Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Cuadernos de Economía

Print version ISSN 0121-4772

Cuad. Econ. vol.34 no.65 Bogotá July/Dec. 2015

https://doi.org/10.15446/cuad.econ.v34n65.42611

http://dx.doi.org/10.15446/cuad.econ.v34n65.42611

The need for official reserves in Latin America: Assessing the precautionary motive, 1995-2011

La acumulación de reservas internacionales en América Latina: evaluando el motivo precautorio, 1995-2011

L'accumulation de réserves internationales en Amérique latine : évaluation du motif de précaution, 1995-2011

A acumulação de reservas internacionais na América Latina: Avaliando o motivo precautório, 1995-2011

Moritz Cruz a

a Profesor-Investigador, Universidad Nacional Autónoma de México, Instituto de Investigaciones Económicas, México. E-mail: moritzc@comunidad.unam.mx

The author is very grateful with two referees of Cuadernos de Economía for their useful suggestions to improve the manuscript. The usual disclaimers apply. He also acknowledges financial support from the DGAPA-PASPA-UNAM.

Sugerencia de citación: Cruz, M. (2015). The need for official reserves in Latin America: Assessing the precautionary motive, 1995-2011. Cuadernos de Economía, 34(65), 327-347. doi:10.15446/cuad.econ.v34n65.42611

Abstract

In this paper we estimate the demand for official reserves in Latin America during the period 1995-2011. We assume that the main concern of the monetary authorities to demand reserves is the fear of suffering external drains, and its associated output costs. In other words, we attempt to show that the so-called precautionary motive drives the demand for international reserves in the region. Our econometric results confirm that Latin American countries demand ever increasing amounts of foreign exchange to protect themselves against the likelihood of external drains.

Keywords: International reserves, precautionary motive, financial variables, Latin America, financial openness.

JEL: F3, F32, F41.

Resumen

En este artículo estimamos la demanda de reservas internacionales en América Latina para el período 1995-2011. Asumimos que la mayor preocupación de las autoridades monetarias para demandar reservas es el miedo a las salidas de capital y a sus costos asociados en cuanto al producto. En otras palabras, intentamos demostrar que el motivo precautorio explica la demanda de reservas en la región. Nuestros resultados econométricos confirman que la región demanda crecientes cantidades de divisas para protegerse contra la posibilidad de salidas de capital.

Palabras clave: reservas internacionales, motivo precautorio, variables financieras, América Latina, apertura financiera.

JEL: F3, F32, F41.

Résumé

Dans cet article, nous évaluons la demande de réserves internationales en Amérique latine pour la période 1995 - 2011. Nous assumons que la plus grande préoccupation des autorités monétaires pour demander des réserves est la crainte des sorties de capital et de leurs coûts associés quant au produit. Autrement dit, nous ressayons de démontrer que le motif de précaution explique la demande de réserves dans la région. Nos résultats économétriques confirment que la région demande des quantités croissantes de devises pour se protéger contre la possibilité de sorties de capital.

Mots-clés : réserves internationales, motif de précaution, variables financières, Amérique latine, ouverture financière.

JEL : F3, F32, F41.

Resumo

Neste artigo estimamos a demanda de reservas internacionais na América Latina para o período 1995-2011. Assumimos que a maior preocupação das autoridades monetárias para demandar reservas é o medo às fugas de capital e aos seus custos associados quanto ao produto. Em outras palavras, tentamos demonstrar que o motivo precautório explica a demanda de reservas na região. Nossos resultados econométricos confirmam que a região demanda crescentes quantidades de divisas para proteger-se contra a possibilidade de fugas de capital.

Palavras-chave: reservas internacionais, motivo precautório, variáveis financeiras, América Latina, abertura financeira.

JEL: F3, F32, F41.

Este artículo fue recibido el 14 de marzo de 2014, ajustado el 4 de julio de 2014 y su publicación aprobada el 8 de agosto de 2014.

INTRODUCTION

Right after the Mexican "Peso" crisis of 1994-95, international reserves in Latin America (LA, henceforth) had increased around 500% during the period 1995-2011; and as a share of GDP, had grown around 6 percentage points, going from 7% in 1995 to 12.7% in 2011. These are unprecedented levels. At the same time, despite the number of financial crises that the region witnessed since the mid-1990s, the free mobility of capital across borders has been kept, which, as is widely known, has been the essence of potential capital reversals and thus of financial crisis.

Interestingly, and contrary to other regions around the world which have also observed unprecedented levels of official reserves, there has been hardly any empirical study aimed at explaining what determines the need for international reserves in the region. To our knowledge, there is only one study that attempts to shed light on the determinants of the demand for reserves in LA (see Cheung & Sengupta, 2011). In this study, the authors show that the demand for reserves is mainly driven by the so-called Joneses effect, suggesting in this sense that the demand for reserves in the region is due mainly to the attempt to emulate the behaviour of neighbour countries in terms of amassing official reserves. Notwithstanding this finding, most authors modelling the ever increasing recent demand for international reserves around the world have concluded that the precautionary motive is the main reason behind this phenomenon (see, inter alia, Aizenman & Lee, 2007; Aizenman & Marion, 2003; Bird & Mandilaras, 2010; Cheung & Ito, 2009; Choi & Baek, 2006; Ghosh, Ostry, & Tsangarides, 2012; Lane & Burke, 2001; Mendoza, 2004; Obstfeld, Shambaugh & Taylor et al., 2010). More precisely, it has been the fear to suffer a large output loss driven by reversals of capital, which implicitly implies the fear of domestic liabilities being converted into foreign exchange at any moment; or what is known as external drains, which have driven the demand for international reserves around the world during the recent past.1 The key variable that these studies have used to conclude this has been the M2/GDP ratio, which, according to them, can capture the possibility of both internal and external drains. This ratio, nevertheless, may only capture potential domestic drains or banking crises, which do not necessarily precede currency and debt crises, or external drains (see Babecký et al., 2012); such as the ones suffered by the LA economies during the 1990s and the early 2000s.

The aim of this paper is, thus, to assess if the demand for international reserves in LA has also been driven primarily for precautionary reasons during the period 1995-2011. To estimate the demand for reserves in the region, we use the data of eight selected LA economies and, following the empirical evidence just mentioned, we include mainly financial variables on the right-hand side of the econometric specification. In our model, however, we do not include the M2/GDP ratio as the variable that captures potential external drains. Instead, we use portfolio liabilities (scaled by GPD), as we believe that this is the amount of resources that are generally converted swiftly into foreign exchange at any moment, causing, as a result, financial instability and eventual crisis.

The paper is set out as follows. Section two presents brief reviews of the literature regarding which real and financial determinants have usually been included when modelling the demand for international reserves. The section aims to illustrate that the inclusion of financial variables has been gaining relevance just recently, and that the empirical results support this fact. Section three presents some information about the evolution of international reserves in LA economies and discusses the results of our panel data estimations. The final section concludes.

THE DEMAND FOR INTERNATIONAL RESERVES: REAL AND FINANCIAL DETERMINANTS

Traditionally, the need for official reserves has been mainly associated with the level of transactions required to cover the country's import needs. For this reason, since long ago, in fact until the different episodes of financial crises erupted around the world during the 1990s and the early 2000s, reserve levels were considered optimal if they were enough to cover at least three months of imports. Unsurprisingly, therefore, real trade variables like imports and/or trade openness have been considered crucial in explaining the demand for official reserves. These real trade variables, nevertheless, have been seen with caution âif not rejectionâ as determinants of international reserves.

For example, Kaldor (1978, p. 37) pointed out that

it will be wrong to suggest that the expansion of world trade 'requires' a corresponding expansion of reserves... or that there is some necessary or 'optimal' relationship between the size of reserves and the value of trade. Reserves are needed to finance trade deficits, not trade flows: the existence of reserves... allows time for [balance-of-payments] adjustments.

In this vein, Balogh (1960, p. 362, emphasis in the original) stressed that "it is the volume of payments and its instability, and not merely that of visible trade, which is the rational determinant of reserves requirements". Machlup (1966, p. 10) took a more radical position when he suggested that "there has been some 'amateur theories' linking reserves with imports, or rather with total foreign trade, by means of the conception of a need to 'finance' trade. This is naive fallacy... a trader (importer, exporter) who wants 'finance' wants credit because his working capital is not adequate to tide him over the intervals between due dates of his payments and receipts. This has nothing to do with official reserves of either any individual country or all countries taken together". He, nevertheless, warned further that in any case "one might find a more plausible relation between the need for official reserves and variations, seasonal or cyclical, in the balance of trade" (1966, p. 11, emphasis in the original). In addition to these criticisms, one can point out that the influence of trade variables on the demand for reserves needs to be related with causality aspects; that is, while it might make sense to suggest that higher trade induces higher demand for official reserves, it might also be valid to think that higher reserves could be the result of higher trade (due simply to trade openness), particularly if there is a trade surplus.2

Interestingly, despite these concerns, all cotemporaneous empirical literature (using cross-sectional or panel data regressions) modelling the demand for official reserves has included trades variables as one of its determinants (using either the share of trade to GDP or the share of imports to GDP). The empirical results, however, are mixed as some studies have found consistently that trade is statistically significant, though the size of the coefficient is relatively small, whereas others have found that trade is not, in statistical terms, significant, particularly for samples of emerging or developing economies (see, inter alia, Aizenman & Lee, 2007; Aizenman & Marion, 2003; Bird & Mandilaras, 2010; Cheung & Ito, 2009; Cheung & Quian, 2009; Lane & Burke, 2001; Mendoza, 2004).3 It seems, therefore, that the empirical evidence supports the concerns mentioned about whether trade variables can indeed be relevant to explain the need for reserves.

Other real variables included in the econometric specifications of demand for reserves are GDP per capita and the country's population. Both variables have been incorporated, arguing either that "reserve holdings should increase with the size of international transactions, so... reserve holdings [are expected] to be positively correlated with the country's population and standard of living" (Aizenman & Marion, 2003, p. 382), or that they help to control the level of development and to check for scale effects (see Lane & Burke, 2001). Under this view, it is not clear, however, how one can explain the unprecedented increments of official reserves in poor and stagnated developing economies (like Latin America's). The empirical evidence regarding the relevance of these variables is remarkably mixed as well, as for some economies, mainly developed, these two variables matter, whereas for developing and/or emerging economies these variables have not been statistically significant.

Now, until very recently, due to the fact that recent financial crises were seen as episodes of foreign exchange illiquidity (namely the inexorable depletion of international reserves), caused by rapid interruptions and/or reversals of capital flows, which in turn made clear that "the increase in developing country's reserves is related to changes not in real quantities (such as imports or output) but in financial magnitudes" (Rodrik, 2006, p. 257, emphasis in the original), there has been a growing concern in the literature regarding the influence of financial magnitudes in the demand for official reserves.

For example, Choi & Baek (2006), add portfolio-flows volatility as a determinant of international reserves to trade and income variables. Their results, using data of 46 countries for the period 1980-1999, suggest that monetary authorities' decisions to accumulate reserve are indeed sensitive to portfolio-flows volatility. A similar paper, in the sense that it intends to capture the relevance of capital flows in reserve holdings, is the one by Choi, Sharma & Strömvisq (2007). Using panel data estimations for emerging and developed economies during the period 1980-2005, the authors found out that, in recent years, and particularly for emerging economies, capital flows have had a strong positive effect on reserves buildings, but a negative effect when the sample only includes advanced economies.

Cheung & Ito (2009) divide the determinants of international reserves into three categories: traditional macro variables, financial variables and institutional variables. Within the category of financial variables they consider money supply to GDP, external debts and capital flows. Using data for more than 100 countries for the period 1975 to 2005, their panel data estimations allowed them to suggest that for both, developed and developing economies, particularly during recent periods, financial variables have been gaining relevance in explaining reserves holdings.

Ghos et al. (2012) show that emerging economies hold reserves, besides mercantilist motives, for precautionary reasons against both current and capital shocks. They consider three variables to capture the precautionary demand against capital account shocks: a measure of the de iure openness of the capital account, short-term debt on a residual maturity basis, captured by the ratio short term debt/GDP, and banking system liabilities/broad money, measured by the money/GDP ratio. Each ratio is expected to be associated with higher precautionary demand for reserves. Their econometric panel data results, using a sample of 43 emerging economies, support the idea that financial magnitudes are relevant in explaining the decisions of the authorities to hold reserves, particularly since the post-East Asian financial crisis of the late 1990s.

Finally, assuming that reserve accumulation is a key tool for managing both financial instability and the exchange rate in an era of highly globalized capital markets, Obstfeld et al. (2010) estimated a reserves demand model using data from 134 countries for the period 1980 to 2004 that, besides traditional real variables, incorporates financial (stability) ones. Among the latter they include a measure of financial openness, different exchange rate regimes dummies and the ratio M2-to-GDP as the indicator that can capture both the potential of internal drains (runs from bank deposits to currency), and external drains (flight to foreign currency). Their panel data results allowed them to suggest that, for the full sample, financial variables matter, especially when they are modeled without real variables. The econometric exercise considering exclusively emerging economies allows the authors to suggest that only financial openness and the ratio M2/GDP matter for reserves accumulation.

In sum, whereas the empirical evidence regarding real variables as determinants of reserves is poor for developing economies, the one for financial variables is more consistent, indicating that these magnitudes are indeed important in explaining the demand for reserves during recent years. In particular, the potential of internal and external drains has been mainly captured by the amount of domestic financial liabilities or domestic money (scaled by GDP). However, this variable might only capture domestic drains, which do not necessarily precede external drains. On the other hand, other debt variables have been also highlighted as relevant in explaining precautionary concerns in the demand for reserves around the world.

LATIN AMERICA AND ITS DEMAND FOR INTERNATIONAL RESERVES

Right after the adoption of policies aimed at deregulating swiftly the domestic and external financial sectors during the late 1980s and 1990s, a number of Latin American economies suffered financial crises, and the concomitant output lost was substantial in most cases. In this vein, the Mexican financial crisis of 1994-95 was followed by Brazil's in 1998-99, Ecuador's in 1999, Argentina's in 2001, Uruguay's in 2002 and the Dominican Republic's in 2003. The root of these crises, as mentioned, has been characterised as a problem of illiquidity in the context of large reversals and/or sudden stops of capital inflows.

The remedy adopted by LA economies to tackle future problems of illiquidity has consisted on a purposeful strategy of ever increasing demand for international reserves (namely, accumulate foreign exchange independently of the balance-of-payments position, particularly that of the current account).4 Unsurprisingly, the demand for international reserves has increased substantially in absolute and in relative terms since 1995.

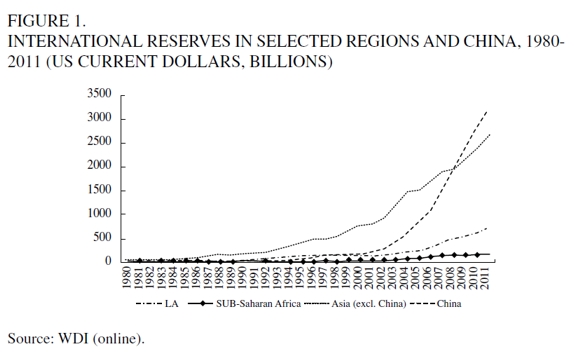

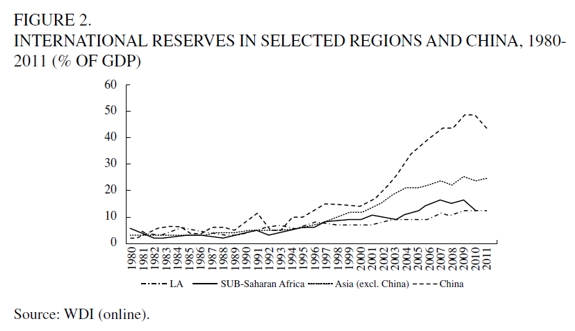

Figure 1 shows the evolution of international reserves for Latin America, Sub-Saharan Africa, Asia, and China during the period 1980-2011. As can be seen, unlike Asia, up until the end of the 1980s, reserves remained very stable in Latin America, China and Sub-Sahara Africa. After that, however, once high-capital mobility was adopted around the developing world, reserves started to surge (it is important to recall that one of the effects of capital account liberalisation is massive inflows of capital). In particular, for Latin America, the observed increase of reserves during the period 1990-1994 can be ascribed to the massive inflows of capital; it cannot therefore be associated with precautionary or other demand purposes, nor with a purposeful strategy of reserve hoardings. This can be confirmed in Figure 2, where reserves as a share of GDP, soared swiftly during the period in which financial liberalisation deepened. As a result, in Latin America reserves as a share of GDP went from 3.2% in 1989 to 4% the next year, to further increase to 6.3% in 1994. A similar increasing evolution can be seen in China and Sub-Saharan Africa.

However, the turning point in the demand for international reserves around the world can be identified during the aftermath of the Mexican "Peso" crisis, that is in 1994-95, as reserves started to depict an ever increasing trend, which magnified notably in Latin America from 2003 onwards (see Figures 1 and 2). As a result, during the period 1995-2011, as we mentioned, reserves in Latin America have increased around 500%, and as a share of GDP, they have grown around 6 percentage points, going from 7% in 1995 to 12.7% in 2011 (see Figure 2). This massive increase is unprecedented. Evidently, when this growth is compared with that which occurred in China and Asia, Latin America's is dwarfed. It is important to note that for many Asian economies (including of course the Chinese) the accumulation of reserves is partly a consequence of their trade surpluses. Finally, it is important to highlight that LA economies, as well as those elsewhere in the developing world, have been demanding reserves whilst in the meantime maintaining or even deepening the free mobility of capital across their borders.5

Despite the relevant increase in the demand for official reserves in LA, there has been hardly any empirical study aimed at explaining this phenomenon in the region. In fact, as mentioned above, the only study that we are aware of is the work of Cheung & Sengupta (2011). Curiously, this paper aims to show that the so-called Joneses effect is the main factor behind the demand for reserves in the region. One consequence of this is that only one financial variable, the ratio M2/GDP, is included in the econometric specification. Notwithstanding that this variable is statistically significant, its size is negligible, suggesting that the likelihood of internal drains has not played a relevant role in the demand for reserves in LA. One possible explanation of this result is that the econometric exercise is carried out for the period 1980-2007, which, as suggested above, might capture a period of time (1980-1994) in which a purposeful strategy of reserves accumulation did not exist in the region, influencing in this way the paper's final results.

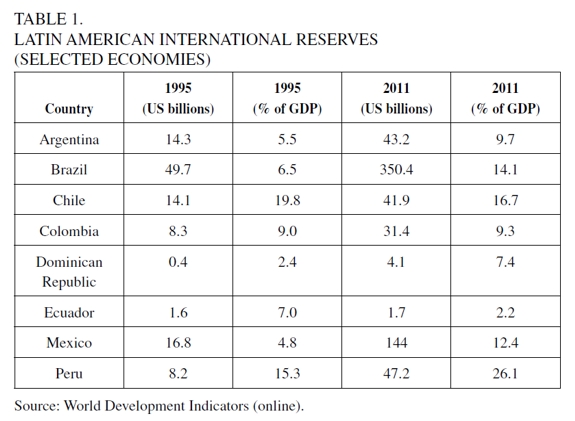

Given the unprecedented level of foreign reserves in LA, and the relevance of financial variables in its demand according to recent literature, we attempt to assess whether financial variables can explain the demand for reserves in LA during the period associated with a purposeful strategy of accumulate official reserves. We use data from eight selected economies: Argentina, Brazil, Chile, Colombia, the Dominican Republic, Ecuador, Mexico and Peru; these economies account for over 90% of total reserves in the region (led by Brazil, Mexico and Argentina, which account for more than half of total reserves in the region), and is representative of countries that have suffered financial crisis recently (Argentina, Brazil, Dominican Republic, Ecuador and Mexico) and others that have not (Colombia, Chile and Peru).

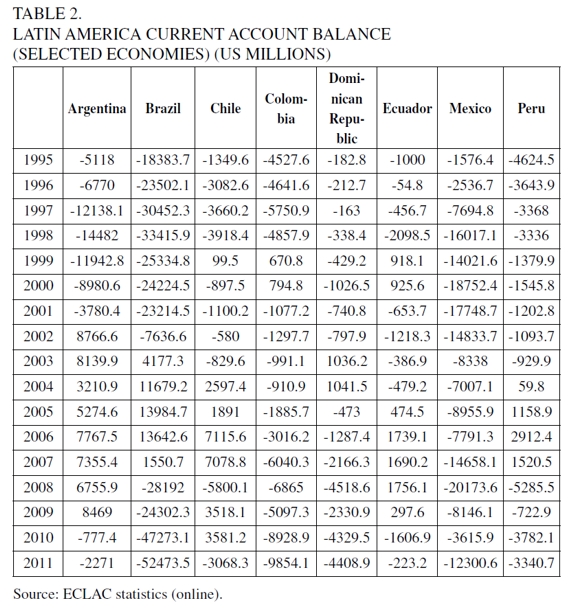

Table 1 provides an idea of the evolution of international reserves for each one of the eight selected economies of the region. As can be seen, from the aftermath of the Mexican 'Peso' crisis until 2011, official reserves have increased to unprecedented levels both in relative and in absolute terms in Argentina, Brazil, the Dominican Republic, Mexico and Peru. All these economies, except Peru, have suffered a financial crisis during the period of study, so this evolution might not be surprising at all. Interestingly, Chile and Colombia have increased massively their reserves in absolute terms, but when they are measured as a share of GDP they have decreased and barely increased, respectively. Finally, Ecuador has kept unchanged its reserves in absolute terms, but they have declined sharply as a share of GDP. In sum, there is a clear trend in the economies of the sample to, implicit or explicitly,6 demand and accumulate reserves. This conclusion is supported when looking at the current account balance of each country (see Table 2). As can be seen, except for Argentina from 2002 to 2009, the rest of the economies in the sample have either a permanent deficit or a short-lived equilibrium or surplus. If international reserves are the counterpart of trade surpluses, then it is clear that they have applied a purposeful strategy to accumulate reserves. This general tendency to accumulate reserves suggests that this behaviour could be independent of other key economic variables, like economic growth, the exchange rate system or trade openness.

Data and Methodology

The database to elaborate our econometric exercise comes from three different sources, unless otherwise noted: the World Development Indicators, the World Development Finance, both from the World Bank database (online), and the International Financial Statistics of the IMF (CD-Rom, 2012). Unlike most of the studies in reserves determination, we do our econometric exercise for the period 1995-2011, because, as suggested above, it covers the exact period that can be related to a purposeful strategy of hoarding reserves in LA.

The estimated equation is:

where i denotes economies (N = 8) and t denotes time (t = 17) and αi is the fixed effect term. The dependent variable yit is, in one specification, reserves scaled by GDP (R/GDP), and in another is in current US dollars. We also estimate a third specification in which the ratio of international reserves-to-domestic liabilities of the central bank (R/M2) is the dependent variable. The idea here is to assess Machlup's (1966, p. 22) hypothesis regarding the fact that official reserves will move in relation to the central bank's liabilities because "... the greater the political responsibility accepted by the central bank for averting liquidity troubles on the part of commercial banks and industry, the larger have to be the foreign reserves in relation to the domestic liabilities of the central bank". In other words, reserves will move in tandem with the evolution of the monetary aggregate M2 as long as the central bank commits to avoid liquidity troubles. This obligation to avoid liquidity troubles is likely to increase substantially in a financially liberalised context. Machlup further stressed that the R/M2 ratio is capable to explain "... not only a 'need' for foreign reserves but also why this need is also related to current domestic liabilities and why the needed ratios may be different from country to country" (ibid). We expect, thus, that this ratio correlates mainly with financial variables.

x'it is the vector of variables that explain reserves demand. Among these, consistent with the review of literature shown in the last section, we mainly include financial variables that can capture the concern of governments with external drains. In this context, we decide to include portfolio liabilities, scaled by GDP (PL/GDP), as a measure of financial openness and at the same time as an indicator of potential external drains (this ratio, in fact, in used instead of the M2/GDP ratio, which as mentioned is used to measure either financial depth or the potential of domestic-and even external-drains). These resources in fact are the first ones that are likely to abandon an economy, leading eventually to a currency or a financial crisis. They represent, in other words, the initial size of a potential external drain. In this sense, they can be considered especially relevant for the demand for reserves in any financially deregulated economy. In this context, governments are also concerned about the evolution of the stock price index, as this is likely to vary largely as a result of massive inflows or outflows of foreign exchange, leading to potential movements of official reserves. To capture this, we include the stock price index volatility (measured as the 360-days standard deviation of the return on the national stock market index).

We also include, following other studies, the volatility of the exchange rate (volat_exra, measured as the annual standard deviation of the monthly growth rate of the nominal exchange rate, based on our own calculations using the IFS and the statistics of the Central Bank of Ecuador), to check whether exchange rate movements, independent of the existing exchange rate system, matter for reserves demand; this will illustrate whether reserves are used to stabilise the exchange rate, as a growing literature has suggested (see, for example, Bayoumi & Saborowski, 2012). We also include the volatility of international reserves (volat_ir, measured as the annual standard deviation of the monthly growth rate of international reserves, based on our own calculations using the IFS), to capture whether variations on the stock of international reserves matter for the demand of reserves.

Demanding and hoarding reserves is not free, it implies an opportunity cost defined as the difference between the yield on reserves and the marginal productivity on an alternative investment, so in theory the higher the opportunity cost the lower the demand for reserves; to capture this we include the differential between the domestic and the US real rates of interests (termed in the specification as cost) as a measure of the cost of holding reserves (see IMF, 2003).

Debts ratios, particularly those denominated in foreign currency, were relevant in triggering the boom of financial crises in LA economies (and in fact around the world, see for example, Arestis & Glickman, 2002; De Paula & Alves, 2000; Drehmann & Juselius, 2012). This is because as debt ratios increase, the vulnerability of a country's public and private borrowers to internal and/or external shocks (for example, an increase in domestic rates of interest, the depreciation/devaluation of the currency and the shrinkage of the supply of credit) that endanger their ability to discharge outstanding debts increase also, leading to higher financial instability and to eventually a Minsky type of crisis.7 The association of debt and reserves, however, can go in either direction. According to Lane & Burke (2001), higher debt can reduce the need for reserves if financial transactions can be financed by debt. At the same time, reserves may be needed as collateral to raising debt and they may be important in stabilizing the external debt market. We, thus, include the following debt ratios: outstanding international private debt securities to GDP (IPRD/GDP), outstanding international public debt securities to GDP (IPUD/GDP), the ratio of short term debt-to-total external debt (STDTOED) and total external debt scaled by GDP (TED/GDP). All these variables are, according to the data sources, originally denominated in US dollars.

Finally, to assess whether real variables are relevant in the demand for reserves, we include trade openness (gauged by the sum of exports plus imports over GDP in US nominal dollars, termed TRADE/GDP,) and an income variable (captured by the evolution of real income per capita in US dollars, 2000 = 100, termed RYPC, and by nominal income per capita in US dollars, termed NYPC, depending on the econometric specification). Almost all variables were transformed into logs.

The Econometric Results

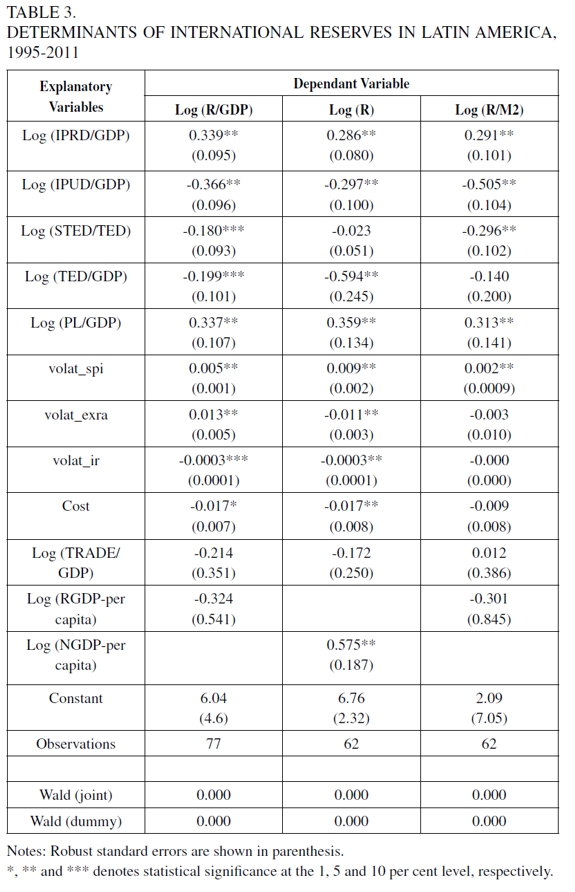

Table 3 reports the econometric results allowing for fixed effects to account for country heterogeneity and presents robust standard errors to correct for heteroscedasticity that could affect it given that we are estimating an unbalanced panel (see Asteriou & Hall, 2011). As mentioned, we elaborate three exercises, having in two specifications as dependent variable international reserves scaled by GDP (R/GDP) and by the monetary aggregate M2 (R/M2), respectively, and in another specification, nominal reserves in US dollars (R). The key findings to note are as follows. There is clear evidence that, for monetary authorities, a relevant concern to demand reserves is the peril of external drains. This can be derived, on the one hand, from the coefficient of the portfolio liabilities-to-GDP ratio, which turned out to be statistically significant in all the specifications and with a positive sign, indicating that as the ratio increases the demand for reserves increases as well. In fact, the size of the coefficient is relatively high, suggesting that an increase of 1% of portfolio liabilities leads to an increase of around 0.30% of reserves, either as a share of GDP or M2, but also in nominal terms. On the other hand, the coefficient of the volatility of the stock price index is also statistically significant and positive in all specifications, though with a small size. This result, nevertheless, can also support the idea that external drains are a major concern for the monetary authorities to demand reserves.

Regarding the influence of foreign denominated debt, the results reveal that debt is indeed relevant to demand international reserves in LA economies. As can be seen, in all specifications and in most cases, the parameters associated with debt ratios are statistically significant and relatively high. In particular, it is clear that private debt tends to be associated positively with the demand for official reserves, suggesting that authorities increase their reserves in response to increments in private debt either to have a collateral or to stabilize the external market, both of these reasons being precautionary.

The findings so far analysed indicate the concern of authorities for external drains and for a subsequent financial crisis. In other words, these results suggest that economies of LA see reserves mainly as an insurance against the likelihood of capital flows to reverse at any moment. From this, it is clear that as long as conditions of high mobility of capital prevail, the ever-increasing demand for international reserves in the region will continue.

Now, international reserves volatility and the exchange rate volatility parameters are, on the other hand, statistically significant only in two specifications: when reserves are scaled by GDP and when they are in nominal terms. In the particular case of the volatility of the exchange rate, however, the sign of the coefficient changes along the different specifications, making it difficult to make any reliable inference from it. In other words, it is unclear whether LA monetary authorities demand reserves to intervene in the foreign exchange market to either stabilize their currency, avoiding further depreciation/appreciation of the exchange rate, or if they do it as a response to increasing foreign exchange volatility. In the case of the international reserves volatility, the negative coefficient suggests that reserves decline as its volatility increases; however, it is important to mention that this response, given the size of the parameter, is negligible.

Another interesting result is related with the opportunity cost. In this case, as expected, the negative coefficient indicates that as the opportunity cost increases, the demand for reserves falls. It is important to notice, in this context, that a number of studies have shown that there is a cost associated with an excess of official reserves, which in some cases has been estimated to be around 1% of GDP (see Cruz & Kriesler, 2010; Rodrik, 2006), but despite this cost not being trivial, the demand for reserves has continued to increase. In our estimations, as can be seen, the cost's coefficient is small, and this might help to understand why the cost of accumulating reserves has not deterred authorities from demanding them.

Finally, one relevant finding is that real variables, in our case real income per capita and trade openness, are not statistically significant (with the exception of nominal income per capita), suggesting that these variables have not had a relevant role in the demand for reserves in the region. This result could be surprising if we keep in mind that both income per capita and trade have grown at a respectable pace during the period of study. In the case of real income per capita, for example, the average growth rate of the countries of the sample during the period 1995-2011 was 2.6%, which largely overwhelms that of the preceding period 1980-1994 of 0.9%. At the same time, trade did increase their pace considerably during the period 1995-2011 with respect to what occurred during the period 1980-1994. In this setting, during the former period, for the sample of economies and as a share of GDP, trade grew on average more than 10 percentage points, going from 42% in 1995 to 53% in 2011, whereas in the latter period this share grew 7 percentage points, going from 33% in 1980 to 40% in 1994. Our results, therefore, support the arguments of Kaldor, Balogh and Machlup previously mentioned, in the sense that trade and income variables have nothing to do with the demand for official reserves. At the same time, our findings are consistent with those studies that have found that real variables are not significant, particularly for developing and/or emerging economies.

Summarising, our econometric exercise allows us to conclude that LA economies demand reserves mainly for precautionary reasons, and that they do it in particular seeking to avoid liquidity troubles emanating from portfolio liabilities and foreign currency denominated debt. Portfolio liabilities are likely to increase suddenly in contexts of free mobility of capital. Thus, as indicated above, one clear consequence of this is that the ever-increasing demand for reserves will continue because governments will be permanently afraid of suffering external drains and eventually a crisis.

Do our findings have any particular relevance in terms of economic policy? We think they do, especially if we consider that LA economies might need policy alternatives that can offer not only financial stability but also aid to their growth and development goals. Demand and hoard ever increasing amounts of reserves do not necessarily aid in these aims. This is because, on the one hand, it is assumed that large hoardings of reserves will be enough to prevent potential external drains, which implies that somehow investors will be deterred sufficiently from attacking a currency. It is important to recall, however, that what determines the desire of investors to abandon a currency remains a mystery. In this sense, it is necessary to bear in mind that even apparently high levels of international reserves could not be large enough to stop an external drain. This, evidently, does not imply that having reserves is helpless to stabilize the financial system; they indeed can help through buffering small shocks. On the other hand, the stockpiling of reserves has, as pointed out elsewhere (see, Cruz & Kriesler, 2010), real and potential costs that hurt the real economy instead of contributing to its growth and development. In fact, the alleged mercantilist benefit of having large amounts of reserves is not unambiguously supported (see, for example, Aizenman & Lee, 2007, and Cruz, 2014). So, large amounts of official reserves do not guarantee maintaining financial stability, or avoid having real and potential high costs; and, finally, it is not clear that their contribution, via the external sector, leads to growth and development.

Authorities in the LA region, therefore, should assess, in the first place, whether to maintain financial deregulation is worthwhile. This strategy, after all, has been the root of financial instability and financial crises during the recent past. An alternative strategy to financial openness, and thus to ever-increasing international reserves, could be the adoption of capital controls. Some economies have started to implement them during the very recent past (since 2009). This policy, it is important to recall, has been able to offer financial stability and, at the same time, to promote economic growth and development during successful episodes of industrialization (see Chang & Grabel, 2004). Furthermore, capital controls have been recognised recently by the IMF as a potential instrument against the negative effects that massive inflows/outflows of capital inflict on the recipient economy (see Ostry et al., 2010; Ostry et al., 2011). This alternative policy, in sum, can offer the possibility to achieve financial stability, aid growth and reduce, as a result, the need for reserves.

CONCLUSIONS

In this paper we attempted to test whether the demand for reserves in selected economies of Latin America is driven mainly for financial factors, as the empirical evidence around the world has recently shown, meaning authorities demand reserves largely to reduce the risk of suffering external drains in a context of high capital mobility. To this end, we included portfolio liabilities as the variable that can capture potential external drains. We also included, among other financial variables, foreign debt indicators.

Our panel data exercise for the period 1995-2011 indicated that the most important concerns to demand reserves in the LA region are the perils of external drains and financial crisis. Both portfolio liabilities and debt variables were statistically significant in all the specifications and they had high coefficients; in particular, the portfolio liabilities' coefficient suggested that reserves are demanded primarily to pre-empt future liquidity troubles. We also found that foreign debt is important in the demand for reserves as in this way a currency and financial (Minsky) crisis can be avoided.

From these results, we can expect that as long as the free mobility of capital prevails in the region, its demand for reserves will maintain the ever-increasing trend observed since the mid-1990s. This is not necessarily good news for the region as the demand for and the accumulation of reserves have real and potential costs for the real economy, and any amount of reserves does not guarantee that investors will be deterred from attacking a currency. An alternative to achieve financial stability and other growth and development goals can be the adoption of capital controls, as has recently been done, under the approval of the IMF, by some developing economies (like Brazil and South Korea).

FOOTNOTES

1 This empirical evidence supports early concerns of Keynes and Balogh. In the 1930s, Keynes, for example, pointed out that "...a bank of a country doing a large international finance and banking business... needs a larger free reserve than a country that is little concerned with such business..." Balogh (1960, p. 362) (Keynes, 1971, quoted by Obstfeld, Shambaugh, & Taylor, 2010, p. 61) on the other hand, had a similar opinion when he suggested that "a system which freely permits capital movements... will... require far higher reserves than a system where speculative capital movements are highly discouraged."

2 An outstanding example of this is China, who at the same time of being one of the largest holders of foreign reserves keeps large trade surpluses.

3 For a review of older empirical studies of reserves determination see Bahmani-Oskooee & Brown (2002). From this review it is clear that trade-related variables have always been included in the econometric models of demand for reserves.

4 Mexico, in fact, could be signaled as the first economy that adopted a purposeful strategy of increasing reserves for precautionary reasons (see, Werner & Milo, 1998). A turning point, thus, can be identified in the demand for foreign exchange in LA since the mid-1990s. At the global level, the turning point for the increasing levels of official reserves can be identified during the aftermath of the East Asian financial crisis of 1998-99 (see United Nations, 2001).

5 A noticeable exception in LA is Brazil since 2009, where certain and temporal capital controls have been adopted.

6 Mexico, as mentioned, announced explicitly its intention to accumulate reserves in 1996 (see Banco the México, 1998 and Werner & Milo, 1998). In early 2011, the Chilean Central Bank announced that "[it] has decided to start a program of foreign currency purchases aimed at strengthening its international liquidity position" (see, Central Bank of Chile, 2011).

7 A Minsky type of crisis implies that once most of the economic agents' margins of safety have disappeared (namely, once their ability to discharge outstanding debts with current cash flows has dramatically fallen), any domestic or external shock, since the economy is an interlinked system of payments, may produce a generalized succession of defaults, which in turn may collapse the economy into a crisis. See Minsky (1986) for his well-known financial fragility hypothesis.

REFERENCES

[1] Aizenman, J., & Marion, N. (2003). The high demand for international reserves in the far east: What's going on? Journal of the Japanese and International Economies, 17, 370-400. doi:10.1016/S0889-1583(03)00008-X. [ Links ]

[2] Aizenman, J., & Lee, J. (2007). International reserves: Precautionary versus mercantilist views, theory and evidence. Open Economies Review, 18, 191-214. doi: 10.1007/s11079-007-9030-z. [ Links ]

[3] Arestis, P., & Glickman, M. (2002). Financial crisis in Southeast Asia: Dispelling illusion in the Minskyan way. Cambridge Journal of Economics, 26(2), 237-60. Retrieved from: http://cje.oxfordjournals.org/content/26/2.toc. [ Links ]

[4] Asteriou, D., & Hall, S. (2011). Applied econometrics (2nd ed.). United Kindom: Palgrave-Macmillam. [ Links ]

[5] Babecký, Havránek, T., Matě jů, J., Rusnák, M., Šmídková, K., & Vašíček, B. (2012). Banking, debt, and currency crises. Early warning indicators for developed countries (Working Paper Series, 1485). European Central Bank, October, 1-45. Retrieved from: www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1485.pdf. [ Links ]

[6] Bahmani-Oskooee, M., & Brown, F. (2002). Demand for international reserves: A review article. Applied Economics, 34, 1209-1236. doi: 10.1080/0003684011009612 9. [ Links ]

[7] Balogh, T. (1960). International reserves and liquidity. The Economic Journal, 70(258), 357-377. Retrieved from: www.jstor.org/stable/i338966. [ Links ]

[8] Banco de México. (1998). Resumen Informe Anual, 1-12. Retrieved from: www.banxico.org.mx/dyn/publicaciones-y-discursos/publicaciones/informes-periodicos/anual/{654DF47A-B56A-5D2D-2697-5E8D1B6C0A21}.pdf] [ Links ].

[9] Bayoumi, T., & Saborowski, C. (2012). Accounting for reserves (Working Paper 302, 1-36). IMF. Retrieved from: https://www.imf.org/external/pubs/ft/wp/2012/wp12302.pdf. [ Links ]

[10] Bird, G., & Mandilaras, A. (2010). Revisiting Mrs. Machlup's wardrobe: The accumulation of international reserves, 1992-2001. Applied Economic Letters, 17, 467-471. doi: 10.1080/13504850701765143. [ Links ]

[11] Central Bank of Chile. (2011). Press Release, January, 1-2. Retrieved from: www.bcentral.cl/eng/press/other/pdf/05012011a.pdf. [ Links ]

[12] Chang, H-J., & Grabel, I. (2004). Reclaiming development. An alternative policy manual. London: Zed Books. [ Links ]

[13] Cheung, Y., & Sengupta, R. (2011). Accumulation of international reserves and keeping up with the Joneses: The case of LATAM economies. International Review of Economics and Finance, 20, 19-31. doi:10.1016/j.iref.2010.07.003. [ Links ]

[14] Cheung, Y., & Ito, H. (2009). A cross-country empirical analysis of international reserves, International Economic Journal, 23(4), 447-481. doi: 10.1080/10168730903372208. [ Links ]

[15] Cheung, Y., & Quian, X. (2009). Hoarding of international reserves: Mrs. Machlup's wardrobe and the Joneses. Review of International Economics, 71(4), 824-843. doi: 10.1111/j.1467-9396.2009.00850.x. [ Links ]

[16] Choi, C., & Baek, S. (2006). Portfolio-flow volatility and demand for international reserve. Seoul Journal of Economics, 19(2), 199-214. Retrieved from: http:www.sje.ac.kr/modules/repec/backIssue_view.html?vol=19&:num=2&p=2&no=175 . [ Links ]

[17] Choi, W., Sharma, S., & Strömvisq, M. (2007). Capital flows, financial integration and international reserves holdings: The recent experience of emerging markets and advanced economies (Working Paper 151, 1-38). IMF. Retrieved from: www.imf.org/external/pubs/cat/longres.aspx?sk= 21034.0. [ Links ]

[18] Cruz, M. (2014). International reserves and the mercantilist approach: Some further evidence. (1), 446-451. Retrieved from: Economics Bulletin, 34. Retrieved from: www.accessecon.com/Pubs/EB/2014/Volume34/EB-14-V34-I1-P42.pdf. [ Links ]

[19] Cruz, M., & Kriesler, P. (2010). International reserves, effective demand and growth. Review of Political Economy, 22(4), 569-587. doi: 10.1080/09538259.2010.510318. [ Links ]

[20] De Paula, L., & Alves, A. (2000). External financial fragility and the 1998-1999 Brazilian currency crisis. Journal of Post Keynesian Economics, 22(4), 589-617. Retrieved from: www.jstor.org/stable/4538703. [ Links ]

[21] Drehmann, M., & Juselius, M. (2012). Do debt service costs affect macroeconomic and financial stability? BIS Quarterly Review, September, 21-35. Retrieved from: www.bis.org/publ/qtrpdf/r_qt1209e.htm. [ Links ]

[22] Ghosh, A., Ostry, J., & Tsangarides, C. (2012). Shifting motives: Explaining the buildup in official reserves in emerging markets since the 1980s. IMF (Working Paper, 34, 1-39). Retrieved from: www.imf.org/external/pubs/cat/longres.aspx?sk=25683.0. [ Links ]

[23] IMF. (2003). World economic outlook. Public debt in emerging markets. Washington, DC: International Monetary Fund. [ Links ]

[24] International Monetary Fund. (2012). International Financial Statistics [CD-Rom]. Author's property. [ Links ]

[25] Kaldor, N. (1978). Further essays on applied economics. Great Britain: Holmes and Meier Publishers. [ Links ]

[26] Keynes, J. (1971). A treatise on money. In The collected critings of John Maynard Keynes (vol. 6). London: Macmillan. [ Links ]

[27] Lane, P., & Burke, D. (2001). The empirics of foreign reserves. Open Economies Review, 12(4), 423-434. Retrieved from: link.springer.com/article/10.1023%2FA%3A1017939118781. [ Links ]

[28] Machlup, F. (1966). The need for international reserves. Reprints in International Finance, 5, 1-48, Princenton University. [ Links ]

[29] Mendoza, R. (2004). International reserve-holding in the developing world: Self insurance in a crisis-prone era. Emerging Markets Review, 5, 61-82. doi: 10.1016/j.ememar.2003.12.003. [ Links ]

[30] Minsky, H. (1986). Stabilizing an unstable economy. USA: Columbia University Press. [ Links ]

[31] Obstfeld, M., Shambaugh, J., & Taylor, A. (2010). Financial stability, the trilemma and international reserves. American Economic Journal: Macroeconomics, 2, 57-94. doi: 10.1257/mac.2.2.57. [ Links ]

[32] Ostry, J., Ghosh, A., Habermeier, K., Laeven, L., Chamon, M., Qureshi, M. & Reinhart, D. (2010). Capital inflows: The role of controls. IMF Staff Position Note, 1-30. Retrieved from: www.imf.org/external/pubs/ft/spn/2010/spn1004.pdf. [ Links ]

[33] Ostry, J., Ghosh, A., Habermeier, K., Laeven, L., Chamon, M., Qureshi, M., & Kokenyne, A. (2011). Managing capital inflows: What tools to use. IMF Staff Position Note, 1-41. Retrieved from: www.imf.org/external/pubs/ft/sdn/2011/sdn1106.pdf. [ Links ]

[34] Rodrik, D. (2006). The social cost of foreign exchange reserves. International Economic Journal, 30(3), 253-266. doi: 10.1080/1016873060087933. [ Links ]

[35] United Nations. (2001). Report of the high-level panel on financing for development, 1-56. Retrieved from: www.un.org/reports/financing/full_report_pdf. [ Links ]

[36] Werner, A., & Milo, A. (1998). Acumulación de reservas internacionales a través de la venta de opciones: el caso de México. Documento de Investigación del Banco de México, 9801, 1-36. Retrieved from: www.banxico.org.mx/publicaciones-y-discursos/publicaciones/documentos-de-investigacion/banxico/%7B4C478DC1-EEEF-DD3D-3DCB-E1F4AC927262%7D.pdf. [ Links ]