Services on Demand

Journal

Article

Indicators

-

Cited by SciELO

Cited by SciELO -

Access statistics

Access statistics

Related links

-

Cited by Google

Cited by Google -

Similars in

SciELO

Similars in

SciELO -

Similars in Google

Similars in Google

Share

Innovar

Print version ISSN 0121-5051

Innovar vol.21 no.42 Bogotá Oct./Dec. 2011

Mary A. Vera-Colina*, Guillermo Rodríguez-Medina** & Zuray Melgarejo-Molina***

* PhD in Economic Sciences. Associate Professor at the Universidad Nacional de Colombia. Economic Sciences Faculty. E-mail: maaveraco@unal.edu.co.

** PhD in Management Sciences. Retired Full Professor at the Universidad del Zulia (LUZ), Venezuela. Researcher at the Center for the Study of Companies at the Economic and Social Sciences Faculty E-mail: grodríguezm@luz.edu.ve

*** PhD in Management. Assistant Professor at the Universidad Nacional de Colombia. Economic Sciences Faculty. E-mail: zamelgarejomo@unal.edu.co

Submitted: March 2011 Accepted: August 2011.

Abstract:

The relationship between the presence of financial planning and difficulties regarding access to financing in small and medium-sized companies (SMEs) in the Venezuelan manufacturing sector is studied. This is an explicative type research work, designed as non-experimental, crosssectional and correlational field work, applied to a sample of 67 SMEs. A questionnaire was applied and a review was made of the relevant literature, to establish the characteristics of the selected variables, according to the high-medium-low measurement for each of the selected indicators. The preliminary results make it possible to affirm that the financial planning variable demonstrates a medium presence in the companies, with medium and low levels of coordination among their components. Average access to financing is classified as low, marked by a medium-high access to credit from suppliers, medium access in reinvestment of profits and medium-low access to bank credit lines. There is also evidence of financing patterns compatible with the Pecking Order Theory. The conclusion is that there is a weak relationship between the characteristics of financial planning and the levels of access to financing, with the inference that the behavior of these variables is determined by a multiplicity of factors.

Keywords:

Small and medium-sized enterprises, SMEs, financial economics, financial planning, access to financing, strategic planning.

Resumen:

Se indaga la relación entre la presencia de planificación financiera y las dificultades de acceso al financiamiento en pequeñas y medianas empresas (Pymes) del sector manufacturero venezolano. Es una investigación de tipo explicativa, con diseño de campo no experimental, transversal y correlacional, aplicada a una muestra de 67 Pymes; se aplica un cuestionario y revisión de literatura pertinente, para establecer las características de las variables seleccionadas, según la escala de medición alta-media-baja para cada uno de los indicadores seleccionados. Los resultados preliminares permiten afirmar que la variable planificación financiera muestra una presencia media en las empresas, con niveles medios y bajos de articulación entre sus componentes. El acceso al financiamiento promedio se califica como bajo, destacándose un acceso medio-alto en el crédito de proveedores, un acceso medio en la reinversión de utilidades y medio-bajo en la línea de crédito bancario; también se evidencian patrones de financiamiento compatibles con la Teoría del orden preferente. Se concluye que existe una relación débil entre las características de la planificación financiera y los niveles de acceso al financiamiento, infiriéndose que el comportamiento de estas variables es determinado por multiplicidad de factores.

Palabras clave:

pequeñas y medianas empresas, Pymes, economía financiera, planificación financiera, acceso al financiamiento, planificación estratégica.

Résumé :

L'auteur veut aborder la relation entre la présence de planification financière et les difficultés d'accès au financement dans les petites et moyennes entreprises (Pymes) du secteur manufacturier vénézuélien. Il s'agit d'une investigation de type explicatif, sur un terrain non expérimental, transversal et corrélationnel, appliquée à un échantillon de 67 petites et moyennes entreprises; un questionnaire est appliqué et les publications pertinentes sont consultées, pour établir les caractéristiques des variables sélectionnées, selon l'échelle de mesure haute-moyenne-basse pour chaque indicateur sélectionné. Les résultats préliminaires permettent d'affirmer que la variable planification financière démontre une présence moyenne dans les entreprises, avec des niveaux moyens et peu élevés d'articulation entre les composants. L'accès au financement moyen est peu élevé, signalant un accès moyen-élevé dans le crédit des fournisseurs, un accès moyen dans le réinvestissement des bénéfices et moyen-peu élevé dans la ligne de crédit bancaire; des modèles de financements compatibles avec la Théorie de l'ordre préférant sont aussi évidents. En conclusion, il existe une relation peu élevée entre les caractéristiques de la planification financière et les niveaux d'accès au financement, déduisant que le comportement de ces variables est déterminé par une multiplicité de facteurs

Mots-clefs :

petites et moyennes entreprises, Pymes, économie financière, planification financière, accès au financement, planification stratégique.

Resumo:

Indaga-se a relação entre a presença de planejamento financeiro e as dificuldades de acesso ao financiamento em pequenas e médias empresas (PME) do setor manufatureiro venezuelano. É uma pesquisa de tipo explicativa, com desenho de campo não experimental, transversal e correlacional, aplicada a uma amostra de 67 PME; aplicou-se um questionário e revisão de literatura pertinente, para estabelecer as características das variáveis selecionadas, segundo a escala de medição alta-média-baixa para cada um dos indicadores selecionados. Os resultados preliminares permitem afirmar que a variável "planejamento financeiro" mostra uma presença uma presença média nas empresas, com níveis médios e baixos de articulação entre seus componentes. O acesso ao financiamento médio qualifica-se como baixo, destacando-se um acesso médio - alto no crédito de fornecedores, um acesso médio no reinvestimento de lucros e médio - baixo na linha de crédito bancário; também evidenciam-se padrões de financiamento compatíveis com a Teoria da Ordem de Preferência. Conclui-se que existe uma fraca relação entre as características do planejamento financeiro e os níveis de acesso ao financiamento, inferindose que o comportamento destas variáveis é determinado por uma multiplicidade de fatores.

Palavras chave:

pequenas e médias empresas, PME, economia financeira, planejamento financeiro, acesso ao financiamento, planejamento estratégico.

The study of the operations and performance of small and medium-sized enterprises (SMEs) is an inexhaustible research topic that is the object of frequent publications in such varied areas as their competitiveness, internal organization, contribution to economic growth and employment, public policies aimed at their strengthening, and the entities that provide them with financing, among others.

Many of these publications agree in stressing the importance and dynamism of the SMEs within the business fabric of any country (BID, 2005; Malhotra et al., 2007; Zevallos, 2007; Galindo, 2005), emphasizing the need to overcome their weaknesses in order to strengthen their permanence in their sectors of activity.

Most research associated with the challenges that the SMEs must surmount in order to be successful focuses on external factors that have an impact on the performance of these organizations, such as the availability of credit mechanisms, administrative procedures, relationships with the governmental sector, with financial institutions, with suppliers and with distributors, the availability of qualified personnel and in general with respect to the business environment that they must face[1]. Another research category that in recent years has become important complements the study of the business environment by focusing on the internal characteristics that describe companies, specifying their weaknesses in areas of business management that make successful performance even more difficult[2].

As can be seen in the referred-to works, support programs for the development of SMEs tend to be mainly aimed at facilitating access to financial resources (Peres y Stumpo, 2002, p. 4; Moll, 2007). To a lesser extent, these programs may include training mechanisms to improve the managerial skills of the managers (generally the owners) of the firms, but to do so there must be a detailed diagnosis to facilitate the identification of critical areas for consideration in the action of these entities.

This research is framed within that concept. While the aspects that must be studied in terms of the functioning of those enterprises are varied, considering their complexity and multi-dimensionality, at this time the focus is on the study of their financial management (planning and financial control), because it is an area that has not been sufficiently studied, and in which deficient performance poses an obstacle for the rest of the organization's operations and the access that the company could have to varied sources of financing.

To this end, the proposed research aims to determine if there is a relationship between the presence and coordination (association) of the components of financial planning and the access to diverse sources of financing available to SMEs, taking the Venezuelan manufacturing sector as a case study. To do so, a theoretical review is structured as support for the proposal, the applied methodological guidelines are presented and the preliminary results obtained for these variables are discussed with respect to a sampling of 67 companies.

The research addresses a set of indicators grouped under two main variables: Financial planning and access to financing.

Financial planning is conceived as a business process that is based on formulation of the organizational and systemic strategy and which includes the design of objectives, strategies, policies and control mechanisms associated with investment and financing decisions, considering their implications for both the short and long terms (García et al., 2003; Brealey and Myers, 2010; Suárez, 2003).

The theoretical approach to this variable makes it possible to schematize its analysis under the following components:

- Conditions for the development of financial planning (Santandreu y Santandreu, 2000; Francés, 2001): Referring to the characteristics and processes that must be present for its correct functioning, such as the existence of business planning practices, and the characteristics of the financial or similar department.

- Development of planning and control processes in the financial function (Brealey and Myers, 2010; Díez y López, 2001; Suárez, 2003), including aspects associated with the formulation of objectives and goals, definition of strategies, design of policies, definition of control mechanisms and preparation of documents of the financial plan.

- Financial parameters for long-term decision-making (Suárez, 2003; Kogan Page et al., 2002; Ortiz, 2005), among others: parameters of performance and risk in the analysis of investments, investment type planning, methods for evaluation of investments, composition of the capital structure, planned financing alternatives.

- Financial parameters for short-term decision-making (Ortiz, 2005; Santandreu y Santandreu, 2000; Brigham and Houston, 2006; Gitman, 2007), among others: Treasury availability, policies of credit and collections regarding customers, inventory handling, planned financing alternatives.

- Coordination of the above components, for harmonious and successful management.

At the same time, access to financing refers to the possibility that a company has to apply for, process and obtain the approval of funds, of both internal and external origin, to finance its operations and development in the short and long terms (The World Bank, 2008a; Zevallos, 2007).

In this sense, the type of access to financial sources is examined: long-term loans, leasing, liabilities and equity issuance, dividends from shares, reinvestment of profits, suppliers, credit lines, short-term loans, guaranteed credits, commercial paper. For each source of financing, the ease of access is analyzed, looking into the speed of approval of applications (fast, slow), their definitive rejection or the entrepreneur's reluctance to apply for them.

With the aim of determining the state of the art in the study of the behavior of these variables in SMEs, an exhaustive review was made of the literature from the last 10 years. At the international level, growing interest was observed in examining the characteristics of business financing, the factors that determine access to different sources of funds and how the size of companies can affect these factors, among other aspects. However, most studies focus on detecting obstacles to financing in the environment of the companies rather than analyzing the internal conditions of the SMEs in terms of their management (Beck et al., 2002, 2004a, and 2004b; Beck and Demirgüç-Kunt, 2005; Berger and Udell, 2005; BID, 2002 and 2005; Cull et al., 2005; Kumar y Francisco, 2005; The World Bank, 2008a y 2008b; Clarke et al., 2002; Zevallos, 2007).

Some studies focus on analyzing the determining factors of the capital structure, particularly with reference to financial indicators in Spanish companies (Aybar et al., 2003; Boedo y Calvo, 2001).

In terms of the incorporation of qualitative variables in the studies associated with financial management, the work of Deakins et al. (2001) is particularly outstanding for its contribution to the consideration of financial decision-making processes in the SMEs, as evolutional and changing, which is why they must be analyzed at different times in order to identify the dynamism of their transformations. His research was based on qualitative data collection and analysis techniques and was carried out using four case studies of British micro and small businesses. The findings from this study included the hypothesis that decisions associated with the composition of the capital structure demonstrate greater complexity than what is suggested by the theory of pecking order, in that it is not the owners' attitude that poses an obstacle to the entry of new shareholders, but rather the lack of investors interested in this type of businesses. Another of his conclusions is the importance of the relationship maintained by the owners-managers with their external advisors (accountants, bank managers, and other professionals), particularly during the first years of a company, a characteristic that turns out to be a determinant in the structuring of its financial processes.

In the documents that were consulted, numerous publications focusing on SMEs exist; a small portion of them focuses on the financial variables but no studies were found that attempted to determine the influence of these companies' internal financial processes on their difficulties regarding access to financing.

The concern over analyzing procedures that apply to SMEs in their financial management, and their effects on access to financing sources, is present in different studies (Zevallos, 2007), but has not been applied to proposals that systematically research these aspects, and it was this gap that led to the execution of this study. We consider that the above-mentioned studies serve as a point of reference for this research; their conclusions shed light on the problem to be analyzed, but they do not provide conclusive results regarding the effects of the quality of financial management of companies on access to formal financing, aspects that will be developed in this work as a complement to the body of already existing knowledge.

An explicative type quantitative research work is proposed, with the aim of identifying some of the causes that could be causing problematic situations in the performance of SMEs, particularly regarding their limited access to financial resources. This explicative organization involves exploratory, descriptive, and correlational processes, in order to provide greater understanding of the phenomenon under study (Hernández et al., 2010). A work plan that is designed as a non-experimental (ex post facto), crosscutting, exploratory, correlational field research is used (Hernández et al., 2010; Hurtado, 2007; Ryan et al., 2004).

With the goal of standardizing information on the financial planning process and the level of access to financing on the part of these entities, a survey was used as an information- gathering technique (Hurtado, 2010; Hurtado, 2007). A questionnaire was used consisting of 79 closed questions and scale-type alternatives for response (62 items for financial planning and 17 items for access to financing), with a measurement level by intervals (Hurtado, 2010, Hernández et al., 2010, p. 306). In this way, for each proposal presented, the manager chooses among alternative answers equivalent to different degrees of presence of financial planning and diverse possibilities for access to financing (see Vera, 2010).

In the case of the dimensions and indicators associated with the financial planning variable, questions and response alternatives are included that will be pre-codified to represent three levels of presence of that variable, each with a quantitative score:

- High presence of planning (2 points).

- Medium presence of planning (1 point).

- Low presence of planning (0 point).

Similarly, access to financing sources is studied according to the following parameters:

- High access: Swift approval of applications (2 points).

- Medium access: Slow approval of applications with excessive paperwork (1 point).

- Low access: Includes cases in which financing applications have not been approved due to failure to comply with the requirements, or applications are not submitted because the paperwork is considered to be too complicated, or because the companies do not need additional resources (0 points).

These point values were not made known to the survey participants to avoid bias in their responses. The questionnaire was designed based on a technical review of the variables, was then validated by expert judges and applied in a pilot test to measure its reliability (Cronbach's alfa), obtaining as a result a valid and reliable instrument (Alfa=0,962). It was applied between September and December of 2009, through electronic correspondence sent to the financial managers or highest ranking personnel responsible for financial decisions. A geographically stratified random sample of 67 Venezuelan manufacturing SMEs[3] was selected, out of a population of 3,651 units (INE, 2006).

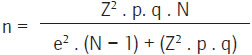

To calculate the sample of the study, the following equation was applied (Hurtado, 2010; Parra, 2006):

n = sample

Z2 = confidence level. A confidence level of 90% is assumed, with a value of Z = 1,645

p.q = probability of responses. It is assumed with values of 50, 50.

e = error of estimation. A value of 10% is used.

N = population size. In this case 3,651 companies (INE, 2006).

With this data, a sample of 67 companies was obtained. Considering that out of the total number of companies in the population, 80% are located in 8 states (Miranda, Carabobo, Aragua, Distrito Capital, Lara, Táchira, Zulia, and Bolívar), these were used to randomly select the units that make up the sample. Only 64 of these organizations agreed to participate in the project by responding to the questionnaire.

The information obtained in the entrepreneurial sample makes it possible to estimate certain preliminary results regarding the behavior of Venezuelan manufacturing SMEs in terms of planning and access to financial resources. These preliminary findings serve as a starting point to continue researching the topic in the future, increasing its scope to a greater number of organizations and including other economic sectors, regions and countries, with the aim of carrying out a more complete analysis of a comparative nature.

The general characteristics of the sample included the fact that the set of companies involved has existed for an average of 29 years, with extremes ranging from 1 year to a maximum of 68. In 92.2% of the cases, they carry out their operations at one single site, while the rest have activities in other states in the country or are associated with some type of foreign economic group (3.1%).

Their personnel oscillate between 11 and 110 workers, with an average of 45 employees per company, whereas their level of annual revenues (for 2009) is less than 250,000 tax units (US$3,780,000) in 87.5% of the cases. It should be pointed out that all of the firms fulfill at least one of the parameters to be classified as an SME, whether in terms of volume of employment or revenues during the previous year; 86% fulfill two of the classification criteria, whereas the remaining 14% fulfill only one.

Companies dedicated to diverse sectors of activity were contacted, particularly food and beverages (31.7%), consumables for construction (17.1%), metallurgy (14.6%), plastic products (14.6%), chemical products (4.9%), medical supplies (4.9%), apparel (4.9%), wood (4.9%), and printing (4.9%).

With the statistical processing of the questionnaire, the average scores were determined for the indicators for each variable, to plot their behavior and estimate the associations between them (correlations). The results are examined in accordance with the scheme of the theoretical dimensions of the variables, in line with the above-mentioned measurement scales (0 minimum presence of indicators - 2 maximum presence).

Financial planning

Initially the existence of conditions that would make it possible to carry out a well-conceived and executed process of financial planning at the companies under study is observed. These results can be seen in Figure 1.

On average, the 3 dimensions obtain an average score of 1.20, from which we may infer that the financial planning process that they must carry out will not overcome the deficiencies already found in these companies in terms of strategic planning and control (Santandreu y Santandreu, 2000; Francés, 2001). The presence of certain key processes for an overall strategy is particularly noteworthy and a strength that could serve as the backbone in facing the challenges and opportunities for improvement in the Venezuelan SMEs in this set of indicators. However, their greatest difficulties are observed in the application of the plan, in other words, there are cases where the organizations demonstrate certain strategic planning practices that are not supported by adequate processes of follow-up and timely correction.

The shaded zone in Figure 1 represents the level of achievement that the organizations have in the conceptual scheme of the variable, whereas the lighter zone constitutes the unfulfilled margin, which can be translated into opportunities for improvement, if management techniques and tools adjusted to the characteristics and size of these businesses are properly applied.

In the second place, the specific components of the financial planning process were analyzed. Regarding the existence of practices for planning and control in the financial function (Brealey and Myers, 2010; Díez and López, 2001; Suárez, 2003), a significant reduction was observed in the evaluated score (Figure 2), when compared to the previously- commented dimension. This allows us to affirm that the SMEs can be applying strategic planning techniques without this translating into functional programs, including a financial one. In this component, the low score for drafting the documents of the plan is particularly striking, in other words, in certain organizations management practices were detected without necessarily being reflected in a formal plan.

Long-term decision-making (Suárez, 2003; Kogan Page et al., 2002; Ortiz, 2005) is characterized by a medium presence of these indicators, and particularly by less use of points of reference in terms of the analysis of performance and risk in the analysis of investments and in the methods for evaluating them (Figure 3).

In the case of short-term decision-making (Ortiz, 2005; Santandreu y Santandreu, 2000; Brigham and Houston, 2006; Gitman, 2007), this is the dimension that shows the best results in the study (Figure 4), beating the scores of the preceding indicators. This coincides with the affirmation that the SMEs have more urgent need to pay attention to their short-term decisions and consider their sustainability over the long-term (Zevallos, 2007).

Each of the dimensions examined regarding the financial planning variable shows the general tendency among the SMEs studied to moderately apply formal management processes, with an emphasis on the strategic business plan and the programming of short-term situations (Figure 5). In addition to the presence of these indicators, the interrelation between them is analyzed, estimating their Pearson correlation coefficients (Hernández et al., 2010), summarized in tables 1 and 2.

In general terms, lower indices of association with the rest of the components are observed in the functional analyses of the financial management (69% of the companies have an administrative department that is responsible for financial management, while 14% report not having a section dedicated to finances) and in the application of control mechanisms.

In the case of the specific components of financial matters, medium correlations are estimated to exist between them, showing insufficient associations between planning and control processes and short and long-term decisionmaking. In other words, on the one hand situations are detected in which there is a formal financial plan, but it is not used as a point of reference for decision-making, whereas on the other hand there are companies that do not develop explicit plans but apply management parameters to their daily decision-making, without tying them to a comprehensive process in their management.

In addition to the correlations presented in tables 1 and 2, other insufficient associations were identified (coefficients of less than 0.5) associated with other indicators in the design of financial policies, preparation of documents of the plan, planning of sources of financing and capital structure, management of inventories.

For the financial planning variable, it may be concluded that a medium presence of its dimensions and indicators is detected in the companies, with an emphasis on shortterm decisions and with incomplete coordination of its elements. The SMEs need to improve this coordination of their plans, so that they may incorporate better management processes into their operations and so that this will be reflected in better performance and sustainability of their businesses.

Access to financing

The results are summarized in Table 3. The alternatives for financing identified and numbered from 1 to 7 refer to common sources for the short term, while those from 8 to 16 are generally associated with long-term resources.

When considering the most widely used financing options, the most notable are the frequent utilization of credit from suppliers (87.5%), reinvestment of company profits (45.3%), and the use of bank credit lines (45.3%). To a lesser extent the SMEs resort to short and long-term bank loans, foreign financing and loans from public entities.

If we compare the level of access to the different types of resources, we only observe a high degree of access to credit from suppliers (1.67 points); there is medium access to funds from retained profits (0.91 points), and medium-low access to bank credit lines (0.73). The SMEs studied have low access to the rest of the instruments (see Figure 6), with particular lack of access to the issuance of commercial paper and preferred or privileged shares.

These results are compatible with findings from prior research, which mentioned the limited access to financial resources traditionally found in this type of organizations (BID, 2002 and 2005).

Regarding the preferred hierarchical order for the most utilized sources of financing, a certain coincidence is observed between the behavior of the Venezuelan manufacturing SMEs and the Pecking Order Theory (Brealey and Myers, 2010; Frank and Goyal, 2005; Myers, 1984; Aybar et al., 2003).

This theory is formulated for the composition of the capital structure (long-term) and proposes a hierarchical level for the choice of sources of financing, in which the company management would prefer, in the first instance, to finance the firm using retained profits (to avoid problems of adverse selection), in the second instance would choose to incur new debt, or would issue liability-equity hybrids, and finally would decide to sell new shares, because they are the instruments with the greatest implications for adverse selection and asymmetrical information.

Table 3 shows the preference for financing using shortterm resources: Credit from suppliers and bank credit lines. But in terms of long-term resources, there is a predominance of the use of reinvestment of profits, followed by different modalities of bank financing and, as a last option, the issuance of new common shares. In a way, this proves the previously commented theoretical postulate.

Relationship between financial planning and access to financing

Once the principal findings in each of these variables have been separately analyzed, it is necessary to study the possible relationships that could exist between them, through the analysis of significant statistical correlations, summarized in Table 4. (No correlations are shown with respect to the options of commercial paper and issuance of preferred shares because those alternatives received no scores).

A correlation was established between the dimensions associated with the conditions for developing financial planning and access to financing. In general terms, the degree of correlation between the selected indicators is weak or very weak; in other words, a certain relationship between them was found but of a very low degree. It must be recalled that this set of dimensions of the financial planning variable showed a medium presence in the companies (a score of 1.20; see Figure 1). The biggest positive correlations are observed in access to foreign financing (0.289), to credit from suppliers (0.259) and to bank credit lines (0.230); in other words, a greater presence of planning elements could foster greater availability of resources from those sources.

On the other hand, the most pronounced negative correlations are observed in leasing (-0.273), decree of dividends on shares (-0.235), and reinvestment of profits (-0.153). Reinvestment of profits is one of the most widely used alternatives, which explains this negative correlation, with the inference that to the extent that there is improvement in the situation of planning at the companies, they will be able to gain access to new options for resources, thereby decreasing their dependence on their own funds.

Upon observing the correlations for the elements of financial planning, a similar result is clear, with weak correlations between indicators. Equally, sources of financing that have the greatest positive and negative correlations coincide. Credit from suppliers (0.279) and bank credit lines (0.309) maintain a weak positive correlation, because they would benefit from improvements in the financial planning process. The reinvestment of profits again shows a negative coefficient (-0.139).

The association between parameters and long-term sources follows the same tendency of weak correlations, in most cases positive ones, indicating that a continuous improvement in management would make it possible to increase access to financial sources. The presence of a very low, almost nonexistent correlation with funds from the reinvestment of profits is particularly noteworthy.

For the short-term analysis, the strongest relationship occurs in bank credit lines, which is conceptually logical insofar as when an organization is better able to plan its procedures and operations, it will receive a higher classification from the financial institutions for obtaining increased resources.

Additionally, the correlation of the sources of financing most used by the SMEs in the study (credit from suppliers, reinvestment of company profits, bank credit lines and long-term bank loans) with each item of the questionnaire (with correlations greater than 0.3) is analyzed in order to provide a more complete understanding of other possible connections.

The case of credit from suppliers turned out to be more greatly affected by aspects associated with the availability of specialized personnel in the financial area, the establishment of policies for managing working capital, identification of organizational weaknesses, consideration of strengths and weaknesses in the plan, definition of objectives and evaluation of their fulfillment, along with advance planning of short-term financial contracting.

The reinvestment of company profits in its operations is the second most widely used financial option and the most frequently utilized that provides long-term resources. Coinciding with previous analyses, its correlations with financial planning can be negative in most cases, for reasons already mentioned (the inference is that to the extent that better financial management helps to increase money from other sources, the importance of this option in the capital structure would decrease). That is the case with respect to the items regarding the definition of business objectives, drafting of a strategic plan, identification of those responsible for deviations from the plan and the use of external sources to finance company activities in the short-term; this latter aspect shows a tendency to finance short-term operations with resources from retained profits (permanent funds; Brigham and Houston, 2006) given the difficulty of gaining access to other alternatives.

At the same time, there are indications of a positive association with the item referring to knowledge of the liability/equity proportions handled by the company.

Another short-term source that was analyzed is the bank credit line, which demonstrates medium correlations with such varied aspects as the substitution of assets and the presence of planning for short-term sources. This trend is notorious, which suggests the share of short-term funds such as credit lines in financing long-term assets, a situation which would force the companies to continuously renew their banking commitments because their expiration occurs before recovery of the investments. This could be due to scarce access to resources that can be repaid in longer periods.

There is a clearly medium negative correlation with item 42, which establishes comparisons between the costs of resources; this could be explained by the fact that more than 50% of the companies (57.8%) have not established that the opportunity costs of equity tend to be greater than those of liabilities, and tend to prefer to use their own resources for financing (retained profits).

The alternative associated with long-term bank loans shows low correlation with the analysis of the cost of interest and the frequency of evaluation of the achievement of objectives (in this case a negative correlation, possibly explained by the 51.6% of companies that do not perform this evaluation or only do so sporadically).

The preliminary results show three general tendencies: The moderately formal use of formal strategic and financial planning procedures at the SMEs, insufficient coordination of these procedures and a discrete association between them and the level of access to sources of financing reported by the companies. In the first two cases, opportunities for improvement in the management of these organizations could lead to better conditions of access to varied sources of resources.

The final column of Table 4 shows the coefficients for the financial planning variable when considered as a whole, as an average of its indicators (62 items). The results are a reflection of what has been mentioned in the previous sections; although they involve weak levels of association between the two variables, there is evidence of a relationship between both components of business management.

There is a clear positive correlation among traditional financing alternatives such as bank credit lines, credits guaranteed by inventories, credit from suppliers, the issuance of long-term bonds, short-term bank loans and the issuance of new common shares. In some of these alternatives, the companies demonstrated a very low level of access, the inference being that to the extent that they develop more formal financial planning and management procedures they would be able to gain greater access to the financial markets, as indicated in the specialized literature (Kogan Page et al., 2002; Páez, 2006; Little, 2005; Burk and Lehnman, 2004, among other authors already mentioned in previous sections).

Alternatives with greater presence at the companies that demonstrated negative correlations with financial planning particularly included reinvestment of profits, decree of dividends on shares and other types of financing cited by those surveyed. This result is notable, in that it mostly involves internal sources that come from the company's operations themselves and which will be more easily used even when planning activities are not carried out. At the same time, as has already been stated, the inference here is that to the extent that they develop more formal business planning and management procedures and techniques, businesses can depend more on their internal sources and improve their access to third-party sources.

It is important to mention that the relatively low correlation coefficients in the indicators that were analyzed showed the existing relationship between the financial planning variables and access to financing at these companies, but are not the only element that has an effect on that behavior.

As has been concluded in earlier studies cited in previous sections, there are also other factors that affect access to financing for the SMEs, such as: Interest rate levels, availability of long-term savings in the financial markets, collateral requirements, lack of consolidation in the financial system, adaptation of risk classification techniques to the SMEs, bureaucracy in financial intermediation insufficient government support policies, deficiency in management processes, among some of the most relevant (BID, 2002 and 2005; Beck et al., 2004a; Berger et al., 2002; Berger and Udell, 2005; Andriani et al., 2003; Zevallos, 2007).

It is necessary to continue researching this set of variables in the sector, to generate relevant knowledge that would help to surmount its deficiencies. The contribution generated through this work constitutes a new step on that path, fundamentally because it persists in seeking explanations within the companies, complimenting already available information and generating new questions for future initiatives.

At the same time, information-gathering tools and scales of measurement and analysis that have been designed in this research (Vera, 2010) facilitate an approach to the day-to-day practices carried out by the companies in this functional area, making it possible to compare their particular situation with other similar companies, and with companies at other levels, sectors or countries.

In general, it facilitates the detection of problems (and opportunities) in these management processes, providing valuable information to improve the performance of the SMEs, encouraging internal actions for improvement in each establishment while promoting the creation of support programs (trade associations, academic institutions, public and private entities) where mechanisms are established for training and advice that help to overcome the identified weaknesses.

It is hoped that future research can replicate the use of this methodology in other contexts and identify analogies with the Venezuelan case. Equally, studies can be carried out in other functional areas (marketing, operations, human resources and innovation) to more intensely focus on the characteristics of the internal management of the SMEs, as a factor to explain their capacities for growth and survival.

[1] In this regard, the works of Berger and Udell (2005), Cull et al. (2005), Beck et al. (2004b), BID (2002), BID (2005), The World Bank (2008a), among others, could be cited.

[2] The works of Deakins et al. (2001), Andriani et al. (2003), Vera (2001), can be cited.

[3] The definition of SME in Venezuela, when carrying out the study, applies to establishments that employ between 11 and 100 workers, or that have revenues between 9,001 and 250,000 tax units (which in this case correspond to amounts equivalent to between US$136,000 and US$3,780,000).

Andriani, C., Biasca, R. & Rodríguez, M. (2003). Un nuevo sistema de gestión para lograr Pymes de clase mundial. Bogotá: Grupo editorial Norma. [ Links ]

Aybar, C., Casino, A. & López, J. (2003). Estrategia y estructura de capital en la PYME: una aproximación empírica. Estudios de economía aplicada, 21(I), 27-52. [ Links ]

Beck, T., Demirgüç-Kunt, A. & Maksimovic, V. (2002). Financing patterns around the world: The role of institutions. World Bank Policy Research Working Paper 2905, October. Available at http://ssrn.com/abstract=636268. [ Links ]

Beck, T., Demirgüç-Kunt, A., Laeven, L. & Maksimovic, V. (2004a). The determinants of financing obstacles. World Bank Policy Research Working Paper 3204, February. Available at http://wdsbeta.worldbank.org/. [ Links ]

Beck, T., Demirgüç-Kunt, A. & Maksimovic, V. (2004b). Financing patterns around the world: Are small firms different? World Bank Working Paper. Available at http://siteresources.worldbank.org/. [ Links ]

Beck, T. & Demirgüç-Kunt, A. (2005). Small and medium-size enterprises: Overcoming growth constraints. World Bank Working Paper. Available at http://siteresources.worldbank.org. [ Links ]

Berger, A., Frame, W. & Miller, N. (2002). Credit Scoring and the Availability, Price, and Risk of Small Business Credit. Federal Reserve Board, Finance and Economics Discussion Series, No. 2002-26. Available at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=315044 [ Links ]

Berger, A. & Udell, G. (2005). A more complete conceptual framework for financing of small and medium enterprises. World Bank Policy Research Working Paper 3795. Available at http://papers.ssrn.com/. [ Links ]

BID Banco Interamericano de Desarrollo. (2002). Acceso de las pequeñas y medianas empresas al financiamiento. Informe de trabajo Grupo DFC. Available at http://www.iadb.org/IDBDocs.cfm?docnum=550713. [ Links ]

BID Banco Interamericano de Desarrollo. (2005). Desencadenar el crédito, Cómo ampliar y estabilizar la banca. Informe Progreso Económico y Social en América Latina. Available at http://www.iadb.org/. [ Links ]

Boedo, L. & Calvo, A. (2001). Incidencia del tamaño sobre el comportamiento financiero de la empresa. Un análisis empírico con SMES gallegas. Revista Galega de Economía, 10(2), 1-23. Available at http://www.redalyc.org. [ Links ]

Brealey, R. & Myers, S. (2010). Principios de finanzas corporativas. Mexico: McGraw-Hill Ed. [ Links ]

Brigham, E. & Houston, J. (2006). Fundamentos de administración financiera. México: Thomson Learning. [ Links ]

Burk, J. & Lehnman, R. (2004). Financing your small business. Naperville, IL: Sphinx Publishing. [ Links ]

Clarke, G., Cull, R., Martínez, M. & Sánchez, S. (2002). Bank lending to small businesses in Latin America. Does bank origin matter? World Bank Policy Research Working Paper 2760, February. Available at http://www-wds.worldbank.org/. [ Links ]

Cull, R., Davis, L., Lamoreaux, N. & Rosenthal, J.-L. (2005). Historical financing of small and medium-sized enterprises. NBER Working Paper No. W11695. Available at http://papers.ssrn.com. [ Links ]

Deakins, D., Logan, D. & Steele, L. (2001). The financial management of the small enterprise. Certified Accountants Educational Trust. London. Available at http://www.accaglobal.com/research/summaries/23924. [ Links ]

Díez, L. & López, J. (2001). Dirección financiera, planificación, gestión y control. Madrid: Financial Times Prentice Hall. [ Links ]

European Commission (2006). La nueva definición de PYME. Publicaciones Empresa e Industria. Available at http://ec.europa.eu/index_es.htm. [ Links ]

Field, A. (2006). Discovering statistics using SPSS. 2nd edition. London: SAGE Publications. [ Links ]

Francés, A. (2001). Estrategia para la empresa en América Latina. Caracas: Ediciones IESA. [ Links ]

Frank, M. & Goyal, V. (2005). Trade-off and pecking order theories of debt. Social Science Research Network, February 22. Available at http://ssrn.com/abstract=670543. [ Links ]

Galindo, A. (2005). El tamaño empresarial como factor de diversidad. Edición electrónica Grupo EUMED. Universidad de Málaga. Available at http://www.eumed.net/libros/2005/agl3/. [ Links ]

García, C., Lejarriaga, G., Gómez, P., Bel, P., Fernández, J. & Miranda, M. (2003). Dirección de la organización de producción (planificación financiera de la empresa). Madrid: Vicerrectorado de Estudios. Universidad Complutense de Madrid. Available at www.ucm.es/info/ecfin3/RMGS/RMGS.htm. [ Links ]

Gitman, L. (2007). Principios de administración financiera. México: Pearson Educación. [ Links ]

Hernández, R., Fernández, C. & Baptista, P. (2010). Metodología de la investigación. 5ta edición. México: McGraw-Hill. [ Links ]

Hurtado, J. (2010). Metodología de la investigación holística. 4ta edición. Caracas: Fundación Sypal. [ Links ]

Hurtado, J. (2007). El proyecto de investigación. 5ta edición. Caracas: Ediciones Quirón - Sypal. [ Links ]

INE Instituto Nacional de Estadística. (2006). Directorio manufacturero 1999-2005. Electronic database in Microsoft Excel (CD-ROM). [ Links ]

Kumar, A. & Francisco, M. (2005). Enterprise size, financing patterns, and credit constraints in Brazil. World Bank working paper series No. 49. Available at http://www-wds.worldbank.org/. [ Links ]

Little, S. (2005). The 7 irrefutable rules of small business growth. New Jersey: John Wiley & Sons. [ Links ]

Malhotra, M., Chen, Y., Criscuolo, A., Fan, Q., Hamel, I. & Savchenko, Y. (2007). Expanding access to finance: Good practices and policies for micro, small, and medium enterprises. Washintong: World Bank Institute. [ Links ]

Moll, S. (2007). Mapa institucional de fomento a la micro, pequeña y mediana empresa en Venezuela. Documento de trabajo FUNDES Venezuela. (Available at http://www.mipyme.com/descargas.aspx Dated 17-03-2008). [ Links ]

Myers, S. C. (1984). The capital structure puzzle. The Journal of Finance, (July), 575-592. [ Links ]

Ortiz, A. (2005). Gerencia financiera y diagnóstico estratégico. Segunda edición. Bogotá: McGraw-Hill. [ Links ]

Páez, T. (2006). Observatorio PYME, estudio de la pequeña y mediana empresa en Venezuela. Caracas: Ediciones CEATPRO. [ Links ]

Peres, W. & Stumpo, G. (2002). Políticas de apoyo a las PYME. Notas de la CEPAL, 23(July), 4-5. [ Links ]

Reuvid, J. (2002). The corporate finance handbook (3rd edition). London: Kogan Page Ltd. Available at http://site.ebrary.com/lib/bibliotecaserbiluz/Doc?id=10023727&ppg=1 [ Links ]

Ryan, B., Scapens, R. & Theobald, M. (2004). Metodología de la investigación en Finanzas y Contabilidad. Barcelona: Ediciones Deusto. [ Links ]

Santandreu, E. & Santandreu, P. (2000). Manual de finanzas. Barcelona: Gestión 2000. [ Links ]

Suárez, A. (2003). Decisiones óptimas de inversión y financiación en la empresa. 20ma edición. Madrid: Ediciones Pirámide. [ Links ]

The World Bank. (2008a). Finance for all? Policies and pitfalls in expanding access. World Bank Policy Research Report. Washington: The International Bank for Reconstruction and Development/The World Bank. Available at www.worldbank.org. [ Links ]

The World Bank. (2008b). Global development finance. The role of international banking. Vol. I: Review, analysis, and outlook. Washington: The International Bank for Reconstruction and Development/The World Bank. Available at www.worldbank.org. [ Links ]

Vera, M. (2001). Gestión financiera de la pequeña y mediana industria en la ciudad de Maracaibo. Revista de Ciencias Sociales, VI(1), 65-89. [ Links ]

Vera, M. (2010). Metodología para el análisis de la gestión financiera en SMEs. Borrador. Available at http://www.econfinanzas.com/. [ Links ]

Zevallos, E. (2007). Restricciones del entorno a la competitividad empresarial en América Latina. Costa Rica: Fundes. Serie Vector. Available at http://www.fundes.org/. [ Links ]