INTRODUCTION

Public debt emission is a powerful macroeconomic policy instrument that can be used by the government in order to fulfil its legal obligations through public expenditure in education, health, infrastructure, etcetera; in order to help the economy to achieve a desirable use of its productive resources; and to provide the financial and monetary system with state-backed financial assets when needed. All this without necessarily undermining the macroeconomic stability of the fiscal, monetary or financial systems.

In order to set an adequate institutional arrangement that allows a country to fully use public debt emission as a policy instrument, and then to actually use this instrument in a desirable and responsible way, it is necessary to understand how it works, what can it be used for and which are its limits. This article intends to answer these questions for the case of Colombia by presenting an analysis of the institutional framework and the empirical evolution of the Colombian public debt for the period 2001-2020 with a post-Keynesian (PK) approach.

Two reasons motivate this study. The first reason is because the PK approach offers a realistic and sufficiently coherent theoretical framework on how public debt works in modern capitalist societies. This understanding is necessary in order to draw realistic paths of actions under the actual institutional, economic and political reality. The second reason is because in Colombia there is an astounding lack of PK studies regarding public debt, and the academic literature, the institutional framework and the policy practice concerning this topic have been dominated by the orthodox approach which has contributed to a narrow understanding of the real functioning, possibilities and restrictions of public debt emission.

The final objective is to contribute to the understanding of public debt as a policy instrument, and to propose various policy routes that would allow the Colombian government to gain all the potentials of public debt emission. These policy routes suggest a different path than the one indicated by the orthodox economic tradition that has ruled policy practice in Colombia. Instead of a passive attitude regarding the fiscal policy and a 'sound finance' orientation, the government should, if needed, use government expenditures financed by debt emission to fulfil its legal obligations, help the economy to achieve a desirable use of its productive resources, and provide the financial and monetary system with financial assets, while maintaining the macroeconomic stability of the fiscal, monetary or financial systems. Finally, taking into account that the current institutional framework and the external conditions impose constraints on these types of policies, this text supports the idea of undertaking institutional reforms that help to overcome them. In particular, it considers the revival of the 'Development Bank' inside the Central Bank of Colombia.

The text is divided into four sections: (1) describes how public debt operates in Colombia; (2) analyses the role Colombian public debt has had as a policy instrument from two different angles; (3) analyses the policy space of Colombian public debt, that is, its sustainability; and (4) brings the previous elements of analysis together, and elaborates on an alternative policy route.

HOW DOES PUBLIC DEBT EMISSION WORK IN COLOMBIA?

This chapter is divided in two: first, it describes the general institutional framework regarding public debt for the Central Bank (CB) and the Central Government (CG); and then describes the general institutional framework of the monetary and exchange system.

Central Bank and Central Government: A post-chartalist relationship

The Ministry of Finance and Public Credit makes decisions regarding the public expenditure and the annual deficit to be financed, which then have to be approved by the Congress (Decree 1068/2015). In order to carry the fiscal, monetary, financial and external macroeconomic policies it has a special coordination with the Central Bank (CB).

The CB is an autonomous institution and hence is not part of any of the three branches of public power. The CB functions are: (a) regulating the monetary emission of the Colombian currency; (b) administrating the international reserves; (c) controlling the exchange regime; (d) being the lender of last resort of the internal financial system; (e) and serving as the fiscal agent of the government for public debt (Hernández, 2020). The main objective of the CB is to maintain the purchasing power of Colombian currency -Colombian peso (COP)-, that is, control inflation.

Regarding public debt, the CB is the fiscal agent of the government in internal and external credit operations and for the emission of public debt TES (local bonds/treasuries), and can directly finance the government only if there is a unanimous decision of the Board of Directors of the CB. In practical terms Colombia has a "post chartalist" scheme for the internal public debt, in which the CB does not directly finance the bond issuance of the government and can only acquire bonds in the secondary market. Bond issuance occurs in a primary market where the market creators ("dealers") acquire the bonds emitted by the government, and then in the secondary market the bonds are freely negotiated1.

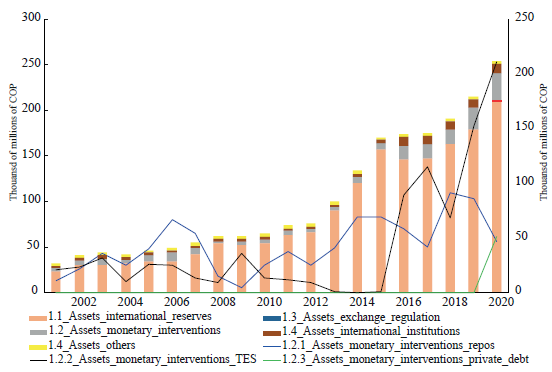

As Figure 1 and Figure 2 suggest, the Colombian CB has not engaged in an active role for financing the government directly, and only slightly indirectly. Figure 1 shows the assets of the CB: the left axis presents the total assets, in which it is clear that the majority of them are international reserves (clear orange), and that the monetary interventions (clear grey) are low; the right axis underscores the monetary interventions, in which the TES possession has increased in three moments: the 2009 financial crisis, the 2016 international commodities prices crisis, and the 2020 Covid crisis.

Source: By the author, data from the Central Bank of Colombia (2022).

Figure 1 Left axis: Assets of the Central Bank of Colombia (taken from annual balance sheet). Right axis: emphasis on the monetary interventions assets

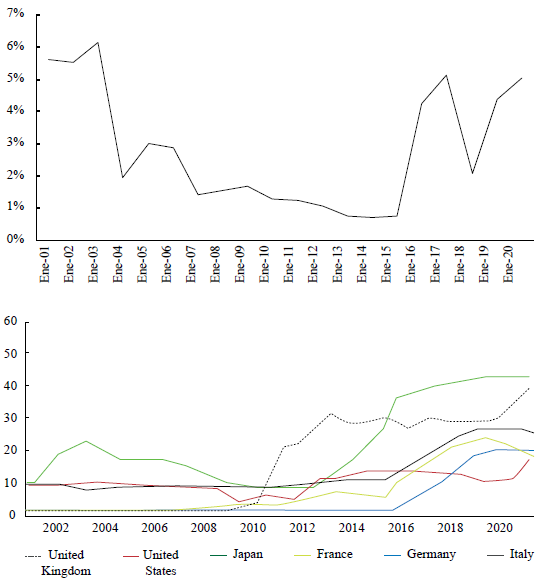

Figure 2 shows the amount of TES controlled by the Colombian CB and compares it with several developed countries. For the case of Colombia, the CB does not hold more than 6% of the total TES, while for the case of USA., France, Germany, and Italy it is approximately 20%, and in case of the United Kingdom and Japan it is around 35%. It is important to notice that the change in the pattern experienced after the 2008 crisis2 did not occur for the case of Colombia.

To complete this subsection, it is important to clarify that it has referred mainly to the internal government bonds (TES) specifically of long term -at least a year or more. This accounts for around 60% of Colombia's public debt. The other 40% comes from external public debt of which almost all of that is denominated in foreign currency, and follows a different logic: the debt in foreign currency appears in the liabilities of the government balance sheet, and the sum of foreign currencies in the assets, without changes in the CB balance sheet. From the perspective of the local economy, the foreign currency already existed before it was borrowed -that is, as in a loanable-funds logic.

Source: By the author, information by Central Bank (2022) and Gabor (2021).

Figure 2 Top graph : % of government bonds held by Colombia CB. Bottom graph: % of government bonds held by other countries

CB and the monetary and exchange regimes

To control inflation, the CB influences the short-term interest rates -what for Colombia are the TIB and the overnight interest rate. For this, it follows a particular kind of corridor system3. It sets up the "penalty rate" (the rate it lends to commercial banks to satisfy the payment system) and the "reserve rate" (the rate of return of the deposits at the CB) in based on the target interest rate. Then it calculates the quantity of additional reserves the system is going to need each day and consequently sets a fixed supply of reserves (credits to commercial banks) available each day (Osorio & Sarmiento, 2018).

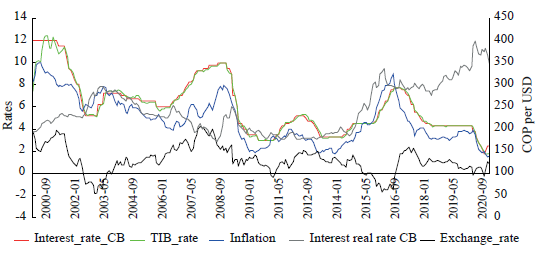

On the left axis Figure 3 presents the CB policy interest rate, the short-term interest rate of the market (TIB), the inflation rate and the real policy rate (the CB interest rate minus inflation); and on the right axis the exchange rate. Three movements can be observed: (a) first, how the CB has managed to attract the short-term interest rate of the market (TIB) to the policy target interest rate. (b) Second, how the real policy interest rate (the CB interest rate minus inflations) partially follows the inflation rate (which has a decreasing tendency), with the exception of the years 2002 and 2016 in which the movement is clearly the opposite. This behaviour is coherent with the one promoted by the orthodox view by means of Taylor's rule, and has been corroborated by the studies of Villa et al. (2014), and by Pabón and Bedoya (2016). And (c) third, the exchange rate, represented in the secondary axis, has a similar movement to the inflation rate. In this sense, there seems to be a movement that goes from the exchange rate to inflation, from inflation to the CB target interest rate, and from the CB interest rate to the short-term rate of the market.

Source: By the author, data from the Central Bank (2022) and Ministry of Finance (2022).

Figure 3 Left axis: CB interest rate, real CB interest rate, TIB rate, and inflation rate. Right axis: exchange rate

To complete this subsection, it is important to briefly mention that Colombia has a floating exchange rate regime and free movement of capital. The floating exchange regime has been used as a policy variable that absorbs external shocks, facilitates inflation targeting and operates as a natural counter-cyclical variable -e.g., when there is a decrease in exports, then the local currency devaluates and the capacity to import is reduced. Regarding capital controls, the free movement of capitals that started in the 90's has increased in the 2000's-e.g., in the first decade of the 21st century there has been a reduction of capital controls specifically with respect to bonds held by foreign actors, and "after October 2008, there have been no restrictions on portfolio inflows" (Ocampo et al., 2020, p. 8).

PUBLIC DEBT EMISSION AS A MACROECONOMIC POLICY INSTRUMENT IN COLOMBIA

Public debt is a macroeconomic policy instrument that can play different roles and serve different policy objectives. This section analyses Colombian public debt from two4 angles: first, based on the fiscal balance and the expenditures/incomes logic; and second, based on the relation with the balance of payment and the possible interpretation of the fundamental macroeconomic identity.

Public debt emission and the Central Government fiscal balance

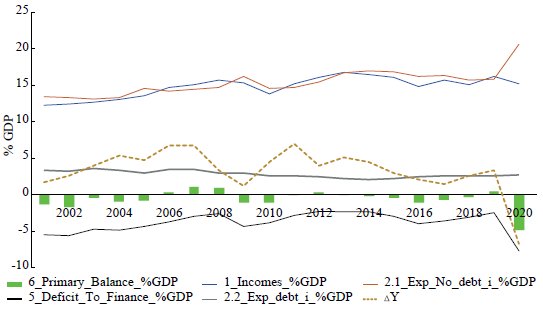

Figure 4 shows the CG incomes, expenditures, primary balance, final deficit, and interest debt payment for the period 2001-2020.

As explained below, to a great degree the fiscal balance of Colombia does not depend on the CG: its fiscal expenditures have legal and political rigidities, its incomes depend on the economic cycle and the international commodities prices, and finally the public finances are subject to fiscal rules. The external side of the economy exerts high pressures on growth, government incomes and a current account balance that reduces the policy space of the government, and pushes it to engage into pro-cyclical policies instead of counter-cyclical policies (Ocampo, 2021). To understand this tendency to pro-cyclical policies it is necessary to delve deeper into the study of (a) the expenditure structure, the (b) incomes structure, and the (c) fiscal rule.

Source: By the author, data from the Ministry of Finance (2022).

Figure 4 CG fiscal balance as % of GDP

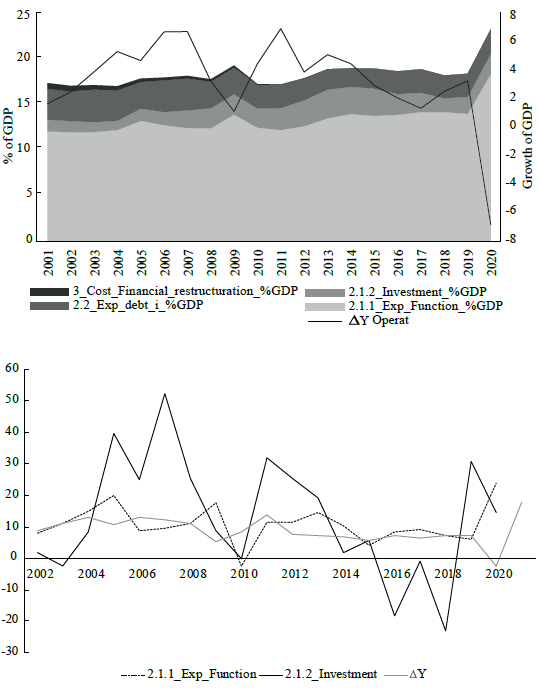

(α) Colombian expenditures can be divided in three types: operating, investment and payment of debt interest -see left part of Figure 5. Most of operating expenditures such as pensions, transfers to the local government, etcetera, are fixed by law or by political constraints. These rigidities make them counter-cycle but not with the deliberate intention of generating aggregated demand during periods of recessions. On the contrary, investment expenditures tend to be the flexible part of expenditures, and they are used as the variable that accommodates the fiscal constraints. As a result, they generally have a pro-cycle behaviour, impeding investment from having an active role in promoting aggregate demand during periods of recession (Becerra & Ramos, 2020). This can be seen on the right part of Figure 5 that contrasts the nominal changes of operating and investment expenditures with the nominal growth rate of the economy. While operating expenditures have small changes in the opposite direction than growth (counter-cyclical), investment expenditures have big oscillations without a clear pattern of counter/pro-cyclicality. Finally, it is important to mention that Colombian government expenditures are low compared to other Latin American countries, with a steady tendency contrary to its neighbouring countries that have an increasing expenditure tendency (CEPALSTAT, 2022).

Source: By the author, data from Ministry of Finance (2022).

Figure 5 Top graph: Type of expenditures of the Central Government as % of GDP and growth rate. Bottom graph: nominal changes in operating expenditure, investment expenditure and growth

(b) Incomes can be classified in three types: current incomes (that include tax revenues), capital gains and other special deposits -left part of Figure 6. Incomes follow a similar path with the growth of the economy, in particular that of current incomes -see right part of Figure 6, that compares the nominal changes in the type of incomes with the growth rate. Government incomes have a high dependence on the international price of commodities in two ways: first, Colombian growth is driven by the exports of oil and coal (see, for example, Figures 7, 8 and 9), thus tax revenues that depend on growth also depend on commodity prices; and second, Ecopetrol, a Colombian oil company and one of the biggest in Latin America, is a public company.

(c) Apart from the analysis of expenditures and incomes, the Colombian government faces a fiscal rule (Law 1473/2011) that has to be considered. The fiscal rule establishes the long-run of public debt/GDP ratio to converge to 30% of the GDP. For this convergence to happen the 'net structural primary balance' should decrease from the year 2012 until it reaches a positive sign in 2025 (Ministry of Finance and Public Credit of Colombia, 2015). The 'net structural primary balance' is the primary balance derived from the structural incomes and structural expenditures, which do not include the cyclical phenomenon of the economy. In particular, the structural income discounts the incomes that are product of taxes and oil cycles. The tax cycles are calculated based on the difference between the observed GDP and the potential GDP, while the oil cycles are calculated based on the difference between the real oil prices and the long-run tendency of prices. The structural expenditure is equal to the normal expenditure when there are no specific programmes of counter-cyclical expenditure (Ministry of Finance and Public Credit, 2014). In this way the fiscal regulation tries to clean the fiscal balance of the international prices of commodities fluctuations and other deviations of the long-run growth path, and hence to establish a "structural" long-run primary balance that tends to be positive.

Source: By the author, data from Ministry of Finance (2022).

Figure 6 Left: incomes of the central government as %GDP. Right: nominal changes of central government incomes

The structural deficit has been decreasing every year and has reached the expected goals (due to the Covid-19 pandemic, the fiscal regulation was suspended in the year 2020). The structural income has been higher than the normal income, which is expected because the real growth has been lower than the potential growth and because between 2012 and 2017 the oil prices had a decreasing tendency. The counter-cyclical expenditure has been zero in all periods, except for the year 2019. This double movement of structural incomes higher than the observed one and no counter-cyclical expenditures are expected: the economy by itself does not tend to full employment and the government has not engaged in active aggregate demand policies to boost the economy.

In conclusion, public expenditure in Colombia is low compared to other Latin American and European countries. The deficit is constrained by fiscal regulation, by the international prices of commodities fluctuations that govern the incomes, and by the fiscal expenditures that have legal and political rigidities (the investment expenditures end up being a pro-cycle variable when they should be counter-cycle). The result of this is that the government assumes a passive fiscal attitude, without engaging in active counter-cyclical policies, and public debt emission is not a source of income available for the government in order to promote higher levels of aggregate demand -particularly during a recession.

Public debt emission and external constraint: The fundamental macroeconomic identity operation

Fundamental macroeconomic identity affirms that the sum of the savings of the private sector, the public sector and the external sector have to be in balance. As an accountable identity this is always true ex-post, but analytically it is necessary to understand the economic mechanisms that enter into operation. In a closed economy, the neoclassical approach sustains that the government deficits have to be financed by the savings of the private sector. The PK theory correctly points out that the mechanism is the opposite: it is the fiscal deficit that allows the private sector to have positive savings by means of an increase in total output (Ciccone, 2020; Lavoie, 2014).

When considering the external sector, the analysis of public deficit in this identity is more complicated and can have at least two different channels: (a) if there is a reduction in exports, it will pressure the external balance deficit with a decrease in government revenues, without an equal decreasing of its expenditure, leading to an increase in the government deficit; or (b) if the government increases public expenditure and emphasises aggregate demand, the productive structure will naturally increase the imports that will pressure the current account deficit. These two channels are more prompted in Latin America countries because of their import-productive structure and their export composition of low technological content (primary products and raw materials, or labour-intensive manufacturing) that are subject to low-income international elasticities, low added value and highly exposed to international fluctuations (Prebisch, 2012 [1949]; Thirlwall, 2011).

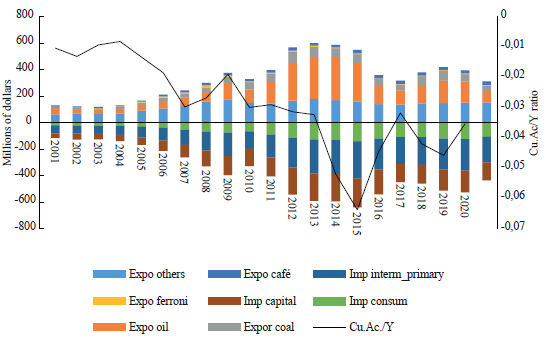

For the case of Colombia, its productive structure is highly dependent on imports of capital goods and intermediary goods -see Figure 7. Exports are dominated by oil and coal, whose price and demand depends on international factors, and not on the neoclassical presupposition that a depreciation of the currency will increase the demand of export products. The right axis of Figure 7 shows the ratio of the current account with the GDP, that presents a negative and constant decreasing behaviour over time.

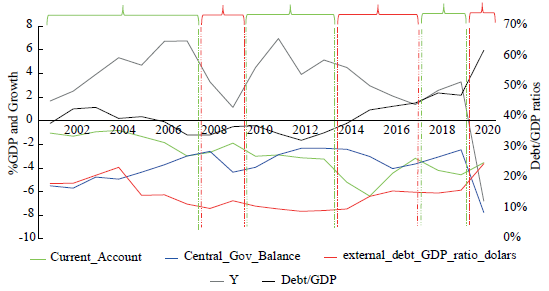

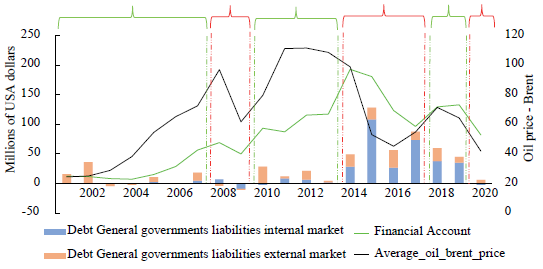

On the left axis Figure 8 presents the deficit of the CG and the current account deficit as percentages of GDP, and the growth rate of the economy. The right axis shows the evolution of the total debt/GDP ratio and the external debt in the USA. The U.S. dollars/GDP ratio -the external ratio is important to compare the external debt movement with the general debt movement. To complement this information, on the left axis Figure 9. shows the financial account of the balance of payment and the liabilities of debt contracted by the general government internally and externally, which is part of the financial account, and on the right axis the international price of oil.

To understand the movements of the variables in Figure 8 and Figure 9. It is useful to divide and contextualise them in time. The periods in green (2001-2007; 2010-2013; and 2018-2019) are the 'normal' times in which most of the macroeconomic indicators are having a positive tendency. The periods in red represent economic crises (2008 -2009; 2014-2017; and 2020).

Source: By the author, Data from the Central Bank of Colombia (2022).

Figure 7 Left axis: Exports and imports composition. Right axis: Current Account/GDP ratio

Taking all this into consideration it is possible to put forward various hypotheses on the relationship between public deficit, public debt and the savings of the private and external sector.

In 'normal' times there is an increase in the international price of oil, economic growth is positive and the government is able to reduce the public deficit. This will naturally decrease the debt/GDP ratio. The current account deficit worsens, with a natural increase in the financial account, but without an increase in the external debt in U.S dollar/GDP in dollars' ratio. Actually, this last ratio follows the normal debt/GDP ratio in a similar way. Finally, if you take a look at the financial account of the balance of payment (which is increasing, as already said), the public debt is decreasing while there is an increase of portfolio investment, direct investment and in the accumulation of reserves (these last three elements are not shown on the graph to avoid overcrowding the visual space).

All this suggests that during 'normal' times: (a) in Colombia the growth is driven mainly by the international prices of oil, its main export commodity, and not by an increase in fiscal expenditure through fiscal deficits; (b) CG balance reduces its deficit when there is an increase in the international prices of commodities and in the economic growth; (c) because of the productive structure, economic growth necessarily increases imports and hence pressures the deficit in the current account that is backed up with an increase of the financial account; (d) both the debt/GDP and the external debt/GDP ratios are improving despite the increase in the current account deficit, suggesting that the external deficit is not directly financing the government deficit, nor that the public debt in foreign currency is financing the external deficit -this is corroborated by the fact that the increase in the financial account is not led by external public debt, which actually decreases. This is also related to the fact that during these periods the COP is stronger and hence the exchange value helps to reduce the external debt as a percentage of the total debt in COP.

Source: By the author, information from the Central Bank (2022) and the Ministry of Finance (2022).

Figure 8 Public deficit (CG), external deficit (current account) and other variables

Source: By the author, information by Central Bank of Colombia (2022) and Macrotrends (2022).

Figure 9 Financial account (with internal and external debt of general government), and oil price

Crises have also a similar behaviour among themselves, but opposite to 'normal' times. There is a decrease in the international prices of oil, a decrease in growth and an increase in the fiscal deficit. This leads to an increase in the debt/GDP ratio, followed by a similar tendency of the external debt in U.S. dollars/GDP in U.S. dollars that, however, is much smoother. Paradoxically, there is always a reduction in the current account deficit due to less pressure on imports, and a decrease in the financial account led by a decrease in portfolio investment, direct investment and in the accumulation of international reserves -however this last one has never been negative. Of particular importance is the increase of external public debt within the financial account during the crisis of 2014-2016, which is explained by the fact that in 2014 the JP Morgan GBI-EM index improved the qualification of Colombian bonds. This led to a massive amount of passive institutional investor funds inundating the local bond market (Romero et al., 2020).

The opposite movement between the current account deficit and the government deficit seems to go from the external side to the public side, and not the other way around as suggested by neoclassical theory. In particular, this occurs because the decrease in the international oil prices contracts the external side of the economy and diminishes the portfolio and direct investment of international financial capital, while having negative effects on government incomes -this phenomenon is reinforced by the high dependence of the productive structure on imports. This is corroborated by the study on the Central Bank set forth by Tejada, Ángel and Castro (2021), in which they concluded that the twin deficit of Colombia did not follow the neoclassical or neo-Keynesian logic of public deficit causing external deficit, but on the contrary, the external deficits are those that put pressure on the public deficit. This double movement of the fiscal end external deficits has also been well described and studied by Ocampo (2021).

THE POLICY SPACE OF COLOMBIAN PUBLIC DEBT

The neoclassical approach understands the sustainability of public debt as the tendency of the debt/GDP ratio to converge to a small ratio, and the main policy recommendation is the application of contractionary policies in order to achieve positive primary balances. However, PK theory has correctly pointed out the flaws of this approach5. What is important is to compare the annual flows of debt payment with the annual GDP and the capacity of the government to serve the debt. In this sense, what is important is to observe the interest in the debt/GDP ratio, the tendency of the state incomes as part of the GDP, and the capacity of the state to pay debt issued in external currency. To address these issues, this section analyses: first, various ratios of debt sustainability; second, the foreign currency debt; third, the interest rate of debt; and fourth, the relationship between the growth rate and public expenditure.

Debt/GDP, interest on debt/GDP, and interest on debt/gov. incomes ratios

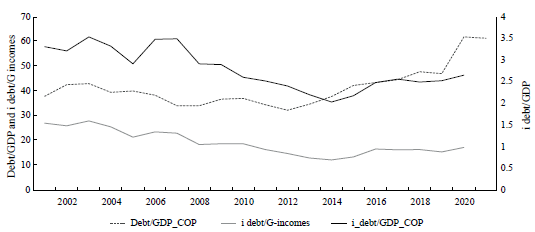

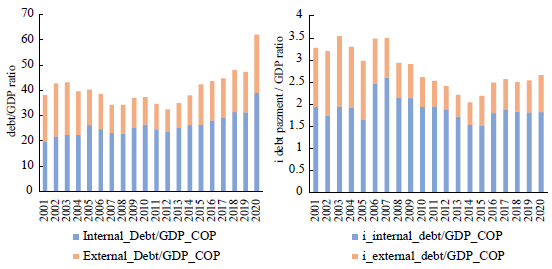

The debt/GDP ratio becomes critical when it exerts a structural pressure on the interest debt payment/GDP ratio, specially of that of the external debt. However, it is possible to have a situation where the debt/GDP ratio is increasing and the interest payment of debt/GDP ratio is decreasing, and thus debt is becoming more sustainable. It is also important to include the movement of government incomes as percentage of GDP: if they increase, it has more space to pay the interest on debt and thus its debt is more sustainable. This is the case for Colombia: while the debt/GDP ratio has an overall increasing tendency, both the interest on debt/GDP and interest on debt/Gov. incomes ratios have an overall decreasing tendency -see Figure 10. The evolution of these indicators shows that the debt in Colombia has become more sustainable even if the debt/GDP ratio has increased.

It is worth mentioning that compared to other similar Latin American countries, Colombia's public debt/GDP ratio is in an intermedium position: Argentina and Brazil have a debt/GDP ratio over 60%, Ecuador and Peru under 40%, while Colombia has oscillated between 40 and 50% in the last decades (CEPALSTAT, 2022). Latin American countries are somehow low if compared to developed countries. In the 2018 Japan had this ratio at 234%, U.S.A at 137%, United Kingdom at 116%, and Germany at 69% (OECD, 2022).

External debt, currency hierarchy and monetary sovereignty

According to MMT, if a country has monetary sovereignty6 then it can "always finance its activities while keeping the interest rate on the public debt under control and maintaining the stability of the payment of systems" (Tymoigne, 2020, p. 1), and can always pay the public debt denominated in its own currency assuring its sustainability7. For the case of countries that have public debt denominated in foreign currency, MMT authors suggest that a flexible exchange rate will tend to maintain monetary sovereignty even with external debt because the country can always devaluate the local currency at a level as to be able to pay the external debt (Tymoigne, 2020). However, as Vernengo and Caldenty (2020) have correctly indicated, the devaluation policy in order to gain monetary sovereignty is not sustainable for the simple fact that it will lead the local economy to a complete crisis through an increase in inflation and in the value of the external debt held both by both the private and the public sector. This is reinforced by the fact that these countries' currencies are low in the international currency hierarchy, limiting the exchangeability for strong currencies and imposing additional limits to the monetary sovereignty (Prates, 2020).

Source: By the author, data from Ministry of Finance (2022).

Figure 10 Left axis: debt/GDP ratio, and interest on debt/Gov. incomes ratio. Right axis: interest on debt/GDP ratio

PK authors have characterised the current international monetary system as essentially asymmetric. From this asymmetry, emerges a currency hierarchy, that is, an institutional arrangement organised around a national currency that becomes the key currency to perform the three functions of money at the international level -means of payment, unit of account and store of value (Paula et al., 2017). In this perspective, currencies are hierarchically positioned according to their degree of liquidity: the key currency (fiduciary U.S. dollar) has the highest liquidity premium, followed by the euro and currencies issued by other core (developed) countries. At the opposite end, currencies issued by developing and emerging economies present the lowest liquidity premium (Prates, 2020). In turn, "currency hierarchy, amplified by financial globalisation, imposes major constraints on the adoption of Keynesian policies for these economies" (Paula et al., 2017, p. 2). The conclusion is that, granted the authority of money emission, the question of sus-tainability moves away from the simple concept of monetary sovereignty to the issue of the external balance and currency hierarchy.

The left side of Figure 11 presents the debt/GDP ratio, while the right side presents the interest payment/GDP ratio, both with the internal and external debt. In both ratios the public debt denominated in foreign currency has an overall decreas ing tendency (with the exceptions of years 2015, 2016 and 2020). This, despite Colombia having constant deficits in its current account (see Figure 8).

Source: By the author, data from Ministry of Finance (2022).

Figure 11 Left part: Debt/GDP ratio - internal and external. Right part: i on debt/GDP ratio -internal and external

One can say that Colombia has achieved monetary sovereignty by reducing the foreign debt, accumulating international reserves over time and expanding and strengthening its internal public debt market. However, at the same time, its current account/GDP ratio has constantly worsened, together with a COP depreciation tendency and no structural international changes in the hierarchy currencies, maintaining the COP at the bottom of the international currency hierarchy. This undermines its monetary sovereignty and renders it more dependent on international financial movements. In the following section a further analysis of the effects of this in the interest rate policy of the CB is addressed.

Interest rate and debt sustainability

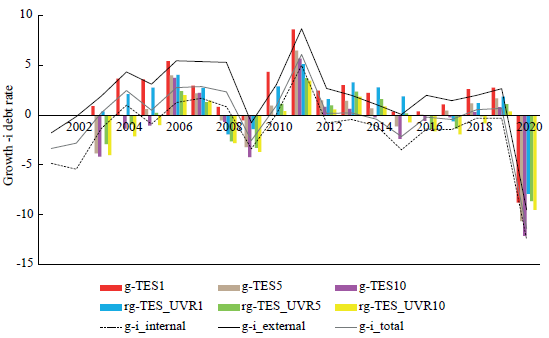

Public debt is sustainable if the growth rate of the economy is higher than the interest rate of public debt, and both these variables are influenced by government policy decisions8. This section analyses whether for Colombia the growth rate has been higher than the interest rate on debt, and whether the government has had some degree of control over the former.

Source: By the author, data from the Central Bank (2022) and the Ministry of Finance (2022).

Figure 12 Growth minus interest rate on debt

Figure 12 shows the difference between: the nominal growth rate and the consolidated interest rate of total public debt, internal public debt, and external public debt; the nominal growth rate and the interest rate of public bonds TES in COP for 1, 5 and 10 years; and the real growth rate and the interest rate of public bonds TES in UVR for 1, 5 and 10 years9. All variables follow, naturally, a similar path with oscillations that do not show any constant increasing or decreasing tendency over time. Throughout the years 2004-2008, 2010-2013 and 2018-2019 the interest rate on debt was, in general, below the growth rate of the economy -under this parameter, 15 years out of 20 the debt was sustainable. These are basically the same periods that were labeled as 'normal' in Figure 8 and Figure 9. If we consider that the interest rate on debt should have the discount of the tax rate, as correctly pointed out by Lavoie (2014), then this result improves because it will give extra space to the difference between growth rate and interest rate on debt.

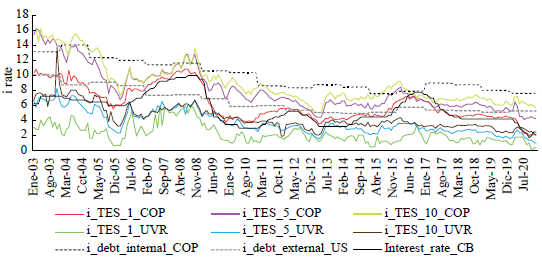

The first question is whether the Colombian government has any control over the interest rate of the debt. The influence of the Government on the interest rate of debt occurs through two economic mechanisms: the first one is by control of the short-term interest rate of the market that the CB has, and that influences all the other interest rates of the market, including the long-terms; the second one is by the fact that the CB can always buy the internal debt of the government, directly or indirectly, and so it could influence the market interest rates of bonds. Figure 13. shows the evolution of the interest rate of the target policy rate of the CB (that as shown in Figure 3 controls effectively the short-term interest rate of the market), the consolidated internal debt, the consolidated external debt, the TES in COP for 1, 5 and 10 years, and the TES in UVR for 1, 5 and 10 years. All variables seem to follow a similar path. In particular: (a) the interest rate of the Central Bank and the interest rate of the TES in COP of 1 year have practically the same movement; (b) the TES in COP of 5 and 10 years have a similar movement to the TES in COP of 1 year, but with a difference of 2-4 points in the interest rate; and (c) The TES in UVR also follows the movement of the TES in COP but with a lower interest rate, which is expected because they are attached to a real value -the difference can be seen as an inflation measure. All this suggests that the CB interest rate influences the debt rate10.

Source: By the author, data from Central Bank (2022) and Ministry of Finance (2022).

Figure 13 Interest rates of public debt and interest rate of CB

The second question is whether the government has real freedom on the target interest rate. As explained by Rey (2015), in the actual situations of free movement of capital and high financialisation of the economy, for peripheral economies the traditional macroeconomic trilemma becomes a dilemma: the CB has factual limits on setting the interest rate because the inflows and outflows of international financial capitals would destabilise the economy. In fact, the interest rate of the CB has to be equal to the international interest rate (which is governed by the interest rate of the FED) plus the liquidity and risk premium of Colombia. If this does not occur, the country will experience massive out-flows of financial capital, both local and foreign, that will generate a crisis on the financial account of the balance of payment, limiting the imports and hence all the productive structure of the country. This has to be connected with the fact that for Colombia the interest rate of the CB follows inflation. These two objectives of the interest rate of the CB -targeting inflation and providing a high level or financial return in such a way as to attract financial investment- move along: inflations have strong connections with devaluation of the currency that results from low levels of exports, which at the same time requires higher levels of foreign incomes from the financial account (Ocampo, 2021).

In conclusion, the policy interest rate of the CB has an important influence on the interest rate on debt, however, as the policy interest rate of the CB has to obey the inflationary demands, the current account pressures and the international financial capitals, then the idea of considering the interest rate as a free policy variable for the CB for Colombia is reduced. If this is true, then the CB is not completely free to set the interest rate below the growth rate of the economy in order to render debt sustainable.

Government expenditure in Colombia: An unsustainable path

For PK, government expenditure increases aggregate demand and growth without necessarily crowding out private investment. If debt is sustainable when the growth rate is higher than the interest on debt, then the government expenditure through public deficit can have the paradoxical -for the neoclassical approach-effect of rendering debt sustainable.

PK's have put the accent first on the role of the government to assure full employment, and then on arguing that this effort is sustainable over time. This view can be summarised in the concept of functional finance inspired by Lerner (1943). Lerner took the Keynesian idea of aggregate demand with the state finance theory, to argue that public expenditure policies should be measured only by the effectiveness in achieving full employment without undermining macroeconomic stability. Different PK views on this topic, such as Godley and Lavoie (2007), Ciccone (2013) or Garbellini (2016) arrive at the same conclusion: there is a level of public expenditure such as to achieve both full employment and sustainability of public debt -or, putting the emphasis on sustainability, public debt is sustainable if expenditures pursue a full employment policy.

For the case of Colombia this has not been the path, even if its public multiplier is higher compared to others in the region, and during recession has even higher values (González, 2020; Restrepo, 2020; Ángel et al., 2020). As already described, public expenditure in Colombia is low and is constrained by fiscal regulation, by the international prices of commodities fluctuations and by legal and political rigidities. The consequence is that the government does not engage in active counter-cyclical policies, and that public debt is not a source of income available for the government in order to promote higher levels of aggregate demand (Rodríguez, 2021; Ocampo, 2021).

The way fiscal expenditures work in Colombia does not help the sustainability of public debt through the increase in growth. On the contrary, fiscal expenditure is subordinated to legal and external causes that push it in the opposite direction: low and counter-cyclical expenditures.

PUTTING THINGS TOGETHER: AN ALTERNATIVE POLICY ROUTE

It is now possible to consider altogether the relationship between the Colombian institutional framework, its economic productive structure, its external dependency, government fiscal behaviour and the sustainability of the public debt. During commodity booms there is an increase in growth, decrease in public deficits, increase of international financial capital inflows (in form of portfolio and direct investment), appreciation of the local currency, low inflation and a decrease in the interest rate, with the result of a more sustainable path of public debt. The opposite happens when there is a fall in the international prices of commodities: there is a decrease in growth, increase in public deficits, decrease of international financial capital inflows, depreciation of the local currency, inflation pressure and an increase in the interest rates, with the result of a less sustainable path of public debt. All this occurs without the intervention of the central government which has a passive attitude regarding its fiscal expenditures, and with not much intervention from the CB except for accommodating the monetary interest rate in accordance to the inflation target and the demands of international financial capital.

The Colombian public debt has become more sustainable in the last 20 years. The debt/GDP ratio is relatively small compared to other Latin American and "developed" countries, and both the interest on debt/GDP and the interest on debt/Gov. incomes ratios have an overall decreasing tendency. This is the result of: (a) relatively small public deficits and a constant GDP growth; (b) a slight increase in the government incomes as % of GDP; (c) an overall decreasing tendency of the interest rate on debt, both internal and external; and (d) a decrease in the external debt, a controlled exchange rate and an increase in international reserves which, at the same time, have improved the monetary sovereignty of Colombia.

However, Colombia still has many social challenges to meet and an economy that has been functioning below its potential capacity. The natural recommendation from a PK perspective is that the government should increase its fiscal expenditures in order to fulfil the legal and political mandates of the state, while pushing the economy to a full employment situation. A way to achieve this is through public debt emission without undermining fiscal or monetary stability. This policy recommendation-which is nothing different than the application of the functional finance principle as taken by PK's- makes sense when the way public finances work inside the capitalist system is understood, that is, inside a monetary mode of production.

Nevertheless, the application of this general recommendation in the case of Colombia faces, at least, two constraints. The first constraint is institutional and ideological: the fiscal reglamentation of the government, the high limitations of the CB to finance the government directly and its low participation in the secondary bond market, the rigid inflation target of the CB, complemented with the widespread idea that public deficits are per se negative, impose legal and political limits to a more active fiscal policy through public debt emission. The second constraint is external: the international prices of commodities have a decisive influence on government incomes, currency devaluation, the value of the external debt, inflation, capital inflows and finally on the policy interest rate of the CB. Therefore, even if the government manages to overcome its institutional and ideological limits, due to the highly import-dependent productive structure, engaging in an active counter-cyclical fiscal policy will actually deteriorate the current account, devaluation and inflation, affecting precisely the variables that are already weak.

The natural question that arises is how can the government increase fiscal expenditures considering the institutional and external constraints? That is, how can the principle of functional finance be applied to the specific case of a small open peripheral country, with an orthodox institutional framework and with high external dependence? The answer can only come from a complex management of the economy in which different policies -tax reforms, fiscal expenditures, debt management, capital controls, industrial policy, etc.- are carefully implemented. Among these, a possible powerful route could be the revival of the Colombian 'Development Bank' (Banco de Desarrollo).

Briefly, a Development Bank (DB) is a financial institution that has as a mission to finance medium and long-term investments that help the development process of a country. The finances of a DB are different and go from direct first level finances through the CB, to a self-financing activity at a second level in the finance system (Griffith-Jones et al., 2018, p. 20).

Colombia has a long history of DB's with sectorial functions, several of them financed by the CB directly. This changed in the 90's with the liberalisation process that included the privatisation of most of the DB's, and more importantly, with the independence of the CB from the CG that resulted in the elimination of the development function of the CB (Ocampo & Arias, 2018).

Considering the revival of a DB within the CB that finances productive projects aiming at reducing the external dependency, and financed directly by the CB through government bonds, is a realistic and balanced economic policy that is in line with the functional finance principle while overcoming the above-mentioned constraints. In particular, the DB within the CB can:

(a) Finance productive projects that tend to reduce external vulnerability, that is, to enlarge and diversify the export basket, and to reduce imports by increasing the local production of capital and intermediary-goods that are imported. This will have a triple effect: it will increase aggregate demand and help to engage in full-employment policies with a counter-cyclical focus; the increase in aggregate demand will have the first impact on the productive investment and not on household consumption -even if then the aggregate demand boosts end in household consumption-; and finally in the medium-long term can help reduce the external dependency of Colombia's productive structure. At this point it might be important to remember that the public multiplier in Colombia is higher if compared to others in the region, and that during recession it is even higher.

(b) Be financed by special public debt emission backed up directly by the CB. Here, it has to be considered that the CB profits go to the CG and, since 2020, these revenues are counted as incomes in the general fiscal balance. This means that even if the amount of debt increases, the flows of debt payment are as if -á la MMT- they passed from the right hand to the left hand. This has several advantages. The CB can still conserve the orthodox monetary functions and independence. This one will not suffer changes, and could have a special coordination with the yearly amount of finance of the CG. The finance will not go to cover functioning fiscal deficits, but investment expenditures in a counter-cyclical way.

It is important to insist that this proposal should not be taken as the only possible route, but as one of the different policy paths that the state has. The discussion on economics should be a complex one in which different policy instruments such as tax reforms, debt management, industrial policies, and capital controls complement each other as a way to achieve better social conditions.

Finally, the PK and structuralist academic literature has somehow analysed the problematic macroeconomic situation of the peripheral countries (as undertaken in this article), but little has been written on how can these countries actually implement heterodox policies such us capital controls, higher corporate and income taxes, higher public expenditure through public debt, or different interest rate targeting from that of the orthodox view, when subject to the international financial movements and to the political-economy dependence of internal and international private economic interest. A way that these countries could implement these types of policies under such conditions is through regional coordination on taxes and capital controls, and cooperation in the financialisation of public debt and investment projects through a regional development bank. This cooperation should be different from a monetary union such as the one in the Euro Zone, in order to avoid the limitation on the monetary sovereignty it exerts on the member countries, but should go further than the traditional Trade agreements. The details and technical economic mechanisms of said institutional infrastructure of coordination and cooperation in the mentioned topics still lacks academic research. These types of investigations are today more relevant in the current situation of post pandemic, high inflation pressures, high capital outflows, increasing interest rate of the strong currencies, international slowdown of the economy, and a wave of progressive governments in Latin America at least in the short-run.