INTRODUCTION

The past twenty years have seen ‘high growth firms’ (henceforth HGFs) become increasingly important1, particularly within North America and Europe where these organisations are recognised as major job creators (Coad, Daunfeldt, Hölzl, Johansson, & Nightingale, 2014a; Henrekson & Johansson, 2010) and key contributors to wider economic development and growth (Anyadike-Danes, Hart, & Du, 2015; Lee, 2014). Researchers have sought to understand many of the facets of high growth entrepreneurship including the age and traits of the entrepreneur (Barringer, Jones, & Neubaum, 2005; Brüderl & Preisendörfer, 2000; Nicholls-Nixon, 2005), the geography of high growth firms (Brown & Mawson, 2016; Mason, Brown, Hart, & Anyadike-Danes, 2015; Rice, Lyons, & O’Hagan 2015), the nature of firm growth and the growth process (Brown & Mawson, 2013; Garnsey, Stam, & Heffernan, 2006), productivity (Daunfeldt, Elert, & Johansson, 2014; Du and Temouri, 2015), innovation activity (Coad & Rao, 2008; Segarra & Teruel, 2014), financing (Brown & Lee, 2014; Lee, 2014; Mohr, Garnsey, & Theyel, 2014) and, more recently, the sustainability of rapid growth and HGFs (Daunfeldt & Halvarsson, 2015; Satterthwaite & Hamilton, 2017).

Despite this abundance of research, our understanding of high growth remains limited, particularly in terms of firm-specific dynamics, processes, and behaviours, which are often overlooked in favour of larger aggregate studies that ‘count’ or ‘measure’ HGFs. As scholars have noted, high growth is a temporary phenomenon or state (Brown & Mawson, 2013; Brown, Mawson & Mason, 2017) rather than a permanent characteristic of firms; however, the literature largely fails to explore actions and behaviours at firm level and how those may contribute to rapid growth. Some studies have briefly acknowledged the role of elements such as founder capabilities (Goedhuys & Sleuwaegen, 2010) and growth intentions (Stenholm, 2011), business strategy (Barringer et al., 2005), and operational flexibility (Hansen & Hamilton, 2011), but the literature has largely overlooked how such elements may differentiate HGFs from their slower-growth counter-parts.

Within the marketing literature, it is widely recognised that creating value for customers acts as a significant competitive advantage and source of superior financial performance for firms (O’Cass & Ngo, 2011; Sirmon, Hitt, & Ireland, 2007). High growth entrepreneurship scholars have, for some time, observed that HGFs appear to differ from other firms due to their ability to create unique value for their customers (Barringer et al., 2005; Birley & Westhead, 1990; Kim & Mauborgne, 1997; Smallbone, Leigh, & North, 1995; Zhang, Yang, & Ma 2008). Surprisingly, however, these often-anecdotal observations have not been rigorously explored. Recently, Chandler, Broberg, & Allison, (2014) have usefully investigated the issue of value propositions -how firms communicate their competitive advantage-as a differentiator between HGFs and non-HGFs in declining industries. However, their business model framing failed to fully address the underlying issue of customer perceived value, which is critical not only for the creation of value propositions, but also for fully understanding the nature of value creation activities within HGFs. As such, observations of HGFs as value creators remain anecdotal.

Taking this gap into consideration, this paper makes an important contribution to the high growth entrepreneurship literature by empirically exploring the issue of customer value creation within the context of HGFs. Drawing on depth interview data from comparative cohorts of HGFs and non-HGFs in Scotland, this paper addresses the following research question: Is the creation of customer perceived value a differentiating characteristic of HGFs?

The paper is structured as follows: The first section assesses the literature on high growth firms contextualised in the value creation literature and presents a theoretical model of value creation. The second outlines the methodology utilised during the course of this study. The third presents empirical findings from the research, which are then discussed in detail in the following section. The final section identifies some conclusions and areas for future research.

HIGH GROWTH ENTREPRENEURSHIP AND VALUE CREATION

As previously noted, empirical research on HGFs has been gaining momentum; the result is that there is now a substantial body of knowledge from a variety of perspectives. Indeed, Coad et al. (2014a) observe that the number of papers published in this area have quadrupled since 1990, which attests to the significant (and still increasing) appeal of HGFs for researchers. As the field has developed, so too has the nature of empirical studies. Particularly, over the past five years, there has been a gradual shift away from the ‘inventory’ or ‘catalogue’ type studies that comprised some of the early literature (e.g. Delmar, Davidsson, & Gartner 2003; Stam, 2005) in favour of more focused and nuanced investigations of high growth entrepreneurship that examine a range of issues including the macroeconomic environment (Teruel & de Wit, 2011), internationalisation (Brown & Mawson, 2016), and business practices and strategies (Coad, Daunfeldt, Hölzl, Johansson, & Wennberg, 2014b; Colombelli, Krafft, & Quatraro, 2014).

Such a shift has arguably been due to increasing recognition of the limitations associated with the focus on growth rates, particularly given recent work calling into question the validity of the most commonly used growth measures (Daunfeldt et al. 2015). Whilst a full discussion of such measures is outwith, the focus of this paper (see Brown et al. 2017 for a concise discussion), the definition and measurement of HGFs is relevant for value creation and cannot be overlooked. This is particularly the case when considering the use of turnover as a growth measure. Although many recent studies have adopted the OECD’s definition of HGFs using turnover, few reflect on how and why such changes in turnover fundamentally occur. Rather than acknowledging that any changes in turnover stem from increased (or decreased) customer purchases or demand (Satterthwaite & Hamilton, 2017), be it in terms of changes in sales volume or sales value, turnover is treated simply as an abstracted concept where issues such as sales and customers do not feature.

Indeed, very few studies generally acknowledge customers and those that do offer only sporadic and superficial insights. These insights indicate that HGFs are likely to shy away from large consumer markets, preferring instead to develop close relationships with a small number of customers (Brush, Ceru, & Blackburn, 2009; Feindt, Jeffcoate, & Chappell, 2002; Hinton & Hamilton, 2013; Siegel, Siegel, & MacMillan, 1993), predominantly in the business-to-business sphere (Mason & Brown, 2010) rather than business-to-consumer. As a result of favouring such close relationships, these firms are thought to have a keen sense of their customers’ needs and desires (Barringer et al., 2005) and to demonstrate strong customer and end user (Mason & Brown, 2010; Parker, Storey, & van Witteloostuijn, 2010) engagement. Interestingly, HGFs are also considered to be customer oriented and, as previously mentioned, focus on strategically creating unique value for their customers (Barringer et al., 2005; Birley & Westhead, 1990; Kim & Mauborgne, 1997; Lindič, Bavdaž, & Kovačič, 2012; Puhakka & Sipola, 2011; Smallbone et al., 1995; Zhang et al., 2008) in a way that differentiates them from other firms. Despite authors noting the importance of value creation as a differentiator of HGFs, none of the studies listed above specifically investigate the issue of value creation. These studies also lack methodological reasoning, clarity, and transparency perhaps due to authors relying on second hand data such as narrative case studies (e.g. Barringer et al., 2005), or due to the complexity of value creation as a construct and its limited use in entrepreneurship research.

Within the marketing literature, however, the concepts of value and value creation have been topics of discussion for decades. As with high growth entrepreneurship, the value literature has also gained momentum over recent years. Value-based and value-focused strategies have become a central theme, not only in marketing but across the wider business literature (Khalifa, 2004; O’Cass & Ngo, 2011), with authors suggesting that a firm’s success rests on its ability to provide superior value to their customers (Rintamäki, Kuusela, & Mitronen, 2007; Sirmon et al., 2007). Given the complexity of the value concept, it is little wonder that the value literature also has its share of conceptualisations and definitions (for a concise review, see Khalifa, 2004). Scholars have explored a number of different ‘types’ of value including shareholder value, supplier value, stakeholder value and customer value - which some consider to be the source of all other forms of value (Lemon, Rust, & Zeithaml, 2001). Even when looking at customer value specifically, it is important to acknowledge that value can be viewed from the perspective of exchange value, measured by the amount of money paid for something, or customer perceived value, where value is measured by customer perceptions of benefit and utility (Bowman & Ambrosini, 2000).

Customer perceived value is a particularly complex construct; the literature contains many divergent views on its conceptualisation. Part of the complexity stems from the fact that customers can form perceptions of value before purchase (pre-use value) (Doyle, 2000; Holbrook, 1999), but also post-purchase though the use of that purchase (value in use) (Payne, Storbacka, & Frow, 2008; Vargo & Akaka, 2009). Whilst these are two unique facets of customer perceived value, they are arguably two equally important parts of the customer value creation process, particularly as value in use is seen to develop directly from pre-use value (Grönroos, 2008). Ultimately, customer perceived value stems from individuals´ unique ‘in use’ experiences and is thus necessarily phenomenological, subjective, intrinsic, and dynamic (Vargo & Lusch, 2008b) although firms can play a role in influencing this value creation process by affecting a customer’s perceived use value (e.g. utility, efficiency, status, benefits etc.) through interactions before use (Ballantyne, 2004). This form of value, henceforth referred to as customer perceived value, will be the focus of this paper.

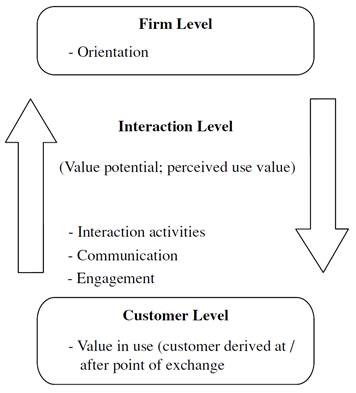

Despite a plethora of studies exploring customer perceived value, there is still little known about the process of customer perceived value creation (Vargo, Maglio, & Akaka, 2008), specifically when the process begins and ends (Grönroos, 2011), what the process includes, and what a firm’s role is in this process. From a firm growth perspective, we also do not understand how value creation links with changes in firm performance. The ‘interaction concept’ stemming from the so-called Nordic School2 provides a useful way of conceptualising value, whereby the interactions or ‘encounter processes’ (Payne et al., 2008) between firms and their customers are what facilitate value creation. Each individual interaction facilitates the sharing of information, fosters joint decision-making, and encourages trust (Batt & Purchase, 2004), allowing for a dialogical process whereby customers are able to create meaning and value for themselves. Thus, it is not the role of the firm to attempt to create value for a customer, but rather to work with a customer to create potential value by incorporating a customer’s own unique value creation activities into the firm’s own system and activities (Ballantyne & Varey, 2006; Normann & Ramirez, 1993; Wikström, 1996).

There are many activities that function on the ‘interaction level’, bearing in mind that some customers will choose to engage with firms more deeply than others (Vargo & Lusch, 2008a). Deeper engagement results in a greater potential for value creation (Brodie, Hollebeek, Juric, & Ilic, 2011). These can be conceptualised as falling into three main categories: general interaction activities such as ‘co-production’ activities focused on the joint creation of products/services with customers (Blazevic & Lievens, 2008; Ertimur & Venkatesh, 2010) and broader ‘co-creation’ activities such as the provision of customisable ‘solutions’ (Davies, 2004; Tuli, Kohli, & Bharadwaj, 2007); communication, including two-way vs. one-way communication with customers (Kumar et al., 2010), method and frequency of communication (Agnihotri, Dingus, Hu, & Krush, 2016; Finne & Grönroos, 2017); and customer engagement, where a firm’s behaviour encourages a customer relationship to develop beyond transactions (Brodie et al., 2011; van Doorn et al., 2010) to ultimately encourage repeat customer purchase and customer referral (Kumar et al., 2010). These elements constitute this paper’s conceptual framework (see Figure 1 below).

Reviewing the high growth entrepreneurship literature, some of these ‘value creating’ activities at the interaction level mirror observations of HGF activities and behaviours. For example, HGFs have been noted to regularly talk to their customers to gain a better understanding of their needs (Barringer et al., 2005) and to develop new, innovative and highly differentiated offerings (Hinton & Hamilton, 2013). They are also considered to be focused on customer service (Kirkwood, 2009), developing strong relationships with their customers (Brush et al., 2009). As discussed earlier, these observations lack empirical backing, which is an important gap in knowledge that this paper attempts to fill.

METHODOLODY

Research Approach

Given the exploratory nature of this paper and its focus on value creation activities within individual firms, a qualitative approach drawing on semi-structured interviews was considered to be the most suitable way to collect the detailed and contextual data needed (King, 2004) to address the core research question.

To avoid ‘success bias’ (Mohr & Garnsey, 2011; Shane, 2009), which is prevalent in much of the current work on HGFs, the study examined a comparative cohort of non-HGFs in order to determine whether value creation activity is in fact a differentiator between high growth firms and their counterparts. Such comparative cohort studies are limited within the HGF literature (Barringer et al., 2005; Boston & Boston, 2007; Brown & Mawson, 2016; Chandler et al., 2014; Coad, Cowling, & Siepel, 2017; Moreno & Casillas, 2007), yet are arguably an important methodology for exploring HGFs as a discrete group.

Sampling, Data Collection, and Data Analysis

In line with other recent work on HGFs (e.g., Brown & Mawson, 2016; Coad et al., 2017; Du & Temouri, 2015; Kidney, Harney, & O’Gorman, 2017; Ng & Hamilton, 2016), firms were identified using the Financial Analysis Made Easy (FAME) commercial database, which contains financial information submitted to Companies House. Scotland was selected as the location for this study given sustained numbers of HGFs and a policy environment promoting entrepreneurship (Lee, 2014; Mason & Brown, 2013). HGFs were purposively identified (Corbin & Strauss, 1990) and were required to meet the OECD turnover definition for the three-year period between 2006-2009. From this population, a random sample of HGFs (50 companies) was selected. For the comparative sample of non-HGFs, purposive sampling was also used. Given that HGFs must have more than ten employees, the population of non-HGFs with more than this number was identified. Those firms that had seen modest turnover growth (1-10% between 2006-2009) were identified as the target non-HGF population. This purposive sampling was required in order to identify a cohort of slower-growing firms that would best contrast with the HGF cohort - firms that were stable or achieving modest growth rather than those in decline. From this population, a random sample of fifty firms was selected and contacted for interview. From the two HGF and non-HGF samples, 22 interviews were arranged and conducted with Managing Directors - eleven with HGFs and ten with non-HGFs.

Depth qualitative interviews were conducted face-to-face, and the discussion was focused on issues relating to customer interaction. At no time were participant firms identified as HGFs or non-HGFs. The average length of the interviews was 68 minutes. Interviews were recorded and transcribed immediately after completion, and companies were allocated a unique identifier to ensure anonymity.

As advocated by several authors (including Graebner, 2004), all the qualitative material collected was subjected to both ‘within-case’ and ‘cross-case’ analysis for each of the firms (Miles & Huberman, 1994). Thus, the qualitative data analysis undertaken focused on enabling the richness of the data to be fully explored and to “let the data speak for itself” (Easterby-Smith, Thorpe, & Lowe, 2006, p. 119). Interview transcripts and notes were first examined for key themes and patterns. The data was then coded into a number of a priori categories, with new categories created for all emergent issues (Graebner, 2009).

FINDINGS

The qualitative data gathered during the interviews provided some very important insight into the nature of value-creating interactions within HGFs. It was possible to discover how HGFs (and non-HGFs) communicated and engaged with their customers (their method, frequency, and depth of communication) and the types of interactions they had with customers. These are now discussed in detail.

Customer Focused Orientation

Whilst not strictly related to activities on the ‘interaction level’, during the interviews, it became clear that firm orientation played a particularly important role when it came to influencing interaction activities. In general, HGFs tended to espouse a much more customer focused orientation than their non-HGFs counter-parts, making it very clear that they consider their customers to be central to all firm level activities.

“Our customers are everything to us. And we will do anything in our power to build long-term relationships with them.” HGF_7

“Of course our customers are important, but we have to remember that they are one part of everything we do here.” nHGF_8

Whilst the quotations above reflect HGFs and non-HGFs’ views, respectively, it is not fair to say that the non-HGFs interviewed were not customer focused. They did appear to be considerably less so, however, when being directly compared with the HGF sample. The non-HGFs clearly recognised the importance of their customers, had an understanding of customer needs, and integrated customer insight back into the company; however, they did not display the same commitment to putting customers at the heart of their business as the HGF cohort.

This lack of ‘customer focused orientation’ may explain why non-HGFs did not demonstrate the same levels of proactiveness, responsibility, and flexibility as the HGF cohort - elements considered to be integral to meeting and exceeding customer expectations (Parker et al. 2010; Sawhney, 2006). A number of non-HGFs (6 out of 11) noted that they strategically chose to focus most of their attention on their biggest clients; thus, smaller customers did not receive the same amount of focus and attention.

“Well, we’ve only got so much time, so we focus based on the size of the account. If the account is coming up towards the size of [a] £1m account then they get more of our time than if it’s a tiny little account £25,000/£30,000 - then we might only go out to speak with them once a year.” nHGF_9

A very different picture emerged for the HGFs: every single one demonstrated significant customer-focus, regardless of whether these were new or existing customers and large or small accounts. The HGFs interviewed exhibited a strong sense of customer focus. For many, customers were not considered to be external purchasers of products or services, but “really part of this company” and “part of the family”. Underlying this commitment to customers was an articulated organisational focus on trust and relationship-building. Interestingly, these issues were never specifically identified by non-HGFs although they were probed for during interviews. HGFs, however, were keen to stress the importance that trust played not only in terms of reputation generally, but also regarding relationship-building with customers. This reflects observations made in other work that looks at HGFs (Reuber & Fischer, 2005).

“[Our sales] are very much relationship sales; it’s a business sale but it’s a relationship sale. It’s all about trust and long-term outcomes that benefit us and our customers.” HGF_3

As HGF_5 further elaborated:

“Once you start actually working with a customer and get to understand where they are [and] where you’re going together, something magical hap-pens. It’s as though they become part of you - and that’s where you really want to get to.”

Customer Communication and Engagement

In line with customer focus issues, the HGF and non-HGF cohorts differed in terms of their communications and engagement with customers. HGFs were more likely to see a greater percentage of their turnover growth come from repeat customers than their non-high growth counterparts who tended to see a higher percentage of turnover growth coming from new customers. As such, HGFs tended to prioritise communication with current customers whilst non-HGFs largely sought to communicate with new customers.

The HGF cohort also tended to focus on ‘two-way’ communications drawing on regular telephone, email, and face-to-face communications in addition to other wider ‘social’ media usage (predominantly Twitter, blogs, YouTube). As HGF_10 noted: “we try to communicate with our customers regularly through a number of different channels - depending on that customer’s preferences of course.” These communications were often conducted in the context of a formalised ‘Account Management’ system, particularly for bigger clients and those requiring a greater amount of support.

“Each of our customers has an Account Manager. We have to be really close to our customers - we need to know what they are going to want at least two years before they know they want it. We need to have foresight. It’s being able to say right, here’s what they are going to want and here’s how we are going to plan for - and deliver - that.” HGF_2

It was often in the context of such an Account Management system that HGFs sought to develop a sense of “extraordinary experience” for their customers, drawing on the relational understanding fostered by account managers to address unique customer needs in depth. This, in turn, allowed the companies to better understand their customers’ changing wants and needs and to react accordingly; they often pre-empted customer requests and mitigated the potential for any problems.

“We have a customer who has this specific bit of kit for the oil and gas sec-tor. We had been working with him for a few years when he told us wanted to do business in China with [Chinese petroleum company], but our service wasn’t available over there yet for them to use and could we do something about that. What else do you do but jump on a plane and spend three months in China and get the service up and running there!” HGF_1

A different picture emerged among the non-HGFs interviewed. These companies tended to prefer more reactive and one-way communications such as cold calling, advertisements, newsletters, and promotions. The rationale for these activities often stemmed from a belief that if prospective customers were more aware of the company and what it offered they would be inclined to purchase, which reflected their focus on new customers for turnover growth.

“[W]hat we also do is we try and get people - when they are buying on our website - to click onto our Facebook page and join us as a fan there. That means that you’ve got them and then you can post on a promotion, like ‘win a free wee [product]’.” nHGF_6

“We just launched a specific website this week for a new product. [Name], our marketing/finance girl, sent an e-mail out - and will continue sending e-mails out - to every single person that has ever had any interest or involvement in [product category] that we have been in contact with. It’s not a heavy sell, it’s just ‘here’s the website - have a look’.” nHGF_4

A number of these non-HGF companies (6 out of 10) also relied heavily on social media, mostly Facebook, as their primary method of customer engagement. How-ever, their use of social media was less about starting a two-way dialogue with existing and potential customers and more about capturing individuals’ attention and leading them to the company website either directly or through promotional activities. Once they had been directed to the main website, communication ceased, and customers were largely left without follow-up interactions. Two-way communications with customers were seldom acknowledged by non-HGFs (1 out of 10 firms), and, when probed during interviews, the issue was glossed over by respondents as “too expensive” or “not something that we do” or “too time consuming”.

This issue of time was another important difference between HGFs and non-HGFs, specifically the frequency of communication and engagement activities undertaken by the two groups. Within the HGF cohort, customer communication took place on a regular (and often daily) basis. HGF 6 noted that: “it’s constant communication. Some clients are further ahead than others, of course, but we’re talking at least a couple of times a week, up to a couple of times a day.” The rationale behind such frequent communication was that these firms sought to build very close and long-term relationships with their customers, rather than have more transactional relationships. To do so, HGFs were quick to articulate the importance of having communications on a “business” or “product” level, but also on a “personal” level.

“If I don’t know about [a client] and what he’s like - how he thinks, how he works, what makes him tick - how can we expect to go and help offer to help meet his and his business’ needs?” HGF_10

This level of frequent customer engagement and communication was not as prevalent amongst the non-HGFs. In line with their preference to undertake more one-way communication activities, the non-HGFs interviewed were more sporadic in their approach, with communications occurring intermittently and not as part of a larger engagement plan or strategy. nHGF_3 was particularly candid and noted: “we do our best, but maybe we’re not as good at this [regular communication with customers] as we ought to be.” A number of the non-HGFs relied on quarterly email newsletters for communication with customers, but many noted that “we don’t always get it out” or “the time-table isn’t set in stone - sometimes it slips by a couple of months or so”. Generally, the sentiment from non-HGFs was that they would prefer to develop and disseminate any communications on their own terms and in their own time rather than taking a more customer-led approach.

“I don’t want to go out bothering people… but we do have very regular communication with our major clients - they call or email [us] every few months or so.” nHGF_2

As noted in the literature, the methods and frequency of communication adopted by firms have a direct impact on the depth of engagement that a firm will be able to develop with its customers (Brodie et al., 2011), and, in turn, on perceived value creation. For HGFs, deep customer engagement was considered to be a core organisational focus, with many firms displaying a clear ‘customer orientation’. Such customer engagement was often facilitated by having what one firm identified as “multiple communication interfaces” between the firm and each customer. This was further elaborated upon by HGF_4:

“It’s a deliberate policy in that we open the doors at all levels between us and our customers. So, for example, we have our planners talking to their planners, we have our R&E [Review & Evaluation] people talking to their R&E people, QA [Quality Assurance] people talking to QA people and managers talking to managers. They will all be talking directly and that is something we have evolved over the years. Again, it’s very much a realisation that the more interconnected we become, the better it is for them and then of course the better it is for us.”

Through investing in customer engagement, HGFs appeared to not only be able to attract new customers and satisfy short-term customer needs, but also able to build long-term relationships that facilitated repeat purchases from existing customers. When looking beyond a transactional approach and focusing on customers’ unique motivational drivers, the HGFs interviewed were actively striving to engage as deeply as possible and to provide as much perceived value as possible.

“We work hard at engaging with clients. We try and factor in some basic thinking around, even at an individual level, what type of person is best to be the main point of contact, as we have got different personality types here. Or how might a client want to be communicated with? Some clients are very sociable, so maybe it’s going for a beer or a coffee, and some of them want to keep it very business-like so we try and adapt accordingly. It’s all about them, after all!” HGF_11

Perhaps unsurprisingly, given their more reactive and intermittent communications with customers, the interviewed non-HGFs appeared less likely to be under-taking deeper customer engagement. Whilst many factors contributed to this, including a perceived lack of time and perceived cost, there seemed to be a genuine belief within these companies that customer engagement was a “secondary issue” or “not core” to the business. Perhaps this is why many non-HGFs were less prepared than HGFs to devote the time, money, and personnel necessary to this process.

Interactions with Customers

As discussed earlier, it is through interactions with customers that firms are ultimately able to influence customer perceived value creation (Ballantyne, 2004).

Whilst communications and engagement with customers are important elements of customer-firm interaction, interactions can also include ‘co-production’ and ‘co-creation’ activities (Blazevic & Lievens, 2008; Ertimur & Venkatesh 2010). When probed about the nature of their offerings, both the HGF and non-HGF cohorts were selling a combination of physical products and intangible services. HGFs were, however, more likely than non-HGFs to be seeing sales growth from more bespoke offerings.

In line with their customer focus and customer engagement, HGFs were actively tailoring offerings to their customers’ specific needs, as well as engaging with customers to undertake product/service co-production. These companies noted a number of ways in which they engaged in co-production, including working with customers to redevelop and customise existing products; involving customers in initial product concept development and testing; and working with customers throughout the entire new product development cycle to develop specific, highly customised offerings. As HGF 2, a potato producer, explained:

“Some people might say that ‘a potato is a potato’, but that’s not really the case. We work closely with our customers to develop potato flavours and textures to suit changing consumer tastes, using consumer preference testing as well as sensory profiling. If our customers are looking for a more ‘buttery’ potato, we will work with them to get the right amount of butter flavour and the right amount of dairy flavour and the right amount of flour-y-ness for that brand of potato and so on.”

The number, type, and frequency of co-creation/co-production interactions varied across HGFs: they were largely dependent upon the type of offering and the individual customers’ preferred level of involvement. Regardless of the approach chosen, the rationale was consistent among firms: to provide as much value as possible to their customers. Many of the HGFs (8 out of 11) articulated that their firm existed to serve customers, noting that they felt “subservient” to or “wholly reliant” on their customers and that it was their responsibility “do whatever it is that’s best for our clients”. For many HGFs, this required the development of customised and integrated business solutions for their customers. In fact, the majority of HGFs (9 out of 11) identified themselves as solutions providers, articulating that they were “solutions driven” and “selling a solution” that was designed with clients to meet their own individual needs.

There was a lot less evidence of such interactions within the non-HGFs; discussions of co-creation and co-production were largely absent during interviews. Whilst these firms were developing their own new products, re-developing existing products and articulating a focus on innovation, the interactions with customers that underpin co-creation or co-production activities were notably lacking. For example, whilst nHGF_5 had its own product development programme, it identified that new products were developed “based on what our customers tell us they need and what we think might be useful to them, which we then develop, make and take to them as a marketable product.” Customers were largely attributed to have some initial input, but were seldom involved during the rest of the development, design and manufacturing process.

“We’re not Apple with thousands of people who come in in the morning and can spend all day trying to innovate. And the customer doesn’t always know what he wants, so we’ve got to show him what he might want. We prefer to lead on product development and then sell it.” nHGF_10

Although several non-HGFs discussed tailoring items to meet customer needs (3 out of 10), when probed further it was apparent that this was more to do with making minor substitutions and changes, rather than actively developing products through an iterative and two-way process. Interestingly, the non-HGFs inter-viewed genuinely believed they were interacting with their customers to provide “added value”. However, when in direct comparison with the cohort of HGFs, it was clear that this interaction was more superficial.

DISCUSSION

The findings presented provide some important insights into the nature of activities facilitating the creation of customer perceived value. As noted earlier, how-ever, there is significant complexity in the perceived value creation construct, which makes it very difficult to empirically examine. This explains why, despite observations in the literature that value creation is a differentiator for HGFs (Barringer et al., 2005; Kim & Mauborgne, 1997; Smallbone et al., 1995; Zhang et al., 2008), there has been a lack of empirical evidence to confirm this relationship. The findings reported, whilst by no means conclusive, empirically support the assertion that the creation of customer perceived value is a differentiating characteristic of HGFs and help us to better understand how these firms differ in terms of their capability (and likelihood) to facilitate the creation of perceived value by their customers.

A firm’s orientation, or the beliefs and values that underpin its actions and decisions, is widely recognised as having an effect on firm performance (Goll, Samb-harya, & Tucci, 2001) and is also increasingly recognised to be an important part of influencing customer perceived value creation (O’Cass & Ngo, 2011), particularly when a firm is focused on its customers. Arguably those firms with an articulated and enshrined desire to create and maintain value for customers have a stronger likelihood of positively influencing value creation. As discussed, HGFs exhibited high levels of customer focus, as well as a proactive approach towards satisfying - and exceeding - the expectations of each and every one of their customers. This was in contrast to the non-HGF cohort, which did not demonstrate the same level of customer focus. Even in terms of competitive priorities, the HGFs prioritised quality and service to customers, rather than price or product leadership (Sawhney, 2006), confirming previous observations in the literature that HGFs exhibit a customer-centric ideology and orientation (Mason & Brown, 2010; Parker et al., 2010).

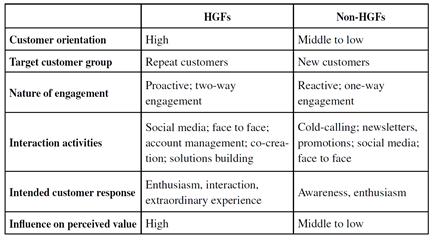

Such customer focus was also reflected in how HGFs communicated and engaged with their customers, differing from their non-HGF counterparts in a number of areas (see Table 1), including the method and frequency of communication with customers, as well as the depth of that engagement.

Table 1 Differences in Interaction Activities and Potential for Influencing Customer Perceived Value.

Source: Author

In general, the HGFs interviewed were engaging deeply with their customers and tended to focus on more proactive two-way engagement activities (e.g. account management systems) that had a high impact on customer perceived value. Given the customer-specific nature of these engagement activities, however, they required more firm resources (notably time) to effectively operate than the more reactive activities (e.g. newsletters or promotions) undertaken by the non-HGFs. Despite the greater resources needed to undertake such a depth of engagement, the HGFs interviewed clearly articulated their organisational focus on facilitating customer interactions with their ultimate goal being to create a sense of extraordinary experience for their customers.

These HGFs seemed to subscribe to the concept found in the value literature that firm-customer interactions should be a “process of parties doing things for and with each other, rather than trading units of output, tangible or intangible” (Vargo & Lusch, 2008b, p. 29). This idea was reflected in how they interacted with customers to influence value creation, for example through co-production and customised solutions (Davies, 2004; Tuli et al., 2007), both of which focus more on the process of requirements definition, customisation, and integration than they do on simple transactions. Interestingly, many of the HGFs identified and articulated (unprompted) how they helped to create value for customers and how this contributed to their firms’ growth and financial performance. This supports assertions in the literature that a firm’s success rests on its ability to provide maintained superior value to their customers (Rintamäki et al., 2007; Sirmon et al., 2007)

CONCLUSIONS

Returning to the original question underpinning this research, this paper fills a gap in the high-growth entrepreneurship literature by empirically exploring the relationship between HGFs and customer perceived value creation. We can now say with greater certainty that value creation does appear to be a differentiator of HGFs (Barringer et al., 2005; Birley and Westhead, 1990; Kim and Mauborgne, 1997; Smallbone et al., 1995; Zhang et al., 2008).

Whilst this paper makes an important contribution to the literature, it is not with-out its limitations. In terms of methodology, this research adopted a cross-sectional approach which scholars have noted can be problematic when trying to examine HGFs (Brown & Mawson, 2013; Lee, 2014). It would have been beneficial to employ a longitudinal approach to collect data on firm-customer interactions and firm performance at more regular intervals over a longer period of time. This would have allowed for the link between value creation activities and firm performance to be more closely scrutinised to see if there is in fact a positive relationship between the elements discussed in this study and changes in firm turnover. Drawing on two small cohorts of firms from a single geography means that the findings reported are context-specific and indicative, rather than widely generalizable to other HGFs in different regions. There is very much a need for further quantitative studies to corroborate this paper’s findings for a wider range of HGFs, ideally across different geographies.

Additionally, it was very difficult to decipher when value creation activities and behaviours were adopted/implemented. This is linked to the perennial problem of identifying HGFs ex ante (Coad et al. 2017). HGFs are, by necessity, identified ret-rospectively, so it was not possible to determine whether the activities observed predated the period of rapid growth, or resulted during/from that growth period. Further research on this issue would make an important contribution to the literature.

Finally, this study applied the OECD turnover definition of a HGF. As noted, there has been substantial debate over definitional issues (Daunfeldt et al., 2015); scholars have queried the current employment and turnover metrics. In relation to value creation, it is important to better understand the link between customer value, turn-over, and profitability. As Vinnel and Hamilton (1999) observe, high growth needs to be profitable in order to be sustainable. Further research is needed to explore whether customers are merely driving sales growth or ensuring profitability (and perhaps longevity) for firms.