Consumers are constantly exposed to situations where they are required make a decision. For instance, they have to decide whether or not to buy a product, or to purchase one brand rather than another. In fact, consumers identify that the product/service feature, such as utility and duration, is the most important consideration at the time of making a purchase, followed by price. This is according to 70% of the 6,400 consumers in 23 countries around the world (Simon-Kucher & Partners, 2019). It has been shown to be part of the psychological meaning of reasoned consumption (Soler, Palacios, Bustos, & Díaz-Loving, 2018). At the same time, 80% of consumers in the CNBC & Survey-Monkey (2019) survey, report having bought something on impulse. This illustrates that there are many ways in which consumers make decisions, both by paying attention to the attributes and price of a product, or on impulse.

These different ways of making decisions are described by what is typically known as consumer decision making styles. Sproles and Kendall (1986, p. 268), pioneers in this field, define a consumer decision making style as "a mental orientation characterizing a consumer's approach to making choices. It has cognitive and affective characteristics (for example, quality consciousness and fashion consciousness). In essence, it is a basic consumer personality, analogous to the concept of personality in psychology."

Consumer decision making style is an important psychological construct, because it has been shown to explain a large variety of behaviors in the consumer and economics fields. For instance, consumer decision making style predicts customer loyalty (McDonald, 1993), mall shopping (Wesley, LeHew & Woodside, 2006) customer satisfaction and purchase intention (Alavi, Razaei, Valaei, & Wan, 2015), and online consumer behaviour (Sam & Chatwin, 2015).

The main challenge in the field of consumer decision making styles is creating a valid and reliable way of assessing them. That is, constructing a set of questions that capture the different styles or "consumer personality" that people can adopt when purchasing products. Sproles and Kendall (1986) generated such a questionnaire. The dimensions identified by them include: (1) perfectionism and high-quality consciousness, (2) brand consciousness, (3) novelty and fashion, (4) hedonic and recreational buying, (5) price as a value, (6) impulsiveness, (7) confusion over information, (8) loyalty, and (9) habituation.

Sproles and Kendall (1986) thus proposed an original way of looking at consumer decision making, by implementing the idea of a somewhat stable consumer personality in the form of various consumer decision making styles.

Unfortunately, the measurement of these different styles turned out not to be very reliable. The internal consistency of the dimensions ranged from 0.48 to 0.76, showing low reliability. Follow-up research confirmed that this questionnaire does not have the appropriate psychometric properties (e.g., Shim, 1996). In addition to the low reliabilities, the factor structure does not replicate well, and there is substantial cultural variability (see Chaudhary & Dey, 2016; Lysonski, Durvasula & Zotos, 1996).

Some of these limitations may stem from the fact that the questionnaire was uniquely based on literature and not on empirical research. As a result, the measurement may have missed relevant dimensions that were not yet identified in the literature. However, the measure includes an affective item, exploring the hedonic and pleasure dimension, neglecting negative emotions, that have been identified as influencing consumer decision-making (Chuang & Lin, 2007).

The goal of the present research is to build upon the original idea of Sproles and Kendall (1986) and to develop a valid and reliable way of measuring consumer decision making styles in order to assess these styles in Mexico. If we succeed in doing so, we would like to examine whether this scale can also be used in other cultures.

In order to create such a scale, we will redact a large number of items that potentially assess the different styles that came from a preliminary study (see Soler et al., 2018). In that Study, 72 Mexican people (36 men and 36 women with an age range of 18 to 54 years M = 32.56, SD = 11.47) participated. Consumption decision-making styles were assessed via the technique of modified natural semantic networks (Reyes, 1993). This technique proposes that a measurement should be developed with the use of a representative sample of behaviors, focus on universal and cultural relevant behavioral manifestations, and come from the explorations that people have about the meaning of the construct to measure. Highlighting the role that people have in the creation of measures, psychological meaning was extracted from the target population (cf., Reyes, 1993). Two stimuli words were used, "Impulsive consumption" and "Reasoned consumption", in line with Sproles and Kendall's (1986) cognitive and affective decision styles, and with Kahneman's (2011) deliberate and slow versus intuitive, emotional and fast systems. These ideas about two dimensions of consumer decision making also find support in Bachkirov (2015) for management decisions, and in Shiv and Fedorikhin (1999) in the consumer decisions area.

The emotional and rational decision styles are expected to be made up from different components. In the emotional purchase decision style, pleasure and excitement are expected to be components in this dimension, which at the same time are related to impulsive shopping (Babin & Darden, 1996). In the field of negative emotions, sadness, has been associated with consumer transactions and specifically monetary spending (Cryder, Lerner, Gross & Dahl, 2008; Garg, Williams & Lerner, 2018; Lerner, Small & Loewenstein, 2004). In the rational purchase decision style, we expect to find product quality, economy, and value or performance, which according to Kotler and Armstrong (1994) are involved in the advertisement message that impacts consumers and influences a purchase. And also negative dimensions like indebtedness, which has been identify related to personality traits like consumer locus of control (Mansilla, Denegri & Álvarez, 2016).

In a new study, we will obtain factor analyse to reveal the underlying structure. In order to assess convergent and divergent validity we will relate the obtained structure to emotions and affective states of purchases scale (Palacios & Viloria, 2017). We use the scale from Palacios and Viloría (2017) because it is an instrument that meets the criteria of reliability and validity, as well as cultural sensitivity having been carried out in Mexican sociocultural context. In order to examine discriminant validity, we will obtain the average variance extracted. To assess predictive validity, we will model spending per week with emotional and reasoned scales from the PDMI. We expect that emotional decision styles have a stronger influence on spending than reasoned decision styles. This expectation is based on Vida and Rear-don (2008), who identified that affective and normative constructs are stronger determinants in domestic consumption than rational constructs.

Method

Participants

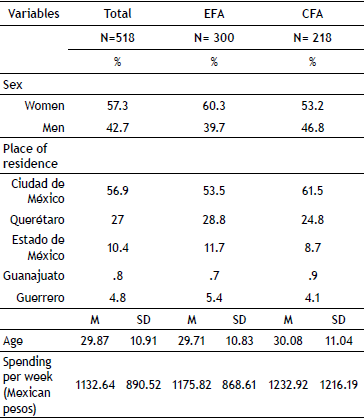

The sample was composed of 518 people selected from a non-probabilistic sampling of university students, their relatives, and acquaintances. The sample was randomly divided, leaving 300 people for the exploratory analysis -sample size recommended by Comrey and Lee (1992), and 218 for confirmatory analysis - sample size recommended by Hoelter (1983) in CFA (see Table 1).

Instruments

The preliminary study (Soler et al., 2018) resulted in 107 items, identifying two scales: emotional decision styles (61 items) and reasoned decision styles (46 items). For the inventory, a frequency scale format of five points was used (1 = never - 5 = always). All the items were reviewed and evaluated by three expert judges (2 psychometricians, and 1 economic psychologist). Once the items battery was formed, a pilot with 20 people was carried out to identify some additional adjustments in the items.

The Emotions and affective states of purchases scale by Palacios and Viloria (2017) was developed in order to evaluate emotions when shopping. It consists of 48 emotions, in which people are asked to evaluate the intensity of each affective state felt during the purchases made last year (1 = Nothing intense - 10 = Very intense). This scale is composed of two factors: positive emotions (e.g., satisfaction, blissful, happy), and negative emotions (e.g., irritable, fearful, sad).

Additionally, a sociodemographic data section was included where they were asked about their age, sex, place of residence, and spending per week; this last asked in the following way "How much money do you spend on average per week?"

Procedure

The instrument was applied in public places, homes, and universities. The participants were asked for their voluntary collaboration. All participants were assured that the information was anonymous and that the data they provided was confidential. Each participant provided verbal consent. The research protocol was established according to the General Health Regulations specifically the section regarding research on human beings. The study project collaborates with the research project "Neuroeconomic factors of financial and consumption behavior" which is evaluated by the Bioethics Committee and registered with the Research Committee of the Universidad del Valle de Mexico, Querétaro Campus, with the registration number CSUVMI2017-002.

Data analysis

The data was analysed in IBM SPSS Statistics version 25 (IBM Corp., 2017) for the Exploratory Factor Analysis (EFA), and AMOS version 24 was used (Arbuckle, 2016) for the Confirmatory Factor Analysis (CFA).

The data was analysed from four stages of the study: First, the descriptive statistics of each item, and Student t-tests for independent samples. In the second stage, the EFA was carried out with a first subsample (N = 300), and internal consistency index (Cronbach's alpha). Later, the correlations between factors were analysed. In the third stage, CFA was carried out with the second subsample (N = 218), from Structural equation modelling (SEM), and the analysis of covariance between latent variables. In the fourth phase, correlation analysis and average variance estimated (AVE) were carried out, in addition to the structural modelling for the analysis of covariance between the scales and the prediction of spending per week.

Results

The Purchase Decision-Making Inventory (PDMI) was composed of two scales, the Scale of Emotional Decisions in Purchases (PDMI-Emotional), and the Scale of Decisions in Reasoned Purchases (PDMI-Reasoned). Therefore, the Exploratory Factor Analysis (EFA) and the Confirmatory Factor Analysis (CFA) are presented separately for each scale.

Phase 1. - Descriptive statistics and items discrimination

Skewness and kurtosis indicators were obtained for each item. With respect to skewness, two items of the PDMI-Emotional presented indexes greater than 2, which were kept in sight, in case they fell in some other indicator that requires removal from later analyses. While all those that correspond to the PDMI-Reasoned presented indicators between -.87 to 1.90, all within the acceptable range. With respect to kurtosis, ten PDMI-Emotional items presented indexes greater than 2. Two were those that obtained equally high scores in skewness. Therefore, those two items were eliminated for further analyses. The kurtosis indicators from the PDMI-Reasoned were between -.975 and .551; all within the acceptable range.

Subsequently, a total score of each scale and quartiles were obtained to create a new variable for the PDMI-Emotional and another for the PDMI-Reasoned, dividing the high and low scores, from the quartiles 1 and 3. The discrimination of the items was analysed from Student t-tests for independent samples to each item by scale. Under this criterion, all the items showed statistically significant differences at p < .001 of the PDMI-Emotional. On the other hand, for the PDMI-Reasoned, it was identified that one item did not show statistically significant differences (t (217) = 0.505, p = .618), due to this, the item was not included for future analyses.

Phase 2. - Exploratory Factor Analysis (EFA)

In order to obtain the construct validity of each scale, an EFA was carried out. In both cases, a reduction of dimensions was made from the maximum likelihood extraction method with orthogonal varimax rotation without forcing a certain number of factors. With this procedure, items that had factor loads less than .40, or that loaded in two or more factors with differences of .20 or less in their factor load were eliminated - 31 items from PDMI-Emotional (e.g., I make better choices about what to buy when I'm happy; I've regretted buying some things), and 26 items from PD-MI-Reasoned (e.g., I make a list before going shopping; I compare products before buying things).

Scale of Emotional Decisions in Purchases (PDMI-Emotional)

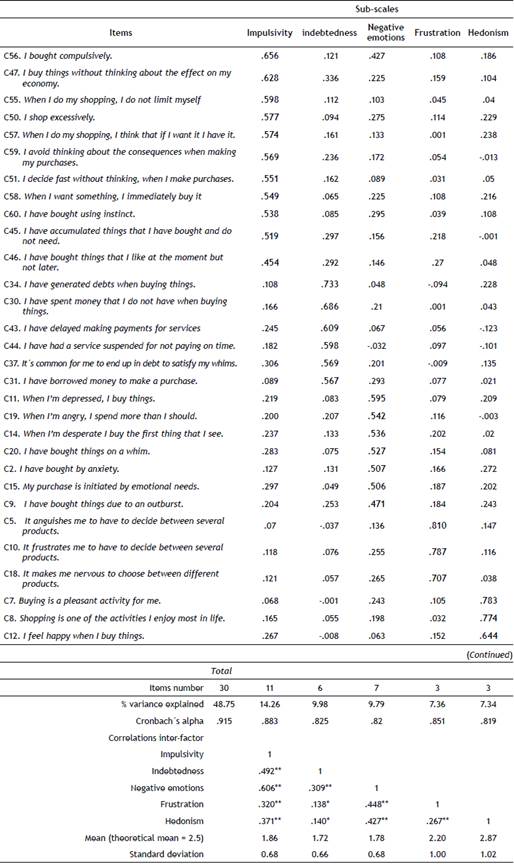

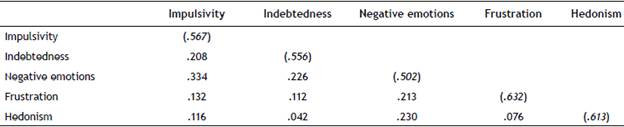

A composition of five factors with eigenvalues greater than 1 was obtained, explaining 48.75% of the total variance (see Table 2). The factorial solution converged in six iterations and an adequate KMO coefficient was presented with a value of .899; Bartlett = 4013.56, p < .001. Factor loads greater than .454 and communalities greater than .341 were presented. Based on Pearson correlations, the association between factors was analysed, ranging from low to medium coefficient. Cronbach's alpha index shows a good internal consistency, for the general scale and for each factor.

Table 2 Sub-scales, factorial loads, psychometric index of internal consistency, inter-factor correlations and descriptive statistics.

*p < .05

** p < .001

The factorial analysis showed components that have been conceptualized as follows:

Impulsivity: Emotional decision style that involves buying without thinking about the economy, and buying at the time the product is desired.

Indebtedness: Emotional decision style that involves generating debts, spending money you don't have and borrowing money, all this to satisfy whims.

Frustration: Emotional decision style involving the feeling of anguish, frustration and feeling nervous when choosing between different products.

Hedonism: Emotional decision style that involves shopping for pleasure, happiness and enjoyment.

Scale of Reasoned Decisions in Purchases (PDMI-Reasoned)

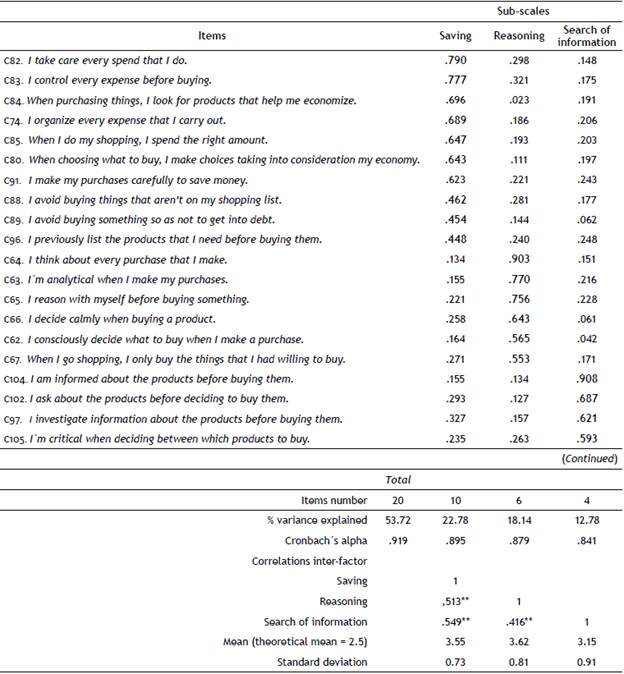

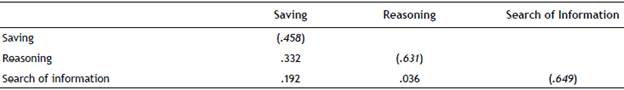

A composition of three factors with eigenvalues greater than 1 was obtained, explaining 53.72% of the total variance (see Table 3). The factorial solution converged in six iterations, and an adequate KMO coefficient with a value of .908 was presented; Bartlett = 3321.42, p < .001. Factorial loads greater than .448 and communalities greater than .320 were obtained. Based on Pearson correlations, the association between factors was analysed. Cronbach's alpha indices show a good internal consistency, for the general scale and each factor.

Table 3 Sub-scales, factorial loads, psychometric index of internal consistency, inter-factor correlations and descriptive statistics of PDMI-Reasoned.

** p < .001

The factorial analysis showed components that have been conceptualized as follows:

Savings: Decision style that involves purchasing things in a conscious way, aimed at analysing each expense for the benefit of one's personal economy.

Reasoning: Reasoned decision style that involves processing, being analytical, and calmly and consciously deciding each purchase.

Information search: Reasoned decision style that involves consulting, being critical, and finding out about the products before making the purchase.

Phase 3. - Confirmatory Factor Analysis (CFA)

CFA of two scales created was carried out, in both cases, the goodness-of-fit estimation was used from the maximum likelihood method.

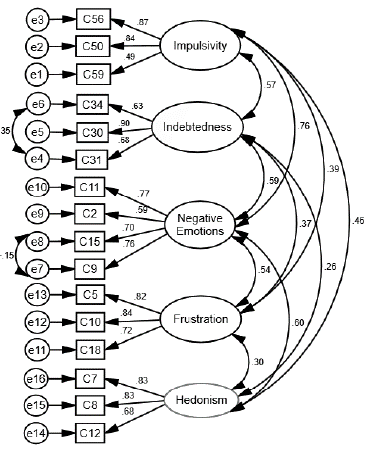

Scale of Emotional Decisions in Purchases (PDMI-Emotional)

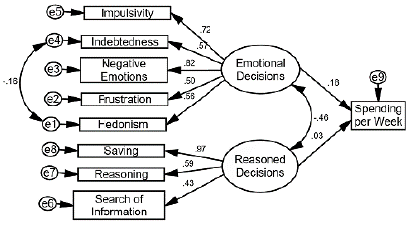

The appraisal of a five-factor structure of the scale was carried out; for a better fit, the items that increased the error in the other items were eliminated. Modification rates were adjusted with the covariances between the items, in two of the five factors. In this way, a model was obtained as shown in Figure 1.

The model presents a good fit to the data of the theoretical model (x2 = 101.01, gl = 92, p = .245; CMIN/DF = 1.098, RMR = .048; GFI = .948; CFI =.994; NFI = .937; IFI = .994; RM-SEA = .021, with a minimum range of .000 and a maximum of .043). This confirms the structure of five factors for the emotional decision making of purchases, as identified in the exploratory analysis.

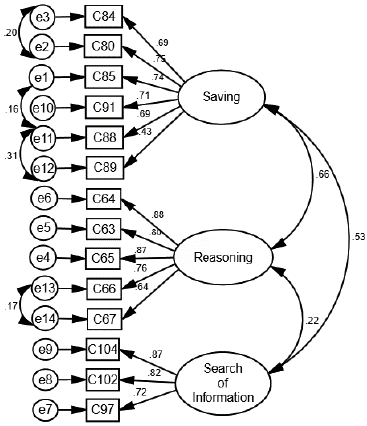

Scale of Reasoned Decisions in Purchases (PDMI-Reasoned)

The evaluation of the three-factor structure of the scale was carried out; for a better fit, the items that increased the error in the other items were eliminated. Modification rates were adjusted with the covariances between the items, in two of the three factors. A model was obtained as shown in Figure 2. Modification rates were adjusted with the covariances between the items, in two of the five factors. In this way, a model was obtained as shown in Figure 1.

The model presents a good fit to the data of the theoretical model (x2 = 87.20, gl = 70, p = .080; CMIN/DF = 1.246, RMR = .039; GFI = .946; CFI =.989; NFI = .947; IFI = .989; RMSEA = .034, with a minimum range of .000 and a maximum of .055). This confirms the structure of three factors for the decision-making of purchases, as identified in the exploratory analysis.

Phase 4. - Convergent, divergent, discriminant and predictive validity

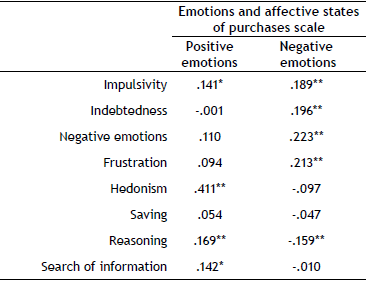

To assess convergent and divergent validity, the PD-MI-Emotional and PDMI-Reasoned factors were correlated with the factors of the Emotions and affective states of purchases scale (Palacios & Viloria, 2017) (see Table 4).

Table 4 Correlation indexes between Emotions and affective states of purchases scale, and the PDMI.

* p < .05

* * p < .001

Correlations confirm the convergent and divergent validity according to the nomological network of the scale. This is associated with negative emotions with most of the factors of PDMI-Emotional, and positively with the hedonism factor. While for PDMI-Reasoned it doesn't present association of saving factor with any of the emotions and affections dimensions. In regard to reasoning, it is positively associated with positive emotions and negatively with negative emotions, while for the search of information, it only presents association with positive emotions.

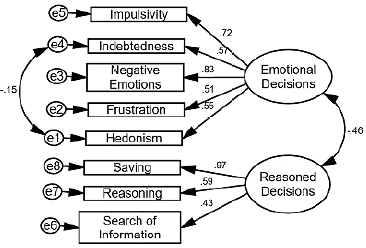

Likewise, to ensure divergent validity, the covariance between PDMI-Emotional and PDMI-Reasoned was modelled (See Figure 3).

The model presents a good fit to the data of the theoretical model (x2 = 25.74, gl = 18, p = .106; CMIN/DF = 1.430, RMR = .031; GFI = .972; CFI =.982; NFI = .943; IFI = .982; RMSEA = .045, with a minimum range of .000 and a maximum of .081). This confirms the structure of two scales of PDMI, also indicating an inversely proportional association between emotional decisions and reasoned decisions, thus ensuring divergent validity.

In order to assure the discriminant validity, the Average Variance Extracted (AVE) of the constructs was obtained and compared with squared inter-factor correlations, which AVE requires to be larger than the square correlations inter-factor (Hair, Anderson, Tatham & Black, 1999). As shown in Tables 5 and 6, each factor the value of AVE is larger than the squares of the correlations, thus ensuring the discriminant validity.

Table 5 Squared correlations inter-factor and AVE of the PDMI-Emotional.

AVE is shown in the diagonal.

Table 6 Squared correlations inter-factor and AVE of the PDMI-Reasoned.

AVE is shown in the diagonal.

To ensure the predictive validity, the effect of emotional and reasoned decisions on spending per week are processed and analysed with the structural model (See Figure 4). This is according to the relation between emotions and monetary expenditure identified by some authors (Cryder et al., 2008; Garg et al., 2018; Lerner et al. 2004).

The model presents a good fit to the data of the theoretical model (x 2 = 42.84, gl = 24, p = .010; CMIN/DF =1.785, RMR = 27.65; GFI = .959; CFI =.957; NFI = .910; IFI =.958; RMSEA = .060, with a minimum range of .029 and a maximum of .089). In addition, the regression line of emotional decisions is significant at p = .045, while the reasoned decisions predictor was not. This confirms the spending per week model, based on the influence of emotional decisions.

Discussion

The goal of the present research was to build develop upon the original ideas of Sproles and Kendall (1986), a way of measuring consumer decision-making styles that would be valid and reliable for assessing these styles in Mexico.

With respect to the variance explained, the PDMI-Emotional presents a conceptually coherent picture with a theoretical meaning. However, the percentage of variance explained per factor is somewhat low, because of the small number of items per factors. However, the factors obtained show theoretical coherence and adjustment in the model. This indicates that a potentially useful, valid and reliable tool has been developed for further work.

With respect to CFA, the size of the sample follows the suggestion of Hoelter (1983) that requires at least N = 200 for a satisfactory fit; in this study a sample of 218 is considered to be a good fit for the CFA. When it comes to sample size, there is no consensus; some studies identify that the size of the sample must be calculated depending on the study design, the relationships among indicators, and the number of parameters (Brown, 2015). For that reason, it is suggested to replicate these results following this another posture in order to identify a sample size which could strengthen the proposed factorial structure.

The CFA was better adjusted deleting items that generated error to the model, and also drawing covariant paths with the errors. This reveals relational implications (Harrington, 2009). In the first case, in the PDMI-Emotional, a covariation path between items 34 and 31 from the Indebtedness factor that refers to getting into debt when buying something, and on the other hand, borrowing money to buy something. This relation has been shown to be supported by Livingstone and Lunt (1992), identifying that borrowing is associated with debt. In the case of the path between items 15 and 9, it identifies the relation between emotional purchasing and buying due to an outburst; this is in accordance with the evolutionary perspective that emphasises that a flow of emotions were vital for the survival of our ancestors, in turn pushing us to outbursts (Adler, Rosen & Silverstein, 1998). In the case of the PDMI-Reasoned, a covariation path between items 84 and 80 refers to searching for products which can economize and, choosing the most economic, are related to indicators such as saving money at the time of purchase. In the case of the covariate paths between items 85 and 88, and 88 and 89, they are related; on one hand, to spend the right amount, to avoid buying things that are not on the shopping list and, economize; this is related to results which identify that consumers who use a shopping list tend to, on average, spend less than non-list users (Thomas & Garland, 1993). And on the other hand, using a shopping list helps avoid wasteful expenditures, including get into debt (Thomas & Garland, 2004).

Development of the inventory from the exploration of the psychological meanings that Mexicans associate with the consumer decision-making styles, provides cultural relevance for the development of psychometric scales (Reyes, 1993). It highlights the way in which the individuals from a certain region share and carry out their economic activities. From this, the composition of inventory by emotional and reasoned scales gives structure for the differentiation of cognitive processing, and affective-emotional style that triggers the purchases of products and services. This coincides with the empirical proposal of Sproles and Kendall (1986), identifying affective and cognitive elements. It also coincides with the theoretical proposal of Kahneman (2011), identifying elements of an intuitive system, which is characterized by being fast and emotional. Elements that can be found embodied in the factorial structure of the PDMI-Emotional, where these dimensions agree with multiple findings on the influence of emotions in economic transactions and consumer decisions (Cui, 2018, Garg et al., 2018; Guven, 2012; Iyengar & Lepper, 2000; Lee & Yi, 2008; Lerner et al., 2004; Palacios & Soler, 2017; Palacios & Viloria, 2017; Schwartz et al., 2002; Soler, Palacios & Bustos, 2017).

On the other hand, elements of the slow, deliberate and logical system (Kahneman, 2011) are reflected in the PDMI-Reasoned factor structure. Such dimensions coincide with the one presented in different researches (Bloch, Sherrell & Ridgway, 1986; Kahneman, 2011; Malhotra, 1982; Schmidt & Spreng, 1996; Scott & Bruce, 1995; Soler et al., 2017), highlighting the deliberate, slow character that involves a certain degree of information processing, as well as contemplating the greatest amount of information so that a decision can be made.

Regarding the descriptive analysis of means, for the dimensions of the PDMI-Emotional, the highest measure is assigned to hedonism, being the only indicator a little above the theoretical average. Next, there is the frustration with various options, and impulsivity follows. The above suggests that, for the selected sample, as far as emotional decisions are concerned, they seem to be motivated initially by hedonic and pleasure states at the time of making the purchases. On the other hand, regarding the dimensions of the PDMI-Reasoned, the highest mean corresponds to reasoning, followed by savings, and finally, the search for information, which suggests that for the selected sample, being calm and analytical when making purchases is what seems to guide the purchases made by the individuals from such a sample. These findings coincide with those identified by Sproles and Kendall (1986), where the highest means correspond to the dimensions of deliberate and reasoned processing of information, in comparison with the emotional or impulsive ones.

Inter-scale correlations and CFA show the moderate association between the PDMI-Emotional dimensions, which supports the idea that scale factors measure different aspects of the same construct. In the same way, it occurs with the dimensions and structure of the PDMI-Reasoned. On the other hand, correlations of the PDMI-Emotional and the PDMI-Reasoned dimensions concerning Emotions and affective states of purchases scale (Palacios & Viloria, 2017) show consistency in the fact that impulsivity, negative emotions, frustration, anger and indebtedness are associated with negative emotions (Iyengar & Lepper, 2000; Keltner & Lerner, 2010), while hedonism is associated with positive emotions (Keltner & Lerner, 2010). Positive relationship of reasoning with positive emotions and inversely proportional relationship with negative emotions has been supported in several studies (Bachkirov, 2015). Previous evidence provides convergent validity, while the appropriate adjustment of the covariance model between the PDMI-Emotional and the PDMI-Reasoned shows evidence of divergent validity, identifying and sustaining the independence of the emotional characteristics of cognitive processing. Having a significantly negative covariance, supporting the need to evaluate differently in the inventory, as well as the decisions aimed at the emotional purchases and the reasoned, coincides with that found by Shiv and Fedorikhin (1999).

The Purchase Decision-Making Inventory (PDMI) turns out to be a useful tool to link and explain behaviors in economic sphere. Evidence of this is the use of the inventory to model monetary expenditure per week. The tested model has adequate adjustment indexes, suggesting, on the one hand, that the scale is useful for predicting economic behaviors, and on the other hand, it highlights the direct influence of the emotional decisions of purchases with the monetary expenditure per week. A finding which is consistent with the evidence of the relationship between emotions decision-making (Loewenstein, 1996), behavior (Lerner & Keltner, 2000), and monetary spending (Babin & Darden, 1996; Cryder et al., 2008; Garg et al., 2018; Guven, 2012; Lerner et al., 2004; Rao, Mei & Zhu, 2016).

The Purchase Decision-Making Inventory (PDMI) has shown to be a useful tool for assessing purchase decisions.

Inventory has adequate factorial weights and it is proposed that for future studies a greater number of items be included for dimensions of the PDMI-Emotional, and also for the searching for information factor of the PDMI-Reasoned. In CFA these factors were left in the limit of the conformation of the factor, and it is not proportional, arising from the rest of the factors of savings and reasoning. It is also proposed that future studies measure a different population from the one used in this study; on the one hand, Mexican populations with different characteristics, and on the other hand, the rest of Latin America. It is the most similar cultural configuration, because as Lysonski et al. (1996) points out, it seems that consumer decision-making and configuration differs significantly in developing countries in contrast to developed countries. These measurements will help to identify the consistency and configuration of the PDMI between cultures, as well as the identification of elements that are shared and those that are idiosyncratic of Mexicans.