INTRODUCTION

The economic growth determinants of developing countries, in Latin America in particular, have been broadly studied in the literature. Several explanatory factors are relevant in explaining the economic performance of emerging economies. Successively, this region has experienced different stages of fast growth and prolonged stagnation. This particular economic performance is the main motivation for this study. Indeed, this paper studies what causes the different economic growth phases throughout the history of the Latin American countries. In this sense, the contribution here is to establish the main factors that propel and determine that the countries converge to regimes of high economic growth or to stages of prolonged stagnation. This differs from the traditional cross country of temporal series approaches. As the empirical study is carried out based on the segmentation of the total sample in different growth regimes, the advantage being that this allows identifying with more precision the factors that propel and are behind the stages of fast or slow economic growth.

Taking this into account, the results obtained from this research should be more plausible than those obtained from works that applied the traditional approach of the determinants of economic growth. In this regard, the evidence found here indicates that the volatility of output growth rate is the key factor behind the regimes of lower growth. Higher volatility implies that the economy transits to a lower growth regimes. High economic instability should discourage investment, which then reduces economic growth. Successively, income inequality is also related to lower growth regimes. According to the political approach referenced below high inequality generates social discontent, which in most cases reduces the duration of the governments in power so that these are more inclined to prioritise current consumption over investment, thereby reducing long-term growth. Openness is not significant, which for the particular case of Latin America can be explained by the difficulties and ultimately by the bankruptcy of the domestic industry provoked by low price imports offsetting the higher competitiveness and productivity associated with aperture. Hence, the growth promoting effects of aperture could be annulled by the negative impact on local production. Finally, neither is inflation significant, which is a surprising result although it can be related to the fact that the output growth rate volatility absorbs the total effect of economic instability.

In short, the results found here seem to indicate that in order to achieve regimes of high economic growth it is necessary to apply policies that reduce income inequality in order to avoid social unrest, as well as anticyclical policies in order to minimise the amplitude of economic cycles. Based on the evidence obtained in this study, both positions should favour investment and growth.

On the other hand, in relation to the specific work carried out in this paper, in an extension of Dabús et al. (2016) explanatory variables such as income inequality, economic instability and the degree of economic openness are included. Consecutively, contrasting with Dabús et al. (2016), we determine the probability of staying in a certain growth regime at different values of the explanatory variables mentioned above. In particular, the hypothesis put forth is that higher levels of income inequality, economic instability and a lower degree of openness imply that the countries of the region remain in lower economic growth regimes. In particular, our results only partially confirm said hypothesis. They indicate that mainly the macroeconomic volatility (approximated by the variability of the growth rate) and income inequality lead the economy to lower growth regimes, while investment favours the transit to upper growth regimes; moreover, inflation and economic openness are not significant. This last result is similar to Astorga (2010), who, in a long-term study of the economic growth determinants for Latin America, found that openness is not significant in explaining economic growth.

Generally, the lack of consensus in the literature regarding the key factors of the stages of high growth and stagnation mentioned in the following section suggests that the determinants of economic growth deserve additional study, in particular in a region such as Latin America. This region presents a low degree of openness, and accordingly a possible external restriction that limits expansion. Historically, it has a high inequality of income distribution, and has weathered macroeconomic instability, as well as different regimes of stagnation and rapid economic growth. In this sense, the aim of this paper is to investigate the effects of openness, income inequality and economic instability on growth in the region in the long-term, in particular during the 1980-2014 period, for three economic growth regimes: high, intermediate and low growth.

The structure of this document is as follows. The following section presents a review of the literature on the topic under study. Then the data and the methodology are detailed. Then the results are presented and discussed, and finally the conclusions.

SURVEY OF THE LITERATURE

Although the literature has shown that numerous and varied factors can explain economic growth, Levine and Renelt (1992) found that the investment share of the GDP is particularly robust. Further to this, considering the history and the economic features of Latin America we consider three key variables potentially relevant: economic instability, the degree of openness and income inequality. In relation to the foremost, the findings presented by De Gregorio (1992) indicate that low physical and human capital accumulation as well as macroeconomic and political instability explain the meager economic growth of the region. Similarly, De Gregorio (2006) shows that macroeconomic instability damages sustained growth in Chile, while previously Martin and Rogers (2000) and Hnatkovska and Loayza (2005) presented evidence indicating that in general countries and regions with a more volatile growth rate present a poorer economic performance. More recently, also Bermúdez et al. (2015) found that such volatility is a key factor in explaining Latin American stagnation in the long-term.1

With regard to economic openness, a potential constraint for economic growth in the region can be external restriction, that is, a poor export performance that limits the insertion of Latin America into the world market, as well as a sustained economic growth. In this sense, the literature on the openness-growth relationship presents mixed evidence. On the one hand, Harrison (1996), with a sample of developing countries, finds a positive association between growth and different measures of openness. Similarly, Liu et al. (1997) for the case of China show a bi-directional causal relationship between openness and growth, while Oskooee and Niroomand (1999) present evidence using a wide sample of countries, of a positive long-term relationship between both variables. For their part, Ekanayake et al. (2003) show a bi-directional causality between the increase of exports and economic growth, and in a similar sense more recently Sakyi et al. (2015) assert a positive bi-directional relationship between trade openness and income level in the long-term.

Previously, Edwards (1992)) found that economies that are more open grow faster than those with trade distortions do, and Edwards (1998), in a comparative analysis for 93 countries, shows that countries that are more open present higher productivity growth. Gundlach (1997) confirms that openness has a strong positive effect on economic growth, in particular in developing countries. Similarly, Yanikkaya (2003) and Karras (2003) find that openness promotes economic growth. Conversely, more recently, the results presented in Hye and Lau (2015) for India indicate a negative relationship between both variables, while Ulaçan (2015), by using several openness indicators, finds that these are not related to growth.

In the case of Latin America, while Taylor (1998) and De Gregorio and Jong-Wha (1999) show that an inward-looking development strategy harms growth, Awokuse (2008)) analyses the trade-economic growth relationship for Argentina, Colombia, and Peru, and states that import-led growth is particularly favourable for growth. Meanwhile, Astorga (2010) shows a negative conditional correlation between trade openness and growth, but a positive link via investment.

In short, even though in several cases the literature suggests a positive openness-economic growth relationship the evidence is still eclectic.

On the other hand, a possible explanatory factor regarding economic growth in developing countries is income inequality. The income inequality-economic growth relationship has been widely analysed in the literature. However, there is no clear consensus concerning the effect of inequality on growth. In fact, the theoretical literature presents two main opposing approaches. In first place, we have the classical theory, which postulates a positive correlation between inequality and growth. This is due to the assumption that the financial saving rate is higher for the rich than for the poor population. Since increasing inequality favours the richer population income share, this should also generate higher aggregate savings, investment and correspondingly economic growth (Stiglitz, 1969).

On the contrary, the second approach, the political economic explanation, affirms that inequality harms economic growth by means of different channels, like social instability. This channel emphasises the negative role of socio-political instability for economic growth. The idea is that higher inequality raises instability, which in turn favours a more propitious environment for social unrest. This shortens the duration of the governments in power, which therefore are more inclined to prioritise current consumption over investment, reducing long-term growth (Alesina & Perotti, 1996).

Empirically, both the classical and the political economy views have support.2 On the one hand, Partridge (1997), Li and Zou (1998) and Forbes (2000), provide evidence indicating that inequality favours economic growth. On the contrary, Persson and Tabellini (1994) and Deininger and Squire (1998) state that inequality is detrimental to growth. Meanwhile, De Dominicis et al. (2008), in a cross-country regressions analysis, present evidence on a negative and significant relationship between initial inequality and growth. In turn, Malinen (2013) presents a negative relation in a wide sample of countries for the 1965-2000 period. Similarly, for a sample of East Asian economies in a recent paper Birdsall et al. (1995) affirm that policies that reduced poverty and income inequality, such as emphasising high-quality basic education and augmenting labour demand, also stimulated growth.

In the same sense, Clarke (1995), Mo (2000, Panizza (2002) and Frank (2005) present evidence of a negative inequality-growth relation, while Knowles (2005) and Kefi and Zouhaier (2012) obtain similar results for a sample of developing countries. Herzer and Vollmer (2012) show a negative effect of inequality on income in the long-term, and Abida and Sghaier (2012) affirm that the long-term elasticity between growth and income inequality is negative and significant in Tunisia, Algeria, Morocco and Egypt in the 1970-2007 period. Similarly, Malinen (2012) finds that there is a long-term negative relation between growth and inequality in developed economies, while Cingano (2014) presents evidence of a negative impact of inequality on economic growth. With regard to the Indian states during the 1980-2010 period, Stewart and Moslares (2012) show that the regional Gini coefficients affect the growth rate negatively. Ostry and Berg (2011) find a more equal income distribution is related to longer periods of economic growth. Meanwhile, Ncube et al. (2014) show that income inequality reduces economic growth in the Middle East and North Africa for the 1985-2009 period. Finally, also Kotlánová (2015) for a sample of 34 OECD member countries in the period 2000-2012 presents evidence of a negative income inequality-economic growth relationship.

On the other hand, literature with eclectic evidence is presented in Delbianco et al. (2014), who find a negative (positive) effect of inequality on economic growth at lower (higher) income levels for a sample of Latin American countries. In a similar sense, Partridge (2005) confirms that the middle-class inequality share and overall inequality are positively related to long-term growth, but the relationship is not as strong when considering short-term effects. Conversely, Halter et al. (2014) evidence that higher inequality helps economic performance in the short-term, but it reduces growth in the future, so that the long-term effect tends to be negative. In turn, Fallah and Partridge (2007) with regard to the US find a positive link between inequality and economic growth in the metropolitan areas, but this relationship is negative in the non-metropolitan regions. Moreover, similar results are presented by Tiwari et al. (2013) for India during the 1965-2008 period. Meanwhile, Banerjee and Duflo (2003) show that inequality is favourable for growth in more egalitarian societies, but it is harmful in the case of more unequal countries, and Lin et al. (2009) find that higher inequality reduces economic growth in low-income countries, but propels it in high-income economies.

In sum, the empirical literature indicates that evidence regarding the relationship between income inequality and economic growth is not conclusive. Moreover, the published contributions in which growth is explained by instability, openness and inequality do not arrive at a clear consensus on the relationship between these variables. Thus, the empirical research carried out in section IV intents to shed some light on this issue by means of the estimation of growth determinants based on the economic growth regimes approach, as previously explained.

DATA AND METHOLOGY

We apply a panel data approach for 18 Latin American countries for the 19802014 period. The list of countries consists of Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Mexico, Nicaragua, Panama, Paraguay, Peru, Uruguay and Venezuela. The source of our variables is the World Bank, except for the inflation rate, which was extracted from CEPAL. All variables are measured as quinquennial averages. Some basic descriptive statistics are shown on Table 1.

Table 1 shows the average values of growth and the share of investment to the GDP in the region. Also, there exists a great dispersion of the variables under study, and in particular of the Gini coefficient, the openness and the inflation rate, which could indicate an important instability during the period under study in Latin America.

Table 1 Descriptive statistics (1980-2014, quinquennial averages)

| Variable | Obs | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| GDP PC Growth | 126 | 3,2 | 2,3 | -5,1 | 8,3 |

| Gini | 105 | 51,5 | 6,9 | 40,2 | 59,9 |

| Investment/GDP | 124 | 20,3 | 4,0 | 12,6 | 32,1 |

| Inflation (CEPAL) | 124 | 119,8 | 428,1 | 0,5 | 2728,5 |

| Openness | 126 | 44,8 | 21,5 | 12,2 | 112,0 |

| Volatilty of Growth | 126 | 3,2 | 2,1 | 0,3 | 11,0 |

Source: Author's own elaboration based on Dabús et al. (2016).

The dependent variable, i.e. the economic growth regimes, is based on instability, measured by the standard deviation of the growth rate and the inflation rate, the economic openness, measured by both imports plus exports as a percentage of the GDP, the economic (income) inequality (i.e. GINI), and finally, following Levine and Renelt (1992), the share of investment to the GDP as control variable.

Growth regimes are built on the results stemming from applying a k-median clustering to the growth rate, as in Dabús et al. (2016). The clustering in the mentioned work is performed by grouping the countries according to the growth rate using the cluster function in Stata and selecting three clusters3. This technique selects the resulting groups by minimising the squared sum of the distances between the observations and the group's centroid (e.g. mean or median). By doing this the dependent variables are discretised and growth regimes are created endogenously, without an ad-hoc definition. This results in three groups, of high, intermediate and low growth, with means of 5.1%, 2.4% and -1.3% respectively. Successively, we choose median clustering instead of k-mean to avoid the influence of outliers.

With the clusters results as input, we define the growth regimes in two different forms. This leads us to a different estimation technique for each specification, and more robustness when we test our hypothesis. First of all, we elaborate two indicator variables, one denoting the high state of growth regime (versus medium and low regimes), and another for low regimes of economic growth (versus medium and high levels). These variables are then regressed against the above mentioned explicatives in a panel probit approach (Baltagi, 2009), which allows us to maintain the panel data approach, while we regress a dummy variable as we would do in logit or probit regressions. In this context, we use both random effects4 and pop ulation averaged estimation for robustness. We use xtprobit function in Stata, that fits via maximum likelihood the random-effects model:

for i = 1.....n panels, where t= 1.....n, n i are i.i.d., N (0, σ 2 V) and Φ is the standard cumulative probability distribution.

Secondly, we use an ordinal approach, with a cardinal variable of growth regime, with values from 1 to 3 indicating a low, intermediate and high growth rate respectively. In this case, maintaining the explicative function previously described, we move to an ordered logit and a generalised ordered logit. In this approach there is a trade-off, because we lose the panel structure, but we specifically gain the logical order, which implies that to move from a low to a high regime, probably involves moving through an intermediate growth regime. The difference between the classic ordinal and the generalised ordinal is that this latter method gives us different estimations in each value as the cardinal variable moves upwards. In other words, this means that the vector of parameters is not unique for the entire space of the ordinal dependent variable. In this way, the methodology can capture different effects of the explanatory variables in each change of regime. The ordinal models formally correspond to the function:

for the i-th regime, with the linear model plus a normal error defining the probability of being between two cut points given by к 0 , к 1 ,...,к к-1 , where k is the number of regimes and parameters are estimated as the β coefficients (Cameron and Trivedi, 2005). The generalised method instead estimates a different set of β coefficients for each interval defined by the k k thresholds.

EMPIRICAL EVIDENCE

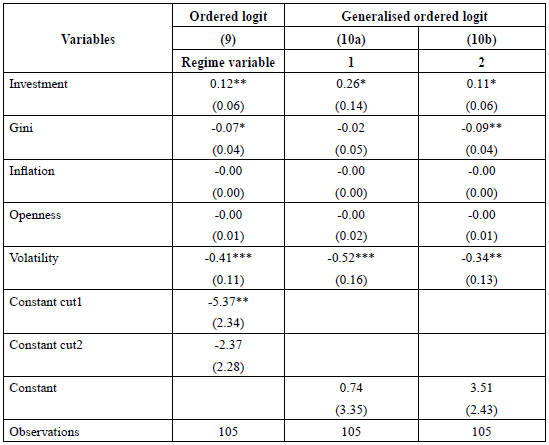

The results obtained are shown on Tables 2, 3 and 4. Table 2 shows the random effects, both for the indicator variable of high growth (columns 1 and 2), and for the low growth regime (columns 3 and 4), in both cases with and without constant. Secondly, Table 3 shows the same estimations but with population averaged instead of random effects (columns 5, 6, 7 and 8). In the first place, Table 4 shows the ordinal logit results (column 9), and the generalised ordinal logit results (column 10a for the results of going from low to intermediate regime, and column 10b for the final step from intermediate to high growth regime).

Not surprisingly, in most cases the share of investment to the GDP is associated with a higher probability of achieving higher growth regimes. In turn, the results are generally very similar to those found previously with panel data and ordinal logit, which suggests that the results are robust with regard to the estimation meth ods that we used. Economic instability, approximated by the output growth rate volatility, is significant and negative. Hence, a more unstable growth trend makes the shift to lesser growth regimes more probable. In addition, inflation is not significant in any case. This result can be due to the fact that the growth rate volatility absorbs the total effect of economic instability, as this is more relevant than the inflation for increasing the probability of changing to lower growth levels. Besides, similarly to Astorga (2010), openness is not significant, while income inequality favours the transition to minor growth states.

Table 2 Panel probit with random effects

Standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1

In short, the investment share favours the economy achieving upper growth rates, and inequality propels the transition to lower levels. Meanwhile, inflation and openness are not significant.

On the other hand, the generalised ordered Logit gives additional insights to the previous results. The effects of output growth rate volatility are more significant when the economy is moving from low to intermediate growth regimes, than when it transits from intermediate to high ones, which implies that, as put forth by Ber-múdez et al. (2015), higher economic volatility reduces the probability of accessing the high economic growth regime, as mentioned previously. Finally, inequality only negatively affects the probability of being in a high growth state, in accord with the results obtained by Malinen (2013), Ncube (2014), Kotlánová (2015), among others.

Table 3 Panel probit with population averaged

Standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1

Although the results were obtained from a sample of several countries, these share sundry common social and economic features that make suitable the obtaining of several general regularities and suggest some policy recommendations. These are developing countries with a per capita middle-income level, a history of economic and political instability, high inequality and a small domestic market that implies the necessity of a greater insertion in the world market in order to achieve upper levels of economic growth. In this regard, the interpretation of these results seems intuitively acceptable. First, a key finding of this study is that higher volatility drives the economy to remain in a low regime of growth. The intuition is that high economic instability associated with a less predictable growth trend discourages both current and future investment projects because of the higher uncertainty regarding potential profits. This is prejudicial for investment and thus for economic performance, inducing the transit to lower growth levels. In second place, income inequality is also the trigger for the transition to lesser economic growth. In this sense, the political economic approach sustains that high inequality promotes social turmoil and generates a general discontent that shortens the duration of the governments in power. Thus, these prioritise current consumption over investment, thus reducing long-term growth. In relation to openness and inflation, the fact that these are not significant can make sense in the particular case of Latin America. Openness is not significant in any specification of the empirical study (panel probit or generalised ordinal regressions). This indicates that this result is robust to different econometric specifications. In this sense, the effects of openness seem to be ambiguous. On one hand, this should be growth promoting because this is related to growing exports as well as to a higher level of competiveness because of the fact that the economy is exposed to foreign competition. Nonetheless, in the particular case of Latin America higher levels of openness could provoke the massive bankruptcy of the domestic industry provoked by the low level of competitiveness of Latin American countries in comparison to both technologically advanced and low labour cost countries such as those of the South Asian region. This negative effect, added to the external restriction that limits the economic expansion of the above-mentioned region, can offset the beneficial effects coming from a higher insertion into the world market. Thus, even though economic openness can be growth promoting within a particular regime, this is not enough to change to an upper growth regime.5 Finally, the fact that inflation is not significant in explain ing the transition to regimes of lower economic growth can be understood based on the fact that the negative effects of uncertainty, associated with instability in the trend of economic growth, is more relevant to propel said transition. In this way, the growth rate volatility should absorb the total effect of economic instability.

Table 4 Ordinal and Generalised ordinal logit results

Standard errors in parentheses. *** p < 0.01, ** p < 0.05, * p < 0.1

To summarise, the results set forth here allow proposing various policy recommendations. First, in order to achieve regimes of high economic growth it is necessary to reduce high levels of global income inequality. This should avoid a generalised social unrest that provokes public decisions tending to stimulate current consumption at the expense of investment and future growth. Moreover, the negative impact of output growth rate variability indicates that policy recommendations are that economic policy must be oriented to minimise the magnitude of economic cycles, such as the volatility of economic growth. Hence, anticyclical policies are recommended in order to minimise the amplitude of economic cycles. Based on this evidence, both should favour investment and the transition to regimes of higher economic growth.

CONCLUSIONS

This paper explores the factors that propel and are the cause of the transition to regimes of different levels of economic growth in Latin America. This region encompasses a wide sample of developing countries, which are within a range of high and low middle income levels. These share a history of high economic and political instability and high income inequality, as well as a small domestic market. In particular, the study focuses on how different factors affect the probability of being in a certain regime. Similar to previous papers cited above, the results show that the volatility of the output growth rate is a key determinant in explaining lower economic growth. In particular, higher volatility implies that the economy should fall and remain in lower growth regimes. The high economic instability associated with such volatility should increase uncertainty, which is harmful for investment and growth. Moreover, the evidence also indicates that higher levels of inequality propel the transition to poorer growth regimes. The interpretation could be based on the political approach. Its viewpoint is that high inequality promotes social turmoil and generates a general discontent. This reduces the duration of the governments in power, which in response to the new environment prioritise current consumption over investment, thus reducing long-term growth.

On the other hand, economic openness and the inflation rate are not significant in explaining the probabilities of a country being in a certain growth regime. Regarding the former a possible explanation of this result is that the domestic industry of the emerging countries of the region has serious difficulties in facing foreign competition of cheaper importation, which could reduce substantially the advantages of higher competitiveness and productivity associated to a higher openness. Finally, the results show that inflation does not affect economic growth, which should be because the output growth rate volatility absorbs the total effect of economic instability, so that higher inflation levels are not enough to provoke the transit to lower growth regimes.

Based on this evidence, the recommendations of economic policy must be oriented toward emphasising the application of anticyclical policies, in order to minimise both the magnitude of economic cycles and the volatility of economic growth. In other words, during periods of economic abundance the governments must be focused on reducing global demand, and vice versa during the stages of long recessions and economic stagnation. Secondly, the results suggest the application of a distributive policy, by means of a progressive tax system and public expenditure measures tending to alleviate the situation of the poor population. This should reduce or even avoid a high concentration of income and the consequent social discontent, which causes governments to increase current consumption in detriment of investment and growth. In sum, the results of this research indicate that a more stable trend of economic growth and socially tolerable levels of inequality should be favourable in order for the economy to remain in regimes of higher growth.

Finally, future work could relate to the comparison of these regional results for Latin America with other regions or groups of countries, in order to give a wider evidence of the determinants of economic growth among different growth regimes in countries with different levels of development and endowment of economic resources, such as the poorer countries of Africa and the more dynamic Asian economies.