1. Introduction

The contemporary resurgence of China as a political, economic and diplomatic superpower in the international arena is of growing academic interest and pivotal in understanding the unfolding consequences of this major geopolitical shift. China as an ascending power is projecting its influence on regions that are out of its traditional sphere, namely East and South Asia, to new regions like Africa or in this case, Latin America and the Caribbean (LAC).

This document aims at discussing the dual role that China is playing in Latin America; on one hand, a strategic trade partner in Asia, source of foreign direct investment (FDI) and key ally in the international arena, and on the other hand, China is a formidable competitor, particularly in the manufacturing sector. In order to accomplish the main objective, we make a brief description of the international trade relation, a review of the investment flows, and lastly, a description of the political and diplomatic relation between Latin America and China.

China's increasing demand for commodities like oil, iron, ore and some agricultural products, and its massive currency reserves -which peaked at almost $4 trillion USD in July 2014-, might explain why China has strengthened its diplomatic and commercial ties with Latin American countries (Barboza, 2009; Ellis, 2005; Ferchen, 2011; Gallagher, 2016 & Wise, 2016) from investing in infrastructure projects, SWAP agreements and as the most recent Asian member of the Inter-American Development Bank since 2009 (Russo, 2014).

The ties between China and Latin America had been weak in the past due to a vast geographical distance between the two regions; but that gap has been bridged in recent years through growing international trade, capital flows, more efficient means of transportation and communication, basically, the ongoing process of globalization. China is engaging in the world aggressively.

In November 2008, China issued its first policy paper regarding Latin America and the Caribbean, giving a framework for the current developments in trade, cooperation and investments (Chinese State Council, 2008). One of the greatest improvements in the implementation for this policy has been the creation of a China - CELAC Forum with the aim of promoting trade and investment between China and CELAC countries1 (CEPAL b, 2015).

To bridge the Pacific Ocean is both a challenge and an opportunity that most likely will shape the fate of the 21st Century relations between China and Latin America. Understanding the implications and possible outcomes of the recent diplomatic, political, economic and commercial engagement of China in Latin America is not only an interesting intellectual and academic pursuit, but it has got practical implications due to the policy making process and the business strategy of all the interested parties.

2. Literature review

This brief literature review is an attempt to identify major themes and debates regarding the evolving relation between China and LAC. The criteria that were used to make this list are relevance, novelty and a digital search of keywords.

The new economic and political ties between China and LAC have captured the attention of different scholars and political leaders. Among them, Ferchen (2011); Ellis (2014) , Gallagher (2016) and Wise (2016) argue that the relationship between China and LAC has been driven by the Chinese increasing commodities such as oil, iron, ore and some agricultural products, business ventures and diplomatic necessity for initiatives with friendly regimes in the region.

Indeed, Barbosa and Guimarães (2010) and CEPAL (2010) suggested that the export of Latin American commodities to China had helped the region during the global financial crisis. Likewise, Gallagher and Porzecanski (2010) pointed out that the import of commodities from China had also helped to restore the economic growth of the region However, Lederman, Olarreaga & Perry (2009) and Cordeiro, Santillan and Valenzuela (2015) argued that the trade relation with China has turned Latin America into an importer of industrial goods and a commodity exporter. Likewise, Rosales (2010) stated that China has intensified the concentration of Latin America's commodity export.

Another theme in the literature is the Chinese foreign policy. In 2008, the Chinese government published its first policy paper regarding the region and a clear intention of its engagement, and a blueprint for the development of stronger ties between the two. The document covers some historical milestones, the scope of the cooperation in the political, economic, cultural and social fields. It is worth to highlight the intention of China to negotiate free trade agreements with regional countries (Chinese State Council, 2008).

The role of China in international political and economic institutions led to tinker with the idea of "The Beijing Consensus", coined by Cooper (2004) as an economic and political model that challenges the established "Washington Consensus", which questions and challenges the legitimacy and relevance of the West and its political and economic practices in our contemporary world. Similarly, Gallagher (2016) states that China has helped Latin America to overcome the slow growth and financial instability generated under two decades of the Washington Consensus.

Medeiros (2009) discusses the international behavior of China in different parts of the world; in this publication, there is a chapter that is dedicated to Chinese political and business ventures out of Asia, namely Africa and Latin America. According to Medeiros, there are four major forces that drive Chinese endeavors in these regions; i) to diversify access to natural resources; ii) to expand access to markets for consumer goods, cars and conventional weapons; iii) to promote multilateralism; iv) to diplomatically isolate Taiwan from Africa, Latin America and the Caribbean where most of the support for Taiwan still exist. Erikson and Chen (2007) addressed the issue of China, Taiwan and Latin America in the following terms:

[...] Latin America has emerged as the crucial battleground where a dozen struggling nations, mainly in Central America and the Caribbean, have become ensnared in the cross-strait dispute. [...] officials in Washington have yet to fully consider the possible implications for U.S. policy of this intensifying competition in their own backyard. (pp. 69-70).

A monograph by Ellis (2005) is probably one of the earliest works linking China and the region. This document presents a strategic-competitive approach to the relation between Latin America, China and the United States regarding strategic resources, investment and political alliances. In this work, the author suggests that the aim of China's investment in Argentina, Brazil, and Chile is to construct a vertical integration with the region in order to guarantee access to critical commodities.

The Chinese involvement in the region has made some influential think tanks call the U.S. government to introduce bolder policies towards Latin America in order to balance the increasing influence of China (Johnson, 2005). Additionally, Yu (2015), argued that China's aim in Latin America is not only to increase trade and investment flows but also to create a "sphere of influence" in the region. Roett and Paz (2008) debate the implications of developments in foreign policy for both regions; they cover some issues on Chinese foreign policy, geopolitical tensions, energy and investments overseas. Additionally, they formulate a question on what Latin America can learn from the economic progress of China and close with some remarks on the "trilateral" relation between China, the U.S. and Latin America.

Security is one of the major themes that appear in specialized literature. The United States National Intelligence Council (NIC) has published a series of reports called Global Trends 2010 (1997), Global Trends 2015 (2000), Mapping the Global Future 2020 (2004), Global Trends 2025 (2008) and the most recent, Alternative Worlds 2030 (2012). These reports, mostly based on military and security assumptions, demographics, and strategic factors and forecasting techniques, outline the ascent of new international players -mainly China-, as contenders of the United States in Latin America and other parts of the world.

3. Trade

The economic growth in China, still strong in recent years despite the global financial crisis and its aftermath, incited the "Middle Kingdom" to explore beyond its traditional trading partners, and take a look at new places like Africa and Latin America, both for suppliers and new markets for its products. China's growing demand for commodities -oil, iron ore, copper, aluminum and others-and abundant foreign reserves allowed China to secure -sometimes at fire-sale prices- some of these strategic assets in something that the international media dubbed as the Chinese "shopping spree" (Barboza, 2009). These strategies are consistent with China's involvement in other developing countries (Zhao, 2014).

Then (Figure 1), depicts the trade flows between Latin America and China for the last 15 years. As the data shows, it has been growing fast since 2001, when the region exported $5.2 billion USD to China and imported $10.4 billion USD. In 2014, Latin America and the Caribbean (LAC) exports to China peaked at $97.5 billion USD, declining in 2015 to $82.5 billion. As for imports from China, it also peaked in 2014 at $179.5 billion USD, closing 2015 at $176.3 billion. During the last 15 years bilateral trade increased by a factor of sixteen, from $15 billion in 2001 to almost $259 billion in 2015. Among the factors that influenced this growth was the Chinese accession to the WTO2 in 2001, and the 2004 and 2008 visits of the Chinese president Hu Jintao to the APEC3 forum and to different countries in Latin America, including Argentina, Brazil and Mexico (Ellis, 2014).

Source. Prepared by the authors with data from the International Trade Centre.

Figure 1 Bilateral trade between Latin America and China, 2001 - 2015.

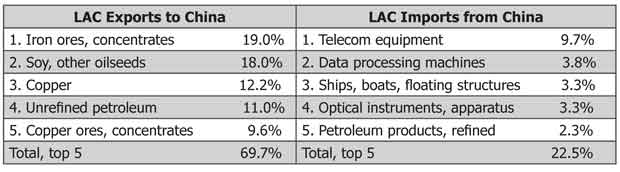

Most of Latin American exports are commodities, highly concentrated in few products. While China's exports to the region are diversified. Table 1 shows, the top five export products are commodities that represent around 70 % of the total exports to China. While the top five exporting products from China represent less than 23 % of the total. CEPAL (2015 a) exhibits that the composition of Latin American exports to China are less sophisticated than the composition of the exports that go to the rest of the world. For instance in 2013, commodities represented 73 % of the total of the exports to China and manufacture represented only 6 %. In contrast, 41 % of the exports to the rest of the world were commodities and 42 % manufactured goods. According to Casanova et al. (2015), the countries with higher export dependency to China are Costa Rica, Colombia and Uruguay. Export dependency means that these countries are highly exposed to a shift in the demand of China (Table 1).

Decline in commodity prices is a current challenge for Latin American exports to China (Gallagher & Porzecanski, 2010; Farooki & Kaplinsky, 2012). Even though the quantity of the main exports have continued to increase, the value has been falling, thus creating a pressure for Latin America to diversify and upgrade its production structure in order to have a more beneficial trade relation with China (OECD/ECLAC/ CAF, 2015) (Figure 2).

Source: Ray, Gallagher & Sarmiento, (2016).

Figure 2 Volume and Value Changes in Major LAC-China Exports, 2015.

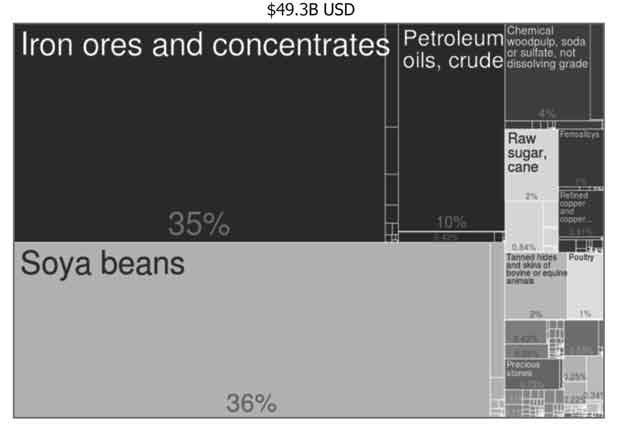

Brazil is an important case to study, due to its recent performance, the size of its market, the enormous potential it has, and the fact that China became Brazil's main trade partner since 2009 (Latin American Herald Tribune, 2009). According to Wilkinson and Wesz (2013), the trade relation with China has produced benefits and losses to Brazil; for instance, China's demand on commodities and agricultural products has helped to promote Brazil's agro-industrial and mineral exports. However, it has generated export concentration. Crude oil, iron ore and soybeans accounted for more than 80% of Brazil's exports to China in 2014 (Casanova et al, 2015) (Figure 3).

Source. The Atlas of Economic Complexity, Center for International Development, Harvard University.

Figure 3 Brazil exports to China in 2014.

Moreover, Chinese manufacturing trade with the region has been increasing while Brazil's regional manufacturing exports have sharply declined; Rosales (2012) suggested in this regard that in around 12 %. Likewise, Jenkins and Barbosa (2011) calculated that Brazil's trade to Chile, Venezuela, Argentina and Mexico have declined in 14.4 %, 8.6 %, 6.8 % and 6.6 % respectively due to exports from China to these countries. A new study has demonstrated that Brazil has been losing market share in the U.S. and Europe against competitors from China. It is important to point out that this phenomenon has happened with low and high technology products (Jenkins, 2014; Jenkins & Barbosa 2012). Indeed, numerous studies show the impact of Chinese competition in LAC. Ray, Gallagher & Sarmiento (2016), found that in the manufacturing sector, the LAC have lost competitiveness in around 80% due to the competition of China. Gallagher et al. (2008) and Devlin, Estevadeordal, and Rodríguez-Clare (2006) demonstrate that Mexico has lost market share in the world because of China.

4. Investment

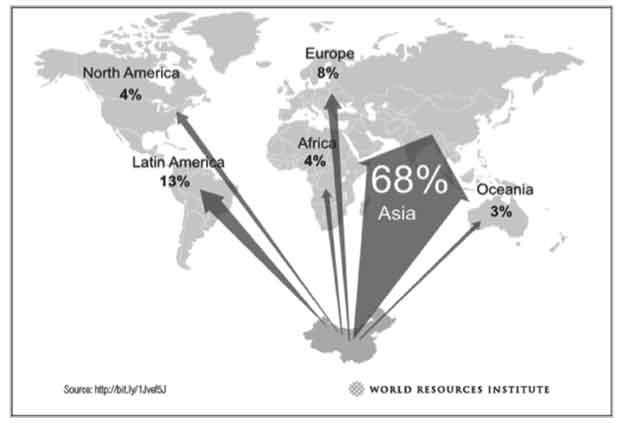

During the last decade, Latin America became an important recipient of Foreign Direct Investment (FDI) and loans from China. Indeed, -as it is shown in figure 3-, Latin America was the second recipient of Chinese FDI, receiving more FDI than the U.S. and Europe combined (Zhou & Leung, 2015). Latin America, and the whole world, are depending on Chinese economy performance, the World Bank Group (2015) forecasted that a decrease of 1 % on the Chinese GDP4 would reduce Latin American growth in 0,6 %.

So, shows the outbound FDI flows from China to different regions in the world. For obvious economic and trade reasons, 68 % of this investment goes to Asian economies with close ties to China's manufacturing corporations and regional value chains for intermediate and final goods. However, the second place in this distribution -13 %- goes to Latin America, surpassing the outbound FDI to Europe and North America (Figure 4).

During the downturn, China became the lender of only resort; but with global credit markets unwilling to lend, China made strategic investments in commodities and large loans to their banking partners (Ellis, 2014). Regarding energy, China closed deals (oil for loans) with Brazil and Venezuela (Barboza, 2009), with Argentina a swap agreement for $10 billion for three years (Faries & Goodman, 2009), and a free trade agreement with Peru (Forbes, 2009). China has secured sources of iron ore for steel production, and copper and aluminum assets for the production of consumer goods. Between 2010 and 2013 almost 90 % of China's FDI outflows to Latin America were invested in natural resources, turning China into one of the biggest investors in oil and gas in Argentina, Brazil, Colombia, Ecuador, Peru and Venezuela (CEPAL a, 2015).

Since 2005, China has been constantly lending money to Latin America, despite China's economic slowdown; most of the funds went to Argentina, Brazil, Ecuador and Venezuela. These four countries have received about 93% of China's loans to Latin America, 81% of the loans come from the China Development Bank and the 19 % remaining from the China Export-Import-Bank. According to Gao and Yu (2011), these financial movements reflected Chinese leadership strategy to internationalize the Yuan Renminbi (CNY). Additionally, it was used to create a financial integration with the region like it happened in ASEAN5 countries with the Chiang Mai Initiative (Figure 5; Table 2; Table 3).

Source.Myers, Gallagher &Yuan, (2015).

Figure 5 Chinese finance to Latin America by year, 2005 - 2015 (USD million).

Source.Myers, Gallagher & Yuan (2015).

Table 2 China loans to Latin America (cumulative, 2007-2015).

With a touch of foresight about this, Ellis (2005) commented that "the pattern of Chinese investment in countries such as Argentina, Brazil, and Chile suggests that the Asian giant is seeking to assure access to critical commodities by constructing vertically integrated supply networks over which it has leverage."

In the report of the OECD/ECLAC/CAF (2015), it is concluded that "trade between Latin America and China has expanded in an unprecedented way over the last 15 years; [...] The result is stronger, though uneven, global value chain linkages between China and Latin America."

In order to avoid the negative externalities a new cooperation plan between China and Latin America was signed in January 2015 (Ministry of Foreign Affairs, the People's Republic of China, 2015). The new plan has emphasis on fostering trade and capital flows into high technology and value added goods production, especially in fields such as machinery, petrochemicals, clean energy, transportation equipment, electronics, digital medical equipment, information and communication technology, biotechnology, and pharma. If the cooperation plan were implemented successfully, Latin America would see greater advantages from its relation with China.

5. Political Aspects

For a long time and since the formulation of the Monroe Doctrine in 1823, Latin America has been of strategic importance for the United States; the U.S. adopted Latin American countries as "Southern Brethren" and favored the then-recent independence and the principle of no-intervention of European Powers in the newly formed republics.

Since then, Latin America and the Caribbean have been considered the backyard of the U.S. in its close sphere of influence and control (Hakim, 2006). For example, the U.S. identified the strategic importance of the Panama Canal, took over the project from the French and promoted the independence of Panama from Colombia; former U.S. president Carter signed the return of control of the Canal to the Panama authorities and finally administered the Canal until December 31, 1999. Now, two ports in the Atlantic and the Pacific are leased to the Chinese company Hutchinson-Whampoa that according to Erikson and Chen (2007) has close ties to the People's Liberation Army.

Recently, the Chinese government and private businesses have tried to develop similar projects: in 2013, China announced the construction of the Nicaragua canal; in June 2015, China announced the construction of a mega-railway to connect the Caribbean and the Pacific through Peru and Brazil. In Colombia, China has sought to build a railway to connect the Pacific Ocean and the Caribbean Sea (Romero, 2015).

The involvement of a major Chinese corporation in one of the most important routes for international trade, as well as the railway and the canal projects are a political-strategic issue that requires deeper analysis in order to identify the implications of these events for the region.

Several scholars argue that China is using soft power in Latin America in order to rise in the global power hierarchy (Lei, 2015; Ellis, 2011; US Government Publishing Office, 2008) and create a new multipolar global order (Harris, 2015). In addition, Pineo (2015) calls to attention the fact that China's trade relation and investment in Latin America appears to be without any evident political or policy conditionality.

However, given the fact that 12 out of the 22 countries7 which recognize Taiwan as an independent state are from Latin America, putting the region at a strategic place for the Chinese government to exert its influence and take the cross-strait puzzle to another level (Erikson & Chen, 2007; Ministry of Foreign Affairs Republic of China, 2016).

6. Conclusions

The analysis of the relation between China and Latin American provides a number of economic and political insights on how China has approached the region. As discussed above, Chinese economic performance has been driving the increasing demand for commodities like oil, iron ore and some agricultural products. China has become one of the most important trade partners for Latin America and the second source of FDI to the region, contributing to the regional economic performance during the world economic downturn of 2008-2009. The commodity boom experienced by Latin American economies might have helped their local economies to grow. The wealth transfer from China to Latin America could have been an opportunity to formulate and implement good practices in public policy in order to reduce inequality and create the basis for long-term sustainable growth and prosperity.

However, this economic relation has also caused several negative externalities for the region. First, the mixture of Chinese demand for commodities and their high prices has generated export concentration, leaving the region exposed to commodity price fluctuation. Second, most of Chinese FDI and loans have been invested in a few countries and in natural resources, creating re-specialization on the production of commodities. Third, modern economic history has shown that countries like Malaysia or Chile can successfully pass the different stages of economic growth, from commodity exports to manufacturing, but the regional manufacturing base is at risk due to Chinese labor competitiveness, technical prowess and more recently, massive investments in manufacturing automation. Fourth, it seems that China is increasing its market share on manufactured products, affecting Brazil's manufactured exports to the region.

Accordingly, China is playing the dual role discussed in the introduction of this document; it has become a major trading partner for the region and source of investment for all kinds of development and infrastructure projects, but on the other hand, the collected evidence shows a re-primarization and de-industrialization on the Latin American side.

The resurgence of China as an economic, political and diplomatic superpower in our contemporary world is a multi-faceted and complex subject, worthy of deeper and more systematic research by scholars and business people alike. Most of the current international institutions and regimes were created after the Second World War and under the tenets and tutelage of the West; Chinese growing influence in international affairs is slowly challenging traditional power structures and alliances worldwide.