p. 628). This function makes effective the “precautionary” motive of demand for money, since, in order to settle or cancel their doubts, people need to possess money.

Exchange method

According to Parking (2018, p. 628), “A medium of exchange is an object that is generally accepted in exchange for goods and services. Without a medium of exchange, it would be necessary to trade goods and services directly for other goods and services; this exchange is called: barter”, then, one of the main functions of money is to serve as a means to make purchases and sales, thus solving the existence of double coincidence that barter brought with it; as stated by Mochón (2012, p. 364-365): “with money it is not necessary for a seller of video games to find a buyer who, in addition to wanting to buy a video game, sells in turn something that interests him, for example, a book”.

A unit of account

Money also has the function of being a unit of account, which is understood as “an agreed-upon measure for setting prices of goods and services” (Parkin, 2018, p. 628). To efficiently execute their budget, people should analyze eating an extra slice of pizza has the value of the opportunity cost it represents.

A store of value

Using the words of Mankiw (2013, p. 148): “money allows transferring purchasing power from the present to the future”, that is, money exercising the function of a store of value allows people to preserve their wealth over time to be able to use it when necessary, at this point it is appropriate to note that: “money is not a perfect store of value, because if prices increase, its purchasing power may change” (Graue Russek, 2014, p. 524); the latter implies that if in the future prices rise, it will not be possible to buy and/or sell the same amount of products as today. 524); the latter implies that if in the future prices rise, it will not be possible to buy and/or sell the same number of products as at present.

2.2. Bitcoin

Companies offer products that meet the needs experienced by customers, but the immense number of competitors in the various markets forces companies to assume “innovation” as a strategy for success: the same happens in the financial field, the adoption of technology has brought significant advances in terms of accessibility. If we look at money, since its beginnings and as time goes by it has sought to provide greater facilities to people, now the trend is to exchange value using digital money or cryptocurrencies.

Bitcoin is the digital currency born of technological innovation, a true gift to the world! Clearly, Bitcoin transforms paper money into digital based on the trust of the web and computers distributed across the planet. “Bitcoin could be a miracle worker in microeconomics and it could be a macroeconomic wrecking ball,” as Lateral Economics General Manager Gruen (2015) puts it.

Bitcoin is a digital file whose copy is kept stored on each computer that makes up the Bitcoin network; whoever is interested in owning Bitcoin “does not have to keep a ledger (...), these are for people who want to help maintain the system” (Driscoll, 2013).

The value of Bitcoin is recognized only in the virtual world, but not in the physical world, because, as it happens with fiat money, as Nakamoto (2008, p. 1) points out: “although the system works well enough in most transactions, it suffers from the inherent weakness of the trust-based model”, that is, Bitcoin has value because there are people who “trust” in its value, therefore, there are people willing to exchange real goods and services with Bitcoin.

To transfer Bitcoin, the owner informs the network that the amount in his account must decrease and the amount in the recipient’s account must increase; simultaneously, the nodes or computers in the Bitcoin network attach a copy of the transaction to the ledger to subsequently pass the transaction to other nodes (Driscoll, 2013).

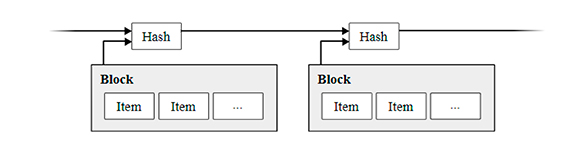

The Bitcoin network orders transactions by placing them in groups called “blocks”, the blocks in turn are joined in a block chain. According to Scott Driscoll (2013): “Each block has a reference to the previous block and this is what places one block after another in time “, it should be clarified that only those transactions that were confirmed are placed in the blocks.

To decide the continuity and order of recording transactions, each valid block must contain the answer to a very special mathematical problem, in which computers scattered around the world run the entire text of a block plus an additional random guess through a cryptographic hash (Driscoll, 2013).

The cryptographic hash function used by Bitcoin is SHA256 and is responsible for creating a short digest from any arbitrary text length; this task is performed by miners. With reference to mining, running mining with thousands of computers does not determine the possibility of being the first to solve a block, this would only be possible if you have control of half of the total computing power in the entire network, this would imply having a 50% chance of solving a block before someone else and a high probability of winning several blocks in a row faster (Tapscott, 2016, p. 37).

Then, transactions on the blockchain are protected by a mathematical race, which pits an attacker against the rest of the network. An attacker would have to outpace the network for longer to perform a double-spend attack and replace a block. Therefore, the system is only vulnerable to a double-spend attack near the end of the chain, so it is recommended to wait several blocks before considering money received definitively Nakamoto (2014).

In this sense, to breach the Bitcoin network is practically impossible; on the one hand, it requires having control of at least 50% of the computers scattered around the world that validate the transactions and order the blocks; on the other hand, it requires a great economic effort consumed in electrical energy and personnel, the results will not be optimal if compared with the results of making investments with Bitcoin.

2.3. Investing in Bitcoin

It is essential to know those basic resources for investing in Bitcoin, according to Ast (2017):

Media

CoinDesk is the longest running media outlet in the crypto industry. They are the organizers of Consensus, held every year in New York, the most important blockchain conference in the world. CoinDesk is the longest running media outlet in the crypto industry. They are the organizers of Consensus, held every year in New York, the most important blockchain conference in the world.

The Defiant is a media created by journalist Camila Russo, mainly focused on news about DeFi and the Ethereum ecosystem.

TheBlock is another major news site on DeFi and more general crypto topics.

Bitcoin Magazine is an excellent source for in-depth articles about the blockchain industry.

BraveNewCoin is highly recommended as a source of information for cryptoasset investors.

Rekt News, a site specializing in DeFi scam investigations.

Within the Spanish-language ecosystem, the most important news sources are “Cripto Noticias”, “Observatorio Blockchain”, “Diario Bitcoin” and “Cripto 24/7”.

To find market data, CoinGecko and CoinMarketCap offer real-time prices and trading volumes for all cryptocurrencies on the market. Also, CryptoCompare allows you to download trading data, volumes and technical indicators for a wide variety of cryptocurrencies.

3. Theoretical Development

After having carried out the data collection under the qualitative approach, on the one hand, with a non-probabilistic sampling using snowball and convenience sampling criteria. Having as study universe three populations with their respective sample sizes: 2 Cryptocurrency Traders with a trajectory between 1 and 3 years; 2 Cryptocurrency Traders with a trajectory between 4 and 7 years; 2 Cryptocurrency Traders with a trajectory between 8 and 11 years.

On the other hand, a review of existing documents on the Bitcoin Cryptocurrency and its cryptography was performed, thus, information is obtained from: “Bitcoin: a peer-to-peer electronic cash system (White Paper)” (Nakamoto, 2008), “Satoshi’s Book” (Champagne, 2014) and “The Blockchain Revolution” (Tapscott, 2016).

The data were organized through coding and in chronological order it is possible to perform an analysis that derives from the relationship of the data collected. For a better interpretation, the analyses are accompanied by causal diagrams, relating those themes that are the cause of others.

3.1. Secure transactions when accessing Bitcoin

The Bitcoin market is extremely volatile; in this sense, whoever is interested in entering the market must be clear that the probability of obtaining profits on the investment is equal to the probability of losing the invested amount. In a context of high volatility, it is in the investor’s best interest to make smart investment decisions that will result in an economically successful investment. However, as we can see in the Figure 1 and Figure 2, making smart decisions requires the investor to have a solid foundation in: Financial Education, Macroeconomics, Financial Mathematics and Blockchain, in this way it will be possible to establish their objectives through an Investment Plan, perform and interpret the Analysis: Fundamental, Technical and On Chain as seen in the Figure 3 and Figure 4.

If market conditions prove to be attractive and, therefore, the investor must make immediate investment decisions, it is essential that the interested party seeks advice from traders with experience in Bitcoin investments; this way, investment decisions can have better results.

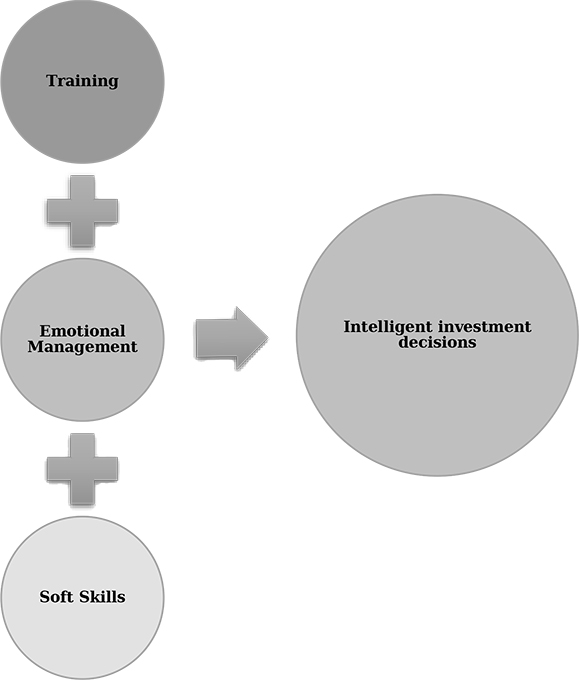

Emotions are considered by all traders interviewed as the element that has the greatest influence on investment decisions, this is because any movement in the market will have a positive or negative impact on investments. In this sense, if the investment results are positive, the investor will experience emotions related to effusiveness and happiness; on the contrary, if the investment results are negative, the investor will experience sadness and frustration. Making investment decisions while experiencing these types of emotions is unwise.

Cryptocurrencies, and especially Bitcoin, is associated with theft, scams and frauds; in most cases this is due to unfavorable results obtained after investing in Bitcoin and to theft, scams and frauds as such. It happens that, generally, the investor motivated by a strong desire to possess more wealth (greed) and the desire not to be left out of the current that is generating good returns in the market (fomo) decides to buy Bitcoin when the market trend is bullish; then, if after a few days, the market trend changes to bearish, the investor will have obtained negative returns.

Clearly, if the investor does not know the market movements, he will spread among his milieu that Bitcoin is a theft, scam or fraud. In this sense, it is essential that the investor learns to manage his emotions and invests in his education.

Additionally, as we can see in the Figure 5, making smart investment decisions involves developing a series of soft skills that will allow the investor to cultivate patience and prudence. Developing critical thinking will allow the investor to correctly discern the information he receives from news about the cryptocurrency market; the ability to concentrate will allow him to serenely observe the behavior of the market; the ability to organize will allow him to distinguish between personal virtual activities and investment activities, zealously guard his keys (private and public), systematically follow the steps of the investment to avoid falling into theft, fraud or scams; willpower and effort to constantly educate himself.

Finally, an investor who has been trained in economics and finance, has learned to manage his emotions and has developed soft skills, can hardly be a victim of intimidation, fraud or scams; because, the knowledge and experience generated from learning will make him question all the proposals he receives, will keep his emotions in balance in different phases of the market and will carefully carry out operations and transactions linked to Bitcoin.

3.2. Bitcoin Blockchain: Public Accounting

Bitcoin, an electronic payment system based on a cryptographic system based on Blockchain technology “in place of trust, allowing two interested parties to transact directly with each other, without the need for a trusted third party” (Nakamoto, 2008, p. 1). Essentially, Blockchain is understood “as a publicly available ledger containing the accounting records of all transactions made in the Bitcoin system, this means that all members of the Bitcoin network share their ledger” (Champagne, 2014, p. 21) and can view it whenever they want because it “resides in the network, not in an institution that is responsible for auditing transactions and keeping records” (Tapscott, 2016, p. 47).

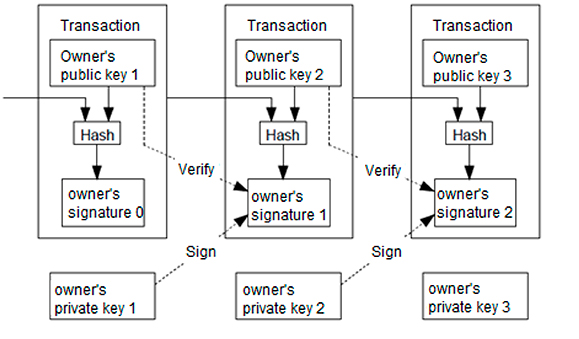

As we can see in the Figure 6, to transfer bitcoins, one owner signs “digitally a hash of the previous transaction and the public key of the next owner; the beneficiary can verify the signatures to verify the chain of ownership” (Nakamoto, 2008, p. 2). When verifying, the next owner must verify that the previous owner has not double-spent, i.e., that the first owner has not spent the same coin twice. To make this verification possible, the Bitcoin network uses a distributed, peer-to-peer time-stamping server that generates computational proof of the chronological order of transactions: the network is responsible for registering the earliest transaction, so subsequent spending should not be of concern to the owners (Nakamoto, 2008, p. 1).

The pages that form the public ledger of the Bitcoin network are called “blocks” which, in turn, compose a blockchain that encompasses all transactions made in Bitcoin since 2009; as seen in the Figure 7, approximately “every ten minutes, like the heartbeat of the bitcoin network, all transactions made are checked, sorted and stored in a block that joins the previous block, thus creating a chain” (Champagne, 2014, p. 18).

In the Bitcoin network, transactions are computationally impossible to reverse, since each block generated must refer to the previous block to be valid, preventing anyone from altering the record. All blockchains are distributed, i.e., they run on computers volunteered by people (miners) around the world, there is no central database that can be attacked. This means that, if someone wants to steal a bitcoin, they have to minimally rewrite 51% of the entire blockchain in full view of everyone, which is practically impossible (Champagne, 2014, p. 18).

Therefore, the following research hypothesis is proposed:

The cryptography of the Bitcoin virtual currency guarantees the invulnerability (confidentiality, integrity and authenticity) of the data used in the investment.

4. Conclusions

The process of investing in the Bitcoin cryptocurrency starts by getting a hardware wallet or wallet, through this software it is possible to make operations on Blockchain. The most popular wallets are: Trezor, Mycelium, Jax, Coinimi and Copay; their main function is to send and receive Bitcoin. Subsequently, an investment plan must be established that includes a profit scenario and a loss scenario, from this, the way in which Bitcoin will be obtained is defined: mining, online purchases, purchases and sales of services, games. For any of the operations, you must create an account in a cryptocurrency market or Exchange, the most popular ones are: Binance, Coinbase, Ripio and Bitex.

Cryptography is concerned with ensuring the confidentiality, integrity and authenticity of data transacted on the Bitcoin network through Blockchain technology, the same consists of a shared registry in which transactions are recorded in blocks linked with a cryptographic chain (Tapscott, 2016, p. 17).

The Bitcoin network transaction system consists of a series of steps that start with the Bitcoin owner’s decision to transfer Bitcoin, this decision is reported in the network to proceed to make the digital signature that leads to the recording of transactions in the ledger. Once recorded, the transactions are ordered to be attached to blocks and these in turn, anchored to a blockchain.

Throughout the life of Bitcoin, a series of events have tarnished the image of the cryptocurrency, although the malicious transactions were not over the network, there were criminal activities in different circumstances that can be classified as follows: intimidation, scams and fraud. In this sense, operating safely in Bitcoin investment involves a sum of fundamental elements: training, emotional management and development of soft skills.

The risk of computer vulnerability in investment is latent on exchanges and wallets, but not on the cryptography of the Bitcoin network, in this sense, people interested in investing in Bitcoin must first invest in training on economics and finance, learn to manage their emotions and develop soft skills; the knowledge and experience generated from learning will make people “question” all the proposals they receive, keep their emotions in balance in different phases of the market and methodically carry out operations and transactions related to Bitcoin to minimize the risk of being a victim of intimidation, fraud or scams through computer vulnerability.