1. Introducción

The Inditex Group and its leading brand, Zara, are among the leaders in prêt-à-porter fashion in Spain and Europe. Through its various brands, the group has always taken pride in its loyalty to production processes in La Coruña, Spain, particularly in the town of Arteijo. This Galician town, where Amancio Ortega, the company’s founder, established his first factory, has been the starting point and emotional link of the company with Spain. From there, the group gained strength and expanded throughout the cities of the northwest peninsula before establishing itself in major cities across Spain. Since then, the group has pursued solid internationalization strategies through its own stores and franchises, taking its first step outside Europe in 1989 in New York City, United States.

The Latin American market has always been fundamental to Inditex’s strategy, particularly due to its cultural proximity. Despite this focus, the group has continued to expand significantly in Asia. The fashion market has become highly competitive, with challenges from low-cost production regions and global companies offering high-end or comparable products, such as H&M (Sweden) and GAP (USA). Zara, described by Goldman Sachs as ‘Armani at reasonable prices,’ is present in 215 markets with over 5,700 stores as of April 2024, strategically located in major cities worldwide. Given this extensive reach, Inditex may be nearing the final phase of its expansion policy.

A critical question arises regarding the transformation of the Inditex Group to revitalize its brands, particularly in countries where it has been present for several years. This transformation may involve expanding store areas, enhancing online market penetration, and implementing social and environmental strategies. In Europe, these strategies are relatively balanced, but they encounter greater challenges in Latin America, a region with promising commercial prospects but reliant on the economic stability of individual countries and burdened by an inefficient logistical model with increasingly costly supply chains.

Based on this context, the following study aims to analyze the expansion policies of the Spanish group, with special attention to Latin America, where Inditex brands have been well received in a growing fast fashion market. The study follows a specific methodology to understand this case.

2. Methodological Process

The proposed research is exploratory. The results obtained are derived from the reviewed literature and data analysis provided by the Inditex Group, aiming to identify the internationalization criteria used for opening its stores. A descriptive research method is employed, as defined by Hernández Fernández and Baptista (2014), which involves measuring, evaluating, and collecting information on various aspects, dimensions, and components of the phenomenon under investigation.

Variables are selected and information on each is collected to represent the subject of investigation. This study describes the strategic internationalization structures proposed by other authors to build a theoretical framework and determine if these theories relate to the strategies used by Inditex brands. The initial method is descriptive, followed by an analytical and interpretive approach. As described by Amaya (2023), this involves examining qualitative and quantitative data. Financial and globalization studies of the group (annual reports from the last 10 years) were consulted, and the data were tabulated accordingly.

Connections were made with specialized press reports in the textile sector of each country and relevant literature. Additionally, an empirical observation process was conducted, correlating observed data with the corresponding data for years, countries, and the number of stores.

In other words, an attempt was made to demonstrate a relationship between the numbers reflecting international expansion and the conducted analysis. The objective of this methodology is to provide a detailed understanding, as a case study, of the successful implementation of global fashion based on the internationalization strategies used by the Inditex Group. This approach aims to explain why these stores were opened. Yin (2004), defines the essence of the case study as “the attempt to clarify a decision or a set of decisions: why they were made, how they were implemented, and with what result.” The usefulness of a research project can be multiple and varied depending on the context and objectives.

This project offers a comprehensive analysis of Inditex’s internationalization strategies, beneficial for academics and industry professionals aiming to grasp the expansion methodologies of large corporations. Moreover, its insights are valuable for companies contemplating global growth. It enriches the existing literature on corporate internationalization, serving as a pivotal case study for future researchers. Furthermore, it serves as instructional material in international business and management courses, illustrating real-world examples of corporate internationalization.

3. An Internationalization strategy based on an efficient logistics model

Internationalization is a critical phase in the logistics process, involving heightened exchanges of goods, services, and capital across borders by corporations, thereby stimulating international trade and foreign investment. This process for companies encompasses two distinct aspects: firstly, commercial flows encompassing exports and imports of goods and services (Canals, 1994); secondly, productive flows involving the integration of raw materials, technology, and innovation.

“Internationalization refers to the operations facilitating the establishment of stable connections between a company and global markets, progressively increasing its international presence and impact” (Root 1994; Rialp i Criado, 1999 as cited by Benavides, 2013). The motives driving internationalization often revolve around administrative goals aimed at enhancing production quality and fostering innovation. This concept underscores a corporate ambition to attain global standards and refine methodologies through international policies and strategies. Consequently, logistics emerges as a pivotal component in developing and executing such strategies.

Logistics encompasses the activities undertaken by a company, either internally or through third parties, to execute product delivery operations to the end customer. According to the Council of Supply Chain Management Professionals [CSCMP] (2021), logistics involves planning, implementing, and controlling the efficient and cost-effective flow and storage of raw materials, work-in-process inventory, and finished goods. It also encompasses the corresponding flow of information from origin to consumption point, ensuring customer requirements are met (Franco, 2008).

Ballou (2004) defines logistics as encompassing all movements and storage facilitating product flow from material procurement to consumption, alongside the information flows crucial for providing adequate customer service at optimal costs. In business logistics, it is essential to define sequentially the activities enabling decision-making across key production and sales operations: inbound logistics, internal logistics, and outbound logistics.

Inbound logistics encompasses the supply chain, while internal logistics comprises support activities, and outbound logistics involves marketing and sales activities. Distribution is often included as a critical element in the delivery process. These operations collectively define the strategy aimed at delivering the best product to the target market, aligned with market needs or desires (Lee, 2005). Therefore, it is crucial within marketing strategies to articulate the commercial structure’s objectives and highlight the benefits of the products being offered - the essence of the business. This approach establishes a cohesive relationship among production, marketing, logistics, and sales (Kotler and Armstrong, 2007).

The supply chain is a critical component of logistics, ensuring a continuous flow of materials for production processes. An efficient supply chain enables an expanded product portfolio, increased purchasing options, and enhanced information management effectiveness. It plays a vital role in internationalization efforts by reducing trade barriers, which initially boosts trade flows and necessitates efficient transportation, management, and delivery mechanisms (Sarathy, 2006).

Johnson (1999) asserts that the supply chain has become a cornerstone of competitiveness, with diminishing opportunities for improvement among competing agents. Additionally, according to Eskigun et al. (2006), logistics costs in the United States constitute 30% of the total cost of goods sold to end customers. Inditex’s expansion strategy has prioritized its distribution chain, leveraging technological and communication innovations to achieve rapidity through continuous enhancements in production and management processes.

This model aims to divide production between “basic” garments, which are considered timeless with low turnover in stores, and “opportunistic” or just-in-time garments that can swiftly respond to market fluctuations. The pioneering company in developing this approach was Benetton, which managed to shorten production cycles for “opportunistic” garments to six months. Subsequently, GAP, an American company, surpassed Benetton by further reducing these cycles to two months.

Ultimately, Zara achieved a remarkable reduction to just two weeks, as noted by Barreiro (2007). Zara’s strategy involves producing and selling “basic” items in Galicia, while “opportunistic” production occurs in China, Bangladesh, and India. Rapid communication and information systems facilitate organized flows between production and sales, enabling the chain to achieve just-in-time supply within 24-hour windows for deliveries in Europe and 48-hour operations globally.

The expansion of the Inditex group’s brands began in Spain with its flagship brand, Zara (established in 1975), followed by Bershka (1998), Massimo Dutti (1995), Pull & Bear (1991), Stradivarius (1999), Oysho (2001), Zara Home (2003), Uterque (2008), and Kiddy Class, renamed as Skhuaban for English-speaking countries (2002), with other projects discontinued due to poor performance (Belmiro et al., 2010). Zara, being the pioneer, remains the most prominent brand within the group. Presently, it operates 2,300 stores worldwide, initiating its internationalization journey in Latin America starting with Mexico in 1992, followed by expansions into South America in 1998 with Zara’s presence in Argentina and Venezuela.

The subsequent phase of internationalization extended into Latin America with the inauguration of its first stores in Peru and Ecuador in 2012. Expansion also reached Eastern European nations including Armenia, Bosnia-Herzegovina, Georgia, and Macedonia. Further expansions in 2016 included Aruba, Nicaragua, New Zealand, and Vietnam, followed by entries into Hong Kong and Macau in 2017.

Presently, the group pursues a robust expansion strategy in Asia, with a particular focus on bolstering its presence in the Chinese market, where it operates 303 stores, ranking it as the third largest market presence after Spain and Russia (Benavides, 2013). Starting in 2022, the business in Russia experienced significant losses, resulting in a decline of more than 3% in the Ibex 35 index. Azadea, a Beirut-based company, was selected to assume the franchise operations in Arab countries, given its management of over 200 Inditex franchises.

The evolutionary internationalization process commenced in 1988 with Portugal, where Inditex now operates 4.7% of its total stores, demonstrating substantial ambitions for market leadership in Spain. This period marked one of the company’s highest growth rates between 1975 and 1988, with a notable 23.8% increase in store openings. Inditex’s first venture outside Europe was in the United States in 1989, where it currently operates 1.5% of its stores.

Inditex’s internationalization in Latin America began in 1992 with Mexico, initially driven by strong economic ties with Spain. Today, Mexico accounts for 5.9% of Inditex’s market presence. However, broader expansion efforts in Latin America commenced a few years later, focusing primarily on Mercosur countries. The second major phase of internationalization occurred in 1999 with store openings in Germany, Poland, Kuwait, the Netherlands, Uruguay, Saudi Arabia, Brazil, Canada, and Chile, marking the company’s entry into South America. This year saw a notable 24.9% increase in the number of stores, underscoring the significance of this expansion phase and its pivotal steps into the Latin American market.

The initial Inditex stores in South America debuted in Venezuela in 2007, operating under a franchise agreement with the Phoenix World Trade Group due to the country’s economic situation. Unlike typical direct distribution in other markets, this arrangement was chosen. By 2021, the Phoenix group was compelled to shut down its remaining stores in Caracas due to stringent currency controls. Inditex’s policy of consolidating larger points over smaller ones also played a role in this decision. Consequently, Venezuela does not feature in the group’s financial reports.

Between 2004 and 2006, Inditex embarked on its third phase of expansion with one of its most visionary projects during that period: opening its first stores in China and expanding into the Eastern European market including Estonia, Latvia, Romania, Lithuania, and Hungary. This initiative led to a 10.3% increase in store openings compared to the total stores and a 13.6% variation. Over the years, Inditex has reinforced its global presence, operating in 95 countries, predominantly through a vertical model involving direct establishment. It only resorts to other outsourcing strategies or legal adaptations when mandated by the investment-receiving country, necessitating a different management approach, as seen in the Venezuelan case or through franchise models in Bahrain, Qatar, and Saudi Arabia (Castellano, 2002). Inditex’s internationalization strategy adapts to each market with three primary approaches: direct implementation, joint ventures, and franchises.

The implementation model predominantly used by the Inditex group is through its own subsidiaries. As of the end of 2022, 86% of the group’s stores were self-managed, with joint ventures accounting for 10%, and franchises for 4%, collectively representing 100% of the group’s turnover. This approach underscores Inditex’s preference for direct investment, except in cases where cultural disparities, specific business risks, or market size discourage direct involvement.

Franchise operations are structured around a single economic entity responsible for the entire country, which must be a nationally recognized entity with established expertise in fashion distribution. Franchisees typically pay a royalty fee ranging from 5% to 10% of sales for comprehensive support, including access to corporate services such as human resources, training, and logistics, provided by Inditex at no additional cost (Belmiro et al., 2010).

Joint venture agreements, facilitated by local partners, are selectively employed by Inditex in countries where market conditions favor the benefits of collaboration with partners possessing local expertise. These ventures allow for synergies that require shared capital, market access, or combined resources, aligning with specific market needs (Breuzard et al, 2005).

Inditex currently maintains joint venture agreements with several local companies, such as Otto Versand in Germany, Bigi in Japan, Premier Investments in Australia, Tata Group in India, and Percassi Group in Italy. These partnerships leverage local knowledge and capabilities to enhance market penetration and operational efficiency in respective regions.

According to research by Belmiro et al. (2010), Inditex opts for franchising in markets with high cultural distance, small market sizes, or low sales forecasts, such as Saudi Arabia, Kuwait, Andorra, or Malaysia. In these instances, franchising mitigates risks associated with direct investment while leveraging local partners’ understanding of the market.

For Zara, franchisees adhere to the same business model as subsidiaries concerning merchandise selection, store location, design, logistics, and human resources. However, franchisees are responsible for investments in assets and hiring staff, distinguishing their role from that of company-owned subsidiaries. This model allows Zara to maintain consistency in brand presentation and customer experience across diverse global markets while mitigating operational risks in challenging or unfamiliar environments.

4. Production organization: production and distribution essentially centralized in Spain

According to Tejero (2007), the operational and production process entails several key steps: controlling and calculating material needs, processing orders with suppliers, coordinating delivery schedules, conducting quality control upon receipt of products, organizing product placement in warehouses, utilizing advanced computer systems for supply processes, and continuously improving production workflows.

In addition, a distribution channel’s primary function, as noted by Vásquez (2009), is to link products with markets and establish a pathway for sellers and buyers to engage in transactions. However, even the most technologically advanced and well-designed distribution channel will fail if it does not receive the right products tailored for appropriate markets. This underscores the critical importance of aligning production and distribution strategies to effectively meet market demands and optimize operational efficiency.

Based on the information provided, Inditex has established twelve factories in Spain along with 162 suppliers. Despite higher labor costs compared to regions like the Middle East, North Africa, or Eastern Europe, these suppliers play a crucial role in Inditex’s supply chain. The supply chain is defined as the operational processes essential for manufacturing a product, encompassing a network of organizations through which information, products, and financial resources flow (Fontalvo-Herrera et al., 2019). This integrated network ensures the efficient production and distribution of Inditex’s products, despite the higher costs associated with manufacturing in Spain.

The Inditex brand manufactures just over half of its items internally, focusing on the most fashionable products that are produced without delays. The remainder, primarily consisting of “basic” items, is outsourced, with over 70% of this outsourcing occurring within Europe, particularly in Portugal and Turkey.

Headquartered in La Coruña, Spain, Inditex directly manages 5,965 of its 6,381 stores located across Europe, the United States, South America, and Japan. The company packs and labels nearly a million items per week, categorizing them by reference, size, color, and destination, ensuring they are ready for global distribution. This high turnover and streamlined distribution process enable Inditex to efficiently serve markets worldwide.

According to Christopher (2016), a key objective of supply chain management is to minimize or eliminate intermediate inventory storage between organizations through effective information exchange on demand and current stock levels. As a result, Inditex’s warehouse in Arteixo (La Coruña) is emptied twice a week, facilitating frequent deliveries to all stores and eliminating the necessity for store-level inventory.

Inditex manages surplus and shortages by conducting rounds between its sites, ensuring efficient redistribution among multiple stores at the same location. This proactive approach ensures that excess inventory does not need to be returned to the warehouse in Spain, optimizing the supply chain’s efficiency and responsiveness to market demands.

Inditex’s business model revolves around a logistics system structured around multiple geographical hubs in Spain, each tailored to meet the distinct distribution requirements of its diverse brands. To manage costs associated with labor, production is outsourced. Distribution is handled through various warehouses across the Iberian Peninsula, utilizing a strategy known as “differentiated distribution centers.

For instance, Massimo Dutti and Stradivarius consolidate their distribution operations in Barcelona due to their shared origins, while Bershka and Oysho utilize facilities in Tordera and Sallent, both located near Barcelona. This strategic distribution setup optimizes operational efficiency and enhances profitability across Inditex’s portfolio of brands.

All production operations for Pull & Bear are centralized in Narón, Spain, while footwear and leather goods are managed at the Tempe facility in Elche, Spain. In the case of Zara, the distribution center in Meco, located near Madrid and Zaragoza, oversees production for Zara Home and Kiddy’s Class. This strategic placement near an airport logistics hub enhances logistical efficiency for distribution operations (Badía, 2008).

5. Key success factors: flexibility and responsiveness

Benavides (2013) characterizes Inditex’s logistics as impeccable, underpinned by advanced computer systems dedicated to daily automatic replenishment management. Real-time communication with each global store ensures an optimal commercial environment. Inditex emphasizes short circuits, enabling rapid multiplication and supply of mini-collections and diverse clothing ranges throughout the year to enhance store traffic. This strategy of limited editions also mitigates risks, reduces inventories, and shortens delivery times.

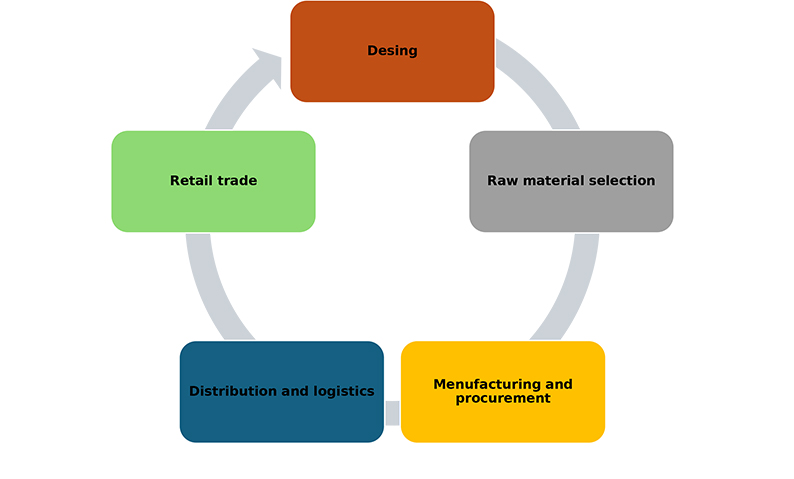

The group attributes much of the success of its internationalization process to its agility and optimization. Inditex’s case serves as a prime example of sustainable differentiation from competitors through the strength of its supply chain (Figure 1).

Inditex’s logistics platform is renowned for its ability to design and deliver a new collection in just 15 days, encompassing the entire process from design and manufacturing to delivery. In contrast, competitors such as GAP and H&M typically take between 3 to 4 months to launch a new collection into the market. This rapid turnover of offerings, combined with continuous introduction of new items, instills a sense of urgency among customers. This prompts them to visit stores regularly to stay updated on the latest trends and avoid missing out on new arrivals.

This proactive and agile approach allows Inditex to swiftly adapt to climate changes and evolving consumer preferences. It represents a significant competitive advantage in an industry heavily influenced by seasonal trends, enabling Inditex to maintain relevance and drive customer engagement effectively.

Furthermore, this integrated production and distribution system is bolstered by a meticulously optimized information system operated via an intranet, facilitating real-time communication among all supply chain stakeholders. This intricate network of integration spans across companies and various public and private entities including banks, transporters, port authorities, warehouses, and insurers. Such collaboration serves to delineate and comprehend the pivotal factors that foster competitiveness within this dynamic business landscape (Valencia and Gallegos Ortiz, 2014).

6. A regional position to strengthen

Inditex’s focus on South American countries over the rest of Europe can be understood from several perspectives. Cultural proximity is certainly a significant factor. Despite the influence of American culture in Latin American countries, they still maintain strong cultural ties with Spain in terms of language, traditions, and values. This shared cultural foundation facilitates the entry of Spanish companies into these markets. Additionally, from a market niche standpoint, the growing middle class with relatively high incomes presents an attractive target for fashion brands like Zara. The youthfulness and trend towards a hedonistic lifestyle in many Latin American countries align well with Inditex’s brand image, promoting the acceptance and success of its products in these markets. Cuervo-Cazurra and Liberman (2010) highlights Latin America as a research laboratory for advancing international business theory.

Following its successful pilot in Mexico, considered phase 1 of internationalization, Inditex expanded its operations to other countries in the region, consistently under its flagship brand, Zara. The advantage for Zara lies in the similarity of collections presented in Latin American countries to those in Europe, primarily featuring garments suitable for warm climates due to the prevalence of summer in the region Belmiro et al. (2010) note that “Zara has adopted the same strategy for most European and South American countries, characterized by high growth potential and low risk for the company.

In 1999, phase 2 began, and Inditex simultaneously ventured into three more countries: Brazil, Chile, and Uruguay. These countries now represent 1.19% of the company’s total stores, capitalizing on the business opportunities offered by Mercosur in that decade and the economic development levels in the subregion. The solid growth experienced in the region since the early 1990s is attributed to the expansion of establishments and the aggressive offering of products that met the fashion standards of the time. Currently, Latin America is the second most important area for the group in terms of the number of stores, despite significant growth in Asia, particularly in China, which accounts for 4.2% of the total stores.

Phase 3 of the internationalization process began in the 2000s with the opening of stores in Central America, including El Salvador, Panama, Costa Rica, Guatemala, and Honduras. This phase continued with expansion into Andean countries such as Colombia, Peru, and Ecuador, achieving rapid market positioning and representing 1.5% of the total stores. Although these countries presented high country risk for attracting foreign capital, they offered a potentially attractive market. This potential is reflected in a significant 15.2% variation compared to the previous measurement, marking one of the most outstanding growth processes for the group in the region (Table 1).

Table 1 Progressive Outsourcing

| Creation date | Country of internationalization | Number of warehouses per country (Individual) | Percentage / Total (%) | Accumulated warehouses | Percentage variation by country (%) |

|---|---|---|---|---|---|

| 1992 | Mexico | 382 | 5.9 | 38 | 19. |

| 1998 | Argentina | 11 | 0.2 | 393 | 2.9 |

| 1999 | Uruguay | 4 | 1.0 | 461 | 17.3 |

| Brazil | 51 | ||||

| Chile | 13 | ||||

| 2000 | Puerto Rico | 3 | 0.05 | 464 | 0.7 |

| 2002 | El Salvador | 8 | 0.12 | 472 | 1.7 |

| 2004 | Panamá | 11 | 0.17 | 483 | 2.3 |

| 2005 | Costa Rica | 11 | 0.17 | 494 | 2.3 |

| 2007 | Colombia | 60 | 1.2 | 569 | 15.2 |

| Guatemala | 15 | ||||

| 2008 | Honduras | 11 | 0.2 | 580 | 1.9 |

| 2011 | Peru | 7 | 0.1 | 587 | 1.2 |

| 2012 | Ecuador | 13 | 0.2 | 600 | 2.2 |

| 2013 | Dominican Republic | 13 | 0.2 | 613 | 2.2 |

| 2016 | Nicaragua | 4 | 0.1 | 619 | 1.0 |

| Paraguay | 2 |

Source: Authors’ own elaboration based on INDITEX Annual Reports data.

We could discuss a final phase that more clearly defines a psychographic segmentation strategy in Caribbean countries. This strategy begins with Puerto Rico, followed by the Dominican Republic and Paraguay, with a variation of 3.7%.

Despite the significance of political and economic hurdles in Latin America, Inditex is grappling with a complex scenario in the region. As per the group’s most recent projections, there’s a structural trend indicating a diminishing contribution from Latin America to its worldwide revenue. This trend can be attributed to several factors. These include a loss of price competitiveness due to exchange rate volatility and inflation, regional political differences that obstruct consistent growth across countries, and the swift proliferation of new stores in other global regions.

Particularly, the Asian market presents a substantial opportunity for Inditex, considering the existence of large urban centers and an expanding middle class with considerable purchasing power. This could inspire a shift in the internationalization strategy towards minimizing production costs in Asia, which would be reflected in a lower final product price.

Several factors keep the region in focus as a target; the high concentration of urban areas and flexibility in advertising regulations present opportunities for growth. Furthermore, economic openness and customs agreements, such as those established between the European Union and Mercosur, or the European Union and individual countries like Colombia, Peru, and Mexico, facilitate a more efficient supply chain by enabling bidirectional product offerings.

Several factors keep the region in focus as a target; the high concentration of urban areas and flexibility in advertising regulations present opportunities for growth. Furthermore, economic openness and customs agreements, such as those established between the European Union and Mercosur, or the European Union and individual countries like Colombia, Peru, and Mexico, facilitate a more efficient supply chain by enabling bidirectional product offerings.

Conversely, the relatively low labor cost from a production standpoint remains appealing. Outsourcing a portion of production to established factories, such as ‘maquiladoras’ in Mexico and Brazil, or specialized textile production in Colombia and Peru, could present an intriguing option for Inditex, particularly considering its presence in these countries. The establishment of a production division in the region would also be strategically sensible, with the potential to impact the entirety of the Americas, spanning from North to South America.

Despite the initial advantages of the comprehensive approach, the global expansion of companies like Inditex encounters various constraints. Commercially, most major urban centers already host their own Zara stores, and numerous Latin American cities lack the population necessary for new store openings (De Mattos, 2006). Technically, catering to an increasing number of stores across such a vast continent necessitates a reevaluation of the logistics model. In terms of the market, Inditex continues to prioritize Europe due to a more uniform population in terms of fashion trends. Technologically, the ‘e-business’ strategy faces cultural obstacles in the region that impede its adoption for purchasing (Montes Cató, 2020)

7. Implemented regional strategies

In developed countries, industrial products are transitioning towards services linked to brands, which complicates innovation in the physical production of textiles and apparel, with the exception of technical textiles. The crux of innovation now rests in the transformation of consumer preferences and the creation of symbolism surrounding clothing. This enables the production of fashion anywhere, making the relocation of production increasingly appealing due to labor costs and the ease of communication, as previously mentioned.

Examples of this approach are evident in companies such as Decathlon, a French group that operates as a producer and distributor of sports goods across five continents. In Latin America, Decathlon focuses its production in Mexico. Conversely, the Swedish company H&M has embraced a distinct strategy: preserving a robust brand and producing on a regional scale, with expansion into Mexico and the Caribbean.

Carrefour, the multinational food distribution company, has emphasized flexibility in response to the economic cycles of each country. Indeed, countries such as Brazil and Argentina have periodically undergone periods of hyperinflation, which may have complicated the management of stores with a vast array of products. As a result, Carrefour’s strategy was centered on a reduced commercial offering, focusing on high turnover products. Innovation at Carrefour remains a continuous process.

For instance, each year sees the introduction of various products and services associated with the brand. These include leisure activities (holidays, shows), ecological products, tires, stores, and gas stations.

Inditex has embraced the strategy of forming joint ventures with local partners, a tactic that has already been implemented in Europe and Far Eastern countries. This strategy entails acquiring equity stakes without investing in production units, thereby reducing costs and capitalizing on the expertise of local companies. The expansion policy executed by the Inditex group has been examined through various case studies. This policy is intimately tied to the success that the group has achieved and can be linked to several of its strategies. Given the unique characteristics of each region, the model has evolved towards new logistics, production, distribution, and sales strategies, with the aim of being closer to the end consumer.

One strategy involves the creation of industrial subsidiaries that function as independent production units separate from their commercial establishments. This approach entails the relocation of production to capitalize on disparities in labor costs, local expertise, and enhanced international logistics. While labor productivity may fluctuate, wage disparities lead to substantial reductions in production costs, thereby bolstering the company’s margins.

The constraints of this strategy encompass current costs and inflexibility, recruitment, training in Inditex policy (both in Spain and in other countries where the brand is established), and adherence to local legislation.

Another strategy involves forming joint ventures with local companies, a tactic that has been successfully implemented in Europe and Far Eastern countries. This approach entails acquiring equity stakes without the necessity to invest in production units, thereby reducing costs and capitalizing on the experience of local companies.

The limitations of this strategy center on the control of joint activities, the risk of discrepancies in strategic management, the distribution of profits, and the potential loss of know-how.

Instead of establishing new subsidiaries from the ground up (internal growth), Inditex has also opted for contract manufacturing, which involves hiring local companies for the production of various products (external growth) (Barreiro, 2008a). This strategy offers significant time-saving advantages when initiating the manufacturing process. Inditex retains complete control over the process, from the conception of collections to the final sale to the customer. This comprehensive and global approach is vital for the group, which has achieved remarkable integration in the industry. By contracting a network of small and medium-sized enterprises for production, distribution, and marketing, Inditex operates efficiently in a highly competitive market (Barreiro, 2008b).

The constraints include identifying a match between the target activities and those of the company to be acquired, as well as the challenge of imposing the group’s model on the existing one in terms of staff training. There’s also a risk of straying from the strategic control policy.

As a final strategy, Inditex establishes subsidiaries rather than opting for franchises in their commercial structure. This decision ensures enhanced control, as the majority of stores are directly owned by the company. Franchises are reserved for smaller markets and are granted to large industrial groups with experience, such as those in the Dominican Republic and El Salvador. Galetti et al. (2020) note that for international expansion, Inditex primarily utilizes its own subsidiaries and joint ventures. These are categorized into participation and non-participation modes, such as exports and license contracts, with the emphasis being that non-participation modes are predominantly used in franchises (Barreiro, 2008b).

Constraints include the challenge of identifying suitable business groups that can uphold the brand identity, as well as the intricate difficulties involved in managing the brand usage contract.

8. Results and conclusions of the study

Based on the analysis conducted, it can be concluded that throughout its history, Inditex has confronted substantial challenges but has devised three robust strategies. Initially, the company concentrated on product development; subsequently, it underscored logistics; and ultimately, it adopted a brand strategy complemented by commercial development. This evolution has propelled productive intensification in all regions where it operates.

In Asia, the feasibility of production is linked to the availability of inexpensive labor, a strategy commonly employed by major local brands. However, the outsourcing of textile production isn’t driven solely by low wages, but also by the proximity necessary to sustain the rapid response required for the brief product cycles in the fashion industry.

Inditex employs a variety of internationalization strategies in Latin America, encompassing industrial subsidiaries, joint ventures, contract manufacturing, and franchises. Each strategy possesses its own merits and constraints, and the selection of the suitable strategy hinges on various factors, such as the economic and political circumstances of each country.

Despite witnessing substantial growth in Latin America, Inditex confronts challenges encompassing commercial, technical, market, and technological constraints. Tackling these challenges necessitates meticulous consideration and adaptation of the company’s strategies to guarantee sustainable growth in the region.

Latin America continues to be identified as a pivotal region for Inditex; however, several challenges emerge from various perspectives. From a logistical standpoint, there’s a necessity to develop infrastructures that facilitate geographical economies of scale and establish a region-specific production system. Commercially, a reassessment of the marketing strategy is required, with a focus on expanding market niches through outlet centers in key urban districts. In terms of production, given the potential of the Chinese and Asian markets in general, it would be strategic for the group to reorganize its production activities on a global scale, capitalizing on its already established commercial presence in the region. From a communication perspective, it’s vital to implement a new commercial policy in Latin America, such as the inauguration of Zara Malls, to stimulate demand and generate needs. Additionally, bolstering advertising and promotion is necessary to solidify the brand’s presence in the region.

The case of Inditex serves as an exemplar of a successful internationalization strategy, predicated on the centralization of production in Spain and a highly efficient logistics network. The company has embraced a rapid-response strategy, enabling it to swiftly and efficiently offer mini-collections and other clothing ranges. This rapid-response capability plays a significant role in its sustainable differentiation in the global market.

In a potential extension of this study, the future trajectory of Inditex could be scrutinized. This would involve focusing on the development of logistics infrastructures in emerging regions, the implementation of technology and automation to enhance operational efficiency, and the diversification of market niches through outlet centers and specialized stores. In addition, there could be an optimization of production in Asia with an emphasis on sustainability, the introduction of new store concepts such as Zara Malls, and an evaluation of political and economic risks that could potentially impact its operations. Ultimately, recommendations would be formulated to fortify Inditex’s competitiveness and ensure its sustainability over the long term.