Introduction

From 1450 to 1914 bullion and monetary flows oiled the integration of world trade. Even before the dramatic decline in transportation costs in the second half of the nineteenth century, the market of several nonferrous metals had been globally integrated for centuries.1 Extensive, dynamic networks of merchants and intermediaries connected producers in Andean highlands, Mexican arid plains, and Colombian tropical forests with coin and manufacturing users in Ottoman, Indian, and Chinese markets. Generations of scholars have discussed the imprints of such connections on the emergence of capitalism, the timing and location of the industrial revolution, and the mechanisms of commodity-money systems.2 Paradoxically, the role of mining in these issues has not attracted enough attention in the literature, with demand-side studies of metallic connections overshadowing the imprints of ore extraction and processing. True, the share of nonferrous and fuel metals production in terms of aggregate economic activity has been modest in many regions worldwide. However, the mining industry’s backward and forward linkages have transformed humans and nature dramatically.3

The reverberations of mining in Latin American history have been particularly significant. Since roughly 1500, most of the region’s economies have experienced mining cycles, with the exploitation of large and diverse mineral deposits exerting profound changes on local societies. Debates have ensued on the positive/negative imprints of such changes. Classic studies have highlighted a negative relationship between economic growth and mineral endowments, suggesting that mining-dependent economies have struggled to achieve capitalistic development despite the historical importance of the sector in shaping labor markets and its technological spillovers. Mining, in this vein, promoted rent-seeking behaviors, sectoral crowding out, and distortions in capital markets, that led some countries to experience what is commonly referred to as the “natural resource curse.”4

In the 2000s, however, scholars began to question the notion that mining necessarily led to economic backwardness. They pointed out notable exceptions such as the United States and Australia, which were able to achieve growth and structural change thanks to their mineral endowments.5 The debate has evolved toward an acknowledgment that the geological and ecological endowments alone do not, per se, determine economic performance. Instead, attention shifted toward the significance of political institutions that coordinate the allocation of revenues generated from the export of natural resources. It became evident that effective management and governance of these revenues play a crucial role in determining growth rates. Variables such as the size of other tradable and non-tradable activities and the opportunities for technological spillovers also matter in generating economic expansion.6

This new focus on the study of mining and development has not interacted with broader issues about the role of mineral extraction in the emergence of capitalism in Latin America. Historians of global economic history have long recognized the centrality of the new world’s mineral output in the development of capitalist societies via expanding trade, technological innovations, and changes in labor and capital allocations.7 Latin American mining historians have debunked traditional views such as the enclave nature of preindustrial mineral extraction and processing while more analytically calibrating its effects on labor and capital markets.8 The emerging field of the new history of capitalism has made important contributions, showing how mining production sustained commercial-oriented, capitalistic societies in the Bajío and in regions traditionally linked with coerced labor and non-commercial forms of resource allocation such as Potosí.9 These studies have helped to decenter the study of capitalism from the traditional cores in the northwestern Atlantic. However, the connections between mineral wealth and the emergence of different types of capitalist societies have remained unexplored.10

This paper seeks to engage with existing literature by providing an analytical synthesis and distilling some opportunities for cross-pollination between historians of capitalism and mining in Latin America. The analysis expands from the integration of the region into the currents of global markets in the 1500s to the twilight of export-led growth and the expansion of industrial and non-selective mining across the region in the early twentieth century. The paper pursues an ample geographic scope, putting Latin American mineral output within the context of global mining history, with comparisons and encompassing approaches shaping the analysis.

A two-way interaction between the practitioners of the new history of capitalism and those who study the history of mining may benefit the two fields in several ways. The former has enriched the understanding of global economic history by emphasizing the worldwide scope of connections before industrialization, the importance of coerced labor, power, and violence in shaping economic exchanges, and the multicentered nature of capitalism’s emergence.11 Yet, as Eric Hilt and other scholars have pointed out, the field has encountered several problems regarding methodologies employed and its growing isolation vis-à-vis classic studies in economic history.12 As a result, historians of capitalism have sometimes encountered challenges in accurately calculating key macroeconomic indicators. This has led to underestimating the significance of incentives and resource allocation at the firm-level analysis.

The very concept of capitalism-or capitalisms-has brought difficulties in defining the basic parameters of the field. While some scholars insist on the Marxian framework privileging wage labor and uncoerced social relations as the yardstick of the system, others have instead emphasized commercialization, sustained economic growth, competitive markets, and institutions as benchmarks.13 Mining historians have been more judicious in integrating economic history in their analysis, with growing multidisciplinary tools from geology, gender studies, and environmental sciences improving the understanding of mineral extraction across the region.14 Yet, the field still lacks the global focus favored by historians of capitalism, while systemic reverberations of mining in local economies have remained mostly unexplored. In short, by identifying key gaps in the analysis of Latin American mineral production and flows, this article seeks to distill hypotheses to study the synergy between the histories of capitalism and of mining.

The paper proceeds as follows. First, it describes the main cycles of Latin American mining and the changing role of the region’s producers in global markets. Second, it examines the geological and ecological characteristics of the deposits in the region. Next, the paper provides a brief discussion of the technology and the economics of mining in Latin America. Finally, it ends with some closing remarks.

1. Global producers and Mining Cycles

Since antiquity, commodity money systems dominated the exchange landscapes of preindustrial economies, with gold, silver, and copper facilitating long-distance trade circuits. This money-driven demand reinforced the interconnectedness of global metalliferous flows, turning mining into a sector that was highly sensitive to international market conditions. Supply-side circumstances mattered as well. Mining has always been a capital-intensive activity, with sunk costs being particularly high.15 The sector, therefore, developed market-oriented forms of corporate investment that were harbingers of capitalistic development.16 It is not surprising, then, that global mining history experienced profound bust-and-bust cycles with frequent changes in the geographical location of leading suppliers and consumers.

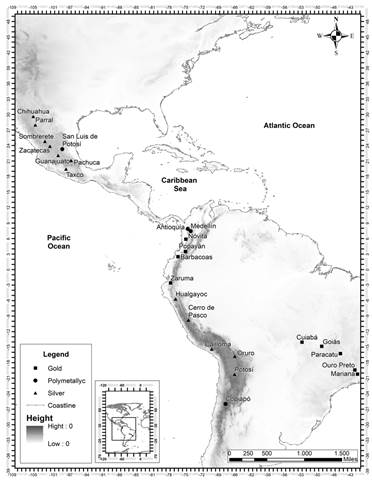

The entrée of Latin American producers into the world economy in the 1500s transformed mining cycles in profound ways (See Map 1 for key locations). These transformations unfolded in distinctive ways within the markets of the three major monetary metals: gold, silver, and copper. The impact on silver flows was substantial, with each successive cycle releasing larger quantities into global markets. On the eve of Columbus’ voyages, argentiferous production in the old world was bouncing back from a long downturn throughout the fifteenth century thanks in part to Chinese demand.17 Latin American producers played a pivotal role in not only strengthening the production of silver-bearing ores but also transforming the global mining industry in significant qualitative and quantitative ways. New technologies and new deposits transformed the cost structure of silver output while reducing its price worldwide, driving some mines in the old world out of business.18 From 1550 to 1650, silver surges were led by Upper Peruvian deposits in Potosí and Oruro, followed by suppliers in the Trans Mexican Volcanic Belt (Pachuca-Real del Monte, Taxco, hereafter tmvb), and the outflows from the mines of Western Japan particularly those located in the Iwami region.19 Estimates on the distribution of world output during these years vary, but there is growing consensus indicating that American silver accounted for around 65% of world production followed by Japanese supplies (30%), and other producers (5%).20 On the demand side, this cycle reinforced the centrality of Asian economies as “silver sinks,” with China and India absorbing growing quantities of Latin American and Japanese silver.21 European, Ottoman, and Safavid merchants became key middlemen in these flows, while the expansion of domestic markets in Latin America led to a growing retention of silver coins for domestic transactions.22

Source: Own elaboration following sources and information in the text.

Map 1. Latin America’s Main Mining Deposits before 1914

The second cycle of worldwide argentiferous flows stretched roughly from 1650 to 1820. On the supply side, despite a contraction in Potosí and other central areas, production stabilized or soared on the aggregate during the seventeenth century, paving the way for the dramatic expansion of the 1700s.23 The surge in supply was further bolstered by growing Chinese and Asian demand, leading to a substantial increase in relative silver prices until the 1750s.24 The expansion phase of this cycle marked the global dominance of suppliers in Spanish America, accounting roughly for 80% of the world output. After 1700, Mexican mines from Taxco to Guanajuato and Zacatecas overshadowed the production of the Andean deposits, despite a brief revival of Potosí.25 The main outflows from Andean mines shifted to Lower Peru, with mines in Cerro de Pasco, Hualgayoc, and Cailloma exceeding Potosí’s production on the aggregate.26 Also during this period Peruvian producers started to take advantage of copper and tin as by-products of silver production.27

The final cycle, less studied among Latin Americanists, spanned approximately from 1820 to 1914. This period was marked by the decline of both Mexican and Peruvian silver production during the early republican period and China’s transformation into a net exporter of silver.28 However, recent studies have shown that recovery was relatively fast in several regions. Production in Zacatecas recovered throughout the 1830s and 1840s, while Guanajuato’s performance bounced back in the 1840s.29 Around 1870, changes in the demand and supply sides of world markets shifted the patterns hitherto drafted. First, the US deposits in Comstock, the Great Basin, Colorado, and Australia’s Broken Hill deposits slowly flooded the market, reducing the once-central role of Latin America in global silver flows.30 Second, the ascendancy of the gold standard had both positive and negative implications for silver producers. On the one hand, it reduced the demand for the gray metal and consequently caused a significant decline in its price.31 However, on the other hand, it provided a competitive advantage to countries like Bolivia, Mexico, and Peru that maintained a domestic silver standard, as favorable exchange rates enhanced their export competitiveness. These changes in relative prices provided an additional incentive for big companies to produce base metals despite the high sunk and average costs that characterize their extraction.32

The study of worldwide cycles of gold flows has attracted less attention in the literature. By highlighting the role of international bimetallism in oiling global exchanges and defining the contours of capitalistic development, new studies have shown the importance of tracing the magnitude, direction, and structure of auriferous streams.33 During the four centuries that followed the integration of Latin American producers into international flows, approximately four cycles of gold production unfolded. The first reinforced an already expanding production from western and eastern African fields, the streams extracted as a by-product of silver mines in Hungary and the Balkans since the 1450s, and small gold-bearing areas in India, Vietnam, Sumatra, and Japan.34 Debates have ensued on the real quantitative imprints of this cycle and the influence of New World flows on them. It is clear, however, that prior to 1550, gold was exported in solid quantities from the placer fields in the Caribbean and New Spain, gradually declining as silver production rose.35

The opening of major placers in New Granada during the second half of the sixteenth century had a profound impact on world markets. Gold production experienced a significant increase, foreshadowing a lasting association between slavery and gold production, as will be explored in the subsequent sections.36 This shift in auriferous production transformed the Americas into the leading global supplier, accounting for 45% of the total, followed by Africa with 35% and South and East Asia with 20%.37 A third cycle unfolded from 1700 to 1850. The Brazilian mining surge (1700-1750) dominated global output until the advent of the second cycle of New Granadan production after the 1760s. During this period, the opening of the Russian auriferous flows in the Urals and the Altai Mountains further contributed to the changing dynamics of global gold production, while West African and Southern Asian production declined or stagnated.38 Brazilian outflows helped to offset the decline in the relative price of silver in bimetallic terms at a moment in which Mexican silver mines were flooding international markets while shoring up Britain’s de facto shift to a domestic gold standard.39 During the second half of the century, North Andean producers benefited from the decline in Brazilian and African production, resulting in higher relative prices for their gold vis-à-vis silver in international markets. British bullion dealers quickly adapted to these new conditions, leading to a shift of the “gold marts” from Lisbon to Jamaica. By the 1800s, the latter had become the key broker between North Andean producers and the global economy.40

The Independence Wars exerted a short-term negative impact on North Andean production, while Brazilian outflows continued their secular decline throughout the nineteenth century. Between 1810 and 1850, global output fluctuated within a range of 20-100 tons per year, with Russia, New Granada, and ancillary flows from other small producers contributing to the overall production.41 This landscape experienced two major transformations throughout the nineteenth century. In the 1850s, production jumped to 200 tons per year and then declined to 150 tons in the 1880s. A new surge unfolded in the 1890s, reaching flows of 450 tons annually in 1900 and almost 600 tons in 1914. Both the US and Australia peaked in the mid and late centuries.42 New Zealand rushed in the 1860s and Russia experienced a new rush in the 1870s. In the 1890s and 1900s, Mexico and South Africa joined the ranks of major gold producers.43 There is a debate among scholars as to whether these rushes were driven by changes in relative prices or simply serendipitous discoveries. However, this cycle witnessed an expansion of gold-based international payments that were pivotal in oiling industrial trade in the context of a new surge of global commodity flows.44

The world economy was much slower in developing a global market for copper. Production was less regionally concentrated than it was for gold and silver. Due to inelasticity of both supply and demand, global copper output remained relatively flat until the 1870s when non-selective mining and the use of electricity changed cupriferous flows on the supply side. At the same time, expanding industrial production transformed the demand side.45 That said, the regional distribution of copper production underwent important changes even before the dominance of mass production. Colonial markets provided an important outlet for expansion given the demand for copper in the supply chain of sugar, silver, and other commodities.46 Besides this, in contrast to silver and gold, a geographic separation between the extraction, refining, and smelting stages of the copper supply chain was developed early on. As historians of capitalism have rightly pointed out, this created an impetus for capitalistic transformations in some areas.47

Central European mines dominated European and West African copper markets until the flooding of American silver affected the cost function of producers given the polymetallic nature of the cupriferous deposits. The entry of Swedish and Japanese producers in the sixteenth and seventeenth centuries signaled a new age in which copper flowed on a global scale.48 In the eighteenth century, the polymetallic deposits of Cornwall and the coal fields of Swansea, allowed Britain to slowly dominate the European market again. Meanwhile, in the Americas, the market had been served by scattering deposits across the Spanish Empire, including Michoacán in New Spain, Moniquirá in New Granada, and Coquimbo in Chile.49 The latter was the first area that served long-distance markets, providing copper as an input for a wide array of activities in nodes along the Pacific and the Andean ranges. Chilean and Cuban mines experienced an enduring expansion in the nineteenth century while Peruvian producers started to benefit from copper as the byproduct of both silver and gold after the 1850s.50

As the nineteenth century unfolded, the industry experienced a process of production concentration. British smelting dominated markets until roughly 1870, drawing ores from Chile, Cuba, and Australia.51 In the 1870s, the United States became the leader in the industry, with production in Minnesota, Montana, and Arizona expanding rapidly.52 Towards 1900, the global copper market was dominated by a few powerful syndicates that soon extended their reach to Chile, Mexico, and the African Copper Belt.53 The expansion of nonselective mining, the mechanization of the industry, and the application of new technologies encouraged the development of economies of scale that soon created opportunities for short-lived yet influential attempts at market cartelization never before witnessed in the history of global mining.54

This bird’s eye view of world production leads to four insights into Latin American mining. First, the region’s mineral deposits were not solely centered on silver. True, the outflow of argentiferous ores exerted worldwide transformations while locally altering the core regions of the Spanish Empire, but gold cycles should be integrated into the metallic landscape since several circuits of global exchange operated on a bimetallic basis. This structure became even more pivotal following the emergence of international bimetallism in the eighteenth century.55 Both historians of mining and capitalism may benefit from the joint study of the flows of the two precious metals, providing new insights into patterns of mining-based development and international trade cycles.

Secondly, the story of base-metals production in the region was characterized by a limited number of producers that only experienced a genuine take-off during the nineteenth century when industrial capitalism transformed global mining markets. Tin in Bolivia and copper in Chile and Mexico are good examples of this pattern. Yet, cupriferous flows that served the demand of sugar and silver producers before industrialization remained scarcely studied. The production of metallic and non-metallic inputs such as salt and lead that were pivotal in silver output, has not received sufficient attention from mining historians. A more comprehensive analysis of the silver and gold supply chain may provide new insights into how mining either encouraged or delayed the development of capitalism in some regions and sectors.

Thirdly, coal mines in Latin America were marginal before 1914, explaining two main drivers in mining history: the precocious adoption of electricity across the region’s mines and the late introduction of steam pumps to exploit ores below the water table.56 The heyday of fuel mining had to wait until the twentieth century when the discovery and exploitation of natural gas in Bolivia, oil in Venezuela, and coal in Colombia had a significant impact on the global energy landscape. The extent to which this lack of coal reserves shaped industrialization in South America is still a matter of debate.

Finally, it appears that colonial policies that forced the colonies to purchase European ores hindered iron and steel production in Latin America. In the nineteenth century, the production of both metallic commodities was limited.57 It wasn’t until the following century that the production of iron and steel promoted large enterprises, such as Volta Redonda in Brazil.58 Analyzing counterfactuals on the potential emergence of iron production in the absence of colonial restrictions can be a useful way to understand the impact of these restrictions on capitalist development in the region. Given the role that iron producers in the United States and some European regions fulfilled through linkages and technological spillovers since the eighteenth century, this is a topic that may be worth exploring further.59

2. Geological Perspectives

In the diaries documenting his travels across the Spanish Empire, the Prussian polymath Alexander von Humboldt often speculated on the diverse nature of the mineral deposits he happened to visit. He yearned for a key to unlock the “arcane processes spanning perhaps thousands of years of mineral formation that make some ores suitable for specific methods of processing.”60 Geology, indeed, is a key variable in understanding mining cycles in Latin America and the world. Metallogenesis defines the nature of the metal compounds contained in each ore and of any collateral metallic species. As Humboldt surmised, the chemistry of the metal compounds and the other elements present in the ore determines the optimal refining process that can be applied to profitably extract its precious metal content, either smelting with lead, amalgamation with mercury, or cyanidation with cyanide.61 The characteristics of mineral deposits, in short, shaped some aspects of the technological and social organization of mining and its imprints on capitalist development.

As Saul Guerrero has convincingly pointed out, scholars have tended to focus on ore grades and the location of metals in the two enrichment zones below and above the water table.62 Nonetheless, mining history should combine the analysis of the chemical composition with the assessment of ore grades. The exploration of the geology of silver deposits provides good insights in this regard. Nine of the ten largest sources of primary silver ore known to humankind are located in the American Cordilleras.63 There were important differences in the chemical composition of the ores across the Americas. Argentiferous deposits in the Upper Andes were basically tin-silver systems, while those of Lower Peru were heavily associated with copper and arsenic. In New Spain’s main mines, silver was accompanied by lead, zinc, and subordinate gold.64 According to Rodman Paul, the silver deposits of the Sierra Nevada were heavily associated with gold. In the Comstock Lode, for instance, silver ores contained almost 40% of auriferous particles.65 This heterogeneity in the chemical composition of the ores forces historians to look beyond the metal content of the minerals (grades). And here again, Gerrero’s remarks are revealing: “a silver ore containing 0.25% of silver in the presence of major amounts of lead or copper cannot be compared on the same basis as a silver ore containing 0.25% in the form of silver sulfide.”66

These geological variations had global implications. In Europe, for example, silver was often found as a secondary metal within galenas and copper compounds, making smelting the method of choice for processing. This technology was favored by the availability of ample biomass sources for fuel, as most European mines were situated below the expected tree line. In contrast, the lead-free ores in the Andes made the systematic use of amalgamation feasible. Amalgamation did not require large amounts of fuel, thus avoiding energy constraints that arose from the location of Andean deposits above the tree line. The procuring of mercury, however, was a complicated business since its production was concentrated in a few deposits located far away from the main argentiferous sources.67 This led to supply-side attempts at monopolization, with the Spanish Crown controlling most of the deposits and subsidizing mercury prices for Mexican and Peruvian silver miners during the colonial era.68 The Rothschilds replaced the Spanish government as the main suppliers after Independence, creating a cartel that led to soaring prices that affected the recovery of mining in several regions. Discoveries of mercury deposits in California during the 1850s lessened the cartel’s market power, gearing up for an era of cheap mercury until the advent of cyanidation.69

New Spain’s ores diverged regionally. In central Mexico and other belts in the western Sierra Madre, amalgamation became the process of choice, while producers in San Luis Potosí and other eastern belts resorted to smelting.70 In the latter, the polymetallic nature of the deposits allowed silver producers to get gold as a by-product while minimizing the consumption of lead and other inputs in the foundries. The simultaneous production of multiple metals enabled merchants in these regions to engage in extensive bimetallic networks, leading to significant technological advancements in extracting traces of subordinate metals.71 In the nineteenth century, as refining centers in Europe became more efficient at detecting small amounts of by-products, the income from these activities became central for bullion dealers and merchants in Latin America.72

The geology of gold diverged significantly from that of silver. In South America, the auriferous deposits exploited before the twentieth century tended to be placer and epithermal deposits in shallow volcanic environments.73 Placer gold is mostly derived from the erosion of orogenic deposits, with auriferous ores usually containing silver and small amounts of other metals such as copper. Gold being a noble metal, does not readily corrode. However, silver is susceptible to oxidation, and as water carries gold particles, some of the accompanying silver is washed away. This phenomenon contributes to the lower purity of gold nearer to the source compared to gold found closer to the end of its journey toward the sea.74 The proximity to the source of ore also influenced the distinctive characteristics of various placer belts in South America.

New Granada’s gold was accompanied by silver, copper, and, given the presence of recent epithermal activity, platinum. The presence of these metals varied according to the region’s mining belts.75 In Antioquia, by-product silver was used in Bogotá to mint small change. Later in the nineteenth century, the processing of subsidiary metals had important spillovers in the region’s smelting activities. In Chocó, subsidiary platinum reigned but the crown’s attempt at monopolizing its flow hampered the spillover effects on other sectors.76 As industrial demand for platinum expanded during the nineteenth century, mechanized, foreign-owned firms exploited polymetallic placers, but its local linkages were few.77 Brazilian orographic systems are much older than the Andean ones and, therefore, their placer deposits were purer, with few by-products exploitable through preindustrial methods.78

The geology of copper belts encompassed three main types of ore bodies: massive sulfides, stratabound, and porphyry. The massive sulfides, found in locations such as Cornwall in England, Butte in Montana, and the Norte Chico in Chile, are rich in sulfur and arsenic, facilitating smelting but also posing important environmental risks. 79 The less common stratabound deposits are exemplified by the African Copper Belt. Finally, porphyry deposits are characterized by their low grade and disseminated nature, lacking a sharp distinction between payable ore and barren rock. The two big members of this group are the Teniente and Chuquicamata fields in Chile, both of which were exploited systemically by the Guggenheims in the 1910s.80 These deposits dominated twentieth-century copper production and given their geological structure, encouraged the transition from selective to non-selective mining.81

This brief discussion on the geological characteristics of mining belts in Latin America provides insights for future investigations into the relationship between mining and capitalism. Firstly, the chemical composition of the ores influenced the predominant extraction methods, with regions relying heavily on amalgamation due to the absence of forests and lead ores required for alternative processes. While this conferred certain advantages, these regions missed out on the positive externalities associated with smelting. According to the literature on mining in Australia and United States, smelting complexes fostered technical spillovers and significant downstream linkages in input production.82 Given the collapse of Huancavelica in the nineteenth century, the main input for amalgamation had to be imported, resulting in shortened mining linkages.83 Regions in which galena compounds were pivotal witnessed the growth of smelting facilities, a topic that has received limited attention from historians. Towards the late nineteenth century, the utilization of US capital in foundry complexes and refineries gained new significance, leading to significant spillover effects and transformations in labor relations that shaped capitalistic development.84

The geological structure of copper and tin deposits in Latin America played a role in promoting nonselective mining practices, yet the absence of coal deposits hindered the development of smelting mills for value addition. Consequently, certain base metal deposits became classic examples of enclaves that did not contribute to overall economic growth.85 A regional focus, however, would enhance the existing framework, as areas like Chile and Antioquia benefited from the industrial mining linkages, leading to sectoral transformations.86 Mining historians can gain valuable insights by conducting more in-depth analyses of the institutional context of mineral extraction.

Finally, the polymetallic nature of Latin American ores kept some mining regions in business for centuries. In Bolivia, Peru, and Mexico some producers quickly switched from silver to tin, copper, and gold respectively. Chile followed a similar path with its copper deposits, while Colombian gold miners also benefited from platinum and silver as by-products. A more comprehensive approach to mining, encompassing the study of mineral inputs and by-products will yield valuable insights into a wide range of topics in the history of capitalism, including corporate structure, production functions, labor relations, and technological spillovers.

3. Mining Ecologies

The study of the two-way interaction between ore extraction and ecological change has gained momentum among mining and environmental historians.87 Scholars of capitalism may also benefit from such interaction. In Latin America, silver mining districts typically emerged in arid and semiarid ecosystems, while gold was predominantly concentrated in lowland tropical ecosystems. This distinction is key as it influenced the availability of energy across mining belts, thereby shaping social and economic structures. Andean miners, despite the scarcity of large biomass sources, extensively utilized water bodies as a renewable source of kinetic energy. For instance, in Potosí, a complex system of dams and channels transformed the city’s stream into the main source of energy for the refining mills. Oruro, Pasco, and Hualgayoc also used watermills, but the literature has not explained the economic and technical processes behind them.88 New Spain’s mines were located below the expected tree line, but the availability of water bodies created diverse energy settings. In the belts that surrounded the central Mexican basin, refineries employed waterpower.89 However, there is no evidence of the building of a system of dams and channels comparable to those of Potosí. Likely, the lack of agglomeration precluded the miners and the crown from investments in large dams. In northern New Spain, the use of waterpower was much more limited.90 Yet, the soils there were especially appropriate for cattle ranching. This activity created a symbiotic relationship with several species of mesquite, a tree that was pivotal in the supply of fuelwood.91

The mining ecology of gold and copper was different from that of silver. The Northern Andes tended to be warmer and greener than the ranges in Bolivia and Peru while most of its placer fields were below the expected tree line and its surroundings had better agricultural conditions. Yet, mining ecologies in the north differed from region to region.92 Gold producers in Chocó, Raposo, and Barbacoas enjoyed elastic supplies of fuelwood for mining activities and shipbuilding but lacked local sources of agricultural staples since high precipitation levels (13.300 mm) affected soil fertility.93 Mines located along the valleys and the highlands of the Andean cordilleras, such as those in Antioquia, had low rainfall levels and better soils. However, the scarcity of water turned mining into a seasonal activity, prompting the construction of small dams and canals to enhance productivity in certain regions. As the nineteenth century unfolded, the control of water supplies emerged as a crucial factor in the mechanization of mining in both Chocó and Antioquia.94

Given the low elevation of the Serra Espinhaço (790 meters above sea level on average) in Minas Gerais, gold producers benefited from ample sources of agricultural supplies and fuelwood. Mining ecologies exhibited regional variations with certain fields located in upper and lower slopes relying on outside sources of biomass due to specific soil conditions in parts of the Mata Atlantica tropical forest.95 In western regions such as Goiás and Matogrosso, mining often followed a seasonal pattern, closely intertwined with agricultural and cattle-raising activities.96 However, despite this heterogeneity, most Brazilian mining belts were blessed with abundant water resources, serving as a valuable source of kinetic energy. Similar to the situation in New Granada, the availability of waterways allowed miners in both regions to employ specific techniques, which will be explored in the following section.

Local ecologies, in short, shaped the way in which mining operated throughout Latin American deposits. At least four points emerge from the former discussion. First, most mining regions tended to be net importers of biomass, creating opportunities for adjacent regions to serve the consumption linkages of ore production. Metallic flows not only oiled the wheels of international trade but also contributed to the multilateral exchange of goods and services in several parts of Spanish America.97 While these connections have been extensively examined in the context of the colonial era, there is a scarcity of studies examining the industrial effects on mining linkages during the nineteenth century. The emerging field of industrial metabolism, which offers methodologies to measure the material and energy turnover of economic systems, holds promise in shedding light on the interplay between mining, ecology, and the unfolding of capitalism.98

Recent studies have explored the transformative impacts of mining on local ecosystems, particularly in terms of deforestation and emissions.99 However, as highlighted by Saul Guerrero, much of this literature falls short in terms of comprehensively understanding the chemical processes involved and identifying the specific ways in which mining activities generate negative externalities.100 This is key for discerning the extent to which these externalities are associated with capitalistic development and what portion unfolds regardless of economic systems. Latin Americanists have much to offer in this regard. For instance, studies on the development of organometallic substances such as methylmercury that affect human and non-human organisms throughout the food chain are pivotal in providing insights into the historical trajectory of metal processing.101 In the same vein, the meaningful presence in some ore-bearing regions of dams, mills, canals, and other infrastructure raises questions about their impact on regional hydromorphology. Periodic flooding near mining centers has clearly been the result of pervasive sedimentation, and historical records are replete with complaints from agricultural producers about the consumption of polluted water downstream from mills and foundries. As in the American West, Latin American mining history has been shaped by little-studied “water wars.”102

4. Mining Technology and Capitalism

Broadly conceived, mining encompasses the exploration, extraction, and processing of ores and mineral resources.103 Each activity involves a diverse range of techniques and technologies that have evolved over centuries, leaving significant impacts on the trajectory of capitalist development. Exploration, despite its crucial role in labor allocation, has been relatively neglected in the literature. Indigenous peoples were the primary actors in prospecting and mine development before European entrepreneurs asserted control through coercion or negotiation.104 Extraction methods in mining involved a dynamic interplay between placer and hard rock mining. Gold, given its geological characteristics, was typically extracted from placers and lodes while silver and copper extraction was the realm of underground mining. Open-pit mining emerged later, in the first half of the twentieth century, as non-selective mining techniques such as cyanidation and flotation gained popularity for extracting non-ferrous metals.105 Refining methods, as mentioned earlier, predominantly involved smelting and amalgamation, but these techniques exhibited significant variations across time and space.106

In hard-rock mining, extraction encompassed four main stages: 1. Access 2. Development and producing mining 3. Shoring-up, and 4. Ores and water removal. Before the nineteenth century, Latin American miners tended to excavate by following the structure of the vein, creating an erratic system of tunnels highly criticized by Humboldt.107 Stages 1 and 2 were carried out by pickmen, whose numbers depended on factors such as the size of the tunnel and the availability of steel and iron tools provided by the mining entrepreneur.108 The compactness of the mine played a significant role in determining the costs in stage 3, as some shafts did not require shoring, but ore-bearing structures had to be left as supports. In stage 4, workers (apiris in Potosi and tenateros in New Spain) manually carried ore to the surface in bags made of leather or vegetable fibers and wooden ladders.109 Both pickmen and ore carriers used tallow candles for illumination in the underground works. Thus, the extraction process was labor-intensive and heavily reliant on biomass as an energy source.

Three innovations transformed extraction from the seventeenth century onwards: blasting, animal-powered whims, and adits.110 The first saved energy and labor in stages 1 and 2. The second saved both in stage 4 while adits also saved energy in stage 4 while providing ventilation. These innovations, however, were not ubiquitously applied and their adoption was slow in some regions. By the eighteenth century, blasting was used widely in both New Spain and the Andes, but the use of animal-powered whims was a device only used in the former. According to Brading and Cross, the conical peak of Potosí’s deposits made adits the most practical and feasible form of access and extraction.111 Miners in Cerro Pasco and Hualgayoc followed the same pattern. 112 In New Spain, entrepreneurs in San Luis Potosí and other areas invested in adits but these never acquired the centrality they did in the Andes.113 During the nineteenth century, the mechanization and electrification of several processes including drilling, better blasting methods, electric pumping, and mine railways radically transformed the production function of mining and its social and environmental imprints.114

Placer mining was simpler. Speculators (faiscadores in Brazil and mazamorreros in New Granada) panned water courses using wooden or metal pans called bateas in Spanish or bateias in Portuguese.115 The oscillation of the pan caused gold particles to sink due to their higher density, while siliceous material was washed over the shallow sides. Using the same technique were the more elaborated taboleiros or canalones, which were sluices that diverted part of the river flow into a series of boxes that retained gold. If the sluices were built on a hillside they were called grupairas in Brazil or canalete in New Granada. Another similar technique was the so-called catas in Brazil or congas in New Granada. These were openings in the hillsides whose gravel was carried to the nearest water source for panning or water transported by wooden aqueducts to the cata where the gravel beds passed through a series of boxes that retained the gold. During the nineteenth century, the use of mechanical dredges was perhaps the main innovation introduced in the sector, saving considerable amounts of labor but creating important changes in hydromorphology and water conditions.116

Refining was another matter. Once extracted, ores were sorted and then transported by mules or llamas to the refining complexes. Amalgamation involved several stages: 1. Milling the ore 2. Mixing the milled ore with salt, mercury, water, and copper compounds 3. Washing the mixture 4. Separation of mercury through volatilization.117 The specifics of stage 1 varied according to local conditions, with Potosí and other Andean miners utilizing kinetic energy effectively. Stage 3 was influenced by the availability of water and the design of the vat containers. Stage 4 depended on the type of ovens employed, with the recovery of mercury being a key endeavor in reducing variable costs. Over time, two main modifications emerged.118 First, in eighteenth-century New Spain, a stone-drag crushing device called arrastre was used to further pulverize the ore between stages 1 and 2. Second, to accelerate stage 2, heating was applied to the mixture in a process called amalgamación en caliente (hot amalgamation).119

As for smelting, it was usually carried out in three steps: 1. Crushing 2. Mixing the crushed ore with lead and iron compounds and 3. Roasting.120 In stage 1, smelting did not require the flour-like consistency demanded by amalgamation, allowing the use of hammers and boulders. However, animal-powered milling stones were also widely used. Stage 2 depended on the lead content of the ore. In New Spain, the addition of tequestite (salt compound) improved the method during the eighteenth century.121 Stage 3 varied according to the furnace and the technique used to provide oxygen, with the use of bellows powered by animals or water improving the processing capacity over time. Variation in oven capacity and technology was important in the refining of copper-bearing ores but here the research has not been as active as in the case of silver or mercury mines.122 Gold refining was much simpler and usually required little mercury. In New Granada and New Spain, the extraction of gold by-products demanded elaborated processing with nitrates whose volumes elicited the development of little-studied, specialized establishments as the nineteenth century unfolded.123

The end use of metals in domestic economies has not attracted enough attention. The study of workshops and independent artisans who produced copper and tin hardware may yield important insights into forgone opportunities for capitalistic development while the study of gold and silver jewelry, traditionally explored by art and social historians, may provide clues on little-explored topics. For instance, in Europe and Asia, gold and silver smiths became key financial intermediaries.124 The field of minting history also lacks comprehensive studies on the technological and financial spillovers associated with minting activity. Although social and institutional histories of Latin American mints abound, further research is needed to explore the linkages of minting activity and its technological and financial spillovers.125

Historians of capitalism may interact with the former discussion on mining technology on several fronts. For instance, research should be conducted to determine whether the late coal-based transformation of the region’s mining stemmed from the location of fossil fuels, or the structure of relative input prices and social relations as studied in other regions. Intersectoral studies, in turn, may enrich the understanding of the incentives and restrictions of technological spillovers from mining to other economic activities. Exploring managerial patterns in mining, which have played a significant role in shaping the corporate organization of economic activity in Europe and Japan, could offer further insight into the distinctive insertion of Latin American societies into capitalism.

5. Some Economics of Mining

The economics of natural resources have tailored theoretical insights to analyze the distinctiveness of mining production functions and markets.126 The prevalence of sunk costs, the joint production of minerals, and the specificity of each ore body turn mining into a special economic sector.127 For generations, Latin American economic historians have studied economic conditions, with a focus on macroeconomic flows and cost structure. Microeconomic analysis has not received sufficient attention and may yield new venues for comprehending their importance in the region’s capitalistic development. The study of ore markets is a case in point. In colonial Latin America, ore flows were regional in scope since transportation costs precluded the formation of large geographical networks.128 This pattern changed when transportation costs declined during the nineteenth century, with ore prices converging internationally. Swansea smelters created a powerful complex capable of processing ores from distant regions such as Chile and Cuba.129 In silver and gold, similar smelting centers drawing worldwide ore supplies were established in Europe and the United States, affecting local backward linkages during the nineteenth century.130

The regional character of ore flows before industrialization led to diversity in ore market structures. According to Brading, in New Spain, most miners sold their output in weekly auctions, with refiners assembling at the pithead and whispering their bids.131 In some regions, refiners had a monopsonistic position (one big refinery possibly with economies of scale and many small miners) while in other areas miners enjoyed a monopolistic position (big mine and many small refiners). Guadalajara mines belong to the first pattern while the Valenciana, in Guanajuato, certainly belonged to the latter.132 In Potosí, the state favored vertical integration that affected the market price of ores, but independent seekers established a parallel market of unrefined metals that competed heavily with big refiners.133 The level of state intervention and the structure of ore markets may have explained productivity divergences in both areas.

Regarding other production factors, Latin American mines operated under distinctive conditions in both labor and capital markets. Labor systems ranged from slave to free, but these two “pure” forms had hybrid, overlapping characteristics. Free workers sometimes received payment through goods sold by the company’s store at prices above the market level, while in several placer fields, slaves were allowed to keep a portion of their output, alleviating the owners’ responsibility for providing rations.134 This created a constellation of working arrangements that nonetheless exhibited broad patterns. The literature has traditionally distinguished between mining labor in New Spain and the Andes.135 The former employed predominantly free workers and the latter a dual system of free and forced labor (mita). This image, if correct on the aggregate level, must be regionally contextualized. Free labor was the rule in Andean deposits such as Cerro de Pasco and Oruro.136 In New Spain, the mines of the tmvb had a long tradition of forced labor and some scholars argue that the resurgence of coercive labor practices, such as the cuatequitl system, contributed to the mining boom in the eighteenth century. 137

The very mechanics of free labor bring complications when it comes to analyzing mining production functions. Wages were paid in coins and goods, but also in shares of ores extracted per worker (partido in New Spain or corpa in the Andes).138 As a result, part of the risk and variable costs of mine operation were absorbed by the workers themselves. In some regions, such as Oruro and Parral, labor was almost entirely paid in shares.139 The extent to which these mechanisms encouraged labor productivity remains a matter of debate among specialists.140 In the same vein, the notion of forced labor demands analytical nuances. Draft labor such as mita and cuatequitl were subsidies given by the crown to the miners as incentives to increase output, with indigenous communities sending a share of their male labor force to work in the mines at wages below the common market price.141 This measure increased output given the marginal income imposed by the market, affecting the incentives to adopt labor-saving technologies.

In both New Spain and Potosí, mine owners and refiners imposed a system of daily quotas on their draft laborers.142 In other words, the wage fixed by the crown was paid not per day of labor but per ore mined. According to Eduardo Saguier the cost of forced labor in mining underwent a transformation into a fixed operational cost.143 Miners used to rent out their draft workers to other producers while accepting payments in silver from the communities to compensate for absentee workers. This income was sometimes used to hire free laborers, or even to temporarily suspend mining operations. After independence, draft labor was abolished but the transition towards a fully oriented wage labor did not occur automatically. The recovery of silver output during part of the nineteenth century was driven by a myriad of small-scale miners and independent prospectors who mined ores paying fees to former mine owners.144 It was only after 1870, when large-scale firms in both regions started to expand their production towards economies of scale and mechanization, that the transition towards full-time, wage-based labor became more prevalent and consistent.145

Labor dynamics in Brazilian and New Granadan gold mining differed from those in copper and silver production. In the gold fields, slave labor was the dominant type of labor, but as the distribution of mining surpluses expanded among former slaves, new mechanisms of labor allocation began to emerge.146 Slavery was profitable and flexible, allowing miners to adjust the size of the slave gangs based on the deposits and fluctuations in both the gold and slave markets. Some miners rented out their slaves to perceive wages during seasonal periods while the structure of rations differed widely from mine to mine. Some owners supplied their slaves with food and clothes, conceding just one free day during the week in which the chattel could pan gold to acquire supplies. Others released their slaves under the condition that they had to pay a weekly rent in gold. These arrangements allowed slaves to save money to buy freedom, participate in consumption markets, and even buy their own slaves. In regions in which slave labor was not dominant such as Antioquia, in New Granada, mestizos and poor whites worked independently in the alluvial fields backed up by credits granted by small-scale merchants.147 During the nineteenth century, dredge mining and mechanized hard rock mining slowly expanded wage labor arrangements in the northern Andes.148

The linkages between mining and the development of the capital markets in the region remains largely unexplored. Traditional studies argue that miners and refiners had little access to church lending, with traders extending loans at high-interest rates to compensate for the sector’s high risk.149 Other scholars have emphasized the market power of merchants, suggesting a negative impact of commercial capital on the development of mining.150 However, this perspective often frames the credit problem as a zero-sum game between commercial and mining capital. Social network analysis and sectoral studies have shed light on the complexity of the ties between miners and merchants, with changes in relative prices driving merchants to reduce interest and discount rates while directly investing in mining throughout the eighteenth century.151 Given the role of mining in capital flows and financial innovation in rapidly developing capitalist economies, analyzing credit structures could provide important insights into the diverging performance of Latin American mining regions in the long run.

State intervention in mining needs further research. In Potosí, the Crown interfered in the credit supply by taking over control of the San Carlos Bank, an institution that bought bullion and provided operating capital and cheap inputs to miners.152 Though excise policies varied from region to region, colonial policies tended to reduce the mining tax burden over the long term, with the aggregate impact of mining taxes on the total income of royal treasuries not being as large as previously thought. Recent research has suggested, in contrast, that the sector was highly subsidized through institutional privileges and the provision of inputs below market prices.153 During the nineteenth century, this approach changed with some governments eliminating export restrictions and tax patterns inherited from the colonial era but becoming highly dependent on mining revenues as large foreign corporations and capital injections shifted to non-selective mining and fuel extraction.154 As is well known, this pattern deepened the volatility of business cycles as the twentieth century unfolded.

The economics of mining, finally, provide pivotal inputs for the study of the intricate social and political processes in Latin American history. And here, further conversations with historians of capitalism emerge. By examining mining factor markets and their institutional underpinnings, we can gain a better understanding of the emergence of rent-seeking groups, technical inefficiencies, and the allocation of fiscal linkages, which have often led to political and military conflicts in the context of capitalist expansion. In the same vein, mining in most Latin American countries failed to encourage an early formation of a large proletariat class, with peasant-miners, coerced laborers, and independent prospectors accounting for a large share of the working force. Therefore, the organization of labor unions was slower than in other mining regions while the limited scope of labor markets has consistently depressed real wages, likely reducing the incentive to adopt labor-saving technologies. As the twentieth century unfolded, skilled jobs in some deposits owned by international syndicates have been filled by foreign workers (in some cases with clear racial biases) who reinforced the enclave character of mining in several regions.155

Conclusions

The entrée of Latin American mining producers into the global economy during the 1500s marked a new era in world history. The emergence of capitalism and globalization, the timing and location of the industrial revolution, and the development of international monetary systems are some of the processes connected to the expanding outflows of minerals from the New World. This paper provided an overview of Latin American mining history to explore opportunities for cross-pollination between mining historians and scholars in the emerging field of the new history of capitalism. Besides examining specific venues of research regarding output cycles, geological and ecological endowments, technological spillovers, and mining economics, the paper highlights four main gaps in the field whose analysis may guide future research.

First, the existing literature has primarily emphasized precious metals, neglecting the integration of non-precious metals and non-metallic minerals within the broader context of capitalistic development in Latin America. Opportunities abound for historians interested in analyzing the role of the technological and managerial spillovers of base metal production. Additionally, examining counterfactual scenarios related to colonial restrictions and incentives on mineral production would be a valuable addition to the field. Second, among precious metals, silver mining has been privileged. Despite the pivotal importance of international bimetallism in promoting and regulating international trade during the eighteenth and nineteenth centuries, there is a scarcity of narratives focused on gold before the dominance of the gold standard in the 1870s. A bias for bimetallism may enrich the understanding of webs and connections within a global perspective while providing empirical fuel to examine different patterns of mining-led growth in Latin America.

Thirdly, economic theory has been creatively used at the aggregate level, but the microeconomic dynamics of mining have not attracted enough attention. Since mining management and technology exerted pivotal transformations in other mining areas of the world, the microeconomic approach may elicit a new understanding of the links between mineral production and capitalistic development in the region. Finally, the environmental history of mining in Latin America is one of the great ecological transformations of modern times, yet it has not received comprehensive attention. In particular, the synergic relationship between environmental settings, energy systems, and mining has not been systematically integrated into the analysis of capitalism in the region. The interdisciplinary nature of the history of mining and that of capitalism provides a unique laboratory from which to expand the study of the region in creative, unexpected directions.