1. Introduction

Dividend policy holds substantial relevance in the realm of corporate finance due to its consequential impact on value generation. The rationale behind firms’ determinations concerning dividends or the retention of cash remains a perplexing puzzle for researchers. Firms are persistently caught between the dual goals of growth - necessitating reinvestment of profits - and the imperative to meet shareholders’ expectations. This empirical endeavor scrutinizes the impact of a cluster of financial indicators (Correa-García et al., 2018) on dividend policy within small and medium-sized enterprises (SMEs) operating in an emerging economy. Hence, the core objective of this paper is to analyze the determining factors of dividend policy in SMEs of an emerging economy such as Colombia.

The impetus for this research emerges from the imperative to comprehend dividend policy behavior within emerging economies, with a particular focus on SMEs. While the discourse on dividend policy has extensively traversed developed economies and publicly listed companies (Vancin and Kirch, 2020), the works of Jabbouri (2016), and Kent and Kilincarslan (2019) underscore the indispensability of comprehending the variables steering dividend policy within SMEs in developing economies. The purview of this study is concentrated on Colombia - a representative emerging economy in Latin America, boasting significant trade agreements, such as the Pacific Alliance, and a business landscape predominantly comprised of SMEs (Fernández, 2018).

The significance of SMEs in Colombia is profound, contributing around 40% of the GDP, employing 80% of the nation’s workforce, and fostering the economic well-being of numerous Colombian families engaged in both formal and informal entrepreneurial ventures (Salazar et al., 2020). Given that SMEs often grapple with informal processes and challenges in securing diverse investment and financing sources, they face elevated rates of business attrition (Romero et al., 2015). Consequently, the study of their financial decisions remains pivotal in devising protective mechanisms to ensure the enduring sustainability of these entities.

Scholars have furnished evidence regarding the correlation between financial indicators and dividend policy (Dewasiri et al., 2019; Barros et al., 2020; Pinto et al., 2019), thereby contributing to a deeper comprehension of this relationship within the corporate finance context and offering empirical insights involving multifaceted variables that underpin dividend policy determinants. However, despite various studies delving into the financial management of SMEs, as highlighted by Mazzarol (2014), a dearth of research exists in relation to analyzing the financial variables influencing this pivotal financial decision within the Latin American context.

The exploration of the relationship between financial indicators and dividend policy stems from a comprehensive review of seminal theories, including the relevance theory pioneered by Lintner (1956), the irrelevance theory developed by Miller and Modigliani (1961), the clientele effect expounded by Elton and Gruber (1970), and the agency cost theory posited by Jensen and Meckling (1976). These theories not only illuminate the nexus between dividend policy and value creation but also underscore their intrinsic interplay with investment and financing choices within business financial management. Therefore, financial indicators serve as apt variables to elucidate dividend policy behavior.

In this study, a sample of Colombian SMEs spanning the 2017-2019 period, post the implementation of IFRS in 2016, is employed. Panel data analysis is utilized to discern the correlation between liquidity, profitability, debt leverage, and debt coverage vis-à-vis dividend policy. Liquidity is gauged through the lens of free cash flow, while indicators like EBITDA margin, gross profit margin, and Return On Equity (ROE) are harnessed to measure profitability. These financial indicators are selected based on an exhaustive literature review. The study encompasses 11,888 observations spanning the three-year timeframe. While financial indicators generally encompass liquidity, indebtedness, and profitability, this study places emphasis on liquidity and profitability indicators, as deduced from the literature review.

To the best of our knowledge, this study stands as one of the pioneering efforts delving into the relationship between financial indicators and dividend policy post the IFRS implementation within a Latin American context. In doing so, this study furnishes empirical evidence that enhances our comprehension of the behavior of pivotal financial management variables influencing dividend policy within an emerging economy. The findings carry practical implications, advocating that proposed dividend payouts by managers and analysts be grounded in judicious liquidity, profitability, and indebtedness management. By dissecting SMEs in an emerging economy, this study contributes to the expansion of financial knowledge and paves the way for future research endeavors aimed at unraveling the idiosyncrasies of this business cohort.

Following this introductory section, the paper is organized as follows: Section 2 delineates the theoretical framework, development of hypotheses, and delves into the institutional context and dividend decisions within SMEs. Section 3 elucidates the methodology, followed by the presentation and discussion of results in Section 4. Lastly, Section 5 encapsulates the conclusions drawn and outlines potential avenues for future research.

2. Theoretical framework

2.1. Conceptual background

In Colombia, approximately 99% of organizations are classified as micro, small, and medium-sized companies (Correa et al., 2009). However, accessing information about their operations and financial decisions proves to be a complex endeavor due to the prevalent high degree of business informality, which, according to Fernández (2018), stands at 59%. This reality mirrors the situation in most Latin American countries, making it challenging to conduct research aimed at analyzing financial performance, determinants, and financial decisions within this business segment within such an environment.

In the context of firm-size classification in Colombia, this is regulated by Law 590 of 2000, which establishes provisions for promoting the development of micro, small, and medium-sized companies. This legislation is commonly referred to as the MIPYME Law, as it serves as an institutional framework for fostering organizations of this scale across the nation. This law has undergone several amendments, particularly its second article, where firm size is defined. The most recent modification was introduced by Law 1450 of 2011, and it has been recently regulated by Decree 957 of 2019, proposing a classification based on firms’ total annual income. Additionally, businesses are categorized based on their primary economic activity, leading to distinct classifications for service, commercial, or industrial (manufacturing) entities.

The financial management of SMEs remains an ongoing subject of interest for the development of countries. SMEs fundamentally constitute the cornerstone of employment and the business fabric (Salazar et al., 2020). As elucidated by Mazzarol (2014), prevalent topics in financial management studies related to SMEs include the nature of SME financing, the interplay between working capital management and profitability, owner-managers’ comprehension of effective working capital management (particularly in emerging economies), and the nexus between financial management and the growth of the entity.

In the realm of financial management research, emerging economies often yield organizational behavior outcomes that diverge from general financial theories, largely due to greater information asymmetries or inefficiencies when compared to developed countries. Consequently, there is substantial interest in exploring how theories regarding dividend policies fare when tested in various emerging countries such as Turkey (Kent and Kilincarslan, 2019), Sri Lanka (Dewasiri et al., 2019), Arab countries (MENA) (Jabbouri, 2016), Indonesia (Nerviana, 2015), Poland (Kaźmierska-Jóźwiak, 2015), and Abu Dhabi (Manneh and Naser, 2015). Despite the burgeoning interest in the behavior of dividend policy decisions within emerging economies, Latin American countries have not been as comprehensively studied in this regard.

Numerous studies frequently incorporate variables such as profitability, indebtedness, and liquidity as determinants of firms’ dividend policies. Dewasiri et al. (2019) conducted a literature review revealing that determinants of dividend policy encompass factors such as past dividends, taxes, earnings, business risk, corporate governance, ownership structure, firm debt or leverage, firm size, free cash flow, profitability, investment, growth opportunities, firm life cycle, liquidity, behavioral determinants, and investor preferences. Similarly, Barros et al. (2020) propose that dividend policy is primarily influenced by three categories of factors: tax determinants, stock market impacts, and ownership and firm-specific determinants. Likewise, Pinto et al. (2019) found determinants of dividend policy to encompass tangibility, business risk, scale of operations, operating profit, market capitalization, debt measures, interest coverage ratio, current ratio, net working capital, profitability measures, investment, growth opportunities, and liquidity measures.

Furthermore, studies including Cheng et al. (2018), Anu et al. (2017), and Pinto et al. (2019) emphasize the significance of financial variables such as EBITDA margin, gross profit margin, and Return On Equity (ROE) in influencing dividend policy. Moreover, Anwer et al. (2020) underscore the importance of liquidity through the free cash flow variable, akin to Jabbouri (2016), with both studies demonstrating a positive and substantial impact of cash flow on dividend policy. Lastly, Pinto and Rastogi (2019) and Tran (2019) demonstrate that financial leverage, interest-to-sales ratio, interest coverage, and financial debt coverage serve as indicators of companies’ debt levels, further influencing dividend policy. Conversely, the level of indebtedness and debt coverage, as indicators of payment capacity, also exert influence on dividend policy decisions.

2.2. Dividend decisions and SMEs

At the corporate level, significant financial decisions are categorized into investment, financing, and dividend distribution choices (Barros et al., 2020). The research conducted on dividends remains contentious, with various findings contradicting each other regarding the observed effects of different variables under examination (Jabbouri and Attar, 2018; Ahmad et al., 2018). Consequently, there persists a need to continue analyzing this critical decision within companies, particularly in smaller enterprises where limited evidence exists.

The agency theory serves to comprehend the potential behavior of agents and principals across different organizational structures. Effective management of this relationship aids in mitigating conflicts of interest between a company’s management and its investors (Jabbouri, 2016). Dividend policies play a pivotal role in the tensions that can arise between investors and managers, as dividend distribution reflects the organization’s growth potential (Ahmad et al., 2020). Consequently, SMEs are inclined to ensure a steady dividend stream to foster lasting confidence in their expansion prospects, even if this entails limitations on future growth. A trade-off exists between opting for equity growth and cash dividend distribution.

As previously discussed, financial position significantly influences dividend decisions, and it’s particularly plausible to establish correlations between dividend decisions and liquidity, indebtedness, and profitability financial indicators (Nerviana, 2015). Regarding liquidity, an SME endowed with ample liquidity - notably positive operating cash flow - possesses greater ease in distributing dividends, as it can allocate resources without impinging on operations or jeopardizing prior commitments with external parties.

Authors like Correa-García and Correa-Mejía (2021), Anwer et al. (2020) , Manneh and Naser (2015), and Jabbouri (2016) underscore how liquidity empowers organizations to shape their dividend policy, particularly centered around cash availability from their cash flows. Owners consistently need to assess whether the SME not only generates profits but also attains the capacity to extend payments to shareholders. In such scenarios, the analysis pertains to emerging economies, reinforcing the notion that organizations seek to curtail agency costs by making significant dividend payments once they possess adequate resources. This engenders investor trust in management, given the frequent occurrence of information asymmetry (Renneboog and Szilagyi, 2020; Jabbouri, 2016).

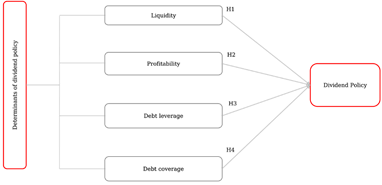

Consequently, the following hypothesis regarding liquidity is posited:

H1: Liquidity exhibits a significant positive correlation with dividend policy.

Concerning profitability, elevated returns from an SME are expected to translate into higher dividends. Investors anticipate benefits from efficient resource utilization. Furthermore, well-managed returns might involve reinvesting a portion for business growth while rewarding investment through dividend distribution.

Profitability consistently emerges as one of the most reliable indicators when investigating the connection between a profitable company and its inclination to declare dividend payments. Authors like Jabbouri (2016), Manneh and Naser (2015), Dewasiri et al. (2019), Nerviana (2015), and Driver et al. (2020) affirm the robust and positive link between profitability and dividend distribution policies. However, it’s crucial to note that SMEs might face operational inefficiencies or contextual challenges that curtail their profitability. Notwithstanding these challenges, market-profitable SMEs - seeking to bolster investor confidence - are inclined to declare dividends. Exceptions arise when investors prefer the organization to maintain growth, refraining from pressuring management for returns, opting instead for reinvestment to enhance equity.

Consequently, the second hypothesis is formulated as follows:

H2: Profitability demonstrates a significant positive correlation with dividend policy.

From a financial indicator perspective, understanding indebtedness requires two analytical dimensions (Correa-García et al., 2018). First, certain indicators correlate with the firm’s debt level, reflecting the extent of debt accrued at the analysis time. Higher debt levels significantly hinder the possibility of declaring dividends. As Abdi and Omri (2020) argue, heightened indebtedness escalates the cost of debt, necessitating an earnings retention policy to mitigate this cost. Secondly, debt coverage indicators unveil whether companies possess the future capacity to service further debt using surpluses. This not only boosts the potential for future debt acquisition but also facilitates dividend distribution by enhancing paying capacity.

When SMEs grapple with substantial indebtedness, prioritizing cash resources primarily for debt servicing diminishes the ability to meet heightened dividend demands. In line with the arguments of Kaźmierska-Jóźwiak (2015) and Nerviana (2015), companies laden with debt tend to abstain from dividend distribution, instead focusing on operational sustenance and fulfilling financial obligations before disbursing resources to investors, which could lead to financial strain vis-à-vis creditors.

Hence, the third hypothesis is established as follows:

H3: The level of indebtedness exhibits a significant negative correlation with dividend policy.

Additionally, SMEs utilize their accounting outcomes and cash flow to cover debt. Such dynamic debt indicators gauge whether a company can feasibly cover additional debt with its current results, focusing on future debt capacity. This distinction regarding indebtedness indicators is less common in the literature, which often concentrates solely on debt level. However, based on agency theory, firms capable of paying dividends - indicative of comprehensive debt coverage and robust future resource availability - should prioritize dividend distribution to optimize shareholder value (Baker et al., 2019).

Consequently, the fourth hypothesis is posited as follows:

H4: Debt coverage displays a significant positive correlation with dividend policy.

Figure 1 illustrates the hypothesis framework linking financial variables - liquidity, profitability, and indebtedness indicators - as determinants of dividend policy.

3. Methodology

This section presents the sample considered in the research and describes the model estimated and the financial variables, including the dependent variable and interest variables.

3.1. Sample

The sample considered for conducting the study consists of SMEs from nine industries that reported their financial information to the Superintendence of Corporations during the years 2017-2019. These years were considered because Colombian SMEs changed their accounting standards in the year 2016 to IFRS for SMEs. After eliminating those companies with inconsistencies or omissions in their financial information, a final sample of 11,888 firm-year observations was obtained. Table 1 shows the composition of the companies studied by industry and year. The research sample includes SMEs that declare and do not declare dividends since, according to Jabbouri (2016), the exclusion of firms not declaring dividends would result in a biased final sample. Years 2020 and 2021 were not considered in this study to avoid bias in results since companies’ results were affected for the lockdowns and social restrictions produced by the COVID-19.

Table 1 Sample composition

| Industry | 2017 | Freq. | 2018 | Freq. | 2019 | Freq. | Total | Freq. |

|---|---|---|---|---|---|---|---|---|

| Commercial | 1,394 | 0.36 | 1,400 | 0.36 | 1,516 | 0.37 | 4,310 | 0.36 |

| Manufacturing | 1,034 | 0.26 | 1,006 | 0.26 | 1,075 | 0.26 | 3,115 | 0.26 |

| Construction | 479 | 0.12 | 473 | 0.12 | 535 | 0.13 | 1,487 | 0.13 |

| Services | 519 | 0.13 | 465 | 0.12 | 484 | 0.12 | 1,468 | 0.12 |

| Agricultural | 253 | 0.06 | 259 | 0.07 | 280 | 0.07 | 792 | 0.07 |

| Communications | 97 | 0.02 | 107 | 0.03 | 101 | 0.02 | 305 | 0.03 |

| Transport | 70 | 0.02 | 69 | 0.02 | 66 | 0.02 | 205 | 0.02 |

| Mines and energy | 44 | 0.01 | 48 | 0.01 | 68 | 0.02 | 160 | 0.01 |

| Financial | 21 | 0.01 | 12 | 0.00 | 13 | 0.00 | 46 | 0.00 |

| Total | 3,911 | 1.00 | 3,839 | 1.00 | 4,138 | 1.00 | 11,888 | 1.00 |

Source: Authors’ own elaboration

Table 1 indicates that 87% of the observations considered operate in the commercial, manufacturing, construction, and service sectors. Furthermore, the studied companies vary from year to year since not all of them report their financial information to the Superintendence of Corporations each period, which resulted in an unbalanced panel data set.

3.2. Variables

3.2.1. Dependent variable.

Dividend policy is the dependent variable, measured as dividend payout ratio. According to Jabbouri (2016), this indicator is defined as the dividends declared divided by a firm’s net income. This definition agrees with what is established by the Colombian regulation given that firms are allowed to declare dividends only if their net income is greater than zero. However, following the studies of Pham et al. (2020) and Tahir et al. (2020), a robustness test was developed considering the dividend to sales ratio indicator.

3.2.2. Interest and control variables.

A total of nine financial indicators which are categorized into liquidity, profitability, and indebtedness (Brédart and Correa-Mejía, 2022); and three control variables, were measured. According to Terreno et al. (2020), liquidity represents a firm’s capacity to face its financial and commercial obligations in the short term. Anwer et al. (2020) argue that liquidity has a direct effect on dividend policy. Although dividends are declared on the basis of net income, which is an accrual measure, firms must assess their cash flows to estimate their liquidity capacity to pay their dividends. To measure liquidity the free cash flow to assets indicator was used as in Benavides et al. (2016) and Correa-Mejía et al. (2021); it shows the ability of a firm’s assets to generate free cash flow. Acording to the works of Jabbouri and Attar (2017) and Benavides et al. (2016), free cash flow has a positive effect on dividend policy.

In turn, profitability represents the efficient use of business resources to generate profits (Agudelo-Rodríguez et al., 2020). Following Renneboog and Szilagyi (2020) and Jabbouri and Attar (2018), profitability has a positive effect on dividend policy. Lai et al. (2020) found that firms with greater profitability levels are those with stable dividend policies. In this study, profitability was considered through three indicators: EBITDA margin, gross margin, and ROE. According to Cheng et al. (2018), EBITDA margin is considered a special measure of profitability which allows to identify the cash-basis operating income capacity produced by a firm. On the other hand, gross margin has been considered in previous studies such as Anu et al. (2017). This profitability margin enables to assess efficiency in the use of a firm’s resources and its capacity to produce income greater than the cost of sales. In turn, ROE is a measure related to dividend policy (Baker et al., 2019). Authors such as Pinto et al. (2019) and Jabbouri and Attar (2017) have suggested ROE can serve as a mechanism to determine whether it is viable to declare dividends since, if ROE is greater than cost of equity (Ke), there would be a favorable scenario in terms of profitability for shareholders to decide to retain earnings.

Lastly, indebtedness is considered by Correa-Mejía and Lopera-Castaño (2020) as the financing level a firm has with third parties. Correa-García et al. (2018) suggest indebtedness indicators be divided into two groups; those measures related to indebtedness level and those that estimate firms’ payment capacity. According to Pinto and Rastogi (2019), an elevated level of indebtedness negatively affects dividend distribution since firms have their cash flows committed to financial creditors. In turn, Tran (2019) revealed that payment capacity indicators have a positive effect on dividend distribution since the greater the payment capacity, the greater the cash flow that will be available to be distributed among shareholders via dividends. Financial leverage and the impact of financial burden were considered in this study as indebtedness measures, while interest coverage and debt service coverage were taken as debt payment capacity.

Three control variables were included in this study. Firm size was initially considered. According to Pinto and Rastogi (2019), firms have more propensity to declare dividends when they are larger and have a stable operation in the market. Dividend of the previous year was also considered since, according to Baker et al. (2019) and Dewasiri et al. (2019), current year’s dividend is correlated with respect to the dividend from the previous year given the income distribution policies firms usually have. Lastly, growth opportunities were employed as control variable in this research. Singla and Samanta (2019) state that firms which present growth opportunities tend to retain earnings with the aim of conducting investment projects that would enable them to broaden their capacity in the market. Table 2 presents a summary of the variables used in this study and the way they were measured.

Table 2 Definition of variables

| Type | Variable | Abreviation | Measure | References |

|---|---|---|---|---|

| Interest variables | Dividend payout ratio | Payout_div | Dividends/Net Profit | Jabbouri (2016) |

| Free cash flow to assets | FCF_assets | Free cash flow /total asset | Anwer et al. (2020) | |

| EBTIDA margin | EBITDA_margin | EBITDA/Sales | Cheng et al. (2018); Sreejith & Ananth (2017); Pinto et al. (2019) | |

| Gross profit margin | GP_margin | Gross profit/Sales | ||

| Return on equity | ROE | Net profit/Equity | ||

| Financial leverage | Fin_leverage | Financial debt/Equity | Pinto & Rastogi (2019); Tran (2019) | |

| Interest to sales | Int_sales | Interests/Sales | ||

| Interest coverage | Int_coverage | 1: Operating profit > interests 0: Otherwise | ||

| Finacial debt coverage | Debt_coverage | 1: Free cash flow > Debt service 0: Otherwise | ||

| Dividend coverage | Div_coverage | 1: Free cash flow > Dividends 0: Otherwise | ||

| Control variables | Size | Size | Natural logarithm of assets | Pinto & Rastogi (2019); Baker et al. (2019); Dewasiri et al. (2019) |

| Past dividends | Past dividend | Natural logarithm of previous year’s dividend | ||

| Growth opportunities | Growth_op | Change in assets |

Source: Authors’ own elaboration.

3.3. Model

This work follows a quantitative approach. In order to corroborate the proposed hypotheses, the panel data model of Singla and Samanta (2019) was employed, which allows to evaluate the effect of the interest variables on the dependent variable of the 11,888 firm-year observations considered. The estimated model was the following:

In this equation, i represents each SME observed, t denotes each year of observation, represents the error term and β 1 ,β 2 …β 11 are the coefficients that serve to estimate the effects of the independent variables on the dividend payout ratio.

4. Results and discussion

Table 3 shows the mean of SMEs’ dividend policy by industry during the three years observed. SMEs’ dividend policy has been decreasing over the years, and the industries with greater dividend payout ratio are services (17.7%), communications (16.5%) and financial (14.9%).

Table 3 Descriptive statistics on dividend policy

| Panel A: Dividend policy per year | |||

|---|---|---|---|

| Year | Mean | Sd | Obs. |

| 2017 | 0.148 | 0.408 | 3,911 |

| 2018 | 0.137 | 0.401 | 3,839 |

| 2019 | 0.108 | 0.343 | 4,138 |

| Panel B: Dividend policy by industry | |||

| Industry | Mean | Sd | Obs. |

| Commercial | 0.133 | 0.381 | 4,310 |

| Manufacturing | 0.143 | 0.401 | 3,115 |

| Construction | 0.078 | 0.321 | 1,487 |

| Services | 0.177 | 0.443 | 1,468 |

| Agricultural | 0.077 | 0.288 | 792 |

| Communications | 0.165 | 0.404 | 305 |

| Transport | 0.122 | 0.443 | 205 |

| Mines and energy | 0.093 | 0.323 | 160 |

| Financial | 0.149 | 0.446 | 46 |

Source: Authors’ own elaboration

Table 4, on the other hand, shows the descriptive results of SMEs that declare and do not declare dividends. The firms observed were divided into two groups since it is essential to consider the characteristics of each group of firms to contrast the results.

Table 4 Descriptive statistics of firms declaring and not declaring dividends

| Variable | Declare dividends | Do not declare dividends | Mean difference (Declare - Do not declare) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Mean | Median | Sd | Obs. | Mean | Median | Sd | Obs. | t-test | |

| Payout_div | 0.796 | 0.649 | 0.611 | 1,948 | 0.000 | 0.000 | 0.000 | 9,940 | 57.529*** |

| FCF_assets | 0.056 | 0.059 | 0.093 | 1,948 | 0.007 | 0.005 | 0.071 | 9,940 | 22.421*** |

| EBITDA_margin | 0.078 | 0.067 | 0.053 | 1,948 | 0.062 | 0.051 | 0.057 | 9,940 | 11.922*** |

| GP_margin | 0.332 | 0.281 | 0.210 | 1,948 | 0.330 | 0.265 | 0.236 | 9,940 | 0.247 |

| ROE | 0.133 | 0.117 | 0.091 | 1,948 | 0.072 | 0.056 | 0.077 | 9,940 | 28.028*** |

| Fin_leverage | 0.490 | 0.228 | 0.632 | 1,948 | 0.700 | 0.375 | 0.822 | 9,940 | -12.703*** |

| Int_sales | 0.017 | 0.011 | 0.024 | 1,948 | 0.028 | 0.015 | 0.046 | 9,940 | -14.881*** |

| Size | 16.397 | 16.356 | 0.957 | 1,948 | 16.317 | 16.251 | 0.996 | 9,940 | 3.3618*** |

| Past dividend | 8.960 | 12.304 | 6.108 | 1,948 | 1.640 | 0.000 | 4.328 | 9,940 | 50.465*** |

| Growth_op | 0.075 | 0.035 | 0.326 | 1,948 | 0.253 | 0.045 | 12.101 | 9,940 | -1.4564 |

| 0 | 1 | Obs. | 0 | 1 | Obs. | ||||

| Int_coverage | 39 | 1,909 | 1,948 | 603 | 9,337 | 9,940 | |||

| Debt_coverage | 695 | 1,253 | 1,948 | 5,760 | 4,180 | 9,940 | |||

| Div_coverage | 782 | 1,166 | 1,948 | 4,427 | 5,513 | 9,940 | |||

Significance codes* p<0.1, **p<0.05, ***p<0.01.

Source: Authors’ own elaboration.

As per Table 4, SMEs tend to retain their earnings by 84% (9,940 SMEs) instead of distributing them in the form of dividends (16% corresponding to 1,948 SMEs). According to Elmagrhi et al. (2017), this result is due to the fact that SMEs are firms at a growing stage and it is usually more convenient financially for them not to declare dividends so as not to affect their liquidity and capacity to carry out investment projects allowing them to grow. However, through the mean difference between firms declaring and not declaring dividends it is possible to observe that the liquidity and profitability indicators of dividend declaring firms are higher and more statistically significant than those of non-declaring firms.

In a different vein, it is observed that financial leverage and the interest to sales ratio are lower in firms that declare dividends, which is consistent with Anu et al. (2017). Lastly, in Table 4 it is evidenced that SMEs not declaring dividends have lower interest coverage capacity, debt payment and dividend payment which, according to Pinto and Rastogi (2019), means the decision not to declare dividends is the financially correct one since, in the event they did, these firms could enter into financial problems.

Table 5 presents the correlation matrix of the variables considered in the study. Through this matrix it is observed that the dividend payout ratio has a strong positive relationship with the free cash flow to assets (0.217), return on equity (0.174), financial debt coverage (0.147) and past dividend (0.392) indicators. On the other hand, no strong negative relationships between the interest variables and the dependent variable of the study are observed.

Table 5 Correlation matrix

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) | (12) | (13) | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Payout_div (1) | 1 | ||||||||||||

| FCF_assets (2) | 0.217*** | 1 | |||||||||||

| EBITDA_margin (3) | 0.059*** | 0.127*** | 1 | ||||||||||

| GP_margin (4) | 0.021** | 0.01 | 0.34*** | 1 | |||||||||

| ROE (5) | 0.174*** | 0.179*** | 0.246*** | -0.041*** | 1 | ||||||||

| Fin_leverage (6) | -0.073*** | -0.093*** | -0.154*** | -0.106*** | 0.038*** | 1 | |||||||

| Int_sales (7) | -0.066*** | -0.032*** | 0.072*** | 0.196*** | -0.146*** | 0.204*** | 1 | ||||||

| Int_coverage (8) | 0.064*** | 0.038*** | 0.177*** | 0.023** | 0.287*** | 0.018** | 0.054*** | 1 | |||||

| Debt_coverage (9) | 0.147*** | 0.607*** | 0.103*** | 0.04*** | 0.103*** | -0.169*** | -0.067*** | 0.05*** | 1 | ||||

| Div_coverage (10) | -0.005 | 0.709*** | 0.087*** | 0.012 | 0.05*** | -0.053*** | 0.003 | 0.029*** | 0.713*** | 1 | |||

| Size (11) | 0.011* | -0.028*** | 0.111*** | -0.077*** | -0.073*** | 0.143*** | 0.136*** | 0.015* | -0.052*** | -0.011 | 1 | ||

| Past dividend (12) | 0.392*** | 0.118*** | 0.075*** | -0.015 | 0.200*** | -0.040*** | -0.066*** | 0.044*** | 0.061*** | 0.002 | 0.081*** | 1 | |

| Growth_op (13) | -0.005 | 0.004 | 0.011 | 0.007 | 0.002 | -0.009 | 0.012 | 0.004 | -0.012 | -0.003 | 0.093*** | -0.007 | 1 |

Significance codes* p<0.1, **p<0.05, ***p<0.01.

Source: Authors’ own elaboration.

Table 6 presents the results of the described model. Regressions for each type of interest variable were performed with the aim of evaluating the hypotheses raised. Additionally, Model 4 shows the results of the estimation considering the interaction of all the variables included in the study. The results of each model are controlled by industry and year.

Through the estimation of Model 1, it is observed that the FCF_assets indicator has a positive relationship (β= 0.247, p-value<0.01), which supports H1. This result shows that liquidity positively influences the amount of dividends shareholders decide to declare. The results obtained are consistent with Anwer et al. (2020) findings, who establish that, although dividends emerge from appropriations of profits, shareholders must evaluate the firm’s liquidity not to affect payment capacity and avoid incurring default risks. Additionally, Jabbouri (2016) suggests dividend payouts reduce agency problems since they diminish free cash flow and thus decrease the risk of managers making investments in unprofitable projects. According to Renneboog and Szilagyi (2020), in the context of emerging economies where corporate governance mechanisms are weak, information asymmetries are high and the institutional context is weak, dividend payout is expected to exhibit a growing trend as long as there are high cash flows, given that this counterbalances investment-related risks in emerging economies.

To evaluate hypothesis H2, three profitability indicators (EBITDA_margin, GP_margin and ROE) were employed. Even though EBITDA_margin does not show a significant relationship with dividend payout ratio (β= 0.032, p-valor>0.1), it is possible to evidence that GP_margin (β= 0.034, p-value<0.1) and ROE (β= 0.034, p-value<0.1) have a positive impact on the decision to declare dividends. H2 is hence corroborated with these results because profitability in SMEs influence their dividend policy. These results agree with the findings of Driver et al. (2020) since profitability plays a key role in the reduction of agency problems, given that it shows resource management efficiency in front of investors. Conversely, an important finding obtained in this study is that EBITDA_margin does not show a significant relationship with dividend policy. This is an important result since previous research by Jiraporn and Chintrakarn (2009), and Huang and Paul (2017), who studied firms from developed markets, identified EBITDA_margin as a determining variable of dividend policy. This result may be explained by the fact that, in Latin American economies, dividend decisions made by SMEs are primarily based on accounting information that is shown through financial statements. Furthermore, because EBITDA is a financial measure not explicitly shown in the income statement and not widely used in the financial management of these firms, SMEs do not consider this variable when defining their dividend policy.

Fin_leverage and Int_sales indicators representing the indebtedness level of the SMEs studied show a negative relationship in the estimation of Model 3 (β= -0.009, p-value<0.01 and β= -0.098, p-value<0.01 respectively), which corroborates what is stated in H3. The negative relationship existing between indebtedness level and dividend policy can be mainly explained for three reasons according to Jabbouri (2016). The first reason is that firms with a high indebtedness level tend not to declare dividends given the pressure exerted by their creditors. According to Benjamin et al. (2018), that declaring dividends, firms allocate this money to make payments towards their obligations. Secondly, Abdi and Omri (2020) argue that highly indebted firms experience an increase in their cost of capital so the most appropriate decision when there are high indebtedness levels is to retain earnings and strengthen business equity. The third reason is that debt plays a fundamental role in agency problems since it helps to discipline administrative actions and reduce information asymmetries (Tran, 2019). Hence, the reduction of information asymmetries caused by a high indebtedness level diminishes the need to send cash signals through dividend payment.

Through the estimation of Model 3, debt service coverage positively influences SMEs’ dividend policy (β= 0.051, p-valor<0.01); these results support what is established in H4 and are consistent with Tran’s (2019) arguments since firms with larger coverage of their financial obligations will have greater cash flow availability for their investments. Additionally, this study evidenced that dividend coverage has a negative relationship with dividend policy (β= -0.033, p-value<0.01), a result contradicting the findings of previous studies by Atieh and Hussain (2012) and Gill et al. (2012) conducted for the U.S. market, and consistent with the findings of ElBannan (2020) for emerging economies. This result can be attributed, following ElBannan (2020), to the fact that firms from emerging markets, especially SMEs, have a preference for using their cash flows to pay first their operating costs and expenses, make their investments in working capital and CAPEX, pay the debt service and lastly pay dividends declared, which is supported in the residual theory of dividends developed by Higgins (1972).

The control variables show that in general company size positively influences dividend policy. According to Barros et al. (2020), the payment of high dividends is an effective tool used by larger firms with a dispersed ownership structure to send signals to the market, revealing management’s good faith and good treatment towards shareholders (Dewasiri et al., 2019). On the other hand, past dividend is clearly a key factor positively influencing current dividend. Baker et al. (2019) argue that companies usually take as a reference the dividend of the previous year to define the dividends for the current year to maintain a sustainable dividend policy and avoid future financial difficulties. Growth opportunities have a negative effect on dividend policy, which is evident in the estimation of all four models. This relationship is consistent with previous studies by Huang and Paul (2017) and Anwer et al. (2020), who identified that growth opportunities most often require cash flows, which counterbalances firms’ dividend-paying capacity. Finally, to evaluate whether the sample and variables considered in this study have any multicollinearity problems, Variance Inflation Factors (VIF) were calculated for each model as shown in Table 6. All values are relatively low, and none exceed 2.9 (Jabbouri, 2016), so it is concluded that the sample and the variables do not have multicollinearity problems and the results obtained are consistent.

Table 6 Empirical results for dividend payout ratio

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Coeff. | Coeff. | Coeff. | Coeff. | |

| (Std error) | (Std error) | (Std error) | (Std error) | |

| (Intercept) | -0.006 | -0.083* | -0.120*** | -0.148*** |

| (0.035) | (0.035) | (0.035) | (0.035) | |

| FCF_assets | 0.247*** | 0.361*** | ||

| (0.013) | (0.018) | |||

| EBITDA_margin | 0.032 | -0.014 | ||

| (0.020) | (0.019) | |||

| GP_margin | 0.034* | 0.036** | ||

| (0.013) | (0.013) | |||

| ROE | 0.343*** | 0.248*** | ||

| (0.017) | (0.017) | |||

| Fin_leverage | -0.009** | -0.011** | ||

| (0.003) | (0.003) | |||

| Int_sales | -0.098*** | -0.051* | ||

| (0.023) | (0.024) | |||

| Int_coverage | 0.052*** | 0.028*** | ||

| (0.004) | (0.004) | |||

| Debt_coverage | 0.051*** | 0.037*** | ||

| (0.002) | (0.002) | |||

| Div_coverage | -0.033*** | -0.064*** | ||

| (0.002) | (0.003) | |||

| Size | 0.003 | 0.015* | 0.018* | 0.030*** |

| (0.007) | (0.007) | (0.007) | (0.007) | |

| Past dividend | 0.169*** | 0.162*** | 0.168*** | 0.151*** |

| (0.004) | (0.004) | (0.004) | (0.003) | |

| Growth_op | -0.009*** | -0.044*** | -0.030*** | -0.035*** |

| (0.006) | (0.006) | (0.006) | (0.006) | |

| Industry | Controlled | Controlled | Controlled | Controlled |

| Year | Controlled | Controlled | Controlled | Controlled |

| Significance codes* p<0.1, **p<0.05, ***p<0.01 | ||||

| VIF Model 1 | VIF Model 2 | VIF Model 3 | VIF Model 4 | |

| FCF_assets | 1.021 | 2.252 | ||

| EBITDA_margin | 1.296 | 1.355 | ||

| GP_margin | 1.183 | 1.235 | ||

| ROE | 1.187 | 1.389 | ||

| Fin_leverage | 1.105 | 1.166 | ||

| Int_sales | 1.069 | 1.164 | ||

| Int_coverage | 1.153 | |||

| Debt_coverage | 2.160 | 2.240 | ||

| Div_coverage | 2.101 | 2.834 | ||

| Size | 1.032 | 1.075 | 1.072 | 1.125 |

| Past dividend | 1.014 | 1.039 | 1.015 | 1.059 |

| Growth_op | 1.027 | 1.052 | 1.037 | 1.078 |

Source: Authors’ own elaboration.

5. Robustness check

The aim of this section is to evaluate whether the previous results are consistent with an alternative variable representing dividend policy. The variable used as a proxy of this policy was dividend to sales ratio. This indicator is, according to Jabbouri (2016), a good option for evaluating dividend policy since, unlike earnings, income is less susceptible to manipulation through accounting estimations. To perform the robustness test, four new models were estimated in which the only change made was to the dependent variable. The estimated model for the robustness test was the following:

The results depicted in Table 7 are consistent with the estimations presented in Table 6 and serve to test that the results obtained in this study are robust in correlational and significance terms with the dividend policy of SMEs in an emerging market. Through Models 5 to 8, H1, H2, H3 and H4 were corroborated again since SMEs consider their level of liquidity, profitability, and indebtedness at the time of declaring their dividends. Likewise, special results persist with respect to the literature regarding the non-significance of the EBITDA margin and the negative effect of the Div_coverage indicator on dividend policy. Table 8 shows the summary of hypotheses validation.

Table 7 Empirical results for dividend to sales ratio

| Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|

| Coeff. | Coeff. | Coeff. | Coeff. | |

| (Std error) | (Std error) | (Std error) | (Std error) | |

| (Intercept) | -0.007 | -0.020** | -0.023*** | -0.025*** |

| (0.006) | (0.006) | (0.006) | (0.006) | |

| FCF_assets | 0.046*** | 0.081*** | ||

| (0.002) | (0.002) | |||

| EBITDA_margin | 0.030 | 0.024 | ||

| (0.003) | (0.003) | |||

| GP_margin | 0.016*** | 0.016*** | ||

| (0.002) | (0.002) | |||

| ROE | 0.049*** | 0.038*** | ||

| (0.002) | (0.002) | |||

| Fin_leverage | -0.002*** | -0.001** | ||

| (0.000) | (0.000) | |||

| Int_sales | -0.001 | -0.000 | ||

| (0.004) | (0.003) | |||

| Int_coverage | 0.003*** | -0.001* | ||

| (0.000) | (0.000) | |||

| Debt_coverage | 0.011*** | 0.008*** | ||

| (0.000) | (0.000) | |||

| Div_coverage | -0.008*** | -0.015*** | ||

| (0.000) | (0.000) | |||

| Size | 0.002* | 0.003** | 0.005*** | 0.006*** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Past dividend | 0.018*** | 0.017*** | 0.018*** | 0.015*** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Growth_op | -0.004*** | -0.009*** | -0.007*** | -0.007*** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| Industry | Controlled | Controlled | Controlled | Controlled |

| Year | Controlled | Controlled | Controlled | Controlled |

| Significance codes* p<0.1, **p<0.05, ***p<0.01 | ||||

| VIF Model 5 | VIF Model 6 | VIF Model 7 | VIF Model 8 | |

| FCF_assets | 1.015 | 2.231 | ||

| EBITDA_margin | 1.285 | 1.334 | ||

| GP_margin | 1.173 | 1.225 | ||

| ROE | 1.172 | 1.357 | ||

| Fin_leverage | 1.086 | 1.138 | ||

| Int_sales | 1.059 | 1.148 | ||

| Int_coverage | 1.011 | 1.146 | ||

| Debt_coverage | 2.189 | 2.268 | ||

| Div_coverage | 2.150 | 2.872 | ||

| Size | 1.035 | 1.074 | 1.074 | 1.122 |

| Past dividend | 1.008 | 1.028 | 1.010 | 1.040 |

| Growth_op | 1.030 | 1.048 | 1.038 | 1.074 |

Source: Authors’ own elaboration.

Table 8 Summary hypotheses validation

| Hypothesis | Results for original test and 5 Robustness check |

|---|---|

| H1: Liquidity has a significant positive association with dividend policy | Accepted |

| H2: Profitability has a significant positive association with dividend policy | Accepted |

| H3: Level of indebtedness has a significant negative association with dividend policy | Accepted |

| H4: Debt coverage has a significant positive association with dividend policy | Accepted |

Source: Authors’ own elaboration.

6. Conclusion

This study addressed the empirical analysis of the determinants of dividend policy for the SMEs segment in an emerging Latin American economy. The analysis focused on liquidity, profitability, and indebtedness variables which represent the main variables of the financial performance analysis in these categories. This work provides empirical evidence for one of the key financial management decisions by SMEs in emerging economies. As such, to the best of our knowledge, this is one of the first works to address the determining factors of dividend policy in Colombia upon IFRS adoption. Accordingly, the results of this study constitute a benchmark for other emerging economies and especially for Latin America.

The relationship established between financial indicators and dividend policy for SMEs implies a greater need for all stakeholders to pay attention to understanding these indicators. This is particularly important in the contexts of emerging economies, where most companies are small and medium-sized.

The results of this research have practical implications for regulators, investors, and financial analysts. The evidence of dividend policy determinants and the robustness of the results allow regulators to reinforce the regulation relating to dividend distribution criteria, the consolidation of SMEs databases, and the support to strengthening the management of this company segment. It provides investors with greater judgment elements for their decisions concerning dividends and reinvestment of resources in firms. The results can help analysts in emerging economies to have a better understanding of how SMEs make decisions regarding dividends, as well as improve their forecasts and provide better professional consulting services, which may contribute to dynamizing the business management and to the growth and continuity of these firms in the long term. In line with agency theory, the empirical evidence from this study also supports managers and boards of directors in their managerial practices and their proposals regarding dividend policy, thus dealing with several agency problems.

This study contributes to expanding the knowledge of finances in SMEs from emerging economies and, more specifically, the factors impacting dividend policy as a decision that creates or destroys value. In this respect, the empirical evidence presented opens the black box on a relevant issue in SMEs’ corporate finance, as most studies have focused their analysis on large companies. The results can guide similar studies in other settings as well as the analysis of the likelihood of dividend distribution by SMEs. In addition, they could encourage the study of the connections and determinants with corporate governance structures, which is precarious in these companies, resulting in a further professionalization of management in SMEs from emerging economies.